Low-Carbon Competitiveness in Asia

Abstract

:1. Introduction

2. Methodology

2.1. Data Sources

2.2. Method

3. Results

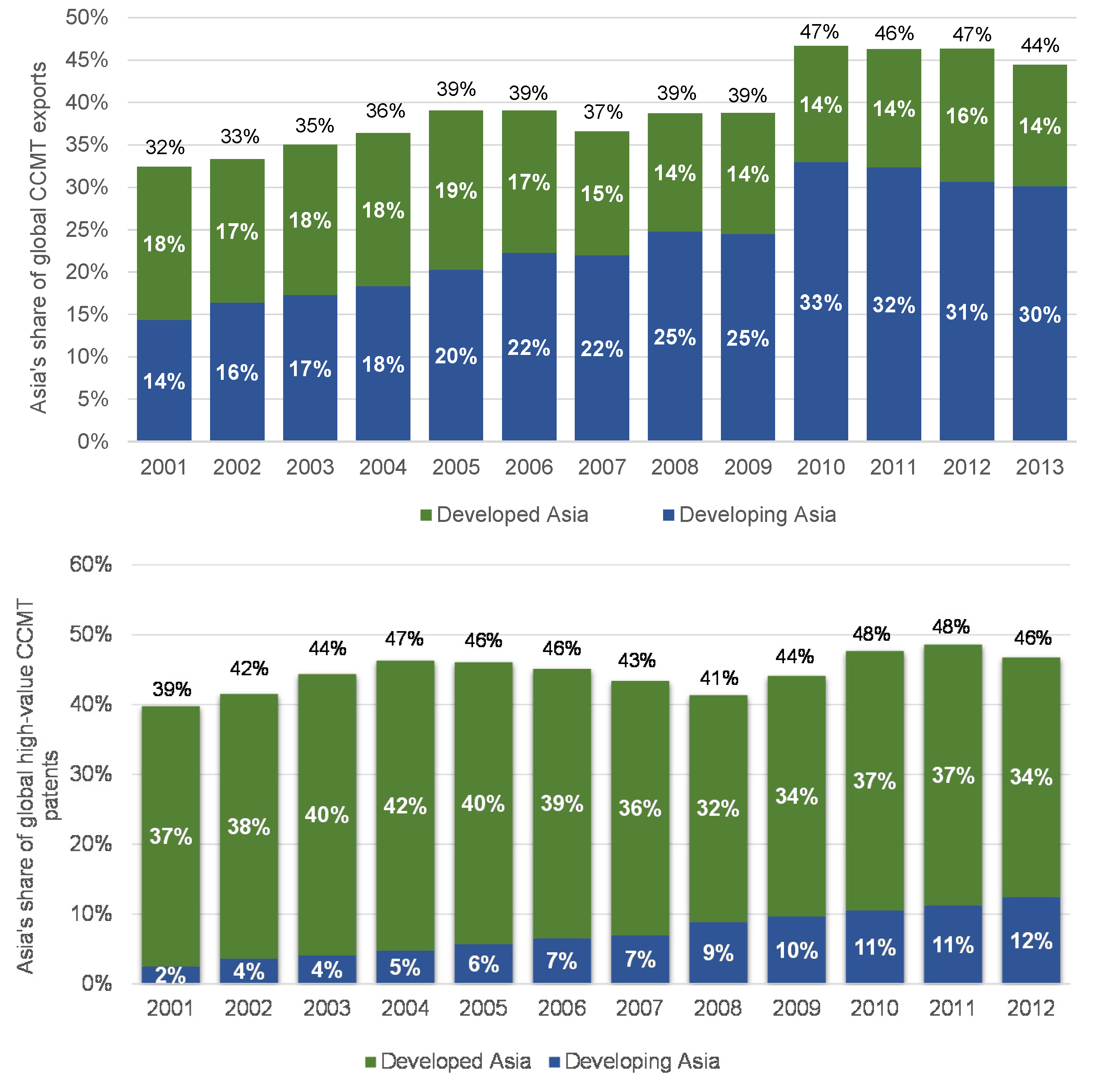

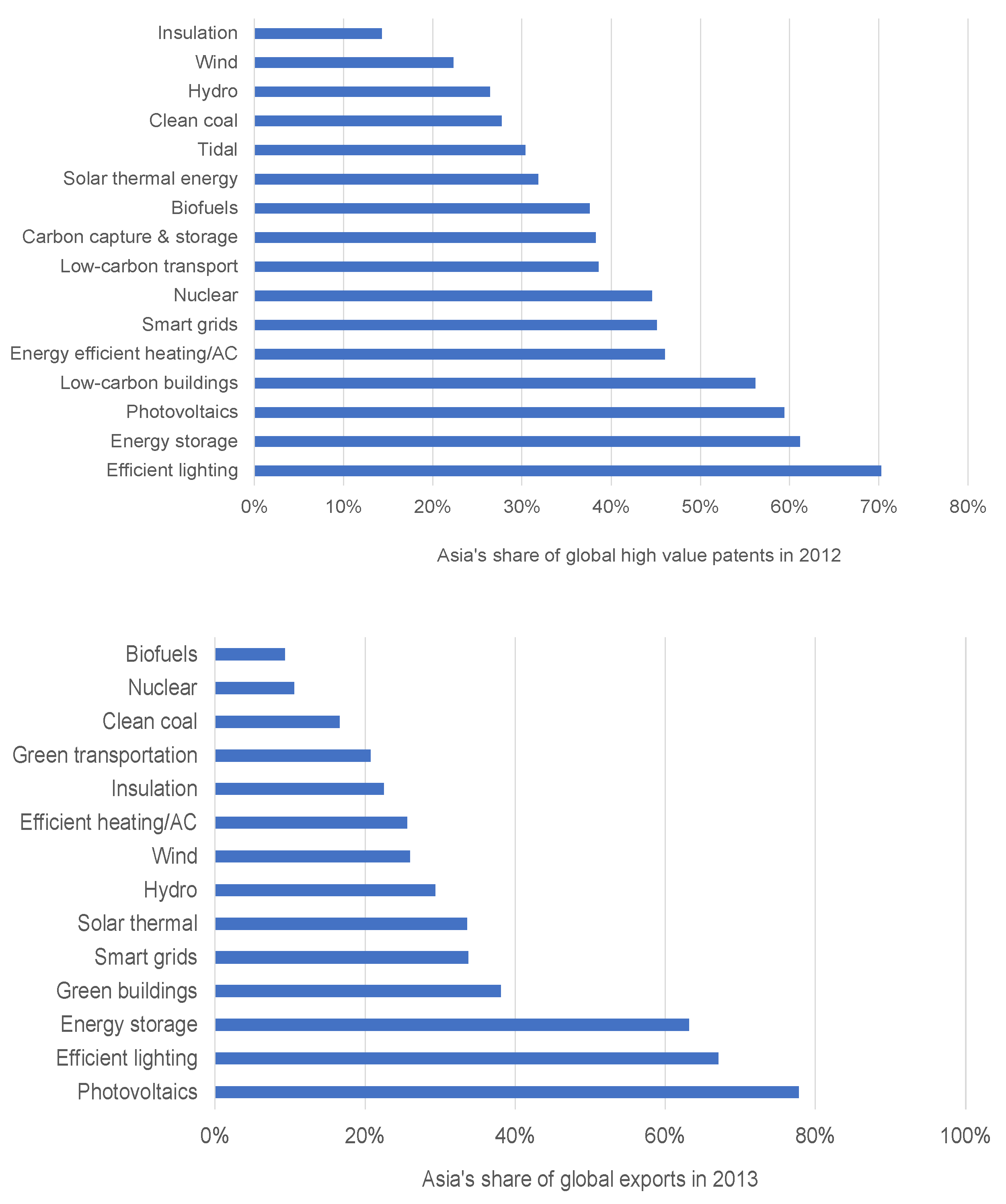

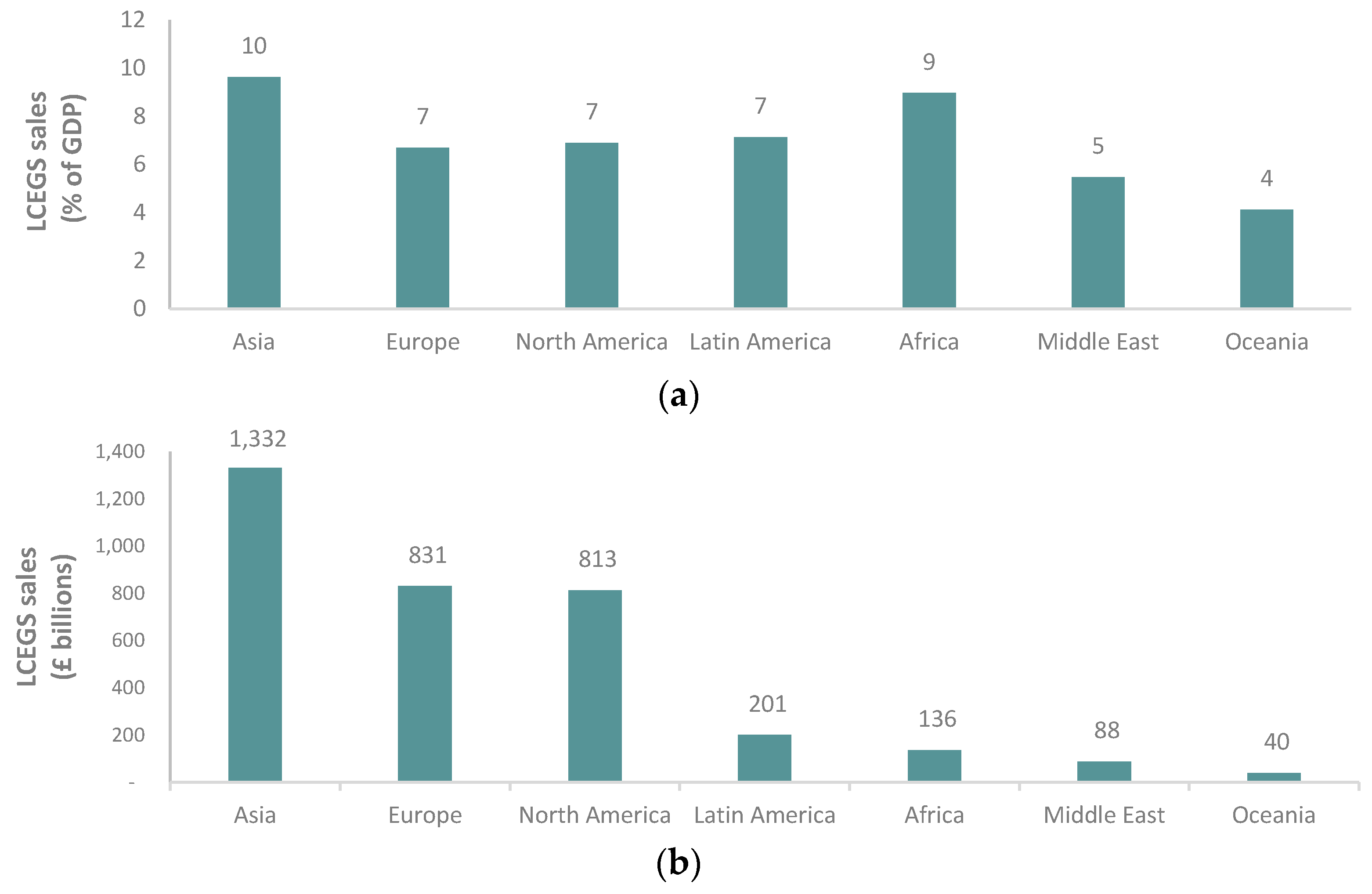

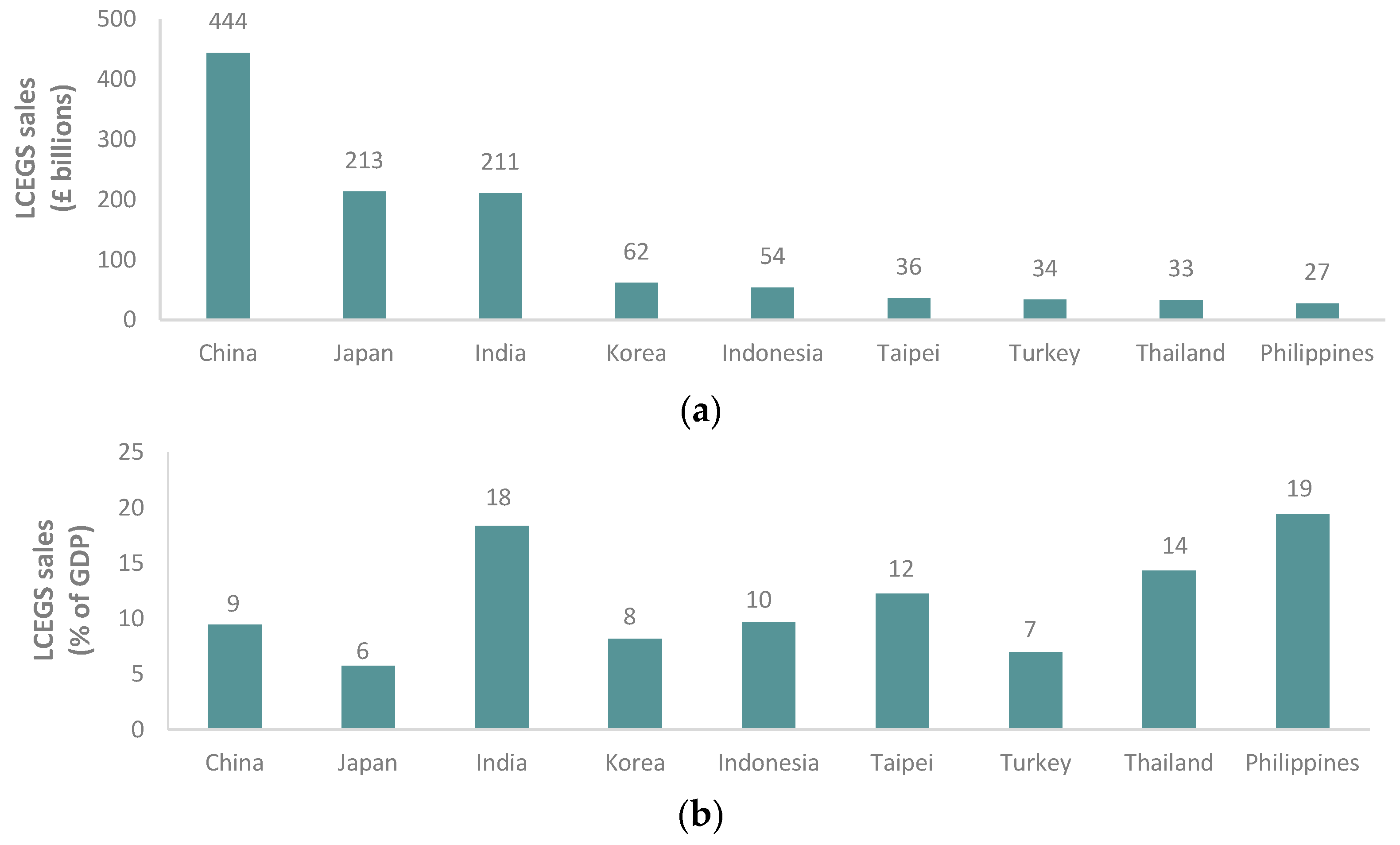

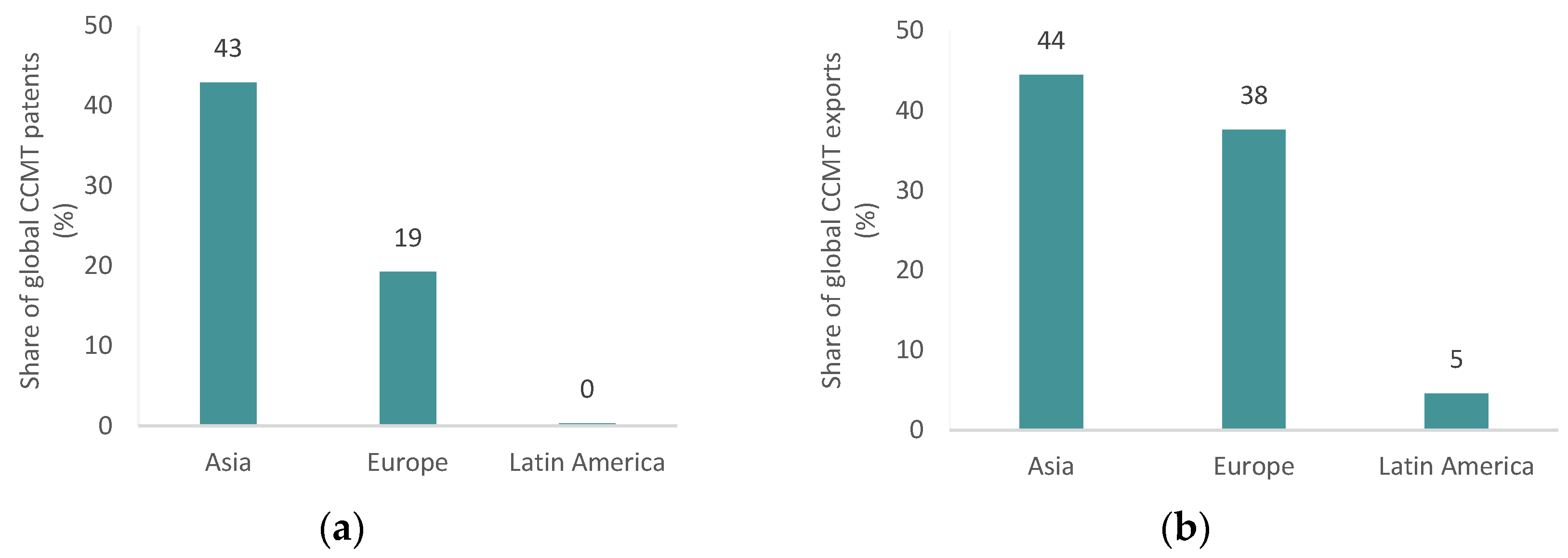

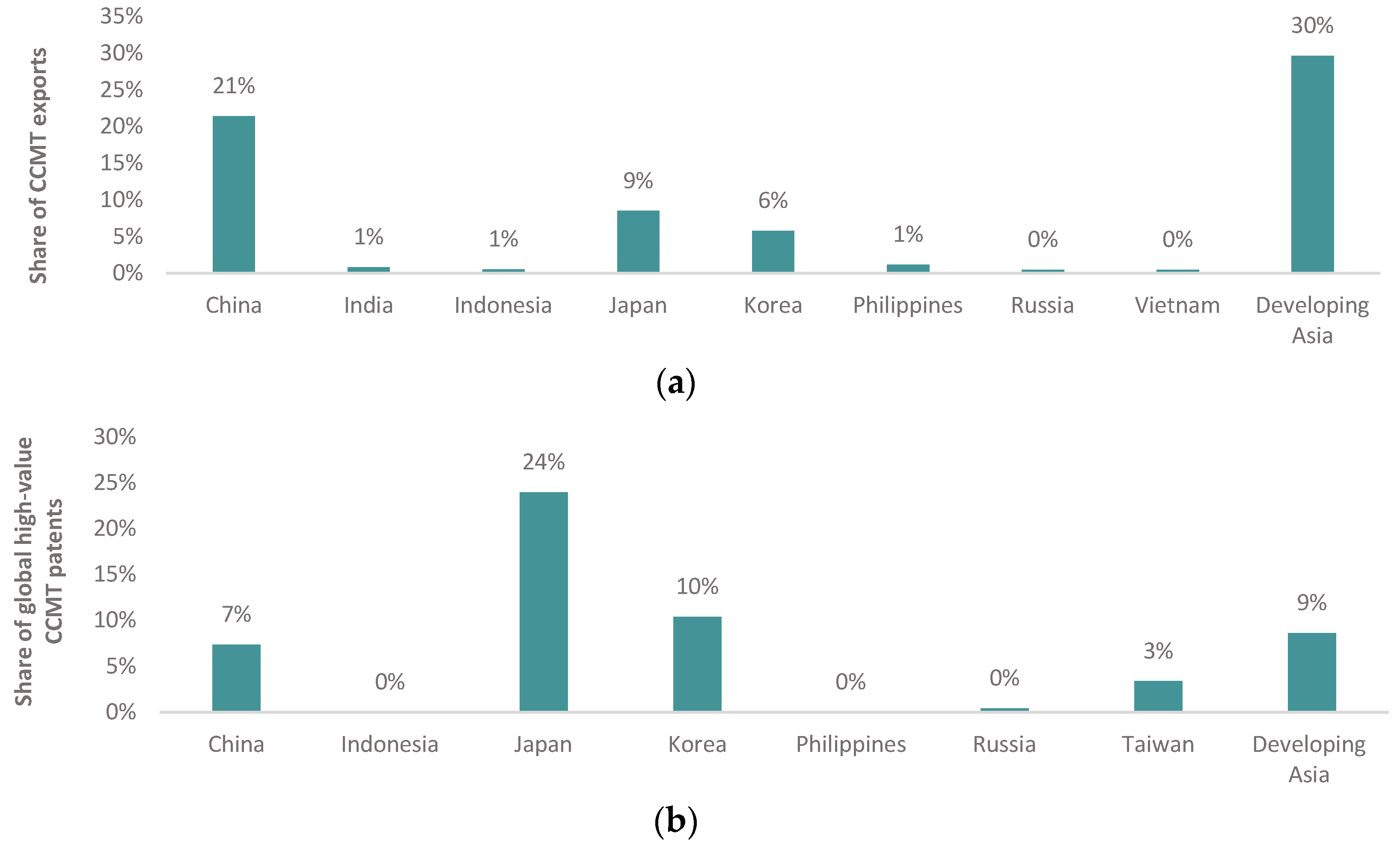

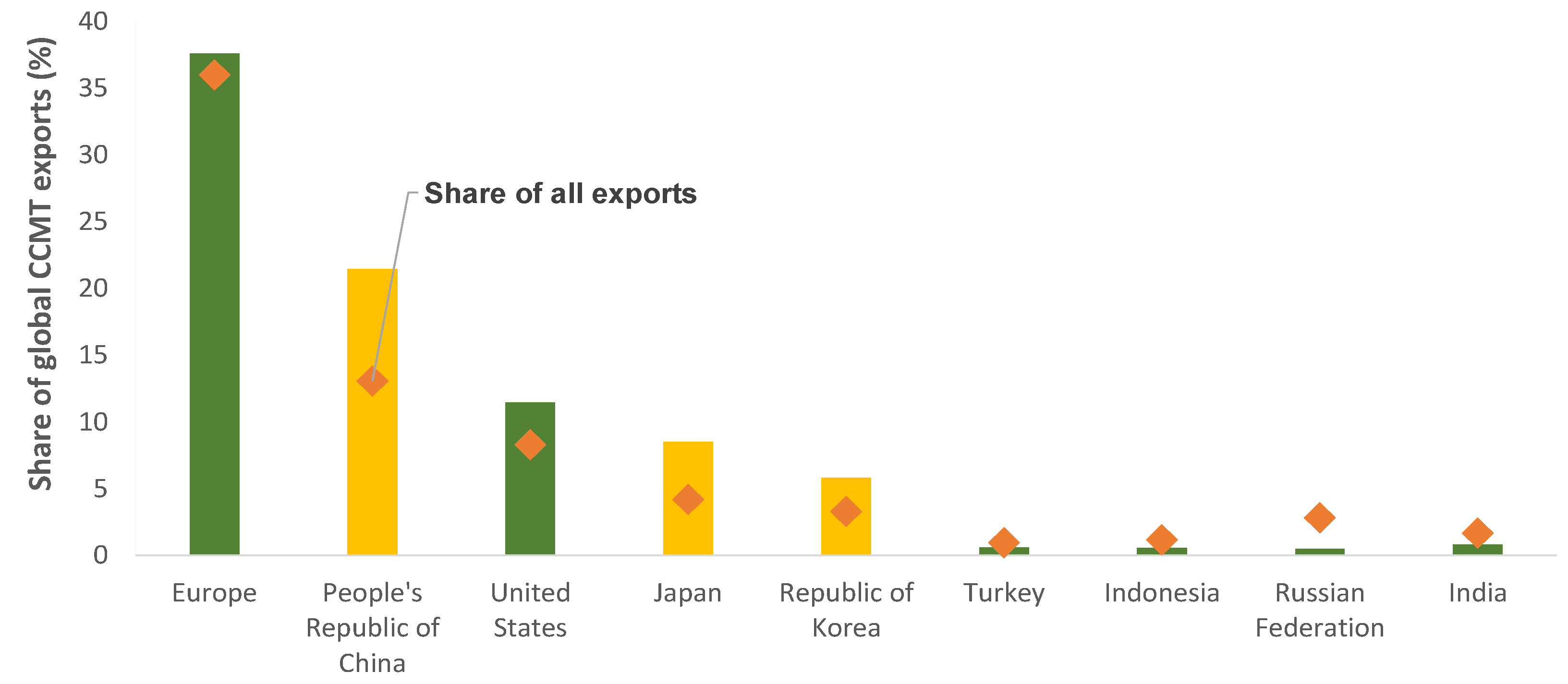

3.1. Descriptive Statistics: Asia’s Scale in the Low-Carbon Economy

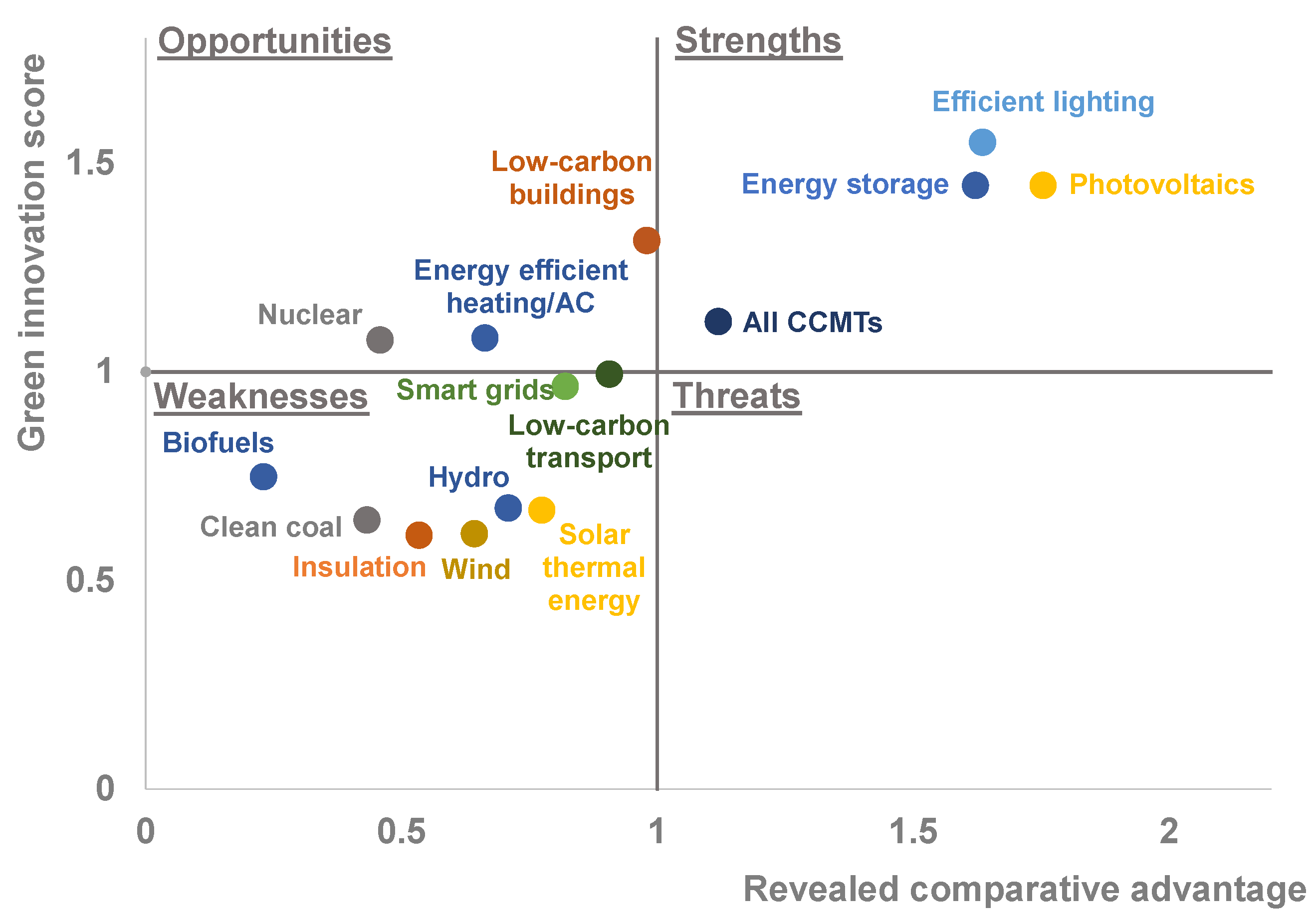

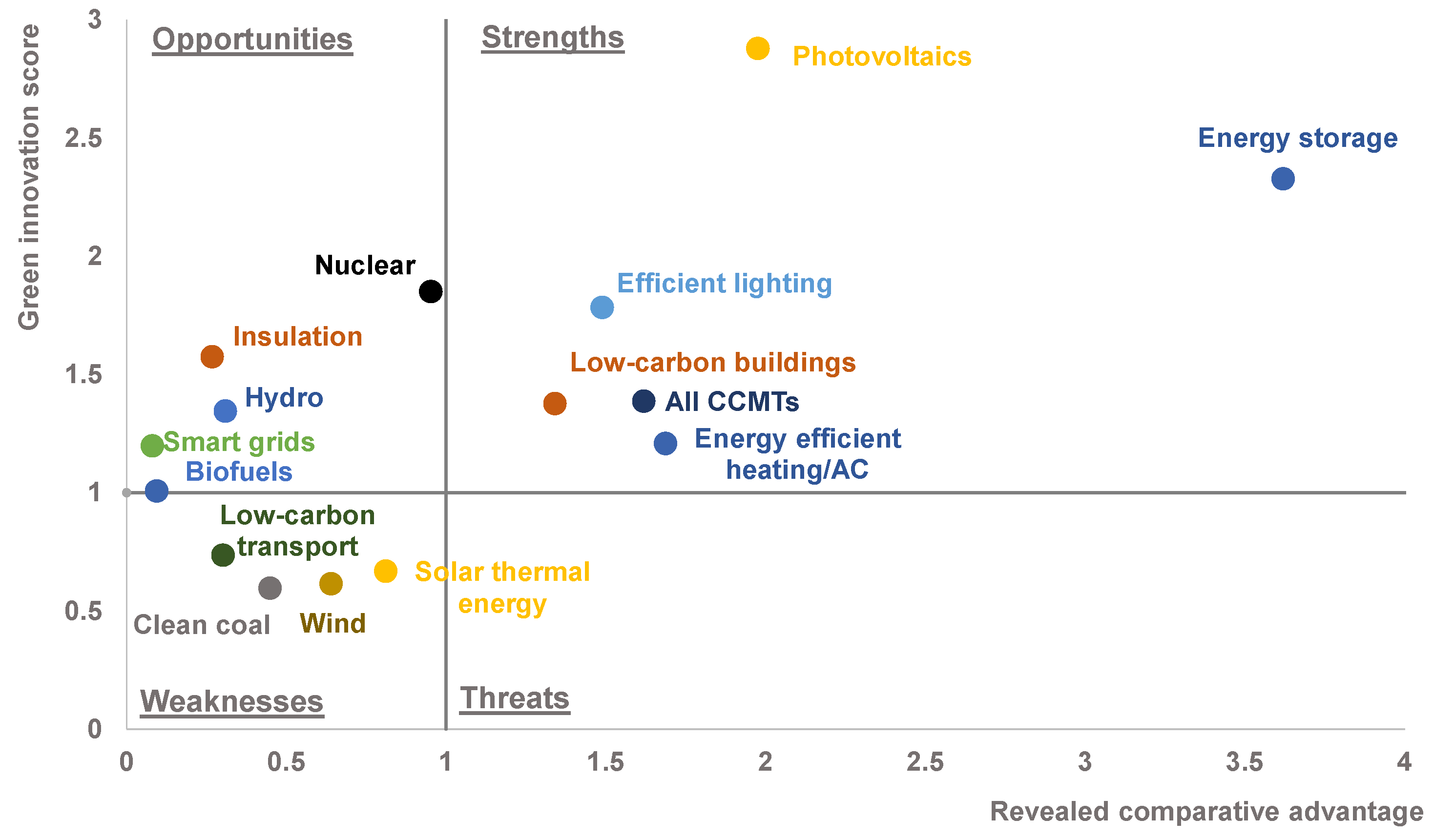

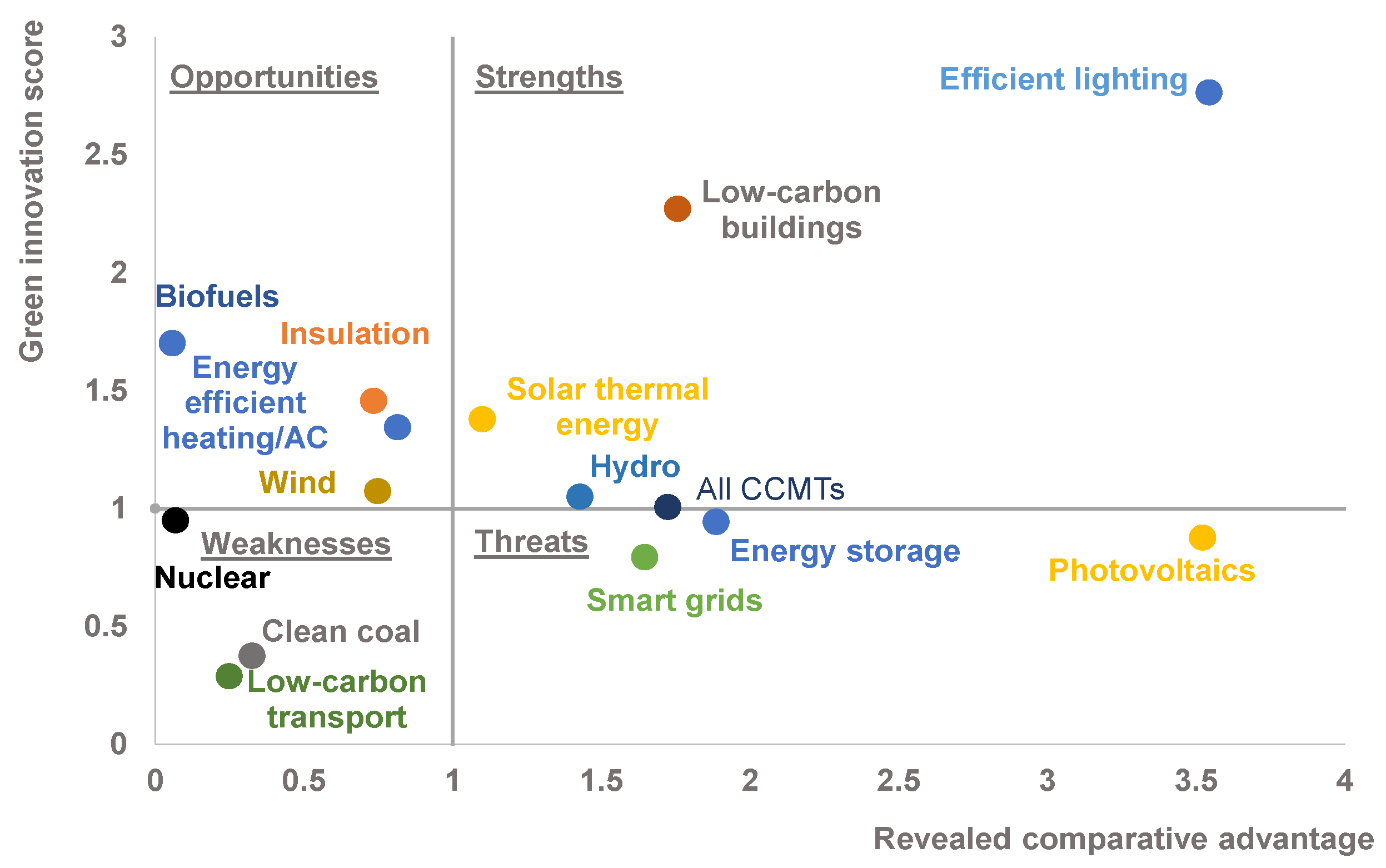

3.2. Asia’s Competitiveness in the Low-Carbon Economy

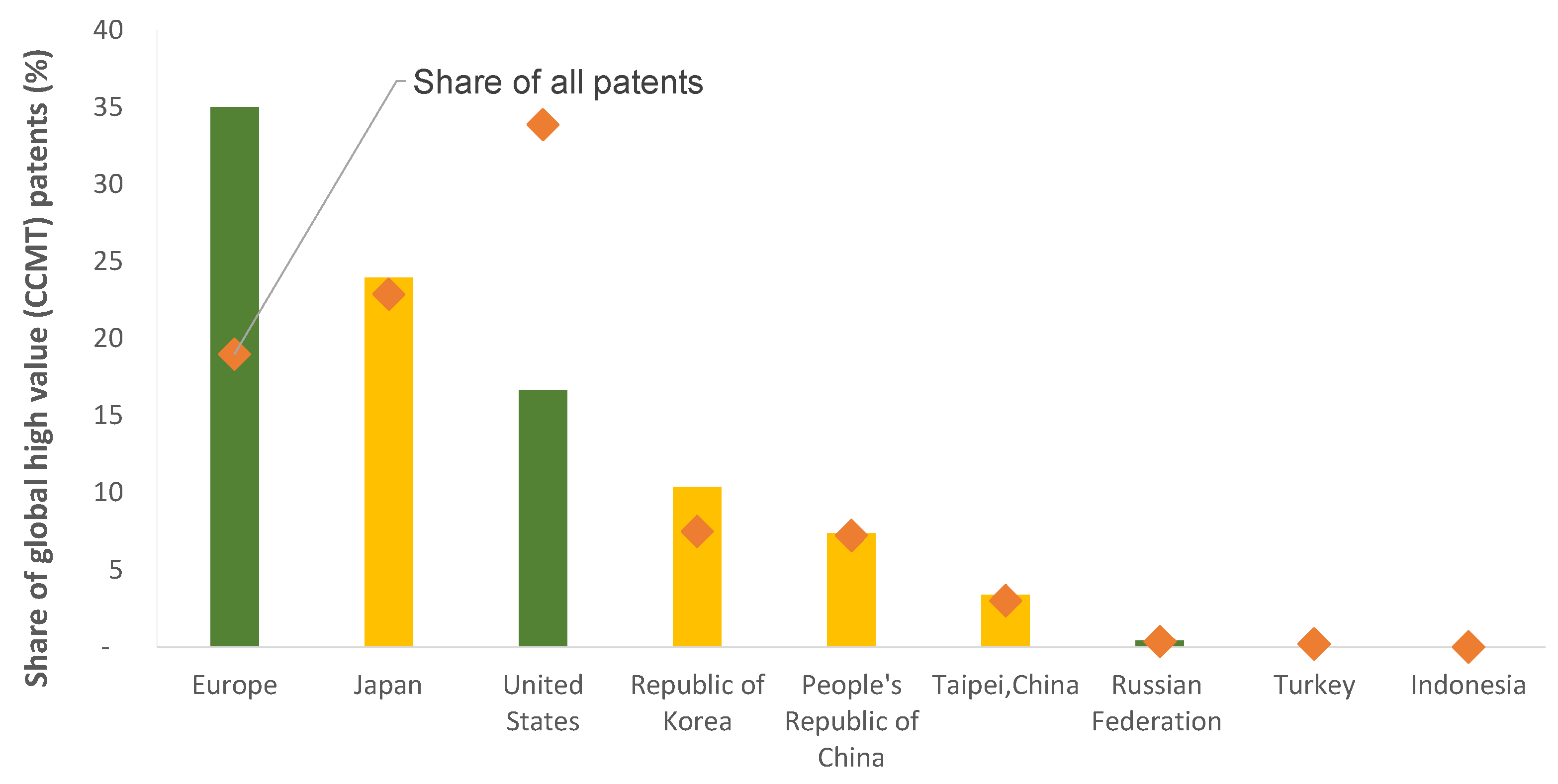

3.3. The Low-Carbon Economy in East Asia

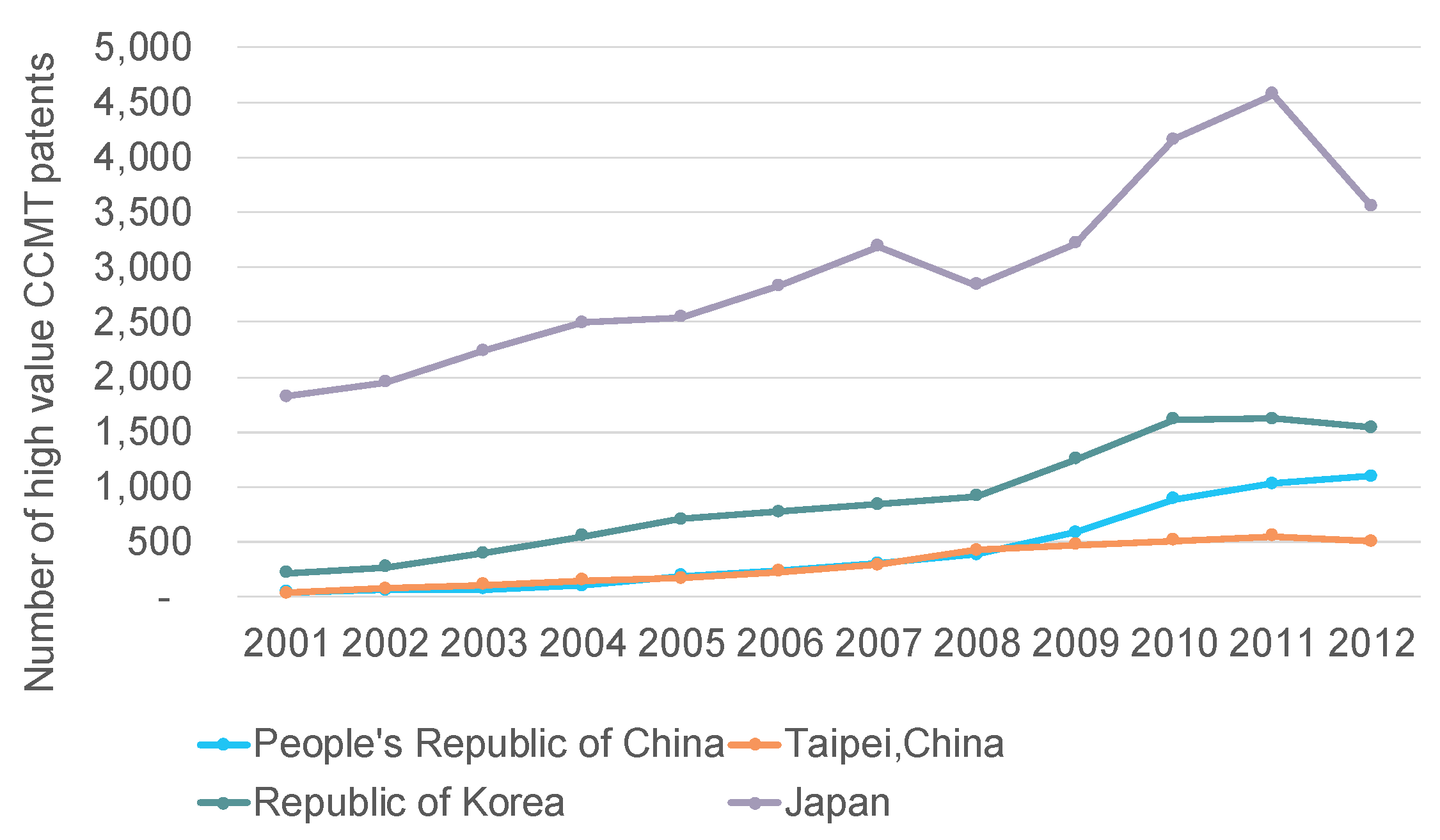

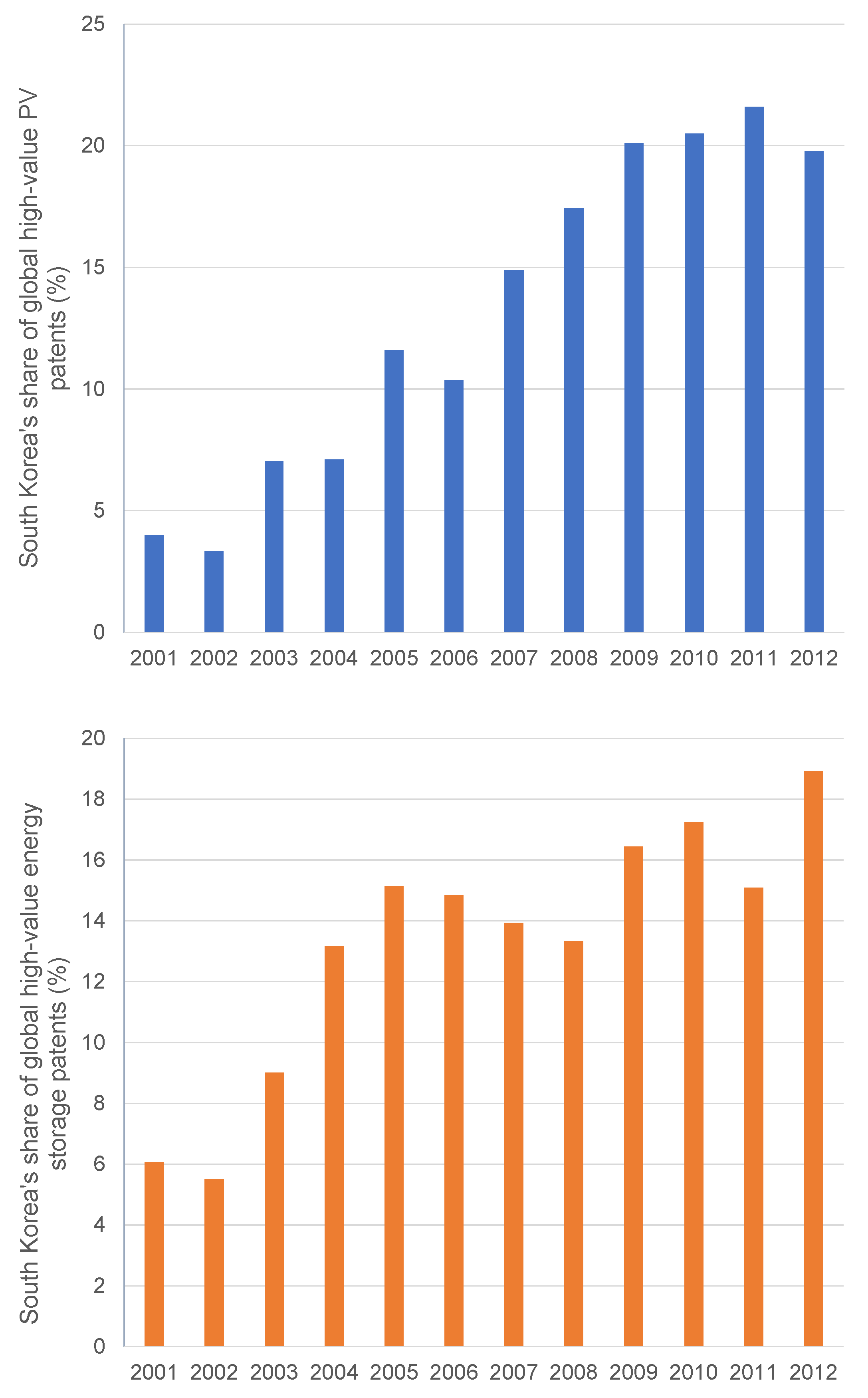

3.3.1. South Korea’s Low-Carbon Economy

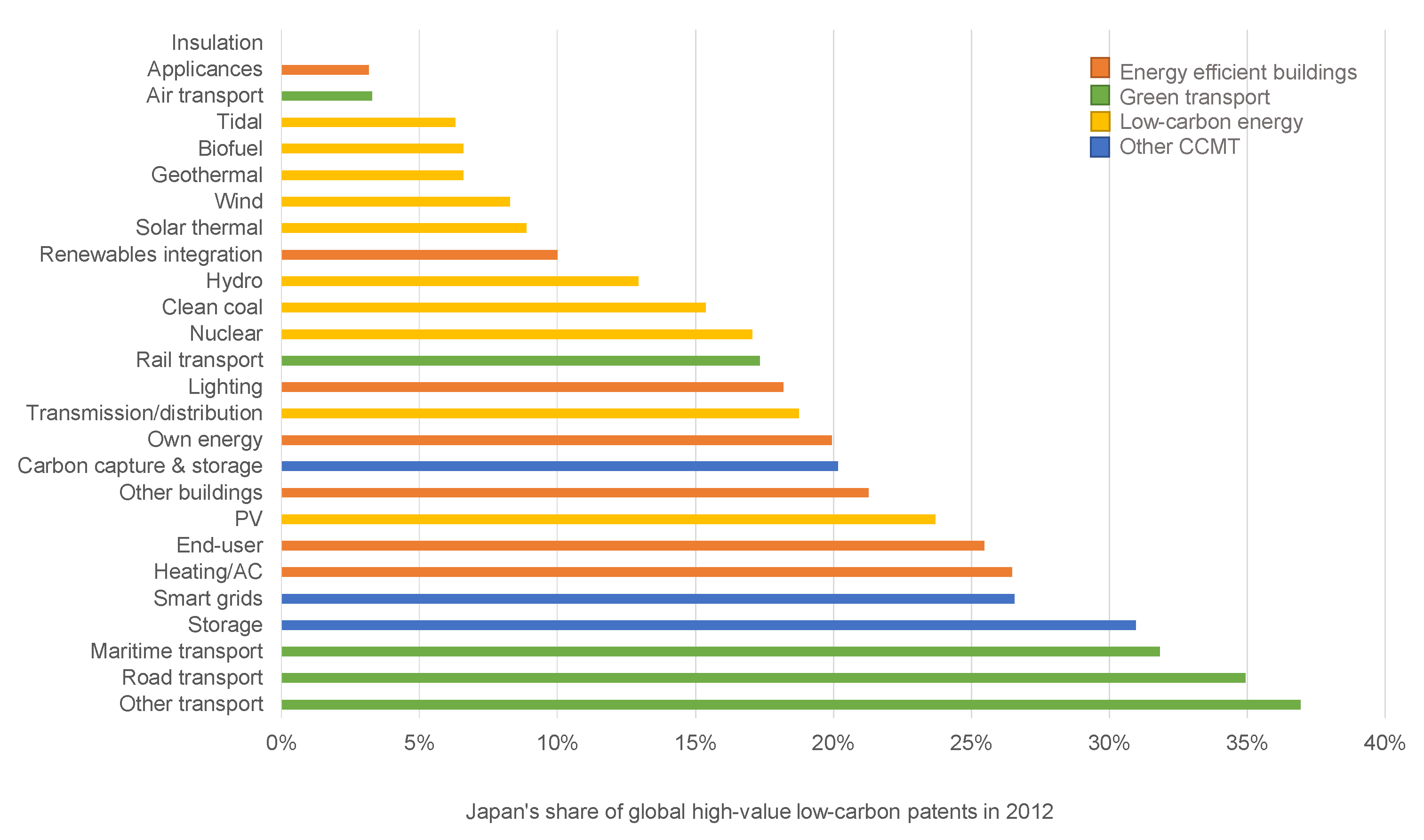

3.3.2. Japan’s Low-Carbon Economy

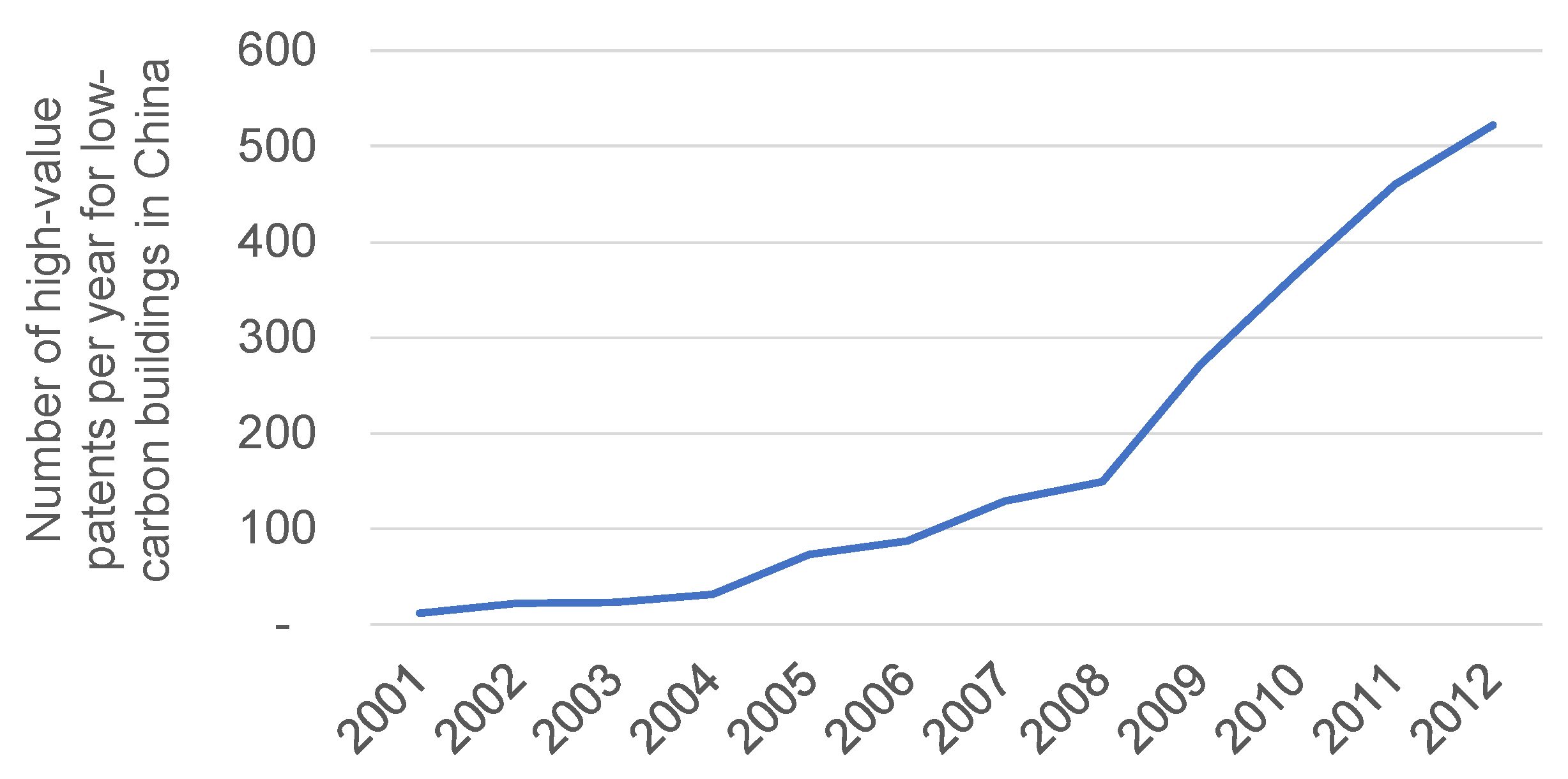

3.3.3. China’s Low-Carbon Economy

4. Discussion

Acknowledgment

Author Contributions

Conflicts of Interest

Appendix A

| Group | Description | Comment | Sub-Groups |

|---|---|---|---|

| Y02B | Climate change mitigation technologies related to buildings, including housing and appliances or related end-user applications | Integration of renewables in buildings, lighting, HVAC (heating, ventilation and air conditioning), home appliances, elevators and escalators, constructional or architectural elements, Information and Commuication Technologies , power management | Y02B10—renewables integration Y02B20—lighting Y02B30—heating/AC Y02B40—appliances Y02B50—elevators/escalators Y02B60—own energy Y02B70—end-user Y02B80—insulation Y02B90—other buildings |

| Y02C | Capture, storage, sequestration or disposal of greenhouse gases | Carbon dioxide capture and storage, also of other relevant greenhouse gases | - |

| Y02E | Climate change mitigation technologies in energy generation, transmission and distribution | Renewable energy, efficient combustion, nuclear energy, biofuels, efficient transmission and distribution, energy storage, hydrogen technology | Y02E10—renewables Y02E101—geothermal Y02E102—hydro Y02E103—sea Y02E104—thermal Y02E105—PV Y02E106—thermal-PV Y02E107—wind Y02E20—clean coal Y02E30—nuclear Y02E40—transmission Y02E50—biofuel Y02E60_70—storage |

| Y02T | Climate change mitigation technologies related to transportation | E-mobility, hybrid cards, efficient internal combustion engines, efficient technologies in railways and air/waterways transport | Y02T10—road transport Y02T30—rail transport Y02T50—air transport Y02T70—maritime transport Y02T90—other transport |

| Y04S | Smart grid technologies | Power networks operation, end-user applications management, smart metering, electric and hybrid vehicles interoperability, trading and marketing aspects | - |

| Category | Sectors |

|---|---|

| Low-carbon | Additional Energy Sources |

| Alternative Fuel Vehicle | |

| Alternative Fuels | |

| Nuclear Power | |

| Building Technologies | |

| Carbon Capture & Storage | |

| Carbon Finance | |

| Energy Management | |

| Renewable energy | Biomass |

| Geothermal | |

| Hydro | |

| Photovoltaic | |

| Renewable Consulting | |

| Wave & Tidal | |

| Wind | |

| Environmental | Air Pollution |

| Contaminated Land Reclamation & Remediation | |

| Environmental Consultancy and Related Services | |

| Environmental Monitoring, Instrumentation and Analysis | |

| Marine Pollution Control | |

| Noise & Vibration Control | |

| Recovery and Recycling | |

| Waste Management | |

| Water Supply and Waste Water Treatment |

References

- ADB. 2015. Managing the Transition to a Low-Carbon Economy: Perspectives, Policies and Practices from Asia. Tokyo: ADB. [Google Scholar]

- Aghion, Philippe, Antoine Dechezlepretre, David Hemous, Ralf Martin, and John Van Reenan. 2016. Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry. Journal of Political Economy 1: 1–51. [Google Scholar]

- Albert, Eleanor, and Beina Xu. 2016. China’s Environmental Crisis. Council on Foreign Relations. Available online: http://www.cfr.org/china/chinas-environmental-crisis/p12608 (accessed on 1 September 2017).

- Balassa, Bela. 1965. Trade liberalisation and revealed comparative advantage. The Manchester School of Economics and Social Studies 33: 99–123. [Google Scholar]

- Calel, Raphael, and Antoine Dechezlepretre. 2016. Environmental Policy and Directed Technological Change: Evidence from the European carbon market. Review of Economics and Statistics 98: 173–91. [Google Scholar]

- Capozza, Ivana. 2011. Greening Growth in Japan. OECD Environment Working Papers. Paris: OECD. [Google Scholar]

- Dechezlepretre, Antoine, and Ralf Martin. 2010. Low Carbon Innovation in the UK: Evidence from Patent Data. Centre for Climate Change Economics and Policy Grantham Research Institute on Climate Change and Environment Policy Paper. London: The Grantham Research Institute on Climate Change and the Environment. [Google Scholar]

- Dechezlepretre, Antoine, Eric Neumayer, and Richard Perkins. 2015. Environmental regulation and the cross-border diffusion of new technology: Evidence from automobile patents. Research Policy 44: 244–57. [Google Scholar]

- Dechezlepretre, Antoine, Matthieu Glachant, Ivan Hascic, Nick Johnstone, and Yann Ménière. 2011. Invention and Transfer of Climate Change Mitigation Technologies: A Global Analysis. Review of Environmental Economics and Policy 5: 109–30. [Google Scholar]

- Dur, Mattine, and Claude Giorno. 1987. Indicators of international competitiveness: conceptual aspects and evaluation. OECD Economics Studies 9: 147–82. [Google Scholar]

- Fankhauser, Sam, Alex Bowen, Raphael Calel, Antoine Dechezlepretre, David Grover, James Rydge, and Misato Sato. 2013. Who will win the green race? In search of environmental competitiveness and innovation. Global Environmental Change 23: 902–13. [Google Scholar]

- Glachant, Matthieu, Damien Dussaux, Yann Ménière, and Antoine Dechezlepretre. 2013. Promoting the International Transfer of Low-Carbon Technologies: Evidence and Policy Challenges. Available online: http://personal.lse.ac.uk/dechezle/Promoting_the_international_transfer_of_low_carbon_techs.pdf (accessed on 1 September 2017).

- Green Alliance. 2013. The Global Green Race: A Business Review of UK Competitiveness in Low Carbon Markets. Available online: https://www.green-alliance.org.uk/resources/The%20global%20green%20race.pdf (accessed on 1 September 2017).

- Hausmann, Ricardo, and César A. Hidalgo. 2010. The building blocks of eocnomic complexity. Proceedings of the National Academy of Sciences 106: 10570–75. [Google Scholar]

- Hidalgo, César A., Bailey Klinger, Albert-László Barabasi, and Ricardo Hausmann. 2007. The Product Space Conditions the Development of Nations. Science 317: 482–87. [Google Scholar]

- Ho, Mun S., and Zhongmin Wang. 2014. Green Growth for China: A Literature Review. Resources for the Future Discussion Paper No. 14–22. Washington, DC: Resources for the Future. [Google Scholar]

- New Climate Economy. 2014. Better Growth, Better Climate: The New Climate Economy Report. Available online: http://static.newclimateeconomy.report/wp-content/uploads/2014/08/NCE-SYNTHESIS-REPORT-web-share.pdf (accessed on 1 September 2017).

- Pothecary, Sam. 2016. South Korea to give incentives for energy storage as part of renewables spending spree. PV Magazine, September 20. [Google Scholar]

- Popp, David. 2002. Induced Innovation and Energy Prices. American Economic Review 92: 160–80. [Google Scholar]

- Statistics Korea. 2012. Korea’s Green Growth: Based on OECD Green Growth Indicators, 56. Available online: http://www.oecd.org/greengrowth/Korea’s GG report with OECD indicators.pdf (accessed on 1 September 2017).

- Stern, N. 2010. China’s Growth, China’s Cities and the New Global Low-Carbon Industrial Revolution. Policy Brief. London: Grantham Research Institute, London School of Economics, November. [Google Scholar]

- UK BIS. 2011. Low Carbon and Environmental Goods and Services Database; London: Department for Business, Innovation & Skills.

- World Bank, Vivid Economics, and Ecofys. 2017. State and Trends of Carbon Pricing 2017. Washington: World Bank. [Google Scholar]

- Yoshida, Fumikazu, and Akihisa Mori. 2015. Green Growth and Low Carbon Development in East Asia. Abingdon: Routledge. [Google Scholar]

| 1 | |

| 2 | |

| 3 | |

| 4 | The categorising of ‘threats’ and ‘opportunities’ rests on the implicit assumption that an ‘innovation specialisation’ is preferable over an ‘export specialisation’, if a country were to only have one. This assumption can be challenged but is based on the fact that the value that is accrued from IP often exceeds that which is accrued from exports. |

| 5 | Other Asian countries could not individually be represented on this chart because they undertake very low levels of high-value CCMT patenting activity for which we could not meaningfully calculate a green innovation score. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Srivastav, S.; Fankhauser, S.; Kazaglis, A. Low-Carbon Competitiveness in Asia. Economies 2018, 6, 5. https://doi.org/10.3390/economies6010005

Srivastav S, Fankhauser S, Kazaglis A. Low-Carbon Competitiveness in Asia. Economies. 2018; 6(1):5. https://doi.org/10.3390/economies6010005

Chicago/Turabian StyleSrivastav, Sugandha, Sam Fankhauser, and Alex Kazaglis. 2018. "Low-Carbon Competitiveness in Asia" Economies 6, no. 1: 5. https://doi.org/10.3390/economies6010005