Private Sector Credit and Inflation Volatility

Abstract

:1. Introduction

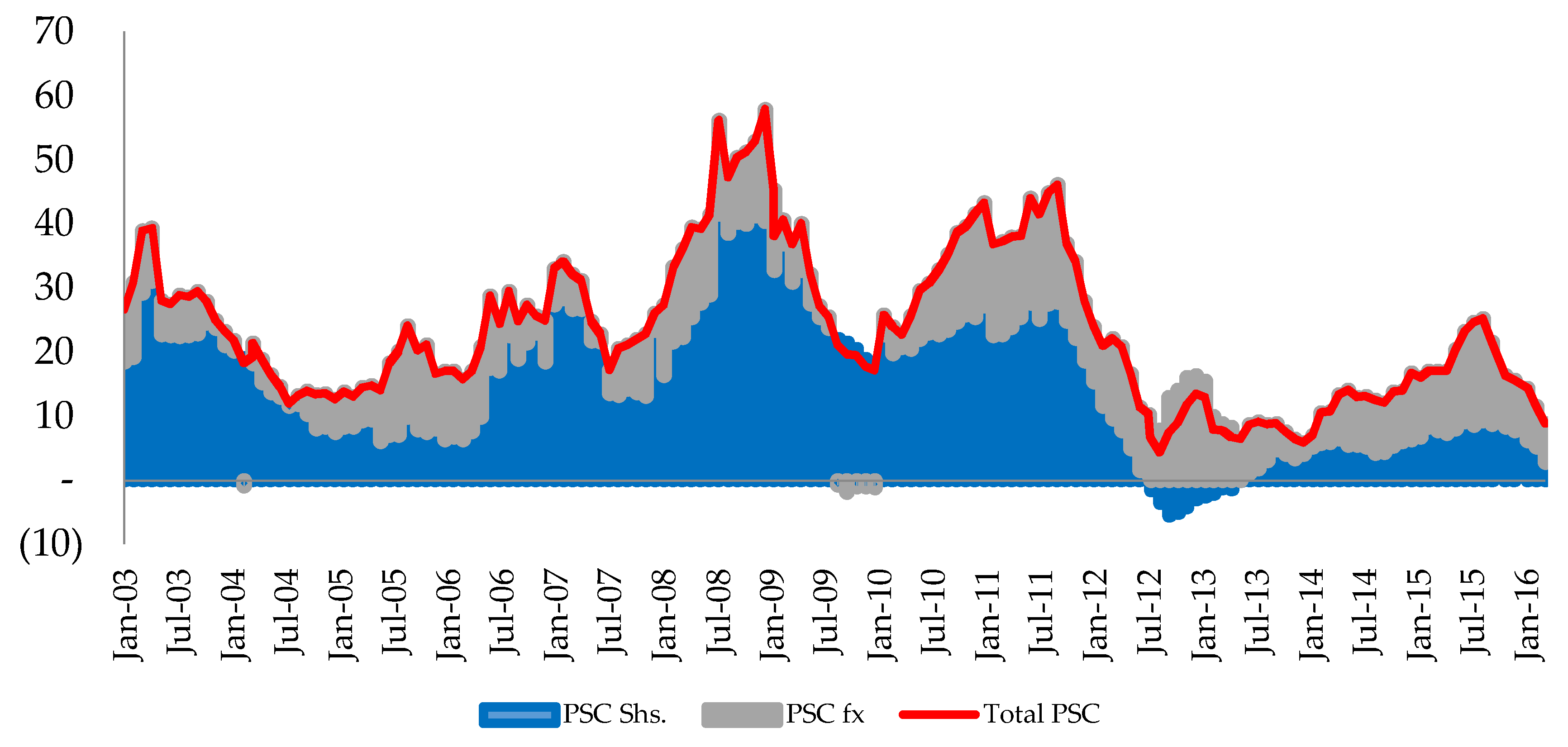

2. Overview of the Evolution of the Financial Sector and Credit to the Private Sector in Uganda

3. Literature Review

4. Methodology

4.1. Data and Estimation Procedure

4.2. Measuring Inflation Volatility

5. Results and Discussion

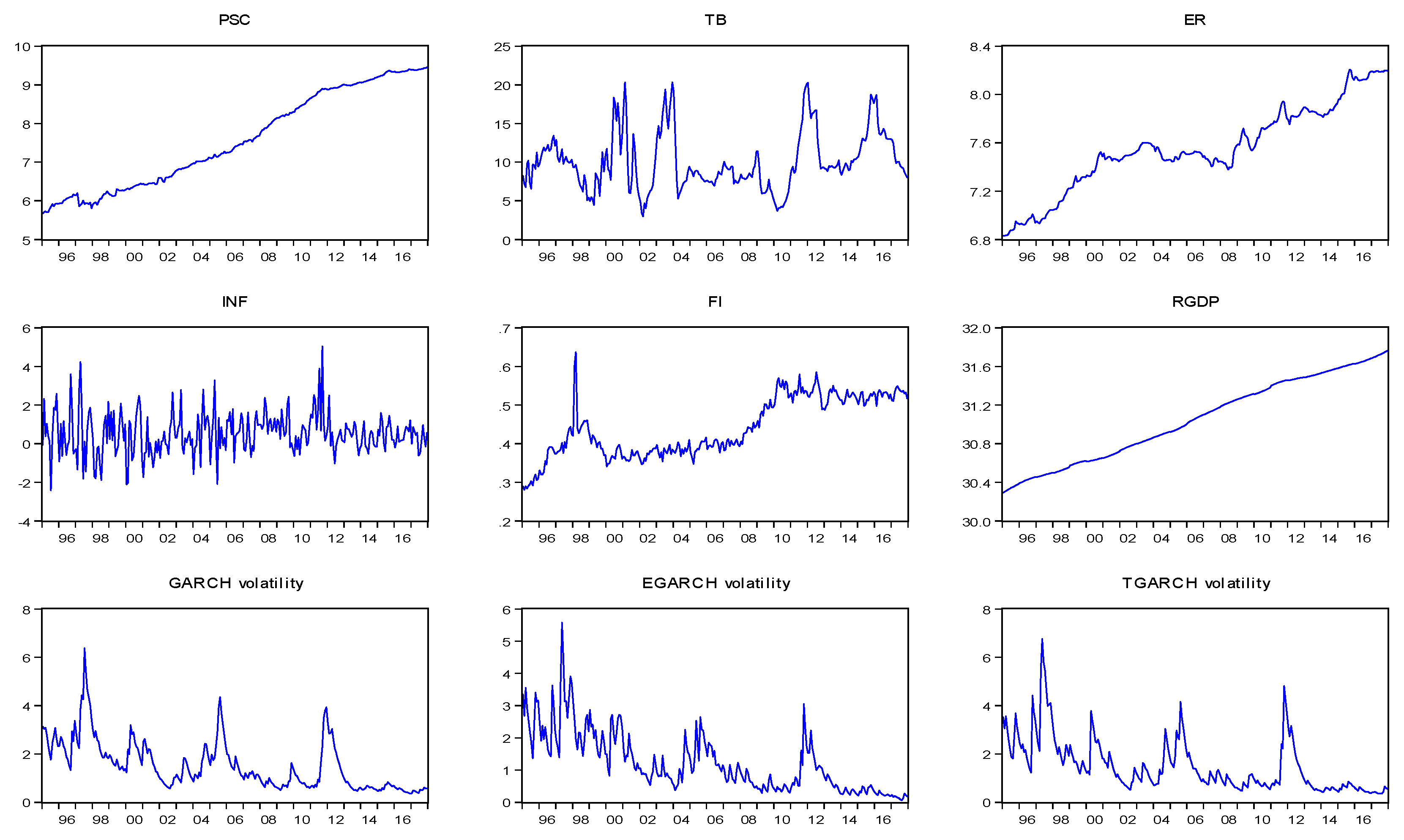

5.1. Descriptive Statistics

5.2. Unit Root Test Results

5.3. Discussion of Results

5.4. Sensitivity and Robustness Analysis

6. Conclusions and Recommendation

Conflicts of Interest

References

- Abuka, Charles A., and Kenneth A. Egesa. 2007. An assessment of private sector credit evolution in the East African Community: The candidates for a region wide reform strategy for the financial sector 1. The Bank of Uganda Staff Papers Journal 1: 107–19. [Google Scholar]

- Aisen, Ari, and Francisco José Veiga. 2007. Does political instability lead to higher and more volatile inflation? A panel data analysis. Panoeconomicus 54: 5–27. [Google Scholar] [CrossRef]

- Akinlo, A. Enisan, and I. Oluwafemi Oni. 2015. Determinants of bank credit growth in Nigeria 1980–2010. European Journal of Sustainable Development 4: 23. [Google Scholar] [CrossRef]

- Albulescu, Claudiu Tiberiu. 2010. Forecasting Credit Growth Rate in Romania: From Credit Boom to Credit Crunch? Romanian Economic Business Review 5: 62–75. [Google Scholar]

- Ansong, Abraham, Edward Marfo-Yiadom, and Emmanuel Ekow-Asmah. 2011. The Effects of Financial Innovation on Financial Savings: Evidence from an Economy in Transition. Journal of African Business 12: 93–113. [Google Scholar] [CrossRef]

- Azam, Jean-Paul. 2001. Inflation and Macroeconomic Instability in Madagascar. African Development Review 13: 175–201. [Google Scholar] [CrossRef]

- Backé, Peter, and Tina Zumer. 2005. Developments in Credit to the Private Sector in Central and Eastern European EU Member States: Emerging from Financial Repression—A Comparative Overview. Focus on European Economic Integration 2: 83–109. [Google Scholar]

- Bank of Uganda. 2016a. About the Bank [WWW Document]. Available online: https://www.bou.or.ug/bou/home.html (accessed on 17 May 2016).

- Bank of Uganda. 2016b. Database. [WWW Document]. Available online: https://www.bou.or.ug/bou/rates_statistics/statistics.html (accessed on 17 May 2016).

- Bollerslev, Tim. 1986. Generalized Autoregressive Conditional Heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bundesbank. 2005. Credit Growth, Bank Capital and Economic Activity. Deutsche Bundesbank Monthly Report. Frankfurt am Main: Deutsche Bundesbank. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association 74: 427–31. [Google Scholar]

- Egert, Balázs, Peter Backé, and Tina Zumer. 2007. Private-Sector Credit in Central and Eastern Europe: New (Over) Shooting Stars? Comparative Economic Studies 49: 201–31. [Google Scholar] [CrossRef]

- Fountas, Stilianos, Menelaos Karanasos, and Jinki Kim. 2006. Inflation uncertainty, output growth uncertainty and macroeconomic performance. Oxford Bulletin of Economics and Statistics 68: 319–43. [Google Scholar] [CrossRef]

- Glosten, Lawrence R., Ravi Jagannathan, and David E. Runkle. 1993. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Grier, Robin, and Kevin B. Grier. 2006. On the real effects of inflation and inflation uncertainty in Mexico. Journal of Development Economics 80: 478–500. [Google Scholar] [CrossRef]

- Guo, Kai, and Vahram Stepanyan. 2011. Determinants of Bank Credit in Emerging Market Economies. IMF Working Paper. Washington, DC: International Monetary Fund. [Google Scholar]

- Hye, Qazi Muhammad Adnan. 2009. Financial innovation and demand for money in Pakistan. The Asian Economic Review 51: 219–28. [Google Scholar]

- Imran, Kashif, and Mohammed Nishat. 2013. Determinants of bank credit in Pakistan: A supply side approach. Economic Modelling 35: 384–90. [Google Scholar] [CrossRef]

- Iossifov, Plamen, and May Y. Khamis. 2009. Credit Growth in Sub-Saharan Africa-Sources, Risks, and Policy Responses. IMF Working Paper. Washington, DC: International Monetary Fund. [Google Scholar]

- Kiley, Michael T. 2007. Is Moderate-to-High Inflation Inherently Unstable? International Journal of Central Banking 3: 173–201. [Google Scholar] [CrossRef]

- Kiss, Gergely, Márton Nagy, and Balázs Vonnák. 2006. Credit Growth in Central and Eastern Europe: Trend, Cycle or Boom. Paper presented at the Conference “Finance and Consumption Workshop: Consumption and Credit in Countries with Developing Credit Markets”, Florence, Italy, June 16–17. [Google Scholar]

- Kontonikas, Alexandros. 2004. Inflation and Inflation Uncertainty in the United Kingdom, Evidence from GARCH Modelling. Economic Modelling 21: 525–43. [Google Scholar] [CrossRef]

- Kwiatkowski, Denis, Peter C. B. Phillips, Peter Schmidt, and Yongcheol Shin. 1992. Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root: How Sure Are We That Economic Time Series Have a Unit Root? Journal of Econometrics 54: 159–78. [Google Scholar] [CrossRef]

- Levine, Ross. 1997. Financial Development and Economic Growth: Views and Agenda. Journal of Economic Literature 35: 688–726. [Google Scholar]

- Mallik, Girijasankar, and Anis Chowdhury. 2011. Effect of inflation uncertainty, output uncertainty and oil price on inflation and growth in Australia. Journal of Economic Studies 38: 414–29. [Google Scholar] [CrossRef]

- Moreno, Antonio. 2004. Reaching Inflation Stability. Journal of Money, Credit and Banking 36: 801–25. [Google Scholar] [CrossRef]

- Mugume, Adam. 2008. Market Structure and Performance in Uganda’s Banking Industry. Working Paper. Kampala, Uganda: Department of Economic Theory and Analysis, Makerere University. [Google Scholar]

- Nelson, Daniel B. 1991. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- Phillips, Peter C. B., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Quagliariello, Mario. 2009. Macroeconomic Uncertainty and Banks’ Lending Decisions: The Case of Italy. Applied Economics 41: 323–36. [Google Scholar] [CrossRef]

- Reinikka, Ritva, and Jakob Svensson. 2001. Confronting Competition: Investment, Profit, and Risk. In Uganda’s Recovery: The Role of Farms, Firms, and Government. Edited by Ritva Reinikka and Paul Collier. Regional and Sectoral Studies. Washington: World Bank, pp. 207–32. [Google Scholar]

- Sharaf, Mesbah Fathy. 2015. Inflation and Inflation Uncertainty Revisited: Evidence from Egypt. Economies 3: 128–46. [Google Scholar] [CrossRef]

- Sharma, Parmendra, and Neelesh Gounder. 2012. Determinants of Bank Credit in Small Open Economies: The Case of Six Pacific Island Countries. Discussion Papers in Finance. Brisbane: Griffith University. [Google Scholar]

- Udoh, Elijah, and Festus O. Egwaikhide. 2010. Exchange Rate Volatility, Inflation Uncertainty and Foreign Direct Investment in Nigeria. Botswana Journal of Economics 5: 14–31. [Google Scholar] [CrossRef]

- Whitworth, Alan, and Tim Williamson. 2010. Overview of Ugandan economic reform since 1986. In Uganda’s Economic Reforms Insider Accounts. Edited by Florence Kuteesa, Emmanuel Tumusiime-Mutebile, Alan Whitworth and Tim Williamson. New York: Oxford University Press Inc. [Google Scholar]

- Wilson, Bradley Kemp. 2006. The links between inflation, inflation uncertainty and output growth: New time series evidence from Japan. Journal of Macroeconomics 28: 609–20. [Google Scholar] [CrossRef]

- World Bank. 2015. World Development Indicators [WWW Document]. Available online: https://elibrary.worldbank.org/doi/abs/10.1596/978-1-4648-0440-3 (accessed on 29 April 2016).

- World Bank. 2016. Uganda Overview [WWW Document]. Worldbank.org. Available online: http://www.worldbank.org/en/country/uganda/overview (accessed on 29 April 2016).

- Zakoian, Jean-Michel. 1994. Threshold Heteroskedastic Models. Journal of Economic Dynamics and Control 18: 931–55. [Google Scholar] [CrossRef]

| 1 | Preliminary analysis was conducted using the ADF, PP, and KPSS unit-root tests to ascertain the order of intergration of the inflation series and show consistent evidence of stationary at the 5% level of significance. The ARCH LM test conducted using residuals from an OLS regression of the mean equation strongly rejects the null hypothesis of no ARCH effects with a p-value of 0.00. The test assesses the null hypothesis that a series of residuals (rt) exhibits no conditional heteroscedasticity (no ARCH effects) against the alternative that an ARCH type model describes the series. |

| Variable | Description | Mean | Maximum | Minimum | Std. Dev. |

|---|---|---|---|---|---|

| PSC | Natural log of Total private sector credit | 7.57 | 9.45 | 5.67 | 1.25 |

| TB | 91-day Treasury bill interest rate (%) | 10.07 | 20.35 | 2.97 | 3.75 |

| ER | Natural log of the nominal UGX/USD exchange rate (Average) | 7.55 | 8.21 | 6.83 | 0.36 |

| INF | Inflation (Natural log difference of the domestic consumer price index) | 0.52 | 5.04 | −2.41 | 1.07 |

| FI | Natural log of Financial innovation (M2/M1) | 0.44 | 0.64 | 0.28 | 0.08 |

| INFV1 | GARCH (1,1): Inflation volatility | 1.52 | 6.37 | 0.36 | 1.03 |

| INFV2 | EGARCH (1,1): Inflation volatility | 1.24 | 5.58 | 0.06 | 0.95 |

| INFV3 | TGARCH (1,1): Inflation volatility | 1.50 | 6.77 | 0.35 | 1.11 |

| RGDP | Natural log of Interpolated monthly GDP | 31.05 | 31.76 | 30.29 | 0.43 |

| Unit Root Tests | Augmented Dicky–Fuller (ADF) | Phillips–Peron (PP) | Kwiatkowski–Phillips– | Inference | |||

|---|---|---|---|---|---|---|---|

| Schmidt–Shin (KPSS) | |||||||

| Levels | 1st Difference | Levels | 1st Difference | Levels | 1st Difference | ||

| PSC | −0.28 | −18.58 | −0.25 | −18.69 | 1.94 | 0.17 | I(1) |

| TB | −3.72 | −3.82 | 0.16 | I(0) | |||

| ER | −1.06 | −11.72 | −0.91 | −11.50 | 1.72 | 0.13 | I(1) |

| INF | −12.15 | −12.07 | 0.22 | I(0) | |||

| FI | −2.06 | −17.18 | −2.18 | −21.08 | 1.50 | 0.09 | I(1) |

| INFV1 | −2.95 | −3.24 | 1.06 | 0.02 | I(1) | ||

| INFV2 | −1.93 | −12.73 | −4.63 | 1.53 | 0.13 | I(1) | |

| INFV3 | −3.87 | −3.82 | 1.05 | 0.10 | I(1) | ||

| RGDP | −0.16 | −4.05 | −0.90 | −12.31 | 1.95 | 0.16 | I(1) |

| Mean Equation | GARCH (1,1): Inflation Volatility | EGARCH (1,1): Inflation Volatility | TGARCH (1,1): Inflation Volatility |

|---|---|---|---|

| Estimated Coefficients | Estimated Coefficients | Estimated Coefficients | |

| Constant | −0.0078 (−0.13) | 0.1916 (11.19) *** | 0.0695 (1.18) |

| Inflation | −0.3379 (−6.63) *** | −0.3279 (−9.76) *** | −0.3283 (−6.66) *** |

| Variance Equation | |||

| ω (Constant) | 0.0361 (2.09) ** | −0.0973 (−2.44) ** | 0.0388 (2.12) ** |

| α (ARCH) | 0.1417 (4.21) *** | 0.1301 (2.63) *** | 0.2789 (3.89) *** |

| β (GARCH) | 0.8340 (28.95) *** | 0.9858 (368.76) *** | 0.8333 (29.98) *** |

| γ (Asymmetry) | 0.2397 (6.17) *** | −0.2499 (−3.07) *** | |

| Persistence | 0.9757 | 0.9858 | 0.8333 |

| Diagnostic Tests | |||

| ARCH LM Test (F-statistic Probability) | 0.42 | 0.15 | 0.76 |

| Schwarz criterion | 4.15 | 4.20 | 4.14 |

| Hannan–Quinn criterion | 4.12 | 4.16 | 4.11 |

| Independent Variables | Model 1 | Model 2 | Model 3 |

|---|---|---|---|

| Constant | 0.0198 (2.07) ** | 0.0200 (2.13) ** | 0.0204 (2.17) ** |

| Δ (Natural log of Total private sector credit (−1)) | −0.1587 (−2.64) *** | −0.1677 (−2.77) *** | −0.1658 (−2.73) *** |

| 91-day Treasury bill rate | −0.0008 (−1.27) | −0.0008 (−1.21) | −0.0008 (−1.31) |

| Δ (Natural log of the nominal UGX/USD exchange rate (Average)) | 0.3376 (3.32) *** | 0.3582 (3.49) *** | 0.3581 (3.52) *** |

| Inflation | −0.0052 (−2.40) ** | −0.0061 (−2.73) *** | −0.0056 (−2.56) ** |

| Δ (GARCH (1,1): Inflation volatility) | −0.0036 (−0.55) | ||

| Δ (GARCH (1,1): Inflation volatility (−1)) | 0.0073 (1.10) | ||

| Δ (EGARCH (1,1): Inflation volatility) | −0.0006 (−0.10) | ||

| Δ (EGARCH (1,1): Inflation volatility (−1)) | 0.0161 (3.18) *** | ||

| Δ (TGARCH (1,1): Inflation volatility) | −0.0012 (−0.24) | ||

| Δ (TGARCH (1,1): Inflation volatility (−1)) | 0.0127 (2.76) *** | ||

| Δ (Natural log of Financial innovation (M2/M1)) | 0.1463 (1.41) | 0.1428 (1.41) | 0.1397 (1.37) |

| Δ (Natural log of Interpolated monthly GDP) | 0.9747 (1.08) | 0.9411 (1.06) | 0.9315 (1.05) |

| Model Diagnostics | |||

| Adjusted R-squared | 0.06 | 0.09 | 0.08 |

| p-value for F-statistic | 0.00 | 0.00 | 0.00 |

| p-value for Q statistic | 0.24 | 0.15 | 0.15 |

| Breush–Godfrey Serial Correlation Test | 0.58 | 0.63 | 0.80 |

| ARCH LM Test (F-statistic Probability) | 0.94 | 0.94 | 0.91 |

| Schwarz criterion | −3.60 | −3.63 | −3.62 |

| Hannan–Quinn criter | −3.67 | −3.70 | −3.69 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Katusiime, L. Private Sector Credit and Inflation Volatility. Economies 2018, 6, 28. https://doi.org/10.3390/economies6020028

Katusiime L. Private Sector Credit and Inflation Volatility. Economies. 2018; 6(2):28. https://doi.org/10.3390/economies6020028

Chicago/Turabian StyleKatusiime, Lorna. 2018. "Private Sector Credit and Inflation Volatility" Economies 6, no. 2: 28. https://doi.org/10.3390/economies6020028