Assessing Port Governance, Devolution and Terminal Performance in Nigeria

Abstract

:1. Introduction

1.1. Research Problem and Context

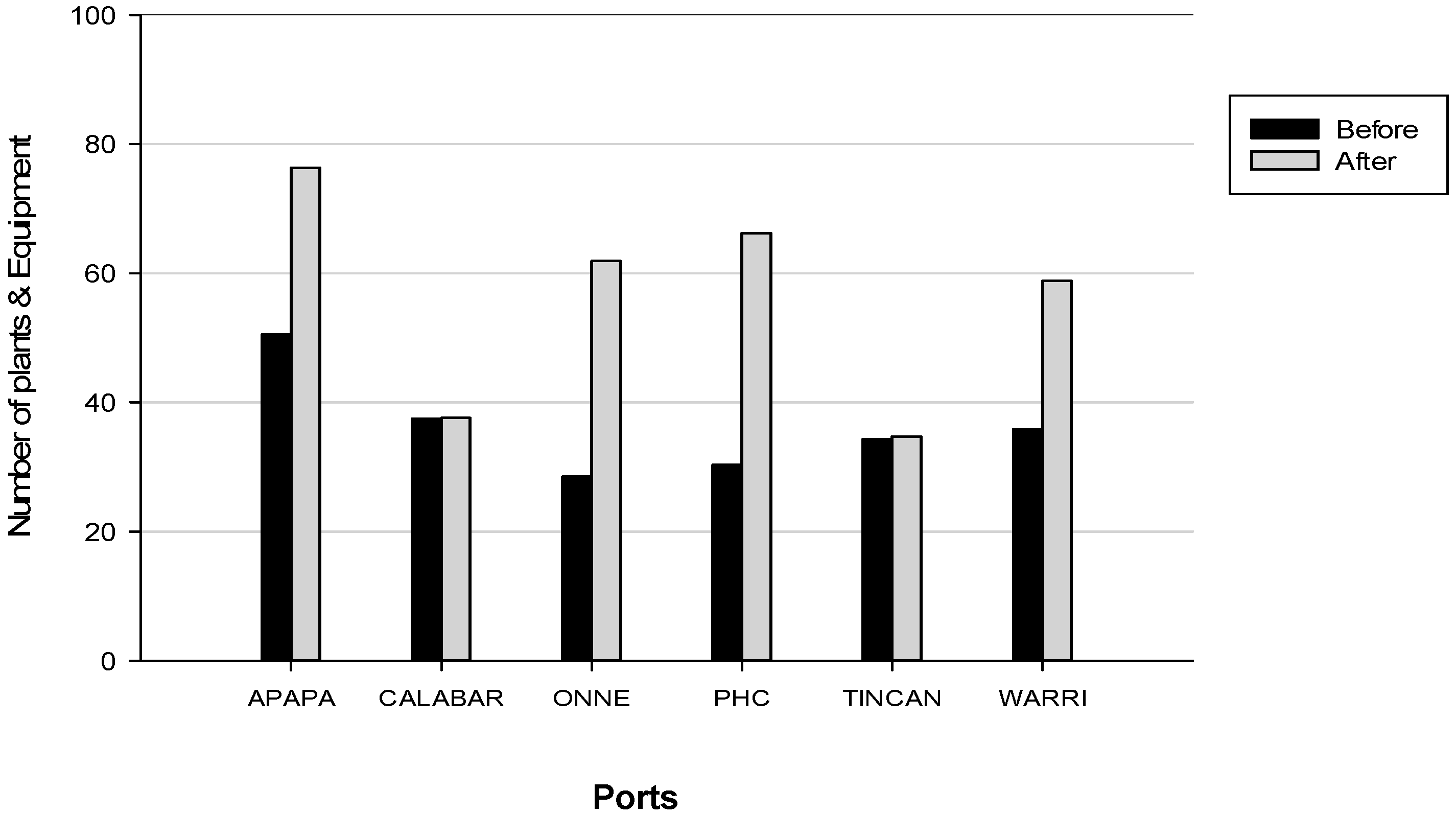

- Substantial investments in physical capital in line with the development plans have been made;

- Injection of managerial expertise and investments leading to productivity improvements;

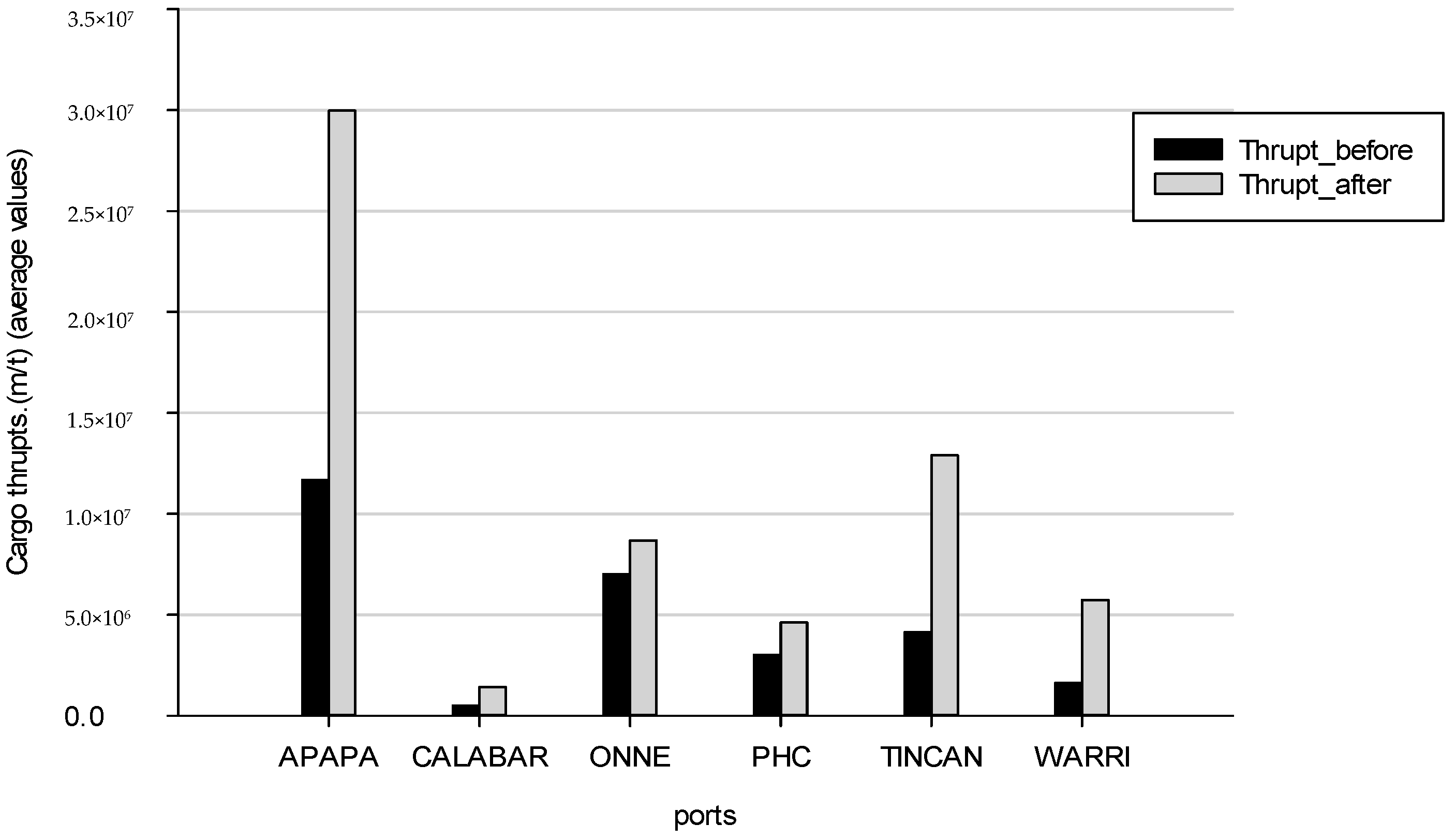

- Throughput expansion; and

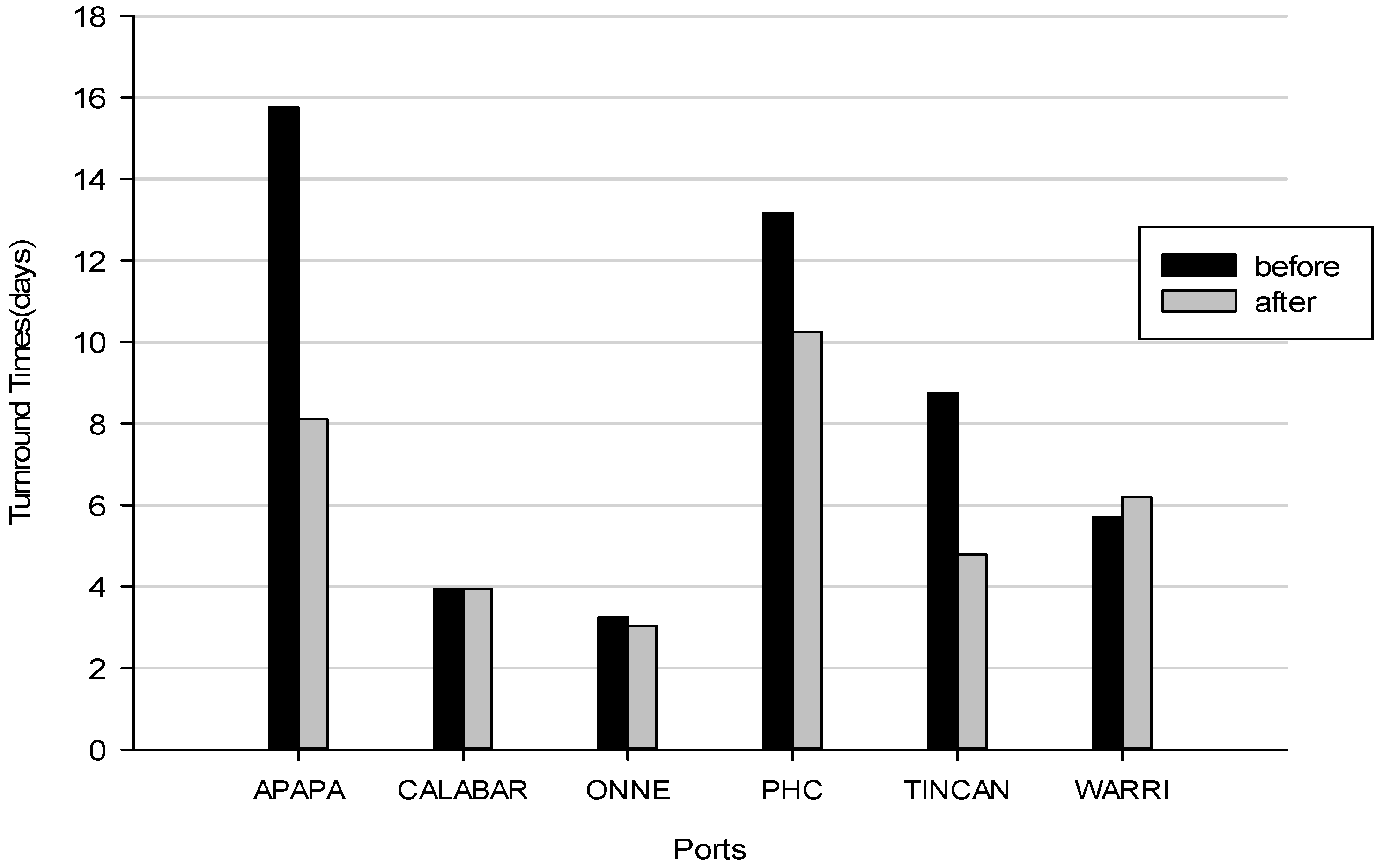

- Reduction in cargo clearance delays.

1.2. Objectives of the Study

- Trends in cargo throughputs;

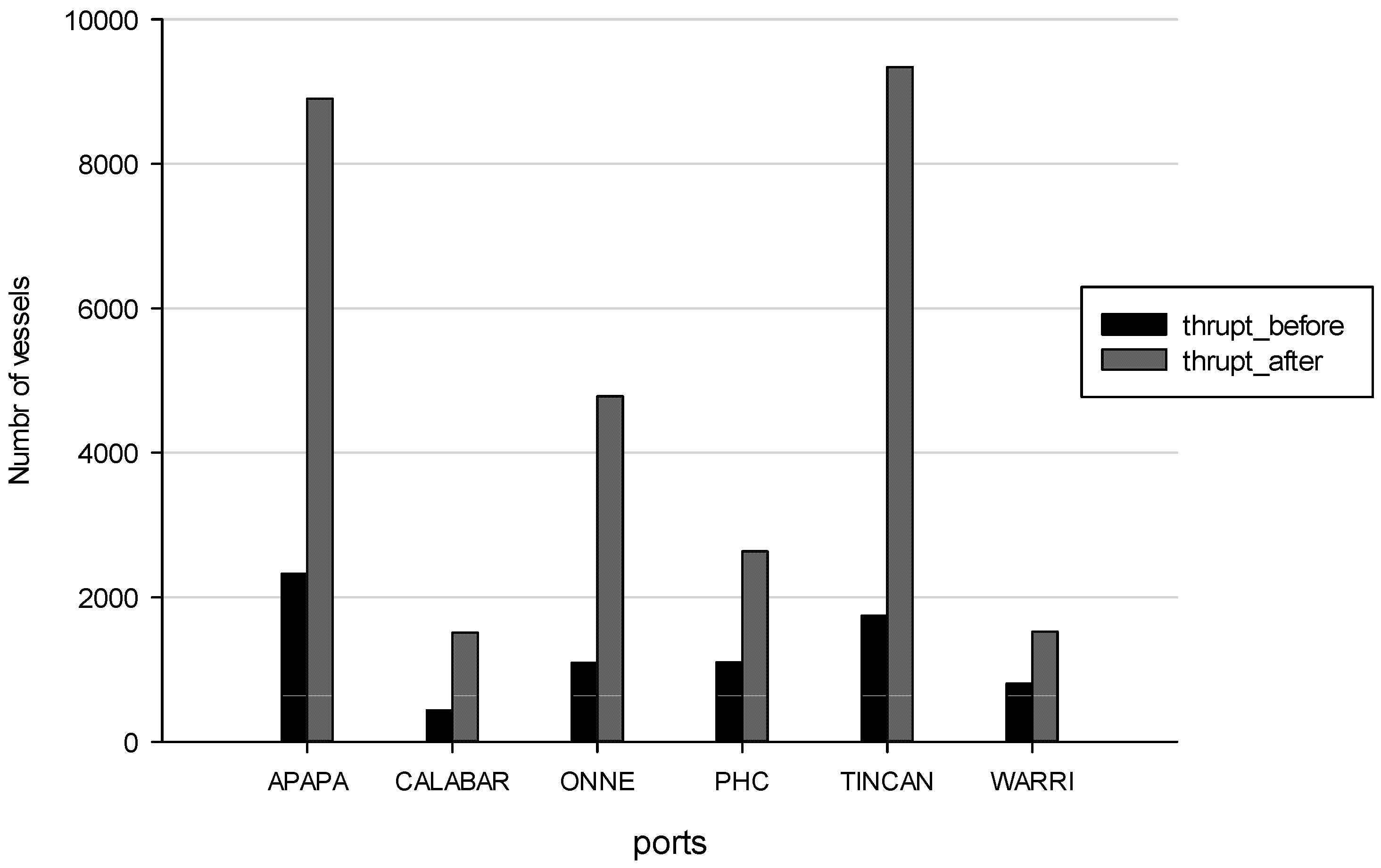

- Trends in vessel throughputs;

- Trends in ships’ turnround times; and

- Level of berth occupancy.

2. Conceptual Framework and Related Studies

2.1. Port Governance Models

2.2. Concession as Instruments in Devolution Process

2.3. Measuring Port Performance: Methodology of Most Studies

2.4. Studies Based on Parametric and Non-Parametric Frontier Models

3. Methodology

4. Data Analysis and Discussion

4.1. Descriptive Analysis of Indicators of Output, Service, and Utilization in Nigeria’s Seaports

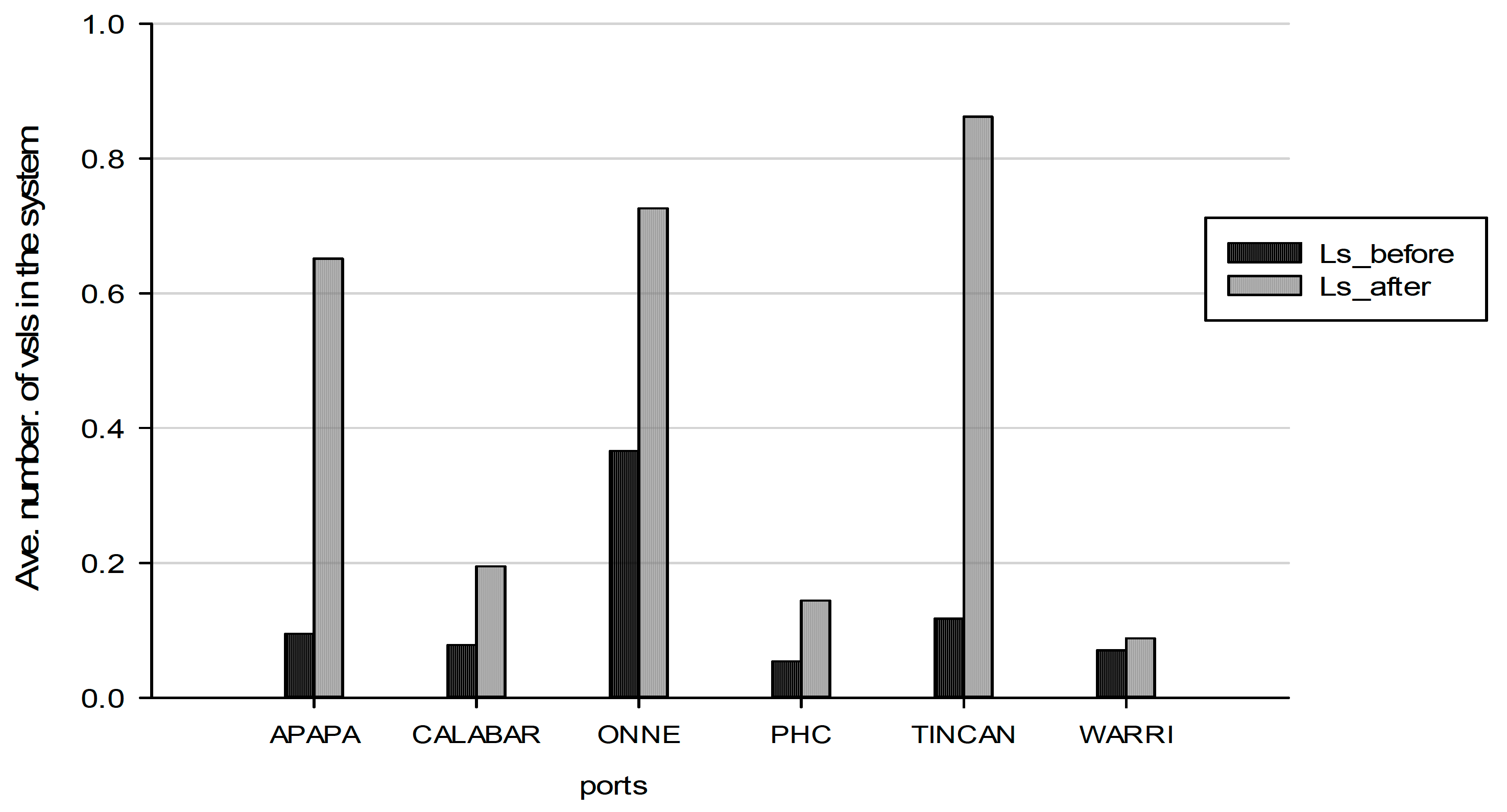

4.2. Queuing Analysis of Nigeria Port Terminals

5. Conclusion

Conflicts of Interest

Appendix A

| S/No | Ports | Year | Ship Calls (nos.) | Ave Arrival Rate per Day | Days Awaiting Berth | Days at Berth | Ave Waiting Time in Days | No. of Berths(c) | Ave Service Time (days) | Berth Occupancy |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | APAPA | 2000 | 517 | 1.4164 | 25 | 6,679 | 0.0484 | 30 | 12.9188 | 77.43 |

| 2 | APAPA | 2001 | 433 | 1.1863 | 1,204 | 5,301 | 2.7806 | 30 | 12.2425 | 77.74 |

| 3 | APAPA | 2002 | 561 | 1.5370 | 5,788 | 6,856 | 10.3173 | 30 | 12.2210 | 81.69 |

| 4 | APAPA | 2003 | 272 | 0.7452 | 2,382 | 3,252 | 8.7574 | 30 | 11.9559 | 62.05 |

| 5 | APAPA | 2004 | 257 | 0.7041 | 805 | 2,713 | 3.1323 | 30 | 10.5564 | 65.96 |

| 6 | APAPA | 2005 | 286 | 0.7836 | 563 | 2,114 | 1.9685 | 31 | 7.3916 | 57.01 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 17 | CALABAR | 2000 | 206 | 0.5644 | 123 | 422 | 0.5971 | 14 | 2.0485 | 16.75 |

| 18 | CALABAR | 2001 | 28 | 0.0767 | 4 | 158 | 0.1429 | 14 | 5.6429 | 14.71 |

| 31 | CALABAR | 2014 | 159 | 0.4356 | 193 | 873 | 1.6000 | 8 | 3.3700 | 24.6 |

| 32 | CALABAR | 2015 | 197 | 0.5397 | 194 | 812 | 1.6060 | 8 | 3.3800 | 36.7 |

| 33 | ONNE | 2000 | 122 | 0.3342 | 15 | 277 | 0.1230 | 9 | 2.2705 | 36.84 |

| 34 | ONNE | 2001 | 231 | 0.6329 | 28 | 498 | 0.1212 | 9 | 2.1558 | 44.44 |

| 47 | ONNE | 2014 | 861 | 2.3589 | 21 | 2,256 | 0.6120 | 6 | 2.3400 | 32.4 |

| 48 | ONNE | 2015 | 820 | 2.2466 | 22 | 2,345 | 0.6135 | 6 | 2.4560 | 24.6 |

| 49 | PHC | 2000 | 205 | 0.5616 | 340 | 1,914 | 1.6585 | 8 | 9.3366 | 77.57 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 63 | PHC | 2014 | 461 | 1.2630 | 1,516 | 2,897 | 3.5210 | 8 | 6.1710 | 62.3 |

| 64 | PHC | 2015 | 447 | 1.2247 | 1,517 | 2,876 | 3.5432 | 8 | 6.1734 | 47.9 |

| 65 | TINCAN | 2000 | 245 | 0.6712 | 75 | 1,739 | 0.3061 | 13 | 7.0980 | 56.78 |

| 80 | TINCAN | 2015 | 1,725 | 4.7260 | 1,538 | 5,993 | 1.0134 | 18 | 3.4100 | 68.3 |

| 81 | WARRI | 2000 | 120 | 0.3288 | 5 | 591 | 0.0417 | 17 | 4.9250 | 8.97 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 95 | WARRI | 2014 | 357 | 0.9781 | 289 | 673 | 1.5965 | 20 | 6.5600 | 15.4 |

| 96 | WARRI | 2015 | 498 | 1.3644 | 281 | 678 | 1.7987 | 20 | 6.1900 | 11.2 |

| Source: Author compiled data based on field work. | ||||||||||

References

- Framework for Port Reform. Available online: https://ppiaf.org/sites/ppiaf.org/files/documents/toolkits/Portoolkit/Toolkit/pdf/modules/01_TOOLKIT_Module1.pdf (accessed on 10 December 2015).

- Leigland, J.; Palsson, G. Port Reform in Nigeria: Upstream Policy Reforms Kick-Start One of the World’s Largest Concession Programs. Gridlines: No. 1, Public-Private Infrastructure Advisory Facility (PPIAF). The World Bank: Washington, DC, USA, 2007. Available online: https://openknowledge.worldbank.org/handle/10986/10717 (accessed on 24 February 2018).

- Gidado, S.U. Port Pricing and Tariff Rates Regime in Nigeria Seaports: Imperatives for Deregulation. Unpublished Ph.D. Thesis, Federal University of Technology, Owerri, Nigeria, December 2008. [Google Scholar]

- United Nations Conference on Trade and Development UNCTAD. How to Utilize FDI to Improve Transport Infrastructure–Ports: Lessons from Nigeria. Best Practices in Investment for Development: Case Studies in FDI. United Nations: Geneva, Switzerland, 2011. Available online: http://unctad.org/en/Docs/diaepcb2011d8_en.pdf (accessed on 10 March 2012).

- Nigeria: Reforming the Maritime Ports. Available online: http://lagoschamber.com/wp-content/uploads/2016/10/Reforming-the-Maritime-Port-New.pdf (accessed on 24 February 2018).

- Brooks, M.R.; Cullinane, K. Governance models defined. In Devolution, Port Governance and Port Performance; Brooks, M.R., Cullinane, K., Eds.; JAI Press (Elsevier): Oxford, UK, 2006; Chapter 18; pp. 405–435. [Google Scholar]

- Baird, A.J. Port Privatization: Objectives, Extent, Process and the UK Experience. Int. J. Marit. Econ. 2000, 2, 177–194. [Google Scholar] [CrossRef]

- Ferrari, C.; Parola, F.; Tei, A. Governance models and port concessions in Europe: Commonalities, critical issues and policy perspectives. Transp. Policy 2015, 41, 60–67. [Google Scholar] [CrossRef]

- Burns, M.G. Port Management and Operations; Taylor & Francis: Boca Raton, FL, USA, 2015. [Google Scholar]

- Port Reform Toolkit PPIAF, World Bank, 2nd ed. Available online: http://ppp.Worldbank.org/public-private-partnership/library/port-reform-toolkit-ppiaf-world-bank-2nd-edition (accessed on 3 May 2011).

- Notteboom, T. Concession agreements as port governance tools. In Devolution, Port Governance and Port Performance; Brooks, M.R., Cullinane, K., Eds.; JAI Press (Elsevier): Oxford, UK, 2006; Chapter 19; pp. 437–455. [Google Scholar]

- United Nations Conference on Trade and Tariffs (UNCTAD). Port Performance Indicators; United Nations: Geneva, Switzerland, 1976; Available online: http://unctad.org/en/PublicationsLibrary/tdbc4d131sup1rev1_en.pdf (accessed on 24 February 2018).

- De Langen, P.; Nijdam, M.; Van der Horst, M. New indicators to measure port performance. J. Marit. Res. 2007, 4, 23–36. [Google Scholar]

- Bichou, K. Port Operations, Planning and Logistics; Informa Law from Rutledge: New York, NY, USA, 2013. [Google Scholar]

- Barros, C.P. A Benchmark Analysis of Italian Seaports Using Data Envelopment Analysis. Marit. Econ. Logist. 2006, 8, 347–365. [Google Scholar] [CrossRef]

- Barros, C.P.; Shunsuke, M. Productivity Drivers in Japanese Seaports. Technical University of Lisbon: Lisbon, Portugal, February 2008. Available online: https://plagiarism.repec.org/barros-managi/barros-managi1.pdf (accessed on 24 February 2018).

- Tongzon, J.; Heng, W. Port privatization, efficiency and competitiveness: Some empirical evidence from container ports (terminals). Transp. Res. Part A 2005, 39, 405–424. [Google Scholar] [CrossRef]

- Dasanayaka, S.W.S.B. Scale of Operations, Productivity Based Profitability and Capacity Utilization in the Colombo Seaports in Sri-Lanka. In Proceedings of the International Conference “Shipping in the Era of Social Responsibility”, Argostoli, Cephalonia, Greece, 14–16 September 2006. [Google Scholar]

- Cullinane, K.; Wang, T.; Song, D.; Ji, P. The Technical Efficiency of Container ports: Comparing Data Envelopment Analysis and Stochastic Frontier Analysis. Transp. Res. Part A 2006, 40, 354–374. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econ. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Cheon, S. Evaluating Impacts of Institutional Reforms on Port Efficiency Changes: Malmquist Productivity Index for World Container Ports. In Proceedings of the 2nd Annual National Urban Freight Conference, Long Beach, CA, USA, July 2007. [Google Scholar]

- Cullinane, K.; Wang, T. Data Envelopment Analysis (DEA) and Improving Container Port Efficiency; Devolution, Port Governance and Port Performance. Res. Transp. Econ. 2007, 17, 517–566. [Google Scholar] [CrossRef]

- Panayides, P.M.; Maxoulis, C.N.; Wang, T.; Ng, K.Y.A. A Critical Analysis of DEA Applications to Seaport Economic Efficiency Measurement. Transp. Rev. 2009, 29, 183–206. [Google Scholar] [CrossRef]

- Barros, C.P.; Haralambides, H.; Hussain, M.; Peypoch, N. A New Approach in Benchmarking Seaport Efficiency and Technological Change. Int. J. Transp. Econ. 2010, 37, 77–96. [Google Scholar]

- Al-Eraqi, A.S.; Mustafa, A.; Khader, A.T.; Barros, C.P. Efficiency of Middle Eastern and East African Seaports: Application of DEA Using Window Analysis. Eur. J. Sci. Res. 2008, 23, 597–612. [Google Scholar]

- Herrera, S.; Pang, G. Efficiency of Infrastructure: The Case of Container Ports. Rev. Econ. Bras. (DF) 2008, 9, 165–194. [Google Scholar]

- Liu, B.; Liu, W.; Cheng, C. The Efficiency of Container Terminals in Mainland China: An Application of DEA Approach. In Proceedings of the WiCOM 4th International Conference on Wireless Communications, Networking and Mobile Computing, Dalian, China, 12–14 October 2008. [Google Scholar]

- Size and Specialization as Determinant of Iberian Port Performance: New Methodology to Group Different Ports. Available online: http://mpra.ub.uni-muenchen.de/31957/ (accessed on 15 May 2012).

- Measuring Seaports’ Productivity: A Malmquist Productivity Index Decomposition Approach. Available online: http://mpra.ub.uni-muenchen.de/40174/ (accessed on 2 October 2012).

- Munisamy, S.; Singh, G. Benchmarking the efficiency of Asian container ports. Afr. J. Bus. Manag. 2011, 5, 1397–1407. [Google Scholar]

- Lu, B.; Wang, X. Application of DEA on the measurement of operating efficiencies for east-Asia major container terminals. J. Syst. Manag. Sci. 2012, 1, 1–18. [Google Scholar]

- Gonzalez, M.M.; Trujillo, L. Reforms and infrastructure efficiency in Spain’s container ports. Transp. Res. Part A Policy Pract. 2008, 42, 243–257. [Google Scholar] [CrossRef]

- Di-Vaio, A.; Medda, F.R.; Trujillo, L. An Analysis of The Efficiency of Italian Cruise Terminals. Int. J. Transp. Econ. 2011, xxxviii, 29–46. [Google Scholar]

- Kennedy, O.R.; Lin, K.; Yang, H.; Banomyong, R. Sea-Port Operational Efficiency: An Evaluation of Five Asian Ports Using Stochastic Frontier Production Function Model. J. Serv. Sci. Manag. 2011, 4, 391–399. [Google Scholar] [CrossRef]

- Onwuegbuchunam, D.E. Productivity and Efficiency in Nigeria’s Seaports: A Production Frontier Analysis. Unpublished Ph.D. Thesis, Federal University of Technology Owerri, Owerri, Nigeria, 2014. [Google Scholar]

- Akinyemi, Y.C. Port Reform in Nigeria: Efficiency Gains and Challenges. GeoJournal 2015, 81, 681–697. [Google Scholar] [CrossRef]

- Taha, H.A. Operations Research, an Introduction, 8th ed.; Prentice Hall, Inc: Upper Saddle River, NJ, USA, 2007. [Google Scholar]

- Little, J.D.C. A Proof of the Queuing Formular: L = λW. Oper. Res. 1961, 9, 383–387. [Google Scholar] [CrossRef]

| Type | Infrastructure | Superstructure | Port Labour | Other Functions |

|---|---|---|---|---|

| Public Service Port | Public | Public | Public | Majority Public |

| Tool Port | Public | Public | Private | Public/Private |

| Landlord Port | Public | Private | Private | Public/Private |

| Private Service Port | Private | Private | Private | Majority Public |

| Classification of Literature | Technique/Methodology | Disadvantages |

|---|---|---|

| Index methods | ||

| • Financial ratios | Financial ratios: NPV, IRR, Gearing ratio, etc. | Financial ratios: Little correlation with the efficient use of resources, focus on short-term profitability, dissimilarity between various port costing and accounting systems, problems with price regulation and access to private equity |

| • Snapshot indicators | Snapshot indicators: Throughput in TEU, total turnround time, service time, cargo dwell time, etc. | Snapshot indicators: Provides an activity measure rather than a performance measure |

| • SFP | SFP: Single output/single input | SFP/PFP: Provides average productivity but does not capture overall productivity. Non-statistical approach |

| • PFP/MFP | PFP: Subset of outputs/subset of inputs | |

| • TFP | TFP: | TFP: Requires estimation of cost, production or distance function (otherwise unable to separate scale effects from efficiency differences). Non-statistical approach |

| • Törnqvist & Fisher (superlative) indexes | ||

| • Malmquist index: Does not require functional form, and can be decomposed into different sources of efficiency | ||

| Frontier analysis | ||

| • Deterministic versus stochastic | • COLS: deterministic/parametric | COLS: Requires functional form and dominated by the position of the frontier firm |

| • Parametric versus non-parametric | • DEA/FDH: deterministic/non-parametric | DEA: Sensitivity to choice of weights attached to input and output variables. No allowance for stochastic factors and measurement errors |

| • SFA: stochastic/parametric | SFA: Requires functional form, specification of exact error terms and probability of their distribution | |

| Process approaches | ||

| • Bottom-up approaches | • Engineering economic analysis (EEA) | EEA: Data intensive, Relies on expert judgement and knowledge of the system |

| • Enterprise modelling (ERP) | BPR/ERP: Expensive to build and maintain | |

| • Benchmarking toolkits | • Process benchmarking (BSC, TQM) | Process benchmarking: Process approach, does not capture operational efficiency component and trends |

| • Expert judgement | • Business process modelling (BPR) | |

| • Perception surveys | • Action research, focus groups, etc. | |

| • Statistical techniques for survey inquiry and hypothesis testing |

| S/No | Ports | Year | λ | µ | Po | Ls | Lq | Ws | Wq |

|---|---|---|---|---|---|---|---|---|---|

| 1 | APAPA | 2000 | 1.42 | 12.92 | 0.8959 | 0.1099 | 0.0000 | 0.0774 | 0.0000 |

| 2 | APAPA | 2001 | 1.19 | 12.24 | 0.9074 | 0.0972 | 0.0000 | 0.0817 | 0.0000 |

| 3 | APAPA | 2002 | 1.54 | 12.22 | 0.8816 | 0.1260 | 0.0000 | 0.0818 | 0.0000 |

| 4 | APAPA | 2003 | 0.75 | 11.96 | 0.9392 | 0.0627 | 0.0000 | 0.0836 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 16 | APAPA | 2015 | 4.10 | 5.03 | 0.4426 | 0.8151 | 0.0000 | 0.1988 | 0.0000 |

| 17 | CALABAR | 2000 | 0.56 | 2.05 | 0.7610 | 0.2732 | 0.0000 | 0.4878 | 0.0000 |

| 18 | CALABAR | 2001 | 0.08 | 5.64 | 0.9859 | 0.0142 | 0.0000 | 0.1773 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 32 | CALABAR | 2015 | 0.54 | 3.31 | 0.8495 | 0.1631 | 0.0000 | 0.3021 | 0.0000 |

| 33 | ONNE | 2000 | 0.33 | 2.27 | 0.8647 | 0.1454 | 0.0000 | 0.4405 | 0.0000 |

| 34 | ONNE | 2001 | 0.63 | 2.16 | 0.7470 | 0.2917 | 0.0000 | 0.4630 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 47 | ONNE | 2014 | 2.36 | 2.43 | 0.3584 | 1.0261 | 0.0000 | 0.4348 | 0.0000 |

| 48 | ONNE | 2015 | 2.25 | 2.41 | 0.3931 | 1.0261 | 0.0000 | 0.4149 | 0.0000 |

| 49 | PHC | 2000 | 0.56 | 9.34 | 0.9418 | 0.0600 | 0.0000 | 0.1071 | 0.0000 |

| 50 | PHC | 2001 | 0.49 | 9.25 | 0.9484 | 0.0530 | 0.0000 | 0.1081 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 63 | PHC | 2014 | 1.26 | 6.11 | 0.8137 | 0.2062 | 0.0000 | 0.1637 | 0.0000 |

| 64 | PHC | 2015 | 1.22 | 6.12 | 0.8193 | 0.1994 | 0.0000 | 0.1634 | 0.0000 |

| 65 | TINCAN | 2000 | 0.67 | 7.1 | 0.9100 | 0.0944 | 0.0000 | 0.1409 | 0.0000 |

| 66 | TINCAN | 2001 | 0.82 | 9.57 | 0.9179 | 0.0857 | 0.0000 | 0.1045 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 79 | TINCAN | 2014 | 4.41 | 3.88 | 0.3209 | 1.1366 | 0.0000 | 0.2577 | 0.0000 |

| 80 | TINCAN | 2015 | 4.73 | 4.01 | 0.3074 | 1.1796 | 0.0000 | 0.2494 | 0.0000 |

| 81 | WARRI | 2000 | 4.73 | 4.01 | 0.3074 | 1.1796 | 0.0000 | 0.2494 | 0.0000 |

| ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ | ‘‘ |

| 95 | WARRI | 2014 | 0.42 | 5.51 | 0.9266 | 0.0762 | 0.0000 | 0.1815 | 0.0000 |

| 96 | WARRI | 2015 | 0.98 | 5.21 | 0.8285 | 0.1881 | 0.0000 | 0.1919 | 0.0000 |

| Source: Author, data analysis using Tora software (version 2, Prentice Hall Inc., Upper Saddle River, NJ, USA) | |||||||||

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Onwuegbuchunam, D.E. Assessing Port Governance, Devolution and Terminal Performance in Nigeria. Logistics 2018, 2, 6. https://doi.org/10.3390/logistics2010006

Onwuegbuchunam DE. Assessing Port Governance, Devolution and Terminal Performance in Nigeria. Logistics. 2018; 2(1):6. https://doi.org/10.3390/logistics2010006

Chicago/Turabian StyleOnwuegbuchunam, D. E. 2018. "Assessing Port Governance, Devolution and Terminal Performance in Nigeria" Logistics 2, no. 1: 6. https://doi.org/10.3390/logistics2010006