The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia

Abstract

:1. Introduction

2. Literature Review

3. Data and Methods

3.1. Data Descriptions

3.2. Methodology

3.2.1. ARDL Bounds Testing Cointegration

3.2.2. Long Run Granger Causality Test

4. Empirical Results and Discussion

4.1. Results of Unit Root Tests

4.1.1. Results of Conventional Unit Root Tests

4.1.2. Results of Breakpoint Unit Root Tests

4.2. Results of ARDL Models

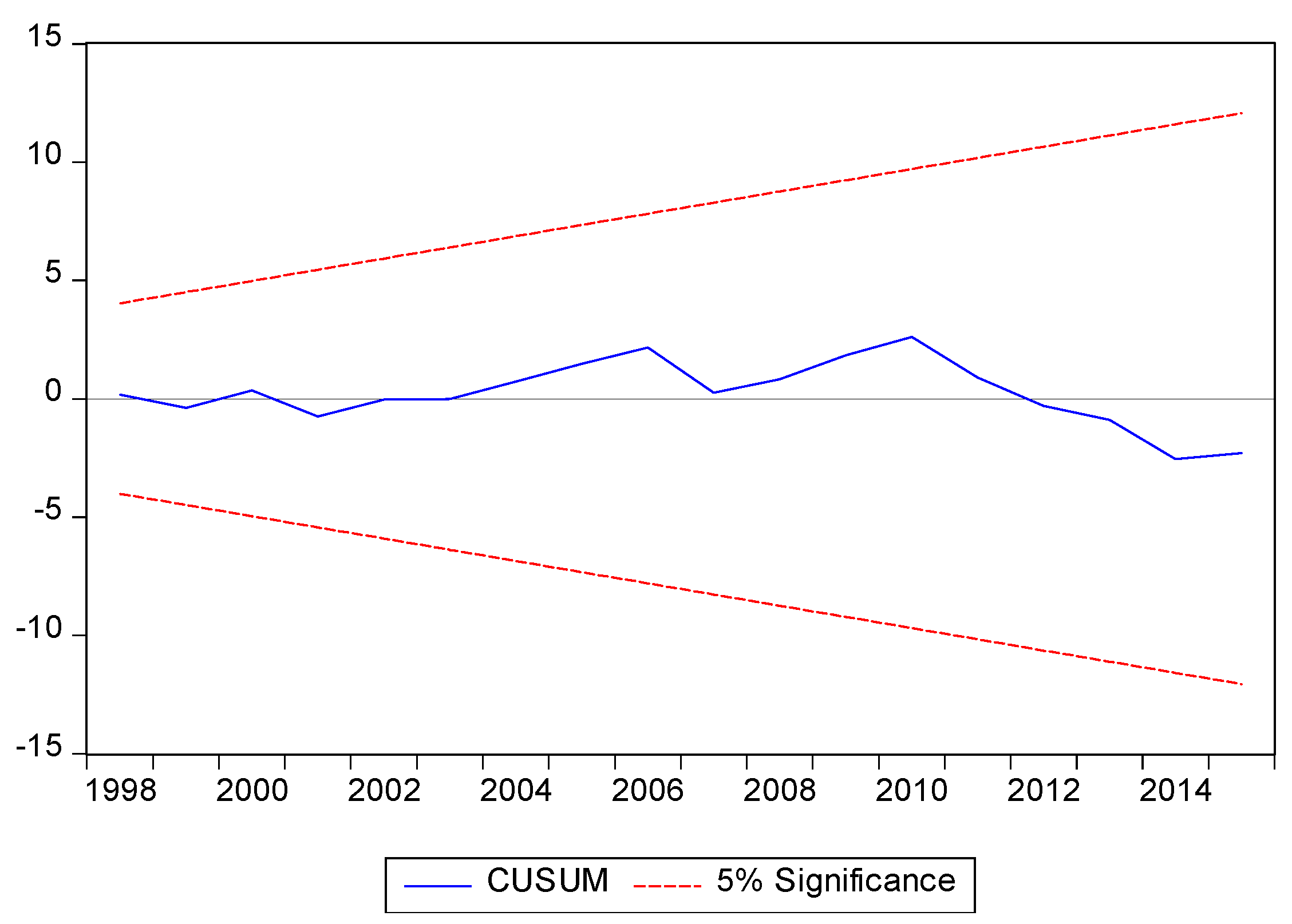

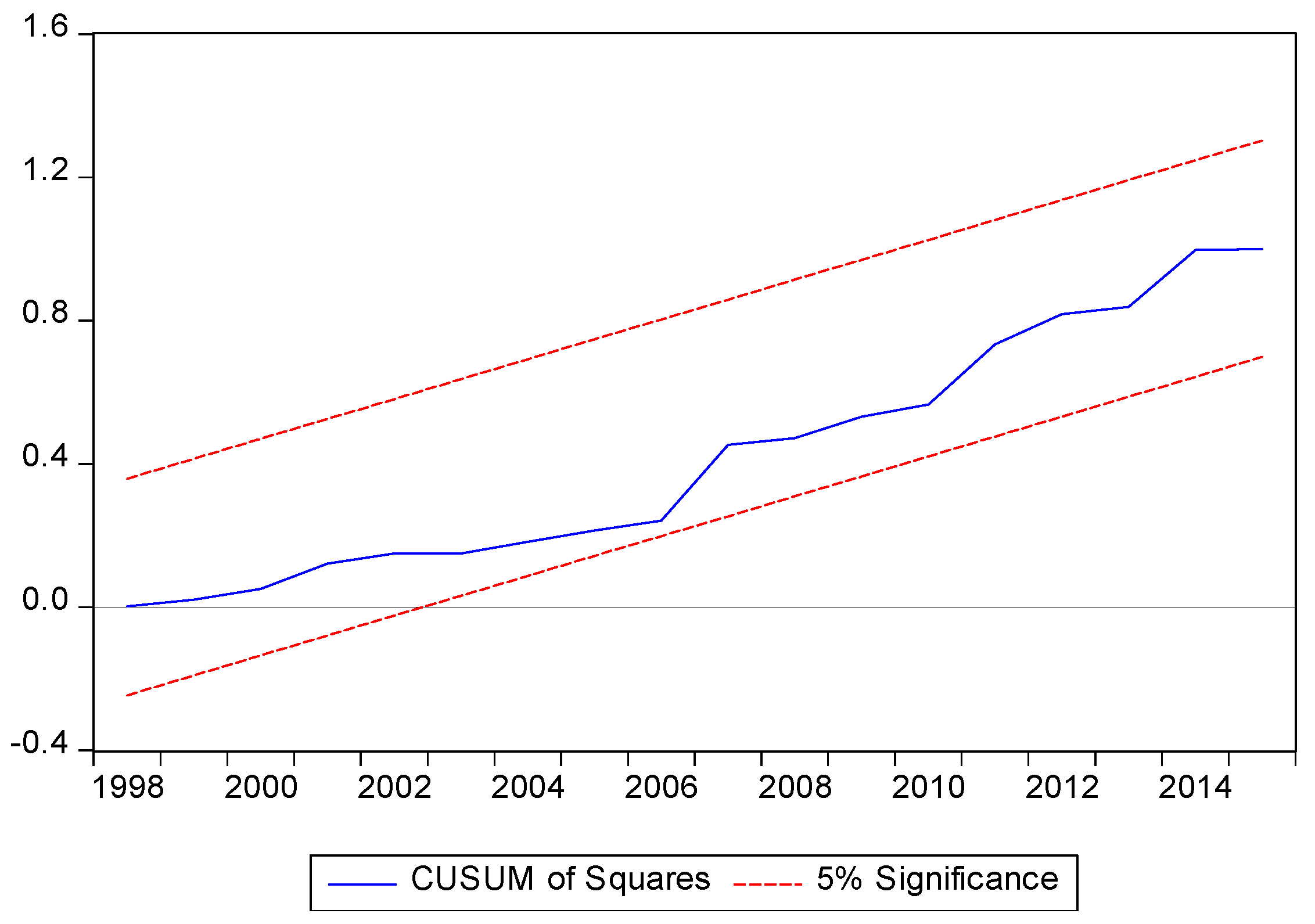

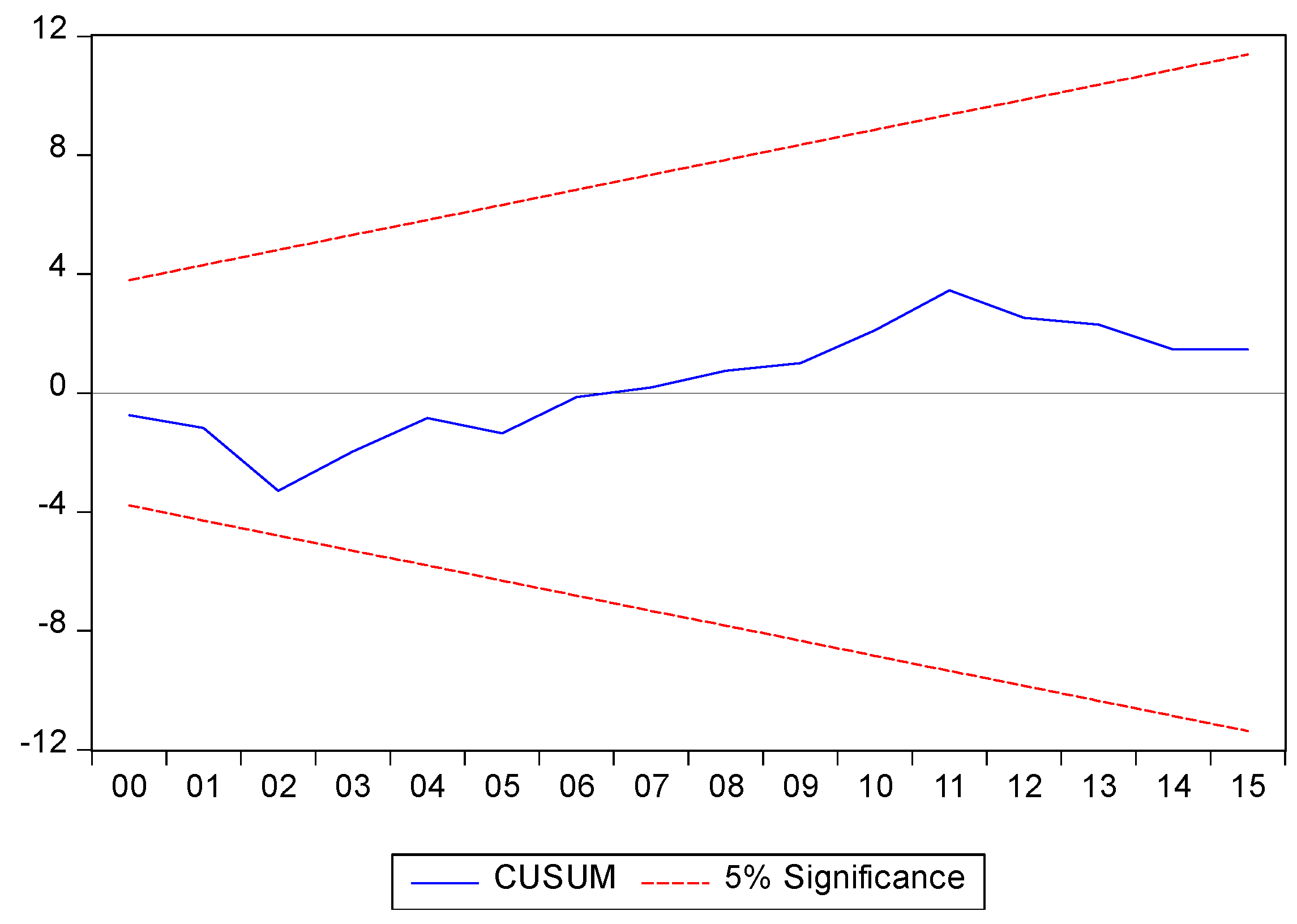

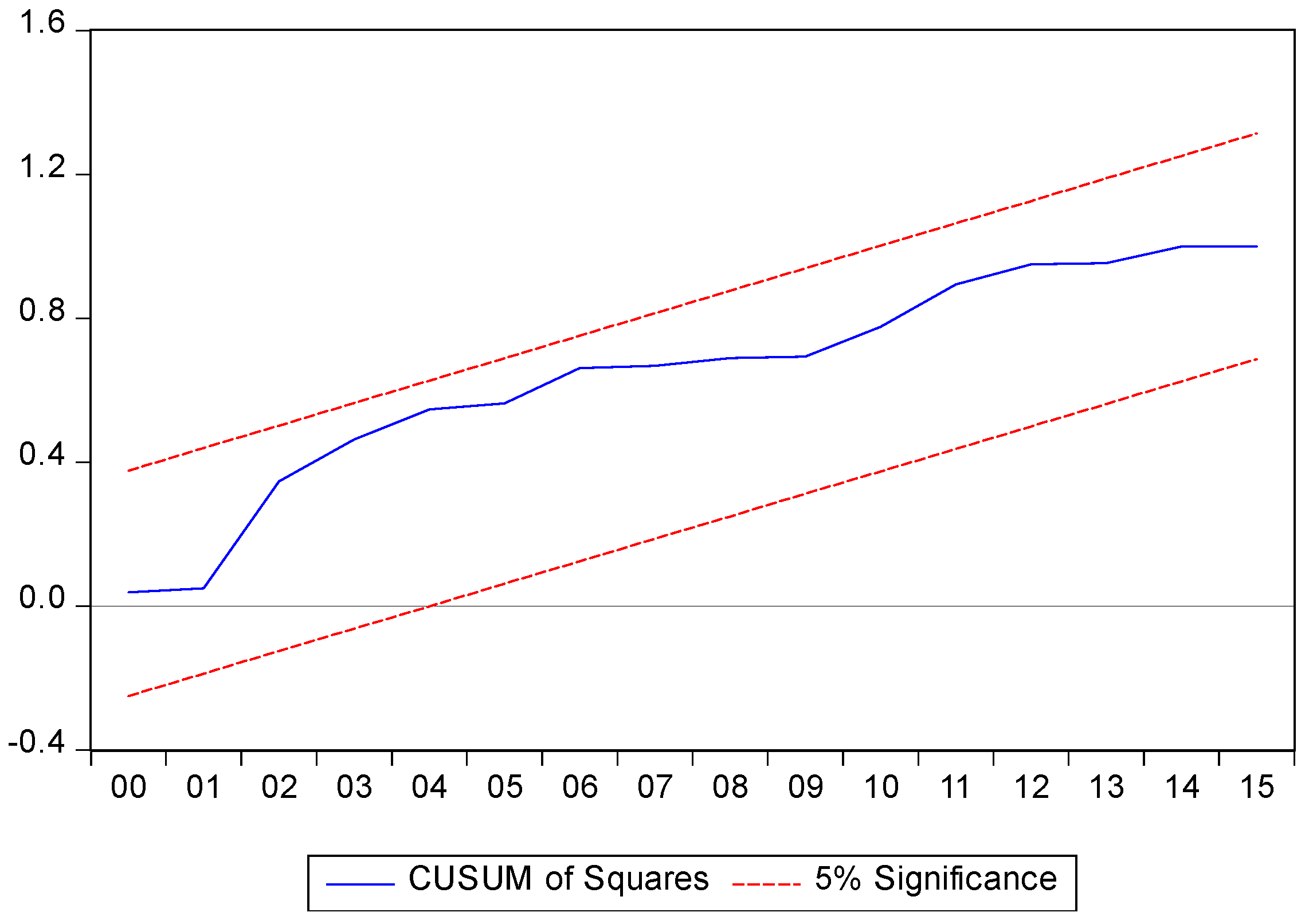

4.3. Robustness of the Results

5. Conclusions and Policy Implications

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Adams, Samuel. 2009. Foreign Direct investment, domestic investment, and economic growth in Sub-Saharan Africa. Journal of Policy Modeling 31: 939–49. [Google Scholar] [CrossRef]

- Akinlo, A. Enisan. 2004. Foreign direct investment and economic growth in Nigeria: An empirical investigation. Journal of Policy Modeling 26: 627–39. [Google Scholar] [CrossRef]

- Al Khathlan, Khalid. 2013. Foreign Direct Investment Inflows and Economic Growth in Saudi Arabia: A Co-integration Analysis. Review of Economics and Finance 4: 70–80. [Google Scholar]

- Al khatib, Hazem, Gassan Altaleb, and Samer Alokor. 2012. Economical determinants of domestic investment. European Scientific Journal 8: 1–17. [Google Scholar]

- Alaya, Marouane. 2006. Investissement direct étranger et croissance économique: Une estimation à partir d’un modèle structurel pour les pays de la rive sud de la Méditerranée. Paper presented at the 7èmes Journées Scientifiques du Réseau “Analyse Economique et Développement de l’AUF”, Paris, France, September 7–8. [Google Scholar]

- Alguacil, Maite, Ana Cuadros, and Vicente Orts. 2002. Foreign direct investment, exports and domestic performance in Mexico: A causality analysis. Economic Letters 77: 371–76. [Google Scholar] [CrossRef]

- Arrow, Kenneth. 1962. Economic Welfare and the Allocation of Resources for Invention. In The Rate and Direction of Inventive Activity: Economic and Social Factors. Princeton: Princeton University Press. [Google Scholar]

- Balasubramanyam, Vudayagiri N., Mohammed Salisu, and David Sapsford. 1996. Foreign direct investment and the growth in EP and IS countries. Economic Journal 106: 92–105. [Google Scholar] [CrossRef]

- Balasubramanyam, Vudayagiri N., Mohammed Salisu, and David Sapsford. 1999. Foreign direct investment as an engine of growth. Journal of International Trade and Economic Development 8: 27–40. [Google Scholar] [CrossRef]

- Bayar, Yilmaz. 2014. Effects of Foreign Direct Investment Inflows and Domestic Investment on Economic Growth: Evidence from Turkey. International Journal of Economics and Finance 6: 69–78. [Google Scholar] [CrossRef]

- Belloumi, Mounir. 2014. The relationship between trade, FDI and economic growth in Tunisia: An application of the autoregressive distributed lag model. Economic Systems 38: 269–87. [Google Scholar] [CrossRef]

- Belloumi, Mounir, and Atef Saad Alshehry. 2015. Sustainable energy development in Saudi Arabia. Sustainability 7: 5153–70. [Google Scholar] [CrossRef]

- Belloumi, Mounir, and Atef Saad Alshehry. 2016. The Impact of Urbanization on Energy Intensity in Saudi Arabia. Sustainability 8: 375–85. [Google Scholar] [CrossRef]

- Borensztein, Eduardo, José de Gregorio, and Jong-Wha Lee. 1998. How does foreign direct investment affect economic growth? Journal of International Economics 45: 115–35. [Google Scholar] [CrossRef]

- Boyd, John H., and Bruce D. Smith. 1992. Intermediation and the equilibrium allocation of investment capital: Implications for economic development. Journal of Monetary Economics 30: 409–32. [Google Scholar] [CrossRef]

- Chandana, Chakraborty, and Basu Parantap. 2002. Foreign direct investment and growth in India: A cointegration approach. Applied Economics 34: 1061–73. [Google Scholar] [CrossRef]

- Choi, Yoon Jung, and Jungho Baek. 2017. Does FDI Really Matter to Economic Growth in India? Economies 5: 20. [Google Scholar] [CrossRef]

- Darrat, Ali F., Samer Kherfi, and Mark Soliman. 2005. FDI and economic growth in CEE and MENA countries: A tale of two regions. Paper presented at The 12th Economic Research Forum’s Annual Conference, Cairo, Egypt, December 19–21. [Google Scholar]

- De Mello, Luzi R. 1997. Foreign direct investment in developing countries: A selective survey. Journal of Development Studies 34: 1–34. [Google Scholar] [CrossRef]

- De Mello, Luiz R. 1999. Foreign direct investment-led growth: Evidence from time series and panel data. Oxford Economic Papers 51: 133–51. [Google Scholar] [CrossRef]

- Dickey, David, and Wayne Fuller. 1979. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Dritsaki, Melina, Chaido Dritsaki, and Antonios Adamopoulos. 2004. A Causal Relationship between Trade, Foreign Direct Investment and Economic Growth for Greece. American Journal of Applied Science 1: 230–35. [Google Scholar] [CrossRef]

- Durham, J. Benson. 2004. Absorptive capacity and the effects of foreign direct investment and equity foreign portfolio investment on economic growth. European Economic Review 84: 285–306. [Google Scholar] [CrossRef]

- Eller, Markus, Peter R. Haiss, and Katharina Steiner. 2005. Foreign Direct Investment in the Financial Sector: The Engine of Growth for Central and Eastern Europe? Europa Institute Working Paper No. 69. Vienna: Vienna University of Economics and Business Administration. [Google Scholar]

- Elliott, Graham, Thomas Rothenberg, and James Stock. 1996. Efficient Tests for an Autoregressive Unit Root. Econometrica 64: 813–36. [Google Scholar] [CrossRef]

- Elsadig, Musa Ahmed. 2012. Are the FDI inflow spillover effects on Malaysia’s economic growth input driven? Economic Modelling 29: 1498–504. [Google Scholar]

- Fabry, Nathalie, and Sylvain Zeghni. 2002. Foreign direct investment in Russia: How the investment climate matters. Communist and Post-Communist Studies 35: 289–303. [Google Scholar] [CrossRef]

- Firebaugh, Glenn. 1992. Growth Effects of Foreign and Domestic Investment. American Journal of Sociology 98: 105–30. [Google Scholar] [CrossRef]

- Ghali, Khalifa H., and Ahmed Al-Mutawa. 1999. The Intertemporal Causal Dynamics between Fixed Capital Formation and Economic Growth in the Group-of-Seven Countries. International Economic Journal 13: 31–37. [Google Scholar]

- Ghirmay, Teame, Richard Garbowski, and Subhash Sharma. 2001. Exports, investment efficiency and economic growth in LDC: An empirical investigation. Applied Economics 33: 689–700. [Google Scholar] [CrossRef]

- Grossman, Gene, and Elhanan Helpman. 1994. Endogenous Innovation in the Theory of Growth. The Journal of Economic Perspectives 8: 23–44. [Google Scholar] [CrossRef]

- Herzer, Dierk, Stephan Klasen, and Felicitas Lehmann. 2008. In search of FDI-led growth in developing countries: The way forward. Economic Modelling 25: 793–810. [Google Scholar] [CrossRef]

- Hisarciklilar, Mehtap, Saime S. Kayam, Ozgur M. Kayalica, and N. L. Ozkale. 2006. Foreign direct investment and growth in Mediterranean countries. Paper presented at the Jean Monnet Project on “Sustainable Development and Adjustment in the MEDA Countries Following the EU Enlargement”, Spetses Island, Greece, July 3–5; Available online: http://emo.pspa.uoa.gr/data/papers/2_paper.pdf (accessed on 17 June 2017).

- Hussain, Mohammed Ershad, and Mahfuzul Haque. 2016. Foreign Direct Investment, Trade, and Economic Growth: An Empirical Analysis of Bangladesh. Economies 4: 7. [Google Scholar] [CrossRef]

- Iamsiraroj, Sasi. 2016. The foreign direct investment–economic growth nexus. International Review of Economics and Finance 42: 116–33. [Google Scholar] [CrossRef]

- Iya, Ibriya, and Umaru Aminu. 2015. An Investigation into the Impact of Domestic Investment and Foreign Direct Investment on Economic Growth in Nigeria. International Journal of Humanities Social Sciences and Education 2: 40–50. [Google Scholar]

- Johansen, Soren. 1995. Likelihood-Based Inference in Cointegrated Vector Autoregressive Models. New York: Oxford University Press. [Google Scholar]

- Johansen, Soren, and Katarina Juselius. 1990. Maximum Likelihood Estimation and Inference on Cointegration―With Applications to the Demand for Money. Oxford Bulletin of Economics and Statistics 52: 169–210. [Google Scholar] [CrossRef]

- Khawar, Mariam. 2005. Foreign Direct Investment and Economic Growth: A Cross-Country Analysis. Global Economy Journal 5: 1–14. [Google Scholar] [CrossRef]

- Kowalski, Elizabeth. 2000. Determinants of Economic Growth in East Asia: A Linear Regression Model. Honors Projects 74. Available online: https://digitalcommons.iwu.edu/econ_honproj/74/ (accessed on 27 January 2018).

- Kumar, Nages, and Jaya Prakash Pradhan. 2002. FDI, Externalities, and Economic Growth in Developing Countries: Some Empirical Explorations and Implications for WTO Negotiations on Investment. RIS Discussion Paper No. 27/2002. New Delhi: Research and Information System for Developing Countries. [Google Scholar]

- Lean, Hooi Hooi, and Bee Wah Tan. 2011. Linkages between foreign direct investment, domestic investment and economic growth in Malaysia. Journal of Economic Cooperation and Development 32: 75–96. [Google Scholar]

- Lensink, Robert, and Oliver Morrissey. 2006. Foreign Direct Investment: Flows, Volatility, and the Impact on Growth. Review of International Economics 14: 478–93. [Google Scholar] [CrossRef]

- Li, Xiaoying, and Xiaming Liu. 2005. Foreign Direct Investment and Economic Growth: An Increasingly Endogenous Relationship. World Development 33: 393–407. [Google Scholar] [CrossRef]

- Liu, Xiaohui, Peter Burridge, and Paul J. N. Sinclair. 2002. Relationships between economic growth, foreign direct investment and trade: Evidence from China. Applied Economics 34: 1433–40. [Google Scholar] [CrossRef]

- Lucas, Robert. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42. [Google Scholar] [CrossRef]

- Marc, Audi. 2011. Is foreign direct investment a cure for economic growth in developing countries? Structural model estimation applied to the case of the south shore Mediterranean countries. Journal of International Business and Economics 11: 32–51. [Google Scholar]

- Meschi, Elena. 2006. FDI and growth in MENA countries: An empirical analysis. Paper presented at The Fifth International Conference of the Middle East Economic Association, Sousse, Tunisia, March 10–12. [Google Scholar]

- Moses, Ekperiware C. 2011. Oil and nonoil FDI and economic growth in Nigeria. Journal of Emerging Trends in Economics and Management Sciences 2: 333–43. [Google Scholar]

- Narayan, Paresh. 2005. The saving and investment nexus for China: evidence from cointegration tests. Applied Economics 37: 1979–90. [Google Scholar] [CrossRef]

- Nicet-Chenaf, Dalila, and Eric Rougier. 2009. FDI and Growth: A New Look at a Still Puzzling Issue. Working Paper GREThA number 2009-13. Bordeaux: University of Bordeaux. [Google Scholar]

- Omonkhanlen, Enisan A. 2011. Foreign direct investment and its effect on the Nigerian economy. Business Intelligence Journal 4: 253–61. [Google Scholar]

- Omri, Anis, and Bassem Kahouli. 2014. The nexus among foreign investment, domestic capital and economic growth: Empirical evidence from the MENA region. Research in Economics 68: 257–63. [Google Scholar] [CrossRef]

- Ozturk, Ilhan. 2007. Foreign Direct Investment-Growth Nexus: A Review of Literature. International Journal of Applied Econometrics and Quantitative Studies 4: 79–98. [Google Scholar]

- Perron, Pierre. 1989. The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57: 1361–401. [Google Scholar] [CrossRef]

- Pesaran, Hashem, and Yongcheol Shin. 1999. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium. Edited by S. Strom. Cambridge: Cambridge University Press. [Google Scholar]

- Pesaran, Hashem, Yongcheol Shin, and Richard Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Phillips, Peter, and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Qin, Duo, Marie Anne Cagas, Pilipinas Quising, and Xin-Hua He. 2006. How much does Investment Drive Economic Growth in China? Journal of Policy Modelling 28: 751–74. [Google Scholar] [CrossRef]

- Ridzuan, Abdul Rahim, Nor Asmat Ismail, and Abdul Fatah Che Hamat. 2017. Does Foreign Direct Investment Successfully Lead to Sustainable Development in Singapore? Economies 5: 29. [Google Scholar] [CrossRef]

- Romer, Paul. 1986. Increasing Returns and Long-Run Growth. Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Romer, Paul. 1990. Endogenous Technological Change. Journal of Political Economy 98: 71–102. [Google Scholar] [CrossRef]

- Roy, Samrat, and Kolkata Kumarjit Mandal. 2012. Foreign direct investment and economic growth: An analysis for selected Asian Countries. Journal of Business Studies Quarterly 4: 15–24. [Google Scholar]

- Ruranga, Charles, Bruno Ocaya, and William Kaberuka. 2014. VAR Analysis of Economic Growth, Domestic Investment, Foreign Direct Investment, Domestic Savings and Trade in Rwanda. Greener Journal of Economics and Accountancy 3: 30–41. [Google Scholar]

- Sadik, Ali T., and Ali Bolbol. 2001. Capital flows, FDI, and technology spillovers: Evidence from Arab countries. World Development 29: 2111–25. [Google Scholar] [CrossRef]

- Sekmen, Fuat. 2007. Cointegration and causality among foreign direct investment in tourism sector, GDP, and exchange rate volatility in Turkey. The Empirical Economics Letters 6: 52–58. [Google Scholar]

- Shell, Karl. 1966. Toward a theory of inventive activity and capital accumulation. American Economic Review 56: 62–68. [Google Scholar]

- Tahir, Muhammad, Imran Khan, and Afzal Moshadi Shah. 2015. Foreign Remittances, Foreign Direct Investment, Foreign Imports and Economic Growth in Pakistan: A Time Series Analysis. Arab Economic and Business Journal 10: 82–89. [Google Scholar] [CrossRef]

- Tang, Sumei, Eliyathamby Antony Selvanathan, and Saroja Selvanathan. 2008. Foreign direct investment, domestic investment and economic growth in China: A time series analysis. The World Economy 31: 1292–309. [Google Scholar] [CrossRef]

- Temiz, Dilek, and Aytaç Gokmen. 2014. FDI inflow as an international business operation by MNCs and economic growth: An empirical study on Turkey. International Business Review 23: 145–54. [Google Scholar] [CrossRef]

- Thangavelu, Shandre, Yik Wei Yong, and Aekapol Chongvilavian. 2009. FDI, growth and the Asian financial crisis: The experience of selected Asian countries. The World Economy 32: 1461–77. [Google Scholar] [CrossRef]

- Tintin, Cem. 2012. Does foreign direct invest spur economic growth and development? A comparative study. Paper presented at The 14th Annual European Trade Study Group Conference, Leuven, Belgium, September 13–15. [Google Scholar]

- UNCTAD. 2016. United Nations Conference on Trade and Development Statistics. Available online: http://unctadstat.unctad.org/wds/ReportFolders/reportFolders.aspx?sCS_ChosenLang=en (accessed on 10 May 2017).

- Villa, Stefania. 2008. Economic growth, investment and government consumption in Italy: A VAR analysis. ICFAI Journal of Applied Economics 7: 23–32. [Google Scholar]

- World Bank. 2016. World Development Indicators. Washington: World Bank. [Google Scholar]

- Yalta, Yasemin A. 2013. Revisiting the FDI-led growth Hypothesis: The case of China. Economic Modelling 31: 335–43. [Google Scholar] [CrossRef]

| 1 | We consider here an “innovational outlier” breakpoint. |

| 2 | The volatility of FDI inflows is the result of an absence of reinvestment and the weak integration of foreign firms in Saudi Arabia. |

| Variables | GGDP | GNOG | GFCF | FDI | FD | TO |

|---|---|---|---|---|---|---|

| Variables Description | GDP Growth | Non-Oil GDP Growth | Gross Fixed Capital Formation (% of GDP) | Inward FDI Flows (% of GDP) | Domestic Credit to Private Sector (% of GDP) | Trade (% of GDP) |

| Mean | 4.398 | 6.128 | 20.592 | 1.159 | 21.468 | 77.927 |

| Median | 3.565 | 4.845 | 20.558 | 0.382 | 20.754 | 75.831 |

| Maximum | 24.170 | 38.620 | 29.990 | 8.496 | 56.632 | 120.619 |

| Minimum | −20.730 | −5.200 | 8.834 | −8.218 | 2.750 | 56.474 |

| Std. Dev. | 9.537 | 6.951 | 4.395 | 2.960 | 13.524 | 12.538 |

| Obs. | 46 | 46 | 46 | 46 | 46 | 46 |

| Variables | ADF | PP | DF-GLS |

|---|---|---|---|

| GGDP | −4.38 (0) * | −4.30 (2) * | −2.60 (0) ** |

| GNOG | −2.05 (0) ** | −2.16 (1) ** | −2.79 (0) * |

| GFCF | −2.14 (0) | −2.16 (3) | −1.30 (0) |

| FDI | −3.12 (0) * | −3.13 (3) * | −3.38 (0) * |

| FD | 2.43 (0) | 3.47 (6) | 1.44 (0) |

| TO | −2.07 (1) | −3.16 (3) ** | −2.01 (1) ** |

| ΔGFCF | −6.12 (0) * | −6.10 (4) * | −5.85 (0) * |

| ΔFD | −5.14 (0) * | −4.71 (5) * | −5.15 (0) * |

| ΔTO | −10.33 (0) * | −10.45 (2) * | −10.24 (0) * |

| Variables | Break | Lag | Intercept | INCPT BREAK | TREND | TREND BREAK | BREAK DUM | ADF Test Statistic | Order of Integration |

|---|---|---|---|---|---|---|---|---|---|

| GGDP | 1985 | 0 | 31.10 (0.00) | 20.85 (0.00) | −3.26 (0.00) | 3.17 (0.00) | −17.06 (0.00) | −8.26 [−5.17] | I(0) |

| GFCF | 2006 | 0 | 5.18 (0.01) | 1.17 (0.10) | - | - | −0.84 (0.76) | −2.60 [−4.44] | I(1) |

| FDI | 2001 | 9 | 2.29 (0.00) | - | −0.10 (0.01) | 0.49 (0.00) | - | −5.94 [−4.52] | I(0) |

| FD | 2015 | 1 | 0.09 (0.89) | - | 0.61 (0.00) | 12.07 (0.00) | - | −4.32 [−4.52] | I(1) |

| TO | 1995 | 1 | 63.17 (0.00) | - | −1.01 (0.00) | 1.79 (0.00) | - | −3.85 [−4.52] | I(1) |

| GNOG | 1985 | 0 | 13.73 (0.00) | - | −0.98 (0.00) | 1.14 (0.00) | - | −4.72 [−4.52] | I(0) |

| ARDL Model | AIC | SIC | HQ | Specification |

|---|---|---|---|---|

| ARDL(GGDP/ GFCF, FDI, FD, TO) | 6.49 | 7.48 | 6.86 | ARDL (2, 4, 4, 4, 4) |

| ARDL (GNOG/ GFCF, FDI, FD, TO) | 3.98 | 5.02 | 4.36 | ARDL (5, 4, 3, 2, 5) |

| ARDL(GFCF/ GNOG, FDI, FD, TO) | 3.11 | 4.15 | 3.49 | ARDL (2, 5, 2, 3, 5) |

| ARDL (FDI/ GFCF, GNOG, FD, TO) | 3.24 | 4.11 | 3.56 | ARDL (1, 5, 5, 0, 4) |

| Models | Breusch-Godfrey LM Test | Normality Test | Breusch-Pagan-Godfrey Test | ARCH Test | ||||

|---|---|---|---|---|---|---|---|---|

| LM Stat | p-Value | J-B Stat | p-Value | X2 Stat | p-Value | X2 Stat | p-Value | |

| FGGDP(GGDP/GFCF, FDI, FD, TO) | [1] 3.76 [2] 3.77 | 0.06 0.15 | 0.16 | 0.91 | 23.64 | 0.42 | [1] 0.89 [2] 2.41 | 0.34 0.29 |

| FGNOG(GNOG/GFCF, FDI, FD, TO) | [1] 0.84 [2] 0.89 | 0.35 0.63 | 13.38 | 0.01 | 18.34 | 0.78 | [1] 2.26 [2] 2.94 | 0.13 0.22 |

| FGFCF(GFCF/GNOG, FDI, FD, TO) | [1] 0.15 [2] 2.16 | 0.69 0.33 | 0.56 | 0.75 | 27.98 | 0.26 | [1] 0.01 [2] 0.47 | 0.90 0.79 |

| FFDI(FDI/GFCF, GNOG, FD, TO) | [1] 3.56 [2] 3.63 | 0.06 0.16 | 1.22 | 0.54 | 21.11 | 0.39 | [1] 0.04 [2] 0.02 | 0.84 0.99 |

| Bounds Testing for Cointegration | ||

| Models | Optimal Lag Length | F-Statistic |

| FGGDP(GGDP/GFCF, FDI, FD, TO) | 2, 4, 4, 4, 4 | 4.49 ** |

| FGNOG(GNOG/GFCF, FDI, FD, TO) | 5, 4, 3, 2, 5 | 5.76 * |

| FGFCF(GFCF/GNOG, FDI, FD, TO) | 2, 5, 2, 3, 5 | 7.32 * |

| FFDI(FDI/GFCF, GGDP, FD, TO) | 1, 5, 5, 0, 4 | 4.46 ** |

| Critical Values | ||

| Significance Level | Lower Bounds I(0) | Upper Bounds I(1) |

| 1% level | 3.74 | 5.06 |

| 5% level | 2.86 | 4.01 |

| 10% level | 2.45 | 3.52 |

| Dep. Var. | ECT(−1) | Long Run Coefficients | Short Run Coefficients | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| GNOG | GFCF | FDI | FD | TO | GNOG | GFCF | FDI | FD | TO | ||

| GGDP | −1.32 (0.00) | - | 0.42 (0.47) | −1.79 (0.10) | −0.04 (0.82) | 0.30 (0.23) | - | 0.53 (0.33) | −0.09 (0.87) | −0.79 (0.04) | 0.09 (0.52) |

| GNOG | −1.67 (0.00) | - | −1.18 (0.00) | −0.35 (0.04) | 0.23 (0.00) | 0.32 (0.00) | - | −0.64 (0.00) | −0.27 (0.18) | −0.06 (0.57) | 0.11 (0.11) |

| GFCF | −1.81 (0.00) | −0.26 (0.01) | - | −0.04 (0.76) | 0.27 (0.00) | 0.14 (0.01) | −0.26 (0.00) | - | −0.29 (0.03) | 0.32 (0.00) | 0.09 (0.02) |

| FDI | −0.52 (0.00) | −1.90 (0.01) | −2.76 (0.01) | - | 0.37 (0.00) | 0.76 (0.00) | −0.27 (0.01) | −0.13 (0.29) | - | 0.02 (0.28) | 0.04 (0.34) |

| Indep. Variables | Equation (1) | Equation (2) | Equation (3) | Equation (4) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FMOLS | DOLS | CCR | FMOLS | DOLS | CCR | FMOLS | DOLS | CCR | FMOLS | DOLS | CCR | |

| GGDP/GNOG | - | - | - | - | - | - | −0.41 (0.00) | −0.35 (0.03) | −0.49 (0.00) | −0.09 (0.49) | −0.12 (0.67) | −0.19 (0.10) |

| GFCF | −1.14 (0.00) | −8.72 (0.01) | −0.86 (0.00) | −0.76 (0.00) | −0.92 (0.01) | −0.89 (0.00) | - | - | - | −0.17 (0.03) | −0.07 (0.87) | −0.05 (0.73) |

| FDI | −1.35 (0.00) | −5.11 (0.26) | −1.62 (0.00) | −0.49 (0.00) | −0.85 (0.29) | −0.39 (0.02) | 0.23 (0.08) | −0.39 (0.38) | 0.09 (0.63) | - | - | - |

| FD | 0.15 (0.36) | 0.66 (0.24) | −0.05 (0.70) | 0.10 (0.01) | 0.36 (0.00) | 0.15 (0.00) | 0.23 (0.00) | 0.08 (0.22) | 0.21 (0.00) | 0.18 (0.00) | 0.10 (0.01) | 0.19 (0.00) |

| TO | 0.17 (0.06) | 3.44 (0.01) | 0.13 (0.21) | 0.31 (0.00) | 0.38 (0.00) | 0.32 (0.00) | 0.12 (0.00) | 0.31 (0.00) | 0.18 (0.00) | 0.10 (0.01) | 0.16 (0.25) | 0.10 (0.08) |

| Diagnostic tests | ||||||||||||

| R squared | 0.44 | 0.95 | 0.43 | 0.64 | 0.93 | 0.64 | 0.64 | 0.96 | 0.60 | 0.36 | 0.89 | 0.37 |

| J-B stat | 0.21 (0.90) | 2.54 (0.28) | 0.55 (0.75) | 200.1 (0.00) | 5.33 (0.07) | 167.9 (0.00) | 8.17 (0.01) | 0.72 (0.69) | 5.14 (0.07) | 3.64 (0.16) | 3.60 (0.16) | 3.15 (0.20) |

| Philipps Ouliaris τ stat | −7.50 (0.00) | −7.53 (0.00) | −7.37 (0.00) | −6.48 (0.00) | −6.40 (0.00) | −6.40 (0.00) | −4.02 (0.17) | −3.44 (0.39) | −4.02 (0.17) | −4.43 (0.08) | −4.50 (0.07) | −4.43 (0.08) |

| Engle-Granger τ stat | −7.33 (0.00) | −7.38 (0.00) | −7.23 (0.00) | −6.31 (0.00) | −6.25 (0.00) | −6.25 (0.00) | −4.03 (0.17) | −3.52 (0.36) | −4.03 (0.17) | −4.38 (0.09) | −4.47 (0.08) | −4.38 (0.09) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Belloumi, M.; Alshehry, A. The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia. Economies 2018, 6, 18. https://doi.org/10.3390/economies6010018

Belloumi M, Alshehry A. The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia. Economies. 2018; 6(1):18. https://doi.org/10.3390/economies6010018

Chicago/Turabian StyleBelloumi, Mounir, and Atef Alshehry. 2018. "The Impacts of Domestic and Foreign Direct Investments on Economic Growth in Saudi Arabia" Economies 6, no. 1: 18. https://doi.org/10.3390/economies6010018