Distributed Energy IoT-Based Real-Time Virtual Energy Prosumer Business Model for Distributed Power Resource

Abstract

:1. Introduction

1.1. Current Energy Prosumer Problems

- High ROI (first 10 years based on government subsidies): Renewable energy (solar power) facilities and ESS construction have a high ROI because the profits are not large compared to the high installation costs. Thus, they rely on government subsidies.

- Difficulty in market formation: The production price of new and renewable energy is higher than that of the actual grid, and it is difficult to accurately set the sales price. Therefore, the actual market between sellers and consumers is not formed.

1.2. Solutions

- Real-time energy trading: A virtual power bank (VPB)-based real-time virtual prosumer management system uses an existing power grid. It is composed of the virtual infrastructure of the EG (VPB), which does not include an ESS, and does not require a large cost to configure the ESS and its own energy trading grid. Thus, a large profit can be obtained at a low price.

- Flexible cost setting: The prosumer market has a structure that allows both sellers and buyers to obtain profits by setting flexible sales/purchase prices for each situation and to provide the maximum benefit between electricity sellers and consumers rather than setting energy costs based on fixed electricity rates.

2. Related Works

2.1. Analysis of the Existing References

2.2. Novel Points of Proposed System from Existing References

- (1)

- Data-driven Virtual Energy Management: Virtual energy trading is possible only through energy data analysis based on distributed energy IoT using a traditional grid without configuring an ESS-based independent local grid in the community space (apartment complex, etc.).

- (2)

- Real-time energy demand management: Virtual energy trading is possible because of energy status monitoring and real-time energy offset by real-time energy data.

- (3)

- Cost-effective energy trading system: It is possible to establish a cost-effective energy system by not installing the ESS and additional local grid.

- (4)

- Energy cost saving: Prosumers sell higher than the existing solar energy transaction costs, and customers benefit from reducing electricity bills by mitigating the progressive electricity tax at home.

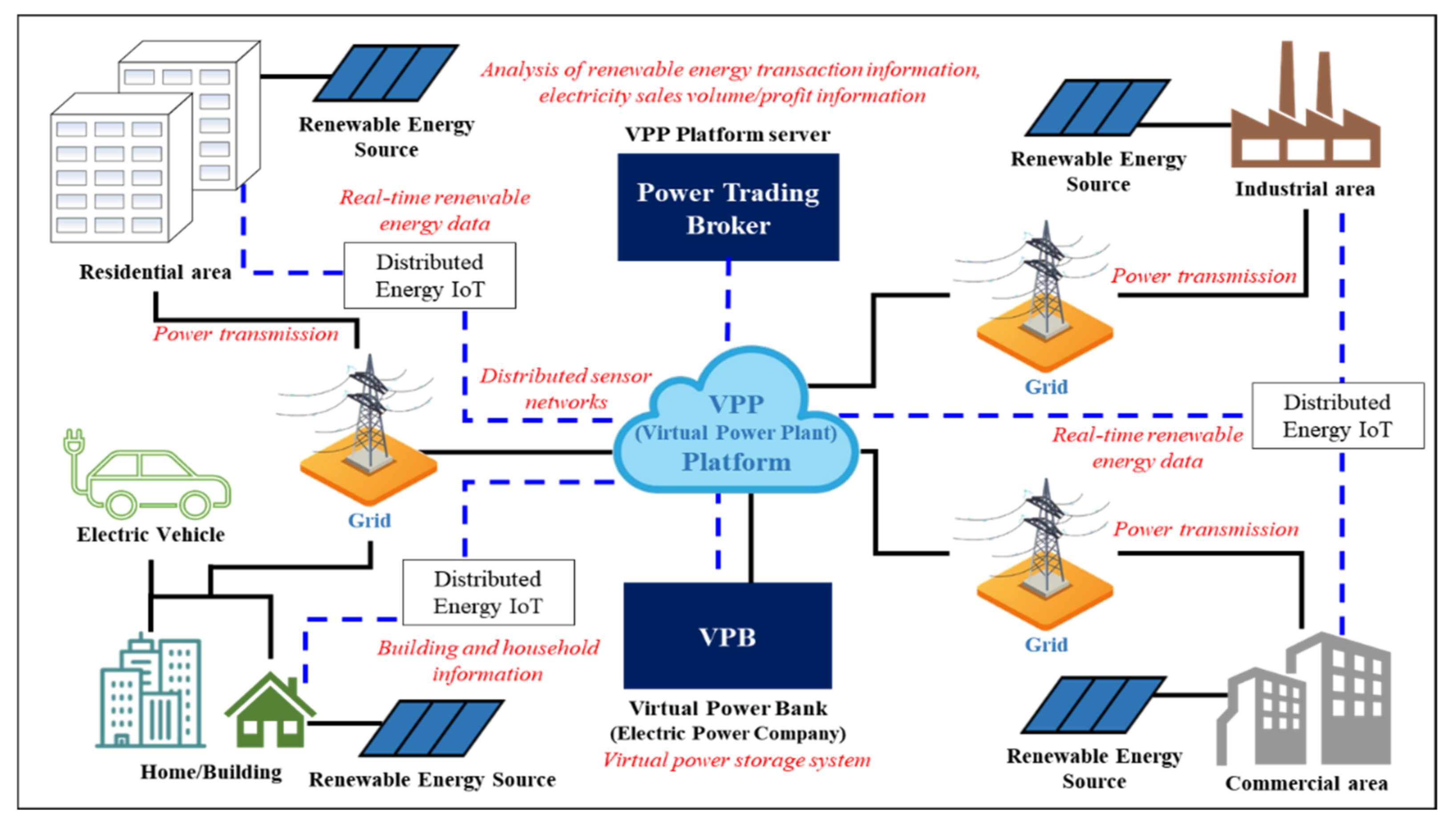

3. System Overview

- Power trading broker: VPP platform server for analysis of energy trading data.

- Virtual power bank: Virtual power storage system for energy trading.

- Distributed energy IoT: IoT based distributed sensor network system.

- Renewable energy source: 325 W solar panel.

- Building and household information: Building management information, building area, scope and gross area, etc.

- Building energy demand and supply status data: Electric energy, etc.

- Real-time generation information of renewable energy sources: Renewable energy sources, capacity, real-time generation, etc.

- Renewable energy surplus energy transaction information, electricity sales volume/profit information

3.1. System Architecture

- Category 1–Net metering (NM) with electric power corporation: The energy prosumer business through NM with a power company is an approach in which the power company purchases the surplus power produced by the consumer through solar power generation and lowers electricity bills. The NM with the power company is performed to reduce the electric charge to be paid by the consumer by calculating the electric charge for the pure electricity quantity obtained by deducting the surplus electric power from the electric power received by the electric power company [28,29,30].

- Category 2—Energy trading of surplus power in local grid (LG): In terms of the sale of surplus power produced by a prosumer, it is the same as the NM of the power company. However, by selling the surplus power to the consumer, sales revenue is obtained separately from the electricity bill. In this case, PT plays the role of a medium to buy and sell surplus power. If the transaction price for surplus power is set rather than the physical flow of surplus power, the focus is on the transaction settlement for the sales profit of the prosumer and payment for the purchase by a net consumer [15,17].

- Category 3—Power trading between prosumers over the Internet: The power trading platform built through the Internet makes it easier to sell surplus power produced by energy prosumers directly between individuals. The amount of surplus electricity and transaction price are set directly on the Internet without going through an intermediary, and the transaction can be concluded if there is a customer. Even in this case, if a transaction is applied, mutual benefits can be obtained through settlement between the parties dealing in the transaction. That is, a transaction price that is lower than the electricity rate and higher than the solar power generation unit price is generated. The prosumer has a profit even after paying the fee, and the customer can make a transaction if the purchase price is lower than the electricity rate even after the fee is paid. Power trading between individuals through the Internet power trading platform is in its early stages, and the number of countries using it through the experimental stage is gradually increasing. It is expected that power trading in this manner will increase in the future [31].

- Category 4—Energy trading of surplus power using a distributed resource broker market: For the sale of surplus power by consumers using the distributed resource brokerage market, the brokerage company collects small-scale distributed resources, trades them in the power wholesale market, and issues a new renewable energy supply certificate. It receives sales profit, which is a business method that consumers share with brokers. In this project, there are variations in profits due to variation in the wholesale market price of electric power and the transaction price of the renewable energy supply certificate. Therefore, it is likely to be selected if the benefits are greater compared to the expected returns of different business model methods [32,33,34].

- PT (Power Trading): Selling surplus power remaining after self-exhaustion among energy produced by renewable energy to a second party

- EG (Existing Grid): Existing grid of electric power institution; KEPCO (Korea Electric Power Corporation)

- LG (Local Grid): Independent grid within the community for energy trading

- PTB (Power Trade Broker): A power broker for energy trading

- (Prosumer): Smallscale power seller

- (Customer): Small-scale personal power buyer

- NM (Net Metering): Sale of offset surplus power to the grid

- VPB (Virtual Power Bank): Store power using EG without building an additional independent grid or ESS within the community for energy trading.

- VG (Virtual Grid): A virtual connection chain made virtually based on data for energy trading, not a real grid.

- Virtual Power Plant (VPP) Platform: Energy data-based virtualization that uses energy data based on distributed energy IoT, monitors the storage of surplus power and transaction status between VPB and prosumer, and mediates virtually for transaction based on this power trading platform.

- : The cost when NM (KRW)

- (NM benefit): Prosumer’s NM benefit (KRW)

- (Power trading benefit): Prosumer’s benefit by power trading (KRW)

3.2. System Configuration

3.3. System Flow

4. Business Model

- Prosumer N (PN): Households that sell surplus power with solar panels

- Consumer n (Cn): Households that want to purchase power savings to reduce the progressive tax due to high power consumption

- Rn (Number of solar panels): Number of solar panels installed in the prosumer

- ROI (Return on Investment): Payback period for prosumer with solar power facilities (Year)

4.1. Scenario 1: Small-Scale Energy Trading Model in an Apartment Complex

- It is impossible to install a large-capacity PV in the apartment complex (Figure 7).

- There is no significant benefit to building a local grid in apartment complexes.

- It is dangerous to install ESS in an apartment complex, and ROI cannot be satisfied because it handles a small amount of PV even if it relies on government subsidies.

- Power loss is expected in the apartment complex during power transactions because the local grid is distant from the power trading company (intermediary).

- Therefore, to trade energy between prosumers in an apartment complex, a VPB-based real-time virtual prosumer management system using existing power grids is required.

4.2. Scenario 2: Surplus Electricity Trading Model Caused by Public Institution Closure Due to Pandemic

- Most PVs are installed in buildings, such as public institutions. The energy consumption of public institutions is decreasing due to the increase in the number of telecommuters, and the energy consumption of apartment complexes is increasing.

- Most of the power produced at workplaces is lost because PV produces the most energy from 9:00 to 18:00 h during the daytime.

- The increase in telecommuting also increases the electricity demand for apartments between 9:00 and 18:00 h.

- For this, a plan is needed to mitigate the progressive tax through energy trading.

- VPB-based energy trading is required because it incurs a high cost to build a local grid in an apartment complex.

5. Simulation

- Outgoing households: The household is empty as the entire family is on vacation or overseas business trip.

- Households who are working from home: Family members are unable to go to work owing to a pandemic and are working from home.

- Working households: The entire family is out in the afternoon because of work.

- Nonworking households: Family members stay at home all day owing to holidays and are temporarily not working.

5.1. Typical Home Devices Used in One Household

- Power prosumer: Prosumer 1 (outgoing households): Households that have solar panels installed and have an empty house due to vacation or overseas business trips and generate excess power.

- Electricity customer 1: Customer 1 (households working from home): Households that are not able to go to work due to a pandemic and are working at home. Households are affected by a progressive tax as electricity use increases during the afternoon (working time: 09:00~18:00 h).

- Power purchaser 2: Customer 2 (nonworking households): Households affected by progressive tax due to high power consumption during the afternoon hours (9–18:00) because they do not work and stay at home all day.

5.2. Actual Energy Consumption per Household

5.3. Prosumer’s Optimal Number of Solar Panels for Each Customer

5.4. Benefit and ROI Analysis for Optimal Prosumer Trading

- (NM benefit): Prosumer’s NM benefit (KRW)

- (Power trading benefit): Prosumer’s benefit by power trading (KRW)

- C(x): Electricity charge paid to electric power institution for the power consumption x (KRW)

- : Total amount consumed by the prosumer (kWh)

- : Power received from electric power institution (kWh)

- : The amount of electricity consumed by the prosumer (kWh)

- : Total power used by customer (kWh)

- Z: Power purchased by customer (kWh)

- γ (Transaction ratio index): A coefficient to shorten the payback period of solar installation costs by multiplying the selling price of a certain ratio or higher to a prosumer who has installed solar panels rather than a consumer who does not have solar panels installed

- ε (Transaction profit index): A coefficient for the difference in profit between prosumer and customer

5.5. Guidelines for Small-Scale Power Trading

- The prosumer can sell power only when surplus power is produced by renewable energy.

- The prosumer obtains the maximum profit from self-consumption rather than selling it when the electricity produced by renewable energy is less than the consumed electricity.

- The prosumer can sell the surplus power when the power produced by renewable energy exceeds the consumed power.

- If the prosumer trades based on this proposed model when the electricity produced by renewable energy is more than the consumed electricity, higher profits can be achieved in small-scale electricity transactions than NM for the surplus electricity to EG.

- When the prosumer is not present, surplus power in the residence can be sold.

- The selling price should have a higher sales profit when sold to other customers (than the sales profit at NM with electric power institution), and the purchase price should be less than the electricity bill amount (including progressive tax) reduced by the customer’s electricity transaction. (Equation (11)).

- ESS is practically unnecessary for small power transactions if real-time transactions are possible because there is a capacity limit when installing an ESS.

6. Conclusions and Future Perspectives

- Data-driven virtual energy management: Virtual energy trading is possible only through energy data analysis based on distributed energy IoT using a traditional grid without configuring an ESS-based independent local grid in the community space (apartment complex, etc.).

- Real-time energy demand management: Virtual energy trading is possible because of energy status monitoring and real-time energy offset by real-time energy data.

- Cost-effective energy trading system: It is possible to establish a cost-effective energy system by not installing the ESS and additional local grid.

- Energy cost saving: Prosumers sell higher than the existing solar energy transaction costs, and customers benefit from reducing electricity bills by mitigating the progressive electricity tax at home.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rodríguez-Molina, J.; Martínez-Núñez, M.; Martínez, J.-F.; Pérez-Aguiar, W. Business models in the smart grid: Challenges, opportunities and proposals for prosumer profitability. Energies 2014, 7, 6142–6171. [Google Scholar] [CrossRef] [Green Version]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 1–6. [Google Scholar] [CrossRef]

- Lopez, A.; Ogayar, B.; Hernández, J.; Sutil, F. Survey and assessment of technical and economic features for the provision of frequency control services by household-prosumers. Energy Policy 2020, 146, 111739. [Google Scholar] [CrossRef]

- Abdella, J.; Shuaib, K. Peer to peer distributed energy trading in smart grids: A survey. Energies 2018, 11, 1560. [Google Scholar] [CrossRef] [Green Version]

- Prosumer. Available online: https://en.wikipedia.org/wiki/Prosumer (accessed on 5 February 2021).

- Lu, X.; Li, K.; Xu, H.; Wang, F.; Zhou, Z.; Zhang, Y. Fundamentals and business model for resource aggregator of demand response in electricity markets. Energy 2020, 204, 117885. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, L.; Li, J. Peer-to-peer (P2P) electricity trading in distribution systems of the future. Electr. J. 2019, 32, 2–6. [Google Scholar] [CrossRef]

- Chen, K.; Lin, J.; Song, Y. Trading strategy optimization for a prosumer in continuous double auction-based peer-to-peer market: A prediction-integration model. Appl. Energy 2019, 242, 1121–1133. [Google Scholar] [CrossRef]

- Lee, Y. Study on System Improvement Plan for Vitalization of Energy Prosumer (Korean); Korea Energy Economics Institute Occasional Research Report; Korea Energy Economics Institute: Ulsan, Korea, 2016; pp. 1–93. [Google Scholar]

- Espe, E.; Potdar, V.; Chang, E. Prosumer communities and relationships in smart grids: A literature review, evolution and future directions. Energies 2018, 11, 2528. [Google Scholar] [CrossRef] [Green Version]

- Zafar, R.; Mahmood, A.; Razzaq, S.; Ali, W.; Naeem, U.; Shehzad, K. Prosumer based energy management and sharing in smart grid. Renew. Sustain. Energy Rev. 2018, 82, 1675–1684. [Google Scholar] [CrossRef]

- Hahnel, U.J.; Herberz, M.; Pena-Bello, A.; Parra, D.; Brosch, T. Becoming prosumer: Revealing trading preferences and decision-making strategies in peer-to-peer energy communities. Energy Policy 2020, 137, 111098. [Google Scholar] [CrossRef]

- Sioshansi, F. Consumer, Prosumer, Prosumager: How Service Innovations Will Disrupt the Utility Business Model; Academic Press: Cambridge, MA, USA, 2019. [Google Scholar]

- Song, P.; Zhou, Y.; Yuan, J. Peer-to-peer trade and the economy of distributed PV in China. J. Clean. Prod. 2021, 280, 124500. [Google Scholar] [CrossRef]

- Rathnayaka, A.D.; Potdar, V.M.; Dillon, T.S.; Hussain, O.K.; Chang, E. A methodology to find influential prosumers in prosumer community groups. IEEE Trans. Ind. Inform. 2013, 10, 706–713. [Google Scholar] [CrossRef]

- Ma, L.; Liu, N.; Zhang, J.; Tushar, W.; Yuen, C. Energy management for joint operation of CHP and PV prosumers inside a grid-connected microgrid: A game theoretic approach. IEEE Trans. Ind. Inform. 2016, 12, 1930–1942. [Google Scholar] [CrossRef]

- Luna, A.C.; Diaz, N.L.; Graells, M.; Vasquez, J.C.; Guerrero, J.M. Cooperative energy management for a cluster of households prosumers. IEEE Trans. Consum. Electron. 2016, 62, 235–242. [Google Scholar] [CrossRef] [Green Version]

- El-Batawy, S.A.; Morsi, W.G. Optimal design of community battery energy storage systems with prosumers owning electric vehicles. IEEE Trans. Ind. Inform. 2017, 14, 1920–1931. [Google Scholar] [CrossRef]

- Azar, A.G.; Nazaripouya, H.; Khaki, B.; Chu, C.-C.; Gadh, R.; Jacobsen, R.H. A non-cooperative framework for coordinating a neighborhood of distributed prosumers. IEEE Trans. Ind. Inform. 2018, 15, 2523–2534. [Google Scholar] [CrossRef] [Green Version]

- Cui, S.; Wang, Y.-W.; Xiao, J.-W.; Liu, N. A two-stage robust energy sharing management for prosumer microgrid. IEEE Trans. Ind. Inform. 2018, 15, 2741–2752. [Google Scholar] [CrossRef]

- Cui, S.; Wang, Y.-W.; Shi, Y.; Xiao, J.-W. An Efficient Peer-to-Peer Energy-Sharing Framework for Numerous Community Prosumers. IEEE Trans. Ind. Inform. 2019, 16, 7402–7412. [Google Scholar] [CrossRef]

- Ghosh, A.; Aggarwal, V.; Wan, H. Strategic Prosumers: How to set the prices in a Tiered Market? IEEE Trans. Ind. Inform. 2018, 15, 4469–4480. [Google Scholar] [CrossRef]

- Chen, L.; Liu, N.; Wang, J. Peer-to-peer energy sharing in distribution networks with multiple sharing regions. IEEE Trans. Ind. Inform. 2020, 16, 6760–6771. [Google Scholar] [CrossRef]

- Carli, R.; Dotoli, M. Decentralized control for residential energy management of a smart users’ microgrid with renewable energy exchange. IEEE/CAA J. Autom. Sin. 2019, 6, 641–656. [Google Scholar] [CrossRef]

- Scarabaggio, P.; Grammatico, S.; Carli, R.; Dotoli, M. Distributed demand side management with stochastic wind power forecasting. IEEE Trans. Control Syst. Technol. 2021, 1–16. [Google Scholar] [CrossRef]

- Giraldo, J.S.; Castrillon, J.A.; López, J.C.; Rider, M.J.; Castro, C.A. Microgrids energy management using robust convex programming. IEEE Trans. Smart Grid 2018, 10, 4520–4530. [Google Scholar] [CrossRef]

- Hosseini, S.M.; Carli, R.; Dotoli, M. Robust optimal energy management of a residential microgrid under uncertainties on demand and renewable power generation. IEEE Trans. Autom. Sci. Eng. 2020, 18, 618–637. [Google Scholar] [CrossRef]

- Dufo-López, R.; Bernal-Agustín, J.L. A comparative assessment of net metering and net billing policies. Study cases for Spain. Energy 2015, 84, 684–694. [Google Scholar] [CrossRef]

- Poullikkas, A.; Kourtis, G.; Hadjipaschalis, I. A review of net metering mechanism for electricity renewable energy sources. Int. J. Energy Environ. 2013, 4, 975–1002. [Google Scholar]

- Eid, C.; Guillén, J.R.; Marín, P.F.; Hakvoort, R. The economic effect of electricity net-metering with solar PV: Consequences for network cost recovery, cross subsidies and policy objectives. Energy Policy 2014, 75, 244–254. [Google Scholar] [CrossRef]

- Zhou, K.; Yang, S.; Shao, Z. Energy internet: The business perspective. Appl. Energy 2016, 178, 212–222. [Google Scholar] [CrossRef]

- Chen, T.; Su, W.; Chen, Y.-S. An innovative localized retail electricity market based on energy broker and search theory. In Proceedings of the 2017 North American Power Symposium (NAPS), Morgantown, WV, USA, 17–19 September 2017; pp. 1–5. [Google Scholar]

- Zhang, C.; Wu, J.; Long, C.; Cheng, M. Review of existing peer-to-peer energy trading projects. Energy Procedia 2017, 105, 2563–2568. [Google Scholar] [CrossRef]

- Vergados, D.J.; Mamounakis, I.; Makris, P.; Varvarigos, E. Prosumer clustering into virtual microgrids for cost reduction in renewable energy trading markets. Sustain. Energy Grids Netw. 2016, 7, 90–103. [Google Scholar] [CrossRef]

- Lang, B.; Dolan, R.; Kemper, J.; Northey, G. Prosumers in times of crisis: Definition, archetypes and implications. J. Serv. Manag. 2020, 32, 176–189. [Google Scholar] [CrossRef]

- Gae-Myoung Lee, C.-G.H. Analysis on the Generation Characteristics of the 1MW PV Plant in the Jeju Island. Trans. Korean Inst. Electr. Eng. 2015, 64, 726–731. [Google Scholar]

| Reference | Publication | Description | Novelties | |

|---|---|---|---|---|

| 1 | “A methodology to find influential prosumers in prosumer community groups” | 2013 | Find influential prosumers by multiple assess system. | Cost-effective energy trading system |

| 2 | “Energy management for joint operation of CHP (combined heat and power) and PV prosumers inside a grid-connected microgrid: A game theoretic approach” | 2016 | A multilateral energy management framework and Stackelberg game–based optimization model. | Cost-effective energy trading system |

| 3 | “Cooperative energy management for a cluster of households prosumers” | 2016 | Energy management system to coordinate the operations of distributed household prosumers. | Cost-effective energy trading system |

| 4 | “Optimal design of community battery energy storage systems with prosumers owning electric vehicles” | 2017 | High penetration rate of prosumers equipped with rooftop solar power and electric vehicles. | Real-time energy demand management |

| 5 | “A non-cooperative framework for coordinating a neighborhood of distributed prosumers” | 2018 | A scalable framework that coordinates net load scheduling, sharing, and matching prosumers | Real-time energy demand management |

| 6 | “A two-stage robust energy-sharing management for prosumer microgrid” | 2018 | An energy-sharing framework for a new prosumer microgrid. | Cost-effective energy trading system |

| 7 | “An efficient peer-to-peer energy-sharing framework for numerous community prosumers” | 2019 | An efficient P2P energy-sharing framework for numerous community prosumers. | Cost-effective energy trading system |

| 8 | “Strategic prosumers: How to set the prices in a tiered market?” | 2018 | A distributed algorithm that converges to the exchange price and the price function in a day-ahead scenario. | VPP-based data-driven energy prosumer |

| 9 | “Peer-to-peer energy-sharing in distribution networks with multiple sharing regions” | 2020 | P2P energy-sharing framework that considers both technical and sociological aspects. | Cost-effective energy trading system |

| 10 | “Decentralized control for residential energy management of smart users’ microgrids with renewable energy exchange” | 2019 | Decentralized control strategy for the scheduling of electrical energy activities of a smart homes. | VPP-based data-driven energy prosumer |

| 11 | “Distributed demand-side management with stochastic wind power forecasting” | 2021 | A distributed demand-side management approach for smart grids taking into account uncertainty in wind power forecasting. | VPP-based data-driven energy prosumer |

| 12 | “Microgrids energy management using robust convex programming” | 2019 | An energy management system for single-phase or balanced three-phase microgrids via robust convex optimization. | VPP-based data-driven energy prosumer |

| 13 | “Robust optimal energy management of a residential microgrid under uncertainties on demand and renewable power generation” | 2021 | A novel robust framework for the day-ahead energy scheduling of a residential microgrid. | VPP-based data-driven energy prosumer |

| Classification | Power Consumption | Total Hours Used | Total | |

|---|---|---|---|---|

| Always Use (W) | Partial Use (W) | Use Time (H) | ||

| Rice cooker | - | 122/366 (Keep warm) | 0.5/5 | 1891 |

| Highlight | - | 5300 | 0.5 | 2650 |

| Washing machine | - | 1840 | 1 | 1840 |

| Laundry dryer | - | 1950 | 1 | 1950 |

| Computer | - | 50 | 6 | 300 |

| Light | - | 100 | 6 | 600 |

| Coffee machine | - | 800 | 0.2 | 160 |

| Oven | - | 1750 | 0.2 | 350 |

| Microwave | - | 1700 | 0.2 | 340 |

| Massage chair | - | 200 | 0.5 | 100 |

| Home theater | - | 90 | 0.5 | 45 |

| Cleaner | - | 15 | 0.1 | 1.5 |

| Water purifier | 20 | - | 24 | 480 |

| Refrigerator | 23 | - | 24 | 552 |

| Router | 15 | - | 24 | 360 |

| Bidet | 50 | 1050 | 0 | |

| Wall pad | 9.5 | 20 | 24 | 228 |

| Classification | Solar Efficiency | Amount | Production Power (Day) | Production Power (Month) | Surplus Power | Sales and Purchases | Remaining after Sale | NM | Total Power Consumption | Electricity Bill | Profit | Transaction Ratio Index (γ) | Transaction Amount | Commission | Actual transaction Amount | Profit from Transactions | Solar Panel Installation | Profit (Year) | ROI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Prosumer | 0.325 | 3 | 2.944 | 88.305 | 39.170 | 37.721 | 1.448 | 4130 | - | - | - | 1.3 | 5381.68 | 269.08 | 5112.5 | 5112.593 | 600,000 | 61,351.11 | 9.78 |

| Customer 1 | - | - | - | - | - | 37.721 | - | - | 291.979 | 42,680 | 8120 | - | - | - | 5112.5 | 3007.407 | - | - | - |

| Classification | Solar Efficiency | Amount | Production Power (Day) | Production Power (Month) | Surplus Power | Sales and Purchases | Remaining after Sale | NM | Total Power Consumption | Electricity Bill | Profit | Transaction Ratio Index (γ) | Transaction Amount | Commission | Actual Transaction Amount | Profit from Transactions | Solar Panel Installation | Profit (Year) | ROI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Prosumer | 0.325 | 5 | 4.906 | 147.176 | 92.745 | 91.931 | 0.814 | 10,990 | - | - | - | 1.19 | 13,169.2 | 658.46 | 12,510 | 12,510.7 | 1,000,000 | 150,129 | 6.661 |

| Customer 1 | - | - | - | - | - | 44.465 | - | - | 285.234 | 41,190 | 9610 | - | - | - | 6051.2 | 3558.76 | - | - | - |

| Customer 2 | - | - | - | - | - | 47.465 | - | - | 312.234 | 46,950 | 10,260 | - | - | - | 6459.5 | 3800.5 | - | - | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, S.; Cho, K.; Kim, S.; Yoon, G.; Choi, M.-I.; Park, S.; Park, S. Distributed Energy IoT-Based Real-Time Virtual Energy Prosumer Business Model for Distributed Power Resource. Sensors 2021, 21, 4533. https://doi.org/10.3390/s21134533

Park S, Cho K, Kim S, Yoon G, Choi M-I, Park S, Park S. Distributed Energy IoT-Based Real-Time Virtual Energy Prosumer Business Model for Distributed Power Resource. Sensors. 2021; 21(13):4533. https://doi.org/10.3390/s21134533

Chicago/Turabian StylePark, Sanguk, Keonhee Cho, Seunghwan Kim, Guwon Yoon, Myeong-In Choi, Sangmin Park, and Sehyun Park. 2021. "Distributed Energy IoT-Based Real-Time Virtual Energy Prosumer Business Model for Distributed Power Resource" Sensors 21, no. 13: 4533. https://doi.org/10.3390/s21134533

APA StylePark, S., Cho, K., Kim, S., Yoon, G., Choi, M.-I., Park, S., & Park, S. (2021). Distributed Energy IoT-Based Real-Time Virtual Energy Prosumer Business Model for Distributed Power Resource. Sensors, 21(13), 4533. https://doi.org/10.3390/s21134533