A Model to Assess the Feasibility of Public–Private Partnership for Social Housing

Abstract

:1. Introduction and Aims of the Work

- meeting housing needs in terms of accessing and living in affordable, decent homes;

- increasing the supply of dwellings for affordable rent, through the construction, management, purchase, and rental of social housing;

- defining criteria for assignment and for the identification of target groups, on the basis of socioeconomic criteria as well as with reference to other types of vulnerability.

- integration of economic and productive data; Cost Volume Profit Analysis (CVPA) [22,23,24,25,26,27] which includes: (i) Break-Even Analysis (BEA), allowing the break-even conditions in a productive process to be estimated [28,29,30,31,32,33,34,35,36]; (ii) Contribution Margin Analysis (CMA) [37,38,39,40], which, in a productive process, allows the financial sums remaining after the fixed costs for variable and extra-profit-related costs are dealt with to be estimated; (iii) Operating Leverage Analysis (OLA), which allows the riskiness of a productive process to be assessed [41,42,43].

- through the BEA, allows the financial feasibility to be assessed, for the SPR, of an intervention in PPP in which the building of SH is contemplated;

- through the CMA, allows the presence to be assessed, where applicable, of extra profits [48] of the initiative which, in this case, may be used to increase the supply of housing or of public services (balancing the initiative in terms of dividing the benefits between the SPU and the SPR).

2. Social Housing: Needs and Implementation Overview

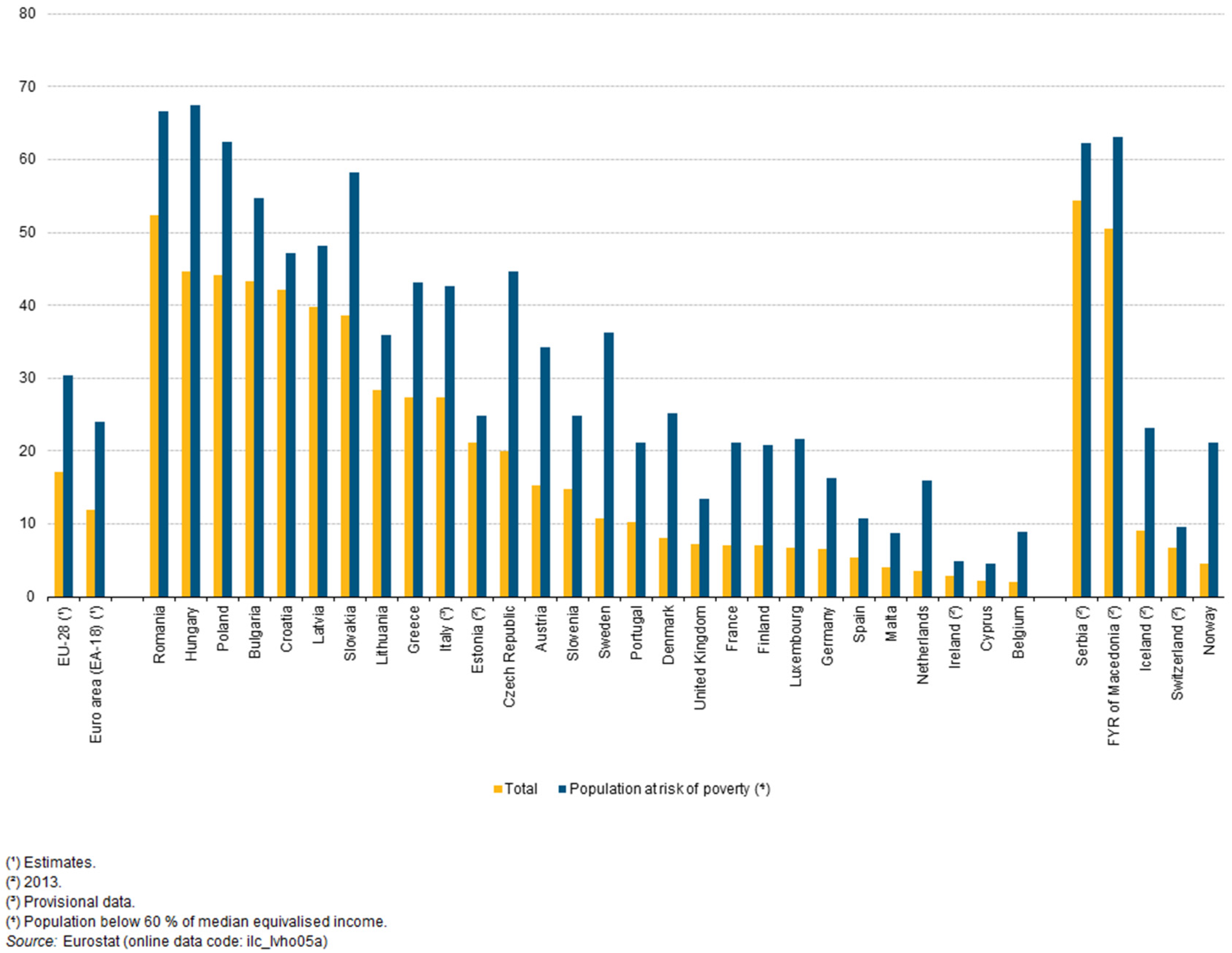

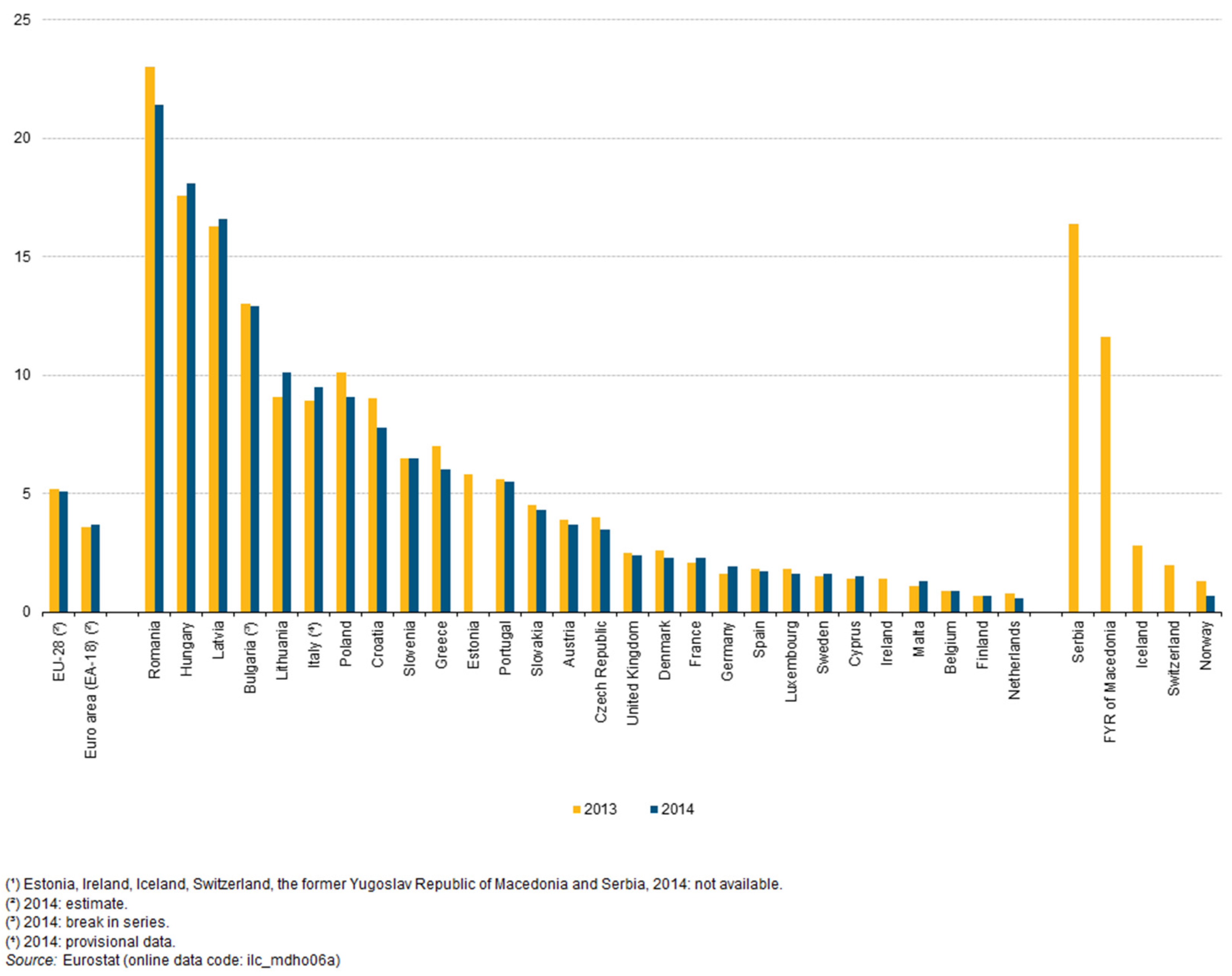

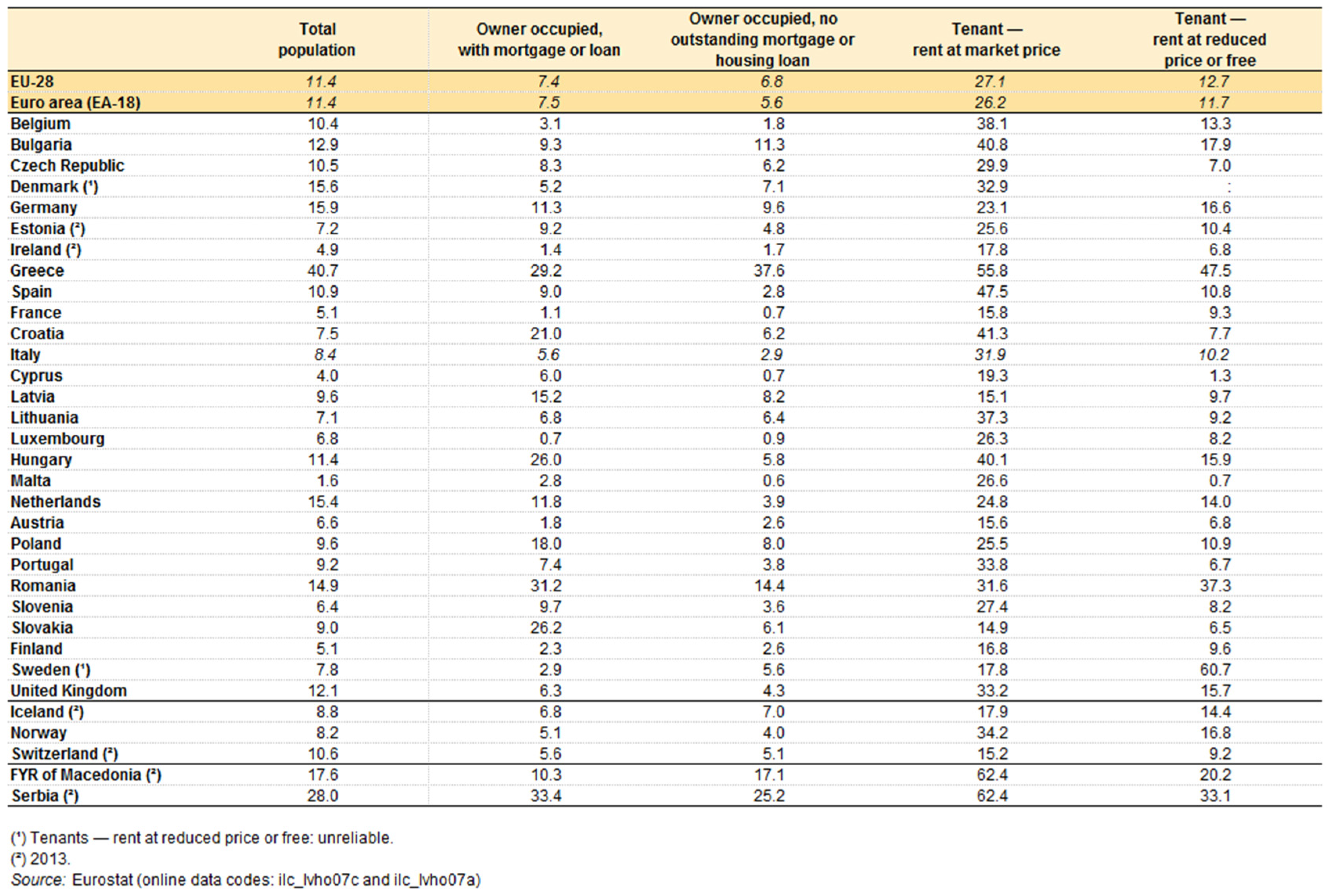

2.1. Social Housing Needs in Europe

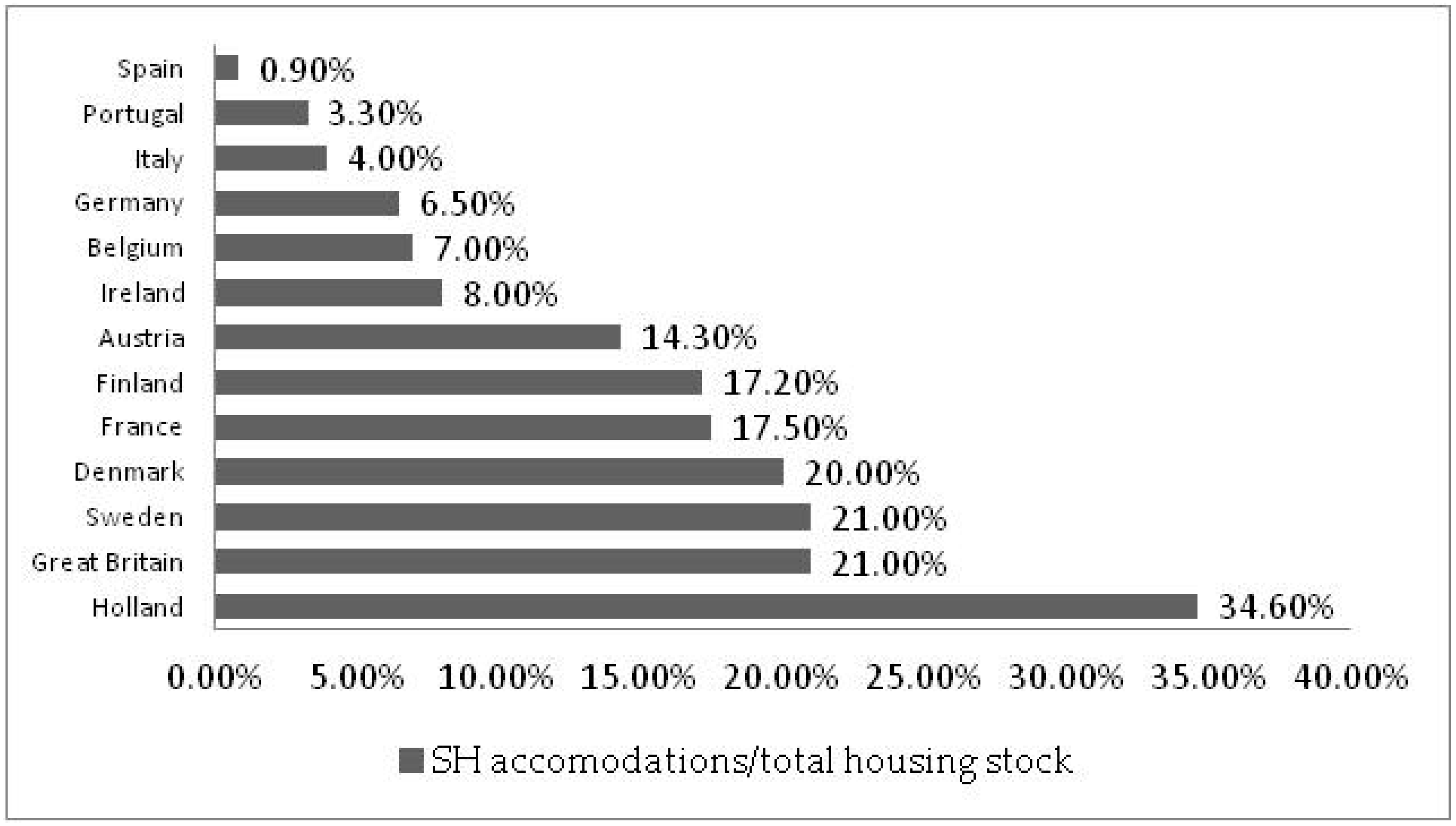

2.2. Social Housing Implementation Programs and Public–Private Partnership in Italy

- non-completion/interruption of work;

- excessively long construction processes (often exceeding 10 years)—well beyond the scheduled deadlines even for many of the works that have been finished,

- significant difference between estimated and actual costs (cost overruns);

- interruptions in work progress due to problems derived from designs not developed in suitable detail.

- identify an asset (area/building), publicly or privately owned, on which to carry out the intervention, and the SH need to be met;

- determine, with regard to the regulatory/legislative framework in force, the content of the initiative (construction potential, intended uses, urbanization);

- have the asset in the initiative at full disposal; the identified property must be or become able to be used by the SPU and then be conferred to the SPR in accordance with the modes provided for by law (transfer in ownership, concession for a determined period of years) through forms of public procedure;

- carry out the settlement transformation intervention; through the contribution of own capital, the SPR builds both public real estate complexes (SH and any buildings for public services) and private ones (private residences and services), in addition to carrying out the urbanization works needed to guarantee the intervention’s full efficiency;

- deliver, at the end of the intervention, the real estate complexes for public/social use to the SPU; the SPU will assign (lease, rent to buy) the SH units, and start operating these and any other non-residential real estate units built by the SPR;

- introduce, in the free market, real estate complexes to private functions; these properties are sold (or rented) by the SPR to recoup the invested capital.

3. A Model to Assess Interventions in Social Housing Public–Private Partnership

3.1. Articulation

- Acquisition of the objectives that the municipal administration intends to pursue with the initiative; quantification of the need for SH and for services; location of the initiative: these elements are the input data for the assessment;

- Definition of the initiative’s settlement parameters; calculation, through logical/mathematical functions, of: construction potential (phase 2.a); urban planning standards (phase 2.b); appurtenant car parks (phase 2.c); type of settlement with regard to maximum height and coverage ratio (phase 2.d): these parameters translate regulatory references into settlement quantities. They make it possible to define the scope of the initiative (in both quality and quantity) and are also indispensable for implementing—while reducing the riskiness and margins of approximation—the financial feasibility assessment phase, as it is interconnected with and dependent upon the dimensions of these same settlement parameters [61];

- Verification of the financial feasibility; calculation of the breakeven construction potential BEA (phase 3.a), and its comparison with the initiative’s construction potential (phase 3.b). To assess the financial feasibility, the choice was made to use BEA, by virtue of the possibility of considering productive/settlement and financial parameters at the same time; having estimated the fixed and variable costs of a settlement transformation intervention, as well as the assets’ unit sale values achievable with that intervention, BEA makes it possible to determine the breakeven construction potential necessary for the intervention to be financially sustainable, which is to say for it to be able to compensate the SPR with ordinary market profitability [27]; the initiative’s financial feasibility will derive from comparison between the intervention’s construction potential and the breakeven construction potential;

- Verification of the initiative’s balance; estimate of any extra profits through CMA (phase 4.a), and, where needed, proposal for balancing the initiative (phase 4.b). The choice was made to use CMA to verify the initiative’s balance conditions. In particular, CMA, from which the possibility of estimating the extra profits generated with the initiative—if financially feasible—derives, allows the financial quantity generated to repay the fixed costs to be estimated; then, by subtracting the fixed costs from this amount, the extra profit that the operation generates can be estimated. With respect to the results of BEA and CMA, scenarios may be constructed to be submitted to the municipal administration, which is tasked with the decisions on the intervention. These may provide for a balanced division of any extra profits between the SPU and the SPR.

3.2. Development of the Assessment Procedure

3.2.1. Acquisition of the Objectives the Municipality Intends to Pursue with the Initiative (Phase 1)

3.2.2. Definition of the Initiative Settlement Parameters (Phase 2)

- qf1 = construction potential intended use 1;

- qf2 = construction potential intended use 2;

- qfn = construction potential intended use n.

- qr = residential construction potential;

- qnr = non-residential construction potential.

- qur = unit residential construction potential per settled inhabitant (inhab) pursuant to the regulations in force;

- Spc = per capita urban planning standard per settled inhabitant pursuant to the regulations in force;

- cnr = coefficient of reference for urban planning standards referring to non-residential construction potentials as per the regulations in force;

- Sus = suppressed urban planning standards to be recovered (where applicable).

- qur = 25 m2 or 80 m3 per inhabitant (m2/inhab or m3/inhab)

- Spc = 18 m2 per inhabitant (m2/inhab)

- cnr = 80% of gross usable area

- cottages and/or duplexes and/or row houses, if ;

- apartment blocks if .

3.2.3. Verification of the Financial Feasibility of the Initiative (Phase 3)

3.2.4. Checking the Balance of the Initiative (Phase 4)

- Pu = unit prices of the initiative’s sellable buildings;

- Cvu = variable unit costs of constructing the initiative’s buildings;

- q = construction potential of the initiative.

4. Application of the Model

4.1. Intervention Case: SH in PPP as an Alternative to a Self-Renovation Initiative

4.2. Acquisition of the Objectives the AC Intends to Pursue with the Initiative

- the municipal administration to adjust the original school building structure, with the construction of 18 three-room units plus a social space, charged against municipal and regional allocations;

- the assignee cooperative, consisting of the future beneficiaries, to carry out all the finishing construction works both of the common parts and outside the building, by means of a loan guaranteed by the municipal administration.

4.3. Definition of the Initiative Settlement Parameters

4.4. Verification of the Financial Feasibility of the Initiative

4.5. Verification of the Balance of the Initiative

- first, the total margin of contribution (Formulas (11) and (12))

- then, the extra profit

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Cecodhas. Housing Europe Review 2012: The Nuts and the Bolts of European Housing System. 2011. Available online: http://www.housingeurope.eu/resource-105/the-housing-europe-review-2012 (accessed on 9 May 2017).

- Benon, K.; Mbabazize, M.; Shukla, J. Effect of private sector involvement in public private partnership performance in housing construction projects in city of Kigali. Eur. J. Bus. Soc. Sci. 2016, 5, 237–250. [Google Scholar]

- Davidson, N.M. Affordable Housing and Public-Private Partnerships; Routledge: London, UK, 2016. [Google Scholar]

- Mital, K.M.; Mital, V. Public Private Partnership and Social Infrastructure; Computer Society of India: Mumbai, India, 2016; Available online: http://www.csi-sigegov.org/1/13_353.pdf (accessed on 9 May 2017).

- Roberts, P.; Sykes, H.; Granger, R. Urban Regeneration; Sage: New York, NY, USA, 2016. [Google Scholar]

- Löhr, D. Sustainable housing: A ground lease partnership model. Land Use Policy 2017, 60, 281–286. [Google Scholar] [CrossRef]

- Scenari Immobiliari. Social Housing in Europa e Focus Sull’Italia. 2010. Available online: http://www.scenari-immobiliari.it/ITPublic/download_free_list.aspx?IdArt=563 (accessed on 9 May 2017).

- Clifton, C.; Duffield, C. Improved PFI/PPP service outcomes through the integration of alliance principles. Int. J. Proj. Manag. 2006, 24, 573–586. [Google Scholar] [CrossRef]

- Sagalyn, L.B. Public/private development: Lessons from history, research, and practice. J. Am. Plan. Assoc. 2007, 73, 7–22. [Google Scholar] [CrossRef]

- Napoli, G.; Giuffrida, S.; Trovato, M.R. Fair planning and affordability housing in urban policy. The case of syracuse (Italy). In Proceedings of the International Conference on Computational Science and Its Applications, Beijing, China, 4–7 July 2016. [Google Scholar]

- Guarini, M.R.; Battisti, F. Benchmarking multi-criteria evaluation methodology’s application for the definition of benchmarks in a negotiation-type public-private partnership. A case of study: The integrated action programmes of the Lazio Region. Int. J. Bus. Intell. Data Min. 2014, 9, 271–317. [Google Scholar] [CrossRef]

- Bubbio, A. L’activity Based Costing per la Gestione dei Costi di Struttura e Delle Spese Generali; Libero Istituto Universitario Carlo Cattaneo: Castellanza, Italy, 1993. [Google Scholar]

- Bartoli, F. Tecniche e Strumenti per L’analisi Economico-Finanziaria. Piani, Programmi, Modelli e Indicatori Economico-Finanziari alla Luce di Basilea 2; Franco Angeli: Milan, Italy, 2006. [Google Scholar]

- Drury, C.M. Management and Cost Accounting; Springer: Berlin, Germany, 2013. [Google Scholar]

- Kaplan, R.S.; Shank, J.K.; Horngren, C.T.; Boer, G.; Ferrara, W.L.; Robinson, M.A. Contribution margin analysis: No longer relevant/strategic cost management: The new paradigm. J. Manag. Account. Res. 1990, 2, 1–32. [Google Scholar]

- Garvey, P.R.; Book, S.A.; Covert, R.P. Probability Methods for Cost Uncertainty Analysis: A Systems Engineering Perspective; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Shrieves, R.E.; Wachowicz, J.M., Jr. Free cash flow (FCF), economic value added (EVA™), and net present value (NPV): A reconciliation of variations of discounted-cash-flow (DCF) valuation. Eng. Econ. 2001, 46, 33–52. [Google Scholar] [CrossRef]

- Ozdemir, U.; Ozbay, I.; Ozbay, B.; Veli, S. Application of economical models for dye removal from aqueous solutions: Cash flow, cost-benefit, and alternative selection methods. Clean Technol. Environ. Policy 2014, 16, 423–429. [Google Scholar] [CrossRef]

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management: Concepts, Techniques and Tools; Princeton University Press: Princeton, NJ, USA, 2015. [Google Scholar]

- De Fusco, R.A.; McLeavey, D.W.; Pinto, J.E.; Runkle, D.E.; Anson, M.J. Quantitative Investment Analysis; John Wiley & Sons: Hoboken, NJ, USA, 2015. [Google Scholar]

- Copiello, S. A discounted cash flow variant to detect the optimal amount of additional burdens in public-private partnership transactions. MethodsX 2016, 3, 195–204. [Google Scholar] [CrossRef] [PubMed]

- Liao, M. Model sampling: A stochastic cost-volume-profit analysis. Account. Rev. 1975, 50, 780–790. [Google Scholar]

- Adar, Z.; Barnea, A.; Lev, B. A comprehensive cost-volume-profit analysis under uncertainty. Account. Rev. 1977, 52, 137–149. [Google Scholar]

- Ismail, B.E.; Louderback, J.G. Optimizing and satisficing in stochastic cost-volume-profit analysis. Decis. Sci. 1979, 10, 205–217. [Google Scholar] [CrossRef]

- Constantinides, G.M.; Ijiri, Y.; Leitch, R.A. Stochastic cost-volume-profit analysis with a linear demand function. Decis. Sci. 1981, 12, 417–427. [Google Scholar] [CrossRef]

- Chung, K.H. Cost-volume-profit analysis under uncertainty when the firm has production flexibility. J. Bus. Financ. Account. 1993, 20, 583–592. [Google Scholar] [CrossRef]

- Morano, P.; Tajani, F. The break-even analysis applied to urban renewal investments: A model to evaluate the share of social housing financially sustainable for private investors. Habitat Int. 2017, 59, 10–20. [Google Scholar] [CrossRef]

- Cafferky, M. Breakeven Analysis: The Definitive Guide to Cost-Volume-Profit Analysis; Business Expert Press: New York, NY, USA, 2010. [Google Scholar]

- Dean, J. Cooperative research in cost-price relationships. Account. Rev. 1969, 14, 181–184. [Google Scholar]

- Colantoni, C.S.; Manes, R.P.; Whinston, A. Programming profit rates and pricing decisions. Account. Rev. 1969, 44, 467–481. [Google Scholar]

- Alhabeeb, M.J. Mathematical Finance; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar] [CrossRef]

- Hassan, N.; Marquette, R.P.; McKeon, J.M., Jr. Sensitivity analysis: An accounting tool for decision making. Manag. Account. 1978, 59, 43–50. [Google Scholar]

- Klipper, H. Break-even analysis with variable product mix. Manag. Account. 1978, 59, 51–54. [Google Scholar]

- Chan, K. Break-even analysis: A unit cost model. CGA Mag. 1985, 31, 19–20. [Google Scholar]

- Schweitzer, M.; Trossmann, E.; Lawson, G.H. Break-Even Analyses: Basic Model, Variants, Extensions; John Wiley & Sons: Hoboken, NJ, USA, 1992. [Google Scholar]

- Welsch, G.A. I Budget: Come Prepararli e Impiegarli per Programmare e Controllare L’attività Aziendale; Franco Angeli: Milan, Italy, 1994. [Google Scholar]

- Kee, R.C. Implementing cost-volume profit analysis using an activity based costing system. Adv. Manag. Account. 2001, 10, 77–94. [Google Scholar]

- Horngren, C.T. A contribution margin approach to the analysis of capacity utilization. Account. Rev. 1967, 42, 254–264. [Google Scholar]

- Kaplan, R.S.; Atkinson, A.A. Advanced Management Accounting; PHI Learning: New Delhi, India, 2015. [Google Scholar]

- Stenis, J. Environmental optimisation in fractionating industrial wastes using contribution margin analysis as a sustainable development tool. Environ. Dev. Sustain. 2005, 7, 363–376. [Google Scholar] [CrossRef]

- Lev, B. On the association between operating leverage and risk. J. Finance. Quant. Anal. 1974, 9, 627–641. [Google Scholar] [CrossRef]

- Peterson, M.A. Cash flow variability and firm’s pension choice: A role for operating leverage. J. Financ. Econ. 1994, 36, 361–383. [Google Scholar] [CrossRef]

- Novy-Marx, R. Operating leverage. Rev. Financ. 2011, 15, 103–134. [Google Scholar] [CrossRef]

- European Commission. Green Paper on Public Private Partnerships. 2004. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=LEGISSUM:l22012&from=IT (accessed on 9 May 2017).

- Battisti, F.; Guarini, M.R. Public interest evaluation in negotiated public-private partnership. Int. J. Multi-Criteria Decis. Mak. 2017, 7. in press. [Google Scholar]

- Li, D.; Chen, H.; Hui, E.C.M.; Xiao, C.; Cui, Q.; Li, Q. A real option-based valuation model for privately-owned public rental housing projects in China. Habitat Int. 2014, 43, 125–132. [Google Scholar] [CrossRef]

- Tajani, F.; Morano, P. Evaluation of vacant and redundant public properties and risk control: A model for the definition of the optimal mix of eligible functions. J. Prop. Invest. Financ. 2017, 35, 75–100. [Google Scholar] [CrossRef]

- Giuffrida, S.; Napoli, G.; Trovato, M.R. Industrial areas and the city. Equalization and compensation in a value-oriented allocation pattern. In Proceedings of the International Conference on Computational Science and Its Applications, Beijing, China, 4–7 July 2016. [Google Scholar]

- European Commission. Charter of Fundamental Rights. 2000. Available online: http://www.europarl.europa.eu/charter/pdf/text_en.pdf (accessed on 9 May 2017).

- Eurostat. Housing Statistics. 2017. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Housing_statistics (accessed on 9 May 2017).

- Censis. 48° Rapporto Sulla Situazione Sociale Del Paese; Franco Angeli: Rome, Italy, 2014. [Google Scholar]

- Federcasa. Abitazioni Sociali. Motore di Sviluppo—Fattore di coesione. 2014. Available online: http://www.federcasa.it/documenti/archivio/Federcasa_DOSSIER_alloggio_sociale_agg_04_2014.pdf (accessed on 9 May 2017).

- Cassa Depositi e Prestiti. Social Housing. Il Mercato Immobiliare in Italia: Focus Sull’edilizia Sociale; Cassa Depositi e Prestiti: Rome, Italy, 2014. [Google Scholar]

- Guarini, M.R.; Battisti, F. Social housing and redevelopment of building complexes on brownfield sites: The financial sustainability of residential projects for vulnerable social groups. Adv. Mater. Res. 2014, 869–870, 3–13. [Google Scholar] [CrossRef]

- Guarini, M.R. Self-renovation in Rome: Ex Ante, in Itinere and Ex post evaluation. In Proceedings of the International Conference on Computational Science and Its Applications, Beijing, China, 4–7 July 2016. [Google Scholar]

- ANCE. Rapporto 2016 Sulla Presenza Delle Imprese di Costruzione Italiane Nel Mondo. 2016. Available online: https://www.ilcorrieredelgiorno.it/wp-content/uploads/2017/04/RAPPORTO-ANCE-2016.pdf (accessed on 9 May 2017).

- Guarini, M.R. Costi finanziari ed economici nell’autocostruzione. In La città Dimenticata una Proposta per L’emergenza Abitativa; Ferretti, L.V., Mariano, C., Eds.; Prospettive Edizioni: Rome, Italy, 2014. [Google Scholar]

- Guarini, M.R.; Battisti, F. Evaluation and management of land-development processes based on the public-private. Adv. Mater. Res. 2014, 869–870, 154–161. [Google Scholar] [CrossRef]

- Manganelli, B.; Del Giudice, V.; De Paola, P. Linear programming in a multi-criteria model for real estate appraisal. In Proceedings of the International Conference on Computational Science and Its Applications, Beijing, China, 4–7 July 2016. [Google Scholar]

- De Mare, G.; Granata, M.F.; Nesticò, A. Weak and strong compensation for the prioritization of public investments: Multidimensional analysis for pools. Sustainability 2015, 7, 16022–16038. [Google Scholar] [CrossRef]

- Bencardino, M.; Nesticò, A. Demographic changes and real estate values. A quantitative model for analyzing the urban-rural linkages. Sustainability 2017, 9, 536. [Google Scholar] [CrossRef]

- Collegio Ingegneri e Architetti Milano. Prezzi Tipologie Edilizie; DEI: Rome, Italy, 2014. [Google Scholar]

| Fixed Costs | |||||||

| Cf1 | Area/property value and registry costs | sold free by SPU | |||||

| Cf2 | Pre-existing demolition | m3 | 5,100 | €/m2 | 20 | € | 102,000 |

| Cf3 | Urbanization | m2 | 6,000 | €/m2 | 30 | € | 180,000 |

| Cf4 | Monetization standard non available | m2 | 0 | €/m2 | 150 | € | 0 |

| Cf5 | Realization underground parking not alienable | m2 | 0 | €/m2 | 800 | € | 0 |

| Cf6 | Realization buildings not alienable (including 18 SH accommodation) | m2 | 1,304 | €/m2 | 1,100 | € | 1,434,400 |

| Cf7 | Technical and general expenses (referred to Fixed Costs) | % | 8 | of | Cf1+Cf2+Cf3+Cf4+Cf5+Cf6 | € | 129,152 |

| Cf8 | Financial cherges (referred to Fixed Costs) | % | 10 | of | Cf1+Cf2+Cf3+Cf4+Cf5+Cf6+Cf7 | € | 174,355 |

| Cfd1 | Municipality contribution | by convention/budget/appropriations | € | −500,000 | |||

| Cfd2 | Accommodation assignees contribution | by convention | € | 0 | |||

| Cft | Total Fixed Costs | Cf1+Cf2+Cf3+Cf4+Cf5+Cf6+Cf7+Cf8+Cf9+Cf10 | € | 1,519,907 | |||

| Variable Costs | |||||||

| Cv1 | Realization alienable residential buildings | m2 | 936 | €/m2 | 1.100 | € | 1,029,600 |

| Cv2 | Technical and general expenses (referred to Variable Costs) | % | 8 | of | Cv1 | € | 82,368 |

| Cv3 | Concession fees | % | 10 | of | Cv1 | € | 102,960 |

| Cv4 | Financial cherges (referred to Fixed Costs) | % | 10 | of | Cv1+Cv2+Cv3 | € | 121,493 |

| Cv5 | Promoter ordinary profit | % | 20 | of | Cv1+Cv2+Cv3+Cv4 | € | 267,284 |

| Cv6 | Unexpected | % | 5 | of | Cv1+Cv2+Cv3+Cv4+Cv5 | € | 80,185 |

| Cvt | Total Variable Costs | Cv1+Cv2+Cv3+Cv4+Cv5+Cv6 | € | 1,683,890 | |||

| Cvu | Variable Costs for m2 | Cvt/qa | € | 1,799 | |||

| Unit Selling Prices | |||||||

| Pu | Unit revenue from the sale of real estate units | OMI, Rome, Area D34, I sem. 2016 (residential and not residential) | €/m2 | 3,600 | |||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guarini, M.R.; Battisti, F. A Model to Assess the Feasibility of Public–Private Partnership for Social Housing. Buildings 2017, 7, 44. https://doi.org/10.3390/buildings7020044

Guarini MR, Battisti F. A Model to Assess the Feasibility of Public–Private Partnership for Social Housing. Buildings. 2017; 7(2):44. https://doi.org/10.3390/buildings7020044

Chicago/Turabian StyleGuarini, Maria Rosaria, and Fabrizio Battisti. 2017. "A Model to Assess the Feasibility of Public–Private Partnership for Social Housing" Buildings 7, no. 2: 44. https://doi.org/10.3390/buildings7020044