1. Introduction

In discrete multi-criteria decision-making (MCDM) processes, we are usually faced with a set of alternatives that need to be evaluated with respect to a set of criteria. The weights of criteria are important components in the process of MCDM. There are two types of criteria weights: objective weights and subjective weights [

1]. The objective weights are derived from the information of decision-matrices and the subjective weights are determined based on the information provided by decision-makers [

2]. In other words, the subjective weights refer to the decision-makers’ subjective perceptions and judgments about the relative importance of criteria [

3]. Entropy, CRITIC (Criteria Importance Through Inter-criteria Correlation) and Standard Deviation (SD) are some of the popular methods for obtaining objective weights; on the other hand, the analytic hierarchy process (AHP), analytic network process (ANP), SIMOS (a method proposed by Simos [

4]) and simple multi-attribute ranking technique (SMART) are the most prevalent methods for determination of subjective weights [

5]. Another method for determining subjective criteria weights is Step-wise Weight Assessment Ratio Analysis (SWARA). The focus of this study is on the extending of this method.

The SWARA is an efficient and relatively new method which was proposed by Kersuliene et al. [

6] for the determination of subjective weights in multi-criteria decision-making problems. This method has lower computational complexity compared to some other methods like AHP. Many researchers have utilized the SWARA method in different MCDM problems. Dehnavi et al. [

7] proposed a novel hybrid approach based on the SWARA method, geographical information system (GIS) and adaptive neuro-fuzzy inference system (ANFIS) to evaluate landslide susceptible areas in Iran. Karabasevic et al. [

8] developed a framework for multi-criteria assessment of personnel using the ARAS (Additive Ratio ASsessment) and SWARA methods under uncertainty handled by fuzzy sets. Nakhaei et al. [

9] proposed a new approach based on SWARA and SMART for the rapid assessment of the vulnerability of office buildings to a blast. They presented a case study of Swiss Re Tower and used the proposed approach. Shukla et al. [

10] integrated the SWARA method with PROMETHEE (Preference Ranking Organization METHod for Enrichment of Evaluations) and applied it to a comprehensive enterprise resource planning (ERP) system selection framework. Işık and Adalı [

11] developed a hybrid MCDM approach based on the SWARA and operational competitiveness ratings analysis (OCRA) methods. They used SWARA to determine criteria weights and OCRA to rank the alternatives in a hotel selection problem. Mavi et al. [

12] presented an integrated approach based on SWARA and MOORA (Multi-Objective Optimization on the basis of Ratio Analysis) in the fuzzy environment. Using a combination of sustainability and risk factors, the presented approach was used to evaluate third-party reverse logistics provider. Panahi et al. [

13] used the SWARA and GIS to define copper prospectivity mapping in a region in Iran. They validated the obtained results by the operating receiver characteristics (ORC) technique. Stanujkic et al. [

14] proposed an MCDM approach that allows the decision-makers involved in a negotiation process to express their preferences in a better way. Their proposed approach, called ARCAS (Additive Ratio Compromise ASsessment), is based on the ARAS and SWARA methods. Karabašević et al. [

15] developed an expert-based method for the determination of subjective weights of criteria in a multi-criteria decision-making problem by integrating the SWARA and Delphi methods. Stanujkic et al. [

16] presented a modified version of the SWARA method in which the most appropriate alternative is selected on the basis of negotiation. They used an empirical example of the personnel selection problem to illustrate their method. Urosevic et al. [

17] developed an integrated MCDM approach based on the SWARA and WASPAS (Weighted Aggregated Sum Product Assessment) methods. They applied the developed approach to an example of personnel selection in the tourism sector. Jamali et al. [

18] analyzed the competitive strategies of a LARG (Lean, Agile, Resilient and Green) supply chain in Iranian cement industries using SWARA, SWOT (Strengths, Weaknesses, Opportunities and Threats) and SPACE (Strategic Position and Action Evaluation) techniques. Juodagalvienė et al. [

19] proposed a hybrid multi-criteria decision-making approach based on the SWARA and EDAS (Evaluation based on Distance from Average Solution) methods for assessment of architectural shapes of the buildings. Tayyar and Durmu [

20] made a comparison between three weighting methods including Max100, SWARA and Pairwise Comparison (or AHP). The results of their study showed that the variation of the weights determined by the Pairwise Comparison method is higher than that of SWARA and Max100 methods. Valipour et al. [

21] presented a hybrid MCDM approach based on the SWARA and COPRAS (COmplex PRoportional ASsessment) methods and applied it to a case study of risk assessment in a deep foundation excavation project in Iran. Keshavarz Ghorabaee et al. [

22] developed a fuzzy hybrid approach to deal with MCDM problems based on the SWARA, CRITIC and EDAS methods and they used it for the assessment of construction equipment considering the sustainability dimensions. Dahooie et al. [

23] proposed a framework of competency with five criteria for choosing the best information technology (IT) expert. They used the SWARA method for weighting the criteria and a grey ARAS (ARAS-G) method for evaluation of alternatives. Interested readers are referred to the recent survey paper presented by Mardani et al. [

24].

The fuzzy set theory is an efficient tool to handle the inexact and imprecise information given by experts or decision-makers in an MCDM process [

25,

26,

27,

28,

29,

30,

31]. Type-1 fuzzy sets are the basic or ordinary fuzzy sets which was introduced by Zadeh [

32]. As an extension of the type-1 fuzzy sets, Zadeh [

33] presented the concept of type-2 fuzzy sets. By increasing the degree of fuzziness, we can handle inexact and imprecise information more efficiently. Hence, we can say that type-2 fuzzy sets (T2FSs) can improve the process of capturing the uncertainty. On the other hand, type-2 fuzzy sets are computationally intensive and this can be considered as a disadvantage of them. To deal with this matter, we can use interval type-2 fuzzy sets (IT2FSs) in which secondary membership functions are interval sets [

34,

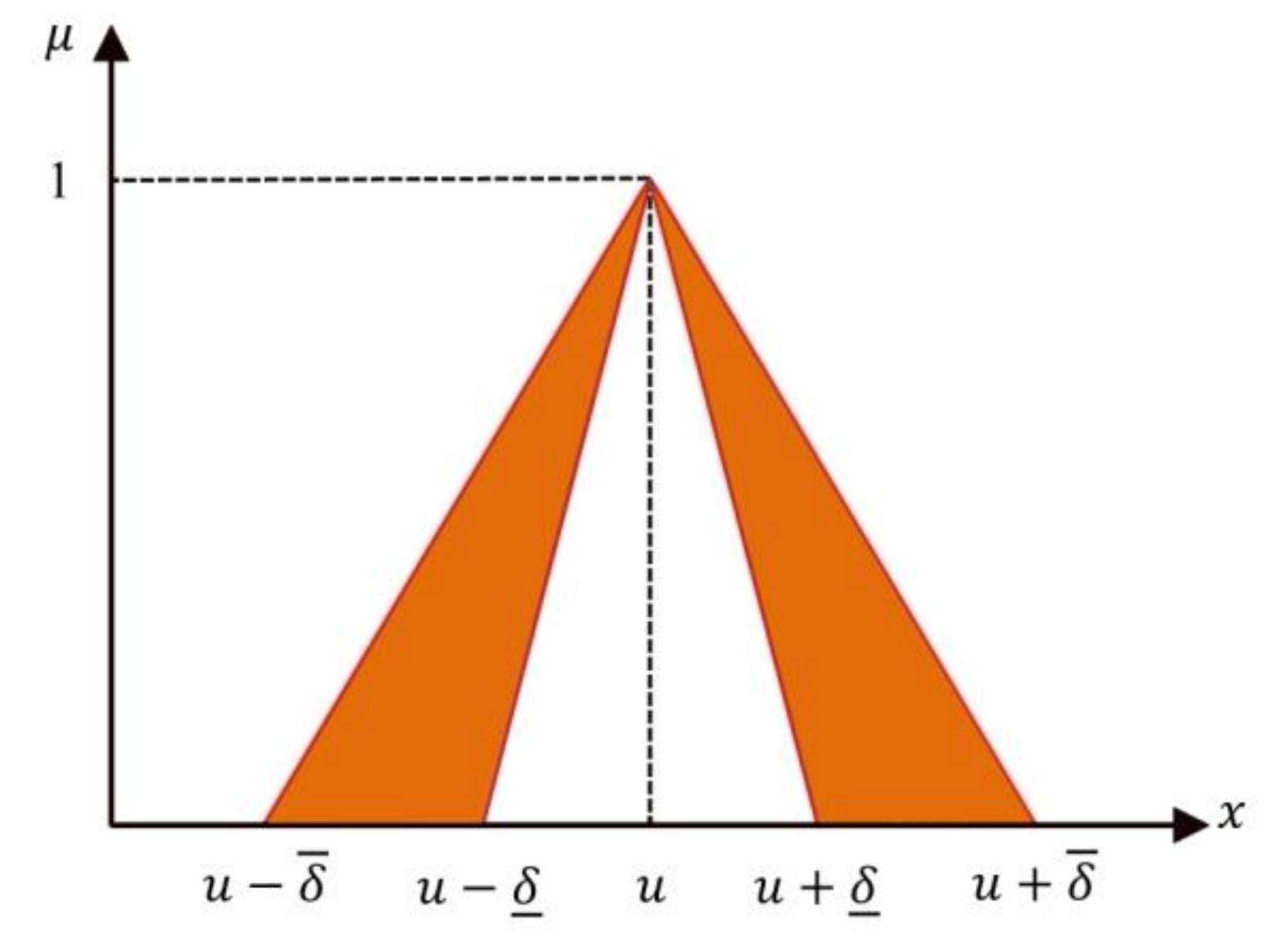

35]. A symmetric interval type-2 fuzzy set (SIT2FS) is a sub-class of IT2FSs and its primary membership function has symmetrical properties [

36]. Using the symmetric IT2FSs simplifies the computations and leads to more interpretable results.

Many studies have been made on interval type-2 fuzzy sets and their applications in real-world problems. This type of fuzzy sets has also been applied to several MCDM processes in past years [

37,

38]. Soner et al. [

39] presented a hybrid MCDM methodology based on the AHP and VIKOR (in Serbian: VIseKriterijumska Optimizacija I Kompromisno Resenje) methods with interval type-2 fuzzy sets. They also provided a practical application of the methodology in maritime transportation industry. Keshavarz Ghorabaee et al. [

40] proposed a novel multi-objective methodology for supplier evaluation and order allocation in supply chains based on the EDAS method and IT2FSs and applied it to a problem considering environmental criteria. Qin et al. [

41] developed a multi-criteria group decision making approach based upon interval type-2 fuzzy sets, the prospect theory and the TODIM (an acronym in Portuguese of interactive and multi-criteria decision making) method. They also introduced a new distance measure for IT2FSs using α-cut technique. Baykasoğlu and Gölcük [

42] presented an approach by integrating TOPSIS (Technique for Order Preference by Similarity to Ideal Solution) with DEMATEL (Decision Making Trial and Evaluation Laboratory) to handle MCDM problems under the uncertain environment defined by IT2FSs. They used the presented approach in a SWOT-based strategy selection problem. Deveci et al. [

43] proposed an interval type-2 fuzzy TOPSIS method to deal with multi-criteria decision-making problems under uncertainty. To verify their method, a case study of airline route selection in Turkey was also presented by them. Zhong and Yao [

44] developed an extended ELECTRE (ELimination Et Choix Traduisant la REalité) method to deal with multi-criteria group decision making with interval type-2 fuzzy sets based on new measures of proximity and entropy of IT2FSs. Kundu et al. [

45] introduced a new ranking method for IT2FSs by using a relative preference index and generalized credibility measures. Based on the ranking method, they presented a fuzzy multi-criteria decision-making methodology and applied it to the transportation mode selection problem. Qin et al. [

46] developed a new approach to handle multi-criteria group decision-making problems under interval type-2 fuzzy environment. Their method is based on the LINMAP (Linear Programming Models with the Aid of Multidimensional Analysis of Preference) method and they showed the application of it in supplier selection problems. Ju et al. [

47] proposed an interval type-2 fuzzy multi-criteria group decision-making approach with unknown weight information. They integrated the grey relational projection (GRP) and AHP methods in the proposed approach. Yao and Wang [

48] presented some factors including hesitant factor, fuzzy factor and interval factor to quantify the hesitancy, fuzziness and interval information related to an IT2FS. Then, based on these factors, they introduced a cross-entropy and an MCDM approach. Liu et al. [

49] proposed an integrated approach for multi-criteria group decision-making based on the ANP and VIKOR methods. In a sustainable supplier selection problem, they obtained the weights of criteria by using ANP and made the final evaluation of suppliers via VIKOR. Wu et al. [

50] developed a new methodology based on the TOPSIS method to handle large scale group decision making problems with social network information in an interval type-2 fuzzy environment. They demonstrated the feasibility of the methodology using an illustrative example. For more information about the applications of IT2FSs in multi-criteria decision-making, interested readers can refer to a comprehensive review presented by Celik et al. [

51].

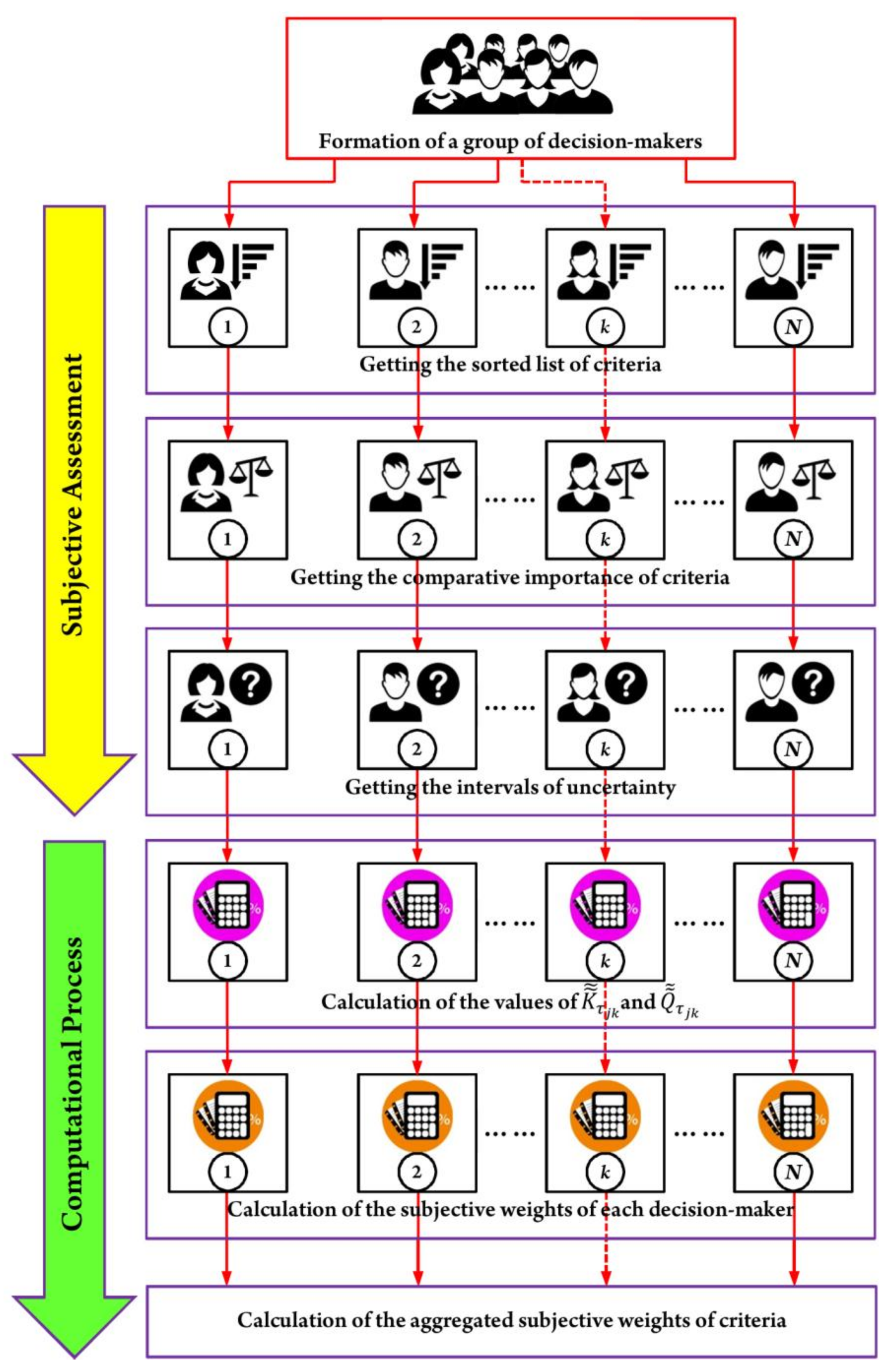

In this paper, the SWARA method is extended with interval type-2 fuzzy sets. Using interval type-2 fuzzy sets helps us to deal more effectively with the uncertainty of experts’ or decision-makers’ opinions, judgements and preferences. Accordingly, the subjective weights determined by the extended SWARA could be more justified for the decision-making process. To extend the SWARA method, we utilize a sub-class of IT2FSs called symmetric interval type-2 fuzzy sets. The computations of the process can be simplified when we use symmetric IT2FSs. Moreover, the subjective weights resulted in the form of symmetric IT2FSs is more interpretable. Therefore, in the proposed approach, we can quantify the uncertain information given by decision-makers efficiently and present interpretable subjective weights for criteria.

The rest of this paper is organized as follows. In

Section 2, firstly, the concepts and definitions related to type-2 fuzzy sets, interval T2FSs and symmetric IT2FSs are presented and then an extended SWARA method with symmetric IT2FSs is detailed. In

Section 3, we illustrated the proposed approach by means of an example of determining the importance of intellectual capital dimensions and components in a company. In

Section 4, conclusions are presented.

3. Illustrative Example

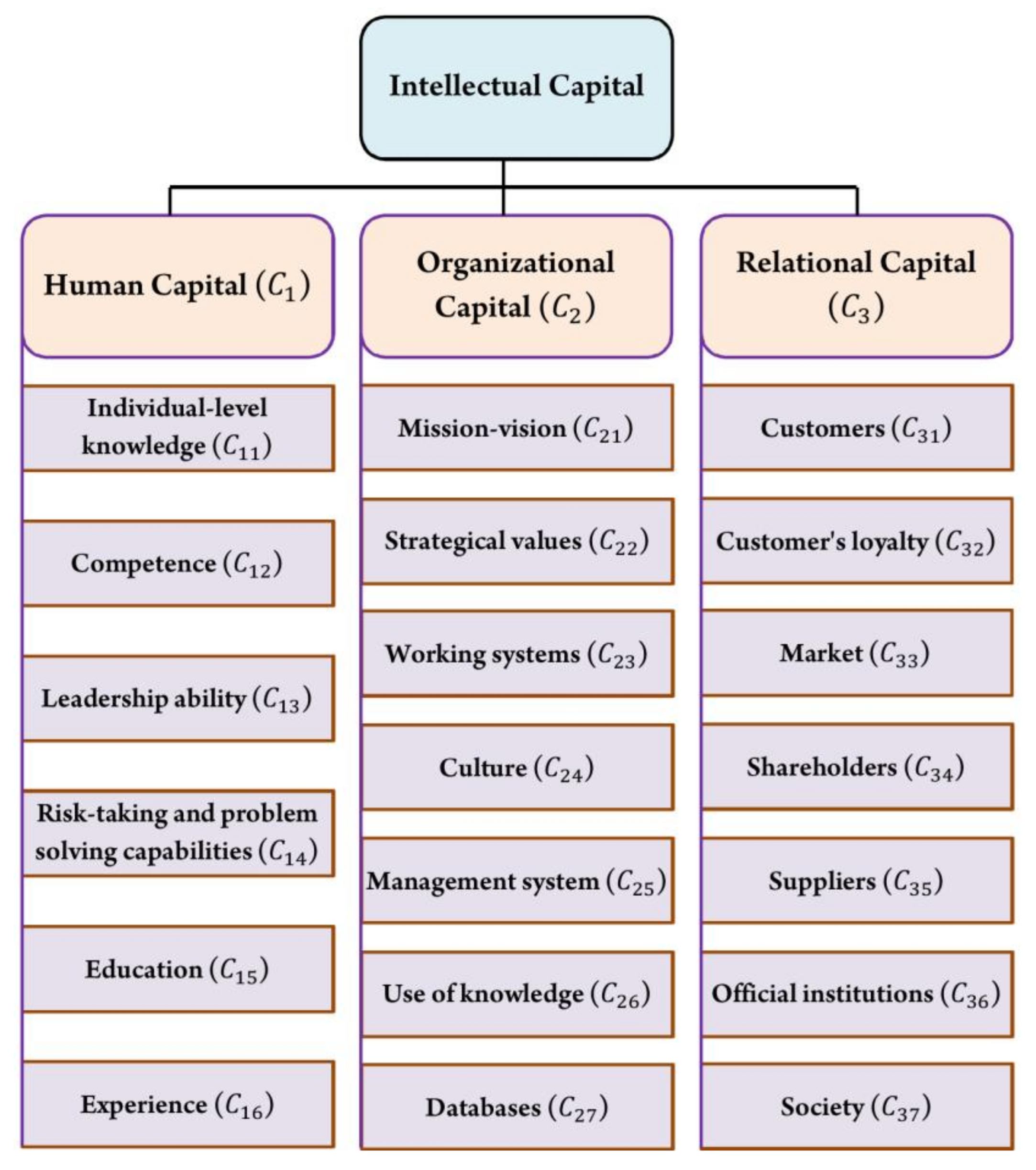

In this section, the extended SWARA with SIT2FSs is used to determine the importance of intellectual capital dimensions and components in a company. The hierarchical structure of the multi-criteria decision-making problem is defined in

Figure 3 based on the study of Bozbura and Beskese [

55]. According to

Figure 3, we have three main criteria which include some sub-criteria. Suppose that three experts (decision-makers) from the company are appointed to perform the process of the criteria and sub-criteria assessment. Based on the hierarchical structure, firstly, the proposed approach is used to determine the importance or weights of the main criteria, then the weights of the sub-criteria of each criterion are calculated. Therefore, the procedure of the proposed approach should be performed four times (Once for the main criteria and three for the sub-criteria of them).

The information given by the first (

), second (

) and third (

) decision-makers about the main criteria are shown in

Table 1 and the information related to sub-criteria are presented in

Table 2,

Table 3 and

Table 4. As can be seen in these tables, according to Step 2 of the proposed approach, the relative importance of each criterion and sub-criterion compared to the previous item of the sorted list (

) is transformed into a triangular SIT2FS based on the IUC provided by each decision-makers and Equation (10). The values of

and

, which are calculated using Equations (11) and (12) in Steps 3 and 4, are also presented in

Table 1,

Table 2,

Table 3 and

Table 4.

As an example, here we calculate the value of

for the second rank main criteria of the first decision-maker. According to

Table 1, the value of

is equal to 0.1 for

and the interval of uncertainty about the center is [1.1, 1.2] for

. Based on Step 2 and Definition 6, we can calculate

and

as follows:

=

= 1.1 × 0.1 = 0.11 and

=

= 1.2 × 0.1 = 0.12. Then we have

= (0.1, 0.11, 0.12). The other values of

are calculated in the same way.

According to the values of

and

and Equation (13) of Step 5, the subjective weights of the main criteria and their sub-criteria can be calculated for each decision-maker. The results of this step are presented in

Table 5.

Based on the values of subjective weights presented in

Table 5 and Equation (14) of Step 6, we can determine the aggregated subjective weights for the main criteria and their sub-criteria. Because of the hierarchical structure of the criteria and sub-criteria, the weights of sub-criteria are local in this step. The global subjective weights of sub-criteria are calculated by multiplying the local weights of them by the weights of the upper level criteria. The local and global subjective weights are represented in

Table 6. It should be noted that Equation (15) is used to calculate the global weights.

The global weights can be used if we have some alternatives which need to be evaluated with respect to these criteria. Here, the local weights are enough to evaluate the importance of criteria. To show the uncertainty of the subjective weights determined (local subjective weights of sub-criteria) in the form of symmetric interval type-2 fuzzy sets, the graphical representation of them is depicted in

Figure 4.

As can be seen in

Figure 4 and

Table 6, based on the experts’ assessments,

(Individual-level knowledge) and

(Experience) are the most important and

(Competence) and

(Leadership ability) are the least important sub-criteria of

(Human Capital). In the second criterion (Organizational Capital), we can say that

(Management system) and

(Working systems) have more importance than the other sub-criteria. Also, we can see the higher weights of

and

in the third criterion, which shows that “Market” and “Shareholders” are more important that the other sub-criteria in the “Relational Capital” dimension.

This example shows that the defuzzified subjective weights of some sub-criteria in different main criteria are very close to each other. For example, we can see small difference between the defuzzified subjective weights of and in the first criterion, and in the second criterion and and in the third criterion. However, these sub-criteria can be differentiated by using on the level of uncertainty or their domains based on the results obtained by the proposed approach.