Bargaining-Based Profit Allocation Model for Fixed Return Investment Water-Saving Management Contract

Abstract

:1. Introduction

2. Materials and Methods

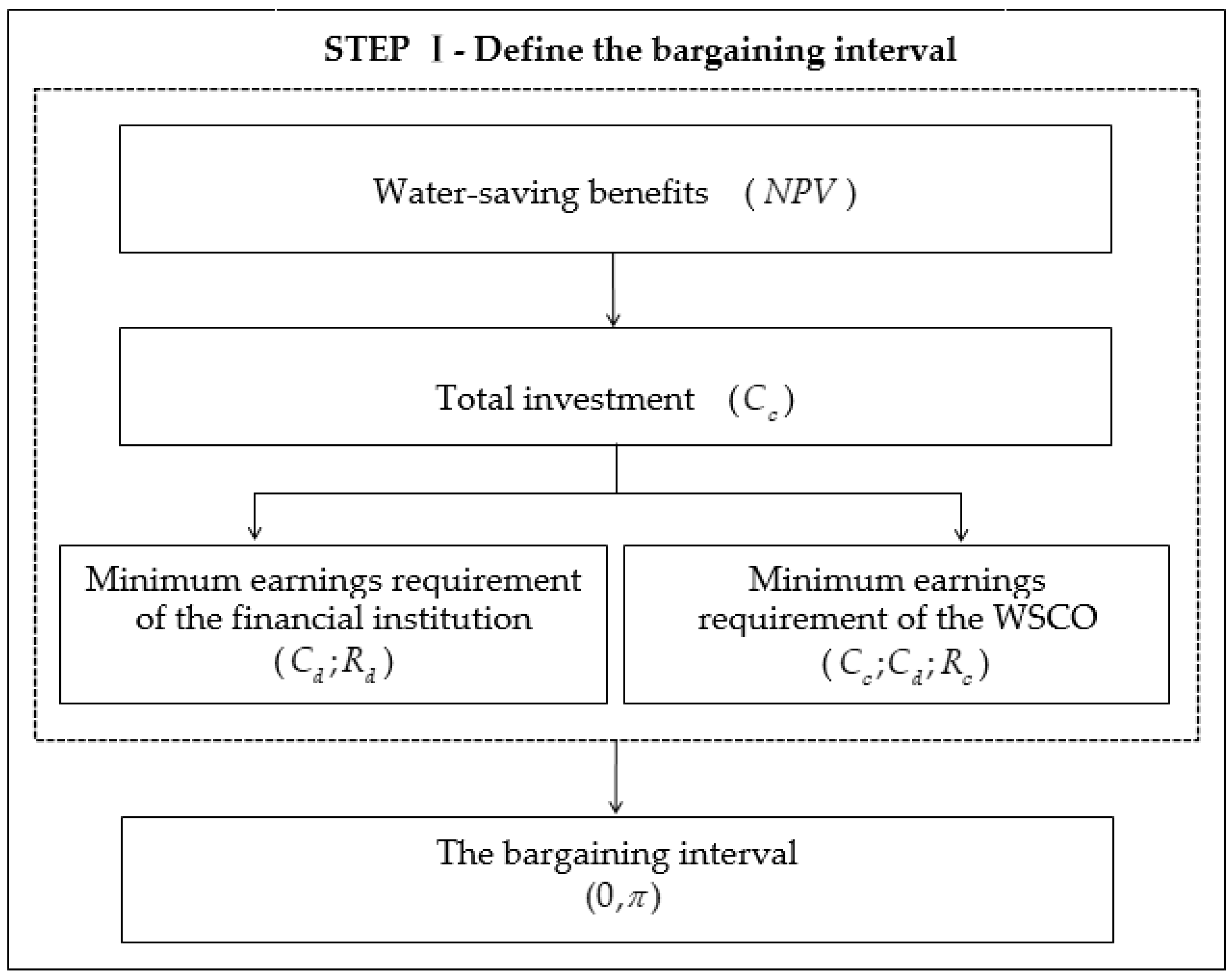

2.1. The Bargaining Interval

2.2. The Deterrence Discount Factor

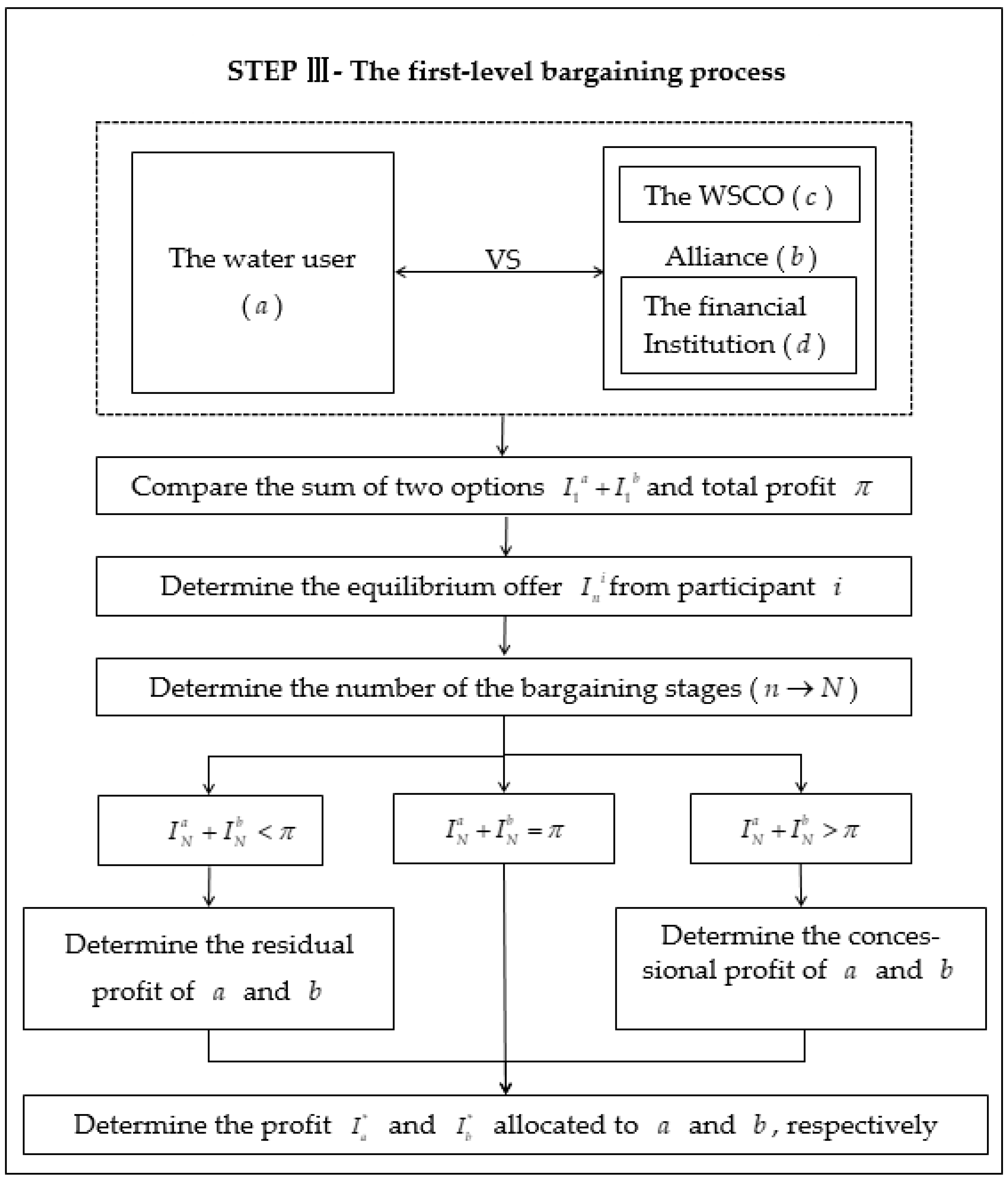

2.3. The First-Level Bargaining Process

2.3.1. Comparison of the Sum of the Two Options and the Total Profit

2.3.2. Equilibrium Offers from Participants

2.3.3. The Number of Bargaining Stages

- If n is an odd integer, then the number of bargaining stages is N = n. At this point,where ; ; and , the water-saving benefits to be distributed are exactly divided.

- If n is not an integer and the integer part is odd, the operation INT(n) is performed; n is rounded down to the nearest integer, and the number of bargaining stages is N = INT(n). At this point,where ; ; and . The parties to the game need to make concessions on their expected water-saving benefits.

- If n is not an integer and the integer part is even, the operation ODD(n) is performed; is rounded up to the nearest odd integer, and the number of bargaining stages is N = ODD(n). At this point,where ; ; and , the parties to the game need to redistribute the undistributed water-saving benefits.

- If n is an even integer, the number of bargaining stages can be either or . If , we havewhere ; ; and ; the parties to the game need to make concessions on their expected water-saving benefits. If , we havewhere ; ; and ; the parties to the game need to redistribute the undistributed water-saving benefits.

- If n is an integer and even, then the number of bargaining stages is . At this point,where ; ; and , the water-saving benefits to be distributed are exactly divided.

- If n is not an integer and the integer part is even, the operation is performed; is rounded down to the nearest integer, and the number of bargaining stages is . At this point,where ; ; and , the parties to the game need to make concessions on their expected water-saving benefits.

- If n is not an integer and the integer part is odd, the operation is performed; is rounded up to the nearest even integer and the number of bargaining stages is . At this point,where ; ; and , the parties to the game need to redistribute the undistributed benefits of water savings.

- If n is an odd integer, the number of bargaining stages can be either or . If , we havewhere ; ; and ; the parties to the game need to make concessions on their expected water-saving benefits. If , we havewhere ; ; and ; the parties to the game need to redistribute the undistributed water-saving benefits.

2.3.4. Distribution of Residual or Concessional Benefits

2.3.5. Profit Allocation Scheme

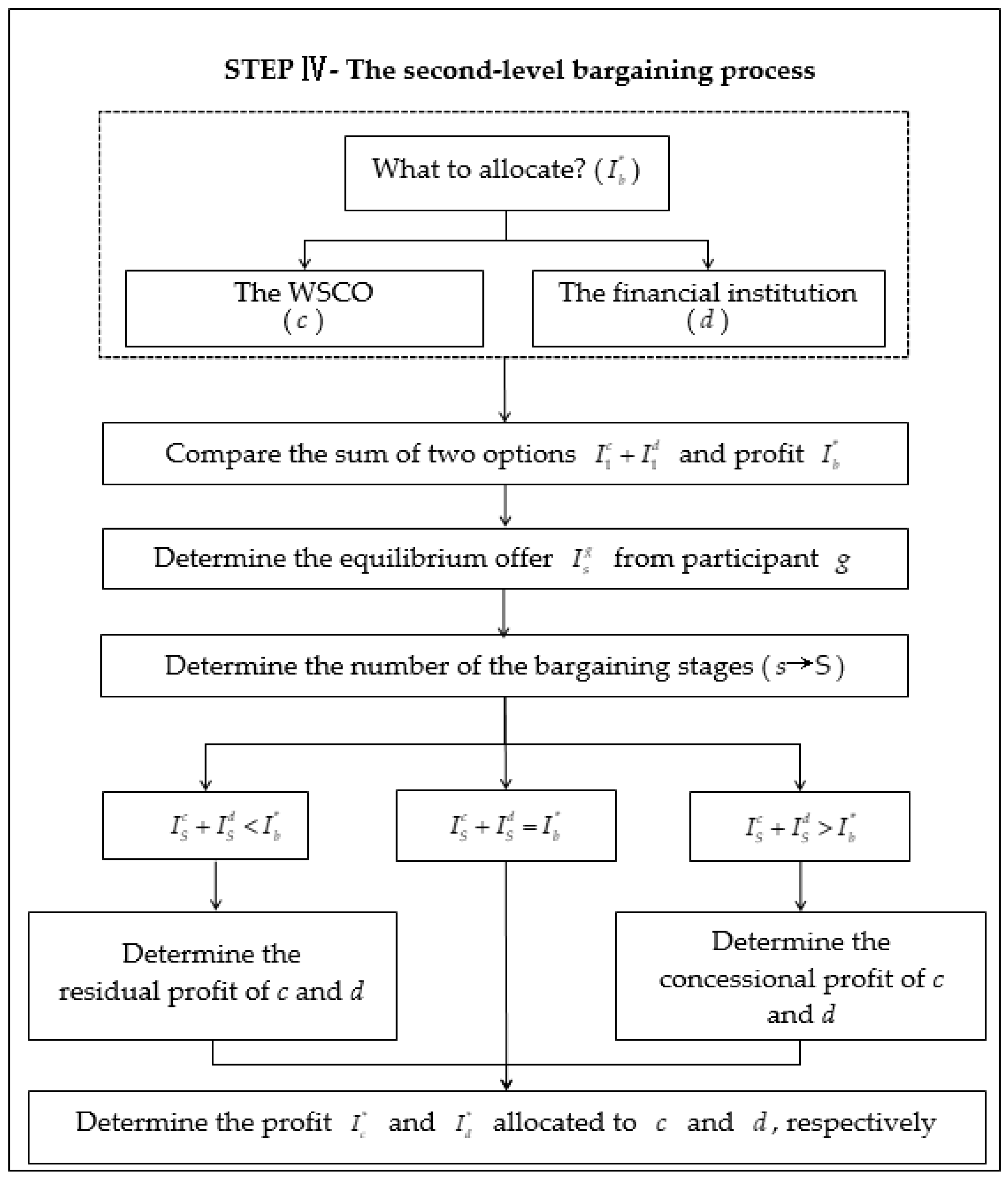

2.4. The Second-Level Bargaining Process

3. Results

4. Numerical Analysis

5. Discussion

5.1. The First-Level Bargaining Process

- Factors such as the amount of water-saving benefits to be allocated, the deterrence discount factor, the number of game stages, and the sunk cost are closely related to the equilibrium earnings of the participants.

- and as the major benefits of participant withandorand

- 3.

- Iforororit will promote the first-mover advantage of participant ; conversely, the first-mover advantage of participant will be suppressed.

- 4.

- For , we haveand

5.2. The Second-Level Bargaining Process

- Factors such as the benefits of the alliance in the first-level bargaining process, the deterrence discount factor, the number of game stages, and the sunk cost are closely related to the equilibrium earnings of the participants.

- The major benefits of participant are positively correlated with the deterrence discount factor of participant and negatively correlated with the deterrence discount factor of participant . If participant has a larger deterrence discount factor, it will gain more of the major benefits. Conversely, it will gain fewer of the major benefits.

- Iforororit will promote the first-mover advantage of participant ; conversely, the first-mover advantage of participant will be suppressed.

- The residual benefits of participant increase with increasing and decrease with increasing . The concession benefits of participant increase with the increase in and decrease with the increase in .

6. Conclusions

- A new profit allocation model is established based on the bargaining theory to create the distribution scheme. The two sides of the game offer first, respectively, and allocate the profit according to their offers to overcome the first-mover advantage. The number of bargaining stages and sunk cost are introduced into the model so that the sum of the options of both sides is not greater than the profit to be allocated, redistributing the remaining profit according to the deterrence discount factor of the players.

- It improves the theoretical mechanism of FRI WSMC and has guiding significance for the profit distribution of FRI WSMC projects in practice. Sixteen profit allocation results of the three participants were proposed and applied in the FRI WSMC projects. The relationship between profit and influencing factors was explored. The profit allocation of participants is closely related to the minimum profit requirements, deterrence discount factors, the number of bargaining stages, and sunk cost. Participants’ major benefits and residual benefits are positively correlated with their deterrence discount factors and negatively correlated with the other side’s deterrence discount factors. The concessional benefits of the participants are negatively correlated with its deterrence discount factors and positively correlated with the other side’s deterrence discount factors. At the same time, the effect of major benefits on first-mover advantage was also explored.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Salehi, M. Global water shortage and potable water safety; Today’s concern and tomorrow’s crisis. Environ. Int. 2022, 158, 106936. [Google Scholar] [CrossRef] [PubMed]

- Orimoloye, I.R.; Belle, J.A.; Olusola, A.O.; Busayo, E.T.; Ololade, O.O. Spatial assessment of drought disasters, vulnerability, severity and water shortages: A potential drought disaster mitigation strategy. Nat. Hazards 2021, 105, 2735–2754. [Google Scholar] [CrossRef]

- Lund Schlamovitz, J.; Becker, P. Differentiated vulnerabilities and capacities for adaptation to water shortage in Gaborone, Botswana. Int. J. Water Resour. D. 2021, 37, 278–299. [Google Scholar] [CrossRef]

- Albrecht, T.R.; Varady, R.G.; Zuniga-Teran, A.A.; Gerlak, A.K.; De Grenade, R.R.; Lutz-Ley, A.; Martín, F.; Megdal, S.B.; Meza, F.; Melgar, D.O.; et al. Unraveling transboundary water security in the arid Americas. Water Int. 2018, 43, 1075–1113. [Google Scholar] [CrossRef]

- Long, D.; Yang, W.; Scanlon, B.R.; Zhao, J.; Liu, D.; Burek, P.; Pan, Y.; You, L.; Wada, Y. South-to-North Water Diversion stabilizing Beijing’s groundwater levels. Nat. Commun. 2020, 11, 3665. [Google Scholar] [CrossRef]

- Han, S.; Zhou, J.; Liu, Z.; Zhang, L.; Huang, X. Influence of Community Factors on Water Saving in a Mega City after Implementing the Progressive Price Schemes. Water 2021, 13, 1097. [Google Scholar] [CrossRef]

- Guo, H.; Chen, X.; Liu, J.; Zhang, H.; Svensson, J. Joint analysis of water rights trading and water-saving management contracts in China. Int. J. Water Resour. Dev. 2020, 36, 716–737. [Google Scholar] [CrossRef]

- Li, Q.; Shangguan, Z.; Wang, M.; Yan, D.; Zhai, R.; Wen, C. Risk assessment of China’s water-saving contract projects. Water 2020, 12, 2689. [Google Scholar] [CrossRef]

- Ma, W.; Li, X.; Wang, X. Water saving management contract, identification and ranking of risks based on life cycle and best-worst method. J. Clean. Prod. 2021, 306, 127153. [Google Scholar] [CrossRef]

- Hu, H.; Wang, X.; Gao, Z.; Guo, H. A real option-based valuation model for shared water saving management contract. J. Clean. Prod. 2021, 289, 125442. [Google Scholar] [CrossRef]

- Liu, X.; Wang, X.; Guo, H.; An, X. Benefit allocation in shared water-saving management contract projects based on modified expected shapley value. Water Resour. Manag. 2021, 35, 39–62. [Google Scholar] [CrossRef]

- Shang, T.; Liu, P.; Guo, J. How to allocate energy-saving benefit for guaranteed savings EPC projects? A case of China. Energy 2020, 191, 116499. [Google Scholar] [CrossRef]

- Heuillet, A.; Couthouis, F.; Diaz-Rodriguez, N. Collective explainable AI: Explaining cooperative strategies and agent contribution in multiagent reinforcement learning with shapley values. IEEE Comput. Intell. Mag. 2022, 17, 59–71. [Google Scholar] [CrossRef]

- Guo, K.; Zhang, L. Guarantee optimization in energy performance contracting with real option analysis. J. Clean. Prod. 2020, 258, 120908. [Google Scholar] [CrossRef]

- Liu, H.; Zhang, X.; Hu, M. Game-theory-based analysis of Energy Performance Contracting for building retrofits. J. Clean. Prod. 2019, 231, 1089–1099. [Google Scholar] [CrossRef]

- Bayat, M.; Khanzadi, M.; Nasirzadeh, F. Bargaining game model to determine concessionary items in build-operate-transfer contracts. J. Constr. Eng. Manag. 2020, 146, 04019109. [Google Scholar] [CrossRef]

- Rubinstein, A. Perfect equilibrium in a bargaining model. Econometrica 1982, 50, 97–109. [Google Scholar] [CrossRef] [Green Version]

- Shaked, A.; Sutton, J. Involuntary unemployment as a perfect equilibrium in a bargaining model. Econometrica 1984, 52, 1351–1364. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.; Wang, X. A Dynamic Multi-Player Bargaining Game with Veto Players. J. Syst. Sci. Complex. 2021, 34, 673–691. [Google Scholar] [CrossRef]

- Feng, Z.; Tan, C.; Zhang, J.; Zeng, Q. Bargaining Game with Altruistic and Spiteful Preferences. Group Decis. Negot. 2021, 30, 277–300. [Google Scholar] [CrossRef]

- Xiao, Y.; Li, D.F. Bargaining model of mutual deterrence among three players with incomplete information. In Proceedings of the 3rd Joint China-Dutch Workshop and 7th China Meeting, GTA 2016, Fuzhou, China, 20–23 November 2016. [Google Scholar] [CrossRef]

- Zhang, C.; Wang, Z. Production mode and pricing coordination strategy of sustainable products considering consumers’ preference. J. Clean. Prod. 2021, 296, 126476. [Google Scholar] [CrossRef]

- Zhang, M.; Kong, Z. A multi-attribute double auction and bargaining model for emergency material procurement. Int. J. Prod. Econ. 2022, 254, 108635. [Google Scholar] [CrossRef]

- Xue, Q.; Cheng, C.; Wang, Z.; Liu, M. Bargaining strategy of oil companies in international oil and gas development Projects–Based on a bilateral bargaining model. Petrol. Sci. 2021, 18, 1270–1279. [Google Scholar] [CrossRef]

- Isaaks, R.; Colby, B. Empirical application of rubinstein bargaining model in Western U.S. Water Transactions. Water Econ. Policy 2020, 06, 1950010. [Google Scholar] [CrossRef]

- Zhu, J.; Wang, J.; Zhu, T.; Zhai, Z.; Zhao, X. Optimization of Benefit Allocation in Contracted Water-Saving Projects Based on the Shapley Value Method. Math. Probl. Eng. 2022, 2022, 8942299. [Google Scholar] [CrossRef]

- Ponsatí, C.; Sákovics, J. Rubinstein bargaining with two-sided outside options. Econ. Theory 1998, 11, 667–672. [Google Scholar] [CrossRef]

| Situation | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B1 | B2 | −D1 | −D2 | −D3 | −D4 | E1 | E2 | E3 | E4 | B3 | B4 | −D5 | −D6 | −D7 | −D8 | E5 | E6 | E7 | E8 | L1 | B5 | B6 | −E5 | −E6 | −E7 | −E8 | D5 | D6 | D7 | D8 | L2 | |

| 1 | √ * | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 2 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 3 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 4 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 5 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 6 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 7 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 8 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 9 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 10 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 11 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 12 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 13 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 14 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 15 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| 16 | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | √ | |||||||||||||||||||||

| Property | Details |

|---|---|

| Investment cost | The WSCO invested a total of CNY 12 million in the project, including CNY 8 million in financing from the bank |

| The water price | CNY 160 per cubic meter |

| Savings | The annual average water saving is 200.000 cubic meters |

| Contract period | 5 years |

| Risk-free discount rate | 3.0% |

| Parameters | Details |

|---|---|

| Return on investment | The WSCO requires an excess return on investment of 15%; the bank requires a minimum return on investment of 4.4% |

| Sunk cost | CNY 10.000 per bid |

| The deterrence capacity | The deterrence capacity of the golf course, the WSCO, and the bank is 0.7, 0.4, and 0.4, respectively |

| The withstand deterrence capacity | The withstand deterrence capacity of the golf course, the WSCO, and the bank is 0.8, 0.3, and 0.4, respectively |

| The deterrence degree coefficient | The deterrence degree coefficient of the golf course, the WSCO, and the bank is 0.8, 0.9, and 0.7, respectively |

| Situations | Number of Bargaining Stage (Odd/Even) | Profit (CNY Million) | |||

|---|---|---|---|---|---|

| The First-Level Bargaining Process | The Second-Level Bargaining Process | The Golf Course | The WSCO | The Bank | |

| 1 | odd | odd | 66.79930 | 33.99990 | 33.75140 |

| 2 | odd | even | 66.79930 | 33.99965 | 33.75165 |

| 3 | even | odd | 66.79930 | 33.99990 | 33.75140 |

| 4 | even | even | 66.79930 | 33.99965 | 33.75165 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, S.; Wang, X.; Li, W. Bargaining-Based Profit Allocation Model for Fixed Return Investment Water-Saving Management Contract. Axioms 2022, 11, 712. https://doi.org/10.3390/axioms11120712

Liu S, Wang X, Li W. Bargaining-Based Profit Allocation Model for Fixed Return Investment Water-Saving Management Contract. Axioms. 2022; 11(12):712. https://doi.org/10.3390/axioms11120712

Chicago/Turabian StyleLiu, Shize, Xiaosheng Wang, and Wei Li. 2022. "Bargaining-Based Profit Allocation Model for Fixed Return Investment Water-Saving Management Contract" Axioms 11, no. 12: 712. https://doi.org/10.3390/axioms11120712

APA StyleLiu, S., Wang, X., & Li, W. (2022). Bargaining-Based Profit Allocation Model for Fixed Return Investment Water-Saving Management Contract. Axioms, 11(12), 712. https://doi.org/10.3390/axioms11120712