Closed-Form Formula for the Conditional Moment-Generating Function Under a Regime-Switching, Nonlinear Drift CEV Process, with Applications to Option Pricing

Abstract

:1. Introduction

2. The Regime-Switching NLD-CEV Process

3. Conditional Moment-Generating Function

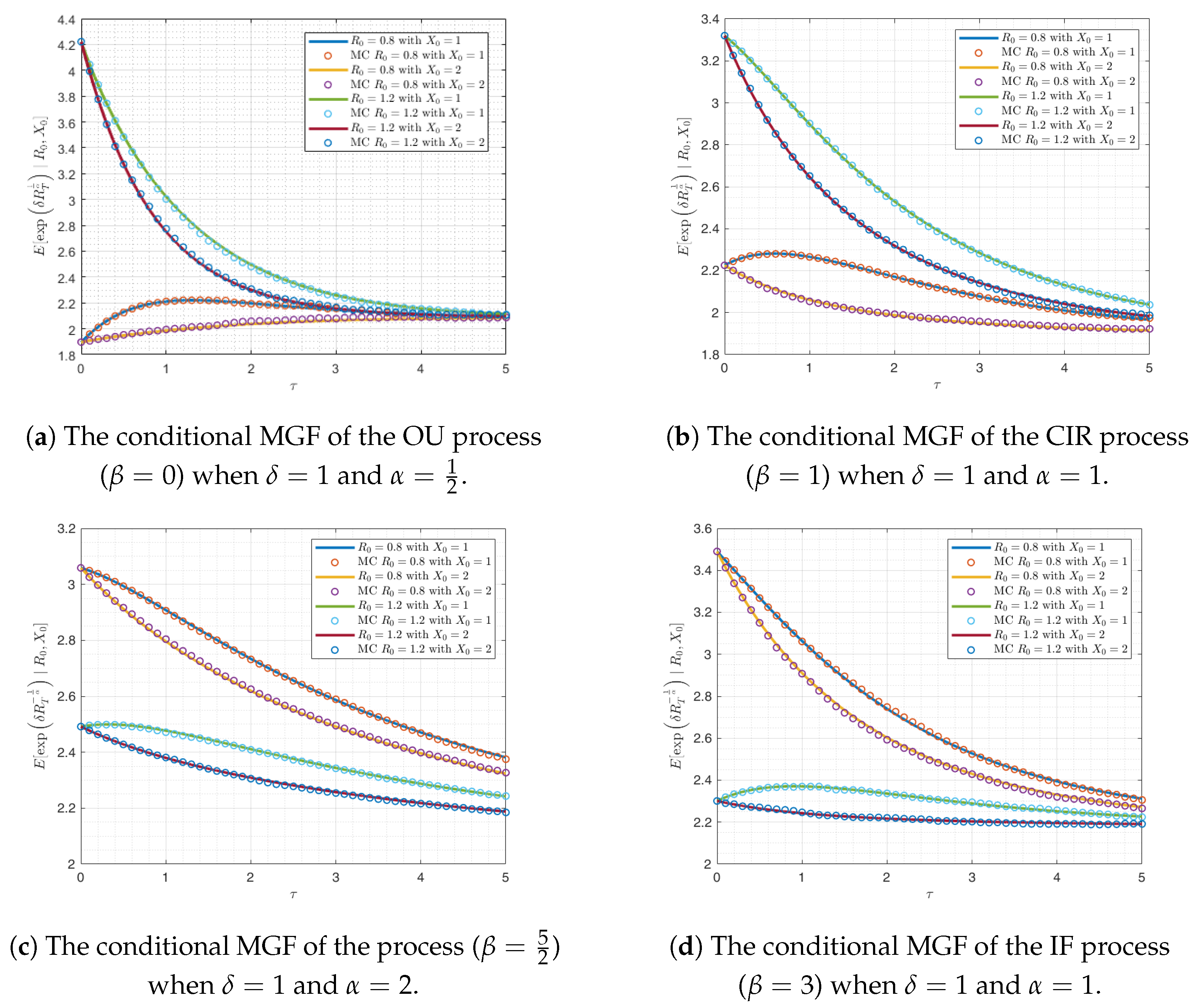

3.1. Conditional Moment-Generating Function of the Model When

3.2. Conditional Moment-Generating Function of the Model When

4. Integral Representation for European Options

5. Experimental Validations

- Calculate the one-step transition probability matrix, .

- Set the initial state . Generate a uniformly distributed random number on to determine the next state according to the following:Then, update .

- Repeat the second step until reaching such that equals the final time, thus completing the discrete Markov chain .

| Algorithm 1 Simulation of the continuous-time Markov chain and EM approximation |

| Input: Generator matrix Q, time step h, terminal time T, initial state , initial value , parameters , , and Output: Simulated discrete Markov chain and

|

6. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| CEV | constant elasticity of variance |

| CIR | Cox–Ingersoll–Ross |

| EM | Euler–Maruyama |

| IF | inverse Feller |

| MAD | mean absolute deviation |

| MGF | moment-generating function |

| NLD-CEV | nonlinear drift CEV |

| ODE | ordinary differential equation |

| OU | Ornstein–Uhlenbeck |

| PDE | partial differential equation |

| probability density function | |

| SDE | stochastic differential equation |

| SVM | stochastic volatility model |

References

- Carr, P.; Wu, L. Leverage effect, volatility feedback, and self-exciting market disruptions. J. Financ. Quant. Anal. 2017, 52, 2119–2156. [Google Scholar] [CrossRef]

- Dumas, B.; Fleming, J.; Whaley, R.E. Implied volatility functions: Empirical tests. J. Financ. 1998, 53, 2059–2106. [Google Scholar] [CrossRef]

- Cox, J. Notes on Option Pricing I: Constant Elasticity of Variance Diffusions; Stanford University, Graduate School of Business: Stanford, CA, USA, 1975; Unpublished note. [Google Scholar]

- Cox, J.C.; Ross, S.A. The valuation of options for alternative stochastic processes. J. Financ. Econ. 1976, 3, 145–166. [Google Scholar] [CrossRef]

- Chapman, D.A.; Pearson, N.D. Is the short rate drift actually nonlinear? J. Financ. 2000, 55, 355–388. [Google Scholar] [CrossRef]

- Jones, C.S. Nonlinear mean reversion in the short-term interest rate. Rev. Financ. Stud. 2003, 16, 793–843. [Google Scholar] [CrossRef]

- Li, M.; Pearson, N.D.; Poteshman, A.M. Conditional estimation of diffusion processes. J. Financ. Econ. 2004, 74, 31–66. [Google Scholar] [CrossRef]

- Marsh, T.A.; Rosenfeld, E.R. Stochastic processes for interest rates and equilibrium bond prices. J. Financ. 1983, 38, 635–646. [Google Scholar] [CrossRef]

- Vasicek, O. An equilibrium characterization of the term structure. J. Financ. Econ. 1977, 5, 177–188. [Google Scholar] [CrossRef]

- Merton, R.C. An asymptotic theory of growth under uncertainty. Rev. Econ. Stud. 1975, 42, 375–393. [Google Scholar] [CrossRef]

- Hamilton, J.D. A new approach to the economic analysis of nonstationary time series and the business cycle. Econom. J. Econom. Soc. 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Boyarchenko, S.; Levendorskii, S. American options in regime-switching models. SIAM J. Control. Optim. 2009, 48, 1353–1376. [Google Scholar] [CrossRef]

- Zhu, S.P.; Badran, A.; Lu, X. A new exact solution for pricing European options in a two-state regime-switching economy. Comput. Math. Appl. 2012, 64, 2744–2755. [Google Scholar] [CrossRef]

- Li, J. Trading VIX futures under mean reversion with regime switching. Int. J. Financ. Eng. 2016, 3, 1650021. [Google Scholar] [CrossRef]

- Lin, S.; He, X.J. A regime switching fractional Black–Scholes model and European option pricing. Commun. Nonlinear Sci. Numer. Simul. 2020, 85, 105222. [Google Scholar] [CrossRef]

- Elliott, R.J.; Lian, G.H. Pricing variance and volatility swaps in a stochastic volatility model with regime switching: Discrete observations case. Quant. Financ. 2013, 13, 687–698. [Google Scholar] [CrossRef]

- He, X.J.; Lin, S. A new nonlinear stochastic volatility model with regime switching stochastic mean reversion and its applications to option pricing. Expert Syst. Appl. 2023, 212, 118742. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, M.h. Pricing volatility swaps under double heston stochastic volatility model with regime switching. Nonlinear Funct. Anal. Appl. 2019, 24, 715–733. [Google Scholar]

- Lin, S.; He, X.J. Analytically pricing variance and volatility swaps with stochastic volatility, stochastic equilibrium level and regime switching. Expert Syst. Appl. 2023, 217, 119592. [Google Scholar] [CrossRef]

- Mehrdoust, F.; Noorani, I.; Hamdi, A. Two-factor Heston model equipped with regime-switching: American option pricing and model calibration by Levenberg–Marquardt optimization algorithm. Math. Comput. Simul. 2023, 204, 660–678. [Google Scholar] [CrossRef]

- Shen, Y.; Siu, T.K. Pricing variance swaps under a stochastic interest rate and volatility model with regime-switching. Oper. Res. Lett. 2013, 41, 180–187. [Google Scholar] [CrossRef]

- Rujivan, S.; Sutchada, A.; Chumpong, K.; Rujeerapaiboon, N. Analytically computing the moments of a conic combination of independent noncentral chi-square random variables and its application for the extended Cox–Ingersoll–Ross process with time-varying dimension. Mathematics 2023, 11, 1276. [Google Scholar] [CrossRef]

- Chumpong, K.; Tanadkithirun, R.; Tantiwattanapaibul, C. Simple closed-form formulas for conditional moments of inhomogeneous nonlinear drift constant elasticity of variance process. Symmetry 2022, 14, 1345. [Google Scholar] [CrossRef]

- Sutthimat, P.; Mekchay, K.; Rujivan, S. Closed-form formula for conditional moments of generalized nonlinear drift CEV process. Appl. Math. Comput. 2022, 428, 127213. [Google Scholar] [CrossRef]

- Chumpong, K.; Mekchay, K.; Rujivan, S. A simple closed-form formula for the conditional moments of the Ornstein–Uhlenbeck process. Songklanakarin J. Sci. Technol. 2020, 42, 836–845. [Google Scholar]

- Chumpong, K.; Mekchay, K.; Rujivan, S.; Thamrongrat, N. Simple Analytical Formulas for Pricing and Hedging Moment Swaps. Thai J. Math. 2022, 20, 693–713. [Google Scholar]

- Nualsri, F.; Mekchay, K. Analytically Pricing Formula for Contingent Claim with Polynomial Payoff under ECIR Process. Symmetry 2022, 14, 933. [Google Scholar] [CrossRef]

- Yao, D.D.; Zhang, Q.; Zhou, X.Y. A regime-switching model for European options. In Stochastic Processes, Optimization, and Control Theory: Applications in Financial Engineering, Queueing Networks, and Manufacturing Systems; Springer: Berlin/Heidelberg, Germany, 2006; pp. 281–300. [Google Scholar]

- Roman, S. The formula of Faà di Bruno. Am. Math. Mon. 1980, 87, 805–809. [Google Scholar] [CrossRef]

- Andresen, L.; Piterbarg, V. Interest Rate Modeling (Volume 1): Foundations and Vanilla Models; Atlantic Financial Press: Luxembourg, 2010. [Google Scholar]

| No. of Paths | |||||

|---|---|---|---|---|---|

| 1 | 5 | 10 | 15 | ||

| 1 | 5000 | 8.756 | 2.789 | 4.204 | 4.041 |

| 10,000 | 6.379 | 1.596 | 2.043 | 3.746 | |

| 20,000 | 4.224 | 6.450 | 5.622 | 2.373 | |

| 40,000 | 2.652 | 8.463 | 6.305 | 2.466 | |

| 2 | 5000 | 2.599 | 3.562 | 8.097 | 7.673 |

| 10,000 | 5.147 | 2.672 | 6.019 | 4.853 | |

| 20,000 | 2.780 | 1.753 | 2.390 | 3.165 | |

| 40,000 | 2.573 | 8.578 | 1.759 | 2.405 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chumpong, K.; Mekchay, K.; Nualsri, F.; Sutthimat, P. Closed-Form Formula for the Conditional Moment-Generating Function Under a Regime-Switching, Nonlinear Drift CEV Process, with Applications to Option Pricing. Mathematics 2024, 12, 2667. https://doi.org/10.3390/math12172667

Chumpong K, Mekchay K, Nualsri F, Sutthimat P. Closed-Form Formula for the Conditional Moment-Generating Function Under a Regime-Switching, Nonlinear Drift CEV Process, with Applications to Option Pricing. Mathematics. 2024; 12(17):2667. https://doi.org/10.3390/math12172667

Chicago/Turabian StyleChumpong, Kittisak, Khamron Mekchay, Fukiat Nualsri, and Phiraphat Sutthimat. 2024. "Closed-Form Formula for the Conditional Moment-Generating Function Under a Regime-Switching, Nonlinear Drift CEV Process, with Applications to Option Pricing" Mathematics 12, no. 17: 2667. https://doi.org/10.3390/math12172667