Simulation and Regulation of Market Operation in Hydro-Dominated Environment: The Yunnan Case

Abstract

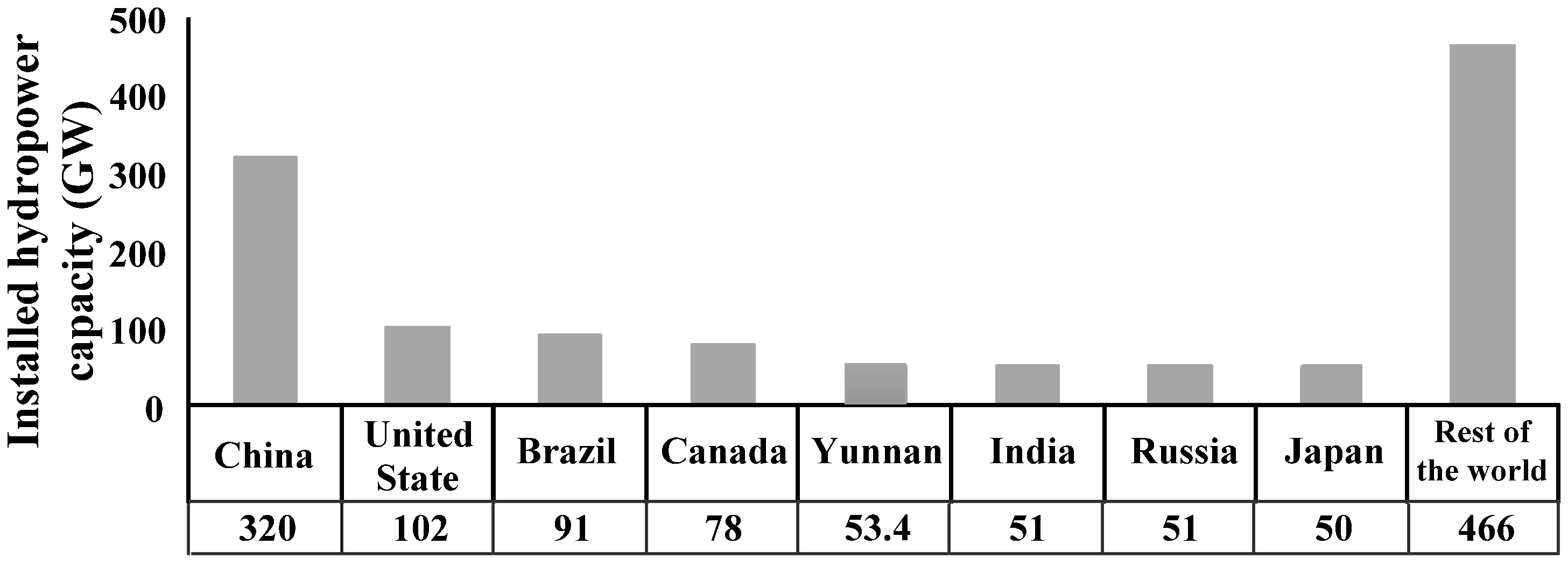

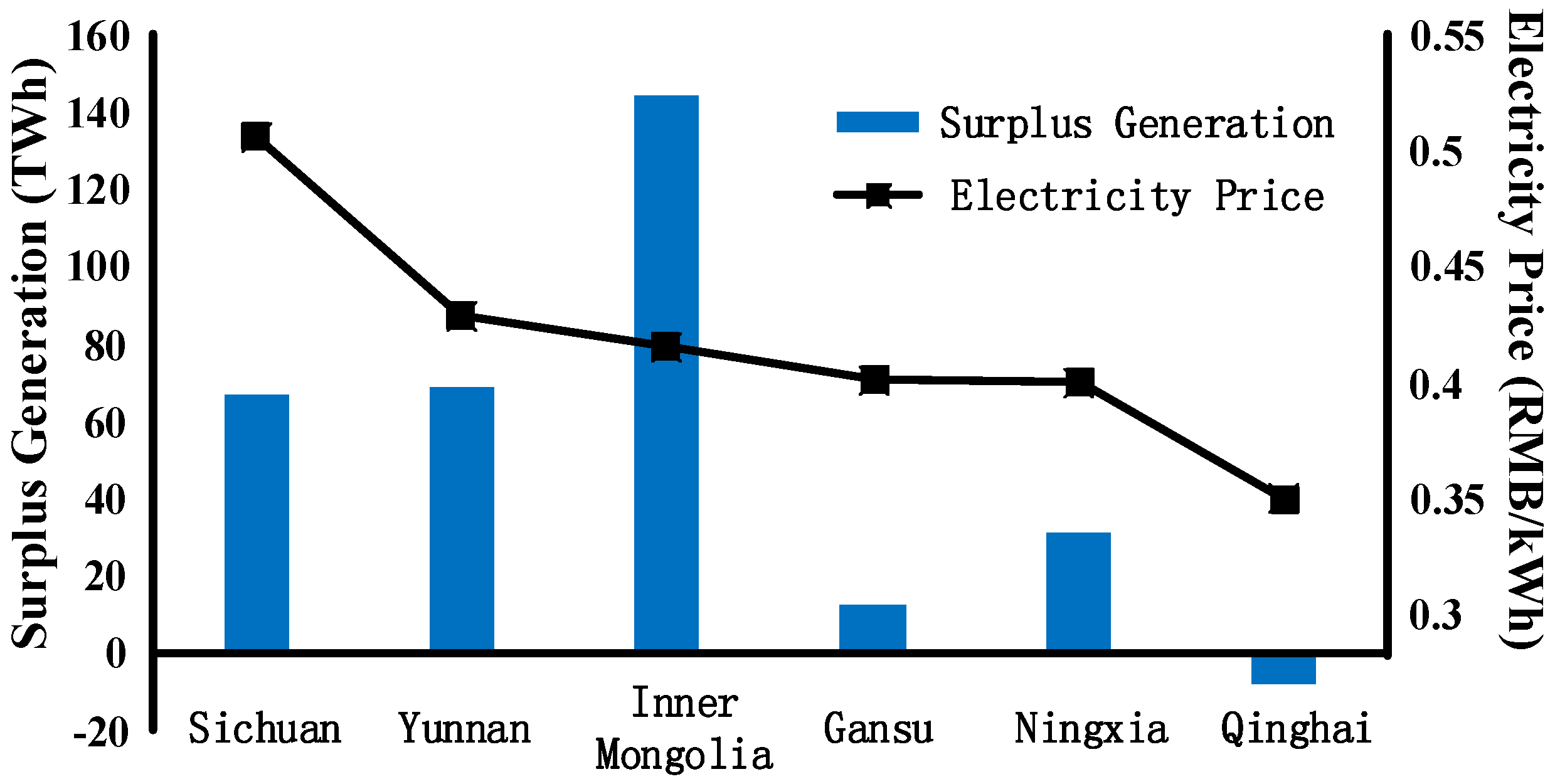

:1. Introduction

2. Indicator of Market Operation Situation

2.1. Market Price Indicator of Market Operation Situation (MPI)

2.2. Electricity Consumption Indicator of Market Operation Situation (ECI)

2.3. Comprehensive Indicator of Market Operation Situation (CI)

3. Mathematical Model

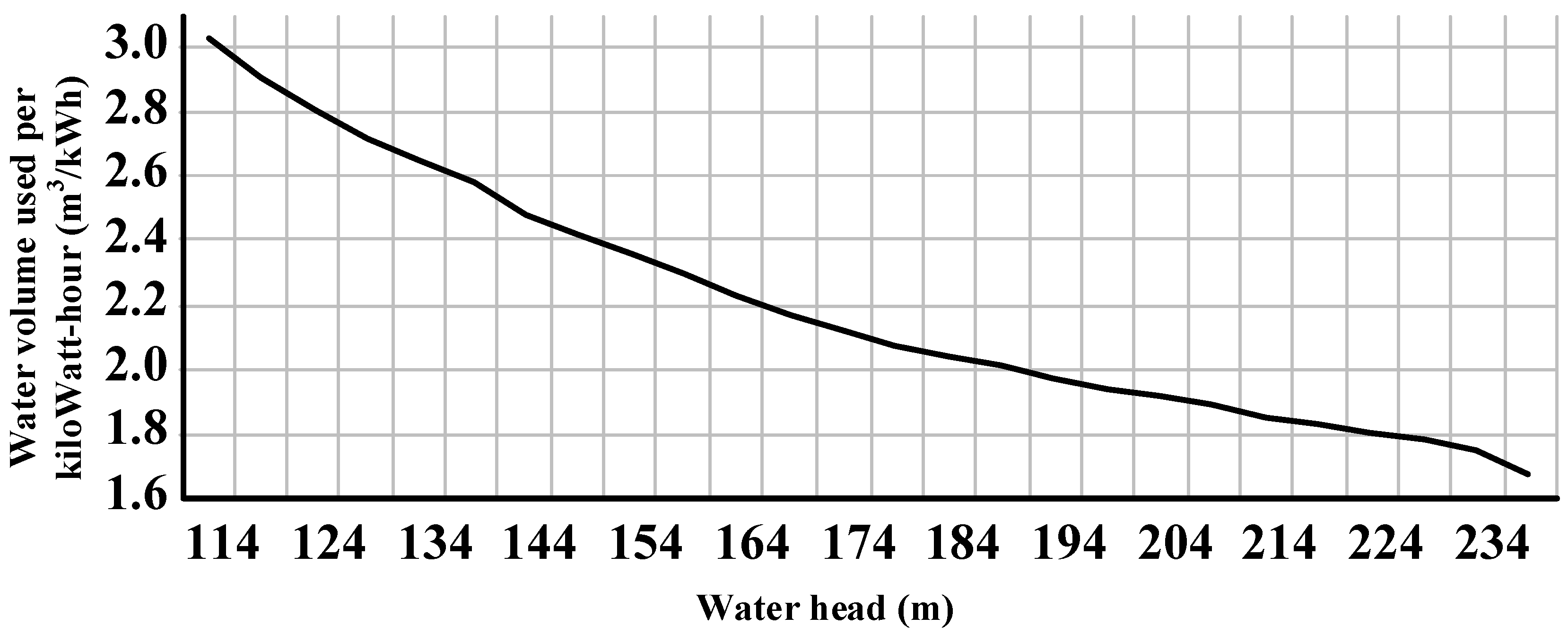

3.1. Giant Cascaded Hydropower Stations

- Mass conservation equation:where (m3) represents the initial storage of hydropower station i at period t; (m3/s) represents the inflow of the hydropower station; and (m3/s) represents the spill discharge of hydropower station i at period t.

- Final reservoir storage constraint:where (m3) represents the reservoir storage at the end of multiple periods of hydropower station i, and it is fixed at (m3), which is determined by the dispatching center of the system operator, considering the non-market functions of the hydropower station such as flood control, irrigation, and navigation. Therefore, the future value of the reservoir storage can be ignored.

- Maximum and minimum turbine discharge constraint:where (m3/s) and (m3/s) represent the maximum and minimum turbine discharge of hydropower station I, respectively. The relationships between , , and net head are neglected in this study.

- Minimum and maximum power output constraint:where (MW) represents the power output by hydropower station i at time period t and (MW) and (MW) represent the minimum and maximum power outputs by hydropower station i, respectively.

- Lower and upper reservoir storage constraint:where (m3) and (m3) represent the lower and upper bounds of the initial reservoir storage of hydropower station i, respectively.

- Minimum and maximum release constraint:where (m3/s) represents the water release of hydropower station i at period t; consists of the generating discharge and the spillage discharge ; and (m3/s) and (m3/s) represent the minimum and maximum releases of hydropower station i, respectively.

- Minimum bilateral contract constraint:where (kWh) represents the bilateral contract assigned to hydropower station i at period t. The generation of hydropower station i at period t must be no less than , which is determined by policy makers.

3.2. Thermal Power Stations

- Number of online units:where represents the number of online units of thermal power station g at period t and and represent the minimum and maximum online units of thermal power station g, respectively.

- Online unit peak and valley minimum duration time:where (h) and (h) represent the time duration at the eth peak and the valley period of thermal power station g, respectively, and (h) and (h) represent the minimum time duration of the online units in the peak and valley periods, respectively.

- Minimum bilateral contract constraint:where (kWh) represents the bilateral contract assigned to thermal power station g at period t. The generation of thermal power station g at period t must be no less than , which is determined by policy makers.

3.3. Power Exchange Policy Makers

4. Solution Methodology

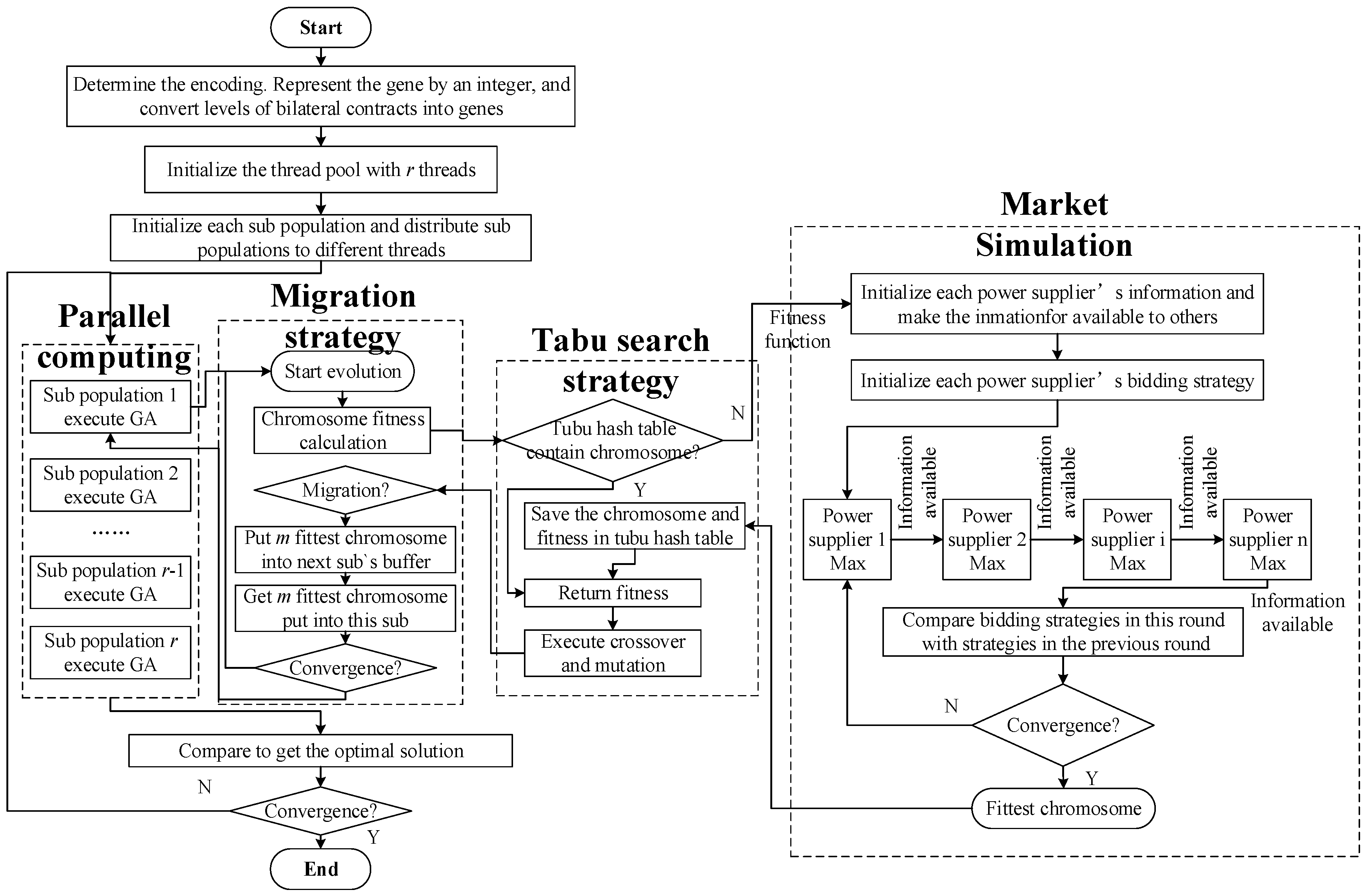

4.1. Market Simulation and Market Equilibrium State

4.2. Multi-Core Parallel Tabu Genetic Algorithm (MPTGA)

5. Case Study

5.1. Case Study Background

5.2. CI Coefficient Analysis and Selection

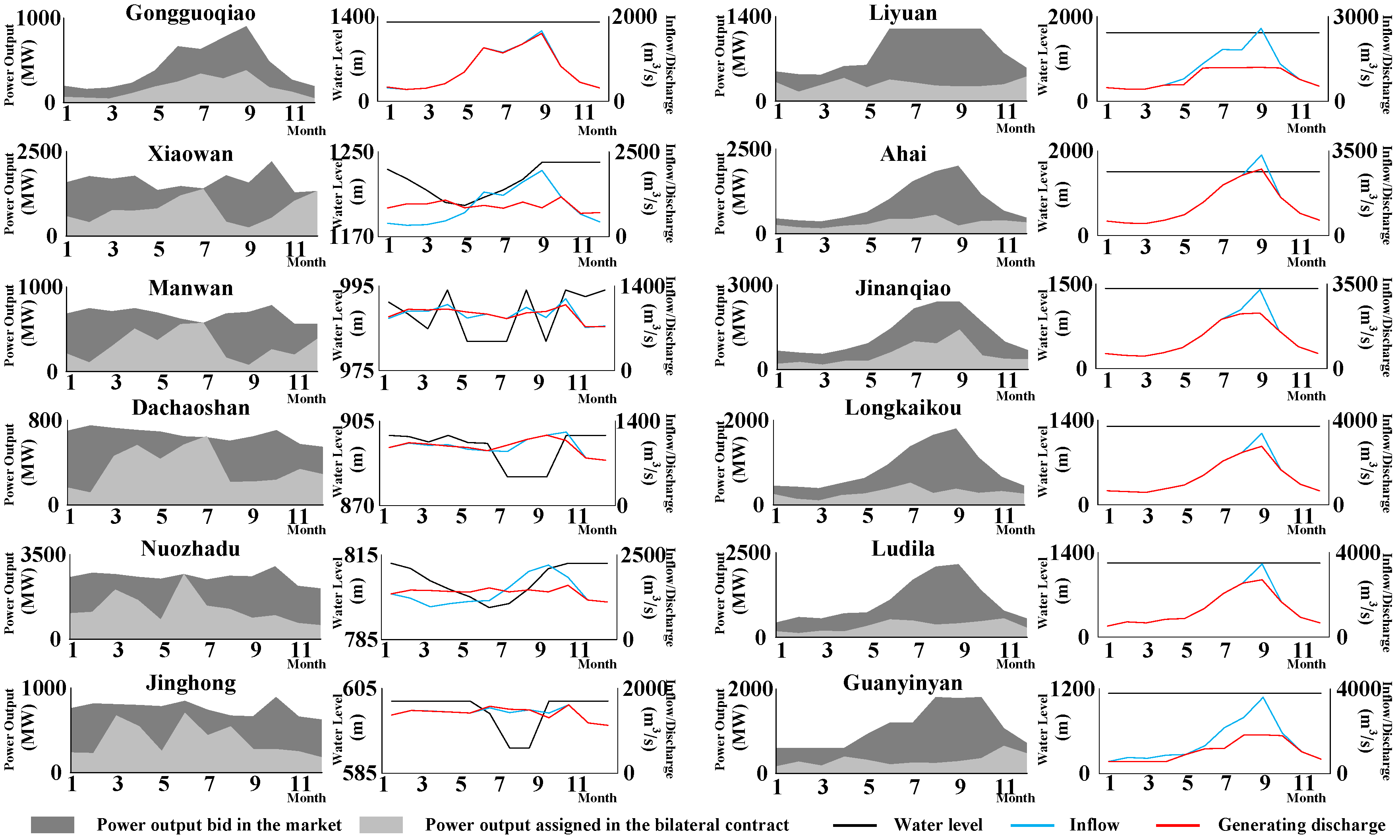

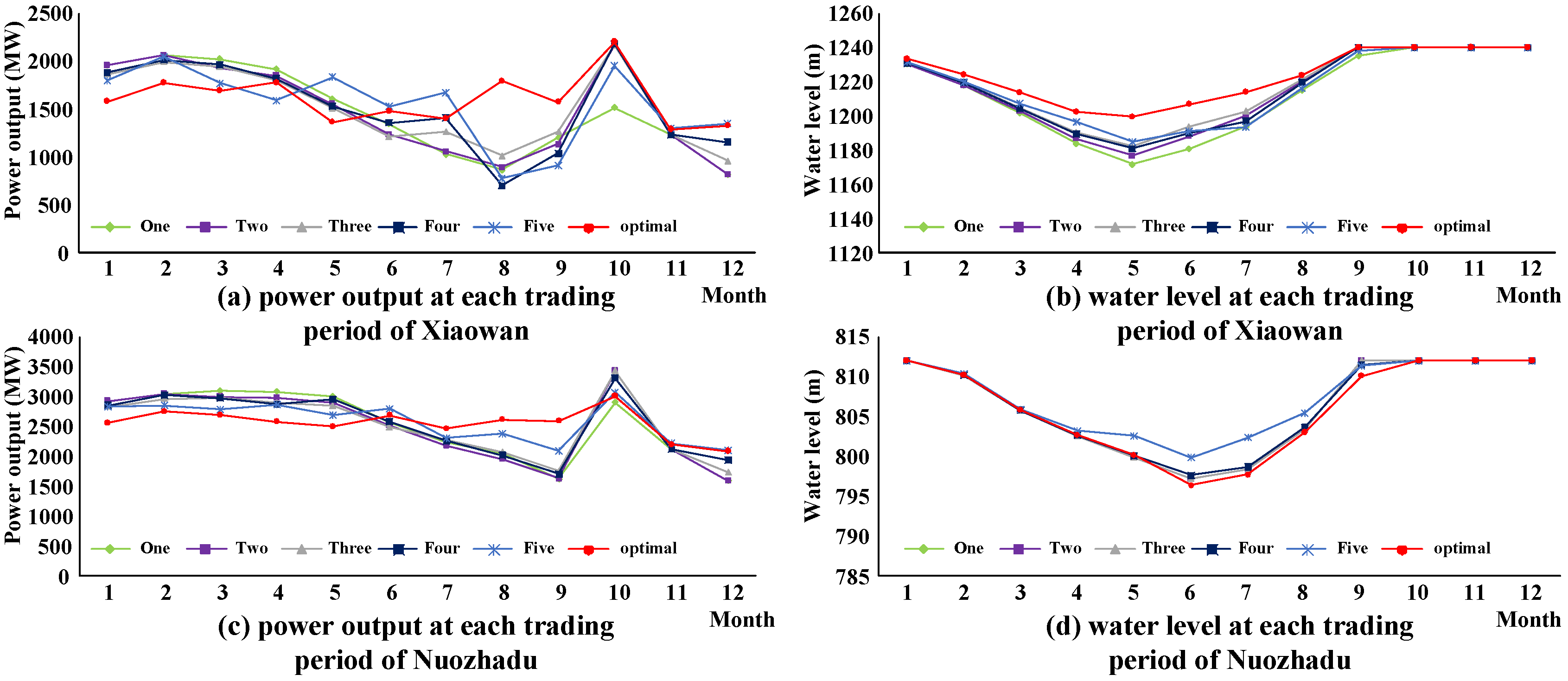

5.3. Market Simulation and Regulation

5.4. Effects of MPTGA

6. Conclusions

- (1)

- The proposed comprehensive indicator composed of the market price and the electricity consumption is an effective method to evaluate the market operation situation. Different coefficients of the comprehensive indicator used by policy makers could result in different situations of market operation.

- (2)

- The optimal level of bilateral contracts derived from the proposed model proves it to be an effective measure to achieve optimal market regulation in hydro-dominated electricity markets since the proposed method takes full consideration of energy shifting abilities and the temporal and spatial couplings of the giant cascaded hydropower stations.

- (3)

- The proposed MPTGA based solution methodology could substantially promote an efficient solution and reduce the computational time in comparison to MPGA.

- (4)

- The proposed integrated method could be used in other similar hydro-dominated environments in their early stages with regulated power suppliers, with some minor modifications according to different practical situations.

- (5)

- This study focuses on the monthly operation of cascaded hydropower stations instead of the weekly or daily operation because the Yunnan electricity market is a monthly transaction market at the present stage. Future studies will focus on weekly or daily simulation and the regulation of market operation in hydro-dominated environments as the transaction time scale changes.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Hennig, T.; Wang, W.; Magee, D.; He, D. Yunnan’s Fast-paced large hydropower development: A powershed-based approach to critically assessing generation and consumption paradigms. Water. 2016, 8, 476. [Google Scholar] [CrossRef]

- Uria-Martinez, R.; O’Connor, P.; Johnson, M.M. 2014 Hydropower Market Report; Oak Ridge National Laboratory: Oak Ridge, TN, USA, 2015.

- Cheng, C.; Yan, L.; Mirchi, A.; Madani, K. China’s booming hydropower: systems modeling challenges and opportunities. J. Water Resour. Plan. Manag. 2016, 143, 02516002. [Google Scholar] [CrossRef]

- Hong, L.; Zhou, N.; Fridley, D.; Raczkowski, C. Assessment of China’s renewable energy contribution during the 12th Five Year Plan. Energy Policy 2013, 62, 1533–1543. [Google Scholar] [CrossRef]

- Rangel, LF. Competition policy and regulation in hydro-dominated electricity markets. Energy Policy 2008, 36, 1292–1302. [Google Scholar] [CrossRef]

- Scott, T.; Read, E. Modelling hydro reservoir operation in a deregulated electricity market. Int. Trans. Oper. Res. 1996, 3, 243–253. [Google Scholar] [CrossRef]

- Ramos, A.; Ventosa, M.; Rivier, M. Modeling competition in electric energy markets by equilibrium constraints. Util. Policy 1999, 7, 233–242. [Google Scholar] [CrossRef]

- Kelman, R.; Barroso, L.; Pereira, M. Market power assessment and mitigation in hydrothermal systems. IEEE Trans Power Syst. 2001, 16, 354–359. [Google Scholar] [CrossRef]

- Baslis, C.; Bakirtzis, A. Mid-term stochastic scheduling of a pricemaker hydro producer with pumped storage. IEEE Trans. Power Syst. 2011, 26, 1856–1865. [Google Scholar] [CrossRef]

- Pousinho, H.M.I.; Contreras, J.; Catalao, J. Operations planning of a hydro producer acting as a price-maker in an electricity market. In Proceedings of the IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012; pp. 1–7. [Google Scholar]

- Flatabo, N.; Doorman, G.; Grande, O.S.; Randen, H.; Wangensteen, I. Experience with the Nord Pool design and implementation. IEEE Trans. Power Syst. 2003, 18, 541–547. [Google Scholar] [CrossRef]

- Wolak, F.A. Market design and price behavior in restructured electricity markets: An international comparison. Top. Regul. Econ. Policy 2000, 36, 79–137. [Google Scholar]

- Villar, J.; Rudnick, H. Hydrothermal market simulator using game theory: Assessment of market power. IEEE Trans. Power Syst. 2003, 18, 91–98. [Google Scholar] [CrossRef]

- Sweetser, A. Measuring a dominant firm’s market power in a restructured electricity market, a case study of Colorado. Util. Policy 1999, 7, 243–257. [Google Scholar] [CrossRef]

- Li, G.; Shi, J.; Qu, X. Modeling methods for GenCo bidding strategy optimization in the liberalized electricity spot market—A state-of-the-art review. Energy 2011, 36, 4686–4700. [Google Scholar] [CrossRef]

- Borenstein, S.; Bushnell, J.; Knittel, C.R. Market power in electricity markets: Beyond concentration measures. Energy J. 1999, 20, 65–88. [Google Scholar] [CrossRef]

- Gaudard, L.; Gabbi, J.; Bauder, A.; Romerio, F. Long-term uncertainty of hydropower revenue due to climate change and electricity prices. Water Resour. Manag. 2016, 30, 1325. [Google Scholar] [CrossRef]

- Ortner, A.; Graf, C. Multi-market unit-commitment and capacity reserve prices in systems with a large share of hydro power: A case study. In Proceedings of the 2013 10th International Conference on the European Energy Market (EEM), Stockholm, Sweden, 27–31 May 2013; pp. 1–8. [Google Scholar]

- Chazarra, M.; Pérez-Díaz, J.I.; García-González, J. Optimal energy and reserve scheduling of pumped-storage power plants considering hydraulic short-circuit operation. IEEE Trans. Power Syst. 2017, 32, 344–353. [Google Scholar] [CrossRef]

- Carpentier, D.; Haas, J.; Olivares, M.; de la Fuente, A. Modeling the multi-seasonal link between the hydrodynamics of a reservoir and its hydropower plant operation. Water 2017, 9, 367. [Google Scholar] [CrossRef]

- Wu, X.; Cheng, C.; Wang, J.; Tang, H.; Li, C. Long term hydropower optimal operation model with electric power transmission restrictions for absorbed energy Maximization. Proc. CSEE 2011, 31, 8–16. [Google Scholar]

- Cheng, C.; Chen, F.; Li, G.; Tu, Q. Market equilibrium and impact of market mechanism parameters on the electricity price in yunnan’s electricity market. Energies 2016, 9, 463. [Google Scholar] [CrossRef]

- Weber, J.D.; Overbye, T.J. A two-level optimization problem for analysis of market bidding strategies. Power Eng. Soc. Summer Meet. 1999, 2, 682–687. [Google Scholar]

- Wang, J.; Liao, S.; Cheng, C.; Cai, H. Optimization of medium-term thermal power boot based on hybrid search algorithm. Proc. CSEE 2011, 31, 94–100. [Google Scholar]

- Shafie-khah, M.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K. Ex-ante evaluation and optimal mitigation of market power in electricity markets including renewable energy resources. IET Gener. Transm. Distrib. 2016, 10, 1842–1852. [Google Scholar] [CrossRef]

- Liu, B.; Liao, S.; Cheng, C.; Wu, X. A multi-core parallel genetic algorithm for the long-term optimal operation of large-scale hydropower systems. In Proceedings of the World Environmental & Water Resources Congress 2016, West Palm Beach, FL, USA, 22–26 May 2016. [Google Scholar]

- Cheng, C.; Wang, W.; Xu, D.; Chau, K.W. Optimizing hydropower reservoir operation using hybrid genetic algorithm and chaos. Water Resour. Manag. 2008, 22, 895–909. [Google Scholar] [CrossRef]

- Cheng, C.; Wang, S.; Chau, K.; Wu, X. Parallel discrete differential dynamic programming for multireservoir operation. Environ. Model. Softw. 2014, 57, 152–164. [Google Scholar] [CrossRef]

- Zhang, X.; Beeson, P.; Link, R.; Manowitz, D.; Izaurralde, R.C.; Sadeghi, A.; Thomson, A.M.; Sahajpal, R.; Srinivasan, R.; Arnold, J.G. Efficient multi-objective calibration of a computationally intensive hydrologic model with parallel computing software in Python. Environ. Model. Softw. 2013, 46, 208–218. [Google Scholar] [CrossRef]

| Hydropower Plant | Power Supplier | Regulation Ability | Installed Capacity | Normal High Water Level (m) | Dead Water Level (m) | Regulating Storage (108 m3) |

|---|---|---|---|---|---|---|

| Gongguoqiao | LR | Daily | 225 MW 4 | 1307 | 1303 | 0.49 |

| Xiaowan | LR | Annual | 700 MW 6 | 1240 | 1166 | 98.77 |

| Manwan | LR | Seasonal | 300 MW + 250 MW 5 + 120 MW | 994 | 982 | 2.57 |

| Dachaoshan | LR | Annual | 225 MW 6 | 899 | 882 | 3.7 |

| Nuozhadu | LR | Plurennial | 650 MW 9 | 812 | 760 | 122.24 |

| Jinghong | LR | Seasonal | 350 MW 5 | 602 | 591 | 3.09 |

| Liyuan | JR | Weekly | 600 MW 4 | 1618 | 1605 | 1.74 |

| Ahai | JR | Daily | 400 MW 5 | 1504 | 1492 | 2.38 |

| Jinanqiao | JR | Daily | 600 MW 4 | 1418 | 1398 | 3.46 |

| Longkaikou | JR | Daily | 360 MW 5 | 1298 | 1289 | 1.26 |

| Ludila | JR | Weekly | 360 MW 6 | 1223 | 1205 | 8.56 |

| Guanyinyan | JR | Weekly | 600 MW 5 | 1134 | 1122 | 5.5 |

| Xuanwei | CGC | - | 300 MW 6 | - | - | - |

| Yangzonghai | CGC | - | 200 MW 2 + 300 MW 2 | - | - | - |

| Xiaolongtan | CGC | - | 300 MW 2 | - | - | - |

| Scenario | Description |

|---|---|

| One | 30% of each station’s average generation capacity over the same period in history |

| Two | 40% of each station’s average generation capacity over the same period in history |

| Three | 50% of each station’s average generation capacity over the same period in history |

| Four | 60% of each station’s average generation capacity over the same period in history |

| Five | 70% of each station’s average generation capacity over the same period in history |

| Optimal | Optimal level of bilateral contracts derived from the proposed method |

| Scenario | EP of LR (TWh) | EP of JR (TWh) | EP of CGC (TWh) | Profit of LR (108 RMB) | Profit of JR (108 RMB) | Profit of CGC (108 RMB) | AMCP (RMB/MWh) | CI |

|---|---|---|---|---|---|---|---|---|

| One | 57.06 | 52.89 | 4.22 | 147.35 | 136.58 | 10.25 | 258.24 | 0.03 |

| Two | 57.08 | 52.89 | 4.22 | 146.59 | 135.83 | 10.21 | 256.81 | 0.05 |

| Three | 57.35 | 52.89 | 4.22 | 146.24 | 134.87 | 10.13 | 255.00 | 0.11 |

| Four | 57.91 | 52.89 | 4.22 | 147.79 | 134.98 | 10.13 | 255.21 | 0.18 |

| Five | 58.31 | 52.89 | 4.22 | 147.14 | 133.46 | 10.00 | 252.34 | 0.27 |

| Optimal | 58.65 | 52.89 | 4.22 | 142.77 | 128.74 | 9.62 | 243.42 | 0.41 |

| Method | Indice | Serial | 2-Core | 4-Core |

|---|---|---|---|---|

| MPGA | Computation time (s) | 313,125 | 158,947 | 81,331 |

| Speedup | 1 | 1.97 | 3.85 | |

| Efficiency | 1 | 0.99 | 0.96 | |

| MPTGA | Computation time (s) | 160,285 | 80,952 | 40,994 |

| Speedup | 1 | 1.98 | 3.91 | |

| Efficiency | 1 | 0.99 | 0.98 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, F.; Liu, B.; Cheng, C.; Mirchi, A. Simulation and Regulation of Market Operation in Hydro-Dominated Environment: The Yunnan Case. Water 2017, 9, 623. https://doi.org/10.3390/w9080623

Chen F, Liu B, Cheng C, Mirchi A. Simulation and Regulation of Market Operation in Hydro-Dominated Environment: The Yunnan Case. Water. 2017; 9(8):623. https://doi.org/10.3390/w9080623

Chicago/Turabian StyleChen, Fu, Benxi Liu, Chuntian Cheng, and Ali Mirchi. 2017. "Simulation and Regulation of Market Operation in Hydro-Dominated Environment: The Yunnan Case" Water 9, no. 8: 623. https://doi.org/10.3390/w9080623