Sequential Auctions with Capacity Constraints: An Experimental Investigation

Abstract

:1. Introduction

2. Theory

- VF1 = VS1 = 18; VF2 = VS2 = 15; VF3 = VS3 = 10; VF4 = VS4 = 0.

- u1F(vi) = u1S(vi) = ; u2F(vi) = u2S(vi) = ; u3F(vi) = u3S(vi) = .

- b1F(vi) = ; b2F(vi) = ; b3F(vi) =

- b1S(vi) = ; b2S(vi) = ; b3S(vi) = .

- ; ; .

3. Experimental Design and Procedures

4. Aggregate Results

4.1. Summary Statistics

4.2. Aggregate Bidding Functions

4.3. Overbidding

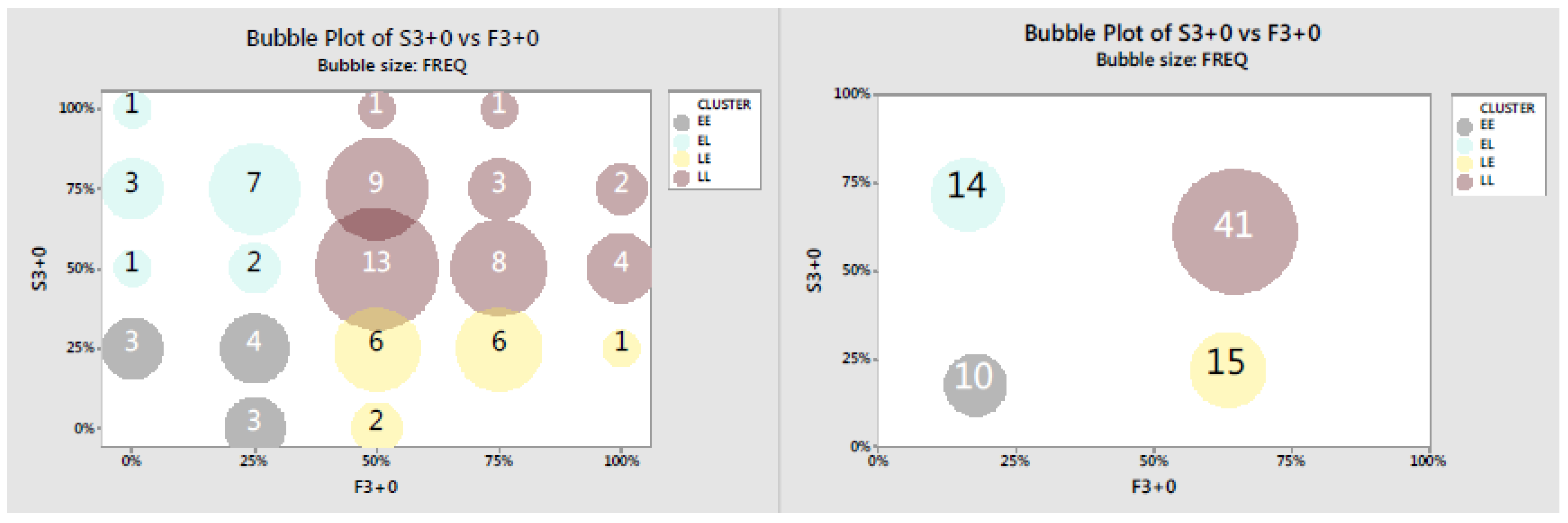

5. Cluster Analysis

5.1. Framework and Basic Statistics

5.2. Overbidding

5.3. Efficiency

5.4. Summary

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Proofs of Propositions 1 and 2

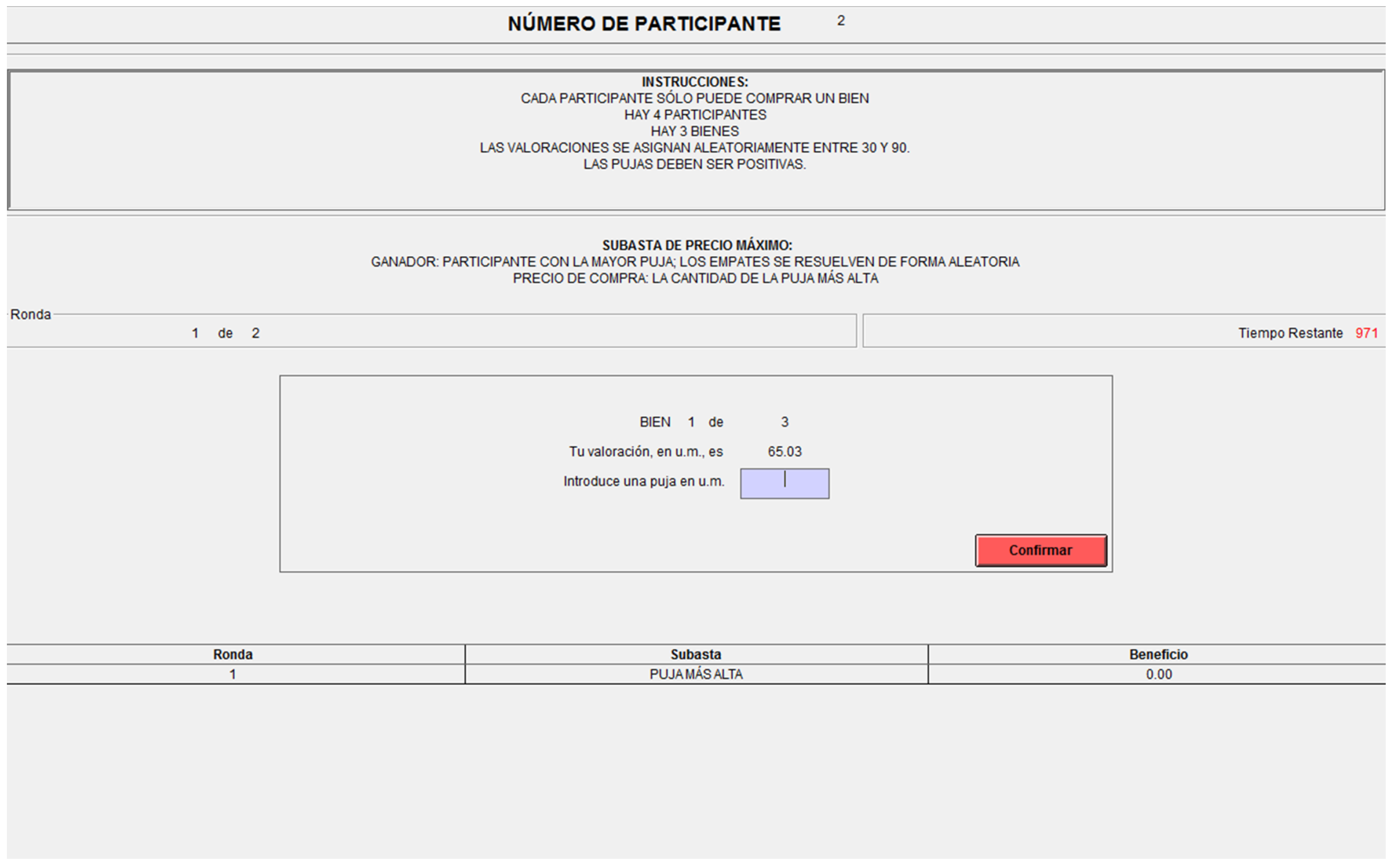

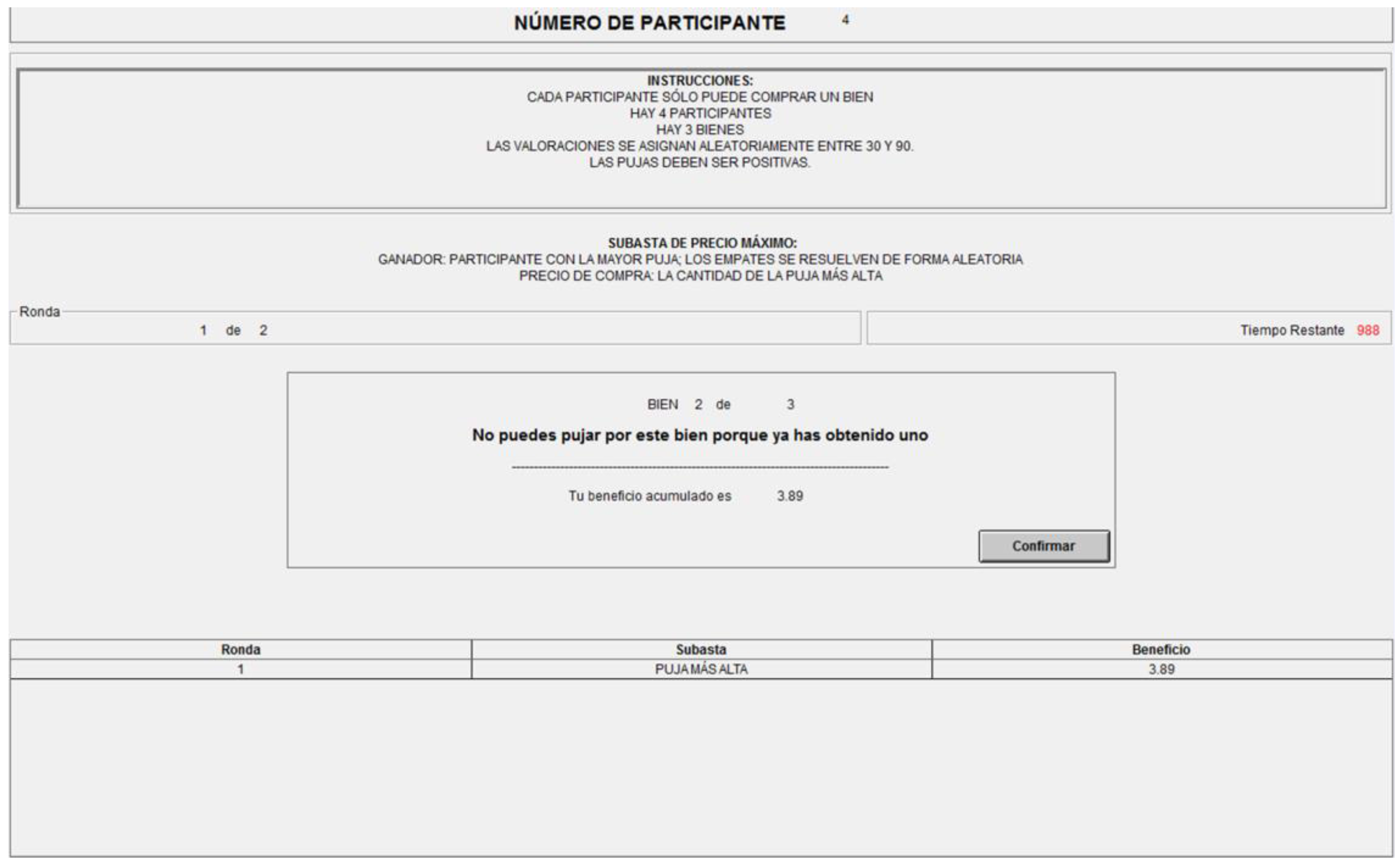

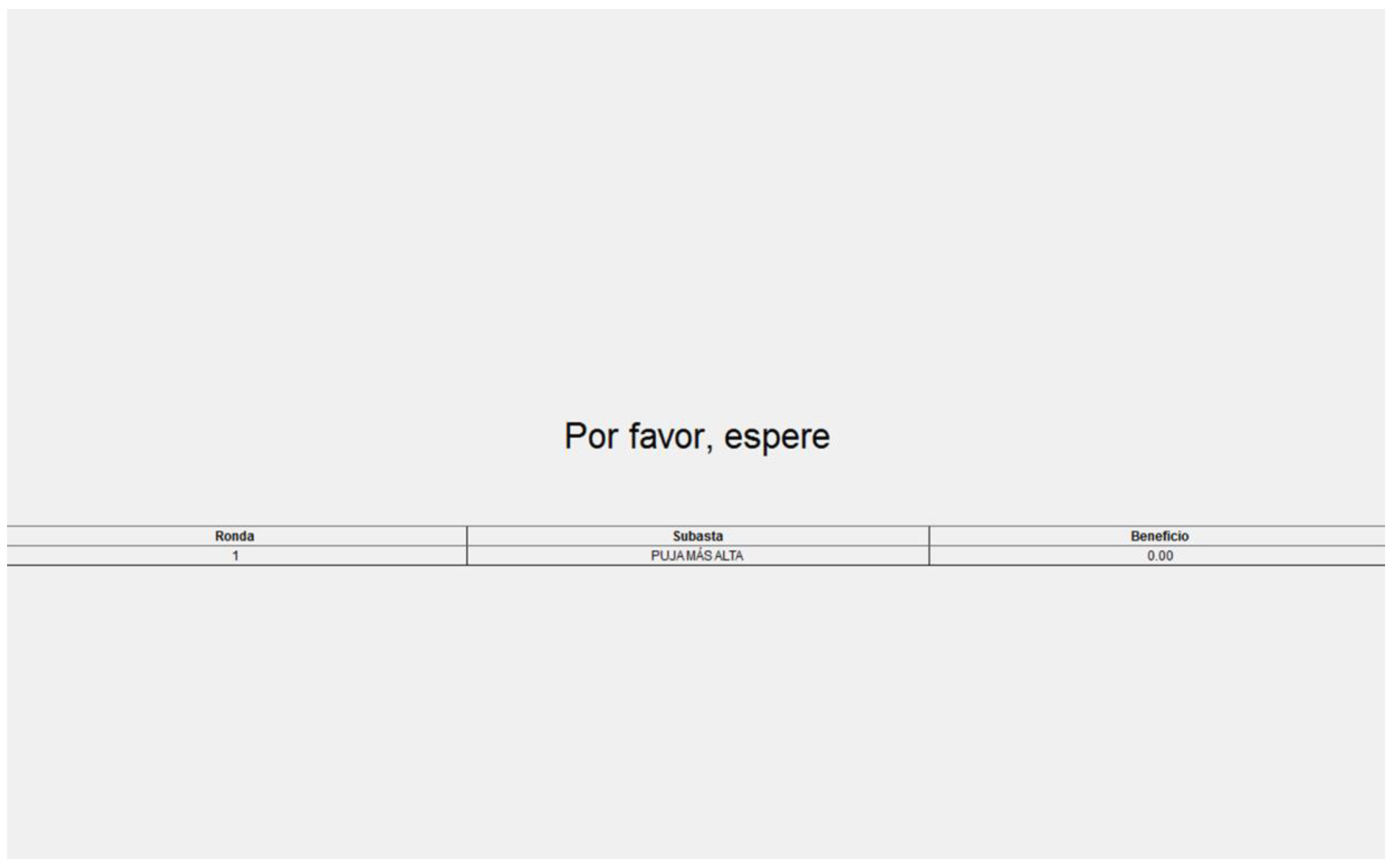

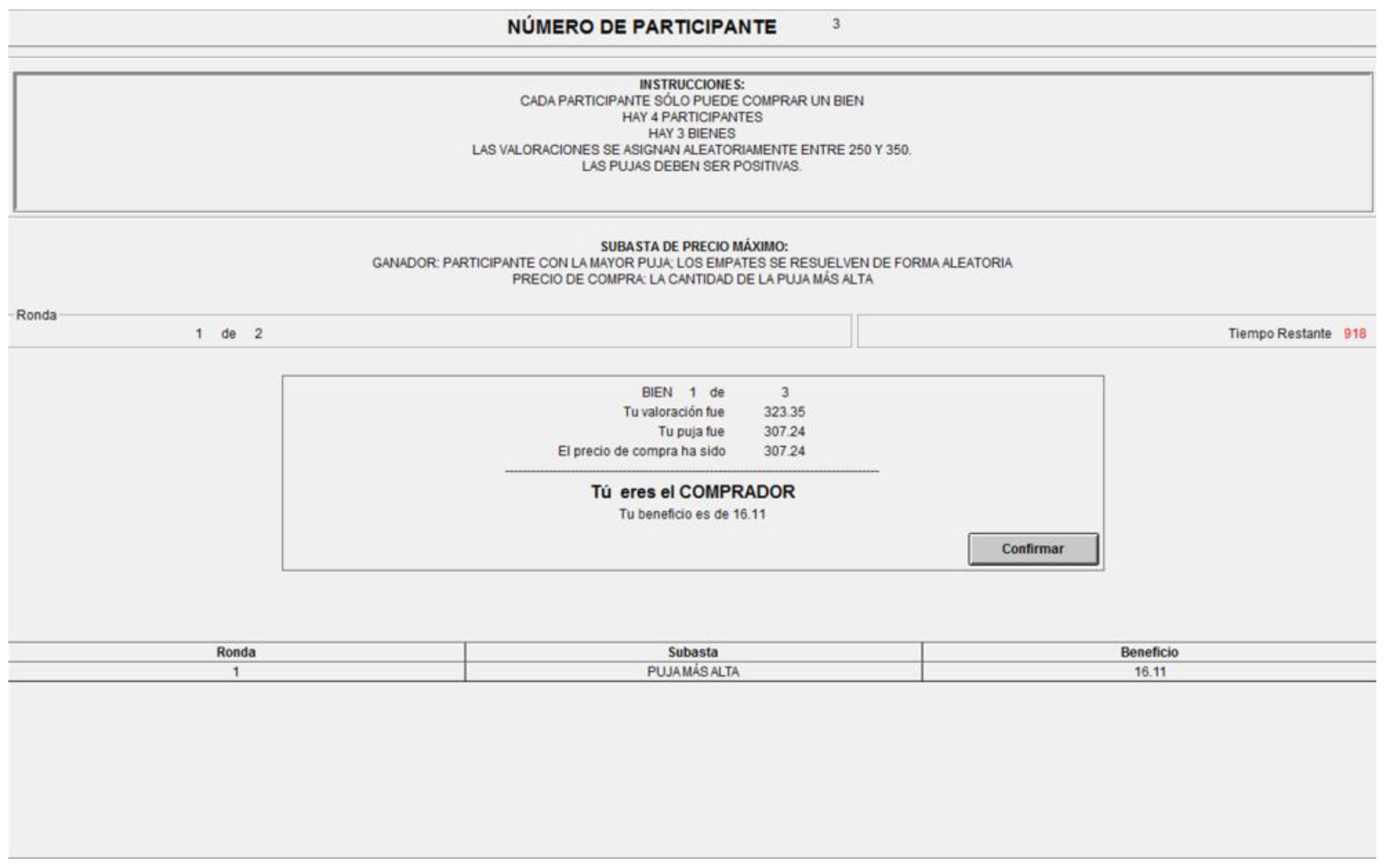

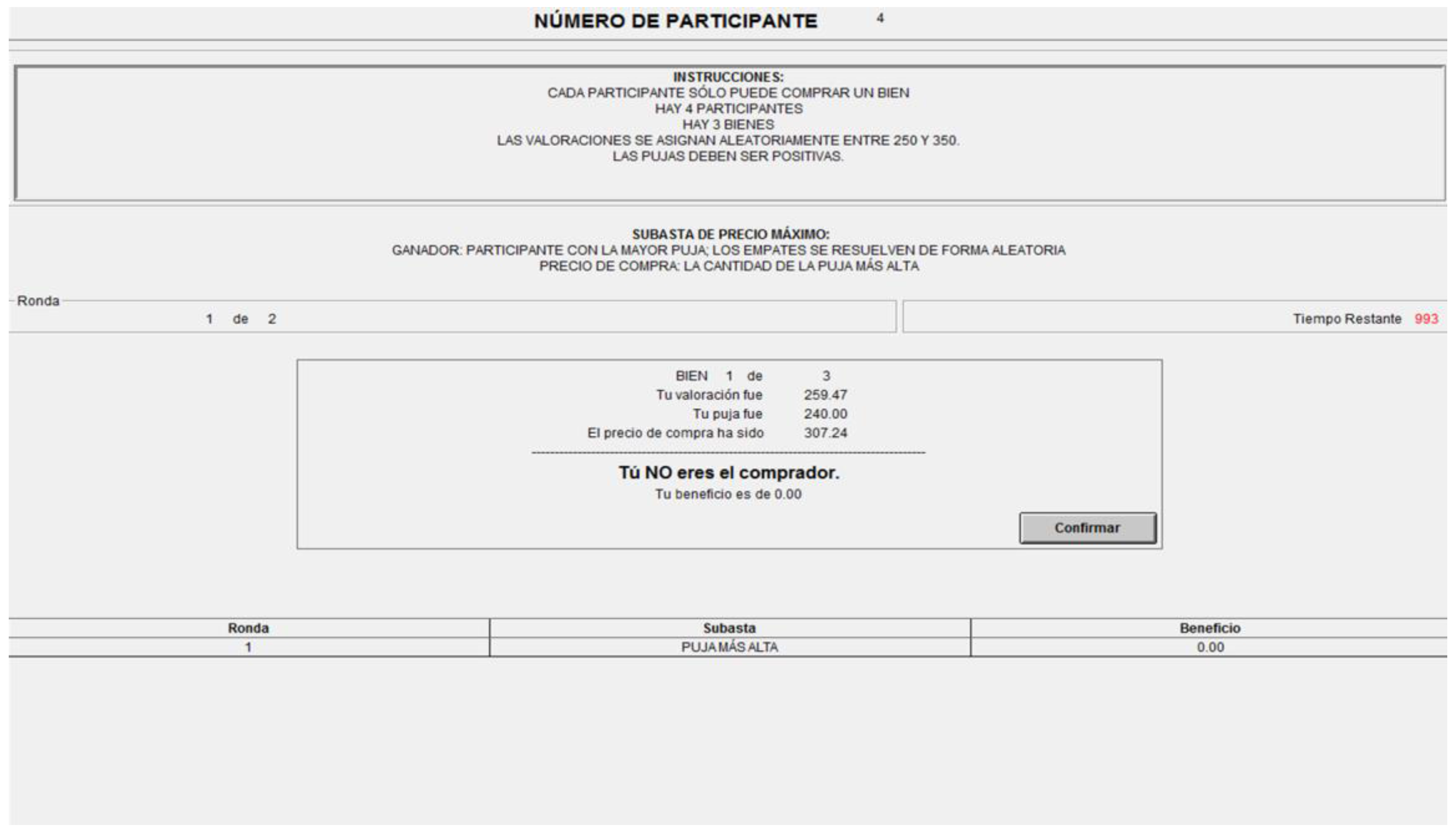

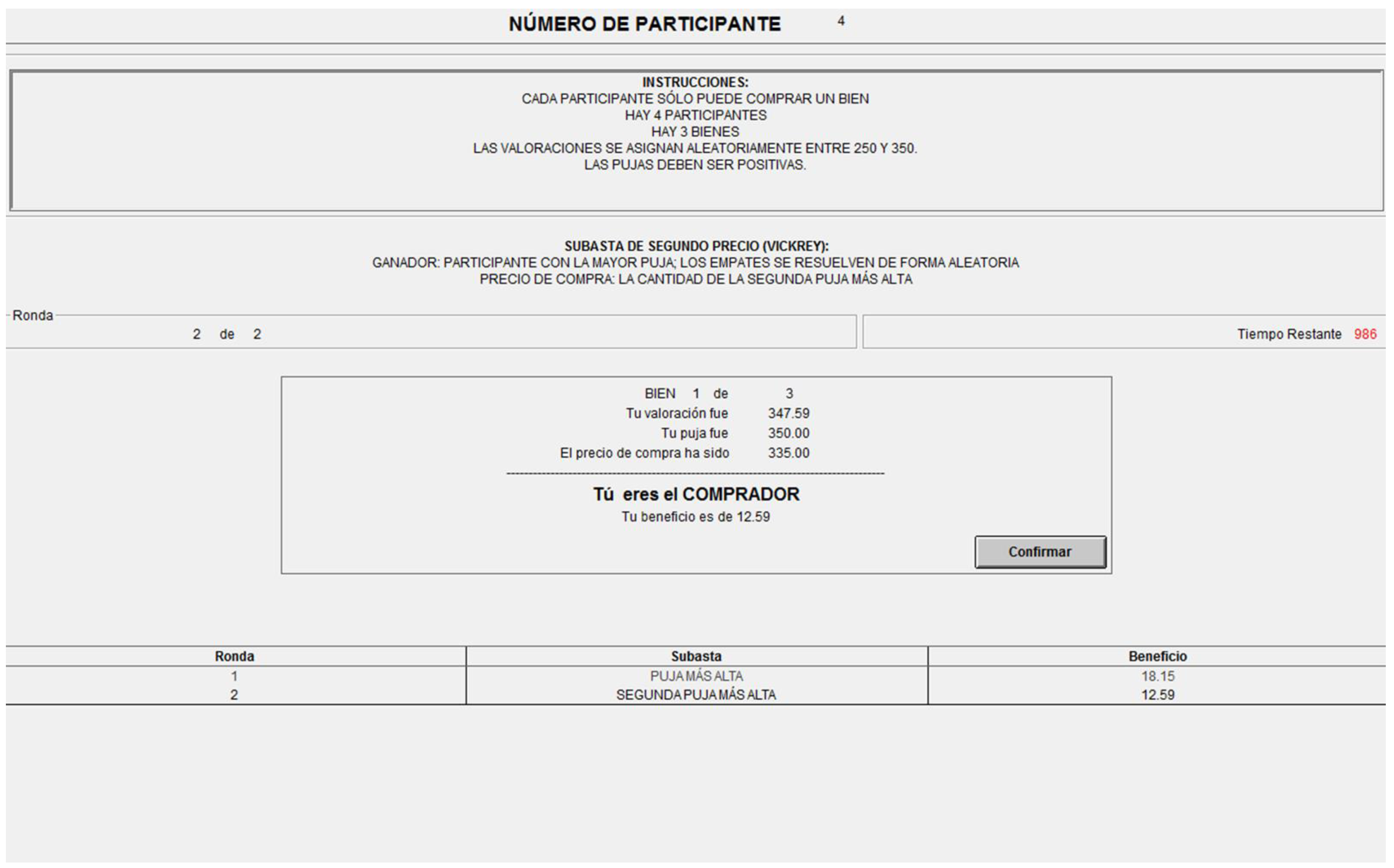

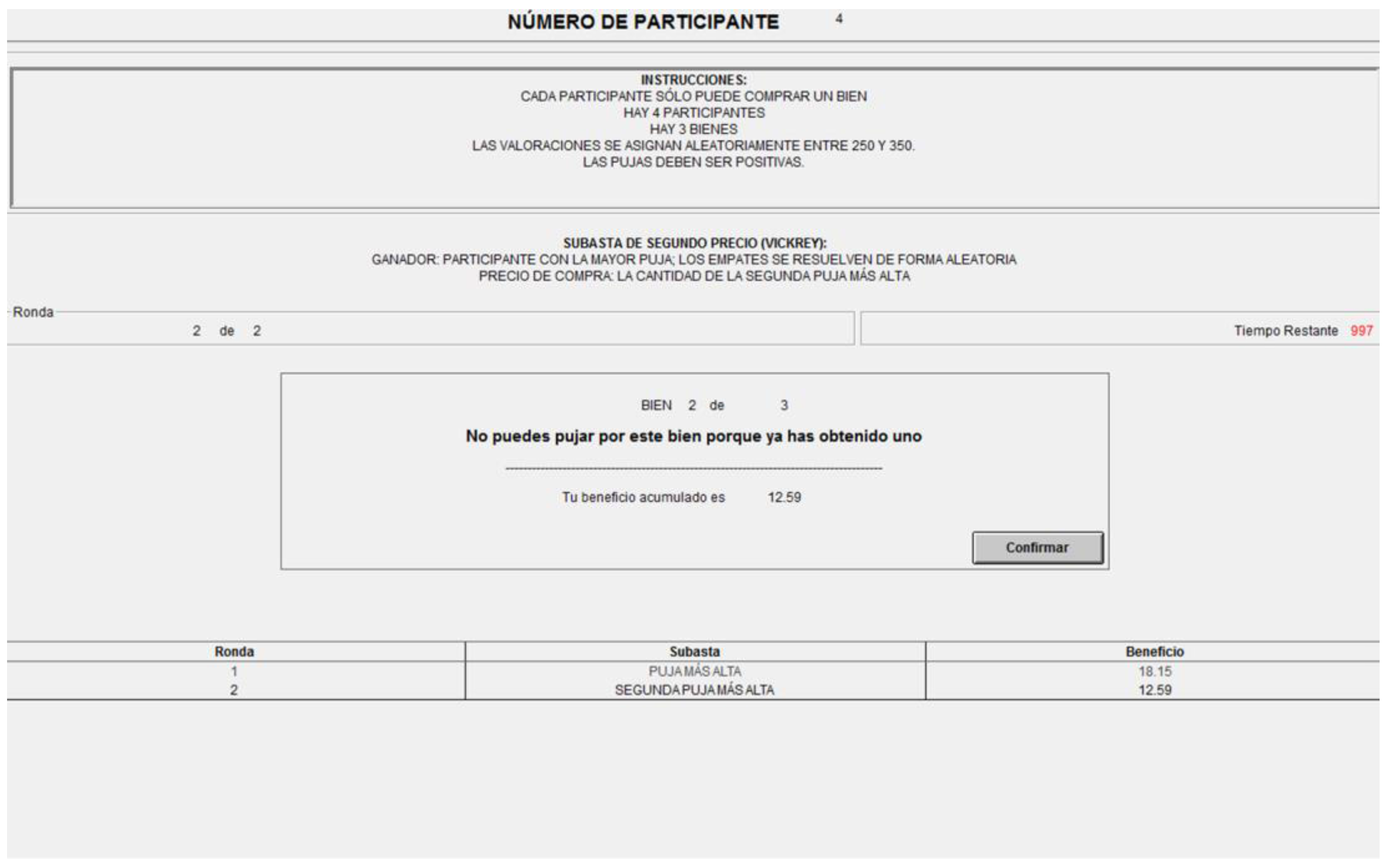

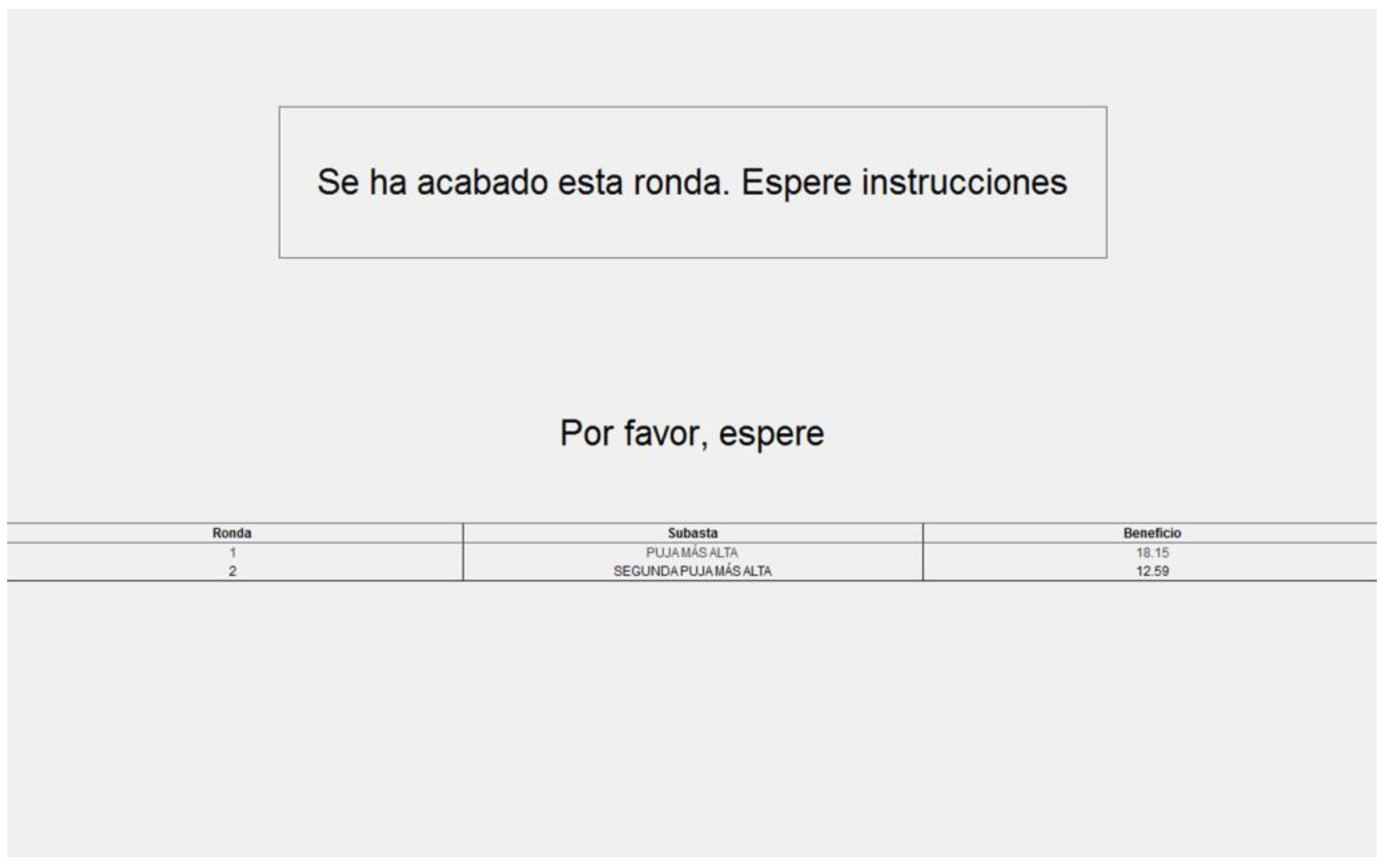

Appendix B. Instructions

- 4 participants in each group and 3 goods per round.

- The valuations are random between 30 and 90 tokens.

- The auction type currently under way: First Price and Second Price. The peculiarities of each of the two types will be explained later.

- The round or period.

- The remaining time to submit a bid.

- The good that it is being auctioned out of the possible 3.

- The history of the experiment, indicating the profit obtained per round.

- Under First Price or Maximum Price, the Price coincides with the bid placed by the winner.

- Under Second Price or Vickrey, the Price corresponds not to one’s own bid but to the second highest bid.

- Assignment of participants to groups

- For each group:

- Auction for Good 1 of 3: Placement of 4 bids and assignment to the winner

- Auction for Good 2 of 3: Placement of 3 bids and assignment to the winner

- Auction for Good 3 of 3: Placement of 2 bids and assignment to the winner

- Presentation of profits in tokens after each good and auction

Appendix C. Comprehension Quiz

- How many rounds of FIRST PRICE auctions are there?

- 1

- 4

- 8

- How many rounds of SECOND PRICE auctions are there?

- 1

- 4

- 8

- In each round, how many participants are there in each group?

- 1

- 3

- 4

- 8

- In each round, how many goods are auctioned in each group?

- 1

- 3

- 4

- 8

- In each round, how are the goods auctioned?

- All at once

- Sequentially

- If you win the first good in a given round, are you allowed to bid for the second good in that round?

- Yes

- No

- If you do not win the first good in a given round, are you allowed to bid for the second good in that round?

- Yes

- No

- If your valuation in a round is 234.56, your bid is 210.98, which is the highest bid, and the second highest bid is 200.00, what is your profit if the auction type is FIRST PRICE?

- 234.56–210.98

- 234.56–200.00

- 210.98–200.00

- If your valuation in a round is 234.56, your bid is 210.98, which is the highest bid, and the second highest bid is 200.00, what is your profit if the auction type is SECOND PRICE?

- 234.56–210.98

- 234.56–200.00

- 210.98–200.00

- What is your final profit in euros?

- The sum of the profits in tokens of each round divided by 4 plus 2 euros

- The average of the profits in tokens of each round divided by 4 plus 2 euros

- The profit in tokens of one round selected at random divided by 4 plus 2 euros

Appendix D. Supplemental Analysis

Appendix D1. Regression Analysis Controlling for Intra-Groups Correlations

| Bid in FIRST | Bid in SECOND | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Value | 0.93 *** | 0.93 *** | 0.94 *** | 0.99 *** |

| (0.03) | (0.05) | (0.03) | (0.03) | |

| Constant (at ) | 25.77 | 24.45 | 32.20 * | 29.66 |

| (2.83) | (3.62) | (1.97) | (2.09) | |

| G2 | 3.62 *** | 2.19 | 0.61 | 4.35 |

| (0.69) | (4.51) | (0.72) | (3.88) | |

| G3 | 3.03 ** | 2.94 | 0.72 | 9.78 *** |

| (0.98) | (3.013) | (1.44) | (2.18) | |

| Value * G2 | 0.02 | −0.06 | ||

| (0.08) | (0.06) | |||

| Value * G3 | 0.001 | −0.14 *** | ||

| (0.06) | (0.04) | |||

| Order | 3.10 | 1.98 | ||

| (3.71) | (3.09) | |||

| # obs. | 720 | 720 | 720 | 720 |

| # clusters | 6 | 6 | 6 | 6 |

| Adj. R squared | 0.60 | 0.60 | 0.63 | 0.64 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Value | 0.93 *** | 0.96 *** | 0.95 *** |

| (0.02) | (0.03) | (0.04) | |

| Constant (at ) | 26.51 | 24.54 | 24.56 |

| (2.66) | (2.90) | (3.02) | |

| G2 | 2.11 *** | 3.44 | 3.45 |

| (0.41) | (3.31) | (3.31) | |

| G3 | 1.88 *** | 6.71 *** | 6.71 *** |

| (0.33) | (1.01) | (1.03) | |

| Second | 5.05 *** | 5.09 *** | 4.99 *** |

| (1.13) | (1.15) | (1.51) | |

| Value * G2 | −0.02 | −0.02 | |

| (0.06) | (0.06) | ||

| Value * G3 | −0.08 *** | −0.08 *** | |

| (0.02) | (0.02) | ||

| Order | 2.52 | 2.52 | |

| (3.24) | (3.24) | ||

| Value * Second | 0.002 | ||

| (0.02) | |||

| # obs. | 1440 | 1440 | 1440 |

| # clusters | 6 | 6 | 6 |

| Adj. R squared | 0.62 | 0.63 | 0.63 |

| Bid in FIRST | Bid in SECOND | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Value | 0.93 *** | 0.92 *** | 0.94 *** | 0.99 *** |

| (0.03) | (0.05) | (0.03) | (0.047) | |

| Constant (at ) | 25.77 | 24.44 | 32.20 * | 29.66 |

| (2.20) | (3.16) | (1.59) | (2.63) | |

| G2 | 3.62 *** | 2.19 | 0.61 | 4.35 |

| (0.93) | (4.70) | (0.96) | (3.33) | |

| G3 | 3.03 ** | 2.94 | 0.72 | 9.78 * |

| (0.99) | (4.36) | (1.30) | (3.89) | |

| Value * G2 | 0.02 | --- | −0.06 | |

| (0.08) | (0.06) | |||

| Value * G3 | 0.001 | −0.14 * | ||

| (0.07) | (0.06) | |||

| Order | 3.10 * | 1.98 | ||

| (1.40) | (1.87) | |||

| # obs. | 720 | 720 | 720 | 720 |

| # clusters | 80 | 80 | 80 | 80 |

| Adj. R squared | 0.60 | 0.60 | 0.63 | 0.64 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Value | 0.93 *** | 0.96 *** | 0.95 *** |

| (0.02) | (0.03) | (0.04) | |

| Constant (at ) | 26.51 | 24.54 | 24.56 |

| (1.47) | (2.17) | (2.55) | |

| G2 | 2.11 ** | 3.44 | 3.45 |

| (0.67) | (2.86) | (2.86) | |

| G3 | 1.88 * | 6.71 * | 6.71 * |

| (0.81) | (2.94) | (2.95) | |

| Second | 5.05 *** | 5.09 *** | 4.99 |

| (0.95) | (0.93) | (2.68) | |

| Value * G2 | −0.02 | −0.02 | |

| (0.05) | (0.05) | ||

| Value * G3 | −0.08 | −0.08 | |

| (0.05) | (0.05) | ||

| Order | 2.52 ** | 2.52 ** | |

| (0.94) | (0.93) | ||

| Value * Second | 0.002 | ||

| (0.04) | |||

| # obs. | 1440 | 1440 | 1440 |

| # clusters | 80 | 80 | 80 |

| Adj. R squared | 0.62 | 0.63 | 0.63 |

Appendix D2. Overbidding

| Across Goods (FIRST) | 1 = 2 | 1 > 3 | 2 > 3 |

| Across Goods (SECOND) | 4 > 5 | 4 > 6 | 5 > 6 |

| Across Mechanisms (G1, G2, G3) | 1 = 4 | 2 > 5 | 3 > 6 |

Appendix D3. Payoffs

| FIRST | SECOND | ||||||

|---|---|---|---|---|---|---|---|

| G1 | G2 | G3 | G1 | G2 | G3 | ||

| SLOPE | Theory | 0.25 | 0.33 | 0.50 | 0.25 | 0.33 | 0.50 |

| Experiment | 0.40 | 0.50 | 0.21 † | 0.96 * | 0.54 * | 0.71 | |

| Std. Error | 0.15 | 0.19 | 0.10 | 0.15 | 0.09 | 0.12 | |

| INTERCEPT (at ) | Theory | 15.00 | 10.00 | 0.00 | 15.00 | 10.00 | 0.00 |

| Experiment | −19.12 † | −23.53 † | −6.24 | −33.97 † | −12.90 † | −7.24 | |

| Std. Error | 11.64 | 14.52 | 7.68 | 12.28 | 6.24 | 8.66 | |

| Payoff in F | Payoff in S | Payoff | |

|---|---|---|---|

| Value | 0.36 *** | 0.71 *** | 0.54 *** |

| (0.10) | (0.07) | (0.06) | |

| Constant (at ) | −17.70 | −22.38 | −27.22 |

| (8.35) | (6.14) | (5.27) | |

| G2 | −0.50 | 2.01 | 1.02 |

| (2.50) | (2.06) | (1.60) | |

| G3 | 5.50 * | 15.05 *** | 10.72 *** |

| (0.97) | (2.17) | (1.73) | |

| Second | --- | --- | 14.00 *** |

| (1.22) | |||

| # obs. | 720 | 720 | 1440 |

| # clusters | 80 | 80 | 80 |

| Adj. R squared | 0.11 | 0.39 | 0.39 |

Appendix D4. Payoffs Across Clusters

| Good | EE | EL | LE | LL | Total | Theory | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| F | S | F | S | F | S | F | S | F | S | All | ||

| G1 | −13.8 | −0.7 | 4.2 | 16.8 | 0.5 | 12.4 | 1.4 | 13.5 | −0.9 | 10.7 | 4.9 | 27.0 |

| G2 | −14.1 | 9.6 | 0.5 | 18.7 | 5.2 | 9.6 | −3.6 | 7.8 | −3.7 | 10.3 | 3.3 | 25.0 |

| G3 | −11.2 | 26.3 | −9.2 | 26.3 | 4.3 | 20.2 | 3.4 | 23.3 | 1.8 | 23.8 | 12.8 | 20.0 |

| Avg. | −13.5 | 7.2 | 1.3 | 22.4 | 3.4 | 12.4 | 0.7 | 16.5 | −0.9 | 14.9 | 7.0 | 24.0 |

References

- Kagel, J.H.; Levin, D. Auctions: A Survey of Experimental Research. In The Handbook of Experimental Economics; Kagel, J.H., Roth, A.E., Eds.; Princeton University Press: Princeton, NJ, USA, 2015; Volume 2, pp. 5636–5637. ISBN 978-0691139999. [Google Scholar]

- Kwasnica, T.; Sherstyul, K. Multiunit auctions. J. Econ. Surv. 2013, 277, 461–490. [Google Scholar] [CrossRef]

- Ashenfelter, O. How auctions work for wine and art. J. Econ. Perspect. 1989, 33, 23–36. [Google Scholar] [CrossRef]

- Ashenfelter, O.; Genesove, D. Testing for price anomalies in real-estate auctions. Am. Econ. Rev. 1992, 822, 501–505. [Google Scholar]

- Van den Berg, G.J.; van Ours, J.C.; Pradhan, M.P. The declining price anomaly in Dutch rose auctions. Am. Econ. Rev. 2001, 91, 1055–1062. [Google Scholar] [CrossRef]

- Weber, R.J. Multiple-object auctions. In Auctions, Bidding, and Contracting; Engelbrecht-Wiggans, R., Shubik, M., Stark, R., Eds.; UP: New York, NY, USA, 1983; pp. 165–191. [Google Scholar]

- McAfee, R.P.; Vincent, D. The declining price anomaly. J. Econ. Theory 1993, 60, 191–212. [Google Scholar] [CrossRef]

- Keser, C.; Olson, M. Experimental examination of the declining-price anomaly. In Economics of the Art: Selected Essays; Ginsburgh, V.A., Menger, P.M., Eds.; Elsevier: Amsterdam, The Netherlands, 1996; pp. 151–176. ISBN 978-0444824028. [Google Scholar]

- Salmon, T.C.; Wilson, B.J. Second chance offers versus sequential auctions: Theory and behavior. Econ. Theory 2008, 34, 47–67. [Google Scholar] [CrossRef]

- Neugebauer, T.; Pezanis-Christou, P. Bidding behavior at sequential first-price auctions with(out) supply uncertainty: A laboratory analysis. J. Econ. Behav. Organ. 2007, 63, 55–72. [Google Scholar] [CrossRef]

- Brosig, J.; Reiss, P.J. Entry decisions and bidding behavior in sequential first-price procurement auctions: An experimental study. Game Econ. Behav. 2007, 58, 50–74. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994; ISBN 978-0691034102. [Google Scholar]

- Leufkens, K.; Peeters, R. Synergies are a reason to prefer first-price auctions. Econ. Lett. 2007, 97, 64–69. [Google Scholar] [CrossRef]

- Leufkens, K.; Peeters, R.; Vorsatz, M. An experimental comparison of sequential first- and -price auctions with synergies. BE J. Theor. Econ. 2012, 12, 2. [Google Scholar] [CrossRef]

- Kagel, J.H. Auctions: A survey of experimental research. In The Handbook of Experimental Economics; Kagel, J.H., Roth, A.E., Eds.; Princeton University Press: Princeton, NJ, USA, 1995; Volume 2, ISBN 0-691-04290-X. [Google Scholar]

- Casari, M.; Ham, J.C.; Kagel, J.H. Selection bias, demographic effects, and ability effects in common value auction experiments. Am. Econ. Rev. 2007, 97, 1278–1304. [Google Scholar] [CrossRef]

- Fischbacher, U. z-Tree: Zurich Toolbox for Ready-made Economic Experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef]

- Cox, J.C.; Roberson, B.; Smith, V.L. Theory and behavior of single object auctions. In Research in Experimental Economics; Smith, V.L., Ed.; JAI Press Inc.: Stamford, CT, USA, 1982; Volume 2, pp. 1–43. ISBN 0-89232-263-2. [Google Scholar]

- Isaac, R.M.; Walker, J.M. Information and conspiracy in sealed bid auctions. J. Econ. Behav. Organ. 1985, 6, 139–159. [Google Scholar] [CrossRef]

- Ockenfels, A.; Selten, R. Impulse balance equilibrium and feedback in first price auctions. Game Econ. Behav. 2005, 51, 155–170. [Google Scholar] [CrossRef]

- Neugebauer, T.; Perote, J. Bidding as if risk neutral in experimental first price auctions without information feedback. Exp. Econ. 2007, 11, 190–202. [Google Scholar] [CrossRef]

- Dorsey, R.; Razzolini, L. Explaining overbidding in first price auctions using controlled lotteries. Exp. Econ. 2003, 6, 123–140. [Google Scholar] [CrossRef]

- Neugebauer, T.; Selten, R. Individual behavior of first-price auctions: The importance of information feedback in computerized experimental markets. Game Econ. Behav. 2006, 54, 183–204. [Google Scholar] [CrossRef]

- Füllbrunn, S.; Neugebauer, T. Varying the number of bidders in the first-price sealed-bid auction: Experimental evidence for the one-shot game. Theor. Decis. 2013, 75, 421–447. [Google Scholar] [CrossRef] [Green Version]

- Kagel, J.H.; Levin, D. Behavior in multi-unit demand auctions: Experiments with uniform price and dynamic Vickrey auctions. Econometrica 2001, 69, 413–454. [Google Scholar] [CrossRef]

- Elbittar, A. Impact of valuation ranking information on bidding in first-price auctions: A laboratory study. J. Econ. Behav. Organ. 2009, 69, 75–85. [Google Scholar] [CrossRef]

- Kagel, J.H.; Levin, D. Independent private value auctions-bidder behavior in 1st-price, 2nd-price and 3rd-price auctions with varying numbers of bidders. Econ. J. 1993, 103, 868–879. [Google Scholar] [CrossRef]

- Goeree, J.K.; Holt, C.A.; Palfrey, T.R. Quantal response equilibrium and overbidding in private-value auctions. J. Econ. Theory 2002, 104, 247–272. [Google Scholar] [CrossRef]

- Güth, W.; Ivanova-Stenzel, R.; Wolfstetter, E. Bidding behavior in asymmetric auctions: An experimental study. Eur. Econ. Rev. 2005, 49, 1–27. [Google Scholar] [CrossRef]

- Filiz-Ozbay, E.; Ozbay, E.Y. Auctions with anticipated regret: Theory and experiment. Am. Econ. Rev. 2007, 97, 1407–1418. [Google Scholar] [CrossRef]

| 1 | This selection effect is related to but different from that in [16], where subjects have an initial endowment and those with financially poor decisions go bankrupt and are forced to leave the auction. Our selection is more directed. In each round, two bidders out of four win goods 1 and 2. They exit and cannot bid for good 3. |

| 2 | We thank an anonymous referee for highlighting this important point. |

| 3 | Indeed, since all bidders at period t decrease their bid by VFt+1 compared to a static auction and there is no reserve price, the winner’s payoff is increased by that amount and the losers’ payoff is also increased by that amount (the value of going to the next stage). |

| 4 | So, within each round, all three goods were allocated using the same mechanism (first- or second-price auction) but with different number of bidders (4, 3 or 2). |

| 5 | If the selected round implied a negative payoff for a subject, we did not ask that participant to pay money back. Limited liability may have had an impact on the behavior of some subjects, although we conjecture that a small one. |

| 6 | The two reasons for the low payment were excessively low conversion rate and significant overbidding. |

| 7 | Surprisingly, a large fraction of the most recent articles in this literature does not discuss efficiency. |

| 8 | Formally, if the highest valuation is x and the winner has valuation y, the efficiency is (y − 30)/(x − 30). This measure corrects for the fact that not all inefficiencies are equally severe. We thank an anonymous referee for suggesting it. |

| 9 | Design choices vary sharply regarding whether to allow bids above value. In many experiments those bids are prevented [19,20,21], discouraged by design [22,23,24] or presented as “wrong” during instructions [10,25,26]. In the rare cases in which bids above value are allowed and not framed any way, some are observed although fewer than in our paper [27,28,29]. |

| 10 | The excessive similarity between bids in F and S relative to the theoretical predictions will be a recurrent result of our analysis. It is particularly noticeable given our within-subject design, which typically exacerbates differences in behavior vía an experimenter demand effect. |

| 11 | We provide a detailed descriptive analysis of overbidding behavior in Appendix D2. |

| 12 | We tried also to cluster subjects in 2 or 3 groups, but the results were not as sharp and they did not lend to a clean test of our hypotheses. |

| 13 | This is not very different from what would occur if all subjects played the equilibrium strategies. Indeed, given our (endogenous) definition of clusters, we would statistically obtain 47% of LL, 10% of EE, 21% of EL and 21% of LE. |

| 14 | Indeed, if each subject sometimes overbids and sometimes not, whenever a subject overbids he will be more likely to win G1 or G2 and therefore be classified as an E. However, if that were the case, there would be no reason why that subject would also overbid consistently and significantly more than the other subjects also in G3. |

| 15 | What follows are the instructions in English. The Spanish version, the one that was used, is available upon request. The screenshots have not been translated. |

| Good | Allocation Efficiency | Surplus Efficiency | ||

|---|---|---|---|---|

| F | S | F | S | |

| G1 | 62.5 | 71.3 | 93.3 | 92.3 |

| G2 | 68.8 | 62.5 | 90.9 | 92.5 |

| G3 | 87.5 | 93.8 | 95.9 | 97.9 |

| Overall | 72.9 | 75.8 | 93.4 | 94.2 |

| Good | F | S | |

|---|---|---|---|

| G1 | Theory | 27.0 | 27.0 |

| Experiment | −0.9 | 10.7 | |

| Std. error * | 2.3 | 2.1 | |

| G2 | Theory | 25.0 | 25.0 |

| Experiment | −3.7 | 10.3 | |

| Std. error * | 2.3 | 1.7 | |

| G3 | Theory | 20.0 | 20.0 |

| Experiment | 1.8 | 23.8 | |

| Std. error * | 1.4 | 1.9 | |

| Indicators | F | ||

|---|---|---|---|

| G1 | G2 | G3 | |

| Mean bid over valuation | 11.98 | 15.50 | 10.87 |

| Median bid over valuation | 8.75 | 9.74 | 5.12 |

| Fraction of observations | 0.19 | 0.20 | 0.17 |

| F | S | ||||||

|---|---|---|---|---|---|---|---|

| G1 | G2 | G3 | G1 | G2 | G3 | ||

| SLOPE | Theory | 0.75 | 0.67 | 0.50 | 1.00 | 1.00 | 1.00 |

| Experiment | 0.93 * | 0.95 * | 0.92 * | 1.00 | 0.93 | 0.84 *† | |

| Std. Error | 0.04 | 0.06 | 0.05 | 0.05 | 0.04 | 0.05 | |

| INTERCEPT (at ) | Theory | 15.00 | 20.00 | 30.00 | 15.00 | 20.00 | 30.00 |

| Experiment | 25.95 * | 28.97 * | 29.11 | 30.60 * | 32.96 * | 35.91 | |

| Std. Error | 3.02 | 3.94 | 2.85 | 2.68 | 2.68 | 3.39 | |

| Variables | Bid in F | Bid in S | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Value | 0.93 *** | 0.92 *** | 0.93 *** | 0.99 *** |

| (0.03) | (0.05) | (0.03) | (0.045) | |

| Constant (at ) | 25.77 | 24.44 | 32.20 * | 29.66 |

| (2.29) | (3.32) | (1.72) | (2.83) | |

| G2 | 3.62 *** | 2.19 | 0.61 | 4.35 |

| (1.01) | (4.71) | (0.98) | (3.28) | |

| G3 | 3.03 ** | 2.93 | 0.72 | 9.78 * |

| (0.95) | (3.90) | (1.17) | (4.80) | |

| Value * G2 | --- | 0.02 | --- | −0.06 |

| --- | (0.08) | (0.05) | ||

| Value * G3 | --- | 0.001 | −0.14 | |

| --- | (0.06) | (0.08) | ||

| Order | --- | 3.10 | 1.98 | |

| (1.88) | (1.87) | |||

| # obs. | 720 | 720 | 720 | 720 |

| # clusters | 80 | 80 | 80 | 80 |

| Adj. R squared | 0.60 | 0.60 | 0.63 | 0.64 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Value | 0.93 *** | 0.96 *** | 0.95 *** |

| (0.02) | (0.03) | (0.04) | |

| Constant (at ) | 26.51 | 24.54 | 24.56 |

| (1.71) | (2.53) | (3.03) | |

| G2 | 2.11 ** | 3.44 | 3.45 |

| (0.75) | (3.28) | (3.28) | |

| G3 | 1.88 * | 6.71 * | 6.71 * |

| (0.82) | (3.26) | (3.24) | |

| Second | 5.05 *** | 5.09 *** | 4.99 * |

| (1.18) | (1.17) | (2.50) | |

| Value * G2 | −0.02 | −0.02 | |

| (0.06) | (0.06) | ||

| Value * G3 | −0.08 | −0.08 | |

| (0.05) | (0.05) | ||

| Order | 2.52 | 2.52 | |

| (1.46) | (1.46) | ||

| Value * Second | 0.002 | ||

| (0.04) | |||

| # obs. | 1440 | 1440 | 1440 |

| # clusters | 80 | 80 | 80 |

| Adj. R squared | 0.62 | 0.63 | 0.63 |

| Overbid in F | Overbid in S | Overbid | ||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Value | 0.26 *** | 0.17 *** | −0.06 *** | −0.01 | 0.08 *** | 0.08 *** |

| (0.03) | (0.05) | (0.03) | (0.05) | (0.02) | (0.03) | |

| Constant (at ) | 8.33 | 9.44 | 17.20 *** | 14.67 *** | 25.77 *** | 14.94 *** |

| (2.29) | (3.32) | (1.72) | (2.83) | (1.85) | (2.61) | |

| G2 | 1.19 | −5.30 | −4.39 *** | −0.64 | −1.84 * | −2.83 |

| (1.02) | (4.71) | (0.98) | (3.28) | (0.76) | (3.36) | |

| G3 | −4.39 *** | −19.56 *** | −14.28 *** | −5.22 | −9.62 *** | −10.11 ** |

| (0.97) | (3.90) | (1.17) | (4.80) | (0.84) | (3.34) | |

| Second | --- | --- | --- | --- | −5.09 *** | −5.10 *** |

| (1.22) | (1.21) | |||||

| Value * G2 | 0.10 | −0.06 | 0.02 | |||

| (0.07) | (0.05) | (0.06) | ||||

| Value * G3 | 0.25 *** | −0.14 | 0.01 | |||

| (0.06) | (0.08) | (0.05) | ||||

| Order | 3.09 | 1.98 | 2.28 | |||

| (1.88) | (1.87) | (1.46) | ||||

| # obs. | 720 | 720 | 720 | 720 | 1440 | 1440 |

| # clusters | 80 | 80 | 80 | 80 | 80 | 80 |

| Adj. R squared | 0.12 | 0.14 | 0.16 | 0.17 | 0.11 | 0.11 |

| Good | Overbid (Empirical–Nash) | |||||||

|---|---|---|---|---|---|---|---|---|

| EE | EL | LE | LL | |||||

| F | S | F | S | F | S | F | S | |

| G1 | 29.8 | 26.6 | 15.7 | 6.9 | 13.2 | 19.0 | 14.6 | 14.1 |

| G2 | 31.9 | 15.7 | 20.7 | 5.5 | 10.9 | 14.6 | 16.0 | 10.9 |

| G3 | 24.4 | 14.8 | 18.9 | −3.8 | 9.7 | 5.4 | 11.0 | 1.2 |

| Avg. | 30.0 | 21.7 | 17.6 | 3.5 | 11.5 | 15.9 | 14.2 | 9.7 |

| Winner Theory | Winner in Experiment | |||||||

|---|---|---|---|---|---|---|---|---|

| F | Same | Other | %Eff | S | Same | Other | %Eff | |

| LL + LE | G1 | 27 | 29 | 48% | G1 | 35 | 19 | 65% |

| EE + EL | 23 | 1 | 96% | 22 | 4 | 85% | ||

| LL + LE | G2 | 31 | 21 | 60% | G2 | 23 | 27 | 46% |

| EE + EL | 24 | 4 | 86% | 27 | 3 | 90% | ||

| LL + LE | G3 | 61 | 8 | 88% | G3 | 63 | 4 | 94% |

| EE + EL | 9 | 2 | 82% | 12 | 1 | 92% | ||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Otamendi, F.J.; Brocas, I.; Carrillo, J.D. Sequential Auctions with Capacity Constraints: An Experimental Investigation. Games 2018, 9, 15. https://doi.org/10.3390/g9010015

Otamendi FJ, Brocas I, Carrillo JD. Sequential Auctions with Capacity Constraints: An Experimental Investigation. Games. 2018; 9(1):15. https://doi.org/10.3390/g9010015

Chicago/Turabian StyleOtamendi, F. Javier, Isabelle Brocas, and Juan D. Carrillo. 2018. "Sequential Auctions with Capacity Constraints: An Experimental Investigation" Games 9, no. 1: 15. https://doi.org/10.3390/g9010015