Profitability Analysis of Soybean Oil Processes

Abstract

:1. Introduction

2. Analysis Methods

2.1. General Assumptions

2.2. Data Inputs

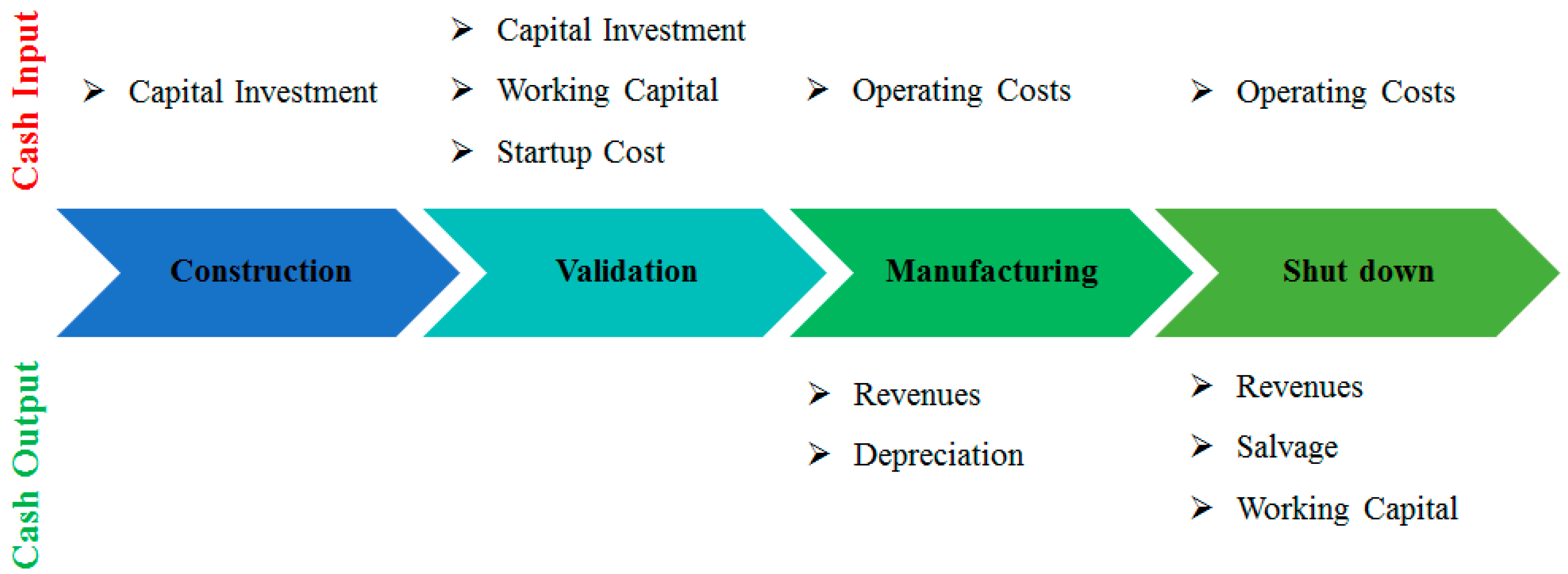

2.3. Cash Flow Calculation

3. Results and Discussions

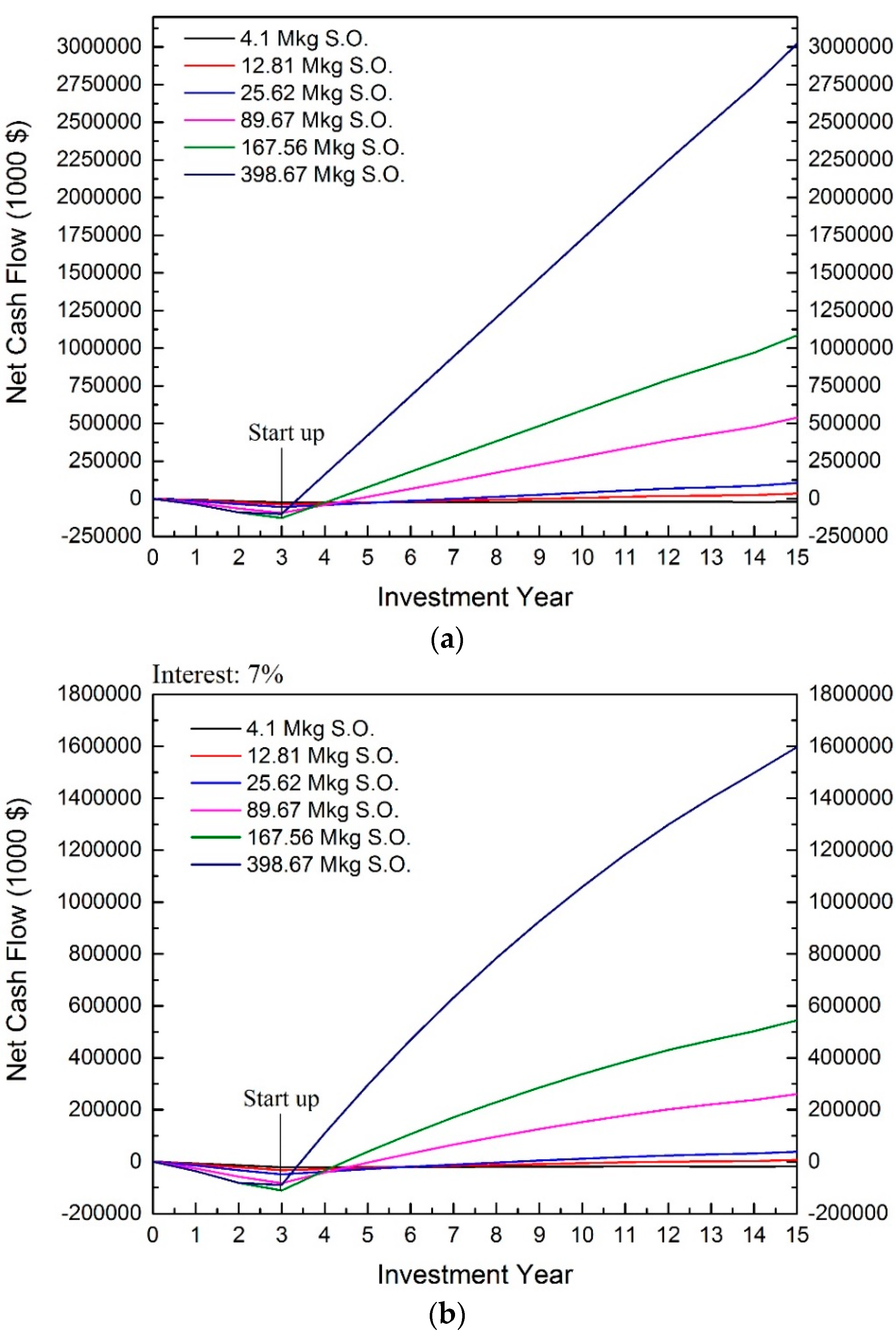

3.1. Extruding-Expelling Process

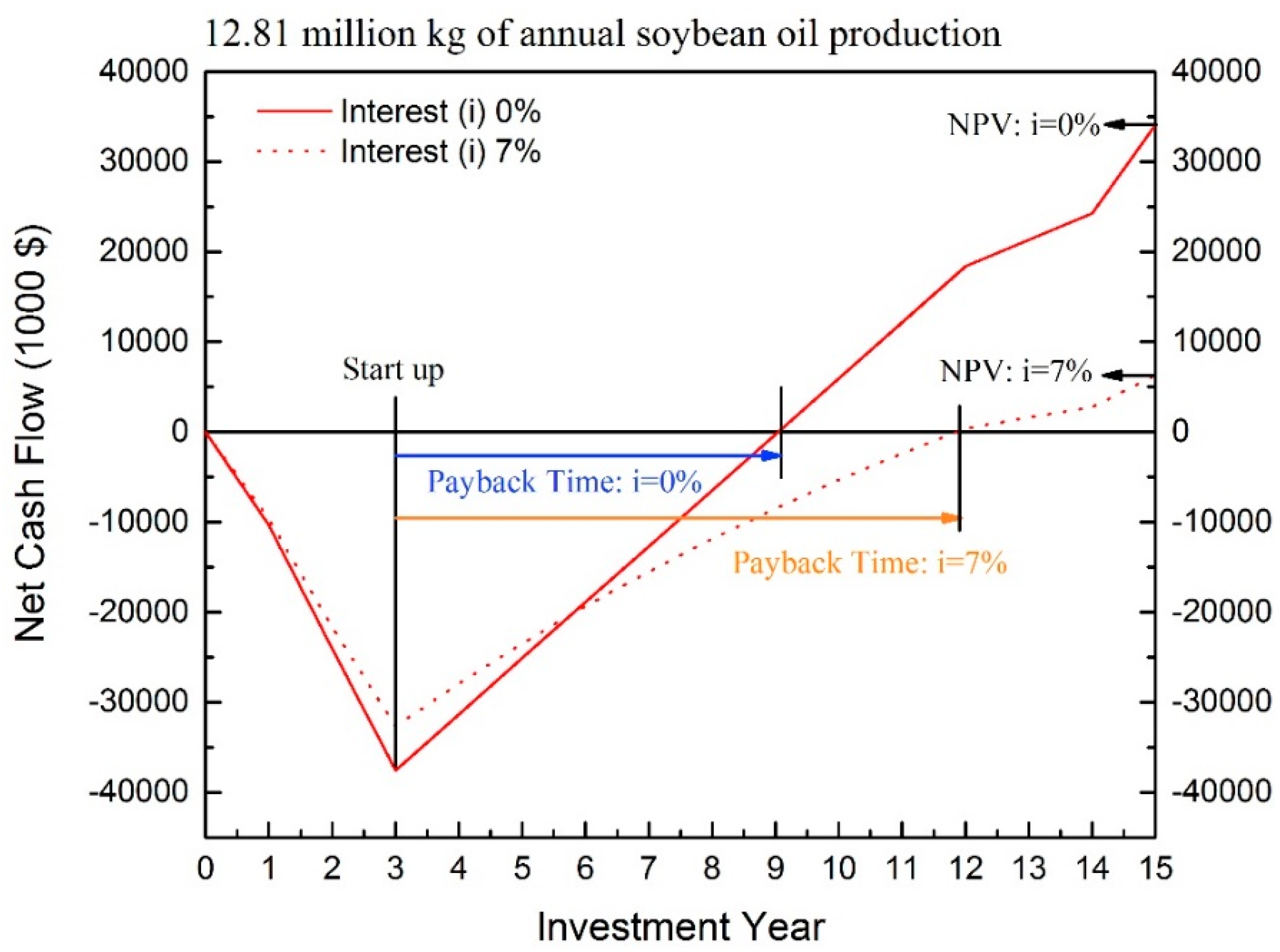

3.2. Hexane Extraction

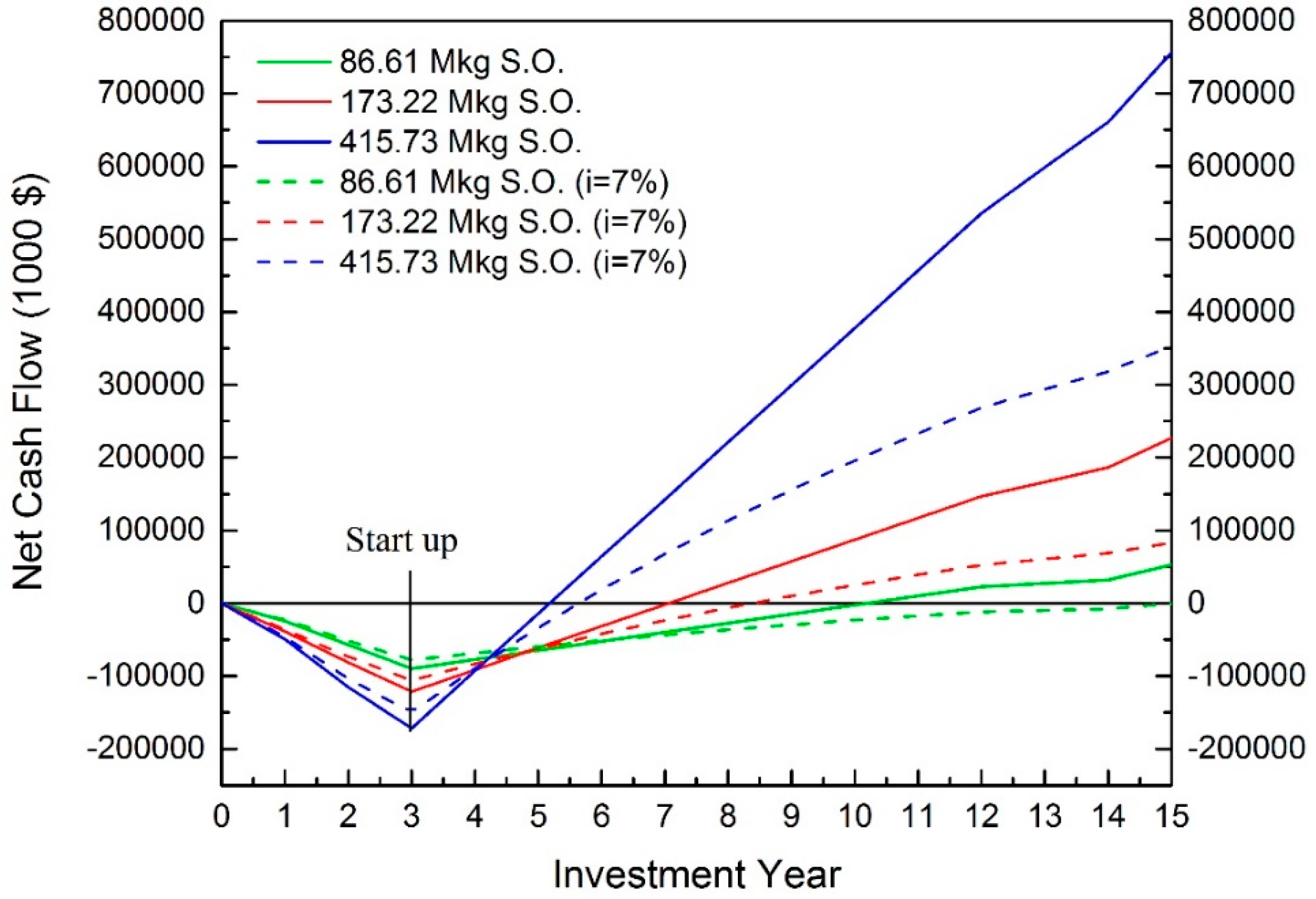

3.3. EAEP

4. Conclusions

Author Contributions

Conflicts of Interest

References

- Markley, K.; Gross, W. Soybean Chemistry and Technology; Chemical Publishing Co.: Brooklyn, NY, USA, 1944. [Google Scholar]

- Nelson, A.; Wijeratne, W.; Yeh, S.; Wei, T.; Wei, L. Dry extrusion as an aid to mechanical expelling of oil form soybean. J. Am. Oil Chem. Soc. 1987, 64, 1341–1347. [Google Scholar] [CrossRef]

- Anderson, G. Solvent Extraction. Retrieved from AOCS Lipid Library. 2011. Available online: http://lipidlibrary.aocs.org/OilsFats/content.cfm?ItemNumber=40337 (assessed on 10 November 2016).

- Pramparo, M.; Gregory, S.; Mattea, M. Immersion vs. percolation in the extraction of oil from oleaginous seeds. J. Am. Oil Chem. Soc. 2002, 79, 955–960. [Google Scholar] [CrossRef]

- Rosenthal, A.; Pyle, D.; Niranjan, K. Aqueous and enzymatic processes for edible oil extraction. Enzym. Microb. Technol. 1996, 19, 402–420. [Google Scholar] [CrossRef]

- Zhang, S.; Liu, X.; Lu, Q.; Wang, Z.; Zhao, X. Enzymatic demulsification of the oil-rich emulsion obtained by aqueous extract of peanut seeds. J. Am. Oil Chem. Soc. 2013, 90, 1261–1270. [Google Scholar] [CrossRef]

- Jung, S.; Mahfuz, A. Low temperature dry extrusion and high-pressure processing prior to enzyme-assisted aqueous extraction of full fat soybean flakes. Food Chem. 2009, 114, 947–954. [Google Scholar] [CrossRef]

- Shah, S.; Sharma, A.; Gupta, M. Extraction of oil from Jatropha curcas L. seed kernels by combination of ultrasonication and aqueous enzymatic oil extraction. Bioresour. Technol. 2005, 96, 121–123. [Google Scholar] [CrossRef] [PubMed]

- Valentova, O.; Novotna, Z.; Svoboda, Z.; Schwartz, W.; Kas, J. Microwave heating and γ-irradiation treatment of rapeseed (Brassica napus). J. Food Lipids 2000, 7, 237–245. [Google Scholar] [CrossRef]

- Pare, A.; Nema, A.; Singh, V.; Mandhyan, B. Combined effect of ohmic heating and enzyme assisted aqueous extraction process on soy oil recovery. J. Food Sci. Technol. 2014, 51, 1606–1611. [Google Scholar] [CrossRef] [PubMed]

- Ulrich, G. Profitability Analysis. In A Guide to Chemical Engineering Process Design and Economics; Ulrich, G., Ed.; John Wiley & Sons Ltd.: New York, NY, USA, 1984; pp. 371–402. [Google Scholar]

- Heinzle, E.; Biwer, A.; Cooney, C. Sustainability Assessment. In Development of Sustainable Bioprocesses: Modeling and Assessment; Heinzle, E., Biwer, A., Cooney, C., Eds.; John Wiley & Sons Ltd.: West Sussex, UK, 2006; pp. 81–94. [Google Scholar]

- Peters, M.; Timmerhaus, K.; West, R. Profitability, alternative investments, and replacements. In Plant Design and Economics for Chemical Engineers; Peters, M., Timmerhaus, K., West, R., Eds.; McGraw Hill.: New York, NY, USA, 2011; pp. 319–352. [Google Scholar]

- Cheng, M.H. Techno-Economic Analysis of Soybean Oil Extruding-Expelling Process in Sustainability Analysis of Soybean Refinery: Soybean Oil Extraction Process. Ph.D. Dissertation, Iowa State University, May 2017; pp. 23–48. [Google Scholar]

- Cheng, M.H.; Rosentrater, K.A. Economic feasibility analysis of soybean oil production by hexane extraction. Ind. Crops Prod. 2017, 108, 775–785. [Google Scholar] [CrossRef]

- Cheng, M.H. Techno-Economic Analysis of Soybean Oil Enzymatic Assisted Aqueous Extraction Process in Sustainability Analysis of Soybean Refinery: Soybean Oil Extraction Process. Ph.D. Dissertation, Iowa State University, May 2017; pp. 79–102. [Google Scholar]

- USDA ERS. Oil Crops Yearbook. 2016. Available online: http://www.ers.usda.gov/data-products/oil-crops-yearbook/ (accessed on 15 November 2016).

- SuperPro Designer Database. SuperPro Designer Heat Exchange Resource Database; Intelligen Inc.: Scotch Plains, NJ, USA, 2015. [Google Scholar]

- City of Ames. Rates and Structure. 2016. Available online: http://www.cityofames.org/government/departments-divisions-i-z/water-pollution-control/rates-and-structure (accessed on 15 July 2016).

- Sigma-Aldrich. Sodium Hydroxide. 2016. Available online: http://www.sigmaaldrich.com/catalog/substance/sodiumhydroxide4000131073211?lang=en®ion=US (accessed on 15 July 2016).

- US EIA. Electricity Data. 2015. Available online: http://www.eia.gov/electricity/data.cfm/ (accessed on 10 November 2016).

- US Bureau of Labor Statistics. Occupational Employment Statistics. 2016. Available online: http://www.bls.gov/oes/tables.htm/ (accessed on 10 November 2016).

- Feedstuffs Magazine. Ingredient Market; Miller Publishing Company Inc.: Minnetonka, MN, USA, 1980–2015. [Google Scholar]

| Extruding-Expelling | Hexane | EAEP * | Citation | ||||

|---|---|---|---|---|---|---|---|

| Operating cost | Materials | Soybean | $/kg | 0.44 | 0.44 | 0.35 | [17] |

| H3PO4 | $/kg | 0.60 | 0.60 | N/A | [18] | ||

| Water | $/L | 0.001 | 0.001 | 0.001 | [19] | ||

| Hexane | $/kg | N/A | 0.89 | N/A | [15] | ||

| NaOH | $/kg | N/A | N/A | 20 | [20] | ||

| Protex 6L | $/kg | N/A | N/A | 19.42 | [16] | ||

| Utility | Electricity | $/kwh | 0.07 | 0.07 | 0.05 | [21] | |

| Steam | $/MT | 12 | 12 | 12 | [18] | ||

| Labor | Agricultural machine | $/hr | 13.12 | 13.12 | 14.9 | [22] | |

| Extraction | $/hr | 13.12 | 20.86 | 22.49 | [22] | ||

| Hazardous material | $/hr | N/A | 20.11 | N/A | [22] | ||

| Revenues | Product | Soybean oil | $/kg | 0.94 | 0.94 | 0.81 | [17] |

| Soybean hull | $/kg | N/A | 0.21 | 0.21 | [23] | ||

| Soybean meal | $/kg | 0.62 | 0.45 | N/A | [17] | ||

| Skim | $/L | N/A | N/A | 0.01 | [19] | ||

| Insoluble fiber | $/kg | N/A | N/A | 0.60 | [16] |

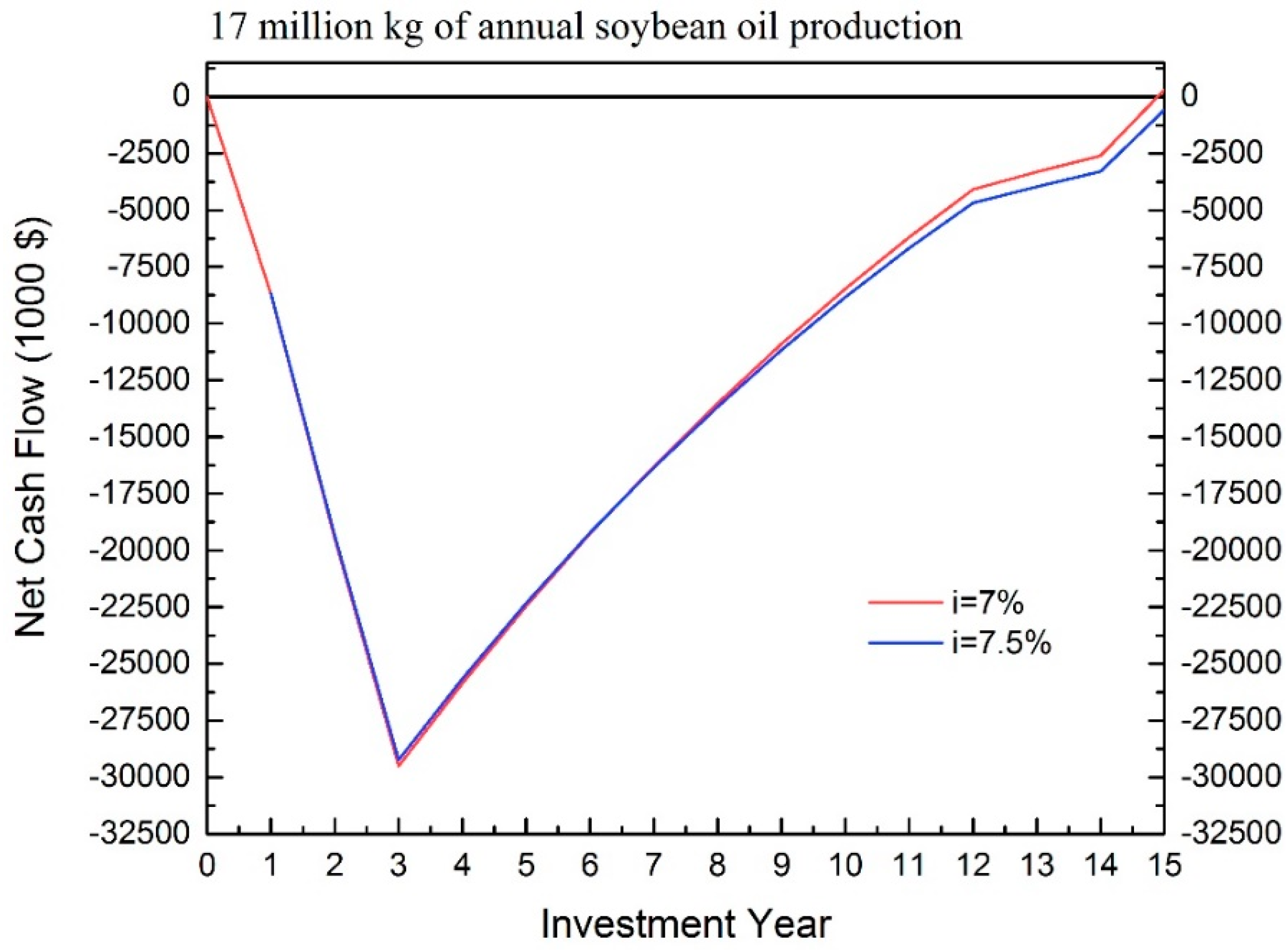

| Investment Year | Capital Investment (CI) | Operating Costs (OC) | Revenues (RS) | Gross Profit (GP) | Tax (T) | Depreciation (DE) | Net Profit (NP) | Net Cash Flow (NCF) | Cumulative Cash Flow (CCF) | Discount Factor (fd) | Discounted Cash Flow (DFC) | Cumulative Discounted Cash Flow (CDC) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 30% DFC | 0 | 0 | OC-RS | 0 | 0 | GP -T+DE | CI+NP | ∑NCF | (1/1.07)^t | NCF × fd | ∑DFC |

| 2 | 40% DFC | 0 | 0 | . | 0 | 0 | . | . | . | . | . | . |

| 3 | 30% DFC + WC + SC | 2 months OC | 2 months RS | . | 35% GP | 0 | . | . | . | . | . | . |

| 4 | 0 | OC | RS | . | . | 90% DFC | . | . | . | . | . | . |

| 5 | . | . | . | . | . | . | . | . | . | . | . | . |

| 13 | . | . | . | . | . | 0 | . | . | . | . | . | . |

| 14 | . | . | . | . | . | 0 | . | . | . | . | . | . |

| 15 | WC + SV | . | . | . | . | 0 | . | . | . | . | . | NPV |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, M.-H.; Rosentrater, K.A. Profitability Analysis of Soybean Oil Processes. Bioengineering 2017, 4, 83. https://doi.org/10.3390/bioengineering4040083

Cheng M-H, Rosentrater KA. Profitability Analysis of Soybean Oil Processes. Bioengineering. 2017; 4(4):83. https://doi.org/10.3390/bioengineering4040083

Chicago/Turabian StyleCheng, Ming-Hsun, and Kurt A. Rosentrater. 2017. "Profitability Analysis of Soybean Oil Processes" Bioengineering 4, no. 4: 83. https://doi.org/10.3390/bioengineering4040083