Strong Welfare States Do Not Intensify Public Support for Income Redistribution, but Even Reduce It among the Prosperous: A Multilevel Analysis of Public Opinion in 30 Countries

Abstract

1. Introduction: Welfare State Strength (Welfarism) and Redistribution Attitudes

1.1. Theory and Prior Research: Why Might the Strength of the Welfare State Affect Public Attitudes about Redistribution? Why Might the Impact Vary According to Social Position?

1.1.1. Theory

1.1.2. Prior Research

1.1.3. Hypotheses

Background: Causality

Hypotheses

2. Methods and Materials

2.1. Measurement

2.1.1. Welfare State Strength (Welfarism)

2.1.2. Social Spending

2.1.3. Corporatism

2.1.4. Social Spending and Corporatism = “Welfarism”

2.1.5. Esping-Andersen’s Three Worlds

2.1.6. Control Variables

Country-Level Controls

Individual-Level Controls

2.1.7. Atomistic Economic Self-Interest and Welfarism: Interaction

2.1.8. Support for Redistribution: Dependent Variable

Differences in income in <country> are too large.It is the responsibility of the government to reduce the differences in income between people with high incomes and those with low incomes.

There is too much of a difference between rich and poor in this country.Income and wealth should be redistributed toward ordinary working people.One of the most important aims in this country over the next ten years should be to reduce differences in income between people with high incomes and those with low incomes.

2.2. Data: World Inequality Study, ISSP “Social Inequality”, ISEA, ANSSS, “Social Inequality in The Netherlands”

2.3. Methods

3. Results

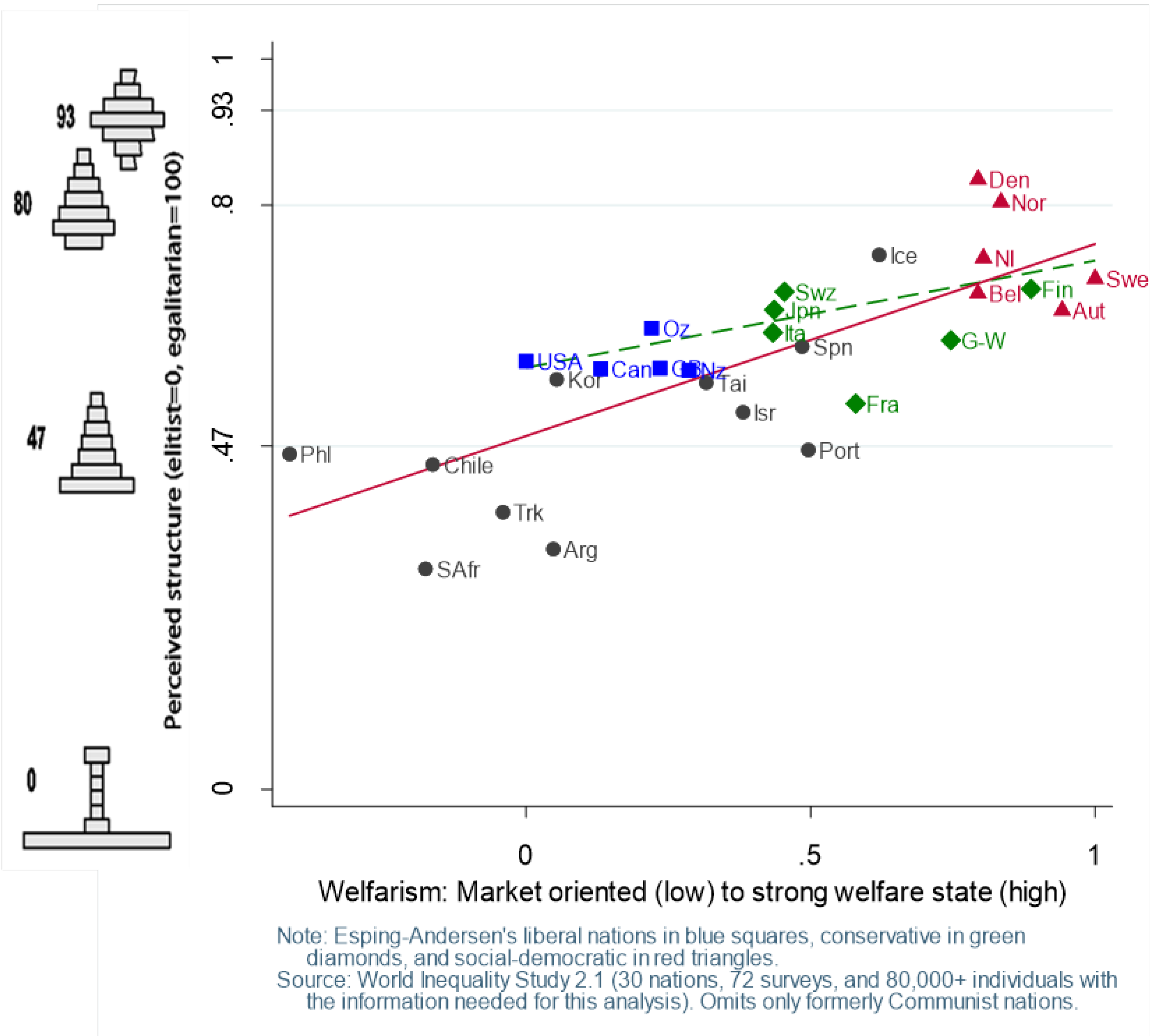

3.1. Welfare State Strength: Description: Levels of Welfarism

3.2. Inequality and Welfare State Strength (Welfarism)

Inequality: Perceptions

3.3. Goals: What Society Ought to Be

3.4. Controlling for Other Things

3.5. Welfare State Strength (Welfarism) and Redistribution

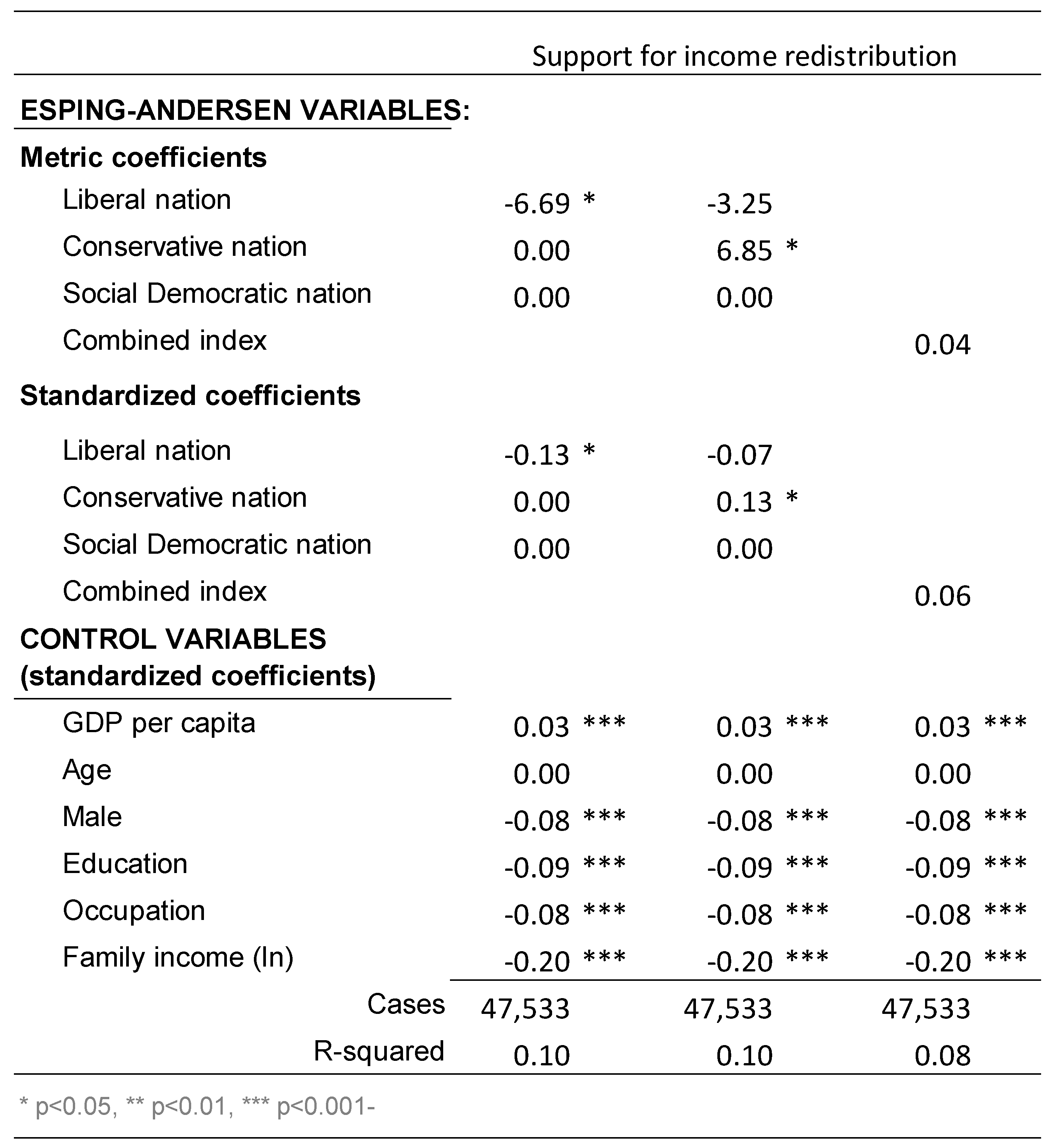

3.5.1. Support for Income Redistribution

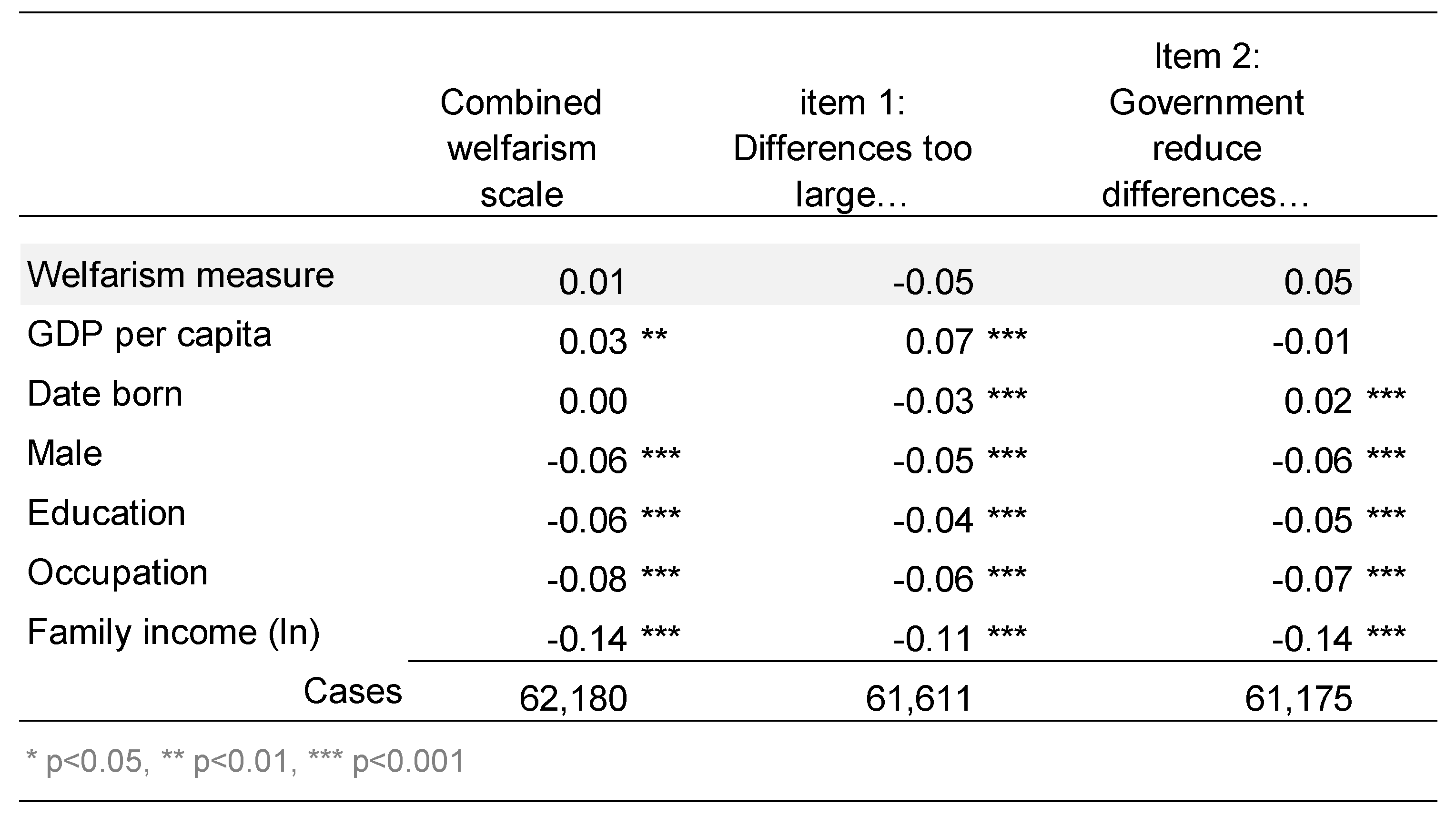

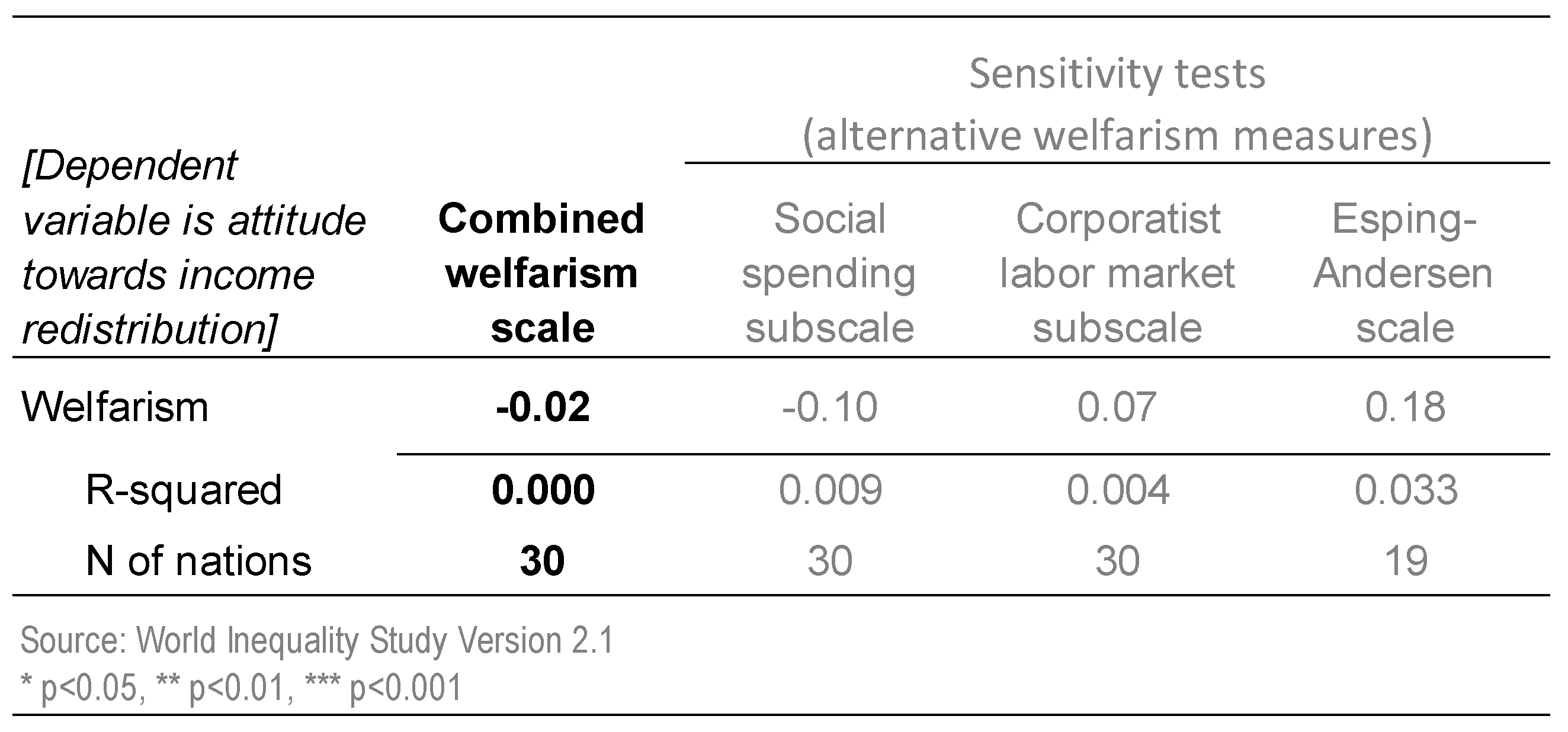

3.5.2. Redistribution Attitudes Do Not Align with Welfarism (No Main Effect)

3.5.3. Redistribution: Effects of Individual SES and Perceptions of Inequality

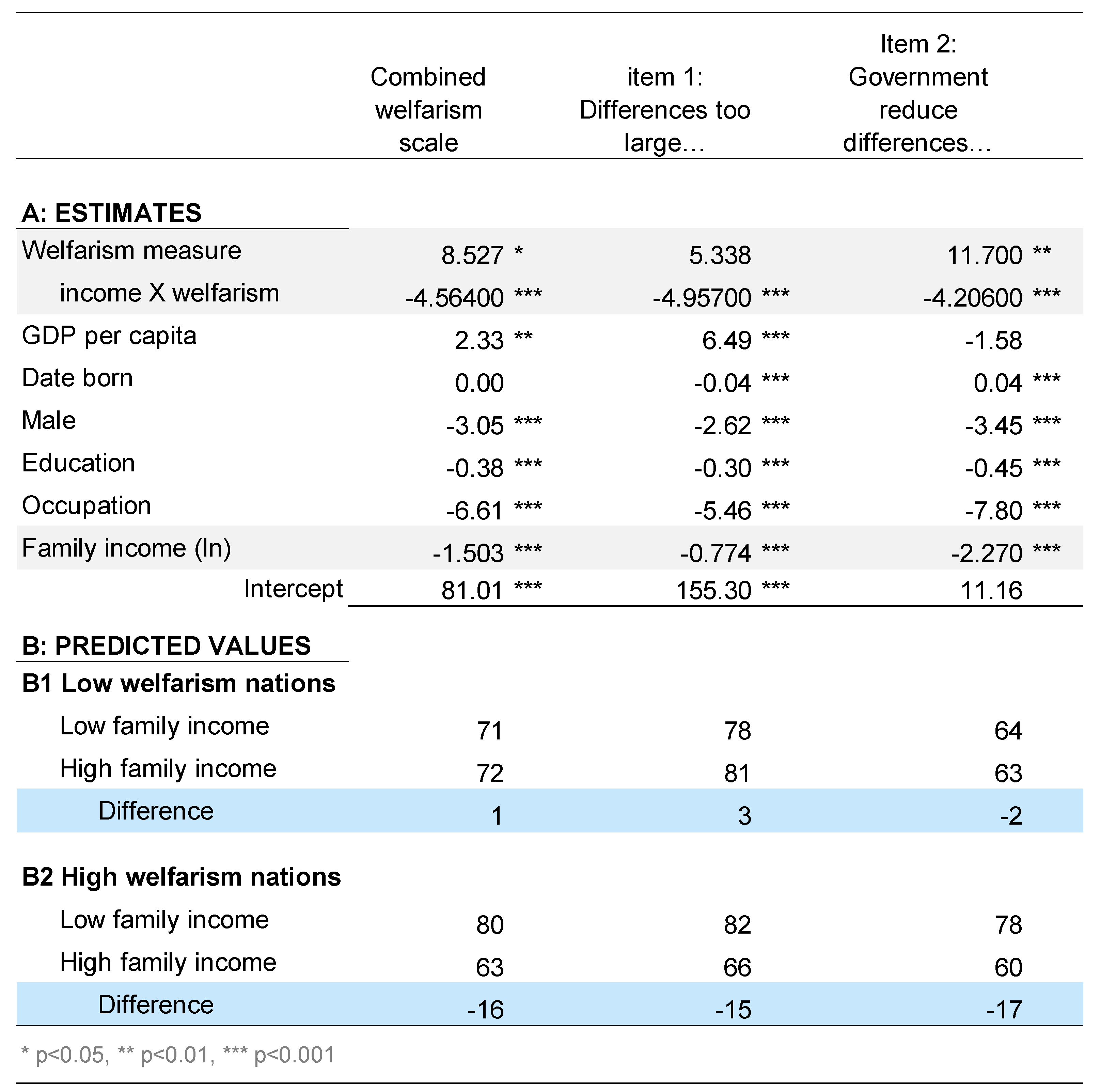

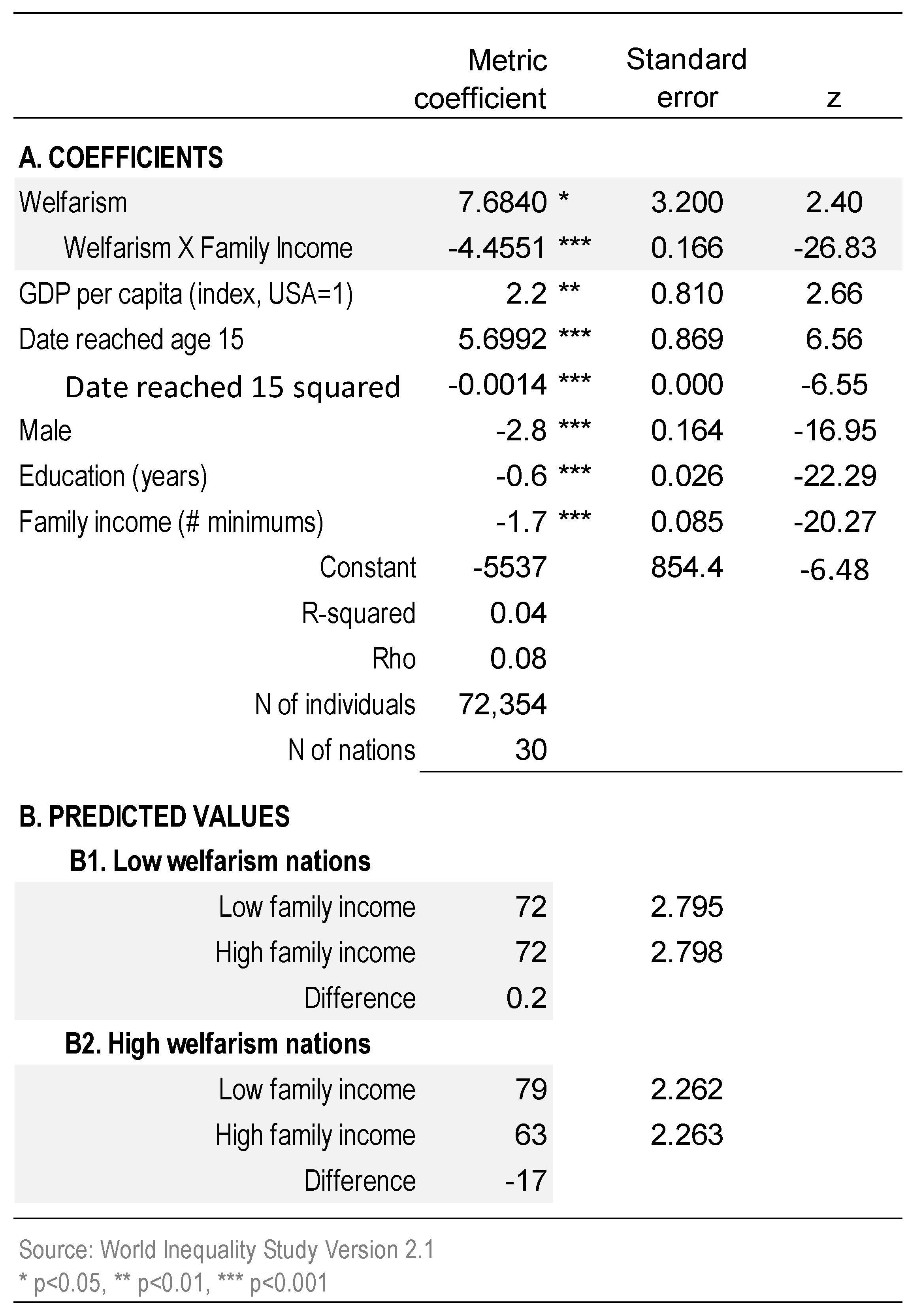

3.5.4. Harvest Fatigue among the Prosperous?

3.6. Exploratory Case Study: Separating Individual-Level Effects into Egotropic and Sociotropic Influences

3.6.1. Family Background and Demographic Characteristics’ Total Effects

3.6.2. Socioeconomic Status, Class

“If America BECAME MORE EQUAL than it is now, how would that affect your position?”Raise me MUCH HIGHER UP with far fewer people above me and many more belowRaise me a LITTLE HIGHER UP, not quite so many people above me and a few more belowNO CHANGE for meLeave me a LITTLE LOWERLeave me MUCH LOWER

3.6.3. Ideology: Perceptions of Society

3.6.4. Inequality Preferences

3.6.5. Party Politics

4. Discussion

4.1. Summary

- The real world performance and ideology of strong welfare states does NOT persuade their citizens to support income redistribution any more than is common for citizens of countries with weaker welfare states.

- Income is unrelated to support for redistribution in market-oriented societies: All across the income spectrum, mild support for redistribution is the dominant attitude.

- By contrast, where welfarism is stronger, income differences emerge. Affluent citizens of strong welfare states are less supportive of income redistribution than are the poor in their societies. They are even less supportive than are equally affluent citizens in liberal, economically conservative nations.

- Case study results suggest that sociotropic concerns tend to be dominant in the formation of attitudes towards income redistribution.

4.2. Implications

4.2.1. Inequality

4.2.2. Redistribution

Author Contributions

Acknowledgments

Conflicts of Interest

Appendix A. Measurement of Welfarism

Appendix B. Individual-Level Controls

Appendix B.1. Age and Date Born

Appendix B.2. Occupational Status

Appendix C. Measurement of Redistributive Attitudes

Appendix D. Inequality Images and Preferences (Different Welfarism Measures)

Appendix E. Sensitivity Tests for the Cross-Level Interaction (Different Welfarism Measures)

Appendix F. Additional Country Level Controls for the Cross-Level Interaction

Appendix F.1. A Note on Gini Inequality

Appendix G. Exploratory Case Study, USA 2016–2017

Appendix G.1. Data

Appendix G.2. Measurement of Functionalism (Three Items, Alpha Reliability = 0.79)

Appendix G.3. Measurement of Meritocracy (6 Items, Alpha Reliability = 0.90)

Appendix G.4. Measuring Perceptions of Corruption

References

- Marsland, D. Welfare or Welfare State? Contradictions and Dilemmas in Social Policy; Springer: New York, NY, USA, 1996. [Google Scholar]

- Bean, C.S.; Papadakis, E. A Comparison of Mass Attitudes towards the Welfare State in Different Institutional Regimes, 1985–1990. Int. J. Public Opin. Res. 1998, 10, 211–236. [Google Scholar] [CrossRef]

- Papadakis, E.; Bean, C.S. Popular Support for the Welfare State. J. Public Policy 1993, 13, 227–254. [Google Scholar] [CrossRef]

- Manza, J.; Brooks, C. How Sociology Lost Public Opinion. Sociol. Theory 2012, 30, 89–113. [Google Scholar] [CrossRef]

- Gingrich, J.R.; Ansell, B.W. Preferences in context: Micro preferences, macro-contexts and the demand for social policy. Comp. Polit. Stud. 2012, 45, 1624–1654. [Google Scholar] [CrossRef]

- Kulin, J.; Svallfors, S. Class, Values, and Attitudes towards Redistribution. Eur. Sociol. Rev. 2013, 29, 155–167. [Google Scholar] [CrossRef]

- Arts, W.; Gelissen, J. Welfare States, Solidarity and Justice Principles: Does the Type Really Matter? Acta Sociol. 2001, 44, 283–299. [Google Scholar] [CrossRef]

- Gelissen, J. Popular Support for Institutionalised Solidarity: A Comparison between European Welfare States. Int. J. Soc. Welf. 2000, 9, 285–300. [Google Scholar] [CrossRef]

- Jæger, M.M. Welfare regimes and attitudes towards redistribution. Eur. Sociol. Rev. 2006, 22, 157–170. [Google Scholar] [CrossRef]

- Jaeger, M.M. United but divided: Welfare regimes and the level and variance in public support for redistribution. Eur. Sociol. Rev. 2009, 25, 723–737. [Google Scholar] [CrossRef]

- Jordan, J. Institutional Feedback and Support for the Welfare State: The Case of National Health Care. Comp. Polit. Stud. 2010, 20, 1–24. [Google Scholar] [CrossRef]

- Larsen, C.A. The institutional logic of welfare attitudes: How welfare regimes influence public support. Comp. Polit. Stud. 2008, 41, 145–168. [Google Scholar] [CrossRef]

- Rothstein, R. Growth with inequality: Is there another way? New Perspect. Q. 1997, 14, 36–40. [Google Scholar]

- Brady, D.; Bostic, A. Paradoxes of social policy: Welfare transfers, relative poverty, and redistribution preferences. Am. Sociol. Rev. 2015, 80, 268–298. [Google Scholar] [CrossRef]

- Kelley, J.; Evans, M.D.R.; Mateju, P.; Knudsen, K.; Skjak, K.; Cichomski, B.; Morawski, P.; Malnar, B. Analytic Guide to the ISSP 1999 Inequality Questionnaire; International Survey Center, 1998. Available online: http://www.international-survey.org/ (accessed on 13 October 2008).

- ISSP Research Group (Zentralarchiv fuer Empirische Sozialforschung). International Social Survey Programme: Social Inequality I-IV ADD ON—ISSP 1987-1992-1999-2009. GESIS Data Archive, Cologne. ZA5891 Data file Version 1.1.0. 2014. Available online: https://dbk.gesis.org/dbksearch/sdesc2.asp?no=5891 (accessed on 27 September 2018).

- Marx, K. Economic and Philosophic Manuscripts of 1844: Selections. In The Marx-Engels Reader; Tucker, R.C., Ed.; W.W. Norton: New York, NY, USA, 1972; pp. 53–103. [Google Scholar]

- Marx, K.; Engels, F.C. Manifesto of the Communist Party. In The Marx-Engels Reader; Tucker, R.C., Ed.; W.W. Norton: New York, NY, USA, 1972; pp. 335–362. [Google Scholar]

- Owens, L.A.; Pedulla, D.S. Material Welfare and Changing Political Preferences. Soc. Forces 2014, 92, 1087–1113. [Google Scholar] [CrossRef]

- Fernandez, J.; Jaime-Castillo, A.M. The Institutional Foundation of Social Class Differences in Pro-redistribution Attitudes: A Cross-National Analysis, 1985–2010. Soc. Forces 2018, 96, 1009–1038. [Google Scholar] [CrossRef]

- Breznau, N.; Eger, M.A. Immigrant presence, group boundaries, and support for the Welfare State in Western European societies. Acta Sociol. 2016, 59, 195–214. [Google Scholar] [CrossRef]

- Abercrombie, N.; Turner, B.S. The Dominant Ideology Thesis. Br. J. Sociol. 1978, 29, 149–170. [Google Scholar] [CrossRef]

- Form, W.H.; Rytina, J.H. Ideological Beliefs on the Distribution of Power in the United States. Am. Sociol. Rev. 1969, 34, 19–30. [Google Scholar] [CrossRef]

- Gramsci, A. Selections from Cultural Writings; Forgas, D., Nowell-Smith, G., Eds.; Boelhower, W., Translator; Haymarket Books: Chicago, IL, USA, 2012. [Google Scholar]

- Rytina, J.H.; Form, W.H.; Pease, J. Income and Stratification Ideology: Beliefs about the American Opportunity Structure. Am. J. Sociol. 1970, 75, 703–716. [Google Scholar] [CrossRef]

- Jost, J.T.; Banaji, M.R.; Nosek, B.A. A Decade of System Justification Theory: Accumulated Evidence of Conscious and Unconscious Bolstering of the Status Quo. Polit. Psychol. 2004, 25, 881–919. [Google Scholar] [CrossRef]

- Homans, G.C. Social Behavior: Its Elementary Forms, Revised ed.; Harcourt, Brace, Jovanovich: New York, NY, USA, 1974. [Google Scholar]

- Campbell, A.L. Policy Makes Mass Politics. Ann. Rev. Polit. Sci. 2012, 15, 333–351. [Google Scholar] [CrossRef]

- Mettler, S.; Sorelle, M. Policy Feedback Theory. In Theories of the Policy Process; Weible, C.M., Sabatier, P.A., Eds.; Westview: Boulder, CO, USA, 2014; pp. 151–182. [Google Scholar]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations: Formal Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Meyer, J.W.; Jepperson, R.L. The “Actors” of Modern Society: The Cultural Construction of Social Agency. Sociol. Theory 2000, 18, 100–120. [Google Scholar] [CrossRef]

- Key, V.O. Public opinion and the decay of democracy. Va. Q. Rev. 1961, 37, 481. [Google Scholar]

- Nisbet, R.A. Voting Practices versus Democratic Theory. Commentary 1961, 31, 60–67. [Google Scholar]

- Durkheim, E. Le Suicide: Étude de Sociologie; Alcan: Paris, France, 1897. [Google Scholar]

- Durkheim, E. The Division of Labour in Society, 2nd ed.; Lukes, S., Ed.; Halls, W.D., Translator; Free Press: New York, NY, USA, 1902. [Google Scholar]

- Esping-Andersen, G.; Nedoluzhko, L. Inequality equilibria and individual well-being. Soc. Sci. Res. 2017, 62, 24–28. [Google Scholar] [CrossRef] [PubMed]

- Mettler, S. The Government-Citizen Disconnect; Russell Sage: New York, NY, USA, 2018. [Google Scholar]

- Converse, P.E. Ideology and Discontent. In The Nature of Belief Systems in Mass Publics; Apter, D.E., Ed.; Free Press: New York, NY, USA, 1964; pp. 206–261. [Google Scholar]

- Edlund, J.; Lindh, A. The Democratic Class Struggle Revisited: The Welfare State, Social Cohesion and Political Conflict. Acta Sociol. 2015, 58, 311–328. [Google Scholar] [CrossRef]

- Esping-Andersen, G. The Three Worlds of Welfare Capitalism; Princeton University Press: Princeton, NJ, USA, 1990. [Google Scholar]

- Pierson, P. Dismantling the Welfare State? Reagan, Thatcher, and the Politics of Retrenchment; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Skocpol, T. Protecting Soldiers and Mothers; Harvard University Press: Cambridge, MA, USA, 1992. [Google Scholar]

- Steele, L.G. Income Inequality, Equal Opportunity, and Attitudes about Redistribution. Soc. Sci. Q. 2015, 96, 444–464. [Google Scholar] [CrossRef]

- Evans, M.D.R.; Kelley, J.; Kolosi, T. Images of Class: Public Perceptions in Hungary and Australia. Am. Sociol. Rev. 1992, 57, 461–482. [Google Scholar] [CrossRef]

- Evans, M.D.R.; Kelley, J. Communism, Capitalism, and Images of Class: Effects of Reference Groups, Reality, and Regime in 43 Nations and 110,000 Individuals, 1987–2009. Cross-Cult. Res. 2017, 51, 315–359. [Google Scholar] [CrossRef]

- Beramendi, P.; Rehm, P. Who Gives, Who Gains? Progressivity and Preferences. Comp. Polit. Stud. 2016, 49, 529–563. [Google Scholar] [CrossRef]

- Lupu, N.; Pontusson, J. The Structure of Inequality and the Politics of Redistribution. Am. Polit. Sci. Rev. 2011, 105, 316–336. [Google Scholar] [CrossRef]

- Svallfors, S. Worlds of welfare and attitudes to redistribution: A comparison of eight western nations. Eur. Sociol. Rev. 1997, 13, 283–304. [Google Scholar] [CrossRef]

- Heuer, J.-O.; Mau, S.; Zimmermann, K. Attitudes to Inequalities: Citizen Deliberation About the (Re-)Distribution of Income and Wealth in Four Welfare State Regimes. In Attitudes, Aspirations and Welfare; Taylor-Gooby, P., Leruth, B., Eds.; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar]

- Breznau, N.; Hommerich, C. The Limits of Income Inequality: Public Support for Social Policy across Rich Democracies. arXiv 2018. [Google Scholar] [CrossRef]

- Breznau, N. Positive Returns and Equilibrium: Simultaneous Feedback between Public Opinion and Social Policy. Policy Stud. J. 2017, 45, 583–612. [Google Scholar] [CrossRef]

- Morgan, S.L.; Winship, C. Counterfacuals and Causal Inference, 2nd ed.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Jacques, O.; Noel, A. The case for welfare state universalism, or the lasting relevance of the paradox of redistribution. J. Eur. Soc. Policy 2018, 28, 70–85. [Google Scholar] [CrossRef]

- Korpi, W.; Palme, J. The Paradox of Redistribution and Strategies of Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries. Am. Sociol. Rev. 1998, 63, 661–687. [Google Scholar] [CrossRef]

- Maas, C.; Hox, J. Sample sizes for multi-level modelling. Am. J. Public Health 1999, 89, 1181–1186. [Google Scholar]

- Maas, C.J.M.; Hox, J.J. Sufficient Sample Sizes for Multilevel Modeling. Methodology 2005, 1, 86–92. [Google Scholar] [CrossRef]

- Cutright, P. Political Structure, Economic Development, and National Social Security Programs. Am. J. Sociol. 1965, 70, 537–550. [Google Scholar] [CrossRef]

- Wilensky, H.W. The Welfare State and Equality: Structural and Ideological Roots of Public Expenditure; University of California Press: Berkeley, CA, USA, 1975. [Google Scholar]

- Brady, D.; Beckfield, J.; Seeleib-Kaiser, M. Economic Globalization and the Welfare State in Affluent Democracies, 1975–2001. Am. Sociol. Rev. 2005, 70, 921–948. [Google Scholar] [CrossRef]

- Brady, D. Rich Democracies, Poor People; Oxford University Press: Oxford, UK, 2009. [Google Scholar]

- Polanyi, K. The Great Transformation; Farrar & Rinehart: New York, NY, USA, 1944. [Google Scholar]

- Castles, F.G. Comparative Public Policy: Patterns of Post-War Transformation; Edward Elgar: Northampton, MA, USA, 1998. [Google Scholar]

- Stier, H.; Lewin-Epstein, N.; Braun, M. Welfare regimes, family-supportive policies, and women’s employment along the life-course. Am. J. Sociol. 2001, 106, 1731–1760. [Google Scholar] [CrossRef]

- Crepaz, M.M.L. Corporatism in Decline? An Empirical Analysis of the Impact of Corporatism on Macroeconomic Performance and Industrial Disputes in 18 Industrialized Nations. Comp. Polit. Stud. 1992, 25, 139–168. [Google Scholar] [CrossRef]

- Crepaz, M.M.L.; Lijphart, A. Linking and Integrating Corporatism and Consensus Democracy. Br. J. Polit. Sci. 1995, 25, 281–288. [Google Scholar] [CrossRef]

- Hicks, A.; Misra, J. Political Resources and the Growth of Welfare in Affluent Capitalist Democracies, 1960–1982. Am. J. Sociol. 1993, 99, 668–710. [Google Scholar] [CrossRef]

- Hicks, A.M.; Swank, D.H. Politics, Institutions, and Welfare Spending in Industrialized Democracies, 1960–1982. Am. Polit. Sci. Rev. 1992, 86, 658–674. [Google Scholar] [CrossRef]

- Kenworthy, L. Corporatism and unemployment in the 1980s and 1990s. Am. Sociol. Rev. 2002, 67, 367–388. [Google Scholar] [CrossRef]

- Kenworthy, L. Quantitative Indicators of Corporatism. Int. J. Sociol. 2003, 33, 10–44. [Google Scholar] [CrossRef]

- Kenworthy, L.; McCall, L. Inequality, public opinion and redistribution. Socio-Econ. Rev. 2008, 6, 35–68. [Google Scholar] [CrossRef]

- Iversen, T.; Soskice, D. Distribution and Redistribution: The Shadow of the Nineteenth Century. World Polit. 2009, 61, 438–486. [Google Scholar] [CrossRef]

- OECD. OECD Employment Outlook; OECD: Paris, France, 2004; ISBN 92-64-10812-2. [Google Scholar]

- Hicks, A.; Kenworthy, L. Cooperation and Political Economic Performance in Affluent Democratic Capitalism. Am. J. Sociol. 1998, 103, 1631–1672. [Google Scholar] [CrossRef]

- Bollen, K.A. Confirmatory Factor Analysis. In Structural Equations with Latent Variables; Wiley-Interscience: Hoboken, CA, USA, 1989; pp. 226–318. [Google Scholar]

- Treiman, D.J. Scale Construction. In Quantitative Data Analysis; Jossey-Bass: San Francisco, CA, USA, 2009; pp. 241–262. [Google Scholar]

- Castles, F.G. What Welfare States Do: A Disaggregated Expenditure Approach. J. Soc. Policy 2009, 38, 45–62. [Google Scholar] [CrossRef]

- Green-Pedersen, C. The Dependent Variable Problem within the Study of Welfare State Retrenchment: Defining the Problem and Looking for Solutions. J. Comp. Policy Anal. Res. Pract. 2007, 6, 3–14. [Google Scholar] [CrossRef]

- Kenworthy, L. Do social-welfare policies reduce poverty? A cross-national assessment. Soc. Forces 1999, 77, 1119–1139. [Google Scholar] [CrossRef]

- Palme, J. Welfare states and inequality: Institutional designs and distributive outcome. Res. Soc. Stratif. Mobil. 2006, 24, 387–403. [Google Scholar] [CrossRef]

- Brett, E.A. From Corporatism to Liberalization in Zimbabwe: Economic Policy Regimes and Political Crisis, 1980–1997. Int. Polit. Sci. Rev. 2005, 26, 91–106. [Google Scholar] [CrossRef]

- Desai, A.; Habib, A. Labour Relations in Transition: The Rise of Corporatism in South Africa’s Automobile Industry. J. Mod. Afr. Stud. 1997, 35, 495–518. [Google Scholar] [CrossRef]

- Dickson, B.J. Cooptation and Corporatism in China: The Logic of Party Adaptation. Polit. Sci. Q. 2001, 115, 517–540. [Google Scholar] [CrossRef]

- Makoba, J. Rethinking Development Strategies in Africa; Peter Lang: New York, NY, USA, 2011. [Google Scholar]

- Lijphart, A.; Crepaz, M.M.L. Corporatism and Consensus Democracy in Eighteen Countries: Conceptual and Empirical Linkages. Br. J. Polit. Sci. 1991, 21, 235–246. [Google Scholar] [CrossRef]

- Castles, F.G.; Obinger, H. Worlds, Families, Regimes: Country Clusters in European and OECD Area Public Policy. West Eur. Polit. 2008, 31, 321–344. [Google Scholar] [CrossRef]

- Breznau, N. The Missing Main Effect of Welfare State Regimes. Sociol. Sci. 2015, 2, 420–441. [Google Scholar] [CrossRef]

- Castles, F.G. The English-Speaking Countries. In The Oxford Handbook of the Welfare State; Castles, F.G., Leibfried, S., Lewis, J., Obinger, H., Pierson, C., Eds.; Oxford Handbooks Online: Oxford, UK, 2010. [Google Scholar]

- Porta, R.L.; López-de-Silanes, F.; Pop-Eleches, C.; Shleifer, A. The Guarantees of Freedom. Harv. Inst. Econ. Res. 2002. [Google Scholar] [CrossRef]

- Faculty of Law—Civil Law Section World Legal Systems. Available online: http://www.droitcivil.uottawa.ca/world-legal-systems/eng-commonwealthmembers.html (accessed on 1 June 2016).

- David, R.; Brierley, J.E.C. Major Legal Systems in the World Today; Free Press: New York, NY, USA, 1978. [Google Scholar]

- Arts, W.; Gelissen, J. Three worlds of welfare capitalism or more? J. Eur. Soc. Policy 2002, 12, 137–158. [Google Scholar] [CrossRef]

- Andrews, F.M. Construct Validity and Error Components of Survey Measures: A Structural Modeling Approach. Public Opin. Q. 1984, 48, 409–442. [Google Scholar] [CrossRef]

- Gjeddebaek, N.F. Grouped observations. In International Encyclopedia of the Social Sciences; Sills, D.S., Ed.; Macmillan Co., Free Press: New York, NY, USA, 1968. [Google Scholar]

- Haitovsky, Y. Grouped data. In International Encyclopedia of the Social and Behavioral Sciences; Baltes, P.B., Smelser, N.J., Eds.; Elsevier: New York, NY, USA, 2001; pp. 14995–15002. [Google Scholar]

- Heitjan, D. Inference from Grouped Continuous Data. Stat. Sci. 1989, 4, 164–179. [Google Scholar] [CrossRef]

- World Bank. Per Capita GDP at Parity Purchasing Power; World Bank: New York, NY, USA, 2012. [Google Scholar]

- Breznau, N. Secondary observer effects: Idiosyncratic errors in small-N secondary data analysis. Int. J. Soc. Res. Methodol. 2016, 19, 301–318. [Google Scholar] [CrossRef]

- Kaufmann, D.; Kraay, A.; Mastruzzi, M. Governance Matters, VII: Aggregate and Individual Governance Indicators, 1996–2007; World Bank: New York, NY, USA, 2008. [Google Scholar]

- OECD. OECD Employment Outlook; OECD: Paris, France, 2005. [Google Scholar]

- OECD. Divided We Stand: Why Inequality Keeps Rising; OECD: Paris, France, 2011; p. 400. [Google Scholar]

- Ryder, N.B. The Cohort as a Concept in the Study of Social Change. Am. Sociol. Rev. 1965, 30, 843–861. [Google Scholar] [CrossRef] [PubMed]

- Kelley, J. The Failure of a Paradigm: Log-Linear Models of Social Mobility. In John Goldthorpe: Consensus and Controversy; Clark, J., Modgil, S., Modgil, C., Eds.; Falmer Press: London, UK, 1990; pp. 319–346. [Google Scholar]

- Kelley, J. Goldthorpe’s Class Typology Revisited: Kelley Replies to Mueller. In John Goldthorpe: Consensus and Controversy; Clark, J., Modgil, S., Modgil, C., Eds.; Falmer Press: London, UK, 1990; pp. 349–357. [Google Scholar]

- Kelley, J.; Evans, M.D.R. The Legitimation of Inequality: Occupational Earnings in Nine Nations. Am. J. Sociol. 1993, 99, 75–125. [Google Scholar] [CrossRef]

- Breznau, N. Economic Equality and Social Welfare: Policy Preferences in Five Nations. Int. J. Public Opin. Res. 2010, 22, 458–484. [Google Scholar] [CrossRef]

- Sikora, J. Perceptions of economic efficiency of government versus private enterprises, and attitudes to government ownership in the economy. Res. Soc. Stratif. Mobil. 2005, 23, 227–274. [Google Scholar] [CrossRef]

- Naumann, E.; Buss, C.; Bähr, J. How Unemployment Experience Affects Support for the Welfare State: A Real Panel Approach. Eur. Sociol. Rev. 2016, 32, 81–92. [Google Scholar] [CrossRef]

- Kelley, J.; Evans, M.D.R.; Sikora, J. World Inequality Study, 1967–2004: Codebook and Machine Readable Data File. International Survey Center: Point Marka, Australia, 2007. [Google Scholar]

- Zlatkov, T.; Zagorski, K.; Kelley, J. Bulgaria: International Survey of Economic Attitudes. Codebook and Machine-Readable Data File; Sofia University: Sofia, Bulgaria, 1998. [Google Scholar]

- Kelley, J.; Zagorski, K.; Evans, M.D.R.; Ervasti, H.; Ganzeboom, H.B.G.; Gijsberts, M.; Kangas, O.; Robert, P.; Zlatkov, T. ISEA, Rounds 1 and 2 (International Survey of Economic Attitudes). Codebook and MRDF; International Survey Center: Point Marka, Australia, 1998. [Google Scholar]

- Kelley, J.; Evans, M.D.R.; Zagorski, K. Australia: International Survey of Economic Attitudes, Round 3. Codebook and MRDF; International Social Science Survey and Melbourne Institute of Applied Economic and Social Research, University of Melbourne: Melbourne, Australia, 1998. [Google Scholar]

- Bollen, K.A. Reliability. In Structural Equations with Latent Variables; John Wiley: New York, NY, USA, 1989; pp. 206–221. [Google Scholar]

- Bollen, K.A. The Consequences of Measurement Error. In Structural Equations with Latent Variables; John Wiley: New York, NY, USA, 1989; pp. 151–169. [Google Scholar]

- Evans, M.D.R.; Kelley, J. Data, Measurement, and Methods. In Australian Economy and Society 2002: Religion, Morality, and Public Policy in International Perspective, 1984–2002; Evans, M.D.R., Kelley, J., Eds.; Federation Press: Sydney, Australia, 2004; pp. 317–336. [Google Scholar]

- Linos, K.; West, M. Self-interest, social beliefs, and attitudes towards redistribution. Eur. Sociol. Rev. 2003, 19, 393–409. [Google Scholar] [CrossRef]

- Kelley, J.; Evans, M.D.R.; Sikora, J.; Breznau, N. World Inequality Study; Survey, I.S.S., Ed.; International Survey Center: Point Marka, Australia, 2015. [Google Scholar]

- Kelley, J.; Evans, M.D.R. International Survey of Economic Attitudes: Australia. Codebook and MRDF; Melbourne Institute of Applied Economic and Social Research, University of Melbourne: Melbourne, Australia, 1998. [Google Scholar]

- Nieuwbeerta, P.; Gijsberts, M.; Ganzeboom, H.B.G. Sociaal-Economische Ontwikkelingen in Nederland 1998 (Social and Economic Attitudes in The Netherlands 1998); Codebook and MRDF; ICS Codebook 38; ICS (Interuniversity Center for Social Science Theory and Methodology): Utrecht, The Netherlands, 1998. [Google Scholar]

- AAPOR (American Association for Public Opinion Research). Standard Definitions: Final Dispositions of Case Codes and Outcome Rates for Surveys; AAPOR: Oakbrook Terrace, IL, USA, 2016. Available online: https://www.aapor.org/Standards-Ethics/Standard-Definitions-(1).aspx (accessed on 16 October 2018).

- Evans, M.D.R.; Kelley, J. Data, measurement, and methods. In Australian Economy and Society 2001: Education, Work, and Welfare; Evans, M.D.R., Kelley, J., Eds.; Federation Press: Sydney, Australia, 2002; Chapter 28; pp. 296–310. [Google Scholar]

- Sikora, J. International Survey of Economic Attitudes in Australia, Finland and Poland: Comparison with the Census. WwA Worldwide. Attitudes 1997, 1–8. Available online: http://www.international-survey.org/wwa_pub/articles/joanna2.htm (accessed on 13 October 2008).

- Berk, R.A. An Introduction to Sample Selection Bias in Sociological Data. Am. Sociol. Rev. 1983, 48, 386–398. [Google Scholar] [CrossRef]

- Evans, M.D.R. Choosing to Be a Citizen: The Time-Path of Citizenship in Australia. Int. Migr. Rev. 1988, 22, 243–264. [Google Scholar] [CrossRef]

- Breznau, N.; Lykes, V.; Kelley, J.; Evans, M.D.R. A Clash of Civilizations? Preferences for Religious Political Leaders in 81 Nations. J. Sci. Stud. Relig. 2011, 50, 671–691. [Google Scholar] [CrossRef]

- Kuhn, A. Comment on Levy’s Review of The Logic of Social Systems. Am. J. Sociol. 1977, 82, 1346–1347. [Google Scholar] [CrossRef]

- Kuhn, A. The Individual Perception of Wage Inequality: A Measurement Framework and Some Empirical Evidence; IZA Discussion Paper No. 9579; University of Zurich, IZA Institute of Labor Economics: Zurich, Switzerland, 2015. [Google Scholar]

- Evans, M.D.R.; Kelley, J.; Kelley, S.M.C.; Kelley, C.G.E. Rising Income Inequality during the Great Recession Had No Impact on Subjective Wellbeing in Europe, 2003–2012. J. Happiness Stud. 2017. [Google Scholar] [CrossRef]

- Kelley, J.; Evans, M. The new income inequality and well-being paradigm. Soc. Sci. Res. 2017, 62, 39–74. [Google Scholar] [CrossRef] [PubMed]

- Kelley, J.; Evans, M.D.R. Societal Income Inequality and Individual Subjective Well-Being: Results from 68 Societies and over 200,000 Individuals, 1981–2008. Soc. Sci. Res. 2017, 62, 1–23. [Google Scholar] [CrossRef] [PubMed]

- Nielsen, F. Inequality and inequity. Soc. Sci. Res. 2017, 62, 29–35. [Google Scholar] [CrossRef] [PubMed]

- Kelley, J.; Evans, M.D.R. Class and Class Conflict in Six Western Nations. Am. Sociol. Rev. 1995, 60, 157–178. [Google Scholar] [CrossRef]

- Davis, K.; Moore, W. Some Principles of Stratification. Am. Sociol. Rev. 1945, 10, 242–249. [Google Scholar] [CrossRef]

- Schneider, S.; Castillo, J.C. Poverty Attributions and the Perceived Justice of Income Inequality. Soc. Psychol. Q. 2015, 78, 263–282. [Google Scholar] [CrossRef]

- Sanchez, A.; Goda, T. Corruption and the ‘Paradox of Redistribution’. Soc. Indic. Res. 2017. [Google Scholar] [CrossRef]

- Gijsberts, M. The legitimation of income inequality in state-socialist and market societies. Acta Sociol. 2002, 45, 269–285. [Google Scholar] [CrossRef]

- Fatke, M. Inequality and Political Behavior: Objective Levels versus Subjective Perceptions. SSRN 2018, 2018. [Google Scholar] [CrossRef]

- Knell, M.; Stix, H. Inequality, Perception Biases and Trust. OeNB WorkingPapers 2016, 2016, 1–56. [Google Scholar]

- Jasso, G. A New Theory of Distributive Justice. Am. Sociol. Rev. 1980, 45, 3–32. [Google Scholar] [CrossRef]

- Jasso, G. Thinking, Saying, Doing in the World of Distributive Justice. Soc. Justice Res. 2015, 28, 435–478. [Google Scholar] [CrossRef]

- Robinson, R.V.; Bell, W. Equality, Success, and Social Justice in England and the United States. Am. Sociol. Rev. 1978, 43, 125–143. [Google Scholar] [CrossRef]

- Evans, M.D.R.; Kelley, J. Population Size, Economic Development, and Attitudes towards Inequality: Evidence from 30 Nations. Popul. Rev. 2007, 46, 1–23. [Google Scholar] [CrossRef]

- Evans, M.D.R.; Kelley, J. Economic Development and Inequality Attitudes: The Long Shadow of the Past; Annual Meeting of the American Sociological Association, Section on Political Sociolog: Montreal, QC, Canada, 2006. [Google Scholar]

- Hadler, M. Why Do People Accept Different Income Ratios? A Multi-level Comparison of Thirty Countries. Acta Sociol. 2005, 48, 131–154. [Google Scholar] [CrossRef]

- Kelley, J.; Evans, M.D.R. Economic Development Reduces Tolerance for Inequality: A Comparative Analysis of 30 Nations. In Charting the Globe: The International Social Survey Programme 1984–2009; Haller, M., Jowell, R., Smith, T., Eds.; Routledge: London, UK, 2009; pp. 49–72. [Google Scholar]

- Osberg, L.; Smeeding, T. “Fair” inequality? Attitudes toward pay differentials. Am. Sociol. Rev. 2006, 71, 450–473. [Google Scholar] [CrossRef]

- Mau, S.; Burkhardt, C. Migration and welfare state solidarity in Western Europe. J. Eur. Soc. Policy 2009, 19, 213–222. [Google Scholar] [CrossRef]

- Taylor-Gooby, P.; Leruth, B.; Chung, H. (Eds.) The context: How European welfare states have responded to post-industrialism, ageing populations, and populist nationalism. In After Austerity; Oxford University Press: Oxford, UK, 2017; pp. 1–26. [Google Scholar]

- Crepaz, M.M.L.; Jazayeri, K.B.; Polk, J. What’s Trust Got to Do with It? Soc. Sci. Q. 2016, 98, 261–281. [Google Scholar] [CrossRef]

- Wilkinson, R.G.; Pickett, K.E. Income Inequality and Social Dysfunction. Ann. Rev. Sociol. 2009, 35, 493–511. [Google Scholar] [CrossRef]

- Scruggs, L.; Allan, J. Welfare-state decommodification in 18 OECD countries. J. Eur. Soc. Policy 2006, 16, 55–72. [Google Scholar] [CrossRef]

- Scruggs, L.; Hayes, T.J. The Influence of Inequality on Welfare Generosity. Polit. Soc. 2017, 45, 35–66. [Google Scholar] [CrossRef]

- Brickman, P.; Campbell, D.T. Hedonic relativism and planning the good society. In Adaptation Level Theory: A Symposium; Appley, M.H., Ed.; Academic Press: New York, NY, USA, 1971. [Google Scholar]

- Headey, B. Life Goals Matter to Happiness: A Revision of Set-Point Theory. Soc. Indic. Res. 2008, 86, 213–231. [Google Scholar] [CrossRef]

- Merton, R.K. Social Structure and Anomie. Am. Sociol. Rev. 1938, 3, 672–682. [Google Scholar] [CrossRef]

- Pierson, P. Increasing Returns, Path Dependence, and the Study of Politics. Am. Polit. Sci. Rev. 2000, 94, 251–267. [Google Scholar] [CrossRef]

- Lockerbie, B. Economics and Politics: Egocentric or Sociotropic? Am. Rev. Polit. 2006, 27, 191–208. [Google Scholar] [CrossRef]

- Larsen, C.A. How three narratives of modernity justify economic inequality. Acta Sociol. 2016, 59, 93–111. [Google Scholar] [CrossRef]

- Crepaz, M.M.L. Rumors that Diversity is the Death of the Welfare State Are Greatly Exaggerated. In Handbook on Migration and Social Policy; Freeman, G.P., Mirilovic, N., Eds.; Edward Elgar: Cheltenham, UK, 2016; pp. 293–329. [Google Scholar]

- Brint, S.; Cunningham, W.L.; Rebecca, S.K.L. The Politics of Professionals in Five Advanced Industrial Societies. In Citizen Politics in Post-Industrial Societies; Clark, T.N., Ed.; Routledge: New York, NY, USA, 1997. [Google Scholar]

- Esping-Andersen, G. Welfare states and the economy. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 1994; pp. 711–732. [Google Scholar]

- Korpi, W. The Working Class in Welfare Capitalism; Routledge & Kegan Paul: London, UK, 1978. [Google Scholar]

- Stephens, J.D. Class Formation and Class Consciousness. Br. J. Sociol. 1979, 30, 389–414. [Google Scholar] [CrossRef]

- Treiman, D.J. Occupational Prestige in Comparative Perspective; Academic Press: New York, NY, USA, 1977. [Google Scholar]

- Ganzeboom, H.B.G.; Treiman, D.J. Internationally Comparable Measures of Occupational Status for the 1988 International Standard Classification of Occupations. Soc. Sci. Res. 1996, 25, 201–239. [Google Scholar] [CrossRef]

- Featherman, D.L.; Hauser, R.M. On the Measurement of Occupation in Social Surveys. Sociol. Methods Res. 1973, 2, 239–251. [Google Scholar] [CrossRef]

- Hodge, R.W.; Siegel, P.M.; Rossi, P.H. Occupational Prestige in the United States, 1925–1963. Am. J. Sociol. 1964, 70, 286–302. [Google Scholar] [CrossRef]

- Siegel, P.M.; Hodge, R.W. A causal approach to measurement error. In Methodology in Social Research; Blalock, H.M., Blalock, A., Eds.; McGraw-Hill: New York, NY, USA, 1968; pp. 28–59. [Google Scholar]

- Duncan, O.D. A Socioeconomic Index for all Occupations. In Occupations and Social Status; Reiss, A.J., Ed.; Free Press: New York, NY, USA, 1961; pp. 109–138. [Google Scholar]

- Hodge, R.W. The measurement of occupational status. Soc. Sci. Res. 1981, 10, 396–415. [Google Scholar] [CrossRef]

- Clifford, S.; Jewell, R.M.; Waggoner, P.D. Are samples drawn from Mechanical Turk valid for research on political ideology. Res. Polit. 2015, 2. [Google Scholar] [CrossRef]

- Weinberg, J.D.; Freese, J.; McElhattan, D. Comparing Data Characteristics and Results of an Online Factorial Survey between a Population-Based and a Crowdsource-Recruited Sample. Sociol. Sci. 2014, 1, 292–310. [Google Scholar] [CrossRef]

- Springer, V.A.; Vezich, I.S.; Lindsey, S.C.; Martini, P.J. Practice-based considerations for using multi-stage survey design to reach special populations on Amazon’s Mechanical Turk. Surv. Pract. 2016, 9, 2800. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Evans, M.D.R.; Kelley, J. Strong Welfare States Do Not Intensify Public Support for Income Redistribution, but Even Reduce It among the Prosperous: A Multilevel Analysis of Public Opinion in 30 Countries. Societies 2018, 8, 105. https://doi.org/10.3390/soc8040105

Evans MDR, Kelley J. Strong Welfare States Do Not Intensify Public Support for Income Redistribution, but Even Reduce It among the Prosperous: A Multilevel Analysis of Public Opinion in 30 Countries. Societies. 2018; 8(4):105. https://doi.org/10.3390/soc8040105

Chicago/Turabian StyleEvans, M. D. R., and Jonathan Kelley. 2018. "Strong Welfare States Do Not Intensify Public Support for Income Redistribution, but Even Reduce It among the Prosperous: A Multilevel Analysis of Public Opinion in 30 Countries" Societies 8, no. 4: 105. https://doi.org/10.3390/soc8040105

APA StyleEvans, M. D. R., & Kelley, J. (2018). Strong Welfare States Do Not Intensify Public Support for Income Redistribution, but Even Reduce It among the Prosperous: A Multilevel Analysis of Public Opinion in 30 Countries. Societies, 8(4), 105. https://doi.org/10.3390/soc8040105