Redistribution Preferences, Inequality Information, and Partisan Motivated Reasoning in the United States

Abstract

:1. Introduction

2. Information, Preferences, and Partisan Motivated Reasoning

2.1. What Accounts for the Limited Effects of Inequality Information?

2.2. Partisan Motivated Reasoning

3. Data and Measures

3.1. American National Election Studies Data

3.2. Measures of Redistribution Policy Preferences

3.3. Hypotheses

4. Results

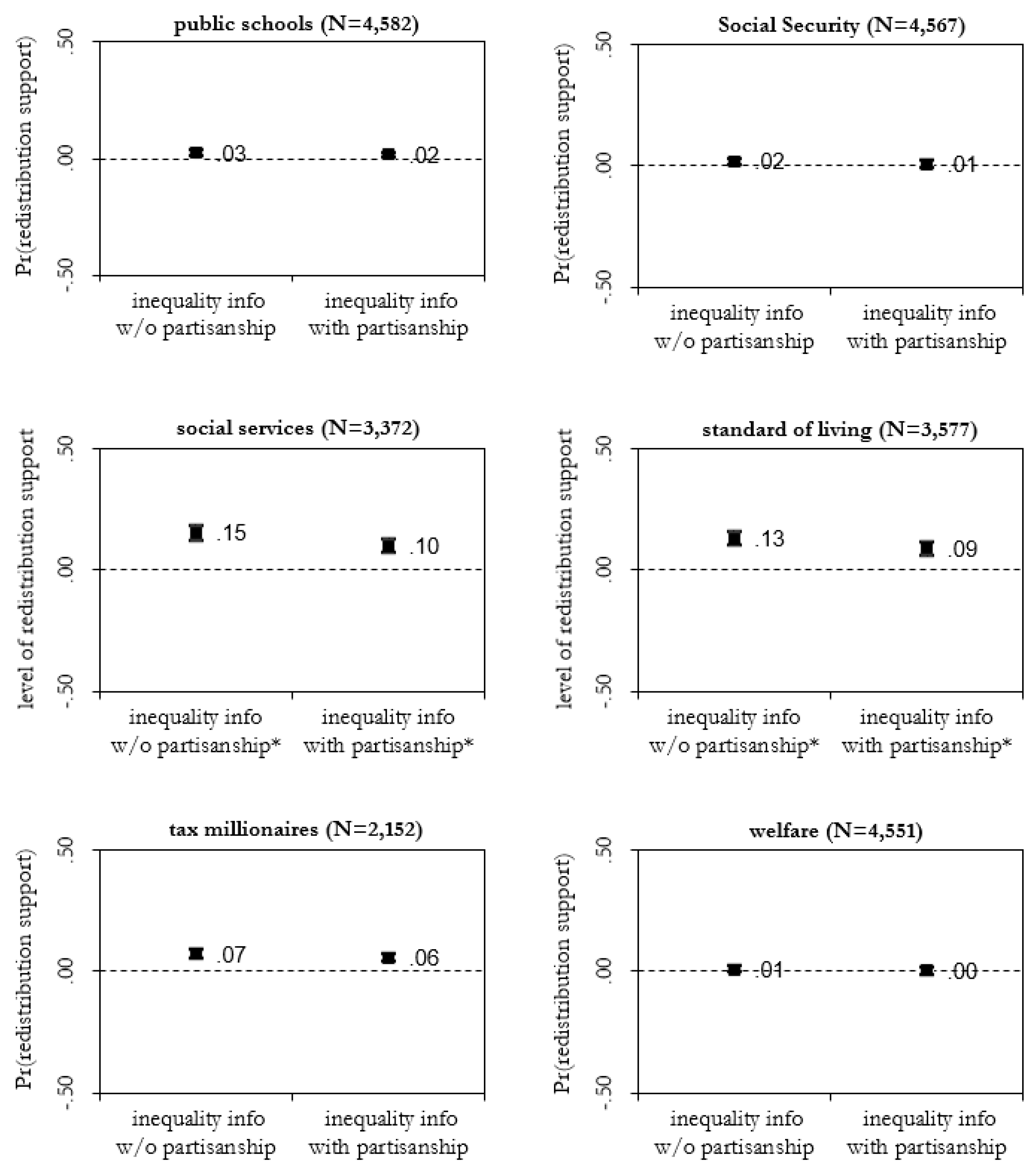

4.1. Inequality Information and Redistributive Preferences

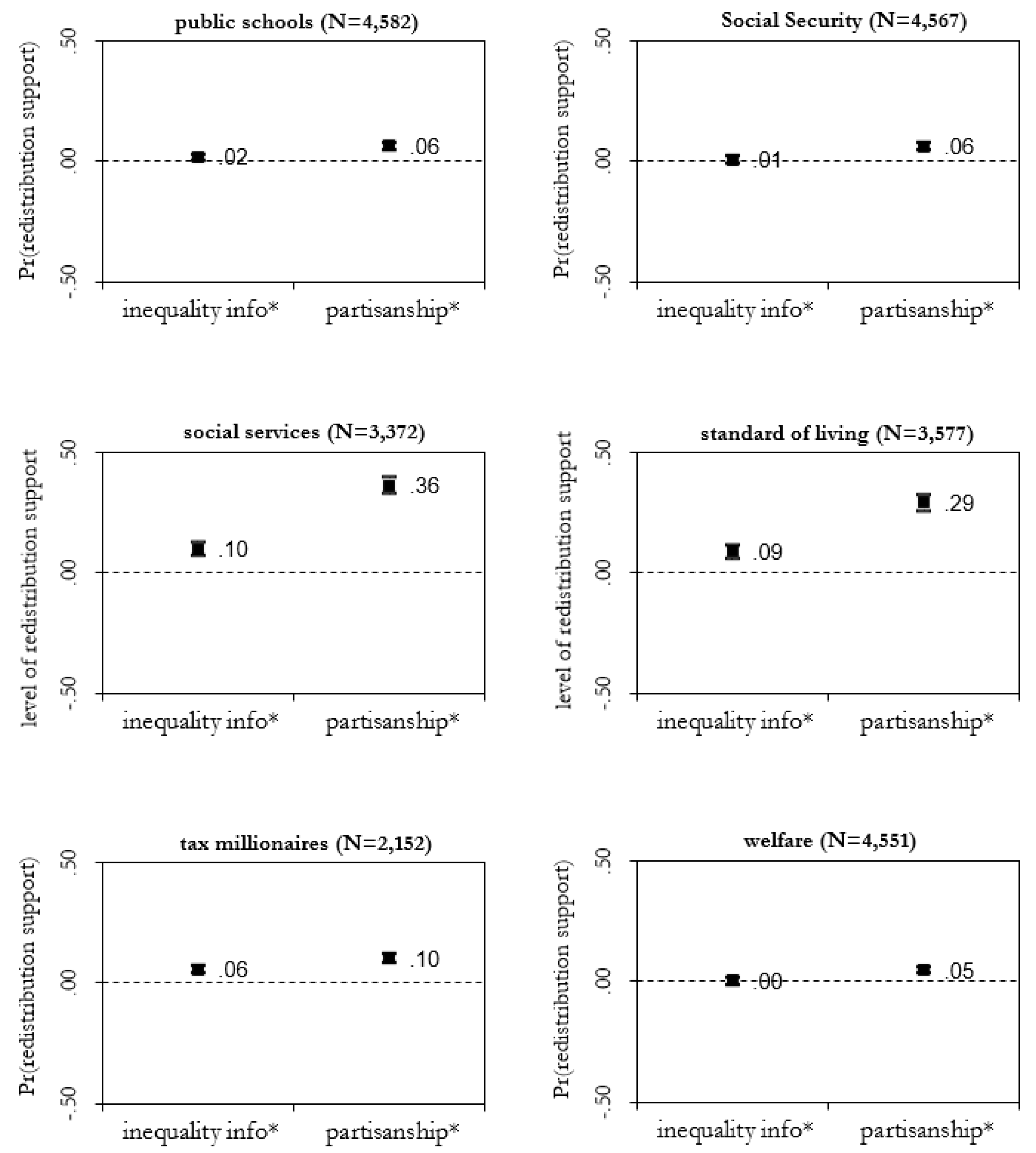

4.2. The Magnitude of Inequality Information versus Partisanship Effects

4.3. Have the Effects of Inequality Information and Partisanship Changed over Time?

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Saez, E. Striking it Richer: The Evolution of Top Incomes in the United States (Updated with 2018 Estimates); Department of Economics, UC Berkeley: Berkeley, CA, USA, 2020; Unpublished manuscript. [Google Scholar]

- Grusky, D.; Kricheli-Katz, T. (Eds.) The Gilded Age: The Critical Inequality Debates of Our Time; Stanford University Press: Stanford, CA, USA, 2012. [Google Scholar]

- Chetty, R.; Grusky, D.; Hell, M.; Hendren, N.; Manduca, R.; Narang, J. The Fading American Dream: Trends in Absolute Income Mobility Since 1940. Science 2017, 356, 398–406. [Google Scholar] [CrossRef] [Green Version]

- Page, B.; Jacobs, L. Class War? What Americans Really Think about Economic Inequality; University of Chicago Press: Chicago, IL, USA, 2009. [Google Scholar]

- Ashok, V.; Kuziemko, I.; Washington, E. Support for Redistribution in an Age of Rising Inequality. Brook. Pap. Econ. Act. 2016, 2015, 367–433. [Google Scholar] [CrossRef] [Green Version]

- Manza, J.; Brooks, C. Mobility Optimism in an Age of Rising Inequality. Sociol. Q. 2021, 62. [Google Scholar] [CrossRef]

- Kuziemko, I.; Norton, M.; Saez, E.; Stantcheva, S. How Elastic Are Preferences for Redistribution? Evidence from Randomized Survey Experiments. Am. Econ. Rev. 2015, 105, 1478–1508. [Google Scholar] [CrossRef] [Green Version]

- Peyton, K. Does Trust in Government Increase Support for Redistribution? Evidence from Randomized Survey Experiments. Am. Political Sci. Rev. 2020, 114, 596–602. [Google Scholar] [CrossRef] [Green Version]

- Lodge, M.; Taber, C. The Rationalizing Voter; Cambridge University Press: New York, NY, USA, 2013. [Google Scholar]

- Bafumi, J.; Shapiro, R.Y. A New Partisan Voter. J. Politics 2009, 71, 1–24. [Google Scholar] [CrossRef]

- Campbell, J. Polarized: Making Sense of a Divided America; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Boudreau, C.; MacKenzie, S. Wanting What Is Fair: How Party Cues and Information about Income Inequality Affect Public Support for Taxes. J. Politics 2018, 80, 367–381. [Google Scholar] [CrossRef]

- Meltzer, A.; Richard, S. A Rational Theory of the Size of Government. J. Political Econ. 1981, 89, 914–927. [Google Scholar] [CrossRef]

- Baldassarri, D.; Gelman, A. Partisans without Constraint: Political Polarization and Trends in American Public Opinion. Am. J. Sociol. 2008, 114, 408–446. [Google Scholar] [CrossRef] [Green Version]

- Davidai, S.; Gilovich, T. Building a More Mobile America–One Income Quintile at a Time. Perspect. Psychol. Sci. 2015, 10, 60–71. [Google Scholar] [CrossRef]

- Bénabou, R.; Ok, E.A. Social Mobility and the Demand for Redistribution: The POUM Hypothesis. Q. J. Econ. 2001, 116, 447–487. [Google Scholar] [CrossRef] [Green Version]

- Alberto, A.; Stantcheva, S.; Teso, E. Intergenerational Mobility and Preferences for Redistribution. Am. Econ. Rev. 2018, 108, 521–554. [Google Scholar]

- Converse, P. The Nature of Belief Systems in Mass Publics. In Ideology and Discontent; David, A., Ed.; The Free Press: New York, NY, USA, 1964; pp. 206–261. [Google Scholar]

- Bartels, L. Uninformed Votes: Information Effects in Presidential Campaigns. Am. J. Political Sci. 1996, 40, 194–230. [Google Scholar] [CrossRef]

- Carpini, M.X.D.; Keeter, S. What Americans Know about Politics and Why It Matters; Yale University Press: New Haven, CT, USA, 1996. [Google Scholar]

- Pierce, D. Uninformed Votes? Reappraising Information Effects and Presidential Preferences. Political Behav. 2015, 37, 537–565. [Google Scholar] [CrossRef]

- Hetherington, M. Why Trust Matters: Declining Political Trust and the Demise of American Liberalism; Princeton University Press: Princeton, NJ, USA, 2006. [Google Scholar]

- Hetherington, M.; Husser, J. How Trust Matters: The Changing Political Relevance of Political Trust. Am. J. Political Sci. 2011, 56, 312–325. [Google Scholar] [CrossRef]

- Kunda, Z. The Case for Motivated Reasoning. Psychol. Bull. 1990, 108, 480–498. [Google Scholar] [CrossRef] [PubMed]

- Taber, C.S.; Cann, D.; Kucsova, S. The Motivated Processing of Political Arguments. Political Behav. 2009, 31, 137–155. [Google Scholar] [CrossRef]

- Hughes, B.; Zaki, J. The Neuroscience of Motivated Cognition. Trends Cogn. Sci. 2015, 19, 62–64. [Google Scholar] [CrossRef]

- Ditto, P.; Lopez, D. Motivated Skepticism: Use of Differential Decision Criteria for Preferred and Nonpreferred Conclusions. J. Personal. Soc. Psychol. 1992, 63, 568–584. [Google Scholar] [CrossRef]

- Taber, C.; Lodge, M. Motivated Skepticism in the Evaluation of Political Beliefs. Am. J. Political Sci. 2006, 50, 755–769. [Google Scholar] [CrossRef]

- Petersen, M.B.; Skov, M.; Serritzlew, S.; Ramsøy, T. Motivated Reasoning and Political Parties: Evidence for Increased Processing in the Face of Party Cues. Political Behav. 2012, 35, 831–854. [Google Scholar] [CrossRef]

- Huddy, L.; Mason, L.; Aaroe, L. Expressive Partisanship: Campaign Involvement, Political Emotion, and Partisan Identity. Am. Political Sci. Rev. 2015, 109, 1–17. [Google Scholar] [CrossRef] [Green Version]

- Druckman, J.; Peterson, E.; Slothuus, R. How Partisan Polarization Affects Public Opinion Formation. Am. Political Sci. Rev. 2013, 107, 57–79. [Google Scholar] [CrossRef] [Green Version]

- Slothuus, R. When Can Political Parties Lead Public Opinion? Evidence from a Natural Experimtent. Political Commun. 2010, 27, 158–177. [Google Scholar] [CrossRef]

- Savage, L. Religion, Partisanship, and Preferences for Redistribution. Eur. J. Political Res. 2020, 59, 91–113. [Google Scholar] [CrossRef]

- Bonica, A.; McCarty, N.; Poole, K.; Rosenthal, H. Why Hasn’t Democracy Slowed Rising Inequality. J. Econ. Perspect. 2013, 3, 103–124. [Google Scholar] [CrossRef] [Green Version]

- McCarty, N.; Poole, K.; Rosenthal, H. Polarized America: The Dance of Ideology and Unequal Riches, 2nd ed.; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Mullinix, K. Partisanship and Preference Formation: Competing Motivations, Elite Polarization, and Issue Importance. Political Behav. 2016, 38, 383–411. [Google Scholar] [CrossRef]

- Arceneaux, K. Can Partisan Cues Diminish Democratic Accountability? Political Behav. 2008, 30, 139–160. [Google Scholar] [CrossRef]

- Druckman, J.; Hennessy, C.; Charles, K.S.; Webber, J. Competing Rhetoric Over Time: Frames Versus Cues. J. Politics 2010, 72, 136–148. [Google Scholar] [CrossRef]

- Center for Political Studies. American National Election Studies 2000, 2004, 2008, and 2016. Ann Arbor. 2020. Available online: https://electionstudies.org/data-center/ (accessed on 21 January 2021).

- Korpi, W.; Joakim, P. The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries. Am. Sociol. Rev. 1998, 63, 661–687. [Google Scholar] [CrossRef] [Green Version]

- Xu, P.; Garland, J. Economic Context and Americans’ Perceptions of Income Inequality. Soc. Sci. Q. 2010, 91, 1220–1241. [Google Scholar] [CrossRef]

- Macdonald, D. Trust in Government and the American Public’s Responsiveness to Rising Inequality. Political Res. Q. 2020, 73, 790–804. [Google Scholar] [CrossRef]

- Sears, D. Symbolic Racism. In Eliminating Racism: Profiles in Controversy; Katz, P., Taylor, D., Eds.; Plenum Press: New York, NY, USA, 1988; pp. 53–83. [Google Scholar]

- Kinder, D.; Sanders, L. Divided by Color; University of Chicago Press: Chicago, IL, USA, 1996. [Google Scholar]

- Tesler, M. The Spillover of Racialization into Health Care: How President Obama Polarized Public Opinion by Racial Attitudes and Race. Am. J. Political Sci. 2012, 56, 690–704. [Google Scholar] [CrossRef]

- Wetts, R.; Willer, R. Privilege on the Precipice: Perceived Racial Status Threats Lead White Americans to Oppose Welfare Programs. Soc. Forces 2018, 96, 1–30. [Google Scholar] [CrossRef] [Green Version]

- Mize, T.; Doan, L.; Long, S. A General Framework for Comparing Predictions and Marginal Effects across Models. Sociol. Methodol. 2019, 49, 152–189. [Google Scholar] [CrossRef]

- Gerber, A.; Huber, G.; Washington, E. Party Affiliation, Partisanship, and Political Beliefs: A Field Experiment. Am. Political Sci. Rev. 2010, 104, 720–744. [Google Scholar] [CrossRef]

- Barber, M.; Pope, J. Does Party Trump Ideology? Disentangling Party and Ideology in America. Am. Political Sci. Rev. 2019, 113, 38–54. [Google Scholar] [CrossRef]

- Piketty, T.; Saez, E. Inequality in the Long Run. Science 2013, 344, 838–843. [Google Scholar] [CrossRef]

- Edlund, J. Attitudes Towards Taxation? Ignorant and Incoherent? Scand. Political Stud. 2003, 26, 145–167. [Google Scholar] [CrossRef]

- McCall, L. The Undeserving Rich; Cambridge University Press: New York, NY, USA, 2013. [Google Scholar]

- Becker, B. Mind the Income Gaps? Experimental Evidence of Information’s Lasting Effect on Redistributive Preferences. Soc. Justice Res. 2020, 33, 137–194. [Google Scholar] [CrossRef]

| Item | Keywords | Coding |

|---|---|---|

| Affordable Care Act | health care reform law | 1–7: 7 = support a great deal |

| aid to the poor | federal spending…poor | 1 = decreased 2 = kept the same 3 = increased |

| assistance to blacks | government make…effort | 1–7: 7 = support a great deal |

| child care | federal spending…child care | 1 = decreased 2 = kept the same 3 = increased |

| health insurance | private…[vs.] government insurance plan | 1–7: 7 = government plan |

| income inequality | government…reduce differences in income | 1–5: 5 = agree strongly |

| public schools | federal spending…public schools | 1 = decreased 2 = kept the same 3 = increased |

| Social Security | federal spending…Social Security | 1 = decreased 2 = kept the same 3 = increased |

| social services | government…provide many more services | 1–7: 7 = more services |

| standard of living | government see to…job and good standard of living | 1–7: 7 = government should |

| tax millionaires | increasing income taxes… over one million dollars | 1 = oppose 2 = neither 3 = favor |

| welfare | federal spending…welfare programs | 1 = decreased 2 = kept the same 3 = increased |

| inequality information (1–5) Do you think the difference in income between rich people and poor people in the United States today is larger, smaller, or about the same as it was 20 years ago? Would you say the difference in incomes is much larger or somewhat larger? / Would you say the difference in incomes is much smaller or somewhat smaller? (1 = much smaller; 2 = somewhat smaller; 3 = same; 4 = somewhat larger; 5 = much larger) |

| partisanship (1–7) Generally speaking, do you usually think of yourself as a Republican, Democrat, Independent, or what? Would you call yourself a strong [Democrat/Republican] or a not very strong [Democrat/Republican]?/Do you think of yourself as closer to the Republican Party or to the Democratic Party? (1 = strong Republican; 2 = weak Republican; 3 = independent Republican; 4 = independent; 5 = independent Democrat; 6 = weak Democrat; 7 = strong Democrat) |

| racial resentment scale (reliability = 0.694 for the following items): Over the past few years, blacks have gotten less than they deserve. (1 = agree strongly… 5 = disagree strongly) |

| Generations of slavery and discrimination have created conditions that make it difficult for blacks to work their way out of the lower class. (1 = agree strongly… 5 = disagree strongly) |

| Irish, Italians, Jewish and many other minorities overcame prejudice and worked their way up. Blacks should do the same without any special favors. (1 = disagree strongly… 5 = agree strongly) |

| It’s really a matter of some people not trying hard enough, if blacks would only try harder they could be just as well off as whites. (1 = disagree strongly… 5 = agree strongly) |

| age (years) |

| education (years) |

| church attendance (1–5: 5 = attend every week) |

| female (0,1) |

| white (0,1) |

| labor force participant (0,1) |

| south (0,1) |

| Inequality Information | Partisanship | |||

|---|---|---|---|---|

| Linear | Non-Linear | Linear | Non-Linear | |

| Affordable Care Act | n.s. | n.s. | n.s. | n.s. |

| aid to the poor | n.s. | n.s. | * | * |

| assistance to blacks | n.s. | n.s. | n.s. | n.s. |

| child care | * | n.s. | * | * |

| health insurance | n.s. | n.s. | * | n.s. |

| income inequality | n.s. | n.s. | n.s. | n.s. |

| public schools | n.s. | n.s. | * | n.s. |

| Social Security | * | * | * | * |

| social services | n.s. | n.s. | * | * |

| standard of living | n.s. | n.s. | n.s. | n.s. |

| tax millionaires | n.s. | n.s. | n.s. | n.s. |

| welfare | n.s. | n.s. | * | * |

| Year | ||||

|---|---|---|---|---|

| 2004 | 2008 | 2012 | 2016 | |

| inequality information: | ||||

| child care a | 0.030 | 0.026 | 0.022 | 0.019 |

| Social Security a | −0.014 | 0.042 | −0.010 | 0.011 |

| partisanship: | ||||

| aid to the poor a | −0.105 | 0.063 | 0.153 | 0.145 |

| child care a | 0.115 | 0.026 | 0.092 | 0.099 |

| health insurance | 0.255 | 0.298 | 0.341 | 0.384 |

| public schools a | −0.005 | 0.046 | 0.094 | 0.138 |

| Social Security a | 0.047 | 0.030 | 0.094 | 0.101 |

| social services | 0.282 | 0.362 | 0.425 | 0.364 |

| welfare a | 0.019 | 0.005 | 0.091 | 0.090 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brooks, C.; Harter, E. Redistribution Preferences, Inequality Information, and Partisan Motivated Reasoning in the United States. Societies 2021, 11, 65. https://doi.org/10.3390/soc11020065

Brooks C, Harter E. Redistribution Preferences, Inequality Information, and Partisan Motivated Reasoning in the United States. Societies. 2021; 11(2):65. https://doi.org/10.3390/soc11020065

Chicago/Turabian StyleBrooks, Clem, and Elijah Harter. 2021. "Redistribution Preferences, Inequality Information, and Partisan Motivated Reasoning in the United States" Societies 11, no. 2: 65. https://doi.org/10.3390/soc11020065

APA StyleBrooks, C., & Harter, E. (2021). Redistribution Preferences, Inequality Information, and Partisan Motivated Reasoning in the United States. Societies, 11(2), 65. https://doi.org/10.3390/soc11020065