Examining Risk Absorption Capacity as a Mediating Factor in the Relationship between Cognition and Neuroplasticity in Investors in Investment Decision Making

Abstract

:1. Introduction

- To investigate the effect of different dimensions of investors’ cognition (ICO) on neuroplasticity in investors (NPL).

- To explore the effect of different dimensions of investors’ risk absorption (RAB) on neuroplasticity in investors (NPL).

- To evaluate the effect of different dimensions of investors’ cognition on investors’ risk absorption capacity.

2. Literature Review

2.1. Dimensions of Investors’ Cognition

2.2. Cognition and Neuroplasticity in Investors

2.3. Dimensions of Risk Absorption

2.4. Risk Absorption and Neuroplasticity

2.5. Cognition and Risk Absorption

3. Research Design and Methodology

3.1. Research Hypothesis

3.2. List of Variable for Measurement Model

3.3. Sample and Respondent Profile

4. Empirical Analysis and Result

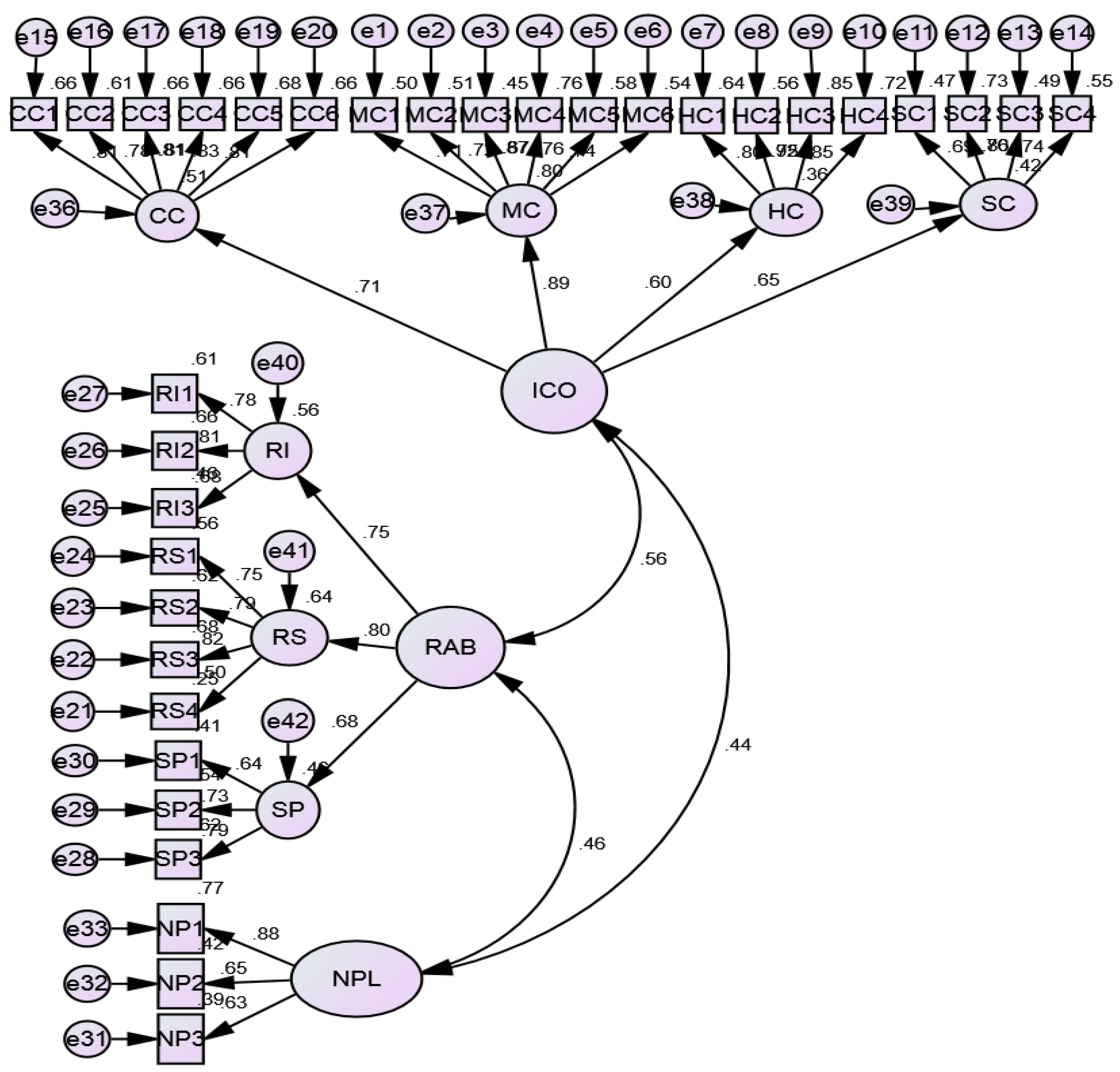

4.1. Neuroplasticity Measurement Models

4.2. Neuroplasticity Structural Model

- SRMR > 0.080 and RMSEA > 0.050;

- SRMR > 0.080 and RMSEA > 0.060 (sample size, case and model sensitivity);

- SRMR > 0.080 and CFI < 0.95;

- SRMR > 0.080 and CFI < 0.96 (sample size, case and model sensitivity).

4.3. The Testing of Hypotheses and the Discovery of the Effects through a Structural Model

5. Discussion

6. Limitations and Future Research Avenues

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aggarwal, Divya. 2019. Defining and measuring market sentiments: A review of the literature. Qualitative Research in Financial Markets. [Google Scholar] [CrossRef]

- Akhtar, Fatima, and Niladri Das. 2019. Predictors of investment intention in Indian stock markets: Extending the theory of planned behaviour. International Journal of Bank Marketing 37: 97–119. [Google Scholar] [CrossRef]

- Almén, Niclas, Hanna Lundberg, Örjan Sundin, and Billy Jansson. 2018. The reliability and factorial validity of the Swedish version of the Recovery Experience Questionnaire. Nordic Psychology 70: 324–33. [Google Scholar] [CrossRef]

- Anantharajan, R. S., and V. Sachithanantham. 2016. Role of Risk Tolerance in Portfolio Management. Paper presented at the the International Conference on “Innovative Management Practices”, Virudhnagar, India; Volume 1, pp. 263–67. [Google Scholar]

- Arbuckle, James L. 2007. Amos 16.0 User’s Guide. Meadville: Amos Development Corporation, Available online: http://www.spss.com (accessed on 15 June 2021).

- Ask, Karl, and Par Anders Granhag. 2007. Hot Cognition in Investigative Judgments: The Differential Influence of Anger and Sadness. Law and Human Behavior 31: 537–51. [Google Scholar] [CrossRef]

- Aydemir, Sibel Dinç, and Selim Aren. 2017. Do the effects of individual factors on financial risk-taking behavior diversify with financial literacy? Kybernetes 46: 1706–34. [Google Scholar] [CrossRef]

- Balwani, Shikhar, Ronojoy Mazumdar, and Nupur Acharya. 2021. Millions of millennials are piling into India’s stock market, shows data|Business Standard News. Business Standard. March 25. Available online: https://www.business-standard.com/article/markets/millions-of-millennials-are-piling-into-india-s-stock-market-shows-data-121032500065_1.html (accessed on 25 March 2021).

- Bechara, Antoine. 2004. The role of emotion in decision-making: Evidence from neurological patients with orbitofrontal damage. Brain and Cognition 55: 30–40. [Google Scholar] [CrossRef]

- Behera, Yadav Devi Prasad, Saroj Kumar Sahoo, and Madhusmita Pati. 2018. Investors’ Risk Absorption: A Strategic Tool for Investors’ Propensity to Invest. In Delivering Winnovate Business Strategies: The Quest for Managerial Excellence. Colombo: Sri Lanka, pp. 11–21. [Google Scholar]

- Behera, Yadav Devi Prasad, Sudhansu Sekhar Nanda, Saroj Kumar Sahoo, and Tushar Ranjan Sahoo. 2021. The Compounding Effect of Investors’ Cognition and Risk Absorption Potential on Enhancing the Level of Interest towards Investment in the Domestic Capital Market. Journal of Risk and Financial Management 14: 95. [Google Scholar] [CrossRef]

- Bezzina, Frank, Simon Grima, and Josephine Mamo. 2014. Risk management practices adopted by financial firms in Malta. Managerial Finance 40: 587–612. [Google Scholar] [CrossRef]

- Bhakta, Pratik. 2017. 1 out of 5 global top executives scared of investing in India due to fraud risks. The Economic Times. January 18. Available online: https://economictimes.indiatimes. com/news/company/corporate-trends/1-out-of-5-global-top-executives-scared-of-investing-in-india-due-to-fraud-risks/articleshow/56647389.cms (accessed on 25 March 2021).

- Bhushan, Puneet. 2014. Insights into Awareness Level and Investment Behaviour of Salaried Individuals Towards Financial Products. International Journal of Engineering, Business and Enterprise Applications (IJEBEA) 8: 53–57. [Google Scholar]

- Blajer-Gołębiewska, Anna, Dagmara Wach, and Maciej Kos. 2018. Financial risk information avoidance. Economic Research-EkonomskaIstrazivanja 31: 521–36. [Google Scholar] [CrossRef]

- Bondia, Ripsy, Pratap Chandra Biswal, and Abinash Panda. 2019. The unspoken facets of buying by individual investors in Indian stock market. Review of Behavioral Finance 11: 324–51. [Google Scholar] [CrossRef]

- Brandimonte, Maria A., Nicola Bruno, and Simona Collina. 2006. Cognition. In Psychological Concepts: An International Historical Perspective. Hove: Psychology Press, pp. 1–50. [Google Scholar]

- Byrne, Barbara M. 2010. Structural Equation Modelling with AMOS, 2nd ed. London: Routledge Taylor and Francis Group. [Google Scholar]

- Carol, Susan. 2003. On the application of social cognition and social location to creating causal explanatory structures. Educational Research Quarterly 26: 17–33. [Google Scholar]

- Carr, Nicholas. 2014. Reassessing the Assessment: Exploring the Factors that Contribute to Comprehensive Financial Risk Evaluation. In ProquestLlc. Manhattan: Kansas State University. [Google Scholar]

- Chen, James. 2020. Investor Definition. Investopedia. January 31. Available online: https://www.investopedia.com/terms/i/investor.asp (accessed on 25 June 2021).

- David, Daniel, and Silviu Matu. 2017. Cold Cognition. Berlin/Heidelberg: Springer International Publishing. [Google Scholar]

- David, Daniel, Julie Schnur, and Alexandra Belloiu. 2002. Another Search for the “Hot” Cognition: Appraisal, Irrational Beliefs, Attribution and their Relation to Emotion. Journal of Relational-Emotive & Cognitive-Behaviour Therapy 20: 93–131. [Google Scholar]

- Díaz, Antonio, and Carlos Esparcia. 2019. Assessing Risk Aversion from the Investor’s Point of View. Frontiers in Psychology 10: 1–6. [Google Scholar] [CrossRef] [PubMed]

- Duong, Chau, Gioia Pescetto, and Daniel Santamaria. 2014. How value—Glamour investors use financial information: UK evidence of investors’ confirmation bias. The European Journal of Finance 20: 524–49. [Google Scholar] [CrossRef] [Green Version]

- Erkut, Burak, Tugberk Kaya, Marco Lehmann-Waffenschmidt, Mandeep Mahendru, Gagan Deep Sharma, and Achal Kumar Srivastava. 2018. A fresh look on financial decision-making from the plasticity perspective. International Journal of Ethics and Systems 2: 1–11. [Google Scholar] [CrossRef]

- Ferree, Myra Marx, and David A Merrill. 2000. Hot movements, cold cognition: Thinking about social movements in gendered frames. Contemporary Sociology 29: 454–62. [Google Scholar] [CrossRef]

- Fiske, Susan T. 1993. Social cognition and social perception. Annual Review of Psychology 44: 155–94. [Google Scholar] [CrossRef]

- Frijns, Bart, and Ivan Indriawan. 2018. Behavioural heterogeneity in the New Zealand stock market Behavioural heterogeneity in the New Zealand stock market. New Zealand Economic Papers 15: 1–19. [Google Scholar] [CrossRef]

- Frydman, Cary, and Colin F. Camerer. 2016. The Psychology and Neuroscience of Financial Decision Making. Trends in Cognitive Sciences 20: 661–75. [Google Scholar] [CrossRef] [Green Version]

- Gefen, David, Detmar Straub, and Marie-Claude Boudreau. 2000. Structural equation modelling and regression: Guidelines for research practice. Communications of the Association for Information Systems 4: 1–7. [Google Scholar] [CrossRef] [Green Version]

- Gurbaxani, Arpita, and Rajani Gupte. 2021. A study on the impact of covid-19 on investor behaviour of individuals in a small town in the state of Madhya Pradesh, India. Australasian Accounting, Business and Finance Journal 15: 70–92. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jr., G. Tomas M. Hult, Christian M. Ringle, and Marko Sarstedt. 2017. A primer on partial least squares structural equation modelling (PLS- SEM). In HoSIPtals, 2nd ed. Thousand Oaks: SAGE Publications. [Google Scholar]

- Hair, Joseph F., William C. Black, Barry J. Babin, Rolph E. Anderson, and Ronald L. Tatham. 2012. Multivariate Data Analysis, 6th ed. New York: Pearson Education Inc. [Google Scholar]

- Haritha, P. H., and Rashmi Uchil. 2020. Impact of investor sentiment on decision-making in Indian stock market: An empirical analysis. Journal of Advances in Management Research 17: 66–83. [Google Scholar] [CrossRef]

- Harman, Harry H. 1961. Modern Factor Analysis. Educational And Psychological Measurement XXI: 1043–7. [Google Scholar]

- Healey, Mark P., Mercedes Bleda, and Adrien Querbes. 2018. Modeling Affect and Cognition: Opportunities and Challenges for Managerial and Organizational Cognition. In Methodological Challenges and Advances in Managerial and Organizational Cognition. Bingley: Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Himanshu, Ritika, Nikhat Mushir, and Ratan Suryavanshi. 2021. Impact of COVID-19 on portfolio allocation decisions of individual investors. Journal of Public Affairs 8: 1–9. [Google Scholar] [CrossRef] [PubMed]

- Hoffmann, Arvid O. I., Hersh M. Shefrin, and Joost M. E. Pennings. 2010. Behavioral Portfolio Analysis of Individual Investors. SSRN Electronic Journal 6: 1–45. [Google Scholar] [CrossRef]

- Hoque, M. Enamul. 2016. Three Domains of Learning: Cognitive, Affective and Psychomotor. The Journal of EFL Education and Research 2: 45–52. [Google Scholar]

- Hoque, Mohammad Enamul, Nik Mohd Hazrul Nik Hashim, and Mohammad Hafizi Bin Azmi. 2018. Moderating effects of marketing communication and financial consideration on customer attitude and intention to purchase Islamic banking products: A conceptual framework. Journal of Islamic Marketing 9: 799–822. [Google Scholar] [CrossRef]

- Hosaini, Behnaz, and Zohre Saadatmand. 2014. The Relationship Between Interactive Skills By Learning Meta- Cognition (Self Directed Learning) High School Students In Isfahan. Kuwait Chapter of Arabian Journal of Business and Management Review 4: 195–203. [Google Scholar] [CrossRef]

- Hu, Li Tze, and Peter M. Bentler. 1999. Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives. Structural Equation Modelling: A Multidisciplinary Journal 6: 1–55. [Google Scholar] [CrossRef]

- Jain, Jinesh, Nidhi Walia, and Sanjay Gupta. 2020. Evaluation of behavioral biases affecting investment decision making of individual equity investors by fuzzy analytic hierarchy process. Review of Behavioral Finance 12: 297–314. [Google Scholar] [CrossRef]

- Jöreskog, Karl G., and Dag Sörbom. 1993. LISREL 8: Structural Equation Modelling with the SIMPLIS Command Language. New York: Scientific Software International. [Google Scholar]

- Kannadhasan, Manoharan. 2015. Retail investors’ financial risk tolerance and their risk-taking behaviour: The role of demographics as differentiating and classifying factors. IIMB Management Review 27: 175–84. [Google Scholar] [CrossRef] [Green Version]

- Kaur, Mandeep, and Tina Vohra. 2012. Understanding Individual Investor’s Behavior: A Review of Empirical Evidences. Pacific Bussiness Review International 5: 10–18. [Google Scholar]

- Khan, Shamila Nabi. 2017. Financial Risk Tolerance: An Analysis of Investor’s Cognitive, Decision-Making Styles and Cultural Effects. Journal of Finance, Accounting and Management 8: 20–38. [Google Scholar]

- Khan, Shebazbano, and Pankaj Natu. 2020. Aa Study on the Impact of Covid-19 on the Investment Pattern of Investors with Specific Reference to Traditional Investment (Real Estate and Gold) and Market Based Financial Products (Equities) in Mumbai. European Journal of Molecular & Clinical Medicine 7: 2020. [Google Scholar]

- King, Daniel W., Lynda A. King, Darin J. Erickson, Mina T. Huang, Erica J. Sharkansky, and Jessica Wolfe. 2000. Posttraumatic stress disorder and retrospectively reported stressor exposure: A longitudinal prediction model. Journal of Abnormal Psychology 109: 624–33. [Google Scholar] [CrossRef] [PubMed]

- Krueger, Norris, David J. Hansen, Theresa Michl, and Dianne H. B. Welsh. 2015. Thinking ‘“Sustainably”’: The Role of Intentions, Cognitions, and Emotions in Understanding New Domains of Entrepreneurship. Social and Sustainable Entrepreneurship 13: 275–309. [Google Scholar]

- Kumaravelu, G. 2019. Studying The Relation Between Information Processing Skills and Metacognition with Academic Achievement. I-Manager’s Journal on School Educational Technology 14: 42–48. [Google Scholar] [CrossRef]

- Kumari, Sharda, Bibhas Chandra, and J. K. Pattanayak. 2020. Personality traits and motivation of individual investors towards herding behaviour in Indian stock market. Kybernetes 49: 384–405. [Google Scholar] [CrossRef]

- Kusev, Petko, Harry Purser, Renata Heilman, Alex J. Cooke, Paul Van Schaik, Victoria Baranova, Rose Martin, and Peter Ayton. 2017. Understanding Risky Behavior: The Influence of Cognitive, Emotional and Hormonal Factors on Decision-Making under Risk. Frontiers in Psychology 8: 1–10. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lee, Hsiu Ming, Chien Pen Chuang, Jeen Fong Li, and Yu Chun Huang. 2013. A study on the relation between meta-cognition and problem solving ability among the students of mechanical engineering. Applied Mechanics and Materials 263–266, Pt 1: 3439–43. [Google Scholar] [CrossRef]

- Liu, Haiyue, Aqsa Manzoor, Cangyu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Long, Michael A., Paul B. Stretesky, and Michael J. Lynch. 2017. Foreign Direct Investment, Ecological Withdrawals, and Natural-Resource-Dependent Economies. Society and Natural Resources 30: 1261–76. [Google Scholar] [CrossRef]

- López-cabarcos, M. Ángeles, Ada M. Pérez-pico, and Paula Vázquez-rodríguez. 2019. Investor sentiment in the theoretical field of behavioural finance. Economic Research-EkonomskaIstraživanja 33: 2101–19. [Google Scholar] [CrossRef]

- Marsh, Herbert W., Kit Tai Hau, and Zhonglin Wen. 2004. In search of golden rules: Comment on hypothesis-testing approaches to setting cutoff values for fit indexes and dangers in overgeneralizing Hu and Bentler’s (1999) findings. Structural Equation Modelling: A Multidisciplinary Journal 11: 320–41. [Google Scholar] [CrossRef]

- Mcdonald, Skye. 2013. Impairments in Social Cognition Following Severe Traumatic Brain Injury. Journal of the International Neuropsychological Society 19: 231–46. [Google Scholar] [CrossRef] [PubMed]

- Mehta, Riju. 2019. 6 Investing Scams Triggered by Your Emotions. The Economic Times. October 21. Available online: https://economictimes.indiatimes.com/wealth/invest/6-investing-scams-triggered-by-your-emotions/articleshow/71661819.cms?from=mdr (accessed on 14 July 2021).

- Merkle, Christoph. 2011. Emotion and Finance—An Interdisciplinary Approach to the Impact of Emotions on Financial Decision Making. SSRN Electronic Journal 85: 1–22. [Google Scholar] [CrossRef] [Green Version]

- Mishra, Alok Kumar, Badri Narayan Rath, and Aruna Kumar Dash. 2020. Does the Indian Financial Market Nosedive because of the COVID-19 Outbreak, in Comparison to after Demonetisation and the GST? Emerging Markets Finance and Trade 56: 2162–80. [Google Scholar] [CrossRef]

- Mushinada, Venkata Narasimha Chary. 2020. How do investors behave in the context of a market crash? Evidence from India. International Journal of Emerging Markets 15: 1201–17. [Google Scholar] [CrossRef]

- Niznikiewicz, Margaret A. 2013. The building blocks of social communication. Advances in Cogntive Psychology 9: 173–83. [Google Scholar] [CrossRef]

- Njegovanović, Ana. 2018. Digital Financial Decision with a View of Neuroplasticity/Neurofinancy/Neural Networks. Financial Markets, Institutions and Risks 2: 82–91. [Google Scholar] [CrossRef]

- Outreville, J. François. 2014. Risk Aversion, Risk Behavior, and Demand for Insurance: A Survey. Journal of Insurance Issues 37: 158–86. [Google Scholar] [CrossRef] [Green Version]

- Özen, Ercan, and Gürsel Ersoy. 2019. The impact of financial literacy on cognitive biases of individual investors. Contemporary Studies in Economic and Financial Analysis 101: 77–95. [Google Scholar] [CrossRef]

- Palmer, Christina. 2015. Does “Hot Cognition” Mediate the Relationship between Dysfunctional Attitudes (Cold Cognition) and Depression? Ph.D. Thesis, University of Surrey, Guildford, UK, November 8. [Google Scholar]

- Pless, Nicola, Filomena Sabatella, and Thomas Maak. 2017. Mindfulness, reperceiving, and ethical decision making: A neurological perspective. Research in Ethical Issues in Organizations 17: 1–20. [Google Scholar] [CrossRef]

- Podsakoff, Philip M., Scott B. MacKenzie, Jeong Yeon Lee, and Nathan P. Podsakoff. 2003. Common Method Biases in Behavioural Research: A Critical Review of the Literature and Recommended Remedies. Journal of Applied Psychology 88: 879–903. [Google Scholar] [CrossRef] [PubMed]

- Robbins, Trevor W. 2011. Cognition: The Ultimate Brain Function. Neuropsychopharmacology Reviews 36: 1–2. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Rugnetta, Michael. 2020. Neuroplasticity. Encyclopedia Britannica. Available online: https://www.britannica.com/ science/neuroplasticity (accessed on 18 September 2021).

- Rustichini, Aldo. 2005. Emotion and Reason in Making Decisions Land Use and Climate Change. Neuroscience 310: 1624–26. [Google Scholar] [CrossRef]

- Saleem, Muhammad, and Rummana Zaheer. 2018. A Study on Influence of Domestic Investment on the Economic Growth during 1980–2016. Journal of Global Economics 6: 1–5. [Google Scholar] [CrossRef]

- Sani, Amizatulhawa Mat, Norzieiriani Ahmad, and Sanysanuri Mohd Mokhtar. 2019. Reliability and validity of instruments measuring individual lifestyle scale. International Journal of Engineering and Advanced Technology 9: 2548–52. [Google Scholar] [CrossRef]

- Schreiber, James B., Amaury Nora, Frances K. Stage, Elizabeth A. Barlow, and Jamie King. 2006. Modelling and Confirmatory Factor Analysis Results: A Review. The Journal of Educational Research 99: 323–37. [Google Scholar] [CrossRef]

- Sharma, Aditya, and Arya Kumar. 2020. A review paper on behavioral finance: Study of emerging trends. Qualitative Research in Financial Markets 12: 137–57. [Google Scholar] [CrossRef]

- Sharma, Rajeev, Philip Yetton, and Jeff Crawford. 2009. Estimating the effect of common method variance: The method-method pair technique with an illustration from tam research. MIS Quarterly: Management Information Systems 33: 473–90. [Google Scholar] [CrossRef] [Green Version]

- Sheedy, Elizabeth, and Martin Lubojanski. 2018. Risk management behaviour in banking. Managerial Finance 44: 902–18. [Google Scholar] [CrossRef]

- Sivaramakrishnan, Sreeram, Mala Srivastava, and Anupam Rastogi. 2017. Attitudinal factors, financial literacy, and stock market participation. International Journal of Bank Marketing 35: 818–41. [Google Scholar] [CrossRef]

- Sohaib, Osama, Kyeong Kang, and Iwona Miliszewska. 2019. Uncertainty avoidance and consumer cognitive innovativeness in E-commerce. Journal of Global Information Management 27: 59–77. [Google Scholar] [CrossRef]

- Statman, Meir. 2017. Financial Advertising in the Second Generation of Behavioral Finance Financial Advertising in the Second Generation of Behavioral Finance. Journal of Behavioral Finance 18: 470–77. [Google Scholar] [CrossRef]

- Syriopoulos, Theodore, and George Bakos. 2019. herding behaviour in globally listed shipping stocks Investor herding behaviour in globally listed shipping stocks. Maritime Policy & Management 46: 545–64. [Google Scholar] [CrossRef]

- Talwar, Manish, Shalini Talwar, Puneet Kaur, Naliniprava Tripathy, and Amandeep Dhir. 2021. Has financial attitude impacted the trading activity of retail investors during the COVID-19 pandemic? Journal of Retailing and Consumer Services 58: 102341. [Google Scholar] [CrossRef]

- Tanaka, J. S. 1987. “How big is enough?”: Sample size and goodness of fit in structural equation models with latent variables. Child Development 58: 134–46. [Google Scholar] [CrossRef]

- Tang, Thomas Li Pin, Yuh Jia Chen, and Toto Sutarso. 2008. Bad apples in bad (business) barrels: The love of money, machiavellianism, risk tolerance, and unethical behavior. Management Decision 46: 243–63. [Google Scholar] [CrossRef]

- Tauni, Muhammad Zubair, Zia Ur Rehman Rao, Hongxing Fang, Sultan Sikandar Mirza, Zulfiqar Ali Memon, and Khalil Jebran. 2017. Do investor’s Big Five personality traits influence the association between information acquisition and stock trading behavior? China Finance Review International 7: 450–77. [Google Scholar] [CrossRef]

- Thagard, Paul. 2006. Hot Thought: Mechanisms and Applications of Emotional Cognition | Reviews | Notre Dame Philosophical Reviews | University of Notre Dame. Notre Dame Philosophical Reviews. September 11. Available online: https://ndpr.nd.edu/reviews/hot-thought-mechanisms-and-applications-of-emotional-cognition/ (accessed on 19 July 2021).

- Tidwell, Pamela S., Cyril J. Sadowski, and Lia M. Pate. 2000. Relationships between need for cognition, knowledge, and verbal ability. Journal of Psychology: Interdisciplinary and Applied 134: 634–44. [Google Scholar] [CrossRef] [PubMed]

- Tooranloo, Hossein Sayyadi, Pedram Azizi, and Ali Sayyahpoor. 2020. Analyzing causal relationships of effective factors on the decision making of individual investors to purchase shares. International Journal of Ethics and Systems 36: 12–41. [Google Scholar] [CrossRef]

- Tully, Laura. M., and Tara A. Niendam. 2014. Beyond “Cold” Cognition: Exploring Cognitive Control of Emotion as a Risk Factor for Psychosis. Current Behavioral Neuroscience Reports 14: 170–81. [Google Scholar] [CrossRef] [Green Version]

- Vasileiou, Evangelos. 2021. Behavioral finance and market efficiency in the time of the COVID-19 pandemic: Does fear drive the market? International Review of Applied Economics 35: 224–41. [Google Scholar] [CrossRef]

- Vijayakumar, V. K. 2021. Are you actually investing or gambling in the stock market? The Economic Times. May 21. Available online: https://economictimes.indiatimes.com/markets/stocks/news/are-you-actually-investing-or-gambling-in-the-stock-market/articleshow/82825088.cms?from=mdr (accessed on 20 May 2021).

- Vitor, Paulo, Gama Silva, Jordana Brandalise Santos, Paulo Vitor, Gama Silva, and Jordana Brandalise Santos. 2019. Behavioral Finance in Brazil: A Bibliometric Study from 2007 to 2017 Behavioral Finance in Brazil: A Bibliometric Study from 2007 to 2017. Latin American Business Review 17: 1–22. [Google Scholar] [CrossRef]

- Wang, Yong, and Hanzhong Deng. 2018. Expectations, Behavior, and Stock Market Volatility. Emerging Markets Finance and Trade 54: 3235–55. [Google Scholar] [CrossRef]

- Xie, Jun, and Chunpeng Yang. 2015. Investor sentiment and the financial crisis: A sentiment-based portfolio theory perspective. Applied Economics 47: 700–9. [Google Scholar] [CrossRef]

- Yang, Lin. 2015. Empirical study on the relationship between entrepreneurial cognitions and strategic change momentum the moderating effect of organizational knowledge structures. Management Decision 53: 957–83. [Google Scholar] [CrossRef]

| Sl. No. | Variables in the Questionnaire for the Measurement and Structural Model |

|---|---|

| 1 | CC1: Investments in the stock market need knowledge relating to it. |

| 2 | RI1: I have been an active investor in the stock market. |

| 3 | CC2: I read the information on the company’s website before investing. |

| 4 | CC3: I read newspaper articles related to investment avenues from time to time. |

| 5 | MC1: I compare similar investment avenues before making a purchase decision. |

| 6 | MC2: I will invest more, if I will receive depth investment training. |

| 7 | RS1: Investing in stock can resolve my greater financial needs. |

| 8 | HC1: I prefer views from experts’ stock market investors. |

| 9 | RS2: Stock market investment gives me more income than FD. |

| 10 | HC2: I consult my family members before making an investment decision. |

| 11 | CC4: I collect and read past and expected returns before making an investment. |

| 12 | SC1: I prefer watching morning news on TV and newspapers relating to the same-day investment. |

| 13 | HC3-People around me also gives me suggestions to invest. |

| 14 | MC3-: I prefer an in-depth analysis of a 5-year profit before making an investment. |

| 15 | SP3: Past losses do not stop me from investing. |

| 16 | HC4: Friends and relatives help me to make better stock market investment decisions. |

| 17 | SC2: I prefer to observe the Twitter handles and Facebook pages of big stock market investors. |

| 18 | SC3: Invest mobile apps help me to make better investment decisions. |

| 19 | CC5: -Financial literacy is a must for making investments. |

| 20 | SP1: I will continue with the same investment, even if the prices are currently low, if analyzed properly. |

| 21 | MC4: I usually study scholarly articles about stock market investment to obtain greater knowledge. |

| 22 | SC4: The financial advisor in our society helps me to make investments. |

| 23 | MC5: I try to analyze the reasons for the fall and rise of a stock market index. |

| 24 | RI2: I will repeat a similar investment in the future. |

| 25 | NP1: In the future, I can make a better investment decision. |

| 26 | RS3: I want to invest more in comparably risky shares. |

| 27 | RS4: Past investment experiences help me to make more investments. |

| 28 | NP2: I am mentally prepared to handle investment securities in the future. |

| 29 | SP2: I am not emotional, but rather rationally choose my investments. |

| 30 | CC6: Transparency of investment information presents me with more reasons to invest. |

| 31 | RI3: If my income rises, I will make more investments. |

| 32 | MC6: I can make more investments if I have confirmed analytical news. |

| 33 | NP3: I will soon make more investments as my ability has improved. |

| Validity of Constructs of the Measurement Model | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Scale Items of the Constructs | Literature Sources | Factor Loading | CR | AVE | MSV | Max R(H) | NPL | ICO | RAB |

| Neuroplasticity (NPL) | (Syriopoulos and Bakos 2019), (Fiske 1993), (Haritha and Uchil 2020), (Bondia et al. 2019) | 0.766 | 0.528 | 0.214 | 0.826 | 0.726 | |||

| NPL1 | 0.878 | ||||||||

| NPL2 | 0.649 | ||||||||

| NPL3 | 0.625 | ||||||||

| Investors’ Cognition (ICO) | (Hosaini and Saadatmand 2014), (Kumaravelu 2019), (Talwar et al. 2021), (Duong et al. 2014), (Sohaib et al. 2019 ) | 0.809 | 0.520 | 0.315 | 0.861 | 0.435 | 0.721 | ||

| CC | 0.714 | ||||||||

| MC | 0.892 | ||||||||

| HC | 0.598 | ||||||||

| SC | 0.646 | ||||||||

| Risk Absorption (RAB) | (Robbins 2011), (Statman 2017), (David and Matu 2017), (Ferree and Merrill 2000), (Bhushan 2014) | 0.786 | 0.552 | 0.315 | 0.795 | 0.463 | 0.561 | 0.743 | |

| RI | 0.747 | ||||||||

| RS | 0.798 | ||||||||

| SP | 0.679 | ||||||||

| Description of Hypotheses Relating to the Structural Model | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Sl. No. | Hypotheses | Dependence On | Estimate | S.E. | C.R. | P | Standardized Regression Weight | Remarks on Hypotheses | ||

| 1 | H1 | NPL | <--- | ICO | 0.248 | 0.116 | 3.907 | *** | 0.257 | Supported |

| 2 | H2 | NPL | <--- | RAB | 0.356 | 0.181 | 3.032 | *** | 0.319 | Supported |

| 3 | H3 | RAB | <--- | ICO | 0.486 | 0.076 | 6.943 | *** | 0.561 | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Behera, Y.D.P.; Nanda, S.S.; Sharma, S.; Sahoo, T.R. Examining Risk Absorption Capacity as a Mediating Factor in the Relationship between Cognition and Neuroplasticity in Investors in Investment Decision Making. Int. J. Financial Stud. 2022, 10, 21. https://doi.org/10.3390/ijfs10010021

Behera YDP, Nanda SS, Sharma S, Sahoo TR. Examining Risk Absorption Capacity as a Mediating Factor in the Relationship between Cognition and Neuroplasticity in Investors in Investment Decision Making. International Journal of Financial Studies. 2022; 10(1):21. https://doi.org/10.3390/ijfs10010021

Chicago/Turabian StyleBehera, Yadav Devi Prasad, Sudhansu Sekhar Nanda, Shibani Sharma, and Tushar Ranjan Sahoo. 2022. "Examining Risk Absorption Capacity as a Mediating Factor in the Relationship between Cognition and Neuroplasticity in Investors in Investment Decision Making" International Journal of Financial Studies 10, no. 1: 21. https://doi.org/10.3390/ijfs10010021

APA StyleBehera, Y. D. P., Nanda, S. S., Sharma, S., & Sahoo, T. R. (2022). Examining Risk Absorption Capacity as a Mediating Factor in the Relationship between Cognition and Neuroplasticity in Investors in Investment Decision Making. International Journal of Financial Studies, 10(1), 21. https://doi.org/10.3390/ijfs10010021