Inequality and Poverty When Effort Matters

Abstract

:1. Introduction

2. Antecedents in the Literature

3. Inequality of What? Observed versus Equivalent Incomes

4. An Empirical Analysis

5. Conclusions

Acknowledgments

Conflicts of Interest

Appendix A

| Log Leisure Ratio | |||

|---|---|---|---|

| Coeff. | SE | Prob. | |

| Constant | 0.256 | 0.056 | 0.000 |

| Log wage rate | 0.150 | 0.031 | 0.000 |

| Log wage rate squared | −0.046 | 0.005 | 0.000 |

| Log unearned income (+1) | −0.073 | 0.009 | 0.000 |

| Log unearned income squared | −0.007 | 0.001 | 0.000 |

| Log wage x log unearned income | 0.036 | 0.002 | 0.000 |

| Female | 0.087 | 0.015 | 0.000 |

| Age-49 * | 0.000 | 0.058 | 0.992 |

| (Age-49) squared * | 0.024 | 0.003 | 0.000 |

| Race: Black | 0.075 | 0.019 | 0.000 |

| Race: Black mixed | 0.087 | 0.084 | 0.303 |

| Race: American Indian | 0.061 | 0.066 | 0.355 |

| Race: Asian | 0.020 | 0.052 | 0.705 |

| Race: Other | −0.008 | 0.058 | 0.885 |

| Hispanic | 0.063 | 0.026 | 0.015 |

| Born US Other Territories | −0.114 | 0.152 | 0.452 |

| Born Central America | 0.037 | 0.123 | 0.762 |

| Born Caribbean | −0.042 | 0.128 | 0.746 |

| Born South America | −0.107 | 0.138 | 0.438 |

| Born Northern Europe | −0.161 | 0.164 | 0.325 |

| Born Western Europe | −0.108 | 0.153 | 0.480 |

| Born Central or Eastern Europe | −0.126 | 0.136 | 0.352 |

| Born East Asia | 0.036 | 0.136 | 0.789 |

| Born SE Asia | −0.055 | 0.142 | 0.698 |

| Born SW Asia | −0.144 | 0.150 | 0.337 |

| Born Middle East | −0.136 | 0.170 | 0.423 |

| Born Africa | −0.174 | 0.133 | 0.192 |

| Foreign born | 0.084 | 0.116 | 0.472 |

| Foreign: Dad | −0.028 | 0.048 | 0.569 |

| Foreign: Mom | 0.023 | 0.051 | 0.660 |

| Foreign: Both | −0.042 | 0.039 | 0.282 |

| N | 5633 | ||

| R2 | 0.122 | ||

| S.E. of regression | 0.529 | ||

| Mean dep. var. | 0.348 | ||

| F-statistic | 25.962 | ||

| Prob (F-statistic) | 0.000 | ||

References

- Allingham, Michael. 1972. The Measurement of Inequality. Journal of Economic Theory 5: 163–69. [Google Scholar] [CrossRef]

- Apps, Patricia, and Elizabeth Savage. 1989. Labour Supply, Welfare Rankings and the Measurement of Inequality. Journal of Public Economics 39: 335–64. [Google Scholar] [CrossRef]

- Atkinson, Anthony B. 1970. On the Measurement of Inequality. Journal of Economic Theory 2: 244–63. [Google Scholar] [CrossRef]

- Bargain, Olivier, Andre Decoster, Mathias Dolls, Dirk Neumann, Andreas Peichl, and Sebastian Siegloch. 2013. Welfare, Labor Supply and Heterogeneous Preferences: Evidence for Europe and the US. Social Choice and Welfare 41: 789–817. [Google Scholar] [CrossRef]

- Barros, Ricardo Paes de, Francisco H. G. Ferreira, J. Molinas Vega, and J. Saavedra Chanduvi. 2009. Measuring Inequality of Opportunities in Latin America and the Caribbean. Washington: The World Bank. [Google Scholar]

- Becker, Gary. 1965. A Theory of the Allocation of Time. The Economic Journal 75: 493–517. [Google Scholar] [CrossRef]

- Blundell, Richard, Costas Meghir, Elizabeth Symons, and Ian Walker. 1988. Labor Supply Specification and the Evaluation of Tax Reforms. Journal of Public Economics 36: 23–52. [Google Scholar] [CrossRef]

- Bourguignon, François. 2015. The Globalization of Inequality. Princeton: Princeton University Press. [Google Scholar]

- Bourguignon, François, Francisco Ferreira, and Marta Menéndez. 2007. Inequality of Opportunity in Brazil. Review of Income and Wealth 53: 585–618. [Google Scholar] [CrossRef]

- Browning, Martin. 1992. Children and Household Economic Behavior. Journal of Economic Literature 30: 1434–75. [Google Scholar]

- Brunori, Paolo, Francisco Ferreira, and Vito Peragine. 2013. Inequality of Opportunity, Income Inequality and Economic Mobility: Some international comparisons. In Getting Development Right. Edited by Eva Paus. New York: Palgrave Macmillan, chp. 5. [Google Scholar]

- Bureau of Labor Statistics. 2016. American Time Use Survey; Washington: United States Department of Labor.

- Champernowne, David, and Frank Cowell. 1998. Economic Inequality and Income Distribution. Cambridge: Cambridge University Press. [Google Scholar]

- Checchi, Daniele, and Vito Peragine. 2010. Inequality of Opportunity in Italy. Journal of Economic Inequality 8: 429–50. [Google Scholar] [CrossRef]

- Coles, Jeffrey L., and Paul Harte-Chen. 1985. Real Wage Indices. Journal of Labor Economics 3: 317–36. [Google Scholar] [CrossRef]

- Decoster, Andre, and Peter Haan. 2015. Empirical Welfare Analysis with Preference Heterogeneity. International Tax and Public Finance 22: 224–51. [Google Scholar] [CrossRef] [Green Version]

- Eichelberger, Erika. 2014. Debunking the Attempted Debunking of Our 10 Poverty Myths, Debunked. Mother Jones, March 28. [Google Scholar]

- Ferreira, Francisco, and Jèrèmie Gignoux. 2011. The Measurement of Inequality of Opportunity: Theory and an Application to Latin America. Review of Income and Wealth 57: 622–57. [Google Scholar] [CrossRef]

- Ferreira, Francisco, and Vito Peragine. 2015. Individual Responsibility and Equality of Opportunity. In Handbook of Well Being and Public Policy. Edited by M. Adler and M. Fleurbaey. Oxford: Oxford University Press. [Google Scholar]

- Ferreira, Francisco, Jèrèmie Gignoux, and Meltem Aran. 2011. Measuring Inequality of Opportunity with Imperfect Data: The Case of Turkey. Journal of Economic Inequality 9: 651–80. [Google Scholar] [CrossRef]

- Fleurbaey, Marc, and Vito Peragine. 2013. Ex Ante versus Ex Post Equality of Opportunity. Economica 80: 118–30. [Google Scholar] [CrossRef]

- Gans, Herbert. 1995. The War against the Poor. New York: Basic Books. [Google Scholar]

- Hassine, Nadia Belhaj. 2012. Inequality of Opportunity in Egypt. World Bank Economic Review 26: 265–95. [Google Scholar] [CrossRef]

- Jorgenson, Dale W., and Daniel Slesnick. 1984. Aggregate Consumer Behavior and the Measurement of Inequality. Review of Economic Studies 60: 369–92. [Google Scholar] [CrossRef]

- Kanbur, Ravi, and Michael Keen. 1989. Poverty, Incentives, and Linear Income Taxation. In The Economics of Social Security. Edited by Andrew Dilnot and Ian Walker. Oxford: Oxford University Press. [Google Scholar]

- Katz, Michael B. 1987. The Undeserving Poor: From the War on Poverty to the War on Welfare. New York: Pantheon Books. [Google Scholar]

- King, Mervyn A. 1983. Welfare Analysis of Tax Reforms Using Household Level Data. Journal of Public Economics 21: 183–14. [Google Scholar] [CrossRef]

- Marrero, Gustavo, and Juan Gabriel Rodriguez. 2012. Inequality of Opportunity in Europe. Review of Income and Wealth 58: 597–21. [Google Scholar] [CrossRef]

- Pencavel, John. 1977. Constant-Utility Index Numbers of Real Wages. American Economic Review 67: 91–100. [Google Scholar]

- Pew Research Center. 2014. Most See Inequality Growing, but Partisans Differ over Solutions. A Pew Research Center/USA TODAY Survey. Washington: Pew Research Center. [Google Scholar]

- Pignataro, Giuseppe. 2011. Equality of Opportunity: Policy and Measurement Paradigms. Journal of Economic Surveys 26: 800–34. [Google Scholar] [CrossRef]

- Pollak, Robert, and Terence Wales. 1979. Welfare Comparison and Equivalence Scale. American Economic Review 69: 216–21. [Google Scholar]

- Preston, Ian, and Ian Walker. 1999. Welfare Measurement in Labour Supply Models with Nonlinear Budget Constraints. Journal of Population Economics 12: 343–61. [Google Scholar] [CrossRef]

- Ramos, Xavier, and Dirk Van de gaer. 2016. Approaches to Inequality of Opportunity: Principles, Measures and Evidence. Journal of Economic Surveys 30: 855–83. [Google Scholar] [CrossRef]

- Ravallion, Martin. 2016. The Economics of Poverty. History, Measurement, Policy. New York: Oxford University Press. [Google Scholar]

- Roemer, John. 1998. Equality of Opportunity. Cambridge: Harvard University Press. [Google Scholar]

- Roemer, John E. 2014. Economic Development as Opportunity Equalization. World Bank Economic Review 28: 189–209. [Google Scholar] [CrossRef]

- Roemer, John, and Alain Trannoy. 2015. Equality of Opportunity. In Handbook of Income Distribution Volume 2. Edited by A. B. Atkinson and F. Bourguignon. Amsterdam: North Holland. [Google Scholar]

- Salverda, Weimer, Marloes de Graaf-Zijl, Christina Haas, Bram Lancee, and Natascha Notten. 2014. The Netherlands: Policy-Enhanced Inequalities Tempered by Household Formation. In Changing Inequalities and Societal Impacts in Rich Countries: Thirty Countries’ Experiences. Edited by Brian Nolan, Wiemer Salverda, Daniele Checchi, Ive Marx, Abigail McKnight, István György Tóth and Herman G. van de Werfhorst. Oxford: Oxford University Press. [Google Scholar]

- Singh, Ashish. 2012. Inequality of Opportunity in Earnings and Consumption Expenditure: The Case of Indian Men. Review of Income and Wealth 58: 79–106. [Google Scholar] [CrossRef]

- Slesnick, Daniel. 1998. Empirical Approaches to the Measurement of Welfare. Journal of Economic Literature 36: 2108–65. [Google Scholar]

- Stein, Ben. 2014. Poverty and Income Inequality. One really has Nothing to do with the Other. The American Spectator, April 4. [Google Scholar]

- Trannoy, Alain, Sandy Tubeuf, Florence Jusot, and Marion Devaux. 2010. Inequality of Opportunities in Health in France: A First Pass. Health Economics 19: 921–38. [Google Scholar] [CrossRef] [PubMed]

- Williamson, Kevin. 2014. Debunker Debunked. National Review, March 26. [Google Scholar]

| 1 | As is well known, a source of ambiguity is that there are opposing income and substitution effects of higher wage rates on labor supply (assuming that leisure is a normal good). Higher unearned income will reduce work effort. The direction of the relationship with total income is unclear on theoretical grounds. |

| 2 | |

| 3 | Of course, effort is only one aspect of the debates about inequality numbers; for example, there are also issues about price indices and equivalence scales. Note also that practitioners are on safer ground in measuring inequality amongst children for whom personal effort is not yet an issue. Here the concern is about inequality among adults. |

| 4 | This is an instance of a more general point that is well understood in welfare economics, namely that inequality of income need not imply inequality of welfare. Heterogeneity in preferences further complicates matters. |

| 5 | There have been a number of applications of the idea of money-metric utility to distributional analysis, including King (1983), Jorgenson and Slesnick (1984), Blundell et al. (1988), Apps and Savage (1989), Kanbur and Keen (1989). Also see the discussions in Slesnick (1998). |

| 6 | The economic arguments for assuring such consistency are reviewed in Ravallion (2016, Part 2). |

| 7 | This is an old idea, but in modern times it became prominent in Katz’s (1987) critique of American antipoverty policy. See Ravallion (2016, Part 1) on the history of economic thought on antipoverty policy. Also see Gans’s (1995, chp. 1) discussion of the history of derogatory labels for poor people. |

| 8 | For example, with reference to the U.S., Stein (2014) argues that: “There is an immense amount of income inequality here and everywhere. I am not sure why that is a bad thing. Some people will just be better students, harder working, more clever, more ruthless than other people”. Stein goes on to claim that long-term poverty reflects “poor work habits”. Also see the debate between Eichelberger (2014) and Williamson (2014) on the proposition that “poor people are lazy”. |

| 9 | Champernowne and Cowell (1998) only give passing reference to the idea, and do not develop its implications. Kanbur and Keen (1989) discuss its use in the context of inequality and taxation. The concept of “full-time equivalent income” is found in business and labor studies; see, for example, the online Business Dictionary. |

| 10 | |

| 11 | This is shown by Kanbur and Keen (1989) in the context of heterogeneous effort though the point is more general. |

| 12 | The measures include Pencavel’s (1977) real wage metric, given by wage rate equivalent of the actual utility level at fixed values of other factors, including unearned income, and an analogous “rent metric” given by the unearned income equivalent of utility. A useful overview of the various measures possible can be found in Preston and Walker (1999). An earlier empirical application of the real wage index idea can be found in Coles and Harte-Chen (1985). |

| 13 | Contributions include Bourguignon et al. (2007), Paes de Barros et al. (2009), Checchi and Peragine (2010), Trannoy et al. (2010), Ferreira and Gignoux (2011), Ferreira et al. (2011), Hassine (2012), Marrero and Rodriguez (2012), Singh (2012) and Brunori et al. (2013). Also see the broader discussions in Pignataro (2011), Roemer (2014), Roemer and Trannoy (2015) and Ferreira and Peragine (2015). |

| 14 | This is sometimes called “ex-ante” equality; “ex-post” equality requires equal reward for equal effort; see the discussion in Fleurbaey and Peragine (2013). For example, if someone starting out with a disadvantage in terms of her ability to generate income can make up the difference by hard work then one would surely be reluctant to say that there is no remaining inequality of opportunity; while the income difference according to circumstances may have vanished (no ex ante inequality), the difference in welfare remains (ex post inequality). |

| 15 | This is explicit in Bourguignon et al. (2007), Trannoy et al. (2010) and Ferreira and Gignoux (2011), but implicit in most of the literature. Ferreira and Peragine (2015) claim that the method has been applied to at least 40 countries. |

| 16 | Effort is bounded, but this is not made explicit for now since attention is confined to interior solutions for effort. (In the parametric model in section 4 a time constraint will be explicit.) |

| 17 | Subscripts for person i are dropped in places to simplify the notation. Twice differentiability is assumed when convenient. Subscripts are used for partial derivatives, in obvious notation. When convenient for the exposition, c and x are treated as continuous scalars (such as parental income and labor supply respectively), but they are vectors in reality and with discrete elements. |

| 18 | Notice that this model is static, in that all effort is a current choice. In extending to a dynamic model one might postulate that there are also current gains from past efforts, which are taken as exogenous to choices about current effort. (An example is past effort at school versus current labor supply given schooling.) |

| 19 | This is explicit in Bourguignon et al. (2007), Trannoy et al. (2010) and Ferreira and Gignoux (2011), but implicit in most of the literature. |

| 20 | Of course, in practice ε also includes unobserved circumstances and measurement errors. A discussion of the econometric issues in specifying and estimating Equation (4) can be found in Ramos and Van de gaer (2016). |

| 21 | A similar comment applies to the use of the wage rate as a metric of welfare. |

| 22 | In obvious notation and subsuming in the definition of the equivalent-income function f. |

| 23 | The interior points on the income Lorenz curve, L(p), are L(1/3) = 0.25 and L(2/3) = 0.5, while those for the welfare Lorenz curve are L(1/3) = (1 − α)/(4 − 2α) < 0.25 and L(2/3) = 0.5. (Note that the two people with lowest incomes are re-ranked when one switches to the welfare space.) |

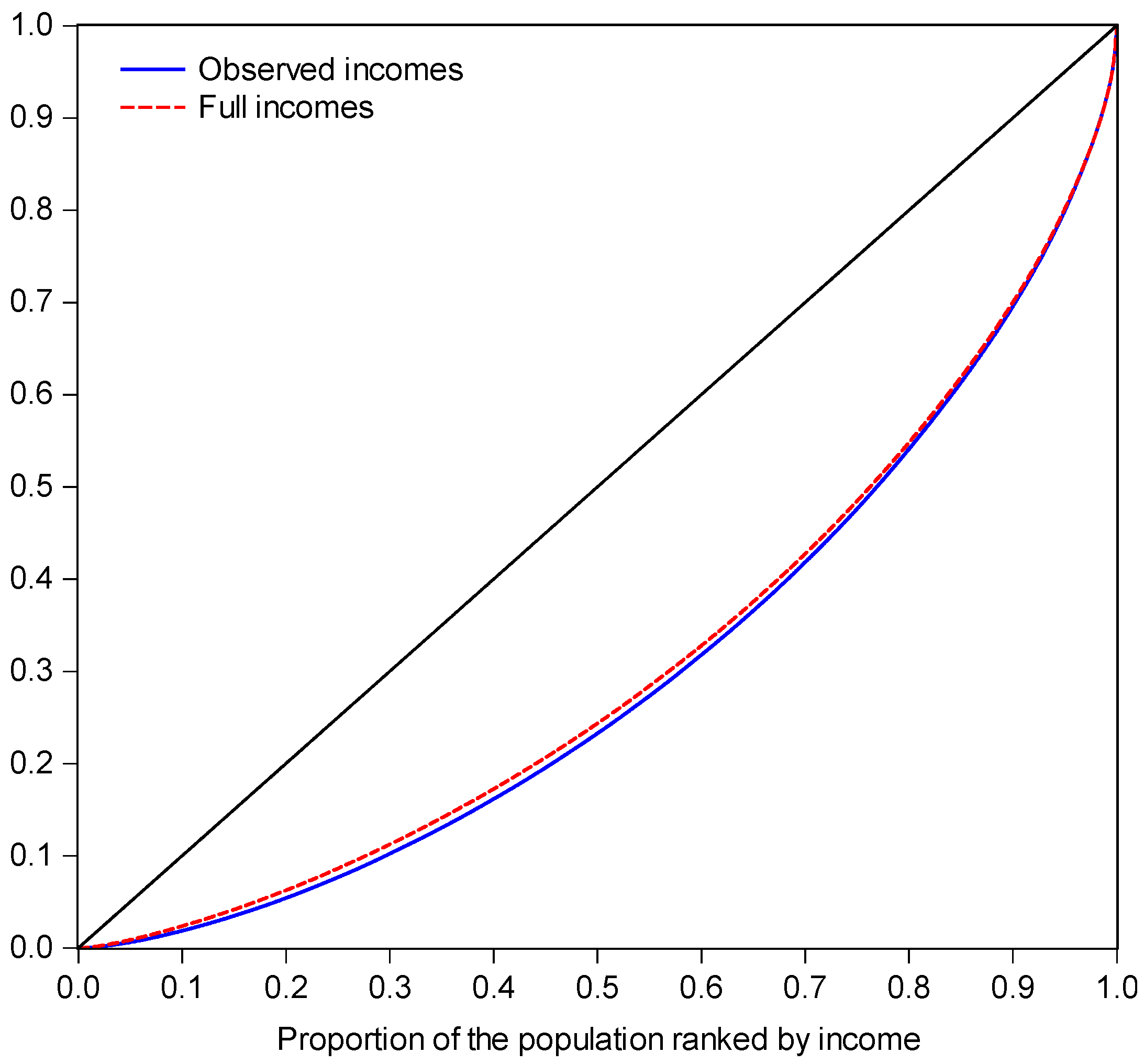

| 24 | This claim uses the well-known Lorenz dominance condition (Atkinson 1970). |

| 25 | This assumes a common poverty line; the empirical work will relax this to allow for leisure as a basic need. |

| 26 | This relates to the long-standing problem of inferring welfare from observed demand or supply behavior across demographically heterogeneous households (Pollak and Wales 1979; Browning 1992). |

| 27 | The CPS data were accessed through the University of Minnesota’s IPUMS-CPS site. |

| 28 | This is obtained by multiplying reported weeks of work in the last year by reported average hours of work per week then dividing by 52. |

| 29 | Recall that pre-tax income (y) is the relevant concept in the model in Section 2 in which taxes are solved-out, assuming that they are some function of y. Also note that the CPS does not ask for taxes paid so imputations of uncertain reliability are required. |

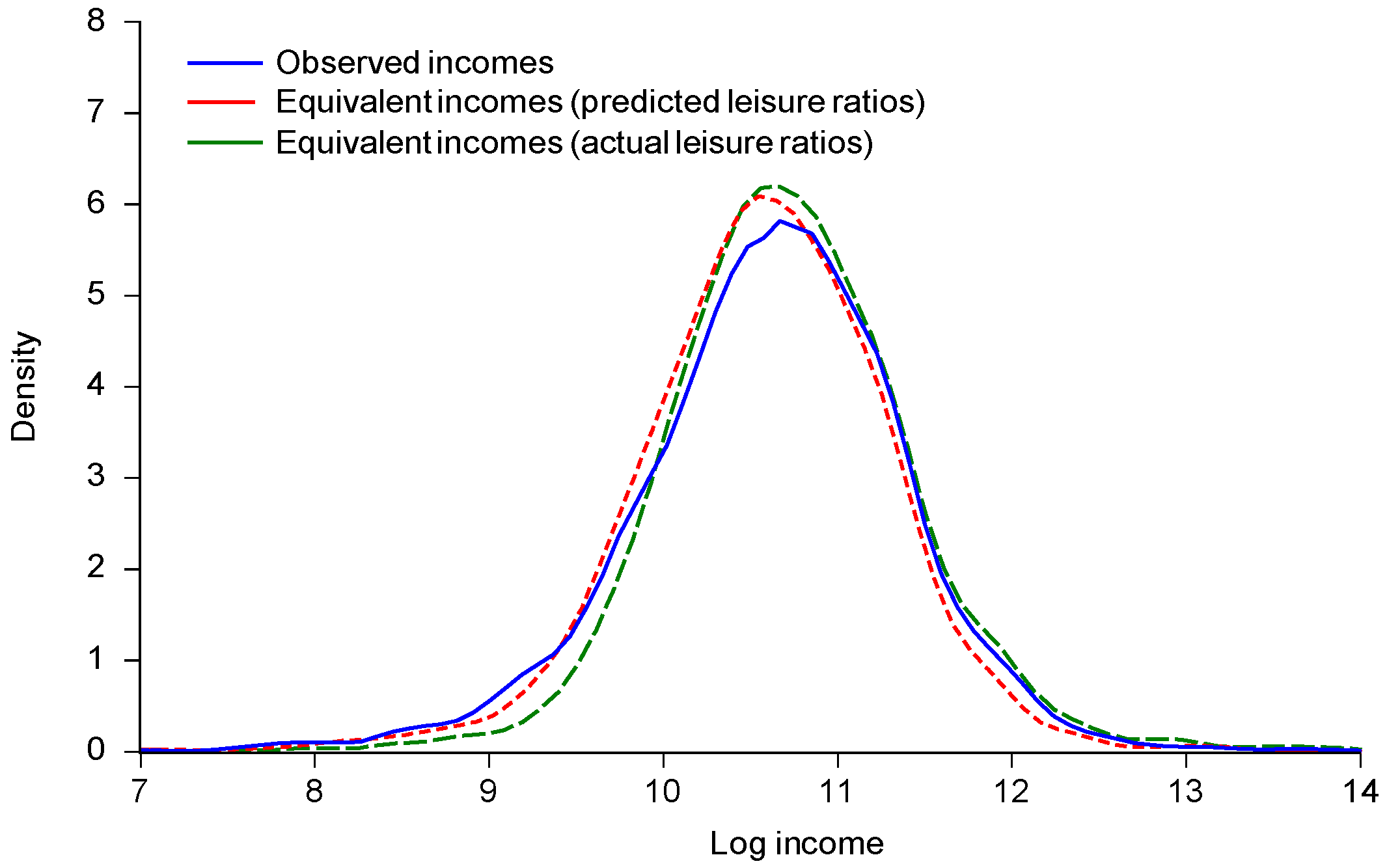

| 30 | The overall mean weekly income of the sample is $1048, while the mean weekly income of those living below $20,000 per annum is $245. |

| 31 | As noted, those reporting any disability affecting work or any difficulty (seeing, hearing, remembering, mobility, personal care) are excluded from the main analysis reported here. 5% of the sample reported a disability affecting their work. |

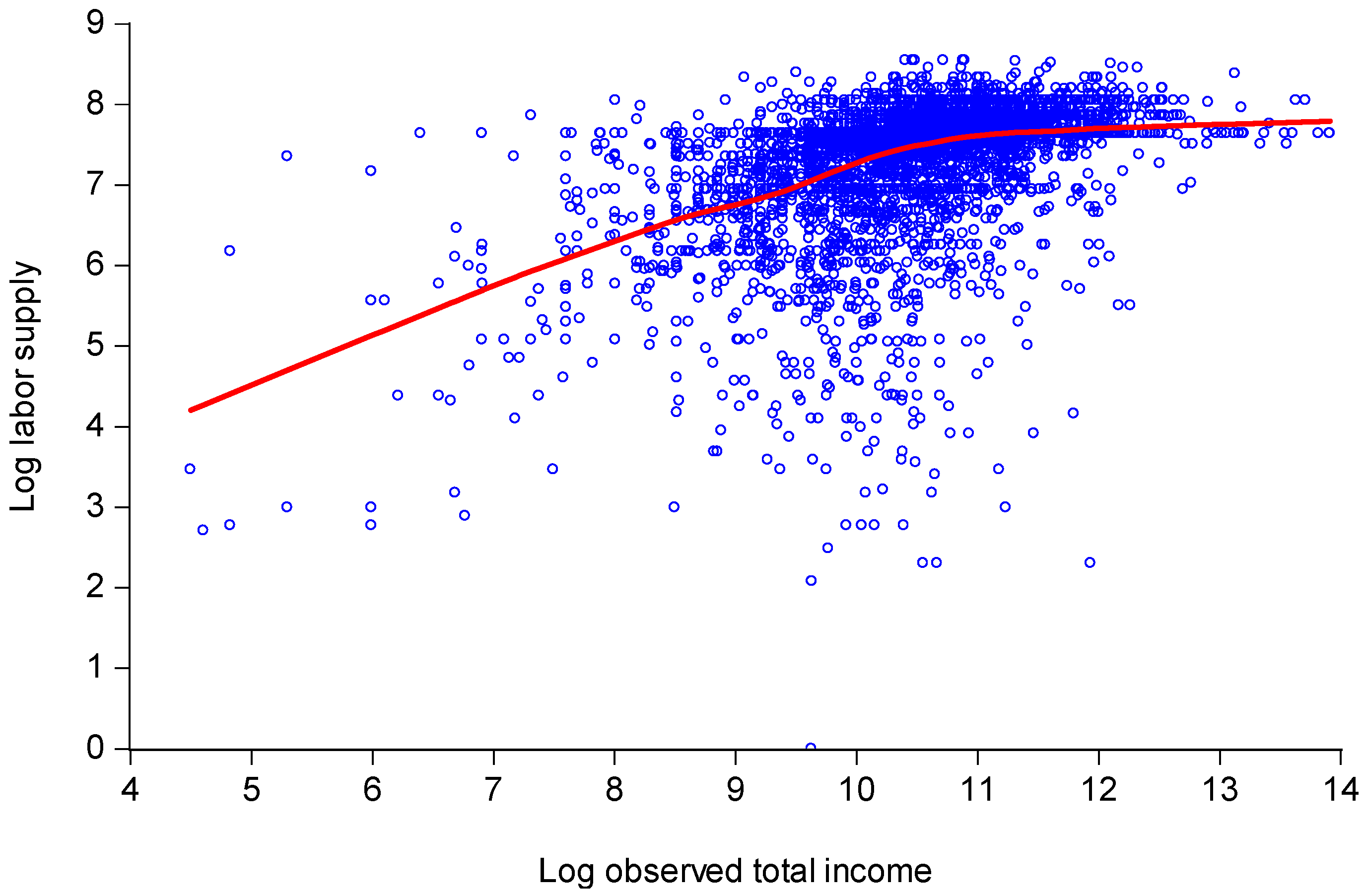

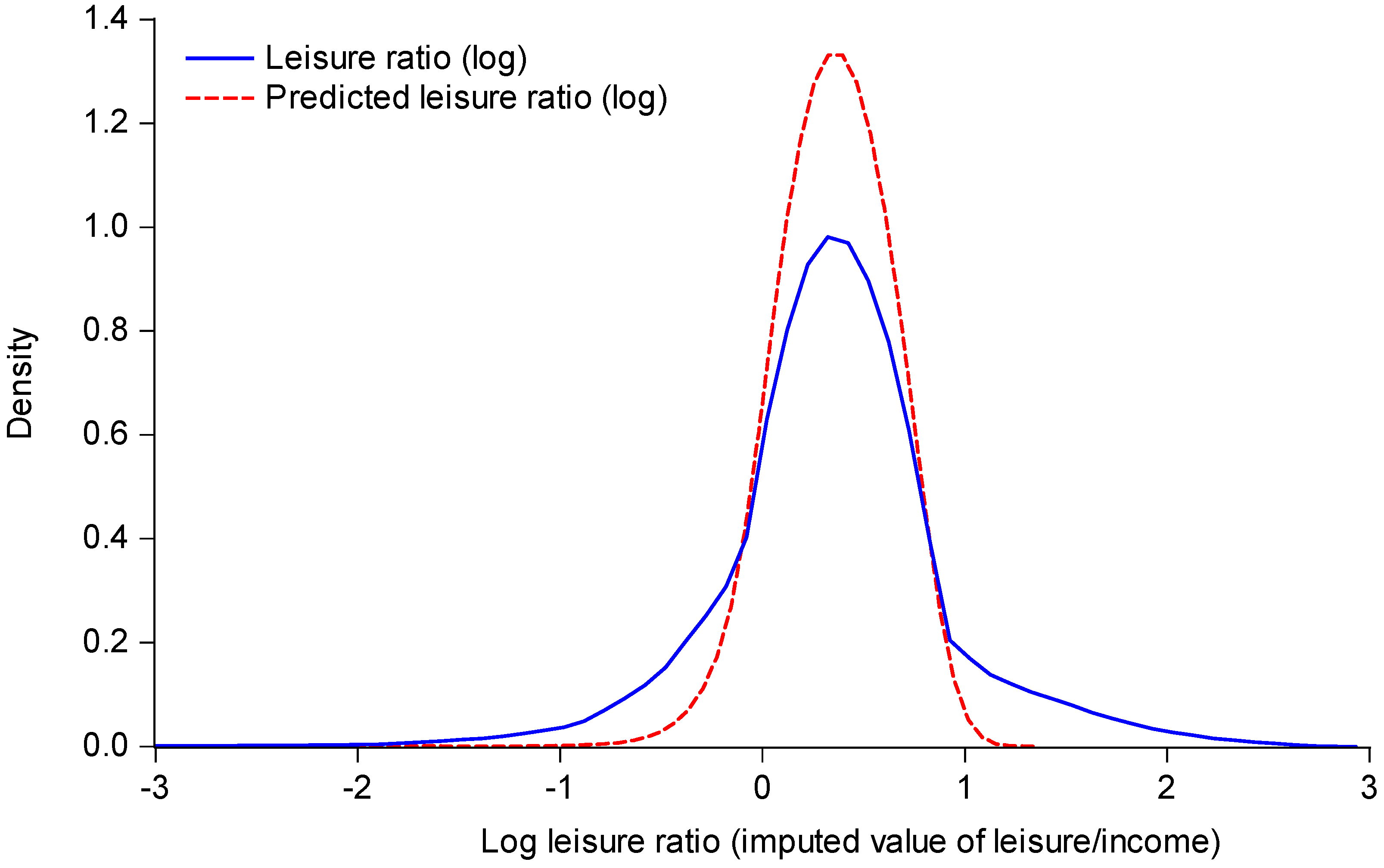

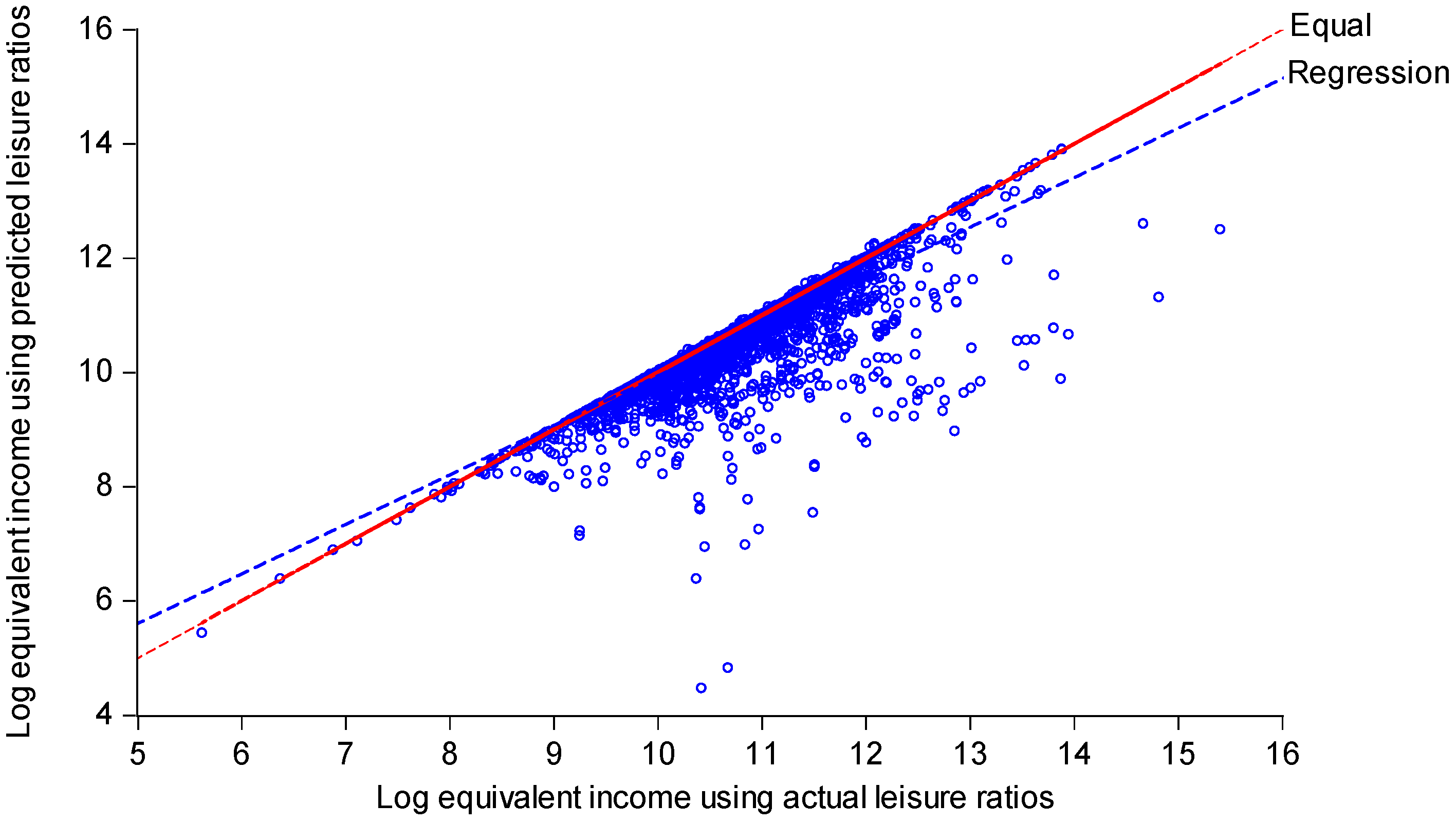

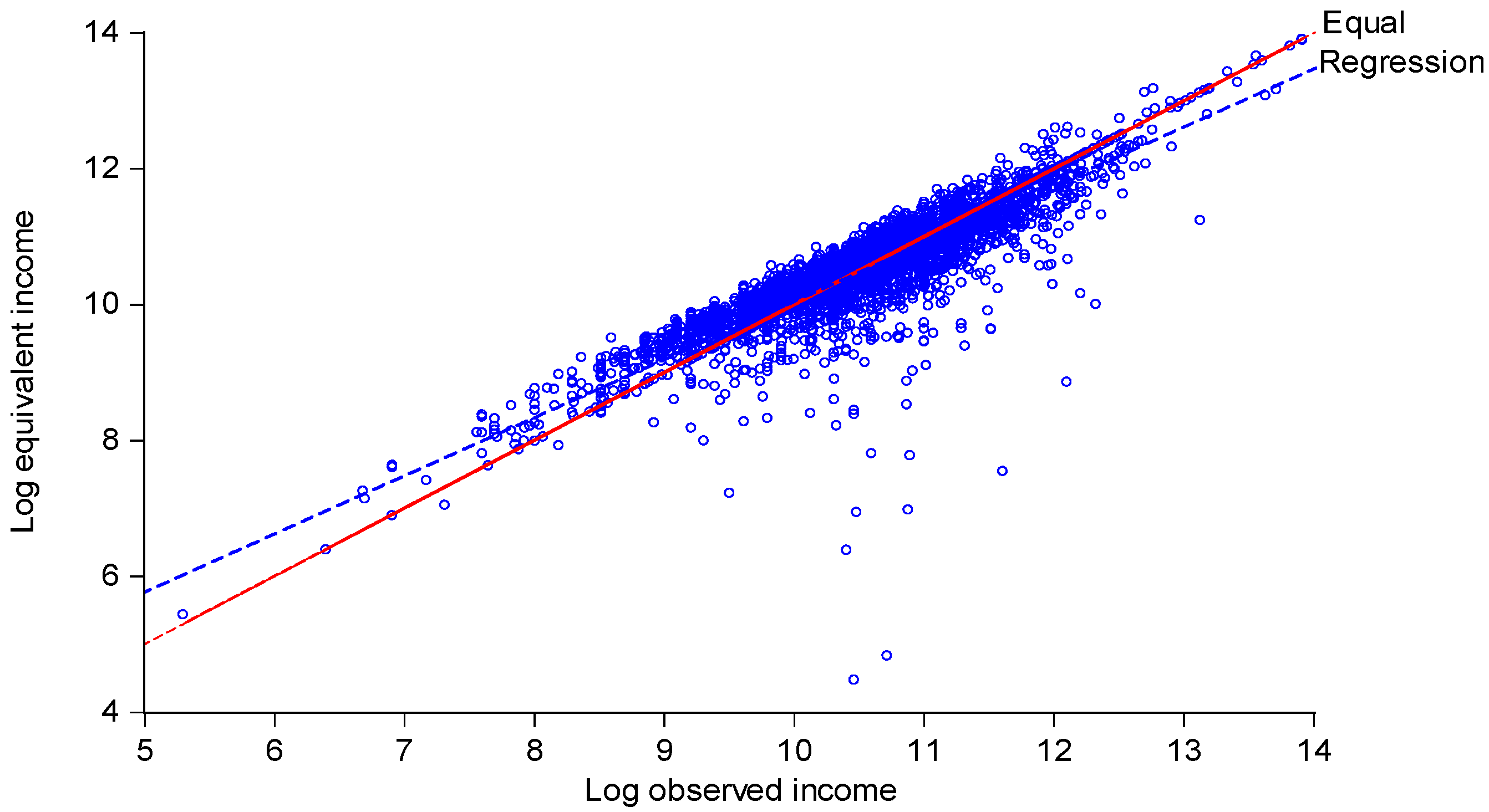

| 32 | The regression coefficient is 0.856 (White s.e. = 0.006). |

| 33 | With two hours per week of leisure the poverty rate using the smoothed data is 9.1% using the $15,000 income line and 16.9% using $20,000. |

| 34 | The data do not include work done within the home, though this is probably similar by gender in the sample of single adults. |

| 35 | For example, the negative income effects of being born in South America or Center-Eastern Europe become somewhat larger (and statistical significant) using equivalent incomes based on the actual leisure ratios. |

| Income Cut-off (z) | % of Sample | Mean Hours of Work per Week () | Mean Wage Rate ($/Hour) () | Mean Income ($/Week) () | % of Income Gap Covered by Working Average Hours per Week () | Extra Hours per Week to Reach Mean Income () |

|---|---|---|---|---|---|---|

| 10,000 | 4.03 | 23.66 | 5.62 | 119.15 | 9.44 | 165.32 |

| 15,000 | 8.31 | 26.35 | 7.10 | 177.20 | 10.52 | 122.68 |

| 20,000 | 15.11 | 29.56 | 8.26 | 244.96 | 9.97 | 97.25 |

| 25,000 | 22.67 | 31.64 | 9.38 | 304.60 | 9.61 | 79.28 |

| 30,000 | 29.66 | 33.00 | 10.28 | 354.90 | 9.28 | 67.45 |

| 35,000 | 38.20 | 34.50 | 11.40 | 411.69 | 8.52 | 55.84 |

| Median | 50.00 | 35.81 | 12.92 | 487.84 | 7.95 | 43.38 |

| Maximum | 100.00 | 39.26 | 24.09 | 1048.26 | n.a. | 0.00 |

| Income Concept | Gini Index | Mean Log Deviation (MLD) | Robin Hood Index |

|---|---|---|---|

| Observed income | 0.402 | 0.296 | 0.284 |

| Full income | 0.387 | 0.262 | 0.275 |

| Equivalent income without trimming extreme values | 0.421 | 0.310 | 0.299 |

| Equivalent income trimming extreme values | 0.385 | 0.272 | 0.272 |

| Income Poverty Line | ||

|---|---|---|

| $15,000 | $20,000 | |

| Observed income | 0.083 | 0.165 |

| Full income | 0.046 | 0.115 |

| Equivalent income without trimming extreme values | ||

| No basic need for leisure | 0.045 | 0.103 |

| Basic need = 10 h/week | 0.081 | 0.155 |

| Basic need = 20 h/week | 0.129 | 0.216 |

| Equivalent income trimming extreme values | ||

| No basic need for leisure | 0.082 | 0.158 |

| Basic need = 10 h/week | 0.133 | 0.219 |

| Basic need = 20 h/week | 0.191 | 0.283 |

| (1) | (2) | (3) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Log Observed Income | Log Equivalent Income (Predicted Leisure Ratios) | Log Equivalent Income (Actual Leisure Ratios) | |||||||

| Coeff. | s.e. | Prob. | Coeff. | s.e. | Prob. | Coeff. | s.e. | Prob. | |

| Constant | 10.842 | 0.019 | 0.000 | 10.727 | 0.019 | 0.000 | 10.847 | 0.018 | 0.000 |

| Female | −0.107 | 0.021 | 0.000 | −0.053 | 0.020 | 0.007 | −0.054 | 0.019 | 0.005 |

| Age-49 * | 0.007 | 0.001 | 0.000 | 0.008 | 0.001 | 0.000 | 0.008 | 0.001 | 0.000 |

| (Age-49) squared * | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.057 |

| Race: Black | −0.224 | 0.026 | 0.000 | −0.182 | 0.024 | 0.000 | −0.189 | 0.024 | 0.000 |

| Race: Black mixed | −0.142 | 0.117 | 0.223 | −0.083 | 0.105 | 0.427 | −0.108 | 0.109 | 0.321 |

| Race: Am. Indian | −0.261 | 0.086 | 0.002 | −0.227 | 0.079 | 0.004 | −0.221 | 0.081 | 0.007 |

| Race: Asian | 0.152 | 0.069 | 0.028 | 0.149 | 0.063 | 0.019 | 0.198 | 0.065 | 0.002 |

| Race: Other | −0.083 | 0.097 | 0.389 | −0.106 | 0.087 | 0.225 | −0.103 | 0.089 | 0.251 |

| Hispanic | −0.162 | 0.037 | 0.000 | −0.134 | 0.036 | 0.000 | −0.127 | 0.034 | 0.000 |

| Born US Oth.Terr. | −0.138 | 0.247 | 0.577 | −0.145 | 0.223 | 0.514 | −0.284 | 0.206 | 0.168 |

| Born Central Am. | −0.724 | 0.197 | 0.000 | −0.668 | 0.176 | 0.000 | −0.667 | 0.157 | 0.000 |

| Born Caribbean | −0.435 | 0.203 | 0.032 | −0.430 | 0.183 | 0.019 | −0.474 | 0.166 | 0.004 |

| Born S. America | −0.311 | 0.215 | 0.149 | −0.342 | 0.196 | 0.082 | −0.438 | 0.178 | 0.014 |

| Born N. Eur. | 0.229 | 0.235 | 0.331 | 0.186 | 0.209 | 0.375 | 0.066 | 0.192 | 0.731 |

| Born Western Eur. | −0.052 | 0.276 | 0.850 | −0.118 | 0.248 | 0.633 | −0.120 | 0.241 | 0.618 |

| Born C-East Eur. | −0.249 | 0.206 | 0.226 | −0.300 | 0.184 | 0.103 | −0.410 | 0.163 | 0.012 |

| Born East Asia | −0.314 | 0.212 | 0.139 | −0.284 | 0.190 | 0.134 | −0.309 | 0.175 | 0.078 |

| Born SE Asia | −0.548 | 0.228 | 0.016 | −0.594 | 0.212 | 0.005 | −0.655 | 0.191 | 0.001 |

| Born SW Asia | −0.143 | 0.226 | 0.526 | −0.210 | 0.213 | 0.326 | −0.299 | 0.186 | 0.108 |

| Born Middle East | 0.096 | 0.267 | 0.719 | −0.021 | 0.246 | 0.932 | 0.088 | 0.244 | 0.717 |

| Born Africa | −0.185 | 0.204 | 0.365 | −0.283 | 0.185 | 0.127 | −0.302 | 0.171 | 0.077 |

| Foreign born | 0.260 | 0.187 | 0.165 | 0.289 | 0.167 | 0.084 | 0.332 | 0.148 | 0.025 |

| Foreign: Dad | 0.106 | 0.059 | 0.073 | 0.087 | 0.056 | 0.117 | 0.083 | 0.058 | 0.152 |

| Foreign: Mom | 0.158 | 0.074 | 0.034 | 0.173 | 0.062 | 0.006 | 0.228 | 0.068 | 0.001 |

| Foreign: Both | 0.132 | 0.056 | 0.018 | 0.119 | 0.051 | 0.020 | 0.087 | 0.050 | 0.083 |

| N | 5633 | 5633 | 5633 | ||||||

| R2 | 0.088 | 0.077 | 0.068 | ||||||

| S.E. of regression | 0.750 | 0.714 | 0.698 | ||||||

| Mean dep. var. | 10.610 | 10.569 | 10.724 | ||||||

| F-statistic | 21.740 | 18.600 | 16.373 | ||||||

| Prob (F-statistic) | 0.000 | 0.000 | 0.000 | ||||||

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ravallion, M. Inequality and Poverty When Effort Matters. Econometrics 2017, 5, 50. https://doi.org/10.3390/econometrics5040050

Ravallion M. Inequality and Poverty When Effort Matters. Econometrics. 2017; 5(4):50. https://doi.org/10.3390/econometrics5040050

Chicago/Turabian StyleRavallion, Martin. 2017. "Inequality and Poverty When Effort Matters" Econometrics 5, no. 4: 50. https://doi.org/10.3390/econometrics5040050