A Panel Analysis Regarding the Influence of Sustainable Development Indicators on Green Taxes

Abstract

:1. Introduction

2. Literature Review

- Cluster 1—red, with eight items, centered around the key concept of energy, connected with the keywords as follows: management, impact, performance, sustainability, China, emissions, and carbon tax.

- Cluster 2—green with six items, centered around the concept of sustainable development, which includes the following keywords: policy, model, technology, growth, innovation, etc.

- Cluster 3—blue with four items, centered around the concept of CO2 emissions, connected with the following keywords: economic growth, consumption, renewable energy.Figure 2. Co-occurrence of keywords. Source: processed by VOS viewer authors, version 1.6.19.

3. Correlations between Green Taxes and Sustainable Development—Empirical Evidence from European Countries

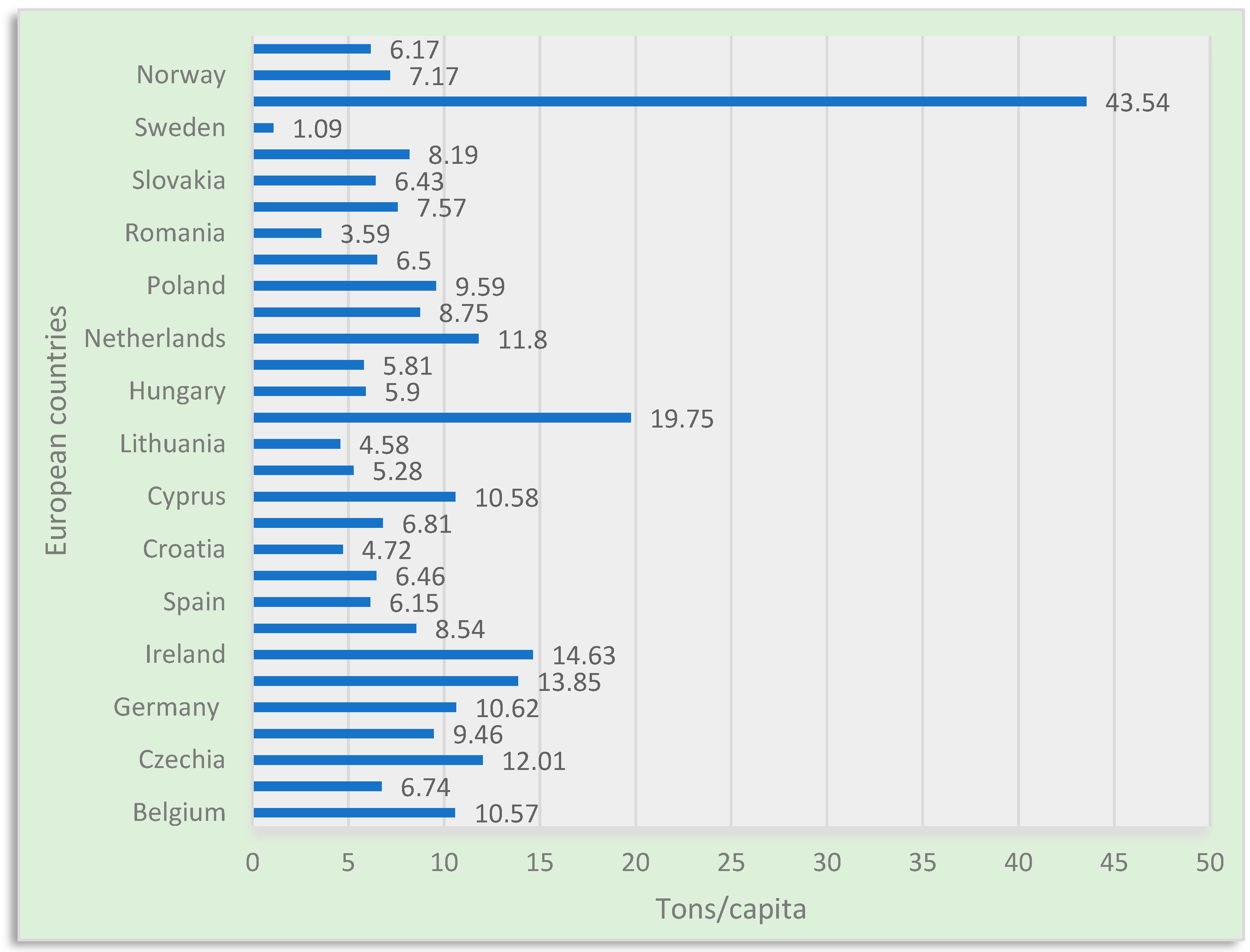

3.1. Variables, Data, and Methodology

3.2. Empirical Results

- The variable is explained by its previous values, from t − 1. The coefficient of 0.93 is statistically significant, having p = 0.00. This result suggests that the current values of total green taxes are strongly positively correlated with past values, indicating the existence of a history effect on this variable.

- For the variable GDP and its main components (diff_gdp_and_main_components) the coefficient is 0.03 and is statistically significant, having p = 0.00. This result indicates a significant positive correlation between the variation of GDP and total green taxes. An increase in GDP is linked with an increase in green taxes.

- Other significant independent variables: Waste generated, waste treatment, the supply, transformation, and consumption of renewable sources and waste—renewable municipal waste, primary energy consumption (primary_energy_consumption), public expenditure for environmental protection, and climate-related economic losses have p-values of less than 0.05, indicating a significant correlation with total green taxes. These results suggest that the differences in waste generation, transformation of renewable sources, and primary energy consumption significantly and positively influence total green taxes, and waste treatment, general government spending, and climate-related economic losses significantly and negatively influence the total green taxes.

- Non-significant independent variables: Human Development Index, net greenhouse gas emissions, private investment and gross value added related to circular economy sectors, and raw material consumption are not statistically significant at a level of 0.05. This means that these variables do not have a significant influence on the dependent variable within this model.

- The variable is explained by its previous values, from t − 1. The coefficient is 0.92 and is statistically significant at the 0.05 level. This result suggests that the current values of energy taxes are strongly positively correlated with past values, indicating the existence of a historical effect on this variable.

- The variable, GDP, with the coefficient of 0.02 statistically significant at a level of 0.05, indicates a significant positive correlation between the variation of GDP and the energy taxes. An increase in GDP is associated with an increase in energy taxes.

- Other significant independent variables: Waste generated, waste treated, the supply, transformation, and consumption of renewable sources, primary energy consumption, public expenditure for environmental protection, and climate-related economic losses have significant coefficients and p-values lower than 0.05, which indicates a significant correlation with the dependent variable—energy taxes. These results suggest that differences in waste generation, waste treatment, energy transformation and consumption, general government expenditure, and climate-related economic losses significantly influence, some positively (such as waste generated and primary energy consumption) and others negatively (waste treated, public spending for environmental protection and climate-related economic losses), green taxes.

- Insignificant independent variables: Human Development Index, net greenhouse gas emissions, private investments related to circular economy sectors, and the consumption of raw materials are not correlated, statistically significantly, with the energy taxes variable within this model.

- GDP and its main components: for a one-unit increase in the variation in GDP, there is a 0.01-unit increase in total green taxes, which is statistically significant at the 5% level (p-value < 0.05).

- Human Development Index, net greenhouse gas emissions, climate-related economic losses: the coefficients and p-values > 0.05 suggest that there is no significant relationship between the respective variables and total green taxes.

- Primary energy consumption: An increase in primary energy consumption generates an increase in total green taxes. The coefficient is statistically significant at the 1% level (p value = 0.00).

- Waste generated, waste treated, the supply, transformation, and consumption of renewable sources, general public expenditure for environmental protection, private investment and gross value added related to circular economy sectors: the coefficient of this variable and the p-values suggest that the relationships are not statistically significant at conventional levels, and the robustness testing of the regression did not validate the correlation of these variables with green taxes.

- GDP and its main components: For a one-unit increase in the difference between variations in GDP, there is a 0.01-unit increase in energy taxes. The coefficient is statistically significant at the 1% level (p value = 0.01).

- Human Development Index, net greenhouse gas emissions, climate-related economic losses: the coefficients of the respective variables suggest that there is no significant relationship between them and energy taxes.

- Primary energy consumption: For a one-unit increase in primary energy consumption, there is an increase of 119.59 units in energy taxes. The coefficient is statistically significant at the 1% level (p value = 0.00).

- Waste generated, waste treated, the supply, transformation, and consumption of renewable sources, general public expenditure for environmental protection, private investment, and gross value added related to circular economy sectors: the coefficient of this variable and the p-values suggest that the relationships are not statistically significant at conventional levels, and the robustness testing of the regression did not validate the correlation of these variables with green taxes.

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mpofu, F. Green Taxes in Africa: Opportunities and Challenges for Environmental Protection, Sustainability, and the Attainment of Sustainable Development Goals. Sustainability 2022, 14, 10239. [Google Scholar] [CrossRef]

- Bovenberg, A.L.; Goulder, L.H. Environmental Taxation and Regulation. In Handbook of Public Economics; Elsevier: Amsterdam, The Netherlands, 2002; Volume 3, pp. 1471–1545. [Google Scholar] [CrossRef]

- Morley, B. Empirical evidence on the effectiveness of environmental taxes. Appl. Econ. Lett. 2012, 19, 1817–1820. [Google Scholar] [CrossRef]

- Braathen, N.A. New information in the OECD database on instruments used for environmental policy. In Green Taxation and Environmental Sustainability; Edward Elgar: Cheltenham, UK, 2012. [Google Scholar] [CrossRef]

- Pitrone, F. Defining ‘Environmental Taxes’: Input from the Court of Justice of the European Union. Bull. Int. Tax. 2015, 58–64. [Google Scholar] [CrossRef]

- OECD. Environmental Fiscal Reform Progress, Prospects and Pitfalls. 2017, pp. 1–47. Available online: www.oecd.org/tax/tax-policy/tax-and-environment.htm (accessed on 17 November 2023).

- Rodríguez, M.; Robaina, M.; Teotónio, C. Sectoral effects of a Green Tax Reform in Portugal. Renew. Sustain. Energy Rev. 2019, 104, 408–418. [Google Scholar] [CrossRef]

- OECD. Environmentally Related Taxes, 2005—OECD Glossary of Statistical Terms. Available online: https://stats.oecd.org/glossary/detail.asp?ID=6437 (accessed on 17 November 2023).

- Nobanee, H.; Saif, U. Mapping green tax: A bibliometric analysis and visualization of relevant research. Sustain. Futures 2023, 6, 100129. [Google Scholar] [CrossRef]

- OECD. Green Growth and Taxation. 2023. Available online: https://www.oecd.org/greengrowth/greengrowthandtaxation.htm (accessed on 17 November 2023).

- Kumar, B.; Kumar, L.; Kumar, A.; Kumari, R.; Tagar, U. Green finance in circular economy: A literature review. Environ. Dev. Sustain. 2023. [Google Scholar] [CrossRef] [PubMed]

- Kumar, L.; Nadeem, F.; Sloan, M.; Restle-Steinert, J.; Deitch, M.J.; Ali Naqvi, S.; Kumar, A.; Sassanelli, C. Fostering Green Finance for Sustainable Development: A Focus on Textile and Leather Small Medium Enterprises in Pakistan. Sustainability 2022, 14, 11908. [Google Scholar] [CrossRef]

- Shahzad, U. Environmental taxes, energy consumption, and environmental quality: Theoretical survey with policy implications. Environ. Sci. Pollut. Res. Int. 2020, 27, 24848–24862. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Zhou, M.; Sun, H.; Liu, J. Assessment of environmental tax and green bonds impacts on energy efficiency in the European Union. Econ. Change Restruct. 2022, 56, 1063–1081. [Google Scholar] [CrossRef]

- Angele, K.; Klyviene, V. The Relationships between Economic growth, Energy Efficiency and CO2 Emissions Results for the Euro Area. Ekonomika 2020, 99, 6–25. [Google Scholar] [CrossRef]

- Zhang, J.; Zhang, Y. Carbon tax, tourism CO2 emissions and economic welfare. Ann. Tour. Res. 2018, 69, 18–30. [Google Scholar] [CrossRef]

- Kwilinski, A.; Ruzhytskyi, I.; Patlachuk, V.; Patlachuk, O.; Kaminska, B. Environmental Taxes as A Condition of Business Responsibility in The Conditions Of Sustainable Development. J. Leg. Ethical Regul. Issues 2019, 1–6. Available online: http://izmail.maup.com.ua/assets/files/maup-2.4.-12.pdf (accessed on 1 March 2024).

- Zioło, M.; Kluza, K.; Kozuba, J.; Kelemen, M.; Niedzielski, P.; Zinczak, P. Patterns of Interdependence between Financial Development, Fiscal Instruments, and Environmental Degradation in Developed and Converging EU Countries. Int. J. Environ. Res. Public. Health 2020, 17, 4425. [Google Scholar] [CrossRef] [PubMed]

- Doran, M.D.; Poenaru, M.M.; Zaharia, A.L.; Vătavu, S.; Lobonț, O.R. Fiscal Policy, Growth, Financial Development and Renewable Energy in Romania: An Autoregressive Distributed Lag Model with Evidence for Growth Hypothesis. Energies 2023, 16, 70. [Google Scholar] [CrossRef]

- Naidoo, M.; Gasparatos, A. Corporate environmental sustainability in the retail sector: Drivers, strategies and performance measurement. J. Clean. Prod. 2018, 203, 125–142. [Google Scholar] [CrossRef]

- Jiang, C.; Fu, Q. A Win-Win Outcome between Corporate Environmental Performance and Corporate Value: From the Perspective of Stakeholders. Sustainability 2019, 11, 921. [Google Scholar] [CrossRef]

- Sharif, A.; Kartal, M.; Bekun, F.; Pata, U.; Foon, C.; Depren, S. Role of green technology, environmental taxes, and green energy towards sustainable environment: Insights from sovereign Nordic countries by CS-ARDL approach. Gondwana Res. 2023, 117, 194–206. [Google Scholar] [CrossRef]

- Available online: https://www.worldbank.org/en/programs/the-global-tax-program/environmental-taxes#1 (accessed on 1 March 2024).

- CSB. EU’s Green Taxation: Tackling Climate Change through Tax. 2022. Available online: https://www.mondaq.com/climate-change/1250524/eus-green-taxation-tackling-climate-change-through-tax (accessed on 17 November 2023).

- Sabău-Popa, C.D.; Bele, A.M.; Dodescu, A.O.; Boloș, M.I. How Does the Circular Economy Applied in the European Union Support Sustainable Economic Development? Sustainability 2022, 14, 9932. [Google Scholar] [CrossRef]

- Heine, D.; Black, S. Benefits beyond Climate: Environmental Tax Reform. In Fiscal Policies for Development and Climate Action; World Bank: New York, NY, USA, 2018. [Google Scholar] [CrossRef]

- Hassan, M.; Oueslati, W.; Rousselière, D. Environmental taxes, reforms and economic growth: An empirical analysis of panel data. Econ. Syst. 2020, 44, 100806. [Google Scholar] [CrossRef]

- Drummond, I.; Marsden, T.K. Regulating Sustainable Development. Glob. Environ. Change 1995, 5, 51–63. [Google Scholar] [CrossRef]

- Gao, X.; Zheng, H.; Zhang, Y.; Golsanami, N. Tax Policy, Environmental Concern and Level of Emission Reduction. Sustainability 2019, 11, 1047. [Google Scholar] [CrossRef]

- Ahmed, N.; Sheikh, A.A.; Hamid, Z.; Senkus, P.; Borda, R.C.; Wysokińska-Senkus, A.; Glabiszewski, W. Exploring the Causal Relationship among Green Taxes, Energy Intensity, and Energy Consumption in Nordic Countries: Dumitrescu and Hurlin Causality Approach. Energies 2022, 15, 5199. [Google Scholar] [CrossRef]

- Abbas, S.; Ahmed, Z.; Sinha, A.; Mariev, O.; Mahmood, F. Toward fostering environmental innovation in OECD countries: Do fiscal decentralization, carbon pricing, and renewable energy investments matter? Gondwana Res. 2024, 127, 88–99. [Google Scholar] [CrossRef]

- Saqib, N.; Usman, M.; Radulescu, M.; Șerbu, R.S.; Kamal, M.; Belascu, L.A. Synergizing green energy, natural resources, global integration, and environmental taxation: Pioneering a sustainable development goal framework for carbon neutrality targets. Energy Environ. 2023. [Google Scholar] [CrossRef]

- Ajeigbe, K.B.; Ganda, F.; Enowkenwa, R.O. Impact of sustainable tax revenue and expenditure on the achievement of sustainable development goals in some selected African countries. Environ. Dev. Sustain. 2023. [Google Scholar] [CrossRef]

- World Bank. World Development Report 2003: Sustainable Development in a Dynamic World: Transforming Institutions, Growth, and Quality of Life. Available online: https://documents.worldbank.org/en/publication/documents-reports/documentlist?qterm=P073946 (accessed on 17 November 2023).

- Ullah, S.; Luo, R.D.; Adebayo, T.S.; Kartal, M.T. Dynamics between environmental taxes and ecological sustainability: Evidence from top-seven green economies by novel quantile approaches. Sustain. Dev. 2022, 31, 825–839. [Google Scholar] [CrossRef]

- Wang, J.; Tang, D.; Boamah, V. Environmental Governance, Green Tax and Happiness—An Empirical Study Based on CSS (2019) Data. Sustainability 2022, 14, 8947. [Google Scholar] [CrossRef]

- Dorband, I.; Jakob, M.; Steckel, J.; Ward, H. Double progressivity of infrastructure financing through carbon pricing—Insights from Nigeria. World Dev. Sustain. 2022, 1, 100011. [Google Scholar] [CrossRef]

- Malerba, D.; Wiebe, K.S. Analysing the effect of climate policies on poverty through employment channels. Environ. Res. Lett. 2021, 16, 035013. [Google Scholar] [CrossRef]

- Govinda, T.; Yazid, D.; Toman, M.; Heine, D. Carbon Tax in an Economy with Informality: A Computable General Equilibrium Analysis for Cote d’Ivoire. In Policy Research Working Paper No. 9710; World Bank: Washington, DC, USA, 2021; Available online: http://hdl.handle.net/10986/35830 (accessed on 1 March 2024).

- Eurostat. 2023. Available online: https://ec.europa.eu/eurostat/web/sdi/database (accessed on 1 March 2024).

- EEA Is Europe Reducing Its Greenhouse Gas Emissions? 2023. Available online: https://www.eea.europa.eu/themes/climate/eu-greenhouse-gas-inventory/is-europe-reducing-its-greenhouse (accessed on 17 November 2023).

- Baltagi, B.H.; Li, Q. A note on the estimation of dynamic fixed effects panel data models. Econom. Theory 1992, 8, 113–119. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. In CESifo Working Paper Series; IZA P.O.: Bonn, Germany, 2004. [Google Scholar]

- Oster, E. Unobservable Selection and Coefficient Stability: Theory and Evidence. J. Bus. Econ. Stat. 2019, 37, 187–204. [Google Scholar] [CrossRef]

- Silva, F.B.G. Fiscal Deficits, Bank Credit Risk, and Loan-Loss Provisions. J. Financ. Quant. Anal. 2021, 56, 1537–1589. [Google Scholar] [CrossRef]

- Ali, S.M.; Appolloni, A.; Cavallaro, F.; D’Adamo, I.; Di Vaio, A.; Ferella, F.; Gastaldi, M.; Ikram, M.; Kumar, N.M.; Martin, M.A.; et al. Development Goals towards Sustainability. Sustainability 2023, 15, 9443. [Google Scholar] [CrossRef]

- Pedersen, C.S. The UN Sustainable Development Goals (SDGs) are a Great Gift to Business. Procedia CIRP 2018, 69, 21–24. [Google Scholar] [CrossRef]

| Variables | Rho | p-Value | Result |

|---|---|---|---|

| Total green taxes | 0.5963 | 0.0041 | Stationary |

| Energy taxes | 0.5781 | 0.0013 | Stationary |

| GDP and its main components | 0.9843 | 1.0000 | Nonstationary |

| Human Development Index | 0.7540 | 0.7051 | Nonstationary |

| Waste generated | 1.1249 | 1.0000 | Nonstationary |

| Waste treatment | 1.1287 | 1.0000 | Nonstationary |

| Net greenhouse gas emissions | 0.6694 | 0.1213 | Nonstationary |

| Supply, transformation, and consumption of resources | 0.6660 | 0.1213 | Nonstationary |

| Primary energy consumption | 0.4044 | 0.0000 | Stationary |

| Public expenditure for environmental protection | 1.1136 | 1.0000 | Nonstationary |

| Private investment and gross value added | 0.3958 | 0.0000 | Stationary |

| Climate-related economic losses | −0.0310 | 0.0000 | Stationary |

| Consumption of raw materials | 0.2372 | 0.0000 | Stationary |

| Y | Total_Green_Taxes | Energy_Taxes | ||||

|---|---|---|---|---|---|---|

| Coef. | t | p > t | Coef. | t | p > t | |

| L1. | 0.93 | 25.01 | 0.00 | 0.92 | 20.81 | 0.00 |

| diff_gdp_and_main_components | 0.03 | 24.02 | 0.00 | 0.02 | 22.26 | 0.00 |

| diff_human_development_index | −3734.30 | −0.23 | 0.82 | −7279.35 | −0.49 | 0.63 |

| diff_waste_generated | 0.55 | 2.00 | 0.05 | 0.51 | 2.25 | 0.03 |

| diff_waste_treatment | −1.00 | −3.26 | 0.00 | −0.89 | −3.68 | 0.00 |

| diff_net_greenhouse_gas_emission | 24.04 | 0.62 | 0.54 | 22.99 | 0.61 | 0.55 |

| diff_supply_transformation_and_c | 0.10 | 3.53 | 0.00 | 0.13 | 3.11 | 0.00 |

| primary_energy_consumption | 32.41 | 2.94 | 0.01 | 28.35 | 2.75 | 0.01 |

| diff _government_expendit_environment | −0.51 | −4.49 | 0.00 | −0.40 | −2.72 | 0.01 |

| private_investment_and_gross_add | 0.0001 | 0.01 | 0.99 | 0.03 | 0.99 | 0.33 |

| climate_related_economic_losses | −0.20 | −4.31 | 0.00 | −0.20 | −4.66 | 0.00 |

| raw_material_consumption | −0.003 | −1.48 | 0.15 | −0.003 | −1.85 | 0.08 |

| _cons | 72.35 | 0.84 | 0.41 | 87.49 | 1.07 | 0.29 |

| Y | Total_Green_Taxes | Energy_Taxes | ||||

|---|---|---|---|---|---|---|

| Coef. | t | p > t | Coef. | t | p > t | |

| diff_gdp_and_main_components | 0.01 | 2.38 | 0.02 | 0.01 | 2.67 | 0.01 |

| diff_human_development_index | −3131.83 | −0.14 | 0.89 | −7629.78 | −0.33 | 0.74 |

| diff_waste_generated | 0.50 | 0.35 | 0.73 | 0.52 | 0.36 | 0.72 |

| diff_waste_treatment | 0.18 | 0.12 | 0.90 | 0.22 | 0.14 | 0.89 |

| diff_net_greenhouse_gas_emission | −108.99 | −1.74 | 0.08 | −102.90 | −1.74 | 0.08 |

| diff_supply_transformation_and_c | 0.04 | 0.22 | 0.83 | 0.01 | 0.06 | 0.95 |

| primary_energy_consumption | 154.87 | 5.96 | 0.00 | 119.59 | 6.16 | 0.00 |

| diff_general_government_expendit | 0.22 | 0.34 | 0.73 | 0.21 | 0.33 | 0.74 |

| private_investment_and_gross_add | 0.23 | 1.58 | 0.11 | 0.21 | 1.79 | 0.07 |

| climate_related_economic_losses | 0.13 | 0.50 | 0.62 | 0.22 | 0.86 | 0.39 |

| raw_material_consumption | 0.01 | 1.98 | 0.05 | 0.01 | 1.99 | 0.05 |

| _cons | 424.52 | 2.50 | 0.01 | 167.56 | 1.28 | 0.20 |

| Rho | 0.76 | 0.64 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sabău-Popa, C.D.; Bele, A.M.; Bucurean, M.; Mociar-Coroiu, S.I.; Tarcă, N.N. A Panel Analysis Regarding the Influence of Sustainable Development Indicators on Green Taxes. Sustainability 2024, 16, 4072. https://doi.org/10.3390/su16104072

Sabău-Popa CD, Bele AM, Bucurean M, Mociar-Coroiu SI, Tarcă NN. A Panel Analysis Regarding the Influence of Sustainable Development Indicators on Green Taxes. Sustainability. 2024; 16(10):4072. https://doi.org/10.3390/su16104072

Chicago/Turabian StyleSabău-Popa, Claudia Diana, Alexandra Maria Bele, Mirela Bucurean, Sorina Ioana Mociar-Coroiu, and Naiana Nicoleta Tarcă. 2024. "A Panel Analysis Regarding the Influence of Sustainable Development Indicators on Green Taxes" Sustainability 16, no. 10: 4072. https://doi.org/10.3390/su16104072