1. Introduction

The closure of material loops has come to be central to circular economy debates, but conventional literature hardly discusses the role of risk, especially where low recycling rates indicate the absence of loop closure. More often than not, lack of loop closure is explained in terms of uneconomic processes reflected in price signals, i.e., where prices of an output material per volume of a recycling process are framed as determinants of feasibility as they are compared to primary processing routes. This focus on output-price, however, ignores the dynamics that occur prior to, and in shaping the formation of prices; in particular, the construction of risk and value in the context of transactions between the different actors that participate in the processing segments. Importantly, focus on output rather than process hinders understanding of the supporting mechanisms needed for transiting to a circular economy in which loop closure is one constituent. This paper contributes an analysis of transaction processes in three case studies in which risk and value is constructed in a way that affects loop closure as a first step towards addressing this wider research gap.

At least since the late 1970s, the ideas of circular economy (CE) have been gaining momentum amid concerns about sustainability of material and mineral-dependent lifestyles [

1,

2,

3]. Pearce and Turner [

4] first conceptualized the notion of a CE in ecological economics. Various schools of thought have engaged with it since, including cradle-to-cradle [

5], systems thinking [

6] and closed-loop approaches to production processes that are integral to industrial ecology in which industrial waste serves as input to another industry [

7]. While the understanding of the CE concept has evolved to incorporate different features and concepts from the above schools see [

8], most share the idea of closed loops [

9].

Recently key institutions have advocated for a transition to a CE, which maintains the value of resources, emphasizing durability and circularity, in juxtaposition to the linearity of “take-make-dispose” models [

10,

11,

12,

13,

14]. The annex to the European Union (EU) Action Plan for the CE for instance, outlines actions for “closing the loop” of product lifecycles through greater recycling and re-use which focuses on recycling target increases for municipal and packaging waste, landfill reduction targets and bans, improvements in definitions and calculations of recycling methods, as well as a focus on industrial symbiosis and economic incentives for producing greener products [

15]. In the EU, the CE has also been linked to addressing raw material criticality, and as such critical materials are specifically targeted in the EU’s CE Action Plan in

Section 5.3 [

15].

The European Commission [

16] defines raw material criticality as a material that: (1) faces high risk with regard to access (i.e., high supply or environmental risks); and (2) is of high economic importance; such that there is a risk of interruption of supply that could significantly affect the economy. Both the U.S. [

17] and EU assess criticality regularly and since 2010 have compiled lists of critical materials which both include rare earth elements (REE), which includes 14 of the 15 lanthanide elements (promethium is not assessed), yttrium and scandium [

18]. A subsequent EU assessment [

19] further grouped heavy (HREE), light (LREE) and scandium. The EU also launched a European Rare Earths Competency Network (ERECON) to examine how the supply chain for rare earths can be strengthened [

20]. One of the working groups within ERECON was specifically focused on EU REE resource efficiency and recycling, highlighting the link with CE strategies that could potentially mitigate such risks through eco-design and closing material loops for critical materials.

An understanding of the materiality of our economies is essential to closing the loop of materials and needs to extend beyond a physical-material focus. The Multi-Stakeholder Platform for a Secure Supply of Refractory Metals in Europe [

21] argues that a “valorization of the resources” is required through “coordination and networking between researchers, entrepreneurs and public authorities”. However, CE research still largely emphasizes physical flows [

22]. A lack of analysis of social and institutional factors constitutes a barrier to further development of the CE [

23]. Reck and Grædel [

24] stated that social behavior poses one of the limitations for closing material cycles. Without the social dimension, the “

how”

and “

why”

of materials flows remain unanswered. These questions need exploring to understand how metal recycling rates can be improved [

25].

Studies based on methodologies centering on physical flows cannot explain why material loops are frequently not closed even when there are demonstrated stocks and technological feasibility is proven at lab-scale. What is required is an understanding of the interaction between individual actors in the market [

26]. This involves opening up the “black box” of the firm to study “circulation processes” [

27]. Barriers and enabling factors for facilitating such flows can then be identified along with the socio-institutional change required to transit to a CE [

28]. Risk–value constructions may play a significant role in circulation processes, even more so if these concern the reintroduction of material into processing loops [

29]. Lepawsky and Billah [

30] make an appeal to the value chain and network scholars to rethink how the capture and creation of value is theorized, proposing that “waste” and “value” be thought relationally.

This paper aims to progress interdisciplinary understanding for scholars, researchers and policy-makers on two aspects. Firstly, it offers an insight into how industrial actors conceive of a risk, an object at risk and form a relationship of risk between the former two at specific segments of a chain/production network. Secondly, it explores how this constructed risk emerges amid governance structures that form in transactions, revealing some of the power dynamics at play. To achieve this, the paper brings the governance structures of the global value chain (GVC) conceptual framework [

31] into conversation with the relational theory of risk [

32]. This serves to showcase how a focus on transactions in the GVC can bring about useful insights for policy and it reaffirms the social construction of risk. In so doing, the paper aims to create an understanding of how and why governance structures and risk communication decisively influence whether or not REE-material loops are closed.

The REE have manifold uses in applications spanning civil, industrial and military use, as components or dopants due to their specific chemical and physical properties. Close to ten different industrial sectors have been delineated that rely on REE input [

33]. Among the most widely cited REE uses are permanent magnets, as well as applications that draw on the fluorescent properties of REE, such as (background-) lighting, including in housing but also in electronic equipment that relies on screens, such as computers, smart phones and tablets.

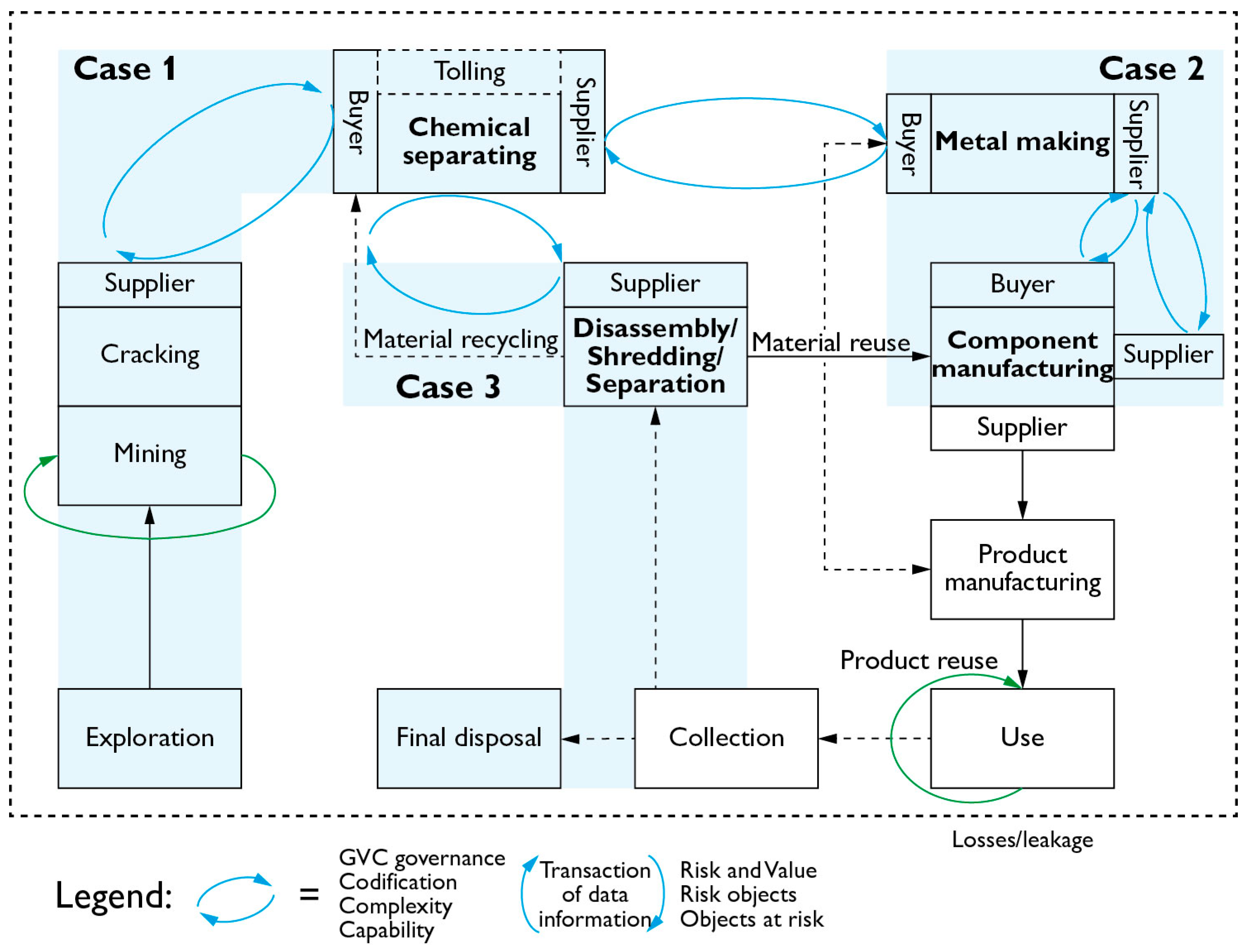

Empirically we examine the relevant GVC segments for three REE recycling case studies. The first case study is that of a proposed chemical separation facility. The second is magnets and the third phosphor powder from EoL lamps (which contain mostly HREE including terbium, europium, yttrium but can also include LREE such as cerium, to a lesser extent). Both magnets and phosphors from lamps are specified as REE priority sectors in ERECON [

20]. Our conceptual lens is applied to each in order to explain how industrial actors construct risk at these segments and why loops are not closed despite available, lab-scale tested recycling technology and support from publicly-funded projects. As Balomenos [

34] outlined, the EU spent close to 90 million EUR on REE projects over the past five years leading up to 2017. Binnemans et al. [

35] cite the improvement of REE recycling as “an absolute necessity” for reasons of their supply risk, economic importance, and the “balance problem” and Binnemans [

36] recommends legislative adaptation of recycling directives to account for minor metals. In light of a demonstrated potential for recovery of REE in anthropogenic deposits [

37,

38,

39], the reason for low REE recycling rates is framed as “a lack of incentives” [

37,

40,

41,

42]. Questions of risk and value have recently begun to be explored in relation to steel and REE respectively [

43,

44,

45,

46,

47]. However, this is the first paper to apply the relational theory of risk to empirical evidence from the REE industry and to systematically analyze the construction of risk–value relationships in the context of forming governance structures as transactions take place in the GVC of REE.

The paper is structured into six sections. In

Section 2, we describe the conceptual elements that underpin the development of our analytical framework.

Section 3 describes the methodology and in

Section 4 we analyze three empirical cases from the REE-industry. In

Section 5, we offer a discussion and we conclude in

Section 6.

2. Linkages, Boundaries and Risk: Exploring the How and Why of Material Flows

From a (bio-)physical perspective, the transformation of geogenic into anthropogenic resources involves numerous segments at which processing occurs, including the transformation of mined mineral-containing rocks to beneficiated minerals, to separated elements, components and their assemblies, to final products, their collecting, sorting and reintroducing into material transforming processes. At the minimum, some of these segments represent the baseline for mapping material stocks, processes and flows [

48] such as, in its broadest sense, in input–output/material flow analyses (MFA) [

49,

50] but also in studies of a global scale [

24]. However, flows of resources and materials do not just occur. They result from decisions made in multidimensional interaction. This interaction may involve different actors, namely individuals, usually associated with a firm, which activities are tied to the segments in which transformations of resources into materials and reprocessing take place.

Global Value Chain (GVC) analysis explores and analyses the interaction of firms, specifically their transactional characteristics, at particular processing steps or so-called segments. It is a parallel school of thought to Global Production Networks (GPN), which also originates in studies of commodity chains and world systems theory [

51]. Questions such as how and why materials flow in a particular way and who is affected advantageously or disadvantageously by these flows are central to GVC analysis. The GVC framework therefore enables us to identify where loopholes exist for material loop closure. In addition to mapping the input-output structure of particular GVCs, a focus is on delineating the geographical location of a segment of transformation. This is a central feature, as it reveals the geography of material flows, as well as market shares in specific segments of the GVC of particular countries and their firms. Lepawsky [

52] demonstrates the limitations of statistical analysis of Comtrade data for explaining e-waste trade networks, specifically for understanding, “

the purposes for which such trade occurs or the end to which the commodity so traded is put (e.g., final disposal, reuse, recycling or recovery)”, and emphasizes the importance of empirical studies.

While the mapping of activities provides a macro-perspective of particular GVCs, the scholarly and policy discourses could benefit from connecting this perspective to the meso- and micro-level analyses to understand how different geographical outcomes arise. This is where the conceptual framework of GVC can assist: GVC analysis places emphasis on governance. It is a central conceptual and analytical element of GVC analysis, and, put differently, rests on an identification of forms of coordination and control among firms. Specifically, decisions on material input and output at GVC segments are informed by governance structures and affect manufacturing process and End-of-Life (EoL) product handling, including recycling. Governance structures are key to gaining an understanding of how material loops can be closed.

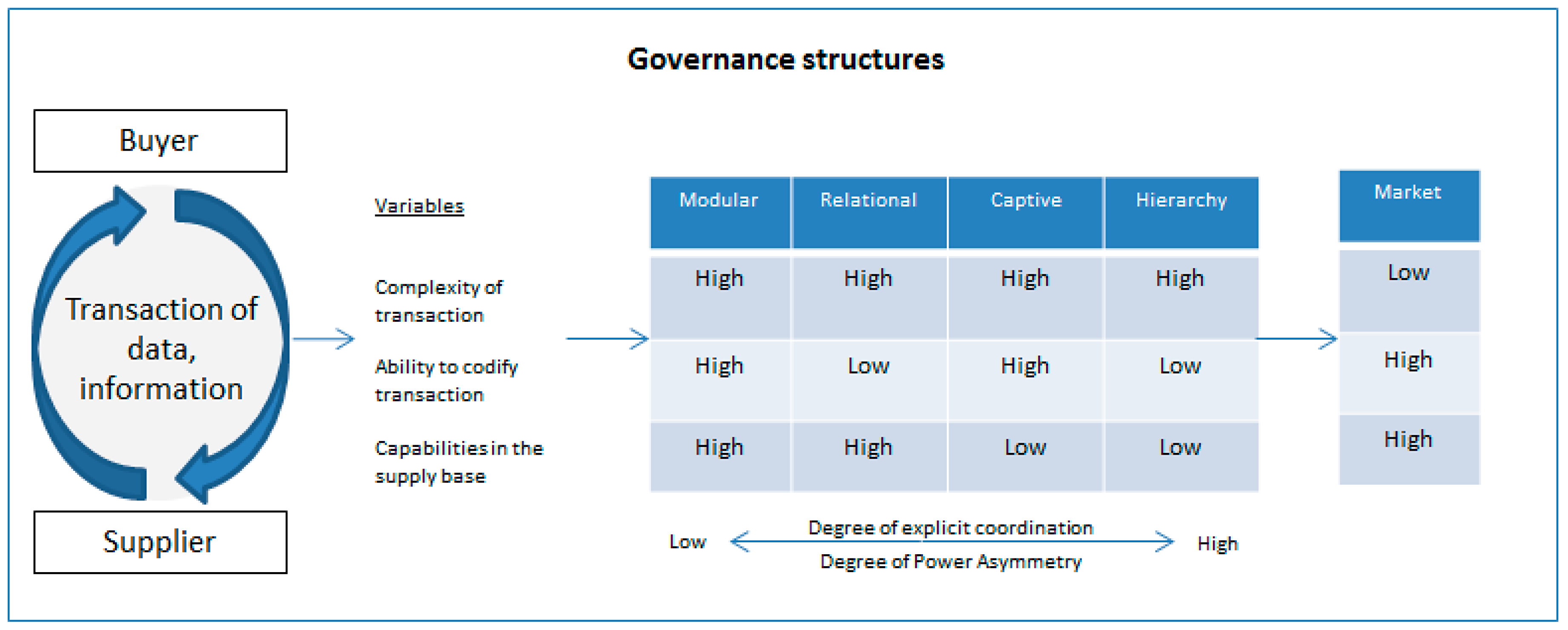

The GVC framework enables an analysis of how these forms of coordination and control come into place [

31,

53]. It provides three variables for a given transaction between a buyer and a supplier to examine how a transaction takes effect: (i) the complexity of the transaction; (ii) the ability to codify transactions; and (iii) capabilities in the supply-base (see

Figure 1). These GVC variables are allocated a high or low value to derive five governance structures, as depicted in

Figure 1. Market and hierarchy structures are at the extreme ends, where price determines a transaction at the former and the acquisition of one firm by another defines the latter. Essentially these structures define the limits of transactions i.e., whether these are effectuated within firm boundaries, among particular firms, or, in principle, accessible for all potentially interested firms in a national or global environment. The latter also gives rise to the regulatory framework, the fourth analytical dimension of the GVC framework. In between these extreme forms of coordination and control are network forms of governance—modular, relational and captive structures—in which the buyer–supplier interaction is seemingly less skewed towards one actor of the transaction [

31].

Recycling activities have become the subject of scholarly focus as these appear to be underpinned by dynamics different to those known from conventional linear models. Crang et al. [

54] challenge the accuracy of the described governance forms for different supply–demand dynamics in recycling activities, i.e., as supply arises independent of, and not in response to demand when products reach their EoL and are reintroduced into material cycles through reuse or recycling. The authors demonstrate the prevalence of brokered forms of governance in recycling networks, the “co-ordination from the middle by brokers”, tied to the “heterogeneous materiality” of used goods [

54]. Lepawsky and Billah [

30] showed that the trade in EoL electronics lacks the formal systems of control that standardize the commodity in terms of quality or that adjudicate disputes in cases of unsatisfactory exchanges. They emphasize the significance of “personal attention” by Bangladeshi rubbish electronic importers to their shipments. The prevalence of brokers [

54] and the “personal attention” to shipments of waste electronics [

30] point to a form of coordination and control with similarities to the relational governance structure. The observations of these authors also imply that some risk–value construction linked to the quality of the materials in a particular transaction is considered by brokers to be worth managing.

The presence of product or process standards can alleviate this risk, as empirically demonstrated and manifested in the market and modular governance structures of the GVC framework. As Humphrey and Schmitz [

55] (p. 23) pointed out, “

the main reason for specifying process parameters along the chain is risk”. As firms engage in non-price competition, these performance risks augment [

55]. These performance risks include continuity and consistency of supply, and the conformity of a product to a standard [

55]. Standards have the potential to determine the transactional characteristics, particularly in market and modular governance forms of the GVC framework where there is a specific point of transaction, in other words, a clear handover point between the buyer and the supplier. In the networked governance forms, a transaction continues to center on the provision of information as well as price. Gregson et al. [

10] emphasize the importance of quality outputs from recycling processes and the challenge in meeting quality standards for recyclates. In a study of the recycling of steel from demolished buildings, Santos and Lane [

29] suggest that the lack of standards for EoL construction materials, which would “express” their material quality to suppliers and clients, is a significant barrier to their reintroduction into material processing. Their point echoes that of Crang et al. [

54] who further emphasize that standards and the related classification of goods and materials as hazardous waste, affect the movement of recycled goods by mandating particular forms of processing. Santos and Lane [

29] (p. 46) conclude that the building construction regime is characterized by “a particular set of practices” which excludes reused steel components. Transactional characteristics, such as those discussed on certain industries, in which risk and value considerations are constructed, may shed light on particular practices and help to explain the lack of material loop closure.

In this paper, we therefore combine the governance structures arising in transactions with the relational theory of risk [

32] and apply this to our REE case studies. The aim of this marriage of two theoretical frameworks into one is to support the specific objective of this paper, namely to inform on the pre-price forming dynamics in transactions between a buyer and a supplier of material. The transaction is key to both the governance structures as well as to the risk construction, where the transaction is that of information and data.

The relational theory of risk builds on the work of Hilgarnter [

56] who argued for a shift in focus from asking “

What is risk?” to “

How do people understand something as a risk?”, and on similar arguments developed other scholars of risk [

57,

58,

59]. This constructivist perspective of risk, which focuses on how risk is constructed by the various actors, takes risk assessment as an inherently normative evaluation [

32,

57]. Importantly, the description of a risk object—which may take the form of a physical, cultural or social artifact—necessarily involves ascribing it “some value” [

32] (p. 177). Corvellec [

60] also argues that value is derived from organizational practice which coincides with the theoretical underpinnings of the GVC framework.

In the risk taxonomy [

61] (

Figure 2), we situate the relational theory of risk [

32] predominantly in the upper right corner of the systems and cultural theory. Systems theory, most prominently argued by Luhmann [

62], works with risk as a social construct, alongside the importance of system boundaries and the focus on the “communication between systems” [

61]. Cultural theory also works with risk as a social construct and places analytical emphasis on cultural patterns, and therefore extends beyond the focus of this paper. The relational theory of risk [

32] also seems to point to a link with the social amplification of risk, namely that of causal relations and the integration of different perspectives of risk, allowing a systematic analysis of empirical findings.

The analytical focus of the relational theory of risk is the communication in which risk is semantically created [

32] (p. 186). This is also emphasized by Howes [

63] who noted that “

risks are partially socially constructed by discourse”. It places the actor center-stage to explain the dynamic of how risk is constructed by drawing on a “tripartite deconstruction of risk elements” namely the semantic networks that contain “objects at risk”, “risk objects” and “relationships of risk”, and their evolvement over time and in space [

32]. These three elements are further explored hereafter.

The risk objects are characterized by a fluid, dangerous identity. Risk is introduced into the social space when an object is designated as risky from which it swiftly becomes independent while remaining tied to social practices and representations [

32]. As societies evolve, so does understanding and formulation of values as well as of dangers with the result that the definition of risk objects also changes.

The objects at risk are endowed with a value at stake. Here the reference to value bypasses moral judgment of good or bad, moving to “something that is held to be of worth” and might be nature, life, principles or a state of affairs. This is in stark contrast to presenting value solely as a monetary unit. Boholm and Corvellec [

32] (p. 180) pinpoint that “

objects at risk are constituted around traits such as value, loss, vulnerability, and need for protection”. Thus, designating an object at risk is equivalent to assigning value. Allwood et al. [

1] acknowledge the involvement of a wider range of values in their work on material efficiency. Bocken et al. [

64] also consider the value proposition between and amongst different stakeholders, including network actors (e.g., firms, suppliers, etc.), customers, society and the environment. This is useful in demonstrating how values can be allocated or traced amongst different stakeholders.

At times, agreement in society is reached about what is valued, and what objects are perceived to be at risk, and how, taking a normative turn, these should be protected. It is here where government, including with its legislative arm, plays a significant role [

32] (p. 180). Indeed, there are many established environmental setting targets for businesses to deal with the environmental impacts of their products; for example, eco-design policies (see e.g., [

65]), top-runner programs (see e.g., [

66]) and extended producer responsibility policies (see [

67]). This is reiterated by Porter and Kramer [

68] who recommend that governments learn how to regulate in ways that enable, what they define as “shared value”. Notably, Porter and Kramer [

68], while presenting some interesting criticism of neoclassical theory, specifically that of Milton Friedman, continue to work with a growth paradigm in which economic and social progress, are separate phenomena, a clear friction with the theoretical underpinning of this paper where these are inseparable. In this paper, individuals are viewed as engaging in transactions, independent of whether they represent a firm, a customer, a government or are associated with another organizational form. When Gereffi and Korzeniewicz [

69] first conceptualized commodity chain analysis, they were partially inspired by M.E. Porter [

70], specifically his “value chain” as opposed to “value added” notion which allowed an exploration of linkages among economic activities. Gereffi and Korzeniewicz [

69] merged these elements with some from sociology to add explanatory potential to the framework for the different socio-economic outcomes of what is now known as global value chains in the field of economic geography.) They specifically point to regulatory measures that work with attainable, yet ambitious targets rather than prescribing a particular mode of reaching these. However, critics of Porter and Kramer point out that reaching consensus in practice might be more difficult, not least because of the complexity of value chains and how systemic problems are perceived by organizations [

71].

Both popular and scholarly narratives can galvanize societal agreement on the object of value and at risk, as well as the approaches towards protection. This is evident in the shifting narratives that frame materials as either useful resources or waste [

72]. Another example is the classification of resources into either primary or secondary materials versus a singular category that embraces both. Moreau et al. [

23] refer to geogenic and anthropogenic resources while Mueller et al. [

44] do not emphasize origins of resources but turn to the issue of “accessibility” of resources. Similarly, the term “stocks” in industrial ecology bridges the natural and the social when, for example, stocks of metals are examined. Here, the term “urban mines” enables a comparison of anthropogenic stocks to geological occurrences. Interestingly, it is here where the different ontologies of the social- and material-/natural sciences come to the forefront. These examples pinpoint scholarly efforts to create narratives to bridge rather distinct worldviews between schools of thought, i.e., whether a particular geogenic occurrence exists without human interference, and is therefore “natural”, or whether it exists solely because of human action, as we “socially construct” it by conceptualizing, describing, and classifying.

Striving towards a co-existence of conceptual understandings seems to offer most positive outcomes, especially as any discourse will inevitably transport particular values of any school of thought participating in it. In other words, when interdisciplinary discourses turn to depicting value including in distorted conceptualizations of the GVC, more often than not, the default understanding will be that value is reflected as the price of a material (and other value, i.e., environment remains vaguely associated).

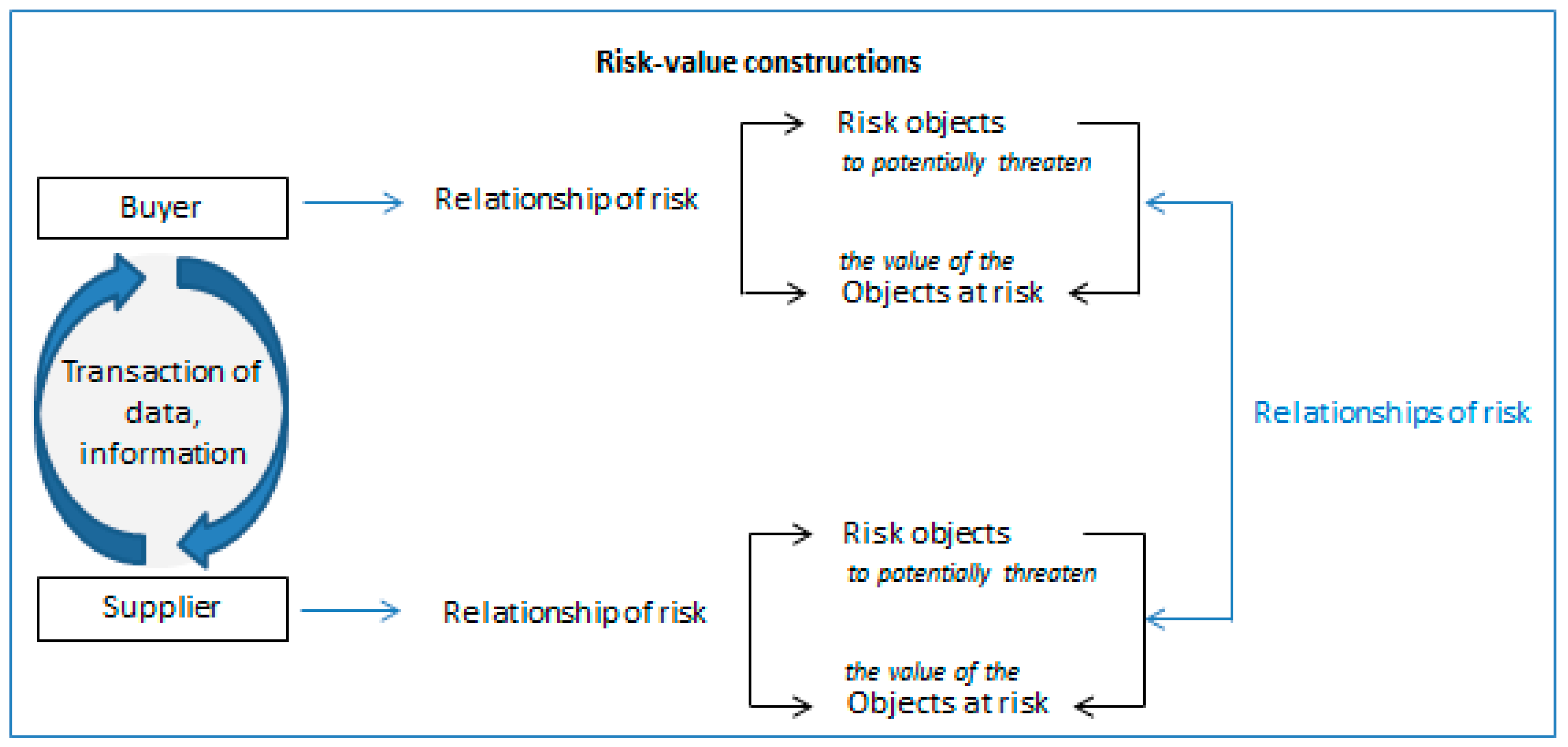

Relationships of risk are observer established, see

Figure 3: When an observer constructs “a link” between a risk object and an object at risk, whereby the former is understood as potentially threatening the value of the latter, then a relationship of risk is present [

32]. Critical to the conceptualization of the relationship of risk in the relational theory of risk is understanding that the relationship is a construct. It needs to be made and crafted, and this process occurs by “

semantic association between objects” [

73].

Examples of these constructions are models, laboratory tests, narratives or probabilities [

32]. The parameters of risk relationships are contingency, causality and action and decisions to act. Exploring these parameters in more depth leads firstly to the “What if?” question which is central to the relationship of risk, and contingent in as far as risk describes a potentiality of occurrence rather than a certainty. Secondly, it is evident that the relationship of risk needs to establish the causality between the risk object and object at risk. Thirdly, action and decisions to act are key to the relationship of risk. As Boholm and Corvellec [

32] (p. 181) put it, “

Risk is conditioned by a modern will to know that remains welded to a will to decide and act under conditions of uncertainty”. It is the assembly and reciprocity in the form of a causal-contingent relationship that allows risk to be established. The continuous reframing and redefinition shapes relationships of risk, as well as the coexistence of various relationships of risk that reflect diverse views, cultures and knowledges embedded in society. Thus, as Boholm and Corvellec [

32] (p. 182) summarize “

What is a risk object for some can be an object at risk for others”.

3. Methodology and Data

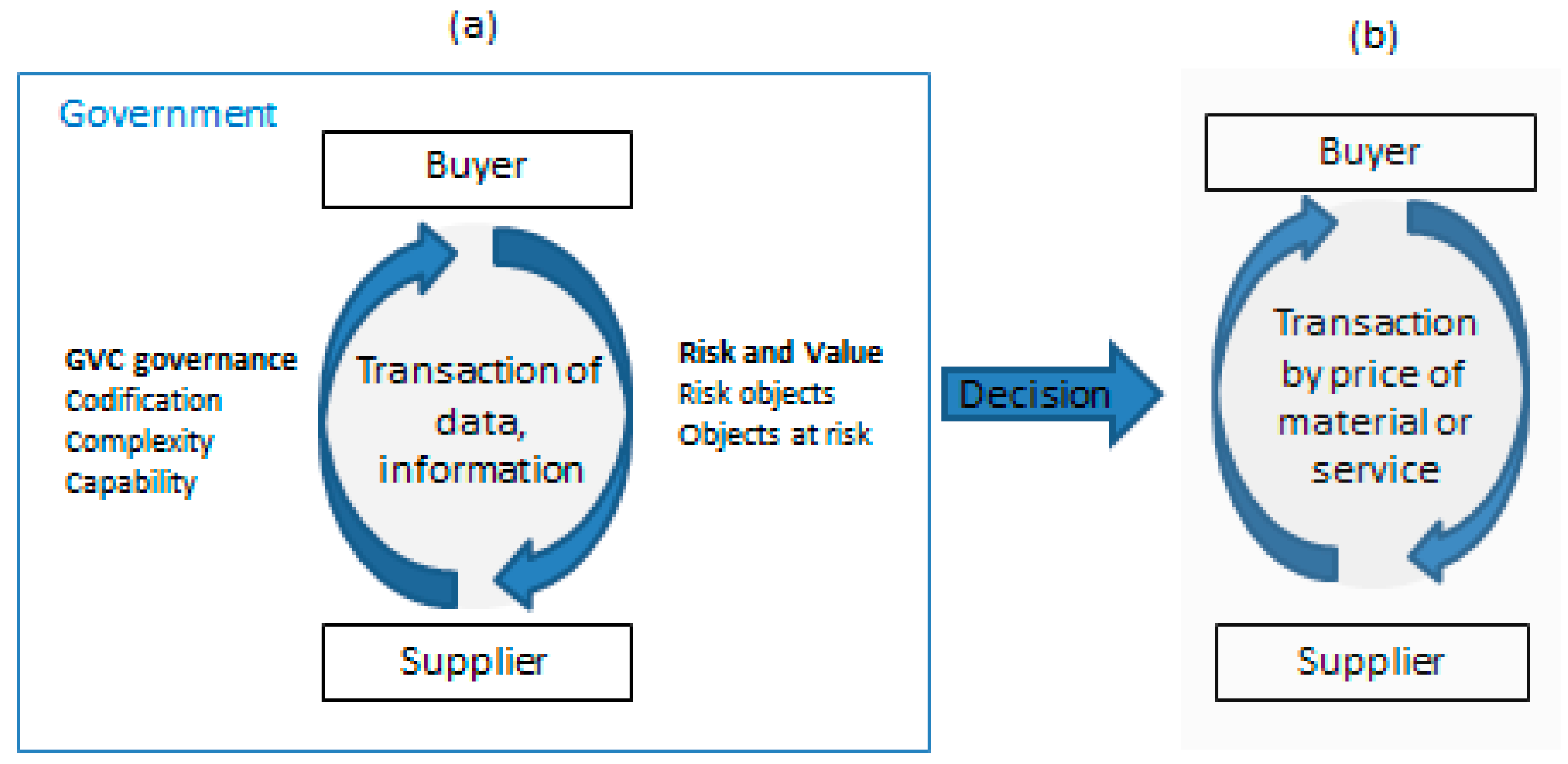

Our analytical framework is built from the conceptual elements of governance derived from the GVC framework, and from the risk–value constructions of the relational theory of risk [

31,

32]. We conceptualize both of these elements as arising in transactions of data and information between interacting individuals or entities, here simplified as the buyer and the supplier. The transaction occurs prior to a (contractual or informal) agreement to exchange a material, product or service, see

Figure 4a,b, with the former (

Figure 4a) illustrating the analytical and empirical focus of this paper. Thus, rather than a transaction based on an established price, the focus in this paper is on the transaction of data and information that occur prior to and shape a price, in light of GVC governance and risk and value constructions.

This transaction simplifies one interaction at a particular segment in which a processing activity occurs that requires an input and an output. As the buyer and supplier exchange data, information is built up on the extent to which the material or service desired can be codified for a “handover”, this process is represented in the GVC governance variable “codification of transaction”. The exchange of data also provides insights into the “complexity of the transaction”, the second GVC governance variable. As the parties exchange data, information builds up that enables them to gather an overview of the respective “capabilities” of the transactional partner, the third GVC governance variable.

The exchange of data between the partners is suggestive of their perception of its value, and thus, in line with the relational theory of risk, they are simultaneously constructing relationships of risk, by identifying risk objects and objects at risk. These constructed risk relationships at the buyer and supplier interaction might con- or diverge from each other. In conjunction with governance structures, they determine whether material loops, such as of REE, are closed in practice. When a positive decision is made, a risk relationship was constructed by either partner that matches that of the other providing a foundation of a stable risk relationship that allows a transaction of a material or service to “materialize”, as shown in

Figure 4b. This conceptualization speaks to that of Lepawsky and Billah [

30] (p. 126) who convincingly argue for recognizing, “value as in-the-making rather than an intrinsic property of things”.

Our methodology follows the analytical framework elaborated above and is inspired by the relational theory of risk which emphasizes the importance of the “lived-in world” as opposed to the “intangible world of concepts” that define risk [

32]. Thus, the relational theory of risk focuses on examples of “communities of practice” [

74] or of “organizational contexts” to “concretize the study of risk objects, objects at risk, and relationships of risk” [

75,

76]. In so doing, it underlines the importance of empirical case studies for creating an understanding of risk.

On three empirical cases we demonstrate how the construction of risk affected the implementation of business plan conceptualizations and lab-scale tests of new technologies and why risk in REE-loops needs to be targeted with governmental response for transparent material characterization. We delineate the governance forms that appear to determine the particular transaction at the segments which are subject to our observations of construction of risk. We then describe the situated view of each concerned actor on the “risk object” and “object at risk” to explore the nature of the actors’ observed “relationship of risk”, i.e., whether it is considered “stable” or “unstable” and with which effect for loop closure. This narrative is guided by our analytical framework.

Our data consist of empirical material, specifically transcripts of interviews conducted between February and June 2017, in addition to empirical evidence gathered since 2012, and literature reviews that include websites of start-up firms in the REE industry and of EC-funded REE-focused research projects on which industry developments are discussed. Some of the semi-informal interviews with industry representatives arose from simple requests for information and clarification in the course of the preparation of a research proposal that aimed at closing REE-loops in practice. This is an important aspect of the data collection, as this approach enabled data collection that, retrospectively, proved highly useful in shedding light on the daily practices of businesses and, importantly, also on the narratives defining their daily practices, in addition to the organizational context of a particular firm.

The analytical variables of the global value chain (GVC) framework—complexity of a transaction, ability to codify a transaction, capability of the supplier—support our assessment of the transactional characteristics, i.e., the governance structures between a buyer and supplier at the segments of our empirical cases. We assess whether a given transaction is characterized by a “low” or “high” complexity, whether the information transferred is easily codifiable or not, i.e., when product or process standards are present, or procedures established, and whether low or high capabilities to execute the transactional requirements are observed at the supplier (and buyer).

We then draw on the three elements—risk object, object at risk, and relationships of risk—that constitute the relational theory of risk, as described earlier, to create an understanding for policy-makers and scholars alike of the risk communication at selected REE-value chain segments, as well as of governance structures, and how these affect the possibility of closing REE loops. To substantiate this approach with pragmatic entry points for action, we follow the proposal of Boholm and Corvellec [

32] (p. 187), that the key to successful risk communication is establishing “

a common understanding of what constitutes a threat, a value, a contingency, and a causal relationship”. This methodological approach provides us with the means to depict the sequence of narratives that impact significantly on, for example, the translation of proven technologies for REE recycling, of which many have arisen over the last few years at sub-commercial scale, to testing these on a commercial-scale for market-readiness.

4. Findings

China, as dominant REE-supplier, was identified by both government and industrial actors as the risk object in the aftermath of REE-price peaks of 2011, and the continuous accessibility of stable-priced separated REE products as the object at risk. A stable relationship of risk was constructed between governments in the EU and in the US, and a common object of risk agreed upon that was evident in narratives of “supply risk”. In response, many publicly funded projects have developed technologies for REE-separation and recycling on a lab-scale (see i.e., EC-funded FP7 or H2020 projects such as [

77,

78,

79,

80,

81,

82,

83,

84]) and the potential for recycling was discussed (e.g., [

37,

85,

86,

87,

88,

89]). Surprisingly little progress occurred from lab-scale tests of the technologies to commercial implementation.

With continuity of China as dominant REE-producer and user, supply risk (notably from registered, documented sources of production) of the REE remains unchanged. However, the REE prices have changed: Since the 2011 REE price peaks they have returned to or even dropped below pre-peak levels [

78] (p. 135). It is proposed that prices are the reason for struggles of REE firms in Europe [

36]. Is it possible that price developments alone are the single reason for why the publicly funded and developed technologies are not transiting into commercial life and are not pursued to close loops of REE? This explanation appeared to be too simplistic given that risk–value constructions occur prior to price formation. As the purpose of initiating many of the projects was to mitigate risk, and this risk arguably remains, closer examination is warranted.

The case studies of specific GVCs of REE reveal insights into numerous complexities: The REE value chain is global and multi-layered with numerous actors interacting at each segment, inevitably bringing a myriad of data and information together in any given transaction prior to reaching agreement for the actual exchange of a material or service, or both, based on price and, in some cases, information accompanying this exchange.

Figure 5 delineates a stylized schema of the global REE value chain segments in which the three empirical cases to be discussed in the following sections are highlighted.

4.1. Case 1: Construction of Risk Relationships for a REE-Tolling Station

Chemical separation is a key segment in the global REE value chain, both in processing of the rocks and of EoL material for closing a loop. Its outputs are individual separated REE, such as oxides of praseodymium, neodymium, dysprosium or europium. Commercialized technological processes for chemical separation are tied to high capital- and operating expenditures (CAPEX, OPEX) and require cross-cutting knowledge of mineralogy, geology, chemistry and metallurgy. The purchase of both batteries and annex equipment for the liquid-liquid extraction (i.e., solvent extraction (SX)), and induced equipment (e.g., for specific effluent treatment) constitute major CAPEX [

90]. OPEX stems from the use of energy and solvents (including losses), handling and storage of radioactive material, effluent treatment and taxes for discharge streams.

From 2012 to early 2016, when REE-industry participants anticipated another imminent rise in REE prices, the discussions on mitigating a potential REE-supply risk centered on the idea of establishing particular organizational structure, referred to as a tolling station. This station had the aim of minimizing the CAPEX a single firm would need investing for a plant infrastructure. It was conceptualized as a centralized facility operated by a consortium of mining companies and end-users, see [

91] (p. 59). The tolling station would provide chemical separation services by processing a mixed REE solution (salts/oxides/chlorides/nitrates), the output of a flotation process, from numerous suppliers of different REE-containing ore into individual REE, complying with quality requirements of potential buyers.

In addition to the government regulator, four actors come together with interests in the processing segment of chemical separation (see

Figure 5 for the processing segments and notes on the GVC of REE): the exploration firm (which seeks to sell its developed deposit to a mining firm), the mining firm (that delivers the input of REE-minerals and conducts in many cases also the cracking of the REE-mineral into a mixed REE solution), the chemical separator (which separates the REE-minerals into individual REE products), and the customer (often a metal maker, which uses the individual separated REE product).

In the transaction between the mining firm selling the REE-containing rock and the chemical separator buying it the ability to codify the transaction is high as it is limited to the knowledge gained from assaying the mineral cores of the drilling programs along with other information from the bankable feasibility study, both of which can easily be exchanged. There is a degree of uncertainty as to the exact composition of each mineral concentrate. However, the complexity of this transaction is low as no additional information needs to accompany the handover of the mineral concentrate. With a view to the capabilities at the supplier end, they are high when it comes to producing a mineral concentrate from an ore that has already been commercially processed in the past. These characteristics of the transaction suggest market governance determined by price, summarized in

Table 1.

However, if the REE-bearing ore has not yet been commercially processed, as would be the case for a tolling station that buys from several REE-bearing deposits that have not been mined previously, the characteristics of the transaction change to one in which the complexity of the transaction is high, as coordination needs arise between the various suppliers of the ore to the operator of the central tolling station. The ability to codify the transaction would be low, as information in addition to price must be exchanged. The capability of the supplier would also be low as it is no longer the individual capability of one supplier but the aggregated capability of the suppliers that must be accounted for. This suggests a hierarchy governance form in which the actual integration of chemical separation with the mining firms is most feasible. This decision-making process for or against entering into such a transaction on either side (supplying mining firm and buying chemical processor and operator of a potential tolling station) gives rise to the construction of risk–value relationships, described hereafter.

As exploration firms eagerly worked towards bankable feasibility studies for their respective REE-bearing mineral deposits, their focus was on attracting customers to demonstrate the feasibility of their business plan to mining firms. The latter would then be willing to purchase their developed mineral deposit, as mining is rarely an activity exploration firms pursue, see [

92]. Thus, their business plan development centered on establishing integrated chains from exploration and mining to chemical separation (see [

33,

93]), when they realized that customers had an interest in separated, individual REE products. REE-mineral mining was therefore to be combined with further processing of the minerals.

The exploration firm with rights to explore deposits, e.g., in Australia, Canada and Greenland, perceived the inexistence of independent

chemical separation facilities outside of China as a

risk object, and the resulting dependence on Chinese suppliers for

individual REE oxides, the output of chemical separation plants, as the

object at risk ([

91], p. 59). The mining firm agreed in principle with this conceptualization of elements in the construction of a risk relationship, while acknowledging that its business portfolio and expertise commonly remains limited to mining and physically beneficiating the minerals. Therefore, the mining firm relies on the chemical separator and customer (metal maker) to confirm the proposed risk relationship of the exploration firm.

For the chemical separator in the EU, the

risk object is

access to REE-ores under tight regulation in China, and the

object at risk is its business activity of

separating REE-minerals into individual REE products. The action that was taken in response to this risk relationship was the establishment of plants in China, where major REE-demand originates. This took the form of, e.g., joint ventures with local firms (see [

33]).

The tolling station concept would provide input from different REE-mineral deposits, and here, the chemical separator would see the risk object as the properties of the minerals fed into the separation process, with the object at risk being the cost structure of its operation, and thus, of its final product, the individual REE elements. This argument rests on the significance of the correct choice of the solvent for a cost-effective separation, followed by the selected technology and the number and fixed sequence of REE to be individually separated.

The risk relationship portrayed by the exploration firm is unlikely to be confirmed by the chemical separator who has already mitigated against the risk relationship with plants in China which also represents a major growth market. Further, the separator appears to perceive the risk relationship for the tolling station as unstable, framing the risk relationship differently to the exploration firm, in the context of REE-industry dynamics in which China continues to play a dominant role and where undocumented production accounts significantly distorts of REE market prices and affects the willingness to invest.

The customer of the individual REE products in the EU, i.e., a metal producer, perceives the risk object as the limited supply channels outside China from which individual REE products can be sourced and the object at risk as its continuous supply of high-quality REE products at stable prices.

In response to this defined risk relationship, the user has taken steps to relocate manufacturing activities to China, in addition to engaging in in-process recycling of REE-materials with its customer, i.e., a magnet manufacturer (see next empirical case). Thus, while the customer shares a common risk object and object at risk with the junior exploration firm, the customer appears to have taken measures to address this risk relationship.

With regards to the proposed tolling station, the customer sees the risk object as the adaptation of the separation process required to accommodate REE-mineral types, and the object at risk as its standards of high purity for the individual REE products. Lab scale tests of the adaptation of the chemical separation process, or new technologies tested at lab scale are unlikely to provide sufficient assurance that the risk is sufficiently addressed.

While the definition of risk object and object at risk by the exploration firm would have in principle approval from the various actors, the differing conceptualizations of the elements of risk by the same actors and their mitigating actions, a common risk object cannot be defined. Thus, the communication of risk is unsuccessful. This may explain why the push for a tolling station has stalled.

4.2. Case 2: Pre-Consumer REE-Magnet Recycling

At the magnet manufacturing segment three actors come together: The magnet manufacturer who purchases a REE-magnet alloy, the metal and alloy producer, and the customer who purchases the REE-magnets. Between the former two the governance form that arises is modular in that the specifications for the metal required are easily codified, including by standards that incorporate material performance qualities. Nonetheless, the complexity of the transaction is high since many performance criteria need to be met. In the context of a very capable supplier, the metal producer, the complexity of the transaction can be handled without problems, as the metal producer possesses the knowledge that enables the codified transaction [

94,

95].

In contrast, when it comes to closing material loops, the ability to codify the transaction of scrap magnet metal, a byproduct of shaping the magnets into the form desired by the customer, is low. The complexity of the transaction between the magnet manufacturer and the metal maker is high, as the highest possible level of detailed information must be exchanged between the two actors in the transaction. This includes for instance confirmation that only sintered magnet material is being returned, as bonded magnet material includes epoxy that poses a contamination risk for the material streams of the metal producer. Further information on the type of magnet alloy, i.e., the composition of the alloy including REE content, is useful in the exchange. The capability of the supplier is high in as far as the magnet manufacturer is a competent partner in the transaction who understands how the magnet alloy should be handled and what type of information facilitates a successful transaction that will deliver new REE-containing metal alloys in return. These characteristics of the transaction suggest a relational governance form in which coordination between the transactional partners is required although they are still relatively independent from each other. However, there has been a clear change in the type of governance structure from the first, conventional linear transaction under modular governance, to that of closing the loop with pre-consumer recycling and relational governance due to increasing coordination needs. The characteristics are summarized in

Table 2.

For the magnet manufacturer, the risk object is the availability of a high-purity REE-metal alloy and the object at risk is the accessibility and stability of the price of this alloy over time. For the supplier of the metal-alloy, the risk object is as described in the previous section, the limited supply channels outside China from which individual REE products can be sourced, and the object at risk is its continuous supply of high-quality REE products at stable prices to the buyer.

To mitigate the established and agreed risk relationship by the magnet manufacturer and alloy producer, the latter communicates the risk to the magnet manufacturer who loses material in the manufacturing process from out-of-spec magnets or from shaping the magnet. The REE-magnet manufacturer provides REE-material for reprocessing to the REE metal producer. This REE-material is solid sintered material and re-melts well and cleanly. The REE-metal producer reprocesses it in batches of material belonging to a particular REE-magnet manufacturer and, while it may be of different compositions, a first-stage melt is conducted to understand the composition (and adjust it accordingly, if needed) and then blend it with 70% of virgin material to produce a new metal alloy for the magnet manufacturer.

The REE-magnet purchasing customer frames its risk object as the REE-alloy used in, and the manufacturing process itself, of the magnet, and the object at risk as the accessibility, price and performance according to magnetic standards of the magnet purchased.

4.3. Case 3: REE Recycling of End-of-Life Lamps

While REE are found in many End-of-Life (EoL) electronics, commercial recycling of REE from this source has so far only been technically and economically feasible for a select number of product groups, including fluorescent lamps. However, before EoL lamps can be processed for recovery of REE, lamps must first be collected. Collecting and environmentally sound recycling of lamps is a net cost for recyclers, making it unlikely that this will happen beyond small-scale voluntary initiatives without legislation [

46]. Extended producer responsibility (EPR) schemes in EU countries is mandated by Waste Electrical and Electronic Equipment (WEEE) legislation, which requires collection and recycling infrastructure for EoL lamps (fluorescent and LEDs) and specifies at least 80% of collected mercury lamps must be recycled and mercury removed. EPR schemes involve multiple actors including national authorities, local municipalities, producers, retailers, local waste management companies, specialized recyclers, and consumers who engage in multiple transactions enabling the physical, financial, and informational flows that underpin EPR schemes (see [

47] for an overview of actors and transactions in EPR systems for lamps in the Nordic countries).

While collection of EoL products is a necessary precondition to recycling of REE from these products, the focus in this case is on the decision to recycle REE from lamps, not on the collection decisions. The main actors influential in this decision are lamp recyclers who process the initial EoL lamp waste, chemical separators of REE, and producers of products using REE, who are the customers buying the recycled REE. Due to the net costs involved in lamp recycling, recyclers operate in mandatory and voluntary schemes with a focus on sound environmental management of the mercury in the lamps and in keeping recycling costs low. Mandatory WEEE legislation in the EU (as well as voluntary standards for mercury containing lamp recycling) require special processes for removal of the mercury, most of which is generally contained in the phosphor powder fraction along with the majority of REE. Recycling processes also aim to recover glass, metal, and plastic fractions though it can be challenging to find markets for recycled fractions (other than metal) [

46].

The treatment of EoL phosphors for recovery of REE typically involves two main steps (as well as several specific technical process steps): (1) removal of mercury, glass and other impurities from the powder, yielding a REE-rich mixture; and (2) separation of REE mixture into individual REO. Both steps can be performed by the same firm (e.g., Solvay-Rhodia operated a commercial process until the end of 2017, with Step 1 in their Saint-Fons plant and then sent the mixture to their La Rochelle plant) or by two different firms (e.g., there are several pilot projects now performing Step 1 and looking for customers for the REE mixture as is or Step 2 chemical separators). While there can be markets for REE mixtures from Step 1, these have lower market value than individual REOs, however chemical separators able to perform individual REE separation are limited and there are no longer options for heavy REE found in lighting phosphors available in the EU with the closing of the Solvay-Rhodia operation [

96].

The recycled phosphor powder fraction comprises 2–3% of the volume by weight of the total recovered material from the lamp recycling process. If disposing of the phosphor powders, lamp recyclers face costs depending on the mercury content of the phosphor powder and the specific hazardous waste requirements for landfilling or permanent storage (e.g., in salt mines in Germany). These costs are driven by disposal costs in the jurisdiction and can be easily quantified and anticipated, and can be characterized as a market governance form. By contrast, the processing the phosphor powder depends on changing this business practice, finding a chemical separator, and negotiating prices with Step 1 chemical processors (also different lamp recycling processes and input waste yield different phosphor powder mixes, some of which may not be compatible with processes for REE recovery [

97]). The lamp phosphor waste represents a new source of REE with its own characteristics requiring refining processes (Step 1) to be specifically designed. At the same time, the supply is dependent on collection of the EoL lamps and is also influenced by product technology change. Thus, there are several challenges to codifying, such as uncertainties about the capabilities of the supplier and high complexity, indicative of a hierarchical governance form.

The ability of chemical processors to operate, in turn, depends on customers and market values for the REE mixtures and REOs, both of which have been dynamic and unpredictable in recent years. While large established chemical separators have the capability to perform Steps 1 and 2 of the chemical separation for lamp phosphors, some smaller operators only perform Step 1 and attempt to sell the refined REE mixture or carbonates to end customers or Step 2 refiners. Even so, the transaction can be codified and the supplier is capable, though the transaction is still complex, indicative of a modular governance form, see

Table 3.

A key actor in the decision of whether to recover REE from phosphor powders is the lamp recycler who first manages the treatment of the waste after collection. However, lamp recyclers are contracted by producers who are fulfilling EPR obligations, municipalities, or actors behind voluntary initiatives. The value for these actors is to soundly manage the waste, particularly the mercury which is often pursuant to mandatory obligations and treatment requirements. Recycling of fluorescent lamps is not economically viable based on material value of the recycled materials alone, so the environmental and health benefits of treating the mercury drive voluntary initiatives as well as mandatory EPR legislation [

40]. The risk object for the government in recycling lamps is the mercury in energy efficient lamps, while the public health and the environment comprise the main object at risk. Lamp products utilize mercury in the design in order to dramatically increase the energy efficiency of the product, in comparison to incandescent lamps, and result in lower overall emissions of mercury when considering the entire lifecycle of the product (due to decreased energy needed, which in turn have associated mercury emissions if there is any coal in the mix of energy used to produce or use the product). To manage the risk of mercury, the WEEE directive specifies that mercury must be removed in the recycling process, and, since 2011, there has been an export ban and disposal obligation for mercury.

Though closing material loops is an explicitly stated aim of EPR legislation in the EU, the legislation does not require the recovery or use of the REE material and thus the decision to send material for further recycling depends on the motivation of the recycler to send the phosphor powder on to a chemical separator. However, to keep the cost of treatment low (to retain contracts for the recycling), the recycler is also incentivized to do this at the least cost while still complying with the legislation as another risk object for the recycler is the cost of treatment in order to preserve competitiveness. The recycler compares the cost of disposing of the waste lamp phosphor powder with sending the phosphor powder to a chemical separator. Some recyclers also investigated refining the phosphors themselves but had little capacity and found there was no business case for small batches, thus necessitating a transaction with a larger chemical separator. The recycler’s decision is also final for the fate of the REE content as a common method of disposal of mercury waste, including waste phosphors, is as mercury sulfide in permanent storage, e.g., in salt mines in Germany or in controlled landfills, depending on mercury content and legislation. Once waste phosphors are stored in this manner their potential as a source of REE is lost [

98].

While some Producer Responsibility Organizations (PROs) who contract the recyclers also indicated that additional value around closing material loops could add to the recycler’s competitiveness, not all PROs interviewed identified this value or expectation in their recyclers. Thus the decision for recyclers to recycle or dispose of waste lamp phosphors can be best framed as dependent on the cost of disposal in controlled landfill or permanent hazardous waste storage (depending on the mercury content of the powder and specific rules in the jurisdiction) compared to the cost of sending this powder to a chemical separation process.

Transactions between lamp recyclers and chemical separators capable of further treating lamp waste phosphors are in turn dependent on the salability of REE recovered from the chemical separation processes (i.e., the object of risk). The risk object is the unpredictable REE market, which in the case of lamp phosphors, reflects not only the uncertainties about supply in the context of price fluctuations in response to the dominant production share of China, its control measures and a significant undocumented/illegal market, but also large uncertainties about demand for rare earths as the lighting market shifts from fluorescent to LED lighting technology. The effect of this technology shift is twofold: (1) it decreases the future supply of REE available for recycling from EoL lamp products as LEDs have substantially smaller amounts of REE; and (2) it decreases demand for some phosphor REE, such as Europium (Eu), due to the fact that phosphors currently dominate the demand for this type of REE. In essence, the loop itself is shrinking unless other sectors increase the demand for the REE used in lamp phosphors.

While this could be viewed positively in that recycled Eu could then more easily satisfy the more limited demand of Eu for lighting producers [

38], this is further complicated by the fact that Eu mining is also driven by demand for other rare earths found in the same deposits (i.e., as a by-product, reflecting the balance problem described by [

35]. As industry faces supply risks, recycling represents one mitigation strategy, but also represents complex transactions between multiple actors and can represent an increased cost. Thus, the value of recycling REE is compared to the value of primary mining and substitution, as these are other strategies for industry to manage such risks. In addition, more focus is needed on the losses of other elements in a REE recycling process [

38].

However, mitigation of the described risks through recycling from anthropogenic sources can also provide environmental benefits through avoiding primary mining [

99,

100,

101,

102,

103,

104]. It was clear from Solvay-Rhodia’s communication of its commercial lamp phosphor REE recycling process that the value of recycling REE from phosphors in the EU was beyond pure economic considerations. A respondent from Solvay was quoted characterizing the value for the company for its sustainability and corporate social responsibility agenda, stating that “This project is driven by our sustainable development approach” [

105]. Validation of the process entailed a €2 million investment in a two-year project during 2012–2014 (after investment in development of the process itself), half of this coming from EU Life+ funding (a financial instrument supporting environmental projects).

The assistance from the EU in terms of Life+ funding again reflects the perception that Chinese dominance of the REE market was perceived as a risk, not only by industry actors such as Solvay-Rhodia, but also by the government actors at the EU level. The recycling of REE in the EU was perceived as socioeconomic value including by enabling a domestic/EU source of REE, 30–40 direct new jobs in the EU, and capacity building in urban mining in the EU [

106]. The project report further declared that recycling REE from lamp phosphors would “

increase the independence of Europe as regards to REE. It will also help conserve natural resources and reduce the use of environmentally damaging processes in their transformation. This will ensure Europe has access to a sustainable provision of these elements without the risk of shortage that could have dramatic social and economic effects.” (p. 11).

However, the closure of the Solvay-Rhodia process, which cited poor economics due to decreased REE prices and decreased demand for the REE in the lighting market [

107], and the continued struggle of pilot technology-ready recycling processes to find markets for their products reflects that the risks and values of REE recycling from waste lamp phosphors are perceived differently by industry in comparison to governments. It is clear in this case that industrial actors, while they may be aware of the environmental and societal values that recycling could bring (as evidenced by the framing of the process by Solvay-Rhodia), in reality have risk–value constructions that do not reflect environmental and societal values beyond the framing of waste as a hazard to be managed. Even then, this risk–value is most often underpinned by legislation. Addressing such risks and capturing value to society and the environment in closing material loops then suggests a role for governments as well as business.

6. Conclusions

A transition to a Circular Economy involves identifying and addressing barriers to loop closure, particularly for critical materials such as REE. In this paper, we argue that it is essential to gain an understanding of the transactional dynamics of data and information between a buyer and a supplier in which governance forms arise and risk–value constructions are made that precede pricing and material or service transactions. This supports explanations of how (segments of) rather complex material loops are currently closed or how they might be. Through a focus on REE, we draw attention to how key critical minerals are framed in these discourses, which are complex due to their geological occurrence, processing specifics and industrial uses.

We bring the relational theory of risk into conversation with the governance structures of the GVC framework to assess existing governance structures and explore how risk–value relationships are constructed by the various actors that have interests at specific GVC segments, with implications for why REE loops are closed or not. We observed different governance structures for closing material loops at the pre- and post-consumer recycling stages, with some more likely to enable loop closure than others. Such findings give relevant background information for policymakers and researchers further investigating policy measures to support closing loops.

By drawing on the relational theory of risk, which understands value and risk as intrinsically linked, we take a constructivist angle. The risk–value construction depends on what type of value is being considered and who is assessing it, i.e., the perspective of the actor. A broader notion of value that includes environmental and social values as well as economic ones highlights the difficulty in weighing and assessing value objectively. A clear starting point for policymakers pursing circular economy aims of closing material loops is to identify what values are perceived, and by whom. From the delineated governance forms of the empirical cases, we argue that the government needs to play a pivotal role in closing material loops when the risk–value construction of industrial actors is at odds with the societal values such as public and environmental health which governments are obliged to protect. The role of government, arguably, is to put measures into place that augment transparency of material qualities at a given segment to facilitate data and information availability for transactions, and, thus, foster the formation of closed loops. Along these lines, we recommended specific measures such as the elaboration of standards to qualify materials for re-entry into material processing, which could then be communicated through bar-coding of materials. These measures could be accompanied by appropriate regulatory amendments.

Finally, we encourage more empirical scholarship that systematically maps transactions and reveals governance forms in which risk–value constructions occur that affect loop closure, a significant element of the circular economy. While we have suggested roles for government and policy approaches to address specific issues, further research with a focus on these issues specifically is still needed. With this paper, we hope to initiate a lively, interdisciplinary discourse on this subject and invite scholars with cross-cutting research interests to participate.