1. Introduction

There was considerable skepticism in the 1990s over whether the Economic and Monetary Union (EMU) should be launched. However, whether the EMU was a wise project when it was conceived is a different question from whether it will be abandoned or retained today. In attempting to answer this question we organize our paper as follows. After our brief introduction, we present some basic data on the damage caused by the crisis in terms of lost output and unemployment. We follow standard economic accounts based on peak to trough measures of damage along with duration of recovery time [

1]. After this, we ask why economic performance has not improved in the Eurozone as fast as one might expect based on similar estimates of damage in the United States. Drawing on the fiscal arrangement of the European Union, the lack of a lender of last resort, and the importance of labor mobility, we argue that the problems of the Eurozone are not likely to be remedied soon. In addition, there are pronounced political differences between core and peripheral countries, generating problems that are not amenable to a quick fix. Despite strong obstacles to the success and continuation of the Eurozone, we offer three reasons why it will survive. These have to do with the economic costs of exit stemming from the loss of economic coordination and increased transaction costs, path-dependent effects that have generated “barriers to exit” [

2], and the net political benefits associated with retaining and reforming the euro.

To ensure clarity, we reiterate that the goal of our manuscript is not to argue whether the Eurozone makes Europe better or worse off. Our focus is to understand the complex and costly process of exiting the Eurozone. Our argument is that these barriers to exit outweigh the costs of staying in the Eurozone. Our theory explains why, despite the clear flaws of the Eurozone, no Eurozone country has yet exited. This is a compelling issue that has not been satisfactorily addressed in the literature. We attempt to do so here.

2. Origins of the Crisis and the Damage Caused

The first ten years of the euro were almost universally judged a resounding success story. Inflation rates were low and predictable. Growth was slow but steady. Unemployment rates varied across different countries but jobs were added to the Eurozone as a whole. Roughly ten years after the introduction of the euro, the then president of the European Central Bank (ECB), Jean-Claude Trichet, lauded the achievements of the EMU. In a speech to the Brussels Economic Forum on 16 May 2008, Trichet stated:

“As the European Central Bank is close to completing its first decade of existence and the euro will soon be ten years old, I would like to take this opportunity to pay a tribute to all those who contributed to this great achievement. The introduction of the euro has been recognized as a remarkable success. Since 1999 the single currency has fully inherited the degree of credibility and confidence that was the privilege of the most credible national currencies before the Euro. This has been in particular illustrated by the fact that the medium and long-term euro market interest rates were at the same low level as the level observed for the most credible previous national currencies. In spite of a succession of significant price shocks of oil and commodities, the average yearly inflation has been 2.1% from the 1st January 1999 up to the end of 2007. Since the setting up of the euro 15.7 million net new jobs were created, three times more than during the same number of years before the euro and around 2 million more than in the US during the same period.”

Despite these optimistic assessments, the leading edge of the euro crisis was observable in late 2007 and 2008

1 when the Eurozone economy contracted. However, what is today called “the euro crisis” was and continues to be a conjuncture of four separate developments. First, there is what Benedicta Marzinotto calls “a silent balance of payments crisis” [

5], itself resulting from profound competitiveness differences between countries in Europe’s core (especially Germany, Austria, and the Netherlands) and countries in Europe’s periphery (Greece, Italy, Ireland, Portugal, and Spain (GIIPS)). This component of the crisis dates from the very beginning of the Eurozone and the fixing of exchange rates in 1999. This can be verified by examining divergence in real exchange rates [

6]. A second aspect of the crisis was present in a credit-fueled boom manifested in excessive borrowing in the periphery from core countries [

7]. Credit was cheap and the risk premium very low since it appeared that most financial actors believed that the ECB would not allow anyone to fail. This pattern of borrowing quickly led to booms in the periphery and bubbles in housing and real estate, especially in Spain and Ireland, two states which had previously been fiscally responsible. A third component of the European crisis was the aftershock of the US housing crisis and in particular the failure of the United States government to save Lehman Brothers in September 2008 [

8]. Finally, there is the fiscal crisis, which became public in October 2009 when the Greek Prime Minister Papandreou announced the true level of Greece’s budget deficit at 13 percent of GDP. The panic that characterized the Eurozone as a result of the Greek crisis and the sudden halts to capital flows from core to periphery resulted in a widespread fiscal crisis of the state. Even countries such as Ireland and Spain, who ran budget surpluses as late as 2007, quickly took on liabilities as governments nationalized bank debt.

All four crises converged in the fall of 2009: balance of trade problems resulting from competitiveness differences, capital flow imbalances from North to South, transmission of the US housing crisis in 2008–2009, and the Greek fiscal crisis. Standing back from the day-to-day details, and taking into account the Greek exception, the crisis appears in overall terms to be more about private sector imbalances and government nationalization of debt than widespread fiscal misbehavior. Whatever the causal interpretation, the results were devastating. As Copelovitch, Frieden, and Walter state:

“… the joint effects of the global financial crisis and the euro crisis have caused more lasting economic damage in Europe than the Great Depression of the 1930s.”

While the dominant popular narrative of the crisis, imposed ex post to be sure, is one of fiscal irresponsibility, the reality is much more complex and does not lend itself to simple solutions such as an austerity program. The politics of austerity are difficult but at least they hold forth the hope that fiscally irresponsible countries can get their houses in order if only they can rein in spending, cut government programs, and collect their taxes efficiently. Opposed to this efficiency and belt-tightening perspective there is the theory that the crisis is caused by natural divergence between two different types of political economies, indeed we might say “institutional political economies”. If, as Peter Hall [

10,

11] and others argue, the crisis is the outgrowth of a Northern model of capitalism based on centralized wage bargaining, high rates of savings, and export performance competing with a Southern model which is in many respects the complement of the first—decentralized wage bargains, low rates of savings, and high levels of importation—it follows that the solutions must cut more deeply into the political, economic, and cultural fabric of the countries in question. To be effective, solutions will have to address the workings of labor markets, wage bargaining, tax collection, banking and finance, and coordination among social partners in general.

3. Damage in the Eurozone and the United States Compared

Warnings of a Eurozone break-up came only after the beginning of the global financial crisis, so proper analysis of the economic damage caused by the crisis is first necessary. Although the financial crisis brought forth many arguments against the Eurozone, including slow economic growth, growth problems cannot be solely attributed to the Eurozone. Indeed, several Eurozone countries (Ireland, Spain, and Greece) did quite well during the first part of the 2000s and only slumped after the onset of the crisis. To be sure, the economic and political crisis turned this modest positive growth negative. Germany, as well as the five GIIPS, all had negative growth rates between 2007–2008 and 2008–2009. Only after 2009 was some small recovery noticeable and then only in a few countries. Clearly, the combination of growth-restricting austerity policies and limits on domestic spending were responsible for much of the downward trajectory in Europe [

12]. On the other hand, Europe is not the only part of the world that is experiencing slow growth. Most other parts of the advanced capitalist world are in an era of what Lawrence Summers calls “secular stagnation” [

13]. Despite near zero interest rates in the U.S. and real interest rates of zero in the Eurozone, growth has been sluggish and is not expected to accelerate in the near future. Whether the emphasis is on weak demand, supply-side limitations, or the disconnect between savings and investment, trends point in the same direction: low growth. Summers is not totally pessimistic and recommends a fiscal stimulus, but for political reasons, we do not think this is likely to happen in Europe.

During the crisis, the Eurozone and the United States experienced severe economic recessions, but the crises played out in different ways on opposite sides of the Atlantic. Standard economic indicators that measure economic vitality (real GDP and employment rate) reveal that the crisis in the Eurozone was longer and deeper than in the US. Also, by the end of 2014, the US had almost fully recovered from the crisis, while the Eurozone lagged far behind the pace set by the US. Below, we produce measurements for the impact and duration of the crisis on output and employment in the twelve original states within the Eurozone and all fifty US states.

Quarterly real GDP and unemployment rates are used for the twelve original Eurozone states (OECD Stat) and the fifty US states (US Bureau of Economic Analysis and the US Department of Labor statistics). Quarterly rather than annual levels are used in order to gain a more exact measure of duration and impact of the crisis. Per capita levels of GDP are unavailable for US states, so we use real GDP levels for both the Eurozone and the US. This will allow us to analyze the change in total economic output. A case can be made that the measurement of GDP per capita could better control for the effect migration has on economic output, but migration is not significant enough between states in this short window of time to have any more than a marginal impact.

The duration of the crisis measured by economic output is determined by the length of time between the peak real GDP level (highest level between and including the first quarter of 2007 and the first quarter of 2009) and the trough real GDP level (lowest level after the peak quarter). The impact of the crisis on economic output is measured by the percentage change in real GDP between the peak and the trough. An identical strategy is used to measure the effect of the crisis on employment. The duration of the crisis measured by employment is determined as the length of time between the peak employment (lowest unemployment rate between and including the first quarter of 2007 and the first quarter of 2009) and the trough employment (highest unemployment rate after the peak). The impact of the crisis on employment is measured by the change in the unemployment rate between the peak and trough periods.

Table 1 and

Table 2 present the average impact of the crisis and the duration of the crisis in the US and the Eurozone states using output and employment data.

Table 1 displays data demonstrating that over the course of the financial crisis, output in Eurozone states fell on average more than three percentage points lower than in the US states and the average duration of the crisis measured by output was a whole year longer.

Table 2 displays that on average Eurozone states’ unemployment increased 2 points more than US states over the course of the financial crisis and on average, the crisis measured by the unemployment rate lasted about two and a half years longer in Eurozone states. Output and employment indicators in these two tables demonstrate that the crisis lasted longer and was significantly deeper in the Eurozone relative to the US.

Next we compare recovery rates in the Eurozone and the US. We measure the progress of recovery as the period from the onset of the crisis to the end of 2014. This timeline is a measure of how much states have recovered relative to pre-crisis levels of output and employment (change from the peak level to the end of 2014).

Table 3 and

Table 4 demonstrate that on average US states have recovered significantly better since the beginning of the crisis. US states have on average already recovered up to and past their pre-crisis levels of economic output and are close to reaching their pre-crisis unemployment rate. By contrast, in Eurozone states, the unemployment rate is on average 5.6 points higher than before the crisis, and output is on average almost 3 percent lower than pre-crisis levels. Since the onset of the crisis, Eurozone states have not recovered nearly as quickly as states within the US.

To comprehend the impact of the financial crisis on individual Eurozone states relative to other financial crises in the past, we use a measure for financial crises created by Reinhart and Rogoff [

1]. They use annual GDP per capita levels to measure the depth and severity of over 100 systemic banking crises and develop a “severity index” that effectively measures the loss in living standards caused by financial crises. The peak of the crisis is the level of GDP per capita at the beginning of the crisis (highest level between and including the first quarter of 2007 and the first quarter of 2009) and the trough is the lowest level to which GDP per capita falls after the peak. Rogoff and Reinhart measure the duration of the crisis as the number of years that the level of GDP per capita is below the peak. Severity is measured by the percent change from the peak to the trough of the crisis. The “severity index” constitutes the sum of these two measurements as shown below [

1]:

We perform the same strategy, except we use quarterly data to gain a more precise severity index.

Table 4 presents the severity index for the first 12 members of the Eurozone (2001) as well as the GDP per capita percentage difference between the fourth quarter of 2014 and the peak level measured at the onset of the crisis (4th Quarter 2014 GDP per capita–Peak GDP per capita divided by Peak GDP per capita). The severity index and this measure provide an understanding of the impact of the financial crisis within these Eurozone states as well as how close they are to a full recovery (reaching pre-crisis levels of GDP per capita).

By way of comparison, Reinhart and Rogoff [

1] concluded that the mean severity index for one hundred financial crises between 1857 and 2013 was 19.8. Three Eurozone states already surpassed this figure by the end of 2014 and it is important to note that 11 of the 12 Eurozone states had yet to reach pre-crisis (peak) levels of GDP per capita by the end of 2014. Gathering a complete severity index for some of these countries may not be possible as some of the hardest hit states are still well below pre-crisis levels of GDP per capita (last column to the right,

Table 5) and not recovering quickly. For example, GDP per capita levels in Greece in the fourth quarter of 2014 were still 25.23 percent lower than the peak pre-crisis level. Spain and Italy also demonstrate similar levels of economic underperformance, while other Eurozone states have almost fully recovered. This is just one of many indications of the divergence between the impact of the financial crisis on core and peripheral states within the Eurozone. This divergence of economic outcomes over the course of a severe financial crisis has fueled the fire of euro-skeptics many of whom blame the Eurozone. There are numerous economic and political problems with the Eurozone—among them the fiscal arrangement of the European Union, a lack of lender of last resort, and low labor mobility between the GIIPS countries and the Northern tier of the Eurozone—all playing a part in the increased duration and impact of the crisis. In the section below, we address these issues.

4. Why Recovery Is So Difficult

4.1. European Union Fiscal Arrangement

Following the financial crisis, the European Union and its member states were unable to implement any significant fiscal stimulus other than an initial recovery plan in December of 2008. The absence of a strong fiscal response to these economic shocks is partly to blame for the slow recovery in the Eurozone [

4]. Lack of fiscal stimulus can be explained through the fiscal arrangements of the European Union. Specifically, the European Union’s weak fiscal center, decentralized institutions, and budget constraints on member states have limited any sizable European fiscal response.

The European Union’s weak fiscal center (EU expenditure amounts to around one percent of EU GDP), significantly limits the funds the EU can redistribute to struggling regions. Without centralized fiscal capacity, automatic or discretionary redistribution of funds from rich to poor regions is almost impossible. Yet, redistribution through a fiscal center is an important tool for quickly aiding regions disproportionately affected by economic shocks. Without a strong fiscal center, the members of the Eurozone are limited to monetary policy and to contributions from the member states, sometimes working outside of the EU’s institutions. Indeed, bailouts of member states in financial trouble have been managed by the Troika composed of the European Commission, the ECB, and the International Monetary Fund (IMF). Reliance on the Troika is outside the Community Method, which typically involves the Commission, the Council of Ministers, and the European Parliament.

Agreement on any kind of fiscal stimulus based on EU institutions is unlikely, because those running the EU institutions are accountable to their respective member states, not the European Union as a whole. Those appointed to run the major institutions of the EU (the European Commission, the Council of Ministers, and European Court of Justice) are selected by the executive branch in their country of origin. The absence of accountability to the greater European electorate incentivizes actors to pursue the self-interest of their country of origin, instead of policy that aids the whole fiscal union. Lacking institutional accountability to the whole European Union, negotiations become deadlocked, leaving only individual member states capable of implementing a strong fiscal response.

European Union member states were also unable to increase fiscal spending to desired levels following the financial crisis, because of budgetary constraints on their national budgets. Upon entering the European Union, member states’ budgets have been constrained by EU fiscal treaties. Domestic fiscal spending was formerly constrained by the Maastricht Treaty (Stability and Growth Pact) and now, currently by a fiscal compact signed in 2012. This fiscal compact enforces a structural deficit cap at either 0.5% or 1.0% of GDP (depending on the state’s debt to GDP ratio). Member states that rely on joint IMF and EU loans to remain solvent are forced to adopt even stricter budgetary constraints that call for harsh austerity policies that further limit economic recovery. The European Union’s weak fiscal center, lack of institutional accountability to the whole European Union, and member state’s budget constraints have made any significant fiscal stimulus following the financial crisis unlikely and have delayed the economic recovery within the Eurozone.

4.2. No Lender of Last Resort

Following the financial crisis, GIIPS states faced liquidity and/or solvency crises that quickly led to investor panic, rising bond market spreads, and financial market volatility. These liquidity and solvency concerns instantly led to harsh consequences (rising interest rates), because Eurozone states lacked a credible lender of last resort.

Monetary policy in the Eurozone is strongly centralized in the European Central Bank (ECB). The ECB has control of liquidity but has not been consistently willing (or able) to take on the role of lender of last resort. Without this role, governments cannot credibly guarantee investors there will be available funds when bonds reach maturity. As [

14] argues, the main function of a lender of last resort at the Eurozone level would be to prevent self-fulfilling prophecies whereby initial fears about bank liquidity lead to higher interest rates and budgetary problems that then lead to insolvency. Financial markets react quickly to uncertainty, and risks of contagion may spread throughout the Eurozone [

15]. If the ECB were to act as a lender of last resort and provide guarantees for government debt, government bonds would be effectively insured, thus alleviating investor concerns.

While the ECB sets interest rates and controls money supply, it did not perform, at least before 2012, lender of last resort functions. It did not have either authority to purchase government bonds directly or to raise taxes to support spending. The creation of the European Financial Stability Fund and the more permanent European Stability Mechanism alleviated but did not solve the problem of financial instability at the European level. It is true that when Draghi spoke his “whatever it takes” words on 26 July 2012, bond markets calmed and interest rates on debt retreated. Nevertheless, a speech is not a permanent institution and European leaders recognized that more needed to be done. The next important step was adoption of Outright Monetary Transactions (OMT) in September 2012. OMT promised to provide “unlimited but conditional” [

14] assistance to troubled financial institutions through the direct purchase of government bonds. However, there is still strong resistance to the full underwriting of debt of individual countries. Part of the opposition stems from those that oppose a transfer union in which countries support the spending and debt of others. There are others who feel that a full guarantee of debt (debt mutualization) will be inflationary and that, once the debt guarantee is in place and fully recognized, it will lead to higher levels of spending spurred by knowledge that bailouts will take place (moral hazard). In short, while important steps toward banking union and lender of last resort functions have been made, fully credible and permanent institutions have not yet been created.

4.3. Labor Mobility

The creation of the Eurozone, a single currency zone, by definition resulted in the loss of flexible nominal exchange rates among member countries. A flexible nominal exchange rate is an important tool for specialized regions within a currency zone during times of asymmetric economic shocks [

16]. Without flexible nominal exchange rates, countries hit by economic shocks have difficulty rebalancing their external trade accounts. There is still a possibility of depreciating real exchange rates by lowering prices of export-oriented goods but this is less effective in the short run. Without a flexible exchange rate, economic inequality between regions would have to be balanced by other mechanisms, such as labor mobility between regions. The importance of labor mobility to balance asymmetric shocks within the Eurozone was documented in “

It Can’t Happen, It’s a Bad Idea, It Won’t Last” by Jonung and Drea [

17] and has fueled euro-skepticism. Labor mobility from lower to higher unemployment regions can smooth over asymmetric shocks [

18]. However, the Eurozone has characteristics that block labor migration between regions. Linguistic and cultural barriers have proved to be the biggest obstacles to European migration [

19].

During the global financial crisis, unemployment rates diverged significantly between the peripheral and the core countries, an imbalance which labor mobility should play a part to correct.

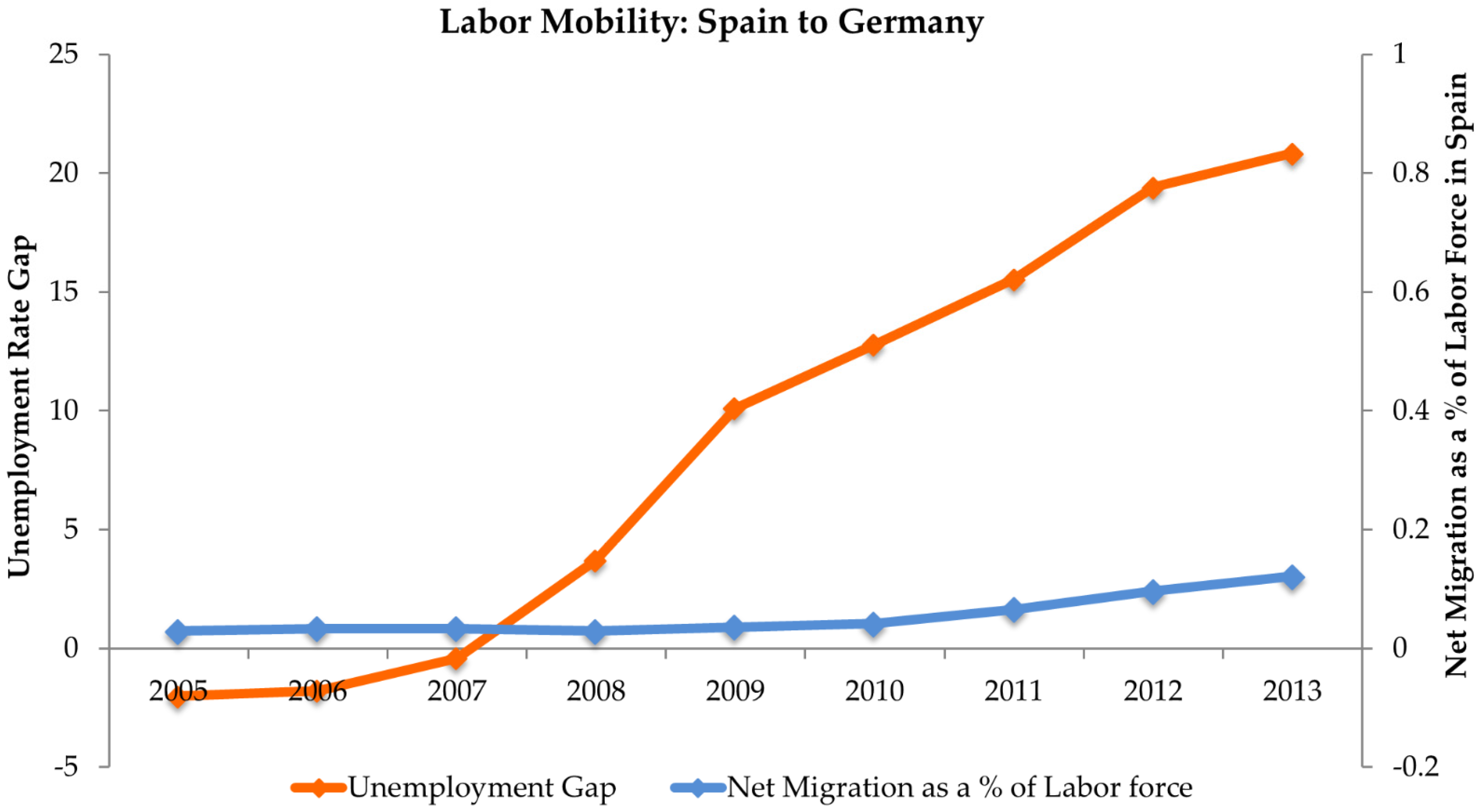

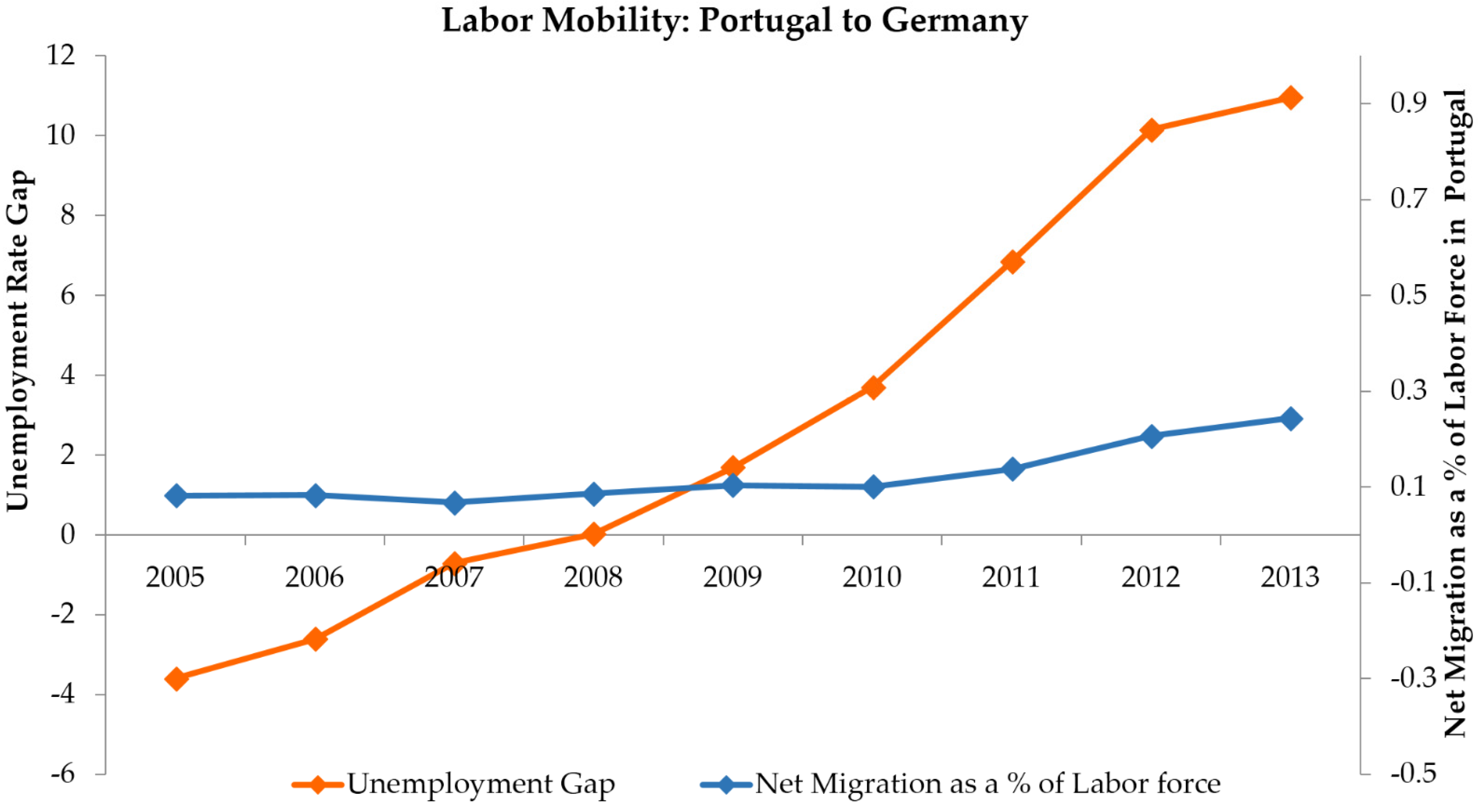

Figure 1 and

Figure 2 display the net migration (proxy for labor mobility) in two dyadic relationships: Spain to Germany and Portugal to Germany. These two dyadic relationships display two of the largest unemployment gaps and migration flows between any two countries during the financial crisis. Note that migration to Germany from Spain and Portugal in 2013 was over double the migration from Spain and Portugal to any other Eurozone state (OECD.Stat Data,

http://stats.oecd.org/).

Figure 1 and

Figure 2 demonstrate that over the course of the financial crisis, labor mobility increased from harder hit regions to less affected regions as the unemployment rate gaps between the regions increased. Although there may be a positive correlation between unemployment gaps and labor mobility, the level of labor mobility is too low as a share of the labor force to have a significant impact on the unemployment rates of Portugal and Spain. By the year 2013, net migration from Spain to Germany was around 0.15% of the Spanish labor force and Portuguese net migration to Germany was around 0.24% of the Portuguese labor force. These figures are swamped by levels of unemployment in 2013: 25.76% and 15.3% in Spain and Portugal respectively (OECD.Stat).

5. Why the Eurozone Will Survive

Weak economic recovery hampered by the absence of a lender of last resort, anemic fiscal institutions, and inadequate labor migration have increased calls for the exit of select states from the Eurozone. Yet the Eurozone has remained intact. Why is this so? Leaving the euro presents complex legal issues. There are no formal rules governing exit from the euro nor is it clear that a member can exit and still remain in the EU. The UK acquired a derogation from having to join EMU, and Denmark’s position is governed by a special protocol to the Maastricht Treaty, but other countries are presumed to become members someday. Nevertheless, it seems clear that exit from the Eurozone requires coordinated action with the members as a whole. Roger Bootle outlines a process/strategy of Eurozone exit in

Leaving the Euro: A practical guide, which clearly stipulates that support from core states is key to mitigating the large uncertainty and high costs of exit on both the exiting state and the Eurozone as a whole [

20]. To avoid massive firm bankruptcy, capital flight, downgraded credit ratings, reduction of government expenditure, and a deepening economic recession, the Eurozone would have to coordinate with the exiting state(s) to restructure debt, implement capital controls, and continue financial support. Therefore, as we move forward to discuss the costs of exit, we will not solely focus on costs to the exiting states but the costs to all Eurozone states.

Withdrawal remains a plausible option because there are potential benefits to non-membership: full legal control over national monetary arrangements, ability of national treasuries to finance the debt, and the potential to realign national democracy with control over money and finance. There is no mechanism to hold officials within the ECB accountable to the preferences of its affected constituents. This is contrary to a similarly large currency area, the United States, where Congress holds the right to check central bank policies. This mechanism (parliamentary control) is less developed in the ECB [

21]. The current Eurozone arrangement implies the loss of national democratic control of some of the most important functions that governments can provide—the provision of liquidity, the setting of interest rates, and the guarantee of lender of last resort. In effect, control of these functions has been relinquished to European institutions and to the bond markets, neither under effective democratic control.

The above are strong arguments for exit. Yet we offer three reasons the Eurozone will last. First, there are large and uncertain “barriers to exit” [

2] in the form of foregone benefits from economic coordination and reduced transaction costs. Second, there are substantial path dependencies making for crucial asymmetries between construction and unwinding of the Eurozone. Third, there are political benefits to the continuation of the Eurozone as is. Even if the economic case for continuation were shaky, the symbolic and political benefits would likely carry the day.

5.1. Economic Barriers to Exit

The broad European project has entailed the creation of Economic and Monetary Union (EMU) to go along with the single market. This monetary union is intended to reduce exchange rate uncertainty, increase Eurozone members’ credibility as an investment target, and allow greater access to financial markets. These benefits should apply for all members but perhaps more so for the weaker economies whose credit ratings and economic desirability are positively affected by association with the stronger economies. The transmission of economic disturbances across bordering states can be high, but these costs can be mitigated by coordination within the Eurozone. The political arrangements to control debt and contagion are an improvement over pre-Eurozone practices when different national economic policies interfered with the goals of other countries (e.g., national demand-management, national interest rate policies, and national banking systems). As an example, efforts to tame inflation in Germany or France might conflict with Italy and Portugal’s efforts to reflate their economies. Exit from the Eurozone would also likely decrease access to some financial markets, decrease investment within the exiting states, and result in a diminished ability to coordinate expectations and policies for those who remained. These costs might be small if we are talking about the exit of Portugal or Greece, but they could be large if we consider the exit of Germany. A Eurozone without Greece is possible to conceive but one without Germany would make little sense.

Another benefit available to all Eurozone members is reduced transaction costs of a single currency. Examples of costs that are likely to reappear for those leaving the Eurozone are currency conversion costs, disruption due to renegotiation of contracts, and decreased cross border exchange due to the uncertainty of exchange rate volatility among newly exited Eurozone states. Within the EMU, the reduction of these transaction costs led to increased trade, greater investment across borders, and cross-border asset holding throughout the Eurozone [

22,

23,

24]. These outcomes increase economic output within the Eurozone and diversify risk across the regions, reducing the likelihood of asymmetric economic shocks and supporting the mission of the European project to increase political and social cooperation throughout Europe [

25,

26]. Exit from the Eurozone by any number of states would increase the transaction costs between those who remain and those who exit, and would introduce a new dividing line in Europe that would look suspiciously similar to the old divide between the Deutschemark zone and the rest of Europe. The costs of re-denominating contracts between Eurozone states and exiting states would aggravate the mentioned exit costs and test the relationships of firms across borders. This would likely lead to decreasing levels of trade and investment between the departed states and Eurozone members.

Of course, the movement from many to one is symmetrical with the reverse movement from one to many, so long as one takes only static (one-time) effects into account. However, there are also important asymmetries involved in advancing to the euro vs. retreating from it. For example, movement to the euro is a change from many currencies to one. This implies dynamic gains in efficiency—not just a one-time gain. The reverse is not true. The coordinated learning that takes place around a single new currency would be absent in the move back to national currencies. Further uncertainties would arise due to exchange rate expectations. As countries plan to leave the euro, anxiety would doubtless appear as to the value of their own currencies in relation to those of others. Fears of undervaluation might stoke positive expectations in export sectors, while raising inflationary fears among consumers and producers who import intermediate goods. In some countries (those in the periphery) interest rates on government bonds could be expected to increase and diverge from the lower rates in the Northern European countries [

2]. Fears that abandoning the euro might appreciate one’s currency (e.g., Germany), might lead to loss of exports and worsening of one’s balance of trade position. This is no small point. Even mighty Germany would suffer losses if its exchange rate moved upward against its trade partners.

5.2. Path Dependencies and Achievements that Are Hard (Costly) to Reverse

Part of the answer to why the euro will survive lies in the path dependent nature of political and economic processes. Path dependencies occur when there are increasing returns to a particular activity, i.e., where a subsequent action is likely to generate a higher net return than the preceding one. A key component of early work on path dependency was the existence of network effects. People, both producers and consumers, tend to place a higher value on a technology or a good to the extent that others adopted it [

27]. Paul David sees the core idea of path dependence in “

the idea of history as an irreversible branching process” [

28]. Brian Arthur [

29] has applied path dependent models to technology especially those in knowledge-intensive sectors, while Douglass North has applied such thinking to institutions [

30,

31]. North’s insight can be applied to the adoption of the euro, which in its essential features is a complex of social, economic and political institutions.

The crucial component of path-dependent processes is a dynamic process in which past decisions make it relatively easier to continue down a certain path and relatively costlier to reverse. Margaret Levi has argued that a better metaphor than a path is a tree [

32]. As one moves along a certain branch, one finds it more difficult to reverse than to continue, even if there are more desirable locations on other branches. This metaphor makes clear that sunk costs are not the issue. It is not that one wants to recover the initial investment (impossible in any case), but that to move to a different (more desirable) branch requires climbing down the tree to start anew. A “bad equilibrium” judged from a global perspective may still be “the best available” given the overall costs of climbing back to the original point and starting over.

We are likely to see path-dependent processes at work under three circumstances, all of which are present regarding the euro: large initial costs in conjunction with increasing returns, learning effects, and network externalities.

Large Initial Costs and Increasing Returns: The introduction of the euro provided the first 11 countries—and then, over the course of time, 19 countries—with a common currency. There were large initial costs associated with using the new currency. Some costs were technical (printing new euros, changing the programming of all ATMs) while others were psychological (becoming familiar with new coins and notes and accepting loss of patriotic national currencies). While there were obvious transition costs, the benefits soon became visible, and they grew. The marginal net benefits of using the common currency rose the more the common currency was used. Electronic transactions became easier and business orders were more easily facilitated. Consumer choices were easier from the start but there was also a growth curve, at least up to a point. These processes are hard to reverse because they involve a complicated infrastructure of exchange. The institutional companions of economic exchange—courts, financiers, banks, credit institutions, stock markets, and debt collecting institutions—emerged as part of a vast social process of adaptive expectations. The technical changes mentioned (ATMs, etc.) may not be prone to increasing returns. But other changes, those involving network effects and changes in institutions, conform to the increasing returns model. Abandoning national currencies and moving to the euro resulted in both the static (one-time) and dynamic (increasing) gains based on learning, scale, and network effects.

Learning Effects and Network Externalities: Learning effects and network externalities occur when people work together, learn new systems together, and find it convenient to coordinate their actions on common standards, software techniques, focal points, specialized languages and so on. The euro provides abundant examples of learning network externalities. The organization of money involves millions of people spread over wide distances with most of the coordination taking place without face to face interaction. We expect to see learning by participants, new practices of bookkeeping, accounting, advanced orders (no longer subject to exchange rate uncertainty), new supervisory mechanisms, and new disciplinary standards, not least of which are those on the fiscal side. The entire evolving governance structure of the Eurozone, from the Maastricht Treaty and Stability and Growth Pact to the Fiscal Treaty and Six Pack, provides complex and dense rules and norms for governance of the Eurozone. There are networks of central bankers, government officials, accountants, fiscal experts, and other expert and non-expert groups who have now formed their expectations around the euro and the institutions of Eurozone governance. The political costs of exit would be very high just in terms of unlearning the current system of institutions and rules and then relearning 19 separate ones. All members of the Eurozone would still be very economically interdependent so their individual national actions would have regional consequences. Some form of international (regional) governance system would have to be rediscovered quickly in order to contain the disturbances that would inevitably emerge in the wake of Eurozone collapse.

Models of path dependency suggest that it is harder to reverse a historical process than to carry out this process initially or to continue behavior in a mode that has already been established. Of course, there are many areas of economics and politics where decreasing returns predominate. Classical models of production, especially those applied to natural resources and land, generally incorporate assumptions of decreasing returns (the hundredth unit of land yields less than the first). We think the process of adopting the euro, for all the limitations of the Eurozone in terms of optimum currency area thinking, conforms to the path dependency model implying costly reversals. Since the Eurozone is a radically incomplete project which is lacking in many of the political and institutional features of a unified currency area, we expect that the future will involve a further embedding of the currency in a broader framework of political institutions involving regulation of banks, national fiscal policies, and mechanisms for balancing out asymmetric shocks across different regions. Here we agree with the analysis provided by Jones, Kelemen and Meunier [

33] and their concept of “failing forward”, i.e., the incompleteness of the Eurozone will generate pressures to find new equilibria. The new equilibria could logically include both reverting to national currencies and moving forward to a more complete regional political union to accompany the Eurozone currency. Although this remains a possibility, our analysis makes clear why the more likely outcome is a more complete regional, political, and economic union.

5.3. Political Benefits of Retention of the Euro

The benefits of reduced transaction costs and economic coordination can be quantified by a variety of economic indicators, but the creation and development of the European Union produce less quantifiable benefits of political cooperation among democratic countries. The overarching goals of the EU include completion of a unified market for goods, services, capital, and labor (the four freedoms) and also achievement of peaceful relations among the European democracies. Membership in the European Union and the Eurozone has proved successful in the consolidation of democracy, the implementation of a common market, and has helped to promote one of the most peaceful periods in Europe’s long history [

34]. It is impossible to separate Europe as a stable and prosperous zone of peace from the institutions of the EU and EMU, not to mention the broader Organization for Economic Cooperation and Development and the Council of Europe.

Exit from the Eurozone could pose a threat to future cooperation, since it could be interpreted as a failure of the European project. This visible symbol of weakness within the European system could lead to an “exit contagion” unraveling the monetary arrangements of the remaining members. Given the intricate connections between the single market and the single currency, damage to the Eurozone could bring with it further damage to the single market. A renationalization of markets could take place, at least at the margins. Angela Merkel has argued that “if the euro fails then Europe fails”, and her finance minister, Wolfgang Schäuble, has also claimed that “We must defend this common European currency as a whole… By defending it we defend at the same time the European project” [

35]. Exit from the Eurozone would put future cooperation at risk and dampen the credibility of the European Union, reducing its influence over European democratic consolidation in newer member states.

With the exit, the remaining states, especially the ones with the greatest commitment to the European project (the old core of Charlemagne’s empire), would be expected to create disincentives for any future exit by diminishing the voice any exiting states have over European Union decisions. States that might exit (Greece, Spain, Portugal) have had a role in influencing the course of development in the EU as a whole, not just the Eurozone. Hirschman, in

Exit,

Voice,

and Loyalty [

36], outlines different strategies for instilling change within an organization. Exit is one strategy. Voice—influencing policy or politics by mobilization and pressure group tactics—is another tactic. Voice is only effective if one is a member of the polity in question and becomes increasingly effective when the member has a credible threat of exit (complementary voice). Greece and other GIIPS states threatening exit hold this privileged position, but if they were to exit and lose EMU membership, they could not influence efforts to democratize monetary institutions, nor enter seriously into discussions relating to fiscal policy. Exiting states would fall from this privileged position of influence and would lose power over key European policy discussions focusing on matters related to monetary affairs (specifically surrounding interest rates and supply of money in Europe). A loss of influence over these decisions would increase the democratic deficit in the sense that exiting states would cease to have control over situations in which they have a large stake. The loss of voice over future European Union decisions increases the incentives to remain.

Exclusion from European decisions may enable the formation of a new bloc, one that draws together Denmark and Sweden (strongly committed to the democratic development of the EU’s institutions) along with newly disenfranchised non-members of the Eurozone. These states may lack membership in the Eurozone but still want to have a voice in the democratic development of the EU. However, since fiscal and monetary policies are likely to affect many sectors (agriculture, trade, social policy), it will be difficult to say with certainty when a non-Eurozone state has a stake and when it doesn’t. We could see not only a Europe of several speeds (Europe à plusieurs vitesses) but also a Europe with different commitments to the democratic process. Differential commitment to a politically and economically integrated Europe is not optimal for an economic federation, and differential commitment to democratic institutions is worse. Policies implemented without the input of disenfranchised non-members will likely lead to dissension and opposition from these disenfranchised states, weakening the chance for an effective “unified” European response to controversial issues and eliminating the benefits of a coordinated European response. Overall, the political costs of exit seem staggeringly high.

6. Note on Brexit

During the process of writing this manuscript, the Brexit referendum took place (23 June 2016) and Britain voted to leave the European Union. This result has increased the feeling among many that Eurozone exit and breakup are real and possible, strengthening the relevance of our manuscript. Indeed, there is nothing inevitable about the survival of the Eurozone. Brexit also forces us, the authors, to make important distinctions between the European Union and the Eurozone as well as the implications that domestic politics have on the European Union.

Although Brexit renews discussions over the robustness and institutional persistence of the EU and Eurozone, we propose that Brexit does not prefigure a downward spiral in either the Eurozone or EU as a whole. It is true that in many ways exit from the EU is more serious than exit from the Eurozone, which did not even exist for the first four decades of the process of European integration. Exit from the EU implies loss of access to the free trade area, customs union, and free movement of capital and labor—in short, the four fundamental freedoms that constitute the economic core of the EU. In addition, there is a huge amount of legislation and court (European Court of Justice) jurisprudence that is inextricably tied up with the Treaty-based four freedoms. Thus, exit from the EU implies a comprehensive range of changes for any exiting country. The UK will experience these effects in a concrete way over the next several years. Indeed, a sharp drop in the pound has already taken place.

Nevertheless, there are some important ways in which exit from EMU is likely to be costlier than exit from the larger economic arrangements in the EU. Money is of course at the heart of any political system so striking out on one’s own, withdrawing from the Eurozone’s monetary arrangements, instituting one’s own currency will be costly in ways we have attempted to describe. A country’s currency is tied up with many other institutions and practices, both economic and political. A change in one’s currency implies changes in trade policies, domestic macro-economic policies (including the crucial issue of interest rates and money supply), fiscal policies, and the all-important issue of how to discipline national budgets without the presence of fiscally conservative EU institutions and policies. The Stability and Growth Pact, as well as other EU fiscal institutions and policies, may have restricted growth-oriented policies and national autonomy, but absent these institutions, domestic actors will have to step in and create their own forms of fiscal restraint. While the issues raised by exit from the Eurozone may be narrower, they are also in some ways stronger. Monetary and fiscal policies are at the heart of domestic politics, indeed of politics at any level. This is the reason it continues to be so difficult to build monetary and fiscal institutions at the European level.

Although Brexit is different from a Eurozone exit, it has made us reconsider the impact of domestic politics on these decisions. Armingeon and Baccarro have argued that domestic politics lack strong influence over decisions affecting the EU and Eurozone, but Brexit would offer a counter example [

37]. Brexit signals that the growing public dissatisfaction with the European Union can have consequences for the European Union.

The United Kingdom is the first nation-state to attempt exit from the European Union, setting the precedent for other actors. In line with arguments in our manuscript, it is most likely that the European Union will amplify the visible costs to Great Britain’s economy and political influence in order to deter possible future defectors. Brexit will be scrutinized and used as an example in future decisions to leave/stay, but it is important to understand the distinction between exit from the European Union and the Eurozone. Even if Brexit transpires smoothly, exit from the Eurozone still poses costly consequences and high levels of economic uncertainty.

7. Conclusions

We set out to answer an important question: Why, after poor economic performance following the economic crisis and many economic arguments against the Eurozone, including austerity policies which stifle growth, is the Eurozone still together? We tackle this particular aspect of the Eurozone and offer a prediction for the future. We have argued that the euro will survive. Costs of exit for any specific country, as well as for those who remain, are likely to be high. Thus the barriers to exit, economically and politically, are correspondingly high. The main reason for survival, and perhaps enhancement, of the euro in terms of its institutional structure, is that the common currency brings substantial benefits to its members, despite loss of flexibility in domestic economic policy making. Initial benefits based on reduction of transaction costs have been amplified by path-dependent processes associated with learning, adaptive expectations, and gains from coordination of policies around a common currency. While the EMU had serious opposition in the 1990s, political events (including German reunification) conspired with the economic advantages mentioned to reinforce support for the euro. Despite the crisis, which was in some ways a predictable outcome of the defects of the Eurozone’s construction, the EMU has survived. This theory behind the Eurozone’s survival has not been significantly laid out in the literature and it is important to understand why this institution persists even under large duress. There are reasons behind its current existence beyond its effectiveness as a currency union.

In some important sense, the worst of the crisis has been weathered and Greece’s problems have been contained. The fear of financial contagion, a pressing concern at the start of the crisis, has abated. The most important question now seems to be “what kind of Euro, with what kinds of political institutions?” How will the incomplete political architecture of the EMU adapt to the common currency? That is the subject of a different paper.