1. Introduction

There is a large body of literature that reports on the effects of oil price shocks on a developed economy like the United States. However, the effect of oil price changes on developing countries has often been ignored. In this study, we empirically analyze the impact of change in oil price on developing countries. Based on a two-block structural vector autoregressive (VAR) model proposed by Kilian and Park (2009) [

1], we investigate the dynamic effects of oil price shocks on the index of the industrial production (IIP) and consumer price index (CPI) for the United States and five developing countries.

The price of oil is one of the most familiar economic indicators for many people as it is highly related to our daily economic activity. Therefore, changes in the oil price and their causes have been an interesting issue for economists. Early works generally employed production functions to investigate the effects of changes in oil prices on an aggregate economy (e.g., Hamilton (1983 [

2], 1985 [

3]) and Gisser and Goodwin (1986) [

4]). Each study finds a negative association between energy prices and output. Hooker (1996) [

5] found that, in the United States, the negative relationship between oil prices and GDP weakened after 1973 by examining the period 1948:1–1994:2. In addition, Hooker (1999) [

6] pointed out that oil price changes would not appear to have a strong impact on the U.S. core inflation after 1980.

The main limitation of these previous works was that they assumed exogeneity of oil price changes: the possibility of reverse causality from the global economy through oil demand fluctuations has not been taken into consideration. To address the exogeneity problem, Kilian (2009) [

7] established the structural VAR model of the global oil market in order to identify three underlying shocks in the global oil market: (1) oil supply shocks; shocks to the physical ability to produce oil; (2) aggregate demand shocks; shocks to the current demand for all industrial commodities which are determined by global macroeconomic conditions and (3) oil-specific demand shocks; shocks which cannot be explained based on oil supply shocks or aggregate demand shocks. Then he reached a conclusion that each oil price shock affects GDP growth and CPI in the United States differently. Following this contribution, the structural VAR model has been widely applied to the later studies investigating oil-related economic issues. For example, Kilian and Park (2009) [

1] constructed a two-block structural VAR model that included the global oil market block and the U.S. stock market block in order to explore the differences in the responses of industry-level stock returns to changes in oil price. In addition, Fukunaga, Hirakata and Sudo (2010) [

8] investigated the impacts of oil price shocks on industry-level production in the United States and Japan and found that each shock would differently affect each industry-level production depending on oil intensiveness, and the transmission mechanism would be different between both countries.

Looking at country coverage of the previous work, however, most empirical literatures have mainly focused on the effects of changes in oil price on the developed economy and the effects of changes in oil price on the developing countries are largely unknown. Therefore, in this study, we set our main objective to be examining the impact of change in oil price on developing countries in terms of their magnitudes, transmission mechanisms. More specifically, we investigate how the underlying causes of oil price changes respectively affect main short-term macroeconomic indicators, i.e., index of industrial production (IIP) and consumer price index (CPI), in five developing countries and the United States in order to make it possible to check whether there are any differences in response pattern to oil price change between developing countries and the United States, which we consider representative of developed countries. We apply a two-block structural VAR approach proposed by Kilian and Park (2009) [

1] with the aim of controlling endogeneity of oil price. To the best of our knowledge, this study is the first attempt to investigate how oil price change affects developing countries, taking the endogeneity of oil price into consideration.

The main findings in this paper are as follows: First, as well as the United States, we showed that the effect of oil price shocks on IIP and CPI in emerging countries also depends on where the changes fundamentally come from. Second, we found that some emerging countries showed unique impulse response patterns, the shapes of which are different from those of the United States. Third, we revealed that the response patterns vary among emerging countries. The importance of oil production for each economy is one of the important factors that affect the response pattern.

The remainder of the paper is organized as follows.

Section 2 contains data description and describes the empirical framework with brief discussions about the identified structural shocks to the global oil market.

Section 3 provides the empirical results.

Section 4 contains concluding remarks.

3. Empirical Results

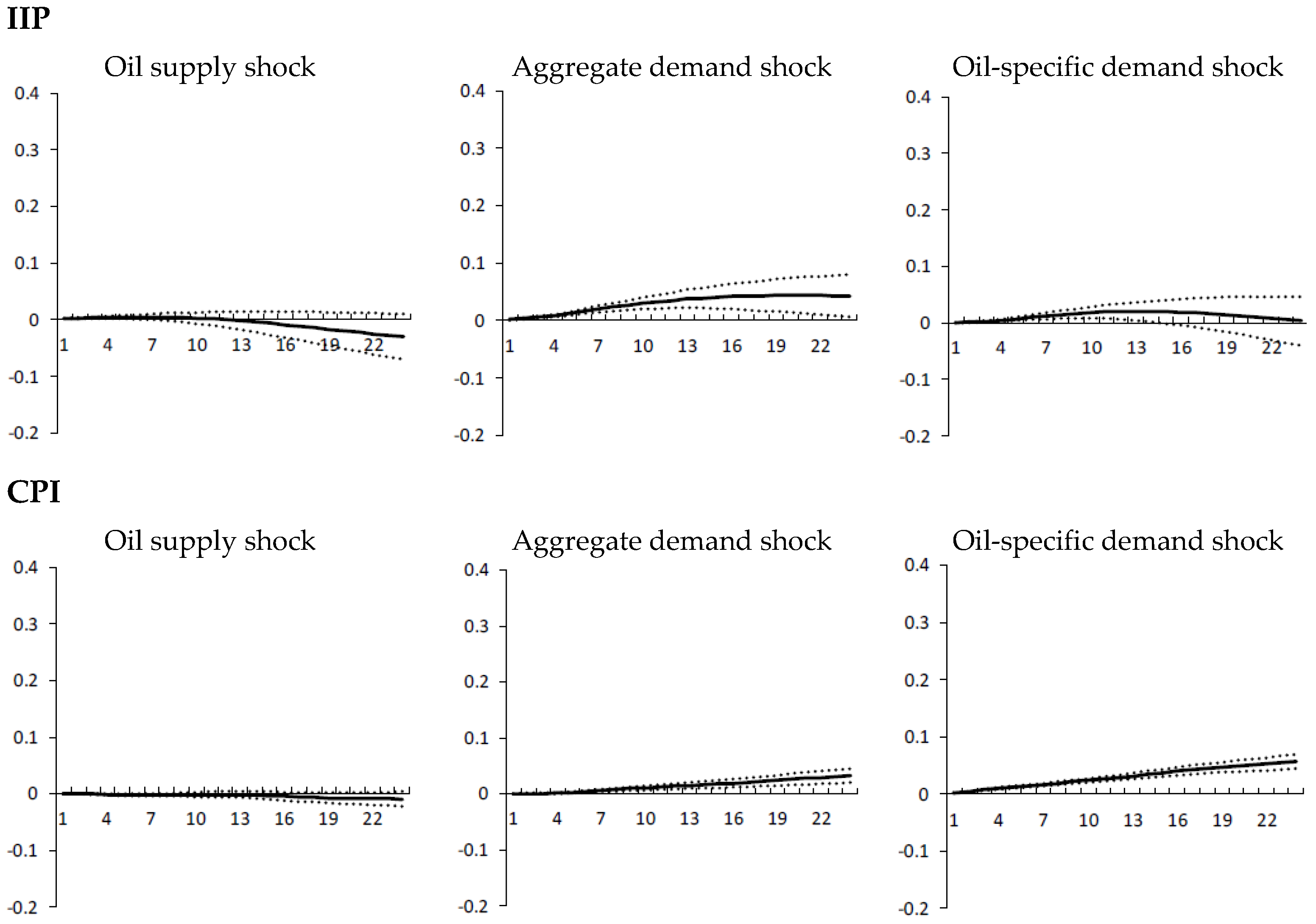

3.1. The United States

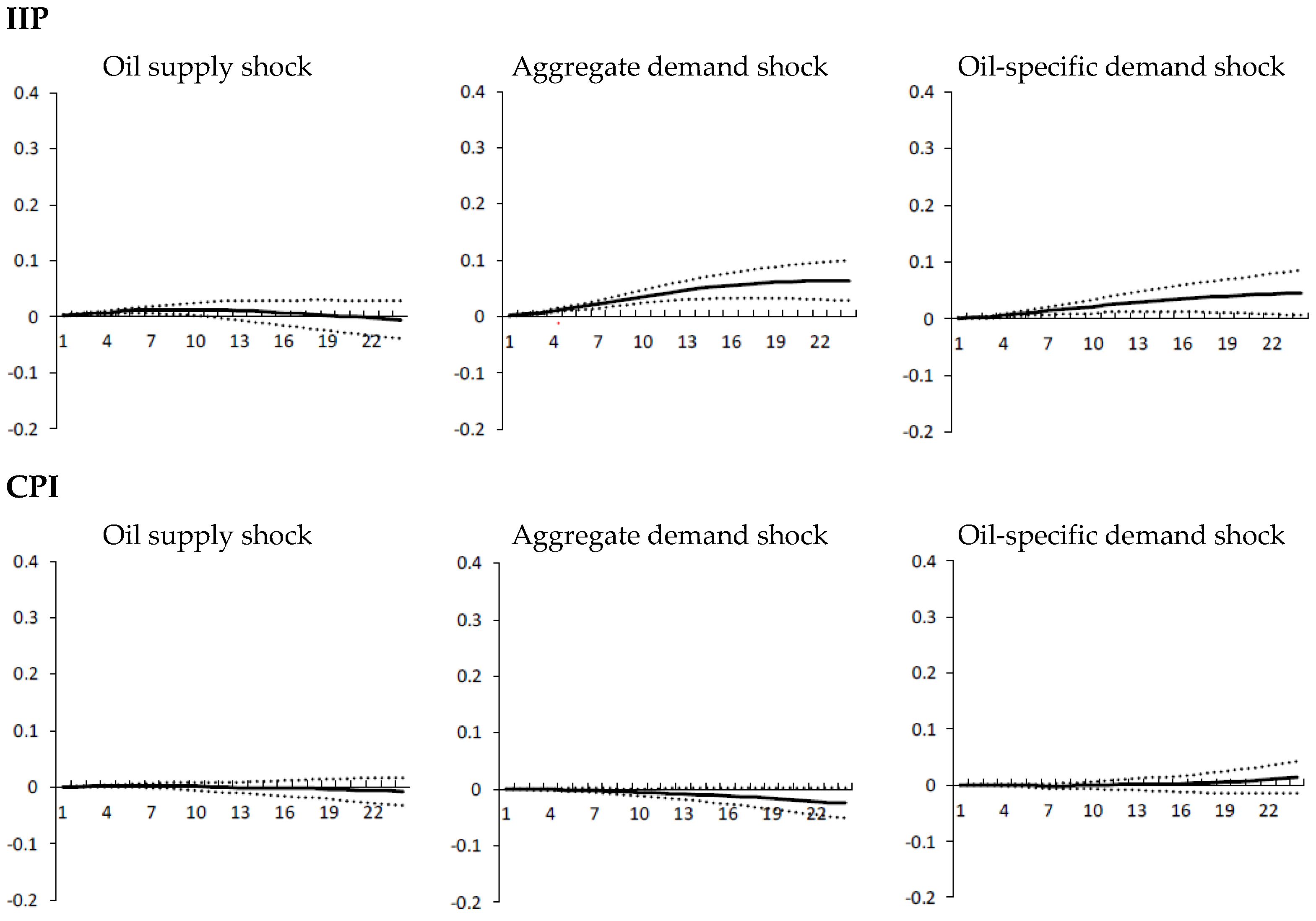

The effects of unanticipated oil supply shock on IIP and CPI are largely flat and statistically insignificant. These response patterns of both indexes are consistent with those of most other emerging countries. Aggregate demand increase provides a sustained level shift in IIP, from initial levels and the responses are statistically significant, while the corresponding response on CPI is in a persistent and statistically significant rise in level. The oil-specific demand expansion causes increases in both IIP and CPI although only the CPI shows statistical significance.

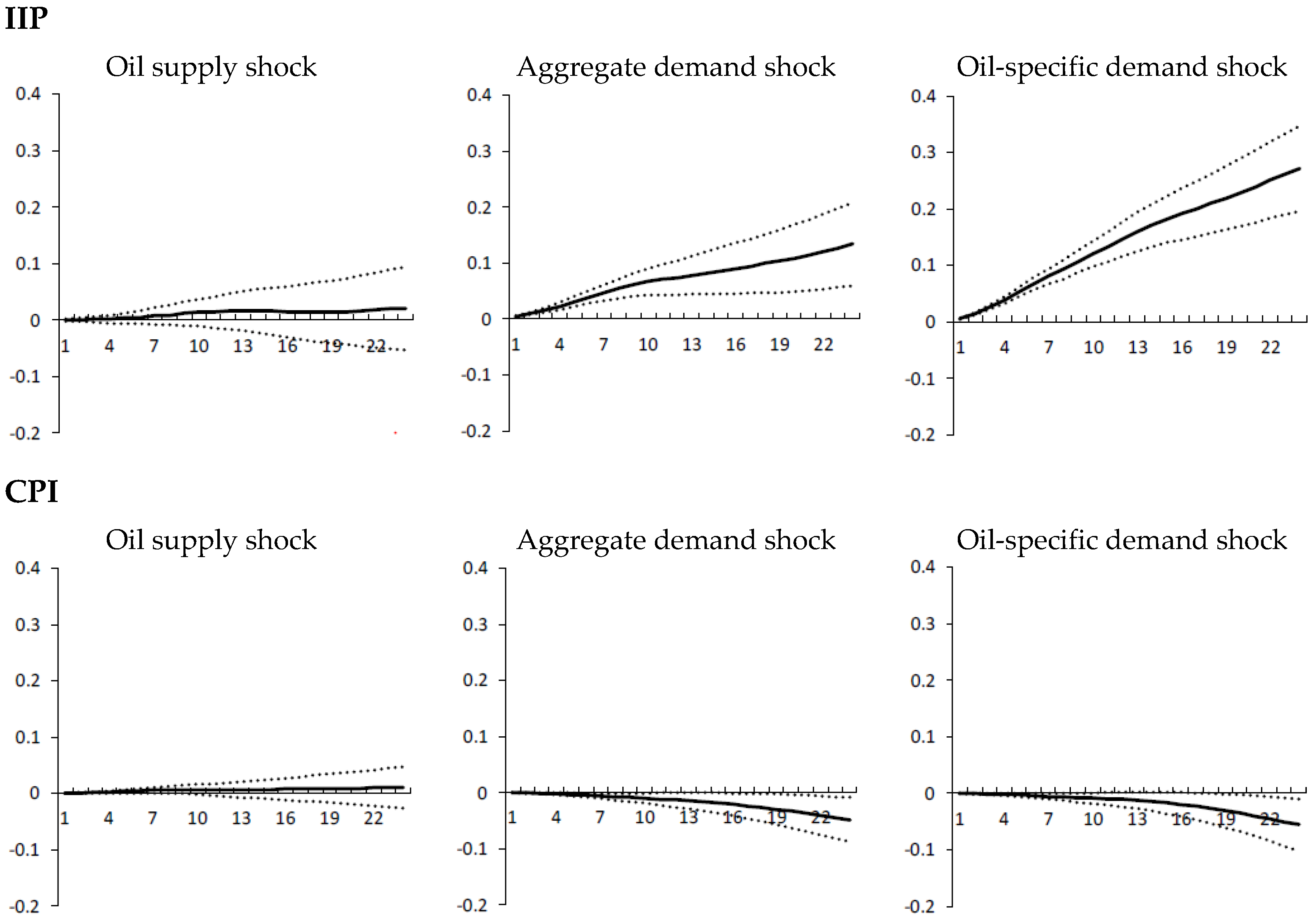

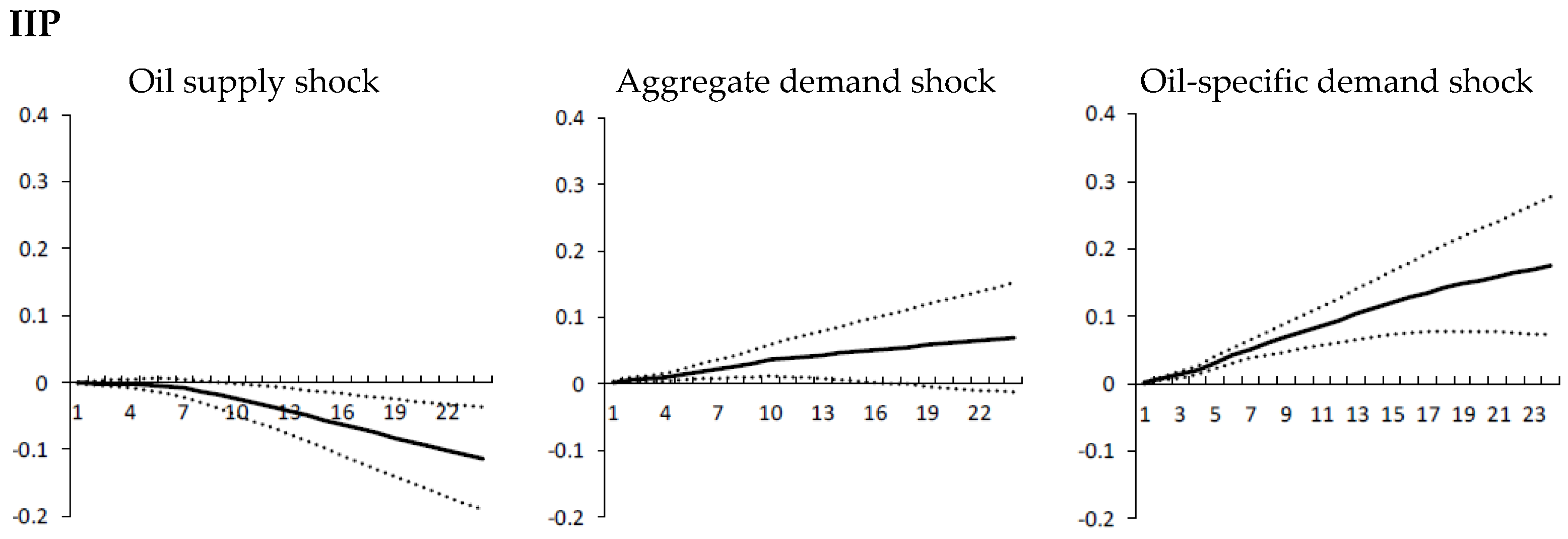

3.2. Brazil

In Brazil, similar to the United States and most other emerging countries, oil supply shocks do not have statistically significant effects neither on IIP nor CPI. Both aggregate demand shocks and oil-specific demand shocks lead to a statistically significant increase above the initial level from the first month onward. The major difference from the United States is that, in Brazil, despite these stimuli in economic activity from aggregate demand shocks and oil-specific demand shocks, these two demand shocks shift the CPI downward. On the other hand, CPI does not go below the initial level in the United States.

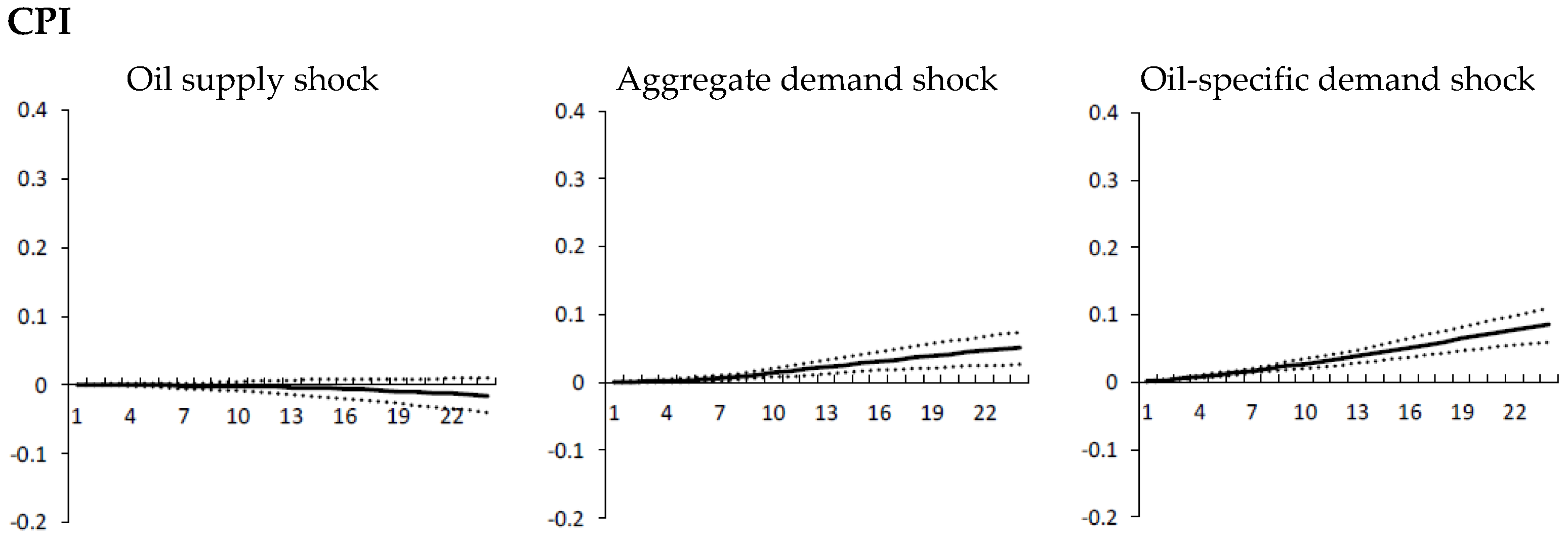

3.3. Chile

The impulse response patterns look similar to those of the United States. The major difference is that unlike in the United States, the oil-specific shock leads to a persistent rise in IIP and the response is statistically significant.

3.4. India

The inconsistent move between IIP and CPI that occurred because of the aggregate demand expansion can be seen in India as well as Brazil. Despite the economic performance being good under the aggregate demand expansion, the CPI goes under the initial level at all horizons. Oil-specific demand shock increases both production and price level in the long run.

3.5. Mexico

The response patterns are very close to those of India. The difference is that the oil-specific shock leads to a much smaller increase in CPI than that of India and the effect is statistically insignificant.

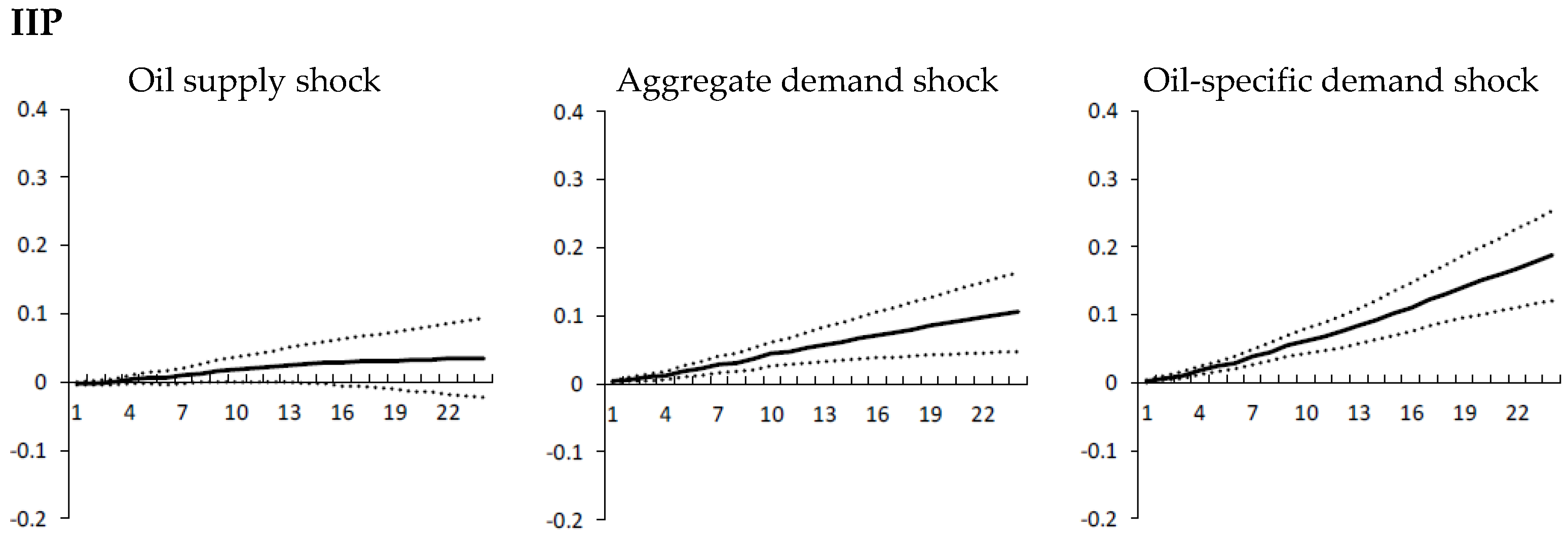

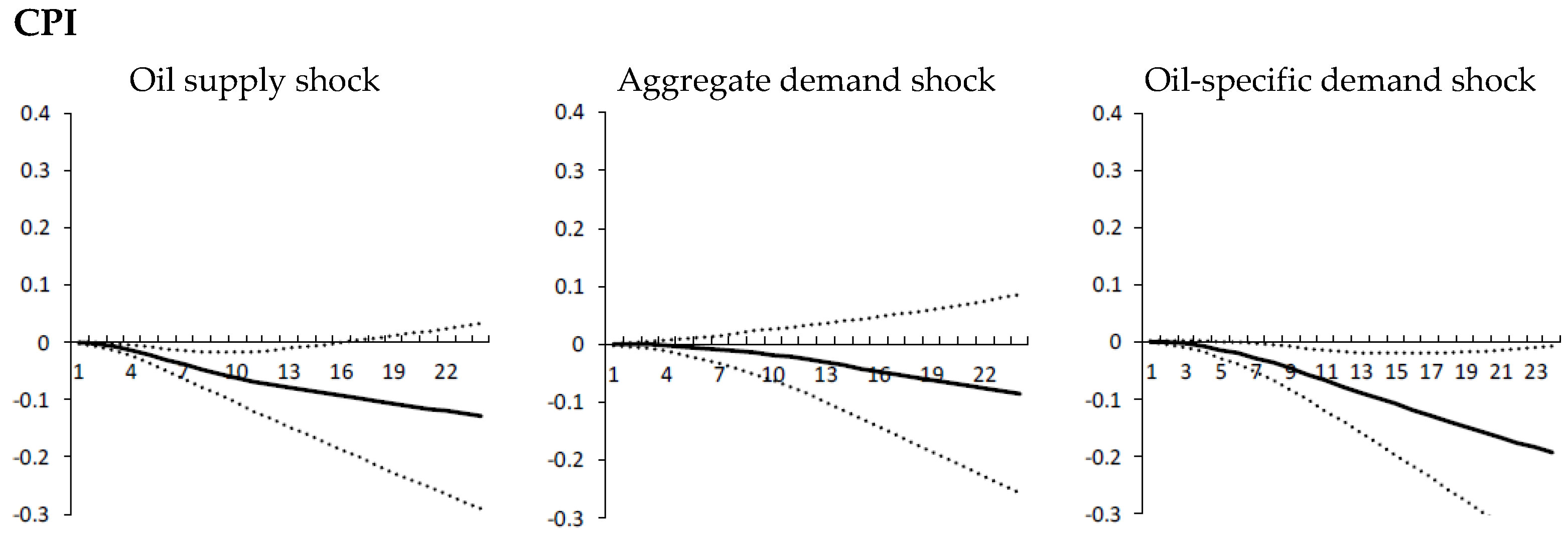

3.6. Russia

The impulse response patterns of Russia differ greatly from other emerging countries. Unanticipated oil supply expansion significantly lowers the level of production in Russia, which is unique among the six countries. The amount of decrease is the largest among sample countries. This may be explained by Russia being the one of the world’s largest oil producers

3; when facing unanticipated oil supply innovation, Russia’s share of the world oil market tends to fall. Therefore, the production level in Russia would also decline. Both aggregate demand shocks and oil-specific demand shocks cause a significant level shift in IIP. At the same time, those two demand shocks push the CPI downward. The effect is significant only when unexpected oil specific-demand shock occurs.

4. Discussion

Based on a two-block structural VAR model established by Killian and Park (2009) [

1], we investigate the effects of oil price shocks on the economic activity and price level of the emerging countries. To the best of our knowledge, this study is the first attempt to show, using the two block SVAR method, how the oil price shock affects the developing economies.

The main results can be summarized as follows: First, as well as the United States, we revealed that the effect of oil price shocks on IIP and CPI in emerging countries also depends on where the changes fundamentally come from. Second, we found that the transmission mechanisms of oil price change differs greatly between the United States and emerging countries. For instance, aggregate demand expansion leads to a significant rise in the U.S. IIP and CPI. Unlike the United States, for some emerging countries (Brazil, India, and Mexico), the shock lowers the level of price significantly. This difference may reflect the existence of a price regulation system in emerging countries on oil related goods and food, etc. Finally, we revealed that the response patterns vary among emerging countries. For example, we find no evidence that unexpected oil supply shocks cause no long-run effect on production in all countries, except Russia. This can be explained by the fact that the Russia’s share in the world oil market is far higher than that of other emerging countries.

Although our two-block structural VAR approach enabled us to reveal the response of CPI to higher oil price in emerging countries, the effects of change in oil price of detailed category of goods and services are still unknown. Considering the existence of price regulation system on some specific goods-categories, it is worth examining the impact of higher oil price on detailed category prices. Moreover, time-varying-VAR models that incorporate possible structural breaks in the global oil market are also promising methods to deepen our understanding of the transmission mechanisms of oil price shocks.