1. Introduction

With the declining mortality rates, life expectancy has been improved over the last few decades and is one key driver of the ageing population all over the world (

World Health Organization 2015). Retirees with longer life expectancy are increasingly exposed to longevity risk.

Improved life expectancy can generate more financial burden for governments that provide social security. Retirees who pursue financial sustainability of their retirement benefits can share this burden by purchasing an annuity to self-insure (

Oppers et al. 2012). The works of

Yaari (

1965) and

Merton (

1969) suggest that investors can hedge longevity risk and further financially benefit themselves by purchasing annuities.

However, low demand for voluntary annuitisation is observed among people, and is known as the annuity puzzle. Numerous explanations for this annuity puzzle have been provided in the literature. The bequest motive was offered as one explanation for the annuity puzzle in

Friedman and Warshawsky (

1990) and

Bernheim (

1991).

Lockwood (

2012), examining empirical data, further found that bequest motives have characteristics akin to luxury goods.

Finkelstein and Poterba (

2004) suggested that adverse selection

1 could reduce demand in the voluntary annuity market.

Bütler et al. (

2017) found that the means test in a social security system can impact annuitisation levels, also shedding light on the annuity puzzle.

The contribution of this paper is that the time-inconsistent behaviour of investors can also be seen as contributing to low voluntary annuity demand.

Strotz (

1955) points out that the preferences of an individual are time-inconsistent due to their dynamic nature. Hence, investors might not be interested in investing in a long-term financial contract, like an annuity. In economic terms, hyperbolic discounting implies that the rate of time preference is no longer constant, but is a function of time. The traditional exponential discounting approach is then a special case of this, where the rate of time preference is held constant.

Most of the benchmark intertemporal decision-making models use constant exponential discounting, consumption and investment literature. The classical problem of this type is Merton’s model (

Merton 1969), where explicit optimal formulae for consumption and portfolio rules under constant relative risk averse (CRRA) utility are obtained.

Richard (

1975) further generalized Merton’s model by adding a bequest utility function. The bequest utility function has an important implication: generating demand for insurance and annuities.

Pliska and Ye (

2007) extended Richard’s model by allowing an unbounded lifetime.

Zhang et al. (

2017) applied Richard’s model to an optimal stopping problem concerning entry into a retirement village. This work of Merton and Richard has answered the question of optimal demand for life insurance and annuities under the assumption of complete markets, rational consumers and exponential discounting.

The hyperbolic discount rate predicates time-inconsistent preferences, which are well documented in the literature. Time-inconsistent preferences of an investor were treated in

Strotz (

1955) as the consequence of dynamic behaviour. In further studying those dynamic behaviors,

Pollak (

1968) separated the dynamic behaviours into two groups: naïve and sophisticated. In

Pollak (

1968), naïve investors were defined as the people who never realise the nature of their dynamic behavior; sophisticated investors were defined as the people who do realise the nature of their dynamic behaviour.

Naïve agents have no commitment technology or commitment mechanism. With a non-constant rate of time preference a problem arises because the relative valuation of utility flows at different dates changes as the planning date evolves. Without a commitment technology/mechanism, there is no way that agents can follow an initially chosen consumption path, as it differs from that which would be chosen sequentially. Naïve agents are unable to follow such initially chosen paths, and their consumption evolves purely sequentially. Compared to naïve agents, sophisticated agents recognise their time inconsistent preferences and adopt a consistent plan—that is, they have a commitment technology/mechanism that enables them to follow a committed chosen consumption path, in spite of the fact that it differs from that which would be chosen sequentially.

Exploring a more general optimal consumption and investment model,

Marín-Solano and Navas (

2010) utilised hyperbolic discounting for both naïve and sophisticated investors within the framework of Merton’s model. Analytical results were then obtained for both cases, but in a framework absent of life insurance and life annuities. Drawing on

Marín-Solano and Navas (

2010), we complete the modelling of life insurance and annuities. We further study the naïve case with bequest motives under Richard’s framework and find the behavior of naïve agents and real world insurance and annuity consumers are very much alike. While we also treat the sophisticated case, generating results for such agents is more complicated as no closed form solution is possible. We leave its results to future research, and note, by its absence, that we are not considering the extremely strong-willed and well-informed members of the insurance and annuity buying public. This paper is structured as follows:

Section 2 develops the the modelling,

Section 3 presents the results, and

Section 4 provides the conclusions.

2. Model

In Richard’s framework (

Richard 1975), an agent at time

t is assumed to maximise lifetime utility via appropriate choices of consumption,

, proportion invested in risky asset,

, and legacy level,

. Here, we assume that the dynamics of the risky asset price available in the market,

, is

where

and

are the return rate and volatility of

, and

is standard Brownian motion.

The agent’s death time is modelled by the force of mortality,

, and survival rate,

, with the density function of mortality,

, defined as

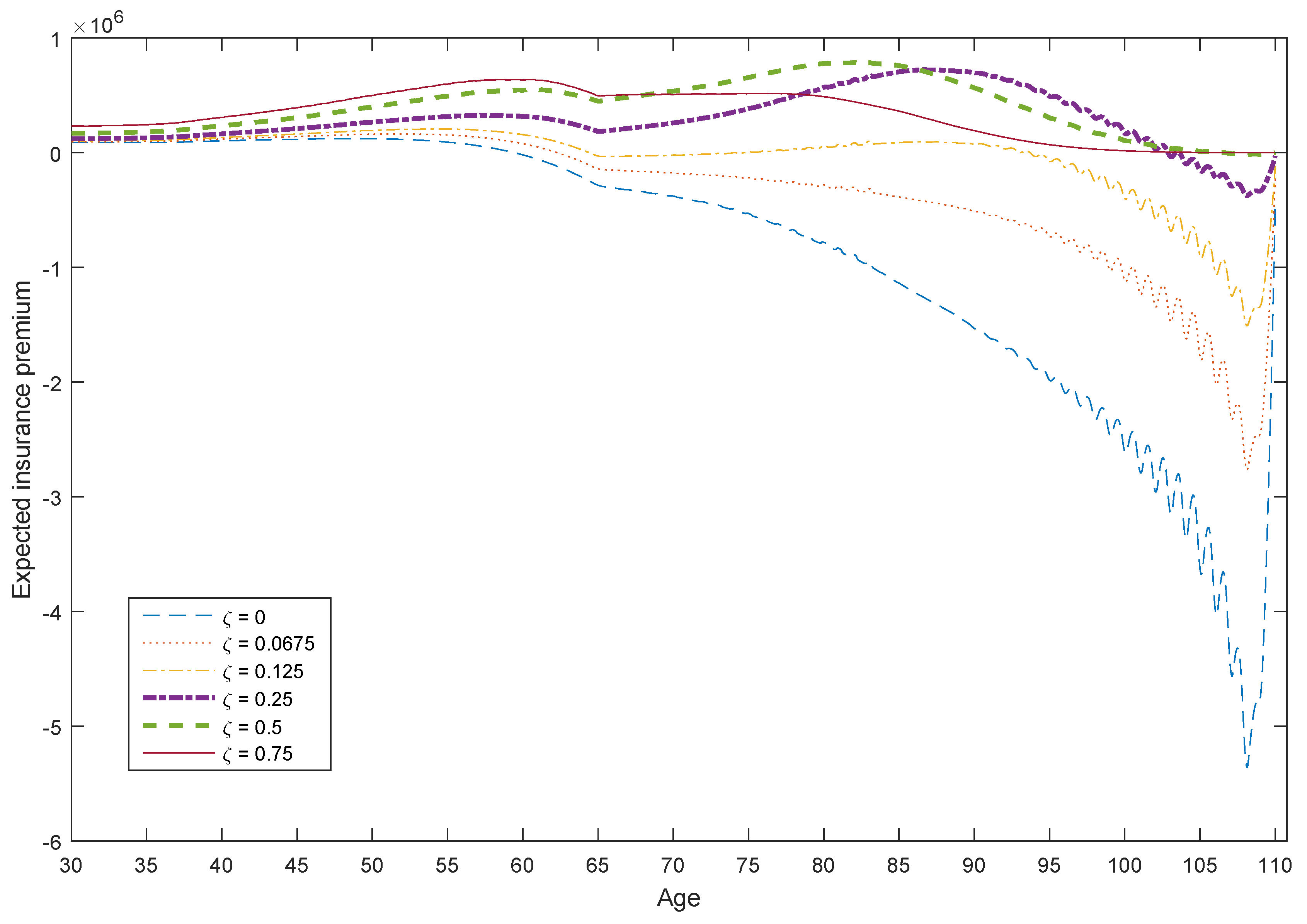

Then, the insurance premium is . Positive insurance premiums imply that agents’ bequest motives exceed their wealth level. Hence, they purchase life insurance from an insurer to cover the gap between and . Negative insurance premiums imply agents’ wealth levels exceed their bequest motives. Hence, they purchase an annuity from an insurer to annuitise the gap between and .

Drawing on

Purcal and Piggott (

2008) and

Marín-Solano and Navas (

2010), with the hyperbolic preferences, the objective of an utility maximising agent with the mortality density function (1) is

subject to the dynamics of financial wealth

W,

where

U and

Z are the utility functions for consumption and bequest,

T is the uncertain time of death,

W is the wealth level,

is the discounting factor,

is the limiting age,

r is the risk free rate available in the market and

Y is (deterministic) income. The hyperbolic discount rate,

, and the discounting factor we use is adopted from

Barro (

1999),

where

is the agent’s (constant) long run rate of time preference,

is the degree of impatience and

is the constant rate of decline in impatience. Note that

becomes a constant exponential discounting factor when

.

In this paper, utility functions are assumed to be CRRA with

where

is the risk aversion parameter and

is the “discount” function for bequest

2. From

Purcal and Piggott (

2008), this “discount” function generates a bequest that provides a continuous annuity certain that commences at the time of the decease of the investor and ends at the limiting age,

, of the life table, having assumed that the investor and spouse are the same age. Specifically, this continuous annuity is assumed to pay

of the consumption level at the time when the investor dies,

2.1. Naïve Case

Let

be the value function. Based on

Marín-Solano and Navas (

2010), the dynamic programming equation for the naïve agent with hyperbolic discounting is derived

3 as follows:

With first-order conditions, we obtain the optimal consumption, portfolio rules, and legacy from (

6), respectively

and

Interestingly, by comparing Equations (

7) with (

9), we see that the optimal legacy is actually the product of optimal consumption and the continuous annuity,

, which fulfill our assumption above.

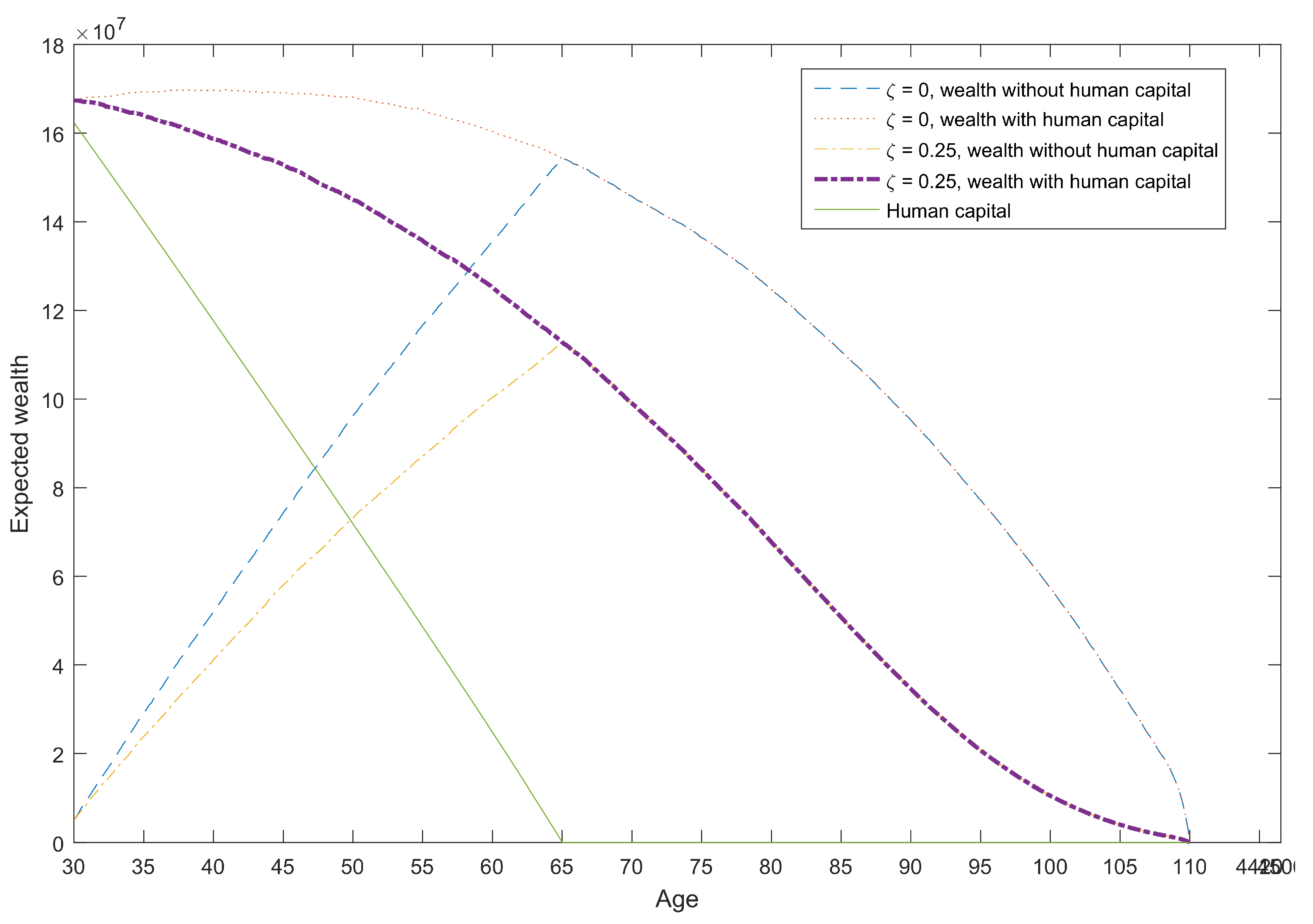

For a deterministic income stream

Y, Richard (

Richard 1975) demonstrates that the capitalisation of the income stream,

, is

and the total wealth,

, is

.

We now use Equations (

7)–(

9) in Equation (

6) to find that

The problem faced by the investor ultimately becomes one of solving the partial differential equation for

. Based on

Richard (

1975) and

Purcal and Piggott (

2008), the form of the solution is

Then, the optimal controls are

and

where

4.

As we expect, these results turn out to be very similar to the ones from

Richard (

1975) and

Purcal and Piggott (

2008). What we are most interested in is the realization of the path of these optimal controls throughout agent’s lifetime, which will be shown graphically in the next section.

2.2. Sophisticated Case

The sophisticated agents solve this optimal control problem via a backwards recursive induction approach. This approach solves the problem retrospectively to obtain the optimal control variables from terminal time backwards, which is also in line with the dynamic programming approach. The objective of the utility maximising sophisticated individual would be the same.

Even though the objective of the individual is the same for both naïve and sophisticated cases, the way to solve each problem differs. As noted above, naïve agents do not have any awareness of their time-inconsistent preferences that are changing from time to time. Sophisticated agents realise that their behaviour is time-inconsistent. Hence, they make decisions based on the equilibrium of a series of future behaviours (

Marín-Solano and Navas 2010). This approach implicitly fulfills the (backwards) recursive induction approach, where equilibrium is found for the states conditioned on the behaviour of two successive players, denoted here as self 1 and self 2 (that is, the player, at two successive time points), or self 2 and self 3, or, etc.—hence generating a recursive relation between successive players. Say, for example, self 1 makes a decision based on the equilibrium of states conditioned on self 1 and self 2; self 2 would make a decision based on the equilibrium of states conditioned on self 2 and self 3—and continue in this fashion until terminal time. Hence, self 1 makes a decision based on all future equilibria indirectly through such recursive relations.

Let

be the value function again. We follow

Marín-Solano and Navas (

2010) and their derivation of the modified dynamic programming equation, which found equilibrium in discrete time fashion, and then passed to the limit for the continuous time case. The modified dynamic programming equation for our extended model is derived

5 and shown below:

where

We solve for the functional form of control and state variables by following exactly the same procedure as in

Section 2.1 and obtain the optimal controls, which are also given by Equations (

11)–(

13). In contrast,

now becomes the solution to the integro-differential equation

The above integro-differential equation needs to be solved numerically

6.

4. Conclusions

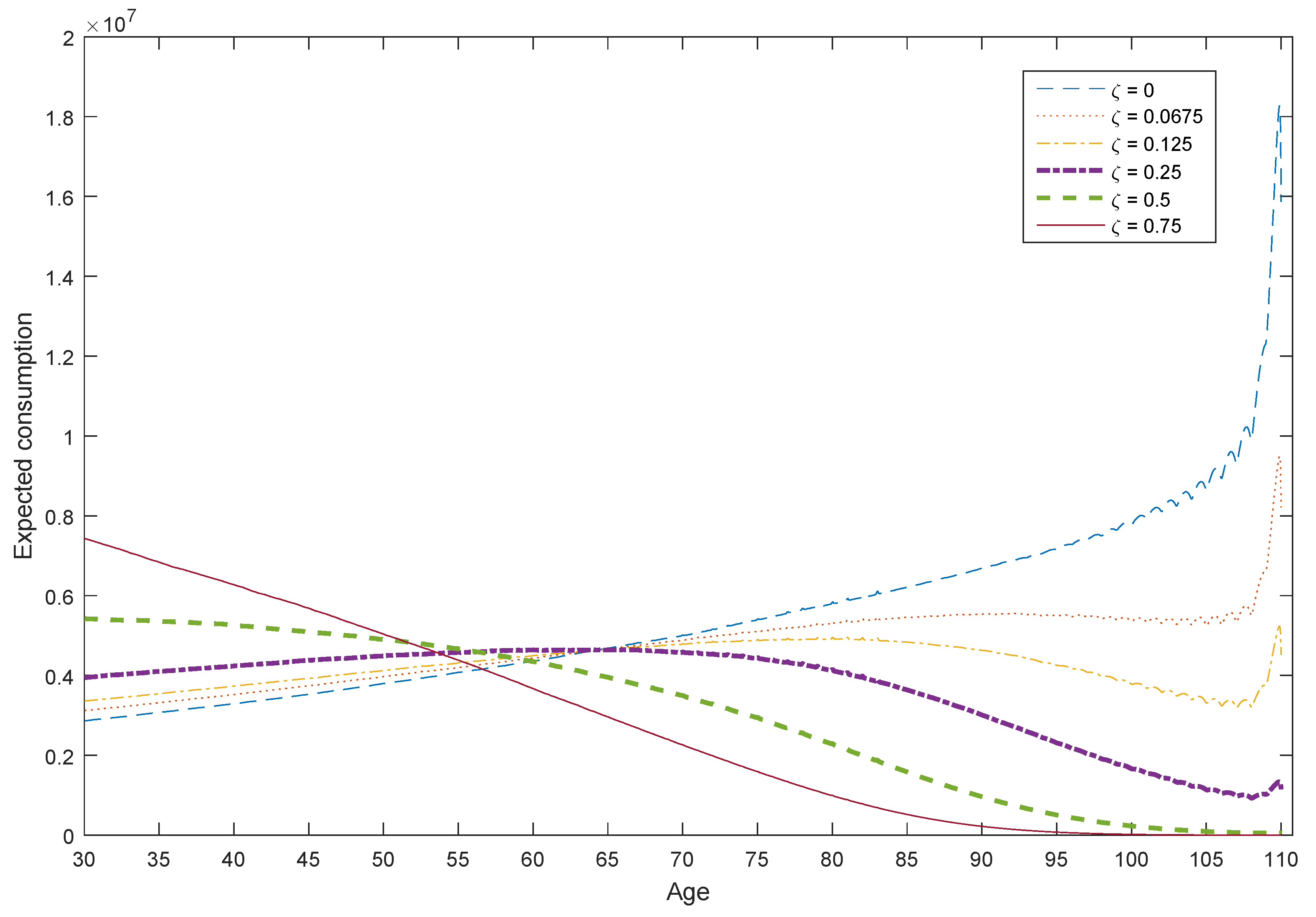

The hyperbolic discounting effect causes naïve agents to prefer immediate consumption, which hinders wealth accumulation at the early stage of life. Low levels of financial wealth constrain agents’ ability to fulfill their desired bequest motive; therefore, agents demand more life insurance, rather than an annuity, to fill this deficit.

We also found that humped shape consumption paths can be obtained in the hyperbolic discounting model under complete market assumptions. This result is in line with empirical observations.

These two results also serve to shed light on the annuity puzzle, as we see naïve agents will have low demand for voluntary annuities.

Numerical results on the annuity demand of sophisticated agents will be pursued in future research. Also of interest would be to treat agents with stochastic labour income as well as optimal financial decision-making for those with a mixture of exponential discounting and hyperbolic discounting structures.