1. Introduction

Risk and money management for investment issues has always been at the heart of finance. Going back to the 1950s,

Markowitz (

1991) invented the “modern portfolio theory”, where the additive expectation of a portfolio of different investments was maximized subject to a given risk expressed by volatility of the portfolio.

When the returns of the portfolio are no longer calculated additive, but multiplicative in order to respect the needs of compound interest, the resulting optimization problem is known as “fixed fractional trading”. In fixed fractional trading strategies an investor always wants to risk a fixed percentage of his current capital for future investments given some distribution of historic trades of his trading strategy.

A first example of factional trading was established in the 1950s by (

Kelly 1956) who found a criterion for an asymptotically optimal investment strategy for one investment instrument. Similarly, Vince in the 1990s (see (

Vince 1990,

1992)) used the fractional trading ansatz to optimize his position sizing. Although at first glance these two methods look quite different, they are in fact closely related as could be shown in (

Maier-Paape 2016). However, only recently (

Vince 2009) extended the fractional trading ansatz to portfolios of different investment instruments. The situation with

M investment instruments (systems) and

N coincident realizations of absolute returns of these

M systems results in a trade return matrix

T described in detail in (

2). Given this trade return matrix, the “Terminal Wealth Relative” (TWR) can be constructed (see (

4)) measuring the multiplicative gain of a portfolio resulting from a fixed vector

of fractional investments into the

M systems. In order to find an optimal investment among all fractions

the TWR has to be maximized

where

is the definition set of the TWR (see Definition 1 and (

8)).

Whereas (

Vince 2009) only stated this optimization problem and illustrated it with examples, in

Section 3 we give as our main result the necessary analysis. In particular, we investigate the definition set

of the TWR and fix reasonable assumptions (Assumption 1) under which (

1) has a unique solution. This unique solution may lie in

or on

as different examples in

Section 4 show. Our result extend the results of (

Maier-Paape 2013;

Zhu 2007) (

case only) and parts of the PhD of (

Hermes 2016) on the discrete multivariate TWR. One of the main ingredients to show the uniqueness of the maximum of (

1) is the concavity of the function

(see Lemma 5). Uniqueness and concavity furthermore guarantee that the solution of (

1) can always be found numerically by simply following steepest ascent.

Before we start our analysis, some more remarks on related papers are in order. In (

Maier-Paape 2015) showed that the fractional trading ansatz on one investment instrument leads to tremendous drawdowns, but that effect can be reduced largely when several stochastic independent trading systems are used coincidentally. Under which conditions this diversification effect works out in the here considered multivariate TWR situation is still an open question. Furthermore, several papers investigated risk measures in the context of fractional trading with one investment instrument (

; see (

De Prado et al. 2013;

Maier-Paape 2013,

2016;

Vince and Zhu 2013)). Related investigations for the multivariate TWR using the drawdown can be found in (

Vince 2009).

In the following sections, we analyse the multivariate case of a discrete Terminal Wealth Relative. That means we consider multiple investment strategies where every strategy generates multiple trading returns. As noted before this situation can be seen as a portfolio approach of a discrete Terminal Wealth Relative (cf. (

Vince 2009)). For example, one could consider an investment strategy applied to several assets, the strategy producing trading returns on each asset. However, in an even broader sense, one could also consider several distinct investment strategies applied to several distinct assets or even classes of assets.

2. Definition of a Terminal Wealth Relative

The subject of consideration in this paper is the multivariate case of the discrete Terminal Wealth Relative for several trading systems analogous to the definition of Ralph Vince in (

Vince 2009). For

we denote the

k-th trading system by (

system k). A trading system is an investment strategy applied to a financial instrument. Each system generates periodic trade returns, e.g., monthly, daily or the like. The absolute trade return of the

i-th period of the

k-th system is denoted by

,

. Thus, we have the joint return matrix

and define

Just as in the univariate case (cf. (

Maier-Paape 2013) or (

Vince 1990)), we assume that each system produced at least one loss within the

N periods. That means

Thus, we can define the biggest loss of each system as

For better readability, we define the rows of the given return matrix, i.e., the return of the

i-th period, as

and the vector of all biggest losses as

Having the biggest loses at hand, it is possible to “normalize” the

k-th column of

T by

such that each system has a maximal loss of

. Using the componentwise quotient, the normalized trade matrix return then has the rows

For

,

, we define the Holding Period Return (HPR) of the

i-th period as

where

denotes the standard scalar product on

. To shorten the notation, the marking of the vector space

at the scalar product is omitted, if the dimension of the vectors is clear. Similar to the univariate case, the gain (or loss) in each system is scaled by its biggest loss. Therefore the HPR represents the gain (loss) of one period, when investing a fraction of

of the capital in (

) for all

, thus risking a maximal loss of

in the

k-th trading system.

The Terminal Wealth Relative (TWR) as the gain (or loss) after the given

N periods, when the fraction

is invested in (

) over all periods, is then given as

Note that in the –dimensional case a risk of a full loss of our capital corresponds to a fraction of . Here in the multivariate case we have a loss of of our capital every time there exists an such that . That is for example if we risk a maximal loss of in the -th trading system (for some ) and simultaneously letting for all other . However these degenerate vectors of fractions are not the only examples that produce a Terminal Wealth Relative (TWR) of zero. Since we would like to risk at most of our capital (which is quite a meaningful limitation), we restrict to the domain given by the following definition:

Definition 1. A vector of fractions is called admissible if holds, where With this definition we now have a risk of

for each vector of fractions

and a risk of less than

for each vector of fractions

. Since

we can find an

such that

and thus in particular

holds.

denotes the Euclidean norm on

.

Observe that the

i-th period results in a loss if

, that means

. Hence the biggest loss over all periods for an investment with a given vector of fractions

is

Consequently, we have a biggest loss of

and

Note that for we do not have an a priori bound for the fractions . Thus it may happen that there are with for some (or even for all) , or at least , indicating a risk of more than for the individual trading systems, but the combined risk of all trading systems can still be less than . So the individual risks can potentially be eliminated to some extent through diversification. As a drawback of this favorable effect the optimization in the multivariate case may result in vectors of fractions that require a high capitalization of the individual trading systems. Thus, we assume leveraged financial instruments and ignore margin calls or other regulatory issues.

Before we continue with the TWR analysis, let us state a first auxiliary lemma for .

Lemma 1. The set in Definition 1 is convex, as is .

Proof. All the conditions

and

define half spaces (which are convex). Since

is the intersection of a finite set of half spaces, it is itself convex.

A similar reasoning yields that is convex, too. ☐

3. Optimal Fraction of the Discrete Terminal Wealth Relative

If we develop this line of thought a little further a necessary condition for the return matrix T for the optimization of the Terminal Wealth Relative gets clear:

Lemma 2. Assume there is a vector with then If in addition there is an such that then Proof. For arbitrary

the function

is monotonically increasing in

s for all

and by that we have

Moreover, if there is an

with

then

and by that

An investment where the holding period returns are greater than or equal to 1 for all periods denotes a “risk free” investment (

) and considering the possibility of an unbounded leverage, it is clear that the overall profit can be maximized by investing an infinite quantity. Assuming arbitrage free investment instruments, any risk free investment can only be of short duration, hence by increasing

the condition

will eventually burst, cf. (

7). Thus, when optimizing the Terminal Wealth Relative , we are interested in settings that fulfill the following assumption

always yielding

.

With that at hand, we can formulate the optimization problem for the multivariate discrete Terminal Wealth Relative

and analyze the existence and uniqueness of an optimal vector of fractions for the problem under the assumption

Assumption 1. We assume that each of the trading systems in (2) produced at least one loss (cf. (3)) and furthermore - (a)

- (b)

- (c)

Assumption 1(a) ensures that, no matter how we allocate our portfolio (i.e., no matter what direction

we choose), there is always at least one period that realizes a loss, i.e., there exists an

with

. Or in other words, not only are the investment systems all fraught with risk (cf. (

3)), but there is also no possible risk free allocation of the systems.

The matrix

T from (

2) can be viewed as a linear mapping

“

” denotes the kernel of the matrix T in Assumption 1(c). Thus, this assumption is the linear independence of the trading systems, i.e., the linear independence of the columns

of the matrix

T. Hence with Assumption 1(c) it is not possible that there exists an

and a

such that

which would make (

) obsolete. So Assumption 1(c) is no actual restriction of the optimization problem.

Now we point out a first property of the Terminal Wealth Relative.

Lemma 3. Let the return matrix (as in (2)) satisfy Assumption 1(a) then, for all , there exists an such that . In fact . Proof. For some arbitrary

we have

. Then Assumption 1(a) yields the existence of an

with

. With

and

we get that

and

for all

. Hence

and clearly

(cf. Definition 1). ☐

Furthermore, the following holds.

Lemma 4. Let the return matrix (as in (2)) satisfy Assumption 1(a) then the set is compact.

Proof. For all

Assumption 1(a) yields an

such that

. With that we define

This function is continuous on the compact support

. Thus, the maximum exists

Consequently the function

is well defined and continuous. Since for all

with equality for at least one index

, we have

and

hence

Altogether we see that

thus the set

is bounded and connected as image of the compact set

under the continuous function

g and by that the set

is compact. ☐

Now we take a closer look at the third assumption for the optimization problem.

Lemma 5. Let the return matrix (as in (2)) satisfy Assumption 1(c) then is concave on .

Moreover if there is a with ,

then is even strictly concave in .

Proof. For

the gradient of

is given by the column vector

where

. The Hessian-matrix is then given by

where

is a row vector. The matrix

can be rearranged as

Since the matrices

are positive semi-definite for all

, the same holds for

and therefore

is concave. Furthermore, if there is a

with

where

, the matrix

further reduces to

If

is not strictly positive definite there is a

such that

and we get that

yielding a non trivial element in

and thus contradicting Assumption 1(c). Hence matrix

is strictly positive definite and

is strictly concave in

. ☐

With this at hand we can state an existence and uniqueness result for the multivariate optimization problem.

Theorem 2. (optimal f existence) Given a return matrix as in (2) that fulfills Assumption 1, then there exists a solution of the optimization problem (8) Furthermore, one of the following statements holds:

- (a)

is unique, or

- (b)

.

For both cases , and hold true.

Proof. We show existence and partly uniqueness of a maximum of the

N-th root of

, yielding existence and partly uniqueness of a solution

of (

10) with the claimed properties.

With Lemmas 1 and 4, the support

of the Terminal Wealth Relative is convex and compact. Hence the continuous function

attains its maximum on

. For

we get from (

9)

which is a vector whose components are strictly positive due to Assumption 1(b). Therefore

is not a maximum of

and a global maximum reaches a value greater than

Since for all

holds, a maximum can not be attained in

either.

Now if there is a maximum on

, assertion (b) holds together with the claimed properties. Alternatively, a maximum

is attained in the interior

. In this case, Lemma 5 yields the strict concavity of

at

. Suppose there is another maximum

then the straight line connecting both maxima

is fully contained in the convex set

(cf. Lemma 1). Because of the concavity of

all points of

L have to be maxima, which is a contradiction to the strict concavity of

in

. Thus, the maximum is unique and assertion (a) holds together with the claimed properties. ☐

In the remainder of this section, we will further discuss case (b) in Theorem 2. We aim to show that the maximum is unique either, but we proof this using a completely different idea. In order to lay the grounds for this, first, we give a lemma:

Lemma 6. If from (2) is a return map satisfying Assumption 1 and if , then each return map , which results from T after eliminating one of its columns, is also a return map satisfying Assumption 1. Proof. Since each of the M trading systems of the return matrix has a biggest loss , , the same holds for the trading systems of the reduced matrix .

For , Assumption 1(b),(c) follow straight from the respective properties of the matrix T.

Now let, without loss of generality,

be the matrix that results from

T by eliminating the last column, i.e., the

M-th trading system is omitted. Let

,

, denote the rows of

and

the vector of biggest losses of

. Then for Assumption 1(a) we have to show that

such that

Using Assumption 1(a) for matrix

T and

the inequality

holds true. Thus, (

11) holds likewise. ☐

Having this at hand, we can now extend Theorem 2.

Corollary 1. (optimal f uniqueness) In the situation of Theorem 2 the uniqueness also holds for case (b), i.e., a maximum is also a unique maximum of in .

Proof. Assume that the optimal solution

is not unique, then there exists an additional optimal solution

with

. Since

is convex (c.f. Lemma 1), the line connecting both solutions

is fully contained in

. Because of the concavity of

on

(c.f. Lemma 5), all points on

L are optimal solutions. Therefore

L must be a subset of

, since we have seen that an optimal solution in the interior

would be unique. Hence, there is (at least) one

such that, for all investment vectors in

L, the trading system (

) is not invested. i.e., the

-th component of

, of

and of all vectors in

L is zero.

Without loss of generality, let

. Then

are two optimal solutions for

However, with that, the

-dimensional investment vectors

are two distinct optimal solutions for

With Lemma 6 the return map which results from T after eliminating the M-th column (i.e., (system M)) satisfies Assumption 1. Applying Theorem 2 to the sub-dimensional optimization problem, yields that and again lie at the boundary of the admissible set of investment vectors

Hence, we have two distinct optimal solutions on the boundary

for the optimization problem with (

M−1) investment systems. By induction this reasoning leads to the existence of two distinct optimal solutions for an optimization problem with just one single trading system. However, for that type of problem, we already know that the solution is unique (see for example (

Maier-Paape 2013)), which causes a contradiction to our assumption. Thus, also for case (b) we have the uniqueness of the solution

. ☐

Remark 1. Note that Assumption 1(c) is necessary for uniqueness. To give a counterexample imagine a return matrix with two equal columns, meaning the same trading system is used twice. Let be the optimal f for this one dimensional trading system. Then it is easy to see that , and the straight line connecting these two points yield TWR optimal solutions for the return matrix .

4. Examples

As an example we fix the joint return matrix

for

trading systems and the returns from

periods given through the following table.

Obviously every system produced at least one loss within the 6 periods, thus the vector

with

is well-defined. For

the

takes the form

where the set of admissible vectors is given by

Since for all

we have

When examining the 6-th row

of the matrix

we observe that Assumption 1(a) is fulfilled with

. To see that let, for some

,

, then

For Assumption 1(b) one can easily check that all four systems are “profitable”, since the mean values of all four columns in (

12) are strictly positive. Lastly, for Assumption 1(c) we check that the rows of matrix

are linearly independent

Thus, Theorem 2 yields the existence and uniqueness of an optimal investment fraction

with

,

and

, which can numerically be computed

In the above example, a crucial point is that there is one row in the return matrix where the -th entry is the biggest loss of (system k), . Such a row in the return matrix implies, that all trading systems realized their biggest loss simultaneously, which can be seen as a strong evidence against a sufficient diversification of the systems. Hence we analyze Assumption 1(a) a little closer to see what happens if this is not the case.

With the help of Assumption 1(a), for all

, there is a row of the return matrix

,

such that

. The sets

describe the hyperplanes generated by the normal direction

,

. Thus, each

from the set

has to be an element of one of the half spaces

In other words the set

has to be a subset of a union of half spaces

If there exists an index

such that

for all

, then the normal direction of the corresponding hyperplane is

hence

and therefore Assumption 1(a) is fulfilled.

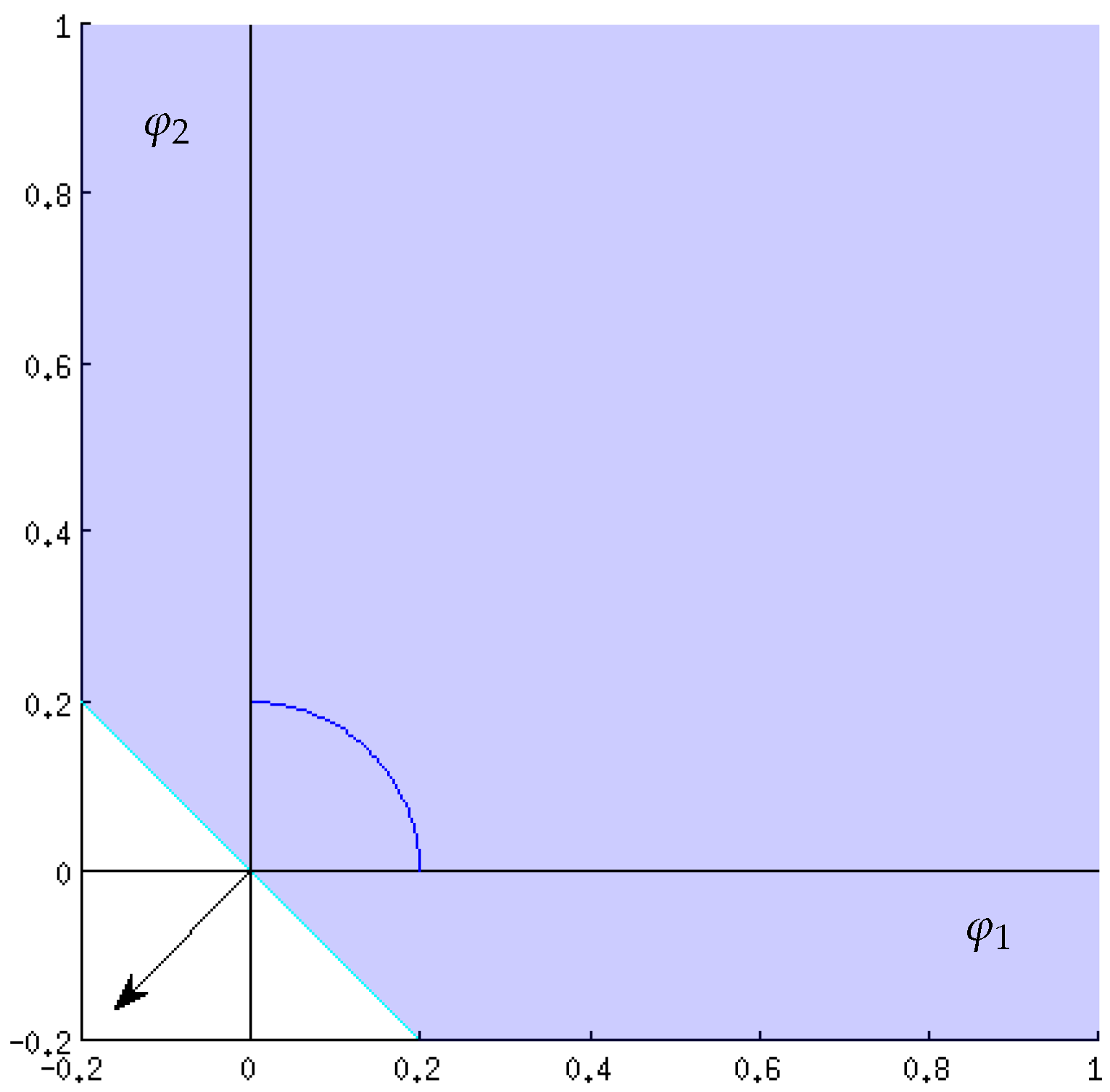

Figure 1 shows a hyperplane for

and a row of the return matrix where all entries are the biggest losses, that means the normal direction of this hyperplane is the vector

However, it is not necessary for Assumption 1(a) that the set

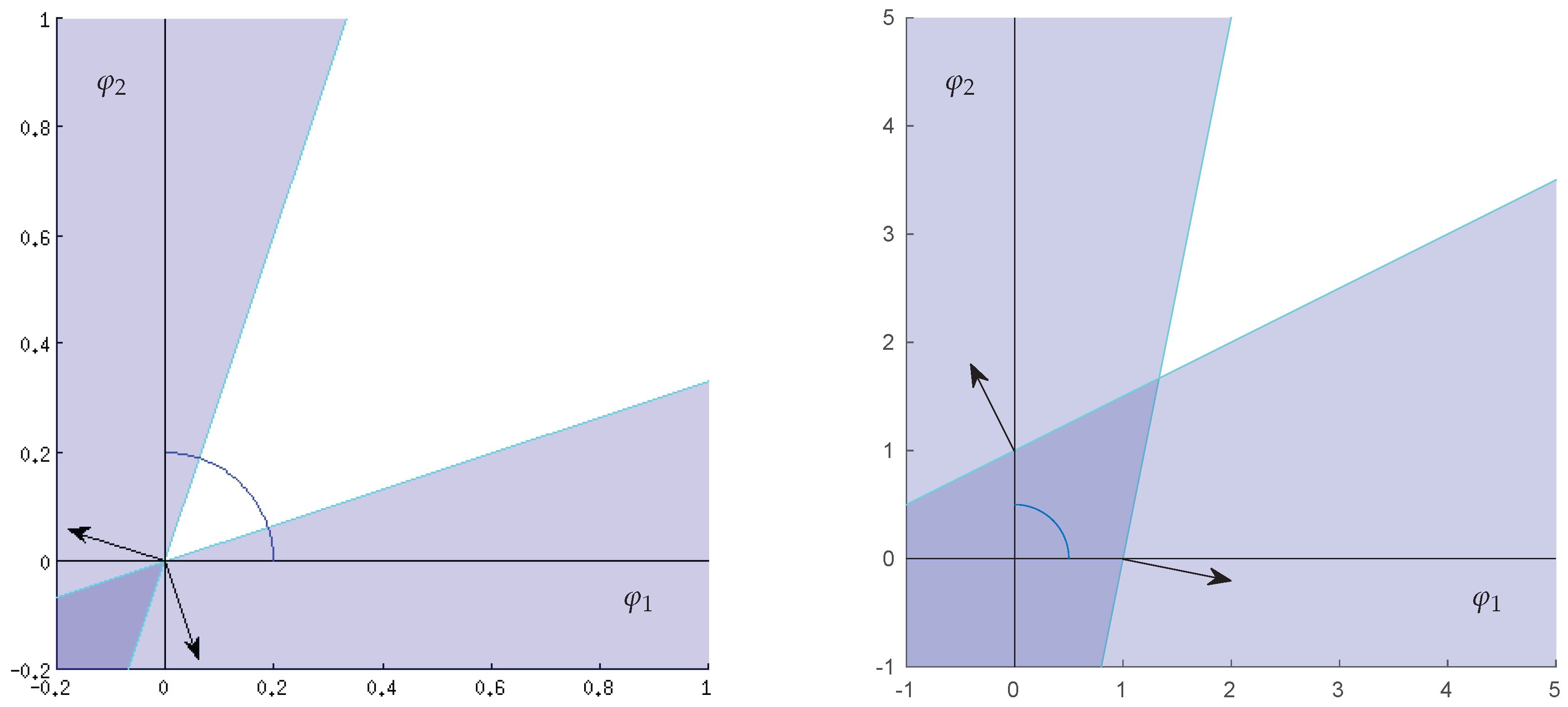

is covered by just one hyperplane. Again for

an illustration of possible hyperplanes can be seen in

Figure 2. The figure on the left shows a case where Assumption 1(a) is violated and the figure on the right a case where it is satisfied.

Remark 2. Following our arguments concerning the example in (12) the question arises whether or not a trading system where biggest losses are realized simultaneously always implies insufficient diversification. In (12) this seems to be the case, but is this true in general? One way diversification is often measured in the literature is volatility or variance/standard deviation of the portfolio returns. In terms of modern portfolio theory where portfolios are searched for which either -

minimize risk for a given chance/utility level

- or

maximize chance/utility for a given risk level,

the volatility stands for the risk part. Transferring this setup for a trade–off between risk and utility to the TWR “utility function” would result in an optimization problem likewhere is a constant restricting the risk (or volatility) level and is a symmetric positive definite covariance matrix stemming from a trading game with trade returns as in (2). The optimization problem in (14) is quite similar to the Markowitz portfolio optimization. The only difference is that the Markowitz utility function “expected portfolio return” is exchanged by the concave function . Since of Theorem 2 solves (10) it is clear that will solve (14) for all . On the other hand, for solutions of (14) will also be “efficient” in this utility/risk setting. However, the volatility decreases as and therefore diversification certainly increases. As a matter of fact, among all efficient portfolios, has the highest volatility and thus the worst diversification. In that sense diversification of is not to be expected. For the next example we fix the return matrix

as

with

and

. Thus, the biggest losses of the two systems are

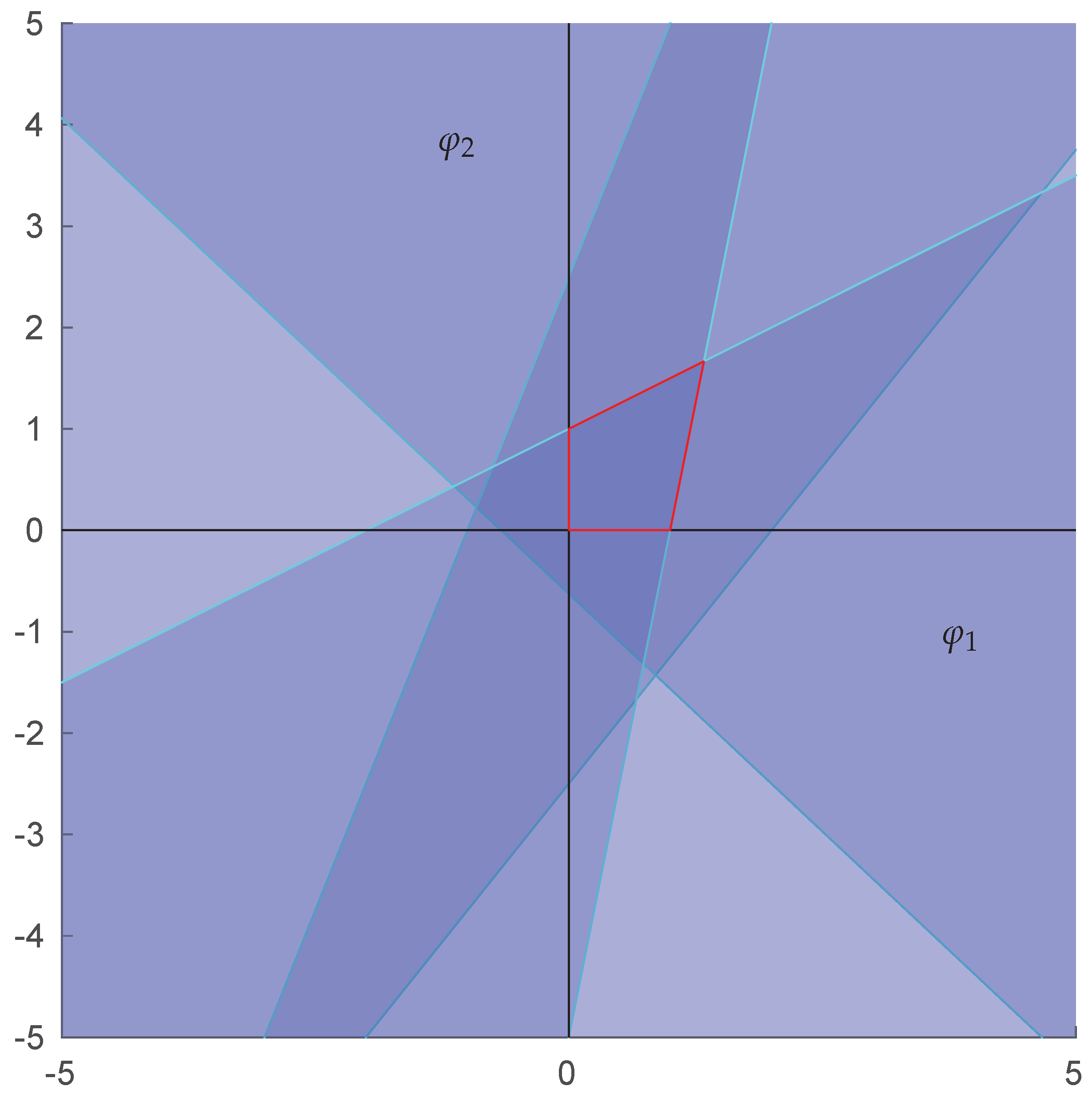

To determine the set of admissible investments (and to check Assumption 1) we examine the vectors

for

and solve the linear equations

The solutions for

are shown in

Figure 3.

Each solution corresponds to a “cyan” line. The area where the inequality

holds for some

is shaded in “light blue”. The set where the inequalities hold for all

is the section where all shaded areas overlap, thus the “dark blue” section. Therefore the set of admissible investments is given by

with

Assumption 1 is fulfilled, since

- (a)

the half spaces for rows 4 and 5 of the return matrix cover the whole set

(cf.

Figure 2b),

- (b)

and and

- (c)

obviously, the columns of the return matrix are linearly independent.

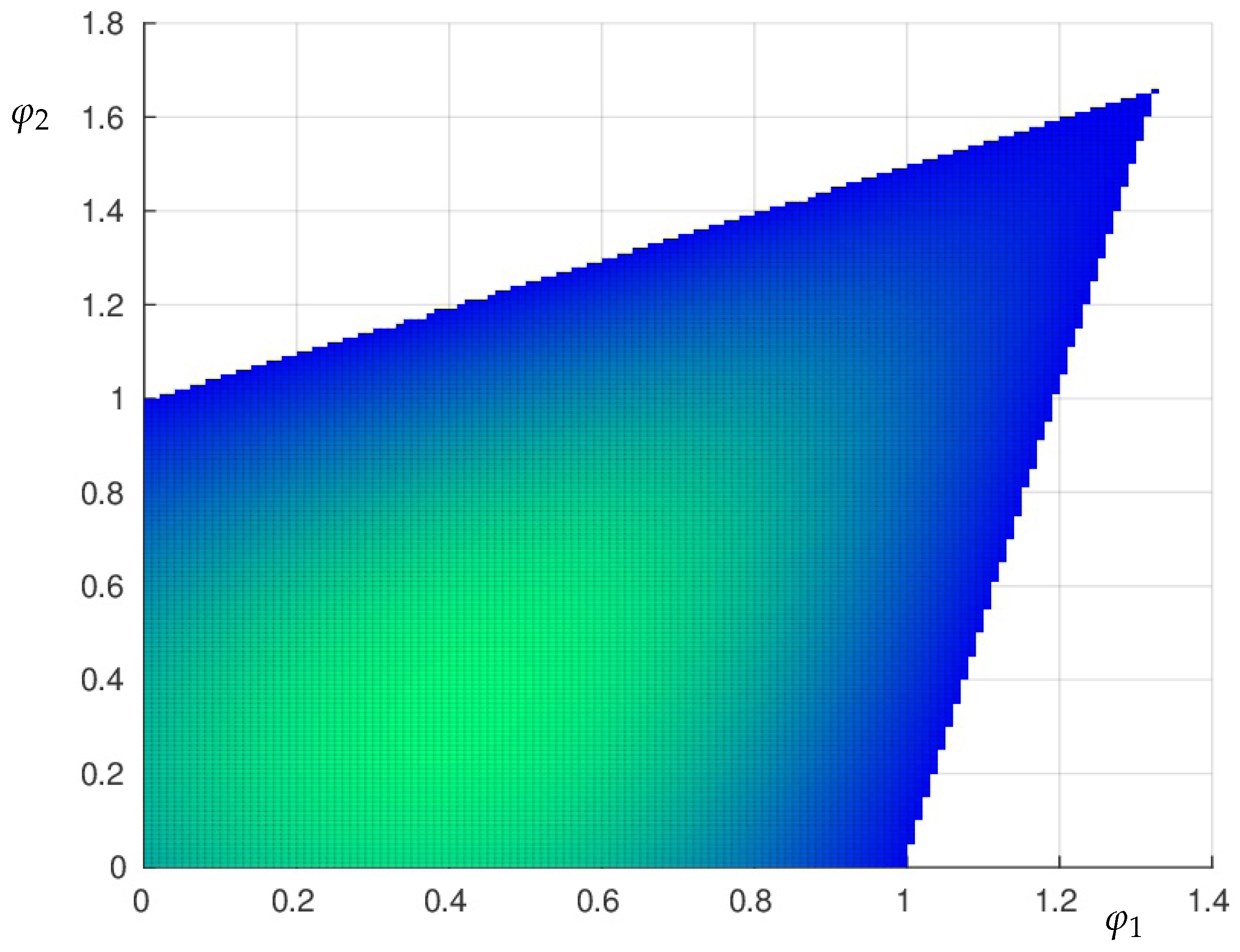

A plot of the Terminal Wealth Relative for the return matrix

from (

15) can be seen in

Figure 4 and

Figure 5 with a maximum at

Therefore the maximum is clearly attained in the interior .

The following example will show that the unique maximum

of Theorem 2 can indeed be attained on

, i.e., the case discussed in Corollary 1. For that we add a third investment system to our last example (

16) with the new returns

such that the vectors

,

, form the matrix

This set of trading systems fulfills Assumption 1(b) since .

Assumption 1(c) is satisfied as well, because the three columns of

are linearly independent. For Assumption 1(a) we have to show that

holds. If not, we would have an investment vector

such that (

20) is not true for all rows of the matrix

. In particular if we look at lines 4 and 5

the sum of both inequalities still has to be true

which is a contradiction to

being an element of

Now we examine the following vector of investments

with

the unique maximum of the optimization problem of the reduced set of trading systems from the last example (cf. (

18)).

The first derivative of the Terminal Wealth Relative in the direction of the third component at

is given by

Moreover with

being the optimal solution of the last example in two variables we have

and

Thus

is indeed a local maximal point on the boundary of

for TWR

5 with the three trading systems in (

19). Corollary 1 yields the uniqueness of this maximal solution for