A Novel Hybrid BND-FOA-LSSVM Model for Electricity Price Forecasting

Abstract

:1. Introduction

2. Basic Theories of BND, FOA, and LSSVM

2.1. BND Method

2.2. FOA

2.3. LSSVM Model

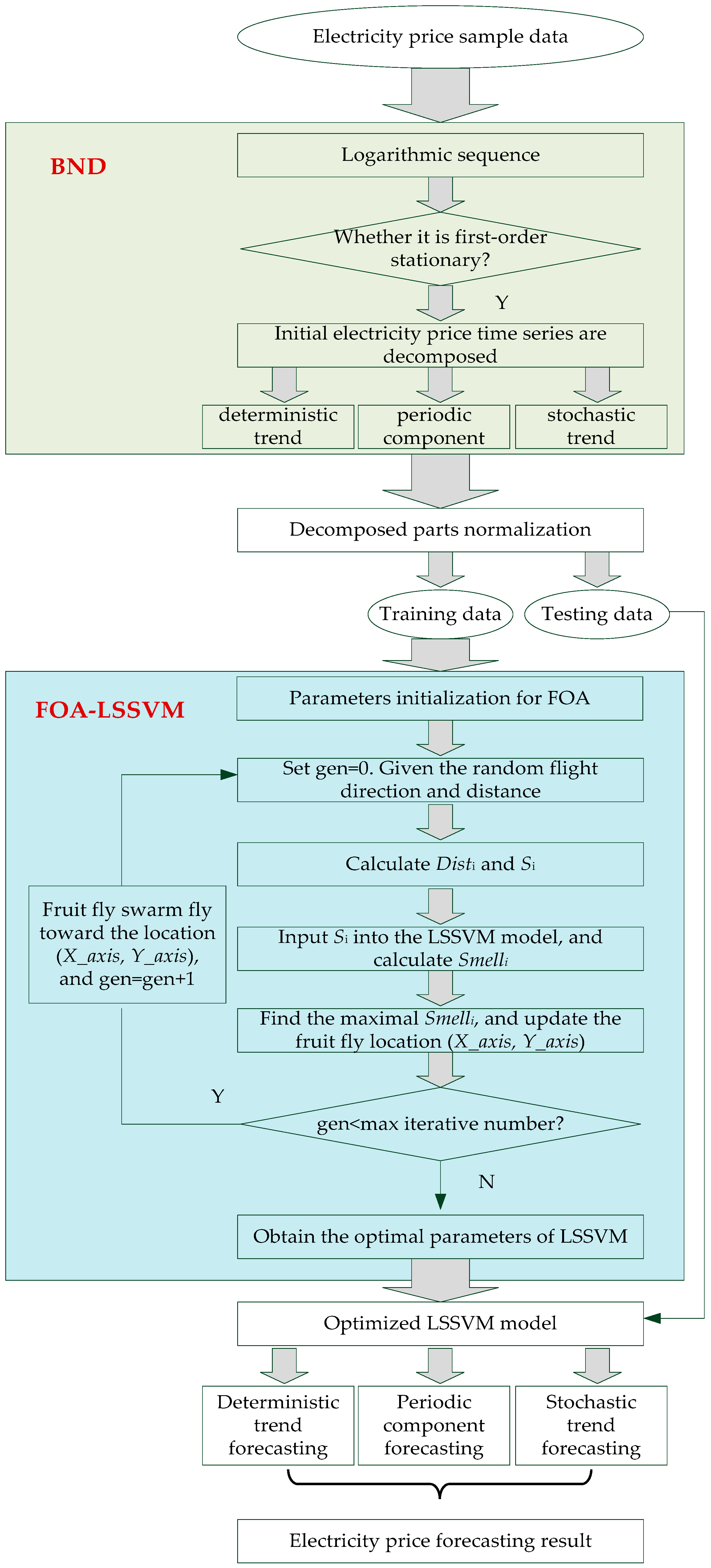

3. The Proposed Novel Hybrid BND-FOA-LSSVM Model for Electricity Price Forecasting

4. Case Study

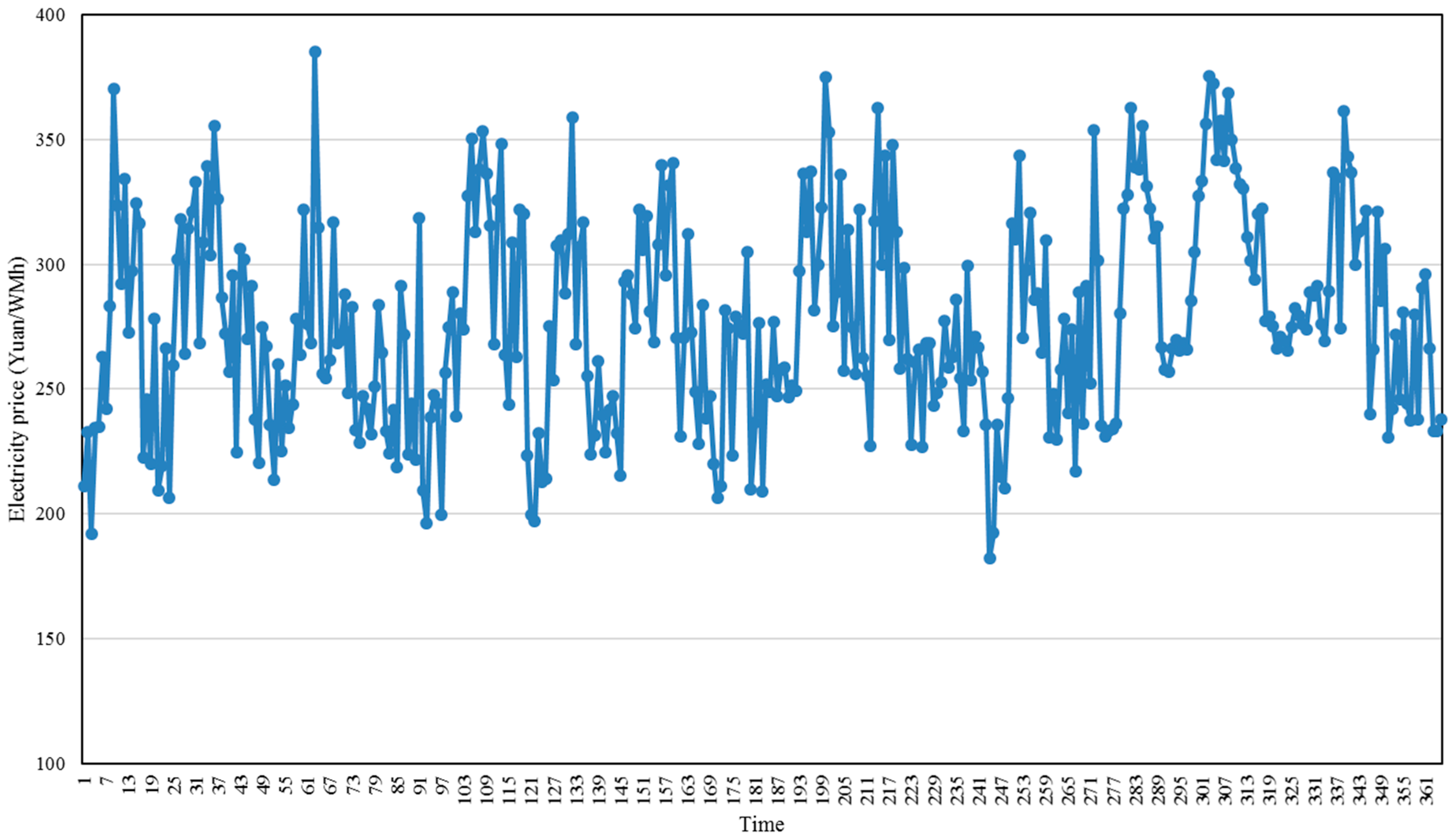

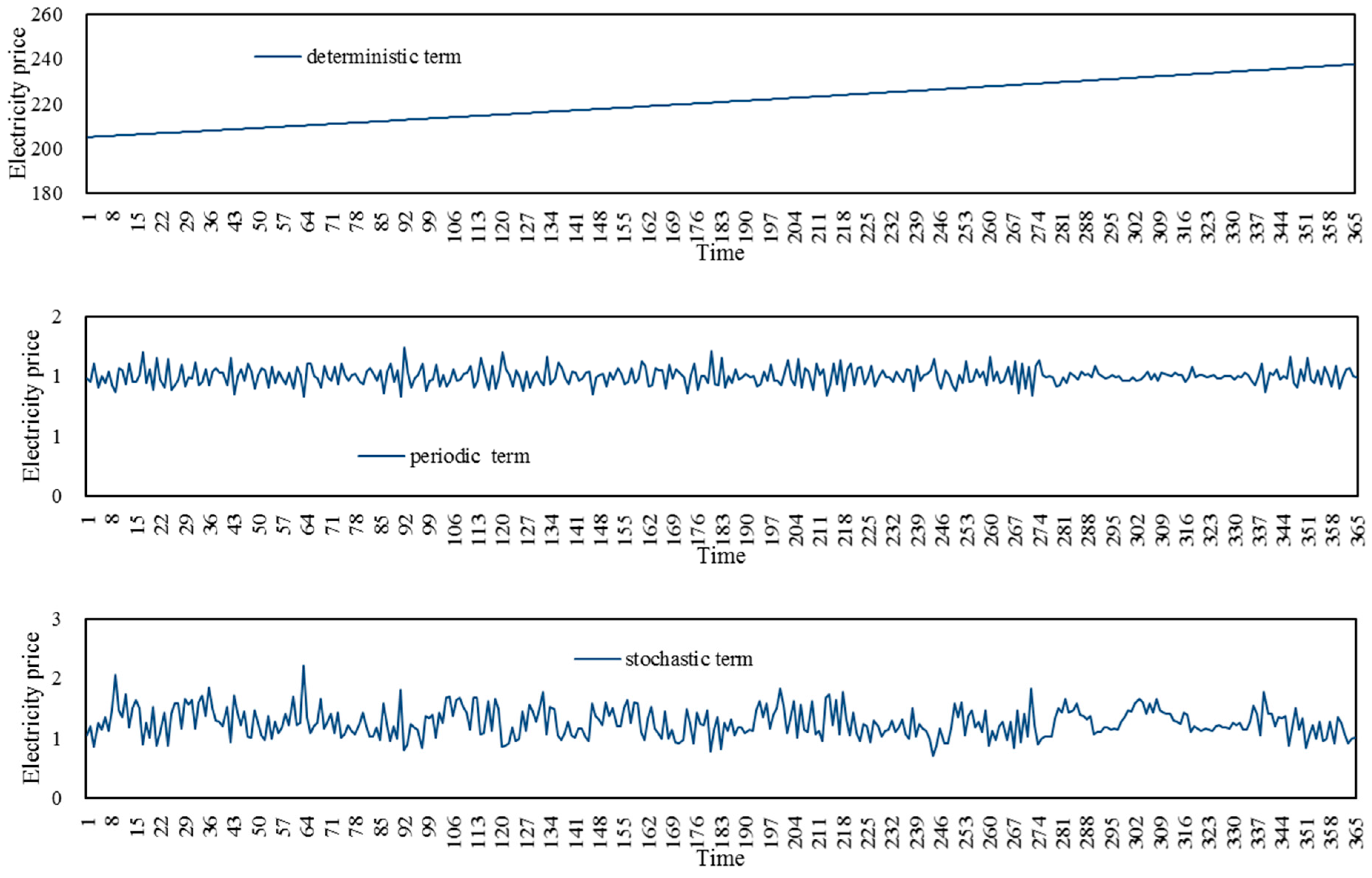

4.1. Electricity Price Decomposition Result

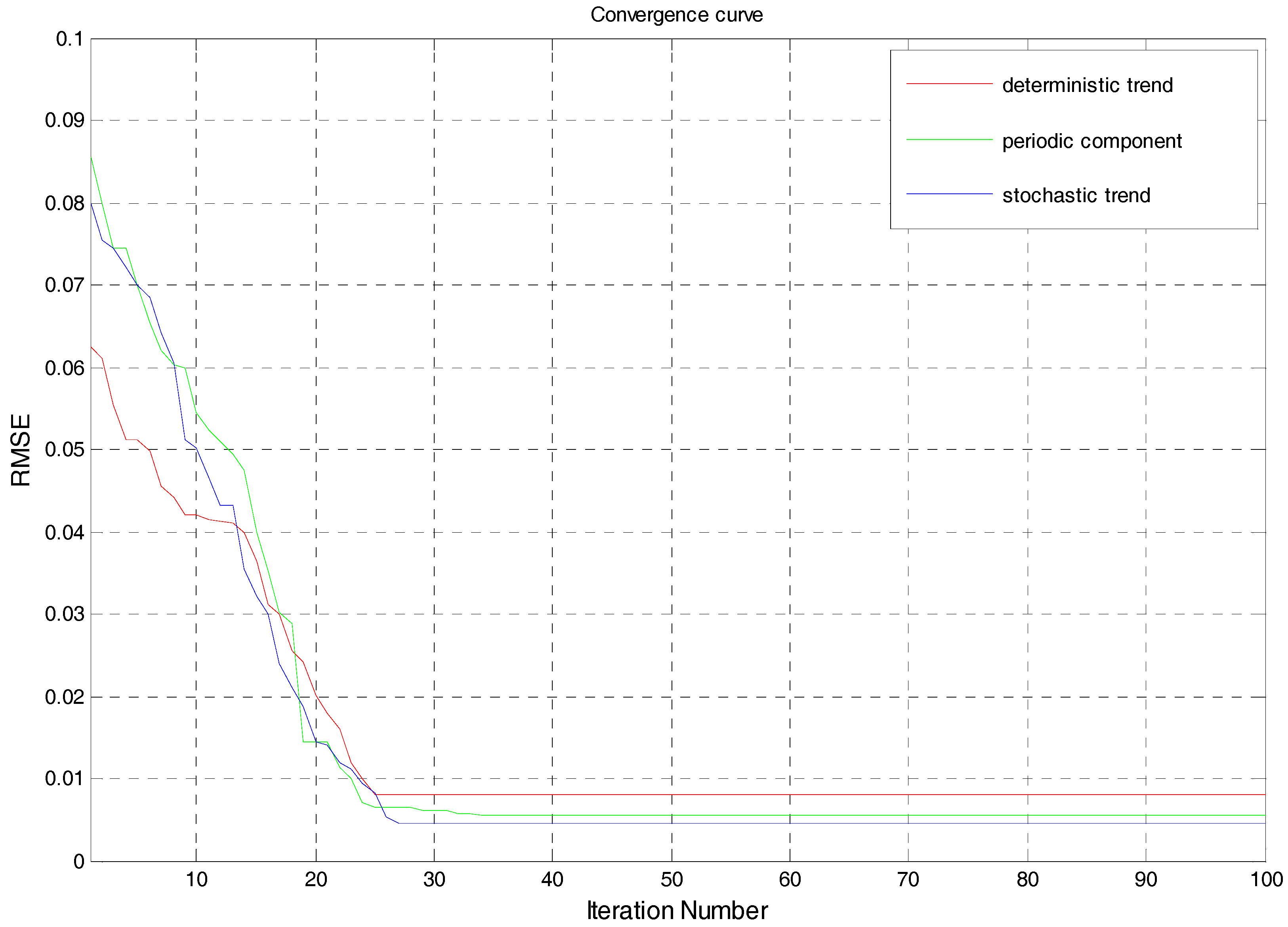

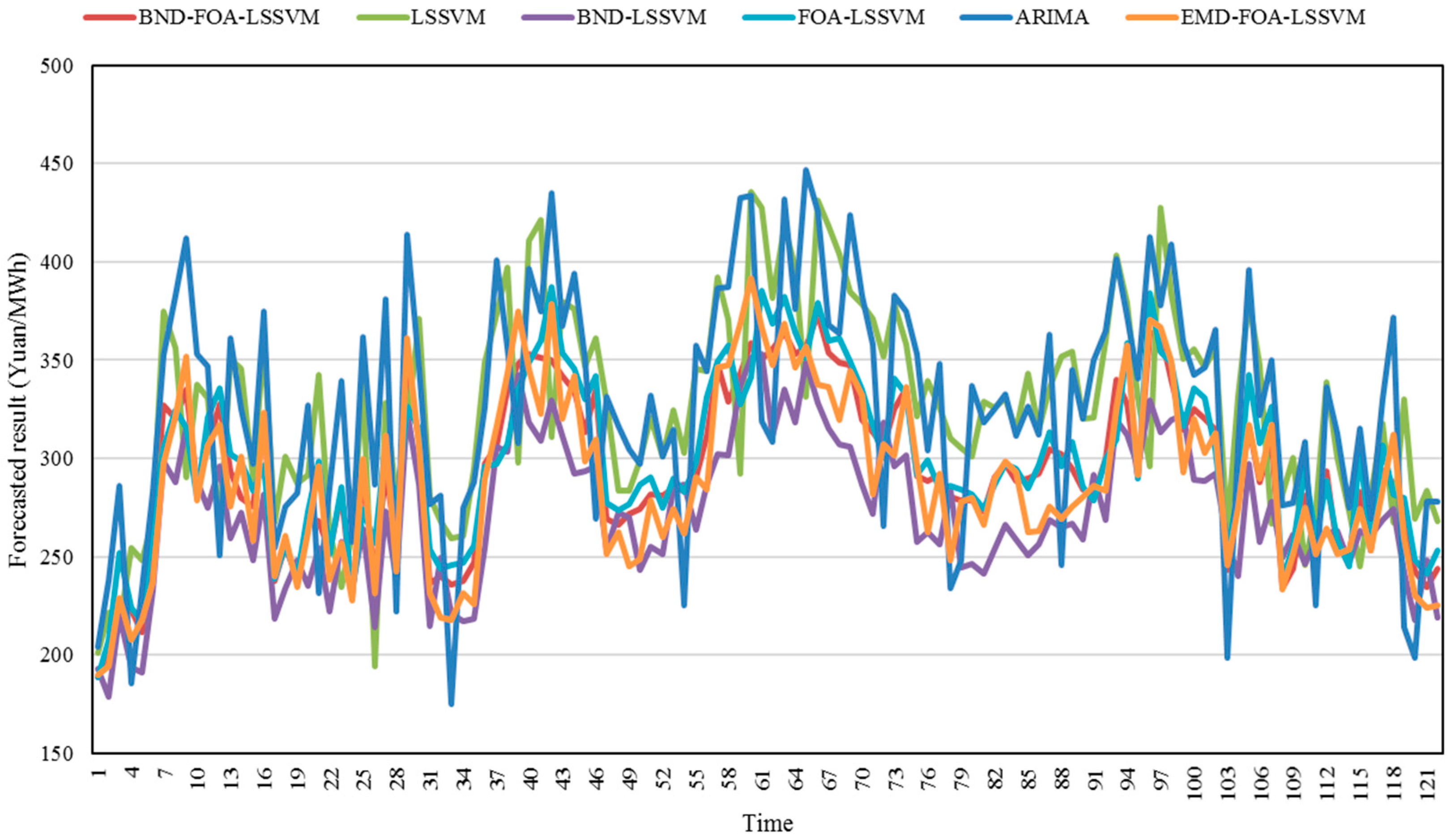

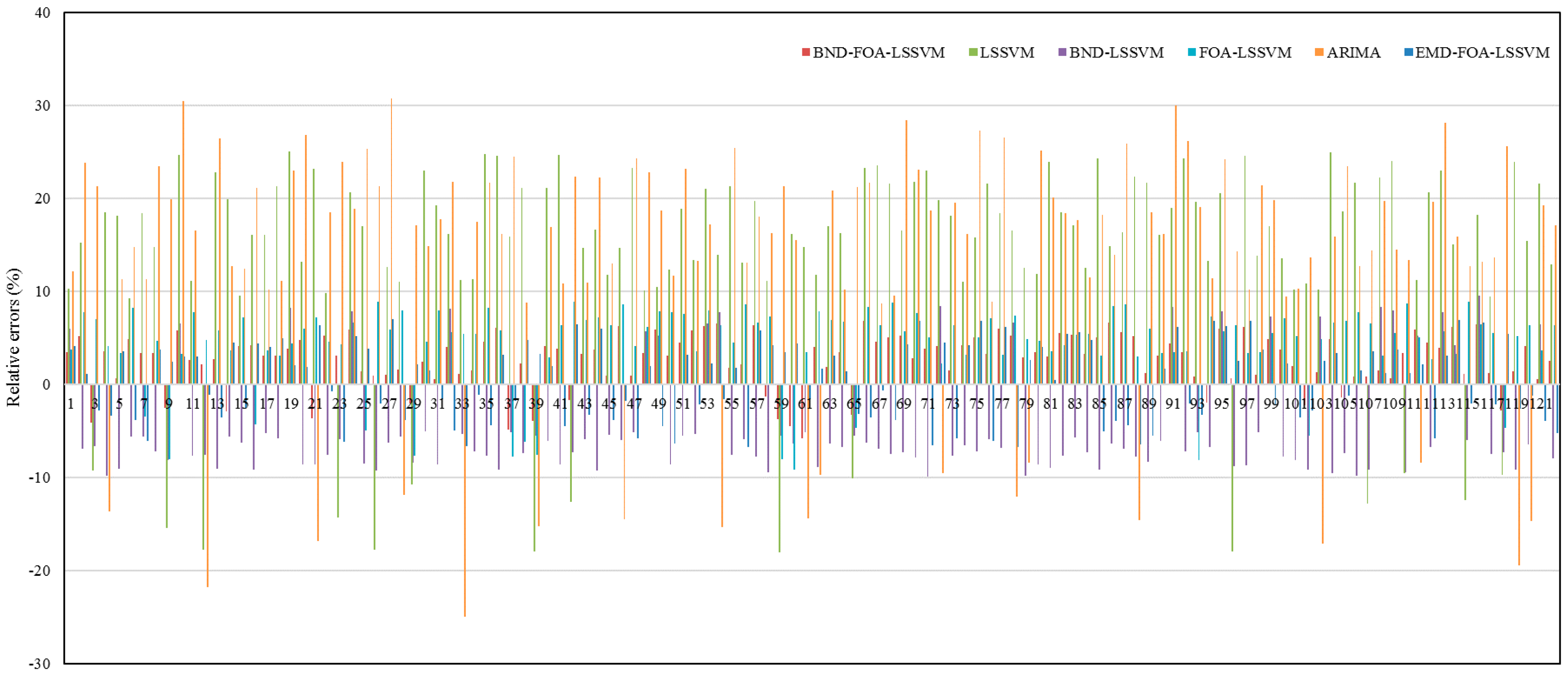

4.2. FOA-LSSVM Forecasting Results

5. Discussions

6. Conclusions

Author Contributions

Conflicts of Interest

References

- Panapakidis, I.P.; Dagoumas, A.S. Day-ahead electricity price forecasting via the application of artificial neural network based models. Appl. Energy 2016, 172, 132–151. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Mandal, P.; Srivastava, A.K.; Senjyu, T.; Negnevitsky, M. Electricity Price Forecasting Using Neural Networks and Similar Days. Adv. Electr. Power Energy Syst. Load Price Forecast. 2017, 215. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. On the importance of the long-term seasonal component in day-ahead electricity price forecasting. Energy Econom. 2016, 57, 228–235. [Google Scholar] [CrossRef]

- Portela, J.; Munoz, A.; Alonso, E. Forecasting functional time series with a new Hilbertian ARMAX model: Application to electricity price forecasting. IEEE Trans. Power Syst. 2017. [Google Scholar] [CrossRef]

- Yang, Z.; Ce, L.; Lian, L. Electricity price forecasting by a hybrid model, combining wavelet transform, ARMA and kernel-based extreme learning machine methods. Appl. Energy 2017, 190, 291–305. [Google Scholar] [CrossRef]

- Gao, G.; Lo, K.; Fan, F. Comparison of ARIMA and ANN models used in electricity price forecasting for power market. Energy Power Eng. 2017, 9, 120–126. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. Recent advances in electricity price forecasting: A review of probabilistic forecasting. Renew. Sustain. Energy Rev. 2017. [Google Scholar] [CrossRef]

- Huang, Y.-S.; Huang, S.-H.; Hu, Y.-P. Short-Term Electricity Price Forecasting Based on Nonparametric GARCH Residuals Correction-Least Square Support Vector Machine. In Management Information and Optoelectronic Engineering, Proceedings of the 2016 International Conference on Management, Information and Communication (ICMIC2016) and the 2016 International Conference on Optics and Electronics Engineering (ICOEE2016), Guilin, China, 28–29 May 2016; World Scientific: Singapore, 2017; pp. 42–48. [Google Scholar]

- Girish, G. Spot electricity price forecasting in Indian electricity market using autoregressive-GARCH models. Energy Strategy Rev. 2016, 11, 52–57. [Google Scholar] [CrossRef]

- Cifter, A. Forecasting electricity price volatility with the Markov-switching GARCH model: Evidence from the Nordic electric power market. Electric Power Syst. Res. 2013, 102, 61–67. [Google Scholar] [CrossRef]

- Keles, D.; Scelle, J.; Paraschiv, F.; Fichtner, W. Extended forecast methods for day-ahead electricity spot prices applying artificial neural networks. Appl. Energy 2016, 162, 218–230. [Google Scholar] [CrossRef]

- Monteiro, C.; Ramirez-Rosado, I.J.; Fernandez-Jimenez, L.A.; Conde, P. Short-Term Price Forecasting Models Based on Artificial Neural Networks for Intraday Sessions in the Iberian Electricity Market. Energies 2016, 9, 721. [Google Scholar] [CrossRef]

- Amjady, N. Day-ahead price forecasting of electricity markets by a new fuzzy neural network. IEEE Trans. Power Syst. 2006, 21, 887–896. [Google Scholar] [CrossRef]

- Chen, X.; Dong, Z.Y.; Meng, K.; Xu, Y.; Wong, K.P.; Ngan, H. Electricity price forecasting with extreme learning machine and bootstrapping. IEEE Trans. Power Syst. 2012, 27, 2055–2062. [Google Scholar] [CrossRef]

- Shrivastava, N.A.; Panigrahi, B.K. A hybrid wavelet-ELM based short term price forecasting for electricity markets. Int. J. Electr. Power Energy Syst. 2014, 55, 41–50. [Google Scholar] [CrossRef]

- Sansom, D.C.; Downs, T.; Saha, T.K. Evaluation of support vector machine based forecasting tool in electricity price forecasting for Australian national electricity market participants. J. Electr. Electron. Eng. Aust. 2003, 22, 227–233. [Google Scholar]

- Yan, X.; Chowdhury, N.A. Mid-term electricity market clearing price forecasting: A multiple SVM approach. Int. J. Electr. Power Energy Syst. 2014, 58, 206–214. [Google Scholar] [CrossRef]

- Catalão, J.P.S.; Pousinho, H.M.I.; Mendes, V.M.F. Hybrid wavelet-PSO-ANFIS approach for short-term electricity prices forecasting. IEEE Trans. Power Syst. 2011, 26, 137–144. [Google Scholar] [CrossRef]

- Pousinho, H.M.I.; Mendes, V.M.F.; Catalão, J.P.S. Short-term electricity prices forecasting in a competitive market by a hybrid PSO–ANFIS approach. Int. J. Electr. Power Energy Syst. 2012, 39, 29–35. [Google Scholar] [CrossRef]

- Huang, S.; Han, Y.; Liu, F.; Song, J. Weights Optimization Based on Genetic Algorithm for Variable Weight Combination Model of BP-LSSVM for Day-ahead Electricity Price Forecasting. DEStech Trans. Comput. Sci. Eng. 2016. [Google Scholar] [CrossRef]

- Alamaniotis, M.; Bargiotas, D.; Bourbakis, N.G.; Tsoukalas, L.H. Genetic optimal regression of relevance vector machines for electricity pricing signal forecasting in smart grids. IEEE Trans. Smart Grid 2015, 6, 2997–3005. [Google Scholar] [CrossRef]

- Guo, Z.; Zhao, J.; Zhang, W.; Wang, J. A corrected hybrid approach for wind speed prediction in Hexi Corridor of China. Energy 2011, 36, 1668–1679. [Google Scholar] [CrossRef]

- Zhu, B.; Wei, Y. Carbon price forecasting with a novel hybrid ARIMA and least squares support vector machines methodology. Omega 2013, 41, 517–524. [Google Scholar] [CrossRef]

- Kaytez, F.; Taplamacioglu, M.C.; Cam, E.; Hardalac, F. Forecasting electricity consumption: A comparison of regression analysis, neural networks and least squares support vector machines. Int. J. Electr. Power Energy Syst. 2015, 67, 431–438. [Google Scholar] [CrossRef]

- Li, H.; Guo, S.; Zhao, H.; Su, C.; Wang, B. Annual electric load forecasting by a least squares support vector machine with a fruit fly optimization algorithm. Energies 2012, 5, 4430–4445. [Google Scholar] [CrossRef]

- Peng, T.; Tang, Z. A small scale forecasting algorithm for network traffic based on relevant local least squares support vector machine regression model. Appl. Math 2015, 9, 653–659. [Google Scholar]

- Yu, Y.; Li, Y.; Li, J.; Gu, X. Self-adaptive step fruit fly algorithm optimized support vector regression model for dynamic response prediction of magnetorheological elastomer base isolator. Neurocomputing 2016, 211, 41–52. [Google Scholar] [CrossRef]

- Yu, Y.; Li, Y.; Li, J. Parameter identification and sensitivity analysis of an improved LuGre friction model for magnetorheological elastomer base isolator. Meccanica 2015, 50, 2691–2707. [Google Scholar] [CrossRef]

- Beveridge, S.; Nelson, C.R. A new approach to decomposition of economic time series into permanent and transitory components with particular attention to measurement of the ‘business cycle’. J. Monetary Econ. 1981, 7, 151–174. [Google Scholar] [CrossRef]

- Guo, S.; Zhao, H.; Zhao, H. A New Hybrid Wind Power Forecaster Using the Beveridge-Nelson Decomposition Method and a Relevance Vector Machine Optimized by the Ant Lion Optimizer. Energies 2017, 10, 922. [Google Scholar] [CrossRef]

- Nelson, C.R.; Plosser, C.R. Trends and random walks in macroeconmic time series: Some evidence and implications. J. Monetary Econ. 1982, 10, 139–162. [Google Scholar] [CrossRef]

- Morley, J.C. A state–space approach to calculating the Beveridge–Nelson decomposition. Econ. Lett. 2002, 75, 123–127. [Google Scholar] [CrossRef]

- Pan, W.-T. A new fruit fly optimization algorithm: Taking the financial distress model as an example. Knowl.-Based Syst. 2012, 26, 69–74. [Google Scholar] [CrossRef]

- Li, H.-Z.; Guo, S.; Li, C.-J.; Sun, J.-Q. A hybrid annual power load forecasting model based on generalized regression neural network with fruit fly optimization algorithm. Knowl.-Based Syst. 2013, 37, 378–387. [Google Scholar] [CrossRef]

- Pan, W.-T. Mixed modified fruit fly optimization algorithm with general regression neural network to build oil and gold prices forecasting model. Kybernetes 2014, 43, 1053–1063. [Google Scholar] [CrossRef]

- Li, M.-W.; Geng, J.; Han, D.-F.; Zheng, T.-J. Ship motion prediction using dynamic seasonal RvSVR with phase space reconstruction and the chaos adaptive efficient FOA. Neurocomputing 2016, 174, 661–680. [Google Scholar] [CrossRef]

- Suykens, J.A.; Van Gestel, T.; De Brabanter, J. Least Squares Support Vector Machines; World Scientific: Singapore, 2002. [Google Scholar]

- Suykens, J.A.; Vandewalle, J. Least squares support vector machine classifiers. Neural Process. Lett. 1999, 9, 293–300. [Google Scholar] [CrossRef]

| Sequence | Test Form (C,T,K) | ADF Test Value | p Value | Conclusion |

|---|---|---|---|---|

| (N,N,1) | −1.5398 | 0.1958 | Unstable | |

| (N,N,0) | −10.6845 | 0.0000 | stable |

| Parameters | Deterministic Trend | Periodic Component | Stochastic Trend |

|---|---|---|---|

| σ2 | 3.2174 | 3.0478 | 4.5733 |

| c | 16.5741 | 10.5822 | 12.9847 |

| Error Criteria | BND-FOA-LSSVM | LSSVM | BND-LSSVM | FOA-LSSVM | ARIMA | EMD-FOA-LSSVM |

|---|---|---|---|---|---|---|

| RMSE (Yuan/MWh) | 11.18 | 50.78 | 21.36 | 18.05 | 53.43 | 12.06 |

| MAPE (%) | 3.48 | 16.89 | 7.27 | 5.84 | 17.71 | 3.76 |

| MAE (Yuan/MWh) | 9.95 | 48.50 | 20.82 | 16.92 | 50.63 | 10.81 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, W.; Zhao, Z. A Novel Hybrid BND-FOA-LSSVM Model for Electricity Price Forecasting. Information 2017, 8, 120. https://doi.org/10.3390/info8040120

Guo W, Zhao Z. A Novel Hybrid BND-FOA-LSSVM Model for Electricity Price Forecasting. Information. 2017; 8(4):120. https://doi.org/10.3390/info8040120

Chicago/Turabian StyleGuo, Weishang, and Zhenyu Zhao. 2017. "A Novel Hybrid BND-FOA-LSSVM Model for Electricity Price Forecasting" Information 8, no. 4: 120. https://doi.org/10.3390/info8040120