3.2. Industry Definition: 3PL and Corresponding Business Models

In general, LSPs can be defined as companies that carry out logistics services on behalf of others [

13] (p. 204). Hofmann and Lampe [

48] differentiate among the following LSP clusters:

Carriers (three types: rail, truck, sea) are the most basic form of LSP and focus on the physical movement of goods by a certain transport mode.

Currier, express and parcel (CEP) providers offer standardized services that can be customized to a certain degree.

3PLs have by far the largest activity scope and provide transportation as well as additional customized logistics-related services.

4PLs develop entire supply chain and logistics management solutions for customers but they do not have their own physical assets. All physical activities are outsourced to other LSPs (see also [

49]).

This paper focuses on 3PLs, as 3PLs play a central role in the logistics service industry and provide a wide range of services, which have several weak points potentially susceptible to digital disruption. A uniform scientific definition for 3PLs does not exist [

50]. Therefore, the following definition for 3PLs was elaborated by extracting the core points from definitions in academic journal articles [

51] (p. 29), [

52] (p. 59), [

53] (p. 26), [

54] (p. 93): Third-party logistics (3PL) providers are companies that provide transportation and further logistics-related services to other companies (in B2B relationships) and private customers (in B2C relationships).

In accordance with the RQ and the described application procedure, the next step is to identify currently existing 3PL business models. A business model can be defined as “the rationale of how an organization creates, delivers and captures value” [

55] (p. 14). For this purpose, a review of the literature on 3PL business models and 3PL service ranges was conducted.

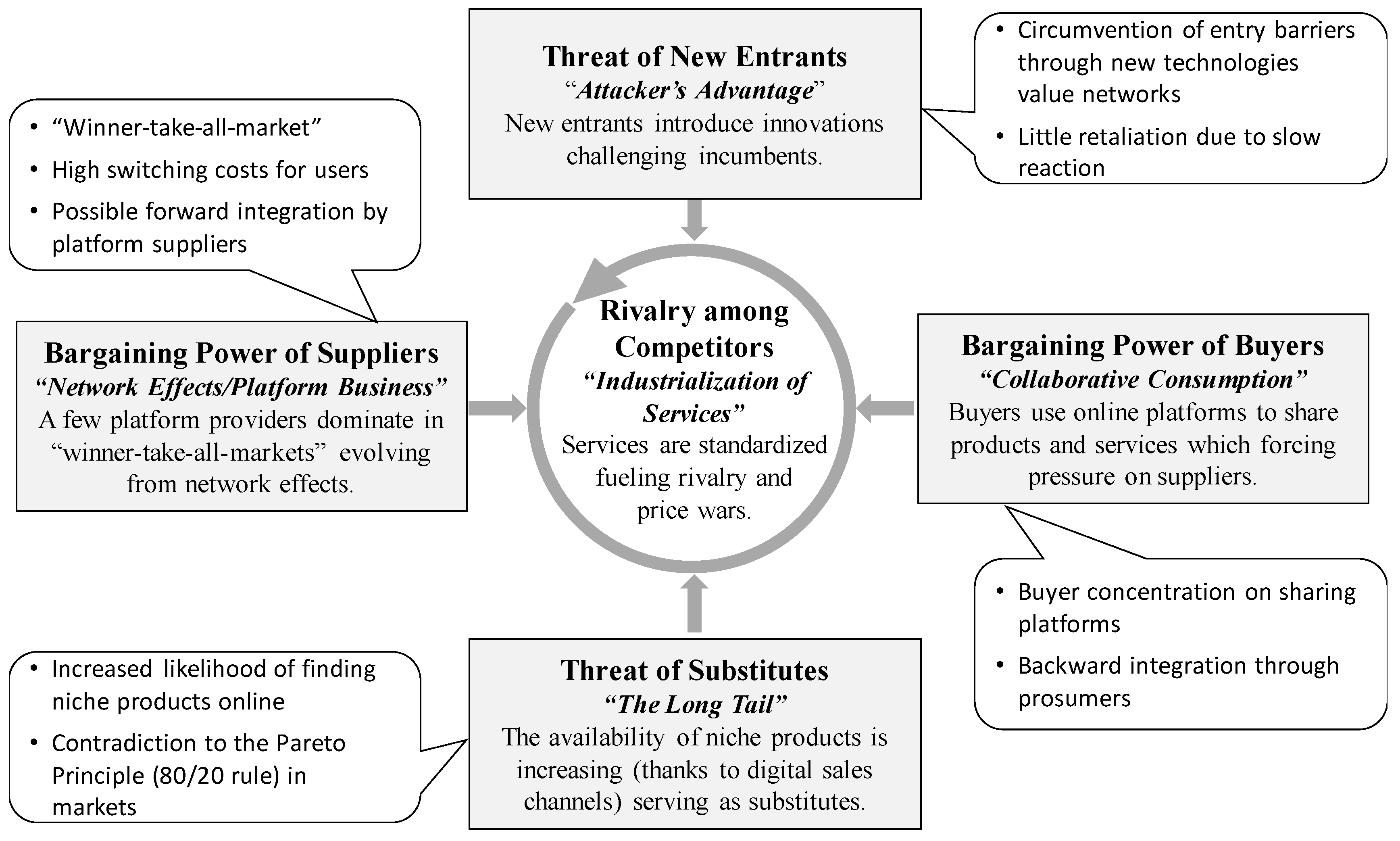

We elaborated a portfolio of four generic 3PL business models as shown in

Figure 2. The portfolio is based on the 3PL clusterings proposed by Alfredsson and Hertz [

56], Berglund et al. [

52] and Delfmann et al. [

13]. The portfolio also refers to the two generic 3PL business models—3PL lernstatts and 3PL factories—identified by Prockl et al. [

57] and includes the service internationalization strategies of 3PL described by Lemoine and Dagnaes [

58].

The generic 3PL business models can be described as follows:

Standard regional 3PLs render standardized short-haul transportation and transportation management services within certain regions such as cities, states, or countries. While such companies also offer warehousing and inventory management, extensive additional services are not provided. As this business model represents the most basic type of 3PL, it is similar to that of pure forwarders. In view of digitalization, standard regional 3PLs may provide basic services such as track-and-trace or digital order processing. However, resources and capabilities for the implementation of advanced digital services and technologies are limited.

Niche service specialists operate on a regional level and provide transportation services, warehousing and inventory management services and other services. Firms using this business model are rather small, have specialized knowledge and develop solutions for business customers (B2B) with special service requirements. Similar to standard regional 3PLs, niche service specialists provide a limited range of digital services that are tailored to the service niche.

Standard international 3PLs are medium-sized or large companies that provide mainly long-haul transportation services as well as warehousing and inventory management services in international networks. To achieve international and global service coverage, companies applying this business model provide different modes of transportation (road, rail, air and sea). For this purpose, standard international 3PLs may subcontract smaller local carriers and book slots on oceangoing ships and airplanes. Due to their size and the larger distances they handle, their transportation and warehousing activities are rather complex and include operations such as crossdocking and terminal handling. Standard international 3PLs provide a set of basic digital services, such as track-and-trace, electronic data interchange (EDI) with customers and digital transportation management solutions.

International service specialists offer global transportation services, global warehousing and inventory management services and a large range of additional services. Companies with this business model focus on business customers and provide global supply chain management solutions, including the development of tailored services. This is the most complex 3PL business model and is closely related to fourth-party logistics (4PL). Compared to the other three business models, international service specialists provide the most complex digital solutions. These include not only EDI and track-and-trace but also services for the management of supply chains.

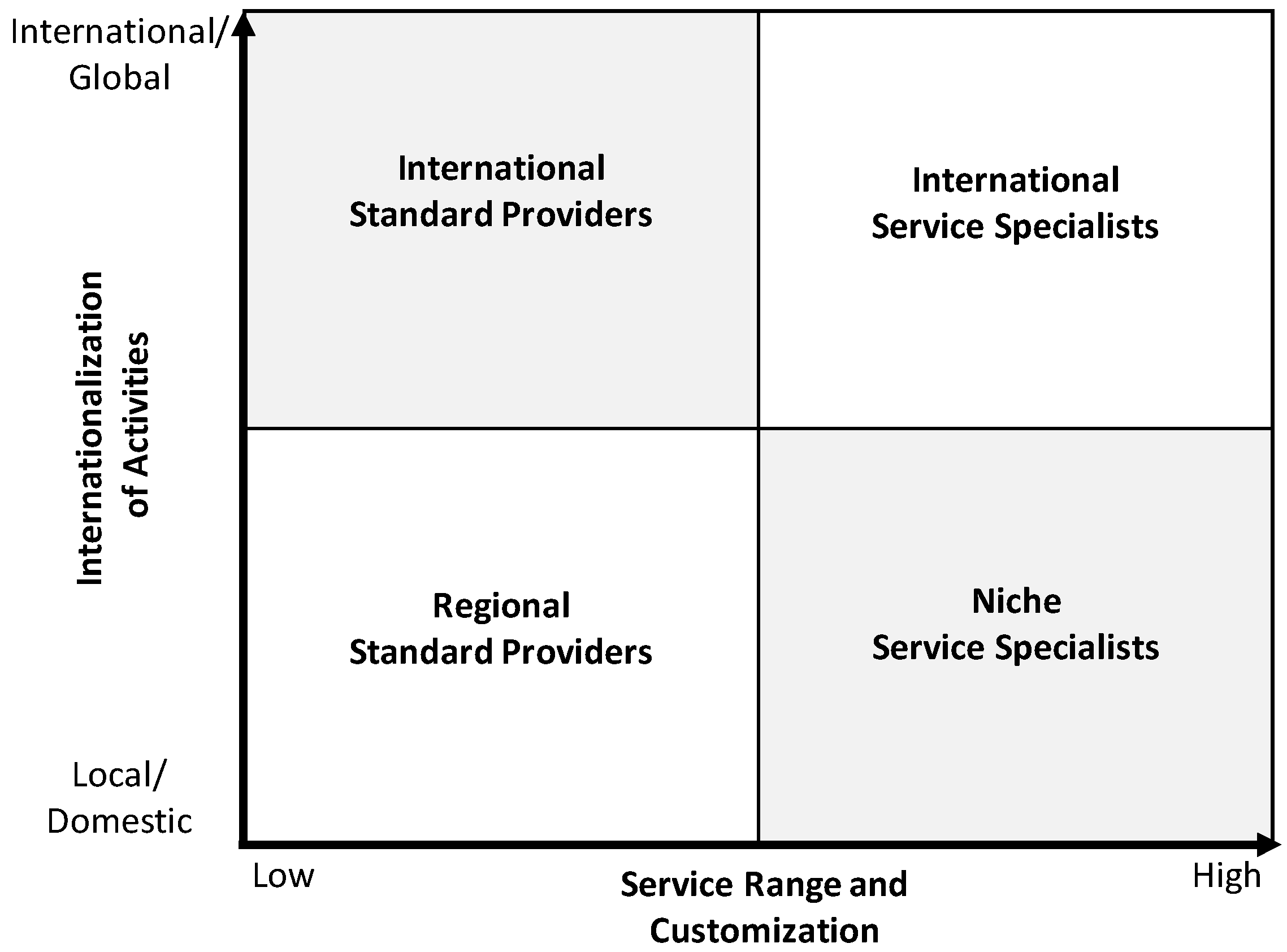

In line with the business model definitions of Osterwalder and Pigneur [

55], the 3PL business models identified above can be compared to each other in terms of their focus on activities along a suggested 3PL value chain consisting of five steps as shown in

Figure 3. The 3PL value chain is further specified in

Table 1, which describes the main activities for each step.

As can be seen from

Figure 3 and

Table 1, the various 3PL business models have different foci along the 3PL value chain. While standard providers (regional and international) focus mainly on the physical movement of goods, service specialists (niche and international) cover almost the entire value chain and concentrate on value-added and immaterial services.

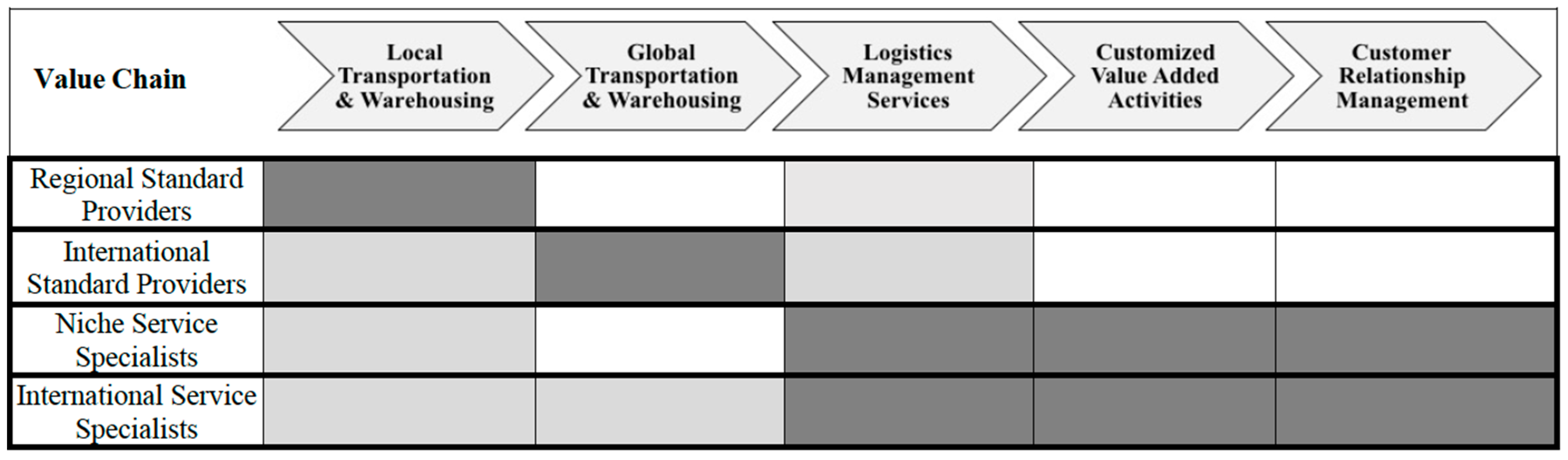

3.3. Screening of the 3PL Industry

Phase 2 of the application of the framework to the 3PL industry can now be described.

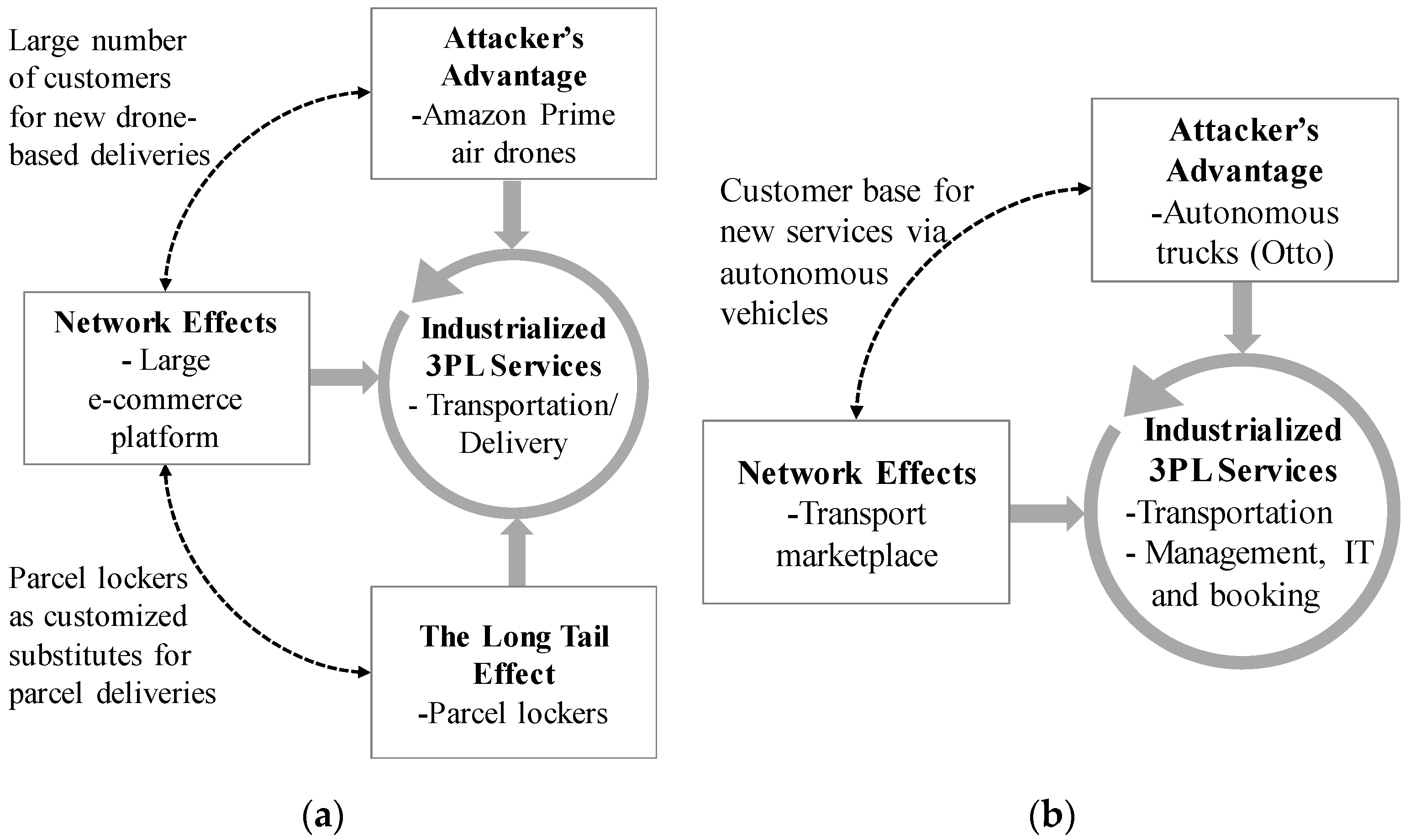

Figure 4 provides an overview of the industry analysis by showing the practical examples analyzed for each force-theory combination.

3.3.1. Threat of New Entrants through the Attacker’s Advantage

(a) Practical Examples

Disruptive logistics technology developments can be found especially plentifully in the field of physical goods movements. Several projects in this field aim to use drones and robots for locally transporting small cargo units and for handling in warehouses. Moreover, various larger autonomous transport vehicles are also under development.

Table 2 and

Table 3 give an overview of practical examples of both technologies.

(b) Theoretical Reasoning

Drones, robots and autonomous vehicles represent completely new technologies in the logistics service industry. Until now, local transportation has been mainly carried out by small trucks, delivery vans, or couriers (in the case of very small consignments). At the same time, international transportation is carried out by trucks, ships and aircrafts. While these classical transportation vehicles require manual operation, drones, robots and autonomous vehicles can be operated remotely by computers and navigate autonomously with sensors. Consequently, the disruptive potential of these technologies lies in efficiency through automation, which allows the cutting of significant costs and thus reduces entry barriers. The same points apply to warehousing, where the use of robots allows a reduction of costs and an increase in the efficiency of warehouse operations. Additionally, autonomous warehouse technologies may be combined with autonomous transportation technologies to create new, completely autonomous logistics systems.

Furthermore, these technologies allow companies to build up new value networks. In the case of e-commerce companies such as Amazon, drones enable the companies to expand their business model by establishing their own delivery services. This enhances the value proposition, as customers have the new opportunity to arrange an immediate delivery of purchased goods at any site within the range of drones (or robots). Conversely, deliveries arranged conventionally in cooperation with 3PLs often require a lead time of several days and the customer runs the risk of missing the delivery due to absence. The provision of one’s own automated in-house transportation services reduces the e-commerce companies’ dependence on logistics service providers. The same point holds true in the case of Google or Swiss Post. Both companies have the opportunity to enhance their value networks by establishing themselves as new suppliers of local transportation solutions tailored to demand.

Similarly, autonomous vehicles allow for the creation of new value networks. As the example of Otto’s acquisition by Uber shows, autonomous vehicles provide the opportunity to enter the physical transportation market by means of a new technology. While Uber Freight currently operates as an intermediary between carriers and customers, its future aim is to expand the business model by operating its own fleet of autonomous trucks in combination with the freight booking platform. Similar developments are also conceivable for vehicle producers such as Daimler, which could establish its own autonomous transportation services in combination with freight platforms. Developments in this direction are already observable in the passenger car industry, where car manufacturers such as BMW [

67] operate their own car-sharing fleets.

Finally, it has to be noted that none of the companies presented in the examples emerges from the field of 3PL. Instead, they come from other industries such as automotive (Daimler), e-commerce (Amazon) and mail service (Swiss Post) and develop technologies that are disruptive for the logistics sector. This can be viewed as support for the thesis that incumbents (in this case 3PLs) react slowly to technological disruptions.

(c) Value Chain Impact

Recent technology trends have the potential to substitute activities both in the field of local transportation and in that of warehousing, especially in the case of small cargo units (i.e., CEP). As autonomous vehicles are significantly larger, have a wider service range and are capable of carrying large amounts of cargo, they can substitute the main transportation leg (national and international). In addition, as can be seen from the examples of container terminals, the storage of goods also has the potential to be fully automated. Moreover, both of these technologies work with its own IT solutions, which allow them to arrange and manage transports more independently than similar services provided by 3PLs. This substitution effect is reinforced by the possibility of full transport automation.

3.3.2. Supplier Power through Network Effects

(a) Practical Examples

Two types of platform businesses are currently emerging in the logistics service industry: logistics marketplace platforms, which act as intermediaries between shippers and LSPs; and vehicle manufacturer platforms, which offer telematics-based data mining services such as fleet management for business customers. Practical examples are stated in

Table 4 and

Table 5.

(b) Theoretical Reasoning

Applied to the logistics service industry, platforms mainly serve as marketplaces for transports. Transports have hitherto been arranged through middlemen or agents. Conversely, logistics marketplace platforms enable direct interactions between shippers and LSPs (3PLs) and thus allow the parties to bypass such middlemen. The direct contact accelerates processes, saves costs and allows services to be customized. In addition, platforms often provide complementary IT services such as real-time track-and-trace, or functions for transport supervision and management. From a customer point of view, this increases the attractiveness of platforms and fosters indirect network effects. Through their role as intermediaries and IT service providers, logistics platform operators have the potential to develop both comprehensive industry knowledge and significant market power. This combination could enable platform operators to take over the role of classical actors in the logistics service industry (such as that of 3PLs) and herein lies the threat of forward integration. A first step towards forward integration by logistics platform operators can be seen in Uber’s acquisition of Otto. This acquisition enables Uber to operate its own fleet that is managed and offered via its own transportation platform. As a result, Uber Freight would become a full LSP with a service range similar to that of 3PLs. Network effects play a special role in this case, as they lead 3PLs to increasingly depend on logistics platforms. Their dependence stems from the fact that an increasing number of potential clients (shippers) use such platforms. This in turn increases switching costs for 3PLs, as leaving a platform is tantamount to losing direct customer contacts. As can be observed in other platform business markets such as social media (Facebook) or e-commerce (eBay and Amazon), network effects may lead to markets with a small number of very large platform providers. It stands to reason that a similar outcome is possible in the case of logistics platforms, if a small number of platform operators manage to gather enough users from both sides—that is, from 3PLs and shippers.

A second important application of platforms in the logistics service industry is data mining and data selling. Vehicle manufacturer platforms especially build on this principle. As the examples show, these platforms gather and evaluate data of vehicle use for provision to vehicle operators (in this case 3PLs). Vehicle operators then use these data for communication purposes such as transport management support and decision making. As the example of the Volkswagen (MAN) Rio platform illustrates, vehicle producers can use both knowledge and data to expand their platform services towards comprehensive supply chain management solutions.

(c) Value Chain Impact

As one-stop-shop solutions for arranging and managing logistics services, logistics marketplace platforms effect almost the entire 3PL value chain. Transports, as the main activity of 3PLs, are likely to be directly substituted by transports managed via logistics platforms, which have the advantage of being more transparent and customized. At the same time, the platform-based coordination of transports holds the potential to reduce the need for storage, which is substituted to a certain degree as well. In conclusion, classical transportation management and customer relationship management are especially likely to be replaced by the data-mining and transportation-planning algorithms of platforms, which erode the value of the IT solutions currently offered by 3PLs. Indeed, the impact of vehicle manufacturer platforms is more diverse. Activities related to physical goods movements are likely to be complemented by vehicle manufacturer platforms, as their functional focus lies in the efficient management of fleets and transports. However, at the same time, knowledge from these platforms is brought to the market in the form of new IT solutions, transportation management concepts and consulting services. As the functional range of the platform Rio shows, vehicle manufacturers are able to develop significant service capabilities in the area of order processing and administration. Therefore, vehicle manufacturer platforms bear the potential to replace the management-related and relationship-related activities of 3PLs.

3.3.3. Buyer Power through Collaborative Consumption

(a) Practical Examples

In the logistics service industry, two types of sharing platforms can currently be distinguished: cargo space sharing platforms and customer-to-customer (C2C) transport platforms. Cargo space sharing platforms are online marketplaces that provide the possibility of booking unused or excess transport or storage capacities on vehicles or in warehouses operated by logistics service providers. Customer-to-customer transport platforms are online marketplaces that allow private persons to offer unused space in vehicles for cargo transport. Practical examples of both are presented in

Table 6 and

Table 7.

(b) Theoretical Reasoning

As can be seen from the practical examples, sharing businesses in the logistics industry are mainly active in the field of transportation of smaller goods. Nevertheless, as companies such as Flexe show, initial efforts aim to expand the concept of the sharing economy to other logistics activities such as warehousing.

Two important aspects of the sharing economy have to be distinguished when looking at the logistics industry from a theoretical point of view. First, online sharing platforms allow for direct communication between buyers and providers of logistics services. This direct interaction enhances transparency and allows parties to publish and utilize extra capacities such as cargo space that would otherwise not have been communicated to the market. This mechanism constitutes a benefit for 3PLs, as available capacities can be utilized more efficiently. However, the more efficient use of cargo space may simultaneously lead to a decline in transport orders, as the same number of services can be performed with fewer physical resources.

Second, as the practical examples show, sharing platforms allow potential buyers of logistics services to offer their own private transport capacities to markets. This represents the classic working principle of the sharing economy, which enables consumers to become producing consumers or “prosumers.” This development constitutes an example of backward integration, as service consumers take on the same activities as service producers (3PLs). Furthermore, the sharing principle allows customers to build up significant market power through network effects. As increasing numbers of private transporters lead to increasing service coverage, the utility of the platform for customers grows with the number of its users. Consequently, buyers can take over significant market shares by providing their own services concentrated on sharing platforms. A first indication of the increasing professional significance of C2C transport sharing platforms can be seen in the business model of Deliv, which uses private drivers for B2C home deliveries from stores.

(c) Value Chain Impact

First, it must be noted that cargo space sharing platforms enable 3PLs to optimize capacity utilization and thereby reduce empty runs of trucks and unused storage capacity. From this point of view, cargo space sharing platforms are complementary to existing 3PL activities and help to mitigate cost-intensive operational challenges. Nevertheless, cargo space sharing platforms simultaneously have the potential to substitute transport and storage services, as more efficiently using capacities may reduce the activities required. Moreover, the 3PL activities of transportation management, IT services and customer relationship management are likely to be substituted by coordinative functions and the interfaces of sharing platforms. The main impact of C2C transport platforms on 3PL value chains lies in the partial substitution of local transportation. As private persons are new actors on the transport market, their transportation offers compete to a certain extent with similar services offered by 3PLs. Although substitution is limited physically by possible size and weight of shipped goods, 3PLs may lose significant market shares in the segment of small regional consignments if C2C transport platforms grow significantly. As with the other platforms presented above, logistics management services and customer relationship management services are entirely substituted by the digital functions of C2C transport platforms.

3.3.4. Threat of Substitutes through the Long Tail Effect

(a) Practical Examples

Examples of the long tail effect in logistics can be classified into two larger categories: substitutes for logistics, which are new technologies that replace the need for logistics; and logistics niche services, which have the potential to replace today’s standard logistics services. Practical examples of both are presented in

Table 8 and

Table 9.

(b) Theoretical Reasoning

The long tail effect may lead to direct and indirect substitution of logistics services. Indirect substitution originates from new non-logistics-related technologies that have the potential to make logistics superfluous. For example, 3D printing (alternatively called additive manufacturing) hardly shares commonalities with logistics but substitutes shipments by printing required goods on demand and directly on site. Further technical evolution of 3D printing holds the potential to make an increasing number of products printable and thus reduces the need for conventional logistics [

77]. The growing range of printable products corresponds to the long tail effect. From this point of view, the long tail effect is closely related to the theory of the attacker`s advantage, as it constitutes a technological disruption. In the example of parcel lockers, the long tail effect becomes apparent in that customers can choose from an increasing number of pick-up stations, which can be considered as an individualized niche service. Representing a new logistics concept beyond the scope of classical deliveries, parcel lockers can also be classified as an indirect substitute for standard logistics services.

As for direct substitution, current standard solutions are replaced by new logistics service niches that fulfill specialized requirements from customers better than the standard services currently on offer. On one hand, such service replacements are realized through platform-based marketplaces and sharing businesses, as described above. Platforms allow customers to find solutions that perfectly match their individual requirements, especially regarding place and time of transport or delivery. From this point of view, the long tail effect is closely linked to network effects, as an increasing number of service suppliers using a platform also leads to a growing number of services supplied. This in turn enhances the likelihood of finding individually fitted solutions. On the other hand, the long tail effect also allows parties to find logistics services that fulfill completely new requirements not offered by standard providers, such as emissions-free transportation in the case of the start-up Fairtransport. Such services can easily be found and acquired online, which significantly reduces search costs for customers. While Fairtransport offers only maritime transportation, the probability of expanding similar business models to land-based transport is deemed to be high. In addition to that, with regard to the growing importance of environmental sustainability, the demand for such clean transport solutions is likely to rise.

(c) Value Chain Impact

Technologies such as 3D printing hold the potential to render logistics services entirely superfluous. Consequently, all the value chain steps and activities of 3PL could potentially be substituted by these technologies.

Niche logistics services constitute alternatives to standard services and thus could potentially replace transportation-related activities. However, the substitution remains at present on a partial level, as the service examples listed are focusing on specific niches. This partial substitution of 3PL activities is also true for management services and customer relationship management, as niches need their own appropriate solutions and address their specific target customers. The effects of platform-based businesses on the 3PL value chain have already been discussed.

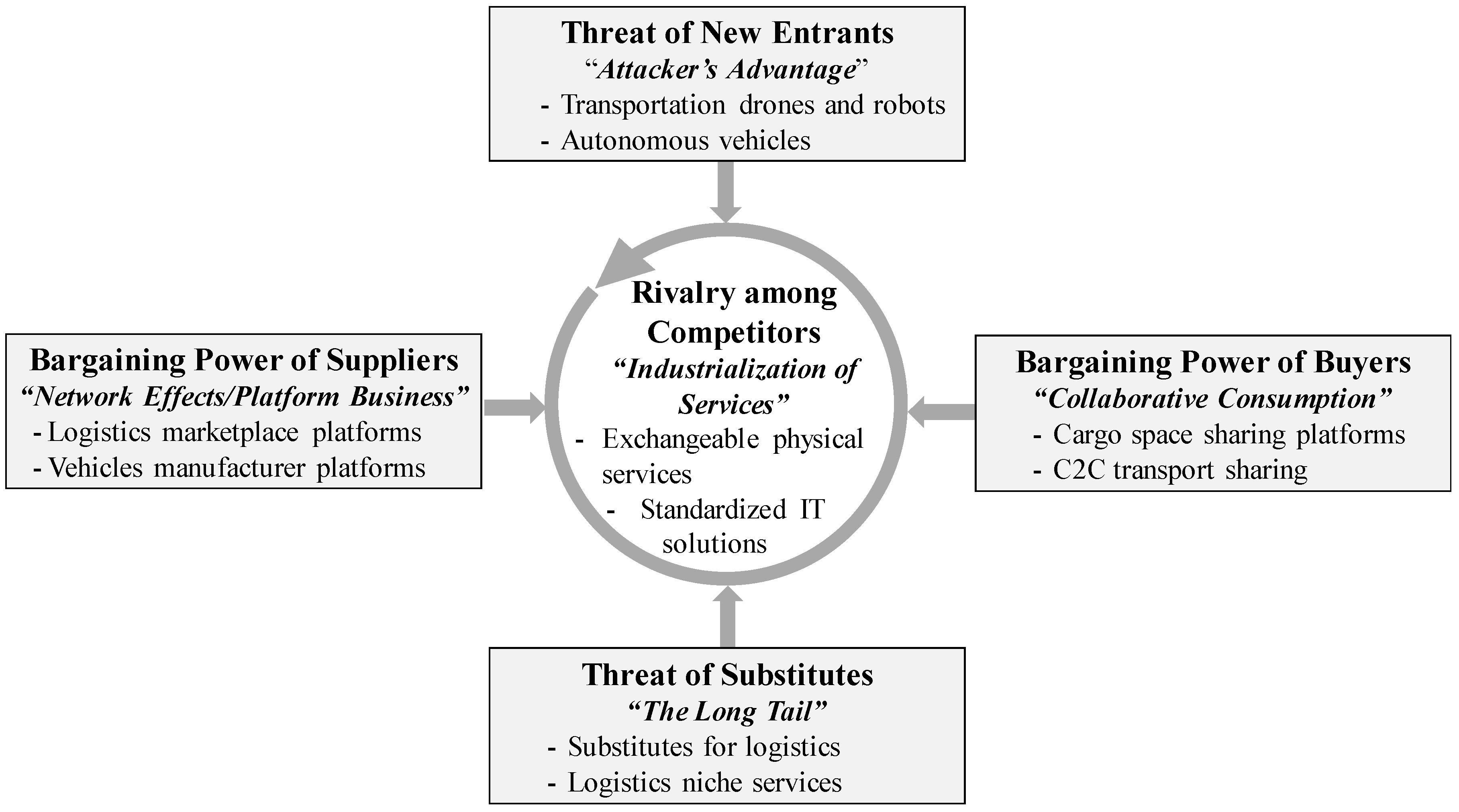

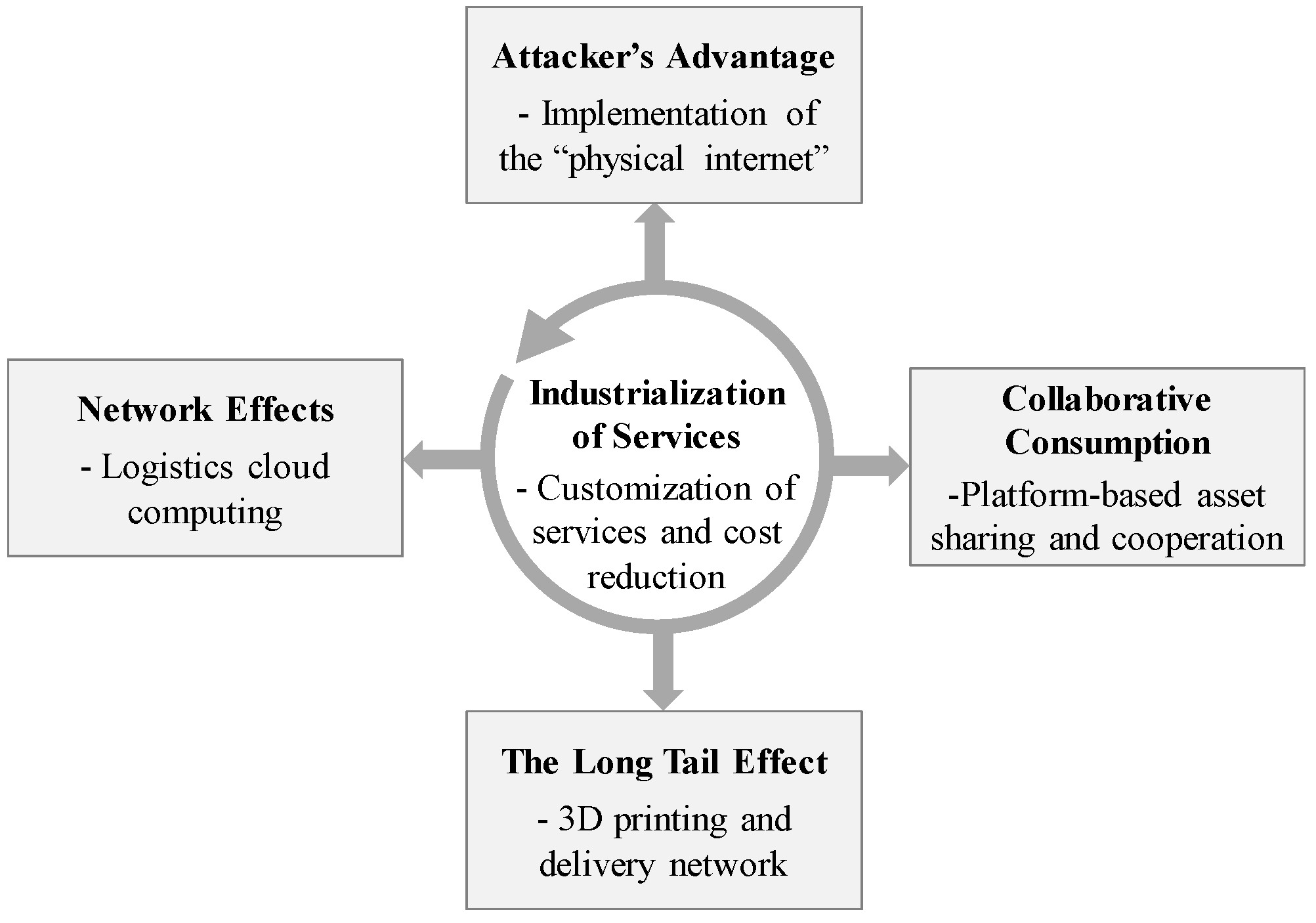

3.3.5. Rivalry among Competitors through the Industrialization of Services

Rivalry among competitors in connection with the industrialization of services stands at the center of the framework and is the force resulting from the other four forces and theories. Therefore, the analysis of this force deviates from the suggested analysis procedure and focuses on a general theory-based explanation.

As von der Gracht and Darkow [

82] outline, increasing competition in spite of significant industry growth remains an important uncertainty factor for the logistics service industry. With respect to Porter’s descriptions, the rivalry among competitors in the logistics service industry is fueled by the general characteristics of services, which include the inseparability of consumption and production as well as perishability [

83,

84]. This not only implies that services cannot be stored but also that service providers have to provide capacities for implementing their services. In the logistics service industry, providing service capacities requires capital-intensive physical assets such as vehicle fleets and warehouses, which render unused capacities expensive. Accordingly, actors in the logistics service industry (3PL) need to optimize their capacity utilization. When looking at service industrialization, two components of 3PL services—the physical and the non-physical components—have to be considered separately.

As already outlined, the most common physical services of 3PL are transportation (long-haul and short-haul) and warehousing. If shipments have no specialized requirements, such as general cargo or parcels, the activities of transportation and warehousing can basically be carried out by any provider. Consequently, transportation and warehousing can be considered highly standardized physical components of logistics services, a standardization that renders providers easily interchangeable. This statement finds practical support in the increasing use of standardized packages and vehicles, such as standard containers (i.e., TEUs), standardized pallet sizes (i.e., Euro-pallets) and standardized truck sizes. This standardization enables especially the spreading of platform-based logistics marketplaces, where shippers can choose among offers from many providers (or prosumers in the case of a sharing platform) for the same service. Thus, a core feature of platforms such as Freightos [

85] is the direct comparison of shipment quotes from different LSPs or carriers. Regarding Porter’s description of competitor rivalry, this can be considered an expression of a price war. In addition, the high degree of standardization makes transportation and warehousing accessible for new technologies such as automation and autonomous vehicles, an aspect that additionally increases competition.

Furthermore, 3PLs offer several non-physical services such as logistics management, order processing and additional IT services. As the practical examples in the analysis show, the majority of such services can be carried out or are supported by digital technologies and digital services. As Leimeister [

84] explains, digital services are increasingly automated and modularized. This allows parties to build up their own digital services by simply combining standardized service modules following a construction-kit logic with different interfaces. This not only constitutes the industrialization of digital services but also enables all providers to easily develop and establish such services, which additionally increases rivalry. This conclusion is supported by the practical examples stated in the analysis. Logistics marketplace platforms (and sharing platforms) in particular offer very similar IT based services such as ordering via mobile devices or real-time tracking and tracing of shipments on digital maps. Autonomous vehicles and drones or robots for local transportation can be accessed through such digital services as well.

Finally,

Figure 5 summarizes the value chain impact of each stated practical example. This summary serves as basis for the following discussion.