Is Technical Analysis Profitable on Renewable Energy Stocks? Evidence from Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems

Abstract

:1. Introduction

2. Research Methods

2.1. Data

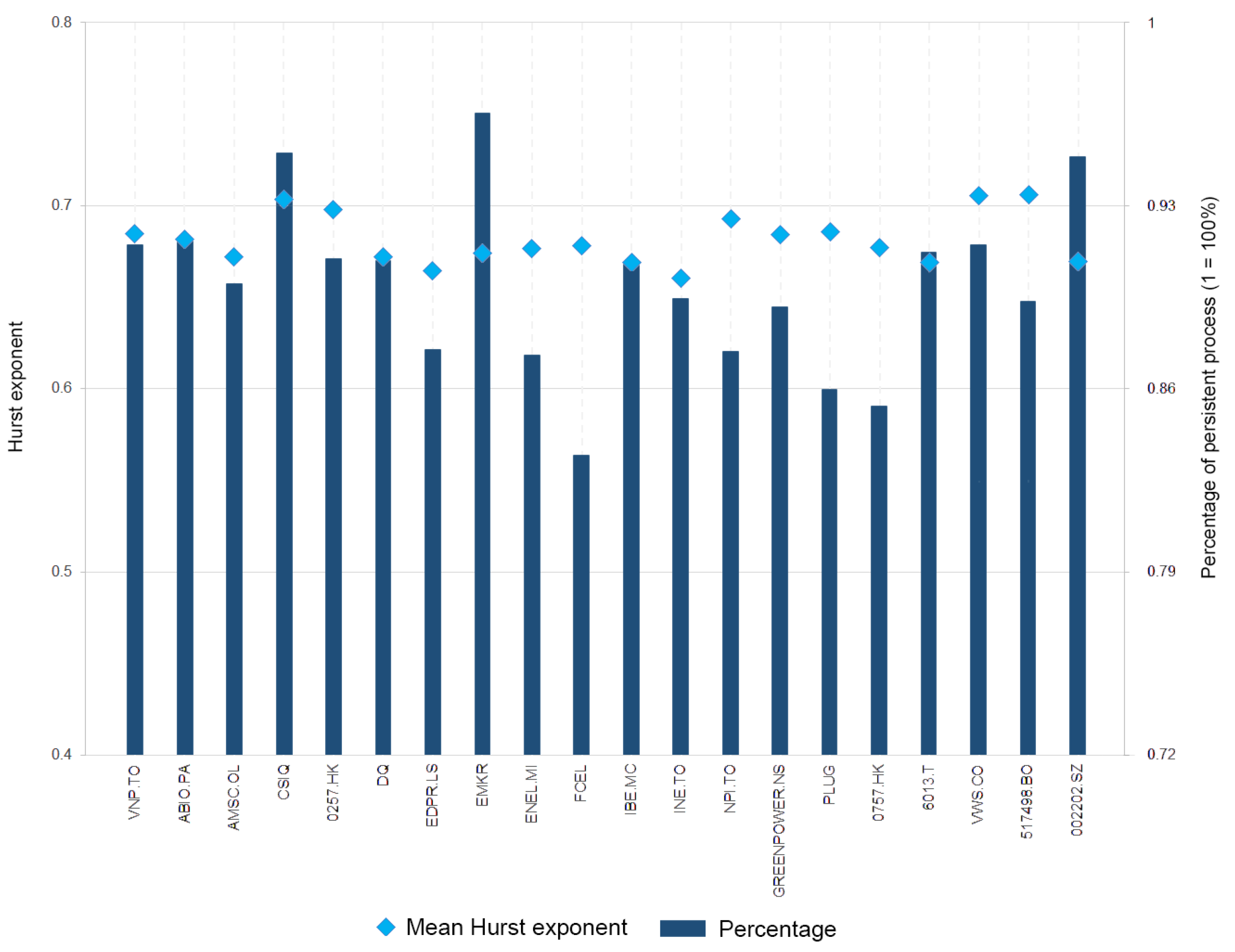

2.2. Fractal Analysis and Technical Indicators

- MACD (trading occurs when signals are generated, regardless of market phases);

- BB (trading occurs when signals are generated, regardless of market phases);

- MACD-BB (trading occurs based on signals from MACD and BB, regardless of market phases);

- D-MACD (trading occurs based on signals triggered by MACD but only when D shows the market is in the trending mode);

- D-BB (trading using BB signals is only executed when the market is in the mean-reversion phase);

- D-MACD-BB (trading is done using signals from MACD when the market is trending and BB when the market is mean-reverting).

2.3. Robustness—Experimental Design and Performance Evaluation

3. Results and Discussion

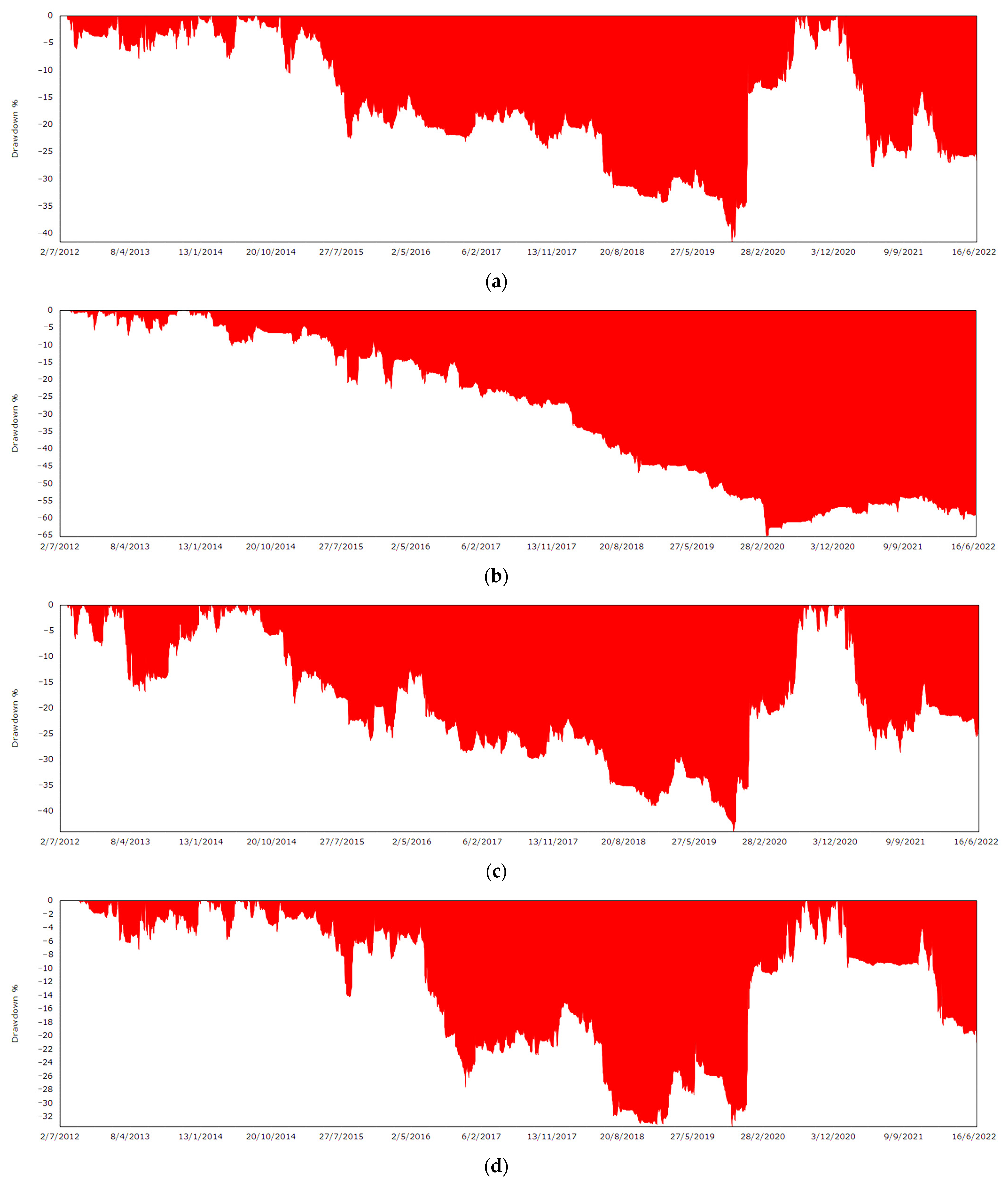

3.1. Performance of Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems

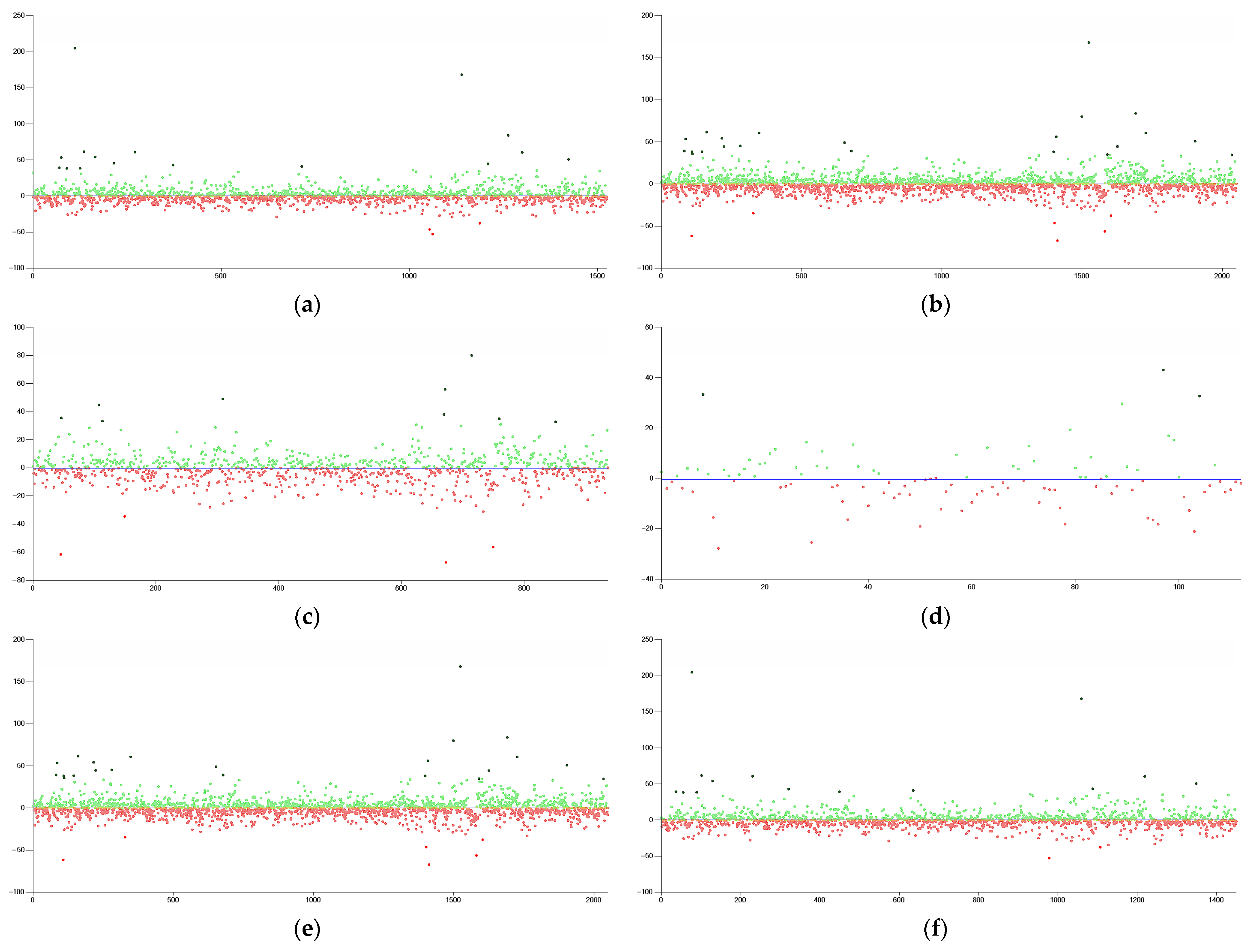

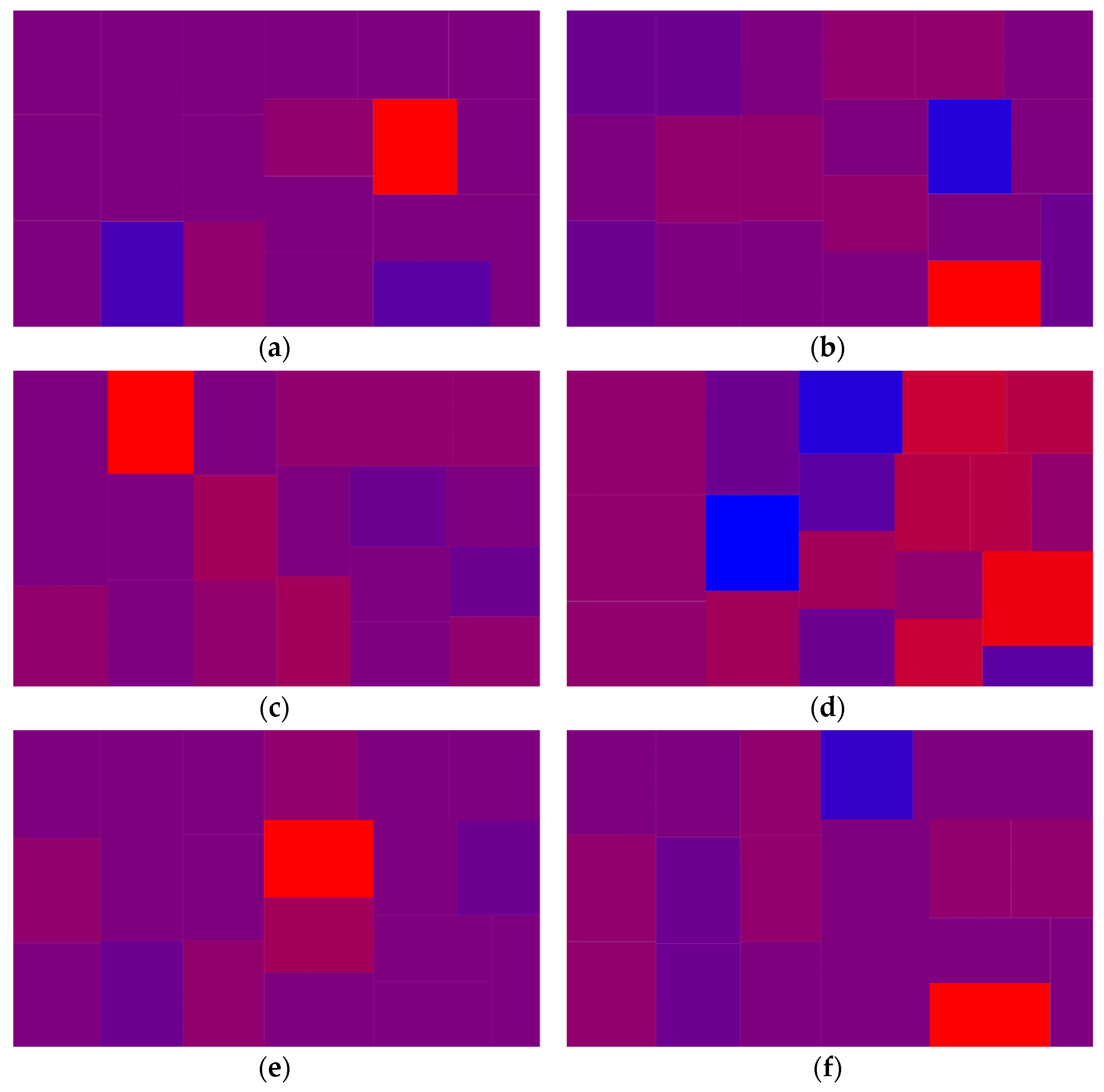

3.2. Robustness

4. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Parameters | NP (%) | MD (%) | MAR | RF | SR | SOR | |

|---|---|---|---|---|---|---|---|

| Panel A. MACD | |||||||

| T1 | MACD (11,19,5) | 164.41 | −30.56 | 0.33 | 3.77 | 0.59 | 1.92 |

| T2 | MACD (14,63,5) | 165.70 | −24.96 | 0.40 | 4.10 | 0.78 | 1.90 |

| T3 | MACD (9,49,7) | 164.89 | −36.04 | 0.28 | 2.43 | 0.63 | 1.89 |

| B3 | MACD (17,72,15) | −36.14 | −53.73 | 0 | 0 | −0.34 | −0.49 |

| B2 | MACD (19,67,15) | −46.66 | −67.73 | 0 | 0 | −0.41 | −0.57 |

| B1 | MACD (20,79,11) | −41.56 | −59.76 | 0 | 0 | −0.42 | −0.61 |

| Panel B. BB | |||||||

| T1 * | BB (59,2.5) | 0.002 | −10.30 | 0 | 0.03 | 0.02 | 0.02 |

| T2 | BB (50,2.5) | −8.68 | −29.25 | 0 | 0 | −0.12 | −0.12 |

| T3 | BB (56,2.5) | −5.76 | −15.44 | 0 | 0 | −0.16 | −0.16 |

| B3 | BB (30,2.5) | −52.19 | −52.95 | 0 | 0 | −1.25 | −1.35 |

| B2 | BB (50,2) | −62.03 | −64.45 | 0 | 0 | −1.29 | −1.36 |

| B1 | BB (25,1) | −72.80 | −76.06 | 0 | 0 | −0.89 | −1.40 |

| Panel C. MACD-BB | |||||||

| T1 | MACD (10,25,7), BB (47,2.5) | 231.18 | −36.63 | 0.35 | 3.14 | 0.70 | 2.31 |

| T2 | MACD (14,37,9), BB (60,2.5) | 214.46 | −24.07 | 0.50 | 4.70 | 0.83 | 2.15 |

| T3 | MACD (9,29,7), BB (60,2.5) | 235.17 | −28.23 | 0.46 | 3.18 | 0.59 | 2.05 |

| B3 | MACD (18,90,15), BB (25,1) | −70.38 | −74.12 | 0 | 0 | −0.70 | −0.95 |

| B2 | MACD (20,90,14), BB (28,1) | −60.05 | −69.02 | 0 | 0 | −0.76 | −1.00 |

| B1 | MACD (16,34,14), BB (38,1) | −61.47 | −66.56 | 0 | 0 | −0.67 | −1.02 |

| Parameters | NP (%) | MD (%) | MAR | RF | SR | SOR | |

|---|---|---|---|---|---|---|---|

| Panel A. D-MACD | |||||||

| T1 | MACD (20,28,6) | 292.18 | −22.83 | 0.57 | 5.70 | 0.67 | 2.55 |

| T2 | MACD (15,20,12) | 183.05 | −30.37 | 0.35 | 3.23 | 0.57 | 2.54 |

| T3 | MACD (20,52,5) | 220.31 | −37.13 | 0.36 | 2.99 | 0.73 | 2.52 |

| B3 | MACD (16,90,12) | −42.27 | −58.27 | 0 | 0 | −0.51 | −0.67 |

| B2 | MACD (20,27,11) | −40.11 | −60.62 | 0 | 0 | −0.43 | −0.71 |

| B1 | MACD (18,88,7) | −49.32 | −61.24 | 0 | 0 | −0.56 | −0.80 |

| Panel B. D-BB | |||||||

| T1 | BB (56,1) | 15.82 | −5.20 | 0.21 | 2.11 | 0.50 | 0.79 |

| T2 | BB (32,2.5) | 4.14 | −1.08 | 0.19 | 1.77 | 0.37 | 0.69 |

| T3 | BB (58,1) | 15.40 | −5.90 | 0.22 | 2.18 | 0.50 | 0.66 |

| B3 | BB (29,1) | −19.30 | −20.83 | 0 | 0 | −0.65 | −0.60 |

| B2 | BB (23,1) | −22.77 | −24.57 | 0 | 0 | −0.63 | −0.66 |

| B1 | BB (24,1) | −29.37 | −30.85 | 0 | 0 | −0.76 | −0.80 |

| Panel C. D-MACD-BB | |||||||

| T1 | MACD (20,47,5), BB (10,1) | 264.31 | −24.60 | 0.56 | 3.98 | 0.77 | 2.94 |

| T2 | MACD (8,66,7), BB (52,1) | 255.63 | −21.94 | 0.62 | 4.66 | 1.02 | 2.92 |

| T3 | MACD (13,30,5), BB (10,2) | 278.74 | −26.90 | 0.53 | 3.80 | 0.71 | 2.82 |

| B3 | MACD (20,90,11), BB (23,1) | −43.40 | −59.99 | 0 | 0 | −0.48 | −0.72 |

| B2 | MACD (18,82,8), BB (60,2) | −51.41 | −59.54 | 0 | 0 | −0.55 | −0.78 |

| B1 | MACD (20,81,13), BB (31,1.5) | −59.79 | −67.94 | 0 | 0 | −0.81 | −0.89 |

References

- Best, R. Switching towards coal or renewable energy? The effects of financial capital on energy transitions. Energy Econ. 2017, 63, 75–83. [Google Scholar] [CrossRef] [Green Version]

- International Energy Agency. World Energy Investment 2021. Available online: https://www.iea.org/reports/world-energy-investment-2021 (accessed on 18 August 2022).

- Centre for Climate Finance and Investment. Clean Energy Investing: Global Comparison of Investment Returns. A Joint Report by the International Energy Agency and the Centre for Climate Finance & Investment. Available online: https://www.iea.org/reports/clean-energy-investing-global-comparison-of-investment-returns (accessed on 18 August 2022).

- Chang, C.L.; Ilomäki, J.; Laurila, H.; McAleer, M. Market timing with moving averages for fossil fuel and renewable energy stocks. Energy Rep. 2020, 6, 1798–1810. [Google Scholar] [CrossRef]

- Chang, C.-L.; McAleer, M.; Wang, C.-H. An econometric analysis of ETF and ETF futures in financial and energy markets using generated regressors. Int. J. Financ. Stud. 2018, 6, 2. [Google Scholar] [CrossRef] [Green Version]

- Bessembinder, H.; Chan, K. The profitability of technical trading rules in the Asian stock markets. Pac.-Basin Financ. J. 1995, 3, 257–284. [Google Scholar] [CrossRef]

- Hudson, R.; Urquhart, A. Technical trading and cryptocurrencies. Ann. Oper. Res. 2021, 297, 191–220. [Google Scholar] [CrossRef] [Green Version]

- Metghalchi, M.; Kagochi, J.; Hayes, L. A technical approach to equity investing in South Africa: A tale of two indexes. Cogent Econ. Financ. 2021, 9, 1. [Google Scholar] [CrossRef]

- Ni, Y.; Day, M.-Y.; Huang, P.; Yu, S.-R. The profitability of Bollinger bands: Evidence from the constituent stocks of Taiwan 50. Phys. A Stat. Mech. Its Appl. 2020, 551, 1241–1244. [Google Scholar] [CrossRef]

- Wong, W.-K.; Manzur, M.; Chew, B.-K. How rewarding is technical analysis? Evidence from Singapore stock market. Appl. Financ. Econ. 2003, 13, 543–551. [Google Scholar] [CrossRef]

- Chen, Y.; Zhang, C.; He, K.; Zheng, A. Multi-step-ahead crude oil price forecasting using a hybrid grey wave model. Phys. A Stat. Mech. Its Appl. 2018, 501, 98–110. [Google Scholar] [CrossRef]

- Gurrib, I.; Kamalov, F.; Elshareif, E. Can the leading US energy stock prices be predicted using the Ichimoku Cloud? Int. J. Energy Econ. Policy 2021, 11, 41–51. [Google Scholar] [CrossRef]

- Lin, Z.W.; Hsu, S.T.H.; Huang, C.S. Technical analysis and market efficiency: An empirical examination on energy markets. Invest. Manag. Financ. Innov. 2014, 11, 189–199. [Google Scholar]

- Thomakos, D.D.; Papailias, F. Momentum trading in New York Stock Exchange (NYSE) Energy Stocks. Int. J. Energy Stat. 2013, 01, 243–256. [Google Scholar] [CrossRef]

- Sullivan, R.; Timmermann, R.; White, H. Data-snooping, technical trading rule performance, and the bootstrap. J. Financ. 1999, 54, 1647–1691. [Google Scholar] [CrossRef]

- Batten, J.A.; Ciner, C.; Lucey, B.M.; Szilagyi, P.G. The structure of gold and silver spread returns. Quant. Financ. 2013, 13, 561–570. [Google Scholar] [CrossRef]

- Auer, B.R. On the performance of simple trading rules derived from the fractal dynamics of gold and silver price fluctuations. Financ. Res. Lett. 2016, 16, 255–267. [Google Scholar] [CrossRef]

- Paluch, M.; Jackowska-Strumiłło, L. Hybrid models combining technical and fractal analysis with ANN for short-term prediction of close values on the Warsaw Stock Exchange. Appl. Sci. 2018, 8, 2473. [Google Scholar] [CrossRef] [Green Version]

- Mahata, A.; Nurujjaman, M. Time scales and characteristics of stock markets in different investment horizons. Front. Phys. 2020, 8, 590623. [Google Scholar] [CrossRef]

- Brock, W.; Lakonishok, J.; LeBaron, B. Simple technical trading rules and the stochastic properties of stock returns. J. Financ. 1992, 47, 1731–1764. [Google Scholar] [CrossRef]

- Ni, Y.; Day, M.-Y.; Cheng, Y.; Huang, P. Can investors profit by utilizing technical trading strategies? Evidence from the Korean and Chinese stock markets. Financ. Innov. 2022, 8, 54. [Google Scholar] [CrossRef]

- James, J.; Yang, L. Stop-losses, maximum drawdown-at-risk and replicating financial time series with the stationary bootstrap. Quant. Financ. 2010, 10, 1–12. [Google Scholar] [CrossRef]

- Virgilio, G.P.M. A theory of very short-time price change: Security price drivers in times of high-frequency trading. Financ. Innov. 2022, 8, 66. [Google Scholar] [CrossRef]

- Vayanos, D.; Woolley, P. An institutional theory of momentum and reversal. Rev. Financ. Stud. 2013, 26, 1087–1145. [Google Scholar] [CrossRef] [Green Version]

- Appel, G. The Moving Average Convergence-Divergence Method; Signalert: Great Neck, NY, USA, 1979. [Google Scholar]

- Bollinger, J. Bollinger on Bollinger Bands; McGraw-Hill: New York, NY, USA, 2001. [Google Scholar]

- Ehlers, J.F.; Way, R. Fractal Dimension as a market mode sensor. Tech. Anal. Stock. Commod. 2010, 28, 16–20. [Google Scholar]

- Gerritsen, D.F. Are chartists artists? The determinants and profitability of recommendations based on technical analysis. Int. Rev. Financ. Anal. 2016, 47, 179–196. [Google Scholar] [CrossRef]

- Lento, C.; Gradojevic, N. The profitability of technical analysis during the COVID-19 market meltdown. J. Risk Financ. Manag. 2022, 15, 192. [Google Scholar] [CrossRef]

- Wang, J.; Kim, J. Predicting stock price trend using MACD optimized by historical volatility. Math. Probl. Eng. 2018, 2018, 9280590. [Google Scholar] [CrossRef] [Green Version]

- Xie, A.; Huang, Y.; Bian, Y.; Zhao, S.; Lin, J. Research on the performance of the trend following trading strategy in the Chinese commodity market. Wirel. Commun. Mob. Comput. 2022, 2022, 5296678. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Phys. A Stat. Mech. Its Appl. 2002, 316, 87–114. [Google Scholar] [CrossRef] [Green Version]

- Mandelbrot, B. The Fractal Geometry of Nature; W. H. Freeman and Company: New York, NY, USA, 1983. [Google Scholar]

- Ehlers, J.F. Cybernetics Analysis for Stocks and Futures; John Wiley & Sons: New York, NY, USA, 2004. [Google Scholar]

- Mulligan, R.F.; Koppl, R. Monetary policy regimes in macroeconomic data: An application of fractal analysis. Q. Rev. Econ. Financ. 2011, 51, 201–211. [Google Scholar] [CrossRef]

- Chong, T.T.-L.; Ng, W.-K. Technical analysis and the London stock exchange: Testing the MACD and RSI rules using the FT30. Appl. Econ. Lett. 2008, 15, 1111–1114. [Google Scholar] [CrossRef]

- Nor, S.M.; Wickremasinghe, G. The profitability of MACD and RSI trading rules in the Australian stock market. Invest. Manag. Financ. Innov. 2014, 11, 194–199. [Google Scholar]

- Nor, S.M.; Zawawi, N.H.M. Does technical analysis work in the Russian market? Insights from MICEX (MOEX Russia) Index component stocks. Econ. Ann.-XXI 2019, 178, 114–122. [Google Scholar] [CrossRef] [Green Version]

- White, H.A. Reality check for data snooping. Econometrica 2000, 68, 1097–1126. [Google Scholar] [CrossRef]

- Hansen, P.R.A. Test for superior predictive ability. J. Bus. Econ. Stat. 2005, 23, 365–380. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Karjalainen, R. Using genetic algorithms to find technical trading rules. J. Financ. Econ. 1999, 51, 245–271. [Google Scholar] [CrossRef]

- Neely, C.; Weller, P.; Dittmar, R. Is technical analysis in the foreign exchange market profitable? A genetic programming approach. J. Financ. Quant. Anal. 1997, 32, 405–426. [Google Scholar] [CrossRef] [Green Version]

- Qu, H.; Li, X. Building technical trading system with genetic programming: A new method to test the efficiency of Chinese stock markets. Comput. Econ. 2014, 43, 301–311. [Google Scholar] [CrossRef]

- Olasolo, A.; Pérez, M.A.; Ruiz, V. Active investment strategies in the Spanish futures market: A solution to avoid data snooping bias. Appl. Econ. Lett. 2016, 23, 609–613. [Google Scholar] [CrossRef]

- Timmermann, A.; Granger, C.W.J. Efficient market hypothesis and forecasting. Int. J. Forecast. 2004, 20, 15–27. [Google Scholar] [CrossRef]

- Chande, T.S. Beyond Technical Analysis: How to Develop and Implement a Winning Trading System; Wiley: New York, NY, USA, 1997. [Google Scholar]

- Pardo, R. The Evaluation and Optimization of Trading Strategies, 2nd ed.; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Balsara, N. Money Management Strategies for Future Traders; John Wiley & Sons: New York, NY, USA, 1992. [Google Scholar]

- Tharp, V.K. Trade Your Way to Financial Freedom; McGraw-Hill: New York, NY, USA, 1998. [Google Scholar]

- Pring, M.J. Martin Pring’s Introduction to Technical Analysis; McGraw-Hill: Singapore, 1999. [Google Scholar]

- Boik, J. Lessons from the Greatest Stock Traders of All Time; McGraw-Hill: New York, NY, USA, 2004. [Google Scholar]

- Bernstein, J. The Compleat Day Trader II; McGraw-Hill: New York, NY, USA, 1998. [Google Scholar]

- Wong, K.; Guppy, D. Stocks and Forex Trading: How to Win; World Scientific: Singapore, 2021. [Google Scholar]

- Opdyke, J. Comparing Sharpe ratios: So where are the p-values? J. Asset Manag. 2007, 8, 308–336. [Google Scholar] [CrossRef]

- Wilmott, P. Paul Wilmott on Quantitative Finance; John Wiley & Sons: West Sussex, UK, 2006. [Google Scholar]

- Metghalchi, M.; Hayes, L.A.; Niroomand, F. A technical approach to equity investing in emerging markets. Rev. Financ. Econ. 2019, 37, 389–403. [Google Scholar] [CrossRef]

- Malkiel, B.A. Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing; W. W. Norton & Company: New York, NY, USA, 2007. [Google Scholar]

- Krajačić, G.; Duić, N.; Carvalho, M.D.G. H2RES, Energy planning tool for island energy systems—The case of the Island of Mljet. Int. J. Hydrog. Energy 2009, 34, 7015–7026. [Google Scholar] [CrossRef]

- McLean, R.D.; Pontiff, J. Does academic research destroy stock return predictability? J. Financ. 2016, 71, 5–32. [Google Scholar] [CrossRef]

- Rosillo, R.; De la Fuente, D.; Brugos, J.A.L. Technical analysis and the Spanish stock exchange: Testing the RSI, MACD, momentum and stochastic rules using Spanish market companies. Appl. Econ. 2013, 45, 1541–1550. [Google Scholar] [CrossRef]

- Nor, S.M.; Zawawi, N.H.M. Technical trading profitability: Evidence from international oil and gas companies. In AIP Conference Proceedings; American Institute of Physics: College Park, MD, USA, 2022; Volume 2644, p. 030036. [Google Scholar] [CrossRef]

- Bouri, E.; Naeem, M.A.; Nor, S.M.; Mbarki, I.; Saeed, T. Government responses to COVID-19 and industry stock returns. Econ. Res.-Ekon. Istraživanja 2022, 35, 1967–1990. [Google Scholar] [CrossRef]

- Shanmugam, V.P.; Ali, K.A.A. Impact of COVID-19 pandemic on equity-oriented mutual funds: A preliminary analysis of Indian mutual funds industry. Int. J. Financ. Eng. 2021, 8, 2150006. [Google Scholar] [CrossRef]

- Khelife, S.B.; Urom, C.; Guesmi, K.; Benkraiem, R. American hedge funds industry, market timing and COVID-19 crisis. J. Asset Manag. 2022, 23, 390–399. [Google Scholar] [CrossRef]

- Yarovaya, L.; Mirza, N.; Abaidi, J.; Hasnaoui, A. Human Capital efficiency and equity funds’ performance during the COVID-19 pandemic. Int. Rev. Econ. Financ. 2021, 71, 584–591. [Google Scholar] [CrossRef]

- Nor, S.M.; Zawawi, N.H.M. A neural network approach for fundamental investment analysis: A case of Athens Stock Exchange. Econ. Ann.-XXI 2020, 182, 56–63. [Google Scholar] [CrossRef]

- Ayala, J.; García-Torres, M.; Noguera, J.L.V.; Gómez-Vela, F.; Divina, F. Technical analysis strategy optimization using a machine learning approach in stock market indices. Knowl.-Based Syst. 2021, 225, 107119. [Google Scholar] [CrossRef]

- Adcock, R.; Gradojevic, N. Non-fundamental, non-parametric Bitcoin forecasting. Phys. A Stat. Mech. Its Appl. 2019, 531, 121727. [Google Scholar] [CrossRef]

- Corbet, S.; Eraslan, V.; Lucey, B.; Sensoy, A. The effectiveness of technical trading rules in cryptocurrency markets. Financ. Res. Lett. 2019, 31, 32–37. [Google Scholar] [CrossRef]

- Gencay, R.; Stengos, T. Technical trading rules and the size of the risk premium in security returns. Stud. Nonlinear Dyn. Econom. 1997, 2, 23–34. [Google Scholar] [CrossRef]

- Gencay, R. Linear, non-linear and essential foreign exchange rate prediction with simple technical trading rules. J. Int. Econ. 1999, 47, 91–107. [Google Scholar] [CrossRef]

- Gradojevic, N.; Kukolj, D.; Adcock, R.; Djakovic, V. Forecasting Bitcoin with technical analysis: A not-so-random forest? Int. J. Forecast. 2023, 39, 1–17. [Google Scholar] [CrossRef]

- Kozyra, J.; Lento, C. Using VIX data to enhance technical trading signals. Appl. Econ. Lett. 2011, 18, 1367–1370. [Google Scholar] [CrossRef]

- Lento, C.; Gradojevic, N.; Wright, C.S. Investment information content in Bollinger Bands? Appl. Financ. Econ. Lett. 2007, 3, 263–267. [Google Scholar] [CrossRef]

- Wen, D.; He, M.; Liu, L.; Zhang, Y. Forecasting crude oil prices: Do technical indicators need economic constraints? Quant. Financ. 2022, 22, 1545–1559. [Google Scholar] [CrossRef]

| Company | Stock Code | Mean | Min | Max | SD | Skew | Kurt | |

|---|---|---|---|---|---|---|---|---|

| 1 | 5N Plus | VNP.TO | 0.333 | −41.63 | 39.81 | 10.187 | 0.09 | 2.992 |

| 2 | Albioma | ABIO.PA | 0.643 | −31.18 | 15.4 | 5.251 | −0.555 | 4.944 |

| 3 | American Shipping Company | AMSC.OL | 1.746 | −32.55 | 160.32 | 14.73 | 6.176 | 58.177 |

| 4 | Canadian Solar | CSIQ | 1.566 | −34.54 | 68.13 | 12.289 | 0.686 | 3.583 |

| 5 | China Everbright Environment Group | 0257.HK | 0.524 | −30.39 | 24.87 | 6.802 | 0.308 | 2.864 |

| 6 | Daqo New Energy | DQ | 2.696 | −44.98 | 94.14 | 18.129 | 1.379 | 5.042 |

| 7 | EDP Renováveis | EDPR.LS | 0.918 | −22.56 | 21.44 | 5.146 | 0.26 | 3.269 |

| 8 | EMCORE Corporation | EMKR | 0.61 | −33.56 | 47.95 | 10.036 | 0.814 | 4.562 |

| 9 | Enel | ENEL.MI | 0.568 | −26.45 | 18.38 | 4.741 | −0.475 | 4.225 |

| 10 | FuelCell Energy | FCEL | 0.903 | −60.26 | 147.62 | 22.772 | 2.617 | 13.883 |

| 11 | Iberdrola | IBE.MC | 0.499 | −19.05 | 10.82 | 4.053 | −0.875 | 3.209 |

| 12 | Innergex Renewable Energy | INE.TO | 0.191 | −19 | 15.81 | 4.242 | −0.024 | 3.037 |

| 13 | Northland Power | NPI.TO | 0.406 | −17.69 | 11.06 | 3.772 | −0.591 | 2.848 |

| 14 | Orient Green Power Company | GREENPOWER.NS | 0.894 | −29.65 | 52.76 | 12.909 | 1.078 | 2.593 |

| 15 | Plug Power | PLUG | 2.758 | −67.5 | 212.12 | 23.778 | 3.689 | 26.705 |

| 16 | Solargiga Energy Holdings | 0757.HK | 0.783 | −35.44 | 108.33 | 13.133 | 3.586 | 22.751 |

| 17 | Takuma | 6013.T | 0.645 | −19.34 | 23.49 | 6.394 | 0.021 | 0.581 |

| 18 | Vestas Wind Systems | VWS.CO | 1.576 | −26.39 | 38.17 | 8.286 | 0.244 | 1.781 |

| 19 | Websol Energy System | 517498.BO | 2.238 | −30.24 | 84.97 | 17.373 | 1.556 | 3.728 |

| 20 | Xinjiang Goldwind Science & Technology | 002202.SZ | 0.813 | −23 | 30.64 | 8.568 | 0.591 | 1.309 |

| Benchmark | Non-Fractal Systems | Hybrid Fractal Systems | |||||

|---|---|---|---|---|---|---|---|

| Performance Measures | B&H | MACD | BB | MACD-BB | D-MACD | D-BB | D-MACD-BB |

| Net Profit (%) | 46.74 | 45.68 | −56.00 | 64.52 | 78.85 | −8.88 | 112.69 |

| Annualized Return (%) | 3.91 | 3.84 | −7.89 | 5.11 | 5.99 | −0.93 | 7.84 |

| Mean Return (USD) | 9.65 | 29.94 | −59.77 | 31.46 | 58.76 | −78.58 | 77.66 |

| µTS > 0 | - | 0.2045 | 0.9945 | 0.0805 * | 0.1810 | 0.8775 | 0.0080 *** |

| µTS > µB&H | - | 0.2030 | 0.9880 | 0.2045 | 0.0670 * | 0.8440 | 0.0102 ** |

| Ulcer Index | 35.68 | 18.88 | 36.40 | 21.72 | 15.62 | 9.24 | 8.14 |

| Max Drawdown (%) | −71.67 | −41.56 | −65.32 | −43.99 | −33.45 | −18.65 | −27.87 |

| Max Drawdown Date | 23 March 2020 | 29 October 2019 | 18 March 2020 | 29 October 2019 | 29 October 2019 | 20 March 2020 | 7 November 2019 |

| Benchmark | Non-Fractal Systems | Hybrid Fractal Systems | |||||

|---|---|---|---|---|---|---|---|

| Performance Measures | B&H | MACD | BB | MACD-BB | D-MACD | D-BB | D-MACD-BB |

| Sharpe Ratio | 0.32 | 0.29 | −0.73 | 0.40 | 0.48 | −0.33 | 0.73 |

| SRTS > 0 | - | 0.1626 | 0.9925 | 0.1118 | 0.0474 ** | 0.8671 | 0.0049 *** |

| SRTS > SRB&H | - | 0.5232 | 0.9993 | 0.3927 | 0.2813 | 0.9240 | 0.0804 * |

| Sortino Ratio | 0.62 | 0.63 | −0.89 | 0.87 | 1.07 | −0.27 | 1.56 |

| Recovery Factor | 0.28 | 0.81 | 0 | 1.03 | 1.54 | 0 | 2.56 |

| MAR Ratio | 0.05 | 0.09 | 0 | 0.12 | 0.18 | 0 | 0.28 |

| Tail Ratio | 1.11 | 1.00 | 0.92 | 1.08 | 1.19 | 0.88 | 1.24 |

| Ulcer Performance Index | 0.11 | 0.20 | −0.22 | 0.24 | 0.38 | −0.10 | 0.96 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nor, S.M.; Zawawi, N.H.M.; Wickremasinghe, G.; Halim, Z.A. Is Technical Analysis Profitable on Renewable Energy Stocks? Evidence from Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems. Axioms 2023, 12, 127. https://doi.org/10.3390/axioms12020127

Nor SM, Zawawi NHM, Wickremasinghe G, Halim ZA. Is Technical Analysis Profitable on Renewable Energy Stocks? Evidence from Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems. Axioms. 2023; 12(2):127. https://doi.org/10.3390/axioms12020127

Chicago/Turabian StyleNor, Safwan Mohd, Nur Haiza Muhammad Zawawi, Guneratne Wickremasinghe, and Zairihan Abdul Halim. 2023. "Is Technical Analysis Profitable on Renewable Energy Stocks? Evidence from Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems" Axioms 12, no. 2: 127. https://doi.org/10.3390/axioms12020127

APA StyleNor, S. M., Zawawi, N. H. M., Wickremasinghe, G., & Halim, Z. A. (2023). Is Technical Analysis Profitable on Renewable Energy Stocks? Evidence from Trend-Reinforcing, Mean-Reverting and Hybrid Fractal Trading Systems. Axioms, 12(2), 127. https://doi.org/10.3390/axioms12020127