Methodology to Assess the Technoeconomic Impacts of the EU Fit for 55 Legislation Package in Relation to Shipping

Abstract

:1. Introduction

2. Background

2.1. Importance of Vessel Operating Expenditure (OPEX)

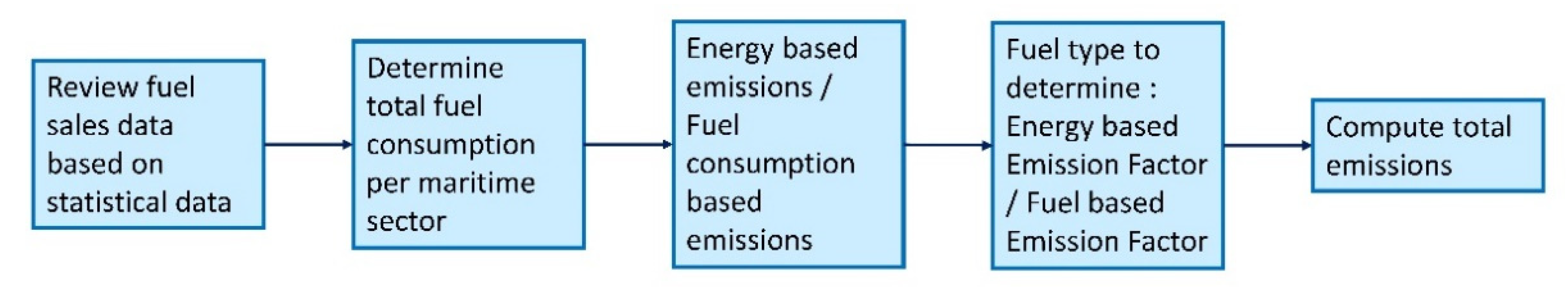

2.2. Various Approaches to Determine Emissions from Shipping

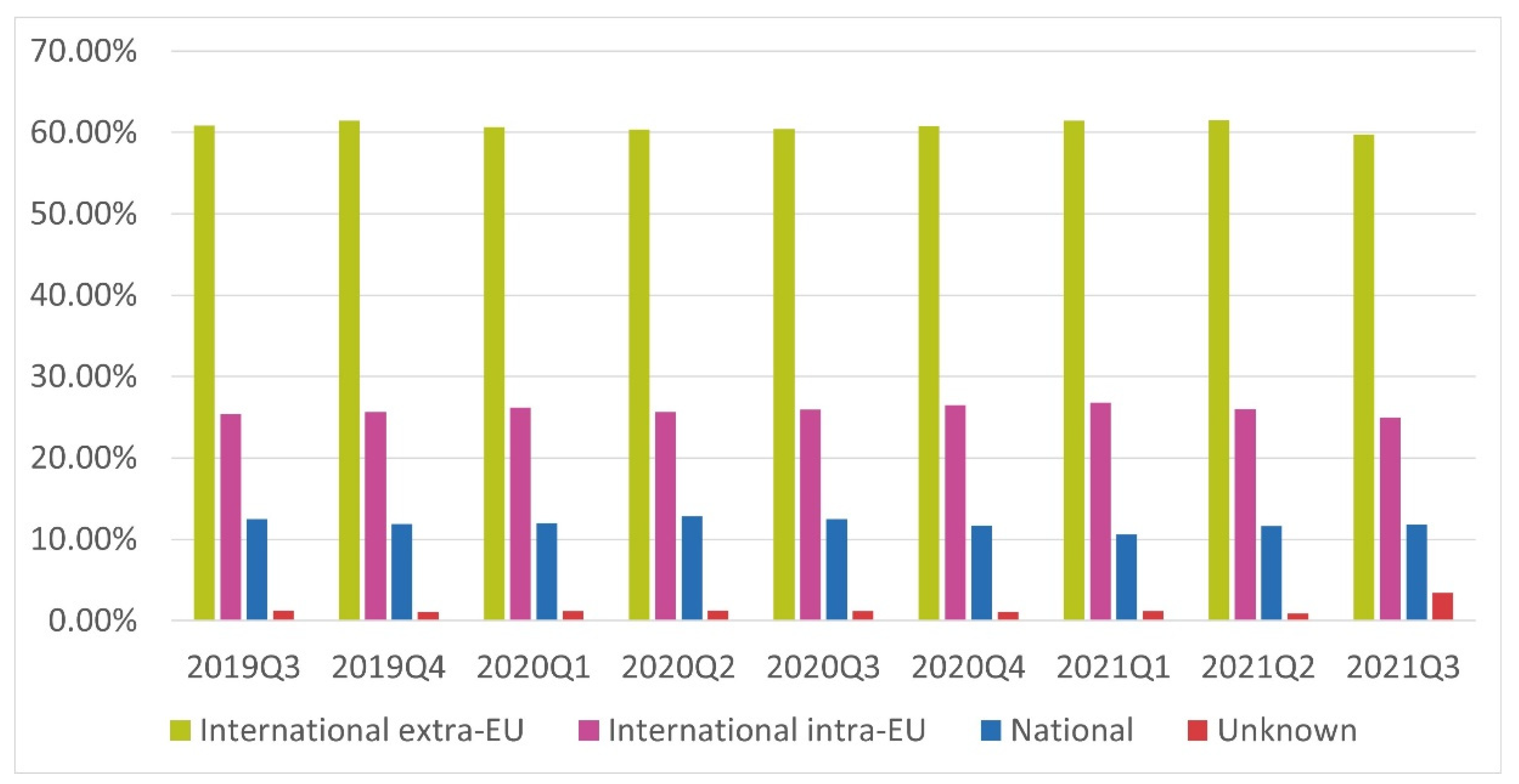

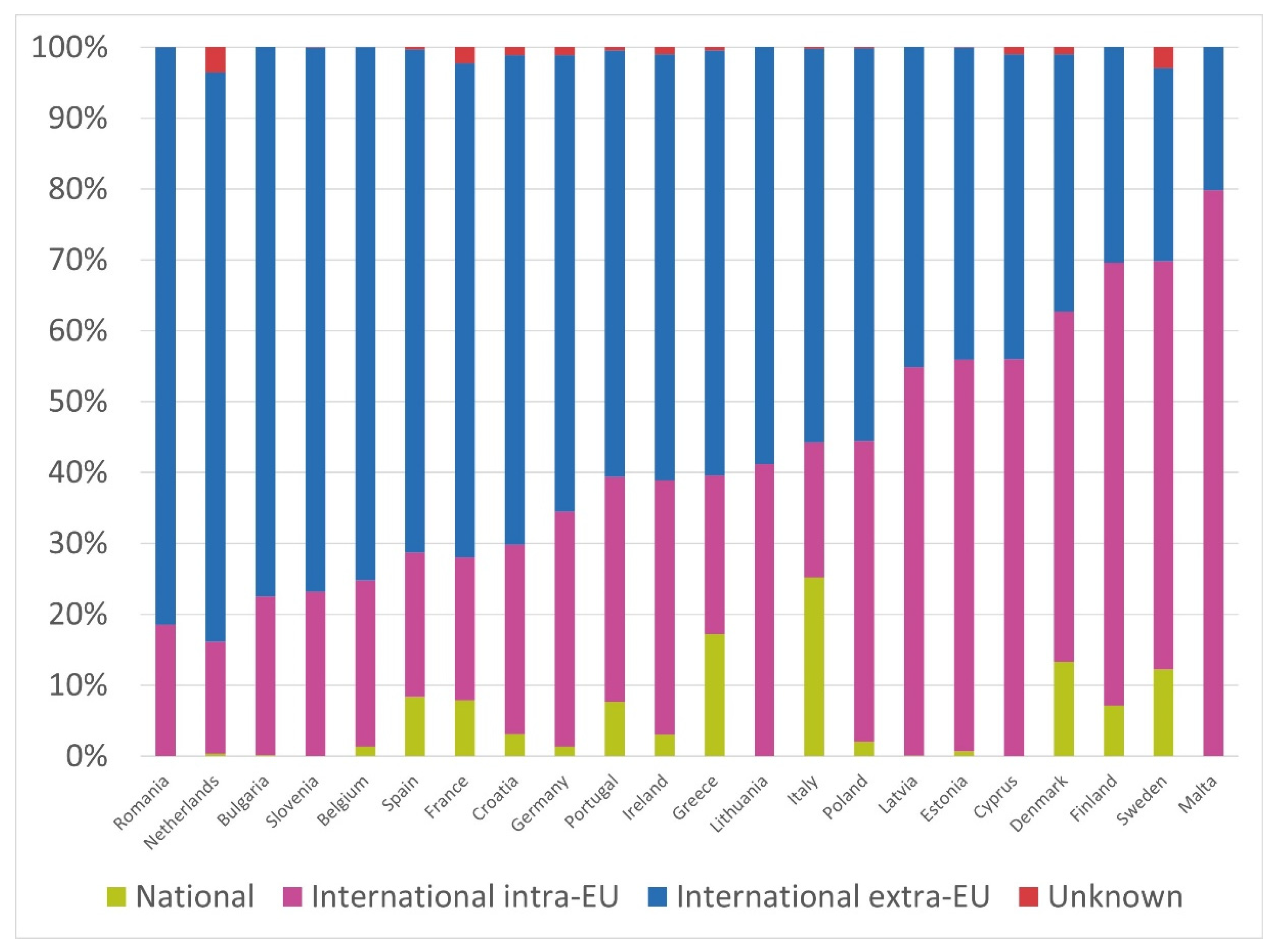

2.3. Intra-EU Versus Extra-EU Imports/Exports Handled by EU Ports

2.4. Market Based Measures

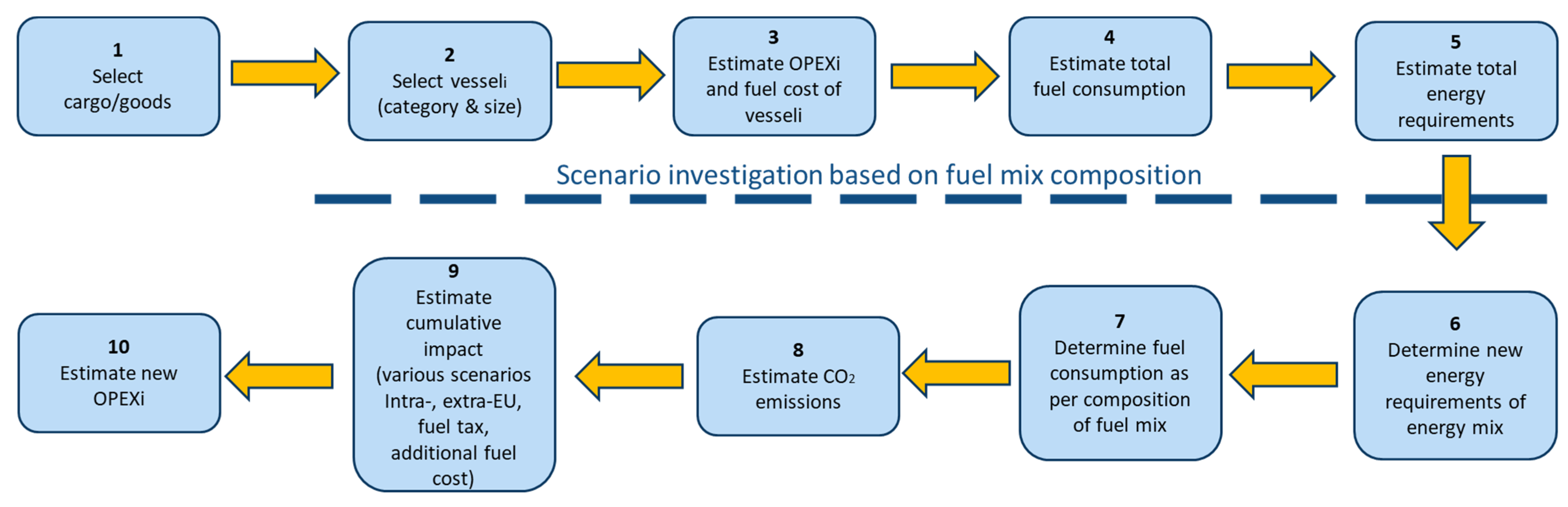

3. Methodology

- Step 1: Select the cargo/goods to be transported, i.e., imported/exported based on value i, where subscript i indicates vessel type.

- Step 2: Based on the category of goods transported, identify the appropriate vessel (e.g., bulker for food, beverages, durable and semi durable items, RoRo for cars and equipment, container for a variety of goods, and tanker for fuels and lubricants) based on vesseli.

- Step 4: Estimate fuel consumption via:

- Step 6: The new energy requirements are determined based on the new energy composition; these are user input requirements:

- Step 7: Determine fuel mass i of fuel mix based on new energy requirements of vessel i:

- Step 8: Estimate total CO2 emissions of new fuel mix of vessel i:

- Step 9: Estimate the cumulative impact based on scenarios for CO2 tax, intra- and extra-EU, fuel tax, and additional fuel cost up to 2050:

- Step 10: Estimate the cumulative impact based on scenarios for CO2 tax, intra- and extra-EU, fuel tax, and additional fuel cost up to 2030:

3.1. Fuel Parameters

3.2. Scenarios Based on Fuel Mix, Fuel Tax, CO2 Penalty, and Cost of Fuel until 2030

4. Results and Discussion

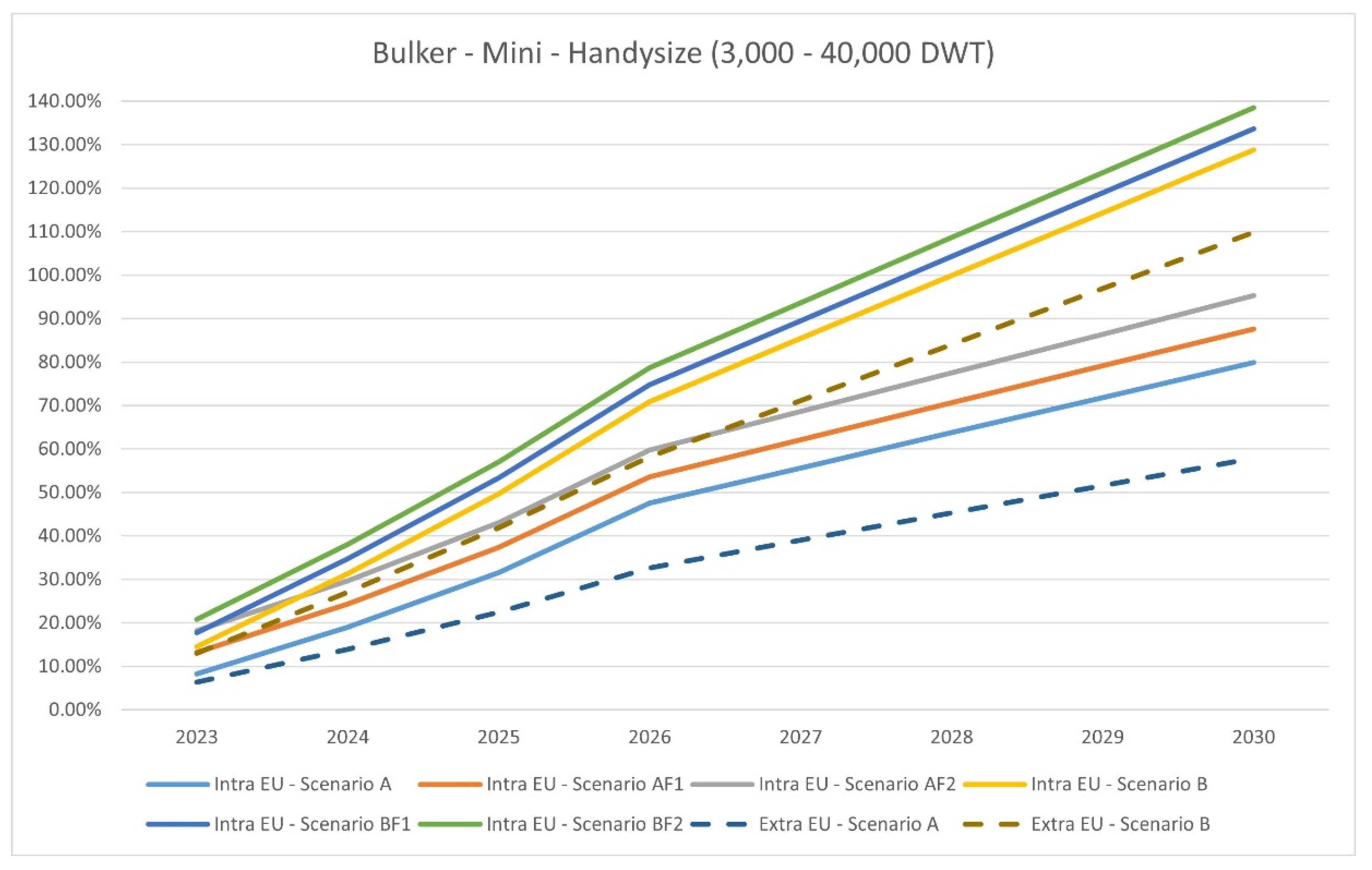

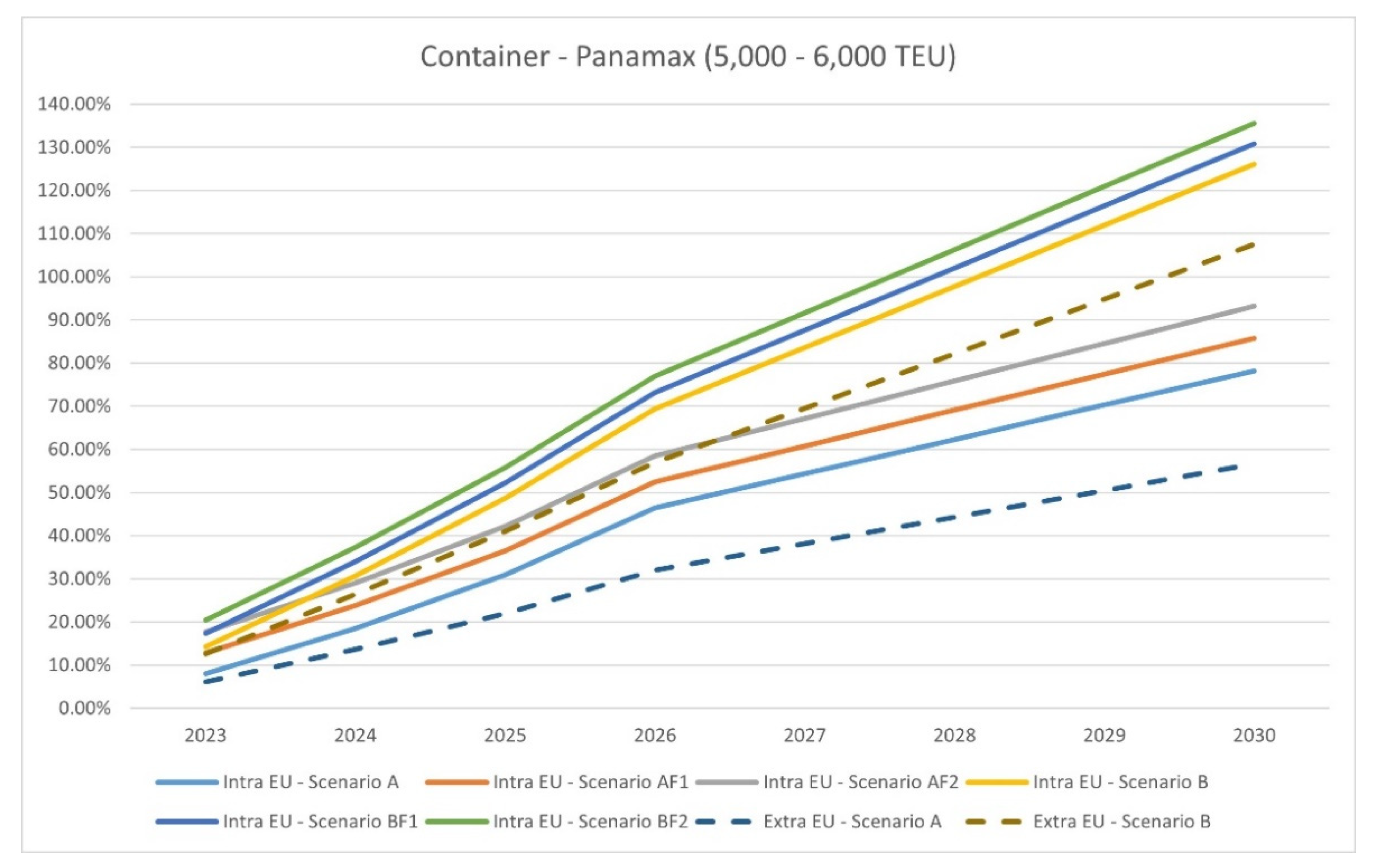

4.1. Effect of OPEX Due to Intra-EU and Extra-EU and Fuel Maritime Tax

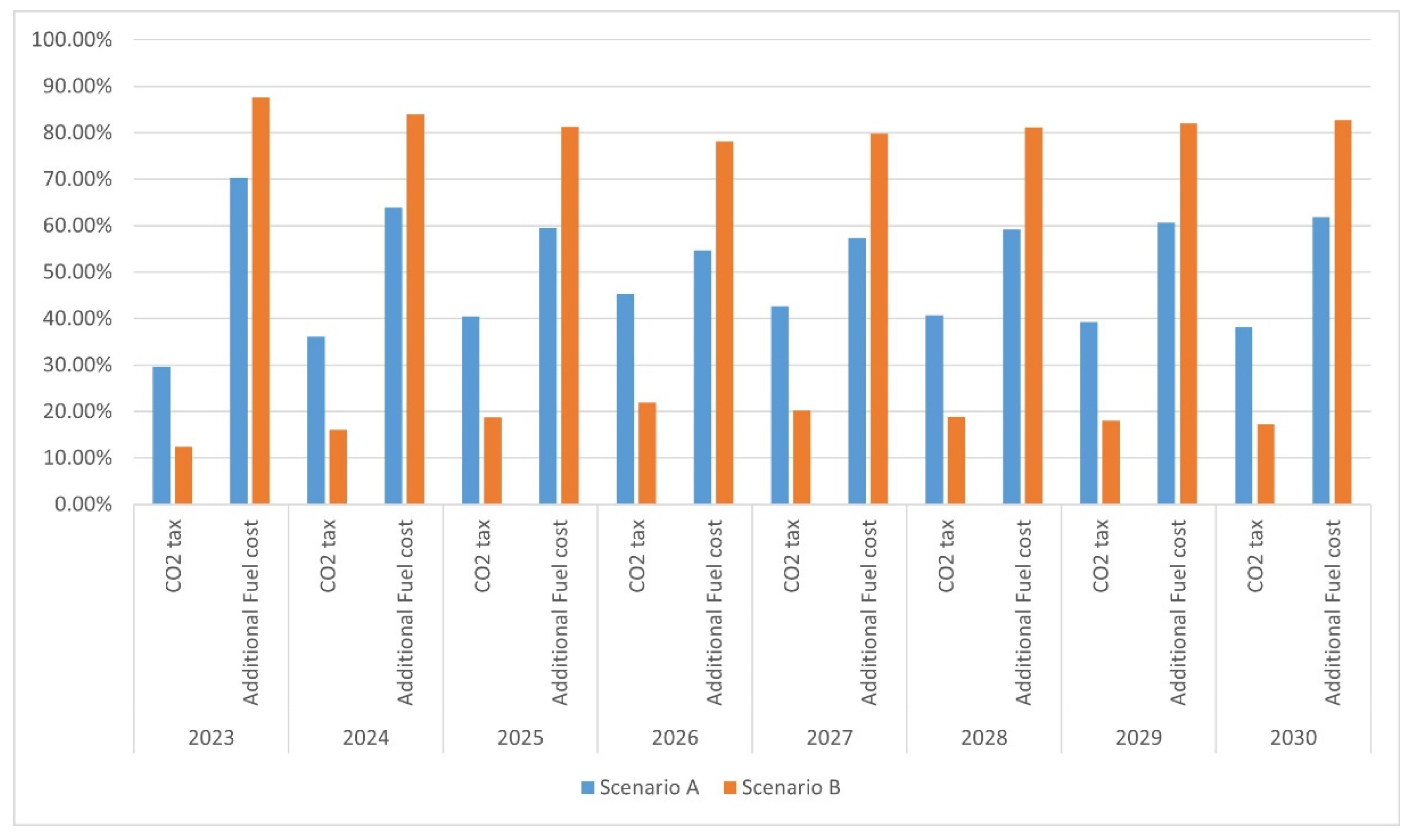

4.2. Breakdown of Taxplus

5. Conclusions and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Abbreviations

| Acronym list: | |

| AFID | Alternative Fuel Instructive Directive |

| AIS | Autonomous Identification System |

| boe | Barrel of Oil Equivalent |

| BAU | Business as Usual |

| CBAM | Carbon Border Adjustment Mechanism |

| DWT | Deadweight Tonnage |

| DNV | Det Norske Veritas |

| EU | European Union |

| EU ETS | EU Emissions Trading System |

| MRV | EU Maritime Monitoring, Reporting and Verification |

| GHG | Greenhouse Gas |

| GDP | Gross Domestic Product |

| HFO | Heavy Fuel Oil |

| IMO | International Maritime Organization |

| IMF | International Monetary Fund |

| LNG | Liquefied Natural Gas |

| LPG | Liquefied Petroleum Gas |

| LHV | Latent Heating Value |

| MEPC | Marine Environment Protection Committee |

| MGO | Marine Gasoil |

| MBMs | Market Based Measures |

| OPEX | Operational Expenditure |

| ETD | Revised Energy Taxation Directive |

| RED | Revised Renewable Energy Directive |

| SECA | Sulphur Emission Control Areas |

| TEU | Twenty-foot equivalent unit |

| VHF | Very High Frequency |

| Common subscripts in Equations: | |

| i | indicates vessel type |

| j | indicates fuel type |

References

- Elmi, Z.; Singh, P.; Meriga, V.K.; Goniewicz, K.; Borowska-Stefańska, M.; Wiśniewski, S.; Dulebenets, M.A. Uncertainties in Liner Shipping and Ship Schedule Recovery: A State-of-the-Art Review. J. Mar. Sci. Eng. 2022, 10, 563. [Google Scholar] [CrossRef]

- Baştuğ, S.; Haralambides, H.; Esmer, S.; Eminoğlu, E. Port competitiveness: Do container terminal operators and liner shipping companies see eye to eye? Mar. Policy 2021, 135, 104866. [Google Scholar] [CrossRef]

- European Commission. 2030 Climate & Energy Framework. 2021. Available online: https://ec.europa.eu/clima/eu-action/climate-strategies-targets/2030-climate-energy-framework_en (accessed on 14 June 2022).

- IMO. UN Body Adopts Climate Change Strategy for Shipping. 13 April 2018. Available online: https://www.imo.org/en/MediaCentre/PressBriefings/Pages/06GHGinitialstrategy.aspx (accessed on 14 June 2022).

- ECSA. Position Paper: A Green Deal for the European Shipping Industry; European Community Shipowners’ Association: Brussels, Belgium, 2020. [Google Scholar]

- KPMG. The European Green Deal & Fit for 55. 2022. Available online: https://home.kpmg/xx/en/home/insights/2021/11/the-european-green-deal-and-fit-for-55.html (accessed on 14 June 2022).

- Sharma, N.R.; Dimitrios, D.; Olcer, A.I.; Nikitakos, N. LNG a clean fuel—The underlying potential to improve thermal efficiency. J. Mar. Eng. Technol. 2022, 21, 111–124. [Google Scholar] [CrossRef]

- Tsitsoni, D. Revenue and Operating Cost Analysis in the Tanker Sector. Master’s Thesis, Department of Maritime Studies, University of Piraeus, Piraeus, Greece, 2021. [Google Scholar]

- Stopford, M. Maritime Economics, 3rd ed.; Routledge: London, UK, 2009. [Google Scholar]

- Bialystocki, N.; Konovessis, D. On the estimation of ship’s fuel consumption and speed curve: A statistical approach. J. Ocean Eng. Sci. 2016, 1, 157–166. [Google Scholar] [CrossRef] [Green Version]

- Wijnolst, N.; Wergeland, T.; Levander, K. Shipping Innovation; IOS Press: Amsterdam, The Netherlands, 2009. [Google Scholar]

- Faber, J.; Hanayama, S.; Zhang, S.; Pereda, P.; Comer, B.; Hauerhof, E.; van der Loeff, W.S.; Zhang, H.; Kosaka, M.; Adachi, J.-M.; et al. Fourth IMO Greenhouse Gas Study; International Maritime Organization: London, UK, 2020. [Google Scholar]

- Toscano, D.; Murena, F. Atmospheric ship emissions in ports: A review. Correlation with data of ship traffic. Atmos. Environ. X 2019, 4, 100050. [Google Scholar] [CrossRef]

- Tichavska, M.; Tovar, B. Port-city exhaust emission model: An application to cruise and ferry operations in Las Palmas Port. Transp. Res. Part A Policy Pract. 2015, 78, 347–360. [Google Scholar] [CrossRef]

- Jalkanen, J.-P.; Brink, A.; Kalli, J.; Pettersson, H.; Kukkonen, J.; Stipa, T. A modelling system for the exhaust emissions of marine traffic and its application in the Baltic Sea area. Atmos. Chem. Phys. 2009, 9, 9209–9223. [Google Scholar] [CrossRef] [Green Version]

- Schrooten, L.; De Vlieger, I.; Panis, L.I.; Chiffi, C.; Pastori, E. Emissions of maritime transport: A European reference system. Sci. Total Environ. 2009, 408, 318–323. [Google Scholar] [CrossRef] [PubMed]

- Song, S.K.; Shon, Z.-H. Current and future emission estimates of exhaust gases and particles from shipping at the largest port in Korea. Environ. Sci. Pollut. Res. 2014, 21, 6612–6622. [Google Scholar] [CrossRef] [PubMed]

- Nunes, R.A.O.; Alvim-Ferraz, M.C.M.; Martins, F.G.; Sousa, S.I.V. The activity-based methodology to assess ship emissions—A review. Environ. Pollut. 2017, 231, 87–103. [Google Scholar] [CrossRef]

- Woo, D.; Im, N. Spatial Analysis of the Ship Gas Emission Inventory in the Port of Busan Using Bottom-Up Approach Based on AIS Data. J. Mar. Sci. Eng. 2021, 9, 1457. [Google Scholar] [CrossRef]

- European Environmental Agency. Environmental Pressures from European Consumption and Production: A Study in Integrated Environmental and Economic Analysis; Technical report for Publications Office of the European Union: Luxembourg, 2013.

- Bernacki, D. Assessing the Link between Vessel Size and Maritime Supply Chain Sustainable Performance. Energies 2021, 14, 2979. [Google Scholar] [CrossRef]

- European Commission. European Commission DG Environment COMPASS. The COMPetiveness of EuropeAn Short-Sea Freight Shipping Compared with Road and Rail Transport; Final Report; European Commission: Brussels, Belgium, 2010.

- Bilen, Ü.; Kramer, H.; Monden, R.; Scott, D.; Bonazountas, M.; Stamatis, S.; Palla, V.; Yrjänäinen, A.; Kahva, E. Holistic Optimisation of Ship Design and Operation for Life Cycle. D.1.1 Market Analysis. HOLISHIP Horizon 2020-689074; HOLISHIP: Hamburg, Germany, 2018. [Google Scholar]

- EuroStat. Maritime Transport of Goods—Quarterly Data. March 2022. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Maritime_transport_of_goods_-_quarterly_data&oldid=560323#Gross_weight_of_goods_handled_in_the_main_EU_ports_increased_by_7.5_.25_in_the_third_quarter_of_2021_compared_to_the_same_quarter_ (accessed on 14 June 2022).

- EuroStat. Maritime Freight and Vessel Statistics. December 2021. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Maritime_freight_and_vessels_statistics (accessed on 14 June 2022).

- IMO. Market-Based Measures. 2019. Available online: https://www.imo.org/en/OurWork/Environment/Pages/Market-Based-Measures.aspx#:~:text=MBMs%20place%20a%20price%20on,in%2Dsector%20reductions)%3B%20and (accessed on 2 June 2022).

- Tanaka, H.; Okada, A. Effects of market-based measures on a shipping company: Using an optimal control approach for long-term modeling. Res. Transp. Econ. 2019, 73, 63–71. [Google Scholar] [CrossRef]

- Mallouppas, G.; Yfantis, E.A. Decarbonization in Shipping Industry: A Review of Research, Technology Development, and Innovation Proposals. J. Mar. Sci. Eng. 2021, 9, 415. [Google Scholar] [CrossRef]

- Psaraftis, H.N.; Zis, T.; Lagouvardou, S. A comparative evaluation of market based measures for shipping decarbonization. Marit. Transp. Res. 2021, 2, 100019. [Google Scholar] [CrossRef]

- EU. Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions; European Commission: Brussels, Belgium, 2019.

- European Commission. EU Reference Scenario 2020. Available online: https://energy.ec.europa.eu/data-and-analysis/energy-modelling/eu-reference-scenario-2020_en (accessed on 10 March 2022).

- DNV-GL. Energy Transition Outlook, Maritime Forecast; DNV-GL: Baerum, Norway, 2019. [Google Scholar]

- Mallouppas, G.; Ioannou, C.; Yfantis, E.A. A Review of the Latest Trends in the Use of Green Ammonia as an Energy Carrier in Maritime Industry. Energies 2022, 15, 1453. [Google Scholar] [CrossRef]

- Schorn, F.; Breuer, J.L.; Samsun, R.C.; Schnorbus, T.; Heuser, B.; Peters, R.; Stolten, D. Methanol as a Renewable Energy Carrier: An Assessment of Production and Transportation Costs for Selected Global Locations. Adv. Appl. Energy 2021, 3, 100050. [Google Scholar] [CrossRef]

- Fasihi, M.; Weiss, R.; Savolainen, J.; Breyer, C. Global potential of green ammonia based on hybrid PV-wind power plants. Appl. Energy 2021, 294, 116170. [Google Scholar] [CrossRef]

- Statista. Annual Liquefied Natural Gas (LNG) Price per Million British Thermal Unit in Japan from 2013 to 2020 with a Forecast Until 2035. 2022. Available online: https://www.statista.com/statistics/252789/lng-prices/ (accessed on 14 June 2022).

- IRENA. A Pathway to Decarbonise the Shipping Sector by 2050; IRENA: Abu Dhabi, United Arab Emirates, 2021.

- Yfantis, E.A.; Mallouppas, G.; Ktoris, A.; Ioannou, C. Fit for 55—Impact on Cypriot Shipping Industry. Preliminary Report—Assessment of the New Measures and Their Effect on the Shipping Industry and the Relevant Cyprus Economy Sectors; Submitted to the Ministry of Energy Commerce and Industry; CMMI: Larnaka, Cyprus, 2022. [Google Scholar]

- EuroStat. Energy Balances. European Commission. 2022. Available online: https://ec.europa.eu/eurostat/web/energy/data/ (accessed on 1 February 2022).

- E3MLab. PRIMES Model; Detailed Model Description; National Technical University of Athens: Athens, Greece, 2018; Available online: https://e3modelling.com/wp-content/uploads/2018/10/The-PRIMES-MODEL-2018.pdf (accessed on 11 March 2022).

- European Commission. Proposal for a Regulation of the European Parliament and of the Impact Assessment Part 2; European Commission: Brussels, Belgium, 2021.

- Transport & Environment. Decarbonising European Shipping. Technological, Operational and Legislative Roadmap; Transport & Environment: Brussels, Belgium, 2021. [Google Scholar]

- IMF. IMF Working Paper. Carbon Taxation for International Maritime Fuels: Assessing the Options (WP/18/203); International Monetary Fund: Washington, DC, USA, 2018. [Google Scholar]

- Lloyd’s List. EU Proposes Tax on All Shipping Emissions and to Limit Polluting Fuels. 14 July 2021. Available online: https://lloydslist.maritimeintelligence.informa.com/LL1137545/EU-proposes-tax-on-all-shipping-emissions-and-to-limit-polluting-fuels (accessed on 16 June 2022).

- IBIA. Fuel EU Maritime, EU ETS and Bunker Tax Proposals Raise Many Questions. 2 August 2021. Available online: https://ibia.net/2021/08/02/ibia-has-studied-the-european-commissions-fit-for-55-package-of-proposals/ (accessed on 16 June 2022).

| Ship Type | DWT/TEU | OPEX ($) | % Fuel Cost to OPEX |

|---|---|---|---|

| Bulker (in DWT) | Mini—Handysize (3000–40,000) | 21,497 | 47% |

| Hadymax & Supramax (40,000–60,000) * | 24,930 | 45% | |

| Panamax (60,000–80,000) | 28,363 | 43% | |

| Container (in TEU) | Small feeder (500–700) | 16,470 | 54% |

| Feeder (1000–2000) | 26,456 | 54% | |

| Feedermax (2000–3000) * | 35,398 | 50% | |

| Panamax (5000–6000) | 53,283 | 46% | |

| Post-Panamax (8000–9000) | 68,776 | 42% | |

| Post-Panamax (10,000–12,000) | 84,217 | 44% | |

| Pure car carrier (in DWT) | 0–10,000 | 68,776 | 42% |

| 10,000–20,000 | 84,217 | 44% | |

| 20,000–30,000 | 100,000 | 45% | |

| 30,000–40,000 | 116,000 | 46% | |

| Ro-Ro (in DWT) | 1000–6000 | 60,000 | 66% |

| Tanker (in DWT) | General Purpose Tanker (10,000–25,000) * | 27,000 | 30% |

| Medium Range Tanker (25,000–45,000) | 30,953 | 30% | |

| Large Range 1; LR1 (45,000–80,000) | 36,636 | 30% | |

| Large Range 2; LR2 (80,000–160,000) | 53,838 | 36% |

| In USD/boe | 2020 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|---|

| Oil | 39.8 | 47.84 | 51.86 | 55.88 | 59.90 | 63.94 | 67.98 | 72.02 | 76.06 | 80.10 |

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|

| ε (%) | 20% | 45% | 70% | 100% | 100% | 100% | 100% | 100% |

| Fuel Mix | HFO | MGO | Green H2 | Green NH3 | Green Methanol | Biogas | LNG | Advanced Biodiesel |

|---|---|---|---|---|---|---|---|---|

| Latent Heat Value (MJ/kg) | 40.00 | 43.00 | 120.00 | 18.60 | 19.90 | 50.00 | 50.00 | 38.00 |

| Emission factor (-) | 3.114 | 3.206 | 0.000 | 0.000 | 0.000 | 0.000 | 2.755 | 0.000 |

| Change in energy requirements () (%) | 100.00 | 100.00 | 98.00 | 98.00 | 98.00 | 98.00 | 98.00 | 98.00 |

| Fuel Mix | HFO | MGO | Green H2 | Green NH3 | Green Methanol | Biogas | LNG | Advanced Biodiesel |

|---|---|---|---|---|---|---|---|---|

| Scenario A—BAU | ||||||||

| Composition (%) | 77.81 | 19.76 | 0.00 | 0.00 | 0.00 | 0.00 | 2.43 | 0.00 |

| Fuel tax (%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Scenario AF1 | ||||||||

| Composition (%) | 77.81 | 19.76 | 0.00 | 0.00 | 0.00 | 0.00 | 2.43 | 0.00 |

| Fuel tax (%) | 10.00 | 10.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Scenario AF2 | ||||||||

| Composition (%) | 77.81 | 19.76 | 0.00 | 0.00 | 0.00 | 0.00 | 2.43 | 0.00 |

| Fuel tax (%) | 20.00 | 20.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Scenario B | ||||||||

| Composition (%) | 17.32 | 44.29 | 0.00 | 0.56 | 0.00 | 0.00 ** | 35.95 | 1.88 |

| Fuel tax (%) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Scenario BF1 | ||||||||

| Composition (%) | 17.32 | 44.29 | 0.00 | 0.56 | 0.00 | 0.00 ** | 35.95 | 1.88 |

| Fuel tax (%) | 10.00 | 10.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Scenario BF2 | ||||||||

| Composition (%) | 17.32 | 44.29 | 0.00 | 0.56 | 0.00 | 0.00 ** | 35.95 | 1.88 |

| Fuel tax (%) | 20.00 | 20.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

|---|---|---|---|---|---|---|---|---|---|

| δ (EUR/tonne) | - | 42.50 | 50.71 | 58.93 | 67.14 | 75.36 | 83.57 | 91.70 | 100.00 |

| HFO (EUR/MJ) | 0.008 | 0.009 | 0.010 | 0.010 | 0.011 | 0.012 | 0.012 | 0.013 | 0.014 |

| MGO (EUR/MJ) | 0.008 | 0.009 | 0.010 | 0.010 | 0.011 | 0.012 | 0.012 | 0.013 | 0.014 |

| Green H2 (EUR/MJ) | 0.031 | 0.030 | 0.029 | 0.028 | 0.027 | 0.026 | 0.025 | 0.024 | 0.023 |

| Green NH3 (EUR/MJ) | 0.031 | 0.030 | 0.029 | 0.028 | 0.027 | 0.026 | 0.025 | 0.024 | 0.023 |

| Green Methanol (EUR/MJ) | 0.042 | 0.039 | 0.037 | 0.034 | 0.032 | 0.030 | 0.029 | 0.026 | 0.022 |

| Biogas (EUR/MJ) | 0.018 | 0.016 | 0.014 | 0.012 | 0.011 | 0.009 | 0.007 | 0.005 | 0.004 |

| LNG (EUR/MJ) | 0.004 | 0.009 | 0.013 | 0.018 | 0.022 | 0.026 | 0.031 | 0.035 | 0.040 |

| Advanced biodiesel (EUR/MJ) | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mallouppas, G.; Yfantis, E.A.; Ktoris, A.; Ioannou, C. Methodology to Assess the Technoeconomic Impacts of the EU Fit for 55 Legislation Package in Relation to Shipping. J. Mar. Sci. Eng. 2022, 10, 1006. https://doi.org/10.3390/jmse10081006

Mallouppas G, Yfantis EA, Ktoris A, Ioannou C. Methodology to Assess the Technoeconomic Impacts of the EU Fit for 55 Legislation Package in Relation to Shipping. Journal of Marine Science and Engineering. 2022; 10(8):1006. https://doi.org/10.3390/jmse10081006

Chicago/Turabian StyleMallouppas, George, Elias A. Yfantis, Angelos Ktoris, and Constantina Ioannou. 2022. "Methodology to Assess the Technoeconomic Impacts of the EU Fit for 55 Legislation Package in Relation to Shipping" Journal of Marine Science and Engineering 10, no. 8: 1006. https://doi.org/10.3390/jmse10081006