Crime Statistics: Modeling Theft in Favour of Victims’ Choices

Abstract

:1. Introduction

Victims are treated simply as witnesses. They are compelled to appear in court and testify, often at great risk of physical danger, embarrassment, and emotional trauma. They are paid a witness fee…and then forgotten.

2. Thefts and Reported Thefts

2.1. The Variables and Assumptions of the Model

- The value (V) that the victim will get back if the thief is caught by the police. In many cases, the object will be damaged and the object may be completely worthless. Anyway, we assume that the victim can estimate the extent of the damage measured in money.

- The time spent on reporting the crime (t).

- The cost per hour the victim must use to report the theft (a). These costs will probably depend on the victim’s income and wealth, but in this paper, these costs are assumed to be constant and therefore independent of income and wealth.

- All other time-independent costs were incurred if the victim reports the theft (b). Non-material losses in the form of reduced welfare due to fear of retaliation from the criminals are included. In some other countries, but not in Norway, a fee payment to the police station is required for being allowed to report a crime.

- The subjective probability that the police will solve the case (p). When we use the term ”subjective probability”, we mean the probability that the victim believes is the correct one. This may be identical to the empirical clarification percentage, but it does not have to be.

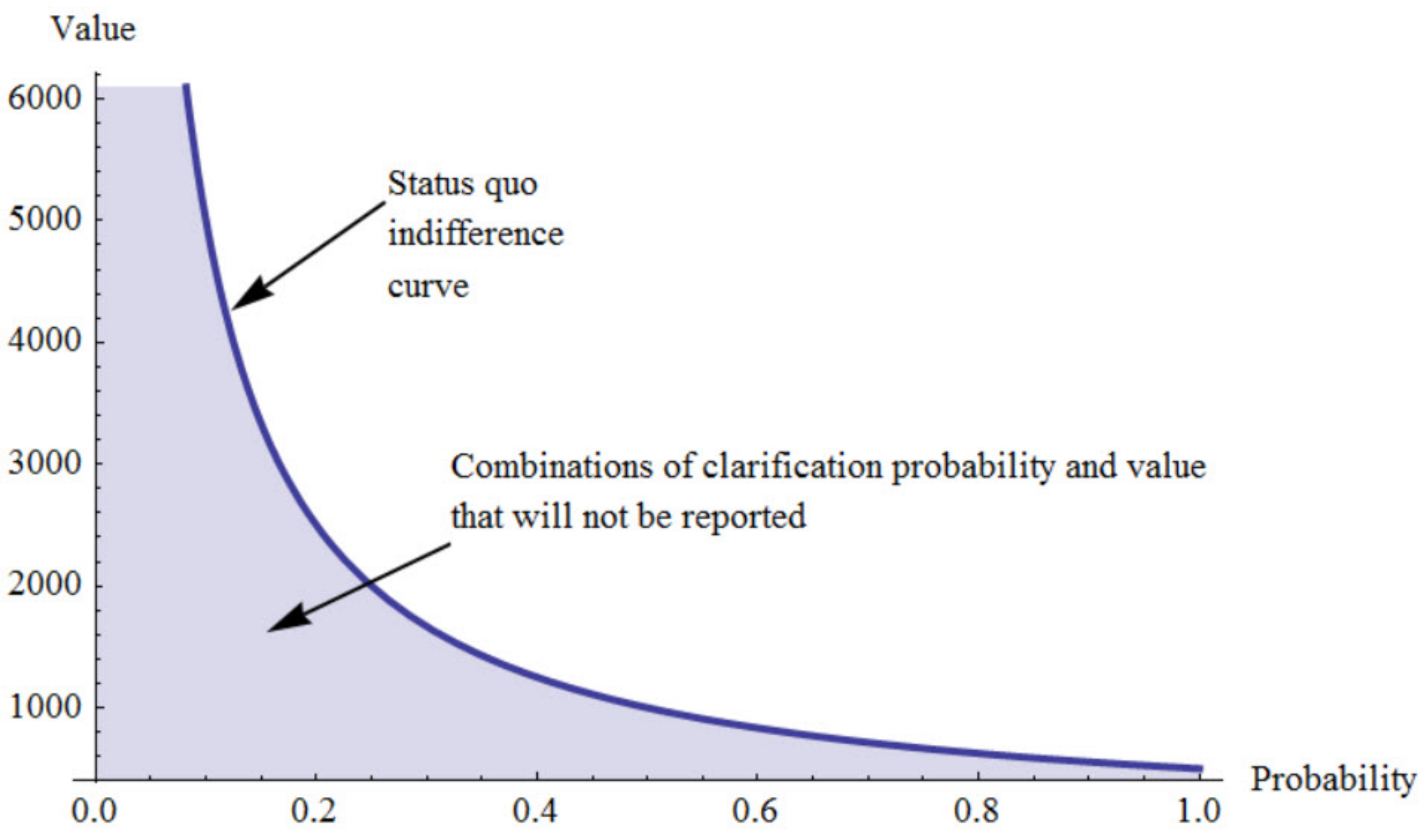

2.2. Model for Reporting Thefts

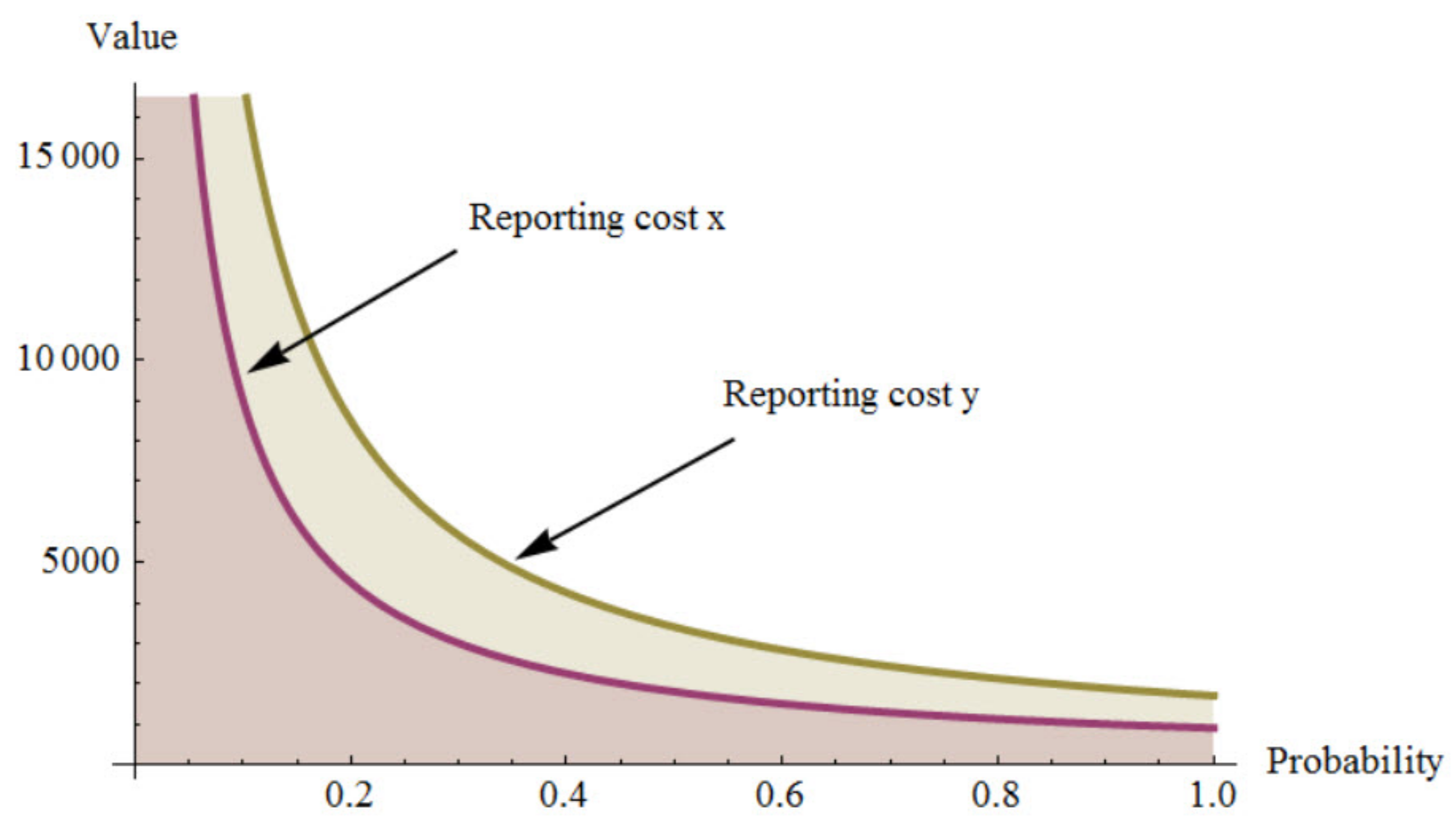

Example: Changes in Reporting Costs

2.3. The Impact of Insurance

3. Crime, Resources and Information

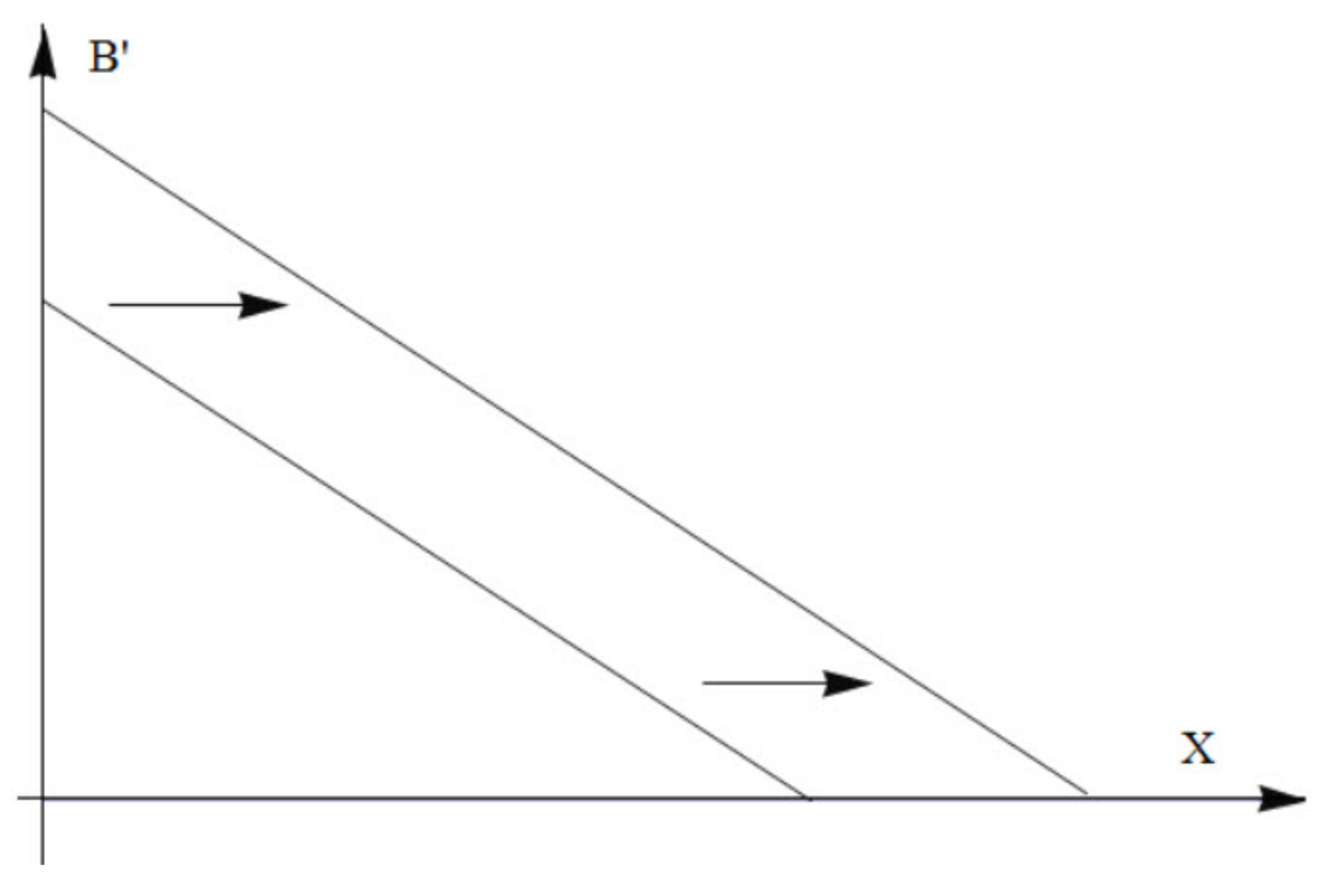

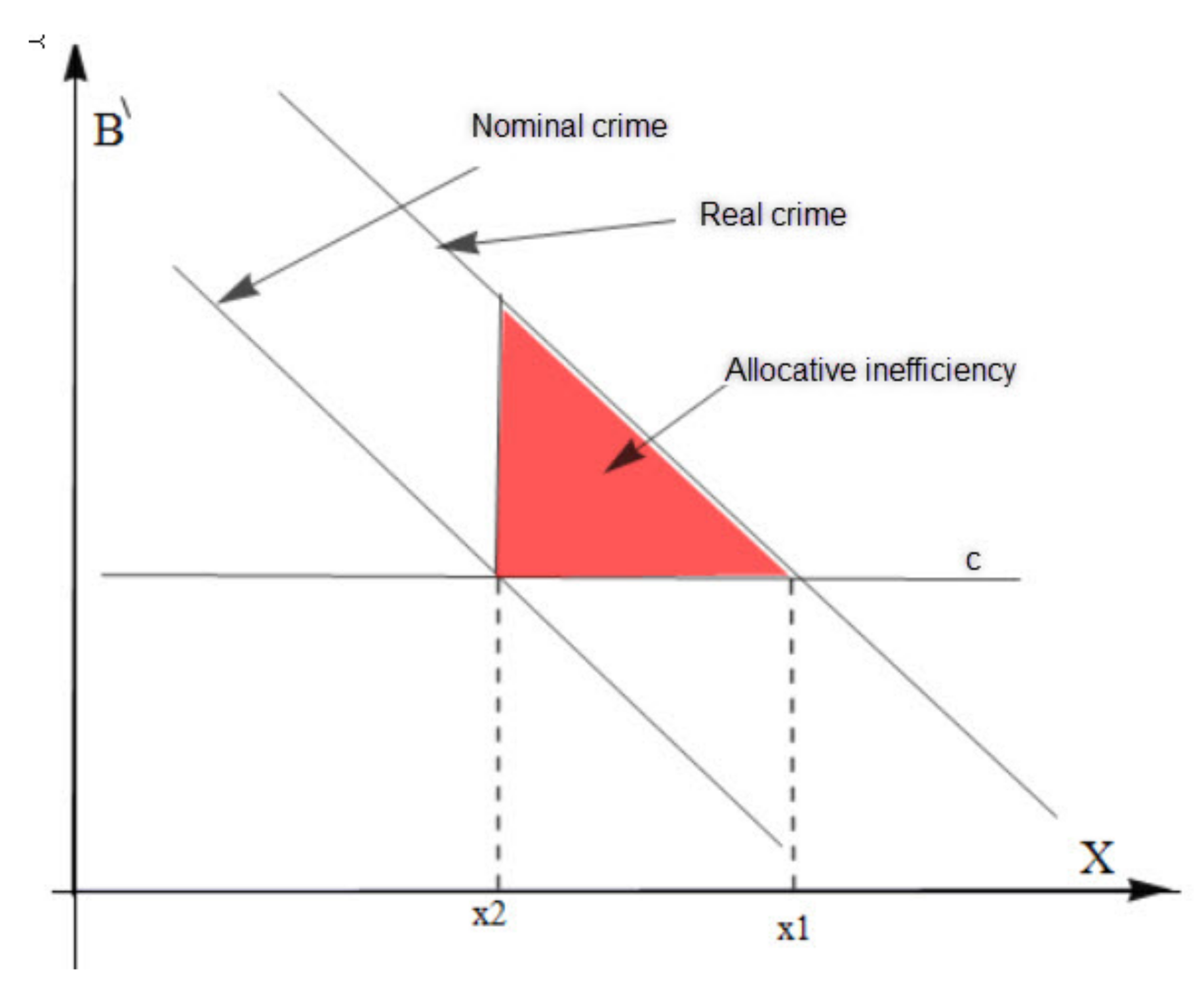

3.1. The Optimum Amount of Crime Prevention

3.2. The Impact on Resource Usage

In addition, one must assume a significant amount of unrecorded crimes. Recorded criminal activities do not show the real crime rate since this type of criminal activity (pickpocketing) does not imply big losses for the victims. The data are therefore not applicable for generalizations about pickpocketing as a social problem.

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Akerlof, George A., and William T. Dickens. 1982. The Economic Consequencies of Cognitive Dissonance. American Economic Review 72: 307–19. [Google Scholar]

- Alarid, Leanne F., and Kenneth J. Novak. 2008. Citizen’s views on using alternate reporting methods in policing. Criminal Justice Policy Review 19: 25–39. [Google Scholar] [CrossRef]

- Atkinson, Antony B., and Joseph E. Stiglitz. 1987. Lectures on Public Economics. Singapore: McGrow-Hill Book Co. [Google Scholar]

- Avail Consulting. 2004. No Witness, No Justice (NWNJ). Pilot Evaluation: Final Report. October 29. Available online: http://www.cps.gov.uk/publications/docs/NWNJ_pilot_evaluation_report_291004.pdf (accessed on 10 October 2017).

- Baltagi, Badi H. 2006. Estimating an economic model of crime using panel data from North Carolina. Journal of Applied Econometrics 21: 543–47. [Google Scholar] [CrossRef]

- Becker, Gary S. 1968. Crime and Punishment: An Economic Approach. Journal of Political Economy 76: 169–217. [Google Scholar] [CrossRef]

- Becker, Gary S. 1974. Essays in the Economics of Crime and Punishment. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Bowles, Roger, Maria Garcia Reyes, and Nuno Garoupa. 2009. Crime Reporting Decisions and the Costs of Crime. European Journal of Criminal Policy Research 15: 365–77. [Google Scholar] [CrossRef]

- Cornish, Derek B., and Ronald V. Clarke, eds. 1986. The Reasoning Criminal. Rational Choice Perspectives on Offending. New York: Springer Verlag. [Google Scholar]

- Cornwell, Christopher, and William N. Trumbull. 1994. Estimating the economic model of crime with panel data. Review of Economics and Statistics 76: 360–66. [Google Scholar] [CrossRef]

- De Haan, Willem, and Jaco Vos. 2003. A crying shame: The over-rationalized conception of man in the rational choice perspective. Theoretical Criminology 7: 29–54. [Google Scholar] [CrossRef]

- Dickens, William T. 1986. Crime and Punishment Again: The Economic Approach with a Psychological Twist. Journal of Public Economics 30: 97–107. [Google Scholar] [CrossRef]

- NRK Dokumentar. 2016. Raser over Henlagte Dieseltyverier—Dokumentar—NRK. Available online: https://www.nrk.no/dokumentar/xl/raser-over-henlagte-dieseltyverier-1.12866040 (accessed on 7 December 2017).

- Ekeland, Ivar. 2003. Tilfeldighetenes Spill. Oslo: Pax Forlag. [Google Scholar]

- Eurostat. 2017. Crime and Criminal Justice Statistics. Available online: http://ec.europa.eu/eurostat/statistics-explained/index.php/Crime_and_criminal_justice_statistics (accessed on 8 December 2017).

- Gaute Torsvik. 1998. Informasjonsproblem og Økonomisk Organisering. Bergen: Fagbokforlaget. [Google Scholar]

- Gottfredson, Michael R., and Don M. Gottfredson. 1987. Decision Making in Criminal Justice: Toward the Rational Exercise of Discretion, 2nd ed. Springer: Berlin. [Google Scholar]

- Goudriaan, Heike, Karin Wittebrood, and Paul Nieuwbeerta. 2006. Neighbourhood characteristics and reporting crime: Effects of social cohesion, confidence in police effectiveness and socio-economic disadvantage. British Journal of Criminology 46: 719–42. [Google Scholar] [CrossRef]

- Gravelle, Hugh, and Ray Rees. 2004. Microeconomics, 3rd ed. Toronto: Pearson Education Canada. [Google Scholar]

- Green, Stuart P. 2012. Thirteen Ways to Steal a Bicycle: Theft Law in the Information Age. Cambridge: The President and Fellows of Harvard College. [Google Scholar]

- Hofseth, Christina, Marianne Sætre, and Veslemøy Grytdal. 2014. Vinningslovbrudd i Oslo 2012/2013. Omfang og Gjerningspersoner—Med Vurdering av Kunnskapen. Oslo: Oslo Politidistrikt. [Google Scholar]

- Just, Richard E., Darrell L. Hueth, and Andrew Schmitz. 2004. The Welfare Economics of Public Policy. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Lasley, James R., and Bernadette Jones Palombo. 1995. When crime reporting goes high-tech: An experimental test of computerized citizen response to crime. Journal of Criminal Justice 23: 519–29. [Google Scholar] [CrossRef]

- LeClerc, Benoit, and Richard Wortley, eds. 2013. Cognition and Crime: Offender Decision-Making and Script Analyses. London: Routledge. [Google Scholar]

- Loughran, Thomas A., Ray Paternoster, Aaron Chalfin, and Theodore Wilson. 2016. Can Rational Choice Considered a General Theory of Crime? Evidence From Individual-Level Panel Data. Criminology 54: 86–112. [Google Scholar] [CrossRef]

- Marie, Olivier. 2014. Lessons from the Economics of Crime. CentrePiece Winter 2013/14. London: The London School of Economics and Political Science. [Google Scholar]

- Matsueda, Ross L. 2013. Rational choice research in criminology: A multi-level framework. In Handbook of Rational Choice Social Research. Edited by R. Wittek, T. Snijders and V. Nee. Palo Alto: Stanford University Press. [Google Scholar]

- Næringslivets Sikkerhetsråd. 2017. Kriminalitets- og Sikkerhetsundersøkelsen i Norge 2017 (Krisino). Available online: https://www.nsr-org.no/publikasjoner/ (accessed on 5 December 2017).

- Nobelprize.org. 2017. Available online: http://www.nobelprize.org/ (accessed on 29 September 2017).

- Pezzin, Liliana E. 1995. Earnings prospects, matching effects, and the decision to terminate a criminal career. Journal of Quantitative Criminology 11: 29–50. [Google Scholar] [CrossRef]

- Piliavin, Irving, Rosemary Gartner, Craig Thornton, and Ross L. Matsueda. 1986. Crime, deterrence, and rational choice. American Sociological Review 51: 101–19. [Google Scholar] [CrossRef]

- Sætre, Marianne, Christina Hofseth, Ingjerd Hansen, and Anne Bakosgjelten. 2017. Trender i Kriminalitet 2016–2017. Utfordringer i den Globale Byen. Oslo: Oslo Politidistrikt. [Google Scholar]

- Sieberg, Katri K. 2005. Criminal Dilemmas. Understanding and Preventing Crime. Berlin/Heidelberg: Springer-Verlag. [Google Scholar]

- Simon, Herbert A. 1978. Rationality as Process and Product of Thought. American Economic Review 8: 1–11. [Google Scholar]

- Singer, Simon I. 1988. The fear of reprisal and the failure of victims to report a personal crime. Journal of Quantitative Criminology 4: 289–302. [Google Scholar] [CrossRef]

- Skogan, Wesley G. 1984. Reporting crimes to the police: the status of world research. Journal of Research in Crime and Delinquency 21: 113–37. [Google Scholar] [CrossRef]

- Starrett, Richard A., Michael P. Connolly, James T. Decker, and Adelina Araujo. 1988. The crime reporting behavior of Hispanic older persons: A causal model. Journal of Criminal Justice 16: 413–23. [Google Scholar] [CrossRef]

- Statistics Norway. 2017. Annual National Accounts: 1970- (CSV files). Available online: https://www.ssb.no/nasjonalregnskap-og-konjunkturer/tabeller/nr-tabeller (accessed on 10 September 2017).

- Statistics Norway. 2017. Offences reported to the police. Available online: https://www.ssb.no/sosiale-forhold-og-kriminalitet/statistikker/lovbrudda (accessed on 10 September 2017).

- Tolsma, Jochem, Joris Blaauw, and Manfred Te Grotenhuis. 2012. When do people report crime to the police? Results from a factorial survey design in The Netherlands, 2010. Journal of Experimental Criminology 3: 117–34. [Google Scholar] [CrossRef]

- Williams, Geoffrey. 2017. The Thief’s Wages: Theft and Human Capital Development. Oxford Economic Papers. Oxford: Oxford University Press. [Google Scholar]

| Country | 2008 | 2015 | Change in Percent |

|---|---|---|---|

| Cyprus | 411.03 | 108.38 | –73.6 |

| Estonia | 1756.22 | 863.51 | –50.8 |

| Poland | 562.54 | 363.54 | –35.4 |

| Germany | 2496.92 | 1646.84 | –34.0 |

| Portugal | 1202.99 | 832.95 | –30.8 |

| Slovakia | 627.65 | 444.37 | –29.2 |

| Belgium | 2303.23 | 1660.42 | –27.9 |

| Lithuania | 921.68 | 688.78 | –25.3 |

| Netherlands | 4292.25 | 3219.39 | –25.0 |

| Austria | 2094.47 | 1586.92 | –24.2 |

| England and Wales | 2916.32 | 2215.82 | –24.0 |

| Denmark | 4504.61 | 3436.13 | –23.7 |

| Slovenia | 1430.9 | 1105.16 | –22.8 |

| Sweden | 4752.8 | 3828.01 | –19.5 |

| Hungary | 1265.5 | 1031.67 | –18.5 |

| Iceland | 1495.6 | 1225.16 | –18.1 |

| Czech Republic | 1605.71 | 1319.87 | –17.8 |

| Italy | 2085.33 | 1719.49 | –17.5 |

| Latvia | 1179.12 | 976.14 | –17.2 |

| Spain | 520.1 | 442.96 | –14.8 |

| Ireland | 1724.2 | 1500.6 | –13.0 |

| Greece | 1038.79 | 923.72 | –11.1 |

| Croatia | 354.83 | 320.62 | –9.6 |

| Bulgaria | 566.01 | 531.99 | –6.0 |

| Northern Ireland (UK) | 1377.12 | 1300.2 | –5.6 |

| Malta | 2090.32 | 2015.4 | –3.6 |

| Finland | 1754.54 | 1781.22 | 1.5 |

| Liechtenstein | 503.45 | 516.51 | 2.6 |

| Montenegro | 128.99 | 132.94 | 3.1 |

| Switzerland | 1591.06 | 1772.66 | 11.4 |

| Luxembourg | 1451.22 | 1650.74 | 13.7 |

| Serbia | 269.68 | 317.71 | 17.8 |

| France | 1503.87 | 1846.91 | 22.8 |

| Romania | 202.92 | 545.72 | 168.9 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Idsø, J.; Årethun, T. Crime Statistics: Modeling Theft in Favour of Victims’ Choices. Economies 2018, 6, 25. https://doi.org/10.3390/economies6020025

Idsø J, Årethun T. Crime Statistics: Modeling Theft in Favour of Victims’ Choices. Economies. 2018; 6(2):25. https://doi.org/10.3390/economies6020025

Chicago/Turabian StyleIdsø, Johannes, and Torbjørn Årethun. 2018. "Crime Statistics: Modeling Theft in Favour of Victims’ Choices" Economies 6, no. 2: 25. https://doi.org/10.3390/economies6020025