Life Cycle Assessment and Cost–Benefit Analysis as Combined Economic–Environmental Assessment Tools: Application to an Anaerobic Digestion Plant

Abstract

:1. Introduction

2. Materials and Methods

2.1. Case Study

2.2. Life Cycle Assessment (LCA)

2.3. Cost–Benefit Analisys (CBA)

Sensitivity Analysis

3. Results

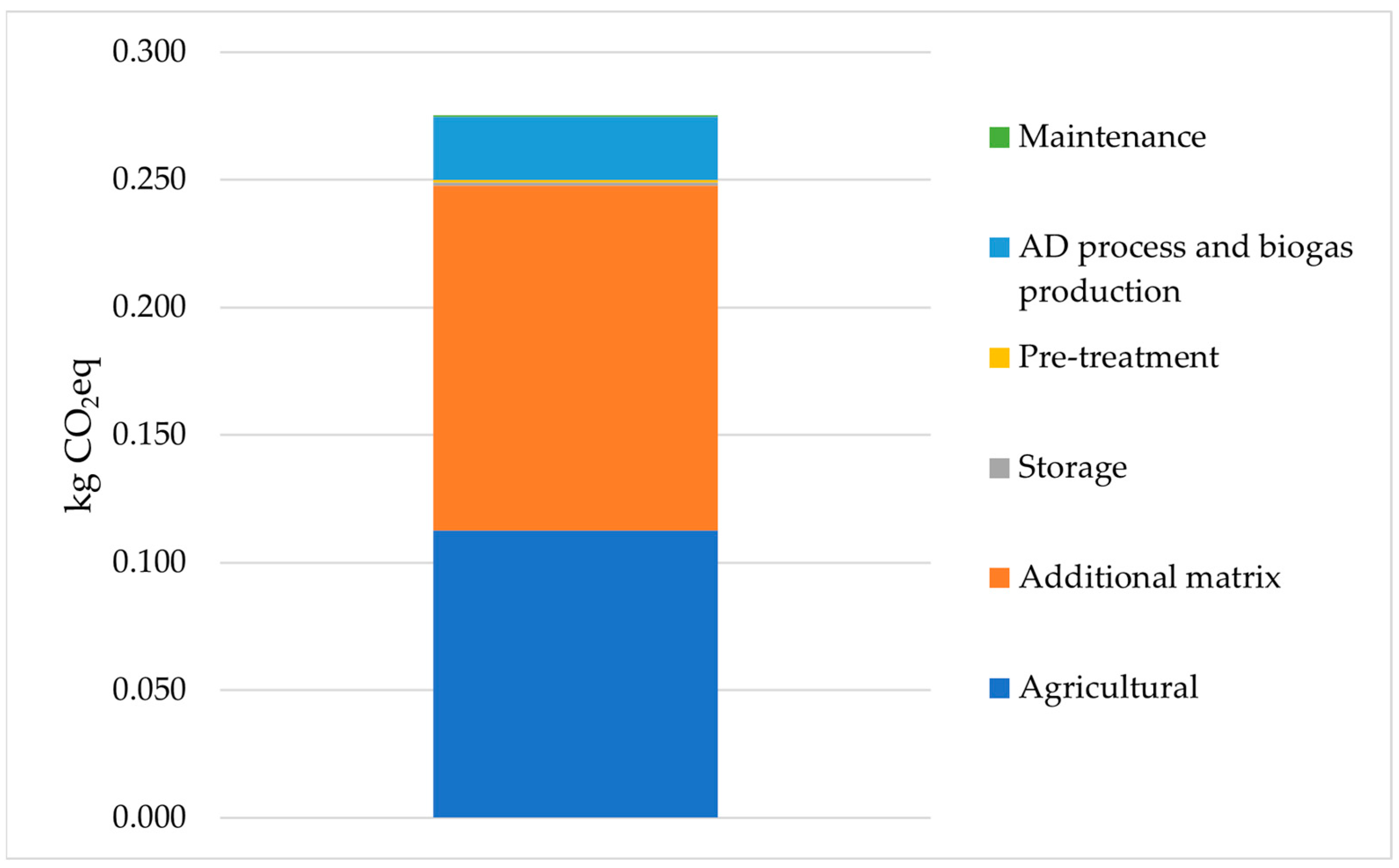

3.1. Environmental Performance

3.2. Economic Performance

3.2.1. Financial and Economic Analysis

3.2.2. Sensitivity Analysis

4. Discussion

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- International Energy Agency (IEA). Net Zero by 2050—A Roadmap for the Global Energy Sector. 2021. Available online: https://unfccc.int/documents/278467?gclid=CjwKCAjw9J2iBhBPEiwAErwpeXG32pZ5wD4fOe9idJF1AaSeYPU4BO8OalvQ37FpW-1MRm_G1oC1rBoCQRMQAvD_BwE (accessed on 20 February 2023).

- International Energy Agency (IEA). World Energy Outlook 2022. 2022. Available online: https://www.iea.org/reports/world-energy-outlook-2020?mode=overview (accessed on 13 March 2023).

- International Energy Agency (IEA). Global Energy Review: CO2 Emissions in 2021 Global Emissions Rebound Sharply to Highest Ever Level. 2021. Available online: https://www.iea.org/reports/global-energy-review-co2-emissions-in-2021-2 (accessed on 20 February 2023).

- Wei, W.; Mushtaq, Z.; Sharif, M.; Zeng, X.; Wan-Li, Z.; Qaisrani, M.A. Evaluating the Coal Rebound Effect in Energy Intensive Industries of China. Energy 2020, 207, 118247. [Google Scholar] [CrossRef]

- Mushtaq, Z.; Wei, W.; Jamil, I.; Sharif, M.; Chandio, A.A.; Ahmad, F. Evaluating the Factors of Coal Consumption Inefficiency in Energy Intensive Industries of China: An Epsilon-Based Measure Model. Resour. Policy 2022, 78, 102800. [Google Scholar] [CrossRef]

- European Commission (EC). European Green Deal. 2022. Available online: https://www.consilium.europa.eu/en/policies/green-deal/ (accessed on 20 February 2023).

- Italia Domani. Piano Nazionale di Ripresa e Resilienza #Nextgenerationitalia. 2022. Available online: https://www.italiadomani.gov.it/content/sogei-ng/it/it/home.html (accessed on 3 March 2023).

- Eurostat. From Where Do We Import Energy? 2022. Available online: https://ec.europa.eu/eurostat/cache/infographs/energy/bloc-2c.html (accessed on 20 February 2023).

- Harvey, F.; Ukraine War Prompts European Reappraisal of Its Energy Supplies. The Guardian 2022. Available online: https://www.theguardian.com/environment/2022/mar/04/ukraine-war-european-reappraisal-energy-supplies-coal-renewables (accessed on 11 March 2023).

- ANSA. Greenpeace, Ecco Quanto Inquina il Carbone Europeo. Wwf, in Italia 12 Centrali Che Possono Essere Chiuse Subito. 2015. Available online: https://www.ansa.it/canale_ambiente/notizie/inquinamento/2015/12/05/greenpeace-ecco-quanto-inquina-il-carbone-europeo_7c6c426c-40f8-4384-a649-7f590067b6b8.html#:~:text=Una%20quota%20modesta%2C%20osserva%20Greenpeace,e%20del%20cemento%20messi%20insieme (accessed on 11 March 2023).

- Italy for Climate. La Corsa Delle Regioni Verso la Neutralità Climatica. Il Primo Ranking Delle Regioni Italiane Sul Clima. 2021. Available online: www.italyforclimate.org (accessed on 11 March 2023).

- De Luca, E. Il Contributo Delle Tecnologie Energetiche Alla Decarbonizzazione. 2020. Available online: https://www.eai.enea.it/archivio/energia-e-green-new-deal-sommario/il-contributo-delle-tecnologie-energetiche-alla-decarbonizzazione.html (accessed on 20 February 2023).

- Enel. Quali Sono le Energie Rinnovabili in Italia, Qual è la più Diffusa e Quanta Energia Producono. 2023. Available online: https://www.enelgreenpower.com/it/learning-hub/energie-rinnovabili/italia (accessed on 13 March 2023).

- Tuscany Region. Documento di Economia e Finanza Regionale. 2020. Available online: https://www.regione.toscana.it/-/documento-di-economia-e-finanza-regionale-2022 (accessed on 11 March 2023).

- Legambiente. Comuni Rinnovabili, Sole, Vento, Acqua, Terra e Biomasse, lo Scenario Della Generazione Distribuita nel Territorio, Toscana. 2018. Available online: https://www.comunirinnovabili.it/comuni-rinnovabili-2018-edizioni-regionali/ (accessed on 11 March 2023).

- National Geographic. Biomass Energy. 2022. Available online: https://education.nationalgeographic.org/resource/biomass-energy (accessed on 20 February 2023).

- Silva Ortiz, P.; Flórez-Orrego, D.; de Oliveira Junior, S.; Maciel Filho, R.; Osseweijer, P.; Posada, J. Unit Exergy Cost and Specific CO2 Emissions of the Electricity Generation in the Netherlands. Energy 2020, 208, 118279. [Google Scholar] [CrossRef]

- Nati, C.; Genesio, L.; Picchi, G.; Sala, C. Digestori anaerobici di biomasse. In Decarbonizzazione Dell’economia Italiana. Il Catalogo Delle Tecnologie Energetiche; Sanson, A., Giuffrida, L.G., Eds.; ENEA: Rome, Italy, 2017; p. 232. [Google Scholar]

- IEA Bioenergy. Fossil vs Biogenic CO2 Emissions. 2023. Available online: https://www.ieabioenergy.com/iea-publications/faq/woodybiomass/biogenic-co2/ (accessed on 20 February 2023).

- Intergovernmental Panel on Climate Change (IPCC). AR5 Climate Change 2014: Mitigation of Climate Change. 2014. Available online: https://www.ipcc.ch/report/ar5/wg3/ (accessed on 20 February 2023).

- Adam, G.; Mottet, A.; Lemaigre, S.; Tsachidou, B.; Trouvé, E.; Delfosse, P. Fractionation of anaerobic digestates by dynamic nanofiltration and reverse osmosis: An industrial pilot case evaluation for nutrient recovery. J. Environ. Chem. Eng. 2018, 6, 6723–6732. [Google Scholar] [CrossRef]

- Ellen MacArthur Foundation. Circulate Products and Materials. 2022. Available online: https://ellenmacarthurfoundation.org/circulate-products-and-materials (accessed on 20 February 2023).

- Burg, V.; Rolli, C.; Schnorf, V.; Scharfy, D.; Anspach, V.; Bowman, G. Agricultural Biogas Plants as a Hub to Foster Circular Economy and Bioenergy: An Assessment Using Substance and Energy Flow Analysis. Resour. Conserv. Recycl. 2023, 190, 106770. [Google Scholar] [CrossRef]

- Seglah, P.A.; Neglo, K.A.W.; Wang, H.; Cudjoe, D.; Kemausuor, F.; Gao, C.; Bi, Y.; Wang, Y. Electricity Generation in Ghana: Evaluation of Crop Residues and the Associated Greenhouse Gas Mitigation Potential. J. Clean. Prod. 2023, 395, 136340. [Google Scholar] [CrossRef]

- Municipality of Grosseto. Monitoraggio Delle Emissioni d Gas Serra Nel Comune di Grosseto. 2020. Available online: https://new.comune.grosseto.it/web/comunicati/monitoraggio-dei-gas-serra-approvato-lo-schema-di-convenzione-con-luniversita-di-siena/ (accessed on 20 February 2023).

- Ruiz, D.; San Miguel, G.; Corona, B.; Gaitero, A.; Domínguez, A. Environmental and economic analysis of power generation in a thermophilic biogas plant. Sci. Total Environ. 2018, 633, 1418–1428. [Google Scholar] [CrossRef] [PubMed]

- Ascher, S.; Watson, I.; Wang, X.; You, S. Township-based bioenergy systems for distributed energy supply and efficient household waste re-utilisation: Techno-economic and environmental feasibility. Energy 2019, 181, 455–467. [Google Scholar] [CrossRef]

- Angouria-Tsorochidou, E.; Teigiserova, D.A.; Thomsen, M. Environmental and economic assessment of decentralized bioenergy and biorefinery networks treating urban biowaste. Resour. Conserv. Recycl. 2022, 176, 105898. [Google Scholar] [CrossRef]

- Bruno, M.; Marini, M.; Angouria-Tsorochidou, E.; Pulselli, F.M.; Thomsen, M. Ex ante Life Cycle Assessment and Environmental Cost-Benefit Analysis of an anaerobic digester in Italy. Clean. Waste Syst. 2022, 3, 100021. [Google Scholar] [CrossRef]

- European Commission. ANNEX to the Proposal for a Council Implementing Decision on the Approval of the Assessment of the Recovery and Resilience Plan for Italy. 2021. Available online: https://data.consilium.europa.eu/doc/document/ST-10110-2021-ADD-1/en/pdf (accessed on 14 April 2023).

- United States Environmental Protection Agency (EPA). Available online: https://sor.epa.gov/sor_internet/registry/termreg/searchandretrieve/glossariesandkeywordlists/search.do?details=&glossaryName=Lifecycle%20Assessment%20Glossary#:~:text=Definition%3A%20The%20background%20data%20include,and%20operations%20are%20not%20identified (accessed on 13 March 2023).

- Edwards, J.; Othman, M.; Crossin, E.; Burn, S. Anaerobic co-digestion of municipal food waste and sewage sludge: A comparative life cycle assessment in the context of a waste service provision. Bioresour. Technol. 2017, 223, 237–249. [Google Scholar] [CrossRef]

- UNI EN ISO 14040; Environmental Management e Life Cycle Assessment e Principles and Framework. International Organization for Standardization (ISO): London, UK, 2006.

- PRé Consultants. SimaPro 9.1.1. 2022. Available online: https://simapro.com/ (accessed on 13 February 2023).

- Ecoinvent. 2022. Available online: https://ecoinvent.org/ (accessed on 13 February 2023).

- Consiglio per la Ricerca in Agricoltura e L’analisi Dell’economia Agraria (CREA); Libera Associazione Agricoltori Cremonesi; Confagricoltura Brescia. Mais: Come Produrre Trinciato di Qualità. 2019. Available online: https://www.crea.gov.it/documents/43052/0/3.%20Volume%20trinciato%20mais_Bergamo.pdf (accessed on 13 February 2023).

- Gioanas, E.M. Compost da Digestato: Valutazioni Agronomiche e con LCA. Master’s Thesis, University of Torino, Torino, Italy, 2017. [Google Scholar]

- Cancila, E.; Orecchini, F.; Zecca, F. Oltre il PIL. I Nuovi Indicatori del Benessere e la Sostenibilità Dello Sviluppo. 2010. Available online: https://cipesalute.org/cedo/allegati/3408-Oltre_il_Pil.pdf (accessed on 15 February 2023).

- Levin, H.M.; McEwan, P.J. Cost-Effectiveness Analysis: Methods and Applications, 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2001. [Google Scholar]

- Florio, M.; Tracogna, A.; Maffii, S.; Levarlet, M.F.; Genco, M.; Finzi, U.; Vignetti, S. Guida All’analisi Costi-Benefici dei Progetti di Investimento, 2nd ed.; Publications Office of the European Union: Luxembourg, 2003. [Google Scholar]

- Sartori, D.; Catalano, G.; Genco, M.; Pancotti, C.; Sirtori, E.; Vignetti, S.; Del Bo, C. Guida All’analisi Costi-Benefici dei Progetti D’investimento. Strumento di Valutazione Economica per la Politica di Coesione 2014–2020; Casalini Libri: Fiesole, Italy, 2014. [Google Scholar]

- Natale, F. I Progetti Generatori di Entrate Nella Valutazione Degli Investimenti Pubblici. 2019. Available online: https://www.unisalento.it/documents/20152/208192/I+progetti+generatori+di+entrate+nella+valutazione+degli+investimenti+pubblici.pdf/a418f926-9c0b-f215-b3d5-5ed0ba006fcf?version=1.0 (accessed on 11 March 2023).

- Reniers, G.; Talarico, L.; Paltrinieri, N. Cost-Benefit Analysis of Safety Measures. In Dynamic Risk Analysis in the Chemical and Petroleum Industry: Evolution and Interaction with Parallel Disciplines in the Perspective of Industrial Application; Butterworth-Heinemann: Oxford, UK, 2016; pp. 195–205. [Google Scholar]

- Huang, J.; Tong, J.; Wang, P.; Zheng, X. Application and Comparison of NPV and IRR Methods in the Company Investment Decision. In Proceedings of the 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022), Zhuhai, China, 14–16 January 2022. [Google Scholar]

- Utilitalia federazione utilities. Schema di Decreto Legislativo Recante Attuazione Della Direttiva (UE) 2018/2001 Sulla Promozione Dell’uso di Energia da Fonti Rinnovabili Atto del Governo Sottoposto a Parere Parlamentare n. 292. 2021. Available online: https://www.senato.it/application/xmanager/projects/leg18/attachments/documento_evento_procedura_commissione/files/000/417/101/2021_09_23_Utilitalia.pdf (accessed on 11 March 2023).

- Tuscany Region. Analisi Dell’impatto Della Regolamentazione Manuale di Pratiche. 2009. Available online: https://www.regione.toscana.it/documents/10180/727277/Manuale+AIR.pdf/22e6ca00-075d-49e4-ac66-ecb493f9c4b8 (accessed on 11 March 2023).

- Gestore dei Servizi Energetici (GSE). Regolamento Operativo per L’accesso agli Incentivi del DM 4 luglio 2019. 2022. Available online: https://www.gse.it/servizi-per-te/news/fer-elettriche-regolamento-operativo-per-l-accesso-agli-incentivi-del-dm-4-luglio-2019-e-apertura-dei-bandi (accessed on 15 February 2023).

- Lorenzoni, A.; Bano, L. I Costi di Generazione di Energia Elettrica da Fonti Rinnovabili. 2007. Available online: https://www.astrid-online.it/static/upload/protected/Stud/Studio-Aper_Universit--Padova_25_10_07.pdf (accessed on 11 March 2023).

- D.P.R. n. 633. Testo Unico Iva. 1972. Available online: https://www.altalex.com/documents/codici-altalex/2019/01/25/decreto-iva (accessed on 11 March 2023).

- Maiolo, S.; Scandizzo, P.L. La valutazione economica nell’analisi costi benefici: Una stima dei prezzi ombra attraverso le tavole Input-Output. In RIV: Rassegna Italiana di Valutazione; Digital Casalini: Fiesole, Italy, 2005; Volume 32. [Google Scholar]

- ISPI (Istituto per gli Studi di Politica Internazionale) Data Lab. Crisi Energetica: L’Italia è Diversa? 2022. Available online: https://www.ispionline.it/it/pubblicazione/crisi-energetica-litalia-e-diversa-33404 (accessed on 15 February 2023).

- Fusi, A.; Bacenetti, J.; Fiala, M.; Azapagic, A. Life cycle environmental impacts of electricity from biogas produced by anaerobic digestion. Front. Bioeng. Biotechnol. 2016, 4, 26. [Google Scholar] [CrossRef]

- Sovacool, B.K. Valuing the greenhouse gas emissions from nuclear power: A critical survey. Energy Policy 2008, 36, 2950–2963. [Google Scholar] [CrossRef]

- Pulselli, R.M.; Marchi, M.; Neri, E.; Marchettini, N.; Bastianoni, S. Carbon accounting framework for decarbonisation of European city neighbourhoods. J. Clean. Prod. 2019, 208, 850–868. [Google Scholar] [CrossRef]

- Pulselli, R.M.; Maccanti, M.; Bruno, M.; Sabbetta, A.; Neri, E.; Patrizi, N.; Bastianoni, S. Benchmarking Marine Energy Technologies Through LCA: Offshore Floating Wind Farms in the Mediterranean. Front. Energy Res. 2022, 10, 902021. [Google Scholar] [CrossRef]

- Bruno, M.; Maccanti, M.; Pulselli, R.M.; Sabbetta, A.; Neri, E.; Patrizi, N.; Bastianoni, S. Benchmarking marine renewable energy technologies through LCA: Wave energy converters in the Mediterranean. Front. Energy Res. 2022, 10, 980557. [Google Scholar] [CrossRef]

- Agostini, A.; Battini, F.; Padella, M.; Giuntoli, J.; Baxter, D.; Marelli, L.; Amaducci, S. Economics of GHG emissions mitigation via biogas production from Sorghum, maize and dairy farm manure digestion in the Po valley. Biomass Bioenergy 2016, 89, 58–66. [Google Scholar] [CrossRef]

- Zulkepli, N.E.; Muis, Z.A.; Mahmood, N.A.N.; Hashim, H.; Ho, W.S. Cost Benefit Analysis of Composting and Anaerobic Digestion in a Community: A Review. Chem. Eng. Trans. 2017, 56, 1777–1782. [Google Scholar]

- Ekinci, K.; Erdal, I.; Uysal, Ö.; Uysal, F.Ö.; Tunce, H.; Doğan, A. Anaerobic Digestion of Three Microalgae Biomasses and Assessment of Digestates as Biofertilizer for Plant Growth. Environ. Prog. Sustain. Energy 2019, 38, e13024. [Google Scholar] [CrossRef]

- Kumar, S.; Sindhu, S.S.D.; Kumar, R. Biofertilizers: An ecofriendly technology for nutrient recycling and environmental sustainability. Curr. Res. Microb. Sci. 2022, 3, 100094. [Google Scholar] [CrossRef] [PubMed]

- Guido, V.; Riva, E.; Finzi, A.; Bacenetti, L.; Provolo, G.; Guidetti, A.; Sanguanini, A.; Merigo, G.; Ruffini, G.; Sommariva, F. Il Digestato, un Buon Fertilizzante per il Mais. 2020. Available online: https://www.informatoreagrario.it/difesa-e-fertilizzazione/fertilizzazione/il-digestato-un-buon-fertilizzante-per-il-mais/ (accessed on 11 March 2023).

- Market Analysis Report. Italy Foliar Fertilizer Market Size Report, 2022–2030. 2021. Available online: https://www.grandviewresearch.com/industry-analysis/italy-foliar-fertilizer-market-report# (accessed on 20 February 2023).

- Cappellini, M. Costi Delle Semine Alle Stelle per i Rincari dei Fertilizzanti. Il Sole 24 Ore. 2022. Available online: https://www.ilsole24ore.com/art/costi-semine-stelle-i-rincari-fertilizzanti-AE5pjC9 (accessed on 20 February 2023).

- Neri, V. News Quale Legame tra Gas e Fertilizzanti. 2022. Available online: https://www.cure-naturali.it/articoli/vita-naturale/vita-green/gas-fertilizzanti.html (accessed on 15 February 2023).

- Ingiuso, N. CO2, Effetto Coronavirus. Report. 2020. Available online: https://www.startmag.it/energia/c02-effetto-coronavirus-report/ (accessed on 11 March 2023).

- Cucchiella, F.; D’Adamo, I.; Gastaldi, M. An economic analysis of biogas-biomethane chain from animal residues in Italy. J. Clean. Prod. 2019, 230, 888–897. [Google Scholar] [CrossRef]

- Salerno, M.; Gallucci, F.; Pari, L.; Zambon, I.; Sarri, D.; Colantoni, A. Costs-benefits analysis of a small-scale biogas plant and electric energy production. Bulg. J. Agric. Sci. 2017, 23, 357–362. [Google Scholar]

- Manzo, S.; Salling, K.B. Integrating Life-cycle Assessment into Transport Cost-benefit Analysis. Transp. Res. Procedia 2016, 14, 273–282. [Google Scholar] [CrossRef]

- Galvin, R.; Dütschke, E.; Weiß, J. A conceptual framework for understanding rebound effects with renewable electricity: A new challenge for decarbonizing the electricity sector. Renew. Energy 2021, 176, 423–432. [Google Scholar] [CrossRef]

- Wang, Z.; Han, B.; Lu, M. Measurement of energy rebound effect in households: Evidence from residential electricity consumption in Beijing, China. Renew. Sustain. Energy Rev. 2016, 58, 825–861. [Google Scholar] [CrossRef]

- Patrizi, N.; Caro, D.; Pulselli, F.M.; Bjerre, A.B.; Bastianoni, S. Environmental Feasibility of Partial Substitution of Gasoline with Ethanol in the Province of Siena (Italy). J. Clean. Prod. 2013, 47, 388–395. [Google Scholar] [CrossRef]

- Marchesi, R.; Bombarda, P.; Bresciani, F.; Casalegno, A.; Guilizzoni, M.; Gino Manfredi, A.; Escobar, P.; Rota, A.; Zago, M. Costi di Produzione di Energia Elettrica da Fonti Rinnovabili. 2013. Available online: https://www.autorita.energia.it/allegati/docs/13/RappPolitecnicoRinn.pdf (accessed on 15 February 2023).

- Del Bo, C.; Fiorio, C.; Florio, M. Shadow Wages for the EU Regions. Fisc. Stud. 2011, 32, 109–143. [Google Scholar] [CrossRef]

| Energy Source | Direct Specific Emissions (gCO2/kJel a) |

|---|---|

| Coal | 0.0783 |

| Oil products | 0.0710 |

| Natural gas | 0.0565 |

| Nuclear | - |

| Wind | - |

| Biomass (e.g., wood) | - |

| Description | Cost (EUR) |

|---|---|

| Civil works | 1,840,000 |

| Electromechanical works | 1,100,000 |

| Ancillary works | 160,000 |

| Engine | 870,000 |

| Field | 90,000 |

| Life Cycle Phase | Input | Quantity | Unit | GWP100y (kg CO2eq· Single Unit of Input−1) | Ecoinvent 3 Process |

|---|---|---|---|---|---|

| 1. Agricultural | Wheat seeds | 11,000.00 | kg | 0.49 | Wheat seed, Swiss integrated production, for sowing {CH}|market for wheat seed, Swiss integrated production, for sowing|Cut-off, U |

| Diesel | 9812.00 | kg | 0.56 | Diesel, low-sulfur {Europe without Switzerland}|market for|Cut-off, U | |

| Urea | 10,000.00 | kg | 3.26 | Urea, as N {GLO}|market for|Cut-off, U | |

| Maize seeds | 225,000.00 | t | 1.03 | Maize seed, Swiss integrated production, at farm {CH}|market for maize seed, Swiss integrated production, at farm|Cut-off, U | |

| Water | 360,000,000.00 | kg | 0.0003 | Tap water {Europe without Switzerland}|market for|Cut-off, U | |

| Urea | 120,000.00 | kg | 3.26 | Urea, as N {GLO}|market for|Cut-off, U | |

| Pesticide | 3600.00 | kg | 9.71 | Pesticide, unspecified {GLO}|market for|Cut-off, U | |

| Herbicide | 99.00 | kg | 10.80 | Glyphosate {GLO}|market for|Cut-off, U | |

| Diesel | 110,721.00 | kg | 0.56 | Diesel, low-sulfur {Europe without Switzerland}|market for|Cut-off, U | |

| Transport | 166,000.00 | t·km | 0.51 | Transport, freight, lorry 3.5–7.5 metric ton, EURO6 {RER}|transport, freight, lorry 3.5–7.5 metric ton, EURO6|Cut-off, U | |

| 2. Additional feedstock matrix | Maize flour | 1,400,000.00 | kg | 0.81 | Maize flour {RoW}|market for maize flour|Cut-off, U |

| Transport | 70,000.00 | t·km | 0.51 | Transport, freight, lorry 3.5–7.5 metric ton, EURO6 {RER}|transport, freight, lorry 3.5–7.5 metric ton, EURO6|Cut-off, U | |

| 3. Storage and pre-treatment | Water | 4,000,000.00 | kg | 0.0003 | Tap water {Europe without Switzerland}|market for|Cut-off, U |

| Compost | 360,000.00 | kg | 0.0031 | Compost {GLO}|market for|Cut-off, U | |

| Diesel | 7932.50 | kg | 0.56 | Diesel {Europe without Switzerland}|market for|Cut-off, U | |

| Electricity | 2626.00 | kWh | 0.12 | Electricity, low voltage {Europe without Switzerland}|market group for|Cut-off, U | |

| Polyethylene (PE) film | 3400.00 | kg | 3.14 | Packaging film, low density polyethylene {GLO}|market for|Cut-off, U | |

| 4. AD and biogas production | Molybdenum trioxide | 60.00 | kg | 40.70 | Molybdenum trioxide {GLO}|market for|Cut-off, U |

| Selenium | 60.00 | kg | 2.52 | Selenium {GLO}|market for|Cut-off, U | |

| Nickel sulphate | 60.00 | kg | 6.00 | Nickel sulfate {GLO}|market for|Cut-off, U | |

| Iron sulphate | 60.00 | kg | 0.17 | Iron sulfate {RER}|market for iron sulfate|Cut-off, U | |

| Copper sulphate | 60.00 | kg | 2.94 | Copper sulfate {GLO}|market for|Cut-off, U | |

| Zinc monosulphate | 60.00 | kg | 0.70 | Zinc monosulfate {RER}|market for zinc monosulfate|Cut-off, U | |

| Magnesium sulphate | 60.00 | kg | 0.43 | Magnesium sulfate {GLO}|market for|Cut-off, U | |

| Aluminium | 7300.00 | kg | 1.01 | Aluminium hydroxide {GLO}|market for|Cut-off, U | |

| Heat | 490.69 | MJ | 0.11 | Heat, central or small-scale, other than natural gas {Europe without Switzerland}|market for heat, central or small-scale, other than natural gas|Cut-off, U | |

| 5. Maintenance | Aluminium | 37.50 | kg | 5.31 | Aluminium, cast alloy {GLO}|market for|Cut-off, U |

| Iron | 45.50 | kg | 0.11 | Iron pellet {GLO}|market for|Cut-off, U | |

| Ceramic | 3.00 | kg | 1.29 | Frit, for ceramic tile {GLO}|market for|Cut-off, U | |

| Lubricating oil | 3520.00 | kg | 1.35 | Lubricating oil {GLO}|market for|Cut-off, U |

| Variable | FNPV before (EUR) | FNPV after (EUR) | Variation (%) | FIRR before (%) | FIRR after (%) | Variation (%) |

|---|---|---|---|---|---|---|

| Electricity feed-in tariff | −838,639 | −1,116,423 | 33 | 1.89 | 1.14 | −40 |

| Operating costs | −838,639 | −1,028,974 | 23 | 1.89 | 1.39 | −27 |

| Variable | ENPV before (EUR) | ENPV after (EUR) | Variation (%) | EIRR before (%) | EIRR after (%) | Variation (%) |

|---|---|---|---|---|---|---|

| Electricity feed-in tariff | 3,876,989 | 3,586,393 | −7 | 11.58 | 11.00 | −5 |

| Operating costs | 3,876,989 | 3,688,426 | −5 | 11.58 | 11.19 | −3 |

| CO2 price (10 EUR·t CO2eq−1) | 3,876,989 | 2,948,495 | −24 | 11.58 | 9.71 | −16 |

| CO2 price (40 EUR·t CO2eq −1) | 3,876,989 | 4,833,466 | 25 | 11.58 | 13.43 | 16 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bruno, M.; Marchi, M.; Ermini, N.; Niccolucci, V.; Pulselli, F.M. Life Cycle Assessment and Cost–Benefit Analysis as Combined Economic–Environmental Assessment Tools: Application to an Anaerobic Digestion Plant. Energies 2023, 16, 3686. https://doi.org/10.3390/en16093686

Bruno M, Marchi M, Ermini N, Niccolucci V, Pulselli FM. Life Cycle Assessment and Cost–Benefit Analysis as Combined Economic–Environmental Assessment Tools: Application to an Anaerobic Digestion Plant. Energies. 2023; 16(9):3686. https://doi.org/10.3390/en16093686

Chicago/Turabian StyleBruno, Morena, Michela Marchi, Nicolò Ermini, Valentina Niccolucci, and Federico Maria Pulselli. 2023. "Life Cycle Assessment and Cost–Benefit Analysis as Combined Economic–Environmental Assessment Tools: Application to an Anaerobic Digestion Plant" Energies 16, no. 9: 3686. https://doi.org/10.3390/en16093686