Social Impact Bonds and the Perils of Aligned Interests

Abstract

:1. Introduction

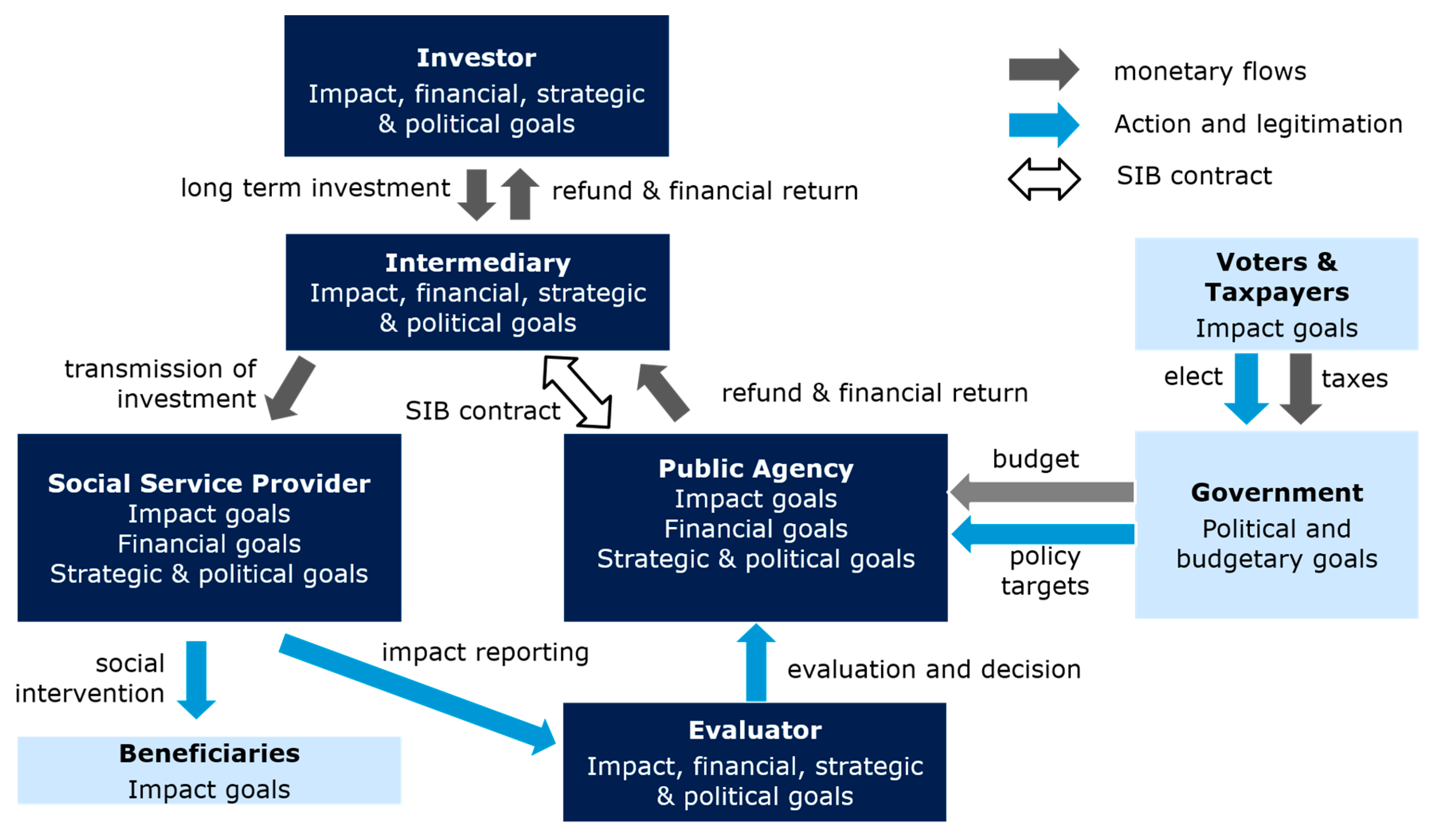

2. How SIBs Align Interests

2.1. What Does ‘Alignment of Interests’ Mean?

2.2. Do SIBs Align Interests?

3. The Perils of Aligned Incentives

3.1. Misleading Incentives: Displacement of Non-Profit SSPs’ Interests to Beneficiaries’ Detriment

3.2. ‘SIB Fever’: Agreement on Funding Conditions to Taxpayer’s Detriment

4. Conclusions: It’s Negotiation, Stupid

Author Contribution

Conflicts of Interest

References

- Arena, Marika, Irene Bengo, Mario Calderini, and Veronica Chiodo. 2016. Social Impact Bonds: Blockbuster or Flash in a Pan? International Journal of Public Administration 39: 927–39. [Google Scholar] [CrossRef]

- Clifford, Jim, and Tobias Jung. 2016. Social Impact Bonds: Exploring and Understanding an Emerging Funding Approach. In The Routledge Handbook of Social and Sustainable Finance. Edited by Othmar Lehner. London: Routledge, pp. 161–76. [Google Scholar]

- Coats, Jennifer C. 2002. Applications of Principal-Agent Models to Government Contracting and Accountability Decision Making. International Journal of Public Administration 25: 441–61. [Google Scholar] [CrossRef]

- Cooper, Christine, Cameron Graham, and Darlene Himick. 2016. Social impact bonds: The securitization of the homeless. Accounting, Organizations and Society 55: 63–82. [Google Scholar] [CrossRef]

- Dear, Annie, Alisa Helbitz, Rashmi Khare, Ruth Lotan, Jane Newman, Gretchen Crosby Sims, and Alexandra Zaroulis. 2016. Social Impact Bonds: The Early Years. London: Social Finance. [Google Scholar]

- Demougin, Dominique, and Claude Fluet. 2001. Monitoring versus incentives. European Economic Review 45: 1741–1764. [Google Scholar] [CrossRef]

- DiMaggio, Paul J., and Walter W. Powell. 1983. The iron cage revisited: Collective rationality and institutional isomorphism in organizational fields. American Sociological Review 48: 147–60. [Google Scholar] [CrossRef]

- Disley, Emma, Jennifer Rubin, Emily Scraggs, Nina Burrowes, Deirdre M. Culley, and RAND Europe. 2011. Lessons Learned from the Planning and Early Implementation of the Social Impact Bond at HMP Peterborough; London: Ministry of Justice.

- Donaldson, Lex, and James H. Davis. 1991. Stewardship Theory or Agency Theory: CEO Governance and Shareholder Returns. Australian Journal of Management 16: 49–64. [Google Scholar] [CrossRef]

- Edmiston, Daniel, and Alex Nicholls. 2017. Social Impact Bonds: The Role of Private Capital in Outcome-Based Commissioning. Journal of Social Policy, 1–20. [Google Scholar] [CrossRef]

- Fraser, Alec, Stefanie Tan, Mylene Lagarde, and Nicholas Mays. 2016. Narratives of Promise, Narratives of Caution: A Review of the Literature on Social Impact Bonds. Social Policy & Administration. [Google Scholar] [CrossRef]

- Giacomantonio, Chris. 2017. Grant-Maximizing but not Money-Making: A Simple Decision-Tree Analysis for Social Impact Bonds. Journal of Social Entrepreneurship. [Google Scholar] [CrossRef]

- Goodall, Emilie. 2014. Choosing Social Impact Bonds: A Practitioner’s Guide. London: Bridges Ventures. [Google Scholar]

- Golden, Megan, Brian Nagendra, and Kevin Seok-Hyun Mun. 2016. Pay for Success in the US: Summaries of Financed Projects. Greenville: Institute for Child Success. [Google Scholar]

- Gustafsson-Wright, Emily, and Sophie Gardiner. 2016. Using Impact Bonds to Achieve Early Childhood Development Outcomes in Low- and Middle-Income Countries. Washington: Brookings Institution. [Google Scholar]

- Gustafsson-Wright, Emily, Sophie Gardiner, and Vidya Putcha. 2015. The Potential and Limitations of Impact Bonds: Lessons from the First Five Years of Experience Worldwide. Washington: Brookings Institution. [Google Scholar]

- Hardin, Russell. 2003. Gaming trust. In Trust and Reciprocity: Interdisciplinary Lessons from Experimental Research. Edited by Elinor Ostrom and James Walker. New York: Russell Sage Foundation, pp. 80–101. [Google Scholar]

- Hirschman, Albert O. 1997. The Passions and the Interests: Political Arguments for Capitalism before Its Triumph. Princeton: Princeton University Press. [Google Scholar]

- Instiglio. 2017. Impact Bonds Worldwide. Available online: http://www.instiglio.org/en/sibs-worldwide/ (accessed on 2 April 2017).

- KPMG. 2014. Evaluation of the Joint Development Phase of the NSW Social Benefit Bonds Trial. Sidney: KPMG. [Google Scholar]

- Loxley, John, and Marina Puzyreva. 2015. Social Impact Bonds: An Update. Winnipeg: Canadian Centre for Policy Alternatives. [Google Scholar]

- Maier, Florentine, Gian Paolo Barbetta, and Franka Godina. Paradoxes of Social Impact Bonds. Paper presented at the ISTR conference, Stockholm, Sweden, 2016. [Google Scholar]

- Malcolmson, John D. 2014. Social Impact Bonds: Cleared for Landing in British Columbia. Burnaby: Canadian Union of Public Employees. [Google Scholar]

- Mazzucato, Mariana. 2015. The Entrepreneurial State: Debunking Public vs. Private Sector Myths. New York: PublicAffairs. [Google Scholar]

- McHugh, Neil, Stephen Sinclair, Michael J. Roy, Cam Donaldson, and Leslie Huckfield. 2013. Social impact bonds: A Wolf in Sheep’s Clothing? Journal of Poverty and Docial Justice 21: 247–64. [Google Scholar] [CrossRef]

- Popper, Nathalie. 2015. Did Goldman Make the Grade? The New York Times, November 4. [Google Scholar]

- Rohacek, Monica, and Julia Isaacs. 2016. PFS + ECE: Outcomes Measurement and Pricing: Pay for Success Early Childhood Education Toolkit Report #3. Washington: Urban Institute. [Google Scholar]

- Ronicle, James, Tim Fox, and Neil Stanworth. 2016. Commissioning Better Outcomes Fund Evaluation: Update Report. N.d.: Big Lottery Fund, ATQ Consultants, Ecorys. [Google Scholar]

- Rousseau, Denise M. 1995. Psychological Contracts in Organizations: Understanding Written and Unwritten Agreements. Thousand Oaks: Sage. [Google Scholar]

- Roy, Michael J., Neil McHugh, and Stephen Sinclair. 2017. Social Impact Bonds: Evidence-based Policy or Ideology? In Handbook of Social Policy Evaluation. Edited by Bent Greve. Cheltenham: Edward Elgar Publishing, pp. 263–78. [Google Scholar]

- Sinclair, Stephen, Neil McHugh, Leslie Huckfield, Michael J. Roy, and Cam Donaldson. 2014. Social Impact Bonds: Shifting the Boundaries of Citizenship. In Social Policy Review 26: Analysis and Debate in Social Policy. Edited by Kevin Farnsworth, Zoë Irving and Menno Fenger. Bristol: Policy Press, pp. 119–13. [Google Scholar]

- Smith, Katherine. 2013. Beyond Evidence Based Policy in Public Health: The Interplay of Ideas. London: Palgrave Macmillan. [Google Scholar]

- A New Tool for Scaling Social Impact: How Social Impact Bonds Can Mobilize Private Capital for the Common Good. 2012. Boston: Social Finance.

- Stump, Erika, and Amy F. Johnson. 2016. An Examination of Using Social Impact Bonds to Fund Education in Maine. Portland: University of Southern Maine. [Google Scholar]

- Tan, Stefanie, Alec Fraser, Chris Giacomantonio, Kristy Kruithof, Megan Sim, Mylene Lagarde, Emma Disley Jennifer Rubin, and Nicholas Mays. 2015. An Evaluation of Social Impact Bonds in Health and Social Care: Interim Report. London: PIRU. [Google Scholar]

- Whitfield, Dexter. 2015. Alternative to Private Finance of the Welfare State: A Global Analysis of Social Impact Bond, Pay-for-Success & Development Impact Bond Projects. Adelaide: University of Adelaine, Australian Workplace Innovation and Social Research Centre and European Services Strategy Unit. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Maier, F.; Meyer, M. Social Impact Bonds and the Perils of Aligned Interests. Adm. Sci. 2017, 7, 24. https://doi.org/10.3390/admsci7030024

Maier F, Meyer M. Social Impact Bonds and the Perils of Aligned Interests. Administrative Sciences. 2017; 7(3):24. https://doi.org/10.3390/admsci7030024

Chicago/Turabian StyleMaier, Florentine, and Michael Meyer. 2017. "Social Impact Bonds and the Perils of Aligned Interests" Administrative Sciences 7, no. 3: 24. https://doi.org/10.3390/admsci7030024