Recycling in Brasil: Paper and Plastic Supply Chain †

Abstract

:1. Introduction

2. Materials and Methods

- (A)

- Social agents participating in all links of the plastic and paper recycling chain;

- (B)

- Quantity of material produced, quality requirements and marketing price at each chain link;

- (C)

- Each social agent production scale;

- (D)

- Description of production processes with introduction of recyclables as feedstock/secondary material;

- (E)

- Understanding possible partnerships among social agents in the supply chain, such as, supplier support practices and production and logistical cost sharing;

- (F)

- Understanding the relationship between materials of a lower value of commercialization and those of a greater value;

- (G)

- Survey of commercialization alternatives for sorted materials.

3. Results

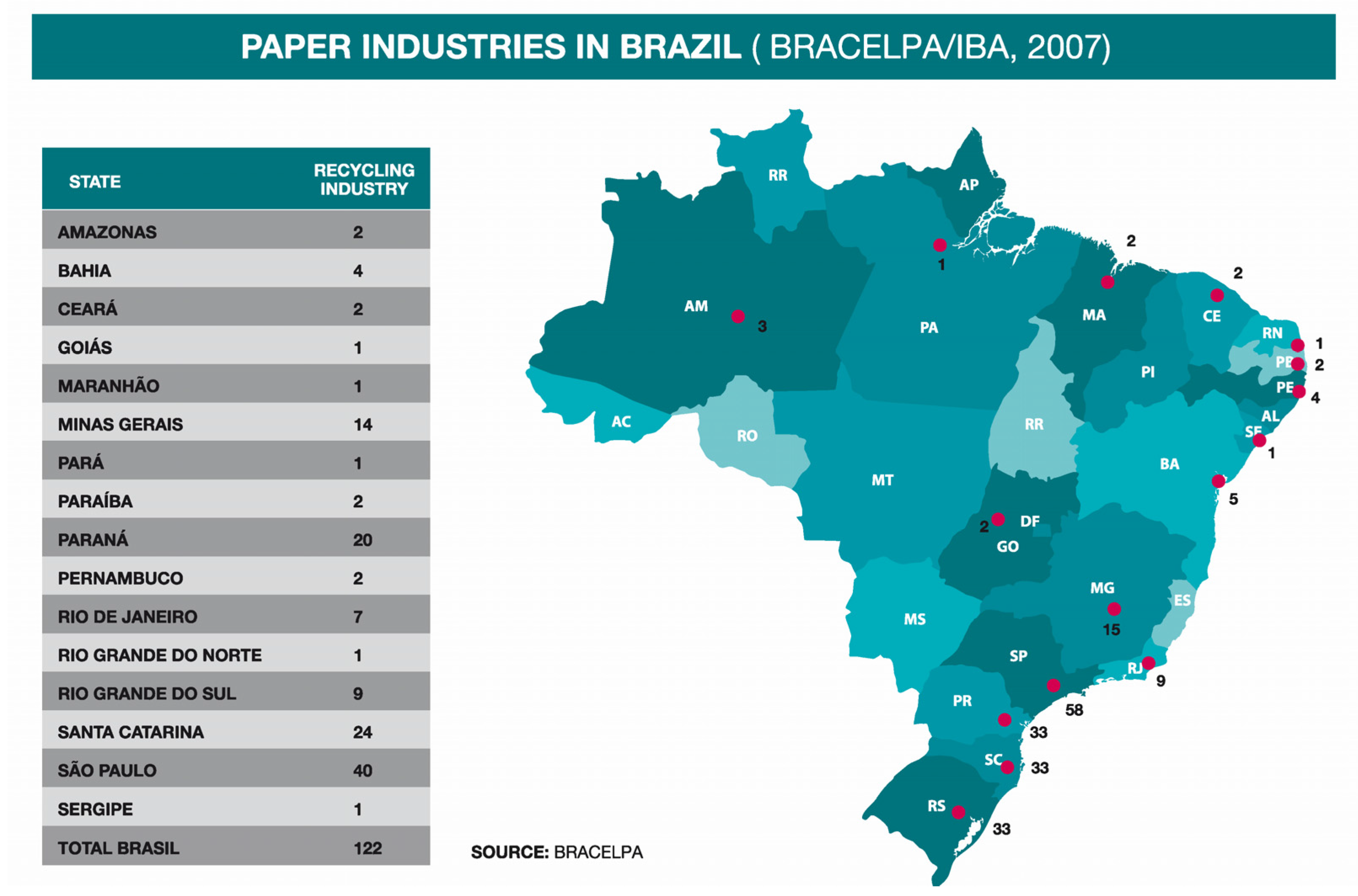

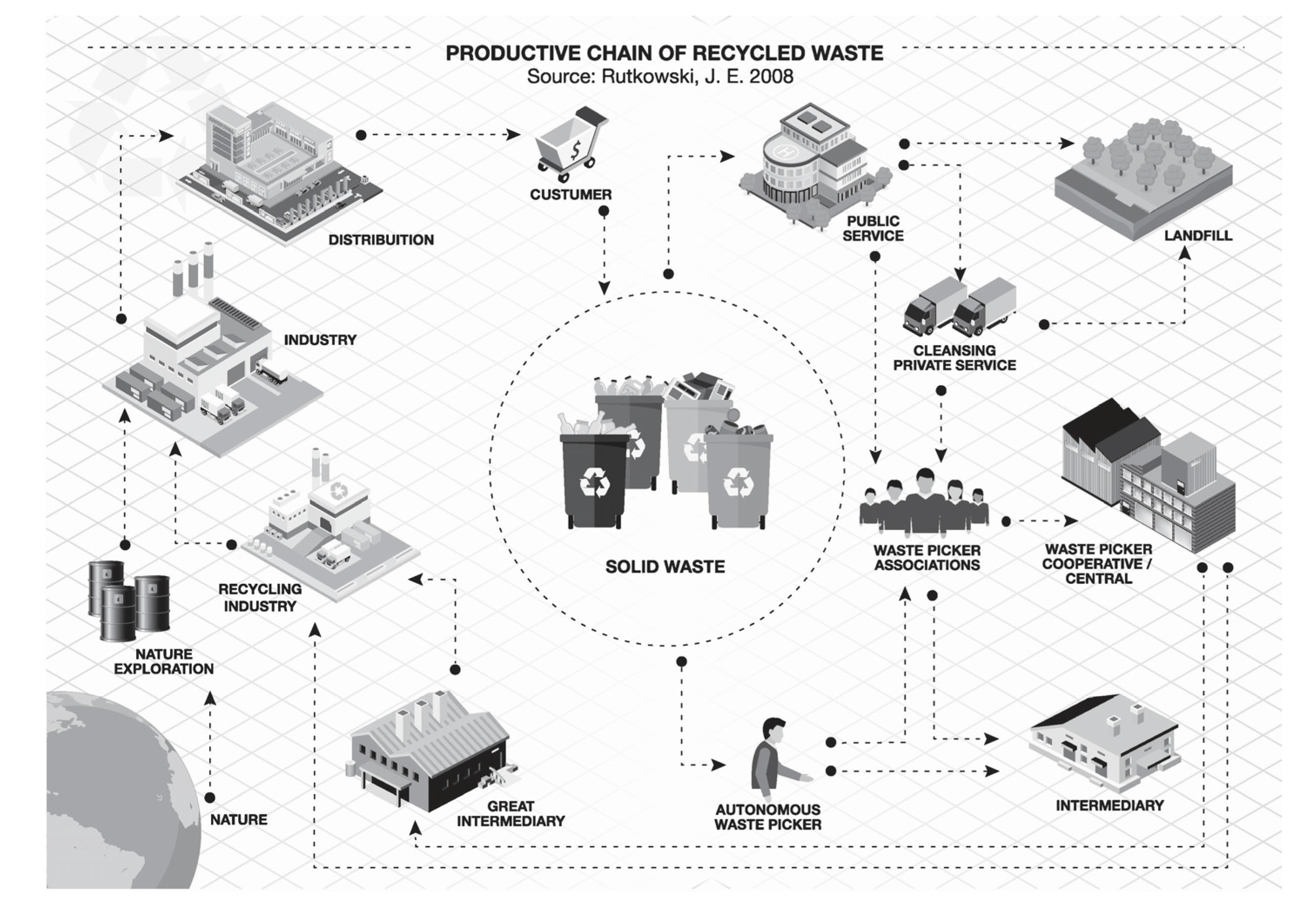

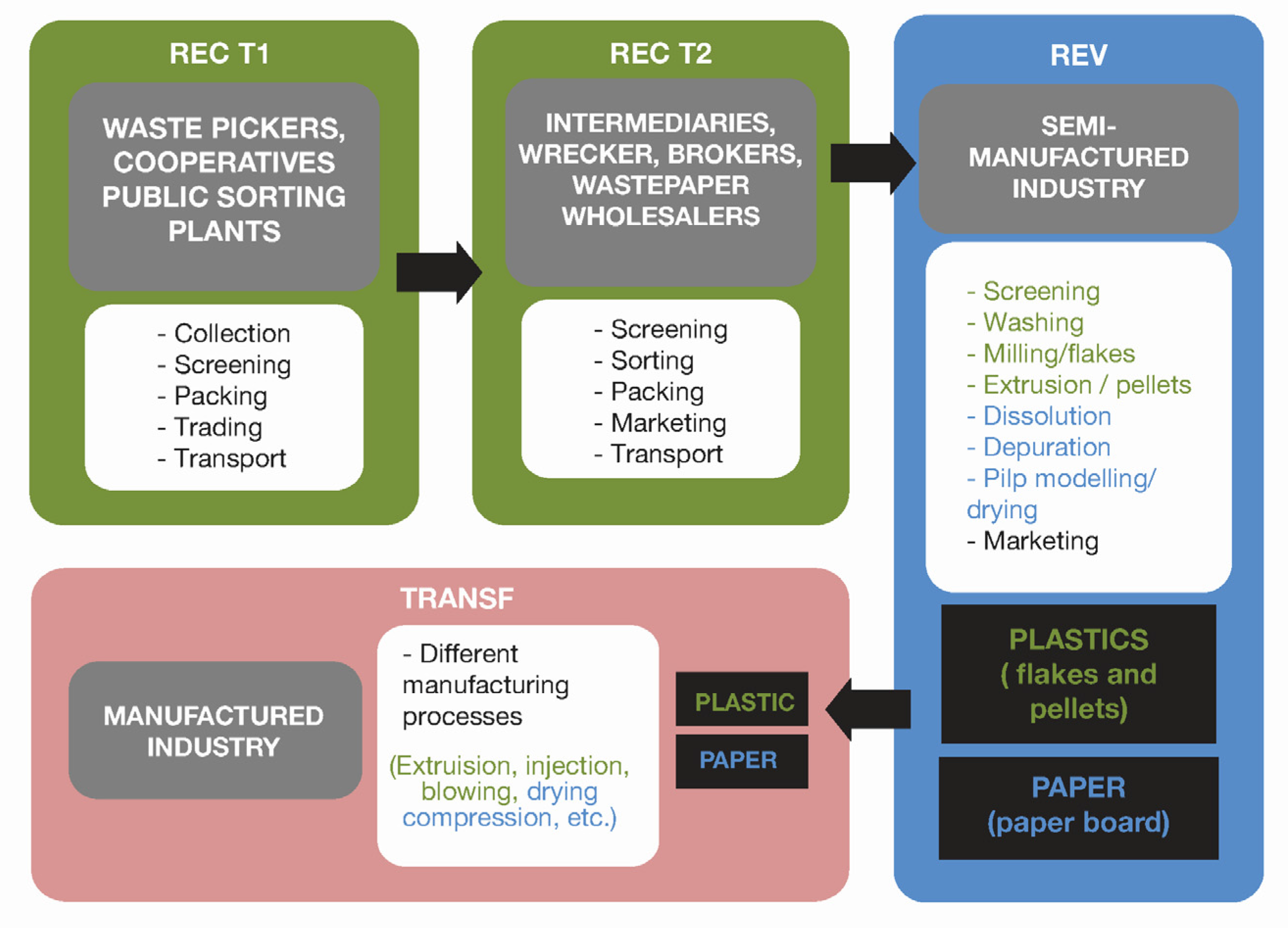

3.1. Recycling Supply Chain

3.2. Input Link: Generators and Recoverers

- • Mixed from various sources;

- • Re-screened for the removal of contaminants according to quality criteria of the purchasing industries (REV or TRANS);

- • Re-baled to bigger bales, to reduce;

3.3. Recoverers’ Business Strategies

3.4. Production Link: Revalorizationers and Transformers

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Destatte, P. Archives de Tag: Economy of Functionality. 2014. Available online: https://phd2050.wordpress.com/tag/economy-of-functionality/ (accessed on 1 March 2017).

- Velis, C.A.; Coronado, M.; Lerpiniere, D. Circular Economy: Closing the Loops; ISWA (International Solid Waste Association): Vienna, Austria, 2015. [Google Scholar]

- ABRELPE, Associação Brasileira de Empresas de Limpeza Pública e Resíduos Especiais. Panorama dos Resíduos Sólidos no Brasil; ABRELPE: São Paulo, Brazil, 2015; p. 92. [Google Scholar]

- IPEA, Instituto de Pesquisa Econômica Aplicada. Plano Nacional de Resíduos Sólidos: Diagnósticos dos Resíduos Urbanos, Agrosilvopastoris e a Questão dos Catadores; Comunicados do IPEA: Brasília, Brazil, 2012; p. 15. [Google Scholar]

- IBGE, Instituto Brasileiro de Geografia e Estatística. Atlas Saneamento/Pesquisa. Nacional de Saneamento Básico—PNSB 2008; IBGE: Rio de Janeiro, Brazil, 2011. [Google Scholar]

- IBGE, Instituto Brasileiro de Geografia e Estatística. Indicadores de Desenvolvimento Sustentável, Brasil; IBGE: Rio de Janeiro, Brazil, 2015. Available online: http://www.ibge.gov.br/home/geociencias/recursosnaturais/ids/default_2015.shtm (accessed on 15 June 2017).

- Valor Econômico. Análise setorial—Resíduos sólidos: Logística Reversa. In Estrutura, Mercado, Perspectivas; Valor Econômico: São Paulo, Brazil, 2011; p. 140. [Google Scholar]

- Rutkowski, J.E.; Rutkowski, E.W. Expanding worldwide urban solid waste recycling : The Brasilian social technology in WPs inclusion. Waste Manag. Res. 2015, 33, 1084–1093. [Google Scholar] [CrossRef] [PubMed]

- BIR (Bureau of International Recycling) Annual Report. 2014. Available online: http://www.bir.org/assets/Documents/publications/Annual-Reports/UK-AR2014-FIN-WEB.pdf (accessed on 20 March 2017).

- Scheinberg, A. Technical Paths for Inclusive Recycling in middle-income countries. In Proceedings of the II ORIS International Seminar, Federal University of Minas Gerais, Belo Horizonte, Brazil, October 2014. [Google Scholar]

- IBA, Indústria Brasileira de Árvores. Relatório de Desempenho do Setor 2014; IBA: São Paulo, Brazil, 2015; p. 80. Available online: http://iba.org/pt/biblioteca-iba/publicacoes / (accessed on 28 August 2017).

- IBGE, Instituto Brasileiro de Geografia e Estatística. Estudos e Pesquisas—Informação Geográfica n° 7, Indicadores de Desenvolvimento Sustentável Brasil 2010; IBGE: Rio de Janeiro, Brazil, 2010; p. 443. [Google Scholar]

- Cooper, J. The dependence of paper recycling on global markets paper. In Proceedings of the ISWA World Congress, Viena, Austria, 7–11 October 2013. [Google Scholar]

- MMA/MCidades. Manual de Coleta Seletiva; MMA/MCidades: Brasília, Brazil, 2008. [Google Scholar]

- Rutkowski, J.E. Sustentabilidade de Empreendimentos Econômicos Solidários: Uma abordagem na Engenharia de Produção. Tese (Doutorado em Engenharia de Produção), COPPE, Universidade Federal do Rio de Janeiro, Rio de Janeiro, Brazil, 2008; p. 239. [Google Scholar]

- Thiollent, M. Pesquisa-Ação nas Organizações; Editora Atlas: São Paulo, Brazil, 1997. [Google Scholar]

- Thiollent, M. Crítica Metodológica, Investigação Social e Enquete Operária; Polis: São Paulo, Brazil, 1981. [Google Scholar]

- Ervasti, I.; Miranda, R.; Kauranen, I. Paper recycling framework, the “Wheel of Fiber”. J. Environ. Manag. 2016, 174, 35–44. [Google Scholar] [CrossRef] [PubMed]

- Eigenheer, E.; Ferreira, J.A.; Adler, R.R. Reciclagem: Mito e Realidade; In-Fólio: Rio de Janeiro, Brazil, 2005. [Google Scholar]

- Bertolini, G. Economie des Déchets; Edition Technip: Paris, France, 2005; p. 178. [Google Scholar]

- CEMPRE. CICLOSOFT 2016. Radiografando a Coleta Seletiva. 2016. Available online: http://cempre.org.br/ciclosoft/id/8 (accessed on 25 June 2017).

- Lima, F.P.A.; Varella, C.V.S.; Oliveira, F.G.; Parreira, G.; Rutkowski, J.E. Tecnologias Sociais da Reciclagem: Efetivando Políticas de Coleta Seletiva com Catadores. In Gerais: Revista Interinstitucional de Psicologia, 4 (2), Ed. Especial; UFMG: Belo Horizonte, Brazil, 2011; pp. 131–146. [Google Scholar]

- ABNT. Recycled paper and board—Recycled fibres content—Specification; NBR 15755:2009; ABNT: São Paulo, Brazil, 2009. [Google Scholar]

- Kaur, A.; Mishra, A.K. Management andRecycling Routes in Plastic Waste Management Framework: A World Prospective. Plast. Polym. Technol. PAPT 2014, 3, 26–30. [Google Scholar]

- Rutkowski, J.E.; Varella, C.V.; Campos, L.; Inácio, J.M. Análise da Cadeia Produtiva dos Materiais Recicláveis no Brasil. In Relatório de Pesquisa; INSTITUTO SUSTENTAR/FBB: Brasília, Brazil, 2013. [Google Scholar]

- IBA, Indústria Brasileira de Árvores. Relatório IBÁ 2017; IBA: São Paulo, Brazil, 2017; p. 80. Available online: http://iba.org/pt/biblioteca-iba/publicacoes (accessed on 28 August 2017).

- ABIPLAST (Brasilian Association of Plastic Industry) Perfil 2014: Brasilian Plastic Processed Industry. 2015. Available online: http://file.abiplast.org.br/download/links/2015/perfil_abiplast_2014_web.pdf (accessed on 26 June 2017).

- PLASTIVIDA (Socioenvironmental Institute of Plastics) Brasil recicla mecanicamente 21% dos Plásticos. 2012. Available online: www.plastivida.org.br/images/releases/Release_091_Reciclagem_Plasticos_.pdf (accessed on 2 January 2014).

- Castelani, L.C. A Cadeia de Reciclagem do Plástico no Brasil: Fragilidades, Potencialidades e Desafios. MScDissertation, Escola Nacional de Saúde Pública Sérgio Arouca, Rio de Janeiro, Brazil, 2014. [Google Scholar]

- Golev, A.; Corder, G. Typology of Options for Metal Recycling: Australia’s Perspective. Resources 2015, 5, 1. [Google Scholar] [CrossRef] [Green Version]

- Quartey, E.T.; Tosefa, H.; Danquah, K.A.B.; Obrsalova, I. Theoretical Framework for Plastic Waste Management in Ghana through Extended Producer Responsibility: Case of Sachet Water Waste. Int. J. Environ. Res. Public Health 2015, 12, 9907–9919. [Google Scholar] [CrossRef] [PubMed]

- Quintas, J.S. Educação no processo de gestão ambiental: Uma proposta de educação ambiental transformadora e emancipatória. In Layrargues, P. P. [coord] Identidades da Educação Ambiental Brasileira; Ministério de Meio Ambiente: Brasília, Brazil, 2004; pp. 113–140. [Google Scholar]

- Stadler, L.; Lin, H. Leveraging Partnerships for Environmental Change: The Interplay between the Partnership Mechanism and the Targeted Stakeholder Group. J. Bus. Ethics 2017. [Google Scholar] [CrossRef]

- Lazarevic, D.A.E.; Buclet, N.; Brandt, N. Plastic waste management in the context of a European recycling society: Comparing results and uncertainties in a life cycle perspective. Resour. Conserv. Recycl. 2010, 55, 246–259. [Google Scholar] [CrossRef]

- Furniss, J. Alternative framings of transnational waste flows: reflections based on the Egypt—China PET plastic trade. Area 2015, 47, 24–30. [Google Scholar] [CrossRef]

- Huysman, S.; Debaveye, S.; Schaubroeck, T.; Meester, S.; De Ardente, F.; Mathieux, F.; Dewulf, J. The recyclability benefit rate of closed-loop and open-loop systems: A case study on plastic recycling in Flanders. Resour. Conserv. Recycl. 2015, 101, 53–60. [Google Scholar] [CrossRef] [Green Version]

| Year | Al Can | Paper | Glass | PET | Steel Can | Tetrapak |

|---|---|---|---|---|---|---|

| 1993 | 50,0 | 38,8 | 25,0 | - | 20,0 | - |

| 1994 | 56,0 | 37,5 | 33,0 | 18,8 | 23,0 | - |

| 1995 | 62,8 | 34,6 | 35,0 | 25,4 | 25,0 | - |

| 1996 | 61,3 | 37,1 | 37,0 | 21,0 | 32,0 | - |

| 1997 | 64,0 | 36,3 | 39,0 | 16,2 | 33,0 | - |

| 1998 | 65,2 | 36,6 | 40,0 | 17,9 | 34,0 | - |

| 1999 | 72,9 | 37,9 | 40,0 | 20,4 | 37,0 | 10,0 |

| 2000 | 78,2 | 38,3 | 41,0 | 26,3 | 40,0 | 15,0 |

| 2001 | 85,0 | 41,4 | 42,0 | 32,9 | 45,0 | 15,0 |

| 2002 | 87,0 | 43,9 | 44,0 | 35,0 | 49,5 | 15,0 |

| 2003 | 89,0 | 44,7 | 45,0 | 43,0 | 47,0 | 20,0 |

| 2004 | 95,7 | 45,8 | 45,0 | 47,0 | 45,0 | 22,0 |

| 2005 | 96,2 | 46.9 | 45,0 | 47,0 | 44,0 | 23,0 |

| 2006 | 94,4 | 45,4 | 46,0 | 51,5 | 49,0 | 24,2 |

| 2007 | 96,5 | 43,7 | 47,0 | 53,5 | 49,0 | 25,5 |

| 2008 | 91,5 | 43,7 | 47,0 | 54,8 | 46,5 | 26,6 |

| Type | Description | Example | |

|---|---|---|---|

| Enterprises Recoverers of recyclable materials (REC) | recover recyclable from waste | ||

| REC T1 | Collects mixed dry waste from generators (domestic and big ones) and performs the first sorting process, baling and transport | Associations and Cooperatives of WPs (ACs), autonomous WPs, municipal screening units | |

| REC T2 | Buys selected material to commercialize, may also perform a secondary sorting, i.e., a finer material classification | Middlemen, scrap yards | |

| Enterprises Revaluators (REV) of recyclable materials | Intermediary industries transforming the material selected in raw material, many times carry out a new sorting to improve quality of the feedstock | Industries producing pellets/grains and flakes from recycled plastics; Factories producing paper coils to feed the paper packaging industry | |

| Transformer Enterprises (TRANS) of recycled raw material | Industries that manufacture paper and plastic products from raw material produced with revalued material in the form of grains or flakes (plastic) or recovered and reinserted in the original production paper chain | Paper producers (writing paper, napkins and sanitary papers, cardboard, etc.). Diverse kind of industries that produce different plastics products, as cars parts, plastic consumable products, textiles with synthetic fibres, etc. | |

| Sales Price (R$) | RECT1 | RECT2 | |

| Individual WP | WPC | ||

| 0,3 | 1,2 | 1,3 | |

| Rise (%) | - | +400 | +8 |

| Value and Operations | Social Agents | |||

|---|---|---|---|---|

| REC T1 | REC T2 | REV | TRANSF | |

| sale price (R$) | 0,40 | 0,60 | 2,20 | 7,00 |

| appropriate value (%) | 6 | 3 | 23 | 69 |

| operation | Sorting and bailing | Stocking | Milling and extrusion | Injection |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rutkowski, J.E.; Rutkowski, E.W. Recycling in Brasil: Paper and Plastic Supply Chain. Resources 2017, 6, 43. https://doi.org/10.3390/resources6030043

Rutkowski JE, Rutkowski EW. Recycling in Brasil: Paper and Plastic Supply Chain. Resources. 2017; 6(3):43. https://doi.org/10.3390/resources6030043

Chicago/Turabian StyleRutkowski, Jacqueline Elizabeth, and Emília Wanda Rutkowski. 2017. "Recycling in Brasil: Paper and Plastic Supply Chain" Resources 6, no. 3: 43. https://doi.org/10.3390/resources6030043