The Inconsistent Effects of Plain English Disclosures on Nonprofessional Investors’ Risk Judgments

Abstract

:1. Introduction

2. Background and Hypothesis Development

2.1. Improving Disclosure

2.2. Risk Disclosure

2.3. Plain English and Readability

2.4. Hypothesis

3. Method and Materials

3.1. Participants

3.2. Design

3.3. Task

4. Results

5. Discussion

6. Patents

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Risk Factor Disclosures in Low versus High Readability

Appendix A.1. Risk Factor 1—Less Readable

Appendix A.2. Risk Factor 1—More Readable (Plain English)

Appendix A.3. Risk Factor 2—Less Readable

Appendix A.4. Risk Factor 2—More Readable (Plain English)

Appendix A.5. Risk Factor 3—Less Readable

Appendix A.6. Risk Factor 3—More Readable (Plain English)

References

- Abraham, Santhosh, and Paul Cox. 2007. Analysing the determinants of narrative risk information in UK FTSE 100 annual reports. The British Accounting Review 39: 227–48. [Google Scholar] [CrossRef]

- Abraham, Santhosh, and Philip J. Shrives. 2014. Improving the relevance of risk factor disclosure in corporate annual reports. The British Accounting Review 46: 91–107. [Google Scholar] [CrossRef]

- Anandarajan, Asokan, Gary Kleinman, and Dan Palmon. 2000. Investors’ expectations and the corporate information disclosure gap: A perspective. Research in Accounting Regulation 14: 245–60. [Google Scholar]

- Anderson, Urton, and Lisa Koonce. 1998. Evaluating the sufficiency of causes in audit analytical procedures. Auditing: A Journal of Practice & Theory 17: 1–12. [Google Scholar]

- Bao, Yang, and Anindya Datta. 2014. Simultaneously discovering and quantifying risk types from textual risk disclosures. Management Science 60: 1371–91. [Google Scholar] [CrossRef]

- Bernstein, David. 2006. Do investors gain from new SEC disclosure? International Financial Law Review 25: 32–34. [Google Scholar]

- Blaskovich, Jennifer, Christopher J. Davis, and Eileen Z. Taylor. 2012. Enterprise risks, rewards, and regulation. Journal of Applied Business Research 28: 563–79. [Google Scholar] [CrossRef]

- Blazzard, Norse N., and Judith A. Hasenauer. 1998. This is our plea for plain English. National Underwriter 102: 16–18. [Google Scholar]

- Bloomfield, Robert J. 2002. The “Incomplete Revelation Hypothesis” and financial reporting. Accounting Horizons 16: 233–43. [Google Scholar] [CrossRef]

- Buffett, W. 2003. Avoiding a “mega-catastrophe”. Fortune, 82–87. [Google Scholar]

- Campbell, N. 1999. How New Zealand consumers respond to plain English. Journal of Business Communication 36: 335–61. [Google Scholar] [CrossRef]

- Campbell, John L., Hsinchun Chen, Dan S. Dhaliwal, Hsin-Min Lu, and Logan B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19: 396–455. [Google Scholar] [CrossRef]

- Chemi, Eric. 2014. Investors Couldn’t Care Less about Data Breaches. Bloomberg. Available online: https://www.bloomberg.com/news/articles/2014-05-23/investors-couldnt-care-less-about-data-breaches (accessed on 16 December 2017).

- Chewning, Eugene G., and Adrian M. Harrell. 1990. The effect of information load on decision makers’ cue utilization levels and decision quality in a financial distress decision task. Accounting, Organizations and Society 15: 527–42. [Google Scholar] [CrossRef]

- Committee of Sponsoring Organizations of the Treadway Commission (COSO). 2004. Enterprise Risk Management—An Integrated Framework. New York: COSO. [Google Scholar]

- Courtis, John K. 1995. Readability of annual reports: Western versus Asian evidence. Accounting, Auditing and Accountability Journal 16: 4–17. [Google Scholar] [CrossRef]

- Courtis, John K. 1998. Annual report readability variability: Tests of the obfuscation hypothesis. Accounting, Auditing and Accountability Journal 11: 459–71. [Google Scholar] [CrossRef]

- Courtis, John K. 2004. Corporate report obfuscation: Artefact or phenomenon? British Accounting Review 36: 291–312. [Google Scholar] [CrossRef]

- Cui, Xiao Carol. 2016. Calisthenics with words: The effect of readability and investor sophistication on investors’ performance judgment. International Journal of Financial Studies 4: 1. [Google Scholar] [CrossRef]

- Deumes, Rogier. 2008. Corporate risk reporting. Journal of Business Communication 45: 120–57. [Google Scholar] [CrossRef]

- Dyer, Travis, Mark Lang, and Lorien Stice-Lawrence. 2017. The evolution of 10-K textual disclosure: Evidence from Latent Dirichlet Allocation. Journal of Accounting & Economics 64: 221–45. [Google Scholar]

- Elliott, W. Brooke, Frank D. Hodge, Jane Jollineau Kennedy, and Maarten Pronk. 2007. Are M.B.A. students a good proxy for nonprofessional investors? The Accounting Review 82: 139–68. [Google Scholar] [CrossRef]

- Erickson, A. J., and Clint Rancher. 2016. Big Disclosure Changes Ahead? SEC Issues Concept Release Exploring Overhaul of Regulation S-K. Lexology. Available online: https://www.lexology.com/library/detail.aspx?g=4e822e82-49ed-4368-b605-8bac29edfa40 (accessed on 16 December 2017).

- Flesch, Rudolph. 1948. A new readability yardstick. Journal of Applied Psychology 32: 221–33. [Google Scholar] [CrossRef] [PubMed]

- Hodder, Leslie, Lisa Koonce, and Mary Lea McAnally. 2001. SEC market risk disclosures: Implications for judgment and decision making. Accounting Horizons 15: 49–70. [Google Scholar] [CrossRef]

- Hutton, Amy. 2004. Beyond financial reporting: An integrated approach to disclosure. Journal of Applied Corporate Finance 16: 8–16. [Google Scholar] [CrossRef]

- Jacoby, Jacob, Margaret C. Nelson, and Wayne D. Hoyer. 1982. Corrective advertising and affirmative disclosure statements: Their potential for confusing and misleading the consumer. Journal of Marketing 46: 61–72. [Google Scholar] [CrossRef]

- Johnson, Don T. 2004. Has the Security and Exchange Commission’s Rule 421 made mutual fund prospectuses more accessible? Journal of Financial Regulation and Compliance 12: 51–63. [Google Scholar] [CrossRef]

- Johnson, Eric J., John W. Payne, and James R. Bettman. 1988. Information displays and preference reversals. Organizational Behavior and Human Decision Performance 42: 1–21. [Google Scholar] [CrossRef]

- Jones, Michael John, and Paul A. Shoemaker. 1994. Accounting narratives: A review of empirical studies of content and readability. Journal of Accounting Literature 13: 142–84. [Google Scholar]

- Kincaid, J. Peter, Robert P. Fishburne, Richard L. Rogers, and Brad S. Chissom. 1975. Derivation of New Readability Formulas (Automated Readability Index, Fog Count, and Flesch Reading Ease Formula) for Navy Enlisted Personnel. Research Branch Report 8-75. Orlando: Institute for Simulation and Training, University of Central Florida. [Google Scholar]

- Koonce, Lisa, Marlys Gascho Lipe, and Mary Lea McAnally. 2005a. Judging the risk of financial instruments: Problems and potential remedies. The Accounting Review 80: 871–95. [Google Scholar] [CrossRef]

- Koonce, Lisa, Mary Lea McAnally, and Molly Mercer. 2005b. How do investors judge the risk of financial items? The Accounting Review 80: 221–41. [Google Scholar] [CrossRef]

- Kravet, Todd, and Volkan Muslu. 2013. Textual risk disclosures and investors’ risk perceptions. Review of Accounting Studies 18: 1088–122. [Google Scholar] [CrossRef]

- Li, Feng. 2008. Annual report readability, current earnings and earnings persistence. Journal of Accounting and Economics 4: 221–47. [Google Scholar] [CrossRef]

- Libby, Robert, and Peter C. Fishburn. 1977. Behavioral models of risk taking in business decisions: A survey and evaluation. Journal of Accounting Research 15: 272–92. [Google Scholar] [CrossRef]

- Linsley, Philip M., and Michael J. Lawrence. 2007. Risk reporting by the largest UK companies: Readability and lack of obfuscation. Accounting, Auditing and Accountability Journal 20: 620–27. [Google Scholar] [CrossRef]

- Linsley, Philip M., and Philip J. Shrives. 2005a. Examining risk reporting in UK companies. The Journal of Risk Finance 6: 292–305. [Google Scholar] [CrossRef]

- Linsley, Philip M., and Philip J. Shrives. 2005b. Transparency and the disclosure of risk information in the banking sector. Journal of Financial Regulation and Compliance 13: 205–14. [Google Scholar] [CrossRef]

- Lipe, Marlys Gascho. 1998. Individual investors’ risk judgments and investment decisions: The impact of accounting and market data. Accounting, Organizations and Society 23: 625–40. [Google Scholar] [CrossRef]

- Luce, R. Duncan, and Elke U. Weber. 1986. An axiomatic theory of conjoint, expected risk. Journal of Mathematical Psychology 30: 188–205. [Google Scholar] [CrossRef]

- Mazor, Christine, Lisa Mitrovich, and Doug Rand. 2016. SEC Concept Release Seeks Comments on Regulation S-K. Heads-Up. Available online: https://www.iasplus.com/en-us/publications/us/heads-up/2016/issue-12 (accessed on 16 December 2017).

- Miller, Brian P. 2010. The effect of reporting complexity on small and large investor trading. The Accounting Review 85: 2107–43. [Google Scholar] [CrossRef]

- Morunga, Maria, and Michael E. Bradbury. 2012. The impact of IFRS on annual report length. Australasian Accounting Business & Finance Journal 6: 47–62. [Google Scholar]

- Nelson, Mark W., and Kathy K. Rupar. 2015. Numerical formats within risk disclosures and the moderating effect of investors’ concerns about management discretion. Accounting Review 90: 1149–68. [Google Scholar] [CrossRef]

- Rennekamp, Kristina. 2012. Processing fluency and investors’ reactions to disclosure readability. Journal of Accounting Research 50: 1319–54. [Google Scholar] [CrossRef]

- Rogers, Richard, Kimberly S. Harrison, Daniel W. Shuman, Kenneth W. Sewell, and Lisa L. Hazelwood. 2007. An analysis of Miranda warnings and waivers: Comprehension and coverage. Law and Human Behavior 31: 177–92. [Google Scholar] [CrossRef] [PubMed]

- Ryan, Stephen G. 1997. A survey of research relating accounting numbers to systematic equity risk, with implications for risk disclosure policy and future research. Accounting Horizons 11: 82–95. [Google Scholar]

- Schrand, Catherine M., and John A. Elliott. 1998. Risk and financial reporting: A summary of the discussion at the 1997 AAA/FASB conference. Accounting Horizons 12: 271–82. [Google Scholar]

- Securities and Exchange Commission (SEC). 1997. Disclosure of Accounting Policies for Derivative Financial Instruments, and Derivative Commodity Instruments and Disclosure of Quantitative and Qualitative Information about Market Risk Inherent in Derivative Financial Instruments, Other Financial Instruments, and Derivative Commodity Instruments; Nos. 33-7386; 34-38223; IC-22487; FR 48. International Series No. 1047; File No. 27-35-95. Washington: SEC.

- Securities and Exchange Commission (SEC). 1998. A Plain English Handbook: How to Create Plain English Disclosure. SEC Office of Investor Education and Assistance. Available online: http://www.sec.gov/pdf/handbook.pdf (accessed on 16 December 2017).

- Securities and Exchange Commission (SEC). 2004. Financial Reporting Release No. 33-8501. Available online: https://www.sec.gov/rules/proposed/33-8501.htm (accessed on 16 December 2017).

- Securities and Exchange Commission (SEC). 2005. Financial Reporting Release No. 33-8591. Available online: https://www.sec.gov/rules/final/33-8591.pdf (accessed on 16 December 2017).

- Securities and Exchange Commission (SEC). 2010. The Investor’s Advocate: How the SEC Protects Investors, Maintains Market Integrity, and Facilitates Capital Formation. Available online: http://www.sec.gov/about/whatwedo.shtml (accessed on 16 December 2017).

- Securities and Exchange Commission (SEC). 2016. Business and Financial Disclosure Required by Regulation S-K. Available online: https://www.sec.gov/rules/concept/2016/33-10064.pdf (accessed on 16 December 2017).

- Skinner, Douglas J. 1994. Why firms voluntarily disclose bad news. Journal of Accounting Research 32: 38–60. [Google Scholar] [CrossRef]

- Skinner, Douglas J. 1997. Earnings disclosures and stockholder lawsuits. Journal of Accounting and Economics 23: 249–82. [Google Scholar] [CrossRef]

- Slovic, Paul. 1987. Perception of risk. Science 236: 280–85. [Google Scholar] [CrossRef] [PubMed]

- Slovic, Paul, Baruch Fischhoff, and Sarah Lichtenstein. 1980. Facts and fears: Understanding perceived risk. In Societal Risk Assessment: How Safe Is Safe Enough? Edited by Richard C. Schwing and Walter A. Albers. San Francisco: Jossey-Bass. [Google Scholar]

- Smith, Malcolm, and Richard Taffler. 1995. The incremental effect of narrative accounting information in corporate annual reports. Journal of Business Finance and Accounting 22: 1195–210. [Google Scholar] [CrossRef]

- Tan, Hun-Tong, Elaine Ying Wang, and Bo Zhou. 2014. When the use of positive language backfires: The joint effect of tone, readability, and investor sophistication on earnings judgments. Journal of Accounting Research 52: 273–302. [Google Scholar] [CrossRef]

- Tan, Hun-Tong, Elaine Ying Wang, and Bo Zhou. 2015. How does readability influence investors’ judgments? Consistency of benchmark performance matters. The Accounting Review 90: 371–93. [Google Scholar] [CrossRef]

- Taylor, Eileen, and Jennifer Riley. 2017. Leveling the playing field for less-sophisticated non-professional investors: Does plain English matter? Journal of Capital Markets Studies 1: 36–57. [Google Scholar] [CrossRef]

- Yayla, Ali Alper, and Qing Hu. 2011. The impact of information security events on the stock value of firms: The effect of contingency factors. Journal of Information Technology 26: 60–77. [Google Scholar] [CrossRef]

| Measure | n | Mean (SD), Range |

| Number of years investing | 358 | 23.38 (13.09), 0–62 years |

| Average # of trades per year | 359 | 10.23 (14.25), 0–120 trades |

| Average age | 359 | 65.03 (10.06), 23–90 years |

| Gender = 58% Male (207/359); 42% Female (152/359) | ||

| Highest Degree Earned | Frequency | Percent (%) |

| High School | 5 | 1.4 |

| Some College/Associate’s Degree | 42 | 11.7 |

| Bachelor’s Degree | 141 | 39.3 |

| Graduate Degree | 171 | 47.6 |

| Total | 359 | 100 |

| Field of Highest Degree | Frequency | Percent (%) |

| Accounting & Finance | 36 | 10.0 |

| Other Business | 67 | 17.8 |

| Health Care | 50 | 13.9 |

| Engineering | 39 | 10.9 |

| Education | 36 | 10.0 |

| Physical Sciences | 31 | 8.6 |

| Other College Degree | 98 | 27.3 |

| High School Diploma | 5 | 1.5 |

| Total | 359 | 100 |

| df | Mean Square | F | p-Value * | |

|---|---|---|---|---|

| Dependent Variable (DV): Probability of economic loss (0 = zero probability to 10 = certainty) | ||||

| Readability × Risk factors | 2 | 74.50 | 20.89 | <0.001 |

| Error | 714 | 3.57 | ||

| DV: Magnitude of economic loss (0 = zero loss to 10 = large loss) | ||||

| Readability × Risk factors | 2 | 43.80 | 11.99 | <0.001 |

| Error | 714 | 3.65 | ||

| DV: Cause for worry (0 = no worry to 10 = high worry) | ||||

| Readability × Risk factors | 2 | 83.52 | 25.80 | <0.001 |

| Error | 714 | 3.24 | ||

| DV: Overall risk (0 = no risk to 10 = high risk) | ||||

| Readability × Risk factors | 2 | 56.97 | 19.68 | <0.001 |

| Error | 714 | 2.90 | ||

| Dependent Variable | RF1: Competitive Environment | RF2: Information Security | RF3: Internal Control Weakness |

|---|---|---|---|

| F p-Value * | F p-Value * | F p-Value * | |

| Probability of economic loss (0 = zero probability to 10 = certainty) | 11.72 p < 0.01 | 0.58 p < 0.45 | 14.05 p < 0.01 |

| Magnitude of economic loss (0 = zero loss to 10 = large loss) | 10.79 p < 0.01 | 0.00 p < 0.98 | 5.26 p < 0.02 |

| Cause for worry (0 = no worry to 10 = high worry) | 5.44 p < 0.02 | 1.97 p < 0.16 | 21.39 p < 0.01 |

| Overall risk to the firm (0 = no risk to 10 = high risk) | 4.74 p = 0.03 | 0.30 p < 0.86 | 17.40 p < 0.01 |

| RF1: Competitive Environment | RF2: Information Security | RF3: Internal Control Weakness | ||||

|---|---|---|---|---|---|---|

| Readability (Low n = 169; High n = 190) | ||||||

| Dependent Variable: | Low | High | Low | High | Low | High |

| Probability of economic loss (0 = zero probability to 10 = certainty) | 5.89 (2.16) | 6.71 (2.31) | 6.27 (2.56) | 6.11 (2.64) | 6.32 (2.66) | 5.26 (2.44) |

| Magnitude of economic loss (0 = zero loss to 10 = large loss) | 6.17 (2.32) | 6.95 (2.19) | 7.52 (2.29) | 7.53 (2.47) | 7.09 (2.58) | 6.48 (2.51) |

| Cause for worry (0 = no worry to 10 = high worry) | 5.51 (2.47) | 6.14 (2.57) | 6.14 (2.48) | 5.77 (2.55) | 6.43 (2.78) | 5.12 (2.58) |

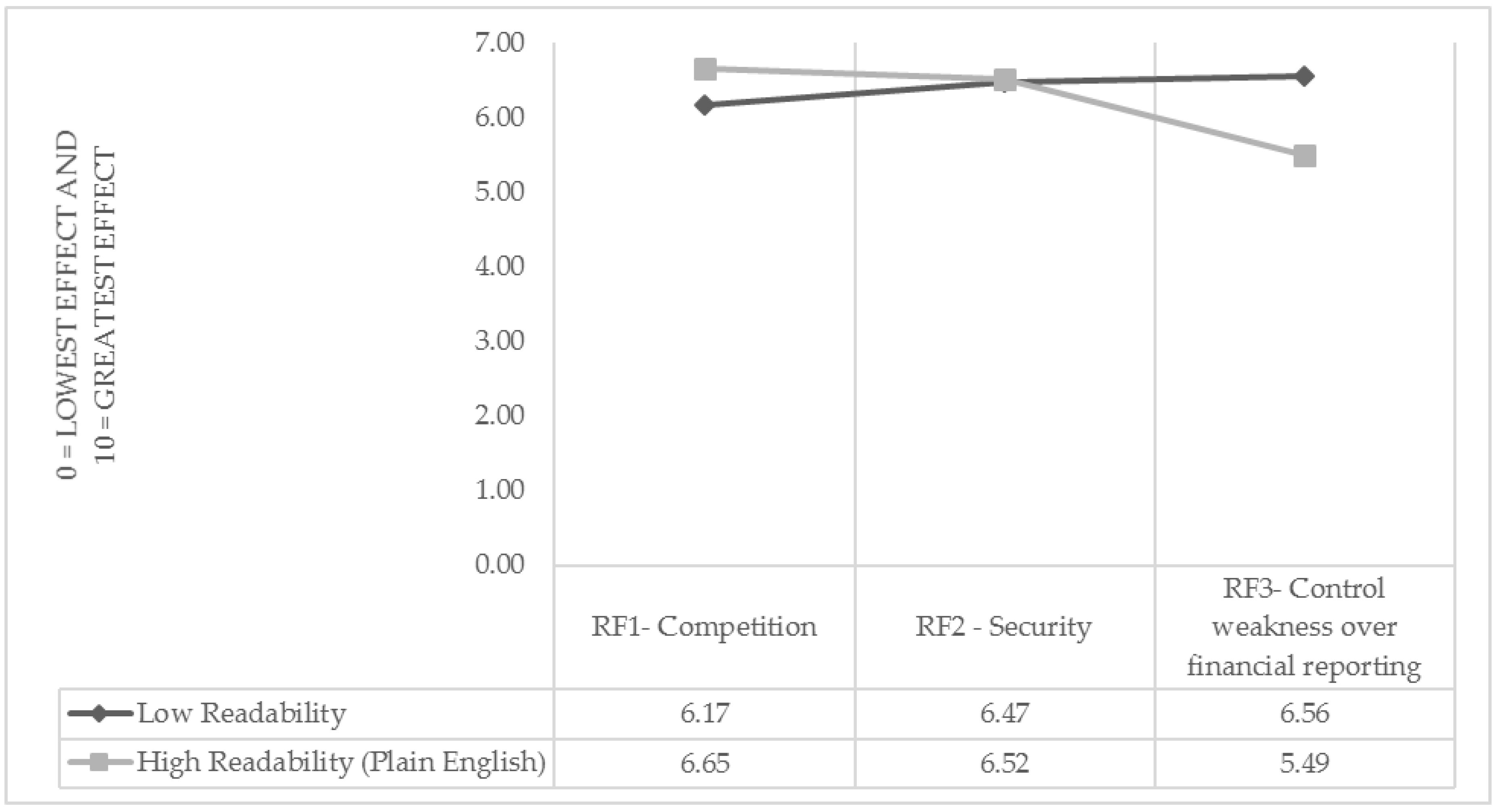

| Overall risk to the firm (0 = no risk to 10 = high risk) | 6.17 (2.02) | 6.66 (2.15) | 6.47 (2.21) | 6.52 (2.41) | 6.56 (2.52) | 5.50 (2.33) |

| Average of all DVs: | 6.17 (2.02) | 6.65 (2.15) | 6.47 (2.21) | 6.52 (2.41) | 6.56 (2.52) | 5.49 (2.33) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Riley, J.; Taylor, E. The Inconsistent Effects of Plain English Disclosures on Nonprofessional Investors’ Risk Judgments. Int. J. Financial Stud. 2018, 6, 25. https://doi.org/10.3390/ijfs6010025

Riley J, Taylor E. The Inconsistent Effects of Plain English Disclosures on Nonprofessional Investors’ Risk Judgments. International Journal of Financial Studies. 2018; 6(1):25. https://doi.org/10.3390/ijfs6010025

Chicago/Turabian StyleRiley, Jennifer, and Eileen Taylor. 2018. "The Inconsistent Effects of Plain English Disclosures on Nonprofessional Investors’ Risk Judgments" International Journal of Financial Studies 6, no. 1: 25. https://doi.org/10.3390/ijfs6010025