Risk Culture during the Last 2000 Years—From an Aleatory Society to the Illusion of Risk Control

Abstract

:1. Introduction—Cultures of Risk

The Risk of losing any Sum is […] the product of the Sum adventured multiplied by the Probability of the Loss.

- The discussion about “risk-taking” starting many years ago from the perspective of psychology (Kahneman and Lovallo 1993) and bank ownership structure (Saunders et al. 1990) to pre-crisis discussions about asymmetric information (Sinn 2003) and competition (Boyd and De Nicoló 2005) to a post-crisis focus on remuneration and incentive pay (Efing et al. 2015; Martynova et al. 2015);

- Darwin College Lecture Series “Risk” of University of Cambridge in 2010;

- Conference on “Kulturen des Risikos im Europa des Mittelalters und der Frühen Neuzeit” (Cultures of Risk in Europe in Mediaeval and Early Modern Times) 2017 in Munich;

- Book “The Illusion of Risk Control: What Does it Take to Live with Uncertainty?” by Gilles Motet (eds. 2017) with focus on “safety culture” in high risk industries.

“Kulturen des Risikos trauen sich im Umgang mit dem Gefährlichen und Bedrohlichen mehr zu als Welten der Sicherheit. Kulturen des Risikos sind darauf angelegt, hinter jeder Gefahr auch eine Chance zu sehen. [...] Welten der Sicherheit beruhen auf dem impliziten Versprechen einer sicheren Welt und befördern auf diese Weise Erwartungen, an denen sie schließlich gemessen werden. Dabei stellt sich dann mit großer Regelmäßigkeit heraus, dass sie diesem Versprechen nicht wirklich genügen …”.

- An aleatory society with diversification of economical endeavours in the Roman society

- Ad risicum et fortunam: individual decision-making and responsibility of medieval merchants

- Dutch Tulipmania with rational gamblers in times of war and plague in the 17th century

- Adventurers and entrepreneurs in the dynamic economic development of the 18th and 19th century

- Scientific Management in the 20th century and faith in clockwork-like models

- Volatility, Uncertainty, Complexity and Ambiguity (VOCA) in the 21st century

2. Definitions of “Risk Culture” and Honourable Merchants

A sound risk culture consistently supports appropriate risk awareness, behaviours and judgements about risk-taking within a strong risk governance framework. A sound risk culture bolsters effective risk management, promotes sound risk-taking, and ensures that emerging risks … are recognised, assessed, escalate and addressed in a timely manner. Risk culture … evolves over time in relation to the events that affect the institution’s history (such as mergers and acquisitions) and to the external context within which the institution operates.

… norms, attitudes and behaviours related to risk awareness, risk-taking and risk management, and controls that shape decisions on risks. Risk culture influences the decisions of management and employees during the day-to-day activities and has an impact on the risks they assume.

These definitions describe “risk culture” as good corporate processes, conscious decision-making and responsibility of banks as organisations5. In other words, this is the 21st century version of the culture of honourable merchants with personal decision-making, individual responsibility, and good conduct6 in long-term commercial relationships based on pragmatic rationality. Mika Kallioinen summarized this as “The Bond of Trade” (Kallioinen 2012).Risk culture: Requirements of responsible corporate governance

[bankers commit] “mortally sin if they dedicate themselves to the type of transactions where they run the risk (danger) of getting involved in a situation where they will be unable to pay for the deposits. For example, if they send such a great amount of merchandise across sea that in case of shipwrecking, or the ship being caught by pirates, it is not possible for them to pay for the deposits, not even by selling their assets. And they not only mortally sin when the business ends badly, but also even if it were to end favorably.”

3. An Aleatory Society—Rome

“Romans used the imaginary of dicing actively to parade (and so, in a sense, manage) uncertainty. […] the luck of the board game became a way of seeing, classifying and understanding what in our terms might be thought of as risk.”

4. Ad Risicum et Fortunam—Medieval Sea Merchants

- “Risicum” was used in the context of individual (commercial) conscious decision under uncertainty, but with the responsibility to accept or cover the (financial) consequences and damages;

- “Periculum” or, respectively, “fortunam” were used for exogenous (natural) forces, with the merchant could not be aware of and which could be covered by a contract, i.e., something unrelated to the individual decision making of a professional and experienced sea merchant.

- Risk was regarded as an outcome of individual decisions, for which the decision maker has the responsibility (in contrast to hierarchical “tribal” societies).

- Risk was interpreted as intertemporal interaction depending on a clear understanding of a “progressing time” with a development from the present and the future (in contrast to the older “steady-state” societies, in which everything was pre-ordained by religion or sovereign).

- Risk was handled as a commercial product, which could be rationally traded, insured or hedged for a certain price (one of the current core functions of a bank; see Baecker 1991).

Cheat not rich man nor poor—since you know not what you may encountera man may buy other things—but not fortune12.

- from Italy to Marseilles, Toulouse, Barcelona and Spain;

- with branches of Italian merchant houses in Bruges as “clearing house for northern Europe, and from Bruges to Antwerp and later to Amsterdam;

- from the fairs of the Champagne to Cologne, to Frankfurt and to Southern Germany;

- with merchants—e.g., Jakob Fugger—learning the business in Venice or other Italian cities

- to London and to the Hanseatic League and further to the Baltics.

5. The Dutch “Tulpmania”—Rational Gamblers in Risky Times (The 17th Century)

- The Dutch Revolt (Eighty Years’ War from 1566/1568 to 1648; in Dutch “Tachtigjarige Oorlog“) against Spanish supremacy with independency de-facto in 1609 and de-jure in 1648

- The Thirty Years’ War in Germany (1618–1648)

- The Bubonic plague in coastal cities in Northern Europe from 1617 to 1630 and isolated outbreaks, e.g., in Amsterdam in summer 1635 to 1637

- The onset of the European “Little Ice Age” in the mid-sixteenth century (continuing to the mid-nineteenth century)

- Professional tulip merchants traded in an efficient market, in which the spot and future prices were determined by supply and demand with plague and wars as exogenous factors.

- The common people used the opportunity of the changed “regulation” of the tulip market as a valve for their desire to gamble in times of plague and wars.

6. Adventurers and Entrepreneurs—Industrialisation and Non-Equilibrium

- The “gambler’s dispute” of Chevalier de Méré led to an exchange of letters between Blaise Pascal and Pierre de Fermat, in which principles of probability were formulated in 1654.

- Christiaan Huygens published the earliest book on probability “De ratiociniis in ludo aleae” (On Reasoning in Games of Chance) in 1657.

- Gerolamo Cardano wrote the “Liber de Ludo Aleae” (Book on Games of Chance) sometime in the mid-1500s, although it was unpublished until 1663.

- Jakob Bernoulli’s book “Ars Conjectandi” was published posthumous in 1713.

- Abraham de Moivre wrote the “Doctrine of Chances” in 1718.

- New social, political, and economical concepts, e.g., by Adam Smith and David Hume, which laid the basis of an open society of free individuals;

- New worlds to be discovered (e.g., self-government of “New Amsterdam” in 1652, which was renamed by the English later in 1664 to New York);

- New technologies, e.g., with the steam engine (i.e., with James Watt’s patent in 1781) and railroads (later at the beginning of the 19th century).

- The risk culture was to embrace risks = size opportunities—and all consequences such as crashes, insolvencies and bubbles were part of the development far from equilibrium.

- However, sellers and buyers had to manage their own risks and take (or sometimes not) their responsibilities. At least, there was no help from a “last resort”.

- In the long run, the economic development generates benefits for the society in general.

7. Scientific Management and the Clockwork as Paradigm (The 20th Century)

Another example is Poincaré’s comment to Walras [as quoted in Ingrau and Israel 1990]:When men are close to each other, they no longer decide randomly and independently of each other, they each reacts to the others19.

… you regard men as infinitely selfish and infinitely farsighted. The first hypothesis may perhaps be admitted in a first approximation, the second may call for some reversion.

- Marie-Esprit-Léon Walras’ “Éléments d’économie politique pure” of (Walras 1874), which was influenced by Antoine Augustin Cournot (1801 to 1877) and the French rationalism, or Cartesian constructivism—adopted after the 1954 translation by William Jaffé in the General Equilibrium Theory of Arrow and Debreu (1954) and McKenzie (1959).

- Louis Bachelier’s “Théorie de la Spéculation” (Bachelier 1900; adopted after Leonard Jimmie Savage translated Bachelier to English and Paul Samuelson promoted his ideas in the 1950s).

- Frederick Winslow Taylor’s “Principles of Scientific Management” of (Taylor 1911; with the rapid adaption of his ideas, e.g., by Henry Ford in the production of Ford Model T in 1918).

The CEO of J.P. Morgan, Dennis Weatherstone, asked the bank’s quants in the wake of the 1987 crash to come up with a short daily summary of the market risk facing the bank. He wanted one single number every day at 4:15 pm which indicates the risk exposure of the entire bank. By that time the quants, i.e., the quantitative financial analysts, disposed of mathematical models for “market risk”, such as the above considered price movements of stocks, options etc. Stochastic models were used to calculate the distribution of total profits or losses from these sources during a fixed period, i.e., the consecutive 10 business days. The “value at risk” was then defined as the 1% quantile of this distribution, i.e., the smallest number M 2 R such that the probability of the total loss being bounded by M; is at least 99%. This was the famous “4:15 number”.

“Let other managers participate in your decision.” and “believe that risk is manageable”.

8. Parenthesis about the Tails of the Unexpected

- One would imagine an area where trees are naturally and randomly growing with occasional lightning strikes that could cause a fire. Over longer time, the forest will develop into a “critical” state: Most of the time, fires are small and contained, but, on rare occasions, a random lightning strike can cause the forest to be lost.

- A forester takes concern for the expected yield of the forest with a trade-off. A more densely filled forest makes for superior expected yield, but it also exposes the forest to higher fire risk. The forester will build firebreaks: larger in number where lightning strikes, and fewer where they are rare. This arrangement maximises expected yield. However, it will also result in occasional “systemic” forest fires as the scrub will be removed, which typically leads to small fires in free nature, which clean the forest naturally from time to time.

“Recent studies of large, formal organizations that perform complex […] tasks under conditions of tight coupling and severe time pressure have generally concluded that most will fail spectacularly at some point, with attendant human and social costs of great severity. The notion that accidents in these systems are “normal” that is, to be expected given the conditions and risks of operation, appears to be as well grounded in experience as in theory.”

9. From Sir Karl R. Popper to the Concept of Resilience

In the heat of battle, plans will go awry, instructions and information will be unclear and misinterpreted, communications will fail, and mistakes and unforeseen events will be commonplace.

All Life is Problem Solving.

… complex phenomena happened and how they might happen, but they can’t tell us when and where it will happen.

trust [is] a hypothesis of future behaviour, which is stable enough to base upon practical actions

- the responsibility for the intertemporal gap between present decisions and future consequences (leading to moral hazard of decision-makers in the classical principal-agent-situation and to problematic impact of incentive pay on risk-taking);

- the responsibility for “faceless” decisions, if such decision-making is distributed along a chain of formal approval processes.

10. Strength of Knowledge and the Importance of Our Ignorance

- Historical loss data defined by R0 = {E, L, N; SoK = 1} with type of OpRisk event E, loss L, recorded number of events N. For aggregated events, a statistical measurement error can be added Ri = {Ei, Li, Ni, σi; SoK = 1}.

- Measured risk R = {E, L, Ps; SoK} with a Bayesian interpretation of Ps as subjective measure of uncertainty under the conscious assumption of a “repeatable game”.

- Estimation of (future) risk R* = {E, L, Pf*, U(Pf*), SoK} with an uncertainty for the probability U(Pf) based on the Strength of Knowledge SoK about the expected future, i.e., the question whether the “game” is fully repeatable.

- Uncertainty of future (extrapolated) risk by replacing the frequency-interpreted probability Pf by the uncertainty U(SoK) itself, giving a risk perspective RU = {E, O, U(SoK)}27, which is aligned to the new ISO 31000 definition of risk (see Purdy 2010) with a shifted emphasis to the uncertain achievement of an objective O.

- The “unknown unknown”, i.e., the risk of possible disasters: RDesaster = (Disaster, O, SoK << 1) about which no knowledge is available.

11. Digitization and Epistemic Uncertainty

But when we start acknowledging our inability to represent the full complexity of the real world using mathematical models, we are faced with leaving the safe land of quantifiable uncertainty and entering (possibly hostile) environment of disputed sciences, ill-understood possibilities and deep uncertainty.

12. Conclusions

- The more statistical methods became available to calculate probabilities, the less understanding of the social aspect of risk remained.

- The more trust in numbers or model developed, the less responsibility was taken for the future consequences of current individual decisions.

The outside world itself knows no risks, for it knows neither distinction, nor expectations, nor evaluations, nor probabilities—unless self-produced by observer systems in the environment of other systems.

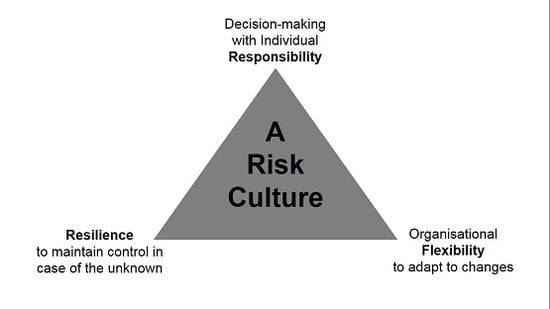

- Responsibility for the decisions made under uncertainty, including the “risk” to admit mistakes afterwards;

- Flexibility for future development with adaptive “Team of Teams” in times of VUCA and for situations far from equilibrium;

- Resilience practice (Walker and Salt 2012) “to build capability to absorb disturbance and maintain function” including the monitoring of “precursors”, i.e., early warning signals within time series of risk-parameters, which indicate some imminent unknown unknown.

Acknowledgments

Conflicts of Interest

References

- Althaus, Catherine E. 2005. A disciplinary perspective on the epistemological status of risk. Risk Analysis 25: 567–88. [Google Scholar] [CrossRef] [PubMed]

- Arrow, Kenneth, and Gerard Debreu. 1954. The Existence of an Equilibrium for a Competitive Economy. Econometrica 22: 65–290. [Google Scholar] [CrossRef]

- Arthur, W. Brian. 2014. Complexity Economics. In Complexity and the Economy. Oxford: Oxford University Press, pp. 1–29. [Google Scholar]

- Aven, Terje. 2010. Misconceptions of Risk. Chichester: John Wiley & Sons. [Google Scholar]

- Aven, Terje. 2012. The risk concept—Historical and recent development trends. Reliability Engineering and System Safety 99: 33–44. [Google Scholar] [CrossRef]

- Bachelier, Louis. 1900. Théorie de la Spéculation. Annales Scientifiques de l’École Normale Supérieure 3: 21–86. [Google Scholar] [CrossRef]

- Baecker, Dirk. 1991. Womit Handeln Banken?—Eine Untersuchung zur Risikoverarbeitung in der Wirtschaft. Frankfurt: Suhrkamp Taschenbuch. [Google Scholar]

- Bak, Peter, Chao Tang, and Kurt Wiesenfeld. 1987. Self-organized criticality: An explanation of the 1/f noise. Physical Review Letters 59: 381–84. [Google Scholar] [CrossRef] [PubMed]

- Basel Committee on Banking Supervision (BCBS). 2015. Guidelines—Corporate Governance Principles for Banks. July. Available online: http:www.bis.org/bcbs/publ/d328.htm (accessed on 28 August 2017).

- Beard, Mary. 2011. Risk and the humanities: Alea iacta est. In Risk. Darwin College Lectures. Edited by Layla Skinns, Michael Scott and Tony Cox. Cambridge: Cambridge University Press. [Google Scholar]

- Bechmann, Gotthard, ed. 1993. Risiko und Gesellschaft: Grundlagen und Ergebnisse Interdisziplinärer Risikoforschung. Opladen: Westdeutscher Verlag. (In German) [Google Scholar]

- Bernstein, Peter L. 1996. Against the Gods: The Remarkable Story of Risk. New York: John Wiley & Sons. [Google Scholar]

- Boyd, John H., and Gianni De Nicoló. 2005. The Theory of Bank Risk Taking and Competition Revisited. The Journal of Finance 60: 1329–43. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K., and Isabel Schnabel. 2015. Bubbles and Central Banks: Historical Perspectives. CEPR Discussion Paper No. DP10528. Available online: https://ssrn.com/abstract=2592370 (accessed on 4 September 2017).

- Caranda, Ramón. 1987. Carlos V y sus Banqueros, Editorial Crítica. Madrid: Barcelona. [Google Scholar]

- Carlson, Jean M., and John Doyle. 2002. Complexity and robustness. Proceedings of the National Academy of Sciences of the United States of America 99: 2538. [Google Scholar] [CrossRef] [PubMed]

- Ceccarelli, Giovanni. 2015. Renaissance Risk Takers: Culture and Practice in Florentine Society. Talk Given at December 2. Available online: www.uni-due.de/graduiertenkolleg_1919/wagnisse (accessed on 2 September 2017).

- Clinton, William J. 1995. Remarks on the National Homeownership Strategy. June 5 The American Presidency Project. Available online: www.presidency.ucsb.edu/ws/?pid=51448 (accessed on 21 August 2017).

- Cohn, Alain, Michel Maréchal, and Christian Zünd. 2016. Civic Honesty across the Globe. Paper presented at the SITE Summer Workshops 2016, Session 8: Psychology and Economics, Stanford University, August 24–26; Available online: https://site.stanford.edu/2016/session-8 (accessed on 17 September 2017).

- D’Aveni, Richard A. 1998. Waking up to the New Era of Hypercompetition. The Washington Quarterly 21: 183–95. [Google Scholar] [CrossRef]

- Daft, Richard L., and Robert H. Lengel. 1983. Information Richness: A New Approach to Managerial Behavior and Organization Design. College Station: Texas A&M University. [Google Scholar]

- Day, Christian C. 2004. Is There a Tulip in Your Future? Ruminations on Tulip Mania and the Innova-tive Dutch Futures Markets. Journal des Economistes et des Etudes Humaines 14: 151–70. [Google Scholar] [CrossRef]

- De Moivre, Abraham. 1718. The doctrine of Chance. W. Pearson, London as extended English version of De Mensura Sortis, Phil. Trans. Roy. Soc No. 329, January, February, March 1711, reprinted with a commentary by O. Hald. International Statistical Review 52: 229–62. [Google Scholar]

- De Molina, Luis. 1597. Tratado sobre los cambios. Cuenca; reprint: Instituto de Estudios Fiscales, Madrid, ICI, 1990; translation: “Treatise on Money”, Translation by Jeannine Emery, with Introduction by Francisco Gómez Camacho. Journal of Markets & Morality 8: 161–323. [Google Scholar]

- De Soto, Jesús Huerta. 1996. New Light on the Prehistory of the Theory of Banming and the School of Salamanca. The Review of Austrian Economics 9: 59–81. [Google Scholar] [CrossRef]

- De Vries, Jan, and Ad van der Woude. 1997. The First Modern Economy: Success, Failure, and Perseverance of the Dutch Economy, 1500–1815. Cambridge: Cambridge University Press. [Google Scholar]

- Dotson, John E. 1994. Merchant Culture in Fourteenth Century Venice: The Zibaldone da Canal. Tempe: Medieval & Renaissance Texts & Studies, Center for Medieval & Early Renaissance Studies. [Google Scholar]

- Dotson, John E. 2002. Fourteenth Century Merchant Manuals and Merchant Culture. In Merchant’s Books and Mercantile Pratiche from the Late Middle Ages to the Beginning of the 20th Century. Edited by Markus A. Denzel, Jean Claude Hocquet and Harald Witthöft. Stuttgart: Franz Steiner, vol. 163, pp. 75–88. [Google Scholar]

- Douglas, Mary, and Aaron Wildavsky. 1982. Risk and Culture: An Essay on the Selection of Technical and Environmental Dangers. Berkeley: University of California Press. [Google Scholar]

- Thompson, Earl A. 2007. The tulipmania: Fact or artifact? Public Choice 130: 99–114. [Google Scholar] [CrossRef]

- Efing, Matthias, Harald Hau, Patrick Kampkötter, and Johannes Steinbrecher. 2015. Incentive pay and bank risk-taking: Evidence from Austrian, German, and Swiss banks. Journal of International Economics 96: 123–40. [Google Scholar] [CrossRef]

- Elliott, E. Donald. 1983. Risk and Culture: An Essay on the Selection of Technical and Environmental Dangers. Faculty Scholarship Series. Paper 2192. Available online: http://digitalcommons.law.yale.edu/fss_papers/2192 (accessed on 3 October 2012).

- Fouquet, Gerhard. 2010. Netzwerke im internationalen Handel des Mittelalters—eine Einleitung. In Netzwerke im Europäischen Handel des Mittelalters, Vorträge und Forschungen. Edited by Gerhard Fouquet and Hans-Jörg Gilomen. Ostfildern: Jan Thorbecke Verlag, vol. 72, pp. 9–20. (In German) [Google Scholar]

- Financial Stability Board (FSB). 2014. Guidance on Supervisory Interaction with Financial Institutions on Risk Culture. Available online: www.financialstabilityboard.org/wp-content/uploads/140407.pdf (accessed on 3 October 2012).

- Garber, Peter M. 1989. Tulipmania. Journal of Political Economy 97: 535–60. [Google Scholar] [CrossRef]

- Haldane, Andrew. 2012. Tails of the unexpected. Speech Given at “The Credit Crisis Five Years On: Unpacking the Crisis” Conference, University of Edinburgh Business School, June 8–9; Available online: www.bankofengland.co.uk/ (assessed on 28 October 2012).

- Jonas, Hans. 1979. Das Prinzip Verantwortung. Versuch einer Ethik für die Technologische Zivilisation. Frankfurt: Insel Verlag. (In German) [Google Scholar]

- Jones, David. 2006. The Bankers of Puteoli: Finance, Trade and Industry in the Roman World. Gloucestershire: Tempus Publishing Ltd. [Google Scholar]

- Kahan, Dan M. 2012. Cultural Cognition as a Conception of the Cultural Theory of Risk. Handbook of Risk Theory. New York: Springer, pp. 725–59. [Google Scholar]

- Kahneman, Daniel, and Dan Lovallo. 1993. Timid Choices and Bold Forecasts: A Cognitive Perspective on Risk Taking. Management Science 39: 17–33. [Google Scholar] [CrossRef]

- Kallioinen, Mika. 2012. The Bonds of Trade: Economic Institutions in Pre-Modern Northern Europe. Cambridge: Cambridge Scholars Publishing, Newcastle upon Tyne. [Google Scholar]

- Keynes, John Maynard. 1921. Treatise on Probability. London: Macmillan & Co. [Google Scholar]

- King, Mervyn. 2016. The End of Alchemy: Money, Banking, and the Future of the Global Economy. London: Little, Brown Book Group. [Google Scholar]

- Knight, Frank H. 1921. Risk, Uncertainty and Profit. New York: Harper. [Google Scholar]

- Letsios, Dimitrios G. 1996. Νόμος ‘Ροδίων Ναυτικός—Das Seegesetz der Rhodier—Untersuchungen zu Seerecht und Handelsschiffahrt in Byzanz. Zeitschrift der Savigny-Stiftung für Rechtsgeschichte: Romanistische Abteilung 117: 624ff. [Google Scholar]

- Luhmann, Niklas. 1968. Vertrauen. Ein Mechanismus der Reduktion sozialer Komplexität. Stuttgart: Enke, (English version: Trust and Power, Wiley, 1979). [Google Scholar]

- Luhmann, Niklas. 1991. Soziologie des Risikos. Berlin: De Gruyter. [Google Scholar]

- Luhmann, Niklas. 1993. Risk: A Sociological Theory. Berlin and New York: De Gruyter. [Google Scholar]

- Madden, Thomas F. 2012. Venice: A New History. London: Viking/Penguin. [Google Scholar]

- Mandelbrot, Benoit. 2004. The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin, and Reward. New York: Basic Books. [Google Scholar]

- Mandeville, Bernard. 1705. The Fable of The Bees: Or, Private Vices, Public Benefits (first published as the poem "The Grumbling Hive: Or, Knaves turn’d Honest" in 1705 and as book in 1714). Available online: hppt://pedagogie.ac-toulouse.fr/philosphie/textesdephilosophes.htm#mandeville (accessed on 29 July 2017).

- March, James G. 1994. Primer on Decision Making: How Decisions Happen. New York: The Free Press. [Google Scholar]

- March, James G., and Zur Shapira. 1987. Managerial Perspectives on Risk and Risk Taking. Management Science 33: 1404–18. [Google Scholar] [CrossRef]

- Marković, Dimitrije, and Claudius Gros. 2014. Power laws and self-organized criticality in theory and nature. Physics Reports 536: 41–74. [Google Scholar] [CrossRef]

- Martynova, Natalya, Lev Ratnovski, and Razvan Vlahu. 2015. Bank Profitability and Risk-Taking, IMF Working Papers, No. 15/249. Washington, DC, USA: International Monetary Fund, November 25.

- Maschke, Erich. 1984. Das Berufsbewußtsein des mittelalterlichen Fernkaufmanns. In Die Stadt des Mittelalters, Vol. 3 (Wirtschaft und Gesellschaft). Darmstadt: Wissenschaftliche Buchgesellschaft. (In German) [Google Scholar]

- McKenzie, Lionel W. 1959. On the Existence of General Equilibrium for a Competitive Economy. Econometrica 27: 54–71. [Google Scholar] [CrossRef]

- McChrystal, Stanley. 2016. Team of Teams: New Rules of Engagement for a Complex World. London: Penguin. [Google Scholar]

- McCormick, Roger, and Chris Stears. 2016. Conduct Costs Project Report 2016. CCP Research Foundation CIC. Available online: conduct-costs-project-report-2016.pdf (assessed on 29 July 2017).

- Mehr, Ralf. 2008. Societas und Universitas: Römischrechtliche Institute im Unternehmensgesellschaftsrecht vor 1800. Köln and Weimar: Böhlau Verlag. (In German) [Google Scholar]

- Milkau, Udo. 2011. Systemic Risk Seen from the Perspective of Physics. The Capco Institute Journal of Financial Transformation 31: 73–82. [Google Scholar]

- Milkau, Udo. 2013. Adequate Communication about Operational Risk in the Business Line. The Journal of Operational Risk 8: 35–57. [Google Scholar] [CrossRef]

- Milkau, Udo, Frank Neumann, and Jürgen Bott. 2016. Development of Distributed Ledger Technology and a First Operational Risk Assessment. The Capco Institute Journal of Financial Transformation 44: 20–30. [Google Scholar]

- Moretti, Franco, and Dominique Pestre. 2015. Bankspeak: The Language of World Bank Reports, 1946–2012. Stanford: Pamphlets of the Stanford Literary Lab, No. 9. March. [Google Scholar]

- Münkler, Herfried. 2010. Strategien der Sicherung: Welten der Sicherheit und Kulturen des Risikos. In Sicherheit und Risiko—Über den Umgang mit Gefahr im 21. Jahrhundert. Edited by Herfried Münkler, Matthias Bohlender and Sabine Meurer. Bielefeld: Transcript Verlag. [Google Scholar]

- Nehlsen-von Stryk, Karin. 1986. Die venezianische Seeversicherung im 15. Jahrhundert. Münchener Universitätsschriften, Juristische Fakultät: Abhandlungen zur rechtswissenschaftlichen Grundlagenforschung 64: 239. [Google Scholar]

- Oltedal, Sigve, Bjørg-Elin Moen, Hroar Klempe, and Torbjørn Rundmo. 2004. Explaining risk perception. An evaluation of cultural theory. Trondheim: Norwegian University of Science and Technology 85: 1–33. [Google Scholar]

- Pacioli, Luca. 1494. The Rules of Double-Entry Bookkeeping—Particularis de Computis et Scriptuis. (Origianallxy Published as the 11th Treatise of Section Nine of the Summa de Arithmetica, Geometria, Proportioni et Proportionalia. Venice 1494). Leipzig: IICPA Publications. [Google Scholar]

- Poincaré, Henri. 1908. Science et Méthode. Paris: Flammarion. [Google Scholar]

- Popper, Karl R. 1991. Alles Leben ist Problemlösen (All Life is Problem Solving). In Karl R.Popper. Alles Leben ist Problemlösen. Munich and Berlin: Piper. [Google Scholar]

- Pryor, John H. 1977. The Origins of the Commenda Contract. Speculum 52: 5–37. [Google Scholar] [CrossRef]

- Puga, Diego, and Daniel Trefler. 2014. International Trade and Institutional Change: Medieval Venice's Response to Globalization. The Quarterly Journal of Economics 2014: 753–821. [Google Scholar] [CrossRef]

- Purcell, Nicholas. 1995. Literate games: Roman society and the game of alea. In Studies in Ancient Greek and Roman Society. Edited by Robin Osborne. Cambridge: Cambridge University Press. [Google Scholar]

- Purdy, Grant. 2010. ISO 31000:2009—Setting a New Standard for Risk Management. Risk Analysis 30: 881–86. [Google Scholar] [CrossRef] [PubMed]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2009. Time Is Different: Eight Centuries of Financial Folly. Princeton: Princeton University Press. [Google Scholar]

- Renn, Ortwin, Andreas Klinke, and Marjolein van Asselt. 2011. Coping with Complexity, Uncertainty and Ambiguity in Risk Governance: A Synthesis. AMBIO 40: 231–46. [Google Scholar] [CrossRef] [PubMed]

- Rochlin, Gene I., Todd R. La Porte, and Karlene H. Roberts. 1987. The Self-Designing High-Reliability Organization: Aircraft Carrier Flight Operations at Sea. Naval War College Review, issue Autumn 1987. Available online: www.projectwhitehorse.com/pdfs/Self_Designing_-_LaPort.pdf (accessed on 20 September 2017).

- Saunders, Anthony, Elizabeth Strock, and Nickolaos G. Travlos. 1990. Ownership Structure, Deregulation, and Bank Risk Taking. The Journal of Finance 45: 643–54. [Google Scholar] [CrossRef]

- Schachermayer, Walter. 2016. Mathematics and Finance. In Mathematics and Society, 7th European Congress of Mathematics & Congress of the European Mathematical Society. Edited by Wolfgang König. July 18–22, Zürich: European Mathematical Society Publishing House, pp. 37–50. [Google Scholar]

- Scheller, Benjamin. 2017. The Birth of Risk. Contingency and Mercantile Practice in Mediterrenean Sea Trade in the High and Later middle Ages. Historische Zeitschrift 304: 305–31. [Google Scholar]

- Shapira, Roy, and Luigi Zingales. 2017. Is Pollution Value-Maximizing? The DuPont Case. Stigler Center for the Study of the Economy and the State, University of Chicago Booth School of Business New Working Paper Series No. 13. , September. Available online: research.chicagobooth.edu/-/media/research/stigler/pdfs/workingpapers/13ispollutionvaluemaximizingsep2017.pdf (accessed on 29 October 2017).

- Simmel, Georg. 1908. Soziologie—Untersuchungen über die Formen der Vergesellschaftung. Berlin: Duncker & Humblot, Kapitel V: Das Geheimnis und die geheime Gesellschaft. pp. 256–304. Available online: http://socio.ch/sim/soziologie/soz_5.htm (accessed on 7 November 2017).

- Sinn, Hans-Werner. 2003. Risk Taking, Limited Liability and the Competition of Bank Regulators. Finanzarchiv 59: 305–29. [Google Scholar] [CrossRef]

- Slovic, Paul. 2000. The Perception of Risk. New York: Earthscan. [Google Scholar]

- Spiegelhalter, David. 2011. Quantifying uncertainty. In Risk. Darwin College Lectures, No. 24. Edited by Layla Skinns, Michael Scott and Tony Cox. Cambridge: Cambridge University Press. [Google Scholar]

- Steinbrecher, Ira (BaFin). 2015. Risk culture: Requirements of responsible corporate governance. Available online: www.bafin.de/SharedDocs/Veroeffentlichungen/EN/Fachartikel/2015/ fa_bj_1508_risikokultur_en.html (accessed on 28 August 2017).

- Taylor, Frederick Winslow. 1911. Principles of Scientific Management. New York: Harper & Brother. [Google Scholar]

- Temin, Peter. 2012. Roman Market Economy. Princeton Economic History of the Western World. Princeton: University Press Group Ltd. [Google Scholar]

- U.S. Marine Corps. 1997. “Warfighting”, Fleet Marine Force Manual. Available online: www.dtic.mil/doctrine/jel/service_pubs/mcdp1.pdf (accessed on 25 August 2012).

- van der Linden, Sander. 2016. A Conceptual Critique of the Cultural Cognition—Thesis. Science Communication 38: 128–38. [Google Scholar] [CrossRef]

- von Hayek, Friedrich A. 1967. The Theory of Complex Phenomena. Studies in Philosophy, Politics and Economics. London: Routledge & Kegan Paul, pp. 22–42. [Google Scholar]

- von Hayek, Friedrich A. 1944. The Road to Serfdom. London: George Routledge & Sons. [Google Scholar]

- von Hayek, Friedrich A. 1982. Law, Legislation and Liberty. London: Routledge and Kegan Paul. [Google Scholar]

- von Petersdorff, Winand. 2017. Warum gibt es in Texas so wenig Deiche. FAZ, September 19. [Google Scholar]

- Walker, Brian, and David Salt. 2012. Resilience Practice. Washington: Island Press. [Google Scholar]

- Walras, Marie-Esprit-Léon. 1874. Éléments D’économie Politique Pure. (English Traslation as: Elements of Pure Economics by William Jaffé). American Economic Association and the Royal Economic Society. Toronto: Thomas Nelson & Sons. [Google Scholar]

- Wang, Bo, Stephen M. Anthony, Sung Chul Baea, and Steve Granick. 2009. Anomalous yet Brownian. Proceedings of the National Academy of Sciences of the United States of America 106: 15160–64. [Google Scholar] [CrossRef] [PubMed]

- Wilhelm, Eva-Maria. 2013. Italianismen des Handel sim Deutschen und Französischen—Wege des frühneuzeitlichen Sprachkontakts. Berlin and Boston: Walter de Gruyter. [Google Scholar]

- Ziegler, Uwe. 1994. Die Hanse. Bern, Munich and Vienna: Scherz Verlag. [Google Scholar]

| 1 | A similar idea—that risk is perceived and/or prioritised aligned to the social network somebody is connected to—is the starting point of the so-called “cultural theory of risk” set forth by Douglas and Wildavsky (1982). Unfortunately, the further development of this approach focussed on how political discussion of and public disagreement about environmental risks (from pollution to nuclear power) depended on social groups in the U.S. with certain worldviews. Therefore, this approach has received critique from the beginning (e.g., Elliott 1983; Oltedal et al. 2004; van der Linden 2016), but was continued in the idea about “Cultural Cognition” (Kahan 2012). Another approach was given by Slovic (2000) with his work on “The Perception of Risk”, which accessed social and political risk taking. |

| 2 | |

| 3 | Translation by the author: “Cultures of risk dare to do more in handling dangerous and perilous situations compared to worlds of safety. Cultures of risk are designed to see an opportunity together with some danger. [...]. Worlds of safety are based on the implicit promise of a ‘safe world’ and promote experiences to be measured to. In the course of this, the fact emerges with large regularity that such “worlds of safety” cannot fulfil the promises”. |

| 4 | As will be discussed later in this paper, the activities of mediaeval merchants created merchant banking and merchant banking developed into financial services. |

| 5 | The notion “governance” first showed up in the 1980s according to Renn et al. (2011). A recent study by Moretti and Pestre (2015) for the use of “governance” in World Bank Reports between 1946 and 2012 showed no use before 1990, but [quote]: “then increased its presence to the point that it is now as frequent as ‘food’, ten times more than ‘law’, and a hundred times more frequent than ‘politics’”. |

| 6 | In an unpublished working paper (see Cohn et al. 2016), Alain Cohn, Michel Maréchal and Christian Zünd conducted nation-wide field experiments in 30 countries and approximately 250 cities around the globe to collect a behavioural measure of civic honesty. They found a significant correlation between civic honesty and economic prosperity. Additionally, civic honesty correlated positively with trust in the society. |

| 7 | Nevertheless, criminal behaviour and prosecution can fall apart: The Conduct Costs Project Report 2016 (McCormick and Stears 2016) for the banks with highest conduct costs reported a grand total of GBP bn 252 for 2011–2015 and (one year overlapping) GBP bn 197 for 2008–2012, which roughly results in “annual conduct costs” of GBP bn 40 over one decade. A lion’s share of GBP bn 11 p.a. comes from fines to Bank of America according to this report. A majority of those fines were to settle allegations for selling “toxic” mortgages to investors. This legacy came from the acquisition of Countrywide, the US largest mortgage lender, by Bank of America in 2008—in the high noon of the subprime crisis to save Countrywide from default, i.e., to stabilize the financial system in the US. Would any bank do the same again? |

| 8 | Other terms were used in parallel depending from region to region for “risk” in the Medieval Germany: for example, “aresche” and “wagnis” in Southern Germany or “aventiure”/”eventhure” in the Hanseatic League (see Maschke 1984 and references therein). |

| 9 | Parallel types of contracts for cooperation were: (i) the “Wedderlegginge” developed in the 13th century in the Hanseatic League (Mehr 2008), as well as the ‘isqa developed by Jewish merchants and the qirād developed by Muslim merchants (Pryor 1977). The same challenge to “manage” risk in long-distance trade resulted in the same principle solutions. |

| 10 | “Piui rixego e piui prexio” as written in Venice 1457 (Nehlsen-von Stryk 1986). |

| 11 | A similar but also different development was the “Hanse” (Hanseatic League, from the 12th to the 16th century with some later survival). Different to the Italian merchant cities, the Hanse started with cross-country (legal) contracts—sponsored by Henry the Lion (1129/1130 or 1133/1135 to 1195)—with Gotland (1161), Sweden (1174) Novgorod (1189). |

| 12 | This was a different “business“ culture compared to the conclusion of D’Aveni (1998), which he made concerning so-called “hypercompetition” between US and Japanese companies in the late 20th century [quote]: “Clearly, in business, chivalry is dead. Western firms, having begun the process of becoming lean, must now become mean.” |

| 13 | Even keeping money in vaults of banks could have been very risky, as documented in the case of confiscation of precious metals from vaults of banks in Seville by Charles V (Carlos V) in 1545 (Caranda 1987 and De Soto 1996). |

| 14 | This has to be compared to the practise, when merchant banks made “risky” unidirectional loans to sovereigns. One example is the Fugger family with two branches, which both made loans to the House of Habsburg, but only on a collateralized bases. Unfortunately, the Fugger of the Deer (in German Fugger vom Reh) lent to archduke Maximilian I, which was collateralised by the city of Leuwen standing surety but which could not been enforced. The Fugger of the Lilly made their first loan to Archduke Sigismund in 1487 collateralised by silver and copper mines in Tirol, which laid the basis for the tremendous success of the family. A similar loan made by Jakob Fugger “the Rich” to Charles V (Carlos V) in 1519 was settled with mines in 1521 again. Nevertheless, later loans to Charles V increased his debt until it was “too big to fail” and resulted in maybe the first documented “evergreening”. As the Fugger were too much linked with Charles V (Carlos V), he could dictate the condition for prolongation. Three defaults of Spain (1557, 1575, 1607) lead to an international financial crisis, which also triggered the long decline of the banking activities of the Fuggers until 1657. |

| 15 | For opaque reasons: either to offer themselves opportunities in such speculative trade, or to reorganise the efficient market for Dutch tulip contracts with a separation of spot/futures from bets/options. |

| 16 | A current example for such a development is the development of Bitcoin (and of the price of Bitcoins) accompanied by similar developments of other so-call digital currencies. Bitcoin started as a “virtual” system for electronic cash based on a non-hierarchical and “trustless” peer-to-peer network in the “cyber space” (Milkau et al. 2016). The cyber space shows some similarities with the new continents, which the merchants of the 18th century discovered: no legislation, no regulation and no central institutions. There was a first peak of the Bitcoin price ($1000) end of 2013, followed by a collapse ($220) in April 2015, and a second peak ($3000) in June 2017, followed by a breakdown ($2000) in July 2017, and a third peak (nearly $5000) in September 2017, followed by a collapse again (3000) on 15 September 2017. The extreme volatility resulted from a “game” played by different groups: speculators, so-called miners providing the infrastructure, core developers with an opaque governance, and national authorities (e.g., in the USA, Japan and China with attempts for regulation). |

| 17 | This collection of “real-world” economic bubbles differs from the well-known book of Reinhart and Rogoff (2009) “Time Is Different”, which focussed on banking, currency, and sovereign debt crisis. |

| 18 | That should be understood in the way that the agents in the market do not need to be selfish; they just do not need to be morally “good”, but simply rational. |

| 19 | This is a first indication towards the later ideas about “complexity” with multiple agents interacting in a dynamic development over the time (see Arthur 2014). |

| 20 | It is more complicated if one takes into account the fact, as Daft and Lengel (1983) quoted Lawrence and Lorsch (1967) that [quote]: “Departments pull against each other to attain diverse goals and to serve unique constituencies and technologies.” |

| 21 | The famous quote by Charles Primce, CEO of Citigroup. It should be noted that this herd phenomenon can be found in both direction: in an underestimation of high-severity, low-frequency risk, i.e., in financial services (“fat tails” of the distribution), and in an overestimation of statistically very rare events with rather low severity. In the example of the Fukushima Dai-ichi disaster, the original tsunami due the Tōhoku earthquake caused more than 10,000 fatalities, but the nuclear meltdowns had no—at least not short-term and direct—death toll. |

| 22 | For an introduction about power laws in theory and nature, see Marković and Gros (2014). |

| 23 | The “clockwork” is used as a symbol for a system with linear equations of motion (in terms of physics) and therefore full calculability of the future development. It should be noted that already “simple” systems such as the mechanical “double pendulum” can show “deterministic chaos”, where all rules are known, but the non-linear equations of motion make it impossible to calculate long-term behaviour of the systems due to the limitation in knowledge about the starting conditions (see (Milkau 2011) for a detailed discussion). |

| 24 | In parallel the “cheap money” provided by central banks for investors around the globe and the development of new financial instruments (such as Securitisation, Collateralised Debt Obligations “CDO“, CDO2, et cetera) have to be seen as necessary pre-requisites. |

| 25 | It also may be seen as a cultural difference “why there are so few dikes in Texas”, as von Petersdorff (2017) pointed out: While the Dutch invest a significant part of the GDP into dikes, which are designed to withstand a once-in-a-century flood, “people in Texas love their heroes”—fighting a flood, which could have been avoided by long-term planning ex-ante. |

| 26 | Brian Arthur (2014) referred to this difference as distinction between allocation of resources in an economic equilibrium versus formation of patterns in dynamical processes (far from equilibrium). |

| 27 | This is more than an algebraic replacement, as it shifts the concept of risk from the calculation of probabilities (with a given SoK) to the question of uncertainties of ex-ante knowledge (with SoK << 1). |

| 28 |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milkau, U. Risk Culture during the Last 2000 Years—From an Aleatory Society to the Illusion of Risk Control. Int. J. Financial Stud. 2017, 5, 31. https://doi.org/10.3390/ijfs5040031

Milkau U. Risk Culture during the Last 2000 Years—From an Aleatory Society to the Illusion of Risk Control. International Journal of Financial Studies. 2017; 5(4):31. https://doi.org/10.3390/ijfs5040031

Chicago/Turabian StyleMilkau, Udo. 2017. "Risk Culture during the Last 2000 Years—From an Aleatory Society to the Illusion of Risk Control" International Journal of Financial Studies 5, no. 4: 31. https://doi.org/10.3390/ijfs5040031