3.1. New London

Assessment ratios in the year of a revaluation should meet certain standards in order to qualify the success of the assessment program. The City of New London’s population of real estate is heterogeneous in both the classes of property and the variety of property within those classes. In addition, the city’s total population of properties is quite small; only 7275 parcels. We examine all ‘qualified’ sales of real estate in New London from 1 October 2007 through 31 September 2009. This period (October through September) corresponds with the tax years 2008 and 2009 and is the term used by the state to calculate assessment ratios for municipalities. Since no land or site value is calculated by the city for condominiums, condominiums were not examined in this study. An assessment ratio of 100 percent for appraised values and 70% for assessed values should be achieved within a certain level of accuracy (C.G.L. §12-62-3(b) et. seq.). Considering the complexity and variety of property in New London, a coefficient of dispersion of fifteen percent or less should be achieved in the year of a revaluation [

10].

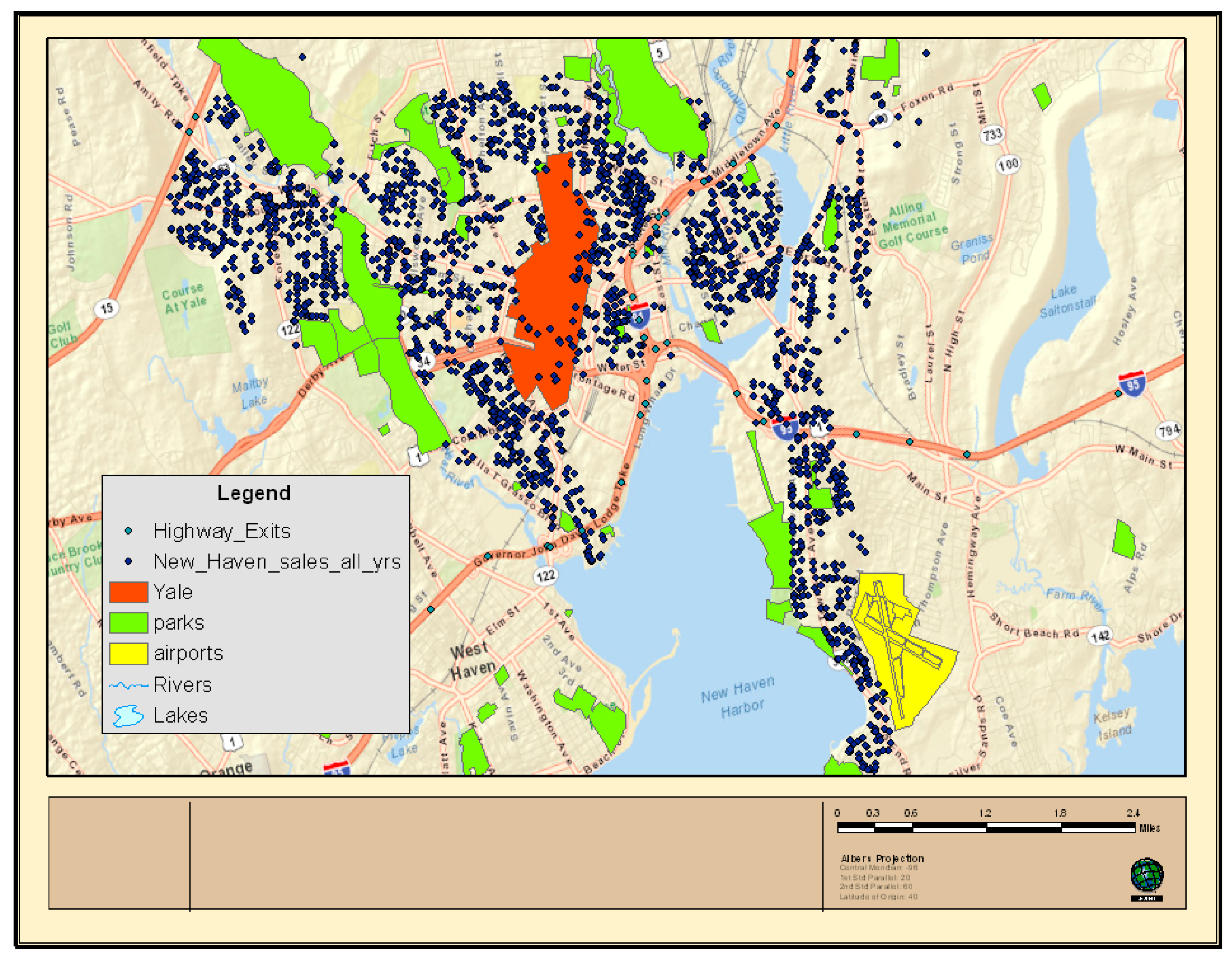

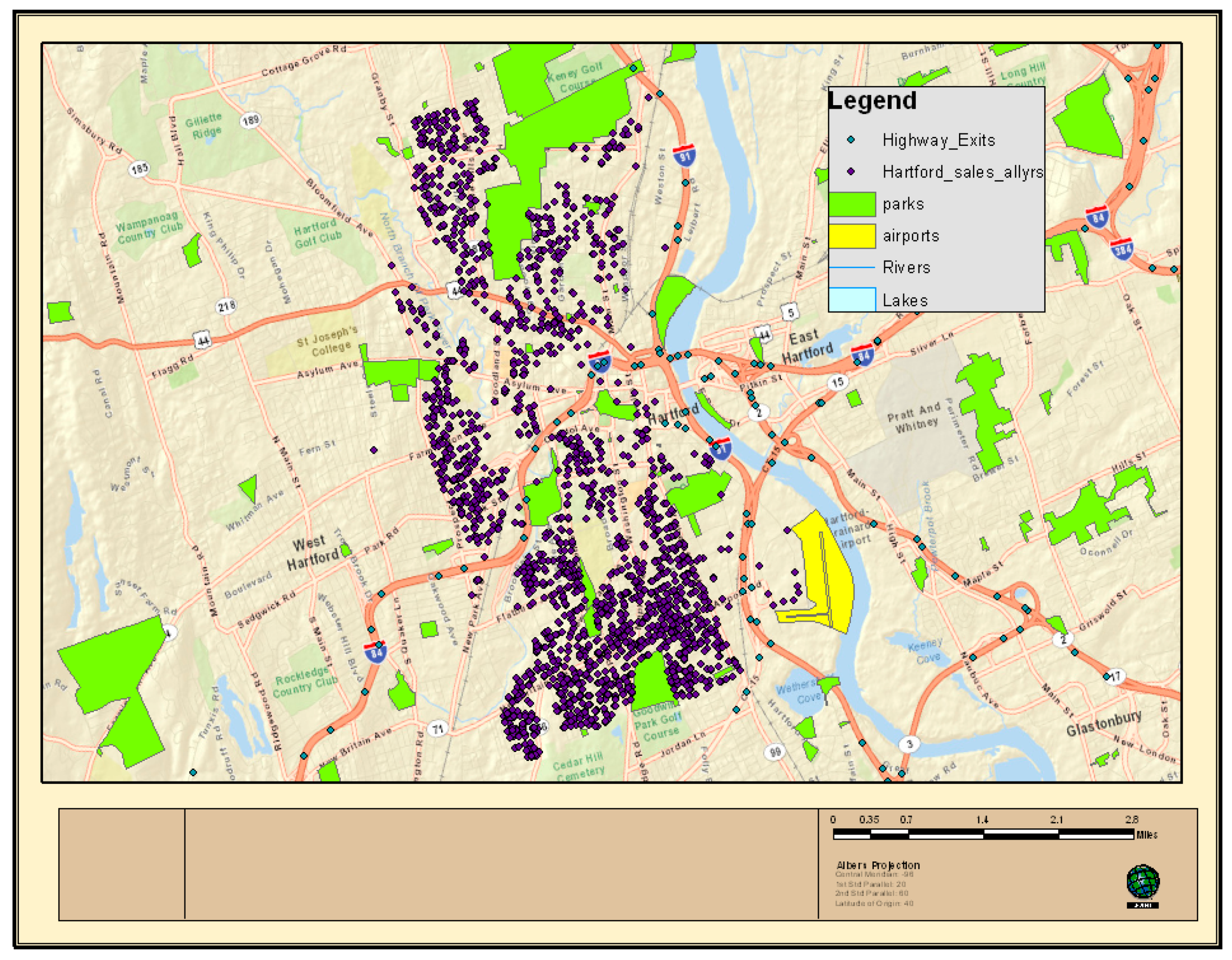

In the selected term, there were only 205 ‘qualified’ sales. The locations of these sales, along with the locations of highway exits, the airport, and parks, can be seen in

Figure 1. Of these 205 qualified sales, 182 were single family residential properties. Twenty two were two-family or three-family residential properties. One was a multifamily apartment building, which may be regarded as a commercial class or a residential class property. There were no industrial properties and no site sales in any class of property. Normally, ratio studies are dominated by observations of residential class properties. Residential properties tend to represent the largest pool in the total population of property classes. Residences also tend to turn-over more frequently in real estate markets. In New London, residential class properties, including multifamily properties, represent eighty-four percent of the total. Due to the lack of qualified sales of properties from other classes, the sample is not representative.

For small jurisdictions like New London, the lack of adequate sales to support assessments means reliance on alternative valuation methods that lack substantial confidence. Even for commercial and industrial class properties, where an income approach to value can be utilized, the development of capitalization rates without actual sales can be less accurate.

Where the sample does represent eighty-four percent of the city’s parcel population, our study tests the accuracy of the assessment program as it pertains to residential properties. We examine the appraised values in addition to the assessed values as an approach to extracting the site value (explained in more detail below). While the purported goal of a revaluation is to appraise all property at 100% of the market value, most programs target between 95% and 98%. Assessors target these lower levels for two reasons. First, an assessment program with a ratio between 95% and 98% will still likely be accurate enough to meet a high confidence level in a null hypothesis analysis that the ratio is 100%. Second, since the ratio is measured as a median, if the actual ratio is 100%, then half of all assessments will exceed the market value. By targeting a lower ratio, the assessor will meet the market value requirement and will have fewer complaints of over-assessment.

The median ratio is 96%, with a coefficient of dispersion of 7.7. The mean ratio is 97%, with a standard deviation of 9.89. The distribution is unimodal (see

Figure 2), with a low degree of dispersion, as indicated by the small standard deviation. There is only a slight skew apparent to the higher ratios. These results are fairly remarkable considering the complexity of the residential pool of properties. They suggest a high degree of accuracy for the assessment of residential properties. They also suggest that additional extrapolation may be permissible.

Since there was a high degree of accuracy in the total assessment of residential class property, extracting the assessed improvement value may reveal accurate site values. Specifically, since (LV + IV) = AV and AV = SP, then (AV − IV) = (SP − IV), where LV is assessed site value; IV is the assessed improvement value; AV is the appraised value; and SP is the sale price. If the extracted appraised site value is accurate when measured against the extracted site value from the sale price, then the use of the site value in a split rate tax will have better results.

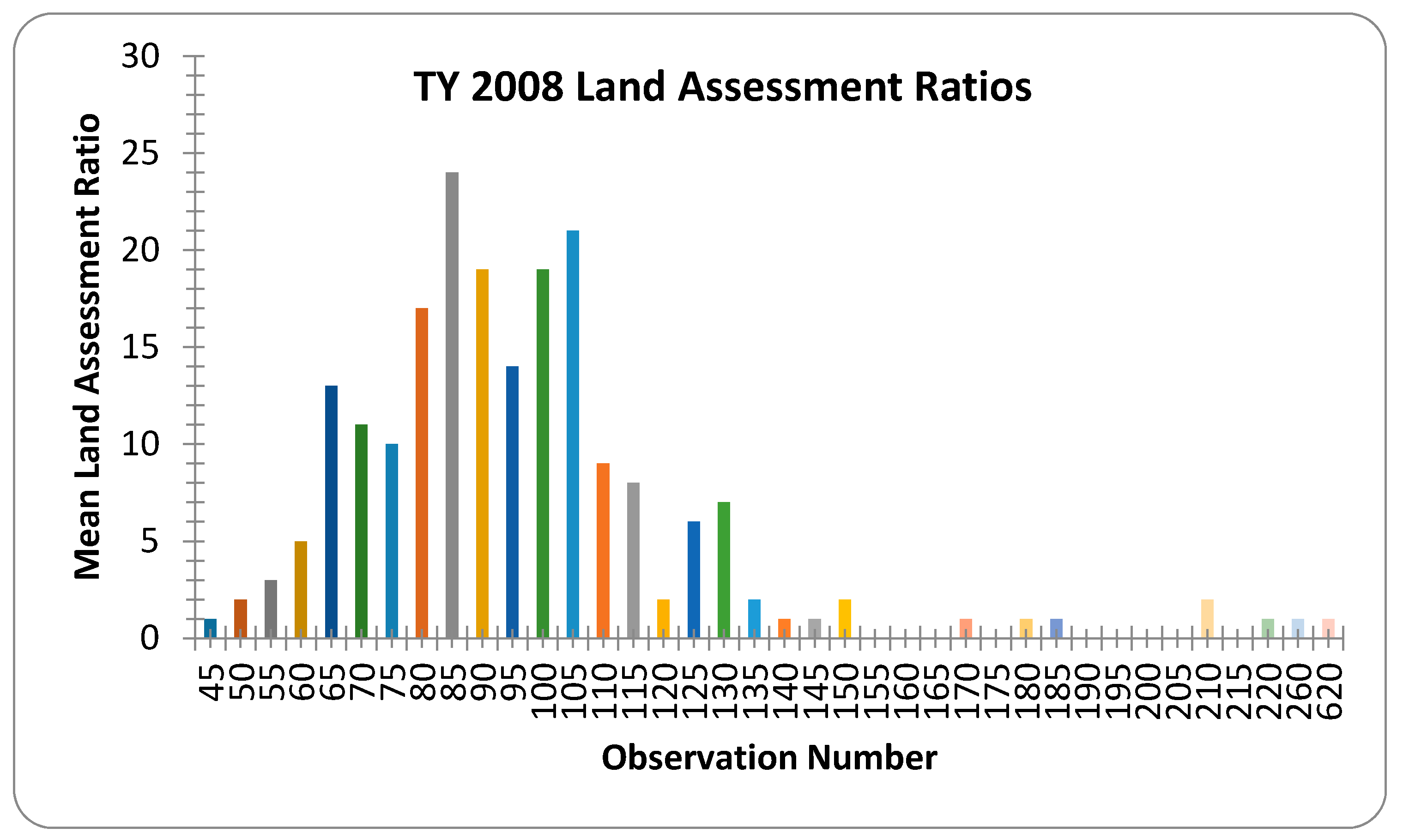

Unfortunately the results are poor. The median ratio for the improvement extracted sample is 90%, with a coefficient of dispersion of 24.5. The mean ratio is 97% with a standard deviation of 46.8. As explained above, the International Association of Assessing Officers standard for a coefficient of dispersion for land is 20. The graphed results show a very different result from the overall assessment ratio. Instead of the standard normal model,

Figure 3 shows a tri-modal result, skewed to the left, with several outliers. These results indicate that, even with an excellent overall assessment program, New London site values cannot simply be extracted for accurate results. The distribution of the land tax in a split rate program would result in inequities.

These results are also examined to determine if vertical inequities exist. The mean ratio and the standard deviation and the median ratio and the coefficient of dispersion are measures of horizontal equity. An assessment program, however can also suffer inequities between the treatments of high value properties versus low value properties. The price-related differential (PRD) is the tool advocated by the International Association of Assessing Officers to measure whether an assessment program is progressive, regressive, or neutral. The goal of an assessment program is to be neutral.

The PRD is calculated by dividing the mean of the observations by the weighted mean. A weighted mean is calculated by summing the assessments, summing the sale prices, then dividing the sum of the assessments by the sum of the sale prices. For a neutral program, this calculation should be close to 1.00. When the PRD is over 1.00, the program is regressive, or lower valued properties are assessed as higher than higher valued properties. If the PRD is less than 1.00, the program is progressive. Ideally, the PRD should fall within a range of 0.98 and 1.03 [

10].

Since assessment programs tend to produce non-parametric results, the PRD has been criticized as not accurately reflecting inequity. The PRD employs the mean, which is a superior tool when the assessment ratios follow a normal distribution. Recently, an alternative tool to measure bias in non-parametric results has been reviewed by the International Association of Assessing Officers. The tool is referred to as the price-related bias (PRB). The coefficient of the PRB is obtained by regressing percentage differences from the median assessment ratio on percentage differences from the median value. The regression coefficient quantifies the relationship between property values and assessment levels. [

17]. Where the PRB has not been adopted as a standard measure by the IAAO, the PRB is simply calculated in this study, and it is not a major focus of our analysis or discussion.

For 2008, the PRD for New London land values is 1.159. This PRD indicates that there is an unacceptable level of bias and that land assessments are regressive in nature. The PRB is 0.77. By 2009, the PRD worsens to 1.31, while the PRB improves to 0.55.

The total assessment levels are analyzed by comparing sales of ‘new’ buildings against the sales of ‘old’ buildings. ‘New’ buildings are defined in a range of age between new and forty years old. Forty is selected because commercial cost manual and revaluation companies frequently use forty as the basis for the economic life of most buildings. Economic life means the anticipated amount of time a building will contribute to the property’s value. ‘Old’ buildings tend to have a greater disparity in condition and utility. If old buildings also have a greater disparity in the uniformity of assessments, then a split-rate tax or land tax should motivate the owner to improve the building’s condition, modify the building to improve its utility, and convert the property to its highest and best use.

For New London in 2008, the overall levels of assessment between old buildings and new buildings are highly similar. The mean ratio for new buildings is 96.6% with a standard deviation of 0.069; the mean ratio for old buildings is 96.1% with a standard deviation of 0.083. The median ratio for new buildings is 95.7% with a coefficient of dispersion of 0.045; the median ratio for old buildings is 95.5% with a coefficient of dispersion of 0.07. The PRD for new buildings is 0.94, and the PRD for old buildings is 0.89. Both indicate progressive assessment programs, with higher valued buildings being assessed at a higher rate. The variations between these, however, suggest that there is no material difference in the assessment levels between new and old buildings. Since the overall COD is above the range of 20%, disaggregating properties between old versus new is unlikely to provide an acceptable range for the COD for either old or new buildings.

A final problem with implementing the land tax program in New London is the term of the revaluation. Connecticut municipalities are required to revalue property once every five years. This was the intent in New London. While excellent statistical results are achieved in the first tax year, the program degrades substantially in the second tax year. There are 159 qualified sales in this term. The median ratio of appraised values is 113%, with a coefficient of dispersion of 16.5. The mean ratio is 117% with a standard deviation of 28.4. Property classes are only slightly more varied, with seven commercial class properties. Considering the poor results in the land extraction in 2008, they are amplified in 2009. The median ratio is 75% with a coefficient of dispersion of 99. The mean ratio is 29% with a standard deviation of 7.5. The lack of accuracy in the assessments would have posed significant problems for the administration of the land tax.

To consider the possibility of differences between ‘large’ versus ‘small’ parcels of land, as well as differences between ‘expensive’ and ‘less expensive’ properties, the accuracy of land assessments in New London is also examined by comparing the assessment of the land with the extracted market value of the land on a unit basis. The assessment assigned to the land is divided by the square footage of the site. Similarly, the market value of the land is extracted from the sale price by subtracting the assessed value of the buildings and then dividing it by the square footage of the land. The assessed value per square foot is then divided by the market value per square foot.

Like the above-findings, there is an acceptable level of assessment in the first year of the revaluation, 2008.

Table 1 shows that the indicated mean is 93.3% with a standard deviation of 0.281. The indicated median is 89.8%, slightly below the ideal level range of 90% to 105%. The coefficient of dispersion also indicates a fair level of uniformity at 20.6. So, for the first year, there are marginally acceptable results indicating that the assessment per square foot is relatively proportionate.

Also, similar to the above-findings, the degree of proportionality falls precipitously in subsequent years. By 2009, the mean ratio leaps to 165.9% with a standard deviation of 2.73. The median ratio also witnesses extreme changes, rising to 125%. The coefficient of dispersion is 99.9, indicating no relationship whatsoever. A helpful referee indicated that these results for post-2008 may reflect the housing crisis, which began around that time.

Variations between residential class properties and commercial class properties are examined. The results suggest that commercial class properties are favorably treated in relation to residential class properties in the assessment program in New London. Commercial class properties have an overall mean ratio of 86.6% and an overall median ratio of 85.8%. A standard deviation of 0.062 and a coefficient of dispersion of 4.8% indicate a strong correlation in the overall values. On the other hand, residential class properties are assessed at an overall mean ratio of 96.9% and an overall median ratio of 96.1%. The measures of variation similarly show strong correlations, with a standard deviation of 0.076 and a coefficient of dispersion of 6%. These results illustrate the underassessment of commercial class properties by nearly 12%.

Driving deeper, variations between the extracted land values of commercial class properties and residential class properties indicate a strong bias towards commercial class. Commercial land is assessed at an overall mean of 57.6% and an overall median of 55.2%. The standard deviation and coefficient of dispersion slip from the whole property assessment but still fall within or near an acceptable range. For commercial land, the standard deviation is 0.166, while the coefficient of dispersion is 21.9%. Residential land is assessed at an overall mean of 96.1% and an overall median of 92.3. Its measures of variation for the standard deviation are 0.28 and for the coefficient of dispersion are 18.8%. The differences in these ratios suggest that commercial land enjoys a 66.8% advantage over residential land. This disparity would need to be rectified before implementing a land tax.

We also plot the extracted sale price of land against square feet and study the mean COD and PRD for two other categories of properties, proximate to parks and near highway exits. The locations of the parks and highway exits can be seen in

Figure 1. For residential land located ¼ mile or less from the nearest park, the COD is approximately 0.32. Similarly, for residential land ¼ mile or less to the nearest highway exit, the COD is approximately 0.42. Both of these estimates for the COD imply that properties within ¼ mile of the nearest park or the nearest highway exit would not be viable candidates for a split tax if assessment equity is a concern. Affirming this is the fact that the sale prices of plots of extracted land exhibited no noticeable relationship.

3.2. New Haven

New Haven completed its last revaluation in 2006 and is scheduled to complete its next revaluation in 2011. Like New London, property types in the city are heterogeneous. As indicated previously, this study examines the performance in terms of equity beginning with the year of revaluation.

Similar to New London, the overall ratio for the City of New Haven results in excellent terms when regarding the overall performance. New Haven’s data are evaluated using assessed values; assessments represent seventy percent of the full value. Like New London, the selected samples represent verified transactions from the first day of the tax year, October 1, through September 30th. All sales in this period are utilized, without determining whether a representative sample is actually acquired. This method corresponds to the State of Connecticut’s method for the equalization of the total assessed values between jurisdictions.

We examine all ‘qualified’ sales of real estate in New Haven from 1 October 2005 through 30 September 2010. This period (October through September) corresponds with the tax years 2006 through 2010 and is the term used by the state to calculate the assessment ratios for municipalities. The locations of the sales for the tax years 2007 to 2010, as well as other landmarks such as parks, highway exits, the airport, and Yale University, can be seen in

Figure 4. Since no land or site value is calculated by the City for condominiums, condominiums are not examined in this study. Similar to New London, the complexity and variety of property in New Haven should result in a coefficient of dispersion of fifteen percent or less in 2006 [

10].

In 2006, New Haven’s equalized assessment ratio is calculated at 92.0%, as is shown in

Table 2. We use an equalized assessment in this study to make comparisons between jurisdictions in similar terms. An assessment is ‘equalized’ by dividing the assessment by the statutory assessment ratio. This result is slightly below an optimum ratio. The statutory overall ratio should be 70%. Although the variances indicated by both the standard deviation, 14, and the coefficient of dispersion, 9.6, suggest relatively low overall variance in observations, there are significant outliers that indicate a non-normal distribution. By 2010, the total assessment ratio had increased to 177%, with significant degradation of the overall program indicated by degrees of variance. The standard deviation shot to 1044, while the coefficient of dispersion leapt to 76.8%. By 2010, there was no significant relationship between assessments and market value in the City of New Haven.

As for New London, because the assessment program was successful in the first two years in terms of total assessments, there is a possibility that the ratio of land assessments to extracted land values might also reflect a significant relationship. Thus, we extract the assessed values of improvements from both the assessment and the sale prices for the New Haven properties.

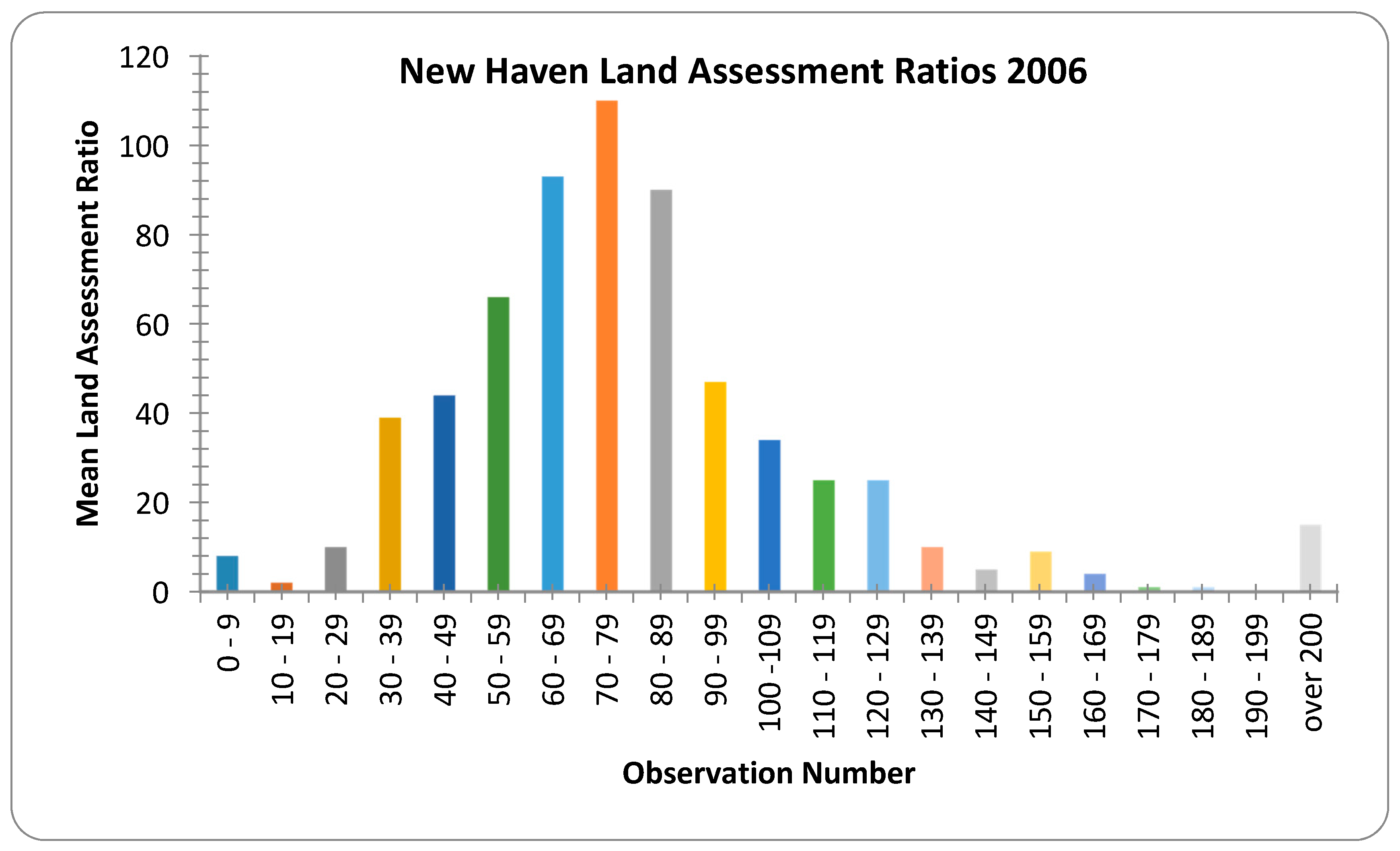

In 2006, the indicated land ratio for New Haven, based on the median, is 75%. The distribution of the land ratios is shown in

Figure 5 and

Figure 6. A review of classes of property and the ages of properties shows no bias to either. The mean ratio is calculated at 80.4% (see

Table 3). The measures of dispersion from both the median and the mean, however, suggest no relationship between the assessed value of land and the extracted market value of land. The standard deviation in 2006 is 3.7, while the coefficient of dispersion is 71.7%. In 2007, measures of dispersion worsen significantly for the standard deviation and for the coefficient of dispersion. By 2010, the median ratio has dropped to 73.6%, with a coefficient of dispersion of 406.3%.

In examining bias in the New Haven program, the price-related differential for land values exceeds the International Association of Assessing Officers’ standard of 0.98 to 1.03 for each year of the assessment program, as can be seen in

Table 3. In both 2006 and 2007, the PRD is 1.12, indicating a slightly regressive program for land valuation. Due to anomalies in the calculation of the land value, the 2008 PRD of −1.53 lacks meaning. For 2009 and 2010, however, the PRD fluctuates wildly between 1.99 and 1.04. Both, however, indicate a regressive land valuation program.

We also examine the possibility of differences between ‘large’ versus ‘small’ parcels of land, as well as differences between ‘expensive’ and ‘less expensive’ properties. In this regard, New Haven land assessments were examined by comparing the assessment per square foot and the extracted market value per square foot. Predictably, the only variations from the overall land value statistics were from the weighted mean and the PRD. The weighted mean varied because it is calculated from the sum of the assessments per square foot divided by the sum of the sale prices less building values per square foot. Since the weighted mean changed, the PRD also changed. The PRD in this analysis never meets equity standards. It is regressive through nearly the whole term of the revaluation, reaching as high as 6.69 in 2009. In 2010, the PRD falls to 0.85, suggesting a swing to a progressive program. More likely, however, the PRD may not be an accurate measure of vertical equity in any year.

Similar to New London, we analyze the overall New Haven assessments between new buildings and old buildings for the year of the revaluation, 2006. Also like New London, the overall levels of assessment between old buildings and new buildings are highly similar. The mean ratio for new buildings is 93.2% with a standard deviation of 0.091; the mean ratio for old buildings is 92.1% with a standard deviation of 0.128. The median ratio for new buildings is 92.4% with a coefficient of dispersion of 0.068; the median ratio for old buildings is 92% with a coefficient of dispersion of 0.09. The PRD for new buildings is 1.01, and the PRD for old buildings is 1.02. These PRD indicate a neutral program with no progressive or regressive bias. The variations between these, however, suggest that there is no material difference in the assessment levels between new and old buildings.

The 2006 revaluation in New Haven was a statistical adjustment of assessed values and not a ‘full’ revaluation. It appears that the factors employed in that revaluation were heavily focused on the costs of improvements. Considering an overall level of assessment of 92% and a level of assessment for land at 75%, a split-rate tax might be employed simply to equalize the effect of an overall tax.

We also examine the COD and PRD for properties in New Haven that are close to parks, close to the airport, and close to the nearest highway exit for the years 2007 through 2010. In addition, we examine the COD and PRD for properties that are ‘close’ to Yale University. The locations of these landmarks relative to the sold properties are shown in

Figure 4. We also plot the extracted land sale price against square feet for each of these categories, although we find no noticeable pattern.

For our purposes, we define ‘close’ as less than or equal to 0.25 miles. Within ¼ miles of parks, we find that the CODs for extracted residential and commercial land values are extremely high; approximately 150% and 300%, respectively. The PRDs are 2.4 and 5.6 for residential and commercial land, respectively. Within ¼ miles of the nearest highway exit, we find that the CODs for residential and commercial extracted land values are 198% and 160%, respectively. For ¼ miles from the nearest airport, the COD for residential extracted land values is approximately 140%, while, for commercial properties ¼ mile from the airport, there are insufficient numbers of observations (only two parcels) to calculate the COD. For properties within ¼ mile of Yale University, the CODs for residential and commercial extracted land values are 108% and 124%, respectively. Also, the PRsD are 1.9 and 2.5, respectively, implying a highly regressive assessment structure for these properties near Yale University. Thus, it appears as if there are no viable candidates for an equitable split tax among the groupings of properties we examine for New Haven.

3.3. Hartford

As did New Haven, Hartford completed its last revaluation in 2006 and was scheduled to complete its next revaluation in 2011. The property types in Hartford are relatively heterogeneous. As indicated previously, this study examines the performance in terms of equity, beginning with the year of revaluation.

Similar to both New London and New Haven, the overall ratio for Hartford results in excellent terms regarding the overall performance. Hartford’s data are evaluated using assessed values; assessments represent seventy percent of the full value. The selected samples represent verified transactions from the first day of the tax year, 1 October through 30 September. All sales are utilized in this period, without determining whether a representative sample is actually acquired. This method corresponds to the State of Connecticut’s method for the equalization of the total assessed values between jurisdictions.

We examine all ‘qualified’ sales of real estate in Hartford from 1 October 2005 through 30 September 2009. This period (October to September) corresponds with the tax years 2006 through 2010 and is the term used by the state to calculate the assessment ratios for municipalities. The locations of these properties, along with the locations of highway exits, the nearest airport, and parks, are shown in

Figure 7. Since no land or site value is calculated by the city for condominiums, condominiums are not examined in our study. Like New London and New Haven, the complexity and variety of property in Hartford should result in a coefficient of dispersion of fifteen percent or less in 2006 [

10].

In 2006, Hartford’s total assessment ratio is calculated at over 97% (as can be seen

Table 4). The purported goal of a revaluation is to appraise all property at 100% of the market value, and most programs target between 95% and 98%. This assessment level is still likely to be accurate enough to meet a high confidence level in a null hypothesis analysis that the ratio is 100%. The Hartford data utilizes full value assessments, like New London. New Haven utilizes equalized assessments. The New Haven assessments are at 70% of their full value assessments.

This result is encouraging, as the full value assessment is close to 100% and the measures of deviation from the central tendency suggest a strong relationship between assessments and sale prices in 2006. The standard deviation is calculated at 14, and the coefficient of dispersion is calculated at 5.3%. For Hartford, the strength of its assessment program remains through 2008. In 2008, the median ratio is 96.9% with a coefficient of dispersion of 12% and a standard deviation of 16. Like New London, the basis for extracting a land value from the assessments and market prices is superior to the basis in New Haven.

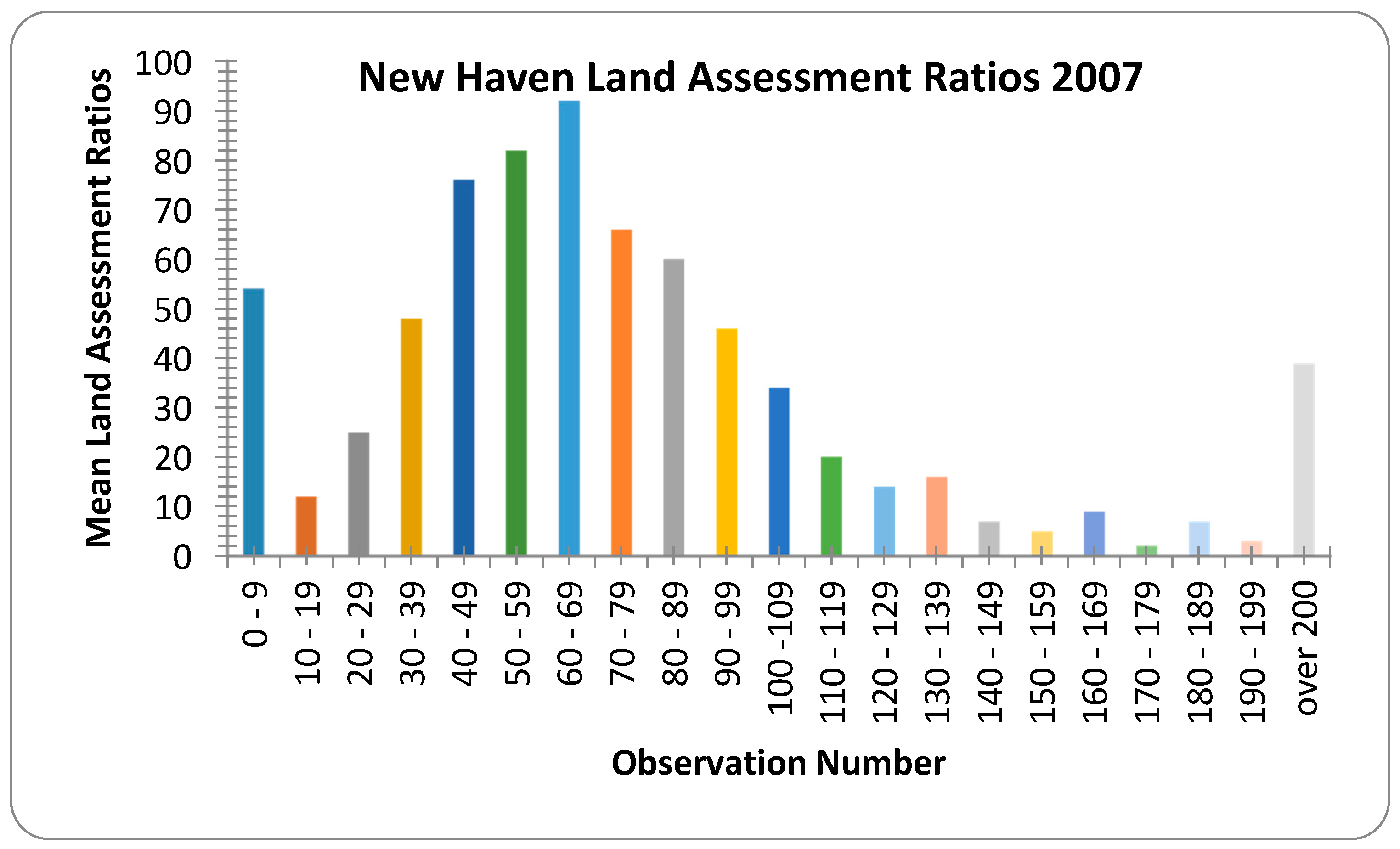

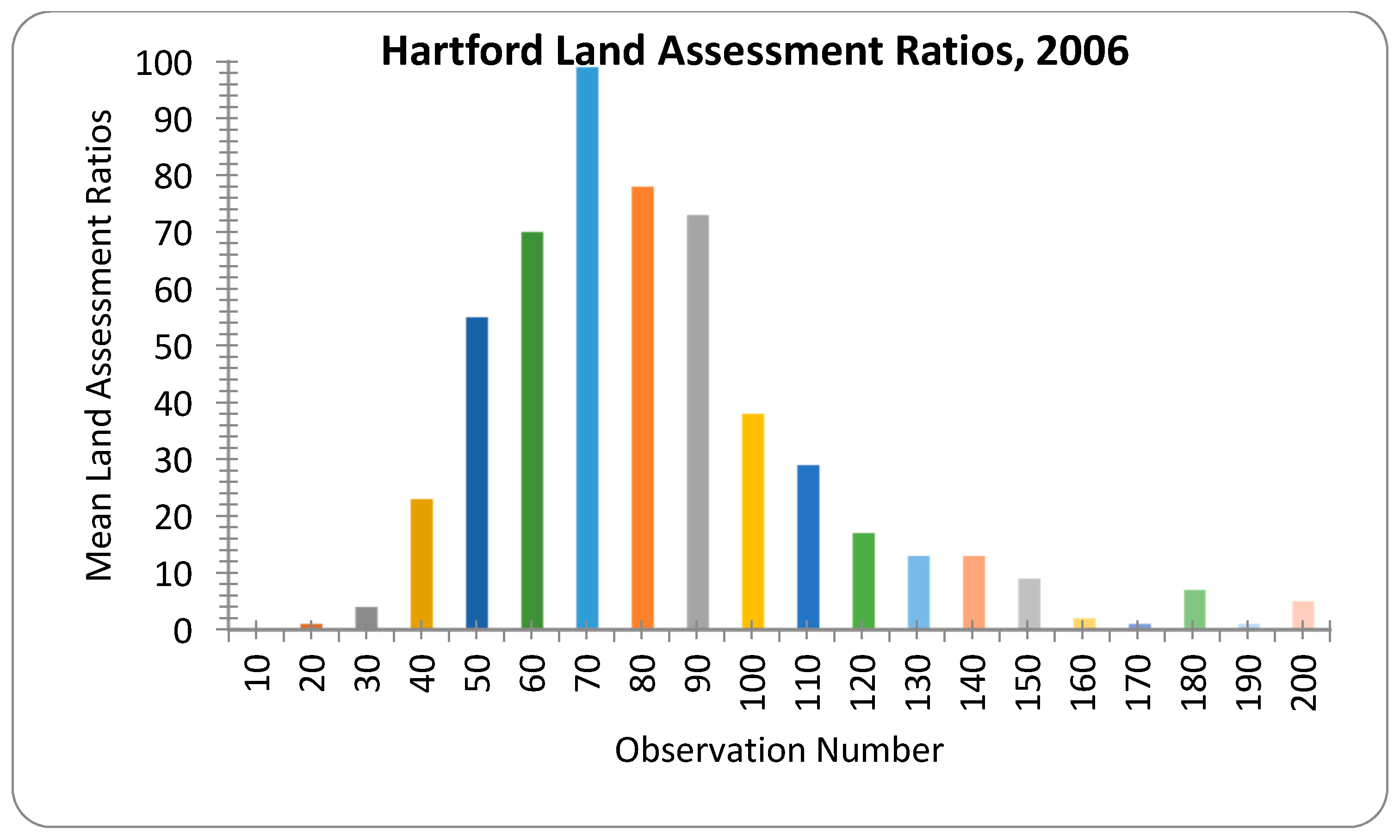

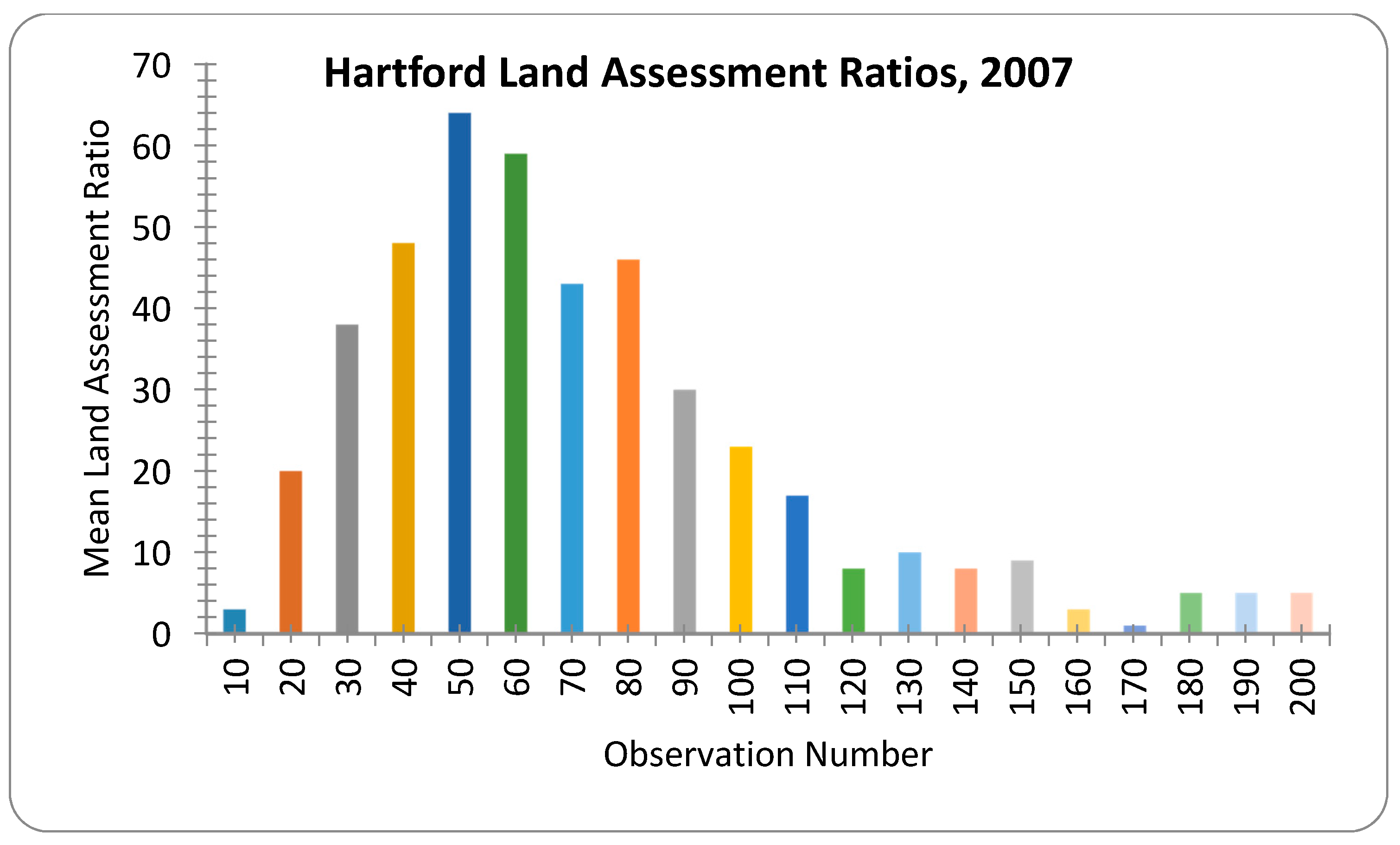

The distributions of land ratios in 2006 and 2007 are shown in

Figure 8 and

Figure 9, respectively. In 2006, the indicated land ratio for Hartford is 81%. The standard deviation in 2006 is 29, which suggests a modest relationship. The coefficient of dispersion is high at 26.4%. Unlike New Haven, however, Hartford’s extracted land values appear to be normally distributed. Trimming high ratios beyond 200% should result in better performance in the study. Trimming at 200% would reflect the lowest limit that these studies impose, which is 0%. Like New London, and without trimming, an assessment program for land in Hartford rapidly degrades. In 2007, measures of central tendency worsen significantly. The median drops to 68% and the mean to 75.7%. The standard deviation rises to 36, while the coefficient of dispersion is 83%. By 2010, the median ratio has risen to 90%, with a coefficient of dispersion of 112%. By 2010, there is no significant relationship between the extracted land assessment and the extracted land market price.

Hartford never achieves vertical equity in land assessments through the entire term of the assessment program. In the first year, the PRD is 0.685, indicating a progressive assessment program. In 2007, the PRD swings dramatically to 4.38 and an overly regressive program. The program remains regressive through 2010, with a noteworthy 4.38 PRD in 2007.

Table 5.

Land ratios descriptive statistics for all qualified sales in Hartford.

Table 5.

Land ratios descriptive statistics for all qualified sales in Hartford.

| Descriptive Statistic | 2006 | 2007 | 2008 | 2009 | 2010 |

|---|

| Mean | 0.871029 | 0.757191 | 0.817581 | 0.969782 | 1.016247 |

| Stand Dev | 0.2909 | 0.363369 | 0.378351 | 0.424603 | 0.421666 |

| Median | 0.814757 | 0.680184 | 0.736478 | 0.926357 | 0.904255 |

| AAD | 0.215159 | 0.564588 | 0.817581 | 0.969782 | 1.016247 |

| COD | 0.264077 | 0.830053 | 1.110122 | 1.046877 | 1.12385 |

| PRD | 0.685 | 4.380 | 1.272 | 1.043 | 1.455 |

| PRB | 0.851 | 0.157 | 1.063 | 1.337 | 1.305 |

| N | 491 | 406 | 246 | 138 | 151 |

As in New London and New Haven, we examine land assessments by comparing the assessment per square foot and the extracted market value per square foot to address potential differences for ‘expensive’ versus ‘less expensive’ properties and ‘small’ versus ‘large’ parcels. Predictably, and like New Haven, there are only minor variations from the overall land value statistics from the weighted mean and the PRD. In fact, the only variation occurs in the 2009 data, where a slightly higher weighted mean results in a slightly lower PRD. The results are a mirror image otherwise.

Total assessments between new buildings and old buildings are analyzed for the first year of the revaluation, 2006. As seen in the New Haven and New London analyses, the overall levels of assessment between old buildings and new buildings are highly similar. The mean ratio for new buildings is 96.9% with a standard deviation of 0.051; the mean ratio for old buildings is 97.2% with a standard deviation of 0.067. The median ratio for new buildings is 96.2% with a coefficient of dispersion of 0.041; the median ratio for old buildings is 96.3% with a coefficient of dispersion of 0.049. The PRD for new buildings is 0.985, and the PRD for old buildings is 0.996. These PRDs indicate a neutral program with no progressive or regressive bias. The variations between these, however, suggest that there is no material difference in the assessment levels between new and old buildings.

We examine land assessments for Hartford by comparing the assessment per square foot and the extracted market value per square foot, both by calculating COD and PRD and by plotting the data to visually examine whether there appear to be any relationships for land that is close to the nearest airport, parks, and the nearest highway exit (these landmarks are shown in

Figure 7). The COD (52%) and PRD (1.27) for residential land close to parks in 2006 are both higher than the IAAO standards. For commercial land near parks in 2006, the COD is 6%, implying the equitable distribution of assessments, while the PRD was 1.51, implying regressive assessments. For residential land in Hartford less than one mile to the nearest airport, the COD is 29% while the PRD is 1.12, both of which are outside of the acceptable range. For commercial land in 2006, less than one mile to the airport, the COD is 20.9% and the PRD is 1.0003. This COD implies a more equitable distribution, and the PRD is neither regressive nor progressive. Finally, for residential land in 2006 less than 0.25 miles to the nearest highway exit, the COD is 26.65% and the PRD was 1.25, both of which are outside of the IAAO acceptable range.

Commercial land in 2006 performs even worse, with a COD of 76% and a PRD of 1.83. The plots for extracted land value against square footage reveal no clear relationships for each of the categories of proximity to parks, highway exits, and airports.