Performance of Exchange Traded Funds during the Brexit Referendum: An Event Study

Abstract

:1. Introduction and Literature Review

2. Methodology and Data

2.1. Data

2.2. Event Study Market Model and Specifications

3. Empirical Results

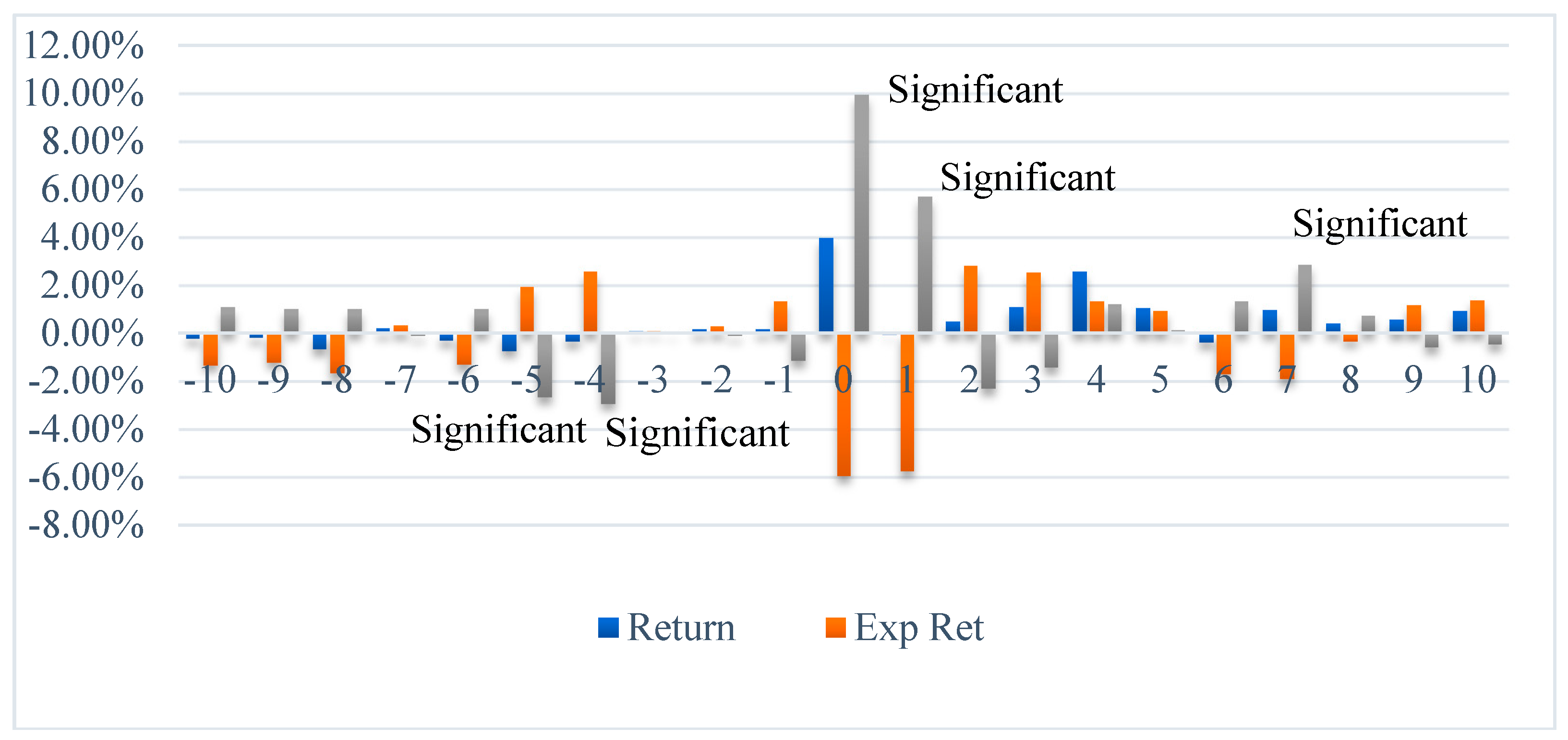

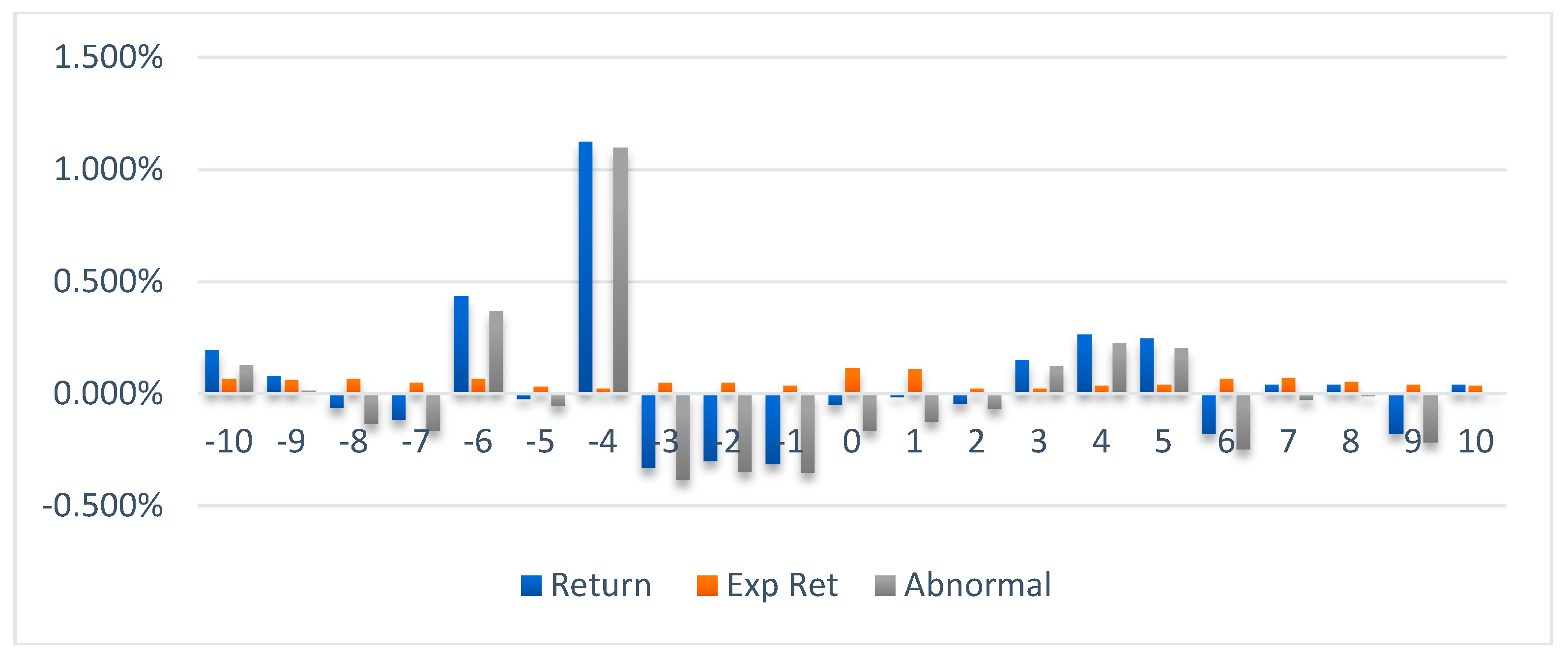

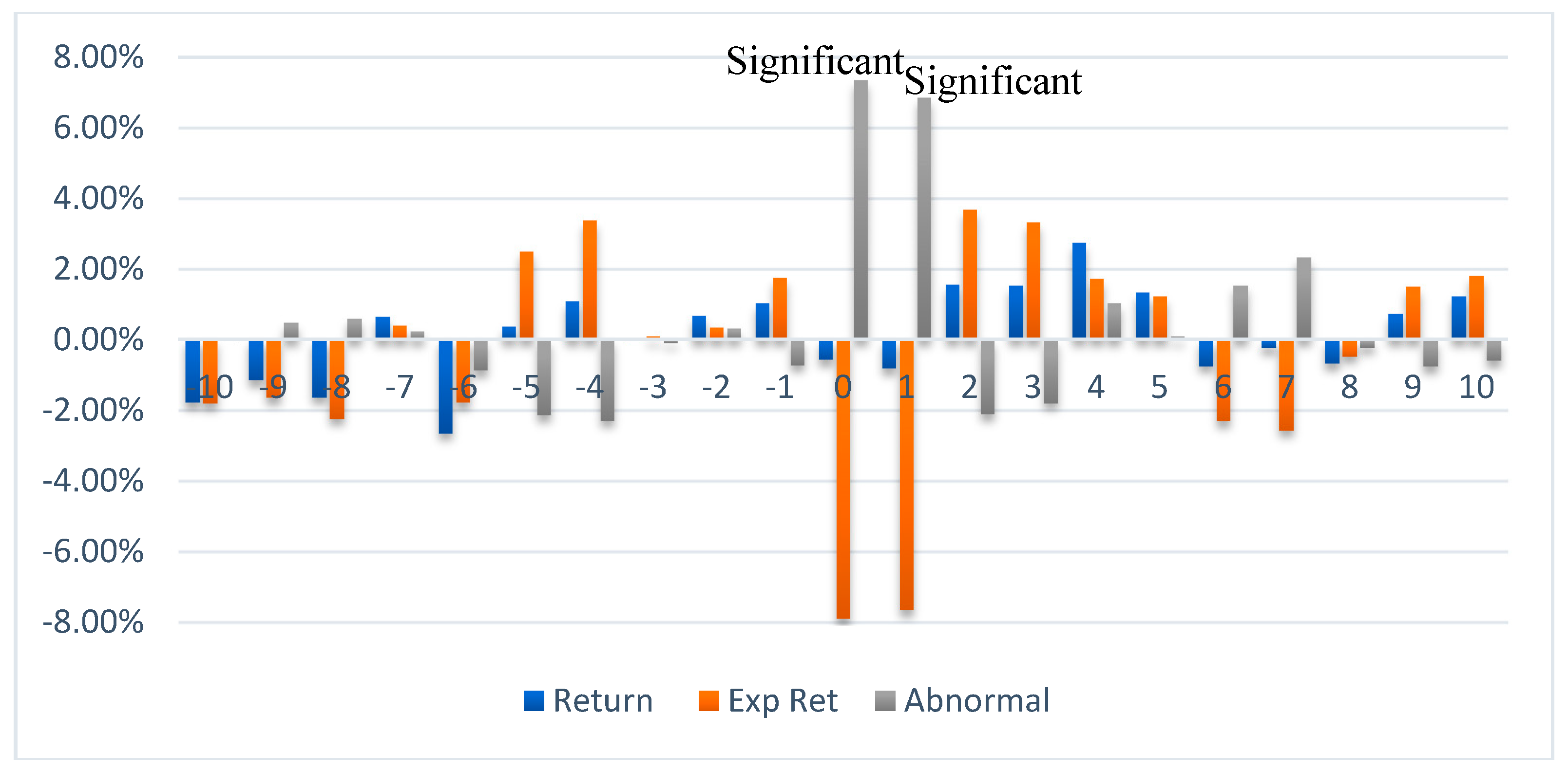

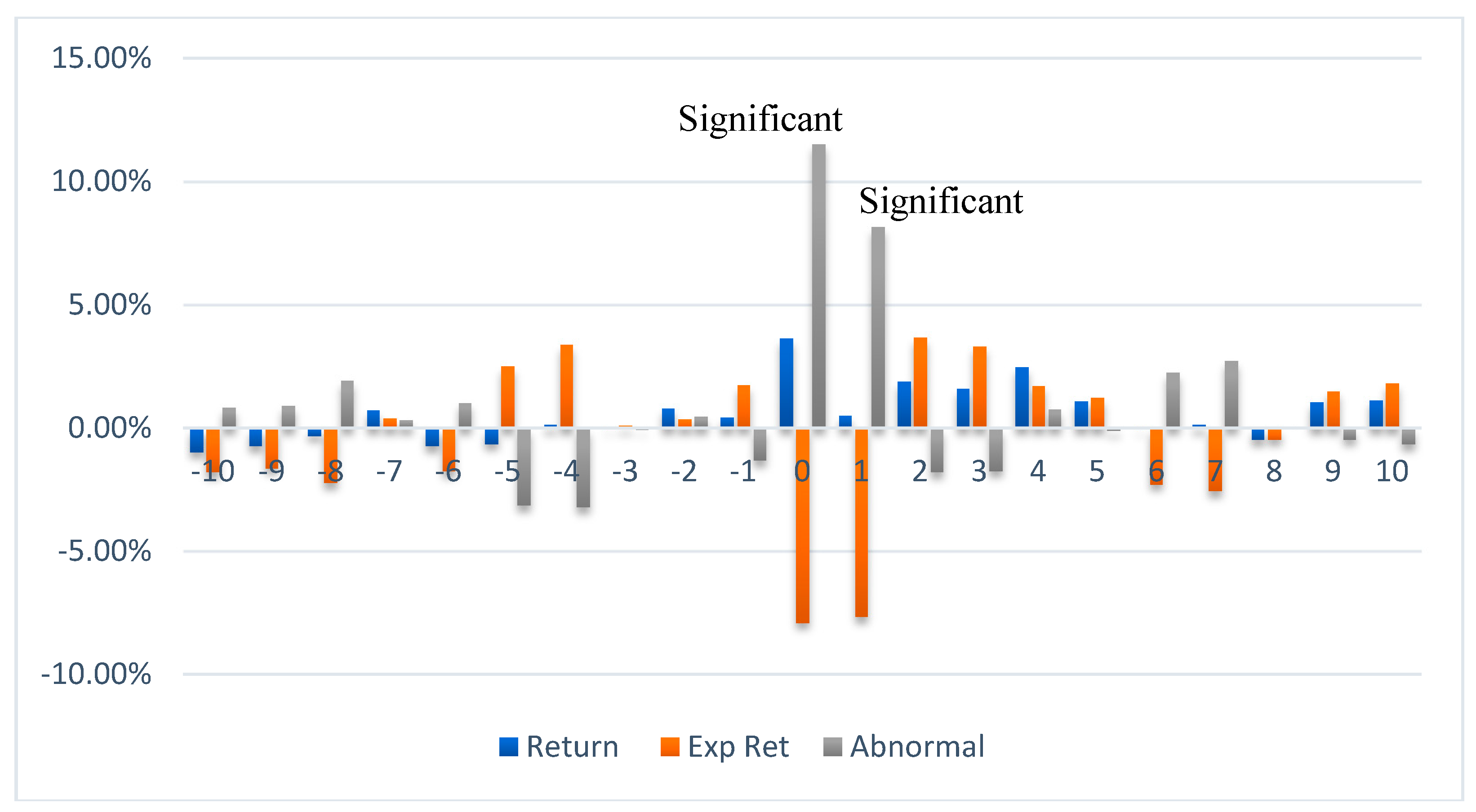

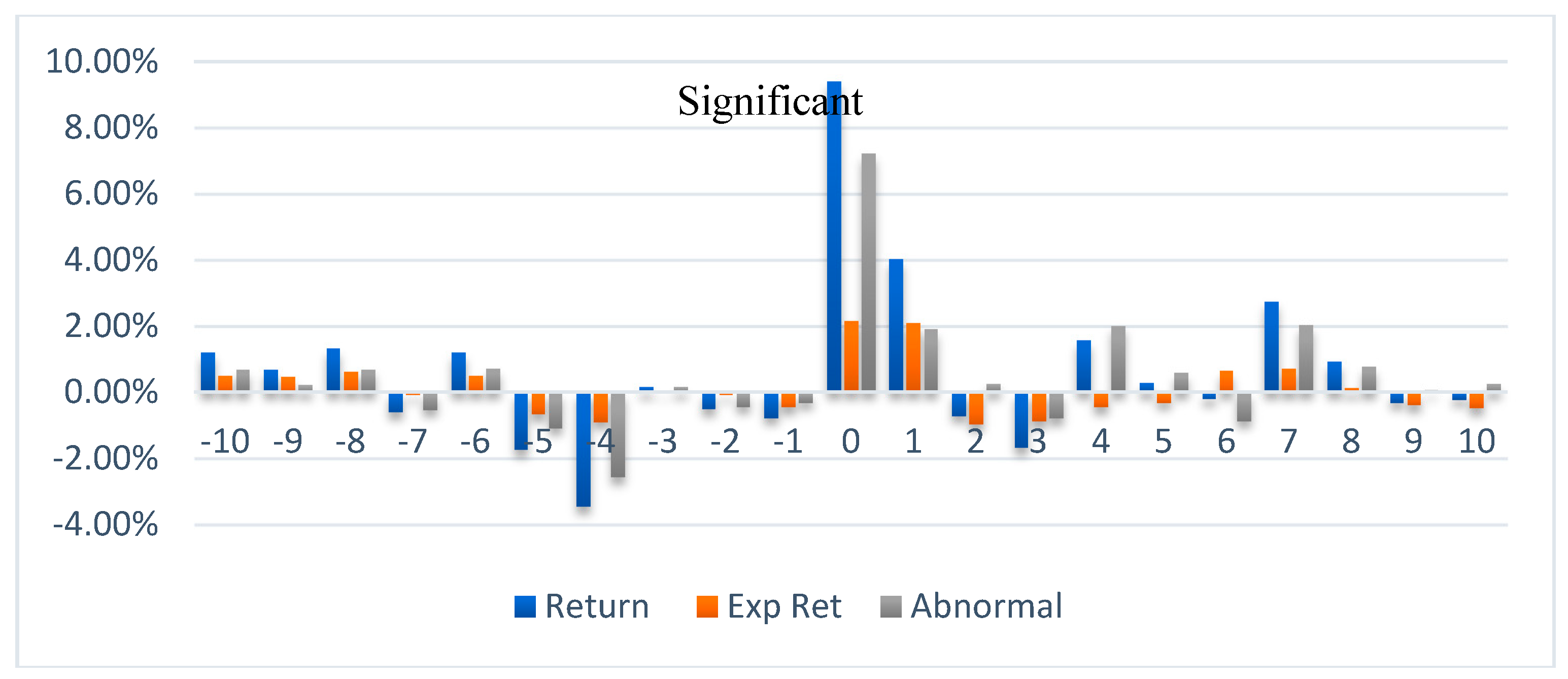

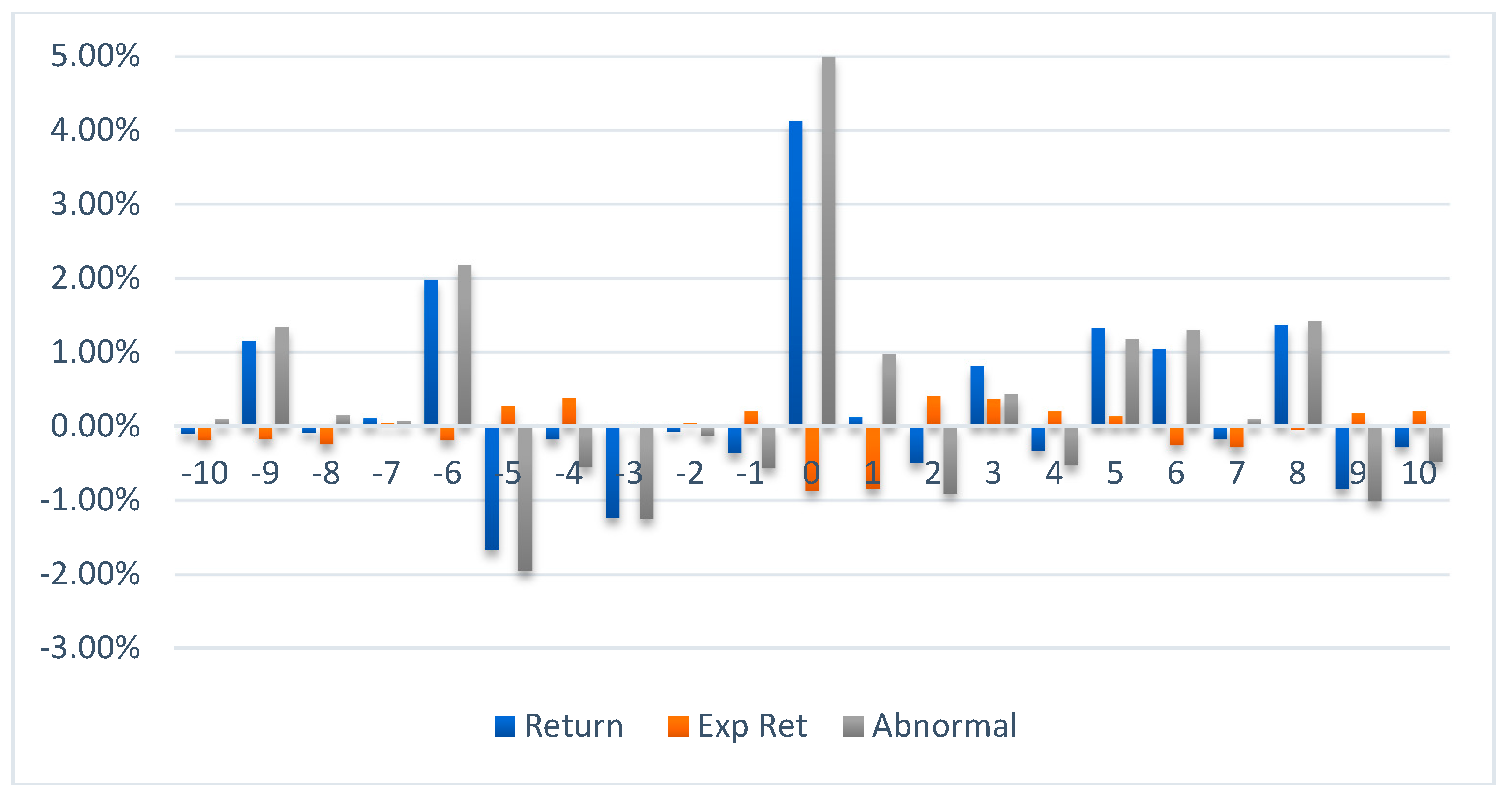

Preliminary Results

4. Main Results

5. Conclusions and Implications

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Assidenou, Komlavi. 2011. Cointegration of Major Stock Market Indices during the 2008 Global Financial Distress. International Journal of Economic and Finance 3: 212–22. [Google Scholar] [CrossRef]

- Baren, Michelle L., and Shiquang Ma. 2002. The Behavior of China’s Stock Prices in Response to the Proposal and Approval of Bonus Issues. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Belgacem, Aymen, Anna Creti, Khaled Guesmi, and Amine Lahiani. 2015. Volatility Spillovers and Macroeconomic Announcements: Evidence from Crude Oil Markets. Journal of Applied Economics 47: 2974–84. [Google Scholar] [CrossRef]

- Binder, John. 1998. The event study methodology since 1969. Review of Quantitative Finance and Accounting 11: 111–37. [Google Scholar] [CrossRef]

- Boumparis, Periklis, Costas Milas, and Theodore Panagiotidis. 2017. Economic Policy Uncertainty and Sovereign Credit Rating Decisions: Panel Quantile Evidence for the Eurozone. Journal of International Money and Finance 79: 39–71. [Google Scholar] [CrossRef]

- Connolly, Robert, Chris Stivers, and Licheng Sun. 2007. Commonality in the time-variation of stock-stock and stock-bond return comovements. Journal of Financial Markets 10: 192–218. [Google Scholar] [CrossRef]

- Fama, Eugene. 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- MacKinaly, Craig. 1997. Event Studies in Economics and Finance. Journal of Economic Literature 35: 13–39. [Google Scholar]

- Madura, Jeff, and Nivine Richi. 2004. Overreaction of Exchange-Traded Funds during the Bubble of 1998–2002. Journal of Behavioral Finance 5: 91–104. [Google Scholar] [CrossRef]

- Plakandaras, Vasilios, Rangan Gupta, and Mark E. Wohar. 2017. The Depreciation of the Pound Post-Brexit: Could it have been predicted? Finance Research Letters 21: 206–13. [Google Scholar] [CrossRef]

- Ramiah, Vikash, Huy Pham, and Imad Mousa. 2016. The Sectoral Effects of Brexit on the British Economy: Early Evidence from the Reaction of the Stock Market. Applied Economics 49: 2508–14. [Google Scholar] [CrossRef]

- Sathyanarayana, S., and Sudhindra Gargesha. 2016. Impact of BREXIT Referendum on Indian Stock Market. IRA-International Journal of Management & Social Science 5: 104–20. [Google Scholar]

- Scruggs, John, and Glabadanidis Paskalis. 2003. Risk Premia and the Dynamic Covariance between Stock and Bond Returns. Journal of Financial and Quantitative Analysis 38: 295–316. [Google Scholar] [CrossRef]

- Stracca, Livio. 2013. The Global Effects of the Euro Debt Crisis. ECB Working Paper No. 1573. Available online: https://ssrn.com/abstract=2302515 (accessed on 25 June 2018).

- Quaye, Issac, Mu Yinpig, Abudu Braimah, and Agyare Ramous. 2016. Review of Stock Markets’ Reaction to New Events: Evidence from Brexit. Journal of Financial Risk Management 5: 281–314. [Google Scholar] [CrossRef]

- Zheng, Yao, and Eric Osmer. 2013. The Pricing of China Region ETFs—An Empirical Analysis. Journal of Finance and Accountancy 12: 1–10. [Google Scholar]

| 1 | “Determinants of Global Spillovers from US Monetary Policy”, ECB working paper series, 2015. |

| 2 | “UK credit rating downgraded over Brexit uncertainty” Financial Times article, 2017. |

| 3 | According to the Daily Telegraph Article “Why we should be at the FTSE 250 and not the FTSE 100 to gauge the impact of the Brexit”. |

| ETF | Issuer | Benchmark | Launch Date | Net Assets |

|---|---|---|---|---|

| World Equity | iShares Core MSCI World ETF | MSCI World Index | 2009 | $13.9 Billion |

| US Treasury | iShares US T-Bond 7–10 Year ETF | ICE US T-Bond 7–10 Year Bond Index | 2006 | $2.5 Billion |

| Euro Equities | iShares MSCI Europe ex-UK ETF | MSCI Europe ex-UK Index | 2006 | $2.4 Billion |

| Emerging Equities | iShares MSCI Emerging Markets ETF | MSCI Emerging Markets ETF | 2005 | $6.3 Billion |

| Private Equity | iShares Listed Private Equity ETF | S&P Listed Private Equity Index | 2007 | $460 Million |

| Gold | ETFS Physical Securities Limited | Spot Gold LMBA Specification | 2007 | |

| Oil | ETFS Commodity Securities Limited | Bloomberg Petroleum Sub index | 2006 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variables | N | Mean | sd | Min | Max | ADF Test | Phillips-Perron |

| FTSE | 1626 | 0.000376 | 0.00982 | −0.0746 | 0.0526 | −38.053 *** | −42.063 *** |

| World Eq | 1626 | 0.000458 | 0.00922 | −0.0498 | 0.0413 | −42.043 *** | −39.880 *** |

| S&P 500 | 1626 | 0.000523 | 0.00892 | −0.0560 | 0.0438 | −39.725 *** | −42.006 *** |

| EU Equity | 1626 | 0.000170 | 0.0121 | −0.0565 | 0.0580 | −41.922 *** | −41.190 *** |

| Emrg Equity | 1626 | 9.37 × 10−5 | 0.0124 | −0.0658 | 0.0614 | −41.201 *** | −39.071 *** |

| Private Equity | 1626 | 0.000392 | 0.0112 | −0.0555 | 0.0502 | −39.161 *** | −40.833 *** |

| US T-Bond | 1626 | 0.000237 | 0.00728 | −0.0346 | 0.0940 | −40.859 *** | −40.859 *** |

| Oil | 1626 | −0.000294 | 0.0111 | −0.187 | 0.188 | −51.426 *** | −51.426 *** |

| Gold | 1626 | 3.99 × 10−5 | 0.0108 | −0.0853 | 0.0578 | −42.525 *** | −42.525 *** |

| Variable | FTSE | World Eq | S&P 500 | EU Equity | Emrg | Private | US T-Bond | Oil | Gold |

|---|---|---|---|---|---|---|---|---|---|

| FTSE | 1 | ||||||||

| World Eq | 0.757 | 1 | |||||||

| S&P 500 | −0.006 | 0.002 | 1 | ||||||

| EU Equity | 0.793 | 0.865 | 0.004 | 1 | |||||

| Emrg Equity | 0.710 | 0.854 | 0.003 | 0.768 | 1 | ||||

| Private Equity | 0.744 | 0.882 | 0.001 | 0.771 | 0.772 | 1 | |||

| US T-Bond | −0.468 | −0.129 | −0.036 | −0.315 | −0.173 | −0.154 | 1 | ||

| Oil | 0.380 | 0.333 | −0.003 | 0.369 | 0.396 | 0.324 | −0.342 | 1 | |

| Gold | 0.072 | 0.028 | −0.046 | 0.087 | 0.155 | 0.025 | −0.079 | 0.370 | 1 |

| World Equity | World Equity | S&P Core | EU Equity | EU Equity | Emerging Equity | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Variables | OLS | Prais | OLS | OLS | Newey-West | OLS |

| FTSE Return | 0.802 *** | 0.799 *** | −0.00836 | 1.057 *** | 1.057 *** | 0.991 *** |

| (0.0138) | (0.0135) | (0.0232) | (0.0184) | (0.0244) | (0.0211) | |

| Constant | 6.59 × 10−5 | 6.49 × 10−5 | 0.000526 ** | −0.000295 * | −0.000295 * | −0.000419 ** |

| (0.000132) | (0.000118) | (0.000223) | (0.000176) | (0.000177) | (0.000202) | |

| Observations | 1624 | 1623 | 1624 | 1624 | 1624 | 1624 |

| R-squared | 0.675 | 0.684 | 0.000 | 0.671 | 0.671 | 0.577 |

| DW Stat | 2.224 | 2.020 | 1.959 | 2.131 | 2.051 | |

| Hetero Prob | 0.763 | 0.0983 | 0.000 | 0.780 |

| Private Equity | Private Equity | US T-Bond | Gold | Gold | Oil | Oil | |

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Variables | OLS | Prais | OLS | OLS | Robust | OLS | Newey-West |

| FTSE Return | 0.953 *** | 0.959 *** | −0.288 *** | 0.117 *** | 0.117 *** | 0.458 *** | 0.458 *** |

| (0.0182) | (0.0179) | (0.0159) | (0.0284) | (0.0399) | (0.0275) | (0.0287) | |

| Constant | −8.46 × 10−5 | −9.54 × 10−5 | 0.000304 ** | 1.90 × 10−5 | 1.90 × 10−5 | −0.000477 * | −0.000477 * |

| (0.000174) | (0.000161) | (0.000152) | (0.000272) | (0.000275) | (0.000263) | (0.000260) | |

| Observations | 1624 | 1623 | 1624 | 1624 | 1624 | 1624 | 1624 |

| R-squared | 0.629 | 0.639 | 0.168 | 0.010 | 0.010 | 0.146 | |

| DW Stat | 2.156 | 2.011 | 1.988 | 2.004 | 2.460 | ||

| Hetero Prob | 0.088 | 0.674 | 0.000 | 0.000 |

| Days −5 | Days −4 | Days 0 | Days +1 | Days +7 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R | E (R) | AR | R | E (R) | AR | R | E (R) | AR | R | E (R) | AR | R | E (R) | AR | |

| World Equity | −0.80 | 2 | −2.80 | −0.25 | 2.80 | −3.05 | 4 | −6 | 10 | −0.05 | 5.85 | −5.90 | 1 | −2 | 3 |

| EU Equity | −0.55 | −8 | 7.45 | −0.65 | −7.80 | 7.15 | |||||||||

| Emerging Equity | 3.60 | −7.80 | 11.40 | 0.50 | −7.70 | 8.20 | |||||||||

| Private Equity | 3.80 | −7.30 | 11.10 | −1.10 | −7 | 5.80 | |||||||||

| US T-Bond | 9.30 | 2.10 | 7.20 | ||||||||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alkhatib, A.; Harasheh, M. Performance of Exchange Traded Funds during the Brexit Referendum: An Event Study. Int. J. Financial Stud. 2018, 6, 64. https://doi.org/10.3390/ijfs6030064

Alkhatib A, Harasheh M. Performance of Exchange Traded Funds during the Brexit Referendum: An Event Study. International Journal of Financial Studies. 2018; 6(3):64. https://doi.org/10.3390/ijfs6030064

Chicago/Turabian StyleAlkhatib, Akram, and Murad Harasheh. 2018. "Performance of Exchange Traded Funds during the Brexit Referendum: An Event Study" International Journal of Financial Studies 6, no. 3: 64. https://doi.org/10.3390/ijfs6030064