Risk Analysis: Changing the Story with the Statistical Stochastic Process and VaR

Abstract

:1. Introduction

2. Literature Review

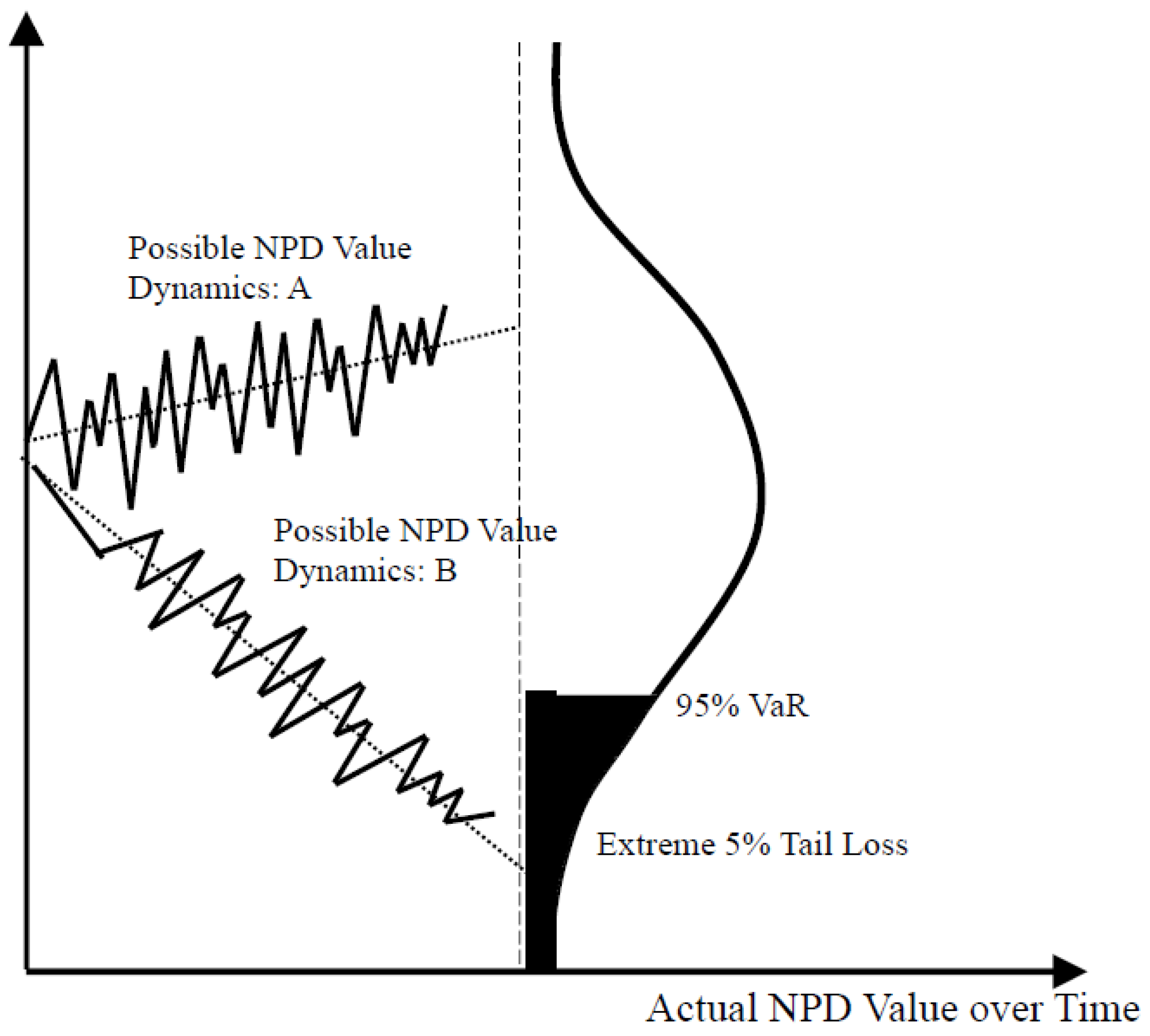

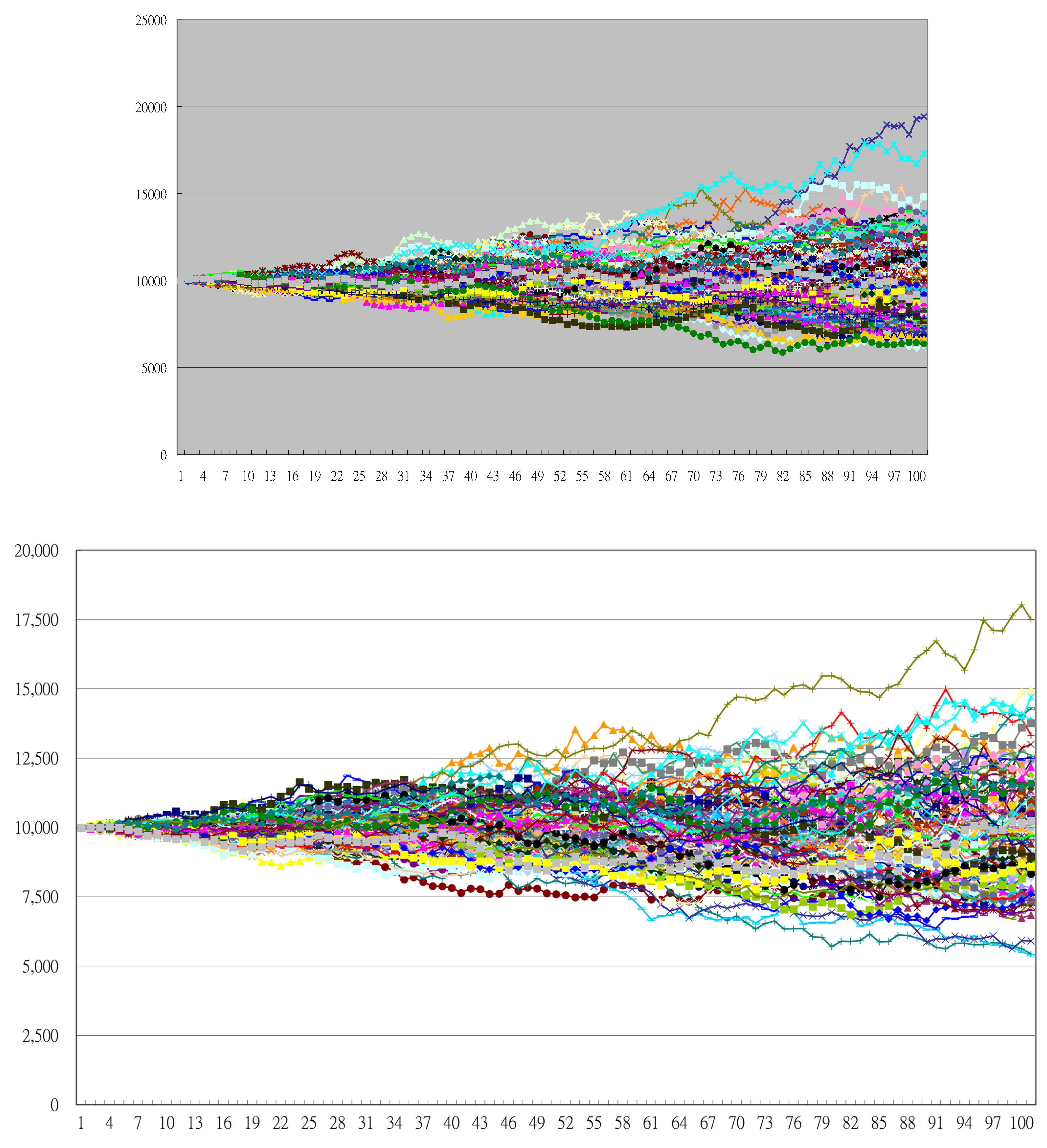

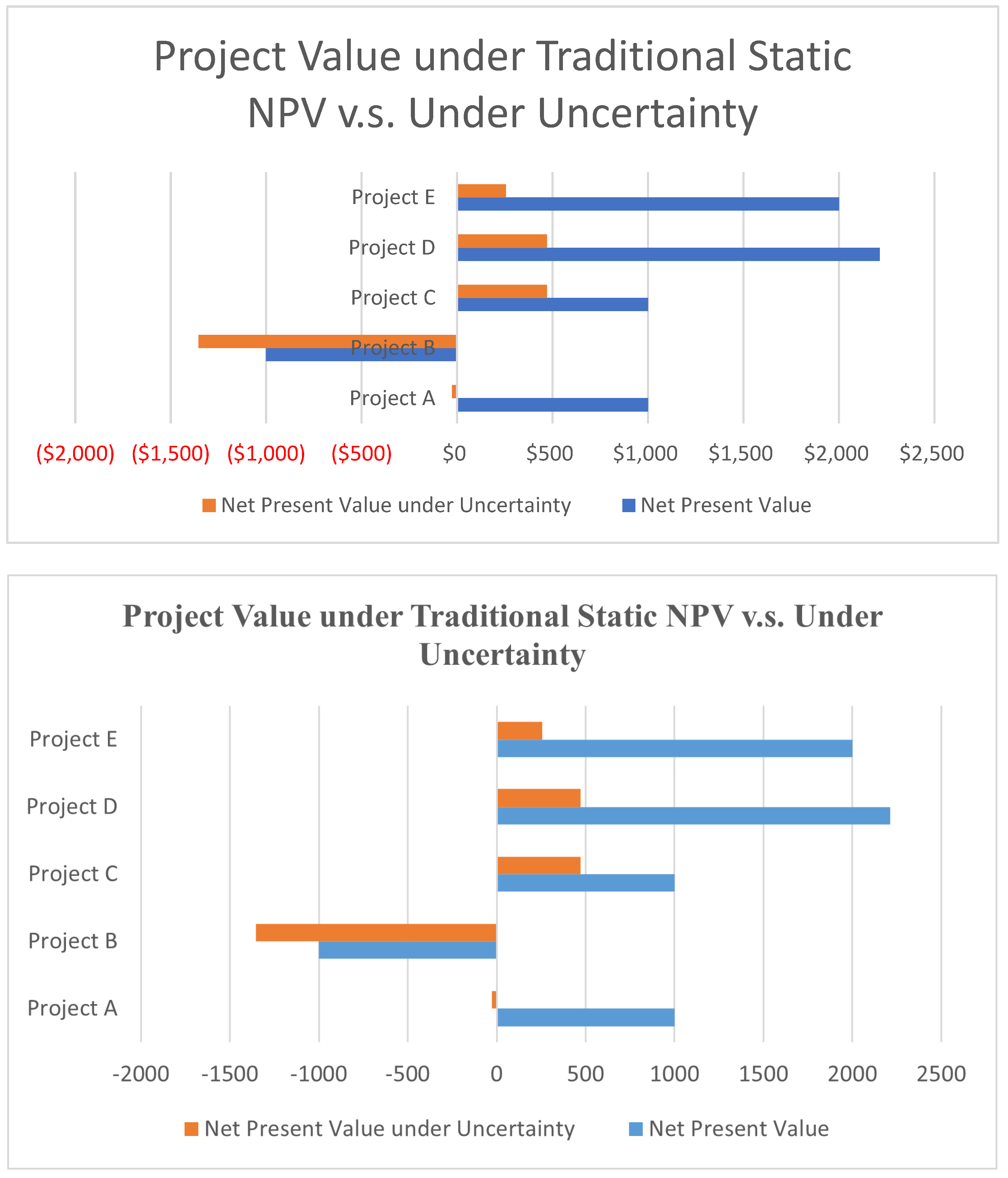

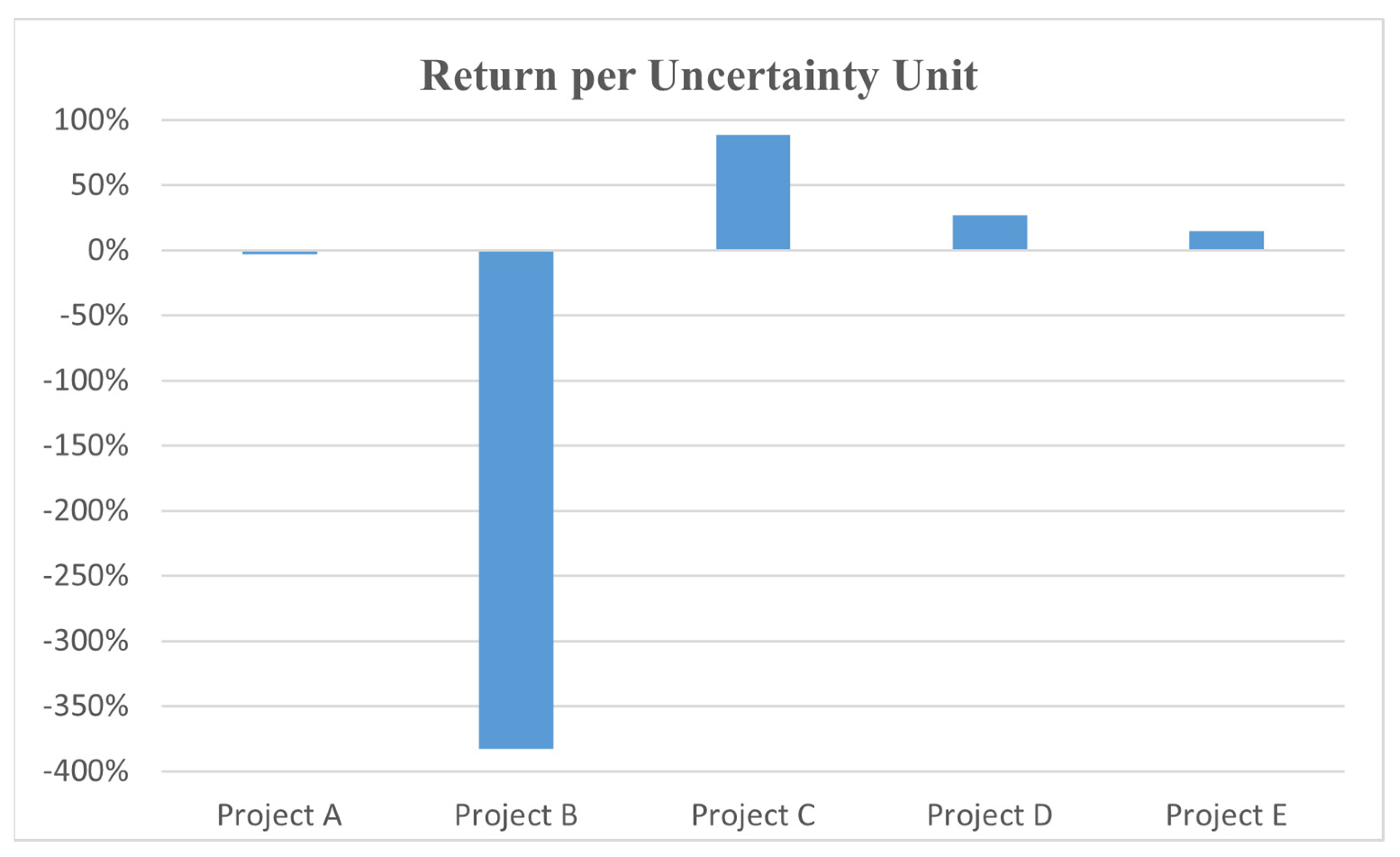

3. A Statistical Risk Analysis under Uncertainty: Stochastic Process and Simulation

4. Conclusions and Managerial Implications

Funding

Data Availability Statement

Conflicts of Interest

References

- Abbasi, D.; Ashrafi, M.; Ghodsypour, S.H. A multi objective-BSC model for new product development project portfolio selection. Expert Syst. Appl. 2020, 162, 113757. [Google Scholar] [CrossRef]

- De Assis, C.A. Early-Stage Assessment and Risk Analysis for Investments in the Bio-Based Industry; North Carolina State University: Raleigh, NC, USA, 2019. [Google Scholar]

- Adomako, S.; Amankwah-Amoah, J.; Ahsan, M. Base of the pyramid orientation, imitation orientation and new product performance in an emerging market. Technovation 2023, 119, 102614. [Google Scholar] [CrossRef]

- Adomako, S.; Simms, C.; Vazquez-Brust, D.; Nguyen, H.T. Stakeholder Green Pressure and New Product Performance in Emerging Countries: A Cross-country Study. Br. J. Manag. 2022, 34, 299–320. [Google Scholar] [CrossRef]

- Afzal, F.; Yunfei, S.; Nazir, M.; Bhatti, S.M. A review of artificial intelligence based risk assessment methods for capturing complexity-risk interdependencies: Cost overrun in construction projects. Int. J. Manag. Proj. Bus. 2021, 14, 300–328. [Google Scholar] [CrossRef]

- Aloulou, W.J. Impacts of strategic orientations on new product development and firm performances: Insights from Saudi industrial firms. Eur. J. Innov. Manag. 2019, 22, 257–280. [Google Scholar] [CrossRef]

- Alteri, E.; Guizzaro, L. Be open about drug failures to speed up research. Nature 2018, 563, 317–319. [Google Scholar] [CrossRef]

- Amédée-Manesme, C.-O.; Barthélémy, F. Proper use of the modified Sharpe ratios in performance measurement: Rearranging the Cornish Fisher expansion. Ann. Oper. Res. 2020, 313, 691–712. [Google Scholar] [CrossRef]

- Angstmann, C.; Henry, B.; McGann, A. Time-fractional geometric Brownian motion from continuous time random walks. Phys. A Stat. Mech. Its Appl. 2019, 526, 121002. [Google Scholar] [CrossRef]

- Bardhan, I.; Sougstad, R. Prioritizing a Portfolio of Information Technology Investment Projects. J. Manag. Inf. Syst. 2004, 21, 33–60. [Google Scholar] [CrossRef]

- Benaroch, M.; Jeffery, M.; Kauffman, R.J.; Shah, S. Option-based risk management: A field study of sequential information technology investment decisions. J. Manag. Inf. Syst. 2007, 24, 103–140. [Google Scholar] [CrossRef]

- Blau, G.E.; Pekny, J.F.; Varma, V.A.; Bunch, P.R. Managing a Portfolio of Interdependent New Product Candidates in the Pharmaceutical Industry. J. Prod. Innov. Manag. 2004, 21, 227–245. [Google Scholar] [CrossRef]

- Brasil, V.C.; Salerno, M.S.; Gomes, L.A.d.V. Valuation of innovation projects with high uncertainty: Reasons behind the search for real options. J. Eng. Technol. Manag. 2018, 49, 109–122. [Google Scholar] [CrossRef]

- Browning, T.R. Planning, tracking, and reducing a complex project’s value at risk. Proj. Manag. J. 2019, 50, 71–85. [Google Scholar] [CrossRef]

- Buyukozkan, G.G.; Feyzolu, O. A fuzzy-logic-based decision-making approach for new product development. Int. J. Prod. Econ. 2004, 90, 27–45. [Google Scholar] [CrossRef]

- Chiu, Y.-J.; Hu, Y.-C.; Yao, C.-Y.; Yeh, C.-H. Identifying Key Risk Factors in Product Development Projects. Mathematics 2022, 10, 1295. [Google Scholar] [CrossRef]

- Chrysafis, K.A.; Papadopoulos, B.K. Decision Making for Project Appraisal in Uncertain Environments: A Fuzzy-Possibilistic Approach of the Expanded NPV Method. Symmetry 2020, 13, 27. [Google Scholar] [CrossRef]

- Cooper, R.G.; Edgett, S.J.; Kleinschmidt, E.J. Portfolio management for new product development: Results of an industry practices study. R&D Manag. 2001, 31, 361–380. [Google Scholar] [CrossRef]

- Cooper, R.G. The drivers of success in new-product development. Ind. Mark. Manag. 2018, 76, 36–47. [Google Scholar] [CrossRef]

- Dastaki, M.S.; Mahootchi, M.; Moehler, R.; Afrazeh, A. Managing Knowledge Requirements in the NPD Portfolio Selection Process Using Knowledge Clustering and Prioritization: A Case Study of an Australian Train Operator. IEEE Trans. Eng. Manag. 2023, 1–13. [Google Scholar] [CrossRef]

- Davis, C. Calculated risk: A framework for evaluating product development. IEEE Eng. Manag. Rev. 2003, 31, 38. [Google Scholar] [CrossRef]

- de Brentani, U.; Kleinschmidt, E.J.; Salomo, S. Success in Global New Product Development: Impact of Strategy and the Behavioral Environment of the Firm. J. Prod. Innov. Manag. 2010, 27, 143–160. [Google Scholar] [CrossRef]

- Disch, M. Estimating the Costs of Product Development Projects Based on External Data: The New Product Development Cost Benchmarking Method. IEEE Trans. Eng. Manag. 2023, 1–12. [Google Scholar] [CrossRef]

- Dixit, A.K.; Pindyck, R.S. Investment under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Galasso, A.; Luo, H. Risk-Mitigating Technologies: The Case of Radiation Diagnostic Devices. Manag. Sci. 2021, 67, 3022–3040. [Google Scholar] [CrossRef]

- George, R.A.; Siti-Nabiha, A.; Jalaludin, D.; Abdalla, Y.A. Barriers to and enablers of sustainability integration in the performance management systems of an oil and gas company. J. Clean. Prod. 2016, 136, 197–212. [Google Scholar] [CrossRef]

- Giannakis, M.; Dubey, R.; Yan, S.; Spanaki, K.; Papadopoulos, T. Social media and sensemaking patterns in new product development: Demystifying the customer sentiment. Ann. Oper. Res. 2020, 308, 145–175. [Google Scholar] [CrossRef]

- Guerra, M.L.; Sorini, L. Value at Risk Based on Fuzzy Numbers. Axioms 2020, 9, 98. [Google Scholar] [CrossRef]

- Han, K.; Kauffman, R.J.; Nault, B.R. Information Exploitation and Interorganizational Systems Ownership. J. Manag. Inf. Syst. 2004, 21, 109–135. [Google Scholar] [CrossRef]

- Harz, N.; Hohenberg, S.; Homburg, C. Virtual Reality in New Product Development: Insights from Prelaunch Sales Forecasting for Durables. J. Mark. 2021, 86, 157–179. [Google Scholar] [CrossRef]

- Hock-Doepgen, M.; Clauss, T.; Kraus, S.; Cheng, C.-F. Knowledge management capabilities and organizational risk-taking for business model innovation in SMEs. J. Bus. Res. 2020, 130, 683–697. [Google Scholar] [CrossRef]

- Huang, H.; Jong, S. Public Funding for Science and the Value of Corporate R&D Projects; Evidence from Project Initiation and Termination Decisions in Cell Therapy. J. Manag. Stud. 2018, 56, 1000–1039. [Google Scholar] [CrossRef]

- Iqbal, M.; Suzianti, A. New Product Development Process Design for Small and Medium Enterprises: A Systematic Literature Review from the Perspective of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 153. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Low-Certainty-Need (LCN) supply chains: A new perspective in managing disruption risks and resilience. Int. J. Prod. Res. 2018, 57, 5119–5136. [Google Scholar] [CrossRef]

- Jamshidnejad, N. Project Portfolio Selection Based on Risk Index. Turk. J. Comput. Math. Ed-Ucation (TURCOMAT) 2021, 12, 1783–1788. [Google Scholar]

- Jayanthi, D.; Thamizhseran, N. Biochemical Changes During Flowering of Spathodea campanulata P. Beauv. Pharmacogn. J. 2019, 11, 842–847. [Google Scholar] [CrossRef]

- Jørgensen, B.; Messner, M. Accounting and strategising: A case study from new product development. Account. Organ. Soc. 2010, 35, 184–204. [Google Scholar] [CrossRef]

- Jorion, P. Value at Risk; Irwin: Homewood, IL, USA, 1997. [Google Scholar]

- Kafetzopoulos, D.; Psomas, E.; Skalkos, D. Innovation dimensions and business performance under environmental uncertainty. Eur. J. Innov. Manag. 2019, 23, 856–876. [Google Scholar] [CrossRef]

- Killen, C.P.; Hunt, R.A.; Kleinschmidt, E.J. Managing the New Product Development Project Portfolio: A Review of the Literature and Empirical Evidence. In Proceedings of the PICMET’07-2007 Portland International Conference on Management of Engineering & Technology, Portland, OR, USA, 5–9 August 2007; pp. 1864–1874. [Google Scholar] [CrossRef]

- Krishnan, V.; Bhattacharya, S. Technology Selection and Commitment in New Product Development: The Role of Uncertainty and Design Flexibility. Manag. Sci. 2002, 48, 313–327. [Google Scholar] [CrossRef]

- Krishnan, V.; Ulrich, K.T. Product Development Decisions: A Review of the Literature. Manag. Sci. 2001, 47, 1–21. [Google Scholar] [CrossRef]

- Kumar, N.; Allada, V. Assessment of risk propagation during different stages of new product development process. Manag. Sci. Lett. 2022, 12, 165–176. [Google Scholar] [CrossRef]

- Lam, P.-K.; Chin, K.-S. Identifying and prioritizing critical success factors for conflict management in collaborative new product development. Ind. Mark. Manag. 2005, 34, 761–772. [Google Scholar] [CrossRef]

- Li, P.; Wen, M.; Zu, T.; Kang, R. A Joint Location–Allocation–Inventory Spare Part Optimization Model for Base-Level Support System with Uncertain Demands. Axioms 2023, 12, 46. [Google Scholar] [CrossRef]

- Lint, O.; Pennings, E. An option approach to the new product development process: A case study at Philips Electronics. R&D Manag. 2001, 31, 163–172. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, M. Entrepreneurial orientation, new product development and firm performance: The moderating role of legitimacy in Chinese high-tech SMEs. Eur. J. Innov. Manag. 2020, 25, 130–149. [Google Scholar] [CrossRef]

- Lucanera, J.P.; Fabregat-Aibar, L.; Scherger, V.; Vigier, H. Can the SOM Analysis Predict Business Failure Using Capital Structure Theory? Evidence from the Subprime Crisis in Spain. Axioms 2020, 9, 46. [Google Scholar] [CrossRef]

- Luo, X.; Wang, H.; Raithel, S.; Zheng, Q. Corporate social performance, analyst stock recommendations, and firm future returns. Strateg. Manag. J. 2015, 36, 123–136. [Google Scholar] [CrossRef]

- Magnacca, F.; Giannetti, R. Management accounting and new product development: A systematic literature review and future research directions. J. Manag. Gov. 2023, 1–35. [Google Scholar] [CrossRef]

- Miskovic, L.; Béal, J.; Moret, M.; Hatzimanikatis, V. Uncertainty reduction in biochemical kinetic models: Enforcing desired model properties. PLoS Comput. Biol. 2019, 15, e1007242. [Google Scholar] [CrossRef]

- Mousavi, S.; Hafezalkotob, A.; Ghezavati, V.; Abdi, F. A new fuzzy multi-criteria decision-making approach for risk assessment of competitors’ cooperation in new product development projects. J. Bus. Ind. Mark. 2022, 37, 2278–2297. [Google Scholar] [CrossRef]

- O’rawe, J.A.; Ferson, S.; Lyon, G.J. Accounting for uncertainty in DNA sequencing data. Trends Genet. 2015, 31, 61–66. [Google Scholar] [CrossRef]

- Ogawa, S.; Piller, F.T. Reducing the risks of new product development. MIT Sloan Manag. Rev. 2006, 47, 65. [Google Scholar]

- Pandya, P.A. Program Management strategies in Bio-similar Development & Commercialization. Clin. Trials 2017, 3, 014. [Google Scholar]

- Picaud-Bello, K.; Johnsen, T.; Calvi, R.; Giannakis, M. Exploring early purchasing involvement in discontinuous innovation: A dynamic capability perspective. J. Purch. Supply Manag. 2019, 25, 100555. [Google Scholar] [CrossRef]

- Pirjol, D.; Zhu, L. Asymptotics for the discrete-time average of the geometric Brownian motion and Asian options. Adv. Appl. Probab. 2017, 49, 446–480. [Google Scholar] [CrossRef]

- Prashad, A.S.; Nolting, B.; Patel, V.; Xu, A.; Arve, B.; Letendre, L. From R&D to clinical supplies. Org. Process Res. Dev. 2017, 21, 590–600. [Google Scholar]

- Rastogi, R.P.; Pandey, A.; Larroche, C.; Madamwar, D. Algal Green Energy—R&D and technological perspectives for biodiesel production. Renew. Sustain. Energy Rev. 2018, 82, 2946–2969. [Google Scholar] [CrossRef]

- Rundquist, J.; Halila, F. Outsourcing of NPD activities: A best practice approach. Eur. J. Innov. Manag. 2010, 13, 5–23. [Google Scholar] [CrossRef]

- Safayeni, F.; Duimering, P.R.; Zheng, K.; Derbentseva, N.; Poile, C.; Ran, B. Requirements engineering in new product development. Commun. ACM 2008, 51, 77–82. [Google Scholar] [CrossRef]

- Shin, K.; Choy, M.; Lee, C.; Park, G. Government R&D Subsidy and Additionality of Biotechnology Firms: The Case of the South Korean Biotechnology Industry. Sustainability 2019, 11, 1583. [Google Scholar] [CrossRef]

- Singh, R.; Charan, P.; Chattopadhyay, M. Effect of relational capability on dynamic capability: Exploring the role of competitive intensity and environmental uncertainty. J. Manag. Organ. 2022, 28, 659–680. [Google Scholar] [CrossRef]

- Song, M.; Montoya-Weiss, M.M. The effect of perceived technological uncertainty on Japanese new product development. Acad. Manag. J. 2001, 44, 61–80. [Google Scholar] [CrossRef]

- Stock, G.N.; Tsai, J.C.-A.; Jiang, J.J.; Klein, G. Coping with uncertainty: Knowledge sharing in new product development projects. Int. J. Proj. Manag. 2021, 39, 59–70. [Google Scholar] [CrossRef]

- Summers, G.J.; Scherpereel, C.M. Flawed decision models and flexibility in product development. J. Eng. Technol. Manag. 2023, 67, 101728. [Google Scholar] [CrossRef]

- Tabesh, M.; Afrapoli, A.M.; Askari-Nasab, H. A two-stage simultaneous optimization of NPV and throughput in production planning of open pit mines. Resour. Policy 2023, 80, 103167. [Google Scholar] [CrossRef]

- Thangamani, G. Modified Approach to Risk Assessment―A Case Study on Product Innovation and Development Value Chain. Int. J. Innov. Manag. Technol. 2016, 7, 16–21. [Google Scholar] [CrossRef]

- Thieme, R.J.; Song, M.; Calantone, R.J. Artificial neural network decision support systems for new product development project selection. J. Mark. Res. 2000, 37, 499–507. [Google Scholar] [CrossRef]

- Wieteska, G. The impact of supplier involvement in product development on supply chain risks and supply chain resilience. Oper. Supply Chain Manag. Int. J. 2020, 13, 359–374. [Google Scholar] [CrossRef]

- Wouters, M.; Anderson, J.C.; Narus, J.A.; Wynstra, F. Improving sourcing decisions in NPD projects: Monetary quantification of points of difference. J. Oper. Manag. 2008, 27, 64–77. [Google Scholar] [CrossRef]

- Xiao-Juan, L. Research on investment risk influence factors of prefabricated building projects. J. Civ. Eng. Manag. 2020, 26, 599–613. [Google Scholar]

- Yi, Y.; Ji, J.; Lyu, C. How do polychronicity and interfunctional coordination affect the relationship between explor-atory innovation and the quality of new product development? J. Knowl. Manag. 2022, 26, 1687–1704. [Google Scholar] [CrossRef]

- Zheng, W.; Li, B.; Song, D.; Li, Y. Innovative development strategy of a risk-averse firm considering product unreli-ability under competition. Transp. Res. Part E Logist. Transp. Rev. 2023, 172, 102970. [Google Scholar] [CrossRef]

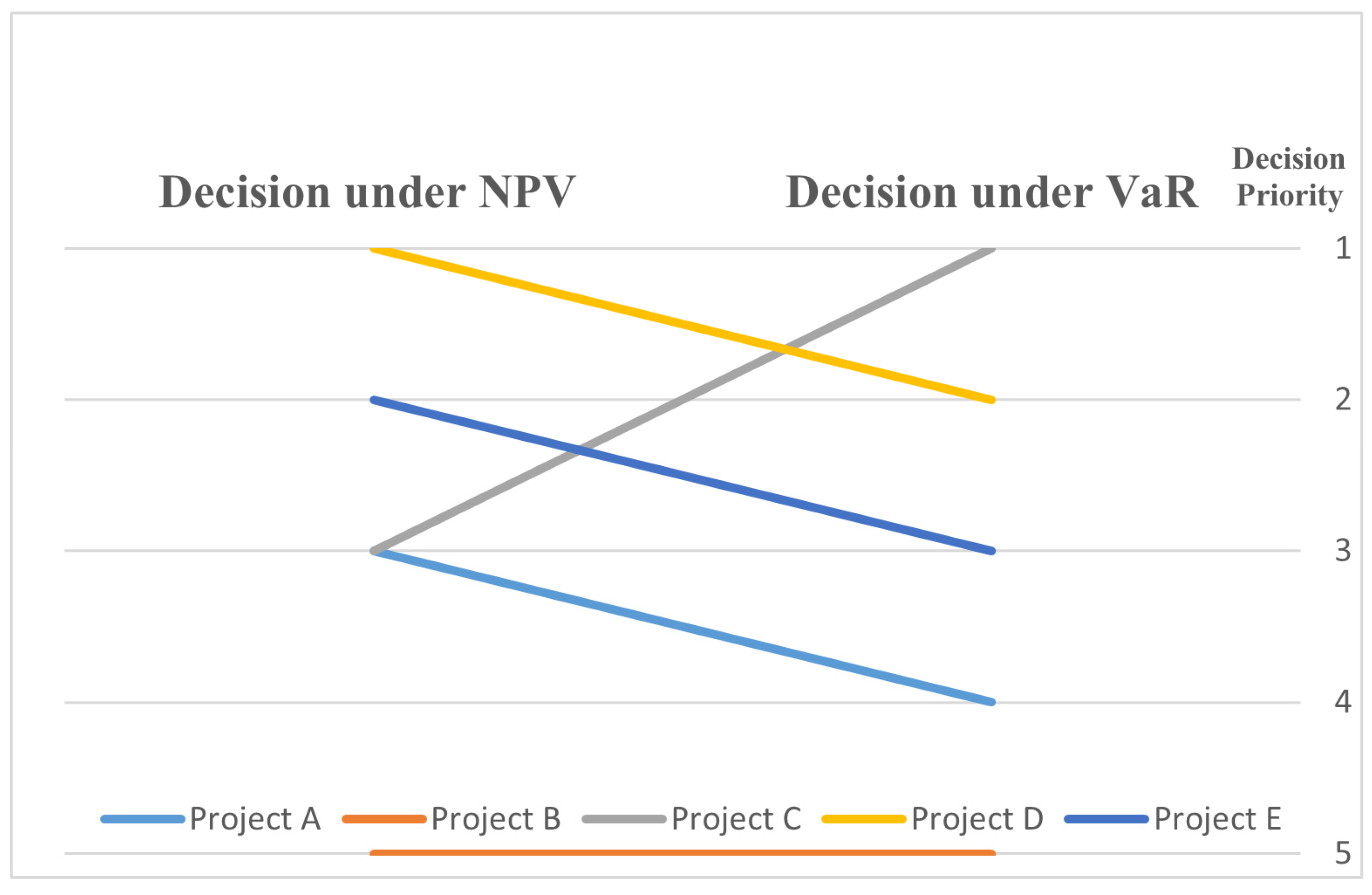

| Project A | Project B | Project C | Project D | Project E | |

|---|---|---|---|---|---|

| Expected Revenues | $5000 | $2000 | $3000 | $10,000 | $6000 |

| Costs | $4000 | $3000 | $2000 | $7786 | $4000 |

| Net Present Value | $1000 | −$1000 | $1000 | $2214 | $2000 |

| Uncertainty Degree (Ignored in the NPV analysis) | 50% | 50% | 50% | 50% | 80% |

| Priority Decision | 3 | 5 | 3 | 1 | 2 |

| Project A | Project B | Project C | Project D | Project E | |

|---|---|---|---|---|---|

| Expected Revenues | $5000 | $2000 | $3000 | $10,000 | $6000 |

| Uncertainty Degree | 50% | 50% | 50% | 50% | 80% |

| Costs | $4000 | $3000 | $2000 | $7786 | $4000 |

| Net Present Value | $1000 | −$1000 | $1000 | $2214 | $2000 |

| Expected Revenues under Uncertainty (VaR 90%) | $3974 | $1646 | $2470 | $8256 | $4256 |

| Monetary Exposed Uncertainty | −$1026 | −$354 | −$530 | −$1744 | −$1744 |

| Net Present Value under Uncertainty | −$26 | −$1354 | $470 | $470 | $256 |

| Return per Uncertainty Unit | −3% | −383% | 88.7% | 27% | 15% |

| Decision under NPV | 3 | 5 | 3 | 1 | 2 |

| Decision under VaR | 4 | 5 | 1 | 2 | 3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, L. Risk Analysis: Changing the Story with the Statistical Stochastic Process and VaR. Axioms 2023, 12, 418. https://doi.org/10.3390/axioms12050418

Wu L. Risk Analysis: Changing the Story with the Statistical Stochastic Process and VaR. Axioms. 2023; 12(5):418. https://doi.org/10.3390/axioms12050418

Chicago/Turabian StyleWu, Lianghong. 2023. "Risk Analysis: Changing the Story with the Statistical Stochastic Process and VaR" Axioms 12, no. 5: 418. https://doi.org/10.3390/axioms12050418

APA StyleWu, L. (2023). Risk Analysis: Changing the Story with the Statistical Stochastic Process and VaR. Axioms, 12(5), 418. https://doi.org/10.3390/axioms12050418