1. Introduction

One of the most important types of insurance-linked securities has been the catastrophe (CAT) bond, which, in a broad sense, provides ex-ante capital to the issuer in the case of a pre-defined catastrophe-related event happening. However, despite various theories on how to value such bonds, their pricing still remains difficult because of the jump processes and heavy-tailed distributional assumptions, which most often underpin such theories. In this paper, we focus on how, in the context of certain traditional CAT bond pricing models, one can simplify and quicken CAT bond pricing by using approximations to their assumed underlying processes.

We now present a brief overview of CAT bonds. CAT bonds have been loosely classified into three main types: indemnity-linked, index-linked and parametric (see

Cummins and Weiss (

2009)). Such classification is based on the “trigger” of the bond, that is the event (or set or even sequence thereof) that causes the bond to release the capital to the issuer. In this research, we, however, focus on index-linked CAT bonds, which, according to the Artemis deal directory, have the second-largest issuance outstanding in the 2016 CAT bond market (

Artemis 2016).

The pricing of CAT bonds is complex. This is mainly because these securities, and other insurance-related derivatives as well, will have a process with jumps as an important modeling component (such as, for example, a compound Poisson process or shot-noise process (see

Dassios and Jang (

2003) and

Schmidt (

2014) for an application of these processes to catastrophe derivatives), and therefore, unique prices based on arbitrage-free pricing techniques in general do not exist (

Chang and Chang 2017;

Embrechts 2000;

Embrechts and Meister 1997;

Lee and Yu 2002). Therefore, it seems clear as to why there have been discussions around a number of methods for pricing CAT bonds. Five differing theoretical frameworks have been postulated in the literature thus far (

Braun 2011;

Galeotti et al. 2013). Firstly, standard actuarial pricing methodologies have been applied to CAT bonds by

Lane and Mahul (

2008) and

Bodoff and Gan (

2009). Secondly, an econometric CAT bond pricing model, based on observable catastrophe-related quantities, was proposed by

Braun (

2016), for pricing in the primary market. Thirdly, utility-based approaches have been proposed by

Cox and Pedersen (

2000);

Egami and Young (

2008);

Reshetar (

2008) and

Dieckmann (

2010) for numerous types of CAT bonds. Fourthly, preference-free no-arbitrage frameworks have been proposed to price CAT bonds, and these frameworks have, in fact, been more traditional and more frequently used.

Baryshnikov et al. (

1998) undertook the first attempt to price catastrophe bonds within a no-arbitrage framework. They argued that the risk-neutral and real-world probability measures would coincide. As a consequence, further no-arbitrage pricing developments arose in

Burnecki and Kukla (

2003);

Härdle and Cabrera (

2010);

Jarrow (

2010);

Lee and Yu (

2002);

Loubergé et al. (

1999);

Ma and Ma (

2013);

Nowak and Romaniuk (

2013);

Vaugirard (

2003a 2003b 2004); and recently in

Jaimungal and Chong (

2014). Finally, pricing concerns surrounding incomplete markets, and non-unique measures can be overcome by a judicious choice of change in measure, such as the Esscher transform (see

Gerber and Shiu (

1996)). Another approach, similar to this, is the Wang transform introduced by

Wang (

2000).

Given the pervasiveness of the usage of aggregate loss processes (ALPs), such as compound Poisson processes, in most of the CAT bond pricing frameworks, it is important to mention the difficulty in explicitly evaluating functionals of the ALP. It is, however, possible to approximate the exact cumulative distribution function of the compound Poisson process using either Fourier transforms, numerical simulation techniques or approximation methods. So far, the literature on CAT bonds’ attention appears to be mainly on numerical simulation techniques, such as Monte Carlo simulation. Monte Carlo simulation and quasi-Monte Carlo simulation have been applied to numerically evaluating the pricing formulae (

Burnecki et al. 2005;

Nowak and Romaniuk 2013). However, Monte Carlo has to be used with caution, since one is working with the simulation of heavy-tailed data (

Burnecki and Giuricich 2017), and therefore, more sophisticated techniques such as importance sampling need to be used.

Approximation methods for evaluating cumulative distribution functions of the compound Poisson processes have been used (

Ma and Ma 2013). Such approximations of the compound Poisson random variable include the normal approximation, the normal power approximation, the Edgeworth approximation (

Beard 2013;

Pentikäinen 1977), the gamma approximation (

Seal 1977;

Sundt 1982), the inverse-Gaussian approximation (

Chaubey et al. 1998) and the Esscher approximation (

Esscher 1932). For a comprehensive treatment of the comparison of their errors, see

Seri and Choirat (

2015). A problem noticed with the usage of such approximations is that their applicability is not always possible in the cases when the underlying severity distributions have only finite first moments.

Now in light of the aforementioned, it seems that despite attempts to numerically evaluate the ALP-based pricing formulae for CAT bonds, no simple, approximate pricing formulae have been derived in the case of very heavy-tailed distributional assumptions. Therefore, we endeavor to fill this gap in the literature.

In this paper, we consider the class of

-stable distributions and associated motions. To tie the notion of

-stable Lévy motion to catastrophe modeling and CAT bond pricing, we present an approximation, of the ALP assumed to underlie CAT bonds, to

-stable Lévy motion by invoking the concept of weak convergence of one process to another. This approximation technique has its roots in ruin theory (see

Grandell (

2012),

Furrer et al. (

1997),

Burnecki (

2000) and

Michna (

2005)) and considers loss severity distributions belonging to the domain of attraction of

-stable laws. We highlight that this approximation explicitly accounts for (and indeed accommodates for) the heavy-tailed nature of the losses (and loss processes) giving rise to CAT bond price behavior.

With our goal in mind,

Section 2 begins by providing the necessary theoretical framework to construct the weak approximations to

-stable Lévy motion. In

Section 3, we present our results and derivations on the convergence of the ALPs to

-stable Lévy motion.

Section 4 applies the general results of

Section 3 to compound Poisson processes. Based on specific examples of loss severity distributions for the ALP (taking the form of a compound Poisson process), we then present closed-form approximations for index-linked CAT bond prices.

Section 5 introduces the existing index-linked CAT bond pricing model we use, and

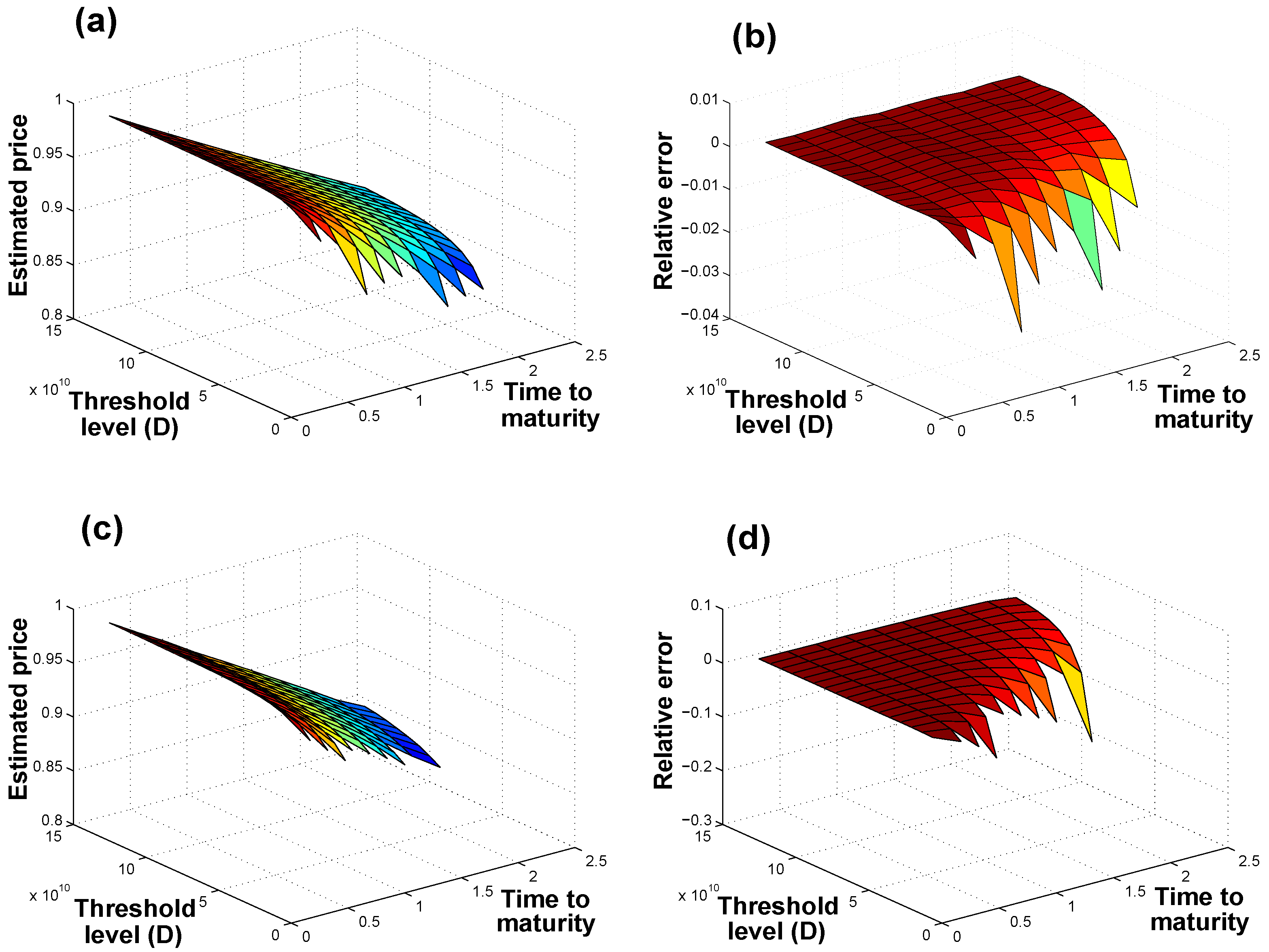

Section 6 shows our approximations at work in this practical setting. We then go on to compare our approximations to standard Monte Carlo simulation exercises for simulating the ALP and also first-order single risk loss process approximations. Moreover, in this section, we provide some guidance on how to test if our approximations are applicable to the situations considered.

Section 7 concludes.

2. Theoretical Framework: Weak Convergence of the Aggregate Loss Process to -Stable Lévy Motion

We begin by contextualizing what we have in mind for the mathematical model for the ALP. We firstly consider a renewal process, as given by Definition 1.

Definition 1. (Grandell (2012)) We define a renewal process, , aswhere the inter-arrival times are iid positive random variables each with , for some , and with , where . Now, we simply assume that the renewal process governs the frequency component in the ALP and that successive losses

form a sequence of iid random variables only with

. Therefore, our ALP takes the form:

which is, in essence, a compound renewal process. The remainder of this section will be devoted to discussing the definitions of

-stable distributions and processes, some assumptions for our paper and the idea of weak convergence.

2.1. -Stable Distributions and -Stable Lévy Motion

The applicability of Gaussian distributions and processes in stochastic modeling has been extensively studied. However, analyses of insurance, as well as financial data often points to the existence of heavy tails (see, for example,

Embrechts et al. (

2013) and the recent work by

Calderín-Ojeda et al. (

2017)), calling the use of Gaussian distributions into question. The more general class of stable distributions can account for such a heavy-tailed feature in the data.

The theory regarding univariate stable distributions was developed in the early 1900s and is covered in detail in the books of

Janicki and Weron (

1994),

Samorodnitsky and Taqqu (

1994) and the forthcoming book of

Nolan (

2015). Despite there being a few ways to define it, we define a stable random variable in terms of its characteristic function to explicitly emphasize its associated parameters.

Definition 2. (Samorodnitsky and Taqqu (1994) and Janicki and Weron (1994)) A random variable X is said to have a stable distribution, written , if there are parameters (the index of stability), (the skewness parameter), (the scale parameter) and (the shift) such that its characteristic function has the following form:Furthermore,The parameters and ν are unique and β is irrelevant when . The notation indicates that the random variable X has a stable distribution with four parameters and . Note that densities for stable random variables expressed in terms of elementary functions only exist in the cases when (the normal distribution), (the Cauchy distribution) and (the Lévy distribution). Moreover, bear in mind that the rate of decay in the stable distribution mostly depends on the parameter . We now define what is meant by an -stable Lévy motion.

Definition 3. - (i)

a.s.;

- (ii)

has independent increments;

- (iii)

for any , for some and for .

Observe that the process

introduced in Definition 3 has stationary increments, and it is Brownian motion when

. We now present some useful properties, which will be relevant to our expositions in

Section 3,

Section 4 and

Section 6.

Property 1: existence of moments. If , and , then and if , then

Property 2: tail probability estimation. If

and

, then:

where:

Property 3: self-similarity. -stable Lévy motions are -self-similar. That is, for all and have the same finite-dimensional distributions.

We also point out that Property 2 will feature prominently in our work: we will apply it in approximating probabilities for

-stable random variables. We do, however, highlight that there are other means to approximate such random variables and processes; see

Kohatsu-Higa and Tankov (

2010), for example.

Before we present the idea of weak convergence, we introduce an important assumption underlying our work. We assume that our sequence of iid loss random variables

underlying the ALP (see Equation (

1)), each with finite mean

, satisfies:

where

denotes convergence in distribution,

(where

L is slowly varying at infinity) and

is an

-stable random variable with

. Based on this assumption, we say that our

’s are in the domain of attraction of an

-stable random variable

, the former random variable only having a finite first moment.

2.2. Weak Convergence of the Aggregate Loss Process

Let

denote the space of all real-valued Càdlàg functions on

endowed with the Skorokhod topology. Then,

is a separable and complete metric space, where

is the Skorokhod metric as defined in

Skorokhod (

1957). See

Lindvall (

1973) for further details.

Definition 4. (Billingsley (2013)) A sequence of stochastic processes is said to converge weakly in to a stochastic process X if for every bounded functional f on , it follows that:When a sequence of stochastic processes satisfies Equation (3), we will write . We now turn to showing that in general, the ALPs we consider do converge to a stable Lévy motion, and we moreover apply the results of

Furrer et al. (

1997) and

Michna (

2005) to ALPs. For our sequence of iid losses

satisfying Equation (

2) and

, a sequence of renewal processes, if:

in probability in

, for

and for a positive constant

, then:

where

is an

-stable Lévy motion (

Furrer et al. 1997). Observe that if

L is a constant, say

d, then we may rewrite Equation (

5) as:

Note that in light of Definition 1, we can set

in Equations (

4) to (

6) since

is a renewal process. Now, the relationship in Equation (

6) is a central idea to our application of the weak convergence to an

-stable Lévy motion. However, Equation (

6) provides no guidance on how to explicitly find the constant

d and the explicit value of

. We now present a less general version of

Nolan (

2015)’s generalized central limit theorem, which helps us find

d. Suppose that

is an iid sequence of random variables each having common distribution function

F firstly with

, secondly exhibiting tail probabilities that satisfy

and

for

and thirdly with

. Then:

The sequences

and

, as well as the the constant

, are given by:

Notice that the sequence is crucial in finding d. That is, , which depends on the distributional form of the ’s. Moreover, it is clear that given the severity distribution, will be equal to a function of its parameters.

Some comments on the applicability of Equation (

6) now follow. In selecting ALPs to model the underlying catastrophe risk inherent in CAT bonds, often heavy-tailed severity distributions are selected. Therefore, in the forthcoming sections of this paper, we shall restrict ourselves to the application of the generalized central limit theorem to heavy-tailed distributions assumed to belong to the domain of attraction of an

-stable distribution with

. Thus, the mean of these distributions is finite; however, the higher-order moments need not be finite. We also point out that while classical Brownian motion approximations to ALPs (see

Embrechts et al. (

2013) and also

Grandell (

2012)) require light-tailed distributions, this assumption can be relaxed in the more general context of

-stable Lévy motion approximations.

3. Weak Approximation of Tail Probabilities of Compound Renewal Processes

Index-linked CAT bond pricing often requires the computation of probabilities such as

, where

D is some positive constant. An example of this is in the case of an index-linked CAT bond that has an associated threshold level (say

D). That is, should total accumulated losses (from a pre-specified source) over a period of time exceed this threshold level, the CAT bond triggers and releases some pre-defined amount of capital to the issuer. Therefore, it is of interest to obtain an approximation to the aforementioned probability. In their index-linked CAT bond pricing framework,

Ma and Ma (

2013) considered a mixed approximation to this probability. However, their approximation, which relies on higher-order moments and cumulants of the loss process, was not always valid since many of their fitted severity distributions did not possess finite second-order (and higher) moments and cumulants. We now consider how to overcome this problem and therefore approximate index-linked CAT bond prices under heavy-tailed distributional assumptions.

We begin by emphasizing that we consider the case when the severity distribution lies in the domain of attraction of an -stable distribution with , which implies that only the first moment is finite. We now present a theorem that allows us to weakly approximate the probability . The basic idea is to consider the compound renewal process over the time period and replace it by a suitable -stable Lévy motion and, within this sphere, apply known results on tail probability estimation to find a closed-form expression for the required probability. Note the notation used in Theorem 1: if and are two functions, by , we mean that .

Theorem 1. Let be a renewal process as defined in Definition 1, and suppose that for each of the ’s. Then, let the constant D be represented as , where . Then, we have, for T a positive constant,where , β is the skewness parameter of the limiting α-stable distribution and where d is a constant that depends on the distributional form of the ’s. Proof. For

T a positive constant, define the sequence of random variables

in

as follows:

By a time transformation on

N, we can specify that:

where

is a renewal process with unit intensity and

. By Equation (

4), the second term converges to zero in probability, and by Equation (

5), the first term converges weakly to

, both as

. The remaining terms converge to

. As a consequence,

converges weakly to

. Since the random variable

is continuous:

By the self-similarity property of

(Property 3), it can be shown that:

Finally, the statement follows by invoking the tail probability estimation of an

-stable random variable (Property 2). ☐

5. Classical Catastrophe Bond Pricing

In this section, we briefly present the index-linked CAT bond pricing model used to illustrate the usefulness of the weak approximations derived in

Section 4. We use the preference-free index-linked CAT bond pricing framework of

Ma and Ma (

2013), with the assumption of a constant interest rate. Importantly, we motivate the use of their pricing framework by the fact that we extend it to circumstances where the underlying distributions are assumed to be heavy-tailed. We briefly recap their framework here and point out that the approximation formulae derived in

Section 3—namely Equations (

8) and (

9)—are highly applicable in the context of their model.

Before presenting the pricing formulae, take note of the less general model setting in which we are now operating. We assume that the ALP,

, is a compound time-inhomogeneous Poisson process with frequency component

having intensity function

and the severity distribution component assumed to be as in

Section 4. However, we do point out that the usage of our approximation formulae (namely Equation (

7)) is not limited to the case where

is a compound Poisson process. They can also be used in the more general case where

is a compound renewal process, and the classical index-linked catastrophe bond pricing framework we use can potentially accommodate for this generalization.

Crucially, it is assumed for the purpose of this exercise that and are independent. Moreover, independence between financial market risk variables (such as interest rates) and catastrophe risk variables (such as insurance loss processes) is assumed.

5.1. General Pricing Rule

Let

be a probability space. In an arbitrage-free financial market, the time-

t discounted value of a contingent claim

,

, at time

, under the real-world probability measure can be written as:

where

denotes the expectation under the real-world probability measure,

r is the constant interest rate over the period

and

is the associated filtration up until time

t.

Notice that the expectation is taken under the real-world probability measure

. This is because in the classical pricing framework, under the risk-neutral probability measure, distributions and stochastic processes employed to price CAT bonds have the same distributional characteristics as under the real-world probability measure.

Ma and Ma (

2013) derived Equation (

10) under a risk-neutral measure using the diversification arguments of

Merton (

1976). However, due to their assumption that catastrophe risk variables are measure independent, Equation (

10) is consequently reflected under

. It must be noted that similar arguments, based on the work of (

Merton (

1976), were also used recently in the context of catastrophe reinsurance contracts by

Chang and Chang (

2017).

5.2. Application to Index-Linked Catastrophe Bond Payoffs

We now consider two payoff structures for CAT bonds and a valuation time of

. The first we consider is an index-linked zero-coupon (ZC) CAT bond, having maturity time

. The structure of the payoff,

, of the ZC CAT bond is given by:

where

D is the bond’s contractually-specified threshold level triggering its payoff; and

(

) expresses the constant recovery rate on the bond should the aggregate losses from the index exceed

D at time

T.

Therefore, the price at time 0,

, of the ZC CAT bond is given by:

In the case of an index-linked coupon-paying (CP) CAT bond, having maturity time

, constant coupon rate

and coupon-paying dates

(

) as measured from the valuation date, the structure we assume for the bond is as follows. For each coupon paying date

, the payoff

per unit nominal is:

where

is defined as in the ZC CAT bond case and

is the index-linked CP CAT bond’s pre-defined threshold level. Observe that the coupon-paying bond has both its coupons and redemption amount written down by

should the threshold be exceeded. At Time 0, the price,

, of the index-linked CP CAT bond having maturity time

is given by:

As can be observed from Equation (

14) and its predecessors, the coupon-paying times are general. However, many index-linked CAT bonds pay quarterly coupons, and we assume this for the purposes of the numerical illustration in

Section 6.

7. Conclusions

In this paper, we considered index-linked ZC and CP CAT bonds under the pricing framework of

Ma and Ma (

2013). As the pricing formulae obtained under this framework were not in closed-form, we invoked a weak approximation of the ALP (assumed to be a compound renewal process) to

-stable Lévy motion. Thereafter, we presented Theorem 1, which allowed one to weakly approximate tail probabilities pertaining to this type of ALP, and then specialized the approximation to the case of a time-inhomogeneous compound Poisson process. The unique, contributing feature of our approximation was that it can be used in the case of heavy-tailed distributions (in particular for when only the first moment is finite) and as a useful check for existing approximations such as the FSRLP approximation. Since such probabilities are essential in computing CAT bond prices, we emphasize the applicability of our weak approximation in obtaining a way to indeed approximate such prices.

Our weak approximation has also other beneficial applications in the insurance sector. Our simple, fast and relatively accurate (compared to Monte Carlo simulation and FSRLP approximations) weak approximation may be applied in the context of other CAT bond pricing models such as in computing attachment probabilities for use in the Lane Financial model of

Lane (

2003), especially when the losses follow heavy-tailed distributional assumptions. Moreover, our approximation can be applied in approximating loss-exceedance probabilities for reinsurance portfolios and also in estimating premiums for catastrophe excess-of-loss reinsurance contracts. Finally, applications, within the sphere of quickly estimating exceedance probabilities for operational risk purposes, are also possible.

We close by briefly recapitulating some of the limitations and general advantages of our weak approximation to the ALP, noticed in the context of Burr and GP-distributed severity components. In this research, we pointed out three limitations. Firstly, we highlighted that the application of our approximation needs to be assessed on a case-by-case basis. It remains to be checked (by the user of our approximation) that the fitted intensity (or its integration) is large enough for our approximation to be applied. Secondly, our weak approximation did not perform well relative to MC estimation and the FSRLP approximations for shorter time horizons. Thirdly, in the extreme cases, our weak approximation did lead to probabilities in excess of one, so this needs to be checked for. However, we posit that our weak approximation does still have merit. Our weak approximation was found to be simple and computationally inexpensive to implement. Moreover, our weak approximation performed similarly to the more traditional approaches of MC estimation and the FSRLP approximation in most situations, but for longer time horizons, our approximation fared better, in the context of all our numerical illustrations. However, most importantly, we stress our weak approximation’s applicability in situations where data follows a heavy-tailed law; this is, ultimately, because our weak approximations only demand finiteness of the first moment of the loss severity distribution.