1. Introduction

Deficiencies in the storage and management of tailings, the post processing wastes of metals, hydrocarbons and fertilizer, are the largest source of high public consequence failures globally. Although each tailings storage facility (TSF) is described and represented to regulators as capable of meeting all applicable environmental and other regulations, and being fit for its intended use and purpose, law and regulation in the permitting and oversight process provides very limited regulatory scrutiny. Policy frameworks offer only broad standards and extremely limited life of facility oversight. High severity failures, when they occur, have tended to be viewed and presented by industry as unavoidable and unforeseeable. The assertion that local damages are more than offset by the greater good of providing the world’s needs for metals, hydrocarbons, and fertilizers is unproven and unprovable.

Though preceded by 40 catastrophic failure events globally, two highly visible catastrophic failures, Mt Polley in Canada (2014) and the Fundao in Brazil (2015), have brought about the first global revisiting of this antiquated implicit assumption that mining impacts are unavoidable and offset by greater public need and benefit. Both industry and governments are now recognizing that loss prevention is both possible and imperative. The dramatic investor impact of the Brazil failure on two of the world’s largest miners, BHP Billiton and Vale, has raised awareness in financial circles that the consequence of mine failure at this scale is not just on local communities and environments. Miners are aware that even with the protection of limitations of legal liability via subsidiaries, large-scale failures can have companywide ramifications and affect all operations.

That emerging conversation between industry and communities on the “path to zero failures”, as it is called, has tended to focus on those physical attributes of tailings storage facilities that insure structural soundness during operations, and after closure into perpetuity. However, even before these two major failures, there was a growing awareness that the root causes of failures lay in other circumstances and conditions that shape the decisions made by miners on each facility, which are at variance with design requirements and with Best Practice, Best Science and Best Knowledge. The World Bank first made note that the key issue facing the industry and communities was the growing spread between ore production volumes and volumes of metal output from mining as available grades or ores fell globally [

1]. That spread represents both a greater waste volume per unit of metal produced and often, as at the Fundao, the largest failure in history, results in a significantly greater rate of tailings deposition and more frequent and larger dam raises, undermining critical safety elements on which the original design depends. These deviations from design were identified by both expert cause of failure panels, Fundao & Mt Polly, as the principal physical cause of failure.

In 2001, long before these two notorious failures reached even small-town newspapers all over the world, the International Commission on Large Dams (ICOLD) announced their conclusion that the frequency and severity of tailings failures from metals, hydrocarbons and fertilizers was increasing globally. To keep that trend in the spotlight, they created a global failures compilation. The database for this work is developed partially from, and expands upon, the 2001 ICOLD database. In releasing their 2001 database, ICOLD announced their finding that the majority of these failures were avoidable and a matter of control and diligence by mine owners and operators. In their landmark 2001 report [

2], they stated:

“...the technical knowledge exists to allow tailings dams to be built and operated at low risk, but that accidents occur frequently because of lapses in the consistent application of expertise over the full life of a facility and because of lack of attention to detail.”

and;

“By highlighting the continuing frequency with which they are occurring and the severe consequences of many of the cases, this Bulletin provides prima facie evidence that commensurate attention is not yet being paid by all concerned to safe tailings management.” (emphasis in original)

and;

“...the mining industry operates with a continual imperative to cut costs due to the relentless reduction in real prices for minerals which has been experienced over the long term, plus the low margins and low return on capital which are the norm. The result has been a shedding of manpower to the point where companies may no longer have sufficient expertise in the range of engineering and operational skills which apply to the management of tailings.”

It is to a further exploration of these prescient observations by ICOLD and the World Bank that this work, and the two prior works of this research partnership [

3,

4], have been addressed. Prior work of this partnership had begun to piece together considerable evidence that financial risk and environmental risk, as well as other public liabilities, are very closely related. This is suggested as a root cause of failure, both in the observations and findings of the World Bank seminal study, and in the very clear statement of findings by ICOLD. In the 2015 work by these authors, it was reported that the data confirmed a greater need to more carefully and independently track initial and life of mine economic viability as a key strategy for loss prevention.

Deeper inquiries and empirical evidence of what the World Bank and ICOLD pointed to as already established as a trend before 2000 has been made possible by extensive improved data on failures prior to and since 2000 and the development of an empirically based typology of failure severity and incident type [

5]. While claiming no statistical proof of causality, appropriate multivariate analytic methods have been applied to explore root causes, and to identify areas in which changes in public law and policy might be more effective in preventing public loss and liability. At the broadest level, the tailings research work by these authors suggests that all high-consequence/high-severity failures are failed public-private partnerships attributable to gaps in policy that fail to adequately identify, defend, and protect the public interest. The authors see regulatory reform more focused on loss prevention and pre-application risk assessment as a more fruitful, and possibly more effective, approach to better outcomes than the presently prevalent use of fines and penalties as deterrent and punishment.

With a view to elevating conversation and deepening understanding of how to improve and correct present trends of public loss from TSF failures, the three works of Bowker-Chambers 2015 [

3], Bowker-Chambers 2016 [

4], and this paper, are pure research in the sense of not starting with a hypothesis to be proved, but coaxing as much reliable information from what reliable data can be assembled. The authors have set about to make a more complete description of what the World Bank and ICOLD pointed to as the previously un-explored relationship between the economics of mining and the history of tailings dam failures.

This paper presents an overlay of new analysis by industry experts on the 2000–2010 decade of the previously studied period, 1946–2009. The period 2000–2010 has been described by the Hamburg Institute of International Economics [

6], as the longest and strongest supercycle in recorded history. A supercycle is a period in which all commodities co-entrain in a sustained multi year period of price increases.

It is customarily assumed that as prices rise, profits and performance also rise with a concurrent effect of fewer high public severity failures. This paper challenges that notion through the authoritative findings of top mine analysts who found that performance during the supercycle was actually very lax as compared to the tight control in leaner times resulting in an unprecedented level of investor losses and write offs as prices across all commodities pushed steadily upward to post-1916 highs in 2011. Copper, the bellwether for base metals, reached a post-1916 high of

$9411 (

$2015) as compared to the prior 50-year average price of

$5133 (

$2015) [

7]. Looking at failures, the incidence of highest severity TSF failures also reached a post-1916 high of 1.0 high-severity failures per year, as compared to the previous 50 mostly lean years of 0.56 high-severity failures per year.

These indisputable facts challenge the notion that failures are mostly shaped by the squeeze of falling prices.

This new data analysis by top mining economists, and analysts and the revised more comprehensive failures data developed by the authors, shows that prices do not bring better performance and fewer failures as many regulators continue to believe.

The consensus assessment by leading mine analysts Deloitte [

8], McKinsey [

9], Ernst & Young [

10], and Price Waterhouse [

11] is that the unexpected price surge created by Chinas high demands for all commodities lead miners to abandon business fundamentals and engage in a frenzied push for high production at any cost. Several of these works specifically address the pushing of economically marginal mines to achieve production goals as a contributing cause of massive investor losses. The ICOLD 2001 attribution of depressed prices and falling grades as a root cause of failures might reasonably lead to an assumption that as prices rose they would fund the restoration of the technical and engineering capacity that was shed and lost in the long price fall, and result in fewer high public consequence failures. In essence, what these top mine analysts concur is that instead of rebuilding engineering and technical capacity and catching up on deferred infrastructure maintenance and needed improvements, many miners counted on price alone to make up for these accrued dry times deficiencies. They expected to achieve profits within the portfolios and corporate capacity that existed at the very bottom of the long down ward leg of the preceding supercycle. In fact, the long and never imagined surge in prices over the supercycle actually brought the worst performance in recorded history not just as measured by the severity and number of high public consequence tailings failures, but also in investor losses, massive write offs and an impairing level of miner debt.

Now, in the down leg of that 2000–2010 supercycle, with grades and prices well below 2011 peaks, there is no within industry appetite to take on the loss prevention reforms summing several decades of mine by mine failure analysis that were offered by the Mt Polley Expert Panel. The industry’s first priority is on economic recovery and debt reduction, which has been demanded by investors. From a public interest point of view, the first priority has been expressed as complete and immediate commitment to the entire framework of reform offered by the Mt Polley Expert Panel.

Industry and mine regulators have avoided the major thrust of the Mt Polley framework for reform. Neither the International Council on Mining and Metals, the Mining Association of Canada, or any government known to the authors, has undertaken, or committed to, the key reforms necessary to achieve TSF failure loss prevention. All mines since approved the government of British Columbia, who commissioned Mt Polley Report, violated the main recommendations [

12].

The possibility that this is more than a conflict in priorities as between public interest demands and the industry (including its regulators), is suggested in a new work by a research team of leading experts in the economics of extractive industries [

13]. Their work was about examining how business decisions are actually made by miners but the data they added provides a background to the failures history, which suggests that the conflict has origins that are more fundamental. To lower debt as investors have demanded and streamline operations, miners have been engaged for several years in a shedding of the marginal assets they pushed into production during the supercycle. The Aguirregabiria & Luengo study [

13] suggests that the total portfolio of mines that are not presently viable and or likely to become viable without significant new discoveries may be as high as 30% to 50% globally. These will become further write offs if they cannot be marketed to new owners as possible future earners. It is reasonable to assume that adoption of the Mt Polley reforms for all operating mines would make many of the mines in this 30% to 50% of the global portfolio “stranded assets”. It would be difficult at the very least to add value through a new or expanded permit or though transfer of existing permits. The public interest sector does not accept that the reforms should only apply to new facilities and that all existing facilities should be managed to closure in accordance with best practices. Thus, the reforms demanded by the public interest sector may conflict fundamentally with the recovery strategy of the industry. Adoption of the Mt Polley framework as policy for all tailings facilities, as the public interest sector demands, could also necessitate closure and its associated capital and other expenses, something that miners and regulators have resisted. This would be especially problematic for the 30% of technically active mines that were not able to produce at all in the super cycle.

The Aguirregabiria & Luengo study also suggests that the relationship between price and failures during periods of high price rises invites more participation in metals production by marginal and poorly vetted mines, which is probably why we have not previously noted correlations between price and other variables.

The authors of this study view this massive spinoff of marginal mines from deeper pockets to more speculative and often less experienced miners as posing a fundamental and difficult to overcome challenge to the public interest goal of reforms necessary to zero failures.

A major purpose of this paper is to describe this crisis of conflicting public interest and miner priorities. The authors believe strongly that an all-stakeholders multi-disciplinary approach to resolving this dilemma can resolve it to the satisfaction of all. The authors do not believe that we need to accept the present high level of catastrophic failure as the new elevated cost of meeting the words needs for metals, hydrocarbons and fertilizers. The partnership in research failure studies that the authors have formed is premised on the belief that at the global level, the world’s needs for metals, hydrocarbons and fertilizers can be met, responsibly in the short term, and sustainably in the long term.

2. Methods

This paper has three major analytic components:

(1) A reexamination of the findings and conclusions of two earlier papers [

3,

4] reporting on failures for the period 1946–2009, in light of new failures data which had developed on pre-2009 failures as of July 2016. A primary objective of this component is to report notable changes in findings especially with respect to failure trends and relationships to economics data.

(2) The reporting of new insights on the dynamics of price over the period 2000–2010, which has been described as a supercycle, a period of price co entrainment of all commodities. In the 2000–2010 supercycle, commodities prices reached all-time highs. Because price itself had, and still has, very low correlations with all other data elements, earlier work by the authors had not been able to directly explore the role of price in failures trends and severity. Unfortunately, that has not changed. However, a number of supercycle autopsies written by reputable mining analysts, by cross reference and overlay reveal more about the dynamics of price in relation to failures, but more importantly have considerable bearing on what could only be inferred about root causes of failure from previously available data.

(3) A reexamination of trends and predictions with both failures and economics data through 31 December 2015.

The failures data for all three analytic components of this paper is Chambers Bowker TSF Failures Database as it existed on 15 August 2016. That version of the failures database, in downloadable excel form, is the technical documentation for all failures-reported data in this current work. All technical documentation, raw data, and technical analysis has a tab within the database bearing the same title as the chart or table in the paper.

For all descriptive and analytic work on trends in failure severity, and in level of severity, the same format and data elements are used for all charts and tables as presented in the two earlier works. All notable confirmations and new insights are noted, but for the sake of brevity, old data and new data are not presented side by side. This approach facilitates comparisons and evaluation by other researchers, while keeping the focus on present conditions trends and new insights. The publicly available database does include these side-by-side comparisons with notes and commentary.

All of the failures data is from our own tailings database, which is an enhanced, more complete, version of the global World Information Service on Energy (WISE) Uranium Project database. Enough additional authoritatively documented data on release volume and runout has been compiled to present it as an independent measure of increasing severity.

Best fit is presented on trend lines with R2s for all chart data, not to establish or assert statistical significance, or in the case of our regressions and multivariate analysis, to demonstrate causality, but only to describe and characterize relationships and trends.

Bowker-Chambers 2015 [

3] included an extensive documentation on the predictive methods and on the use of Canonical Correlation Analysis (CCA) to explore the relationship between high severity failures and global mining economics. That previous documentation is relied on as the technical documentation for this paper, both for the CCA and our revised failure predictions. The new CCA runs, with both CCA comparisons to the prior runs, are included with the publicly available database on which this paper is based. In the paper itself, only changes in the key outputs of the CCA are presented and analyzed, in comparison with the 2015 CCA.

Much of Hoteling’s work was addressed to the economics of extraction of non-renewable resources. CCA is his creation, and intended to explore the dimensionality of relationship between two data sets with no established prior interdependence. In the case of the author’s three works, the data sets are the economics data and the failures data.

Copper ore production is used as the surrogate for all failures (not just all metals, but for all reported failures, including hydrocarbons and fertilizers). Time will tell whether our success in accurately predicting failure occurrence rates relies on the fact that all commodities were co-entrained in the supercycle, or whether copper will remain a reliable way of expressing failure rates and predicting all failures. It has proven itself reliable, so far. The analysis suggests that copper stands in well pre- and post- 2000–2010 supercycle, for purposes of predicting future failures for all commodities in the failures database, all other metals, hydrocarbons and fertilizers.

For one major 2014 failure, Mt Polley, the largest failure in Canada’s history, a pre-failure history of the economics of the mine was developed using the annual reports and other publicly available data presented by the owner.

The predictive methods developed in 2015 [

3] are based on the loss-development methodology for property and casualty ratemaking generally employed by the Insurance Services Office and by most in-house rate-making by major insurers. This paper relies on the extensive prior documentation in our other papers as adequate and relevant documentation for this work as well. This method accurately predicted total Very Serious Failures for the period 2006–2015 based on the 1946–2009 data alone. We report the revised prediction results using the same previously documented method. The raw data runs, and annotation, are included in the publicly available database for this paper.

The Chambers Bowker failures database now includes mine specific data on throughput to date of failure, resource grade by metal, and estimated Cu eq. (Cu eq. is the equivalent of Copper grade taking into account saleable other metals). This data is not yet available for all failures in the database, or for all high severity failures, but we have reported key statistics from what we have.

For this work, further exploring economics as a root cause of failure, the original mining economics database-by-decade was expanded to a publicly available annualized global database of the main economic descriptors; grade, copper production, price, ore production, and ore productions costs. The database [

14] includes complete technical documentation on sources and compilation methods, as well as tabs with raw data for all charts and tables in this paper, which were produced from that database.

While the two major original data compilations supporting this work may be the most comprehensive set of data presently publicly available globally geared to TSF failure studies, both are far from complete and still missing data on many variables for major failures. Still, we believe the results have spoken usefully and reliably through our chosen methods and compilations.

3. Results & Discussion

3.1. New Insight on the Economics of the Previously Studied Period through 2010

The impetus for this paper and its title was the additional analysis on the economics of mining over the previously examined period (1946–2009) in which the trend to catastrophic failure emerged. This new information came in the form of many authoritative independent analyses of the dynamics and fallout of the supercycle. They observed that the sustained and significant rise in prices brought not stability, higher profits and success, but also massive write-offs and huge investor losses [

8,

9,

10,

11], in addition to what had previously been documented from the public interest point of view as the worst failure performance in recorded history [

3]. An important independent work by Aguirregabiria and Luengo [

13] added further insight through its examination of 333 mines over the period of emergence of the high public consequence failure trend.

3.2. Supercycle Dysfunctional Economics

The dysfunctional, reactive economics of the supercycle are expertly analyzed and well characterized by Deloitte in their 2014 market trend analysis. “

In their relentless pursuit of growth in response to pressure from investors and analysts, companies developed massive project pipelines. Some also developed marginal mines, hoping commodity prices would buoy poor project economics. In their headlong pursuit of volume, many mining companies abandoned their focus on business fundamentals. They compromised capital allocation decision making in the belief that strong commodity prices would compensate for weak business practices. Rather than maintaining a long-term view of the market, many acted opportunistically.” [

8]

Price Waterhouse Coopers, looking at the performance of the top 40 over the supercycle, note that much of the massive commitment of capital to expansion and production at any cost ended up as impairment write offs: “…

from 2010–

2015, the top 40 have impaired the equivalent of a staggering 32% of the capex incurred”. They note that

$36 billion, or 68% of the total impairments, were taken by Glencore, Freeport Vale and Anglo American and that “

2015 saw the first widescale mothballing of marginal projects”. The top 40 took a collective net loss of

$27 billion and investors punished them for “squandering the benefits of boom” and for “poor capital management and investment decisions“ [

11].

It is in this dysfunctional “maximum production at any cost” dynamic of the supercycle that the dramatic upturn in the frequency and severity of failures occurred, and in which there is with very little doubt a higher global portfolio risk of accrued and unexamined public liability. As presented in

Section 3, changes in waste to metals ratios for gold suggest the possibility of a more than 100% increase in the level of potential unexamined risk [

15].

3.3. Additional Analysis on the Entire Period of Emergence of the Trend to High Severity Failures

A recent study of actual annual mine records of 330 mines comprising 85% of world copper production sheds some light on the economics that may apply for all metals, and may hold keys to a deeper understanding of the relevant economic red flags of possibly incubating failure conditions [

10]. The study reports that on average only 52% of mines were active at any time in their study period, 1993–2010 (173/330) and that 32% produced no mined output at all during the supercycle (maximum active was 226). This suggests the possibility that from 30% to 52% of all “still open” copper mines globally may not be economically feasible and cannot be expected to generate revenue sufficient to cover production costs. In many instances, perhaps mines should never have been developed in the first place. Certainly, no one would dispute there are many mines which have never been profitable, and have frequently been in and out of production due to price sensitivity.

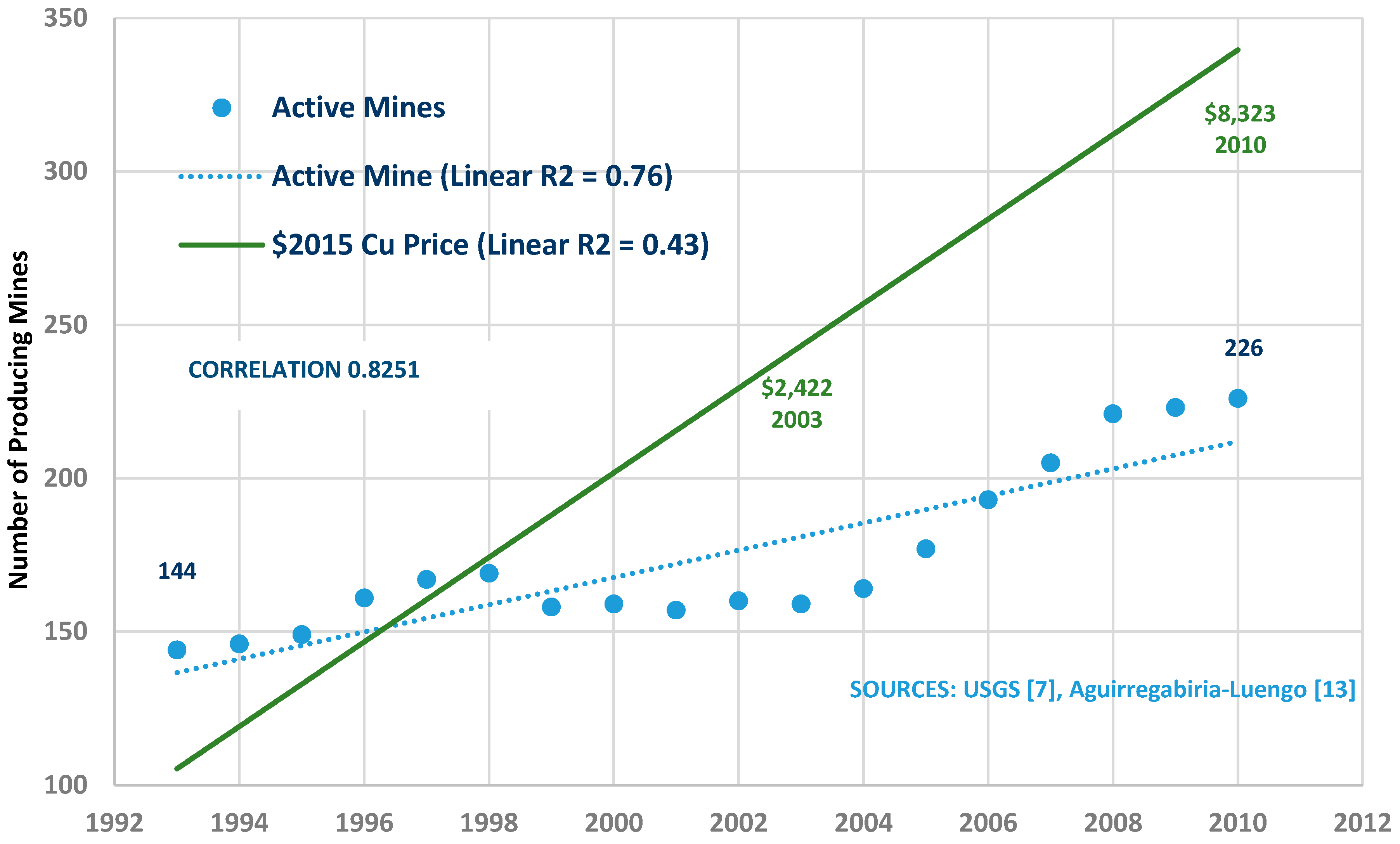

As

Figure 1 shows, based on the Aguirregabiria & Luengo [

13] report, in the run up of the supercycle the active participation among the 330 mines swelled from 144 (44%) to 226 (68%), viz. an average of 173 active at any one time. It is in this increased re-entry, and often expansion of economically fragile mines (see Price Waterhouse Coopers [

11]), that the trend to ever-increasing severity and frequency of catastrophic TSF failures has manifested.

In response to investor demands for miners to reduce debt, there has been an aggressive campaign to clear these marginal mines from the portfolios of the top producers. Leading industry economists agree that this is a healthy restructuring at the company level. From the public interest point of view, however, this widespread cleansing is problematic because whatever risks have accrued in the waste facilities of these non-performing mines, and mines pushed beyond design capacity in the production fever of the supercycle, remain unexamined. Whatever problems exist have not been corrected. Based on the Aguirregabiria & Luengo study, it appears that without significant new discoveries, perhaps as many as 30% of all currently permitted mines may never produce revenue again, and have had a poor history of production. It is reasonable to assume based on what is known about the history of TSF management that most are upstream construction, have slurry depositions of unstudied stability, and by design or neglect have water covers, which are all markers of elevated risk.

Prior to transfer to new owners, regulators have avoided enforcement and ducked corrections at these marginal mines hoping for a return of prices that will allow problems to be addressed out of mine revenues. For the 30% of mines that were not able to produce at all during the supercycle, it seems unlikely there will be any new revenue soon, or perhaps ever, without major new discoveries or major new technology breakthroughs. Therefore, a healthy restructuring from the point of view of mine companies effectively represents a transfer of the TSF failure risk of these mines to the public, as there are no mechanisms in place to force corrections or closure outside of the application and permit process. Even after re-openings, regulators fear that enforcement actions may trigger bankruptcy, as occurred at the short-lived reopening of the Yellow Giant Mine in Canada.

Regulators who believe that rising prices will restore production and bring revenue to fund negotiated correction and closure of any serious TSF problems will have either to fund it themselves or accept the consequences of failure.

3.4. Updates to pre-2010 Failures Data and Revised Predictions 2010–2020

Between the release date of the 2015 paper, reporting analyzing failures 1946–2009, and preparation of the current paper, a great deal of new information developed on the pre- 2009 failures and significant incidents. This new information included both the details of failures already in the database, and the identification of previously unreported failures. It is normal in all loss development for there to be an estimable amount of what insurers call incurred but not reported, but in this case the identification of three additional high severity failures resulted in an unusually significant change from 7 to 10, a 42% rate of unreported high-severity failures. This has resulted in an upward revision of the predicted number of high-severity failures in 2020–2020 from 11 to 13.

Analysis on the impact of the revised data on earlier reported trends and descriptive statistics from 1946 to 2009 indicates that the chronic condition of incomplete reporting, even in the Chambers-Bowker Failures Database, has no effect on the bottom line findings and conclusions. What did emerge, and is reported in the next section, is a greater clarity on the second highest severity category, as well as some very interesting changes in the relationship between the two databases, failures vs mining economics.

The unreported very significant failure that did not appear in WISE, or in any other compilation, was in Brazil, and is well known throughout the mining industry. ICOLD’s wise design for the data base, and the foundations it created on the initial 221 records, and the work WISE has done stands up to even a 40% under-reporting rate of high severity failures. The database still tells its story. The WISE database appears to be sourced mainly by direct reporting from the industry, and often encompasses under-reporting or missing runout and release data. The publicly available Chambers-Bowker database [

5] is far more complete than the WISE database. It is sourced directly from the communities where the mine is located through media accounts, technical reports, and court records, and is supplemented through continuous multi-language scan available online, and by inviting authoritatively documented corrections and additions. What has been added to the WISE database from this process has made it possible to do deeper and broader analysis of failures and failure causes.

3.5. Failure Updates and Revised Analysis through 2015

There has previously not been sufficient data on the release volume or runout distance of failures to conduct any meaningful analysis on these variables. By ICOLD’s design, all records of release events were to have this data, but as of the Rico study in 2007, they had to look to other sources to gather 28 records with both release and run out [

16]. The new data added to Chambers-Bowker has nearly doubled that number, making it possible for the first time to make a preliminary report on severity, as measured by release and run out, across all failure categories. As graphically illustrated in

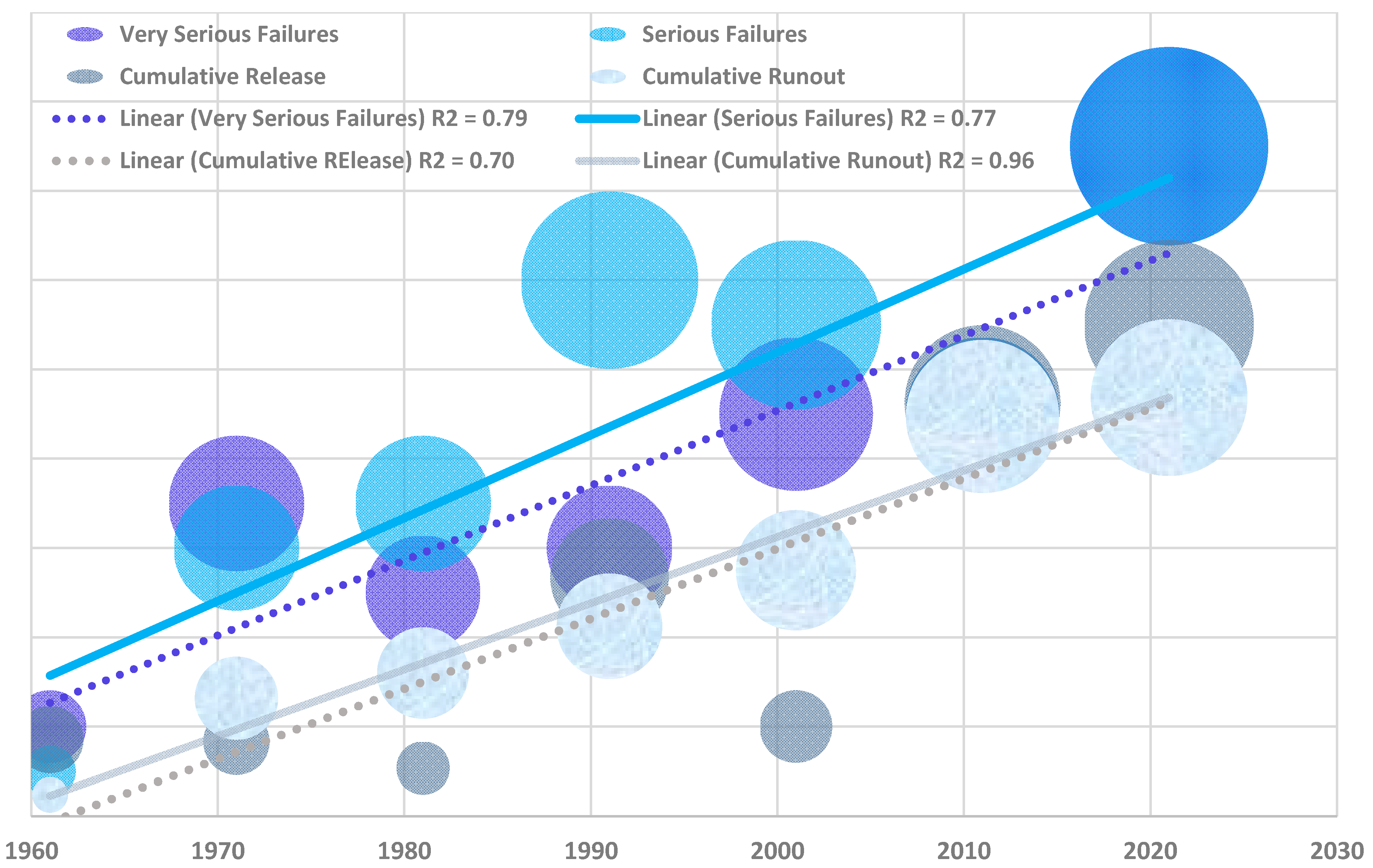

Figure 2, the absolute number of major failures, and the severity of all failures as indicated by cumulative release and cumulative runout per decade, has steadily escalated reaching all new highs. The present decade (2006–2015) captures the steepest part of the price run up of the supercycle, and just the beginning of the steep and sudden downward leg. It is important to note that the escalation of severity, as measured in release volumes and run out distance for all recorded events, is nearly parallel with the slope of the trend lines of the two high-severity classifications. This indicates the possibility of common root causes, even for the lowest severity failure events. It also confirms that the magnitude of all significant events is increasing, and is affecting ever-larger areas by the increasing runout and release of the failure events.

Estimating major failures by proven actuarial methods [

4] and projecting cumulative runout and release by trend line, the overall severity profile for the coming decade, 2016–2025 (

Table 1), will be 67% higher for both major failure categories and severity will reach all-time highs with more modest projected increases of 5% and 8% respectively.

Although not statistically significant by normal standards of minimum observation size, the fit to a linear trend line and the strong r-square values for both Serious and Very Serious failures and for the two severity elements shown in

Figure 2 completes the compelling and persuasive forensic evidence of increasing frequency and severity of TSF failures.

The data set on all 290 events in the failures database is shown in

Table 2 with predictions for 2010–2020 and for 2016–2025 on a per million tonnes of Cu ore production basis. The 2010–2020 projection has increased from 11 to 13 based on the additional five years of failures and substantially more complete information on pre-2010 failures. Predictions for 2016–2025 are 15 for both high severity categories, an annual rate 67% higher than the 2006–2015 decade.

3.6. Root Causes of Failure beyond Proximate Cause

Virtually all Very Serious Failures in recorded history were preventable, either by better design or by better operational management. Although ICOLD was the first to authoritatively name it in 2001, it is widely recognized now that proximate cause (the precipitating final physical cause of a major failure) of failure is not a matter of force majeure, unforeseeable and uncontrollable events, black swans (high severity loss that results unforeseeably from the cumulative effect of a large number of small events or conditions), or ordinary human error, but a result of conscious decisions at odds with Best Practice, Best Knowledge and Best Available Technologies. Of course, the proximate cause of all TSF dam failures is geophysical and structural in nature, but the root cause is a failure to design, build and manage TSFs to known Best Practice, Best Knowledge, and Best Available Technology. Though few put it in these plain terms, the Mt Polley Expert Panel, convened by the Government of British Columbia to examine causes of the Mt Polley failure, and to make recommendations for applicable to all tailings facilities, was very clear.

In Brazil and British Columbia, professional practice and regulatory guidance allowed unrestrained reliance on the Observational Method, a term of art in mining that refers to a continuous, managed and integrated process of design, construction control, monitoring and review enabling appropriate, previously-defined modifications to be incorporated during, or after, construction.

The Mt Polley Report notes:

“The Observational Method … relies on recognition of the potential failure modes, an acceptable design to deal with them, and practical contingency plans to execute in the event observations lead to conditions that require mitigation. The lack of recognition of the critical undrained failure mode that prevailed reduced the Observational Method to mere trial and error.”

The Fundão dam had serious construction flaws in the base drain and filters, concrete decant galleries were structurally deficient, operational deviations allowed structurally weak slimes to be deposited in areas where they were prohibited by the operating plan, and the dam crest was moved and constructed over these slimes causing the dam failure [

18].

At Mt Polley, the miner deviated from the construction design, and the review committee found the dam would not have failed if the original design had been followed, despite the undiscovered glacial lake beneath the dam [

17].

All of the earthquake triggered failures in Chile in the 1960s were found to be associated with the prevalent use of upstream construction for TSFs in an area known to be prone to frequent, high severity earthquakes [

19].

With the exception of recent updates to law and policy in New South Wales [

20], Australia, which requires use of the Australian National Committee on Large Dams (ANCOLD). Guidelines on Tailings Dams Planning, Design, Construction, Operation and Closure [

21]. We are not aware of any other legal framework for mining that enforces a primary Best Practice/Best Available Technologies performance standard life of mine. Regulatory agencies do not formally adopt existing guidelines like ANCOLD, leaving industry to depend largely on their own or consulting engineers without independent review to make key decisions affecting public risk and viability. As the Mt Polley Expert Panel noted, the standard applied in this prevailing framework often puts economic exigencies and production schedules ahead of the public interest.

It is widely acknowledged even by the industry and major industry trade groups that Best Knowledge and Best Practice and Best Available Technology will not be universally applied without a legal mandate. For example, the standards adopted by the Mining Association of Canada (MAC) and [

22] and the International Council on Mining and Metals (ICMM) [

23] leave the final determination to the individual mine site or company. The British Columbia Ministry of Energy and Mines (BC MEM) response to the Mt Polley Expert Panel recommendations avoided several of the main recommendations of the Mt Polley Expert Panel to the point where BC MEM requirements will not adequately protect tailings dams from future failures [

12].

The focus only on proximate cause in the autopsy of catastrophic events on the one hand, and the determined avoidance of Best Available Technology, Best Knowledge and Best Practice in law and policy on the other, sets up a system wherein it’s easy to look to short cuts on all aspects of waste management practice without raising any concerns on the part of regulators or investors. To B.C. Ministry of Energy and Mines’s credit, they did flag the exact location of failure two years before and did press for a full buttress, which was resisted and contested [

17].

More importantly, the focus on proximate cause fails to address or understand the more fundamental root causes that result in these deviations where law does not require and enforce adherence to the application of best practices in all phases of TSF design, construction, operation, and closure, or to require expert independent review of key decisions affecting public risk and economic viability.

3.7. The Directly Measureable Relationship between Failure Trends & Global Mine Economics

The global economic history of metallic mining is best and most frequently described with four key variables: (1) volume of metals produced from mines, (2) realized price for that volume, (3) costs to produce, and (4) grade of ore to the mill. Over the past 100 years, the key dynamic of metallic metal mining globally for all metals has been declining grades and declining prices punctuated by a few short-term supercycles. As grades fell across all metals for discoveries, reserves and head grades, economic feasibility and the possibility of profit has turned mainly on the economics of ore production made possible through open pit mining. The cost to move a tonne of ore from the ground to the mill is completely independent of grade and of the ultimate price that will result.

This brings two additional key variables into play as the background economics that result in high failure frequency and severity: (1) ore production volume, and (2) the mining cost per tonne of ore.

Mine economist Richard Schodde correctly mapped the major historic role the unit cost of ore production has played in holding the line against falling grades, and against the long-term decline in prices [

24]. He calculated that while overall mine costs, from 1900–2010, had declined by 50% in real dollars, that when distributed over ore volume, the per-tonne of ore production cost had declined 87%. This is what made the mining metric workable and profitable for some but not all. Schodde argued that the decline in ore production costs would continue to grow the resource even as grades continued to fall (discovery, reserves, and as milled). What the World Bank detected was the dramatically widening gap between ore production volumes and mined metals output [

20].

This gap could also be described as declining yields on the economics side and exponential growth in wastes on the environmental side. In only eight years, from 2005 to 2013, the decline in yields for gold was 29%, from 1.68 g/t in 2005 to 1.20 g/t in 2013. On a waste to metals basis, that translates to a 117% increase from 52 tonnes/oz. to 113 tonnes/oz. [

15]. It is to this gap of ever-declining yields, and its relationship to the emerging trends of catastrophic failures that prior research [

3,

4] and this paper are addressed.

The previously established correlations between failure severity and these five key mining economics parameters (Cu Ore, Cu Grade, Cu Metal, Cu Cost, Cu Price) is reaffirmed in failures and mine economics data as of December 31, 2015, as shown in

Table 3.

What emerges with more complete data on pre-2010 failures than we had in July 2015 and the additional six years of data (2010–2015) is an interesting, new view of the relative strength of correlations in the two high severity failure categories. Ore production is reaffirmed as the most dominant but with much higher correlations with both severity categories, 0.953 for Very Serious Failures and 0.824 for Serious Failures. Grade clearly emerges as much more dominant for Very Serious Failures and copper production cost (Cu Cost) emerges as much less important for Very Serious Failures and much more important for Serious Failures. Overall, there is more clarity on Serious Failures, and it is now apparent they are shaped by the same forces as Very Serious Failures.

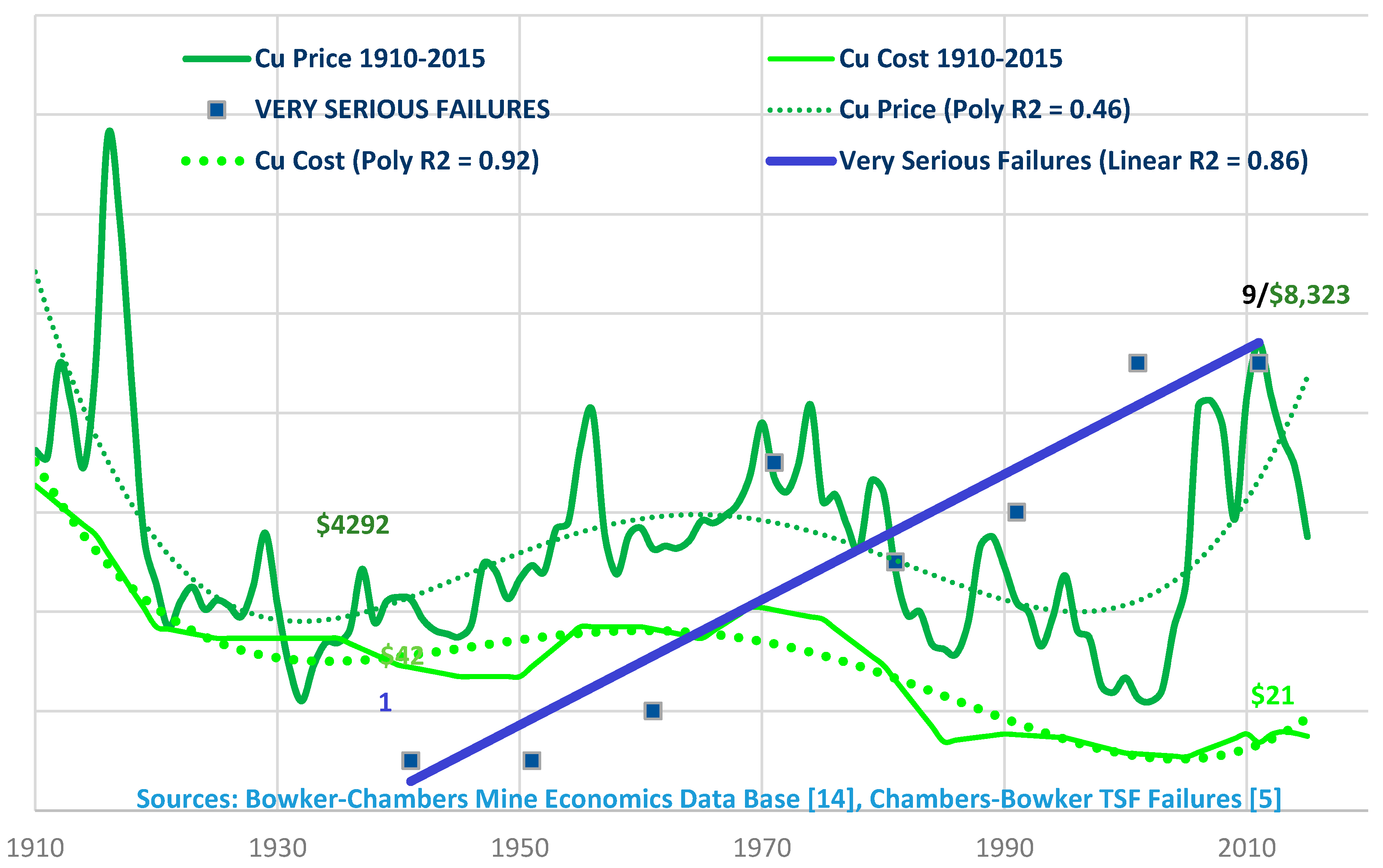

As is clear in

Figure 3, the rising trend of Very Serious Failures emerges despite the long-term offsetting effects of lower ore production unit costs that accompany the plunge in as-milled grades.

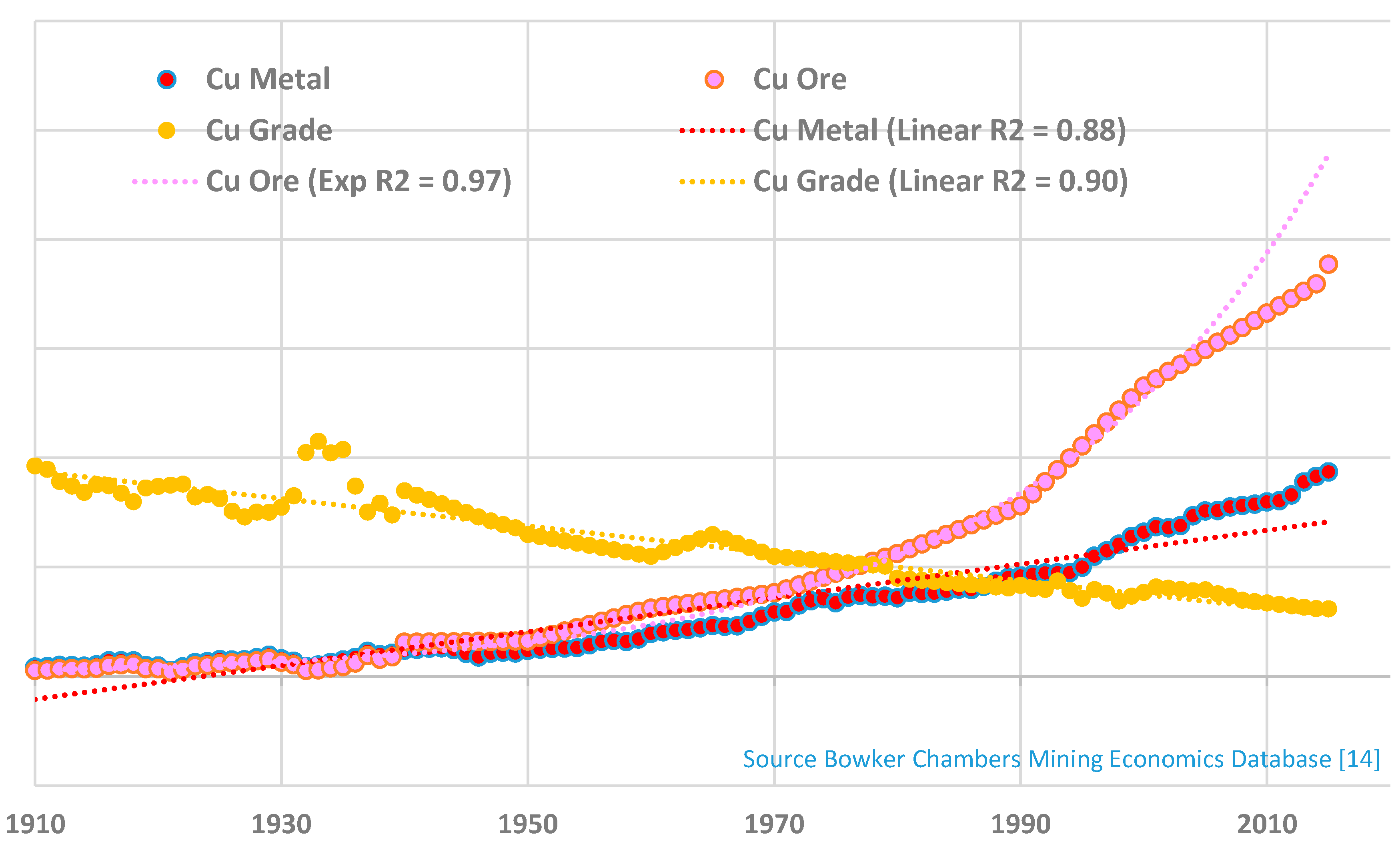

The World Bank noted this shift in the relationship between finished metals production and ore production as of 2000 [

1]. As was previously mapped [

8], that spread continued to widen through 2009 [

4]. In the six years since 2009, the spread is even more pronounced, primarily as a result of an even steeper and faster decline in available ore grades that the industry neither foresaw nor prepared for. This increasing spread between metals production from mines and ore production needed to attain that level of production very clearly begins around 1990, almost a full decade before the start of the supercycle. See

Figure 4. A closer look at what was happening to grades, in

Figure 5, as prices rose over the supercycle reveals the key impetus for failure.

Over the entire period of the supercycle, as shown in

Figure 5, “as milled” grades have dropped significantly, affecting not only smaller economically marginal mines but the behemoth Chilean and Top-40 producers as well.

As devised by ICOLD [

23] and carried on by WISE [

25], the tailings dam failures database captures no data on geological, geochemical or econometric descriptors of the mines with failed TSFs. The data on physical characteristics of the TSF facility (height, capacity, type of construction) and severity (run out release deaths) is sporadically reported, even for catastrophic failures. It has nevertheless been possible, with volunteer support from a colleague, to piece together some mine-level econometric markers on some of the mines with Very Serious Failures post 1990. The data on 7 of 18 mines with Very Serious Failures post 1996 strongly indicate that the econometric markers of these mines are significantly below global averages.

Average resource grade as of failure for the six mines which are primarily copper producers was 0.37 as compared with a global average head grade at producing copper mines of 0.76. Of 7 mines with Very Serious Failures 1992–2010, the Cu equivalent grade (i.e., taking account of other metals produced or translating all metals into Cu equivalent) was 1.10 as compared to a realized grade of 2.25, as reported by Aguirregabiria & Luengo [

5] for their 330 producing copper mines, operating from 1992 to 2010. These are imperfect and non-exact comparisons, but they are also strongly persuasive that mines that produce Very Serious TSF Failures are poor performers viz. average global econometrics. This in turn suggests a significant public interest in giving independent authoritatively verified economic feasibility a specific and prominent place in mine and mine expansion approval, and in life-of-mine and life-of-facility regulatory oversight.

These adverse grade deviations at the mine-level translate to, and are determinant of, higher costs to produce, as well as of larger waste volumes per unit of metal produced.

The fundamentals of how this plays at the mine-level is simply and succinctly expressed by Andrey Dashkov, Senior Analyst, Casey Research: “

As a project moves to the development stage, the higher the grade, the more robust the projected economics of a project. For a mine in production, the higher the grade, the more technical sins and price fluctuations it can survive.” [

26]. Continuing in this analysis, Dashkov goes on to declare that volume and throughput (the Scholz foundation for profitability of low grade mines) is no longer king, and that grade is now king in determining which mines will be successful and which will fail. This was essentially validated by Bowker-Chambers [

4] as the context and main driver in the emerging prevalence of catastrophic failures.

Dashkov’s analysis is that a grade advantage is a critical determinant of ability to survive serious technical flubs and dramatic unpredictable price fluctuations. As a norm for all metals, this means that smaller, lower grade mines will suffer more and have more physical manifestations of their economic stress than larger, higher-grade mines. Very simply, smaller, lower grade mines operated by junior and midsize miners have less cushion. They must ride too close to the edge of financial viability viz. global metals markets and major producers to try to stay in production. They also have less access to high quality capital markets, paying more and operating under more onerous terms of credit than the top producers. George Ireland has frequently cited this factor as creating financial instability and uncertainty, when the due dates of credit do not match up with cash flow needs, expected revenue generation, and production capacities of the mine. This mismatch can actually lead to failure or involuntary investor takeover elevating uncertainty and instability [

27].

In gold, as respected analyst Mark Fellows explains, a 10% fall in global average ore grade gives rise to a

$50/oz. rise in average global production costs [

28]. At the mine-level, a difference between a gold mine with 1.72 g/t and 2.2 g/t translates to a likely cost difference of

$100/oz. in total production costs. These are the actual differences at the Gold Ridge mine, Guadalcanal, in 2009. This mine with complex anomalous ores never achieved profitability, not because of political unrest or weather, but because of the low quality and complexity of the deposit compared to others shaping world markets. Gold Ridge, with approximately 20 million cubic meters tailings storage capacity with a long history of many owners, frequent interruptions, and continually falling recovery rates (another emerging consequence of mining very low-grade ores), under ownership of landowners with limited technical competence, has hovered on the brink of complete failure by overtopping for two years [

29]. While its resource grade is still 1.70 (or was when last studied for Allied by Golder in 2011, the best recovery rate Golder could project was 75% creating an effective (realizable grade) of only 1.4% [

30]. That is still high compared to present global averages but the tailings problems have not been solved and the feasibility of actually re-entering production has not been assessed. The new owner, AXF, is a Chinese real estate company with no prior history or experience in mining [

31].

3.8. Further Exploration of the Dimensionality of Relationship between Failures and Global Mining Economics

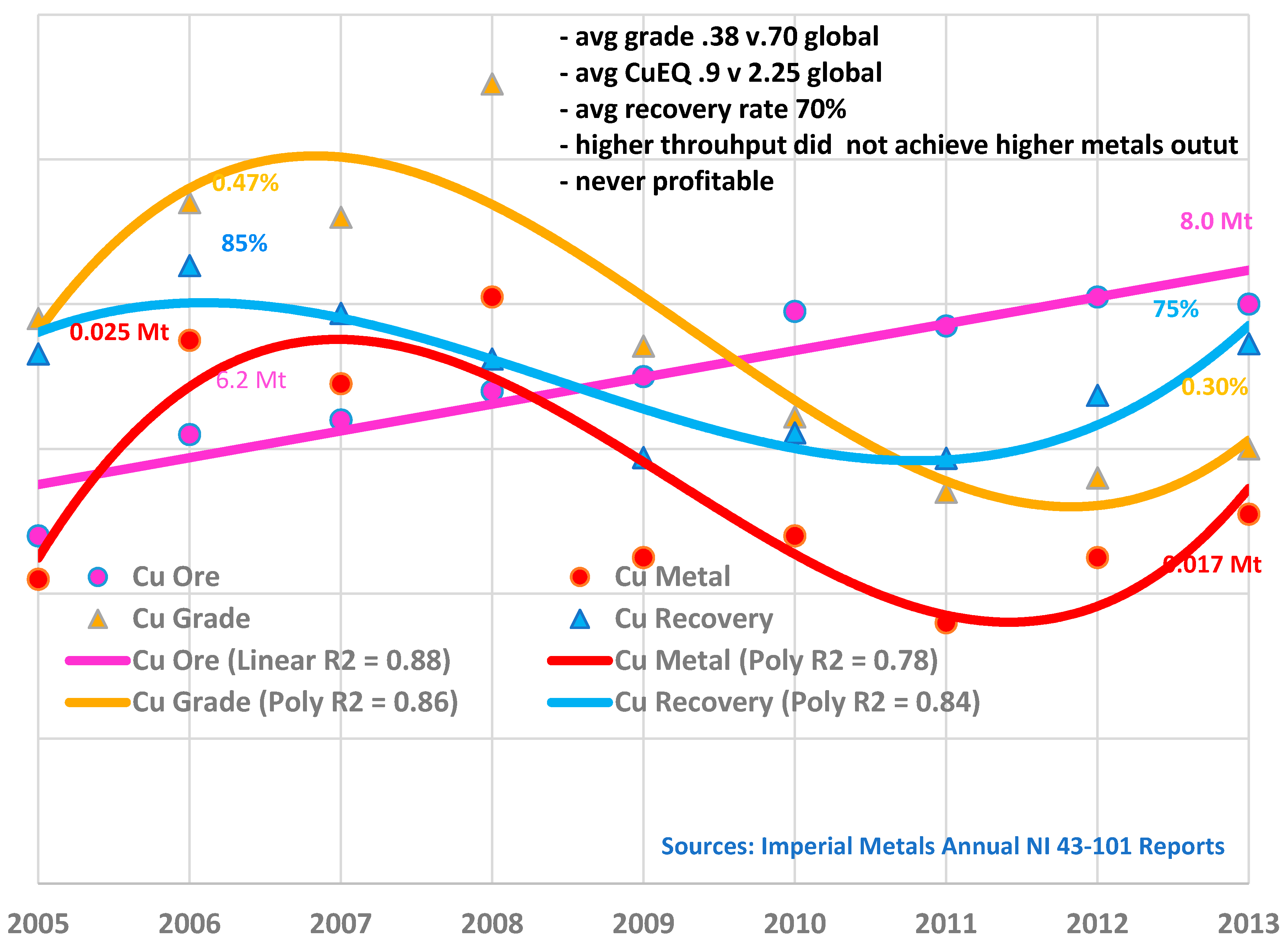

If the legal frameworks for mining mandated the maintenance of public information on the tailings facilities and their larger context of mine and miner on the mines they have approved (or are reviewing), it would be possible to directly compare mine-level with global economic profiles and develop proven failure risk markers that might help intercept the incubation of failure conditions early enough for correction before the failure occurs. This information does not exist in any permitting regime we have seen. We know from the mine-level narrative of catastrophic failures that poor vetting, shoestring economics, and production schedules ahead of safety were very much the key backstory at Mt Polley, which never attained economic feasibility. From the outset, Mt Polley was plagued by low grades and low recovery rates. A careful reading of all annual reports and of the NI 43-101 prepared by an in-house geologist indicates that the reopening in 2005 was based on sparse 4-year old data that was not independently verified or re-examined. Life of mine Average Cu Grade was 0.38 vs 0.70 global; higher throughput did not achieve higher metals output as recovery grades constantly were below expected. Imperial processed 29% more ore in 2013 as compared with 2006, its year of peak grade, but produced 3.2% less metal. As is obvious in

Figure 6 falling grades parallel metals output. Life of mine to failure, the Very Serious failure rate for Mt Polley is 0.011 per million tonnes of ore to the mill vs 0.0004 globally, that is 27 times higher than the global failure performance.

The amount of debt Samarco had amassed for the 2010 expansion put great weight on them going forward. They did not stop to fix the Fundao dam or to create more long-term capacity onsite [

5]. Piecing this economic back-story together for all failures into a database has so far been impossible. However, it is still possible to probe more deeply the dimensionality of the connection between failures and global economics over time at the aggregate level via Canonical Correlation Analysis (CCA). CCA is a way of exploring whether two data sets, in our case the failures data set and the global economics data set, are independent. It can also help identify the dimensions of cross influences or common unidentified external influences (e.g., technical incompetence, brain drain, improper application of technology, geographic shifts in production advantage, excessive debt lost productivity).

Prior research on failures 1940–2009 [

4] utilizing CCA strongly indicated that TSF failures and copper economics data sets are interdependent, and this is reaffirmed with data through 2015 (see Database for technical documentation). More than 95% of the total variance is explained through the two canonical variables for both the pre-2010 and pre-2015 data sets. In both, extremely high eigenvalues (0.950 and 0.854), cumulatively explain 100% of the variation. These results strongly indicate the presence of a clear and powerful correlation between failures data and economics data that is linear in nature. The results also further suggest that there are no “missing variables” (no external latent variables commonly affecting both data sets). The Wilks Lambda variables for the entire CCA model for both pre-2010 (0.011) and post 2010 (0.007) data sets are extraordinarily low, supporting the assertion that the two data sets, failures and econometrics, are not independent.

What is most notable though over only 6 years (2010–2015) is the change in the composition of the canonical variables again pointing to the strong influence of grade, as shown in

Table 4.

In the canonical variable most closely associated with Very Serious Failures, the correlations with the three mining economics variables is stronger for all 3 post 2010 v pre- 2010. The most dramatic change is with grade from 0.6064 pre- 2010, to 0.8827 post 2010.

The eigenvalues imply a very strong simple linear relationship between Very Serious Failures and both grade and ore production volume.

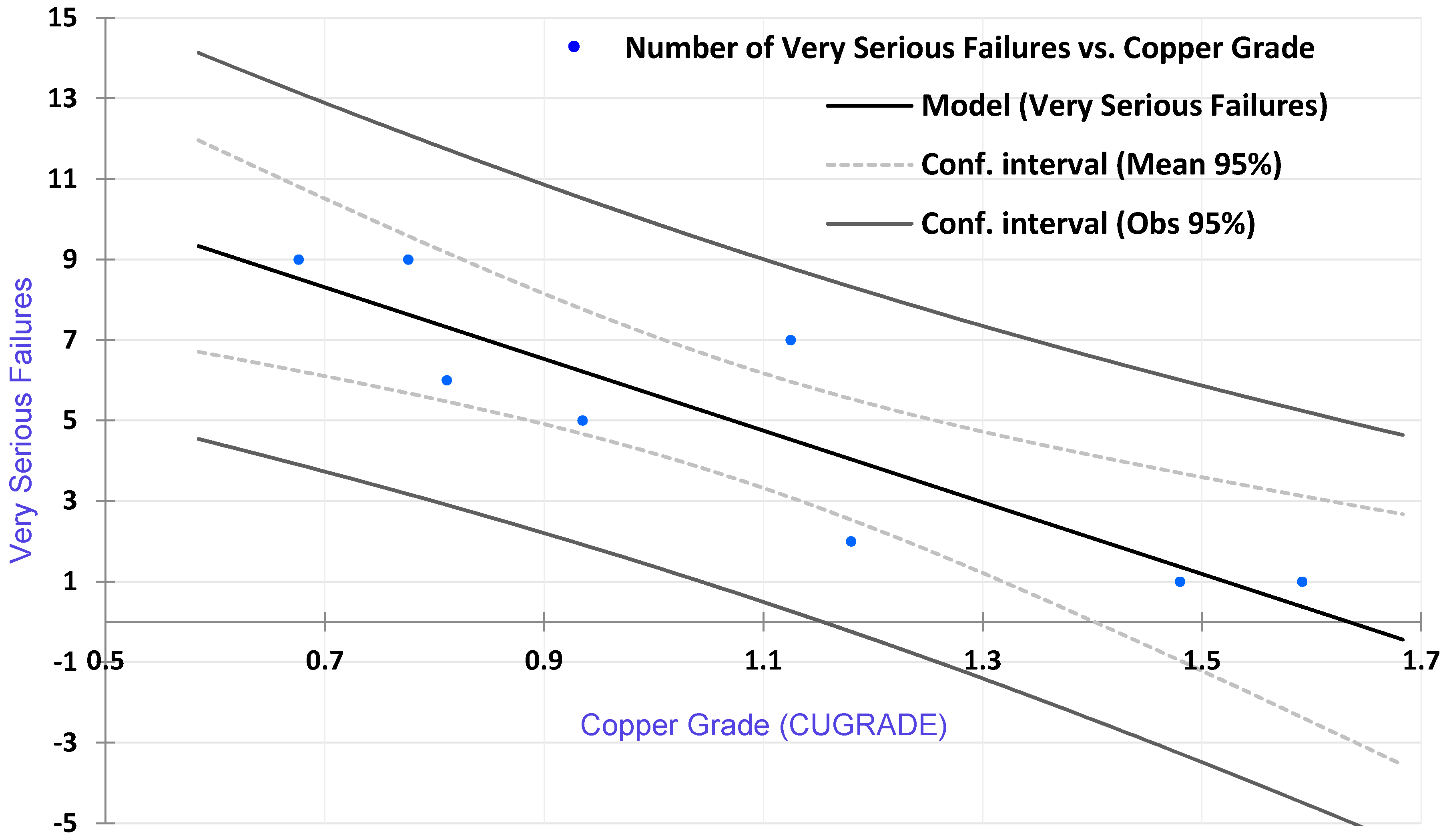

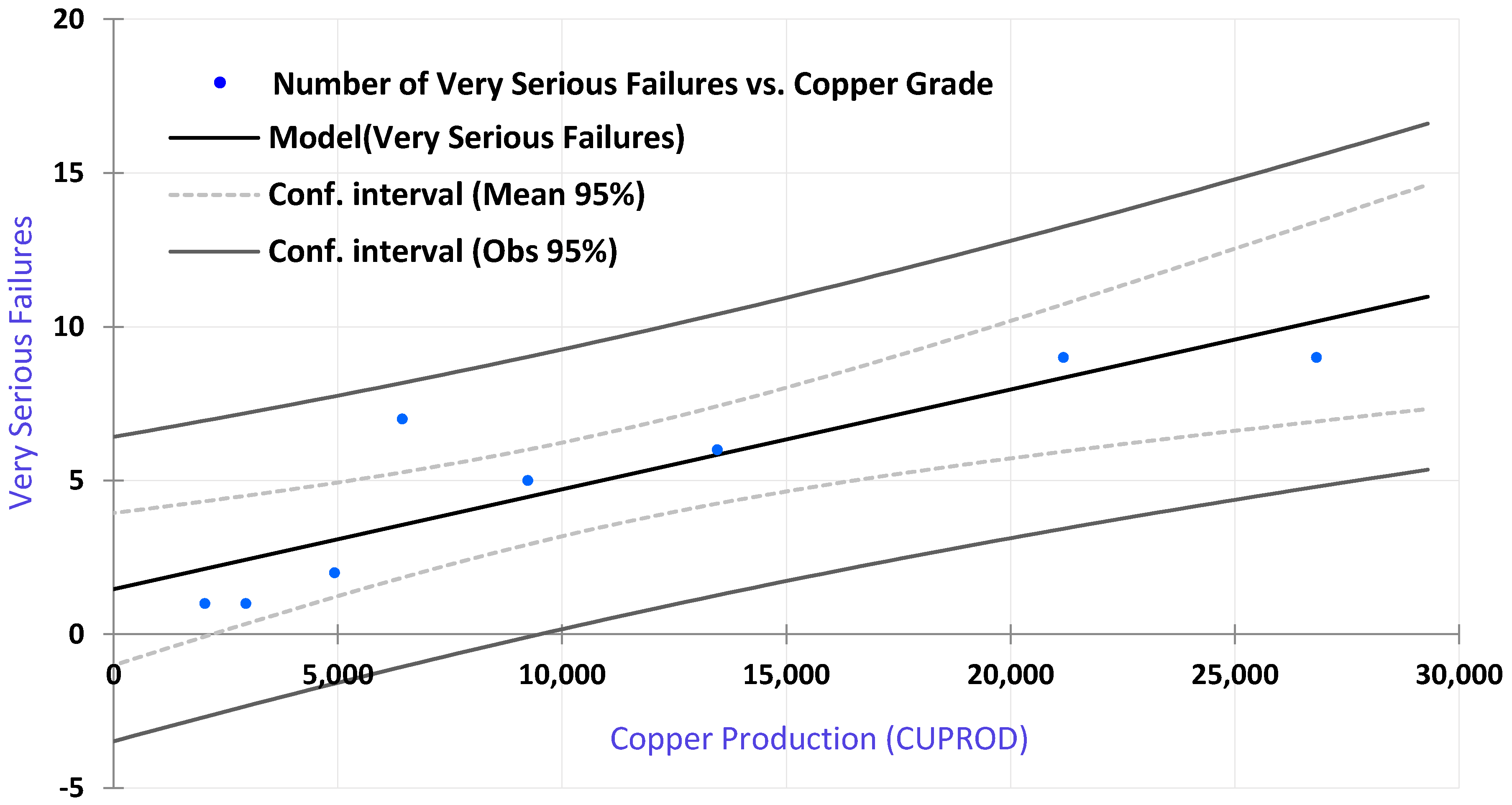

We undertook examination of these relationships through linear regression, again not to establish statistical significance but just to describe the relationships.

The regression of Very Serious Failures by grade explained 79% of the total variance as shown in

Figure 7. Each blue dot is an actual observation. The chart shows the dispersion of observation with reference to the 95%confidence intervals. Again, this confirms the very strong influence of global average mill grade on catastrophic failures.

The regression of Very Serious Failures by ore production volume (copper production—CUPROD), essentially tailings waste volume, explained 76% of total variance as shown in

Figure 8.

4. Conclusions

Overlaying the supercycle autopsies of some of the world’s top mining analysts onto what we previously documented in Bowker-Chambers [

3] explains the extent and nature of dysfunctions in global mine planning, development and operation that shaped what we previously had mapped and inferred from our data.

In their independent examination of the supercycle, there is a clear consensus among the world’s top mining analysts that we have crossed the threshold into a new and as-yet unclear era of mining. If it is understood at all, the industry, its regulators and even its key investment analysts have not publicly recognized that present discovery and as milled grades have reached levels that are beyond presently known technology that had previously worked to create economic viability for low grade large scale mines. No regulatory agency known to us has recognized the need to reexamine the large-scale low-grade mining projects like KSM, Pebble, and PolyMet that were originated in the frenzy of the supercycle on assumptions that were never proven in the first instance, and which are very clearly no longer true. No regulatory agency known to us has recognized that the supercycle was a time of pushing marginal mines and their existing infrastructure beyond design capacity and that, as at Mt Polley and Samarco, those are practices in which failure incubates and matures.

Neither the industry itself nor its regulators are taking realistic account of the implications of the fact that somewhere between 1/3 and 1/2 of all technically operating mines are no longer economically viable or never were viable. Such a high incidence of stranded assets does not indicate wellness for the industry as a whole. Regulators passively stand by while the wholesale dumping of these mines continues assuming that production will resume, that jobs will be retained, and that new revenue will finance identification and correction of any potential flaws in infrastructure aggressively pushed into production levels beyond planned capacity. These are not assumptions supported by available data or expert economic analysis.

There is not enough data to say what percentage of these no longer viable mines have TSF’s large enough to cause catastrophic failure, but we have confidence in our prediction methods which accurately predicted the 9 very serious failures 2006–2015. We have confidence that the fall out of the supercycle dysfunctions will manifest in higher than previously expected Serious and Very Serious Failures. The data and our proven method of prediction tell us that the expected number of high severity failures is greater than previously estimated for the decade 2010–2020, and that we can expect a record high of at least 15 in each high consequence category for 2016–2025.

We now can clearly see a significantly elevated and not fully examined global portfolio risk of failure. History itself proves that characterization wrong. We had pieced together a patchwork quilt of costs and legal judgments on post 1990 Very Serious failures predicting $6 billion in 11 Very Serious failures 2010–2020. Samarco alone has damages that exceed that hobbled together estimate by at least 3-fold from a TSF with only a capacity of only 60 Mm3. We now reasonably anticipate 13 not 11 Very Serious failures and an additional 13 Serious Failures based on actual ore production volumes and compilation and reconciliation of independent expert predictions post 2015.

Portfolio Public Liability Risk is Not Going to Simply Self-Correct to Less Elevated Levels

Nether MAC nor ICMM nor any mining jurisdiction we are aware of has undertaken any reforms that will be effective in lowering public liability portfolio risk.

In risk management we live by that old adage “an ounce of prevention is worth a pound of cure”. Waiting for revenue that will never come to fix broken and no longer serviceable infrastructure is not in the public interest. It offers neither prevention nor hope of cure for whatever already formed catastrophic losses are maturing to final event.

Continuing to advance and tout mega scale low-grade projects conceived in the supercycle and based on its cowboy economics offers no reform, no future with better outcomes.

Regulators have clearly chosen protection and support for the mining industry over reducing public risk and public liability. That, and past long-standing issues of enormous gravity, have brought a loud public backlash in anti-mining anger in the form of extreme and reactive legislation with outright complete prohibitions on all metallic mining, bans on open pit mining, bans of varying degrees on all upstream construction. In the case of Maine, a state with only two modern era mines, both failures with unresolved, unfunded, public consequence, recent legislative changes to mining law sponsored by a statewide coalition of non-governmental organizations requiring upfront payment in cash-equivalent for an independently verified worst-case scenario. This is the first evidence of reactive mining statutes in the United States and Canada since passage of Wisconsin’s ”Prove-It” statute, which most in the industry also regard as anti-mining.

If regulators and the industry do not address themselves more actively to public risk and public liability than they have done to date, three years after Mt Polley and two years after Samarco, it is reasonable to expect that elevated public outrage will spawn more of these public opinion-driven reactionary extreme anti-mining proposals.

While all that unfolds as it may, our data say the public liability risk continues to elevate and the consequence of failure continues to grow.