Multivariable Supplier Segmentation in Sustainable Supply Chain Management

Abstract

:1. Introduction

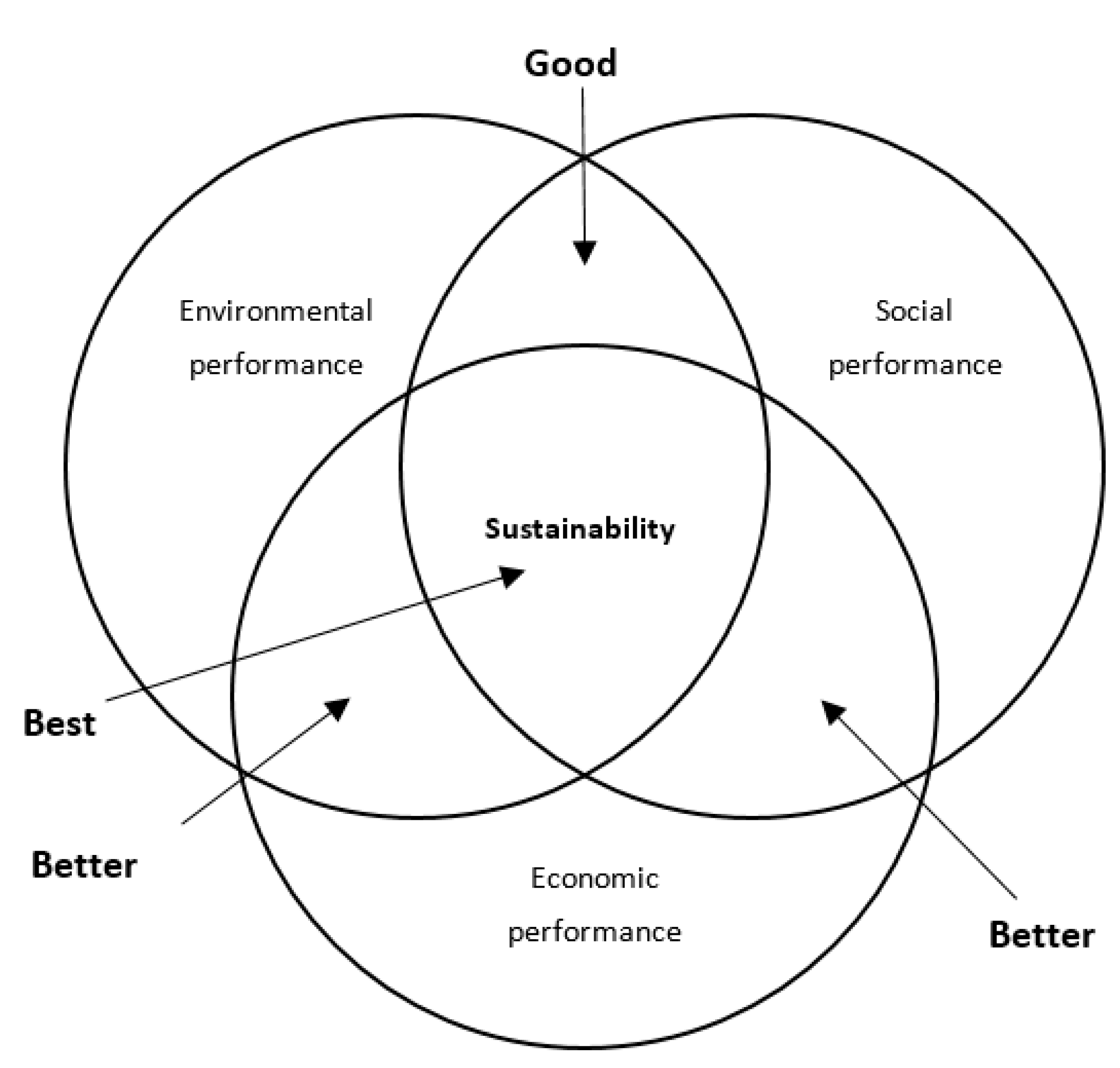

2. A Systematic Review of the Literature on Supplier Segmentation and Sustainable Development

- (1)

- The process method identifies distinguishable segments of potential suppliers for each item to be purchased by an industrial company. These segments are based on characteristics that are closely related to the key characteristics of the company’s own customer segments [36].

- (2)

- The portfolio method classifies the materials or components that a firm can purchase. Two variables are considered: profit impact and supply risk. Based on these two variables, materials or components can be divided into four supply categories: (1) non-critical items (supply risk: low; profit impact: low), (2) leverage items (supply risk: low; profit impact: high), (3) bottleneck items (supply risk: high; profit impact: low), and (4) strategic items (supply risk: high; profit impact: high). Each category requires a specific supplier strategy [37]. However, positioning in the matrix in terms of supply risk and benefit impact is subjective; it does not take into account suppliers’ reactions or joint development, nor does it encourage a joint working mentality [41]. Years later, Kraljic noted “the importance of trust in long-term relationships with suppliers. You need trust to create win-win” [42]. Other authors have also used the portfolio model by introducing other classification dimensions: Van Stekelenborg et al. [43] used control need of the internal market demand and control need of the external supply market as classification dimensions. Olsen et al. [44] used difficulty of managing the purchase situation and the strategic importance of the purchase as classification dimensions. Bensaou [45] used buyer’s and supplier’s specific investments as classification dimensions. Finally, Gelderman et al. [46] used supplier’s and buyer’s dependence as classification dimensions.

- (3)

- According to the involvement method, firms should determine their core competencies as relevant core activities and non-core activities. Resources that relate to core activities are strategic resources, while those that relate to non-core activities are non-strategic resources. With this method, the level of involvement determines the type of relationship. Based on this classification, the authors suggest two types of buyer-supplier relationships [28]:

- (a)

- Durable arm’s-length (quasi-market) relationships are suitable for the first class of inputs or resources, which are necessary but non-strategic.

- (b)

- Strategic partnerships (quasi-hierarchies) are suitable for the second class of inputs or strategic inputs, which are important in differentiating the buyer’s final product.

3. Business Evidence of Supplier Development

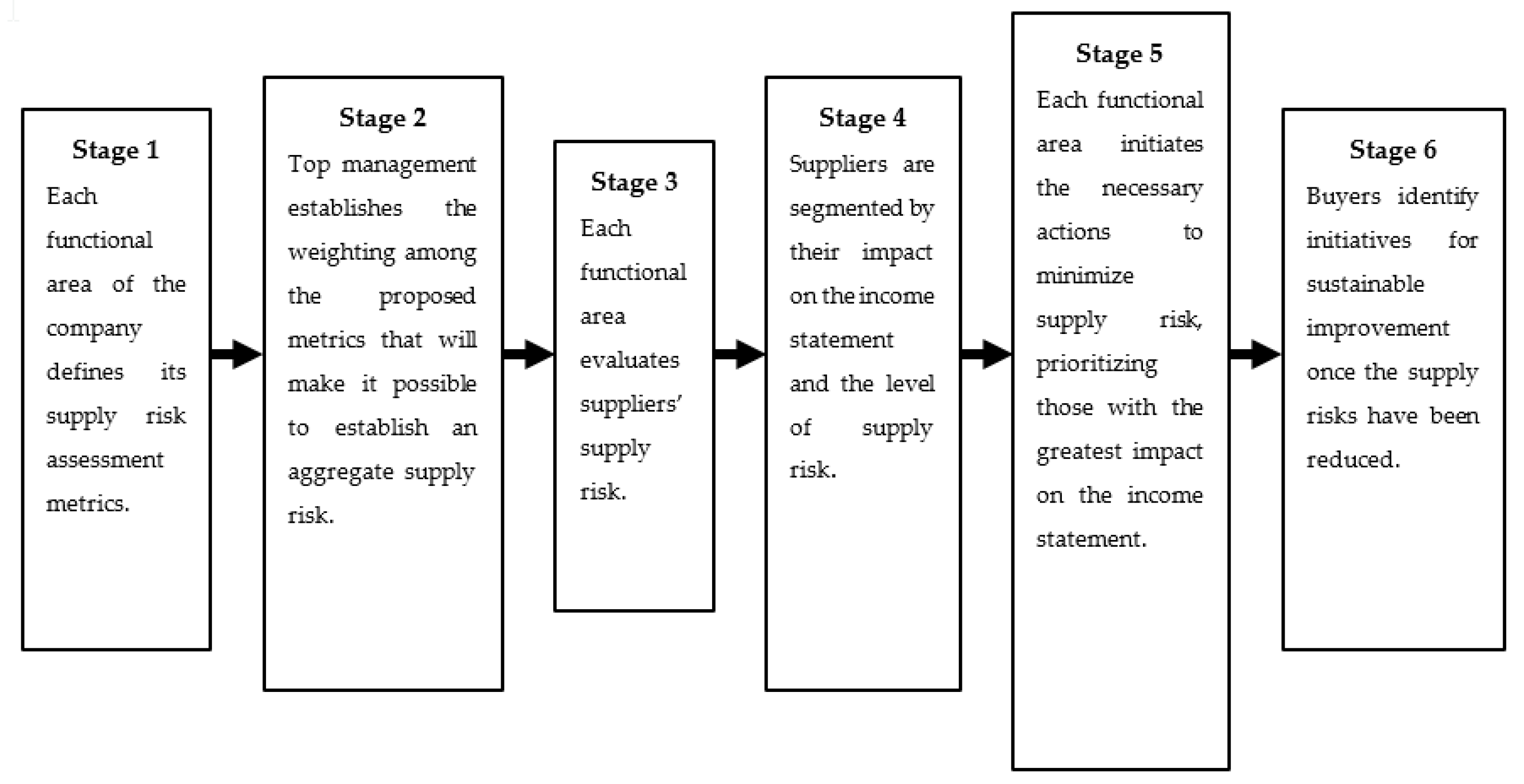

4. A Supplier Segmentation Proposal

5. Application of the Supplier Segmentation Proposal to Real Cases

5.1. Application of the Supplier Segmentation Proposal

5.2. MAThread® in Ford Europe

6. Results and Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Rabieh, M.; Fadaei Rafsanjani, A.; Babaei, L.; Esmaeili, M. Sustainable Supplier Selection and Order Allocation: An Integrated Delphi Method, Fuzzy TOPSIS and Multi-Objective Programming Model. Sci. Iran. 2018, 26, 2524–2540. [Google Scholar] [CrossRef] [Green Version]

- Joyce, A.; Paquin, R.L. The triple layered business model canvas: A tool to design more sustainable business models. J. Clean. Prod. 2016, 135, 1474–1486. [Google Scholar] [CrossRef]

- Barney, J.B. Introduction to the special issue on the resource-based view of the firm. J. Manag. 1991, 17, 97–99. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J.B. Is the resource-based “view” a useful perspective for strategic management research? Yes. Acad. Manag. Rev. 2001, 26, 41–56. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Furr, N.R.; Bingham, C.B. CROSSROADS—Microfoundations of Performance: Balancing Efficiency and Flexibility in Dynamic Environments. Organ. Sci. 2010, 21, 1263–1273. [Google Scholar] [CrossRef]

- Teece, D.J. The Foundations of Enterprise Performance: Dynamic and Ordinary Capabilities in an (Economic) Theory of Firms. Acad. Manag. Perspect. 2014, 28, 328–352. [Google Scholar] [CrossRef]

- Gold, S.; Seuring, S.; Beske, P. Sustainable supply chain management and inter-organizational resources: A literature review. Corp. Soc. Responsib. Environ. Manag. 2010, 17, 230–245. [Google Scholar] [CrossRef]

- Walker, H.; Jones, N. Sustainable supply chain management across the UK private sector. Supply Chain Manag. An Int. J. 2012, 17, 15–28. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance; Cambridge University Press: Cambridge, UK, 1990; ISBN 9780521394161. [Google Scholar]

- North, D.C. Understanding the Process of Economic Change; Princeton University Press: Princeton, NJ, USA, 2005; ISBN 9780691145952. [Google Scholar]

- Bowen, H.R. Social Responsibilities of the Businessman; Harper & Row: New York, NY, USA, 1953. [Google Scholar]

- Carroll, A.B. Corporate Social Responsibility. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Elkington, A.R. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone Publishing Ltd.: Oxford, UK, 1997; ISBN 1-900961-27-X. [Google Scholar]

- Xia, Y. Competitive strategies and market segmentation for suppliers with substitutable products. Eur. J. Oper. Res. 2011, 210, 194–203. [Google Scholar] [CrossRef]

- Seuring, S.; Müller, M. From a literature review to a conceptual framework for sustainable supply chain management. J. Clean. Prod. 2008, 16, 1699–1710. [Google Scholar] [CrossRef]

- Bai, C.; Rezaei, J.; Sarkis, J. Multicriteria Green Supplier Segmentation. IEEE Trans. Eng. Manag. 2017, 64, 515–528. [Google Scholar] [CrossRef]

- Akhavan, R.M.; Beckmann, M. A configuration of sustainable sourcing and supply management strategies. J. Purch. Supply Manag. 2017, 23, 137–151. [Google Scholar] [CrossRef]

- UNCSD Industry and Sustainable Development—6th Session. Available online: http://www.un.org/ga/search/view_doc.asp?symbol=E/CN.17/1998/4&Lang=E (accessed on 15 December 2019).

- Vivas, R.; Sant’anna, Â.; Esquerre, K.; Freires, F. Measuring Sustainability Performance with Multi Criteria Model: A Case Study. Sustainability 2019, 11, 6113. [Google Scholar] [CrossRef] [Green Version]

- AENOR Certificación ISO 14001 sistemas de gestión ambiental. Available online: https://www.aenor.com/certificacion/medio-ambiente/gestion-ambiental (accessed on 23 February 2020).

- AENOR Certificación SA 8000. Available online: https://www.aenor.com/certificacion/responsabilidad-social/sa-8000-empresa-saludable (accessed on 23 February 2020).

- Merli, R.; Preziosi, M.; Massa, I. Social Values and Sustainability: A Survey on Drivers, Barriers and Benefits of SA8000 Certification in Italian Firms. Sustainability 2015, 7, 4120. [Google Scholar] [CrossRef] [Green Version]

- Pagell, M.; Wu, Z.; Wasserman, M.E. Thinking differently about purchasing portfolios: An assessment of sustainable sourcing. J. Supply Chain Manag. 2010, 46, 57–73. [Google Scholar] [CrossRef]

- Carter, C.R.; Liane Easton, P. Sustainable supply chain management: Evolution and future directions. Int. J. Phys. Distrib. Logist. Manag. 2011, 41, 46–62. [Google Scholar] [CrossRef]

- Cammish, R.; Keough, M. A Strategic Role for Purchasing. Available online: https://go.gale.com/ps/anonymous?id=GALE%7CA11739695&sid=googleScholar&v=2.1&it=r&linkaccess=abs&issn=00475394&p=AONE&sw=w (accessed on 15 November 2019).

- Van Weele, A.J. Purchasing and Supply Chain Management; Cengage, Ed.; Annabel Ainscow: Andover, UK, 2018; ISBN 9781473749443. [Google Scholar]

- Dyer, J.H. Specialized supplier networks as a source of competitive advantage: Evidence from the auto industry. Strateg. Manag. J. 1996, 17, 271–291. [Google Scholar] [CrossRef]

- Mol, M. Outsourcing, Supplier Relations and Internationalisation: Global Sourcing Strategy as a Chinese Puzzle; Erasmus University Rotterdam: Rotterdam, The Netherlands, 2001; ISBN 9058920143. [Google Scholar]

- Chen, I.J.; Paulraj, A.; Lado, A.A. Strategic purchasing, supply management, and firm performance. J. Oper. Manag. 2004, 22, 505–523. [Google Scholar] [CrossRef]

- Dubois, A.; Pedersen, A.C. Why relationships do not fit into purchasing portfolio models a comparison between the portfolio and industrial network approaches. Eur. J. Purch. Supply Manag. 2002, 8, 35–42. [Google Scholar] [CrossRef]

- Rezaei, J.; Fallah Lajimi, H. Segmenting supplies and suppliers: Bringing together the purchasing portfolio matrix and the supplier potential matrix. Int. J. Logist. Res. Appl. 2019, 22, 419–436. [Google Scholar] [CrossRef] [Green Version]

- Lilliecreutz, J.; Ydreskog, L. Supplier Classification as an Enabler for Differentiated Purchasing Strategy. Global Purchasing and Supply Chain Management. In Best Practice Procurement; Erridge, A., Fee, R., Mcilroy, J., Eds.; Gower Publishing Limited: Aldershot, UK, 2001; pp. 66–74. ISBN 0566083663. [Google Scholar]

- Day, M.; Magnan, G.M.; Moeller, M.M. Evaluating the bases of supplier segmentation: A review and taxonomy. Ind. Mark. Manag. 2010, 39, 625–639. [Google Scholar] [CrossRef]

- Svensson, G. Supplier segmentation in the automotive industry: A dyadic approach of a managerial model. Int. J. Phys. Distrib. Logist. Manag. 2004, 34, 12–38. [Google Scholar] [CrossRef]

- Parasuraman, A. Vendor segmentation: An additional level of market segmentation. Ind. Mark. Manag. 1980, 9, 59–62. [Google Scholar] [CrossRef]

- Kraljic, P. Purchasing Must Become Supply Management. Harward Bus. Rev. Bost. 1983, 61, 109–117. [Google Scholar] [CrossRef]

- Zsidisin, G.A.; Ellram, L.M. An Agency Theory Investigation of Supply Risk M anagement. J. Supply Chain Manag. 2003, 39, 15–27. [Google Scholar] [CrossRef]

- Lee, D.M.; Drake, P.R. A portfolio model for component purchasing strategy and the case study of two South Korean elevator manufacturers. Int. J. Prod. Res. 2010, 48, 6651–6682. [Google Scholar] [CrossRef] [Green Version]

- Rezaei, J.; Ortt, R. A multi-variable approach to supplier segmentation. Int. J. Prod. Res. 2012, 50, 4593–4611. [Google Scholar] [CrossRef] [Green Version]

- Gelderman, C.J.; Van Weele, A.J. Purchasing portfolio models: A critique and update. J. Supply Chain Manag. 2005, 41, 19–27. [Google Scholar] [CrossRef]

- Keith, B.; Vitasek, K.; Manrodt, K.; Kling, J. Strategic Sourcing in the New Economy: Harnessing the Potential of Sourcing Business Models for Modern Procurement; Palgrave Macmillan: London, UK, 2015; ISBN 9781137552181. [Google Scholar]

- Van Stekelenborg, R.H.; Kornelius, L. A diversified approach towards purchasing and supply: Evaluation of production management methods. In Proceedings of the Evaluation of Production Management Methods: IFIP WG 5.7 Working Conference, Gramado, Brazil, 21–24 March 1994. [Google Scholar]

- Olsen, R.F.; Ellram, L.M. A portfolio approach to supplier relationships. Ind. Mark. Manag. 1997, 26, 101–113. [Google Scholar] [CrossRef]

- Bensaou, B.M. Portolios of buyer-supplier relationships. Sloan Manag. Rev. Summer 1999, 40, 35. [Google Scholar]

- Gelderman, C.J.; Van Weele, A.J. New perspectives on Kraljic’s purchasing portfolio approach. In Proceedings of the 9th International IPSERA Conference and the Third Annual North American Research Symposium on Purchasing and Supply Chain Management, Toronto, ON, Canada, 24–27 May 2000. [Google Scholar]

- Rezaei, J.; Wang, J.; Tavasszy, L. Linking supplier development to supplier segmentation using Best Worst Method. Expert Syst. Appl. 2015, 42, 9152–9164. [Google Scholar] [CrossRef]

- Ellram, L.M.; Pearson, J.N. The Role of the Purchasing Function: Toward Team Participation. Int. J. Purch. Mater. Manag. 1993, 29, 2–9. [Google Scholar] [CrossRef]

- Giunipero, L.C.; Vogt, J.F. Empowering the Purchasing Function: Moving to Team Decisions. Int. J. Purch. Mater. Manag. 1997, 33, 8–15. [Google Scholar] [CrossRef] [Green Version]

- Johnson, P.F.; Klassen, R.D.; Leenders, M.R.; Fearon, H.E. Determinants of purchasing team usage in the supply chain. J. Oper. Manag. 2002, 20, 77–89. [Google Scholar] [CrossRef]

- Kitchenham, B.; Pearl Brereton, O.; Budgen, D.; Turner, M.; Bailey, J.; Linkman, S. Systematic literature reviews in software engineering—A systematic literature review. Inf. Softw. Technol. 2009, 51, 7–15. [Google Scholar] [CrossRef]

- Rius-Sorolla, G.; Maheut, J.; Estelles-Miguel, S.; Garcia-Sabater, J.P. Protocol: Systematic Literature Review on coordination mechanisms for the mathematical programming models in production planning with decentralized decision making. WPOM-Working Pap. Oper. Manag. 2017, 8, 22. [Google Scholar] [CrossRef] [Green Version]

- Rius-Sorolla, G.; Maheut, J.; Estellés-Miguel, S.; Garcia-Sabater, J.P. Coordination mechanisms with mathematical programming models for decentralized decision-making: a literature review. Cent. Eur. J. Oper. Res. 2020, 28, 61–104. [Google Scholar] [CrossRef]

- Cooper, M.C.; Lambert, D.M.; Pagh, J.D. Supply Chain Management: More Than a New Name for Logistics. Int. J. Logist. Manag. 1997, 8, 1–14. [Google Scholar] [CrossRef]

- Errasti-Opacua, A. Gestión de compras en la empresa; Piramide: Madrid, Spain, 2012; ISBN 978-84-368-2724-8. [Google Scholar]

- Colla, E.; Dupuis, M. Research and managerial issues on global retail competition: Carrefour/Wal-Mart. Int. J. Retail Distrib. Manag. 2002, 30, 103–111. [Google Scholar] [CrossRef]

- Dyer, J.H.; Cho, D.S.; Cgu, W. Strategic Supplier Segmentation: The Next “Best Practice” in Supply Chain Management. Calif. Manage. Rev. 1998, 40, 57–77. [Google Scholar] [CrossRef] [Green Version]

- Walton, R. Wal-Mart, Supplier-Partners, and the buyer power issue. Antitrust Law J. 2005, 72, 509–527. [Google Scholar]

- Bloom, P.N.; Perry, V.G. Retailer power and supplier welfare. J. Retail. 2001, 77, 379–396. [Google Scholar] [CrossRef]

- Müller, H.E. Supplier integration: An international comparison of supplier and automaker experiences. Int. J. Automot. Technol. Manag. 2009, 9, 18–39. [Google Scholar] [CrossRef]

- Dyer, J.; Chu, W. The determinants of trust in supplier–automaker relations in the US, Japan, and Korea: A retrospective. J. Int. Bus. Stud. 2011, 42, 28–34. [Google Scholar] [CrossRef]

- Dyer, J.H.; Chu, W. The Determinants of Trust in Supplier-Automaker Relationships in the U.S., Japan and Korea. J. Int. Bus. Stud. 2000, 31, 259–285. [Google Scholar] [CrossRef]

- Dyer, J.H.; Chu, W. The Role of Trustworthiness in Reducing Transaction Costs and Improving Performance: Empirical Evidence from the United States, Japan, and Korea. Organ. Sci. 2003, 14, 57–68. [Google Scholar] [CrossRef] [Green Version]

- Kelleher, J.B. GM Ranked Worst Automaker by U.S. Suppliers: Survey Reuters. Available online: https://www.reuters.com/article/us-gm-suppliers-survey/gm-ranked-worst-automaker-by-u-s-suppliers-survey-idUSBREA4B01I20140512 (accessed on 5 March 2020).

- Ritchie, P. McDonald′s: A Winner through Logistics. Int. J. Phys. Distrib. Logist. Manag. 1990, 20, 21–24. [Google Scholar] [CrossRef]

- Vitasek, K.; Manrodt, K.B.; Kling, J. Vested: How P & G, McDonald’s, and Microsoft Are Redefining Winning in Business Relationships; Palgrave Macmillan: New York, NY, USA, 2012; ISBN 9780230341708. [Google Scholar]

- McDonald’s Our History. Available online: https://www.mcdonalds.com/us/en-us/about-us/our-history.html (accessed on 29 February 2020).

- Xing, X.; Liu, T.; Wang, J.; Shen, L.; Zhu, Y. Environmental Regulation, Environmental Commitment, Sustainability Exploration/Exploitation Innovation, and Firm Sustainable Development. Sustainability 2019, 11, 6001. [Google Scholar] [CrossRef] [Green Version]

- Deloitte Global Powers of Retailing 2018. Available online: https://www2.deloitte.com/ni/es/pages/consumer-business/articles/global-powers-of-retailing-2018.html (accessed on 29 February 2020).

- Ton, Z.; Harrow, S. Mercadona. Available online: https://ssrn.com/abstract=1607757 (accessed on 1 March 2020).

- Valencoso, C. Balance Gran Consumo 2016. Available online: https://www.kantarworldpanel.com/es/Noticias/El-Gran-Consumo-cae-en-2016#downloadThankyou (accessed on 3 December 2018).

- Blanco-Callejo, M.; de Pablos-Heredero, C. Co-innovation at Mercadona: A radically different and unique innovation model in the retail sector. J. Bus. Retail Manag. Res. 2019, 13. [Google Scholar] [CrossRef] [Green Version]

- Calabrese, A.; Scoglio, F. Reframing the past: A new approach in service quality assessment. Total Qual. Manag. Bus. Excell. 2012, 23, 1329–1343. [Google Scholar] [CrossRef]

- Albors-Garrigos, J. Bringing your customers to the lab: Barriers and facilitators for consumer coinnovation. In Proceedings of the 2015 Portland International Conference on Management of Engineering and Technology (PICMET); IEEE: Piscataway, NJ, USA, 2015; Volume 2015, pp. 689–698. [Google Scholar]

- Mercadé-Melé, P.; Molinillo-Jiménez, S.; Fernández-Morales, A. Influencia de las prácticas de responsabilidad social corporativa en la actitud del consumidor: análisis comparado de Mercadona, Carrefour y Eroski/Influence of the corporate social responsibility practices in the consumer attitude: A comparative analysis. Rev. Empres. Fam. 2014, 4, 73. [Google Scholar] [CrossRef] [Green Version]

- Zaragozá, J.L. Siro acelera su desconexión de Mercadona con la venta de la planta de Navarrés. Available online: https://www.levante-emv.com/economia/2019/11/06/siro-acelera-desconexion-mercadona-venta/1941206.html?utm_medium=rss (accessed on 6 March 2020).

- Harris, L.C.; O’Malley, L.; Patterson, M. Professional interaction: Exploring the concept of attraction. Mark. Theory 2003, 3, 9–36. [Google Scholar] [CrossRef]

- Vitasek, K.; Ledyard, M.; Manrodt, K. Getting to We: A New Negotiating Model. In Vested Outsourcing: Five Rules That Will Transform Outsourcing; Palgrave Macmillan US: New York, NY, USA, 2013; pp. 177–184. ISBN 978-1-137-32118-3. [Google Scholar]

- Vitasek, K.; Manrodt, K. Vested outsourcing: A flexible framework for collaborative outsourcing. Strateg. Outsourcing An Int. J. 2012, 5, 4–14. [Google Scholar] [CrossRef]

- Krause, D.R.; Scannell, T.V.; Calantone, R.J. A Structural Analysis of the Effectiveness of Buying Firms’ Strategies to Improve Supplier Performance. Decis. Sci. 2000, 31, 33–55. [Google Scholar] [CrossRef]

- Zimmer, K.; Fröhling, M.; Schultmann, F. Sustainable supplier management—A review of models supporting sustainable supplier selection, monitoring and development. Int. J. Prod. Res. 2015, 54, 1412–1442. [Google Scholar] [CrossRef]

- Wynstra, F.; Pierick, E. Ten Managing supplier involvement in new product development: A portfolio approach. Eur. J. Purch. Supply Manag. 2000, 6, 49–57. [Google Scholar] [CrossRef]

- Audicana Arcas, J. Mercadona-Conservas Ubago: The Intersupplier Concept. Available online: https://www.santelmo.org/mercadona-conservas-ubago-the-intersupplier-concept/4971 (accessed on 15 November 2019).

- Swinney, R.; Netessine, S. Long-Term Contracts Under the Threat of Supplier Default. Manuf. Serv. Oper. Manag. 2009, 11, 109–127. [Google Scholar] [CrossRef]

- Zhu, W.; Wang, Z. The collaborative networks and thematic trends of research on purchasing and supply management for environmental sustainability: A bibliometric review. Sustainability 2018, 10, 1510. [Google Scholar] [CrossRef] [Green Version]

- Matsuo, H. Implications of the Tohoku earthquake for Toyota’s coordination mechanism: Supply chain disruption of automotive semiconductors. Int. J. Prod. Econ. 2015, 161, 217–227. [Google Scholar] [CrossRef]

- Pagell, M.; Wu, Z. Building a more complete theory of sustainable supply chain management using case studies of 10 exemplars. J. Supply Chain Manag. 2009, 45, 37–56. [Google Scholar] [CrossRef]

- Stuart, I.; McCutcheon, D.; Handfield, R.; McLachlin, R.; Samson, D. Effective case research in operations management: a process perspective. J. Oper. Manag. 2002, 20, 419–433. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Navarro Alonso, G. Análisis de la Gestión de Compras y Aplicación de la Teoría de Kraljic Para una Empresa Ferroviaria; Universitat Politècnica de València: Valencia, Spain, 2019. [Google Scholar]

- MAThread MAThread. Available online: https://mathread.com/ (accessed on 12 March 2020).

- Nuñez, M. Constant evolution in fasterners. AutoRevista 2015, 2303, 100–115. [Google Scholar]

- Garcia-Sabater, J.J.; Marín-Garcia, J.A. Can we still talk about continuous improvement? Rethinking enablers and inhibitors for successful implementation. Int. J. Technol. Manag. 2011, 55, 28. [Google Scholar] [CrossRef]

- Paipa-Galeano, L.; Bernal-Torres, C.A.; Agudelo Otálora, L.M.; Jarrah Nezhad, Y.; González-Blanco, H.A. Key lessons to maintain continuous improvement: A case study of four companies. J. Ind. Eng. Manag. 2020, 13, 195. [Google Scholar] [CrossRef]

| Type | % | Sector |

|---|---|---|

| Manufactured goods | 50–70% | Automotive, appliances, engineering, machinery and consumer goods, advanced software |

| Process industry | 60–85% | Food, drugstore and cosmetics, pharmacy, iron and steel, cement, glass, chemistry, gas, petroleum, mining |

| Services | 60–90% | Distribution, wholesalers, retailers, transportation, financial, professional services, telephone |

| Measure | Department |

|---|---|

| Financial capacity | Finance |

| Supplier alternatives | Purchasing |

| Delivery time | Logistics |

| Technological capacity | Engineering |

| Negotiation time requirement | Purchasing |

| Quality indicator | Quality |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rius-Sorolla, G.; Estelles-Miguel, S.; Rueda-Armengot, C. Multivariable Supplier Segmentation in Sustainable Supply Chain Management. Sustainability 2020, 12, 4556. https://doi.org/10.3390/su12114556

Rius-Sorolla G, Estelles-Miguel S, Rueda-Armengot C. Multivariable Supplier Segmentation in Sustainable Supply Chain Management. Sustainability. 2020; 12(11):4556. https://doi.org/10.3390/su12114556

Chicago/Turabian StyleRius-Sorolla, Gregorio, Sofía Estelles-Miguel, and Carlos Rueda-Armengot. 2020. "Multivariable Supplier Segmentation in Sustainable Supply Chain Management" Sustainability 12, no. 11: 4556. https://doi.org/10.3390/su12114556

APA StyleRius-Sorolla, G., Estelles-Miguel, S., & Rueda-Armengot, C. (2020). Multivariable Supplier Segmentation in Sustainable Supply Chain Management. Sustainability, 12(11), 4556. https://doi.org/10.3390/su12114556