The Nonlinearity of the New Keynesian Phillips Curve: The Case of Tunisia

Abstract

:1. Introduction

2. Literature Review

2.1. Linear Phillips Curve Modeling

2.2. Micro Foundations for a Non-Linear Phillips Curve

3. Methodology and Data

3.1. The Model

3.2. Data Description

4. Estimation and Empirical Results

4.1. Specification and Estimation of the Linear Phillips Curves

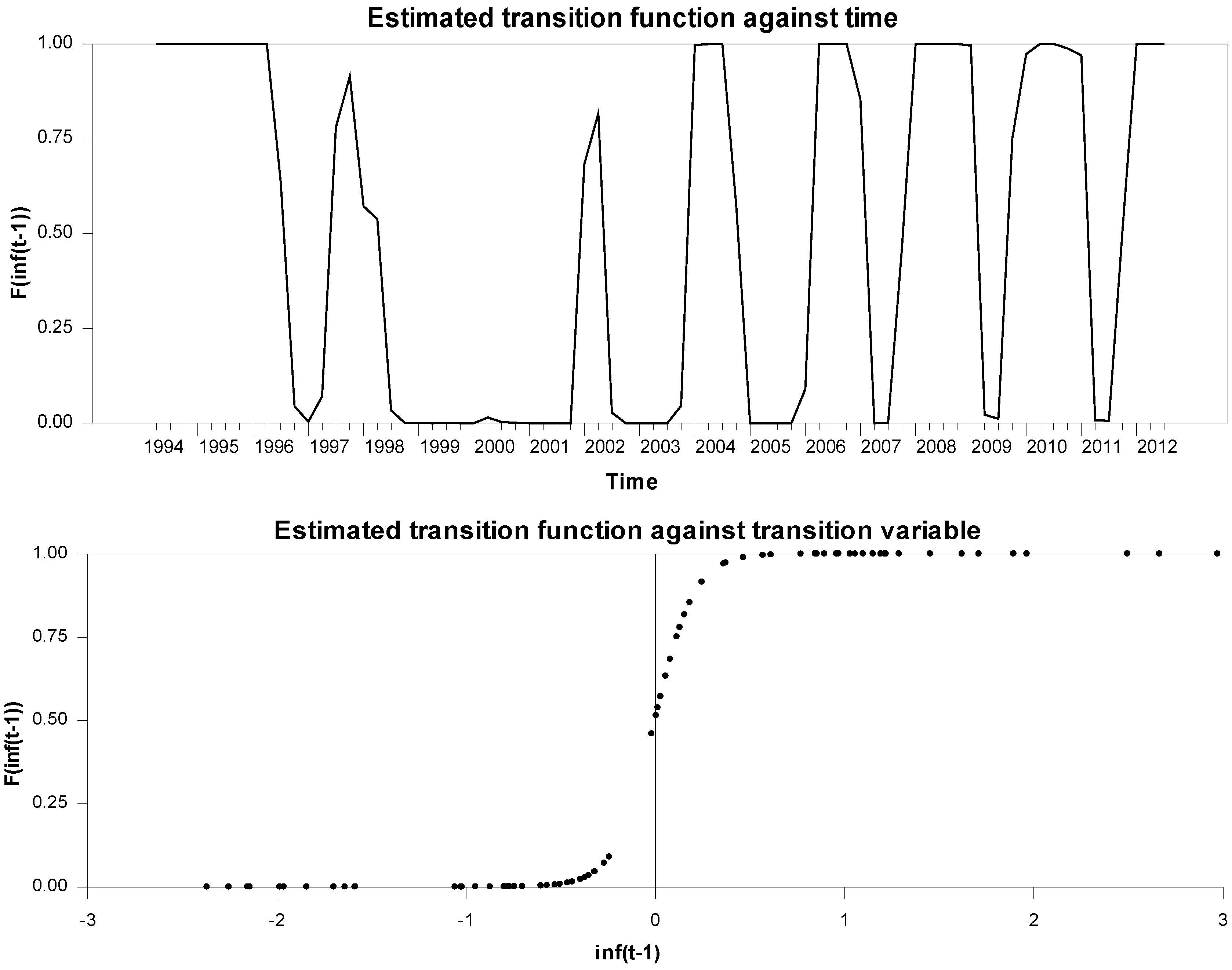

4.2. Linearity Tests and LSTR Estimation

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Agénor, Pierre-Richard, and Nihal Bayraktar. 2008. Contracting Models of the Phillips Curve Empirical Estimates for Middle-Income Countries. Discussion Paper Series, n° 094; Manchester: University of Manchester. [Google Scholar]

- Alvarez, Lois P. 2000. Endogenous Capacity Utilization and the Asymmetric Effects of Monetary Policy; WP 469. UFAE (Unitat de Fonaments de l’Anlisi Econmica) and IAE (Institut d’Anlisi Econmica). Available online: http://www.recercat.cat/bitstream/handle/2072/1978/46900.pdf?sequence=1 (accessed on 3 July 2017).

- Ball, Laurence, and Gregory N. Mankiw. 1994. Asymmetric Price Adjustment and Economic Fluctuations. Economic Journal 104: 247–61. [Google Scholar] [CrossRef]

- Ball, Laurence M., and Sandeep Mazumder. 2011. Inflation Dynamics and The Great Recession, Brookings Papers on Economic Activity. Washington: The Brookings Institution, vol. 42, pp. 337–405. [Google Scholar]

- Ball, Laurence, Gregory N. Mankiw, and David Romer. 1988. The New Keynesian Economics and the Output-Inflation Trade-off. Brookings Papers on Economic Activity 1: 1–65. [Google Scholar] [CrossRef]

- Boughrara, Adel, Mongi Boughzala, and Hassouna Moussa. 2010. Financial Fetters of the Monetary Policy of Tunisia to be presented in the Vlème Colloque International. Hammamet: Prospectives Stratégies E Développent Durable. [Google Scholar]

- Calvo, Guillermo A. 1983. Staggered Prices in a Utility Maximising Framework. Journal of Monetary Economics 12: 383–98. [Google Scholar] [CrossRef]

- Clark, Peter B., Douglas Laxton, and David Rose. 1996. Asymmetry in the U.S. Output-Inflation Nexus: Issues and Evidence. IMF Staff Papers 43: 216–51. [Google Scholar] [CrossRef]

- Dammak, Thouraya, and Younès Boujelbène. 2009. The long run Phillips curve and the role of downward nominal wage rigidity in Tunisia. Economics Bulletin 29: 1211–23. [Google Scholar]

- Debelle, Guy, and Douglas Laxton. 1997. Is the Phillips Curve Really a Curve? Some Evidence for Canada, the United Kingdom, and the United States. IMF Staff Papers 44: 249–82. [Google Scholar] [CrossRef]

- Debelle, Guy, and James Vickery. 1998. Is the Phillips Curve a Curve? Some Evidence and Implications for Australia. Economic Record 74: 384–98. [Google Scholar] [CrossRef]

- Dolado, Juan J., Pedrero Ramón Maria-Dolores, and Manuel Naveira. 2005. Are Monetary Policy Reaction Functions Asymmetric? The Role of Non-linearity in the Phillips Curve. European Economic Review 49: 485–503. [Google Scholar] [CrossRef]

- Eisner, Robert. 1997. A New View of the NAIRU. In Improving the Global Economy. Edited by Paul Davidson and Jan A. Kregel. Cheltenham: Edward Elgar, pp. 196–230. [Google Scholar]

- Eliasson, Ann-Charlott. 2001. Is the Short-run Phillips Curve Nonlinear? Empirical Evidence for Australia, Sweden and the United States. Working Paper Series n° 124; Stockholm: SverigesRiksbank. [Google Scholar]

- Gali, Jordi, and Mark Gertler. 1999. Inflation Dynamics: A Structural Econometric Analysis. Journal of Monetary Economics 44: 195–222. [Google Scholar] [CrossRef]

- Gali, Jordi, Mark Gertler, and David Lopez-Salido. 2005. Robustness of the Estimates of the Hybrid New Keynesian Phillips Curve. Journal of Monetary Economics 52: 1107–18. [Google Scholar] [CrossRef]

- Gordon, Robert. 2011. The history of the Phillips curve: Consensus and bifurcation. Economica 78: 10–50. [Google Scholar] [CrossRef]

- Granger, Clive, and Timo Teräsvirta. 1993. Modelling Nonlinear Economic Relationships. New York: Oxford University Press. [Google Scholar]

- Hansen, Lars P. 1982. Large Sample Properties of Generalized Method of moments Estimators. Econometrica 50: 1029–54. [Google Scholar] [CrossRef]

- Hasanov, Mübariz, Aysen Araç, and Funda Telatar. 2010. Nonlinearity and Structural Stability in the Phillips curve: Evidence from Turkey. Economic Modelling 27: 1103–15. [Google Scholar] [CrossRef]

- Huh, Hyeon-seung, and Inwon Jang. 2007. Nonlinear Phillips curve, Sacrifice ratio, and the Natural rate of Unemployment. Economic Modelling 24: 797–813. [Google Scholar] [CrossRef]

- Kobbi, Imen, and Foued Gabsi. 2014. L’asymétrie de la politique monétaire en Tunisie: Estimation d’unerègle forward-looking non linéaire pour la Banque centrale. Economie Appliquée 67: 139–68. [Google Scholar]

- Lucas, Robert. 1973. Some International Evidence on Output-Inflation Tradeoffs. American Economic Review 63: 326–34. [Google Scholar]

- Mladenovic, Zorica, and Aleksandra Nojkovic. 2012. Inflation Persistence in Central and Southeastern Europe: Evidence from Univariate and Structural Time Series Approaches. Panoeconomicus 2: 255–66. [Google Scholar] [CrossRef]

- Nell, Kevin. 2006. Structural Change and Nonlinearities in a Phillips Curve Model for South Africa. Contemporary Economic Policy 24: 600–17. [Google Scholar] [CrossRef]

- Rudd, Jeremy, and Karl Whelan. 2005. New tests of the new-Keynesian Phillips curve. Journal of Monetary Economics 52: 1167–81. [Google Scholar] [CrossRef]

- Rudd, Jeremy, and Karl Whelan. 2007. Modelling inflation dynamics: A Critical Review of Recent Research. Journal of Money, Credit, and Banking 39: 155–70. [Google Scholar] [CrossRef]

- Stiglitz, Joseph E. 1984. Price Rigidities and Market Structure. American Economic Review 74: 350–55. [Google Scholar]

- Teräsvirta, Timo. 1998. Modeling Economic Relationships with Smooth Transition Regressions. Handbook of Applied Economic Statistics. Edited by Ullah Aman and David Giles. New York: Dekker, chapter 15. pp. 507–52. [Google Scholar]

- Teräsvirta, Timo. 2006. Chapter 8 Forcasting Economic Variables with Nonlinear Models. In Handbook of Economic Forecasting. Edited by Graham Elliott, Clive W.J. Granger and Allan Timmermann. Amsterdam: Elsevier, vol. 1, pp. 413–57. [Google Scholar]

- Turner, Paul. 1997. The Phillips Curve, Parameter Instability and the Lucas Critique. Applied Economics 29: 7–10. [Google Scholar] [CrossRef]

- Villavicencio, Antonia, and Valérie Mignon. 2013. Nonlinearity of the Inflation-Output Trade-Off andTime-Varying Price Rigidity. WP No. 2. Paris: CEPII. [Google Scholar]

- Van Dijk, Dick, Timo Teräsvirta, and Philip Franses. 2002. Smooth Transition Autoregressive Models: A Survey of Recent Developments. Econometric Reviews 21: 1–47. [Google Scholar] [CrossRef]

| Variable | ADF Test | KPSS Test |

|---|---|---|

| Inflation | −5.158*** | 0.262*** |

| Output gap | −4.397*** | 0.139*** |

| AIC | SBC | J-STAT | ||||

|---|---|---|---|---|---|---|

| Forward | - | 1.078 ** | 0.037 | 259.681 | 266.426 | 12.69 |

| (0.045) | (0.038) | (0.241) | ||||

| Hybrid | 0.505 ** | 0.601 ** | −0.053 ** | 182.155 | 191.149 | 11.69 |

| (0.035) | (0.041) | (0.018) | (0.23) |

| Arch/LM | LB | SK | KU | J-B | |

|---|---|---|---|---|---|

| Hybrid Model Residuals | 4.969 | 12.039 | −0.423 | −0.253 | 2.05 |

| [0.174] | [0.149] | [0.18] | [0.679] | [0.358] |

| Transition Variable | F-Stat |

|---|---|

| Linearity Tests | |

| 1.06 [0.388] | |

| 1.805 [0.061] | |

| 0.424 [0.922] | |

| Transition Function Specification Tests | |

| H02 | 2.784 [0.039] |

| H03 | 2.114 [0.096] |

| H04 | 0.373 [0.771] |

| At lower Trend Inflation | At Higher Trend Inflation | Threshold () | |

|---|---|---|---|

| 0.236 ** (0.093) | 0.622 ** (0.127) | ||

| 0.771** (0.108) | −0.589** (0.14) | 3.55**(0.077) | |

| −0.036 (0.04) | 0.102* (0.057) | ||

| J-STAT | 4.813 (0.682) | ||

| LB(8) | 12.039 (0.149) | ||

| ARCH (LM) | 0.292 (0.961) | ||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kobbi, I.; Gabsi, F.-B. The Nonlinearity of the New Keynesian Phillips Curve: The Case of Tunisia. Economies 2017, 5, 24. https://doi.org/10.3390/economies5030024

Kobbi I, Gabsi F-B. The Nonlinearity of the New Keynesian Phillips Curve: The Case of Tunisia. Economies. 2017; 5(3):24. https://doi.org/10.3390/economies5030024

Chicago/Turabian StyleKobbi, Imen, and Foued-Badr Gabsi. 2017. "The Nonlinearity of the New Keynesian Phillips Curve: The Case of Tunisia" Economies 5, no. 3: 24. https://doi.org/10.3390/economies5030024