Suitability of a Consensual Fuzzy Inference System to Evaluate Suppliers of Strategic Products

Abstract

:1. Introduction

2. Literature Review

2.1. Terminology Matters

2.2. Main Methodologies and Factors Used in SSE Models

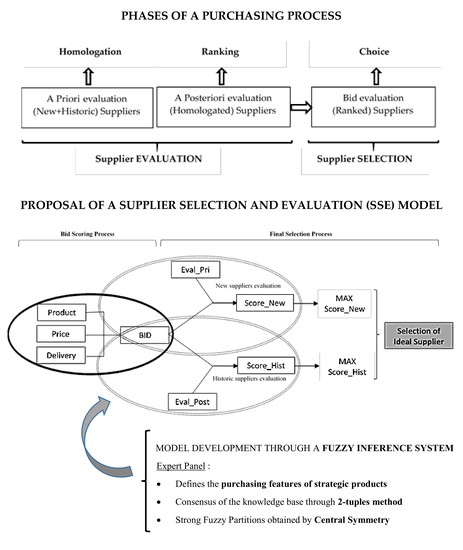

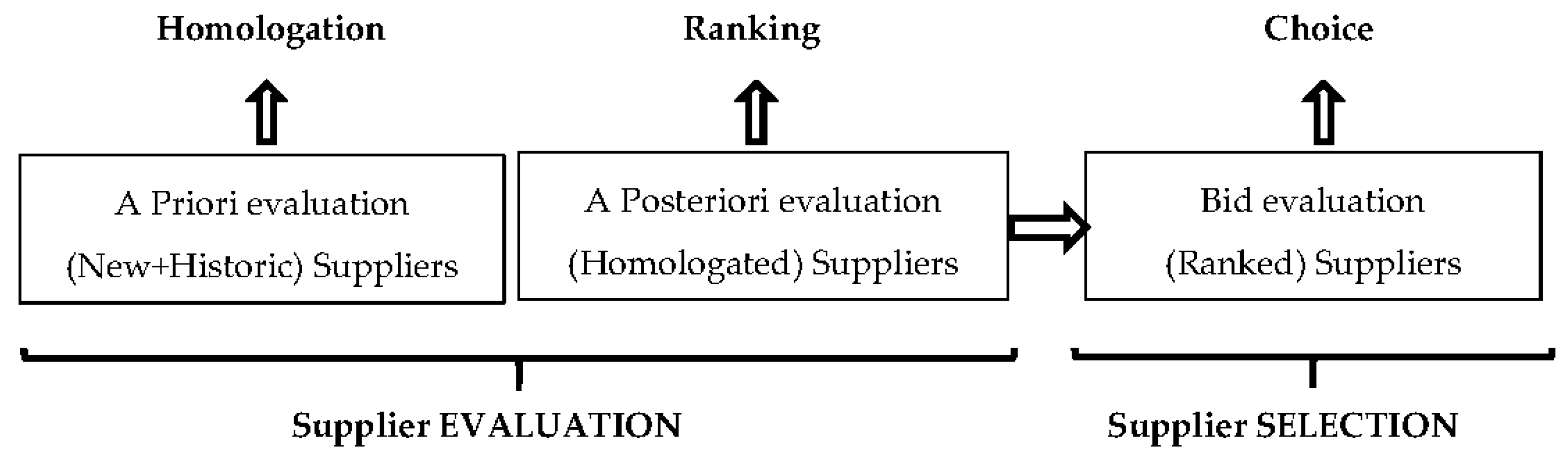

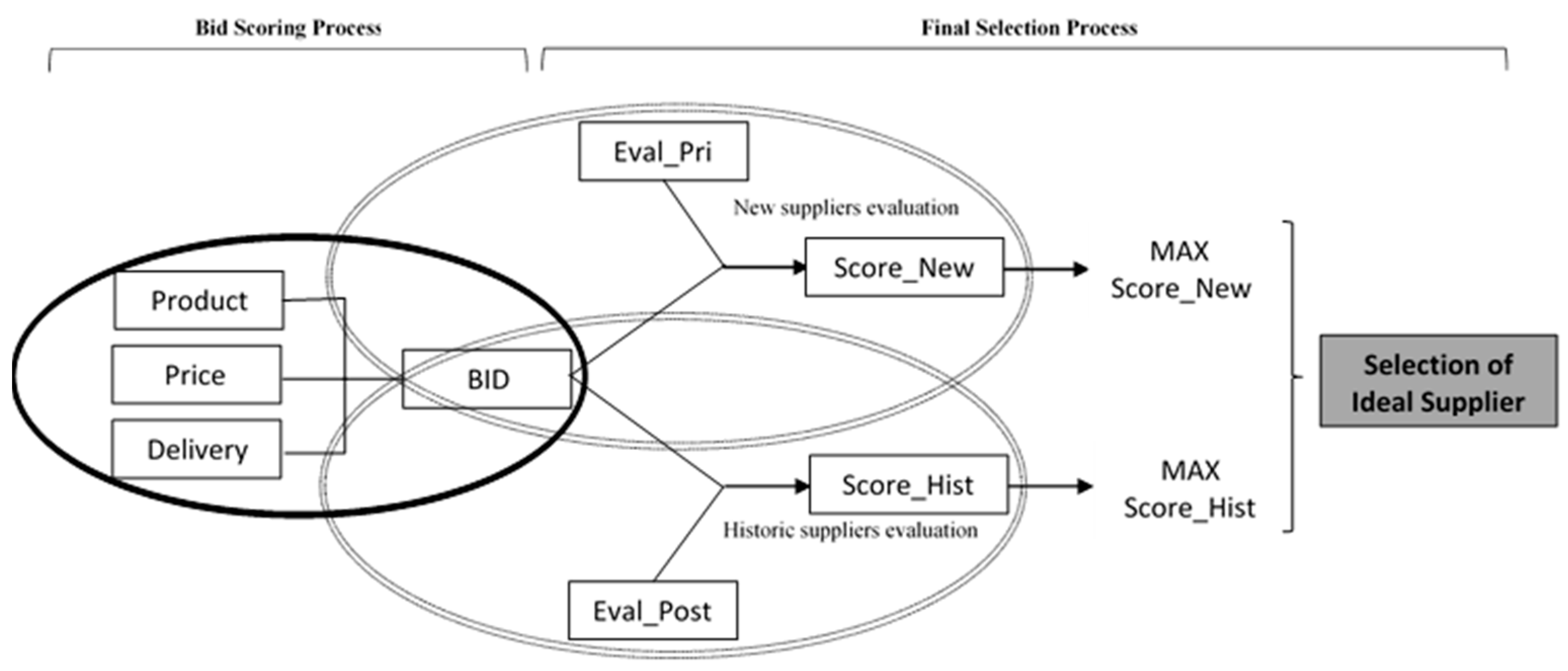

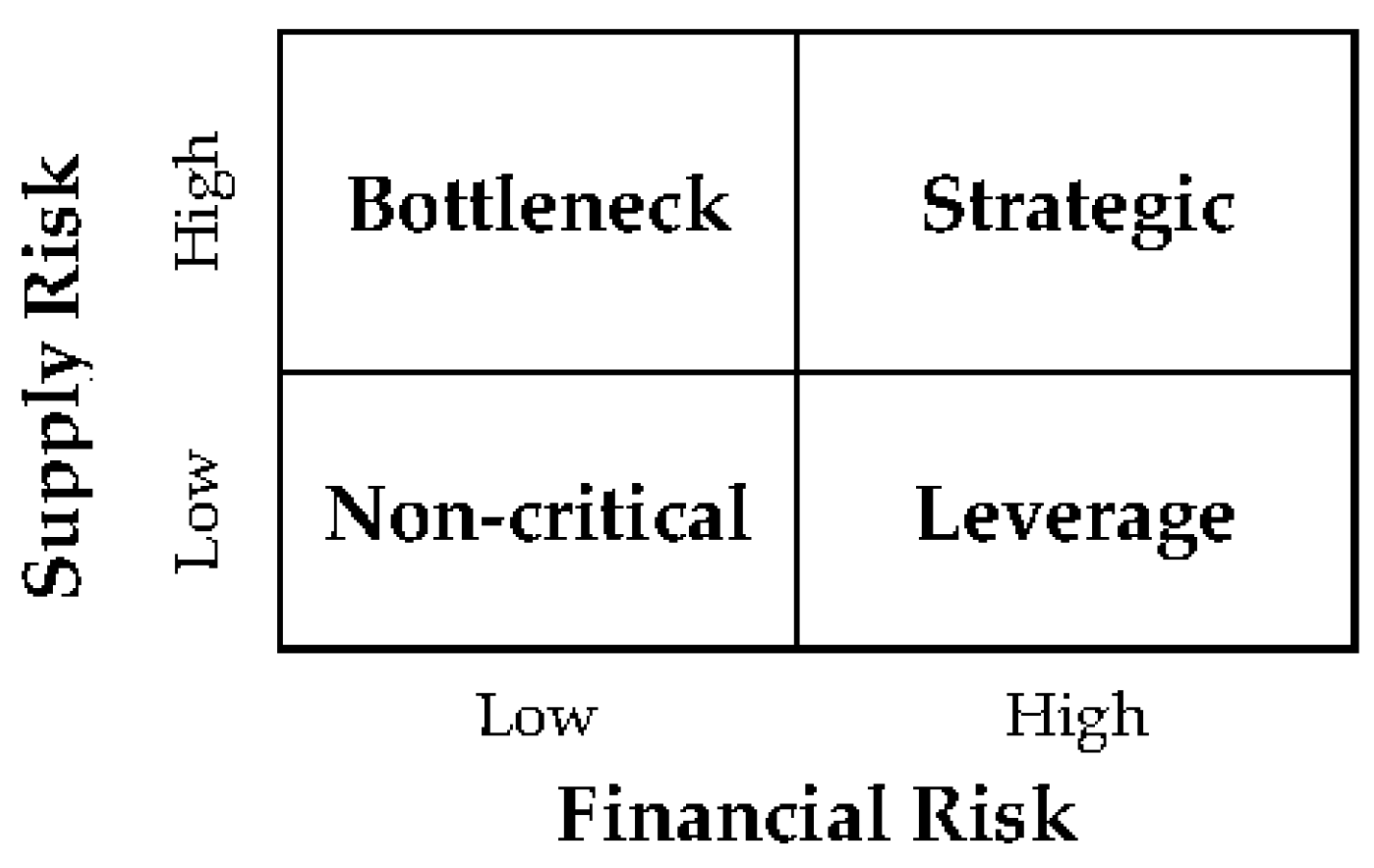

3. Supplier Evaluation Model for Strategic Products Purchasing

Knowledge about Strategic Product Bid Evaluation

4. Inference Methods Applied in the Evaluation Model

4.1. Factor Weighting Method

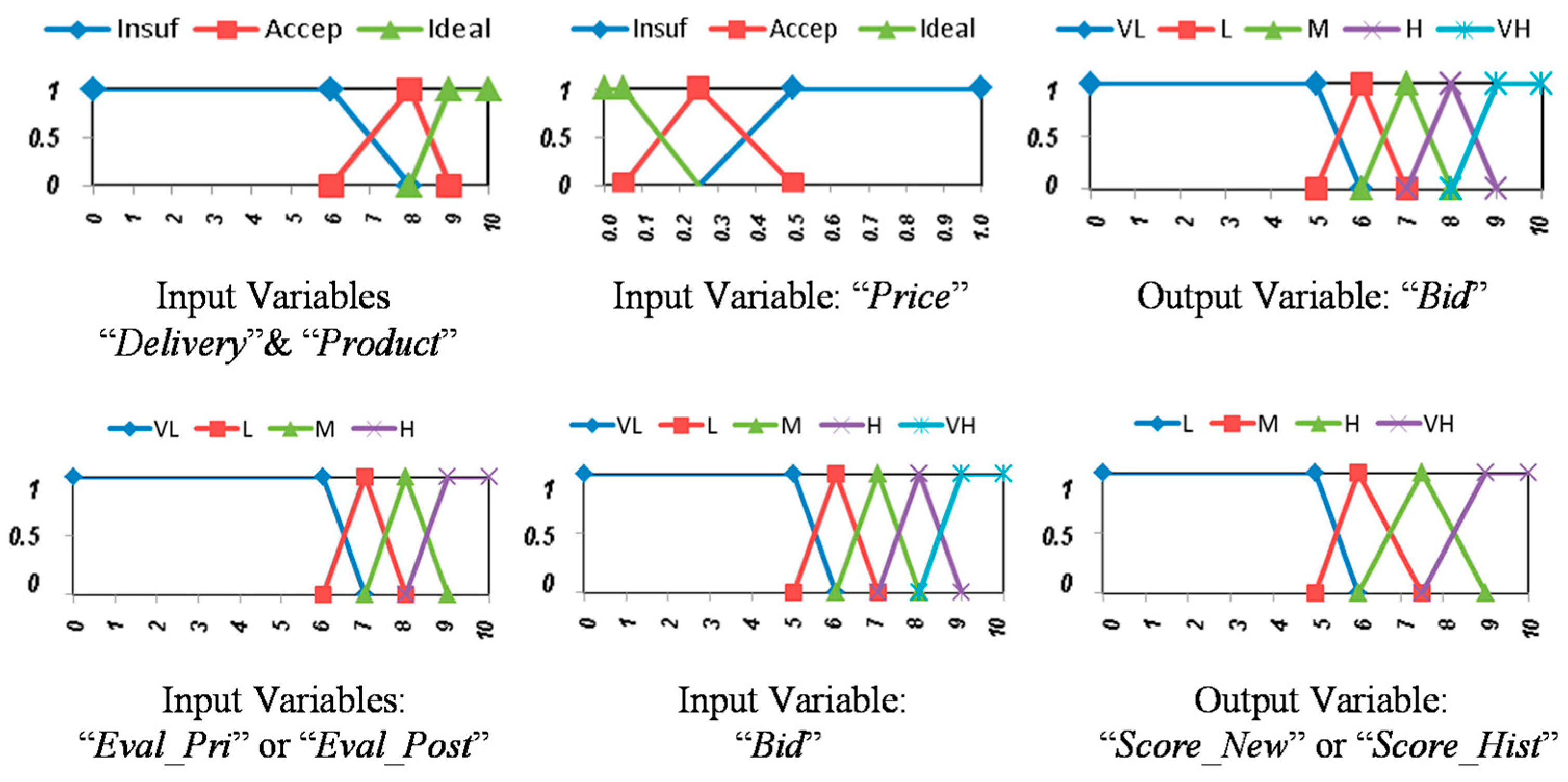

4.2. Fuzzy Inference System (FIS)

4.2.1. Variables Domain Partitioning Using 2-Tuplas and Central Symmetry

- (i)

- Definition of an ordered set {Si} of linguistic labels of preference (see Table 5).

- (ii)

- (iii)

- Preference assessment {Si} from the experts for each proposed structure (see Table 6).

- (iv)

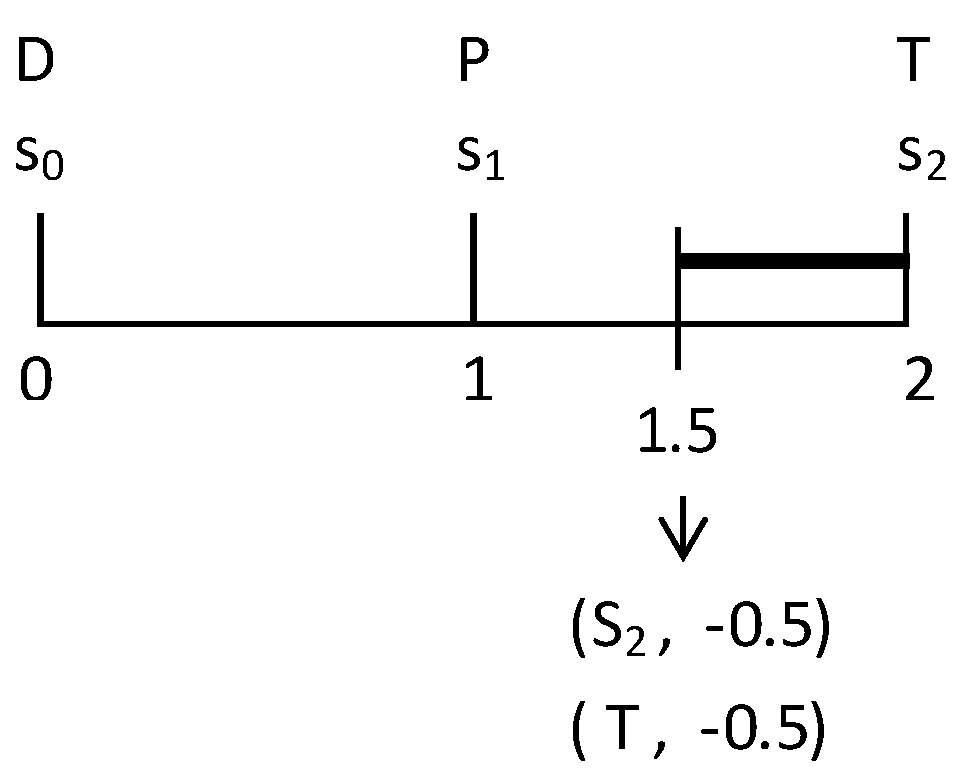

- In each structure, aggregate all the expert estimations (e.g., through the “Extended Arithmetic Mean (EAM)”, taking as values the order of labels in the scale {Si} [87]. Example: EAM (Struc_1) = (0 × 0 + 1 × 2 + 2 × 2)/4 = 1.5).

- (v)

- By means of a symbolic translation process based on the interval [−0.5, 0.5), development of the 2-tuples related to each structure (each 2-tuple should identify the original preference label nearest to the calculated EAM and its closeness (to left or right) See Figure 5.

- (vi)

- After identifying two-tuples of all structures, the one representing the highest preference according to their lexicographic order will be chosen as optimal (in this case, “Struc_1”).

- (vii)

- To obtain the cores of the internal fuzzy labels, an agreement should be reached on the value given by the experts, e.g., through modal value (mode). In this case, after revealing the cores of the external fuzzy labels, the following mode values were obtained: Low (L = 6), Medium (M = 7) and High (H = 8).

4.2.2. Knowledge Elicitation for Rule Bases

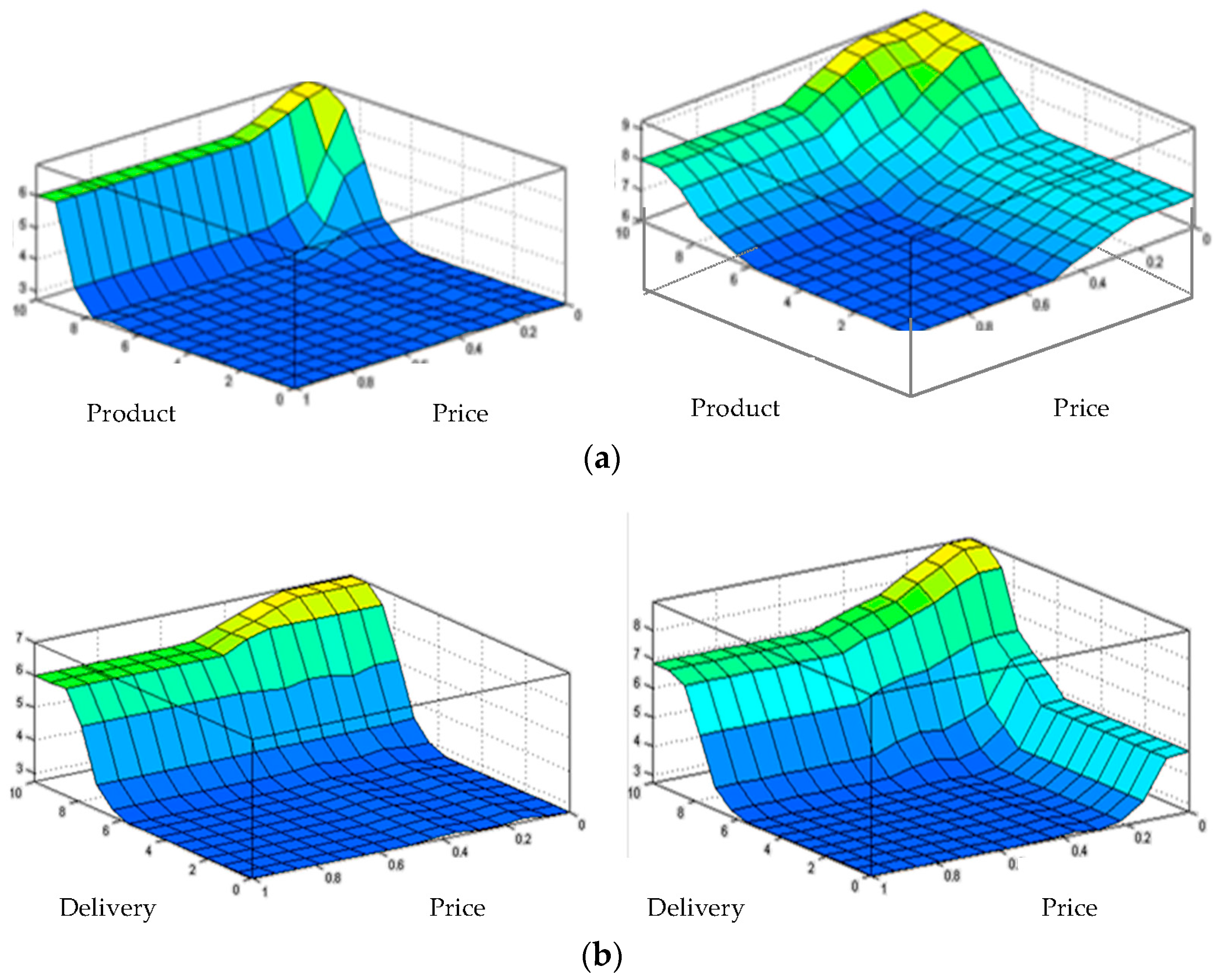

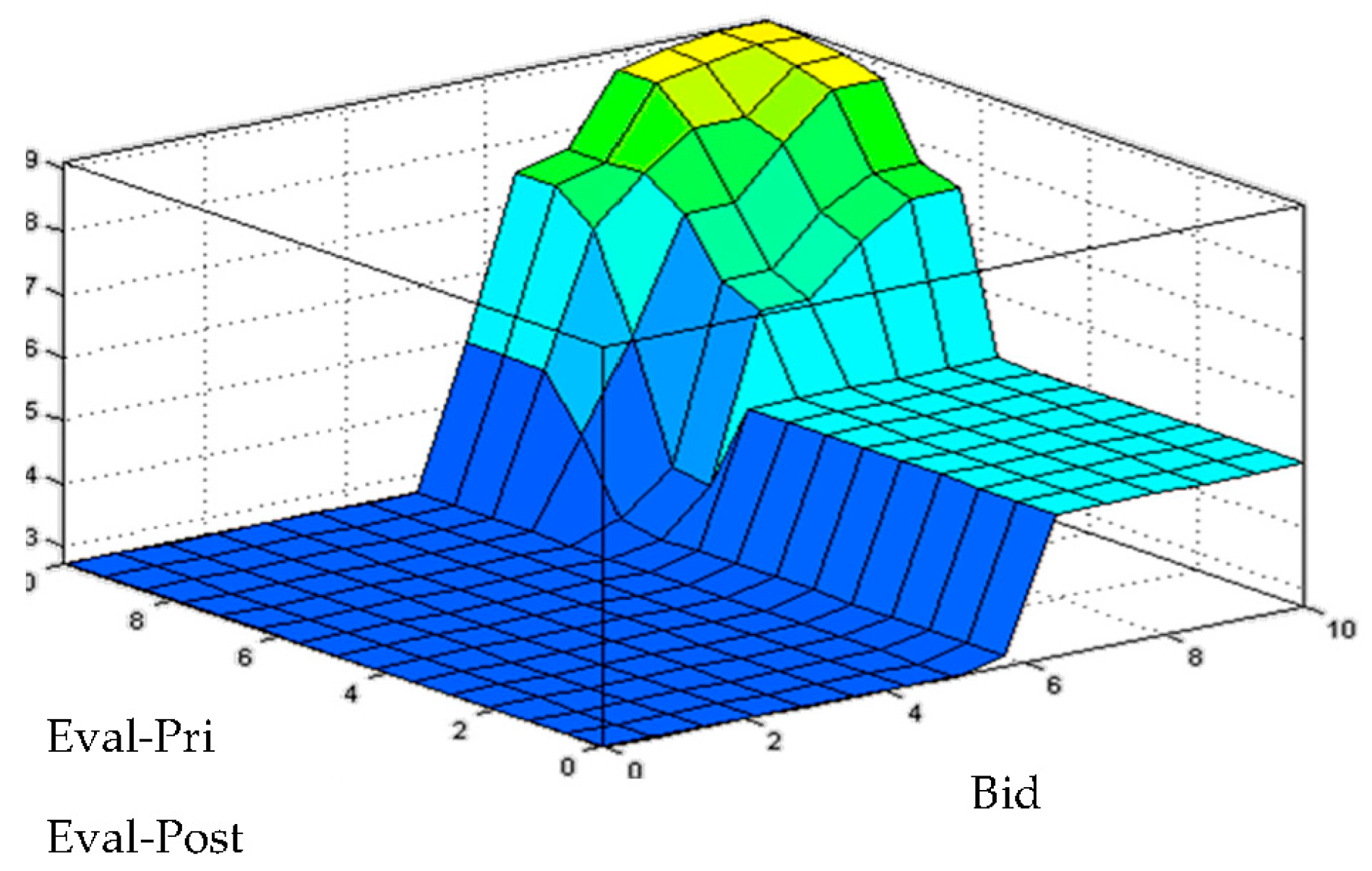

4.2.3. Performance of the FIS

4.3. Case Analysis Results and Discussion

- (1)–(5): Input variable values.

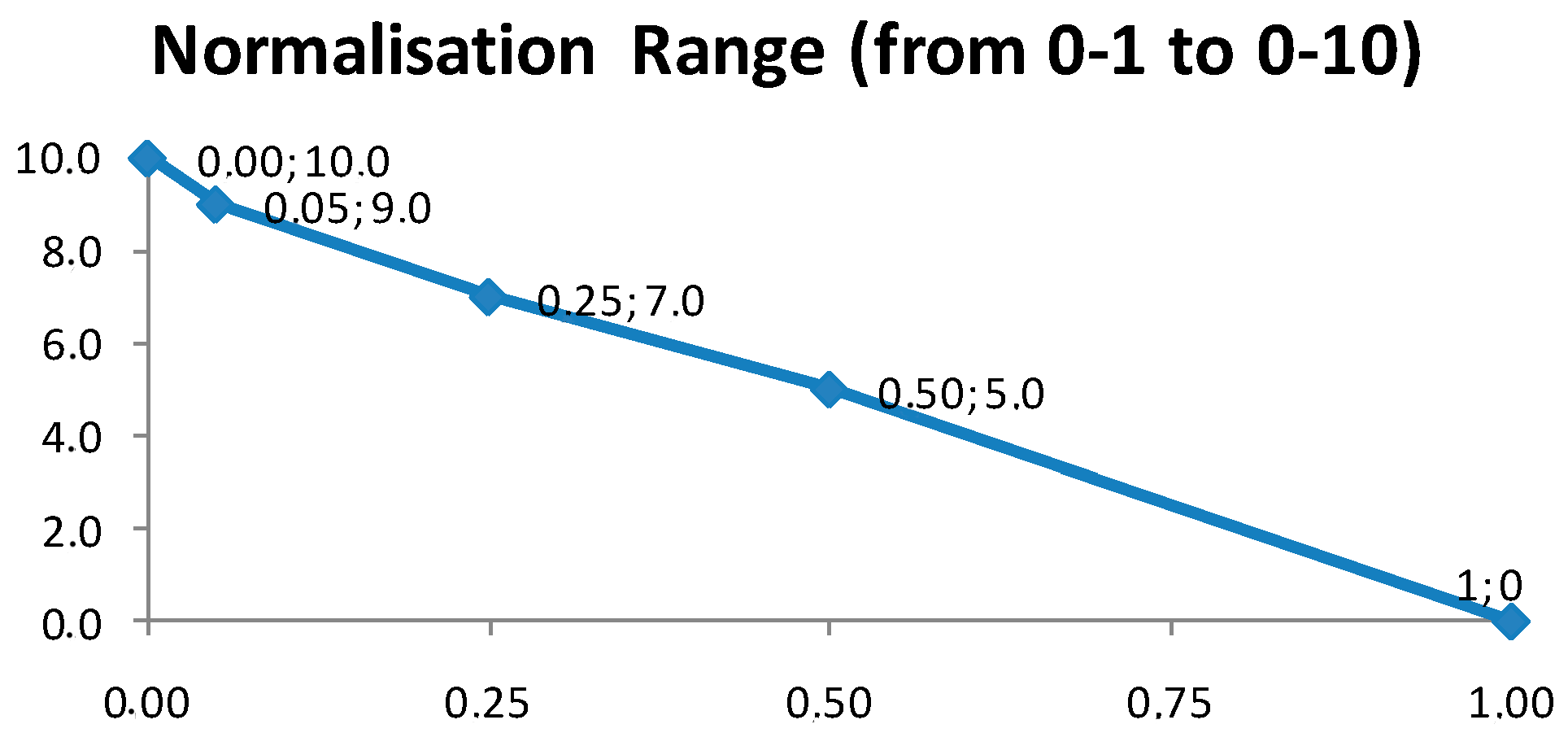

- (4’): Normalized values of “Price” (4) based on the interpolation function shown in Figure 11.

- (6W)/(6F): Bid scores by WM and FIS methods.

- (7): Variation rate (%) between the two methods.

- (8W)/(8F): Final evaluation by the two proposed methods.

- (i)

- FIS provides less linearity, penalizing suppliers (02) and (06) for their low “Delivery” rates and suppliers (07), (08) and (09) for not exceeding the lower limit value in “Eval_post”.

- (ii)

- With FIS, it is not necessary to standardize the domain range of the factor “Price”.

- (iii)

- The inserted knowledge in the bid subsystem rule-base concords with the features of strategic products given by experts (priority variable: “Delivery”, followed by “Product” and lastly “Price”). Similarly, the agreed inserted knowledge in the final subsystem permits to adequately restrict the global valuation of strategic products suppliers, preventing their acceptance when “Bid” and “Eval_Pri”/”Eval_Post” factors present deficient ratings (see suppliers (03) and (07)/(08)/(09) in Table 10 and Table 11).

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Ghorabaee, M.K.; Amiri, M.; Zavadskas, E.K.; Antucheviciene, J. Supplier evaluation and selection in fuzzy environments: A review of MADM approaches. Econ. Res.-Ekon. Istraž. 2017, 30, 1073–1118. [Google Scholar] [CrossRef]

- Petriçli, G.; Emel, G.G. Determining Strategy Based Supplier Pre-Qualification Criteria with Fuzzy Relational Maps. Alphanumeric J. 2016, 4, 11–40. [Google Scholar] [CrossRef]

- Wisner, J.D.; Leong, G.; Tan, K.-C. Principles of Supply Chain Management: A Balanced Approach, 4th ed.; South-Western: Boston, MA, USA, 2015; ISBN 978-1-285-42831-4. [Google Scholar]

- Cao, Y.; Luo, X.; Kwong, C.K.; Tang, J. Supplier pre-selection for platform-based products: A multi-objective approach. Int. J. Prod. Res. 2014, 52, 1–19. [Google Scholar] [CrossRef]

- Jain, V.; Wadhwa, S.; Deshmukh, S.G. Supplier selection using fuzzy association rules mining approach. Int. J. Prod. Res. 2007, 45, 1323–1353. [Google Scholar] [CrossRef]

- Pal, O.; Gupta, A.K.; Garg, R.K. Supplier selection criteria and methods in supply chains: A review. Int. J. Soc. Manag. Econ. Bus. Eng. 2013, 7, 1403–1409. [Google Scholar]

- Simić, D.; Kovačević, I.; Svirčević, V.; Simić, S. 50 years of fuzzy set theory and models for supplier assessment and selection: A literature review. J. Appl. Log. 2017, 24, 85–96. [Google Scholar] [CrossRef]

- Yu, C.; Wong, T.N. A supplier pre-selection model for multiple products with synergy effect. Int. J. Prod. Res. 2014, 52, 5206–5222. [Google Scholar] [CrossRef]

- Aghai, S.; Mollaverdi, N.; Sabbagh, M.S. A fuzzy multi-objective programming model for supplier selection with volume discount and risk criteria. Int. J. Adv. Manuf. Technol. 2014, 71, 1483–1492. [Google Scholar] [CrossRef]

- You, X.-Y.; You, J.-X.; Liu, H.-C.; Zhen, L. Group Multi-criteria Supplier Selection Using an Extended VIKOR Method with Interval 2-tuple Linguistic Information. Expert Syst. Appl. 2015, 42, 1906–1916. [Google Scholar] [CrossRef]

- Liu, J.; Liu, P.; Liu, S.-F.; Zhou, X.-Z.; Zhang, T. A study of decision process in MCDM problems with large number of criteria. Int. Trans. Oper. Res. 2015, 22, 237–264. [Google Scholar] [CrossRef]

- Zhao, J.; You, X.-Y.; Liu, H.-C.; Wu, S.-M. An Extended VIKOR Method Using Intuitionistic Fuzzy Sets and Combination Weights for Supplier Selection. Symmetry 2017, 9, 169. [Google Scholar] [CrossRef]

- Qin, J.; Liu, X. 2-tuple linguistic Muirhead mean operators for multiple attribute group decision making and its application to supplier selection. Kybernetes 2015, 45, 2–29. [Google Scholar] [CrossRef]

- Zhang, Z.; Chen, J.; Hu, Y.; Yang, J.; Ye, Y.; Chen, J. A Dynamic Fuzzy Group Decision Making Method for Supplier Selection. J. Appl. Sci. 2013, 13, 2788–2794. [Google Scholar] [CrossRef]

- Wetzstein, A.; Hartmann, E.; Benton, W.C., Jr.; Hohenstein, N.-O. A systematic assessment of supplier selection literature—State-of-the-art and future scope. Int. J. Prod. Econ. 2016, 182, 304–323. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Integrating sustainability into supplier selection with grey system and rough set methodologies. Int. J. Prod. Econ. 2010, 124, 252–264. [Google Scholar] [CrossRef]

- Meixell, M.J.; Gargeya, V.B. Global supply chain design: A literature review and critique. Transp. Res. Part E Logist. Transp. Rev. 2005, 41, 531–550. [Google Scholar] [CrossRef]

- Ojala, M.; Hallikas, J. Investment decision-making in supplier networks: Management of risk. Int. J. Prod. Econ. 2006, 104, 201–213. [Google Scholar] [CrossRef]

- Wu, D.D.; Olson, D. Enterprise risk management: A DEA VaR approach in vendor selection. Int. J. Prod. Res. 2010, 48, 4919–4932. [Google Scholar] [CrossRef]

- Wu, L.-C. Supplier selection under uncertainty: A switching options perspective. Ind. Manag. Data Syst. 2009, 109, 191–205. [Google Scholar] [CrossRef]

- Xia, W.; Wu, Z. Supplier selection with multiple criteria in volume discount environments. Omega 2007, 35, 494–504. [Google Scholar] [CrossRef]

- Kuo, R.J.; Lee, L.Y.; Hu, T.-L. Developing a supplier selection system through integrating fuzzy AHP and fuzzy DEA: A case study on an auto lighting system company in Taiwan. Prod. Plan. Control 2010, 21, 468–484. [Google Scholar] [CrossRef]

- Herbon, A.; Moalem, S.; Shnaiderman, H.; Templeman, J. Dynamic weights approach for off-line sequencing of supplier selection over a finite planning horizon. Int. J. Phys. Distrib. Logist. Manag. 2012, 42, 434–463. [Google Scholar] [CrossRef]

- Braglia, M.; Petroni, A. A quality assurance-oriented methodology for handling trade-offs in supplier selection. Int. J. Phys. Distrib. Logist. Manag. 2000, 30, 96–112. [Google Scholar] [CrossRef]

- Chan, F.T.S. Interactive selection model for supplier selection process: An analytical hierarchy process approach. Int. J. Prod. Res. 2003, 41, 3549–3579. [Google Scholar] [CrossRef]

- Chen, I.J.; Paulraj, A. Understanding supply chain management: Critical research and a theoretical framework. Int. J. Prod. Res. 2004, 42, 131–163. [Google Scholar] [CrossRef]

- Lee, E.-K.; Ha, S.; Kim, S.-K. Supplier selection and management system considering relationships in supply chain management. IEEE Trans. Eng. Manag. 2001, 48, 307–318. [Google Scholar] [CrossRef]

- Kasirian, M.N.; Yusuff, R.M. An integration of a hybrid modified TOPSIS with a PGP model for the supplier selection with interdependent criteria. Int. J. Prod. Res. 2013, 51, 1037–1054. [Google Scholar] [CrossRef]

- Rezaei, J.; Ortt, R. A multi-variable approach to supplier segmentation. Int. J. Prod. Res. 2012, 50, 4593–4611. [Google Scholar] [CrossRef]

- Karsak, E.E.; Dursun, M. An integrated fuzzy MCDM approach for supplier evaluation and selection. Comput. Ind. Eng. 2015, 82, 82–93. [Google Scholar] [CrossRef]

- Igoulalene, I.; Benyoucef, L.; Tiwari, M.K. Novel fuzzy hybrid multi-criteria group decision making approaches for the strategic supplier selection problem. Expert Syst. Appl. 2015, 42, 3342–3356. [Google Scholar] [CrossRef]

- Dickson, G.W. An analysis of vendor selection: Systems and decisions. J. Purch. 1966, 2, 5–17. [Google Scholar] [CrossRef]

- Kaufmann, L.; Carter, C.R.; Buhrmann, C. Debiasing the supplier selection decision: A taxonomy and conceptualization. Int. J. Phys. Distrib. Logist. Manag. 2010, 40, 792–821. [Google Scholar] [CrossRef]

- Luthra, S.; Govindan, K.; Kannan, D.; Mangla, S.K.; Garg, C.P. An integrated framework for sustainable supplier selection and evaluation in supply chains. J. Clean. Prod. 2017, 140, 1686–1698. [Google Scholar] [CrossRef]

- Rajesh, R.; Ravi, V. Supplier selection in resilient supply chains: A grey relational analysis approach. J. Clean. Prod. 2015, 86, 343–359. [Google Scholar] [CrossRef]

- Liao, C.-N.; Fu, Y.-K.; Wu, L.-C. Integrated FAHP, ARAS-F and MSGP methods for green supplier evaluation and selection. Technol. Econ. Dev. Econ. 2016, 22, 651–669. [Google Scholar] [CrossRef]

- Yazdani, M.; Chatterjee, P.; Zavadskas, E.K.; Zolfani, S.H. Integrated QFD-MCDM framework for green supplier selection. J. Clean. Prod. 2017, 142, 3728–3740. [Google Scholar] [CrossRef]

- Liou, J.J.H.; Tamošaitienė, J.; Zavadskas, E.K.; Tzeng, G.-H. New hybrid COPRAS-G MADM Model for improving and selecting suppliers in green supply chain management. Int. J. Prod. Res. 2016, 54, 114–134. [Google Scholar] [CrossRef]

- Azadi, M.; Jafarian, M.; Saen, R.F.; Mirhedayatian, S.M. A new fuzzy DEA model for evaluation of efficiency and effectiveness of suppliers in sustainable supply chain management context. Comput. Oper. Res. 2015, 54, 274–285. [Google Scholar] [CrossRef]

- Yang, J.-B.; Wang, H.-H.; Wang, W.-C.; Ma, S.-M. Using data envelopment analysis to support best-value contractor selection. J. Civ. Eng. Manag. 2016, 22, 199–209. [Google Scholar] [CrossRef]

- Puri, J.; Yadav, S.P.; Garg, H. A new multi-component DEA approach using common set of weights methodology and imprecise data: An application to public sector banks in India with undesirable and shared resources. Ann. Oper. Res. 2017, 259, 351–388. [Google Scholar] [CrossRef]

- Sangaiah, A.K.; Gopal, J.; Basu, A.; Subramaniam, P.R. An integrated fuzzy DEMATEL, TOPSIS, and ELECTRE approach for evaluating knowledge transfer effectiveness with reference to GSD project outcome. Neural Comput. Appl. 2017, 28, 111–123. [Google Scholar] [CrossRef]

- Ertay, T.; Kahveci, A.; Tabanli, R.M. An integrated multi-criteria group decision-making approach to efficient supplier selection and clustering using fuzzy preference relations. Int. J. Comput. Integr. Manuf. 2011, 24, 1152–1167. [Google Scholar] [CrossRef]

- Hashemian, S.M.; Behzadian, M.; Samizadeh, R.; Ignatius, J. A fuzzy hybrid group decision support system approach for the supplier evaluation process. Int. J. Adv. Manuf. Technol. 2014, 73, 1105–1117. [Google Scholar] [CrossRef]

- Polat, G.; Eray, E.; Bingol, B.N. An integrated fuzzy MCGDM approach for supplier selection problem. J. Civ. Eng. Manag. 2017, 23, 926–942. [Google Scholar] [CrossRef]

- Yang, W.; Chen, Z.; Zhang, F. New group decision making method in intuitionistic fuzzy setting based on TOPSIS. Technol. Econ. Dev. Econ. 2017, 23, 441–461. [Google Scholar] [CrossRef]

- Li, D.F. TOPSIS-Based Nonlinear-Programming Methodology for Multiattribute Decision Making with Interval-Valued Intuitionistic Fuzzy Sets. IEEE Trans. Fuzzy Syst. 2010, 18, 299–311. [Google Scholar] [CrossRef]

- Kumar, K.; Garg, H. TOPSIS method based on the connection number of set pair analysis under interval-valued intuitionistic fuzzy set environment. Comput. Appl. Math. 2016, 1–11. [Google Scholar] [CrossRef]

- Kumar, K.; Garg, H. Connection number of set pair analysis based TOPSIS method on intuitionistic fuzzy sets and their application to decision making. Appl. Intell. 2017, 1–8. [Google Scholar] [CrossRef]

- Shemshadi, A.; Shirazi, H.; Toreihi, M.; Tarokh, M.J. A fuzzy VIKOR method for supplier selection based on entropy measure for objective weighting. Expert Syst. Appl. 2011, 38, 12160–12167. [Google Scholar] [CrossRef]

- Kahraman, C.; Onar, S.C.; Oztaysi, B. Fuzzy Multicriteria Decision-Making: A Literature Review. Int. J. Comput. Intell. Syst. 2015, 8, 637–666. [Google Scholar] [CrossRef]

- Dalalah, D.; Hayajneh, M.; Batieha, F. A fuzzy multi-criteria decision making model for supplier selection. Expert Syst. Appl. 2011, 38, 8384–8391. [Google Scholar] [CrossRef]

- Liou, J.J.H.; Chuang, Y.-C.; Tzeng, G.-H. A fuzzy integral-based model for supplier evaluation and improvement. Inf. Sci. 2014, 266, 199–217. [Google Scholar] [CrossRef]

- Balezentis, A.; Balezentis, T. A Novel Method for Group Multi-Attribute Decision Making with Two-Tuple Linguistic Computing: Supplier Evaluation under Uncertainty. Econ. Comput. Econ. Cybern. Stud. Res. 2011, 45, 5–29. [Google Scholar]

- Zhao, K.; Yu, X. A case based reasoning approach on supplier selection in petroleum enterprises. Expert Syst. Appl. 2011, 38, 6839–6847. [Google Scholar] [CrossRef]

- Ghadimi, P.; Heavey, C. Sustainable Supplier Selection in Medical Device Industry: Toward Sustainable Manufacturing. Procedia CIRP 2014, 15, 165–170. [Google Scholar] [CrossRef]

- Amindoust, A.; Ahmed, S.; Saghafinia, A.; Bahreininejad, A. Sustainable supplier selection: A ranking model based on fuzzy inference system. Appl. Soft Comput. 2012, 12, 1668–1677. [Google Scholar] [CrossRef]

- Zhang, H.; Deng, Y.; Chan, F.T.S.; Zhang, X. A modified multi-criterion optimization genetic algorithm for order distribution in collaborative supply chain. Appl. Math. Model. 2013, 37, 7855–7864. [Google Scholar] [CrossRef]

- Tavana, M.; Shabanpour, H.; Yousefi, S.; Saen, R.F. A hybrid goal programming and dynamic data envelopment analysis framework for sustainable supplier evaluation. Neural Comput. Appl. 2017, 28, 3683–3696. [Google Scholar] [CrossRef]

- Schramm, F.; Morais, D.C. Decision support model for selecting and evaluating suppliers in the construction industry. Pesqui. Oper. 2012, 32, 643–662. [Google Scholar] [CrossRef]

- Büyüközkan, G.; Göçer, F. Application of a new combined intuitionistic fuzzy MCDM approach based on axiomatic design methodology for the supplier selection problem. Appl. Soft Comput. 2017, 52, 1222–1238. [Google Scholar] [CrossRef]

- Garg, H.; Kumar, K. Some Aggregation Operators for Linguistic Intuitionistic Fuzzy Set and Its Application to Group Decision-Making Process Using the Set Pair Analysis. Arab. J. Sci. Eng. 2017, 1–15. [Google Scholar] [CrossRef]

- Aissaoui, N.; Haouari, M.; Hassini, E. Supplier selection and order lot sizing modeling: A review. Comput. Oper. Res. 2007, 34, 3516–3540. [Google Scholar] [CrossRef]

- De Boer, L.; Labro, E.; Morlacchi, P. A review of methods supporting supplier selection. Eur. J. Purch. Supply Manag. 2001, 7, 75–89. [Google Scholar] [CrossRef]

- Degraeve, Z.; Labro, E.; Roodhooft, F. An evaluation of vendor selection models from a total cost of ownership perspective. Eur. J. Oper. Res. 2000, 125, 34–58. [Google Scholar] [CrossRef]

- Ho, W.; Xu, X.; Dey, P.K. Multi-criteria decision making approaches for supplier evaluation and selection: A literature review. Eur. J. Oper. Res. 2010, 202, 16–24. [Google Scholar] [CrossRef]

- Weber, C.A.; Current, J.R.; Benton, W.C. Vendor selection criteria and methods. Eur. J. Oper. Res. 1991, 50, 2–18. [Google Scholar] [CrossRef]

- Genovese, A.; Koh, S.C.L.; Bruno, G.; Esposito, E. Greener supplier selection: State of the art and some empirical evidence. Int. J. Prod. Res. 2013, 51, 2868–2886. [Google Scholar] [CrossRef]

- Govindan, K.; Rajendran, S.; Sarkis, J.; Murugesan, P. Multi criteria decision making approaches for green supplier evaluation and selection: A literature review. J. Clean. Prod. 2015, 98, 66–83. [Google Scholar] [CrossRef]

- Lee, T.R.; Phuong Nha Le, T.; Genovese, A.; Koh, L.S.C. Using FAHP to determine the criteria for partner’s selection within a green supply chain: The case of hand tool industry in Taiwan. J. Manuf. Technol. Manag. 2011, 23, 25–55. [Google Scholar] [CrossRef]

- Zimmer, K.; Fröhling, M.; Schultmann, F. Sustainable supplier management—A review of models supporting sustainable supplier selection, monitoring and development. Int. J. Prod. Res. 2016, 54, 1412–1442. [Google Scholar] [CrossRef]

- Balzer, W.K.; Sulsky, L.M. Halo and performance appraisal research: A critical examination. J. Appl. Psychol. 1992, 77, 975–985. [Google Scholar] [CrossRef]

- Nakayama, M.; Sutcliffe, N.G. Exploratory analysis on the halo effect of strategic goals on IOS effectiveness evaluation. Inf. Manag. 2005, 42, 275–288. [Google Scholar] [CrossRef]

- Gelderman, C.J.; Van Weele, A.J. Handling measurement issues and strategic directions in Kraljic’s purchasing portfolio model. J. Purch. Supply Manag. 2003, 9, 207–216. [Google Scholar] [CrossRef]

- Hudnurkar, M.; Rathod, U.; Jakhar, S.K. Multi-criteria decision framework for supplier classification in collaborative supply chains: Buyer’s perspective. Int. J. Product. Perform. Manag. 2016, 65, 622–640. [Google Scholar] [CrossRef]

- Kraljic, P. Purchasing must become supply management. Harv. Bus. Rev. 1983, 61, 109–117. [Google Scholar]

- García, N.; Puente, J.; Fernandez, I.; Gomez, A. How to improve the suppliers evaluation process using fuzzy inference systems. DYNA 2014, 89, 449–456. [Google Scholar]

- García, N.; Puente, J.; Fernández, I.; Priore, P. Supplier selection model for commodities procurement. Optimised assessment using a fuzzy decision support system. Appl. Soft Comput. 2013, 13, 1939–1951. [Google Scholar] [CrossRef]

- Timmerman, E. An Approach to Vendor Performance Evaluation. J. Purch. Mater. Manag. 1986, 22, 2–8. [Google Scholar] [CrossRef]

- Chen, C.-T.; Lin, C.-T.; Huang, S.-F. A fuzzy approach for supplier evaluation and selection in supply chain management. Int. J. Prod. Econ. 2006, 102, 289–301. [Google Scholar] [CrossRef]

- Amid, A.; Ghodsypour, S.H.; O’Brien, C. Fuzzy multiobjective linear model for supplier selection in a supply chain. Int. J. Prod. Econ. 2006, 104, 394–407. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Chen, C.; Klein, C.M. An efficient approach to solving fuzzy MADM problems. Fuzzy Sets Syst. 1997, 88, 51–67. [Google Scholar] [CrossRef]

- Gaines, B.R.; Mamdani, E.H. Fuzzy Reasoning and Its Applications; Academic Press: London, UK; New York, NY, USA, 1981; ISBN 978-0-12-467750-0. [Google Scholar]

- Delgado, M.; Verdegay, J.L.; Vila, M.A. Linguistic decision-making models. Int. J. Intell. Syst. 1992, 7, 479–492. [Google Scholar] [CrossRef]

- Ruspini, E.H. A new approach to clustering. Inf. Control 1969, 15, 22–32. [Google Scholar] [CrossRef]

- Mencar, C.; Fanelli, A.M. Interpretability constraints for fuzzy information granulation. Inf. Sci. 2008, 178, 4585–4618. [Google Scholar] [CrossRef]

- Herrera, F.; Martinez, L. A 2-tuple fuzzy linguistic representation model for computing with words. IEEE Trans. Fuzzy Syst. 2000, 8, 746–752. [Google Scholar] [CrossRef]

- Arena, P.; Fazzino, S.; Fortuna, L.; Maniscalco, P. Game theory and non-linear dynamics: The Parrondo Paradox case study. Chaos Solitons Fractals 2003, 17, 545–555. [Google Scholar] [CrossRef]

| Variable Mentioned in Literature | Frequency of Mention | % | Name Assigned in the Proposed Model |

|---|---|---|---|

| Quality | 68 | 16.7% | Q_System |

| Delivery | 64 | 15.7% | Delivery |

| Price/Cost | 63 | 15.4% | Price |

| Manufacturing capability | 39 | 9.6% | Structure |

| Service | 35 | 8.6% | Response |

| Management | 25 | 6.1% | Structure/Product |

| Technology | 25 | 6.1% | Structure/Product |

| Research & Development | 24 | 5.9% | Structure/Product |

| Finance | 23 | 5.6% | Economic |

| Flexibility | 18 | 4.4% | Quality/Response |

| Reputation | 15 | 3.7% | Structure |

| Relationship | 3 | 0.7% | n.a. |

| Risk | 3 | 0.7% | n.a. |

| Safety & Environment | 3 | 0.7% | n.a. |

| 2010—Adapted from [66] | |||||

| Single | papers | % | Hybrid | papers | % |

| DEA | 14 | 35.0% | AHP+ others | 16 | 39.0% |

| MP | 9 | 22.5% | Fuzzy+ others | 9 | 22.0% |

| AHP | 7 | 17.5% | MP+ others | 8 | 19.5% |

| CBR | 7 | 17.5% | DEA+ others | 5 | 12.2% |

| ANP | 3 | 7.5% | SMART+ others | 3 | 7.3% |

| 2017—Adapted from [1] | |||||

| Single | papers | % | Hybrid | papers | % |

| AHP | 29 | 36.7% | AHP+ others | 56 | 42.4% |

| TOPSIS | 28 | 35.4% | TOPSIS+ others | 47 | 35.6% |

| VIKOR | 10 | 12.7% | ANP+ others | 21 | 15.9% |

| ANP | 7 | 8.9% | VIKOR+ others | 8 | 6.1% |

| DEMATEL | 5 | 6.3% | |||

| Variable Names | Description | Data Source | Variable Score Calculus | Range and Interpretation | |

|---|---|---|---|---|---|

| Input Variables | [Product] | Measures the adaptability of the product to the requirements of the company: Multi-functionality, ease of storage, proper packaging, shelf life, guarantee ... | Questionnaire designed “ad hoc” | Proportion of points obtained in the survey respect to the total possible points × 10 | Range: 0–10 <6: Deficient ~8: Acceptable >9: Optimal |

| [Price] | Rate of change in the price of the supplier’s bid with respect to the minimum bid (taking into account collateral aspects such as the payment period, the discount or taxes) | Provider bids. | Range: 0–1 >0.50: Deficient ~0.25: Acceptable <0.05: Optimal | ||

| [Delivery] | Measures the adaptability to the transportation company used by the supplier and the delivery conditions, the adaptation of the batch size, frequency and delivery schedules, handling units, identification and labelling, returns at no cost ... | Questionnaire design “ad hoc” | Proportion of points obtained in the survey respect to the total possible points × 10 | Range: 0–10 <6: Deficient ~8: Acceptable >9: Optimal | |

| Output Variable | [BID] | Score of the Provider’s bid. | Values awarded [Product], [Price] and [Delivery] | Weighting Method (WM) or Fuzzy Inference System (FIS) | Range: 0–10 <6: Deficient ~8: Acceptabl e >9: Optimal |

| Variable Names | Description | Data Source | Variable Score Calculus | Range and Interpretation | |

|---|---|---|---|---|---|

| Input Variables | [Eval_Pri] or [Eval_Post] | “A Priori” or “A posteriori” score of the supplier | List of Approved Suppliers or Historical behavior reports | Previous evaluation process | Range: 0–10 <6: Not approved ~8: Acceptable >9: Optimal |

| [BID] | Score of the supplier’s bid | Assigned values to [Product], [Price] and [Delivery] | (WM) or (FIS) | Range: 0–10 <6: Deficient ~8: Acceptable >9: Optimal | |

| Output Variable | [SCORE_New] or [SCORE_Hist] | Score of a new supplier or Score of a previous supplier | Assigned values to [Eval_Pri] or [Eval_Post], and [BID]—from previous subsystem | (WM) or (FIS) | Range: 0–10 <6: Deficient ~8: Acceptable >9: Optimal |

| Label | Concept | TrFNs | 2-Tuples | |

|---|---|---|---|---|

| s0 | D | Disagreement | (0.0 0.0 0.3 0.5) | (D, 0) |

| s1 | P | Partial Agreement | (0.3 0.5 0.5 0.7) | (P, 0) |

| s2 | T | Total Agreement | (0.5 0.7 1.0 1.0) | (T, 0) |

| Struc_1 | Struc_2 | Struc_3 | Struc_4 | |

|---|---|---|---|---|

| Exp1 | T | P | - | - |

| Exp2 | T | - | - | P |

| Exp3 | P | T | - | - |

| Exp4 | P | - | T | - |

| EAM | 1.5 | 0.75 | 0.5 | 0.25 |

| 2-tuples | (T, −0.5) | (P, −0.25) | (P, −0.5) | (D, 0.25) |

| - | VL | L | M | H | VH |

|---|---|---|---|---|---|

| Exp1 | - | P | T | - | - |

| Exp2 | - | - | P | T | P |

| Exp3 | P | T | P | - | - |

| Exp4 | - | P | T | P | - |

| EAM | 0.25 | 1.00 | 1.5 | 0.75 | 0.25 |

| 2-tuples | (D, 0.25) | (P, 0.00) | (T, −0.5) | (P, −0.25) | (D, 0.25) |

| Delivery | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Insuf | Accep | Ideal | Insuf | Accep | Ideal | Insuf | Accep | Ideal | |||

| Product | Insuf | VL | VL | L | L | M | M | H | H | VH | BID |

| Accep | VL | VL | L | L | M | M | H | H | VH | ||

| Ideal | VL | VL | L | L | M | M | H | H | VH | ||

| Insuf | Accep | Ideal | |||||||||

| Price | |||||||||||

| VL = Very Low/L = Low/M = Medium/H = High/VH = Very High | |||||||||||

| Eval_Pri or Eval_Post | ||||||

|---|---|---|---|---|---|---|

| VL | L | M | H | |||

| BID | VL | L | L | L | L | |

| L | L | L | M | H | Score_New | |

| M | L | M | H | H | or | |

| H | L | M | H | VH | Score_Hist | |

| VH | L | H | VH | VH | ||

| [1] | [2] | [3] | [4] | [4’] | [5] | [6W] | [6F] | [7] | [8W] | [8F] | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| New/Hist | Eval_Pri | Eval_Post | Product | Price | Price’ | Delivery | Bid (WM) | Bid (FIS) | Variation Rate (%) | Final Eval (WM) | Final Eval (FIS) | |||

| New | Hist | New | Hist | |||||||||||

| SUPP 01 | New | 7.17 | 6.0 | 0.03 | 9.4 | 8.7 | 8.0 | 6.7 | 15.83% | 7.5 | 4.3 | |||

| SUPP 02 | New | 6.13 | 7.5 | 0.54 | 4.6 | 7.8 | 7.4 | 4.8 | 35.05% | 6.6 | 2.7 | |||

| SUPP 03 | New | 8.30 | 3.2 | 0.12 | 8.3 | 2.8 | 3.5 | 2.8 | 19.31% | 6.4 | 2.7 | |||

| SUPP 04 | New | 7.87 | 7.0 | 0.75 | 2.5 | 9.0 | 7.8 | 6.5 | 16.13% | 7.8 | 5.7 | |||

| SUPP 05 | Hist | 6.66 | 9.0 | 0.04 | 9.2 | 7.4 | 8.1 | 7.7 | 4.47% | 6.9 | 6.2 | |||

| SUPP 06 | Hist | 8.08 | 6.5 | 0.33 | 6.4 | 6.1 | 6.2 | 2.9 | 53.57% | 7.7 | 2.7 | |||

| SUPP 07 | Hist | 5.28 | 7.5 | 0.19 | 7.6 | 9.5 | 8.7 | 8.1 | 7.00% | 6.0 | 5.0 | |||

| SUPP 08 | Hist | 5.91 | 8.5 | 0.03 | 9.4 | 7.0 | 7.7 | 7.0 | 8.97% | 6.3 | 5.0 | |||

| SUPP 09 | Hist | 5.51 | 7.0 | 0.75 | 2.5 | 9.0 | 7.8 | 6.5 | 16.13% | 6.0 | 5.0 | |||

| SUPP 10 | Hist | 7.32 | 3.2 | 0.12 | 8.3 | 2.8 | 3.5 | 2.8 | 19.31% | 6.6 | 2.7 | |||

| Bid Subsystem | Final Evaluation Subsystem | |||

|---|---|---|---|---|

| Behaviour WM | Behaviour FIS | Chosen Method | Score | |

| SUPP 01 | √ | √√ | FIS | 4.3 |

| SUPP 02 | X | √ | FIS | 2.,7 |

| SUPP 03 | √ | √√ | FIS | 2.7 |

| SUPP 04 | √ | √√ | FIS | 5.7 |

| SUPP 05 | √ | √ | WM/FIS | 6.9/6.2 |

| SUPP 06 | X | √ | FIS | 2.7 |

| SUPP 07 | √ | √ | FIS | 5.0 |

| SUPP 08 | √ | √ | FIS | 5.0 |

| SUPP 09 | √ | √√ | FIS | 5.0 |

| SUPP 10 | √ | √√ | FIS | 2.7 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Garcia, N.; Puente, J.; Fernandez, I.; Priore, P. Suitability of a Consensual Fuzzy Inference System to Evaluate Suppliers of Strategic Products. Symmetry 2018, 10, 22. https://doi.org/10.3390/sym10010022

Garcia N, Puente J, Fernandez I, Priore P. Suitability of a Consensual Fuzzy Inference System to Evaluate Suppliers of Strategic Products. Symmetry. 2018; 10(1):22. https://doi.org/10.3390/sym10010022

Chicago/Turabian StyleGarcia, Nazario, Javier Puente, Isabel Fernandez, and Paolo Priore. 2018. "Suitability of a Consensual Fuzzy Inference System to Evaluate Suppliers of Strategic Products" Symmetry 10, no. 1: 22. https://doi.org/10.3390/sym10010022