Study of the Effect of Time-Based Rate Demand Response Programs on Stochastic Day-Ahead Energy and Reserve Scheduling in Islanded Residential Microgrids

Abstract

:1. Introduction

- Optimal management of an islanded MG with RTP-based DR programs using a scenario-based two-stage stochastic programming model.

- Simultaneous energy and reserve scheduling of MGs with regard to different DR schemes in an uncertain environment.

- Assessment of TBR-based DR programs under different scenarios with/without considering EVs participation.

2. Model Description

- (1)

- Normal operation uncertainties (including errors in forecasting wind data, EV operation, and real-time market prices).

- (2)

- Contingency-based uncertainties (including random forced outages, unintentional islanding, and resynchronization events).

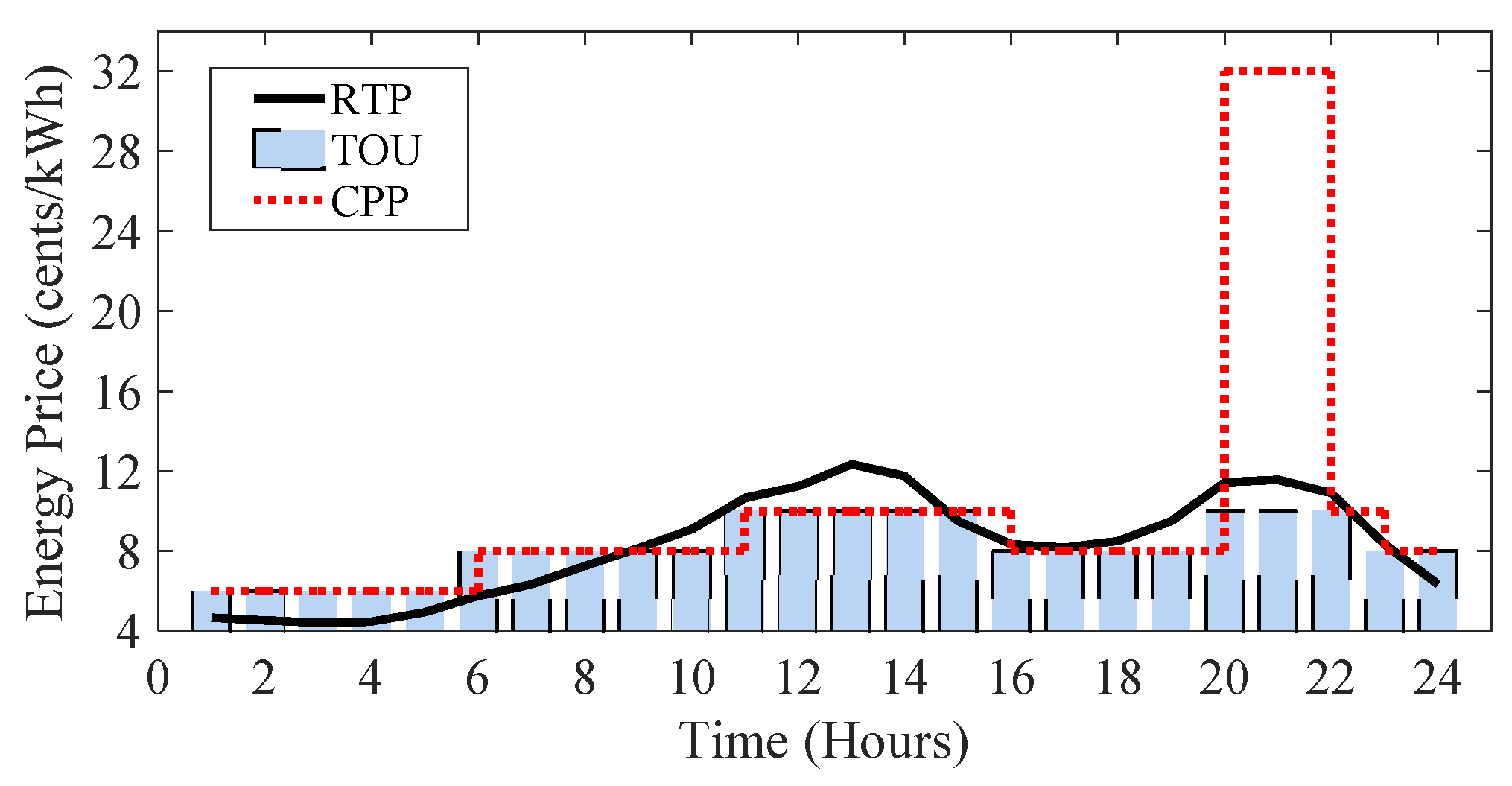

2.1. Market-Based DR Model

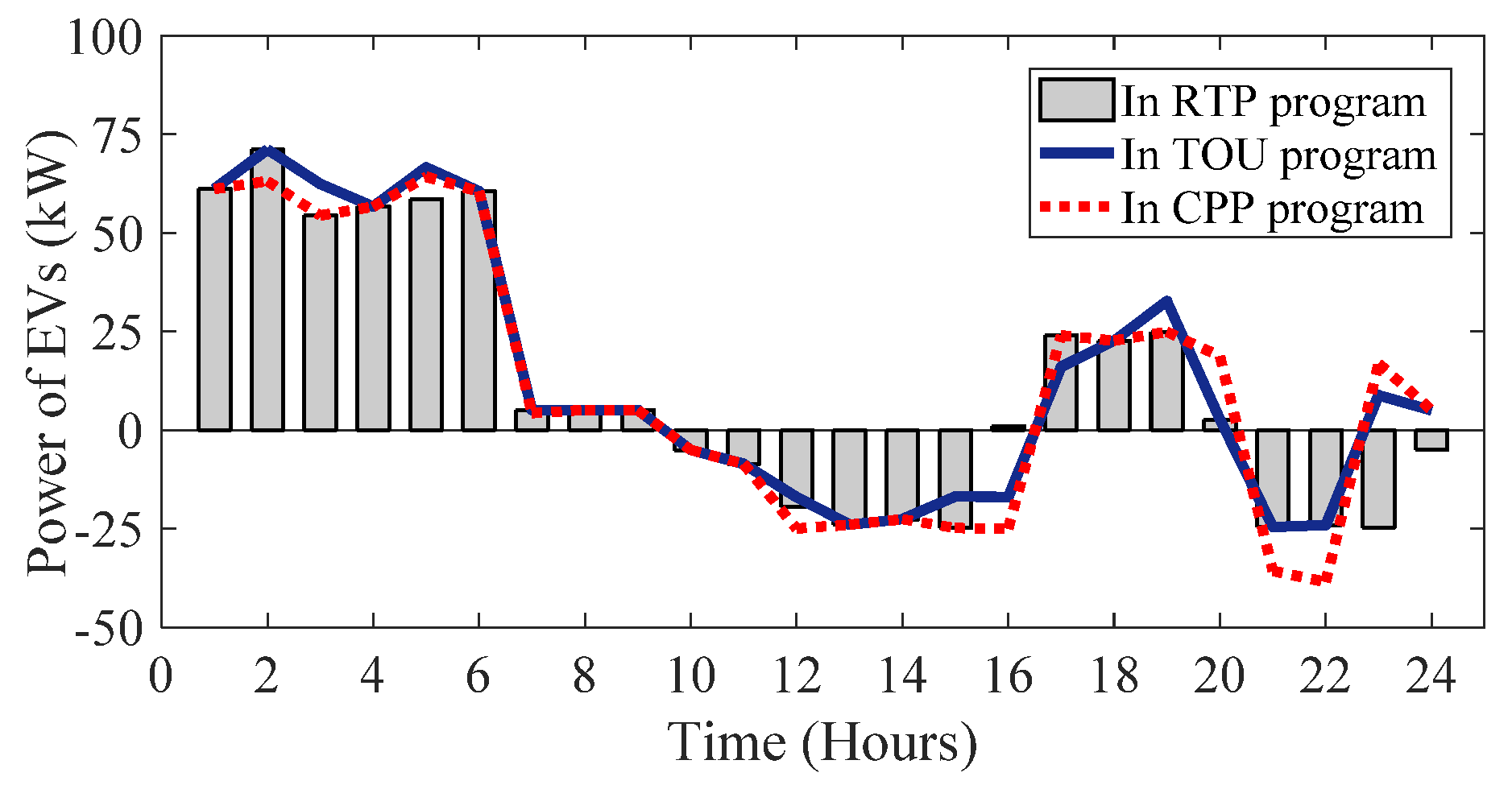

2.2. EVs Participation in DR Programs

2.3. Renewable Energy Resources

3. Optimization Problem Formulation

3.1. Objective Function

3.2. Constraints

- Power balance in steady state; Equation (18) represents the active power balance in MG in steady state [21].where, is power flow through line l in period t, (), is voltage angle at node x in period t. The power flow through line l is limited as:

- Real power generation constraints; The real power generated by DG units are constrained by (20) and (21) [21].

- Generation-side reserve limits; Constraints (22)–(24) impose limits on the provision of spinning reserve in terms of up and down regulations, as well as non-spinning reserve from the generating units.

- Demand-side reserve limits; Constraints (25) and (26) restrict the procurement of up and down reserves from the responsive loads.

- Unit commitment constraints; Equation (27) determines the start-up and shut-down status of units, while (28) states that a unit cannot start-up and shut-down during the same period [29].

- Generating units startup cost constraint; constraints (29) and (30) represent generating units startup cost limitations [21].

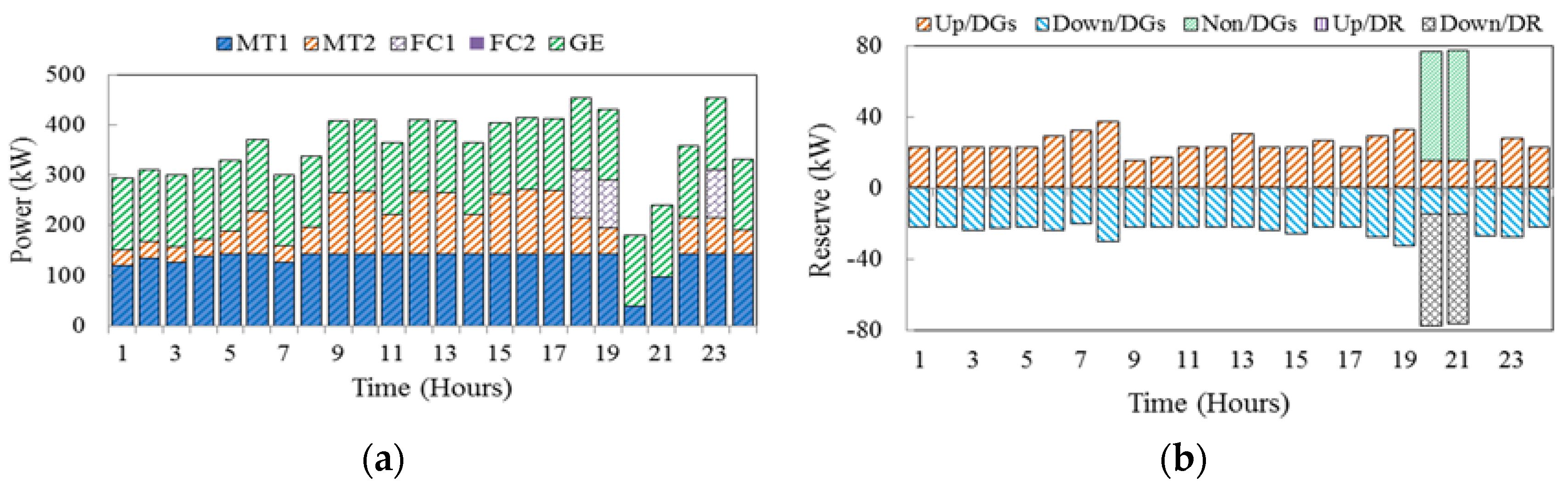

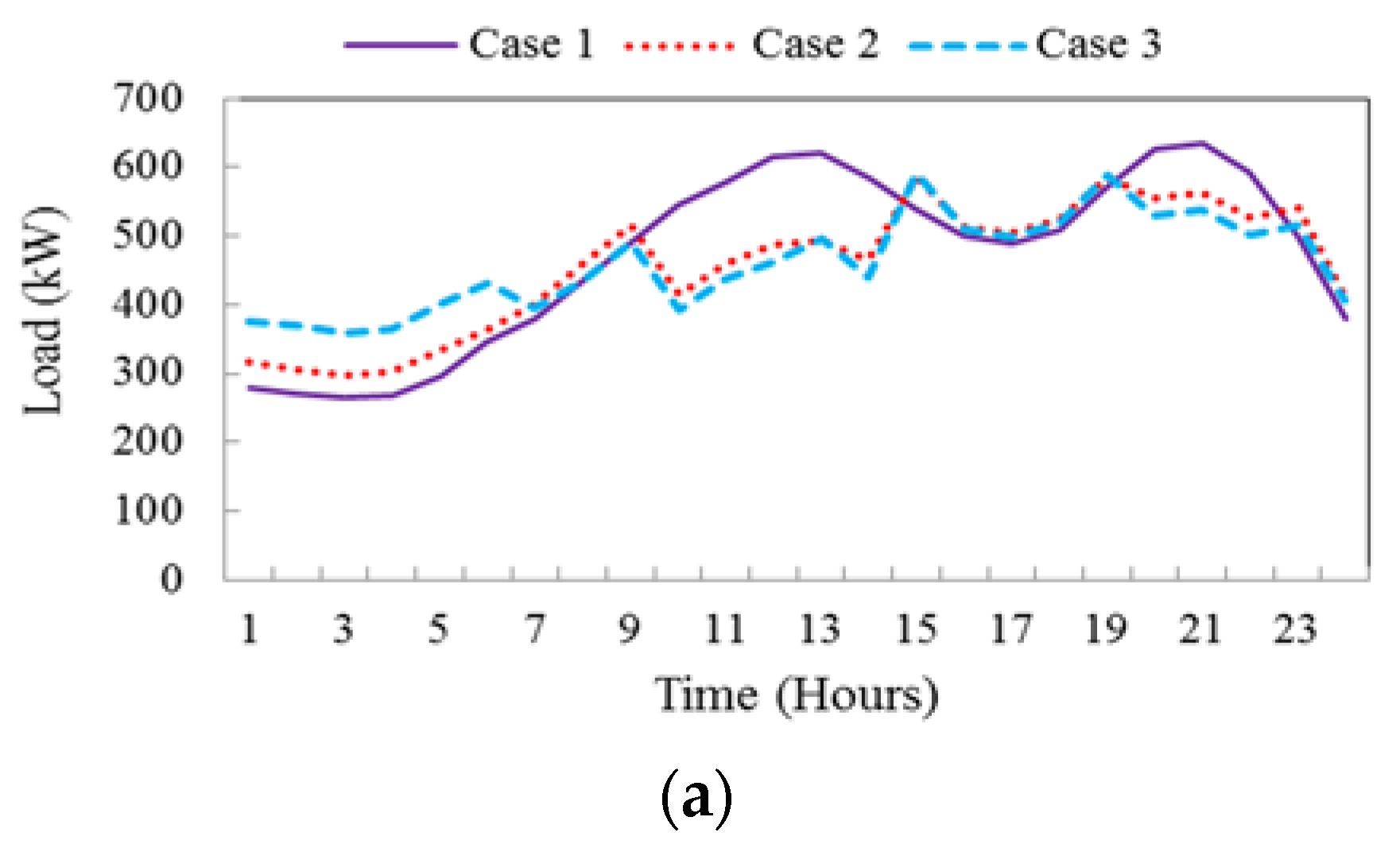

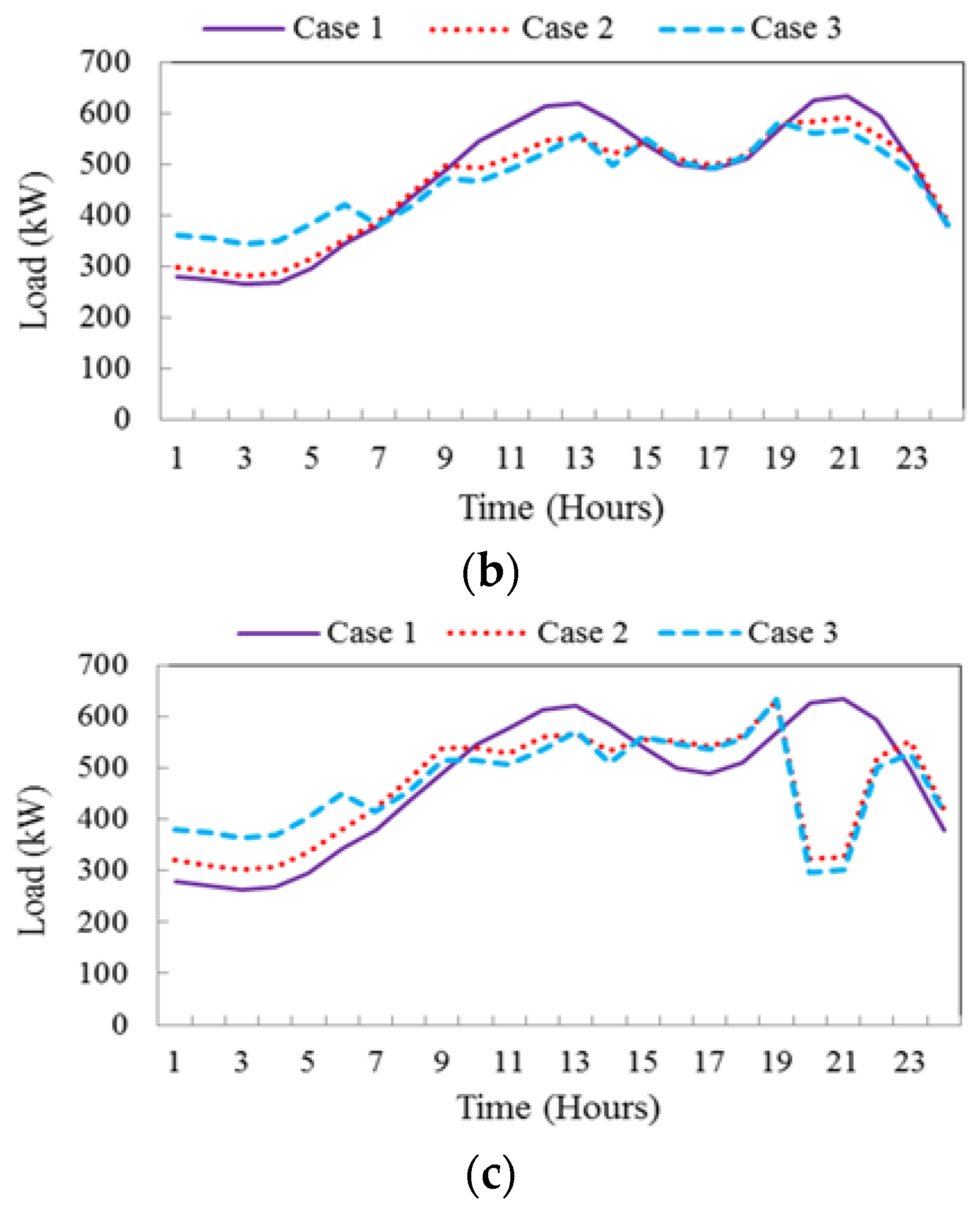

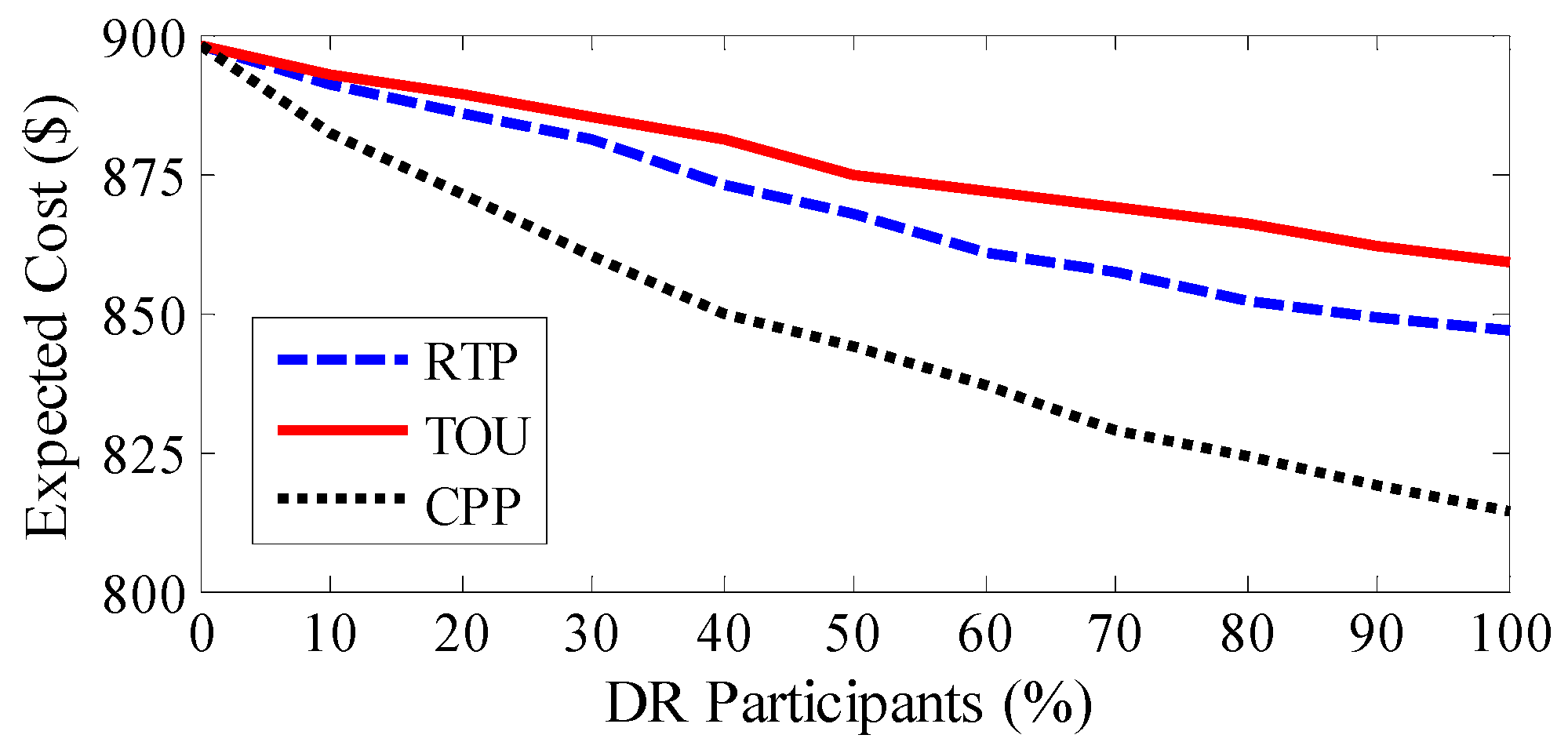

4. Simulation Results and Discussion

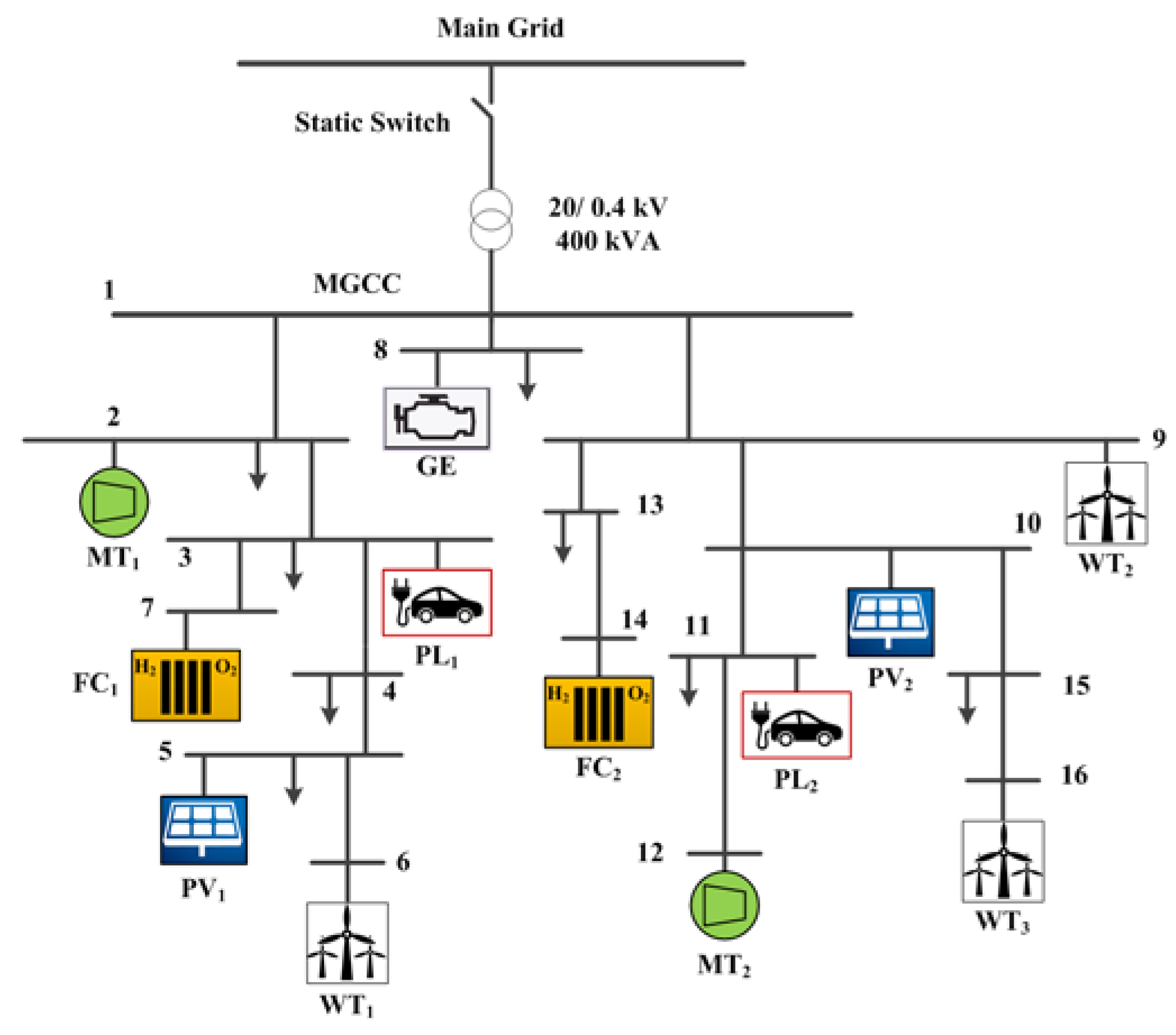

4.1. Test Case

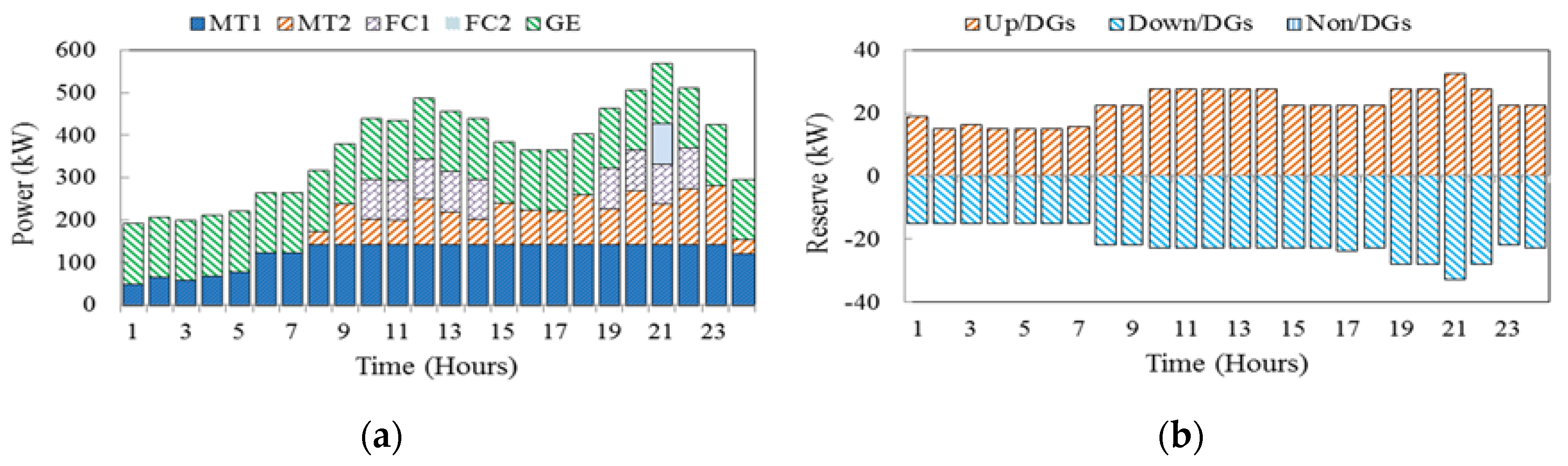

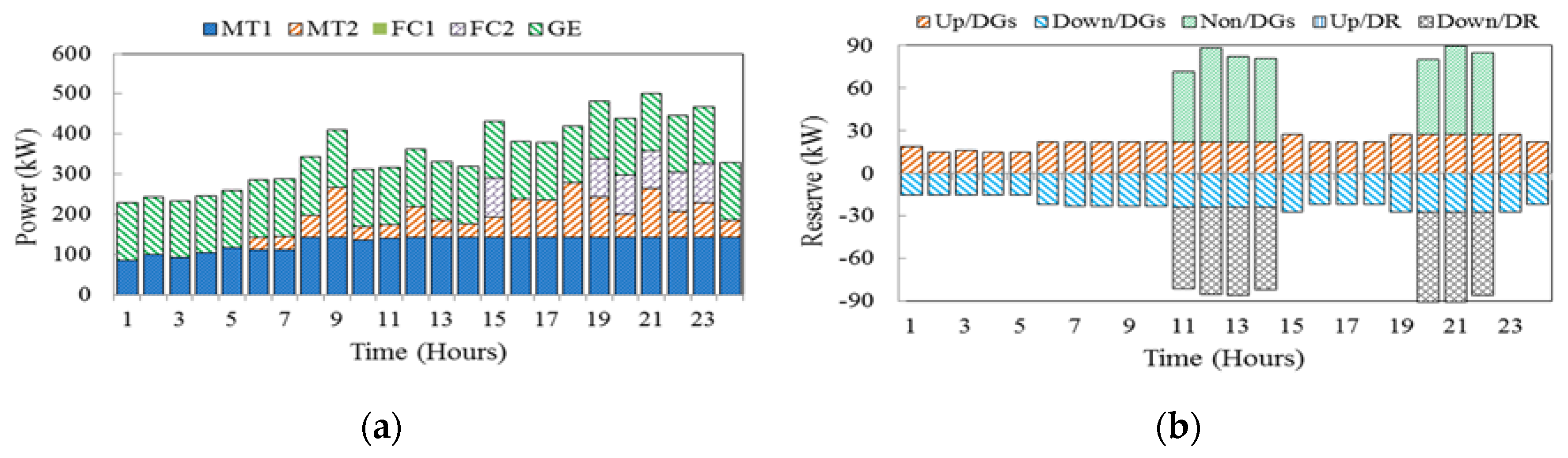

4.2. Presentation and Discussion of Results

- ■

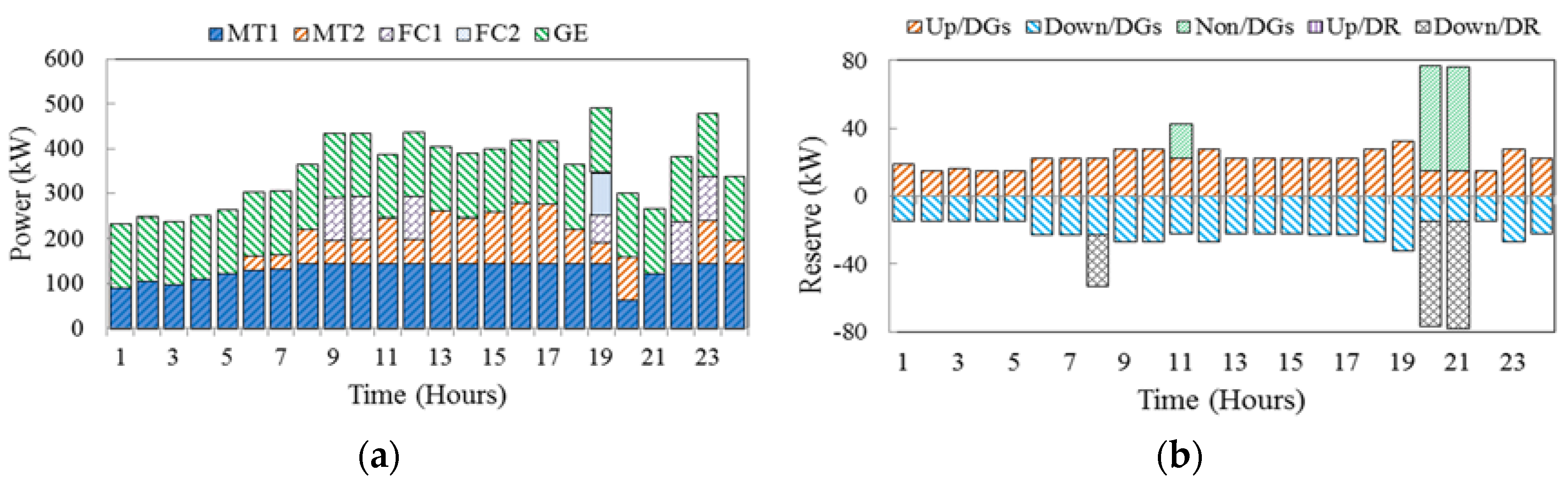

- Case 1: without demand side participation and EVs commitment,

- ■

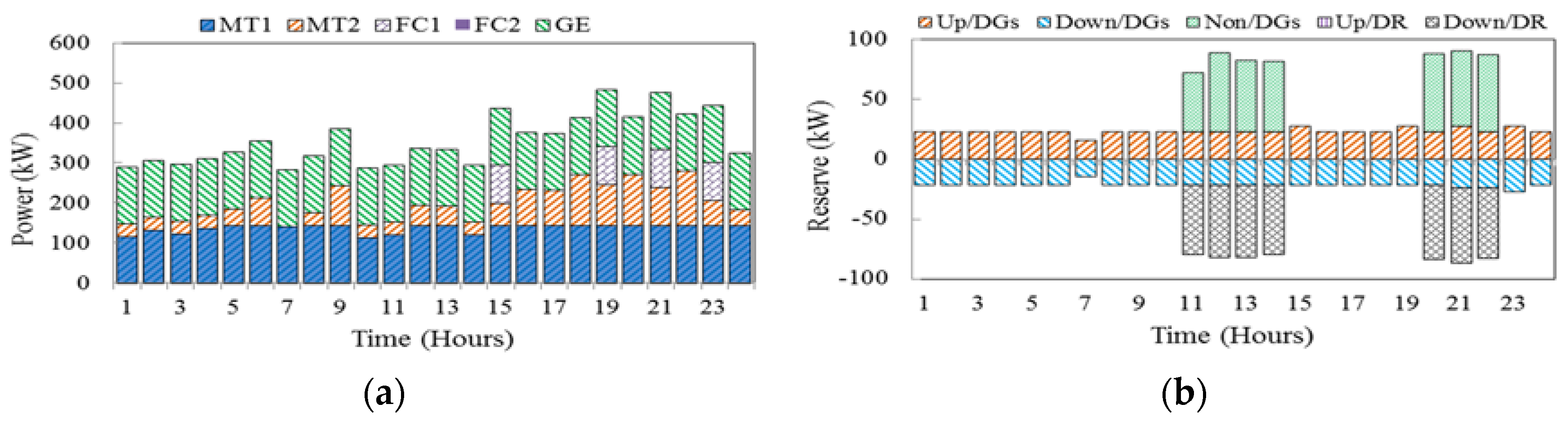

- Case 2: with demand side participation and without EVs commitment,

- ■

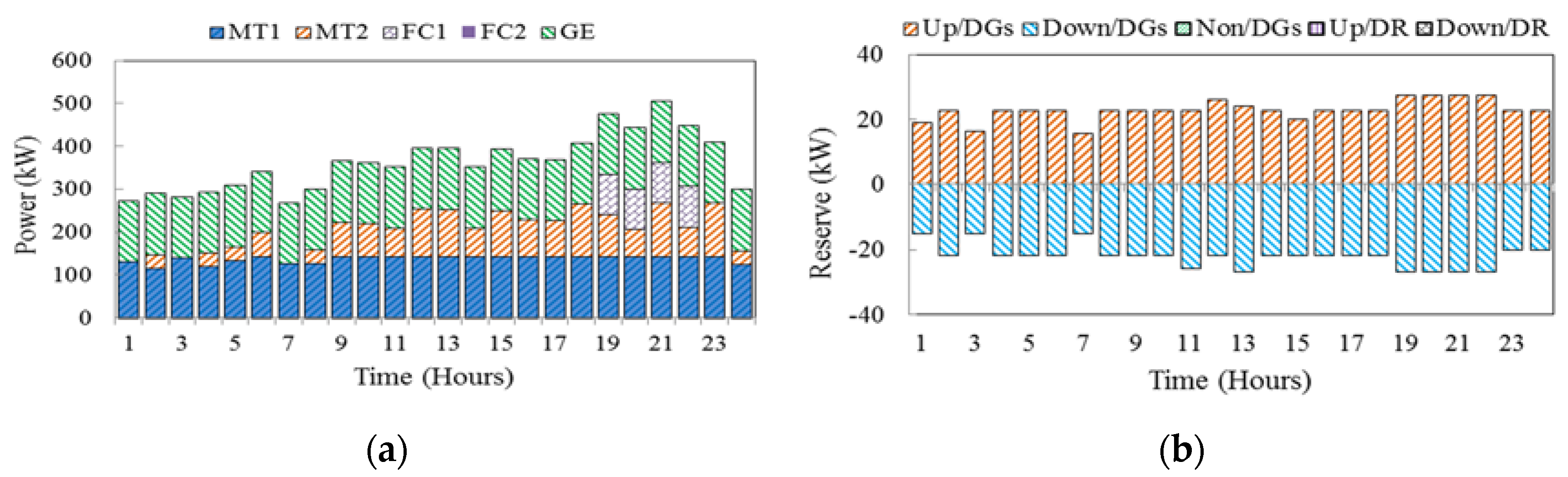

- Case 3: with demand side participation and EVs commitment.

5. Conclusions and Future Work

Author Contributions

Conflicts of Interest

Nomenclature

| Number of system buses. | |

| Number of generating units. | |

| Set of loads number. | |

| Number of scenarios. | |

| () | Number of WT (PV) units. |

| Number of EVs. | |

| Scheduling time (24 h a day). | |

| i (j) | Index of generating units (loads), running from 1 to (). |

| Indices of system buses, running from 1 to . | |

| t | Index of time periods, running from 1 to T. |

| s | Index of scenarios, running from 1 to . |

| w (p) | Index of WT (PV) units, running from 1 to (). |

| Index of EVs, running from 1 to . | |

| v | Wind speed (m/s). |

| Customer’s benefit in period t ($). | |

| () | Electricity baying (selling) price for EVs charging (discharging) in period t ($/kWh). |

| () | Energy bid submitted by WT w (PV p) in period t ($/kWh). |

| () | Bid of the up (down) -spinning reserve submitted by unit i in period t ($/kWh). |

| () | Bid of the up (down) -spinning reserve submitted by load j in period t ($/kWh). |

| Bid of the non-spinning reserve submitted by unit i in period t (cents/kWh). | |

| Power demand in period t (kW). | |

| Power demand after implementing DR programs in period t (kW). | |

| Elasticity of load demand. | |

| () | Start-up (Shut-down) cost of unit i in period t ($). |

| Electricity price in period t ($/kW). | |

| () | Scheduled power of unit i in period t (and scenario s) (kW). |

| () | Output power of WT w in period t (and scenario s) (kW). |

| () | Output power of PV p in period t (and scenario s) (kW). |

| () | Maximum (Minimum) generating capacity of unit x (kW). |

| () | Charging (Discharging) power of EV k in period t (kW). |

| Power of EV k in period t (kW). | |

| () | Scheduled up-spinning reserve for unit i (load j) in in period t (kW). |

| () | Scheduled down-spinning reserve for unit i (load j) in period t (kW). |

| Scheduled non-spinning reserve for unit i in period t (kW). | |

| () | Up-spinning reserve deployed by unit i (load j) in period t (and scenario s) (kW). |

| () | Down-spinning reserve deployed by unit i (load j) in period t (and scenario s) (kW). |

| Customer’s income at period t ($). | |

| Cost of involuntary load shedding for inelastic loads ($/kWh). | |

| () | Power scheduled for load j in period t (and scenario s) (kW). |

| Inelastic load shedding level of jth load in period t and scenario s (kW). | |

| () | Power flow through line l in period t (and scenario s) (kW). |

| () | Voltage angle at node x in period t (and scenario s) (radian). |

| () | Charging (Discharging) efficiency of EV |

| () | Binary variable, equal to 1 if unit i is scheduled to be committed in period t (and scenario s), otherwise 0. |

| () | Binary variable, equal to 1 if unit i is starting up in period t (and scenario s), otherwise 0. |

| () | Binary variable, equal to 1 if unit i is shut down in period t (and scenario s), otherwise 0. |

| Binary variable expressing the charging/discharging status of EV k, equal to 1 if it is charging, otherwise 0. |

Appendix A

References

- Khodaei, A.; Shahidehpour, M.; Bahramirad, S. A Survey on Demand Response Programs in Smart Grids: Pricing Methods and Optimization Algorithms. IEEE Commun. Surv. Tutor. 2015, 17, 564–571. [Google Scholar]

- Anvari-Moghaddam, A.; Mokhtari, G.; Guerrero, J.M. Coordinated Demand Response and Distributed Generation Management in Residential Smart Microgrids. In Energy Management of Distributed Generation Systems; Lucian, M., Ed.; InTechOpen: Rijeka, Croatia, 2016; ISBN 978-953-51-4708-4. [Google Scholar]

- Shariatzadeh, F.; Mandal, P.; Srivastava, A.K. Demand response for sustainable energy systems: A review, application and implementation strategy. Renew. Sustain. Energy Rev. 2015, 45, 343–350. [Google Scholar] [CrossRef]

- Mohagheghi, S.; Yang, F.; Falahati, B. Impact of demand response on distribution system reliability. In Proceedings of the IEEE PES General Meeting, San Diego, CA, USA, 24–28 July 2011. [Google Scholar]

- Palensky, P.; Dietmar, D. Demand side management: Demand response, intelligent energy systems smart loads. IEEE Trans. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Negnevitsky, M.; de Groot, M. Pool-based demand response exchange-concept and modeling. IEEE Trans. Power Syst. 2011, 26, 1677–1685. [Google Scholar] [CrossRef]

- Aghajani, G.R.; Shayanfar, H.A.; Shayeghi, H. Presenting a multi-objective generation scheduling model for pricing demand response rate in micro-grid energy management. Energy Convers. Manag. 2015, 106, 308–321. [Google Scholar] [CrossRef]

- Jovanovic, R.; Bousselham, A.; Safak Bayram, I. Residential Demand Response Scheduling with Consideration of Consumer Preferences. Appl. Sci. 2016, 6, 16. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Rahimi-Kian, A.; Monsef, H. Optimal Smart Home Energy Management Considering Energy Saving and a Comfortable Lifestyle. IEEE Trans. Smart Grid 2015, 6, 324–332. [Google Scholar] [CrossRef]

- Babar Rasheed, M.; Javaid, N.; Ahmad, A.; Ali Khan, Z.; Qasim, U.; Alrajeh, N. An Efficient Power Scheduling Scheme for Residential Load Management in Smart Homes. Appl. Sci. 2015, 5, 1134–1163. [Google Scholar] [CrossRef]

- Rodriguez-Diaz, E.; Anvari-Moghaddam, A.; Vasquez, J.C.; Guerrero, J.M. Multi-Level Energy Management and Optimal Control of a Residential DC Microgrid. In Proceedings of the 35th IEEE International Conference Consumer Electronics (ICCE), Las Vegas, NV, USA, 8–11 January 2017. [Google Scholar]

- Rabiee, A.; Sadeghi, M.; Aghaeic, J.; Heidari, A. Optimal operation of microgrids through simultaneous scheduling of electrical vehicles and responsive loads considering wind and PV units uncertainties. Renew. Sustain. Energy Rev. 2016, 57, 721–739. [Google Scholar] [CrossRef]

- Alvarez, E.; Campos, A.M.; Arboleya, P.; Gutiérrez, A.J. Microgrid management with a quick response optimization algorithm for active power. Int. J. Electr. Power Energy Syst. 2012, 43, 465–473. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Seifi, A.R.; Niknam, T.; Alizadeh Pahlavani, M.R. Multi-objective operation management of a renewable MG (microgrid) with back-up micro-turbine/fuel cell/battery hybrid power source. Energy 2011, 36, 6490–6507. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Seifi, A.R.; Niknam, T. Multi-operation management of a typical microgrid using Particle Swarm Optimization: A comparative study. Renew. Sustain. Energy Rev. 2012, 16, 1268–1281. [Google Scholar] [CrossRef]

- Chaouachi, A.; Kamel, R.M.; Andoulsi, R.; Nagasaka, K. Multiobjective intelligent energy management for a microgrid. IEEE Trans. Ind. Electron. 2013, 60, 1688–1699. [Google Scholar] [CrossRef]

- Karangelos, E.; Bouffard, F. Towards full integration of demand-side resources in joint forward energy/reserve electricity markets. IEEE Trans. Power Syst. 2010, 27, 280–289. [Google Scholar] [CrossRef]

- Shan, J.; Botterud, A.; Ryan, S.M. Impact of demand response on thermal generation investment with high wind penetration. IEEE Trans. Smart Grid 2013, 4, 2374–2383. [Google Scholar]

- Peng, X.; Jirutitijaroen, P. A stochastic optimization formulation of unit commitment with reliability constraints. IEEE Trans. Smart Grid 2013, 4, 2200–2208. [Google Scholar]

- Vrakopoulou, M.; Margellos, K.; Lygeros, J.; Andersson, G. A prob-abilistic framework for reserve scheduling and N-1 security assessment of systems with high wind power penetration. IEEE Trans. Power Syst. 2013, 28, 885–3896. [Google Scholar] [CrossRef]

- Paterakis, N.G.; Erdinc, O.; Bakirtzis, A.G.; Catalão, J.P.S. Load-Following Reserves Procurement Considering Flexible Demand-Side Resources under High Wind Power Penetration. IEEE Trans. Power Syst. 2015, 30, 1337–1350. [Google Scholar] [CrossRef]

- Aghaei, J.; Ahmadi, A.; Rabiee, A.; Agelidis, V.G.; Muttaqi, K.M.; Shayanfar, H. Uncer-tainty management in multiobjective hydro-thermal self-scheduling under emission considerations. Appl. Soft Comput. 2015, 37, 737–750. [Google Scholar] [CrossRef]

- Amjady, N.; Aghaei, J.; Shayanfar, H.A. Stochastic multiobjective market clearing of joint energy and reserves auctions ensuring power system security. IEEE Trans. Power Syst. 2009, 24, 1841–1854. [Google Scholar] [CrossRef]

- Dong, Q.; Yu, L.; Song, W.Z.; Tong, L.; Tang, S. Distributed demand and response algorithm for optimizing social-welfare in smart grid. In Proceedings of the 26th IEEE IPDPS, Shanghai, China, 21–25 May 2012; pp. 1228–1239. [Google Scholar]

- Gholami, A.; Shekari, T.; Aminifar, F.; Shahidehpour, M. Microgrid Scheduling with Uncertainty: The Quest for Resilience. IEEE Trans. Smart Grid 2016, 30, 1337–1350. [Google Scholar] [CrossRef]

- Kirschen, D.S.; Strbac, G. Fundamentals of Power System Economics; Wiley: Hoboken, NJ, USA, 2004. [Google Scholar]

- Abdollahi, A.; Parsa-Moghaddam, M.; Rashidinejad, M.; Sheikh-El-Eslami, M.K. Investigation of Economic and Environmental-Driven Demand Response Measures Incorporating UC. IEEE Trans. Smart Grid 2012, 3, 12–25. [Google Scholar] [CrossRef]

- Ma, Y.; Houghton, T.; Cruden, A.; Infield, D. Modeling the Benefits of Vehicle-to-Grid Technology to a Power System. IEEE Trans. Power Syst. 2012, 27, 1012–1020. [Google Scholar] [CrossRef]

- Zakariazadeh, A.; Jadid, S.; Siano, P. Smart microgrid energy and reserve scheduling with demand response using stochastic optimization. Electr. Power Energy Syst. 2014, 63, 523–533. [Google Scholar] [CrossRef]

- Rezaei, N.; Kalantar, M. Smart microgrid hierarchical frequency control ancillary service provision based on virtual inertia concept: An integrated demand response and droop controlled distributed generation framework. Energy Convers. Manag. 2015, 92, 287–301. [Google Scholar] [CrossRef]

- Youcef, F.; Mefti, A.; Adane, A.; Bouroubi, M. Statistical analysis of solar measurements in Algeria using beta distributions. Renew. Energy 2002, 26, 47–67. [Google Scholar] [CrossRef]

- Anvari-Moghaddam, A.; Monsef, H.; Rahimi-Kian, A.; Nance, H. Feasibility Study of a Novel Methodology for Solar Radiation Prediction on an Hourly Time Scale: A Case Study in Plymouth, UK. J. Renew. Sustain. Energy 2014, 6, 033107. [Google Scholar] [CrossRef]

- Arthur, D.; Vassilvitskii, S. k-means++: The advantages of careful seeding. In Proceedings of the 18th Annual ACM-SIAM Symposium Discrete Algorithms (SODA ‘07), New Orleans, LA, USA, 7–9 January 2007; pp. 1027–1035. [Google Scholar]

- Rezaei, N.; Kalantar, M. Stochastic frequency-security constrained energy and reserve management of an inverter interfaced islanded microgrid considering demand response programs. Int. J. Electr. Power Energy Syst. 2015, 69, 273–286. [Google Scholar] [CrossRef]

- Rassaei, F.; Soh, W.S.; Chua, K.C. Demand Response for Residential Electric Vehicles with Random Usage Patterns in Smart Grids. IEEE Trans. Sustain. Energy 2015, 6, 1367–1376. [Google Scholar] [CrossRef]

- Vahedipour-Dahraei, M.; Rashidizadeh-Kermani, H.; Najafi, H.R. A Proposed Strategy to Manage Charge/Discharge of EVs in a Microgrid Including Renewable Resources. In Proceedings of the 24th Iranian Conference on Electrical Engineering (ICEE), Shiraz, Iran, 10–12 May 2016; pp. 649–654. [Google Scholar]

- The General Algebraic Modeling System (GAMS) Software. Available online: http://www.gams.com (accessed on 15 September 2016).

| Emission (kg/kWh) | ($) | ($) | ($) | SDC ($) | SUC ($) | B ($) | A ($/kWh) | (kW) | (kW) | DG |

|---|---|---|---|---|---|---|---|---|---|---|

| 0.550 | 0.019 | 0.020 | 0.021 | 0.080 | 0.090 | 0.043 | 0.851 | 150 | 25 | MT1 |

| 0.550 | 0.019 | 0.020 | 0.021 | 0.080 | 0.090 | 0.044 | 0.851 | 150 | 25 | MT2 |

| 0.377 | 0.015 | 0.015 | 0.015 | 0.090 | 0.160 | 0.028 | 2.552 | 100 | 20 | FC1 |

| 0.377 | 0.015 | 0.015 | 0.015 | 0.090 | 0.160 | 0.029 | 2.552 | 100 | 20 | FC2 |

| 0.890 | 0.017 | 0.017 | 0.017 | 0.080 | 0.120 | 0.031 | 2.120 | 150 | 35 | GE |

| - | - | - | - | - | - | 0.106 | 0 | 80 | 0 | WT |

| - | - | - | - | - | - | 0.548 | 0 | 70 | 0 | PV |

| 23–24 | 20–22 | 16–19 | 11–15 | 6–10 | 1–5 | Hour |

|---|---|---|---|---|---|---|

| 0.03 | 0.034 | 0.03 | 0.034 | 0.03 | −0.08 | 1–5 |

| 0.03 | 0.04 | 0.03 | 0.04 | −0.11 | 0.3 | 6–10 |

| 0.04 | 0.01 | 0.04 | −0.19 | 0.04 | 0.034 | 11–15 |

| 0.03 | 0.04 | −0.11 | 0.04 | 0.03 | 0.03 | 16–19 |

| 0.04 | −0.19 | 0.03 | 0.01 | 0.04 | 0.034 | 20–22 |

| −0.11 | 0.04 | 0.03 | 0.04 | 0.03 | 0.03 | 23–24 |

| Attribute | Case 1 | Case 2 | Case 3 | ||||

|---|---|---|---|---|---|---|---|

| No DR | RTP | TOU | CPP | RTP | TOU | CPP | |

| Expected cost | 897.833 | 872.943 | 881.164 | 850.395 | 866.113 | 878.253 | 853.049 |

| Energy cost of DGs | 436.622 | 416.790 | 420.549 | 410.590 | 403.482 | 413.482 | 400.620 |

| Scheduling reserve cost of DGs | 19.752 | 25.076 | 19.172 | 21.600 | 23.482 | 21.085 | 22.801 |

| Scheduling reserve cost of DR | 0 | 23.856 | 0 | 10.048 | 33.856 | 0 | 10.048 |

| Energy cost of RESs | 443.206 | 443.206 | 443.206 | 443.206 | 443.206 | 443.206 | 443.206 |

| Deployed reserve cost of DGs | −2.365 | 10.182 | −2.131 | 1.536 | 9.923 | −2.081 | 1.189 |

| Deployed reserve cost of DR | 0 | −56.785 | 0 | −40.192 | −56.785 | 0 | −40.192 |

| Start-up cost of DGs | 0.78 | 0.78 | 0.62 | 0.87 | 0.87 | 0.64 | 1.02 |

| Shut-down cost of DGs | 0.27 | 0.27 | 0.18 | 0.35 | 0.35 | 0.25 | 0.46 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vahedipour-Dahraie, M.; Najafi, H.R.; Anvari-Moghaddam, A.; Guerrero, J.M. Study of the Effect of Time-Based Rate Demand Response Programs on Stochastic Day-Ahead Energy and Reserve Scheduling in Islanded Residential Microgrids. Appl. Sci. 2017, 7, 378. https://doi.org/10.3390/app7040378

Vahedipour-Dahraie M, Najafi HR, Anvari-Moghaddam A, Guerrero JM. Study of the Effect of Time-Based Rate Demand Response Programs on Stochastic Day-Ahead Energy and Reserve Scheduling in Islanded Residential Microgrids. Applied Sciences. 2017; 7(4):378. https://doi.org/10.3390/app7040378

Chicago/Turabian StyleVahedipour-Dahraie, Mostafa, Hamid Reza Najafi, Amjad Anvari-Moghaddam, and Josep M. Guerrero. 2017. "Study of the Effect of Time-Based Rate Demand Response Programs on Stochastic Day-Ahead Energy and Reserve Scheduling in Islanded Residential Microgrids" Applied Sciences 7, no. 4: 378. https://doi.org/10.3390/app7040378