Mapping Risk–Return Linkages and Volatility Spillover in BRICS Stock Markets through the Lens of Linear and Non-Linear GARCH Models

Abstract

:1. Introduction

2. Literature Review

3. Methodological Approach

3.1. Objectives of This Study

- To investigate the presence of volatility persistence in BRICS countries’ stock market returns.

- To examine the risk–return linkages in BRICS countries’ stock market returns using the GARCH-M model.

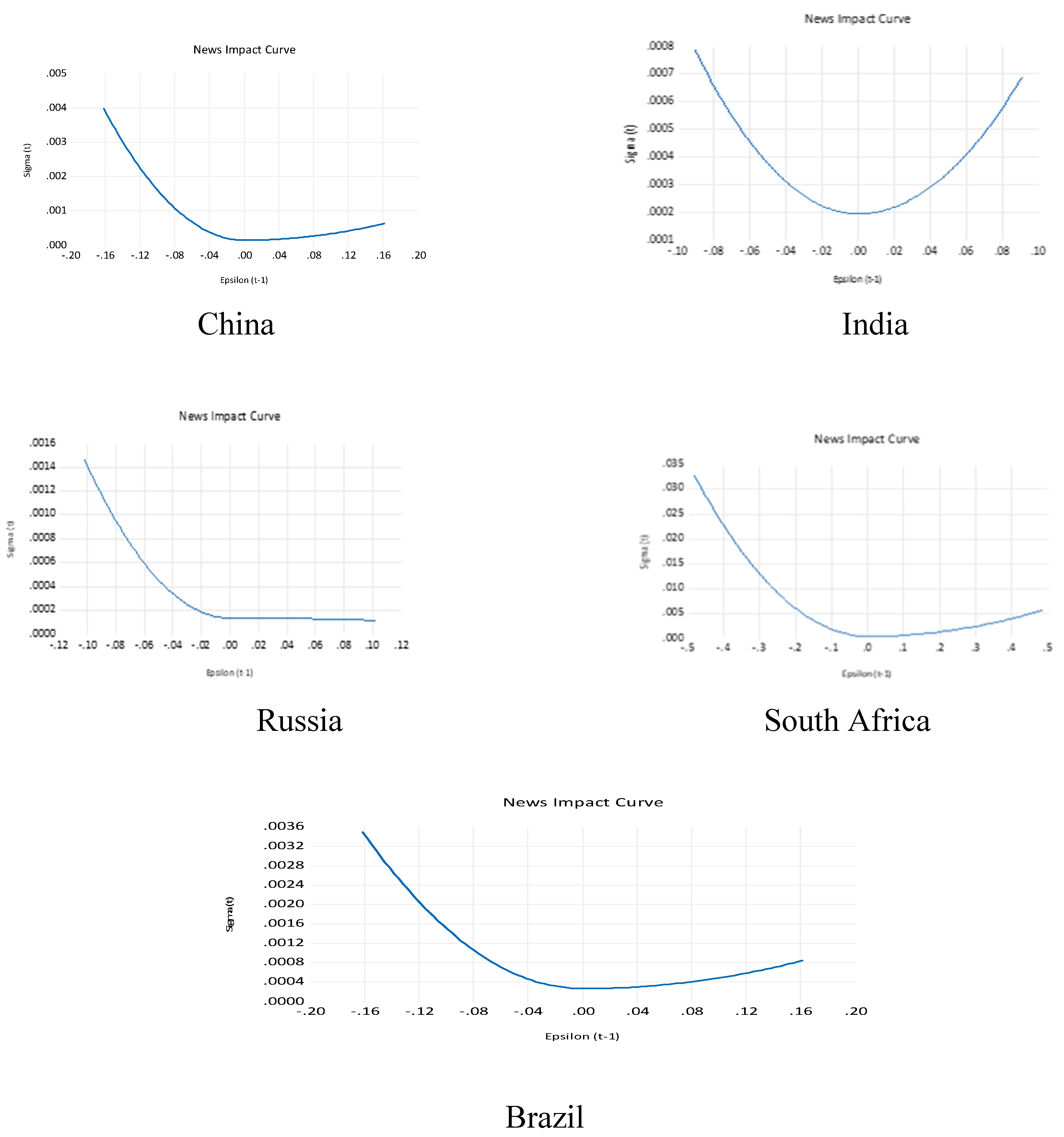

- To assess the leverage effect on BRICS countries’ stock market returns using the non-linear models.

- To identify the best-fitted model for capturing the volatility of BRICS countries’ stock market returns.

- To analyse the volatility spillover effect among BRICS countries’ stock market returns.

3.2. Sample Selection and Database

3.3. Distributional Assumption of Error Term

3.4. Model Specification

3.5. Diagnostic Test

4. Discussion and Interpretation

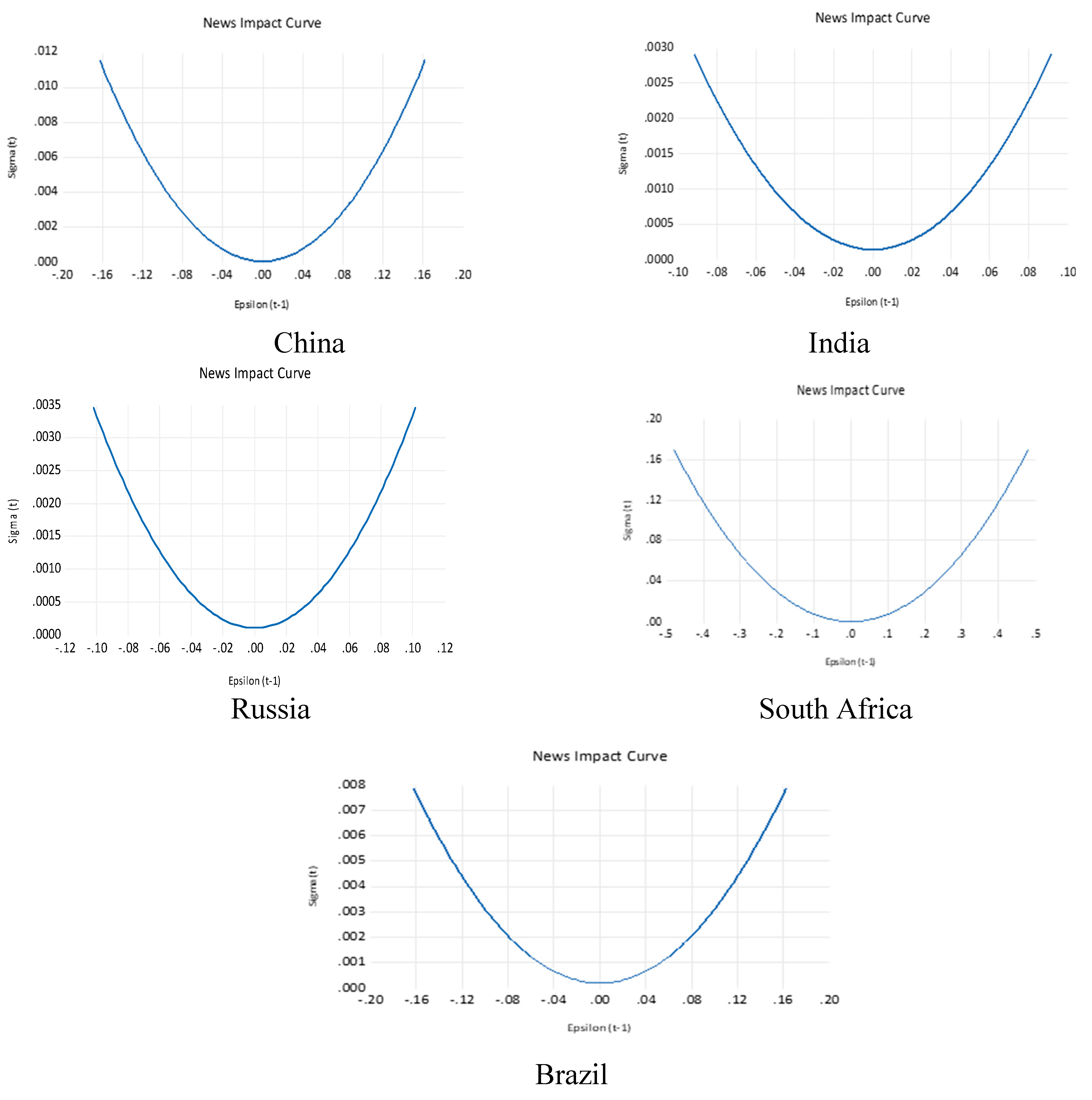

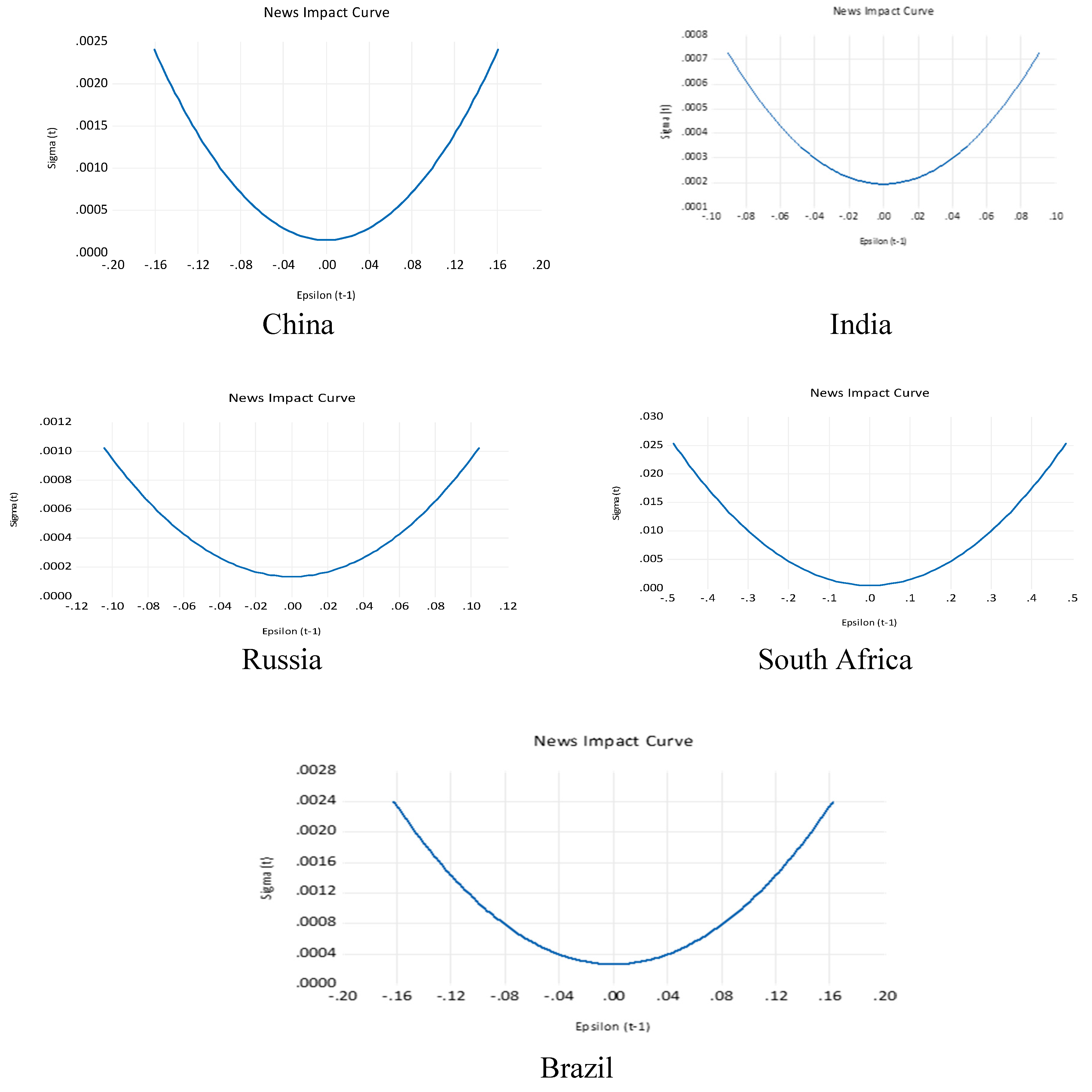

4.1. Risk–Return Relationship and Leverage Effect

4.2. Prediction of the Best-Fitted Model among BRICS Countries Stock Markets

4.3. Return and Volatility Spillover Effect among BRICS Stock Market

5. Conclusions and Policy Implications

6. Limitations and Scope for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ahmed, Rahil Irfan, Guohao Zhao, and Umme Habiba. 2021. Dynamics of Return Linkages and Asymmetric Volatility Spillovers among Asian Emerging Stock Markets. The Chinese Economy 55: 156–67. [Google Scholar] [CrossRef]

- Ahmed, Rizwan Raheem, Jolita Vveinhardt, Dalia Štreimikienė, Saghir P. Ghauri, and Muhammad Ashraf. 2018. Stock Returns, Volatility and Mean Reversion in Emerging and Developed Financial Markets. Technological and Economic Development of Economy 24: 1149–77. [Google Scholar] [CrossRef]

- Akhtar, Shahan, and Naimagt U. Khan. 2016. Modelling Volatility on the Krachi Stock Exchange, Pakistan. Journal of ASIA Business Studies 10: 253–75. [Google Scholar] [CrossRef]

- Alfreedi, A. Ajab. 2019. Shocks and Volatility Spillover between Stock Markets of Developed Countries and GCC Stock Markets. Journal of Taibah University for Science 13: 112–20. [Google Scholar] [CrossRef]

- Al-Rjoub, Samer AM, and Hussam Azzam. 2012. Financial Crises, Stock Returns and Volatility in an Emerging Stock Market: The Case of Jordan. Journal of Economic Studies 39: 178–211. [Google Scholar] [CrossRef]

- Arsalan, Tazeen, Bilal A. Chishty, Shagufta Ghouri, and Nayeem H. Ansari. 2022. Comparison of Volatility and Mean Reversion Among Developed, Developing, and Emerging Countries. Journal of Economic and Administrative Sciences. [Google Scholar] [CrossRef]

- Bagchi, Bagchi. 2017. Volatility Spillover between Crude Oil Price and Stock Markets: Evidence from BRIC Countries. International Journal of Emerging Markets 12: 352–65. [Google Scholar] [CrossRef]

- Bentes, R. Sonia. 2021. How COVID-19 has Affected Stock Market Persistence? Evidence from the G7’s. Physica A 581: 126210. [Google Scholar] [CrossRef]

- Bhar, Ramaprasad, and Biljana Nikolova. 2009. Return, Volatility, and Dynamic Correlation in the BRIC Equity Markets: An Analysis using a Bivariate EGARCH Framework. Global Finance Journal 19: 203–18. [Google Scholar] [CrossRef]

- Black, Fischer. 1976. Studies of Stock Price Volatility Changes. In Proceedings of the 1976 Meeting of the Business and Economic Statistics Section. Washington, DC: American Statistical Association, pp. 177–81. [Google Scholar]

- Bollerslev, Tim. 1986. Generalised Autoregressive Conditional Heteroscedasticy. Journal of Econometrics 31: 307–327. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Robert F. Engle, and Jeffrey M. Wooldridge. 1988. A capital asset pricing model with time-varying covariances. Journal of Political Economy 96: 116–31. [Google Scholar] [CrossRef]

- Chaudhary, Rashmi, Priti Bakshi, and Hemendra Gupta. 2020. Volatility in International Stock Markets: An Empirical Study During COVID-19. Journal of Risk and Financial Management 13: 208. [Google Scholar] [CrossRef]

- Corbet, Sorbet, Yang Hou, Yang Hu, and Les Oxley. 2022. Financial contagion among COVID-19 concept-related stocks in China. Applied Economics 54: 2439–52. [Google Scholar] [CrossRef]

- Dania, Akash, and D. K. Malhotra. 2013. Returns dynamics and global integration of BRICS stock markets. International Journal of Business and Emerging Markets 5: 217–33. [Google Scholar] [CrossRef]

- Dedi, Lidija, Burhan F. Yavas, and David McMillan. 2016. Return and Volatility Spillovers in Equity Markets: An Investigation Using Various GARCH Methodologies. Cogent Economics & Finance 4: 1–18. [Google Scholar] [CrossRef]

- De Villiers, Nadia, and Pierre J. Venter. 2022. Volatility Modelling of volatility indices: The case of Emerging Markets. In Springer Proceedings in Business and Economics. Cham: Springer International Publishing, pp. 31–46. [Google Scholar] [CrossRef]

- Dutta, Probal, Md Hasib Noor, and Anupam Dutta. 2017. Impact of Oil Volatility Shocks on Global Emerging Market Stock Returns. International Journal of Managerial Finance 13: 578–91. [Google Scholar] [CrossRef]

- Emenogu, Ngozi G., Monday O. Adenomon, and Nwaze O. Nweze. 2020. On the Volatility of Daily Returns of Toatl Nigeria Plc: Evidence from GARCH Models, Value at Risk and Backtesting. Financial Innovation 6: 1–25. [Google Scholar] [CrossRef]

- Engle, Robert F. 1982. Autoregressive Conditional Heteroscedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Engle, Robert F., and Victor K. Ng. 1993. Measuring and testing the impact of news on volatility. The Journal of Finance 48: 1749–78. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1965. The Behavior of Stock-Market Prices. The Journal of Business 38: 34–105. [Google Scholar] [CrossRef]

- Ghozzi, Bechir Ben, and Hasna Chaibi. 2021. Political Risks and Financial Markets: Emerging vs Developed Economies. EuroMed Journal of Business 17: 677–97. [Google Scholar] [CrossRef]

- Glosten, Lawrence, Ravi Jagannathan, and David E. Runkle. 1993. On the Relation Between the Expected Value and The Volatility of the Nominal Excess Return on Stocks. Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Gupta, Himani. 2024. Asymmetric Volatility in Stock Market: Evidence from Selected Export-based Countries. The Indian Economic Journal, 1–20. [Google Scholar] [CrossRef]

- Guptha, Sivakiran, and R. Prabhakar Rao. 2017. The Volatility Behaviour of Emerging BRICS Stock Market. International Journal of Management and Development Studies 6: 95–111. [Google Scholar]

- Hameed, Abid, Hammad Ashraf, and Rizwana Siddiqui. 2006. Stock Market Volatility and Weak-form Efficiency: Evidence from an Emerging Market [with Comments]. The Pakistan Development Review 45: 1029–40. [Google Scholar] [CrossRef]

- Jayasuriya, Shamila, William Shambora, and Rosemary Rossiter. 2009. Asymmetric volatility in emerging and mature markets. Journal of Emerging Market Finance 8: 25–43. [Google Scholar] [CrossRef]

- Jebran, Khalil, Shihua Chen, Irfan Ullah, and Sultan S. Mirza. 2017. Does volatility spillover among stock markets varies from normal to turbulent periods? Evidence from emerging markets of Asia. The Journal of Finance and Data Science 3: 20–23. [Google Scholar] [CrossRef]

- John, Abonongo, Francis Tabi Oduro, and Ackora-Prah J. 2016. Modelling Volatility and the Risk-Return Relationship of Some Stocks on the Ghana Stock Exchange. American Journal of Economics 6: 281–99. [Google Scholar] [CrossRef]

- Joo, B. Ahmad, Younis A. Ghulam, and Simtiha Ishaq M. Ghulam. 2023. Symmetric and asymmetric Volatility Spillover among BRICS Countries’ Stock Markets. Decision 50: 473–88. [Google Scholar] [CrossRef]

- Kao, Wei-Shun, Tzu-Chuan Kao, Chang-Cheng Changchien, Li-Hsun Wang, and Kuei-Tzu Yeh. 2018. Contagion in International Stock Markets After the Subprime Mortgage Crisis. The Chinese Economy 51: 130–53. [Google Scholar] [CrossRef]

- Ke, Jian, Liming Wang, and Louis Murray. 2010. An Empirical Analysis of the Volatility Spillover Effect Between Primary Stock Markets Abroad and China. Journal of Chinese Economic and Business Studies 8: 315–33. [Google Scholar] [CrossRef]

- Khan, Imran. 2023. An Analysis of Stock Markets Integration and Dynamics of Volatility Spillover in Emerging Nations. Journal of Economic and Administrative Sciences. [Google Scholar] [CrossRef]

- Kishore, Nawal, and Raman P. Singh. 2014. Stock Return Volatility Effect: Study of BRICS. Transnational Corporation Review 6: 406–18. [Google Scholar] [CrossRef]

- Kisinbay, Turgut. 2010. Predictive ability of Asymmetric Volatility Models at Medium Term Horizons. Applied Economics 42: 3813–29. [Google Scholar] [CrossRef]

- Kumar, Dilip, and S. Maheswaran. 2012. Modelling Asymmetry and Persistence under the Impact of Sudden Changes in the Volatility of Indian Stock Markets. IIMB Management Review 24: 123–36. [Google Scholar] [CrossRef]

- Kundu, Srikanta, and Nityananda Sarkar. 2016. Return and Volatility Interdependences in up and Down Markets Across Developed and Emerging Countries. Research in International Business and Finance 36: 297–311. [Google Scholar] [CrossRef]

- Li, Yanan, and David E. Giles. 2014. Modelling Volatility Spillover Effects Between Developed Stock Markets and Asian Emerging Stock Markets. International Journal of Finance and Economics 20: 155–77. [Google Scholar] [CrossRef]

- Lin, Zhe. 2018. Modelling and Forecasting The Stock Market Volatility of SSE Composite Index using GARCH Models. Future Generation Computer Systems 79: 960–72. [Google Scholar] [CrossRef]

- Lohani, K. Kumar. 2020. Trade Flow of India with BRICS Countries: A Gravity Model Approach. Global Business Review 25: 22–39. [Google Scholar] [CrossRef]

- Mandelbrot, Benoit. 1963. New Methods in Statistical Economics. Journal of Political Economy 71: 421–40. [Google Scholar] [CrossRef]

- Markowitz, Harry. 1952. Portfolio Selection. The Journal of Finance 7: 77–91. [Google Scholar] [CrossRef]

- Maryam, Javeria, and Ashok Mittal. 2019. An Empirical Analysis of India’s Trade in Goods with BRICS. International Review of Economics 66: 399–421. [Google Scholar] [CrossRef]

- Mensi, Walid, Ramzi Nekhili, Xuan V. Vo, and Sang H. Kang. 2021. Good and bad High-frequency Volatility Spillovers among Developed and Emerging Stock Markets. International Journal of Emerging Markets 18: 2107–32. [Google Scholar] [CrossRef]

- Naik, Maithili S., and Y. V. Reddy. 2021. India VIX and Forecasting Ability of Symmetric and Asymmetric GARCH Models. Asian Economic and Financial Review 11: 252–62. [Google Scholar] [CrossRef]

- Nasr, A. Ben, Juncal Cunado, Riza Demirer, and Rangan Gupta. 2018. Country Risk Rating and Stock Market Returns in Brazil, Russia, India, and China (BRICS) Countries: A Nonlinear Dynamic Approach. Risks 6: 94. [Google Scholar] [CrossRef]

- Nelson, Daniel B. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 59: 347–70. [Google Scholar] [CrossRef]

- Nyamongo, Morekwa Esman, and Roseline Misati. 2010. Modelling the Time-varying Volatility of Equities in Kenya. African Journal of Economic and Management Studies 1: 183–96. [Google Scholar] [CrossRef]

- Panda, Pradiptarathi, and Malabika Deo. 2014. Asymmetric cross-market volatility spillovers: Evidence from Indian equity and foreign exchange markets. Decision 41: 261–70. [Google Scholar] [CrossRef]

- Rao, Ananth. 2008. Analysis of Volatility Persistence in Middle East Emerging Equity Markets. Studies in Economics and Finance 25: 93–111. [Google Scholar] [CrossRef]

- Refai, Hisham Al, Mohamed A. Eissa, and Rami Zeitun. 2017. Asymmetric Volatility and Conditional Expected Returns. International Journal of Emerging Markets 12: 335–51. [Google Scholar] [CrossRef]

- Sabri, N. Rashid. 2004. Stock Return Volatility and Market Crisis in Emerging Economies. Review of Accounting and Finance/Review of Accounting & Finance 3: 59–83. [Google Scholar] [CrossRef]

- Sahiner, Mehmet. 2022. Forecasting Volatility in Asian Financial Markets: Evidence from Recursive and Rolling Window Methods. SN Business & Economics 2: 1–74. [Google Scholar] [CrossRef]

- Salameh, H. Mohammad, and Bashar Alzubi. 2018. An Investigation of Stock Market Volatility: Evidence from Dubai Financial Market. Journal of Economic and Administrative Sciences 34: 21–35. [Google Scholar] [CrossRef]

- Salisu, Afees A., Oluwatomisin J. Oyewole, and Ismail O. Fasanya. 2018. Modelling Return and Volatility Spillovers in Global Foreign Exchange Markets. Journal of Information and Optimization Sciences 39: 1417–48. [Google Scholar] [CrossRef]

- Setiawan, Budi, Marwa B. Abdallah, Maria Fekete-Farkas, Robert J. Nathan, and Zoltan Zeman. 2021. GARCH (1,1) Models ans Analysis of Stock Market Turmoil during COVID-19 Outbreak in Emerging and Developed Market. Journal of Risk and Financial Management 14: 576. [Google Scholar] [CrossRef]

- Sharma, Sudhi, Vaibhav Aggarwal, and Miklesh P. Yadav. 2021. Comparison of Linear and Non-linear GARCH Models for Forecasting Volatility of Select Emerging Countries. Journal of Advances in Management Research 18: 526–47. [Google Scholar] [CrossRef]

- Singhania, Monica, and Jugal Anchalia. 2013. Volatility in Asian Stock Markets and Global Financial Crisis. Journal of Advances in Management Research 10: 333–51. [Google Scholar] [CrossRef]

- Singhania, Monica, and Shachi Prakash. 2014. Volatility and Cross Correlations of Stock Markets in SAARC Nations. South Asian Journal of Global Business Research 3: 154–69. [Google Scholar] [CrossRef]

- Srivastava, Aman. 2008. Volatility of Indian Stock Market: An Emperical Evidence. Asia-Pacific Business Review 4: 53–61. [Google Scholar] [CrossRef]

- Uludag, B. Kirkulak, and Muzammil Khurshid. 2019. Volatility Spillover from The Chinese Stock Market to E7 and G7 Stock Markets. Journal of Economic Studies 46: 90–105. [Google Scholar] [CrossRef]

- Wang, Yun, Abeyratna Gunasekarage, and David M. Power. 2005. Return and Volatility Spillovers from Developed to Emerging Capital Markets: The Case of South Asia. In Contemporary Studies in Economic and Financial Analysis. Leeds: Emerald Group Publishing Limited, pp. 139–66. [Google Scholar] [CrossRef]

- Yıldırım, Hakan, and Festus V. Bekun. 2023. Predicting Volatility of Bitcoin Returns with ARCH, GARCH, and EGARCH Models. Future Business Journal 9: 2–8. [Google Scholar] [CrossRef]

- Zhang, Ping, Yezhou Sha, and Yifan Xu. 2021. Stock Market Volatility Spillovers in G7 and BRIC. Emerging Markets Finance and Trade 57: 2107–19. [Google Scholar] [CrossRef]

- Zhang, Weiping, Xintian Zhuang, and Dongmei Wu. 2020. Spatial Connectedness of Volatility Spillovers in G20 Stock Markets: Based on Block Models Analysis. Finance Research Letters 34: 101274. [Google Scholar] [CrossRef]

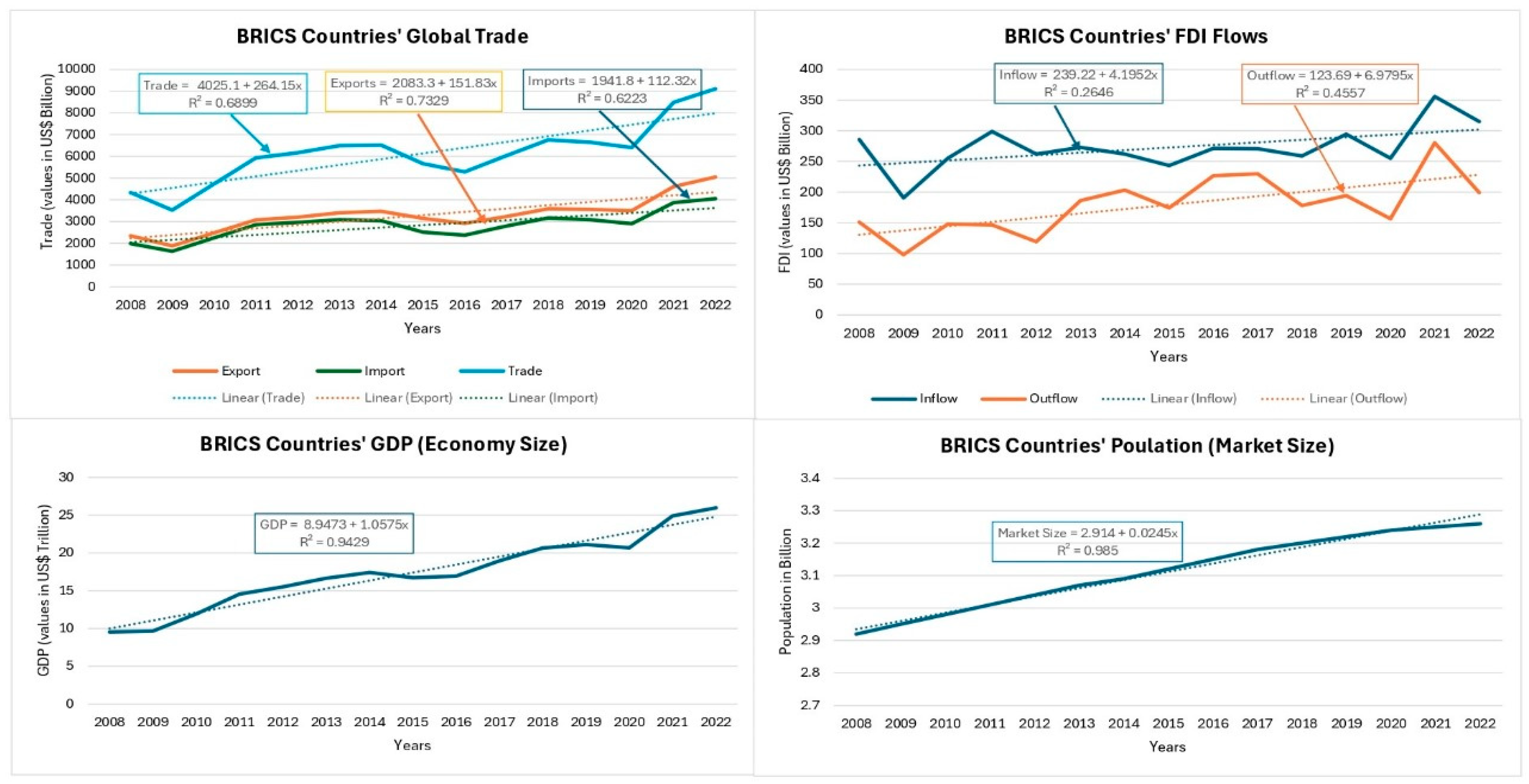

| Years | Trade (bn) | FDI Inflows (Bn) | GDP (Tn) | Population (Bn) | Intra-BRICS Trade (%) | Market Capitalization * (tn) | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| BRICS | World | BRICS | World | BRICS | World | BRICS | World | BRICS | World | ||

| 2008 | 4337.12 (13.21) | 32,836.37 | 285.54 (9.63) | 1454.36 | 9.55 (14.90) | 64.11 | 2.92 (42.92) | 6.81 | 7.23 | 7.84 (15.52) | 47.47 |

| 2022 | 9111.08 (18.16) | 50,189.72 | 314.91 (23.95) | 1314.91 | 25.99 (25.78) | 100.83 | 3.26 (40.91) | 7.98 | 10.40 | 17.57 (18.75) | 93.69 |

| CAGR | 5.45 | 3.08 | 0.70 | −0.72 | 7.41 | 3.29 | 0.79 | 1.13 | --- | 7.61 | 6.38 |

| Index | ADF Test | PP Test | ||

|---|---|---|---|---|

| Trend | Trend and Intercept | Trend | Trend and Intercept | |

| t-Statistic | t-Statistic | Adj. t-Stat | Adj. t-Stat | |

| RTSI | −61.714 * | 61.710 * | 61.727 * | 61.722 * |

| FTSE | −63.197 * | −63.189 * | −63.552 * | −63.543 * |

| Nifty | −60.935 * | −60.928 * | −60.927 * | −60.928 * |

| SSE | −60.827 * | −60.822 * | −60.827 * | −60.821 * |

| BOVESPA | −66.386 * | −66.388 * | −66.390 * | −66.392 * |

| Index/Statistics | RTSI | FTSE | Nifty | SSE | BOVESPA |

|---|---|---|---|---|---|

| X-Squared Values | 590,129.0 | 6516.820 | 45,987.38 | 5547.347 | 19,021.53 |

| Prob. Values | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| Index/Statistics | RTSI | FTSE | Nifty | SSE | BOVESPA |

|---|---|---|---|---|---|

| ARCH-LM test Statistic | 257.1276 | 126.4262 | 69.24618 | 176.6656 | 598.6967 |

| Prob. Chi-Square | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

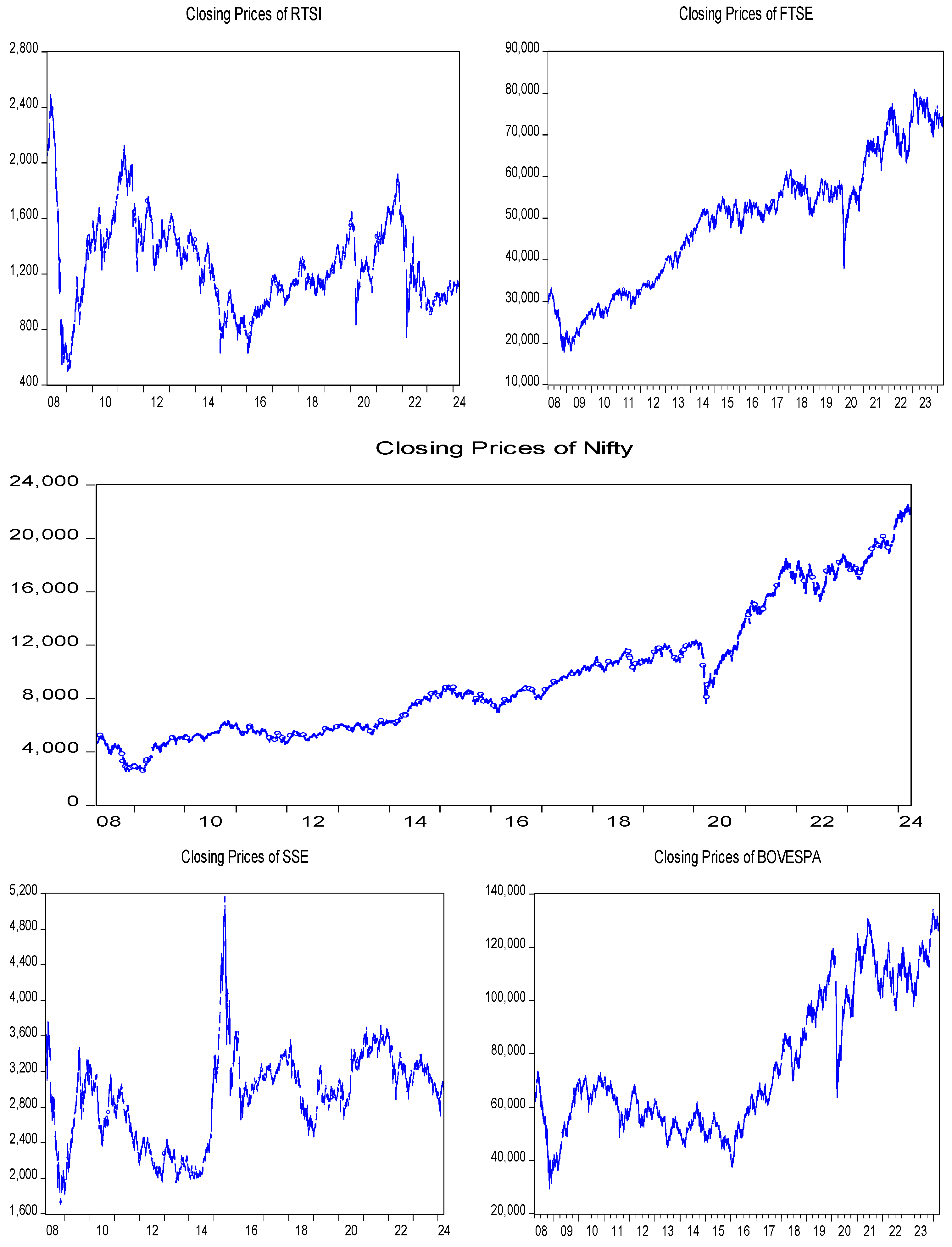

| Country | Indices | N | Mean | Min. | Max. | Std. Dev. | Skew | Kurt |

|---|---|---|---|---|---|---|---|---|

| Russia | RTSI | 4007 | −0.00015 | −0.48292 | 0.23204 | 0.02295 | −2.517243 | 62.2389 |

| South Africa | FTSE | 3997 | 0.00023 | −0.10227 | 0.09048 | 0.01210 | −0.256194 | 9.23440 |

| India | Nifty | 3959 | 0.00039 | −0.13904 | 0.16334 | 0.01284 | −0.262342 | 19.6885 |

| China | SSE | 3890 | −2.33 × 105 | −0.08873 | 0.09034 | 0.01442 | −0.574847 | 8.73617 |

| Brazil | BOVESPA | 3961 | 0.00018 | −0.15993 | 0.13677 | 0.01701 | −0.426321 | 13.7017 |

| Parameters | RTSI | FTSE | NIFTY | SSE | BOVESPA |

|---|---|---|---|---|---|

| Mean Equation Constant (µ) | 0.000754 * | 0.000413 * | 0.000431 * | −0.000170 | 0.000217 |

| Variance Equation Constant (c) | 0.000257 * | 0.000104 * | 9.84 × 105 * | 0.000148 * | 0.000194 * |

| ARCH Term α | 0.327868 * | 0.324399 * | 0.433929 * | 0.327868 * | 0.291403 * |

| Parameters | RTSI | FTSE | NIFTY | SSE | BOVESPA |

|---|---|---|---|---|---|

| Mean Equation Constant (µ) | 0.000584 ** | 0.000468 * | 0.000681 * | −2.41 × 106 | 0.000489 ** |

| Variance Equation Constant (c) | 5.56 × 106 * | 1.99 × 106 * | 6.32 × 106 * | 0.000135 * | 6.32 × 106 * |

| ARCH Term α | 0.105867 * | 0.081130 * | 0.086815 * | 0.150000 * | 0.081130 * |

| GARCH term β | 0.886934 * | 0.903966 * | 0.905193 * | 0.600000 * | 0.903966 * |

| Persistence (α + β) | 1.03548 | 0.985096 | 0.992008 | 0.75 | 0.985096 |

| Parameters | RTSI | FTSE | NIFTY | SSE | BOVESPA |

|---|---|---|---|---|---|

| Mean Equation Constant (µ) | 2.33 × 105 | 0.000111 | 0.000529 * | 2.33 × 105 | 0.000168 |

| Risk premium λ | 0.783788 | 3.960830 *** | 1.861960 | 0.423704 | 1.735242 |

| Variance Equation Constant (c) | 5.61 × 106 * | 2.02 × 106 * | 1.40 × 106 * | 1.23 × 106 * | 6.35 × 106 * |

| ARCH Term α | 0.106063 * | 0.081463 * | 0.087213 * | 0.065318 * | 0.081524 * |

| GARCH term β | 0.886588 * | 0.903375 * | 0.904745 * | 0.929615 * | 0.891748 * |

| Persistence (α + β) | 0.994651 | 0.984838 | 0.991958 | 0.994633 | 0.973272 |

| Parameters | RTSI | FTSE | NIFTY | SSE | BOVESPA |

|---|---|---|---|---|---|

| Mean Equation Constant | −0.000116 | 3.16 × 105 | 0.000367 * | 3.37 × 105 | 0.000118 |

| Variance Equation Constant | −0.250792 * | −0.245044 * | −0.257286 * | −0.205928 * | −0.312047 * |

| ARCH Term α | 0.149606 * | 0.105574 * | 0.152779 * | 0.157227 * | 0.147723 * |

| GARCH Term β | 0.982870 * | 0.982192 * | 0.984814 * | 0.989852 * | 0.976677 * |

| Asymmetry γ | −0.092590 * | −0.116614 * | −0.089785 * | −0.017192 * | −0.076977 * |

| Persistence (α + β) | 1.132476 | 1.087766 | 1.137593 | 1.147079 | 1.1244 |

| Parameters | RTSI | FTSE | NIFTY | SSE | BOVESPA |

|---|---|---|---|---|---|

| Mean Equation Constant | 7.57 × 105 | 8.47 × 10 | 0.000363 * | 3.08 × 105 | 0.000179 |

| Variance Equation Constant | 5.50 × 106 * | 1.84 × 106 * | 1.75 × 106 * | 1.28 × 106 * | 6.50 × 106 * |

| ARCH Term α | 0.022247 * | −0.002094 | 0.018759 * | 0.059620 * | 0.022128 * |

| GARCH term β | 0.906231 * | 0.922443 * | 0.905076 * | 0.928545 * | 0.898608 * |

| Asymmetry γ | 0.116489 * | 0.129361 * | 0.128014 * | 0.012381 * | 0.102213 * |

| Persistence (α + β + γ/2) | 0.9867225 | 0.9850295 | 0.987812 | 0.9943555 | 0.9718425 |

| Particulars | ARCH | GARCH | GARCH-M | EGARCH | TGARCH |

|---|---|---|---|---|---|

| Russia | |||||

| LL | 9881.053 | 10,567.34 | 10,567.92 | 10,618.32 | 10,619.70 |

| AIC | −4.931130 | −5.273262 | −5.273049 | −5.298213 | −5.298902 |

| SIC | −4.924844 | −5.265405 | −5.263620 | −5.288783 | −5.289473 |

| South Africa | |||||

| LL | 12,126.47 | 12,589.18 | 12,591.06 | 12,656.80 | 12,650.70 |

| AIC | −6.067301 | −6.298390 | −6.298831 | −6.331734 | −6.328679 |

| SIC | −6.061002 | −6.290516 | −6.289382 | −6.322285 | −6.319230 |

| India | |||||

| LL | 11,980.47 | 12,523.50 | 12,524.18 | 12,580.84 | 12,573.02 |

| AIC | −6.051777 | −6.325669 | −6.325510 | −6.354612 | −6.350188 |

| SIC | −6.045427 | −6.317731 | −6.315985 | −6.350759 | −6.340662 |

| China | |||||

| LL | 11,139.86 | 10,756.17 | 11,659.21 | 11,658.38 | 11,660.21 |

| AIC | −5.726852 | −5.529016 | −5.992909 | −5.992481 | −5.993420 |

| SIC | −5.720407 | −5.520960 | −5.983242 | −5.982814 | −5.983753 |

| Brazil | |||||

| LL | 10,825.25 | 11,167.82 | 11,168.45 | 11,192.10 | 11,198.07 |

| AIC | −5.465276 | −5.637786 | −5.637603 | −5.649547 | −5.652560 |

| SIC | −5.458928 | −5.629852 | −5.628082 | −5.640026 | −5.643039 |

| Parameters | Russia | South Africa | India | China | Brazil |

|---|---|---|---|---|---|

| Mean Equation Constant (µ) | −0.0001 | 0.0002 | 0.0004 * | 1.69 × 105 | 0.0002 |

| Russia | ------------- | 0.0002 | 0.0004 ** | 0.0002 | −7.57 × 105 |

| South Africa | 0.0003 | ------------ | −0.0002 | 8.20 × 106 | 0.0002 |

| India | 0.0006 ** | −0.0004 | ------------- | 2.22 × 106 | 0.0006 * |

| China | 5.84 × 105 | −3.69 × 106 | −0.0001 | ----------- | −0.0002 |

| Brazil | −6.83 × 105 | 0.000105 | 0.0004 ** | −0.0001 | ------------- |

| Parameters | Russia | South Africa | India | China | Brazil |

|---|---|---|---|---|---|

| Variance Equation Constant (Ѡ) | −0.2562 * | −0.2235 | −0.2648 * | −0.2264 * | −0.3437 * |

| ARCH Term α | 0.1349 * | 0.0878 | 0.1438 * | 0.1530 * | 0.1443 * |

| GARCH Term β | 0.9793 * | 0.9823 | 0.9823 * | 0.9858 * | 0.9716 * |

| Asymmetry γ | −0.2562 * | −0.2235 | −0.2648 * | −0.2264 * | −0.3437 * |

| r2t-1(Russia) | --------------- | 1.13 × 106 * | −4.90 × 107 | −3.89 108 | 5.83 × 108 |

| r2t-1(South Africa) | 1.63 × 107 | -------------- | −2.55 × 107 | 5.84 × 108 | −5.12 × 107 ** |

| r2t-1(India) | −7.38 × 107 * | −3.20 × 107 ** | --------------- | −6.90 × 107 * | 4.36 × 107 ** |

| r2t-1(China) | −1.01 × 106 * | −4.73 × 107 * | −1.21 × 106 * | -------------- | −9.60 × 107 * |

| r2t-1(Brazil) | 8.41× 107 *** | −7.63 × 107 *** | 1.23 × 106 ** | −6.50 × 107 | -------------- |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Singh, R.K.; Singh, Y.; Kumar, S.; Kumar, A.; Alruwaili, W.S. Mapping Risk–Return Linkages and Volatility Spillover in BRICS Stock Markets through the Lens of Linear and Non-Linear GARCH Models. J. Risk Financial Manag. 2024, 17, 437. https://doi.org/10.3390/jrfm17100437

Singh RK, Singh Y, Kumar S, Kumar A, Alruwaili WS. Mapping Risk–Return Linkages and Volatility Spillover in BRICS Stock Markets through the Lens of Linear and Non-Linear GARCH Models. Journal of Risk and Financial Management. 2024; 17(10):437. https://doi.org/10.3390/jrfm17100437

Chicago/Turabian StyleSingh, Raj Kumar, Yashvardhan Singh, Satish Kumar, Ajay Kumar, and Waleed S. Alruwaili. 2024. "Mapping Risk–Return Linkages and Volatility Spillover in BRICS Stock Markets through the Lens of Linear and Non-Linear GARCH Models" Journal of Risk and Financial Management 17, no. 10: 437. https://doi.org/10.3390/jrfm17100437