1. Introduction

To allow the owner to make the right decisions about the size of the investment and whether or not to realize it. Every project proposal needs realistic cost estimates. Similarly, every project manager is dependent on realistic cost estimates to allow for successful cost management. Budgeting and cost control is very critical but also challenging under uncertainty. Uncertainty means we do not have all information about the future, and assumptions we make today may come out differently in reality as the project progress.

Since the early 1990s, the authors of this paper have been actively performing and researching cost estimation and uncertainty analysis in projects. We have been involved in more than 100 major projects, both individually and jointly, as facilitators and support functions in cost estimation and uncertainty analysis. In this paper, we identify some practical challenges with cost estimation under uncertainty and discuss ways of handling these. Based on the case of cost estimation under uncertainty for the decommissioning of Barsebäck nuclear power plant, we will demonstrate some practical solutions for cost estimation and uncertainty analysis in complex projects.

Complexity is a fundamental issue here: Simple systems are easy to understand and represent in a model. Thus, simple projects are no challenge in an analytical sense, although they too can be prone to misunderstandings and mistakes. The complex system is a different matter altogether. Causality is not easily understood and the large number of elements constitutes all sorts of challenges. One major challenge is the uncertainty it brings into the decision making. This is the terrain we will explore here. There are four types of complexity [

1]:

- (1)

Structural complexity—seeing how projects fit together and how interdependencies pose risk and uncertainties;

- (2)

Technical complexity—maturity of technology and how problems are solved through the design of processes or products;

- (3)

Directional complexity—alignment of people’s objectives and motivation; and

- (4)

Temporal complexity—bringing on project parts or components at the right time and the handling of changes, especially in design, as well as cultural understanding of time.

The process of decommissioning the Barsebäck nuclear power plant is for sure a complex system, including high degrees of all four types of complexity. In such a case, it is challenging to develop analytical methods, processes and tools that are sufficiently precise to give reliable answers, yet simple enough to be practical in use. With respect to project analyses and modelling, there is a need to reduce the complexity to be able to handle the information. At the same time, the aim is to develop a good model, and get as realistic results as possible. This means we want to make the issues in question sufficiently simple so that they can be understood and assessed, while at the same time making the models and assumptions upon which analyses are based sufficiently precise. This is a known dilemma [

2]. For the Barsebäck case, we applied an approach previously well proven in traditional infrastructure projects to do cost estimation under uncertainty.

Many authors identify numerous challenges in cost estimations and uncertainty analyses in complex projects [

2,

3,

4,

5,

6]. We want to show that it is possible to handle at least some of these challenges through a systematic approach to the process and by choosing the right analytical method and tools and performing the analysis well. We will use the case Decommissioning of Barsebäck to show how some of the challenges in early cost estimation and uncertainty analyses can be handled in complex cases. We also identify some challenges that still need development of new practice for complex systems. The main focus is on the analytical process itself, with the assumption that a high quality process will give high quality results.

The purpose of this paper is to illustrate better solutions to some of the major weaknesses identified in current cost estimation practice. The following critical problems in front-end cost estimation and uncertainty analysis processes are prominent in today’s practice [

5]. The five challenges are reviewed in the literature section and reformulated here for the purpose of this paper. We will address the first four of these challenges. The result of number five is yet unknown since the project is still in its planning stages and the real cost is not yet revealed:

- (1)

The resource group is not well composed;

- (2)

Too much details in the cost estimation models;

- (3)

There is no focus on opportunities;

- (4)

The level of uncertainty is underestimated in all phases; and

- (5)

The expected cost is underestimated;

The paper is conceptual in the sense that is does not prove anything—it is still early days. No-one knows if the cost estimation and uncertainty analysis of this project revealed the right uncertainties, identified a realistic cost level and gave a robust starting point for the forthcoming planning and management of the project Decommissioning Barsebäck Nuclear Power Plant. The issues discussed here still have broad value as basis for informed discussions on good practice in cost estimation and uncertainty analysis. As pointed out by Flyvbjerg [

7], there is a lot to learn from a single case story.

2. Literature Review

2.1. Project Management and Cost Estimation Challenges

Project management (PM) is traditionally considered a means of planning and control of activities producing a unique product or service. A major challenge in planning is realistic cost estimation. This is true in IT-development projects based on a comprehensive review of previous cost estimation papers and articles [

8,

9]. Cost estimation is also a challenge in construction [

10], oil and gas projects [

11], and in defence and aerospace industries [

12].

General project management cost estimation techniques and tools are listed here (project management skills 2016), [

13]: Tools and techniques in project cost estimation: work breakdown, expert judgment, analogous estimating, parametric estimating, bottom-up estimating, three-point estimates, reserve analysis, vendor bid analysis, and project management estimation software. For cost estimation methods in IT, we add: regression, function points, classification and regression trees, simulation, neural network theory, and Bayesian combination of estimates [

9]. This multitude of methods, techniques and tools indicate there are many ways to address the challenges, but no single recipe or simple way to counteract them all.

Even though there has been much emphasis on developing new and sophisticated tools and methods to improve cost estimation in projects, we still face the challenges of cost overruns in projects [

3,

14,

15]. Different authors have identified challenges with cost estimation processes under uncertainty [

5,

15,

16,

17]. Obviously there is a need for more knowledge and better practices.

Cost estimation is the iterative process of developing an approximation of the monetary resources needed to complete project activities. Project teams should estimate costs for all resources that will be charged to the project [

18]. PMI also emphasize that cost estimation is dependent on all other project management skills (scope, time, quality, risk management, etc.). This indicates that cost estimation is a complex process that includes a multitude of tasks. Estimating cost of complex projects naturally adds even more complexity.

One topic that comes up when trying to find ways to handle the complexity in assessing future developments is forecasting. In operational management forecasting is the use of certain techniques to help business managers develop plans and estimates, and reduce uncertainty about future events. Key questions are: What is the future value of a certain variable? How precise can we predict it? Forecasting techniques are used to predict construction costs as well. One early example concluded that forecasting is only useful in short construction projects in stable environments and not able to predict outbreak of war or certain government actions [

19]. Of course, they were right that there are limitations to what forecasting can do, but we disagree that it is not useful. It has to be done well, and that is no easy task.

Forecasting techniques [

20]: (1) Judgmental Forecasts: Useful when forecasts must be done in a short period of time, when data is out dated, unavailable, or there’s limited time to collect it; (2) Time Series Forecasts: Most common, are used to identify specific patterns in data and use them to project future forecasts; (3) Associative models: Identify related variables in order to predict necessary forecasts.

The method we are about to demonstrate here uses elements from several of the identified cost estimation and forecasting techniques identified above. The fundamental basis is a Bayesian approach (combining the best possible available objective facts with subjective expert judgement). We use a combination of top-down estimation, work breakdown and triple estimates to express the level of uncertainty. In the bottom of the breakdown, we use the estimation techniques that are relevant and have available data in each specific case. This might be parametric, analogous or even resource based cost estimation. In the following, we will focus on the estimation process and not these estimation-technical issues.

2.2. Cost Estimation under Uncertainty

One major challenge for planning and control is the uncertainty. There are several definitions of the term uncertainty. We use one that is based on economic terms and is useful when working with planning and decision making. It follows from the original works of John Kenneth Galbraith [

21] and implies that uncertainty is the difference between the information needed to make a decision in certainty and the information actually available on the time of making that decision [

22]. The uncertainty comes from variability associated with estimates, and the basis of estimates, design and logistics, objectives and priorities, and fundamental relationships between project parties [

23]. The latest trends include discussing opportunities management in addition to risk management [

24,

25]. The content and results of future activities and processes are uncertain and so are the conditions under which they will take place. Such uncertainty influences the planning, execution, result and outcome of project activities, and even their objectives. This implies that all projects involve risks of different nature and magnitude. We include the following definition of risk:

Risk: An uncertain event or condition that, if it occurs, has a positive or negative effect on a project’s objectives.

This definition of risk covers both positive and negative effects. Both positive and negative effects have to be included for an uncertainty analysis to be complete. In analyses, these effects may be characterized as estimation uncertainty (variability in time, cost, etc. for activities and conditions known to be present and which influence the result) and event uncertainty (probability and consequence of possible events). The uncertainty may be unsystematic (individual stochastic occurrences) and systematic (influencing many elements of the estimate or plan at the same time and in the same direction). Another way of structuring the uncertainty is in contextual vs. operational uncertainty [

27]. The analysis process needs to take all these aspects into consideration.

There are many fundamental reasons why even PM professionals struggle with handling uncertainty. One obvious reason is the need for competence and capacity in handling the complications and complexity described above. A further reason is lack of information (certain knowledge) about the future [

22]. A third reason is the lack of practices that apply the latest and most updated knowledge about how human beings reason and think about uncertainty, risk and opportunities. On an individual level, a person’s psychology and attitudes towards risk and uncertainty are important—people think differently about similar issues and they assess risks differently. This has implications for how to approach uncertainty in analysis: It matters how a question is asked [

28,

29]. People’s ability to imagine the future is limited and the level of precision in judgement and communication about uncertainty is low [

30]. Influences of group risk attitudes are identified as comprising the individual members of a group (personal qualities, competence and positions), power and propinquity (potential for influence and closeness in relationships) and collective influences on group behaviour (group dynamics, organizational culture, national culture, societal norms) [

31] (pp. 44–47). These issues certainly do not make handling uncertainty any easier, and clearly fundamental challenges are involved. Many of these include handling more complicated issues than human capacity is accustomed to handling. Awareness of these issues developed early in Scandinavia [

32]. Later, we have become educated by the work of Kahneman and Tversky [

33].

2.3. Methods and Processes for Risk- and Uncertainty Management

Several methods and tools have been developed to help PM professionals handle such challenges. Most of these combine the capacity of computer-based tools with structured processes and systematic approaches, which help keep human thinking on the right track. A comprehensive overview of such methods is developed [

27]. Different methods divide the Risk Management Process into different steps and use approaches of different complexity at each of these steps.

One example widely recognized and of medium complexity, is the Shampu- method [

23]. Similar methods are found in the Project Risk Analysis and Management (PRAM) guide [

34] and PMBoK [

26]. Many Risk Management processes with similar logic are described in the literature [

35,

36]. The generic steps for the uncertainty analysis process includes: purpose of analysis, identify uncertainty elements, quantification of effects, calculation, conclusion and communication of results, normally, developing actions to address uncertainty is also included [

27].

Lichtenberg [

4] builds on Klakegg [

37] and states that such an analytical process is not one-man’s work, but needs a group process. No- one is able to see the issues from all angles, not even the greatest expert. A well-composed group of experts is the best possible resource in assessing uncertain aspects of a project. Consequently, the composition of this group is an important issue. The general requirement is that the group needs to have specific competence necessary to understand the technical, organizational and financial side of the project at hand, and broad experience from similar projects or challenges. This ideal is of course not always fully achievable, but a group of individuals with different background has remarkable ability to ask key questions and understand the important issues of even highly complex projects.

There are different roles to be covered in the group, and based on literature [

4,

37] some recommendations include: The group process needs a facilitator. His job is not to be an expert on the key disciplines of the project but he should be an expert on the process and tools used in the group process, the analytical method. The facilitator needs to have deep knowledge on group dynamics, be trained to ask the right questions in the right way, be able to make the group communicate and to guide the group in correct use of the chosen method.

The facilitator needs support to handle the tools and document the process and results, so that the facilitator can focus on the group dynamics. Therefore, a software operator/ secretary is necessary in the process and an important role. The software operator needs to be well prepared and should have an updated estimate and analysis model, ideally at every step of the process; in addition, the software operator should secure the documentation of the process, in close cooperation with the facilitator.

We call the facilitator and the secretary the analysis team. In complex and/or controversial projects, the analysis team should be external to the project team. Not necessarily external to the responsible organisation, although this is advantageous if the purpose of the analysis is project assurance or other critical analysis, or when there is already conflict over issues in the project.

Another key role is the participants in the resource group: They should constitute a balanced mix of topic specialists on relevant issues of the project to be analysed and generalists with a broad experience from projects of relevant complexity and size. The quality of the process is dependent on having the right participants in the group. An ideal size of a group of this kind is between 5 and 12 depending on the purpose of the analysis. Five to seven members is the most productive size [

38]. Too big groups are not efficient in performing the task.

The individuals in the resource group should be both from the project organization and externals. Members of the project team have the most intimate knowledge of the plans and assumptions made, whereas externals are needed to challenge the established thinking in the established project team and bring in alternative views. In general, one should prefer a group with wide representation in terms of age, gender, background and experience [

37].

The different methodologies are open for any choice of computerized tool to support a given project. Internationally, the typical choice for this purpose is some form of simulation tool (typically Monte Carlo type simulation). There are other approaches, which are designed to give more precise and sophisticated answers to complicated optimization tasks. Examples are the Integrated Risk Modelling Approach (IRMA) [

27] (p. 100) and others used in the oil and gas industry, aeronautics and advanced industries. However, despite their advantages in capability to handle complex projects, these methods and tools are not easy to use, and demand advanced competence and a lot of resources. Therefore, their distribution is not particularly wide.

In the Scandinavian countries, there is a tendency to choose even simpler methods and processes; examples include the Successive Principle [

4] and the Step-by-Step Process [

37]. The tools based on Lichtenberg’s successive calculation techniques also have a wide distribution and strong position in Scandinavia [

39]. Chapman and Ward [

23] argue in favour of simple approaches to managing project risks and uncertainty. Chapman, Ward and Harwood [

40] argue for simple approaches to minimize the effect of dysfunctional corporate culture that does not favour assessing risks and opportunities. The method used in the case study builds on these contributions.

The dilemma between good and simple in analytical processes have been discussed [

2]. There seems to be challenges with defining the purpose of the analysis, identifying uncertainty elements, quantification of effects, calculation and estimation and communication of the results from the analysis. It is concluded that [

2]:

there should be focus on having serious preparations for everyone involved, no matter how simple or sophisticated the approach is;

the purpose of the analysis and keeping the corresponding right perspective (strategic or operational) is the most important determinant of the quality of analysis;

prior knowledge of the users of methods and tools is decisive for what is perceived as “user friendly”, not whether it is simple or complex;

the best systems and tools are ‘no good’ if they are too difficult to understand and handle, and thereby not used by the organisation.

2.4. Documented Challenges in Current Practice

As shown above, a considerable amount of scientific knowledge is available for those who seek. Still, Johansen et al. [

5] recently identified five challenges with current practice, which will affect the output from the analyses. We discuss them below:

- (1)

The expected value/the base case challenge;

- (2)

The detail challenge;

- (3)

Realistic standard deviation in all phases of the project challenge;

- (4)

The human/team challenge; and

- (5)

The lost opportunities challenge;

A key objective of the estimation process is to estimate the right level of expected costs for the completed project. Analysis based on a wide range of projects internationally and over a long period of time, identified an average of 45% cost overspend for rail projects and 20% average cost overspend for road projects [

3]. Obviously, there are challenges in current practice.

The first challenge, expected value challenge, covers a growth in expected costs over time during the project planning [

5], also called the cost estimation paradox [

41]. A sample of 67 Norwegian projects on average finished within expected cost [

42]. However, in another study a sample of 12 projects shows that the first estimate was normally far below what ultimately approved as the project’s final budget [

43]. Welde [

42] also sums up several other studies that confirm this pattern. A cost overrun predictive model for complex systems development projects shows the importance of schedule and reliability as determinants of cost overrun [

44]. This shows that significant knowledge is available about the reasons for low estimates and there are significant effort made to improve it. Still this is a major challenge that we need to address.

The second challenge, detail challenge [

5]—meaning that the relative level of uncertainty in cost estimates is reduced significantly in detailed analyses, for no other reason than the statistical effect from dividing the cost items into many small parts. A typical engineer’s approach is to add more details to give precise answers. According to Lichtenberg [

4] a top-down approach should be used, with only a few overall items. Going into too much detail too early only takes more time and “give precise answers to the wrong questions”. However, it seems like current practice is shifting towards analyses that are more detailed witch risks hiding the real uncertainty in details.

The third challenge is pointing at the tendency to underestimate the level of uncertainty in the analysis results [

5]. The AACE International Estimation Classification states that concept screening and feasibility studies estimates typically should have variation from −30% to +50% and correspondingly −20% to +30% at budget authorization and control [

5]. Studies of more than 100 uncertainty analyses done in the last 10 years demonstrates considerably lower uncertainty than suggested in the AACC standard and points out that this represents unrealistically low degrees of uncertainty [

5]. Merrow [

45] (p. 326) points to the same challenge and even concludes for this reason that cost risk analyses does not work. These authors do not agree with Merrow [

45] in this conclusion, but we agree that if the standard deviation shown in cost analysis in his sample of 318 projects is less than 4% of the expected cost, then these analyses are simply wrong. This third challenge is obviously connected to the level of detail- and other challenges.

The fourth challenge is the human/team challenge where research shows that situational factors such as training, role and how accountable the different participants are in relation to the end results have influence on the project members preferred attitude towards risk [

18]. These findings are related to the work of Lichtenberg [

4] and Klakegg [

37] mentioned above.

At last, the fifth challenge is the “lost opportunities” challenge, also discussed by Samset and Volden [

41] as lack of systematically scrutinizing the opportunity space up front. The logic is fascinatingly simple: if you do not look for opportunities, you will not see them. There is a widespread tendency to focus only risks and forget about opportunities. This challenge is documented and discussed in detail by Hillson [

24] and Johansen [

25].

3. Research Approach in This Study

The purpose of this paper is to illustrate better solutions to some of the major weaknesses identified in current practice. The challenges concerns both cost estimation and uncertainty analysis.

The case project is the most prominent element in this paper. The initial presentation of theory and literature forms the backcloth against which the case story is explained and discussed. The literature review identified challenges with today’s practice in uncertainty analyses and cost estimation under uncertainty. We acknowledge these challenges and aim to demonstrate how they can be handled in a complex project through the work with the case. Yin [

46] states that choice of research method in a large part depends on your research questions. The more your questions seek to explain some present circumstance (e.g., how and why some social phenomenon works) the more that case study will be relevant. Through our study, we discuss how to illustrate better solutions to some of the major weaknesses identified in current cost estimation practice. According to Yin [

46] case study could fit with this kind of research questions. The basis for this paper is data relating to one case project. The case is decommissioning of Barsebäck Nuclear Power Plant. A single case study does not prove anything, but is a way to dive deep into details of the process to learn from what is experienced [

7]. Diving deep is the best way to come closer to excellent practice.

This paper as a whole does not only correspond to experience from a single research project. Rather, it sums up experience gathered over many years by the authors in their research on projects, development of methods within project management and management system development, as well as practical performance of uncertainty analysis in a large number of projects. The authors have a wide range of experiences from a large number of normal and complex projects, both individually and shared. The experiences include cost estimation and uncertainty analysis support over more than two decades. In general, these experiences are well supported by literature.

The framework for the research done in this study could be presented through the following steps:

- (1)

Identifying challenges with today’s practice; going through a literature review identifying challenges with the practice of cost estimation and uncertainty analysis processes;

- (2)

Planning the work on the case study; planning a cost estimation and uncertainty analysis process for the case, taking the identified challenges into consideration;

- (3)

Performing the cost estimation and uncertainty analysis process for the case; and

- (4)

Evaluation of the process for the case against the identified challenges from the literature.

The literature review was performed with search in research databases, searching for uncertainty analysis, risk analysis combined with challenges and weaknesses. We found much literature on uncertainty analysis and risk analysis, where some of this literature was pointing at challenges with today’s practice. The findings from the literature review are presented in

Section 2, concluding with a set of weaknesses with today’s practice.

Planning the work with the case study took place over a six months period. The planning included two workshops with people from the case study project and stakeholders around the project. During the planning, different approaches were discussed and a plan for the estimation and uncertainty analysis process was developed. Before the first workshop, an analysis team was established. The analysis team is described in more detail in

Section 5.1. The analysis team introduced themselves to the challenges embedded in the case project, through a thorough briefing with an expert in the field of nuclear power plants, together with studies of relevant documents about the case project. The first workshop was performed over one day, and this included discussion around challenges in the project that would have implications on the cost estimation and uncertainty analysis process, and discussions on how to structure the process. After the first workshop the analysis team set up proposals on how to structure the cost estimation and uncertainty analysis process, and how to compose the expert group to participate in the process. The second workshop was also over one day, on the site of the case project. The second workshop included discussions around the cost breakdown structure and more detailed discussions around the structure of the analysis process, including a site inspection to see first-hand the project’s dimensions and technical complexities.

The cost estimation and uncertainty analysis process was performed as a group process. The focal point in the description of the practical approach is the group process. The group process is a social phenomenon. We approach the phenomenon from a critical realist position. Truth about what works and how needs to be interpreted in light of the participants’ positions. The research here is qualitative and based on the researchers being involved in the phenomenon we study. Thus, this can be viewed as action research. The systematic approach for uncertainty analysis used in the case Decommissioning of Barsebäck Nuclear Power Plant holds the essence of theory and our practical experience. The process was performed over a three-day workshop, described in more detail in

Section 5. An important issue in such a process is how to compose the analysis group. This is described in

Section 5.2.2. The process followed a well-planned program, following the structure as described in

Section 5.3. The challenges identified in the literature was considered during the planning of the process, and again considered during the three-day workshop. This case project illustrates well some of the major challenges and how we handled them in this specific case.

Evaluation of the process for the case against challenges identified in literature included evaluation of both the process and results from the process. The results from the process were evaluated in a plenary session with the participants in the group process, experts on decommissioning of nuclear power plants, as the last part of the three-day workshop. The process was evaluated by the researchers together with some of the participants in the group process after the group session was finished. The researchers experience from similar processes made an important background for this evaluation.

This case project is far too complex to be explained in detail here. Thus the authors have only included information relevant for the methodological points discussed in the article. A brief but hopefully sufficiently rich context description is included so that readers may consider for themselves how they interpret the issues discussed here in their own context.

4. Decommissioning of Barsebäck Nuclear Power Plant—Context and Description

The Swedish power industry has been generating electricity by means of nuclear power for about 40 years. There are ten nuclear power reactors in operation in Sweden today, distributed between the three nuclear power plants located at Forsmark, Oskarshamn and Ringhals. The plants at Forsmark and Oskarshamn have three reactors each and the Ringhals plant has four reactors. Together, these plants represent around half of Sweden’s power supply. In addition, there are two reactors at a location in Barsebäck. Decommissioning of these reactors is the case project explained in this paper.

The Barsebäck nuclear power plant is situated in the south of Sweden in the Skåne region, 30 km from Malmö and only 20 km from Copenhagen, Denmark: More than three million people in two countries live in its neighborhood. The two 600 MWe BWR units commenced operations in 1975 and 1977, and were shut down in November 1999 and May 2005. Radioactive components are already removed. The Barsebäck plant is not expected to be decommissioned until after 2020, when storage for radioactive components is expected to be ready for operation. The decommissioning will be financed by funds from the Swedish Nuclear Waste Fund. A plan for the dismantling and removal exists, which describes in detail the plan for decommissioning.

Barsebäck’s two reactors, B1 and B2 supplied electricity to Skåne’s electricity users for 30 years. Although both reactors have been taken out of operation and despite the fact that they do not produce any electricity today, Barsebäck Kraft AB is still very much a living company. The change from electricity production to what is known as service operation has meant that new business areas have been developed. One of Barsebäck Kraft AB’s main responsibilities is to prepare for decommissioning of the plant and restoration of the site for future use.

The planning process regarding decommissioning the site at Barsebäck has been going on for a long time, and the plan still develops continuously. Parts that cause immediate risk of radiation is already dismantled and much of it is removed from the site. Still, the large constructions remain. As far as the case project goes; this project is partly in a planning phase and partly already in execution phase. The cost estimation and uncertainty analysis reported here is thus not an example of very early estimation, but due to its complexity and long planning horizon—and being the first of its kind in Sweden, the reported process was truly a unique challenge.

The timing for decommissioning the site at Barsebäck depends on finding a suitable solution for permanent storage of the nuclear waste. The current plan is to store short-lived radioactive waste (SFR) at an existing site in Forsmark, and to store the long-lived radioactive waste (LFR) in a new permanent site in Östhammar municipality. The site already established in Forsmark to handle SFR has to be expanded to take care of the volume of waste from Barsebäck. It will take some years to prepare this. The existing plan states that SFR should be ready to receive waste from Barsebäck in 2022, but this still is not finally decided. In terms of the project plan, Barsebäck either has to wait until SFR is finalized and ready to receive waste for permanent storage or they could find a solution for safe interim storage another place. The second option could create opportunities to start decommissioning earlier and hereby give earlier access to the site for new purposes.

In 2005, a cost analysis was developed by the consultant company TLG Services Inc. In 2008, the cost estimate was updated based on revised premises and based on the new OECD/NEA structure. Early 2013 a new update was made based on a revised basic structure; ISDC (International Structure for Decommissioning Costing of Nuclear Installations). This cost estimation process has resulted in a comprehensive, detailed and well documented cost estimate, but also illustrated a few general challenges with cost estimation: the object itself changes over time, the assumptions the project and its estimates are based on changes over time, and so does the way cost is represented and structured. This kind of process makes the cost estimation fragmented and in risk of being inconsistent in terms of today’s assumptions compared to actual future situation. In addition, this project is the very first of its kind in Sweden and an early decommissioning project internationally. Experience with this kind of process is very limited and so is access to relevant cost experience (facts to base the cost estimate on).

The Swedish Radiation Safety Authority (SRSA) questioned the uncertainty of the cost estimates presented from 2005 to 2013. The case obviously involves major decisions including technical and financial risks, but just as important from a societal perspective is the consequence of uncertainties in future development. How do all these uncertainties and risks add up?

In 2013, the SRSA gave Department of Civil and Transport Engineering at NTNU the assignment to perform an uncertainty analysis of the cost estimate for Decommissioning of the Barsebäck site. The main objective for SRSA in this case was to improve the understanding of costs related to decommissioning of Nuclear Power Plants and learning for future processes. NTNU was chosen due to their long and rich experience in analyzing major investment projects for the Norwegian state.

The objective of the analysis was defined as providing a clearly as possible overview of the total remaining costs and the related uncertainties for the complete dismantling and decommissioning of the reactors B1 and B2 and the release of the site to other purposes.

5. The Barsebäck Uncertainty Analysis

The general steps of an analysis are Preparations, Analysis and Communication. The different steps are explained related to the Barsebäck case study in the following paragraphs.

The method used in the uncertainty analysis in this case is similar to the methods described in literature [

4,

23,

27]. The authors used Excel spreadsheet in the cost estimation and a Monte Carlo simulation model in the uncertainty analysis. The analysis process, the group session and the analysis tools are developed with a view to maximize utilization of the joint knowledge about the actual project and similar projects, and right methodical treatment of the input of the analysis.

A more detailed description of the analysis process, showing some main activities, is presented in

Figure 1.

During the description of each of the analysis steps, we explain the method and practice. The main idea is that everything should be included in the cost estimate and the uncertainty analysis of the cost estimate. Making the right decisions require the whole picture to be taken into consideration—but not all the details. The question guiding the analysis was: What will the project Decommissioning Barsebäck actually cost at the point in time when the project is actually finished, everything included?

The analysis should cover all the remaining costs for the project, including factors not described by a physical object, but that affects the costs of the project, including emerging trends, changing assumptions, new knowledge, future technologies etc. Since this is the first project of its kind in Sweden, the project is complex in all four dimensions of complexity [

1]: structural complexity, technical complexity, directional complexity and temporal complexity. The complexity of the situation, combined with the additional fact that it should be implemented over a long period of time, it is obvious that the uncertainty related to the costs is high. This situation represents all the major challenges identified in the theory part concerning cost estimation and uncertainty analysis.

5.1. The Analysis Team

Three experienced facilitators and uncertainty analysis experts were chosen to perform the analysis. They all have long experience as facilitators and have worked with a wide range of different projects, often major public infrastructure projects in Norway. The team had collaborated in many analyses before, and they had already worked with SRSA for several years to challenge the practice of assessing risks in cost estimations. Such estimations are used to back up decisions on how to finance the decommissioning of the whole nuclear power industry in Sweden—the nuclear fund. Still, this was the first time SRSA and the analysis team took on analyzing the decommissioning of a specific nuclear power plant.

Therefore, in dialogue with the client, the analysis team was able to use six months to prepare. This is a lot more time than normal, although it included a limited number of hours spent in this period. The reason for using more time than usual was that the team needed to understand the specific language and some fundamental issues in nuclear power industry. The analysis team was able to develop their knowledge about the challenges of a project like decommissioning of a nuclear power plant into some detail. This was achieved through document studies and by arranging a two-day workshop with an experienced nuclear power plant expert from Sweden, then two one-day workshops together with key individuals at Barsebäck. This made the analysis team able to ask the right questions during the analysis, and was a part of the process of establishing trust that the analysis team was able to do a neutral and good assessment.

During this preparation process the team developed individual roles for the three team members so that there was clarity in who does what during the analysis process. The three members of the team defined three roles: individual A was the facilitator, individual B tended to data and documentation, individual C focus challenging the resource group. Thorough discussions on roles did not only prepare for an efficient and goal-targeted process, but also increased the team’s ability to respond to potential group challenges and would make the members of the team able to cover for each other in case of illness, etc.

5.2. Preparations

The starting point for the process is gathering relevant information and documented knowledge gathered up till now. This includes summary of plans and estimations—not more details than the people involved in the process can absorb and understand. Unnecessary and too detailed information will only confuse the participants.

A typical uncertainty analysis process does not include enough effort into the preparations of the process [

2]. Often the client buying uncertainty or risk analyses are not able or willing to take enough time for proper preparations. The preparations included document studies, one internal workshop in the analysis team, two meetings with the main people at Barsebäck as a part of getting to know the project and the basis for cost estimation of the project and detailed planning of the successive process for the project.

It is important to understand that it is not only the analysis team that needs to prepare. In addition, the resource team of experts needs to be informed up front and given time to prepare to give their subjective cost judgement in the analysis process. Normally the facilitator and the project manager will select a relevant information package and inform the experts individually approximately 2–4 weeks before the analysis workshop. In this period they are expected to consider carefully their cost experience and check their references. This practice corresponds with large, somewhat complex projects where the experts know the method in advance. In the Barsebäck case more time was awarded and two physical meetings included in the preparations. The complexity was way beyond normal and the participants did not know the method from before.

5.2.1. The Input Data Model

Establishing the Input Data Model should be a part of the preparations. In this case we studied the existing cost estimates of the project with updates from 2008 and 2013. Based upon the existing estimates we developed the cost breakdown structure to be used in the analysis, based on a top-down approach [

4]. The analysis team had already built a data model with input prior to the three-day workshop. This helps the team prepare for the upcoming discussions, identifying questions and issues to assess in the group. It also means the model is already tested and working when the analysis starts.

Prior to the successive process, we hid the cost numbers in the model, because if we include numbers into the model in advance, the discussions in the group will be limited to a discussion around these already established numbers, and not on what the real costs will be. The numbers represent anchors with a priming effect as explained by Kahneman [

33] (p. 122). If you show the numbers, the distribution of answers will be too narrow. We kept the numbers available in the model so that it could be presented easily for the group during the process in case the discussion needed a nudge. For most of the process it was not necessary, so we kept them hidden for the team of experts. This is one of the characteristics of real experts—they need no predefined input, only the structure of the cost estimate.

5.2.2. The Analysis Group

One important part of the preparations and for the results from the process is the composition of the analysis group. The size of the group, the number of people, is important: too small and it does not cover all the competencies needed, too large and it takes too much time and becomes hard to conclude. The composition in terms of skills and experience of the individual experts and their personal qualities also matters. The most efficient groups are 5-9 people, and the most effective groups have maximum spread in background (length and type of experience, age, gender, cultural background, etc.).

In this case, we did not have a lot of people to choose from—not many experts has the competence needed to assess costs and uncertainties related to decommissioning of a Nuclear Power Plant. Therefore, it was discussed to include international experts, but it was decided not to. The group was in the end twelve people including the analysis team of three. This gives nine experts on Nuclear Power Plants and decommissioning. Four of the experts came from Barsebäck Kraft AB, which is the company running the service of Barsebäck today and will be responsible for dismantling and decommissioning of Barsebäck. They have intimate knowledge of the decommissioning plans and the specific technicalities at Barsebäck. The group included three experts from the Swedish Radiation Safety Authority (SRSA). They know the national context for the nuclear industry very well, and follow international development closely. In addition two experts from two different consultant companies was included in the group, their task was to have the “outside view” in the process and to challenge the “insiders”. They also added specific knowledge on characteristic themes of importance: One was an expert in public finance and future development. The other was expert on Nuclear Power Plants, their structures, constructions and operation. There was one woman in the group—we would have wanted more if possible, and the age profile was good with people from 35 to 65 years of age. All but one individual was Scandinavian.

5.3. Successive Process

A symbolic presentation of the successive process is shown in

Figure 1. The successive process includes the seven steps broadly consistent with general models presented in literature. The process was performed during a three-day workshop at the site in Barsebäck. Holding the workshop close to the site is in itself a part of the setting that has influence on the group of experts. It helps them come closer to the reality that they are considering that would elsewhere become distant and abstract.

5.3.1. Defining the Problem/Task

This is the start-up of the successive process, discussing the purpose and objectives of the analysis, discussing the scope definition of the project, summarizing the characteristics of the project, etc. Main issues are making sure the participants understand what the analysis is going to be used for, and to create a common starting point. In a project that is already underway, it is important to get a fresh update on current status and development.

The group discussed around the characteristics of the project when it comes to size, duration, implementation intensity, complexity, needs for innovation, technical challenges, the objectives, acceptance of the project, market conditions, organization and stakeholders. The most crucial characteristics based on the discussion were the needs for innovation and the long duration together with its size and complexity.

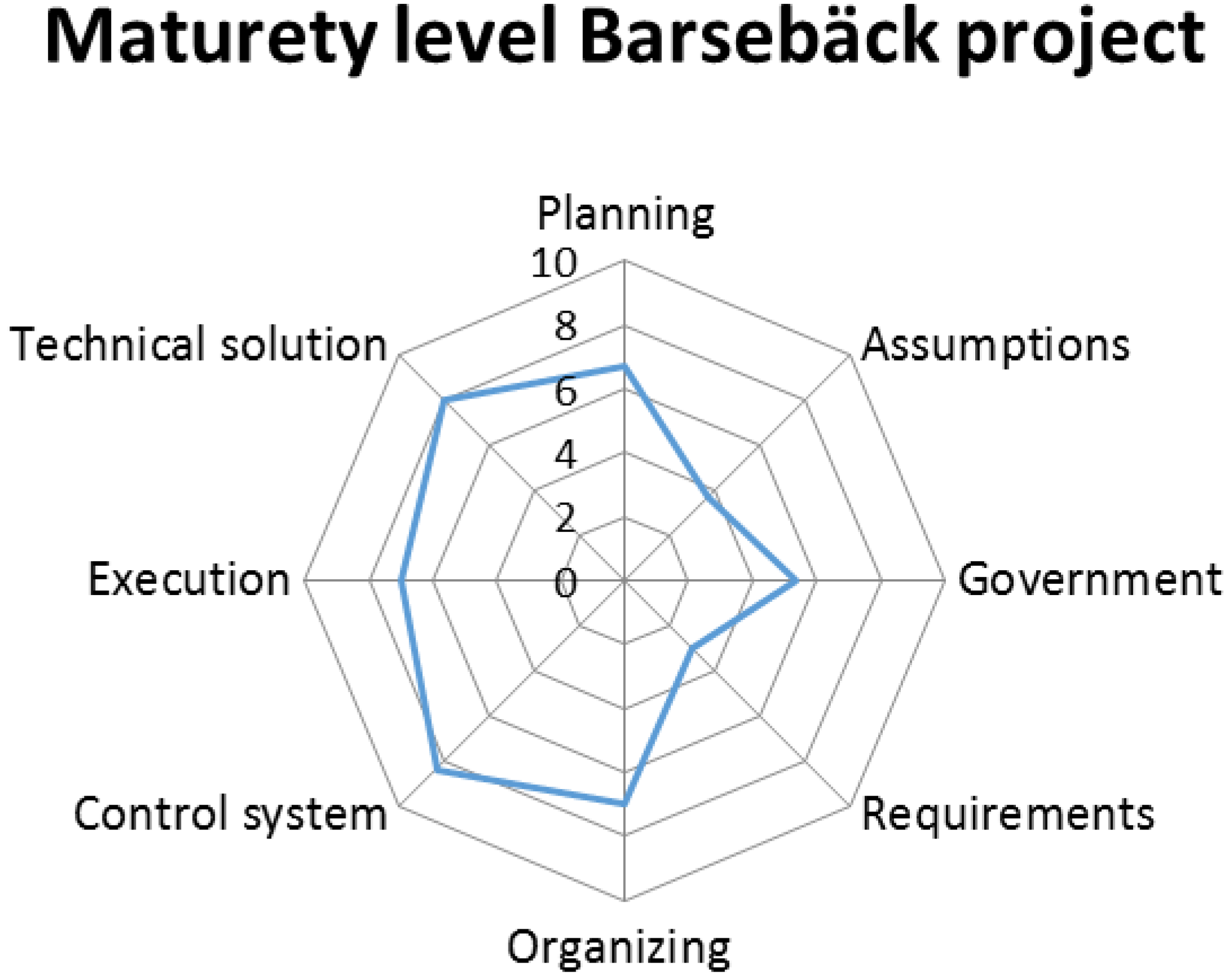

A stakeholder analysis was included in this part to chart the complex picture of the stakeholders of the project, and a maturity model was developed to look into how mature different parts of the project plan was at the time. The “Maturity Map” of the project is shown in

Figure 2 illustrates that the technical solutions and the management system are well developed, while the premises are not well developed. Neither the Government involvement nor the requirements from the authorities and other stakeholders were mature at the time of the analysis. The group assessed each aspect and put grading from 0 to 10 (10 being completely matured and clear at this point, 0 meaning not defined at all). The discussion on the project characteristics and the maturity of assumptions gave input to the uncertainty discussion to follow. They might even be interpreted as simple indications of where we would find uncertainty. Increased maturity reduces uncertainty.

5.3.2. Identification of Uncertainty

Identification of uncertainty was performed by a structured brainstorming process. One hundred issues were identified, concerning both internal and external assumptions, and technical, social/human and economic aspects. It is not practical to include 100 uncertainty factors in the analysis, and it would not be wise. Some of the issues express the same uncertainties in different words. Thus, the issues were structured into factor groups; all in all, 12 factor groups were included in the analysis, see

Table 1. These groups of issues identify uncertainties with similar cause and effect. Therefore, these can be defined, described and assessed by the experts in terms of how much they may influence the cost of the project.

In the first round of identifying elements of risks and opportunities you should not criticize or evaluate the suggestions. Let the group members suggest anything—think of it as a creative problem solving process. This will help the process later. Structuring and grouping factor as shown in

Table 1 is done to reduce the amount of work (you do not have capacity to consider 100 issues), and to sort it out so you do not include the same risks and opportunities many times, or leave them out.

5.3.3. Cost Breakdown Structure

The Cost Breakdown Structure was established in the preparation stage and through the work with the input data model. Top-down approach was used and the CBS was limited to eight main cost items, with a total of 30 sub-items to be estimated. The main items are shown in

Table 2.

There is a challenging balance between identifying the most uncertain cost areas sufficiently precise to know where to add more planning effort, and to avoid details that make it too complex and hard to oversee—resulting in confusion and spending too much time on the analysis. None of these will increase the quality of the group’s considerations. There is no reason to believe the human mind is better at handling massive amounts of details in a big, complex project than in a small, straight forward one. Always keep it small and simple. 30 items is a good number to start with. If you need more details in some area—add them later when overview is established. Note that experts (and especially engineers) always love to discuss more in detail their specialty—but tend to dislike discussing things they do not know. It is the facilitator’s challenge to moderate the group into discussing the uncertain issues—these are the items we need to consider more carefully.

5.3.4. Estimation

The cost estimate is in our case composed by the following items:

Base estimate—the best possible cost calculation, based on the planned project as it is documented at this point in time.

Unspecified costs—costs we know will appear, but that is for now impossible to place based on lack of detail knowledge (a part of the base estimate).

Uncertainty factors—assessments of what premises/conditions that could change during the project and what internally and externally influences that can increase or decrease the costs.

Single events—events that could or could not happen during the project (political decisions, accidents and other events that could happen), which is of considerable size and consequences.

Correlation effects—correlations between both cost items in the base estimate and uncertainty factors that could affect the costs. Correlation effects cause the cost effect to be stronger than the sum of influences of each item.

The estimation was done by three-point estimation (triple estimates), where the analysis group estimated low estimate, most likely estimate and high estimate for each cost item and for each factor group of uncertainties. To help the estimation a template was used to describe each cost item and each uncertainty factor group prior to the estimation. For each cost item, basic premises, the base estimate and the contingencies, assessments and the basic situations for the high and low estimate were described as good as possible by words. For each uncertainty factor group, the uncertainties included in the group, the base premise for how the uncertainty was handled in the base estimate of cost items, best case, worst case and most likely case were described by words. Only after the item and best/worst scenarios were described were the experts allowed to mention numbers. Always describe first by words (create pictures or associations in the minds of group members), then by numbers (specify consequences).

After the description of each item, each group member was challenged to estimate the low, most likely and high value individually and without discussion. Then the facilitator asks for the estimates—one at the time. It is important to start with low and high estimate and assess the most likely last to avoid the most likely value to work as an anchor. For each item, the single group members note their individual estimates on a piece of paper. Normally they do not come up with the same numbers. This raises the question of what to include as the group’s estimate. We chose to use the lowest of the lowest values and the highest of the highest values, unless the group members assessed the numbers as totally unrealistic. If so we discussed the estimates more closely. The general principle is: include as much uncertainty as possible from the resource group’s estimates. We know from experience the estimate will still tend to be too narrow. If the resulting distribution function should become too wide it is no problem because then it will be reconsidered in the next round of the process circle (see

Figure 2).

5.3.5. Calculation and Evaluation

After all the cost items and the uncertainty factor groups were estimated the calculation was done with a Monte Carlo Simulation tool. The result of the analysis was closely evaluated by the analysis team and resource group together in a plenary session. The evaluation included a discussion about the realism in major items, groups of items, the total cost estimate, the level of the standard deviation and a discussion about whether or not the right uncertainties was on top of the uncertainty profile. This way we systematically kept focus on the most uncertain items in the cost estimation and the holistic perspective of the project.

The main results are shown in

Table 3 and include two scenarios: Strategy 1 (base case)—waiting for SFR to be built. This was the official plan at the time of the analysis. During the identification of opportunities the resource group realized there was an alternative: Strategy 2—building an interim storage to be able to start decommissioning earlier and consequently free the site for new purposes earlier. This would have significant added value to society.

Table 3 indicates that the alternative scenario give 850 MSEK savings compared to the base alternative, i.e. to wait for the SFR to be built. However, the relative standard deviation is higher in the alternative to build an interim storage, indicating this it is a more uncertain alternative. The main reason for this uncertainty may simply be that the experts had not considered this alternative before.

Based on a holistic assessment and careful consideration the group agreed that the total cost estimate was realistic. However, the level of uncertainty, i.e. the size of the standard deviation was evaluated as still unrealistically low, even though it seems much higher than comparable studies have revealed. This is compatible with the general experience of the authors. We think the standard deviation should have been even bigger.

5.3.6. Detailing of Items

The main idea from the principles of Lichtenberg [

4] is that you should start on an overall level with a small number of cost items, and then successively break the most uncertain items down into sub-items to get better and less uncertain estimates. In this case, we did not have time to add more details on the most uncertain items. Neither had the resource group detailed insight to do so.

5.3.7. Conclusion

Towards the end of the analysis workshop the analysis team and the group of experts assessed the results in a plenary session. The analysis group concluded that we had reached a realistic level for the expected costs for the project. This was as far as the competence of the group went, and what the available data could tell at this stage of development. In addition, the profile of the uncertainty was considered realistic—according the experts in the group, the most uncertain items was identified and shown on top of the priority list.

5.4. Finishing Work

After the group process ended, the analysis team continued the work on the documentation of the process. To assure quality of the report, a first draft was sent to the participants as soon as possible after the group process. Any comments or questions from the resource group would then be considered by the analysis team and included when appropriate. Only a few minor issues were raised in hindsight when the draft report came. The report was more directed towards collecting experience with the method than to be used as a formal basis for decision making. Therefor more details on the process were included than normal for such documents. The analysis team always has to consider carefully how the report should be structured, formulated and concluded according to the purpose of the analysis.

6. Discussion

In this article we address the following challenges:

- (1)

The resource group is not well composed;

- (2)

Too much details in the cost estimation models;

- (3)

There is no focus on opportunities;

- (4)

The level of uncertainty is underestimated in all phases; and

- (5)

The expected cost is underestimated.

Challenge of composing the group is finding the right experts, the right competences, to include people with a mix of backgrounds to balance opinions. Often, we see that the group includes the people/experts that are available, rather than the right mix of people. Often technical experts, with mainly focus on technical issues, more than an overall focus are prioritized when composing the group. The analysis team of the Barsebäck case, together with the Project Management, put effort into including the right people into the process. First of all, through thoroughly preparations, the analysis team was well prepared and got to know the members of the group/team well prior to the group process. We also included external participants, not a part of the planning team of the project, to secure the outside view. Flyvbjerg et al. [

16] mention situational factors such as training, role and how accountable the different participants are in relation to the end results have influence on the project members preferred attitude towards risk. Through the preparations, especially planning meetings with some of the group members, we have to understand the roles of the different people in the project; we discussed the approach to apply in the process with them so that the team understood the basics of the methodology. Of course, there are still possibilities of different attitudes towards risks in the group, but that is also an advantage in a group process if we are able to exploit it. The thorough preparations, including two workshops with parts of the analysis team played an important role in understanding the different roles and helped composing the group in a good way.

Level of detail—a normal cost estimation process includes a lot of details about the different cost items, and it might be hard to get overview of the project and the uncertainties in the project, due to all these details. A question is what is right for the purpose, and what is possible given the available time and data. The analysis of Barsebäck was done over a three-day workshop. Because of the well-prepared process over six months and the work put into the input data model, we were able to go through all the cost items, all the uncertainty factor groups and a good discussion of the results of the analysis. However, we had too little time to discuss single-events and risk-reducing actions. Even in a three day workshop we did not manage to exploit the advantages of the successive principle with stepwise decomposition and reconsideration of the most uncertain cost items and uncertainty drivers, as described by Lichtenberg [

4]. We had to stick to the pre-defined cost breakdown structure and did not have time to go into more details on the most uncertain items. However, according to the detail challenge described by Johansen et al [

5] the level of calculated uncertainty decrease due to increased detailing of the Cost Breakdown Structure. This is right if we do not handle correlation between the items in the analysis. For the Barsebäck case, still with around 30 cost items, we included correlation between items in the analysis. When it comes to time spent on the group process, for a project of this size and complexity would probably a five-day workshop give enough time to discuss and cover all the aspects to make it a high quality process in a project as complex as this one. In ordinary projects, workshops of 1–2 days may be sufficient.

Experiences and literature confirms that it is hard to identify opportunities. If you do not ask for opportunities during the identification of uncertainties, the group would mainly focus on risks. The positive side of uncertainty has to be on the agenda. Risk and opportunities may be seen as two sides of a coin (not one without the other), but in the discussion you need to split them apart to focus clearly on both risks and opportunities. In the case of decommissioning Barsebäck we pinpointed the opportunities in particular, as a separate part of the brainstorming process. In this case, important opportunities were identified. The most important one was the possibility to find a solution for safe interim storage while waiting for the SFR to be finished. This option could give opportunities to start decommissioning earlier and hereby earlier access to the site for new purposes (added value for the community), and in addition a decrease in the expected costs of around 15% (added value for the owner). It would also reduce the total project time and thus reduce some of the contextual uncertainties. This opportunity gave two different future scenarios, so the group chose to handle them as two alterative projects. It would intuitively seem a better choice to go for an interim solution than the planned case waiting for SFR to be finished. Further planning is needed to establish if this is a real option, but in fact, we were able to identify significant opportunities, by addressing them properly.

When it comes to the level of calculated uncertainty, it seems like the level of standard deviation from the analysis tends to be unrealistically low in all uncertainty analyses. The level of uncertainty is dependent on maturity of the project, its complexity; the timespan from the analysis is performed until the project is finished etc. For the Barsebäck project, which we would say is at a level of Feasibility study and planning, the calculated standard deviation was above 20%, whereas comparing with analysis of 100 Norwegian infrastructure projects resulting in a calculated standard deviation between 6%–12% [

5]. The results from Barsebäck are much higher uncertainty than the Norwegian cases, however of course the right level of uncertainty we do not know. We achieved this through a systematically way of addressing uncertainties, by systematically making sure all consequences of uncertainty is expressed through the input and by including correlation between items that are correlated. Our advice is also to choose the extreme estimates from the different group members as input in triple estimates.

When it comes to underestimated cost level, Flyvbjerg et al. [

15] states that cost escalations happens in almost 9 out of 10 projects, with an average increase of 28%. For the Barsebäck case, we cannot know if the project will have a cost escalation, even if the quality of the cost estimation process and the uncertainty analysis is as good as possible.

We have discussed some of measures to improve the cost estimation and uncertainty analysis process of complex projects especially to handle identified challenges with today’s practice. This can influence practice in future cost estimation and uncertainty analysis processes, and give additional knowledge to the theory about these kinds of processes. Even though we would claim that we have been able to meet some of the challenges in today’s practice in this case, there are still challenges to meet. One remaining challenge is that it is not always possible to allocate enough time and resources for good preparation of the process, as we were able to do in this case. This will affect all the challenges addressed, like the resource group, the detail challenge and the focus on opportunities, which again will affect the level of uncertainty and the underestimation challenge. Another question that remains to be answered is if we were able to find the right level for the cost estimate of the case project, which we are not able to answer yet.

7. Conclusions

The research question to be answered in this paper was how to find better solutions to some of the major weaknesses identified in current cost estimation and uncertainty analysis practice.

We have used the case of Decommissioning Barsebäck Nuclear Power Plant to show that challenges in current practice can indeed be met. A well prepared process with a positive and suitable group that go through a well-structured process, using a top-down approach and focusing on both risks and opportunities, can compensate for some of the challenges related to the quality of the cost estimation and uncertainty analyses processes. We have managed to raise the level of uncertainty compared to results from similar comparable analyses. We have managed to show the consequences of opportunities, but it is up to the project in the continuing planning to implement the opportunity into the project plan. We have used a quite simple model on a complex system, and according to the experts in the field, this managed to describe the real situation in a good way.

Of course, how good the results of the process are when it comes to the level of expected costs, and the level of uncertainty, we cannot know before we have the end results. We do not know before the project has developed some years and the true cost development of the project is known, whether we have managed to describe the right level of uncertainty in the analysis. However, we see that the results from the structured process for Barsebäck is in line with the results from similar processes done for other complex projects, and in line with previous estimates for the project. It is also in line with the theoretical guidelines for a reasonable level of uncertainty at this stage of a project.

This paper gives contribution to the literature in several ways. A detailed and concrete procedure on how to handle the challenges in today’s practice in cost estimation and uncertainty analysis is not previously found in current literature. The paper contributes to increased consciousness of what the challenges in practice really means, and how they can be met. Publishing the case story has additional value as a reference for improvement of cost estimation and uncertainty analysis in complex projects in the future.

Future work should include following the cost development of the case project, to see how realistic the results from the process are. Applying a similar framework and similar processes on other cases will also be interesting, both to further develop the process and to see if this gives equally positive results as the case of Barsebäck.