The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development

Abstract

:1. Introduction

2. Understanding the Functioning of the Raw Materials World

- −

- All the resources from the geosphere, i.e., primary resources.

- −

- All the resources from the technosphere, i.e., secondary resources, reusable by recycling.

- −

- In addition, last but not least, the most important resource: human ingenuity and creativity [9].

3. Increasing Raw Materials Efficiency to Achieve Inter- and Intra-Generational Fairness

3.1. Raw Materials Efficiency—Achieving More with Less

3.2. Replacing Primary Raw Materials by Secondary Ones

- (l)

- The production of secondary metals always requires less energy than the production of primary ones (Table 1), in the extreme case of aluminum only 5% compared with material from the primary process route. The energy savings are even higher for recycling of gold, platinum or palladium from jewelry or coins. Therefore, pure scrap is always the preferred raw material. In the case of aluminum, for example, the share of production from secondary sources increased from 17% in 1960 to 30% in 2009 and is expected to increase to 37% in 2020 [30]. The limit of use of secondary material is its availability, controlled by the lifetime of products and the collection and recycling efficiency that will be discussed later with the example of electronic scrap.

| Metal | Energy Savings |

|---|---|

| Steel | 74% |

| Aluminum | 95% |

| Copper | 85% |

| Lead | 65% |

- (2)

- The curve of energy requirement for secondary material intersects the one for primary material, unless there are favorite conditions as outlined above. This has the consequence that there is an optimum for mixing secondary with primary material. This optimum is shown principally in Figure 5b, in this case about 70% secondary material with 30% primary material.

4. The Feedback Control Cycle of Mineral Supply to Increase Raw Materials Efficiency

4.1. Introduction to the Feedback Control Cycle

- (a)

- A market economy system in which shortages result in price signals, meaning price rises produce incentives to find new solutions, first to alleviate and then to end the shortage.

- (b)

- Human creativity and ingenuity, the most important resource for finding solutions [9]. It is widely acknowledged that scientific curiosity is an important driver to find new solutions for raw material problems. Experience, however, shows that the price incentive, as an indicator of an urgent need, is a much stronger motivator for finding a solution to a concrete problem quickly because it promises financial rewards for those who are first to be successful in the quest for new ideas.

4.2. Learning Effects Triggered by the Feedback Control Cycle

- (1)

- There are no seasons and no growing cycles as in agriculture with the consequence of cyclicity.

- (2)

- Reactions cover a wide time range. Direct substitution can start immediately if the alternative material can be readily bought on the market. If there are reserve capacities in mines and smelters, these can also be mobilized quickly. In addition, metals might be produced from intermediates on stock from metallurgical processes which at higher prices become attractive to treat, or it becomes economically viable to recycle manufacturing scraps which at lower prices had been discarded or stocked. Next are probably material savings as soon as new ideas develop. Then follow investments in new mines which are on the shelf and can readily be brought into production, reworking of tailing ponds or new smelting facilities for primary and secondary material as well as technological substitution.

- (3)

- Substitution often is irreversible.

- (4)

- Investments in mines are very capital-intensive. Once investments have been made, mines attempt to stay in production as long as possible, producing even at a loss for a certain length of time.

4.3. Limits of Market Forces within the Feedback Control Cycle of Mineral Supply

| Secondary Material | Grade Gold | Grade Platinum Group Elements (PGE) |

|---|---|---|

| PC circuit boards * | ≈100–200 g/t Au | ≈30–80 g/t Pd |

| Mobile phones (without batteries) | ≈200–300 g/t Au | ≈50–100 g/t Pd |

| Monolithic car catalysts | - | ≈2000 g/t PGE |

| Metals of the EU-20 List [54] | Recycling Rates According to UNEP [55] |

|---|---|

| antimony | 1%–10% |

| beryllium | <1% |

| cobalt | >50% |

| gallium | <1% |

| germanium | <1% |

| indium | <1% |

| magnesium | >25%–50% |

| niobium (columbium) | >50% |

| platinum | >50% |

| palladium | >50% |

| rhodium | >50% |

| ruthenium | >10%–25% |

| iridium | >25%–50% |

| osmium | <1% |

| heavy rare earths elements | <1% |

| light rare earths elements | <1% |

| tungsten | >10%–25% |

| chromium | >50% |

- (1)

- Iron ores mostly contain some phosphorus. During the smelting process this phosphorus reports to the slag phase. If the slag is used in the production of cement and then goes into concrete it is functionally lost forever.

- (2)

- Sewage sludge contains phosphorus often in significant amounts. So far, it is uneconomic to reprocess the sewage sludge for making fertilizer. Only in the production of phosphoric acid or elementary phosphorus might the recovery from sludge be economic. If sewage sludge is not deposited or burned separately, it is diluted with other waste in the incinerator process and probably lost forever.

4.4. Possible Actions for Optimizing the Feedback Control Cycle of Mineral Supply

- (1)

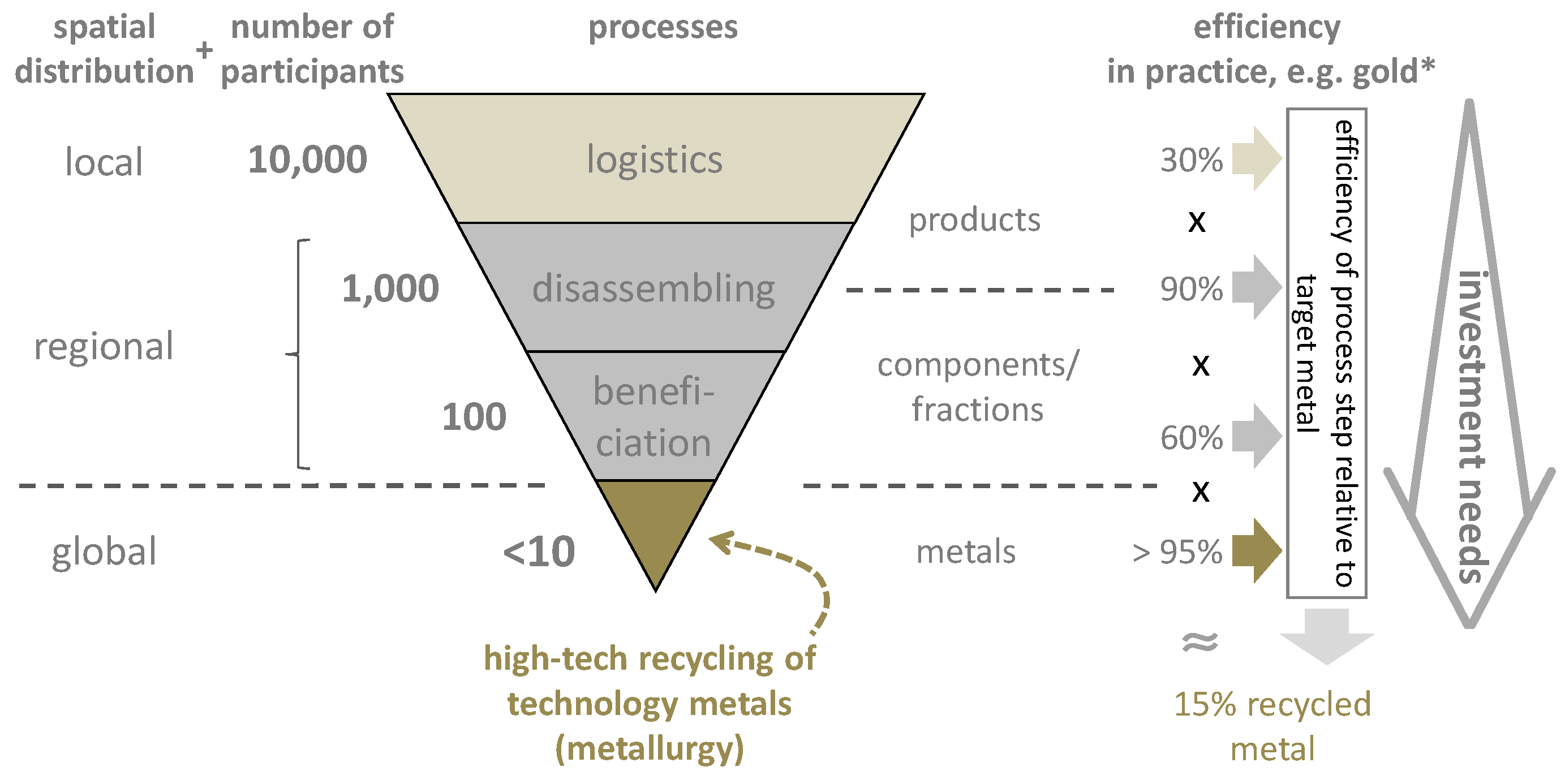

- Tackle the political challenge to build up efficient national and international recycling systems. Figure 13 shows the process chain with the number of actors for consumer goods—in this case printed circuit boards. It also shows an assumed efficiency for each stage of the process chain. The overall efficiency is the total product of the efficiencies at each stage. It is evident that in the first collection stage the efficiency is by far the lowest. It is, therefore, mainly at this stage that significant gains in recycling efficiency can be achieved. In France, for instance, mobile phones are collected for recycling even in laundry shops.

- (2)

- Prevent dilution of waste streams, but concentrate as much by selective treatment and/or deposition. An example is the separate burning of sewage sludge in mono-incinerators for direct reprocessing or separate deposition. Residues can be stockpiled until economic circumstances would allow the exploitation of such secondary “phosphate deposits”. The present Federal German government’s programme includes plans for such action [61,62].

- (3)

- Foster the transparency of waste flows and the use of technically and environmentally superior recycling processes all along the recycling chains. The secure channeling of certain waste flows to such well-supervised facilities can bring a significant overall improvement in metals recycling. This is specifically relevant for complex waste streams such as end-of-life electronics or spent batteries, which contain a mix of valuable and hazardous materials. Here, the establishment of auditable treatment standards and mandatory certification schemes for recycling processes will create level playing field conditions for facilities using best available technologies. Without stringent quality requirements for recycling often only a few valuable and easily recoverable base and precious metals are recovered while other critical metals are lost. At the same time, by avoiding the costs for proper treatment of hazardous waste, environmental and social costs are externalized. Such a ruthless economic optimization is today the main driver for sub-standard recycling and illegal or dubious exports of scrap to some developing or transition countries that lack technologically advanced plants to recover a wider range of metals under environmentally sound conditions.

- (4)

- Support research and development as described above, taking the new German research programme “Economic-strategic raw materials for the high-tech position of Germany” as a model [58].

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Brundtland, G.H. Our Common Future—Report of the World Commission on Environment and Development; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Solow, R. An almost practical step towards sustainability. Resour. Policy 1993, 19, 162–172. [Google Scholar] [CrossRef]

- Ernst, W.G. Global equity and sustainable earth resource consumption requires super-efficient extraction-conservation-recycling and ubiquitous, inexpensive energy. Int. Geol. Rev. 2002, 44, 1072–1091. [Google Scholar] [CrossRef]

- Hartwick, J.M. Intergenerational Equity and the Investing of Rents from Exhaustible Resources. Am. Econ. Rev. 1977, 67, 972–974. [Google Scholar]

- Ayres, R.U. On the practical limits of substitution. Ecol. Econ. 2007, 61, 115–128. [Google Scholar] [CrossRef]

- Tilton, J.E. On Borrowed Time: Assessing the Threat of Mineral Depletion; Resources for the Future: Washington, DC, USA, 2003; p. 30. [Google Scholar]

- United Nations. Agenda 21. In Proceedings of the UN Conference on Environment and Development, Rio de Janeiro, Brazil, 3–14 June 1992; Available online: https://sustainabledevelopment.un.org/content/documents/Agenda21.pdf (accessed on 10 July 2015).

- Wellmer, F.-W.; Steinbach, V. Is a road to sustainable use of non-renewable mineral raw materials possible? In Proceedings of the 5th International Conference on SDIMI 2011 Sustainable Development in the Minerals Industry, Aix-la-Chapelle, Germany, 14–17 June 2011; pp. 517–534.

- McKelvey, V.E. Mineral resource estimate and public policy. Am. Sci. 1973, 60, 32–40. [Google Scholar]

- Wyman, O. World Energy Trilemma, World Energy Council, 2015. Available online: https://www.worldenergy.org/work-programme/strategic-insight/assessment-of-energy-climate-change-policy/ (accessed on 22 May 2015).

- Jasinski, S.M. Phosphate Rock. In US Geological Survey Mineral Commodity Summaries; US Geological Survey: Washington, DC, USA, 2014; pp. 118–119. [Google Scholar]

- Scholz, R.; Wellmer, F.-W. Approaching a dynamic View on the Availability of Mineral Resources: What we may learn from the Case of Phosphorus? Glob. Environ. Chang. 2013, 23, 11–27. [Google Scholar] [CrossRef]

- Schebek, L.; Becker, B.F. Substitution von Rohstoffen—Rahmenbedingungen und Umsetzung. In Strategische Rohstoffe—Risikovorsorge; Kausch, P., Bertau, M., Gutzmer, J., Matschullat, J., Eds.; Springer Spektrum Verlag: Berlin, Germany; Heidelberg, Germany, 2014; pp. 3–12. [Google Scholar]

- Thimm, U. Reformator der Welternährung. idw—Informationsdienst Wissenschaft. 16 April 1998. Available online: https://idw-online.de/de/news4377 (accessed on 17 April 2015).

- Wellmer, F.-W. Reserves and resources of the geosphere, terms so often misunderstood. Is the life index of reserves of natural resources a guide to the future? Z. Dtsch. Ges. Geowiss. 2008, 159, 575–590. [Google Scholar]

- Statistisches Bundesamt. Nachhaltige Entwicklung in Deutschland—Indikatorenbericht 2014. Available online: http://www.destatis.de/DE/Publikationen/Thematisch/UmweltoekonomischeGesamtrechnungen/Umweltindikatoren/IndikatorenPDF_0230001.pdf?__blob=publicationFile (accessed on 21 August 2015).

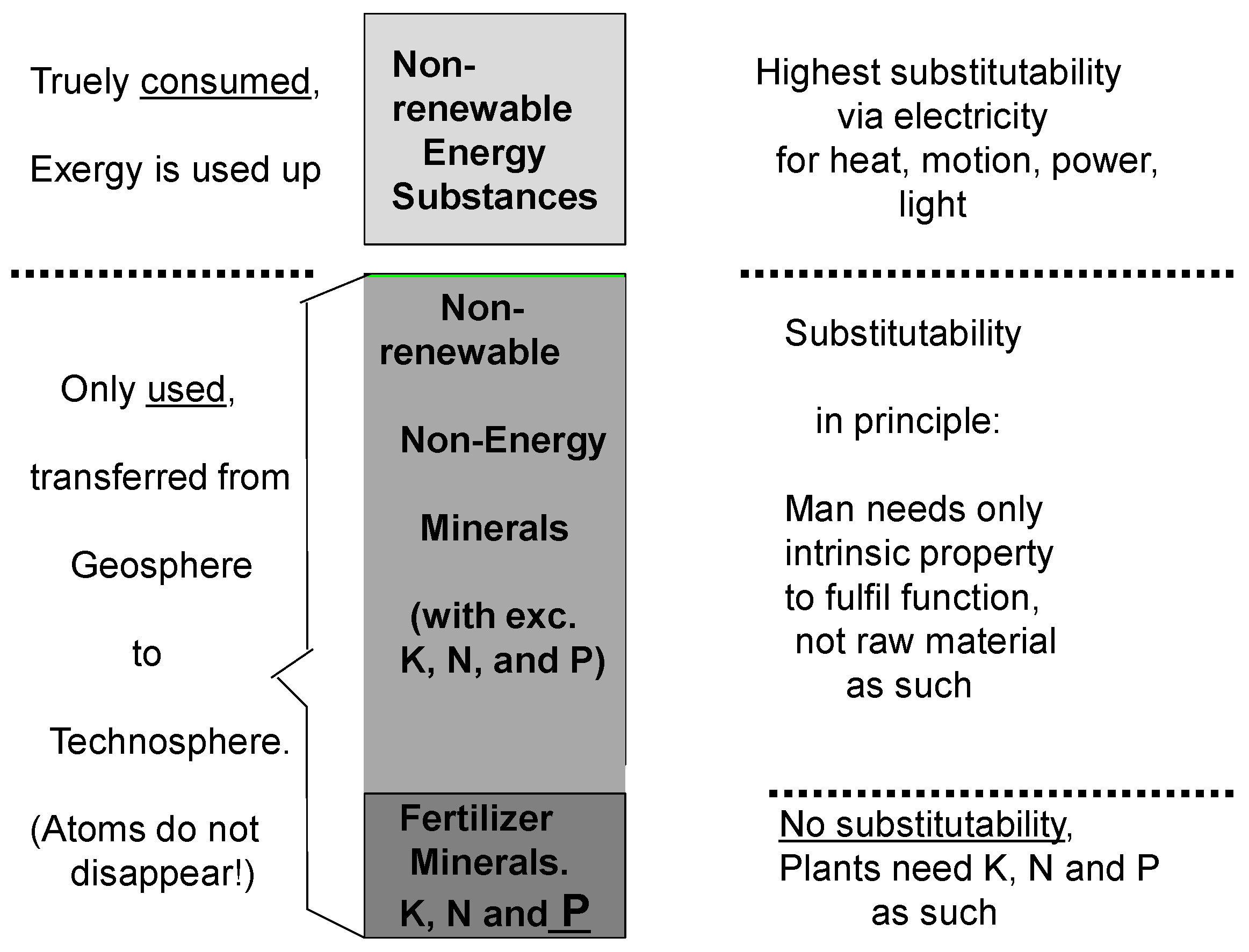

- Wagner, M.; Wellmer, F.-W. A hierarchy of natural resources with respect to sustainable development—A basis for a natural resources efficiency indicator. In Mining, Society and a Sustainable World; Richard, J.P., Ed.; Springer: Heidelberg, Germany; Dordrecht, The Netherlands, 2009; pp. 91–121. [Google Scholar]

- Hagelüken, C. Metallische Werkstoffe im Kontext von Ressourceneffizienz und Kreislaufwirtschaft. In Proceedings of the i-WING 2015, Dresden, Germany, 28 April 2015. (In German)

- Rickmann, D.; Luvall, J.C.; Shaw, J.; Mask, P.; Kissel, D.; Sullivan, D. Precision Agriculture—Changing the Face of Farming. Geotimes 2003, 48, 28–31. [Google Scholar]

- Bührer, W. 50 Jahre Düngemittelstatistik in Deutschland; Wirtschaft und Statistik May 2001; Statistisches Bundesamt: Wiesbaden, Germany, 2001; pp. S367–S371. (In German)

- Simonis, U.E. Resource Decoupling and Impact Decoupling—Central Elements of a Global Ecological U-Turn, Paper 5. In Proceedings of the 5th Freiberg Innovation Symposium, Freiberg, Germany, 25–26 March 2015.

- International Resource Panel UNEP. Decoupling Natural Resources Use and Environmental Impacts from Economic Growth. Available online: http://www.unep.org/resourcepanel/decoupling/files/pdf/Decoupling_Report_English.pdf (accessed on 28 April 2015).

- Australia’s Gold Industry—The Exploration Challenge. Available online: http://www.minerals.org.au/resources/gold/the_exploration_challenge/ (accessed on 21 April 2015).

- Ernst & Young. US Oil and Gas Reserves Study 2014. Available online: http://www.ey.com/Publication/vwLUAssets/EY-US-Oil-and-Gas-reserves-study-2014/$FILE/EY-US-Oil-and-Gas-reserves-study-2014.pdf (accessed on 28 April 2015).

- Carencotte, F.; Geldron, A.; Villeneuve, J.; Gaboriau, H. Économie circulaire et recyclage des métaux. Géosciences 2012, 15, 64–71. (In French) [Google Scholar]

- Steinbach, V.; Wellmer, F.-W. Consumption and Use of non-Renewable Mineral and Energy Raw Materials from an Economic Geology Point of View. Sustainability 2010, 2, 1408–1430. [Google Scholar] [CrossRef]

- Wellmer, F.W.; Becker-Platen, J.D. World natural resources policy—Focusing on mineral resources. In Our Fragile World—Challenges and Opportunities for Sustainable Development; Encyclopedia for Life Support Systems Publishers: Oxford, UK, 2001; Volume 1, pp. 183–207. [Google Scholar]

- Skinner, B.J. A Second Iron Age Ahead. Am. Sci. 1976, 64, 258–269. [Google Scholar]

- Hagelüken, C. Recycling of (critical) metals. In Critical Metals Handbook; Gunn, G., Ed.; American Geophysical Union: Washington, DC, USA, 2014; pp. 41–69. [Google Scholar]

- Gerber, J. Strategy towards the red list from a business perspective. In Proceedings of the ETH Workshop on Scarce Raw Materials, Davos, Switzerland, 1–2 September 2007.

- European Aluminium Association. Environmental Profile Report for the European Aluminium Industry—Life Cycle Inventory Data for Aluminium Production and Transformation Processes in Europe; European Aluminium Association: Brussels, Belgium, 2008. [Google Scholar]

- Johnson Matthey. PGM Market Report November 2014—Forecast of Platinum Supply & Demand in 2014; Johnson Matthey: London, UK, 2014; p. 32. [Google Scholar]

- DERA Rohstoffinformation. Rohstoffrisikobewertung–Platingruppenmetalle–Platin, Palladium, Rhodium; DERA Rohstoffinformation: Hannover, Germany, 2015; p. 155. (In German) [Google Scholar]

- BCS. Incorporated: 2007—Mining Industry Energy Bandwith Study—US Department of Energy-Industrial Technology Program. Washington, DC, USA. Available online: http://energy.gov/sites/prod/files/2013/11/f4/mining_bandwidth.pdf (accessed on 1 October 2015).

- Wellmer, F.-W.; Dalheimer, M. The Feedback Control Cycle as Regulator of past and future Mineral Supply. Miner. Depos. 2012, 47, 713–729. [Google Scholar] [CrossRef]

- Van Kerckhoven, T. Optimizing (precious) metals recovery out of electronic scrap. In Proceedings of the Electronics Recycling Asia 2014, Singapore, 13 November 2014.

- Thomas, W.I.; Thomas, D.S. The Child in America: Behavior Problems and Programs; Alfred A. Knopf: New York, NY, USA, 1928. [Google Scholar]

- Capon, E. Qin Shihuang—Terracotta Warriors and Horses. Catalogue to the “Exhibition of the Terracotta Figures of Warriors and Horses of the Qin Dynasty of China”; International Cultural Corporation of Australia: Sydney, Australia, 1982. [Google Scholar]

- Raymond, R. Out of the Fiery Furnace—The Impact of Metals on the History of Mankind; Macmillan: Melbourne, Australia, 1984. [Google Scholar]

- National Research Council (NRC), Committee on Critical Mineral Impacts on the US Economy. Minerals, Critical Minerals, and the US Economy; The National Academy Press: Washington, DC, USA, 2008. [Google Scholar]

- Achzet, B.; Reller, A.; Zepf, V.; Rennie, C.; Ashfield, M.; Simmons, J. Materials Critical to the Energy Industry: An Introduction (Report for the BP Energy Sustainability Challenge). Universität Augsburg, 2011. Available online: http://www.physik.uni-augsburg.de/lehrstuehle/rst/downloads/Materials_Handbook_Rev_2012.pdf (accessed on 28 October 2014).

- Kaldor, N. A Classificatory Note on the Determinateness of Equilibrium. Rev. Econ. Stud. 1934, 1, 122–136. [Google Scholar] [CrossRef]

- Ezekiel, M. The cobweb theorem. Q. J. Econ. 1938, 52, 255–280. [Google Scholar] [CrossRef]

- Kesler, S.E. Mineral Resources, Economics and the Environment; Macmillan: New York, NY, USA, 1994; p. 106. [Google Scholar]

- Wellmer, F.-W.; Becker-Platen, J.D. Sustainable development and the exploitation of mineral and energy resources: A review. Int. J. Earth Sci. 2002, 91, 723–745. [Google Scholar]

- Wellmer, F.-W.; Dalheimer, M. Trends und Perspektiven der Rohstoffversorgung Deutschlands im 21. Jahrhundert. In Rohstoffwirtschaft im Prozess der Transformation; Slaby, D., Brezinski, H., Eds.; Freiberger Forschungshefte: Freiberg, Germany, 1999; Volume 5, pp. 11–52. (In German) [Google Scholar]

- Bundesanstalt für Geowissenschaften und Rohstoffe; Deutsches Institut für Wirtschaftsforschung; Institut zur Erforschung Technologischer Entwicklungslinien. Ausfallrisiko bei 31 Rohstoffen; Bundesanstalt für Geowissenschaften und Rohstoffe: Berlin, Germany; Deutsches Institut für Wirtschaftsforschung: Hamburg, Germany; Institut zur Erforschung Technologischer Entwicklungslinien: Hannover, Germany, 1997. (In German) [Google Scholar]

- Minowa, T. Rare Earth Magnets: Conservation of Energy and the Environment. Resour. Geol. 2008, 58, 414–422. [Google Scholar] [CrossRef]

- Duclos, S.; Otto, J.; Konitzer, D. Design in an era of constrained resources. Mech. Eng. 2010, 132, 36–40. [Google Scholar]

- Elsner, H. Zur aktuellen Entwicklung bei Seltenen Erden für die Automatisierungstechnik, Quest-Trendmagazin. 23 July 2012. Available online: http://www.quest-trendmagazin.de/ressourcen/seltene-erden/Interview-BGR.html (accessed on 21 April 2015). (In German)

- BGR-Newsletter. Mineralische Rohstoffe—Nachfrage nach Schweren Seltenen Erden bricht ein. 25 December 2014. Available online: http://www.bgr.bund.de/SharedDocs/Newsletter/DE/2014/newsletter-2014–06.html?view=renderNewsletterHtml&nn=1544598 (accessed on 21 April 2015). (In German)

- Kingsnorth, D. The Global Green Economy: Opportunities & Threats for the Rare Earths Industry, Paper 5. In Proceedings of the Freiberg Innovation Symposium, Freiberg, Germany, 25–26 March 2015.

- Hagelüken, C. Die Bedeutung des Recyclings für die Verfügbarkeit von Strategischen Metallen. In Proceedings of the WING-Conference, Session 3—Strategic Raw Materials, Substitution, Chemistry, Berlin, Germany, 5 October 2011. (In German)

- European Commission (EC). Critical Raw Materials for the EU (Report of the Ad-Hoc-Working Group on Defining Critical Raw Materials), Brussels, 2010. Available online: http://ec.europa.eu/enterprise/policies/raw-materials/files/docs/report-b_en.pdf (accessed on 26 June 2014).

- United Nations Environment Programme (UNEP). Recycling Rates of Metals—A Status Report. A Report of the Working Group on the Global Metal Flows to the International Resource Panel; Graedel, T.E., Allwood, J., Birat, J.P., Reck, B.K., Sibley, S.F., Sonnemann, G., Buchert, M., Hagelüken, C., Eds.; UNEP: Paris, France, 2011. [Google Scholar]

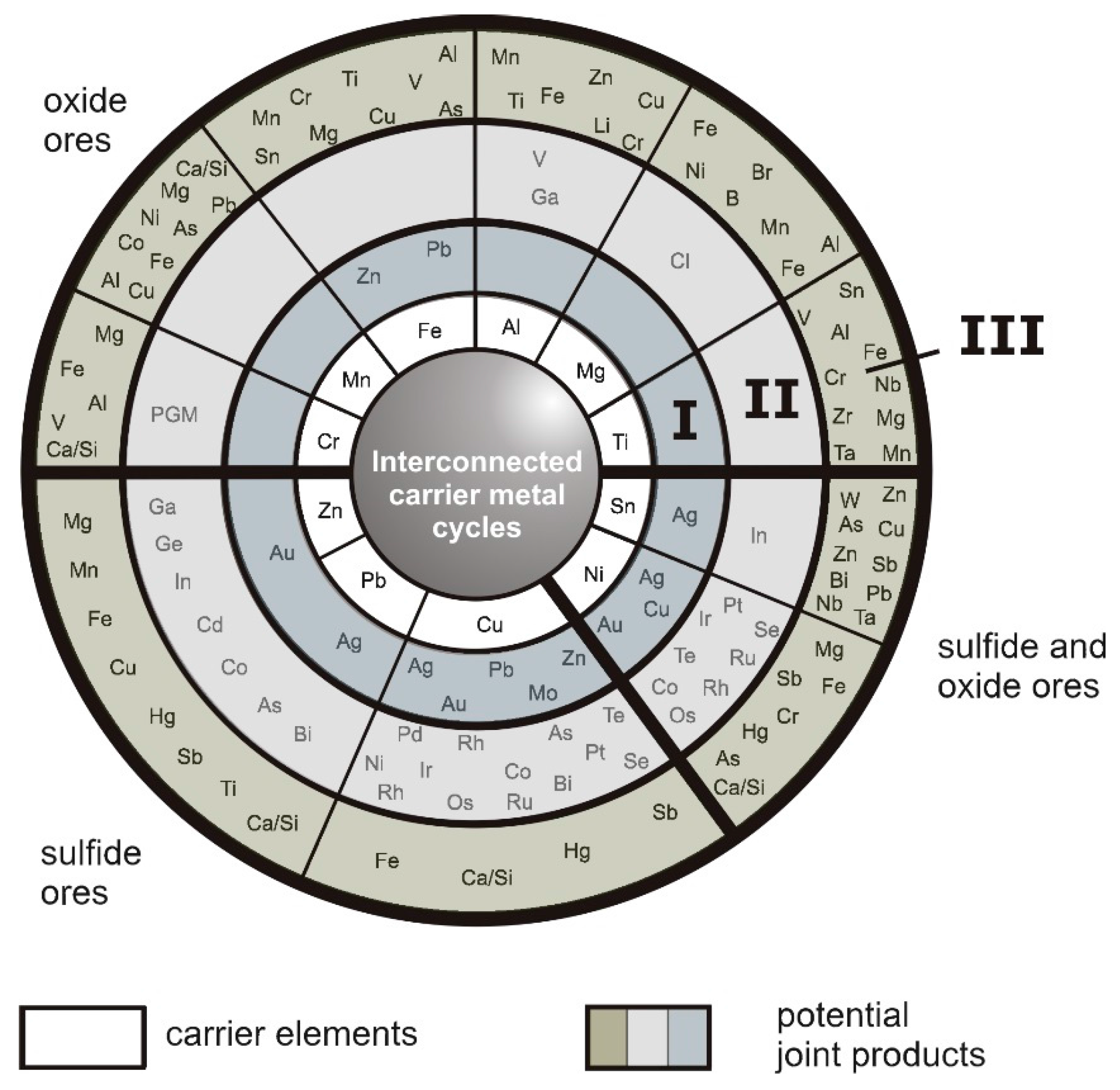

- Reuter, M.A.; Boin, U.M.J.; van Schaik, A.; Verhoef, E.V.; Heiskanen, K.; Yang, Y.; Georgalli, G. The Metrics of Material and Metal Ecology, Harmonizing the Resource, Technology and Environmental Cycles; Elsevier: Amsterdam, The Netherlands, 2005. [Google Scholar]

- Verhoef, E.V.; Gerard, P.J.; Reuter, M.A. Process knowledge, system dynamics and metal ecology. J. Ind. Ecol. 2004, 8, 23–43. [Google Scholar] [CrossRef]

- BMBF (Bundesministerium für Bildung und Forschung). Raw Materials of Strategic Economic Importance for High-Tech Made in Germany—BMBF Research and Development Programme for New Raw Materials Technologies; BMBF: Bonn, Germany, 2013; p. 52. [Google Scholar]

- Scholz, R.W.; Wellmer, F.-W. Losses and use efficiency along the phosphorus cycle: Definitions, notions, and significance for sustainable management. In Proceedings of the Conference Losses and Efficiency, Stuttgart, Germany, 28 October 2014.

- Hagelüken, C. Technologiemetalle—Systemische Voraussetzungen entlang der Recyclingkette. In Strategische Rohstoffe—Risikovorsorge; Kausch, P., Bertau, M., Gutzmer, J., Matschullat, J., Eds.; Springer Spektrum Verlag: Berlin, Germany; Heidelberg, Germany, 2014; pp. S161–S172. (In German) [Google Scholar]

- CDU, CSU, SPD. Deutschlands Zukunft Gestalten-Koalitionsvertrag 18. Legislaturperiode. 17 December 2013. Available online: http://www.bundesregierung.de/Content/DE/_Anlagen/2013/2013-12-17-koalitionsvertrag.pdf;jsessionid=FD08C83649DF66AF04E8FDA4C3733613.s1t2?__blob=publicationFile&v=2 (accessed on 28 April 2015). (In German)

- BMU (Bundesministerium für Umwelt, Naturschutz, Bau und Reaktorsicherheit). Deutsches Ressourceneffizienzprogramm ProgRess—Programm zur Nachhaltigen Nutzung und zum Schutz der Natürlichen Ressourcen. Available online: http://www.bmub.bund.de/fileadmin/Daten_BMU/Pools/Broschueren/progress_broschuere_de_bf.pdf (accessed on 28 April 2015). (In German)

- Eurometaux. Eurometaux’s Proposed Measures to Ensure an Effective EU Circular Economy; Position Paper; Eurometaux: Bruxelles, Belgium, 2015. [Google Scholar]

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons by Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wellmer, F.-W.; Hagelüken, C. The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development. Minerals 2015, 5, 815-836. https://doi.org/10.3390/min5040527

Wellmer F-W, Hagelüken C. The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development. Minerals. 2015; 5(4):815-836. https://doi.org/10.3390/min5040527

Chicago/Turabian StyleWellmer, Friedrich-W., and Christian Hagelüken. 2015. "The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development" Minerals 5, no. 4: 815-836. https://doi.org/10.3390/min5040527

APA StyleWellmer, F.-W., & Hagelüken, C. (2015). The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development. Minerals, 5(4), 815-836. https://doi.org/10.3390/min5040527