1. Introduction

A circular economy is based on the principle of maintaining the value of products, materials and resources as long as possible, minimizing waste and resource use [

1]. At the end of its life, a product can be recovered to create further value [

2]. Biogas is the product of anaerobic digestion beginning from several feedstocks, such as agricultural residues (e.g., manure and crop residues), energy crops, organic-rich waste waters, the organic fraction of municipal solid waste (ofmsw) and industrial organic waste [

3].

Biomethane is obtained from properly-treated biogas through the process of purification [

4]. In the last few decades, biomethane has achieved a significant importance in the field of Renewable Energy (RE) [

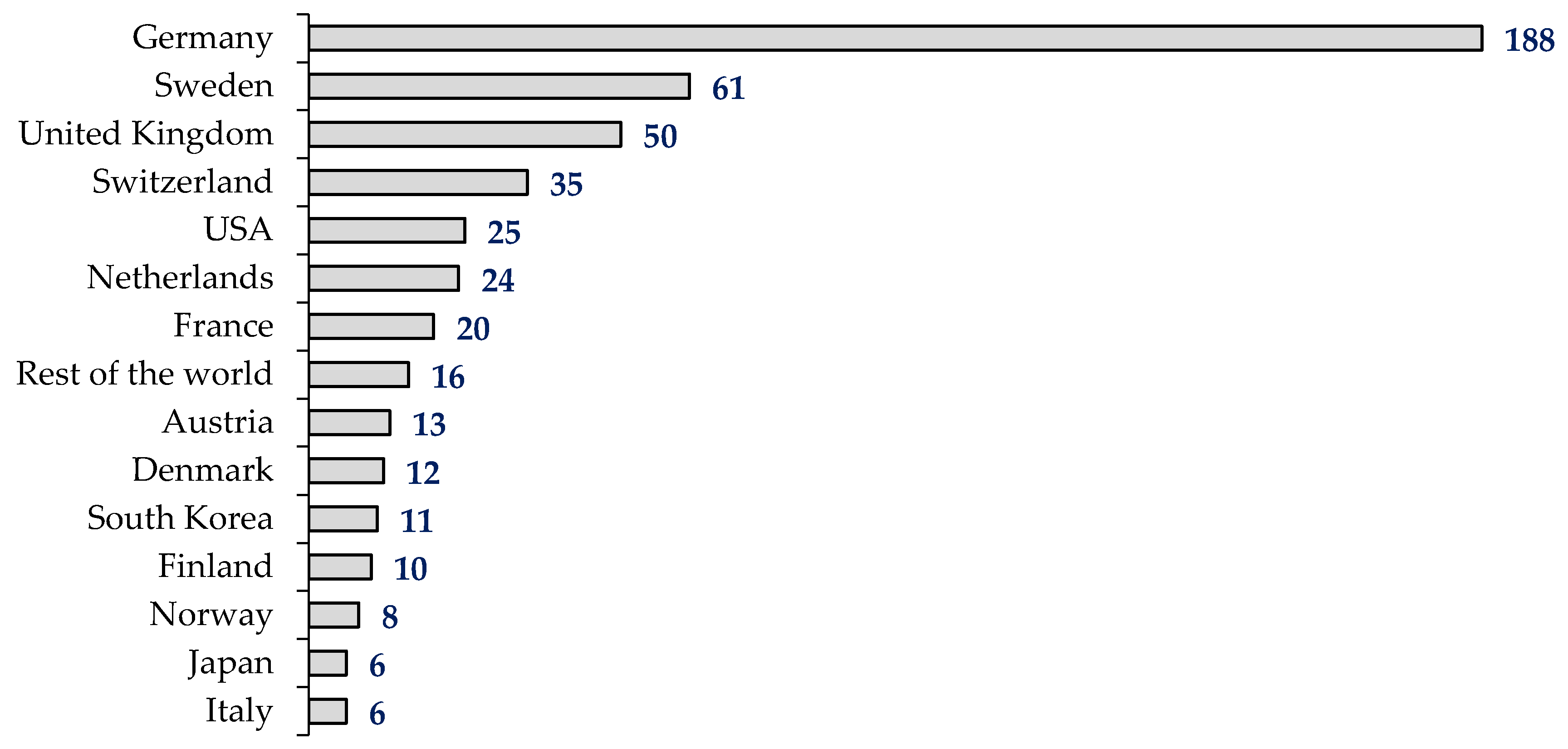

5]. The evolution of the numbers of upgraded plants in Europe has grown from 187 in 2011 to 435 in 2015. It is the most significant market in the world (90%) (

Figure 1) [

6]. However, biomethane production is highly localized in a few countries, and this represents a great limit for this market [

7].

Biomethane has properties potentially equivalent to methane and can be used directly as vehicle fuel, or be injected into the natural gas grid, or be converted into electricity and heat in cogeneration units [

8]. Current technologies of biomethane consume less than about 20% of biogas energy for upgrading and compression aims [

9]. A review of this topic underlines innovative and highly effective technologies along the whole chain of biomethane production [

10]. Among several feedstocks used, the application of a multi-criteria analysis underlines the advantageous linked to the use of organic waste [

11]. A comprehensive analysis of agricultural waste highlights also its strategic role in a circular economy model [

12].

The biogas-biomethane chain is able to tackle the environmental pollution as an alternative to the consumption of natural gas [

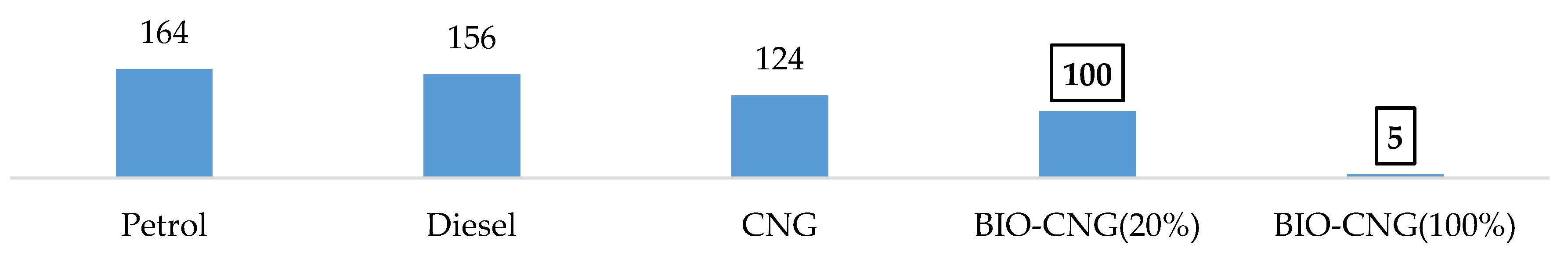

13]. GHG emissions of vehicle powertrain systems are recorded from the Well To Wheel (WTW). According to the DENA (Deutsche Energie-Agentur) study, methane or Compressed Natural Gas (CNG) has a reduction potential of the order of around 21% and 24% in comparison to diesel and petrol, respectively. The use of biomethane is able to reduce emissions further. This value is equal to 24 gCO

2eq/km, if CNG is composed also by 20% of biomethane (also called BIO-CNG (20%)). Instead, when pure biomethane (also called BIO-CNG (100%)) is used, WTW emissions are equal to 5 gCO

2eq/km (

Figure 2) [

14].

For this reason, a policy support for biofuels is justified [

15]. Changes in the legal framework had direct impacts on their development [

16]. Furthermore, European countries can reduce their reliance on natural gas imports [

17], reaching also renewable targets [

18].

The economic feasibility of biogas plants is well defined in the literature [

19], but also, the analysis of biomethane production is analyzed for several final uses (fed into the grid, destined for cogeneration or sold as vehicle fuel) [

20]. However, there are several approaches.

In fact, the economic impact of upgrading can be evaluated varying the quantity of biogas processed and the technology used [

21]. The biomethane cost of production is 0.54 €/m

3 injected into the grid and 0.73 €/m

3 as transportation fuel [

22]. The discounted total cost for the organic fraction of municipal solid waste (ofmsw) substrate varies from 0.46–0.82 €/m

3, while it is equal to 0.49–0.76 €/m

3 for a mixed substrate (maize and manure residues) [

20].

The EU project “Record Biomap” defines that it is relevant to propose solutions to make biomethane production profitable also at small- and medium-scale biogas plants. Literature analysis has shown attention to this topic [

23]. A previous analysis underlining the profitability of ofmsw substrate is verified with the following configurations: a minimum size for the plant of 100 m

3/h if the biomethane is used for cogeneration and 250 m

3/h for the other two final destinations. Instead, the financial feasibility of mixed substrate is verified only for a 500 m

3/h plant if the biomethane is used as vehicle fuel [

20].

This paper aims to evaluate the profitability of biomethane plants in a market with subsidies. One hundred and eighty case studies were analyzed as a function of four critical variables:

Plant size (50 m3/h, 100 m3/h and 150 m3/h).

Feedstock (ofmsw and a mixture of 30% maize and 70% manure residues on a weight basis).

Subsidies (varying from 0.162 €/m3–0.487 €/m3).

Selling price of biomethane (varying from 0.1384 €/m3–0.2397 €/m3).

Italy is chosen as the case study, considering that it: (i) is the country with the highest number of Natural Gas Vehicles (NGVs) in Europe; (ii) has a widespread presence of biogas plants; and (iii) has high energy dependence on foreign imports [

24]. Consequently, this country has great potentials, but the biomethane sector is not yet developed despite a decree of incentivization from 2013. This work can be useful for researchers, entrepreneurs and industry leaders since it provides an insight toward the commercialization of the technology and softens several environmental issues.

The paper is organized as follows.

Section 2 presents the methodology used in this paper, and an economic model is defined to evaluate the profitability of a biomethane plant. Starting by input data, it is possible to calculate NPV and Discounted Payback Time (DPBT), and the results are shown in

Section 3. A discussion of the role of biomethane in the transport sector and some concluding remarks are proposed in

Section 4.

2. Materials and Methods

Discounted Cash Flow (DCF) is a recognized economic assessment method used to evaluate the attractiveness of a project. Two financial indexes are considered: NPV is defined as the sum of the present values of the individual cash flows, and DPBT represents the number of years needed to balance cumulative discounted cash flows and initial investment [

24].

The profitability of a project depends on the index used. Considering NPV, it is verified when the value obtained is greater than zero. Considering DPBT, it is verified when the value obtained is lower than the cut-off period. DPBT > 20 y (years) indicates that the investment cannot be recovered within this date, and this is coherent with an NPV < 0.

With a decree introduced in December 2013, Italy adopted a new system of incentives for biomethane, depending on its type of utilization [

25]. In the case of biomethane used as vehicle fuel, the decree states that the subsidy is released through certificates called CIC (Certificates of Emission of Biofuel in Consumption). The obliged subjects are companies that market fuels in Italy and every year are responsible for entering into consumption a share of sustainable biofuels as a proportion of the amount of consumed fossil fuels. A pecuniary penalty is provided when this is not verified for each CIC. A single certificate is released when the biomethane quantity corresponding to 41,840 MJ (equivalent of 10 Gcal) is used as transportation fuel. This subsidy lasts twenty years.

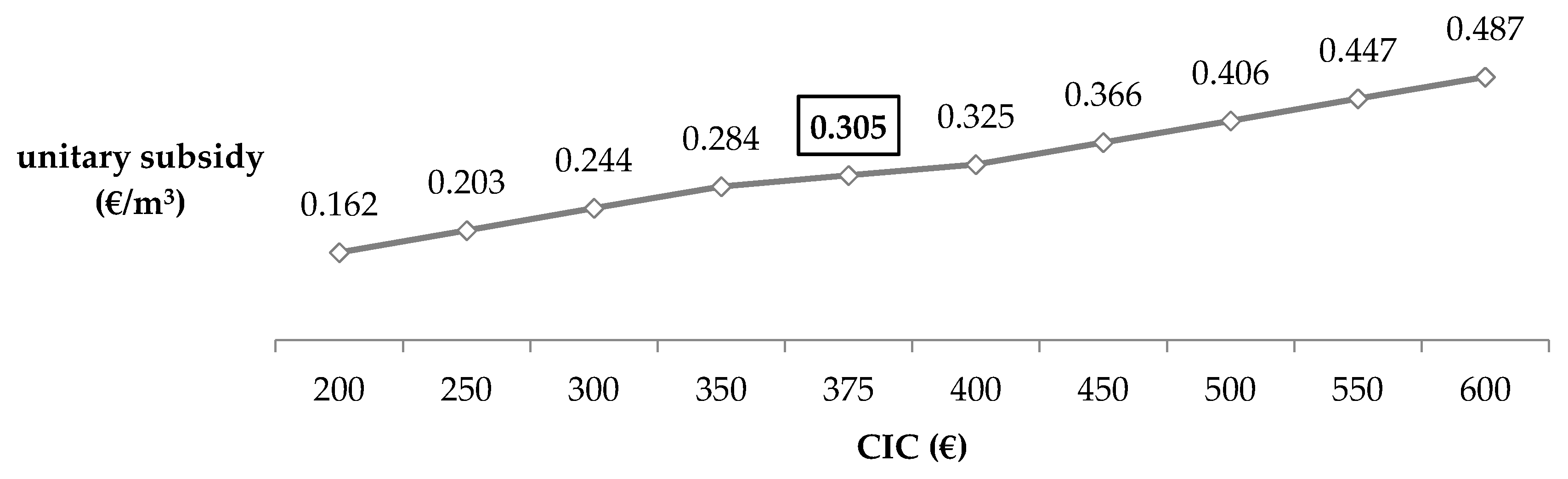

The value of CIC is characterized by uncertainty, and a draft of the new decree of biomethane by the Italian Ministry of Economic Development provides a value of 375 €. Furthermore, this work proposes ten possible values of CICs starting in the range of 300–500 € [

20] (

Figure 3).

For example, when one CIC is equal to 200 €, the transformation of this value in terms of cubic meters () is obtained as the ratio between 200 € and 1231 m3. In fact, one CIC corresponds to 0.837 t of biomethane, which is equivalent to 1231 m3 of CH4. This conversion is obtained considering that 1 m3 CH4 = 0.68 kg under normal conditions (standard temperature of 273.15 K and pressure of 101.325 kPa).

If the biomethane has been produced from specific products as reported in the Ministerial Decree, the number of released CIC doubles (double counting). For example, this is verified for ofmsw, while the corrective coefficient is equal to 1.7 with a mixture of 30% maize and 70% manure residues. Furthermore, there is a notable premium (another corrective coefficient equal to 1.5) when the producer firm is also the methane distributor. This paper did not analyze this scenario, considering that the benefits of this choice were defined by [

24].

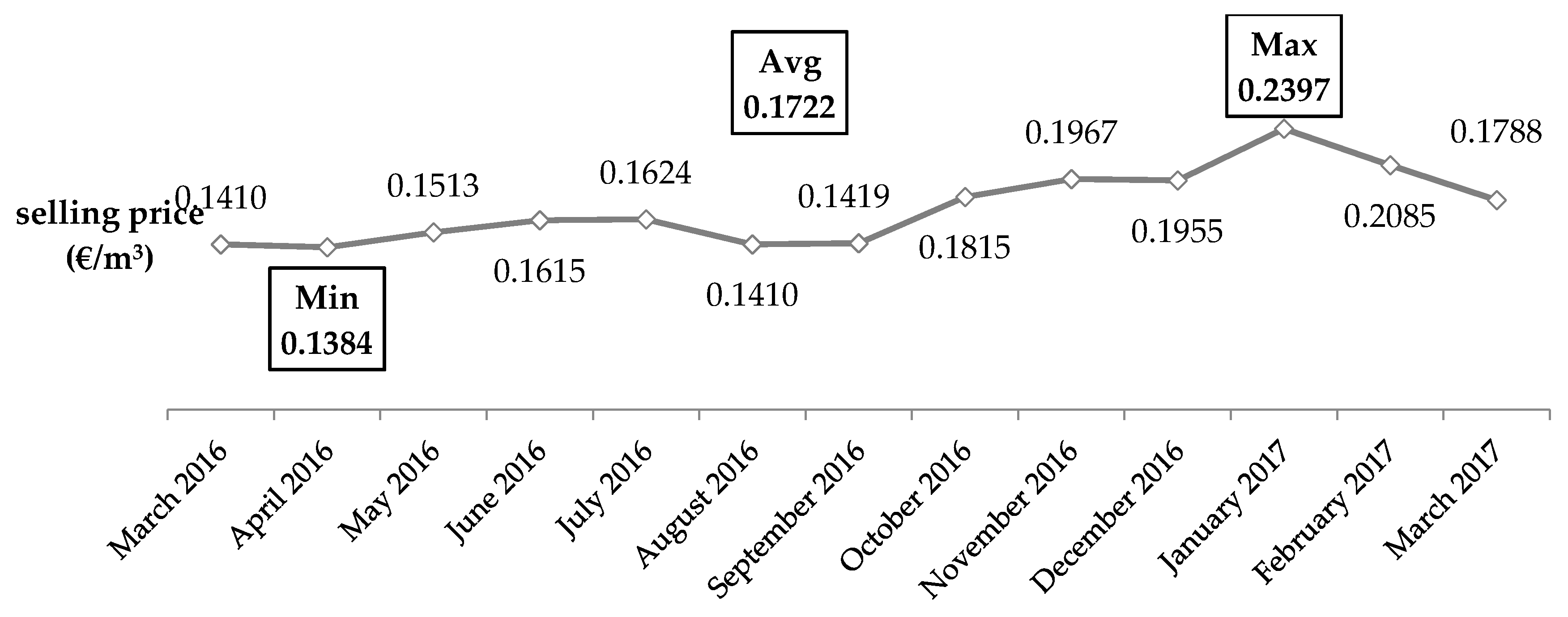

The revenues of a biomethane plant used for transportation fuel are basically two: (i) subsidies and (ii) the selling of biomethane. The first is determined by a Ministerial Decree, as defined above, while the second item is calculated as a function of the selling price of natural gas. It is calculated as a function of wholesale gas price defined in the virtual exchange point. Values proposed in

Figure 4 were already decreased of 5%, in accordance with the draft of the new decree of biomethane.

This work proposes three possible values of selling price of biomethane to a vehicle-fuel distribution plant (). Considering the period March 2016–March 2017, three values during this interval are chosen: minimum, average and maximum.

The costs of biomethane production can be subdivided into three main phases: (i) biogas production; (ii) upgrading; and (iii) compression and distribution. Investment costs are lower than operational costs and range from 15%–20% [

20].

The capital investment of a biogas facility is a function of feedstock and plant size [

26], while the investment cost of upgrading phase depends on the technology used and the quantity of biogas processed [

21]. This work analyzed the membrane separation (MEMS) technology that is typically used for small plants [

27].

Operation costs associated with biogas and biomethane production are: (i) substrate; (ii) transport; (iii) labor; (iv) maintenance and overhead; (v) depreciation fund for mechanical and electrical elements; (vi) electricity consumption; and (vii) insurance. Among these items, maintenance and overhead is the most relevant cost varying from 46%–50% when ofmsw substrate is used and from 24%–29% with mixes. These considerations are obtained for 100−1000 m

3/h plants, and the results underline that transport costs become more relevant than maintenance and overhead costs when a 1000 m

3/h plant is considered for a mixed substrate [

20].

Finally, the cost of the third phase is lower than the other two phases, if the production location is not far from the distribution grid [

28]. The treatment of ofmsw as a substrate determines from one side the income because the process of urban waste is a paid service and from the other side also the cost for pre-treatment required. However, the net cash flow is positive [

24].

The mathematical model used to evaluate the profitability of biomethane plant is reported below:

| | (1) |

| | (2) |

| | (3) |

| | (4) |

| | (5) |

| | (6) |

| | (7) |

| | (8) |

| t = 0…n | (9) |

| t = 0…n | (10) |

| t = 0…n | (11) |

| | (12) |

| | |

| | (13) |

| t = 0…ndebt−1 | (14) |

| t = 0…ndebt−1 | (15) |

| | (16) |

| t = 0…ndebt−1 | (17) |

| t = 0…ndebt−1 | (18) |

| | (19) |

| t = 0…ndebt−1 | (20) |

| t = 0…ndebt−1 | (21) |

| t = 0…n | (22) |

| t = 0…n | (23) |

| t = 0…n | (24) |

| t = 0…n | (25) |

| t = 0…n | (26) |

| t = 0…n | (27) |

| t = 0…n | (28) |

| t = 0…n | (29) |

| t = 0…n | (30) |

| t = 0…n | (31) |

| t = 0…n | (32) |

| with | t = 0…n | (33) |

| with | t = 0…n | (34) |

| t = 0…n | (35) |

This paper examines the financial feasibility of biomethane plants used as a vehicle fuel. One hundred and eighty case studies were proposed by the combination of these variables:

plant size, in which three values are analyzed: 50 m3/h, 100 m3/h and 150 m3/h.

feedstock used, in which two typologies are considered: ofmsw and a mixture with 30% maize and 70% manure residues on a weight basis.

unitary subsidy, in which ten values are considered (

Figure 3), varying from 0.162 €/m

3–0.481 €/m

3.

selling price of biomethane, in which three values are considered (

Figure 4), varying from 0.1384 €/m

3–0.2397 €/m

3.

Other economic and technical inputs are proposed in

Table 1, and the investment cost is covered by third party funds with the useful lifetime of the plant defined equal to the lifetime of the subsidies (20 years). The aggregation of cash flows is obtained through the opportunity cost of capital fixed equal to 5%. The definition of the optimal size of biogas plant is chosen in order to maximize the grade of saturation of the upgrading phase according to the approach used by [

20].

3. Results

The great challenges of climate change have increased the propensity towards sustainable choices. The automotive sector is characterized by new solutions from cradle to grave [

33]. The substitution of fossil fuels with renewable sources is a choice adopted by several governments. Biomethane permits a reduction of emissions as defined in

Section 1, while the economic opportunities are verified for some sizes and substrates.

This work follows this direction of research, and several case studies are proposed. The profitability is calculated as a function of two variables: unitary subsidy (

) and selling price of biomethane (

. NPV and DPBT for ofmsw substrate are reported in

Table 2 and

Table 3, respectively, while NPV and DPBT for mixed substrate are reported in

Table 4 and

Table 5, respectively.

The financial feasibility of biomethane production is verified in twenty-eight of nineteen case studies (31%) concerning ofmsw plants. These results are coherent with

Section 1, and it can be underlined that:

The 50 m3/h plant is always unprofitable.

The 100 m3/h plant is profitable in ten scenarios; positive NPV varies from 3.48 k€/(m3/h)–29.73 k€/(m3/h), and DPBT ranges from 1–3 years. Starting from a value of CIC equal to 500 € the profitability is verified for all prices of selling of biomethane, while with a CIC of 450 €, only with a price of selling equal to 0.2397 €/m3.

The 150 m

3/h plant is profitable in eighteen scenarios; positive NPV varies from 1.72 k€/(m

3/h)–44.12 k€/(m

3/h) and DPBT ranges from 1–4 years. Starting from a value of CIC equal to 400 €, the profitability is verified for all prices of selling of biomethane, while with a CIC of 375 €, that is the supposed value by the new decree (see

Section 2), the plant is profitable in the Avg

and Max

scenarios. Finally, NPV is positive also with a value of CIC of 350 € and

of 0.2397 €/m

3.

The role of subsidies is strategic, and the current incentive scheme does not provide specific supports to small plants. This choice could be incentivized by the structure of the incentive scheme adopted in the past for other REs.

A previous research work has defined that 250 m

3/h is the profitable minimum plant size in the baseline scenario, and also the 100 m

3/h plant has NPV > 0 in alternative scenarios with an increase of incentive (

equal to 0.41 €/m

3) or a decrease of the maintenance and overhead cost of biogas production (

equal to 15%) [

20]. Results obtained in

Table 2 and

Table 3 define that the 150 m

3/h plant is basically profitable, because CIC = 375 € is the more probable value. The analysis of several scenarios underlines that profits can be very relevant, but there also significant economic losses in some case studies.

The profitability of biomethane production is verified only in four of nineteen case studies (4%) concerning mixed plants. Furthermore, this part of the work is coherent with

Section 1, and it can be highlighted that:

The 50 m3/h plant is always unprofitable.

The 100 m3/h plant is always unprofitable.

The 150 m3/h plant is profitable when a CIC equal to 600 € is present for all prices of selling of biomethane and in the case study with CIC = 550 € and = 0.2397 €/m3. Positive NPV varies from 0.47 k€/(m3/h)–10.49 k€/(m3/h), and DPBT ranges from 2–5 years.

The current incentive scheme does not favor the use of substrates as energy crops, which could subtract agricultural land from the primary sector. A mixture plant with 30% maize and 70% manure residues on a weight basis presents a lower corrective coefficient than ofmsw ( is equal to 1.7 instead of two).

For this motive, NPV is lower in this typology of investment in addition to the absence of net revenues linked to the treatment of municipal solid waste. Certainly, plants with 100% of agricultural residues have a corrective coefficient equal to two, but in this case, there is a great risk of not maximizing the degree of saturation of the plant. In fact, agricultural residues have a lower potential of biomethane than one of the energy crops, and consequently, great quantities of these residues are required.

A previous work has defined 500 m

3/h as the minimum plant size in terms of profitability considering a baseline scenario. Furthermore, the 250 m

3/h plant has NPV > 0 when there is an increase of incentive (

equal to 0.41 €/m

3) or a decrease of transport cost of the substrate (

equal to 1 €/t) [

20].

Table 4 and

Table 5 highlight that the probability of positive NPV with mixed substrate is very low; in fact, CIC equal to 550 € or 600 € is not tracked in the current market.

4. Discussion and Conclusions

Italy presents a strong contradiction. This country has the highest number of NGVs in the global context (about equal to 950,000 units), and the number of biogas plants is very significant. In addition, the production of natural gas is very low, and consequently, Italy depends on foreign imports. Biomethane can be a valid solution, but its use is very limited [

13]. This paper tries to offer new discussion items useful to researchers, firms and public administrators.

The first aim of this work was to define the environmental benefits linked to the use of biomethane. Initially, the quantity of biomethane required to satisfy the demand was calculated. Hypothesizing that the annual NGV’s consumption was equal to 1100 m

3 of methane, two alternative scenarios were considered according to

Section 1:

The necessary resource is equal to 209 million m

3/y when BIO-CNG (20%) is considered, obtained by the product between the number of NGVs and the annual NGV’s consumption. The reduction of GHG linked to this choice is 360 ktCO

2eq per year considering the unitary reduction of 24 gCO

2eq/km defined in

Section 1 and hypothesizing that an NGV travels 15,000 km per year. Nine hundred fifty thousand NGVs powered by BIO-CNG (20%) save 6840 ktCO

2eq compared to those powered by fossil fuel during 20 years (

Table 6).

The annual amount of subsidies required to produce biomethane depends on two parameters: (i) the value of CIC (see

Figure 3); and (ii) the quantity of biomethane demand (see

Table 6) (

Table 7). For example, when the CIC is equal to 375 € (0.305 €/m

3) and a use of 209 million m

3/y is hypothesized, the amount of subsidies is equal to 64 million €/y.

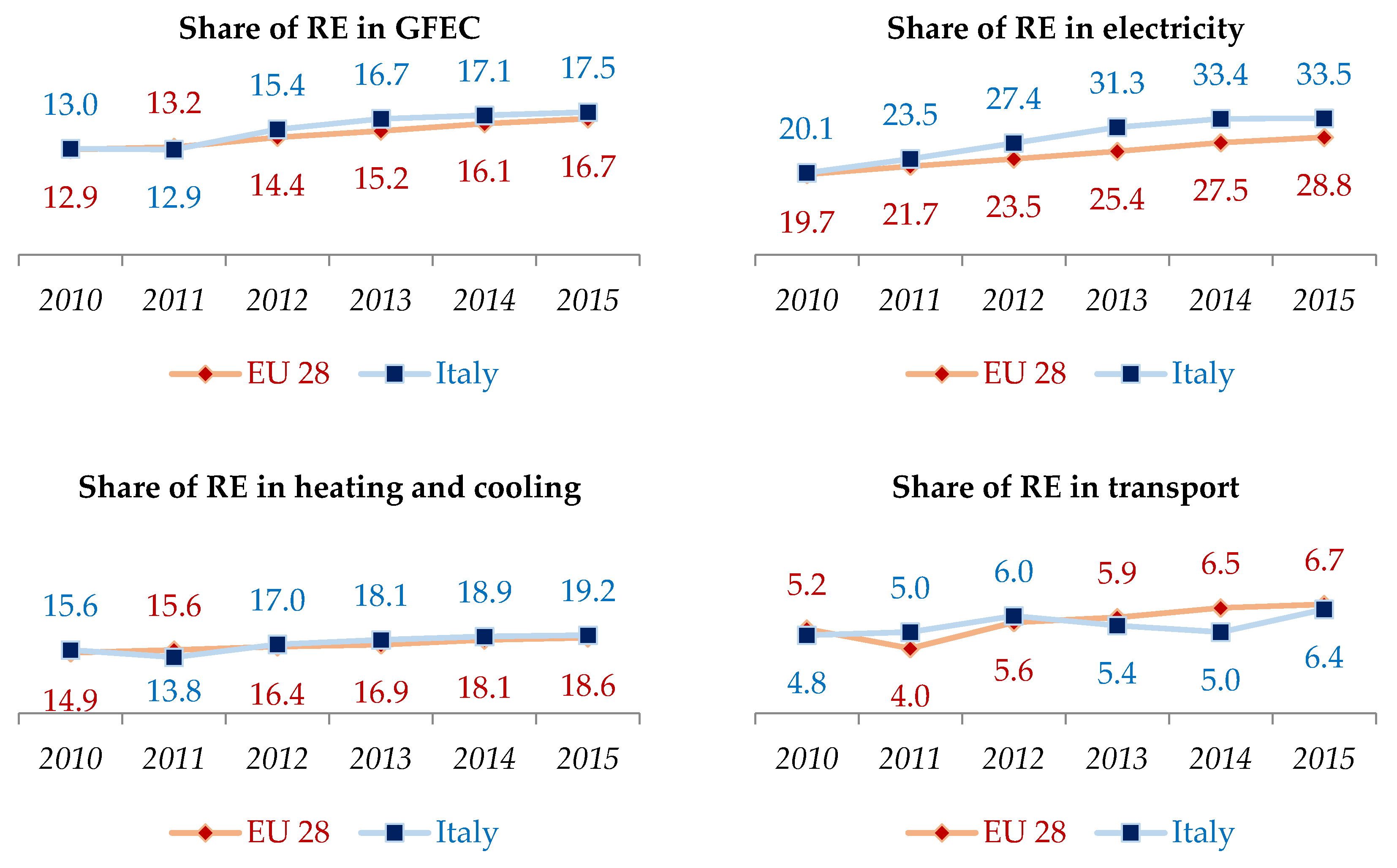

In 2015, the share of RE in Gross Final Energy Consumption (GFEC) is equal to 16.7% in EU 28, and Italy has achieved its national target (17%) in 2014 (

Figure 5). Currently, this value is greater than the average of EU 28. This is verified also in electricity (+4.7%) and heating and cooling (+0.6%), and there is a reduction of this difference in comparison to previous years [

20]. The EU has set a mandatory target for renewable fuels of 10% for each member state by 2020. Italy, but also EU 28, is far past this goal. Data presented in

Figure 1 underline that biomethane is expanding in the European context, while Italy presents only a number of upgraded plants equal to 1.4% and 1.2% of the European and global scenarios, respectively.

Biomethane used as a vehicle fuel can be profitable, favoring the increase of the share of RE in the transport sector, and also, environmental improvements are obtained. These considerations permit biomethane to play a role in the development of the circular economy. Private and public firms operating in environmental services can use municipal solid waste to feed their own vehicle fleets. Agricultural residues are no longer a problem, but a resource for operators that are active in this sector.

Previous works have highlighted the key role of the plant size in the analysis of profitability. Furthermore, subsidies and the substrates used are critical variables. Results of this work define that the profitability of ofmsw substrate is verified also for a 150 m3/h plant, while one with mixed substrate can be obtained starting with a 250 m3/h plant in the scenario with a low cost of the transport of substrates. Alternatively, economic opportunities are provided by the incentive scheme when the producer of biomethane is also the distributor of methane. In this case, another corrective coefficient is recognized, and the pump price to the consumer is certainly higher than the price of selling of biomethane examined in this work. The excessive volatility of CICs influences in a negative way the investments in this sector, and consequently, new policy measures must be made to reduce this uncertainty.