What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study

Abstract

1. Introduction

2. Literature Review

2.1. Development Status of Smart Home

2.1.1. Development History of Voice-Enabled Smart Home System

- The first stage: bud stage (2015–2016). Chinese IT companies identified business opportunities from Amazon. In July 2015, the first technology giant Linglong Technology was quickly established by Iflytek and Jingdong (JD) in the four months after the launch of Amazon Echo, focusing on the smart speaker market. With the dual support of Iflytek’s voice technology and the strength of the JD e-commerce platform, Linglong Technology released the first smart speaker Dingdong one month after its establishment, which kicked off the prelude to the development of the Chinese smart speaker market. Relevant data show that Dingdong speakers monopolized the Chinese smart speaker market with a 65% share in 2016. Although Dingdong speakers have taken the lead position in the Chinese market at that time, the whole industry has not received much attention. The market model was not transparent, and many Internet companies were still waiting or accumulating commercial foundations. Moreover, the cost and price of smart speaker were still relatively high at this period (the price of the first Dingdong smart speaker was 798 CNY).

- The second stage: accumulation stage (2017–2018). In 2017, Alibaba, Xiaomi, and Baidu successively launched their first smart speaker product. Alibaba’s Tmall Genie received various subsidies and applied preferential strategies to control the product price under 100 CNY and fought fierce price wars during the “Double Eleven” festival. The start of this price war also means that the Chinese smart speaker market has entered the second phase. Alibaba, Xiaomi, and Baidu have all stepped down, using the strategy of investing significant amounts of money and providing subsidies to despoil market share, create market demand, and form user groups quickly. In 2018, as the price war gradually became more normalized [22], Linglong Technology, which was overwhelmed, divided up due to internal conflicts and withdrew from the market sadly. So far, the Chinese smart speaker market has officially entered the era of three dominant players, Alibaba, Xiaomi, and Baidu.

- The third stage: outbreak stage (2018–2019). After forming the top three players pattern, Chinese smart speakers development entered the third stage. In this period, the overall market size has grown by leaps and bounds and even rushed into the global head market. According to IDC data statistics, in 2018, Chinese smart speaker annual shipments exceeded 20 million units with a yearly increase of 1051.8%, marking the outbreak of the Chinese smart speaker market [23]. The total shipments of the Chinese smart speaker market in 2019 were 45.89 million units with a yearly increase of 109.7% [24]. The market share of the three top players, Alibaba, Baidu, and Xiaomi, exceeds 90% [24]. Among them, Alibaba’s Tmall Genie ranked first with 15.61 million units shipment throughout the year, which is a yearly increase of 87.9%. Baidu Xiaodu shipped 14.9 million units throughout the year with an increase of 278.5% compared to last year. Xiaomi Xiaoai shipped 11.3 million units throughout the year, which is a yearly increase of 89.7% [24]. Moreover, the Chinese smart speaker market also presents a tripartite state with the basic pattern of differentiated development of other IT companies, such as JD, Huawei, Himalaya, etc. The year 2019 has witnessed the turning point of smart speakers becoming a standard accessory for Chinese families. However, the potential and capability have not been fully explored yet.

- The fourth stage: rational stage (2020–present). Although the shipment volume of the Chinese smart speaker market is growing rapidly, compared with the principal developed countries, the penetration rate remains low. This is mainly because Chinese users have not cultivated their habits yet and are not sufficiently sticky with related usage scenarios. In 2019, the US smart speaker penetration rate was the highest, reaching 26% [25]. The user number of smart speakers in China ranks first globally, with nearly 86 million, but the penetration rate of smart speakers is only 10%, which is much lower than the United States. Followed by the United Kingdom, the scale of smart speaker users and the penetration rate is 13 million people with a 22% penetration rate. For other countries, Germany and Canada are more than 15% [26]. This also means that China still has a large amount of “black land” waiting to be reclaimed. Affected by the COVID-19 epidemic, although the market still maintains a high growth level, the growth trend has slowed down compared to 2019. In meeting the diversified needs of consumers, Alibaba, Baidu, and Xiaomi have added screen speakers, which have been an important driving force for developing the smart speaker market in the past two years and will become the next main battle field. The screen speaker has completed the leap from voice extension to vision, from single-mode to multi-mode interaction, especially when the product is superimposed with functions such as video, entertainment, learning, call, etc. Overall, the explosive market growth occupied in the early developing stage of the smart speaker industry is slowly disappearing. The market is gradually tending to a rational state while excellent system quality and service experience have gradually become a rigid demand for the expansion of the future market.

2.1.2. Development Strategies of Chinese IT Giants for Smart Home

2.2. Research on Trust

2.3. Theories and Models of Technology Adoption

2.4. Research on Trust and Technology Adoption of Smart Home

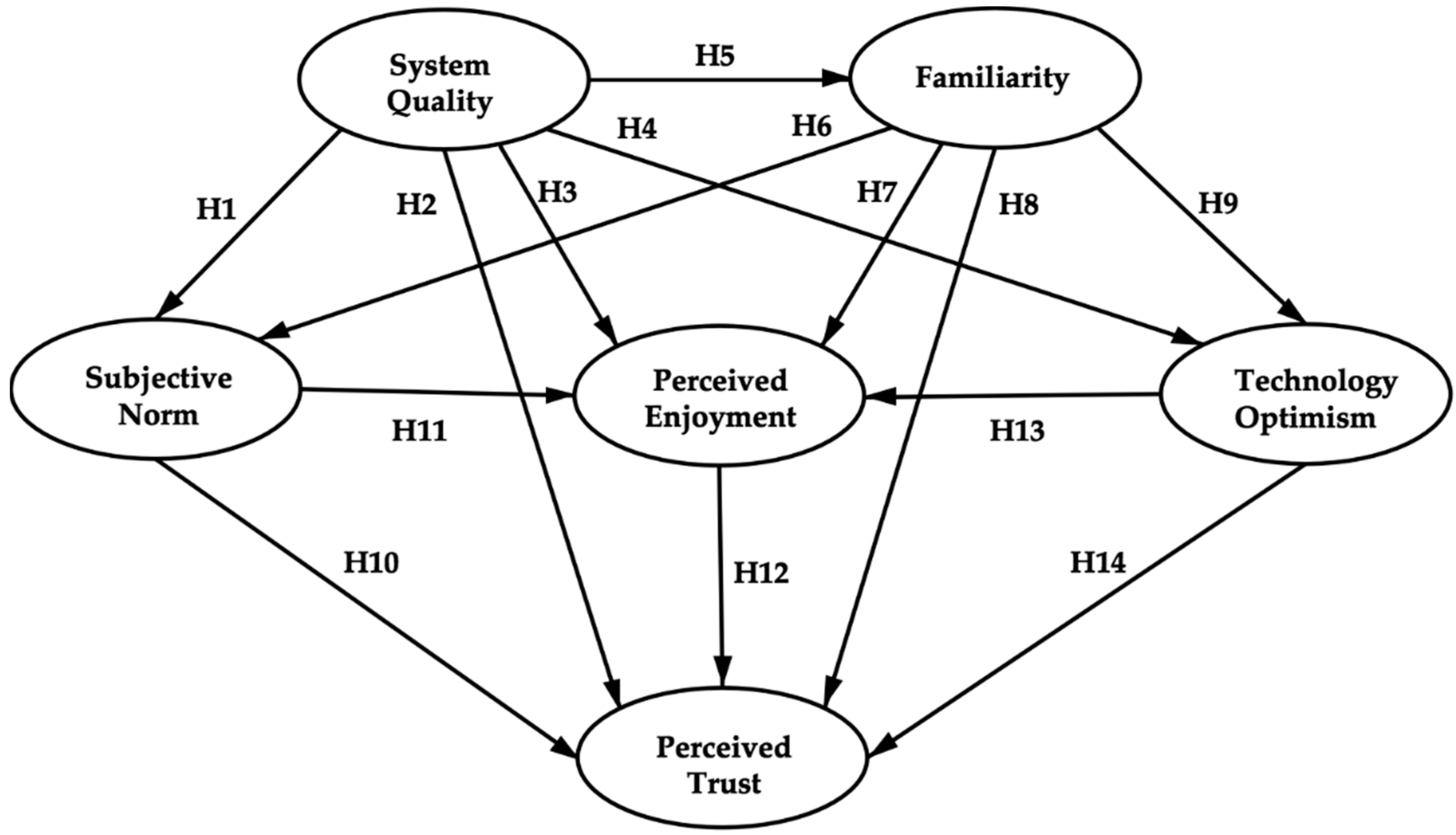

3. Hypotheses Development and Research Framework

3.1. System Quality

3.2. Familiarity

3.3. Subjective Norm

3.4. Perceived Enjoyment

3.5. Technology Optimism

4. Methodology

4.1. Measurement Development

4.2. Survey Procedure and Data Collection

4.3. Data Analysis Plans

4.4. Demographic Information

5. Results and Findings

5.1. Descriptive Analysis, Reliability, and Validity

5.2. Model Fit

5.3. Hypothesis Testing and Path Analysis

6. Discussion and Implications

7. Limitations and Future Studies

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Demographics

Appendix A.2. Measurement

- SQ1: Voice-enabled smart homes enable me to control many applications and devices.

- SQ2: Voice-enabled smart homes perform their functions quickly, efficiently, and precisely.

- SQ3: Voice-enabled smart homes and the output of information fully meet my needs.

- SQ4: Voice-enabled smart homes can protect my privacy and security.

- FAM1: I am familiar with the concept and related knowledge about voice-enabled smart homes devices.

- FAM2: I am familiar with the brands, products, and services of voice-enabled smart homes devices.

- FAM3: I am familiar with how to operate voice-enabled smart homes devices.

- SN1: I will use voice-enabled smart homes devices if the media/government encourages to use them.

- SN2: I will use voice-enabled smart homes devices in my house if my family members and friends do so.

- SN3: I will use voice-enabled smart homes devices if people whose opinion I value recommend me that I so.

- SN4: I will use voice-enabled smart homes devices if people who influence my behavior recommend that I do so.

- SN5: I will use voice-enabled smart homes devices if people who are most important to me support me to do so.

- ENJ1: Using voice-enabled smart homes would be fun.

- ENJ2: Using voice-enabled smart homes would be pleasurable.

- ENJ3: Using voice-enabled smart homes would be enjoyable.

- ENJ4: Using voice-enabled smart homes would make me excited.

- TO1: I feel that the newest technologies contribute to a better quality of life.

- TO2: I feel that the products and services that use the newest technologies are much more convenient to use.

- TO3: I feel confident that the newest technology-based systems will follow through with what I instruct them to do.

- TO4: I feel that the newest technologies can allow me to tailor things to fit my own needs.

- PT1: I consider voice-enabled Smart Homes to be trustworthy.

- PT2: I consider voice-enabled Smart Homes to be reliable.

- PT3: I consider voice-enabled Smart Homes to be controllable.

- PT4: I consider voice-enabled Smart Homes to be competent.

References

- Nakamura, M.; Tanaka, A.; Igaki, H.; Tamada, H.; Matsumoto, K.-i. Constructing home network systems and integrated services using legacy home appliances and web services. Int. J. Web Serv. Res. (Ijwsr) 2008, 5, 82–98. [Google Scholar] [CrossRef][Green Version]

- Liu, Y.Q.; Tamura, R.; Song, Y. Constructing a Smart Home for Future Elders toward All-around Happiness: Taking Connectivity as the Core Element. Appl. Sci. 2020, 10, 5690. [Google Scholar] [CrossRef]

- Hong, A.; Nam, C.; Kim, S. What will be the possible barriers to consumers’ adoption of smart home services? Telecommun. Policy 2020, 44, 101867. [Google Scholar] [CrossRef]

- Watkins, D. Global Smart Speaker Vendor & OS Shipment and Installed Base Market Share by Region: Q4 2019. Available online: https://www.strategyanalytics.com/access-services/devices/connected-home/smart-speakers-and-screens/reports/report-detail/global-smart-speaker-vendor-os-shipment-and-installed-base-market-share-by-region-q4-2019?slid=1285353&spg=15 (accessed on 4 March 2021).

- Watkins, D. Global Smart Speaker and Screen Vendor & OS Value Market Share by Region: Q1 2020. Available online: https://www.strategyanalytics.com/access-services/devices/connected-home/smart-speakers-and-screens/reports/report-detail/global-smart-speaker-and-screen-vendor-os-value-market-share-by-region-q1-2020?slid=1285361&spg=14 (accessed on 4 March 2021).

- Watkins, D. Global Smart Speaker Vendor & OS Shipment and Installed Base Market Share by Region: Q2 2020. Available online: https://www.strategyanalytics.com/access-services/devices/connected-home/smart-speakers-and-screens/reports/report-detail/global-smart-speaker-vendor-os-shipment-and-installed-base-market-share-by-region-q2-2020?slid=1285368&spg=13 (accessed on 4 March 2021).

- Watkins, D. Global Smart Speaker Vendor & OS Shipment and Global Smart Speaker and Screens Shipments, Wholesale Revenue, ASP and Price Band by Model: Q3 2020. Available online: https://www.strategyanalytics.com/access-services/devices/connected-home/smart-speakers-and-screens/reports/report-detail/global-smart-speaker-vendor-os-shipment-and-global-smart-speaker-and-screens-shipments-wholesale-revenue-asp-and-price-band-by-model-q3-2020?slid=1285382&spg=1 (accessed on 4 March 2021).

- Watkins, D. Global Smart Speaker and Smart Display Vendor & OS Shipment and Installed Base Market Share by Region: Q4 2020. Available online: https://www.strategyanalytics.com/access-services/devices/connected-home/smart-speakers-and-screens/reports/report-detail/global-smart-speaker-and-smart-display-vendor-os-shipment-and-installed-base-market-share-by-region-q4-2020?slid=1285391&spg=3 (accessed on 4 March 2021).

- Zhou, J. Analysis of the Market Status and Development Trend of the Global Smart Speaker Industry in 2020. Available online: https://www.qianzhan.com/analyst/detail/220/201231-304d3ebd.html (accessed on 8 March 2021).

- Xiao, X.-T.; Kim, S.-I. A study on the user experience of smart speaker in China-focused on Tmall Genie and Mi AI speaker. J. Digit. Converg. 2018, 16, 409–414. [Google Scholar]

- Kim, E.; Keum, C. Trustworthy gateway system providing IoT trust domain of smart home. In Proceedings of the 2017 Ninth International Conference on Ubiquitous and Future Networks (ICUFN), Milan, Italy, 4–7 July 2017; pp. 551–553. [Google Scholar]

- 2019 Chinese Smart Speaker Market Summary Report. Available online: https://www.shangyexinzhi.com/article/501547.html (accessed on 4 March 2021).

- Corporate, I.D. IDC China Smart Speaker Equipment Market Monthly Tracking Report. Available online: https://t.cj.sina.com.cn/articles/view/1649608047/6253056f02000xwvm (accessed on 4 March 2021).

- Runto. Chinese Smart Speakers Retail Market Monthly Tracker. Available online: https://baijiahao.baidu.com/s?id=1681624319542202443&wfr=spider&for=pc (accessed on 4 March 2021).

- Gundlach, G.T.; Murphy, P.E. Ethical and legal foundations of relational marketing exchanges. J. Mark. 1993, 57, 35–46. [Google Scholar] [CrossRef]

- Fukuyama, F. Trust: The Social Virtues and the Creation of Prosperity; Free Press: New York, NY, USA, 1995; Volume 99. [Google Scholar]

- Gefen, D.; Karahanna, E.; Straub, D.W. Trust and TAM in online shopping: An integrated model. Mis Q. 2003, 27, 51–90. [Google Scholar] [CrossRef]

- Luor, T.T.; Lu, H.-P.; Yu, H.; Lu, Y. Exploring the critical quality attributes and models of smart homes. Maturitas 2015, 82, 377–386. [Google Scholar] [CrossRef]

- Park, E.; Kim, S.; Kim, Y.; Kwon, S.J. Smart home services as the next mainstream of the ICT industry: Determinants of the adoption of smart home services. Univers. Access Inf. Soc. 2017, 17, 175–190. [Google Scholar] [CrossRef]

- Neville, S. Eavesmining: A critical audit of the Amazon Echo and Alexa conditions of use. Surveill. Soc. 2020, 18, 343–356. [Google Scholar] [CrossRef]

- All View Cloud: Chinese Smart Speaker Market Summary in the First Half of 2020. Available online: http://finance.sina.com.cn/tech/2020-12-14/doc-iiznctke6373527.shtml (accessed on 4 March 2021).

- DVBCN. Smart Speaker Revenue Reached 7.9 Billion Dollars in 2018, Giants Will Compete for the Import Scale Via Price Wars. Available online: http://www.dvbcn.com/p/92560.html (accessed on 4 March 2021).

- There is No Stopping Timetable for Smart Speaker Subsidies, Baidu Ranked the First in China This Year. Available online: https://www.biaoshufanyi.org.cn/keji/1284501.html (accessed on 4 March 2021).

- IDC: The Shipments of Chinese Smart Speaker Market in 2019 Were 45.89 Million Units with a Yearly Increase of 109.7%. Available online: https://www.chinaz.com/2020/0320/1119520.shtml (accessed on 4 March 2021).

- Voicify. Smart Speaker Consumer Adoption Report 2019. Available online: https://voicebot.ai/wp-content/uploads/2019/03/smart_speaker_consumer_adoption_report_2019.pdf (accessed on 4 March 2021).

- Market Analysis of the Global Smart Speaker Industry in 2020: The Market Size is Nearly 12 Billion Dollars, and the Domestic Market Penetration Rate Remains to Be Improved. Available online: https://baijiahao.baidu.com/s?id=1664480648239134219&wfr=spider&for=pc (accessed on 4 March 2021).

- Anderson, J.C.; Narus, J.A. A model of distributor firm and manufacturer firm working partnerships. J. Mark. 1990, 54, 42–58. [Google Scholar] [CrossRef]

- Doney, P.M.; Cannon, J.P. An examination of the nature of trust in buyer–seller relationships. J. Mark. 1997, 61, 35–51. [Google Scholar]

- Pavlou, P.A. Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. Int. J. Electron. Commer. 2003, 7, 101–134. [Google Scholar]

- Ring, P.S.; Van de Ven, A.H. Developmental processes of cooperative interorganizational relationships. Acad. Manag. Rev. 1994, 19, 90–118. [Google Scholar] [CrossRef]

- Luhmann, N. Trust and Power; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Colquitt, J.A.; Scott, B.A.; LePine, J.A. Trust, trustworthiness, and trust propensity: A meta-analytic test of their unique relationships with risk taking and job performance. J. Appl. Psychol. 2007, 92, 909. [Google Scholar] [CrossRef]

- Kivijärvi, H.; Leppänen, A.; Hallikainen, P. Antecedents of information technology trust and the effect of trust on perceived performance improvement. Int. J. Soc. Organ. Dyn. It (Ijsodit) 2013, 3, 17–32. [Google Scholar] [CrossRef][Green Version]

- McKnight, D.H.; Choudhury, V.; Kacmar, C. The impact of initial consumer trust on intentions to transact with a web site: A trust building model. J. Strateg. Inf. Syst. 2002, 11, 297–323. [Google Scholar] [CrossRef]

- Marriott, H.R.; Williams, M.D. Exploring consumers perceived risk and trust for mobile shopping: A theoretical framework and empirical study. J. Retail. Consum. Serv. 2018, 42, 133–146. [Google Scholar] [CrossRef]

- Keen, P.; Ballance, G.; Chan, S.; Schrump, S. Electronic Commerce Relationships: Trust by Design; Prentice Hall PTR: Saddle River, NJ, USA, 1999. [Google Scholar]

- Martin, J.; Mortimer, G.; Andrews, L. Re-examining online customer experience to include purchase frequency and perceived risk. J. Retail. Consum. Serv. 2015, 25, 81–95. [Google Scholar] [CrossRef]

- Hsu, M.-H.; Chang, C.-M.; Chu, K.-K.; Lee, Y.-J. Determinants of repurchase intention in online group-buying: The perspectives of DeLone & McLean IS success model and trust. Comput. Hum. Behav. 2014, 36, 234–245. [Google Scholar]

- Roy, S.K.; Kesharwani, A.; Bisht, S.S. The impact of trust and perceived risk on internet banking adoption in India. Int. J. Bank Mark. 2012, 30, 303–322. [Google Scholar]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M.D. Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: Extending UTAUT with innovativeness, risk, and trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Fishbein, M. Reasoned Action, Theory of. In The International Encyclopedia of Communication; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Ajzen, I. From intentions to actions: A theory of planned behavior. In Action Control; Springer: Heidelberg/Berlin, Germany, 1985; pp. 11–39. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. Mis Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. Extrinsic and intrinsic motivation to use computers in the workplace 1. J. Appl. Soc. Psychol. 1992, 22, 1111–1132. [Google Scholar] [CrossRef]

- Wani, T.A.; Ali, S. Innovation diffusion theory. J. Gen. Manag. Res. 2015, 3, 101–118. [Google Scholar]

- Schunk, D.H. Social cognitive theory and self-regulated learning. In Self-Regulated Learning and Academic Achievement; Springer: New York, NY, USA, 1989; pp. 83–110. [Google Scholar]

- Thompson, R.L.; Higgins, C.A.; Howell, J.M. Personal computing: Toward a conceptual model of utilization. Mis Q. 1991, 15, 125–143. [Google Scholar] [CrossRef]

- Yang, H.; Lee, H.; Zo, H. User acceptance of smart home services: An extension of the theory of planned behavior. Ind. Manag. Data Syst. 2017, 117, 68–89. [Google Scholar] [CrossRef]

- Mulcahy, R.; Letheren, K.; McAndrew, R.; Glavas, C.; Russell-Bennett, R. Are households ready to engage with smart home technology? J. Mark. Manag. 2019, 35, 1370–1400. [Google Scholar] [CrossRef]

- Shuhaiber, A.; Mashal, I. Understanding users’ acceptance of smart homes. Technol. Soc. 2019, 58, 101110. [Google Scholar] [CrossRef]

- Pal, D.; Funilkul, S.; Charoenkitkarn, N.; Kanthamanon, P. Internet-of-Things and Smart Homes for Elderly Healthcare: An End User Perspective. IEEE Access 2018, 6, 10483–10496. [Google Scholar] [CrossRef]

- Ferraris, D.; Bastos, D.; Fernandez-Gago, C.; El-Moussa, F. A trust model for popular smart home devices. Int. J. Inf. Secur. 2020. [Google Scholar] [CrossRef]

- Cannizzaro, S.; Procter, R.; Ma, S.; Maple, C. Trust in the smart home: Findings from a nationally representative survey in the UK. PLoS ONE 2020, 15, e0231615. [Google Scholar] [CrossRef]

- Gorla, N.; Somers, T.M.; Wong, B. Organizational impact of system quality, information quality, and service quality. J. Strateg. Inf. Syst. 2010, 19, 207–228. [Google Scholar] [CrossRef]

- Alba, J.W.; Hutchison, J. Dimension of consumer experimental. Soc. Psychol. 1987, 15, 27–31. [Google Scholar]

- Bettman, J.R.; Park, C.W. Effects of prior knowledge and experience and phase of the choice process on consumer decision processes: A protocol analysis. J. Consum. Res. 1980, 7, 234–248. [Google Scholar] [CrossRef]

- Park, C.W.; Lessig, V.P. Familiarity and its impact on consumer decision biases and heuristics. J. Consum. Res. 1981, 8, 223–230. [Google Scholar] [CrossRef]

- Johnson, R.L.; Kellaris, J.J. An exploratory study of price/perceived-quality relationships among consumer services. Acr North Am. Adv. 1988, 15, 316–322. [Google Scholar]

- Campbell, M.C.; Keller, K.L. Brand familiarity and advertising repetition effects. J. Consum. Res. 2003, 30, 292–304. [Google Scholar] [CrossRef]

- Luhmann, N. Familiarity, confidence, trust: Problems and alternatives. Trust: Mak. Break. Coop. Relat. 2000, 6, 94–107. [Google Scholar]

- Fishbein, M.; Ajzen, I. Belief, Atitude, Intention and Behaviour: An Introduction to Theory and Research; Addison-Wesley: Boston, MA, USA, 1975; Volume 578. [Google Scholar]

- Park, H.S. Relationships among attitudes and subjective norms: Testing the theory of reasoned action across cultures. Commun. Stud. 2000, 51, 162–175. [Google Scholar] [CrossRef]

- Lam, T.; Baum, T.; Pine, R. Subjective norms: Effects on job satisfaction. Ann. Tour. Res. 2003, 30, 160–177. [Google Scholar] [CrossRef]

- Hirschman, E.C.; Holbrook, M.B. Hedonic consumption: Emerging concepts, methods and propositions. J. Mark. 1982, 46, 92–101. [Google Scholar] [CrossRef]

- Menon, S.; Kahn, B. Cross-category effects of induced arousal and pleasure on the internet shopping experience. J. Retail. 2002, 78, 31–40. [Google Scholar] [CrossRef]

- Babin, B.J.; Darden, W.R.; Griffin, M. Work and/or fun: Measuring hedonic and utilitarian shopping value. J. Consum. Res. 1994, 20, 644–656. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Xin, Z.; Liang, M.; Zhanyou, W.; Hua, X. Psychosocial factors influencing shared bicycle travel choices among Chinese: An application of theory planned behavior. PLoS ONE 2019, 14, e0210964. [Google Scholar] [CrossRef]

- Nor, K.M.; Shanab, E.A.A.; Pearson, J.M. Internet banking acceptance in Malaysia based on the theory of reasoned action. Jistem-J. Inf. Syst. Technol. Manag. 2008, 5, 3–14. [Google Scholar]

- Gefen, D. E-commerce: The role of familiarity and trust. Omega 2000, 28, 725–737. [Google Scholar] [CrossRef]

- Komiak, S.Y.; Benbasat, I. The effects of personalization and familiarity on trust and adoption of recommendation agents. Mis Q. 2006, 30, 941–960. [Google Scholar] [CrossRef]

- Zhang, J.; Ghorbani, A.A.; Cohen, R. A familiarity-based trust model for effective selection of sellers in multiagent e-commerce systems. Int. J. Inf. Secur. 2007, 6, 333–344. [Google Scholar] [CrossRef]

- Pal, D.; Funilkul, S.; Vanijja, V.; Papasratorn, B. Analyzing the Elderly Users’ Adoption of Smart-Home Services. IEEE Access 2018, 6, 51238–51252. [Google Scholar] [CrossRef]

- Deng, Z.; Mo, X.; Liu, S. Comparison of the middle-aged and older users’ adoption of mobile health services in China. Int. J. Med. Inf. 2014, 83, 210–224. [Google Scholar] [CrossRef]

- Jen, W.-Y.; Hung, M.-C. An empirical study of adopting mobile healthcare service: The family’s perspective on the healthcare needs of their elderly members. Telemed. E-Health 2010, 16, 41–48. [Google Scholar] [CrossRef]

- Pikkarainen, T.; Pikkarainen, K.; Karjaluoto, H.; Pahnila, S. Consumer acceptance of online banking: An extension of the technology acceptance model. Internet Res. 2004, 14, 224–235. [Google Scholar] [CrossRef]

- Kim, J.; Ahn, K.; Chung, N. Examining the Factors Affecting Perceived Enjoyment and Usage Intention of Ubiquitous Tour Information Services: A Service Quality Perspective. Asia Pac. J. Tour. Res. 2013, 18, 598–617. [Google Scholar] [CrossRef]

- Wang, Y.-S.; Lin, H.-H.; Liao, Y.-W. Investigating the individual difference antecedents of perceived enjoyment in students’ use of blogging. Br. J. Educ. Technol. 2012, 43, 139–152. [Google Scholar] [CrossRef]

- Walczuch, R.; Lemmink, J.; Streukens, S. The effect of service employees’ technology readiness on technology acceptance. Inf. Manag. 2007, 44, 206–215. [Google Scholar] [CrossRef]

- Parasuraman, A. Technology Readiness Index (TRI) a multiple-item scale to measure readiness to embrace new technologies. J. Serv. Res. 2000, 2, 307–320. [Google Scholar] [CrossRef]

- Parasuraman, A.; Colby, C.L. An updated and streamlined technology readiness index: TRI 2.0. J. Serv. Res. 2015, 18, 59–74. [Google Scholar] [CrossRef]

- Kim, M.-J.; Chung, N.; Lee, C.-K. The effect of perceived trust on electronic commerce: Shopping online for tourism products and services in South Korea. Tour. Manag. 2011, 32, 256–265. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 1998; Volume 5. [Google Scholar]

- Bilgin, Y. Qualitative Method Versus Quantitative Method in Marketing Research: An Application Example at Oba Restaurant. In Qualitative versus Quantitative Research; IntechOpen: London, UK, 2017. [Google Scholar]

- Cleff, T. Univariate Data Analysis. In Exploratory Data Analysis in Business and Economics; Springer International Publishing: Basel, Switzerland, 2014; pp. 23–60. [Google Scholar]

- Cheung, M.F.Y.; To, W.M. The influence of the propensity to trust on mobile users’ attitudes toward in-app advertisements: An extension of the theory of planned behavior. Comput. Hum. Behav. 2017, 76, 102–111. [Google Scholar] [CrossRef]

- Schiller, F. Should We Use SEM? Pros and Cons of Structural Equation Modeling. Methods Psychol. Res. Online 2003, 8, 1–22. [Google Scholar]

- Chen, N.; Zhao, M.; Gao, K.; Zhao, J. The Physiological Experimental Study on the Effect of Different Color of Safety Signs on a Virtual Subway Fire Escape—An Exploratory Case Study of Zijing Mountain Subway Station. Int. J. Environ. Res. Public Health 2020, 17, 5903. [Google Scholar] [CrossRef] [PubMed]

| Construct | Measure Item | Reference |

|---|---|---|

| System Quality (SQ) | SQ1: Voice-enabled smart homes enable me to control many applications and devices. | [19,54,68,69] |

| SQ2: Voice-enabled smart homes perform their functions quickly, efficiently, and precisely. | ||

| SQ3: Voice-enabled smart homes and the output of information fully meet my needs. | ||

| SQ4: Voice-enabled smart homes can protect my privacy and security. | ||

| Familiarity (FAM) | FAM1: I am familiar with the concept and related knowledge about voice-enabled smart homes devices. | [70,71,72] |

| FAM2: I am familiar with the brands, products, and services of voice-enabled smart homes devices. | ||

| FAM3: I am familiar with how to operate voice-enabled smart homes devices. | ||

| Subjective Norm (SN) | SN1: I will use voice-enabled smart homes devices if the media/government encourages me to use them. | [73,74,75] |

| SN2: I will use voice-enabled smart homes devices in my house if my family members and friends do so. | ||

| SN3: I will use voice-enabled smart homes devices if people whose opinion I value recommend that I do so. | ||

| SN4: I will use voice-enabled smart homes devices if people who influence my behavior recommend that I do so. | ||

| SN5: I will use voice-enabled smart homes devices if people who are most important to me support me doing so. | ||

| Perceived Enjoyment (PE) | ENJ1: Using voice-enabled smart homes would be fun. | [19,50,76,77,78] |

| ENJ2: Using voice-enabled smart homes would be pleasurable. | ||

| ENJ3: Using voice-enabled smart homes would be enjoyable. | ||

| ENJ4: Using voice-enabled smart homes would make me excited. | ||

| Technology Optimism (TO) | TO1: I feel the newest technologies contribute to a better quality of life. | [49,79,80,81] |

| TO2: I feel that products and services that use the newest technologies are much more convenient to use. | ||

| TO3: I feel confident that the newest technology-based systems will follow through with what I instruct them to do. | ||

| TO4: I feel the newest technologies can allow me to tailor things to fit my own needs. | ||

| Perceived Trust (PT) | PT1: I consider voice-enabled smart homes to be trustworthy. | [50,82] |

| PT2: I consider voice-enabled smart homes to be reliable. | ||

| PT3: I consider voice-enabled smart homes to be controllable. | ||

| PT4: I consider voice-enabled smart homes to be competent. |

| Attributes | Value | Frequency | Attributes | Value | Frequency |

|---|---|---|---|---|---|

| Gender | Male | 194 | Income (RMB) | <1000 | 102 |

| Female | 281 | 1000–3000 | 31 | ||

| Age | 20- | 71 | 3000–5000 | 75 | |

| 21–30 | 242 | 5000–7000 | 92 | ||

| 31–40 | 108 | 7000+ | 175 | ||

| 41–50 | 40 | Occupation | Students | 138 | |

| 51+ | 14 | Teachers | 22 | ||

| Education | Some colleges | 142 | Civil Servants | 35 | |

| Undergraduate | 291 | Workers | 22 | ||

| Postgraduate | 42 | Others | 258 |

| Construct | Cronbach’s Alpha | Variable | Mean | Standard Deviation | Standardized Factor Loading | C.R. (t-Value) | SMC | AVE | Composite Reliability |

|---|---|---|---|---|---|---|---|---|---|

| System Quality (SQ) | 0.846 | SQ1 SQ2 SQ3 SQ4 | 3.81 3.97 3.69 3.83 | 0.900 0.779 0.932 0.887 | 0.751 0.765 0.748 0.796 | - 17.908 17.004 16.851 | 0.564 0.586 0.559 0.633 | 0.587 | 0.850 |

| Familiarity (FAM) | 0.853 | FAM1 FAM2 FAM3 | 4.25 4.20 4.26 | 0.747 0.761 0.742 | 0.773 0.832 0.831 | - 18.343 18.098 | 0.597 0.692 0.691 | 0.661 | 0.854 |

| Subjective Norm (SN) | 0.893 | SN1 SN2 SN3 SN4 SN5 | 3.99 3.86 3.88 3.76 3.74 | 0.879 0.860 0.848 0.864 0.895 | 0.726 0.797 0.829 0.818 0.791 | - 20.616 19.367 17.011 19.793 | 0.527 0.626 0.687 0.670 0.625 | 0.629 | 0.894 |

| Perceived Enjoyment (ENJ) | 0.844 | ENJ1 ENJ2 ENJ3 ENJ4 | 4.23 4.20 4.25 3.94 | 0.742 0.754 0.743 0.841 | 0.735 0.780 0.804 0.726 | - 16.430 16.133 15.029 | 0.540 0.609 0.646 0.527 | 0.581 | 0.847 |

| Technology Optimism (TO) | 0.810 | TO1 TO2 TO3 TO4 | 4.21 4.24 4.31 4.48 | 0.729 0.771 0.721 0.654 | 0.706 0.732 0.750 0.698 | - 14.432 14.853 13.746 | 0.498 0.535 0.563 0.488 | 0.521 | 0.813 |

| Perceived Trust (PT) | 0.809 | PT1 PT2 PT3 PT4 | 3.93 4.04 3.93 4.11 | 0.830 0.788 0.860 0.820 | 0.715 0.699 0.737 0.720 | - 15.128 13.722 13.846 | 0.512 0.488 0.544 0.518 | 0.516 | 0.810 |

| CR | AVE | MSV | ASV | SQ | FAM | TO | SN | ENJ | PT | |

|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 0.850 | 0.587 | 0.595 | 0.435 | 0.766 | |||||

| FAM | 0.854 | 0.661 | 0.662 | 0.401 | 0.595 *** | 0.813 | ||||

| ENJ | 0.847 | 0.581 | 0.618 | 0.453 | 0.704 *** | 0.649 *** | 0.763 | |||

| SN | 0.894 | 0.629 | 0.576 | 0.423 | 0.759 *** | 0.570 *** | 0.705 *** | 0.793 | ||

| TO | 0.813 | 0.521 | 0.662 | 0.475 | 0.648 *** | 0.814 *** | 0.785 *** | 0.614 *** | 0.722 | |

| PT | 0.810 | 0.516 | 0.595 | 0.443 | 0.771 *** | 0.615 *** | 0.753 *** | 0.742 *** | 0.702 *** | 0.718 |

| Category | Measure | Acceptable Values | Value |

|---|---|---|---|

| Absolute fit indices | Chi-square | 479.9 | |

| d.f. | 238 | ||

| Chi-square/d.f. | 1–5 | 2.016 | |

| GFI | 0.90 or above | 0.922 | |

| SRMR | 0.08 or below | 0.025 | |

| RMSEA | 0.05–0.08 | 0.046 | |

| Incremental fit indices | NFI | 0.90 or above | 0.928 |

| IF | 0.90 or above | 0.963 | |

| TLI | 0.90 or above | 0.956 | |

| CFI | 0.90 or above | 0.962 |

| Path Direction | Standardized Coefficient | Standard Error | C.R. (t-Value) | Result | |

|---|---|---|---|---|---|

| H1 | SQ → SN | 0.648 *** | 0.060 | 10.820 | Accepted |

| H2 | SQ → PT | 0.325 *** | 0.065 | 4.199 | Accepted |

| H3 | SQ → ENJ | 0.165 * | 0.064 | 2.238 | Accepted |

| H4 | SQ → TO | 0.196 *** | 0.040 | 4.797 | Accepted |

| H5 | SQ → FAM | 0.595 *** | 0.046 | 10.651 | Accepted |

| H6 | FAM → SN | 0.192 *** | 0.064 | 3.672 | Accepted |

| H7 | FAM → ENJ | −0.068 | 0.092 | −0.792 | Rejected |

| H8 | FAM → PT | 0.012 | 0.088 | 0.140 | Rejected |

| H9 | FAM → TO | 0.659 *** | 0.058 | 10.155 | Accepted |

| H10 | SN → PT | 0.233 ** | 0.061 | 3.201 | Accepted |

| H11 | SN → ENJ | 0.282 *** | 0.058 | 4.207 | Accepted |

| H12 | ENJ → PT | 0.227 ** | 0.087 | 2.536 | Accepted |

| H13 | TO → ENJ | 0.563 *** | 0.122 | 5.540 | Accepted |

| H14 | TO → PT | 0.159 | 0.136 | 1.366 | Rejected |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Gan, Y.; Song, Y.; Liu, J. What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study. Sensors 2021, 21, 2037. https://doi.org/10.3390/s21062037

Liu Y, Gan Y, Song Y, Liu J. What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study. Sensors. 2021; 21(6):2037. https://doi.org/10.3390/s21062037

Chicago/Turabian StyleLiu, Yuqi, Yan Gan, Yao Song, and Jing Liu. 2021. "What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study" Sensors 21, no. 6: 2037. https://doi.org/10.3390/s21062037

APA StyleLiu, Y., Gan, Y., Song, Y., & Liu, J. (2021). What Influences the Perceived Trust of a Voice-Enabled Smart Home System: An Empirical Study. Sensors, 21(6), 2037. https://doi.org/10.3390/s21062037