Acquisition War-Gaming Technique for Acquiring Future Complex Systems: Modeling and Simulation Results for Cost Plus Incentive Fee Contract

Abstract

:1. Introduction

2. Acquisition as a War-Gaming Concept

- DAA-PWGE: Government plays the game to select optimum PTB solutions. Past acquisition data and market survey data are used to characterize each contractor’s bidding behavior. A PTB solution is selected based on minimum program execution risk and cost. From the program execution risk and cost associated with the selected PTB solution, a contract type is selected for the acquisition strategy.

- DAA-AWGE: Government plays the game to optimize acquisition strategy associated with the selected contract type. Past acquisition data and market survey data are used to characterize each contractor’s bidding behavior. An optimum acquisition strategy is achieved when the selected contract parameters and incentives are optimized for program execution risk and cost.

- KTR-PWGE: In this game, the contractors are simulated as players, and the goal is to select optimum contractors’ PTB solutions. Past acquisition data and market survey data are used to characterize each contractor’s bidding behavior. A PTB solution is selected for each contractor based on minimum program execution risk and maximum contractor profit. The purpose for this game is not to predict a winner, but to determine if the contractors’ solutions are consistent with the Government’s solutions. The selected PTB solutions from the contractors’ perspective will be used to “shape” the Government’s PTB solution to achieve “Affordability” criterion. The “Affordability” condition is achieved when at least two contractors are bidding for the selected Government’s PTB solution.

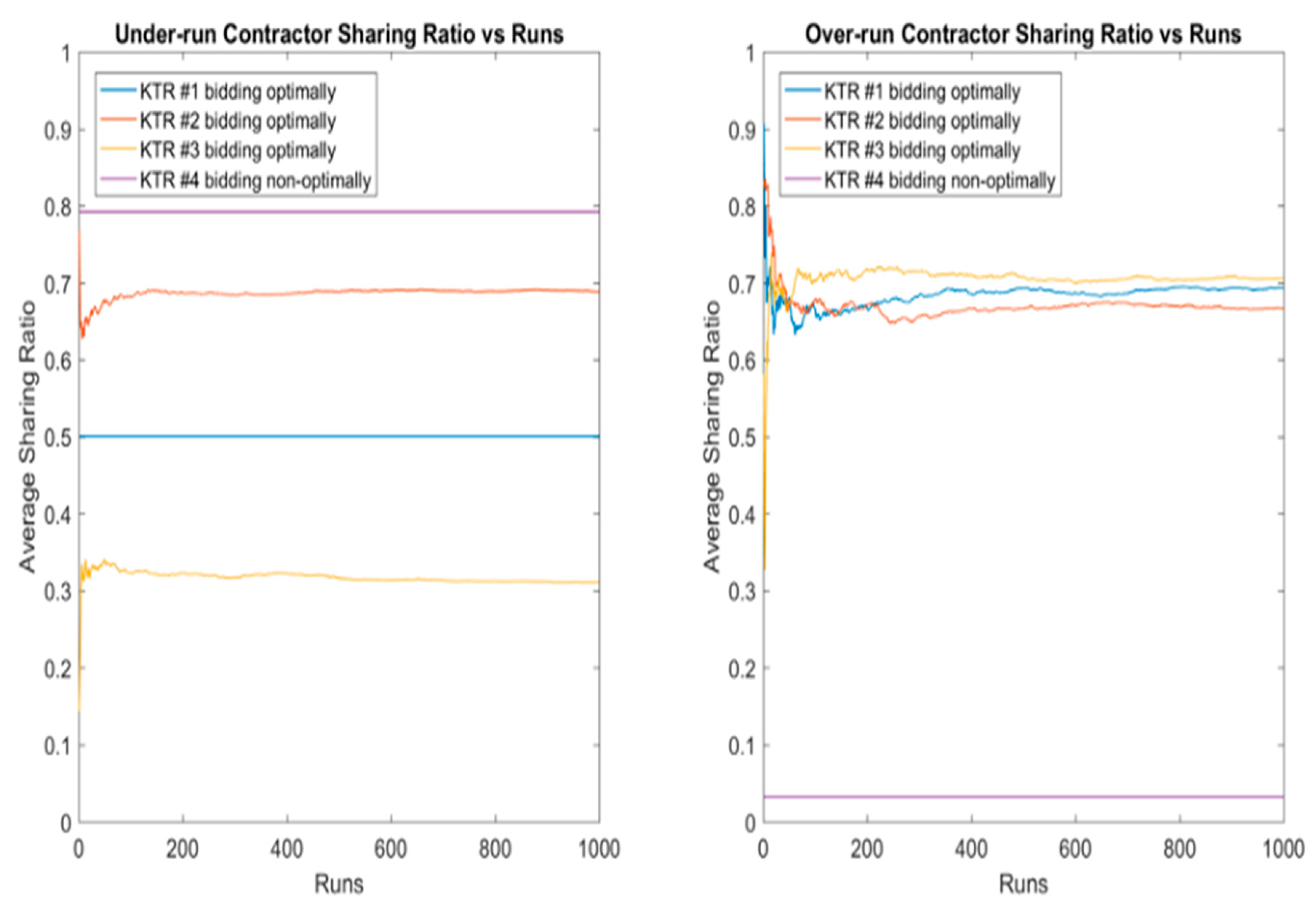

- KTR-BWGE: As mentioned earlier, this game also is referred to as KTR-AWGE because the results of the contractors’ bidding games will be used to shape the Government’s acquisition strategies. The KTR-AWGE game simulates the contractors as players and the goal is to optimize the contractors’ bidding strategies associated with the contractors’ selected PTB solution. Past acquisition data and market survey data are used to characterize each contractor’s bidding behavior. The optimum bidding strategies are achieved when the selected contract’s parameters are optimized based on minimum program execution risk and maximum contractors’ profit.

3. Advanced Game-Based Mathematical Framework (AGMF)

4. Unified Game-Based Acquisition Framework (UGAF)

5. PTB War-Gaming Engine (PWGE) Models

5.1. Game Models for Government’s PTB

DAA-PWGE Cooperative Bayesian Games Set-Up for Complete Information with Pure and Mixed Strategies from Government’s Perspective

DAA-PWGE Cooperative Game Set-Up with Complete Information and Pure Strategy

DAA-PWGE Cooperative Game Set-Up with Complete Information and Mixed Strategy

5.2. Models for Contractor PTB Games

- -

- Step 1: Contractor set: Assume to have N contractors to play the game (see Equation (1)).

- -

- Step 2: Contractor identifies a set of potential “I” architecture solution based on the requirements described in the release of RFI or RFP from a Government agency:

- -

- Step 3: Each architecture solution selected by a KTR will be mapped into a unique PTB solution type defined by DAA

- -

- Step 4: The Non-Cooperative (NC) game with mixed strategy and incomplete information: The strategy for the kth contractor to map the ith architecture solution to the jth PTB solution type is performed using the following mathematical expression:

- -

- Step 5: The “Belief Function” set or conditional probability set “P” for NC games: For each contractor “k”, the belief function “” is defined as the probability of selecting a PTB solution type “j” given the ith architecture solution:where is defined as:Like the DAA games, the above equation provides a better mathematical model than the one described in [3] for contractor games, and Equation (22) must also satisfy the following condition:

- -

- Step 6: PTB Utility Set for a “NC Mixed Strategy” is defined as . This is the PCFNC for selecting a mixed strategy for the kth contractor. Mathematical, it is given by the following equation:

- -

- Step 7: The KTR plays the following mixed game to select the optimum PTB solution:

6. Acquisition-Bidding War-Gaming Engine (AWGE) Models

6.1. Models for Government Acquisition Games—DAA-AWGE Game Set-Up

6.2. Models for Contractor Bidding Games—KTR-AWGE Game Set-Up

7. From Bidding to Contracting: Extending AWGE Model to CPIF Contract Type

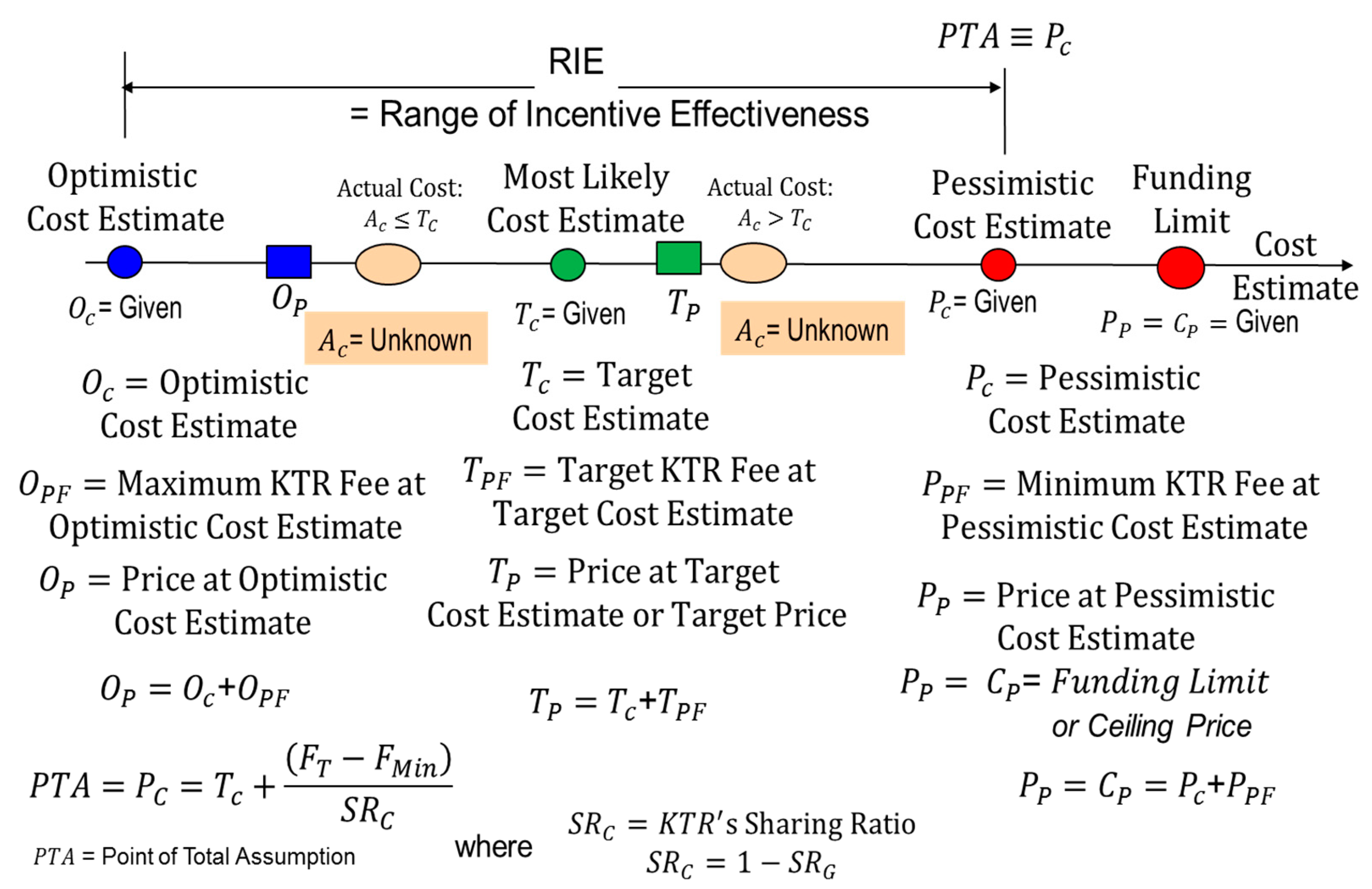

- Cost = Actual KTR Production/Service Cost, which is usually “unknown” from one contractor to another and Government (during the pre-award contract phase) = AC

- Fee = KTR Fee

- Price = Cost + Fee

- Funding Limit = Maximum price the government expects to pay

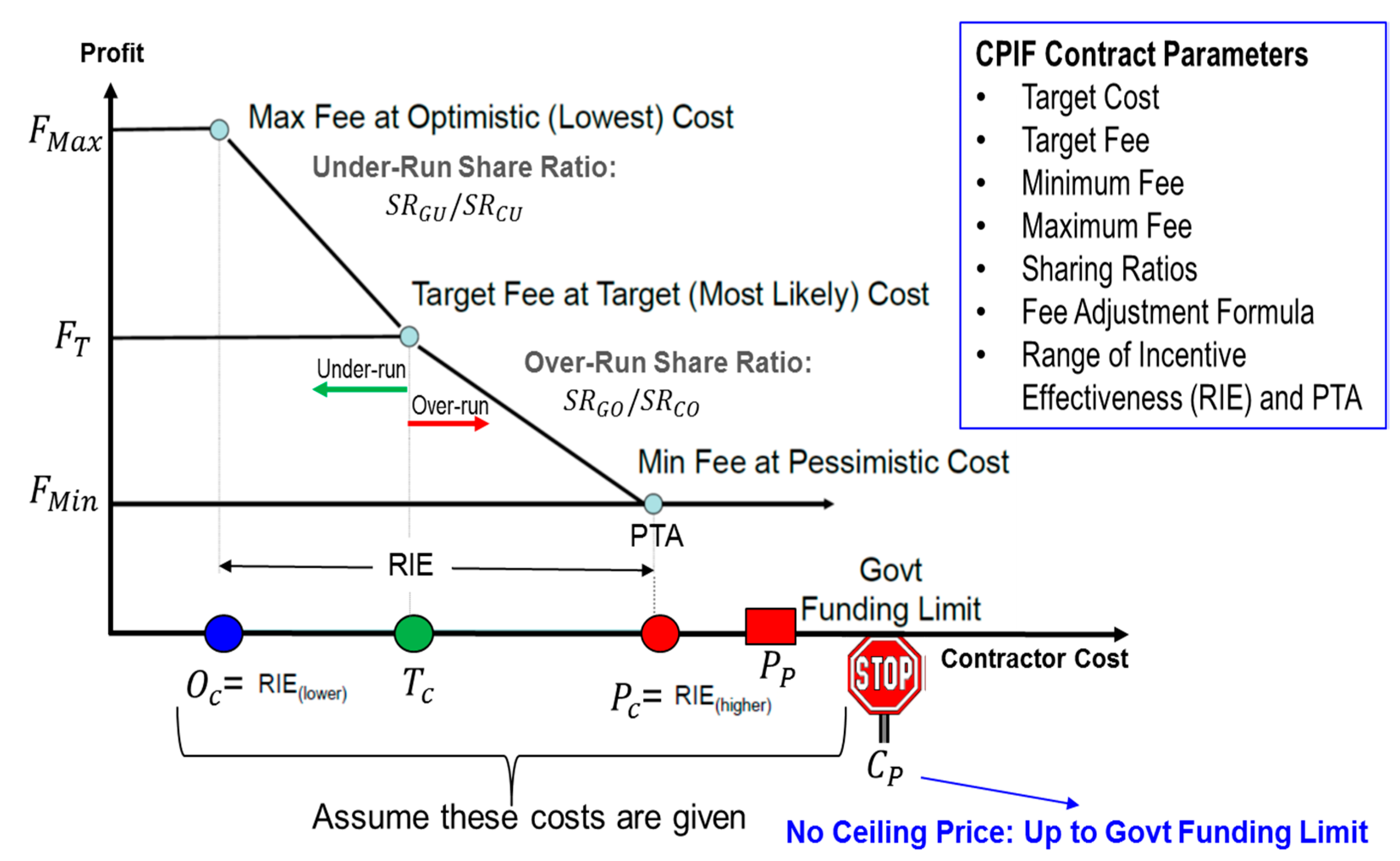

- Target Cost (TC): The initially negotiated figure for estimated contract costs and the point at which profit pivots

- Target Fees (TF): The initially negotiated fees at target cost, i.e., it is the difference between cost and price at target cost

- Share Ratio (SR): The Govt/contractor SR for cost savings or cost overruns that will increase or decrease the actual profit.

- Point of Total Assumption = PTA Pessimistic Cost Estimate = PC

- Range of Incentive Effectiveness = RIE = The range of cost outcomes over which the contract contemplates the sharing of some “pool of profit”

- Funding Limit = CP = Equivalent to Ceiling Price in FPIF, which is the Maximum Price that Government is willing to pay

7.1. Model for Government Acquisition Game: DAA-AWGE

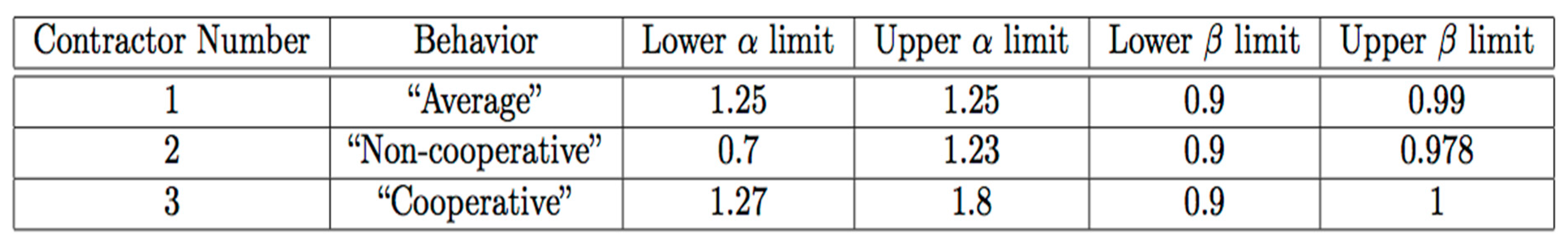

7.2. Mathematical and Simulation Model for Contractor Bidding Game: KTR-AWGE

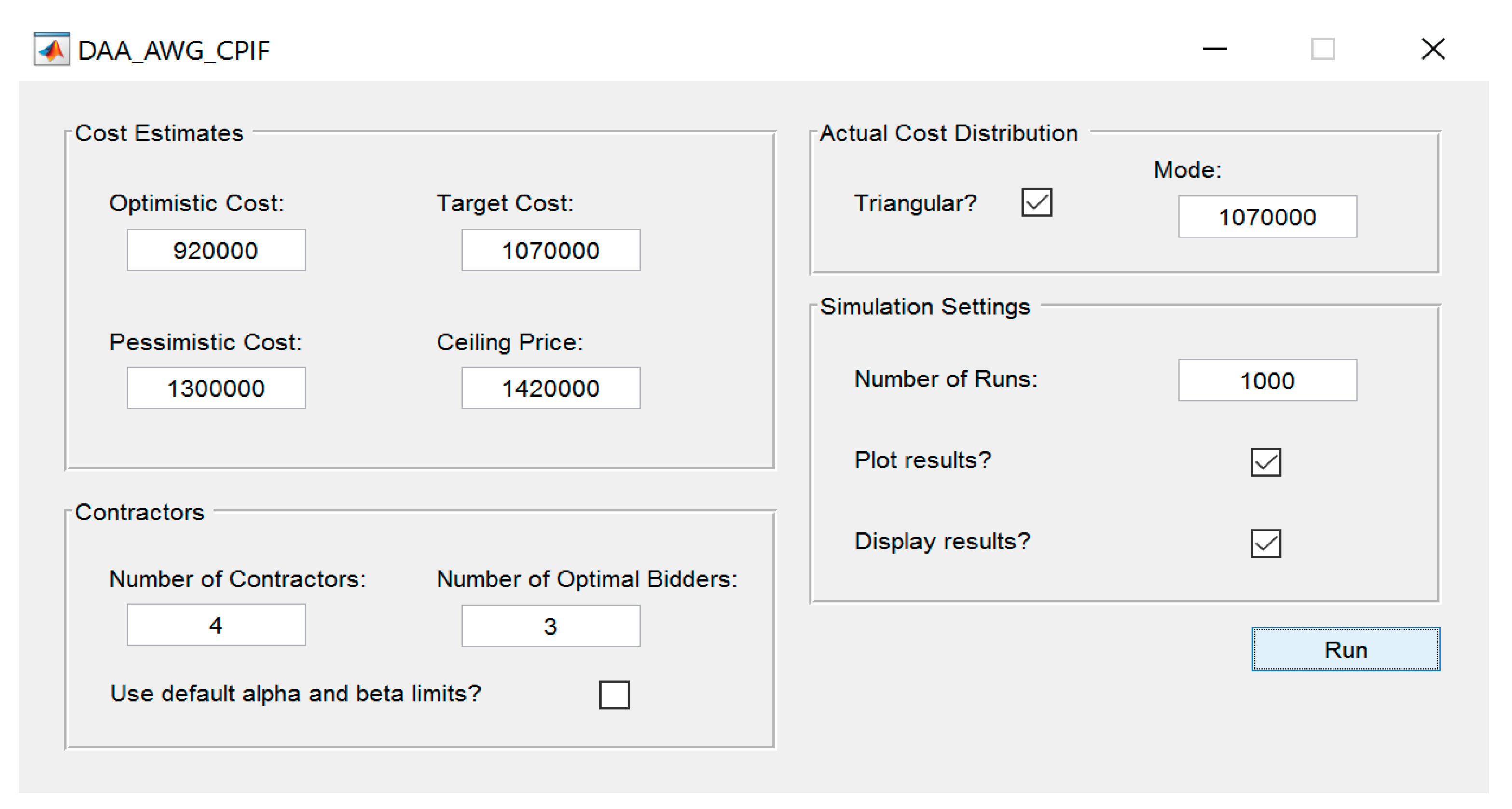

7.3. Proof of Concept: Simulation Results for CPIF Under Government’s Perspective

- Optimal bidding: Contractors choose parameters according to the Bayesian games described above.

- Non-optimal bidding: Contractors choose parameters based on an expected profit rate described above.

8. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Hagel, C. The Defense Innovation Initiative (DII). Secretary of Defense 1000 Defense Pentagon; Washington, DC, USA, 2014. Available online: http://archive.defense.gov/pubs/OSD013411-14.pdf (accessed on 6 March 2018).

- Nguyen, T.M.; Guillen, A.T.; Matsunaga, S.S.; Tran, H.T.; Bui, T.X. War-Gaming Applications for Achieving Optimum Acquisition of Future Space Systems; Simulation and Gaming; Cvetkovic, D., Ed.; InTech: London, UK, 2018; ISBN 978-953-51-5788-5. [Google Scholar]

- Nguyen, T.M.; Guillen, A. Development of an Optimum Technical Baseline for Future Space Systems Using Advanced Game-Based Mathematical Framework—Invited Paper; SIAM—Special Session on Applied Mathematics in Industry; California State University at Fullerton: Fullerton, CA, USA, 2015. [Google Scholar]

- Nguyen, T.M.; Guillen, A.T.; Matsunaga, S.S. A Resilient Program Technical Baseline Framework for Future Space Systems. In Proceedings of the SPIE, Baltimore, MD, USA, 22 May 2015; Volume 9469. [Google Scholar]

- Nguyen, T.M.; Guillen, A.; Hant, J.; Kizer, J.R.; Min, I.; Siedlak, D.J.L.; Yoh, J. Owning the Program Technical Baseline for Future Space Systems Acquisition: Program Technical Baseline Tracking Tool. In Proceedings of the SPIE, Anaheim, CA, USA, 5 May 2017; Volume 10196. [Google Scholar]

- Nguyen, T.M.; Guillen, A.T. War-Gaming Application for Future Space Systems Acquisition. In Proceedings of the SPIE, Anaheim, CA, USA, 2015; Volume 983808. [Google Scholar]

- Nguyen, T.M.; Guillen, A. War-Gaming Application for Future Space Systems Acquisition: Part 1—Program and Technical Baseline War-Gaming Modelling Approach. In Proceedings of the SPIE, Anaheim, CA, USA, 5 May 2017; Volume 10196. [Google Scholar]

- Nguyen, T.M.; Guillen, A.T. War-Gaming Application for Future Space Systems Acquisition: Part 2—Acquisition and Bidding War-Gaming Modelling and Simulation Approaches for FFP and FPIF. In Proceedings of the SPIE, Anaheim, CA, USA, 2017; Volume 10196. [Google Scholar]

- Shelton, G.M.L. Report to Congressional Committees: Space Modernization Initiative (SMI) Strategy and Goals; House Armed Services Committee, U.S. House of Representatives: Washington, DC, USA, 2014.

- Rubinstein, A. Perfect Equilibrium in a Bargaining Model. Econometrica 1982, 50, 97–109. [Google Scholar] [CrossRef]

- Tsiropoulou, E.E.; Kapoukakis, A.; Papavassiliou, S. Energy-efficient subcarrier allocation in SC-FDMA wireless networks based on multilateral model of bargaining. In Proceedings of the IFIP Networking Conference, Brooklyn, NY, USA, 22–24 May 2013. [Google Scholar]

- Asheim, G.B. A unique solution to n-person sequential bargaining. Games Econ. Behav. 1992, 4, 169–181. [Google Scholar] [CrossRef]

- Vienhage, P.; Barcomb, H.; Marshall, K.; Black, W.A.; Coons, A.; Tran, H.T.; Nguyen, T.M.; Guillen, A.T.; Yoh, J.; Kizer, J.; et al. War-Gaming Application for Future Space Systems Acquisition: MATLAB Implementation of War-Gaming Acquisition Models. In Proceedings of the SPIE, Anaheim, CA, USA, 5 May 2017; Volume 10196. [Google Scholar]

- Bui, T.X. A Group Decision Support System for Cooperative Multiple Criteria Group Decision Making; Lecture Notes in Computer Science; Springer: Berlin, Germany; New York, NY, USA, 1987. [Google Scholar]

- Hempsch, C.; Sebastian, H.-J.; Bui, T. Solving the Order Promising Impasse Using Multi-Criteria Decision Analysis and Negotiation; Logistics Research; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Bui, T.; Jarke, M. A DSS for Cooperative Multiple Criteria Group Decision Making. In Proceedings of the International Conference on Information System, New York, NY, USA, 1984; pp. 101–113. [Google Scholar]

- Port, D.; Bui, T. Investigating Mixed Agile and Plan-Based Requirements Prioritization Strategies. 2008. Available online: https://www.researchgate.net/profile/Daniel_Port2/publication/268413207_Investigating_Mixed_Agile_and_Plan-based_Requirements_Prioritization_Strategies/links/56ec37e808ae59dd41c4f7bd/Investigating-Mixed-Agile-and-Plan-based-Requirements-Prioritization-Strategies.pdf (accessed on 6 March 2018).

- Bui, T.X.; Alexendre, G.; Sebastian, H.-J. Web Services for Negotiation and Bargaining in Electronic Markets: Design Requirements, Proof-of-Concepts, and Potential Applications to e-Procurement; Springer: Berlin, Germany, 2006. [Google Scholar]

- Nicolella, A.J. Incentive Contracting: Contract Type Overview; Defense Acquisition University: Fort Belvoir, VA, USA, 2014. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen, T.M.; Tran, H.T.; Guillen, A.T.; Bui, T.X.; Matsunaga, S.S. Acquisition War-Gaming Technique for Acquiring Future Complex Systems: Modeling and Simulation Results for Cost Plus Incentive Fee Contract. Mathematics 2018, 6, 43. https://doi.org/10.3390/math6030043

Nguyen TM, Tran HT, Guillen AT, Bui TX, Matsunaga SS. Acquisition War-Gaming Technique for Acquiring Future Complex Systems: Modeling and Simulation Results for Cost Plus Incentive Fee Contract. Mathematics. 2018; 6(3):43. https://doi.org/10.3390/math6030043

Chicago/Turabian StyleNguyen, Tien M., Hien T. Tran, Andy T. Guillen, Tung X. Bui, and Sumner S. Matsunaga. 2018. "Acquisition War-Gaming Technique for Acquiring Future Complex Systems: Modeling and Simulation Results for Cost Plus Incentive Fee Contract" Mathematics 6, no. 3: 43. https://doi.org/10.3390/math6030043