The Relationship between Financial Development and Energy Consumption in South Africa

Abstract

:1. Introduction

2. Review of the Literature

2.1. Theoretical Literature

2.2. Empirical Literature

3. Methodology

3.1. Data Description

3.2. Empirical Model

3.3. Definition of Terms and a Priori Expectations

3.4. Estimation Techniques

4. Results

4.1. Results of Descriptive Statistics

4.2. Results of Formal Unit Root Test

4.3. Results of Cointegration Test

4.4. Results of Long-Run Elasticities

4.5. Results of Short-Run Elasticities

4.6. Results of Granger Causality Test

4.7. Diagnostic Test

4.7.1. Results of Serial Correlation

4.7.2. Results of Heteroscedasticity

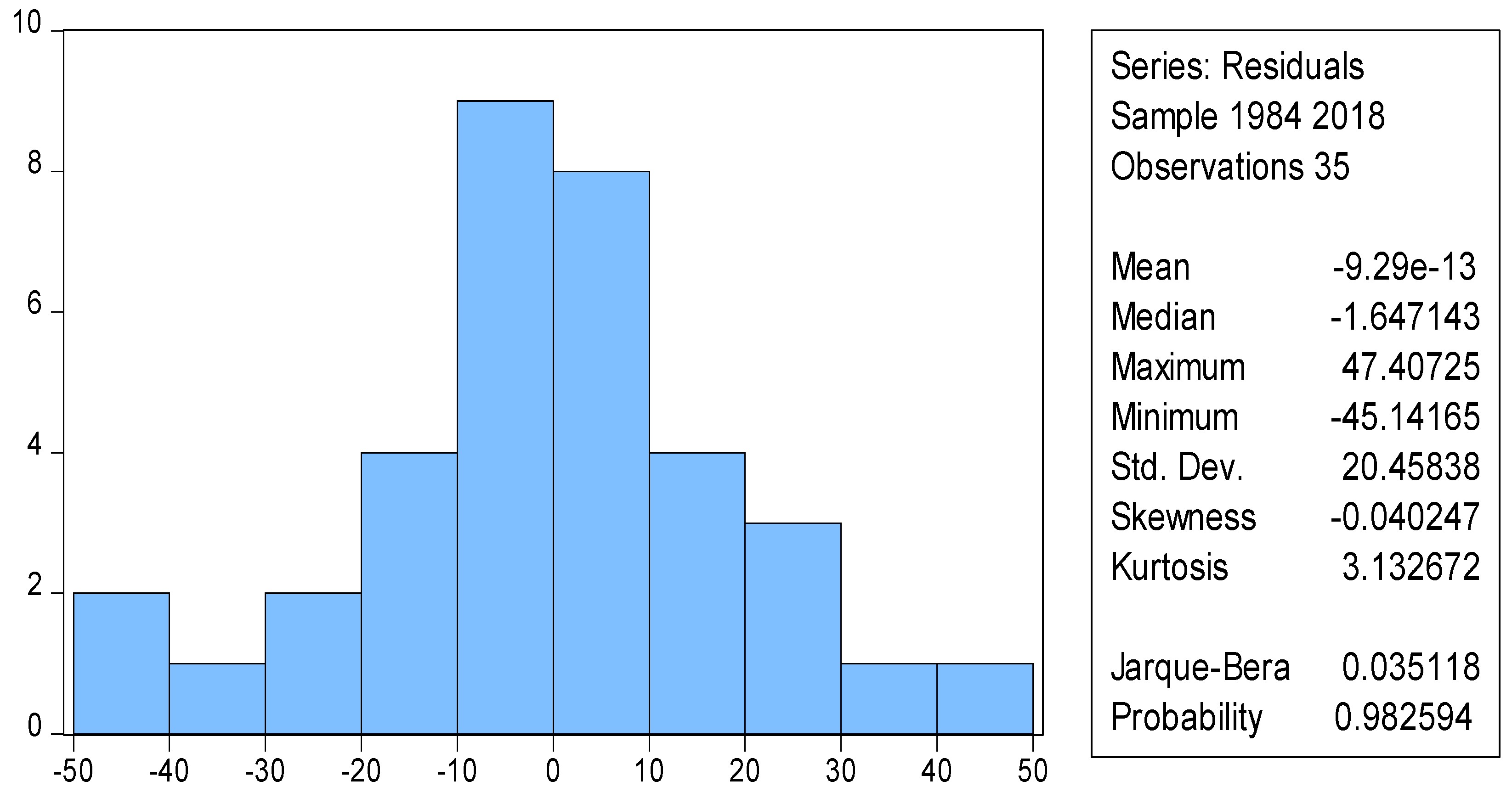

4.7.3. Results of Normality

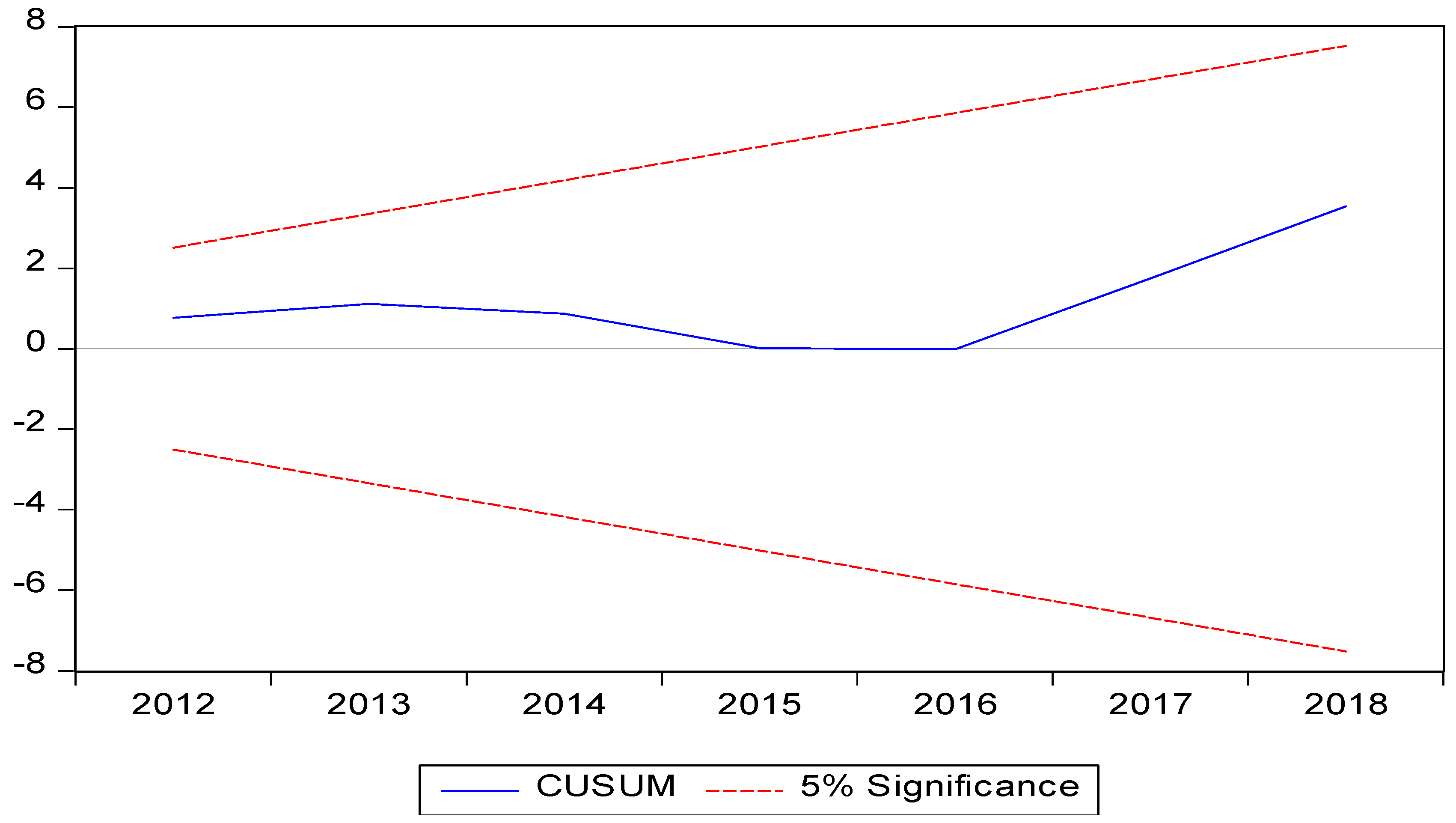

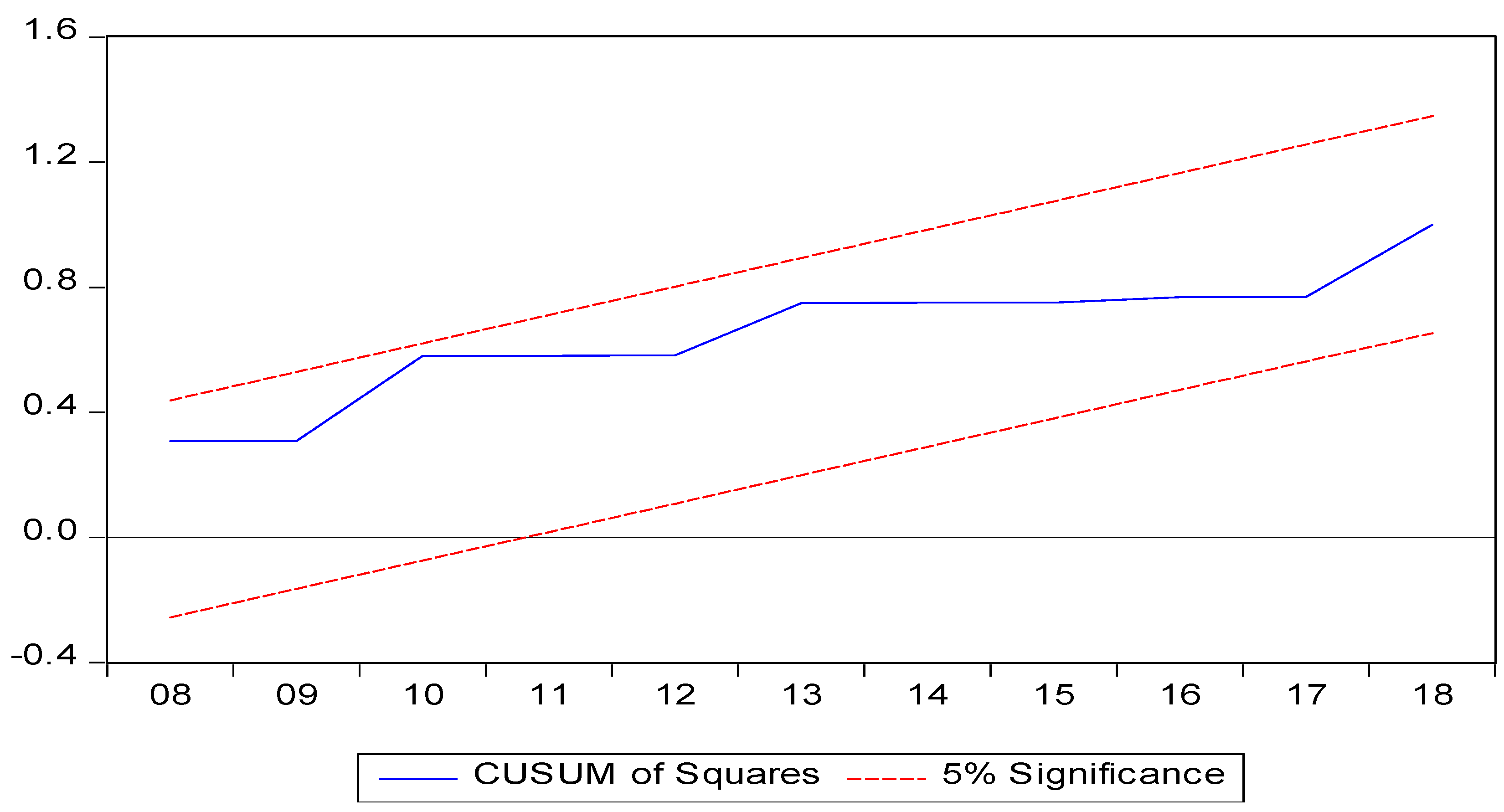

4.7.4. Results of Parameter Stability

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Adebola, Sakiru Solarin. 2011. Electricity consumption and economic growth: Trivariate investigation in Botswana with capital formation. International Journal of Energy Economics and Policy 1: 32–46. [Google Scholar]

- Ahmed, Khalid. 2017. Revisiting the role of financial development for energy-growth-trade nexus in BRICS (Brazil, Russia, India, China, and South Africa) economies. Energy 128: 487–95. [Google Scholar] [CrossRef]

- Al-Mulali, Usama, and Janice Ying Lee. 2013. Estimating the impact of the financial development on energy consumption: Evidence from the GCC (Gulf Cooperation Council) countries. Energy 60: 215–21. [Google Scholar] [CrossRef]

- Alexandra, Jason. 2020. The science and politics of climate risk assessment in Australia’s Murray Darling Basin. Environmental Science and Policy 112: 17–27. [Google Scholar] [CrossRef]

- Avtar, Ram, Saurabh Tripathi, Ashwani Kumar Aggarwal, and Pankaj Kumar. 2019. Population-urbanization-energy Nexus: A review. Resources 8: 136. [Google Scholar] [CrossRef] [Green Version]

- Baloch, Muhammad Awais, Danish, and Fanchen Meng. 2019. Modelling the non-linear relationship between financial development and energy consumption: Statistical experience from OECD (Organisation for Economic Co-operation and Development) countries. Environmental Science and Pollution Research 26: 8838–46. [Google Scholar] [CrossRef]

- Bayer, Yilmaz, Mehmet Hilmi Ozkaya, Laura Herta, and Marius Dan Gavriletea. 2021. Financial Development, Financial Inclusion and Primary Energy Use: Evidence from the European Union Transition Economies. Energies 14: 3638. [Google Scholar] [CrossRef]

- Bernanke, Ben. 2008. Outstanding issues in the analysis of inflation. In Understanding Inflation and the Implications for Monetary Policy. Edited by Jeff Fuhrer, Yolanda Kodrzycki, Jane Sneddon Little and Giovanni Olivei. Cambridge: MIT Press, pp. 447–56. [Google Scholar]

- Breusch, Trevor Stanley. 1978. Testing for autocorrelation in dynamic linear models. Australian Economics Papers 17: 334–55. [Google Scholar] [CrossRef]

- Bulfone, Fabio. 2020. New forms of industrial policy in the age of regulation: A comparison of electricity and telecommunications in Italy and Spain. Governance 33: 93–108. [Google Scholar] [CrossRef]

- Cheng, Benjamin Shin, and Tin Wei Lai. 1997. Government expenditures and economic growth in South Korea: A VAR approach. Journal of Economic Development 22: 11–24. [Google Scholar]

- Chitiyo, Fadzai Emmah. 2017. Demand for Non-Life Insurance: Evidence from Select Insurance Markets in Africa. Master’s thesis, Graduate School of Business, University of Cape Town, Cape Town, South Africa. [Google Scholar]

- Chowdhury, Hemal, Tamal Chowdhury, Piyal Chowdhury, Monirul Islam, Rahman Saidur, and Sadiq M. Sait. 2019. Integrating sustainability analysis with sectoral exergy analysis: A case study of rural residential sector of Bangladesh. Energy and Buildings 202: 109397. [Google Scholar] [CrossRef]

- Cornia, Giovanni Andrea, Tony Addison, and Sampsa Kiiski. 2003. Income Distribution Changes and Their Impact in the Post-World War II Period. UNU-WIDER Discussion Papers No.2003/28. Available online: http://hdl.handle.net/10419/52822 (accessed on 30 November 2020).

- Destek, Mehmet Akif. 2018. Financial development and energy consumption nexus in emerging economies. Energy Sources, Part B: Economics, Planning, and Policy 13: 76–81. [Google Scholar] [CrossRef]

- Dutt, Amitava Krishna. 2017. Heterodox theories of economic growth and income distribution: A partial survey. Journal of Economic Surveys 31: 1240–71. [Google Scholar] [CrossRef]

- Eden, Yu S. H., and Jang C. Jin. 1992. Cointegration tests of energy consumption, income, and employment. Resources and Energy 14: 259–66. [Google Scholar]

- Engle, Robert Fry. 1982. Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 50: 987–1007. [Google Scholar] [CrossRef]

- Fedderke, Johannes Wolfgang. 2014. Exploring Unbalanced Growth in South Africa Understanding the Sectoral Structure of the South African Economy. ERSA Working Paper No. 468. Johannesburg: Economic Research Southern Africa. [Google Scholar]

- Furuoka, Fumitaka. 2015. Financial development and energy consumption: Evidence from a heterogeneous panel of Asian countries. Renewable and Sustainable Energy Reviews 52: 430–44. [Google Scholar] [CrossRef]

- Godfrey, Leslie George. 1978. Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica 46: 1293–301. [Google Scholar] [CrossRef]

- Gómez, Mario, and Jose Carlos Rodríguez. 2019. Energy consumption and financial development in NAFTA countries, 1971–2015. Applied Sciences 9: 302. [Google Scholar] [CrossRef] [Green Version]

- Grossman, Gene Michael, and Alan Bennett Krueger. 1991. Environmental Impacts of a North American Free Trade Agreement. No. w3914. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Gujarati, Damodar N., and Dawn C. Porter. 2010. Basic Econometrics, 5th ed. New York: McGraw-Hill Education. [Google Scholar]

- Gungor, Hasan, and Angela Uzoamaka Simon. 2017. Energy consumption, finance and growth: The role of urbanization and industrialization in South Africa. International Journal of Energy Economics and Policy 7: 268–76. [Google Scholar]

- Haider, Salman, and Masudul Hasan Adil. 2019. Does financial development and trade openness enhance industrial energy consumption? A sustainable developmental perspective. Management of Environmental Quality: An International Journal 30: 1297–313. [Google Scholar] [CrossRef]

- Hui, Tin-Yu Jonathan. 2012. Testing for Random Walk Hypothesis with or without Measurement Error. Master’s thesis, Imperial College, London, UK. [Google Scholar]

- Iheonu, Okechukwu Chimere, Simplice Asongu, Kingsley Odo, and Patric K. Ojiem. 2020. Financial sector development and investment in selected ECOWAS (Benin, Burkina Faso, Cabo Verde, Cote d’Ivoire, The Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, and Togo) countries: Empirical evidence using heterogeneous panel data method. Financial Innovations 6: 1–15. [Google Scholar]

- Islam, Faridul, Muhammad Shahbaz, Ashraf Uddin Ahmed, and Md Mahumudul Alam. 2013. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Economic Modelling 30: 435–41. [Google Scholar] [CrossRef] [Green Version]

- Jarque, Carlos M., and Anil K. Bera. 1980. Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters 6: 255–59. [Google Scholar] [CrossRef]

- Jarque, Carlos M., and Anil K. Bera. 1987. A Test for Normality of Observations and Regression Residuals. International Statistical Review / Revue Internationale de Statistique 55: 163–72. [Google Scholar] [CrossRef]

- Kakar, Zaheer Khan. 2016. Financial development and energy consumption: Evidence from Pakistan and Malaysia. Energy Sources, Part B: Economics, Planning, and Policy 11: 868–73. [Google Scholar] [CrossRef]

- Karakurt, Metehan, and Aykut Aykutalp. 2020. Can Social Media Be Seen as a New Public Sphere in the Context of Hannah Arendt’s Public Sphere Theory? London: IJOPEC Publication Limited. [Google Scholar]

- Keskingoz, Hayrettin, and Selim Inancli. 2016. The causality between financial development and energy consumption in Turkey: The period of 1960–2011. Journal of Economics and Administrative Sciences 11: 101–14. [Google Scholar]

- Kotnik, Žaga, Lan Umek, Polonca Kovač, Dalibor Stanimirović, and Mikro Vintar. 2020. Analysis of the key factors for successful public policy implementation: A qualitative study in Slovenia. DANUBE: Law, Economics and Social Issues Review 11: 113–40. [Google Scholar] [CrossRef]

- Kregel, Jan A. 2004. External Financing for Development and International Financial Instability. G-24 Discussion Paper No. 32. New York and Geneva: UNCTAD. [Google Scholar]

- Kregel, Jan A. 2010. What would Minsky have thought of the mortgage crisis? In The Elgar Companion to Hyman Minsky. Edited by Dimitri B. Papadimitriou and L. Randall Wray. Cheltenham: Edward Elgar Publishing, chp. 2. [Google Scholar]

- Liu, Xiaoyu, and Duyun Peng. 2018. Study on the threshold effect of urbanization on energy consumption. Theoretical Economics Letters 8: 2220. [Google Scholar] [CrossRef] [Green Version]

- Liu, Yaobin. 2009. Exploring the relationship between urbanization and energy consumption in China using ARDL (autoregressive distributed lag) and FDM (factor decomposition model). Energy 34: 1846–54. [Google Scholar] [CrossRef]

- Lukasiewicz, Mariusz. 2018. The making of the Johannesburg Stock Exchange, 1888–1890. Journal of Southern African Studies 43: 715–32. [Google Scholar] [CrossRef]

- Ma, Xiaoxin, and Qiang Fu. 2020. The influence of financial development on energy consumption: Worldwide evidence. International Journal of Environmental Research and Public Health 17: 1428. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mahalik, Mantu Kumar, and Hrushikesh Mallick. 2014. Energy consumption, economic growth and financial development: Exploring the empirical linkages for India. The Journal of Developing Areas 48: 139–59. [Google Scholar] [CrossRef]

- Mahalik, Mantu Kumar, M. Suresh Babu, Nanthakumar Loganathan, and Muhammed Shahbaz. 2017. Does financial development intensify energy consumption in Saudi Arabia? Renewable and Sustainable Energy Reviews 75: 1022–34. [Google Scholar] [CrossRef] [Green Version]

- Masanet-Llodra, Maria Jose. 2012. Environmental Management in Businesses: Does It Make Money? An Accounting Perspective. London: InTech. [Google Scholar] [CrossRef] [Green Version]

- Minsky, Hyman Philip. 1982. The Financial-Instability Hypothesis: Capitalist Processes and the Behavior of the Economy. Hyman P. Minsky Archive Paper No. 282. Available online: http://digitalcommons.bard.edu/hm_archive/282 (accessed on 13 October 2020).

- Mukhtarov, Shahriyar, Jeyhun I. Mikayilov, Jeyhun Mammadov, and Elvin Mammadov. 2018. The impact of financial development on energy consumption: Evidence from an oil-rich economy. Energies 11: 1536. [Google Scholar] [CrossRef] [Green Version]

- Mukhtarov, Shahriyar, Sugra Humbatova, Ilgar Seyfullayev, and Yashar Kalbiyev. 2020a. The effect of financial development on energy consumption in the case of Kazakhstan. Journal of Applied Economics 23: 75–88. [Google Scholar] [CrossRef] [Green Version]

- Mukhtarov, Shahriyar Sugra Humbatova, Natig Gadim-Oglu Hajiyev, and Sannur Aliyev. 2020b. The financial development—Renewable energy consumption nexus in case of Azerbaijan. Energies 13: 6265. [Google Scholar] [CrossRef]

- Muyambiri, Brian, and Nicholas Mbaya Odhiambo. 2018. South Africa’s financial development and its role in investment. Journal of Central Banking Theory and Practice 7: 101–120. [Google Scholar] [CrossRef]

- Narayan, Paresh, and Saud Al-Siyabi. 2005. An Empirical Investigation of the Determinants of Oman’s National Savings. Economics Bulletin 3: 1–7. [Google Scholar]

- Nasreen, Samia, and Sofia Anwar. 2014. Causal relationship between trade openness, economic growth and energy consumption: A panel data analysis of Asian countries. Energy Policy 69: 82–91. [Google Scholar] [CrossRef]

- Nkalu, Chigozie Nelson, Samuel Chinwero Ugwu, Fredrick Onyebuchi Asogwa, Mwuese Patricia Kuma, and Queen O. Onyeke. 2020. Financial development and energy consumption in Sub-Saharan Africa: Evidence from Panel Vector Error Correction Model. Sage Open 10: 1–12. [Google Scholar] [CrossRef]

- Nowbutsing, Baboo A. 2014. The impact of openness on economic growth: Case of Indian Ocean rim countries. Journal of Economics and Development Studies 2: 407–427. [Google Scholar]

- Odhiambo, Nicholas Mbaya. 2010. Energy consumption, prices and economic growth in three SSA countries: A comparative study. Energy Policy 38: 2463–69. [Google Scholar] [CrossRef]

- Odhiambo, Nicholas Mbaya. 2018. Energy Consumption and Financial Development in South Africa: An Empirical Investigation. UNISA Economic Research Working Paper Series No. 03; Pretoria: University of South Africa, Preliminary Statement. [Google Scholar] [CrossRef] [Green Version]

- Odhiambo, Nicholas Mbaya. 2019. Energy consumption and financial development in South Africa: An empirical investigation. Ekonomski Pregled 70: 41–61. [Google Scholar] [CrossRef] [Green Version]

- Paganini, Fernando. 1994. White Noise Rejection in a Deterministic Setting. Pasadena: California Institute of Technology Pasadena Department of Electrical Engineering. [Google Scholar]

- Pesaran, M. Hashem, and Yongcheol Shin. 1999. An autoregressive distributed lag modeling approach to cointegration analysis. In Econometrics and Economic Theory in the 20th Century: The Ragna Frisch centennial Symposium. Edited by S. Strom. Cambridge, UK: Cambridge University Press. [Google Scholar]

- Pesaran, M. Hashem, Yoncheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Peterson, E. Wesley F. 2017. The role of population in economic growth. Sage Open 7. [Google Scholar] [CrossRef] [Green Version]

- Phiri, Andrew, and Bothwell Nyoni. 2015. Re-Visiting the Electricity-Growth Nexus in South Africa, Munich. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/64489 (accessed on 30 November 2020).

- Piketty, Thomas. 2013. The Kuznets’ curve, yesterday and tomorrow. In Understanding Poverty. Edited by Abhijit Vinayak Banerjee, Ronald Benabou and Dilip Mookherjee. Oxford: Oxford University Press. [Google Scholar]

- Raza, Syed Ali, Muhammad Shahbaz, and Duc Khuong Nguyen. 2015. Energy conservation policies, growth and trade performance: Evidence of feedback hypothesis in Pakistan. Energy Policy 80: 1–10. [Google Scholar] [CrossRef] [Green Version]

- Raza, Syed Ali, Nida Shah, Muhammad Asif Qureshi, Shahzad Qaiser, Ramsha Ali, and Farhan Ahmed. 2020. Non-linear threshold effect of financial development on renewable energy consumption: Evidence from panel smooth transition regression approach. Environmental Science and Pollution Research 27: 32034–47. [Google Scholar] [CrossRef]

- Regan, Michael. 2017. Capital markets, infrastructure investment and growth in the Asia Pacific region. International Journal of Financial Studies 5: 5. [Google Scholar] [CrossRef] [Green Version]

- Rehman, Mobeen Ur, and Mushab Rashid. 2017. Energy consumption to environmental degradation, the growth appetite in SAARC nations. Renewable Energy 111: 284–94. [Google Scholar] [CrossRef]

- Renke, Stefan, and Reinhard Steennot. 2020. The marketing of consumer and mortgage credit as a responsible lending tool: A comparison of South African, European and Belgian Law: Part 1. PER: Potchefstroomse Elektroniese Regsblad 23: 1–26. [Google Scholar]

- Roubaud, David, and Muhammad Shahbaz. 2018. Financial development, economic growth, and electricity demand: A sector analysis of an emerging economy. The Journal of Energy and Development 43: 47–98. [Google Scholar]

- Rüttenauer, Tobias, and Volker Ludwig. 2020. Fixed effects individual slopes: Accounting and testing for heterogeneous effects in panel data or other multilevel models. Sociological Methods & Research 34: 52–63. [Google Scholar]

- Sadorsky, Perry. 2011. Financial development and energy consumption in central and eastern European frontier economies. Energy Policy 39: 999–1006. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2012. Energy consumption, output and trade in South America. Energy Economics 34: 476–88. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2014. The effect of urbanization on CO2 emissions in emerging economies. Energy Economics 41: 147–53. [Google Scholar] [CrossRef]

- Sadorsky, Perry. 2019. The impact of financial development on energy consumption in emerging economies. Energy Policy 38: 2528–35. [Google Scholar] [CrossRef]

- Sadraoui, Tarek, Hamid Hamlaoui, Zine Youness, and B. I. Sadok. 2019. A dynamic panel data analysis for relationship between energy consumption, financial development and economic growth. International Journal of Econometrics and Financial Management 7: 20–26. [Google Scholar] [CrossRef] [Green Version]

- Sare, Yakubu Awudu. 2019. Effect of financial sector development on energy consumption in Africa: Is it threshold specific? International Journal of Green Energy 16: 1637–45. [Google Scholar] [CrossRef]

- Sbia, Rashid, Muhammad Shahbaz, and Iihan Ozturk. 2017. Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Economic Research–Ekonomska Istraživanja 30: 527–49. [Google Scholar] [CrossRef] [Green Version]

- Sekantsi, Lira Peter, and Mamofokeng Motlokoa. 2015. Evidence on the nexus between electricity consumption and economic growth through empirical investigation of Uganda. Review of Economic and Business Studies 8: 149–65. [Google Scholar] [CrossRef] [Green Version]

- Sekantsi, Lira Peter, Retselisitsoe I. Thamae, and Letsie E. Mohatonyane. 2016. Electricity consumption in Lesotho: The role of financial development, industrialisation and urbanisation. Journal of International Business and Economics 4: 1–12. [Google Scholar] [CrossRef] [Green Version]

- Sekantsi, Lira Peter, and Sayed Timuno. 2017. Electricity consumption in Botswana: The role of financial development, industrialization and urbanization. Review of Economic and Business Studies 10: 75–102. [Google Scholar] [CrossRef] [Green Version]

- Shafik, Nemat. 1994. Economic development and environmental quality: An econometric analysis. Oxford Economic Papers 46: 757–73. [Google Scholar] [CrossRef]

- Shahbaz, Muhammad, and Hooi Hooi Lean. 2012. Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40: 473–79. [Google Scholar] [CrossRef] [Green Version]

- Simon, Angela Uzoamaka. 2016. Financial Development and Energy Use (Consumption), Urbanization and Industrialization Role in South Africa. Master’s thesis, Eastern Mediterranean University (EMU)—Doğu Akdeniz Üniversitesi (DAÜ), Gazimağusa, Turkey. [Google Scholar]

- Singh, Kamaljit, and Simmi Vashishtha. 2020. A re-examination of the relationship between electricity consumption and economic growth in India. Energy Economics Letters 7: 36–45. [Google Scholar] [CrossRef]

- Stern, David I., and J. Cutler Cleveland. 2004. Energy and Economic Growth. Rensselaer Working Papers in Economics, No. 0410. Troy: Rensselaer Polytechnic Institute. [Google Scholar]

- Takahashi, Maressa Q., Jessica M. Rothman, David Raubenheimer, and Marina Cords. 2019. Dietary generalists and nutritional specialists: Feeding strategies of adult female blue monkeys (Cercopithecus mitis) in the Kakamega Forest, Kenya. American Journal of Primatology 81: e23016. [Google Scholar] [CrossRef]

- Tamazian, Artur, Juan Pineiro Chousa, and Krishna Chaitanya Vadlamannati. 2009. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 37: 246–53. [Google Scholar] [CrossRef]

- Topcu, Mert, and James E. Payne. 2017. The financial development–energy consumption nexus revisited. Energy Sources, Part B: Economics, Planning, and Policy 12: 822–30. [Google Scholar] [CrossRef]

- Vermeulen, Cobus. 2020. On the mandate, ownership and independence of the South African Reserve Bank. South African Journal of Economic and Management Sciences 23: 1–11. [Google Scholar] [CrossRef]

- Wirth, Harry. 2020. Recent Facts about Photovoltaics in Germany. Germany: Fraunhofer Institute for Solar Energy Systems. [Google Scholar]

- World Bank. 2020. World Development Indicators. Available online: http://databank.worldbank.org/data/views/reports/tableview.aspx (accessed on 10 March 2019).

- Wu, Hung-Ming. 2015. The impact of energy consumption and financial development on economic growth in the United States: An ARDL bounds testing approach. Journal of Business Economics and Policy 2: 179–86. [Google Scholar]

- Xu, Shao Jun. 2012. The impact of financial development on energy consumption in China: Based on SYS-GMM estimation. In Advanced Materials Research. Edited by Jianguo Wu, Jie Yang, Nobukazu Nakagoshi, Xixi Lu and He Xu. Stafa-Zurich, Switzerland: Trans Tech Publications Ltd., vol. 524, pp. 2977–81. [Google Scholar]

- Yang, Xinyu, Ping Jiang, and Yao Pan. 2020. Does China’s carbon emission trading policy have an employment double dividend and a Porter effect? Energy Policy 142. [Google Scholar] [CrossRef]

- Yue, Shujin, Rou Lu, Yongchang Shen, and Hongtao Chen. 2019. How does financial development affect energy consumption? Evidence from 21 transitional countries. Energy Policy 130: 253–62. [Google Scholar] [CrossRef]

| Energy Consumption (EC) | Financial Development (FD) | Economic Growth (GDPC) | Industrialisation (IND) | Urbanisation (URB) | |

|---|---|---|---|---|---|

| Mean | 2612.475 | 60.86315 | 0.485774 | 31.75468 | 56.76839 |

| Median | 2614.269 | 62.17783 | 0.842932 | 29.51877 | 56.65100 |

| Maximum | 2964.770 | 78.29413 | 4.277783 | 45.27759 | 66.35500 |

| Minimum | 2289.558 | 41.50275 | −4.550333 | 25.85349 | 48.42500 |

| Standard Deviation | 172.0865 | 9.633719 | 2.376830 | 5.783077 | 5.702014 |

| Skewness | 0.111072 | −0.102290 | −0.471650 | 0.815134 | 0.060729 |

| Kurtosis | 2.335533 | 1.971789 | 2.502538 | 2.276462 | 1.738409 |

| Jarque-Bera | 1.740195 | 1.740195 | 1.800697 | 5.037029 | 2.543409 |

| Probability | 0.418911 | 0.418911 | 0.406428 | 0.080579 | 0.280353 |

| Sum | 2312.800 | 2312.800 | 18.45941 | 1206.678 | 2157.199 |

| Sum Sq. Dev. | 3433.916 | 3433.916 | 209.0249 | 1237.427 | 1202.979 |

| Observations | 38 | 38 | 38 | 38 | 38 |

| Variables | Model Specification | t-Statistic | Order of Integration | p-Value |

|---|---|---|---|---|

| EC | Trend and Intercept | −1.787251 | I(0) | 0.3809 |

| Trend and Intercept | −5.783402 ** | I(1) | 0.0000 | |

| FD | Trend and Intercept | −1.984325 | I(0) | 0.2921 |

| Trend and Intercept | −6.741113 ** | I(1) | 0.0000 | |

| GDPC | Trend and Intercept | −3.780510 ** | I(0) | 0.0065 |

| IND | Trend and Intercept | −3.388540 ** | I(0) | 0.0176 |

| URB | Trend and Intercept | 0.506745 | I(0) | 0.9846 |

| Trend and Intercept | −3.606268 ** | I(1) | 0.0105 |

| Variables | Model Specification | t-Statistic | Order of Integration | p-Value |

|---|---|---|---|---|

| EC | Trend and Intercept Trend and Intercept | −2.046652 −5.781845 *** | I(0) I(1) | 0.2666 0.0000 |

| FD | Trend and Intercept Trend and Intercept | −1.956598 −6.743105 *** | I(0) I(1) | 0.3039 0.0000 |

| GDPC | Trend and Intercept | −3.781243 *** | I(0) | 0.0065 |

| IND | Trend and Intercept | −3.693658 *** | I(0) | 0.0082 |

| URB | Trend and Intercept | 2.255979 | I(0) | 0.9999 |

| Trend and Intercept | −3.109118 ** | I(1) | 0.0345 |

| t-Statistic | Value | K |

|---|---|---|

| F Statistic | 17.63728 | 5 |

| Critical value bounds

(Actual sample size = 88) | ||

| Significance | I(0) Bound | I(1) Bound |

| 10% | 2.08 | 3 |

| 5% | 2.39 | 3.38 |

| 2.5% | 2.7 | 3.73 |

| Variable | Coefficient | Standard Errors | t-Statistic | p-Value |

|---|---|---|---|---|

| FD | 0.113414 | 0.058952 | 1.923835 | 0.0625 * |

| GDPC | 0.045325 | 0.265111 | 0.170968 | 0.8652 |

| IND | 0.023131 | 0.002272 | 10.17866 | 0.0000 *** |

| URB | 0.332685 | 0.104730 | 3.176601 | 0.0031 *** |

| D | −0.083940 | 0.296390 | 0.283209 | 0.7786 |

| Variable | Coefficient | Standard Errors | t-Statistic | p-Value |

|---|---|---|---|---|

| D (FD) | 0.026933 | 0.001162 | 23.17046 | 0.0000 *** |

| D(GDPC) | 0.208532 | 0.260424 | 0.800741 | 0.4285 |

| D(IND) | 0.435756 | 0.093304 | 4.670303 | 0.0000 *** |

| D(URB) | 0.016921 | 0.001297 | 13.04820 | 0.0000 *** |

| D(D) | −0.209213 | 0.056690 | 3.690452 | 0.0007 *** |

| ECM CointEq (−1) | −0.332685 | 0.104730 | −3.176601 | 0.0031 *** |

| Null Hypothesis | Obs | F-Statistic | Prob. |

|---|---|---|---|

| FD does not Granger cause EC EC does not Granger cause FD | 34 | 0.26795 0.14114 | 0.0348 ** 0.8690 |

| GDPC does not Granger cause EC EC does not Granger cause GDPC | 37 | 0.25597 1.10445 | 0.7757 0.3437 |

| IND does not Granger cause EC EC does not Granger cause IND | 37 | 0.39439 0.93556 | 0.0453 ** 0.4028 |

| URB does not Granger cause EC EC does not Granger cause URB | 37 | 2.36644 1.27168 | 0.1100 * 0.0821 * |

| Breusch-Godfrey Serial Correlation LM Test | |||

|---|---|---|---|

| F Statistic | 0.008002 | Prob. F | 0.9303 |

| Obs R Squared | 0.025443 | Prob. Chi-Squared | 0.8733 |

| Heteroscedasticity Test: Breusch-Pagan-Godfrey | |||

|---|---|---|---|

| F statistic | 1.978931 | Prob. F | 0.1109 |

| Obs*R Squared | 27.43740 | Prob. Chi-Squared | 0.1951 |

| Scaled explained SS | 3.439248 | Prob. Chi-Squared | 1.0000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lefatsa, P.M.; Sibanda, K.; Garidzirai, R. The Relationship between Financial Development and Energy Consumption in South Africa. Economies 2021, 9, 158. https://doi.org/10.3390/economies9040158

Lefatsa PM, Sibanda K, Garidzirai R. The Relationship between Financial Development and Energy Consumption in South Africa. Economies. 2021; 9(4):158. https://doi.org/10.3390/economies9040158

Chicago/Turabian StyleLefatsa, Palesa Milliscent, Kin Sibanda, and Rufaro Garidzirai. 2021. "The Relationship between Financial Development and Energy Consumption in South Africa" Economies 9, no. 4: 158. https://doi.org/10.3390/economies9040158