1. Introduction

Studies indicated a positive impact of entrepreneurship on economic development, innovation, and competitiveness [

1,

2]. At the same time, entrepreneurship has sparked the increasing interest of academics and policymakers and is becoming the government’s top priority [

3], proof of this is the potent growth of policies to stimulate entrepreneurship [

4]. Understanding how entrepreneurship and innovation affect competitiveness, and the factors that influence that relationship became fundamental to designing policies to stimulate economic and social growth. That is a relevant issue, especially the COVID-19 pandemic, which negatively affected early-stage entrepreneurship activity [

5] and reduced household income in 2021, strongly affecting people and businesses in lower-income economies [

6]. Indeed, specialists recommend is to support entrepreneurship activity to recover the economy [

6].

Researchers [

7] stated that Latin American (LA) countries and companies seek to increase innovation and entrepreneurship but face challenges and barriers. Policies and practices in the public and private sectors need to be improved to increase innovation. Alternatively, the authors suggested increasing business research and university-business partnerships, which is the first research gap. Moreover, academics [

8] state that “… countries represent developing economies that have in common a high rate of entrepreneurship but entrepreneurial ventures with poor growth potential” [

8].

This paper contextualises the scenario of innovation and entrepreneurship in LA, focusing on Brazil and Peru to guide development policies and stimulate the company’s competitiveness. The primary motivation is to shed light on how these economies encourage companies to become more competitive while indicating that there are still gaps.

In fact, the case study demonstrated that both countries’ economies depend on raw materials exports, lacking technological exports. The region’s great challenge is diversifying exports and increasing innovation. Along with that, the constraints of structural conditions affect business decisions and innovative behaviour. That is reflected in the Global Innovation Index (GII) ranking for 2022, where Brazil occupied the 54th position and Peru the 65th among 132 economies. Although the country’s governments have been providing subsidies since 2006 in innovation, the invested resources still need to be improved. Also, there is a need for more effective instruments to stimulate innovation, such as laws and incentive policies. In addition, both countries have the highest level of initial entrepreneurship worldwide, according to the Global Entrepreneurship Monitor (GEM). However, the entrepreneurship activities in Brazil and Peru, likely LA, occur more markedly because of necessity than opportunity. Concerning competitiveness levels, LA still needs to improve compared to other regions. According to the IMD World Competitiveness (IMD WC) ranking of 2022, Peru occupies 54th place and gained four positions from the previous year. That is the second position in the region, behind Chile (45th) and followed by Mexico in 55th, Colombia in 57th, and Brazil in 59th. On the contrary, Brazil lost two positions. Although the countries may have different economic sizes, their performance on competitiveness might be related to other factors. The choice of these countries for the investigation has the objective of showing different facts and finding solutions adapted and scalable to countries with similar characteristics. On the other hand, complexity and uncertainty will likely increase because the speed of change has skyrocketed, and the interdependencies between countries, sectors, companies, and people are increasing [

9].

Given this necessity to improve the country’s performance and cope with uncertainty, the decision-makers need to know what factors could overcome challenges and improve competitiveness. The body of knowledge suggests that the competitiveness of a country depends on its ability to promote and keep an environment of competitiveness for Enterprises [

10]. The IMD WC ranking postulates that private and public enterprises are crucial in generating wealth and contributing to the country’s competitiveness. In turn, innovation and entrepreneurship are essential to developing enterprises’ competitiveness [

11,

12], impacting the country’s economy [

13]. In this sense, we assume that innovation and entrepreneurship reflect in the economic attractiveness factors, which are related to competitiveness, both on enterprise and country levels. Considering this interdependence, the study intends to verify the relationship between the main indicators configuring the competitiveness landscape and its most significant and attractive factors, adapting the methodology established by IMD WC ranking [

10]. Thus, this study attempts to answer the following Research Question (RQ):

RQ1: How are economic attractiveness factors related to the country’s competitiveness?

Therefore, the hypothesis of the study is proposed:

H1. There are affinity relationships between economic attractiveness factors and competitiveness.

Under uncertainty, applying an algorithm based on Fuzzy Logic [

14] reduces risks and facilitates decision-making [

15] since the mathematics of uncertainty accurately considers the intersection of objectives and constraints within a multistage process in which human subjectivity influences the decision [

16]. Moreover, the fuzzy approach allows modeling imprecision, uncertainty, or lack of information [

17]. For these reasons, the authors use the Affinities Theory [

18] to determine the relationships between economic attractiveness factors and competitiveness indicators. Affinities are those homogeneous groupings at certain levels, structured orderly, which link elements of two sets of different natures, related by the essence of the phenomena they represent [

18].

The proposed algorithm is particularly suitable for this type of research, unlike other correlational data analyses, such as, for example, Pearson’s [

19] or Spearman’s [

20] coefficients. In a broad sense, correlation is a measure of association between variables. However, it does not guarantee that the relationship between two variables is causal and unsuitable for concordance analysis [

21]. On the other hand, the Affinities Theory allows for a broad exploration of the notion of relationship, its links, and causality based on the concept of incidence [

22], which can be strengthened or weakened by varying the intensity of relationships [

23]. The membership function expresses intensity, and variation is explained by max-min composition [

18]. In addition, the algorithm supports combining uncertainty management models, such as Moore’s Families and Galois lattices, and classical quantitative analysis for data processing [

24]. Both elements can help decision-making since they allow forming groups and displaying them holistically according to current affinities [

24], whether indicators of economic attractiveness or competitiveness. In summary, the Affinities Theory allows the analysis of the possibility of establishing causal relationships from similarities rather than measuring statistical correlations.

In this context, the article aims to explore the relationship between the multiple factors that influence competitiveness, especially the role of innovation and entrepreneurship in Brazil and Peru, from the perspective of development programs and highlight policies aimed at improving the quality and impact of entrepreneurship.

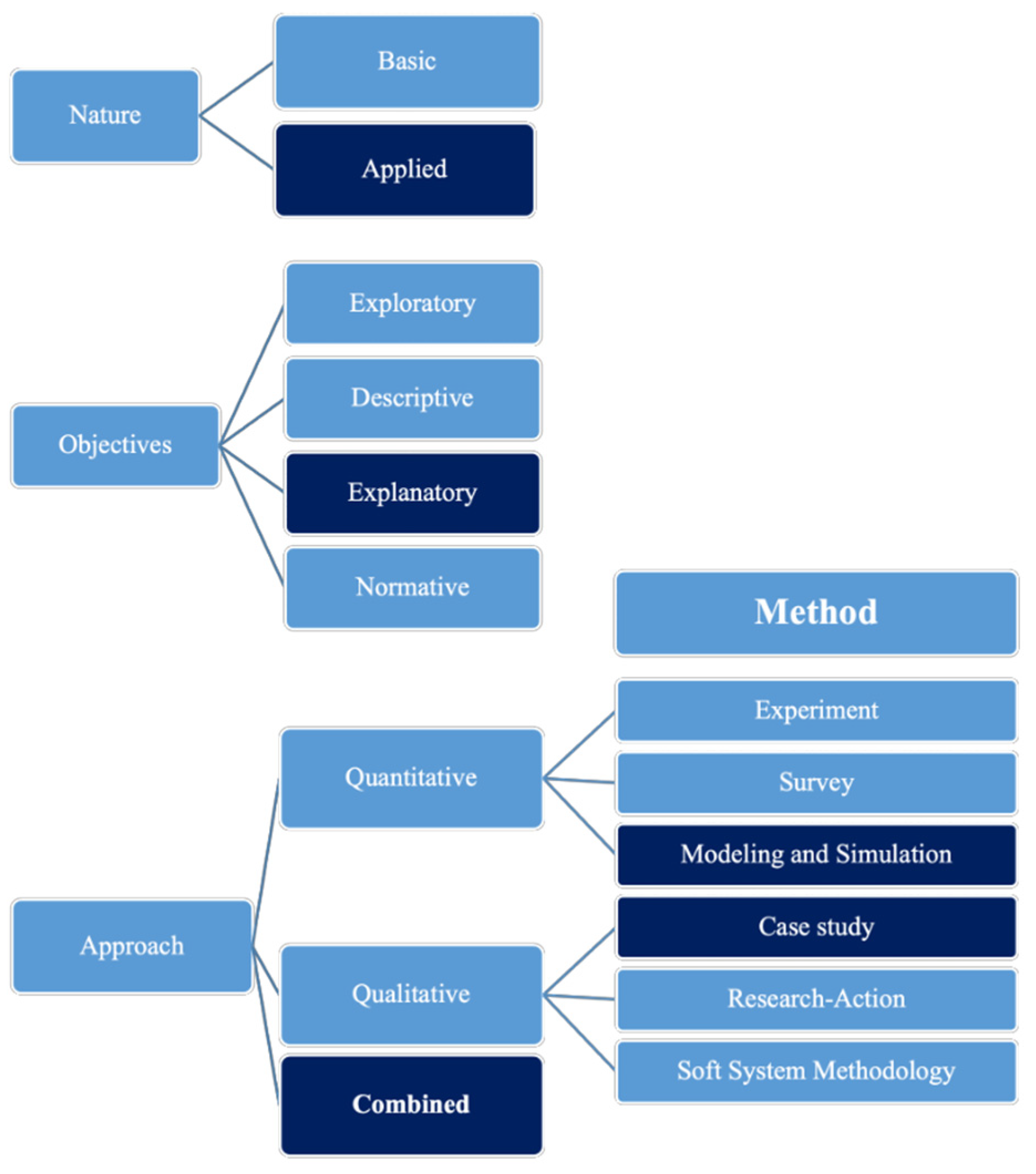

Understanding how innovation, entrepreneurship, and finally economic attractiveness factors impact competitiveness can contribute to developing management strategies to foster economic development in Brazil and Peru. Accordingly, the authors carry out applied research with an explanatory objective, a combined approach (quantitative-qualitative) through Modeling and Simulation (M and S), and a case study [

25].

Figure 1 shows the research classification.

As its main contributions, at a practical level, the study warns about the importance of public power in promoting and consolidating innovation and entrepreneurship in these territories. This study advances the frontier of knowledge at a theoretical level since few studies address competitiveness in developing countries. This research is novel because the authors suggest an alternative methodology to understand the relationships and affinities that impact competitiveness. As a limitation the case study of only two Latin American countries. Future research can focus on comparative studies with other countries. The manuscript is organized as follows:

Section 2 presents a theoretical framework.

Section 3 details the methodology.

Section 4 shows the algorithm’s application.

Section 5 includes a discussion of the results, and

Section 6 the conclusion.

3. Methodology

The Affinities Theory [

18] is a fuzzy algorithm based on the existence of three aspects. First, the homogeneity of each grouping is linked to the level chosen. Depending on the requirement of each characteristic, a higher or lower level will be assigned to define the threshold beyond which homogeneity exists. The second expresses the need for the elements of each of the sets to be linked to each other by specific rules. The third demands constructing a constitutive structure of a particular order susceptible to allowing the subsequent decision. The purpose of the grouping, on the one hand, and the type and strength of the relationship between the elements of one set and another, on the other, unequivocally determine all possible groupings. To establish the affinity relationships, the Moore Family Model is applied, which allows for obtaining appropriate groupings. The presentation of these groupings employing reticular structures highlights the affinities and facilitates decision-making.

Researchers must follow a six-stages process to obtain affinities.

Figure 2 shows the flowchart used in this research.

The first stage establishes a Boolean matrix of fuzzy relatedness of the sets and , cut at some appropriate levels. The second stage lies in obtaining the family of subsets of objects, each of which gathers those with the same characteristics. The third stage presents the corresponding clan from the non-empty mini-terms or atoms. The fourth stage details, for each of the elements of the clan, the calculations of the intersections of the subsets of characteristics possessed by the components of the respective elements of the clan. The fifth stage chooses the corresponding clan element with the largest number of components when more than one feature subset is repeated due to intersection. Finally, the sixth stage presents the meeting of the clan elements with the maximum number of repeated feature subsets forming the affinities. Next, the Fuzzy Logic algorithm is presented in more detail.

The process starts from the knowledge of some fuzzy subsets that define an object

, through some characteristics or elements

, as it is conducted in the field of similarity relations. The sets are:

and

, and the corresponding fuzzy subsets:

| | | | | | |

| | | | ⋯ | | (1) |

,

These fuzzy subsets can be put together to form a fuzzy relation

, such as:

| | | | | | | | |

| | | | | | | | |

| | | | | | | | (2) |

| | | | | | | |

| | | | | | | | |

where we have noted,

To establish the minimum degree from which homogeneity exists for each element, of the set E2 a limit or threshold is determined. Therefore, the values of the , which satisfy will be assigned in a new matrix , values for their elements equal to 1, while when , will be made equal to zero. In this way, the constitute the thresholds above which the desired homogeneity exists for each element of the set E2. The same could be conducted based on set E1, if the nature of the problem is so required.

Here appears the first of the generalizing aspects concerning the schemes based on obtaining distances, since now the resulting Boolean matrix

carries different levels of the values of the characteristic membership function

, for each

. In short, one has:

| | | | | | | | |

| | | | | | | | |

| | | | | | | | (3) |

| | | | | | | |

| | | | | | | | |

where evidently

. The matrix

is the starting point for finding the affinity relations at the chosen

levels.

The concept of a power set is considered next. Given a finite set

, we designate as its power set,

, the one formed by all the possible combinations of its elements taken from 1 by 1, from 2 by 2, …,

m by

m, if

m is its cardinal. In this way, the set obtained is given by:

and set of all its parts or power set is given by:

We now define a Moore family. Let , which, therefore: , if verifies:

(1)

(2) The intersection of the number of parts of

that belongs

, belongs to

. It is written:

therefore

is a “Moore’s family”.

From a Moore’s family closing can be constructed. Moore’s Closure is a functional application, in which all elements of the subset

are made to correspond with a

, such as:

where

represents the subset of the elements of

that contains

and

all elements of

. Note that mathematically to make a Moore closing must be satisfied by the properties of: Extensivity:

; Idempotency:

; Isotony:

Given the matrix form, its analysis normally takes place through the 𝛼−𝑐𝑢𝑡𝑠 (different levels). Thus, a fuzzy relation

on being broken down by any system gives rise to a determined number of Boolean matrices.

From the fuzzy relationship , which is represented in a Boolean matrix with a threshold are obtained right connection and left connection.

The connection to the right,

, the subset elements of

such that for every

, the 𝐵+ are the successors of all elements belonging to

.

where

.

From its definition, the following expression is given:

The connection to the left,

, the subset elements of

such that for every

, the

are the successors of all elements belonging to 𝐴.

where

.

From its definition, the following expression is given:

Due

and

come from a fuzzy relationship

, the closures of Moore

are given by:

where

is the max-min composition.

The closure subsets

come from closure

and

are given by:

In this phase of the process one and the same group of elements of the set can include groups of different elements corresponding to. This occurs if there is always a grouping of elements of that includes the remainder. Therefore, it is necessary to obtain . In the phenomenon occurs for the same group of elements of there are several different elements of . In fact, there is a group of elements of that includes the remainder.

From fuzzy relationship

is considered as the starting point to the rectangular relationship. With a connection to the right and to the left, it is obtained Moore’s closing

and

. In order to the family of closed elements corresponding to the Moore closing

and

are given by:

The families of closed elements

and

are associated by the same cardinal:

Note that these families constitute isomorphic lattices.

Finally, for formal purposes, the relation the Galois lattice can be constructed. Having found the related groupings, it is established an order and structure of the single lattice. To each vertex of the single lattice, both the grouped elements are attached. Assembling the single lattice uses a Galois lattice.

A Galois lattice is an algebraic structure that allows the making of clusters by affinities. Being

and

the power set of

and

are established the ordered relationship [

18] given by:

The following section presents the algorithm’s application considering the attractiveness factors of the Peruvian and Brazilian economies and competitiveness indicators.

5. Discussion

First, in an orderly and systematic manner, the Galois Lattices presents not only all the existing affinities of the economic attractiveness variables, listing the competitiveness indicators each homogeneous group has but also interrelating them through a coherent structure, answering research question RQ1 and confirming the hypothesis H1.

Second, the results show that, in both countries, the business-friendly environment (d) has a relationship of affinities with the government efficiency (B) and business efficiency (C) indicators. In this case, policymakers should act to develop business frameworks favorable to entrepreneurs [

6] and improve innovation incentive policies [

3,

59] since the quality of public institutions influences entrepreneurship, innovation, and competitiveness [

11]. These measures could improve the business-friendly environment (d) and contribute to the competitiveness indicator (B). Another suggestion would be to increase business research and university-business partnerships [

7,

46,

84] since institutions that stimulate business entrepreneurship and sustainable development are essential for innovation and business structuring. These strategies would contribute to the business environment and the competitiveness indicator (C).

Third, access to financing (g) has a relationship of affinities with the indicators of economic performance (A) and business efficiency (C). In Brazil and Peru, it is necessary to increase investment [

52] so that both countries go from being economies driven by efficiency to economies driven by innovation. Furthermore, innovation is the way to ensure greater participation of Small and Medium Enterprises (SMEs) in the national economy [

8] and improve performance in the market [

42]. These strategies could improve access to financing (g) and contribute to competitiveness indicators A and C.

Fourth, the results also reveal that attractiveness factors (b and f) are present only in the Peruvian case. In this case, government competence (b) has an affinity with indicators A and B, and policymakers should create more favorable business conditions with policies and laws that stimulate business development and combat bureaucracy, which is one of the biggest obstacles for entrepreneurs [

39]. Furthermore, public and private incentives for innovation would be essential to increase competitiveness and strengthen Latin American start-ups [

38,

85]. These actions can improve the government’s competence (b) and contribute to competitiveness indicators A and B. On the other hand, a high educational level (f) is associated with indicators C and D. As a recommendation, the country should improve the skills of individuals and support business growth [

58].

Fifth, this research has some limitations. First, this case study has limited regarding the number of countries analyzed, in this case, two, and the amount of information processed. In addition, the countries selected are from LA, which may offer the same challenges and restrictions of the region, limiting the overall view of the subject. The second limitation refers to the number of attractiveness factors used in the model since this study employs the most representative regarding the strongest, intermediate, and weakest factors. Using all fifteen factors of IMD methodology can help shed more light on the understanding of competitiveness. The third limitation concerns the type of model applied. The Affinity Theory presents advantages, but other Fuzzy Logic algorithms can deepen the data analyses, such as Bonferroni Averages with distance and fitness coefficient measures in group theory [

86]. In this case, the BON-OWAAC and BON-OWAIMAM operators allow continuous aggregations, multiple comparisons between each argument, and distance measures in the same formulation according to the ordered position of each argument. In addition, Moore families and Galois lattices gather parameters according to their affinities [

86]. Another suggestion would be to apply the Forgotten Effects Theory [

16] since this method reveals forgotten elements or effects that are not readily observable with other methodologies, allowing for predicting and acting more effectively on the causes, thus minimizing the effects [

16].

Finally, some scientists may suggest performing a Sensitivity Analysis (SA) to show the robustness of the proposed method. By definition, SA means a process in which one or several factors of a problem are modified to evaluate their effects on some result or quantity of interest [

87]. Despite the importance of this type of analysis, researchers revealed the inappropriate use of SA [

88] and that 42% of publications with SA need to comply with the elementary requirement of adequately exploring the space of input factors [

89]. Therefore, the authors [

87] recommend first knowing the need to run the SA for a given problem and how the SA is expected to respond to this question. Likewise, it is necessary to design the SA experiment to address that underlying question [

87]. In this direction, the variables used in the proposed model result from a literature review, as well as the alpha threshold used. Likewise, the entries come from real data from an applied study [

10]. The main objective was to know the relationships of affinities between the factors of economic attractiveness and indicators of competitiveness, with scientific support and not assumptions. Likewise, the proposed model is validated in other research [

24,

79] and follows the recommendations to ensure confidence in the M and S process [

90]. For these reasons, the authors consider not applying to perform an SA, modify variables, and make assumptions about the input values.

6. Conclusions

This research analyzed how innovation and entrepreneurship influence competitiveness in Brazil and Peru, revealing central policies to improve entrepreneurship’s quality and impact. A literature review allowed for identifying knowledge gaps and understanding the landscape in both countries in these topics. In addition, the authors applied a Fuzzy Logic algorithm to identify the affinity relationships between the attractiveness factors of the economies and the competitiveness indicators.

As practical implications, the study might support policymakers in formulating development strategies and stimuli for business competitiveness. In this sense, the relationships of affinities allowed for the identification of points of convergence between the two countries, information that can help in planning public policies for regional development. In addition, the manuscript alerted the importance of promoting innovation and entrepreneurship. Also, the authors suggested increasing public investment in R&D and encouraging private sector R&D. On the other hand, academic and business leaders may strengthen university-business collaboration with applied research in innovation and entrepreneurship.

As theoretical implications, the research expanded the frontier of knowledge about innovation and entrepreneurship. Surprisingly, few studies explore competitiveness in developing countries. The Affinities Theory demonstrated that it could facilitate decision-making by establishing the level of relationship between the variables and obtaining the corresponding affinities. The Galois lattices revealed in a structured way the affinities between the different variables in terms of their degrees of compliance. Also, the step-by-step explanation given by the authors allows the audience to understand how it works methodology. So, this paper could help researchers in the application of this algorithm. Additionally, the study was novel in comparing the two countries in these lines of research and contributing to science by reducing the gaps identified. Future research can compare different countries at different levels of development to verify how attractiveness factors are related to competitive factors.