Robust Operation of Energy Storage System with Uncertain Load Profiles

Abstract

:1. Introduction

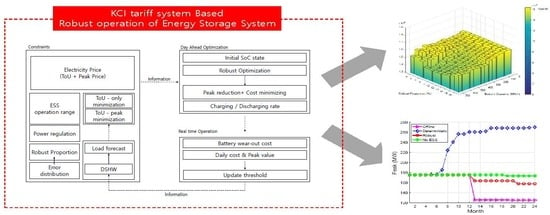

2. Robust ESS Operation Framework

2.1. System Model

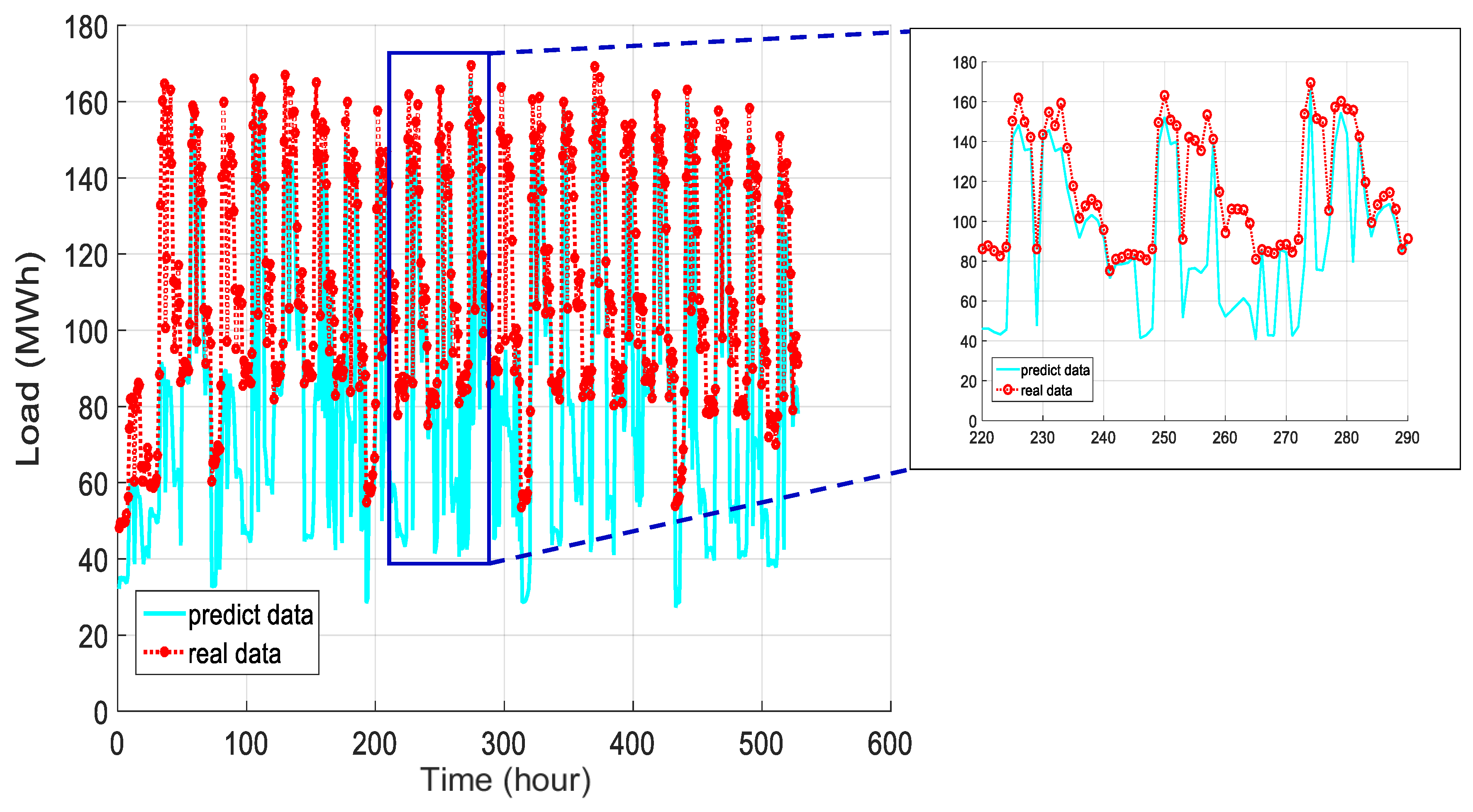

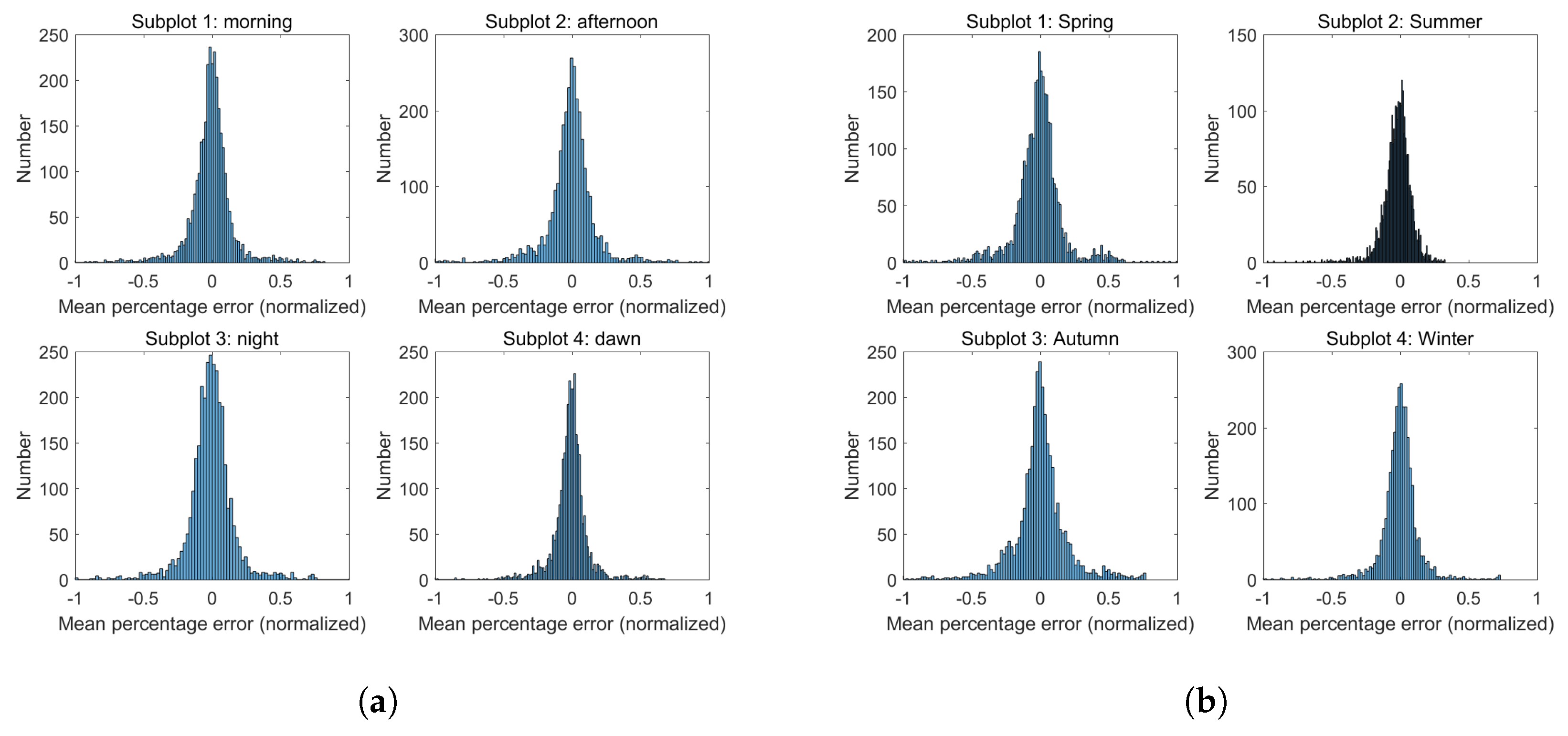

2.2. Load Uncertainty

2.3. Daily Operation of ESS with Uncertain Load Profile

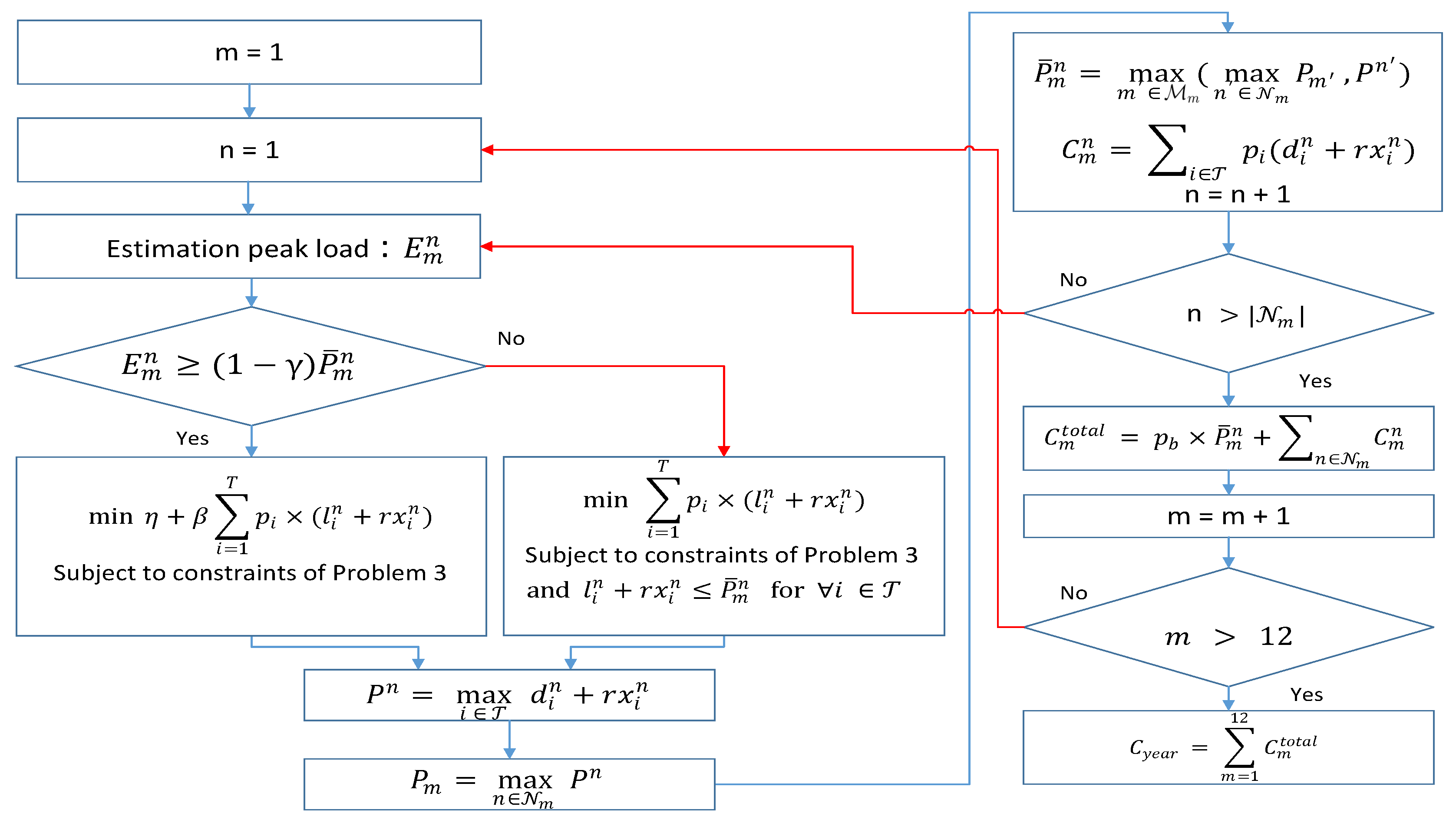

2.4. Year-Round Operation of ESS with Uncertain Load Profile

3. Simulation Results

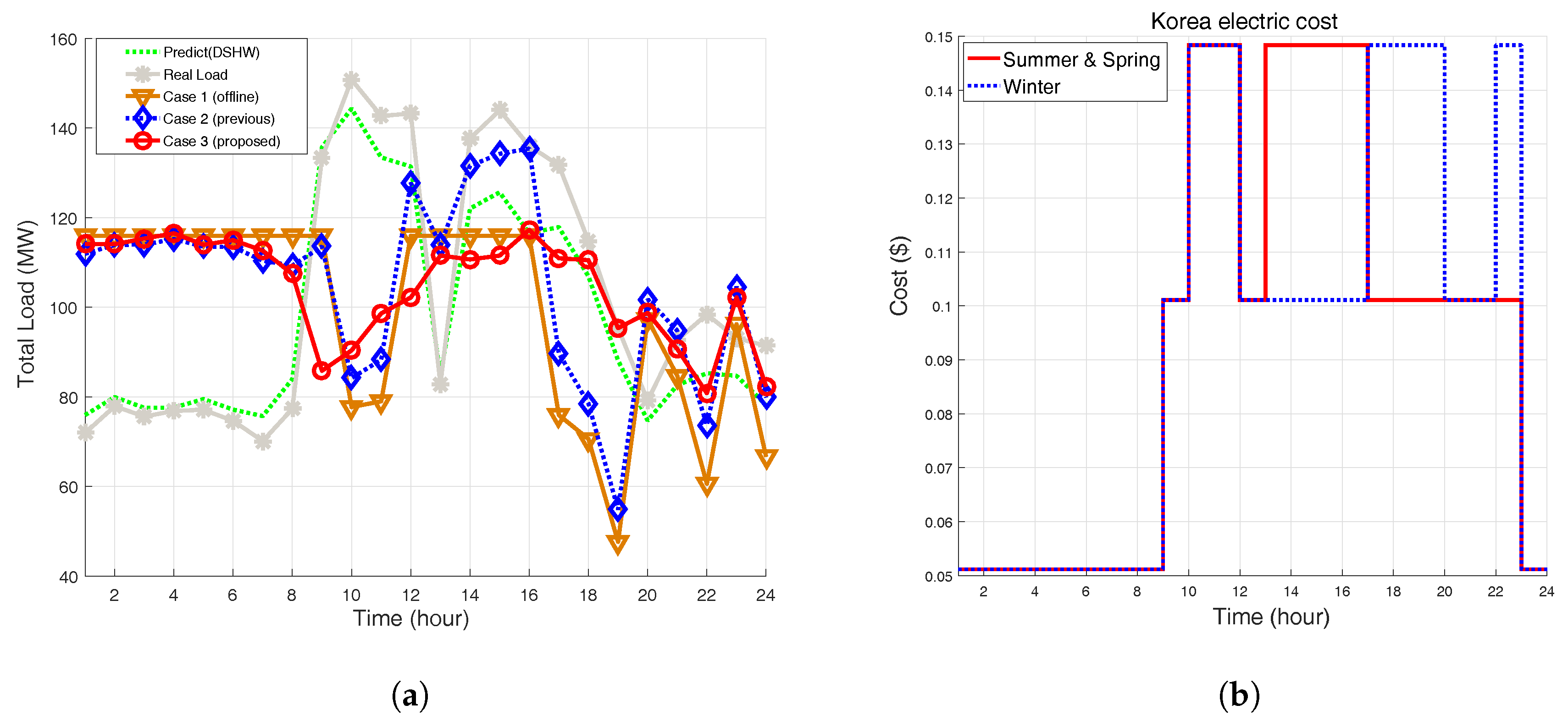

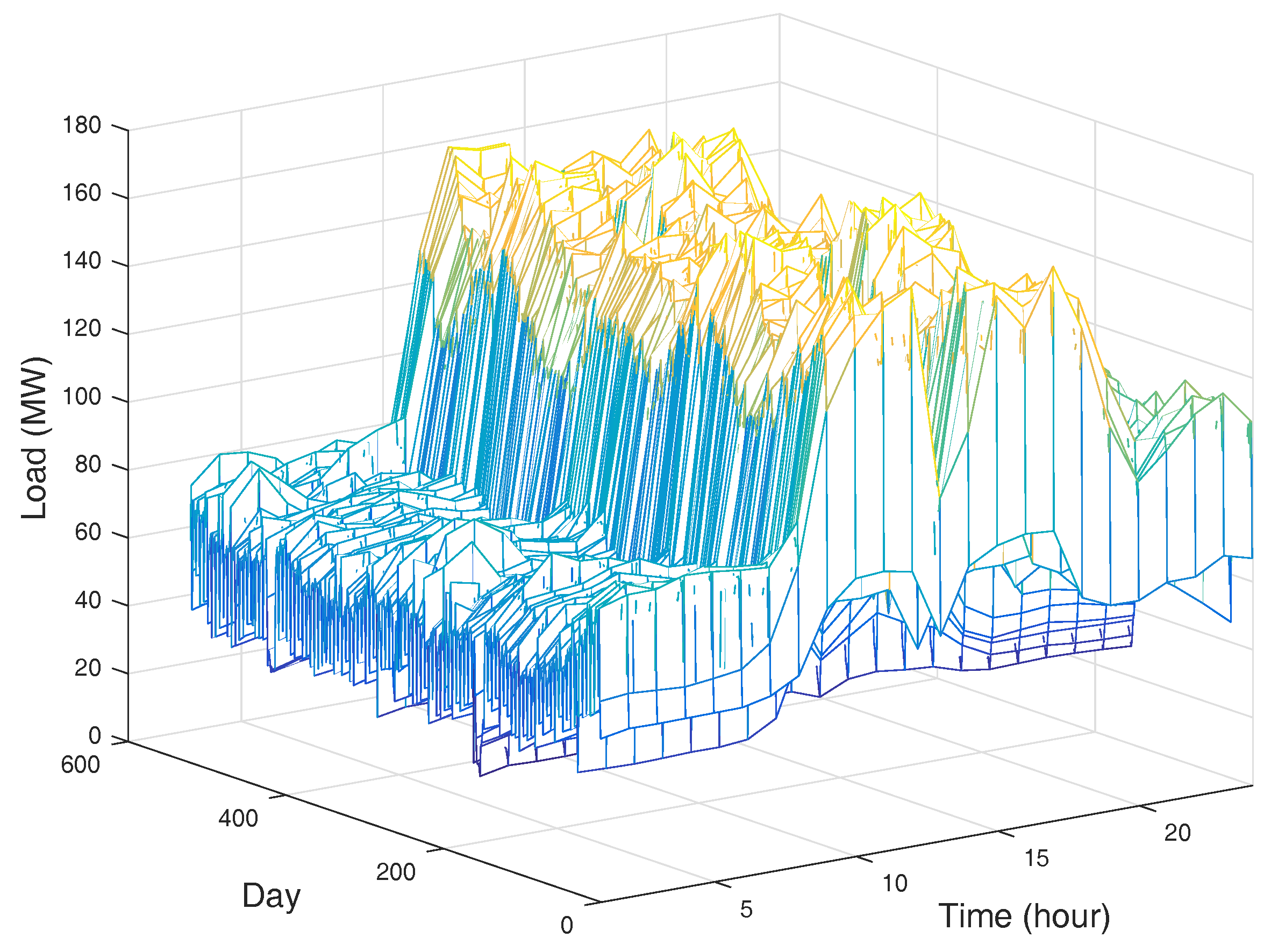

3.1. Experimental Set-Up

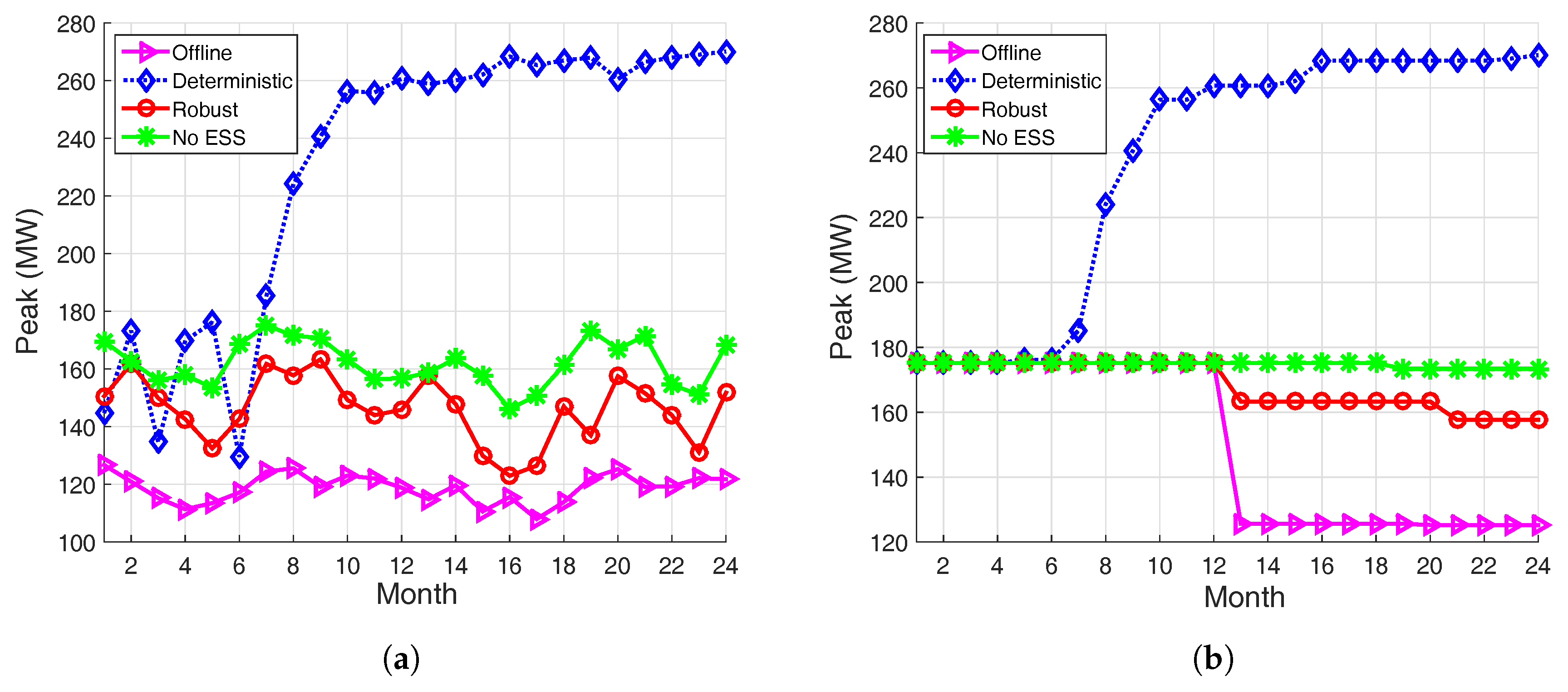

3.2. Case 1: Comparison of Peak Reduction

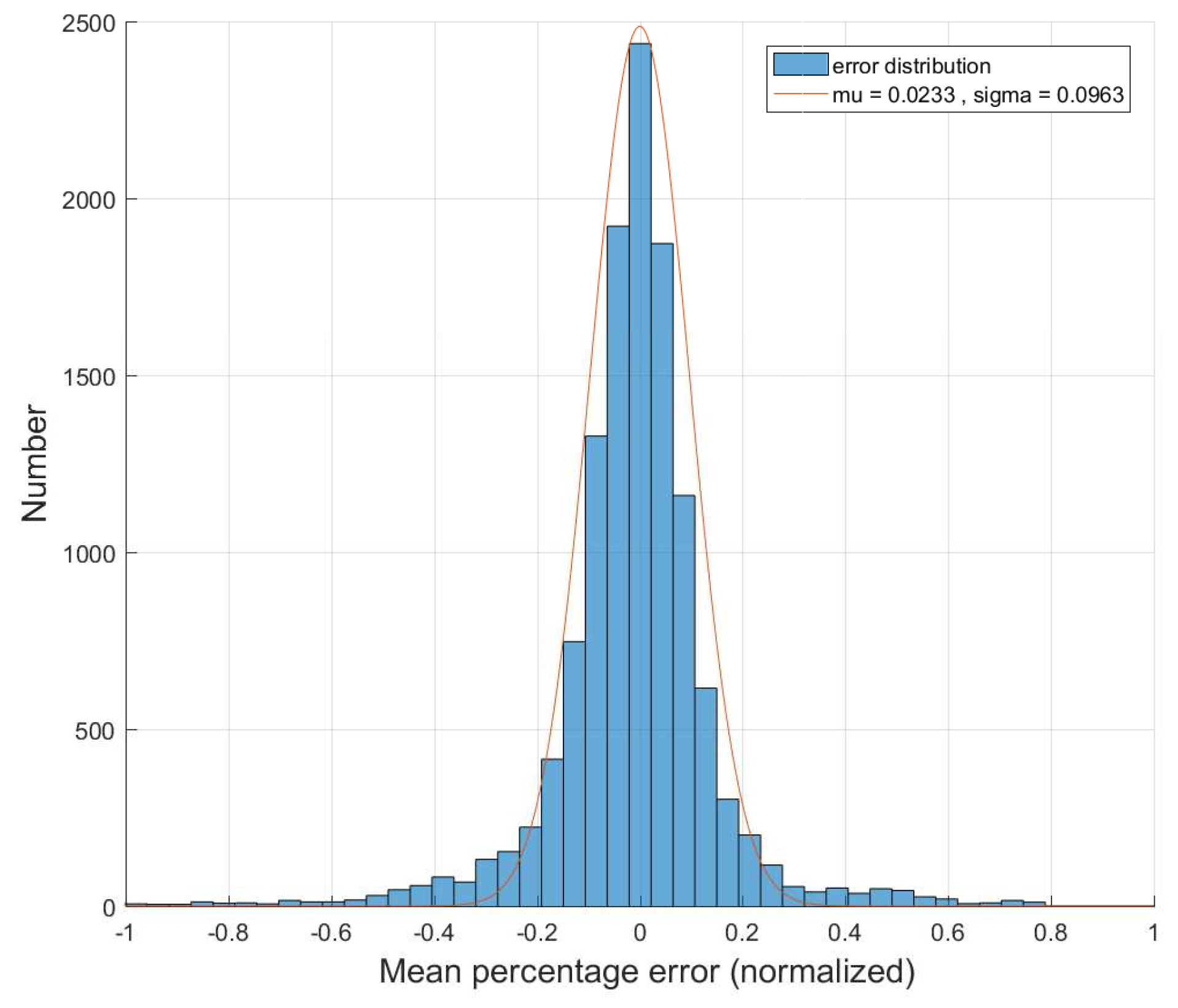

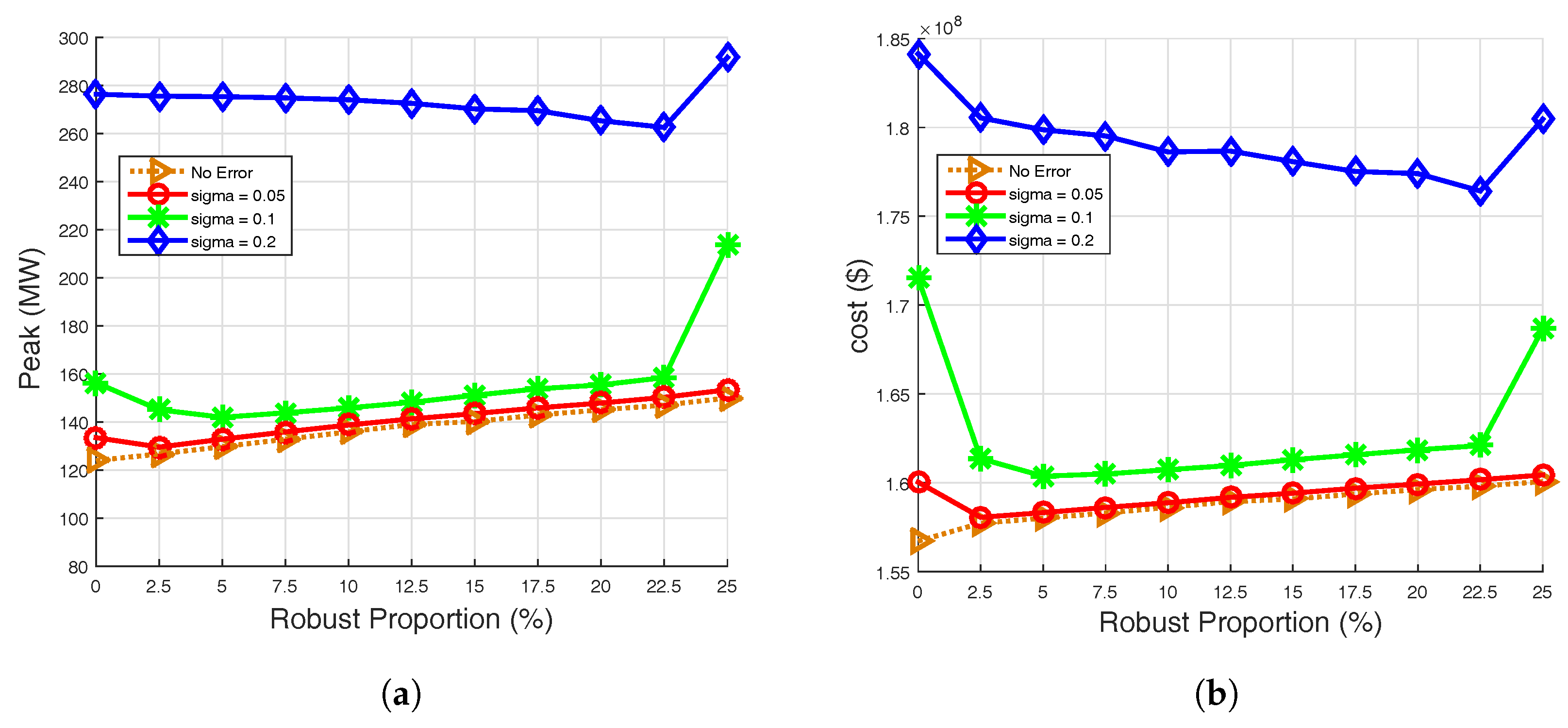

3.3. Case 2: Monte Carlo Simulation to Determine Proper Robust Proportion

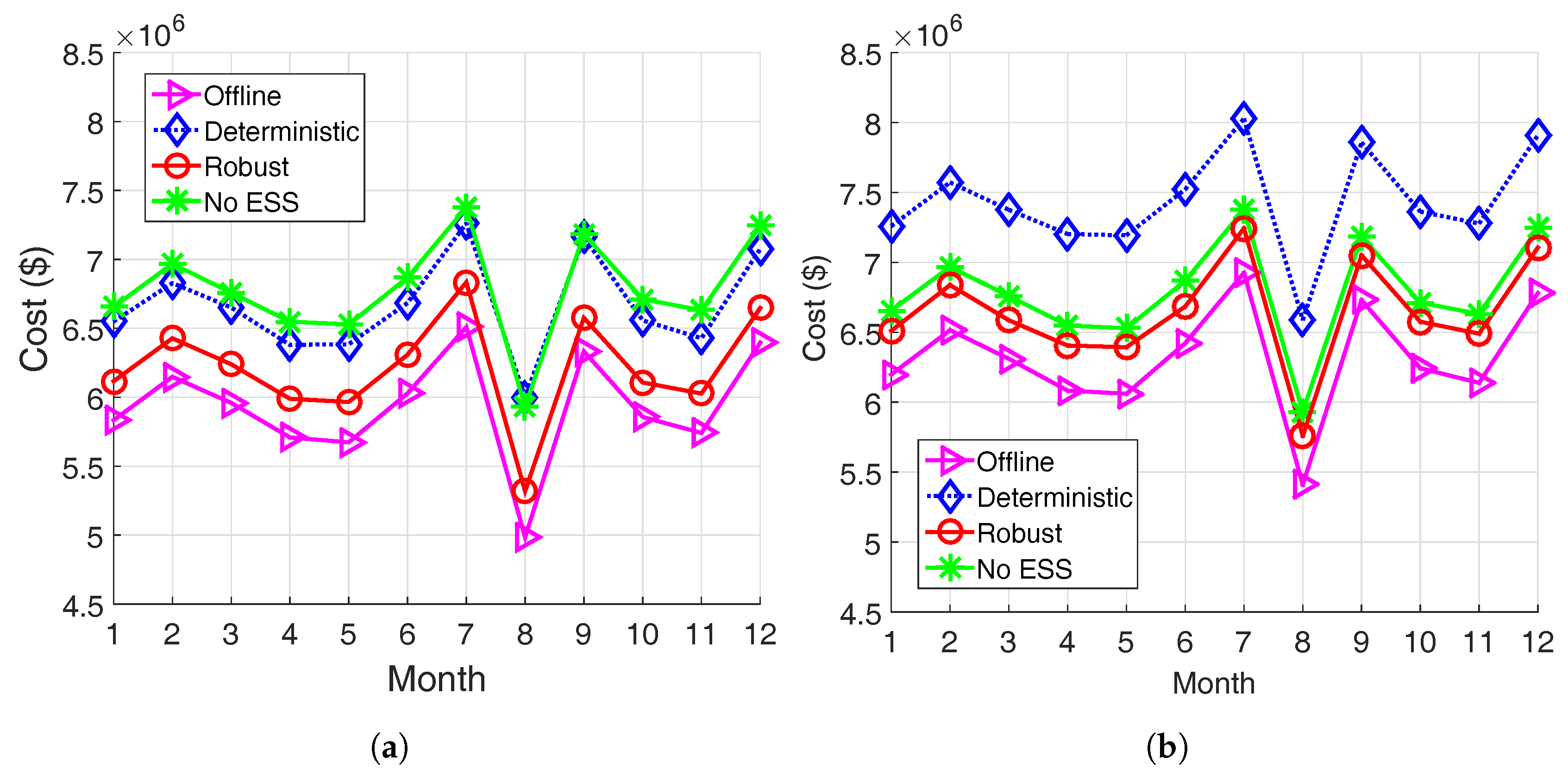

3.4. Case 3: Cost Comparison for Year-Round Operation

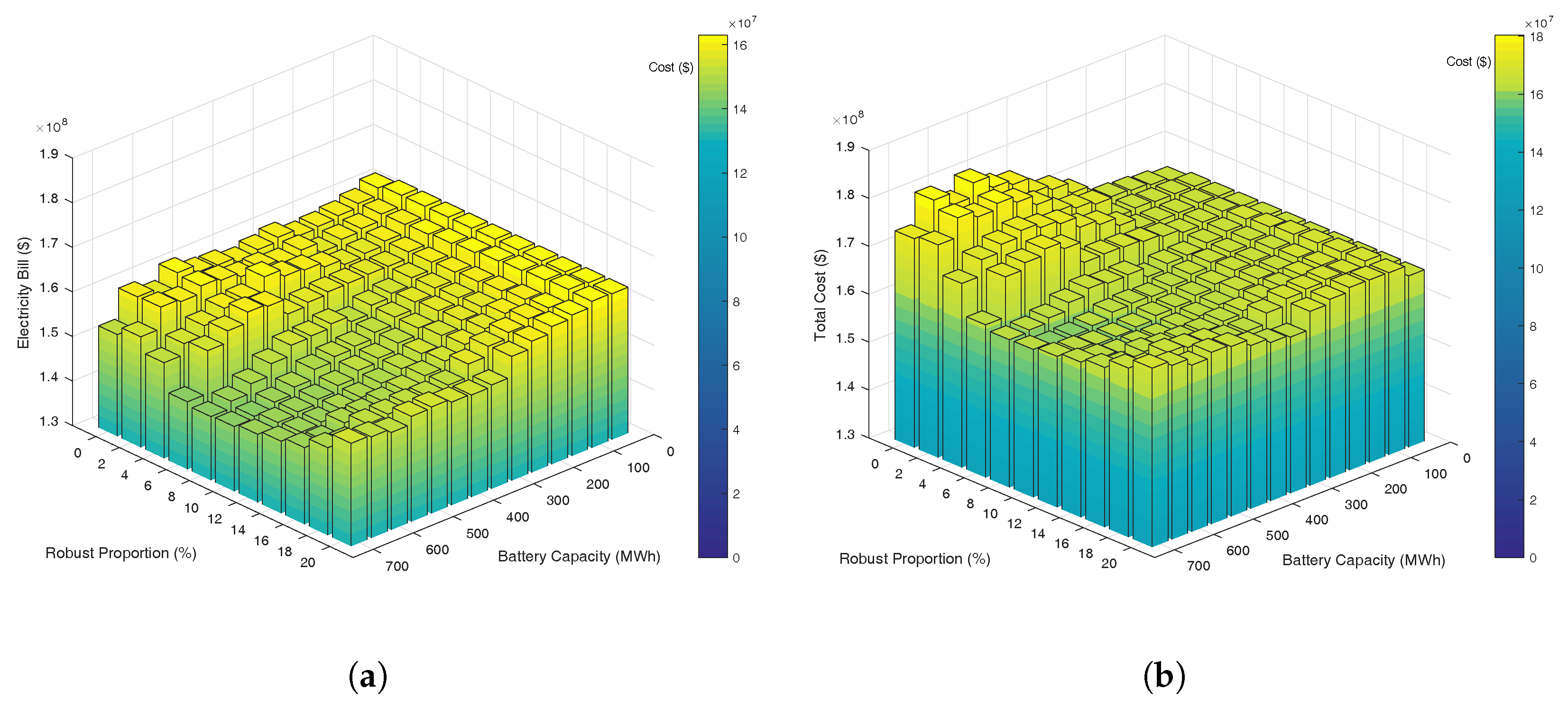

3.5. Case 4: Battery Capacity and Robust Proportion to Minimize Total Cost

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Mohsenian-Rad, A.H.; Leon-Garcia, A. Optimal residential load control with price prediction in real-time electricity pricing environments. IEEE Trans. Smart Grid 2010, 1, 120–133. [Google Scholar] [CrossRef]

- Du, P.; Lu, N. Appliance commitment for household load scheduling. IEEE Trans. Smart Grid 2011, 2, 411–419. [Google Scholar] [CrossRef]

- Yan, Y.; Qian, Y.; Sharif, H.; Tipper, D. A survey on smart grid communication infrastructures: Motivations, requirements and challenges. IEEE Commun. Surv. Tutor. 2013, 15, 5–20. [Google Scholar] [CrossRef]

- Sun, S.; Dong, M.; Liang, B. Joint supply, demand, and energy storage management towards microgrid cost minimization. In Proceedings of the 2014 IEEE International Conference on Smart Grid Communications (SmartGridComm), Venice, Italy, 3–6 November 2014; pp. 109–114. [Google Scholar]

- Oudalov, A.; Chartouni, D.; Ohler, C. Optimizing a battery energy storage system for primary frequency control. IEEE Trans. Power Syst. 2007, 22, 1259–1266. [Google Scholar] [CrossRef]

- Isaac Herrera, V.; Gaztanaga, H.; Milo, A.; Saez-de Ibarra, A.; Etxeberria-Otadui, I.; Nieva, T. Optimal energy management and sizing of a battery-supercapacitor-based light rail vehicle with a multiobjective approach. IEEE Trans. Ind. Appl. 2016, 52, 3367–3377. [Google Scholar] [CrossRef]

- Ippolito, M.; Favuzza, S.; Sanseverino, E.; Telaretti, E.; Zizzo, G. Economic feasibility of a customer-side energy storage in the Italian electricity market. In Proceedings of the 2015 IEEE 15th International Conference on Environment and Electrical Engineering (EEEIC), Rome, Italy, 10–13 June 2015; pp. 938–943. [Google Scholar]

- Chaudhari, K.; Ukil, A. TOU pricing based energy management of public EV charging stations using energy storage system. In Proceedings of the 2016 IEEE International Conference on Industrial Technology (ICIT), Taipei, Taiwan, 14–17 March 2016; pp. 460–465. [Google Scholar]

- Erol-Kantarci, M.; Mouftah, H.T. TOU-aware energy management and wireless sensor networks for reducing peak load in smart grids. In Proceedings of the 2010 IEEE 72nd Vehicular Technology Conference Fall (VTC 2010-Fall), Ottawa, ON, Canada, 6–9 September 2010; pp. 1–5. [Google Scholar]

- Nguyen, H.K.; Song, J.B.; Han, Z. Demand side management to reduce peak-to-average ratio using game theory in smart grid. In Proceedings of the 2012 IEEE Conference on Computer Communications Workshops (INFOCOM), Orlando, FL, USA, 25–30 March 2012; pp. 91–96. [Google Scholar]

- Park, D.C.; El-Sharkawi, M.; Marks, R.; Atlas, L.; Damborg, M. Electric load forecasting using an artificial neural network. IEEE Trans. Power Syst. 1991, 6, 442–449. [Google Scholar] [CrossRef]

- Park, S.; Ryu, S.; Choi, Y.; Kim, J.; Kim, H. Data-driven baseline estimation of residential buildings for demand response. Energies 2015, 8, 10239–10259. [Google Scholar] [CrossRef]

- Nguyen, H.K.; Song, J.B.; Han, Z. Distributed demand side management with energy storage in smart grid. IEEE Trans. Parallel Distrib. Syst. 2015, 26, 3346–3357. [Google Scholar] [CrossRef]

- Jeong, M.G.; Moon, S.I.; Hwang, P.I. Indirect load control for energy storage systems using incentive pricing under time-of-use tariff. Energies 2016, 9, 558. [Google Scholar] [CrossRef]

- Taylor, J.W.; McSharry, P.E. Short-term load forecasting methods: An evaluation based on european data. IEEE Trans. Power Syst. 2007, 22, 2213–2219. [Google Scholar] [CrossRef]

- Ryu, S.; Noh, J.; Kim, H. Deep neural network based demand side short term load forecasting. In Proceedings of the 2016 IEEE International Conference on Smart Grid Communications (SmartGridComm), Sydney, Australia, 6–9 November 2016; pp. 308–313. [Google Scholar]

- Ryu, S.; Noh, J.; Kim, H. Deep neural network based demand side short term load forecasting. Energies 2017, 10, 3. [Google Scholar] [CrossRef]

- Han, S.; Han, S.; Aki, H. A practical battery wear model for electric vehicle charging applications. Appl. Energy 2014, 113, 1100–1108. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Soyster, A.L. Technical note convex programming with set-inclusive constraints and applications to inexact linear programming. Oper. Res. 1973, 21, 1154–1157. [Google Scholar] [CrossRef]

- Kim, K.; Choi, Y.; Kim, H. Data-driven battery degradation model leveraging average degradation function fitting. Electron. Lett. 2016, 53, 102–104. [Google Scholar] [CrossRef]

- Choi, Y.; Kim, H. Optimal scheduling of energy storage system for self-sustainable base station operation considering battery wear-out cost. Energies 2016, 9, 462. [Google Scholar] [CrossRef]

| Parameters | Symbols | Values (Unit) |

|---|---|---|

| Time interval | − | 15 min |

| Time slot | i | 1–96 (based on 24 h) |

| Battery price | − | $150/kWh |

| Battery type | − | Battery C [22] |

| Battery efficiency | − | 90% |

| Operational SoC range | − | 10%–90% |

| Weighting factor | 1/base electricity price | |

| Initial SOC | 10% | |

| Battery capacity | B | 400 MWh |

| Maximum battery power rate | r | 200 MW |

| Base electricity price | $8.3/kW | |

| Time of Use Pricing | $0.05–0.15/kWh |

| Algorithms | Electricity Bill ($) | Max Peak Load (kW) | ESS Wear-Out Cost ($) | Total Cost ($) |

|---|---|---|---|---|

| Offline | 142,520,000 | 145,530 | 14,490,000 | 157,010,000 |

| Deterministic | 159,760,000 | 342,870 | 19,788,000 | 179,548,000 |

| Robust | 144,910,000 | 171,850 | 15,255,000 | 160,165,000 |

| No ESS | 164,750,000 | 175,170 | 0 | 164,750,000 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.; Choi, Y.; Ryu, S.; Kim, H. Robust Operation of Energy Storage System with Uncertain Load Profiles. Energies 2017, 10, 416. https://doi.org/10.3390/en10040416

Kim J, Choi Y, Ryu S, Kim H. Robust Operation of Energy Storage System with Uncertain Load Profiles. Energies. 2017; 10(4):416. https://doi.org/10.3390/en10040416

Chicago/Turabian StyleKim, Jangkyum, Yohwan Choi, Seunghyoung Ryu, and Hongseok Kim. 2017. "Robust Operation of Energy Storage System with Uncertain Load Profiles" Energies 10, no. 4: 416. https://doi.org/10.3390/en10040416